31

31

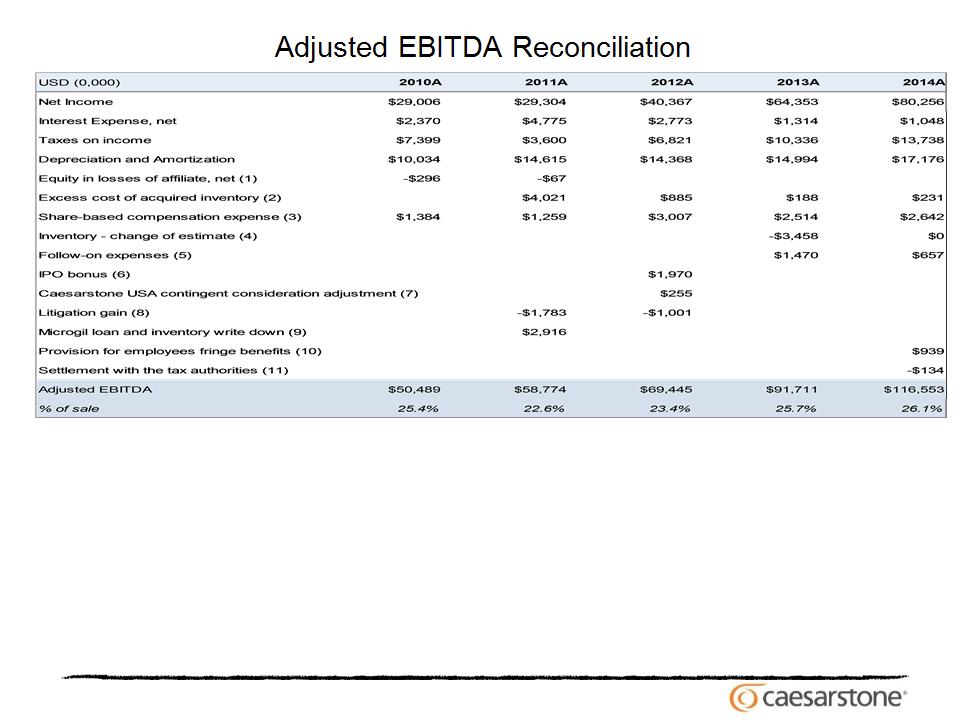

(1) Consists of charges to cost of goods sold for the difference between the higher carrying cost of the inventory of two of the Company's subsidiaries- Caesarstone USA's inventory at the time of its acquisition and

inventory that was purchased from its distributor and Caesarstone Australia Pty Limited's inventory that was purchased from its distributor, and the standard cost of the Company's inventory-which adversely

impacts the Company's gross margins until such inventory is sold. The majority of the inventory acquired from Caesarstone USA was sold in 2011, and the majority of the inventory acquired from the Australian

distributor was sold in 2012.

(2) In 2013, share-based compensation consists of expenses related to the stock options granted to employees of the Company. In 2014, share-based compensation consists primarily of expenses related to the stock

options granted to employees of the Company, as well as expenses related to share-based rights granted during the period.

(3) Consists of the payment of $1.72 million to certain employees of the Company and $0.25 million to the Company's Chairman for their contribution to the completion of the Company's IPO.

(4) Relates to the change in fair value of the contingent consideration that was part of the consideration transferred in connection with the acquisition of Caesarstone USA.

(5) Relates to a change in estimate for the value of inventory following the implementation of the Company's new ERP system in April 2013.

(6) In 2013, consists of direct expenses related to a follow on-offering that closed in April 2013, including a bonus paid by the Company' former shareholder, Tene, to certain of its employees that under US GAAP the

Company is required to expense against paid-in capital. In 2014, consists of direct expenses related to a follow on offering that closed in June 2014.

(7) In 2011, litigation gain consists of a mediation award in the Company's favor pursuant to two trademark infringement cases brought by Caesarstone Australia Pty Limited. In 2012, litigation gain resulted from a

settlement agreement with the former chief excecutive officer of Caesarstone Australia Pty Limited related to litigation that had been commenced in 2010. Pursuant to the settlement, he transferred to the Company

the ownership of all his shares in Caesarstone Australia Pty Limited received in connection with his employment. The Company did not make any payments in connection with such transfer or other payments to the

former chief executive officer. As a result of the settlement, the Company reversed the liability provision in connection with the litigation and the adjustment is presented net of the related litigation expenses incurred

in connection with the settlement.

(8) Relates to our writing down to zero the cost of inventory provided to Microgil, our former third-party quartz processor in Israel, in 2011 in the amount of $1.8 million and our writing down to zero our $1.1 million loan

to Microgil, in each case, in connection with a dispute.

(9) Relates to an adjustment of provision for taxable employee fringe benefits as a result of a settlement with the Israel Tax Authority and with the National Insurance Intitute of Israel.

(10) Relates to a refund of Israeli value added tax (VAT) associated with a bad debt from 2007

(11) Tax adjustment as a result of tax settlement with the Israeli tax authorities.

(12) The tax adjustments for the three and Twelve months ended December 31, 2014 and 2013 were based on the effective tax rate (excluding adjustments to the tax line item) for these periods, respectively.