Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS1

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS2

Table of Contents

As filed with the Securities and Exchange Commission on December 24, 2014

Registration No. 333-197341

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NGL ENERGY PARTNERS LP*

NGL ENERGY FINANCE CORP.*

(Exact name of registrant as specified in its charter)

| | | | |

Delaware

Delaware

(State or other jurisdiction

of incorporation or organization) | | 5900

5900

(Primary Standard Industrial

Classification Code Number) | | 27-3427920

80-0956287

(I.R.S. Employer

Identification Number) |

6120 South Yale Avenue

Suite 805

Tulsa, Oklahoma

(918) 481-1119

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

H. Michael Krimbill

Chief Executive Officer

NGL Energy Partners LP

6120 South Yale Avenue

Suite 805

Tulsa, Oklahoma

(918) 481-1119

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Henry Havre

Andrews Kurth LLP

600 Travis, Suite 4200

Houston, Texas 77002

(713) 220-4200

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large Accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 144-1(d) (Cross-Border Third-Party Tender Offer) o

Each Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

* The following are co-registrants that guarantee the debt securities:

| | | | | | |

Exact name of registrant guarantor(1) | | State or other

jurisdiction of

incorporation or

organization | | I.R.S. Employer

Identification

Number | |

|---|

NGL Energy Operating LLC | | Delaware | | | 27-3428096 | |

NGL Crude Logistics, LLC | | Delaware | | | 47-0794813 | |

NGL Propane, LLC | | Delaware | | | 26-0648745 | |

NGL Liquids, LLC | | Delaware | | | 27-3756258 | |

NGL Crude Transportation, LLC | | Delaware | | | 46-5216792 | |

NGL Crude Cushing, LLC | | Oklahoma | | | 27-4216425 | |

High Sierra Crude Oil & Marketing, LLC | | Colorado | | | 03-0611248 | |

High Sierra Energy, LP | | Delaware | | | 32-0133367 | |

High Sierra Energy Operating, LLC | | Colorado | | | 32-0133362 | |

High Sierra Compression LLC | | Colorado | | | 65-1259662 | |

NGL Crude Pipelines, LLC | | Oklahoma | | | 27-2635247 | |

NGL Energy Logistics, LLC | | Delaware | | | 90-0999490 | |

NGL Energy Holdings II, LLC | | Delaware | | | 27-2639996 | |

NGL Crude Terminals, LLC | | Delaware | | | 27-4016063 | |

Lotus Oilfield Services, LLC | | Texas | | | 27-2394590 | |

Andrews Oil Buyers, Inc. | | Texas | | | 75-2331321 | |

NGL Crude Canada Holdings, LLC | | Colorado | | | 30-0762281 | |

NGL Marine, LLC | | Delaware | | | 87-0758428 | |

High Sierra Transportation, LLC | | Colorado | | | 73-1732045 | |

Osterman Propane, LLC | | Delaware | | | 45-3263311 | |

Hicksgas, LLC | | Delaware | | | 27-3573860 | |

NGL-NE Real Estate, LLC | | Delaware | | | 37-1663246 | |

NGL-MA Real Estate, LLC | | Delaware | | | 80-0781281 | |

NGL-MA, LLC | | Delaware | | | 90-0790881 | |

Centennial Energy, LLC | | Colorado | | | 84-1227036 | |

Centennial Gas Liquids, ULC | | Alberta | | | 85-6127923 | |

NGL Shipping and Trading, LLC | | Delaware | | | 68-0486837 | |

NGL Supply Terminal Company, LLC | | Delaware | | | 01-0749898 | |

NGL Supply Wholesale, LLC | | Delaware | | | 20-0317348 | |

NGL Water Solutions, LLC | | Colorado | | | 20-8661032 | |

AntiCline Disposal, LLC | | Wyoming | | | 41-2031951 | |

NGL Water Solutions DJ, LLC | | Colorado | | | 37-1632639 | |

NGL Water Solutions Eagle Ford, LLC | | Delaware | | | 80-0858222 | |

NGL Water Solutions Permian, LLC | | Colorado | | | 32-0412772 | |

TransMontaigne Inc. | | Delaware | | | 06-1052062 | |

TransMontaigne Product Services Inc. | | Delaware | | | 84-1477374 | |

TransMontaigne Services Inc. | | Delaware | | | 26-1409042 | |

TransMontaigne GP L.L.C. | | Delaware | | | 51-0536032 | |

NGL Milan Investments LLC | | Colorado | | | 37-1766148 | |

NGL Water Solutions Mid-Continent, LLC | | Colorado | | | 61-1748866 | |

- (1)

- The address for each the registrant guarantors is 6120 S. Yale, Suite 805, Tulsa, OK 74136, and the telephone number for each of the registrant guarantors is (918) 481-1119. The Primary Standard Industrial Classification Code for the registrant guarantors is 5900.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 24, 2014

PROSPECTUS

NGL Energy Partners LP

NGL Energy Finance Corp.

Offer to Issue

Up to $450,000,000 of

6.875% Senior Notes due 2021

That Have Been Registered Under

the Securities Act of 1933

("new notes")

In Exchange For

Up to $450,000,000 of

6.875% Senior Notes due 2021

That Have Not Been Registered Under

the Securities Act of 1933

("old notes")

Terms of the New Notes:

- •

- The terms of the new notes are identical to the terms of the old notes that were issued in October 2013, except that the new notes will be registered under the Securities Act of 1933, as amended, (the "Securities Act") and therefore freely tradable, and will not contain restrictions on transfer, registration rights or provisions for additional interest.

Terms of the Exchange Offer:

- •

- We are offering to issue new notes in exchange for the same principal amount of old notes.

- •

- Interest on the new notes will accrue from the last interest payment date on the notes at the rate of 6.875% per annum, and will be payable on April 15 and October 15 of each year.

- •

- The exchange offer expires at 5:00 p.m., New York City time, on , 2015, unless extended.

- •

- Tenders of old notes may be withdrawn at any time prior to the expiration of the exchange offer.

- •

- Your exchange of old notes for new notes will not be a taxable event for U.S. federal income tax purposes. Please read "Certain U.S. Federal Income Tax Consequences."

You should carefully consider the risks set forth under "Risk Factors" beginning on page 11 of this prospectus for a discussion of factors you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.

Table of Contents

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission. In making your investment decision, you should rely only on the information contained in this prospectus and in the accompanying letter of transmittal. We have not authorized anyone to provide you with any other information. If you receive any unauthorized information, you must not rely on it. We are not making an offer to sell these securities or soliciting an offer to buy these securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone whom it is unlawful to make an offer or solicitation. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

WHERE YOU CAN FIND MORE INFORMATION | | | ii | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | | iii | |

PROSPECTUS SUMMARY | | | 1 | |

RISK FACTORS | | | 11 | |

EXCHANGE OFFER | | | 33 | |

RATIO OF EARNINGS TO FIXED CHARGES | | | 41 | |

USE OF PROCEEDS | | | 42 | |

SELECTED CONSOLIDATED HISTORICAL FINANCIAL AND OPERATING DATA | | | 43 | |

BUSINESS | | | 44 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 71 | |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | 137 | |

MANAGEMENT | | | 139 | |

EXECUTIVE COMPENSATION | | | 145 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED UNITHOLDER MATTERS | | | 156 | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | | | | |

DESCRIPTION OF NOTES | | | 159 | |

PLAN OF DISTRIBUTION | | | 218 | |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES | | | 219 | |

LEGAL MATTERS | | | 220 | |

EXPERTS | | | 220 | |

INDEX TO FINANCIAL STATEMENTS | | | F-1 | |

i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

Our SEC filings will be available to the public over the Internet at the SEC's web site at http://www.sec.gov. You may also read and copy any document we file at the SEC's public reference room located at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room and copy charges. We will provide you upon request, without charge, a copy of the notes and the indenture governing the notes. You may request copies of these documents by contacting us at:

NGL Energy Partners LP

6120 South Yale Avenue

Suite 805

Tulsa, Oklahoma 74136

(918) 481-1119

ii

Table of Contents

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains various forward-looking statements and information that are based on our beliefs and those of our general partner, as well as assumptions made by and information currently available to us. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. When used in this prospectus, words such as "anticipate," "believe," "could," "estimate," "expect," "forecast," "goal," "intend," "may," "plan," "project," "will," and similar expressions and statements regarding our plans and objectives for future operations, are intended to identify forward-looking statements. Although we and our general partner believe that the expectations on which such forward-looking statements are based are reasonable, neither we nor our general partner can give assurances that such expectations will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, estimated, projected or expected. The following are key risk factors that may impact our consolidated financial position and results of operations:

- •

- the prices for crude oil, natural gas, natural gas liquids, refined products, ethanol, and biodiesel;

- •

- energy prices generally;

- •

- the price of propane relative to the price of alternative and competing fuels;

- •

- the price of gasoline relative to the price of corn, which impacts the price of ethanol;

- •

- the general level of crude oil, natural gas, and natural gas liquids production;

- •

- the general level of demand for crude oil, natural gas liquids, refined products, ethanol, and biodiesel;

- •

- the availability of supply of crude oil, natural gas liquids, refined products, ethanol, and biodiesel;

- •

- the level of crude oil and natural gas drilling and production in producing basins in which we have water treatment facilities;

- •

- the ability to obtain adequate supplies of propane and distillates for retail sale in the event of an interruption in supply or transportation and the availability of capacity to transport propane and distillates to market areas;

- •

- actions taken by foreign oil and gas producing nations;

- •

- the political and economic stability of petroleum producing nations;

- •

- the effect of weather conditions on supply and demand for crude oil, natural gas liquids, refined products, ethanol, and biodiesel;

- •

- the effect of natural disasters, lightning strikes, or other significant weather events;

- •

- availability of local, intrastate and interstate transportation infrastructure, including with respect to our truck, railcar, and barge transportation services;

- •

- availability, price, and marketing of competitive fuels;

- •

- the impact of energy conservation efforts on product demand;

- •

- energy efficiencies and technological trends;

- •

- governmental regulation and taxation;

- •

- the impact of legislative and regulatory actions on hydraulic fracturing and on the treatment of flowback and produced water;

iii

Table of Contents

- •

- hazards or operating risks incidental to the transporting and distributing of petroleum products that may not be fully covered by insurance;

- •

- the maturity of the crude oil and natural gas liquids industries and competition from other marketers;

- •

- the loss of key personnel;

- •

- the ability to hire drivers;

- •

- the ability to renew contracts with key customers;

- •

- the ability to maintain or increase the margins we realize for our terminal, barging, trucking, and water disposal and recycling and discharge services;

- •

- the ability to renew leases for general purpose and high pressure railcars;

- •

- the ability to renew leases for underground natural gas liquids storage;

- •

- the nonpayment or nonperformance by our customers;

- •

- the availability and cost of capital and our ability to access certain capital sources;

- •

- a deterioration of the credit and capital markets;

- •

- the ability to successfully identify and consummate strategic acquisitions at purchase prices that are accretive to our financial results;

- •

- the ability to successfully integrate acquired assets and businesses;

- •

- changes in the volume of crude oil recovered during the wastewater treatment process;

- •

- changes in the financial condition and results of operations of entities in which we own noncontrolling equity interests;

- •

- changes in laws and regulations to which we are subject, including tax, environmental, transportation and employment regulations or new interpretations by regulatory agencies concerning such laws and regulations and the impact of such laws and regulations (now existing or in the future) on our business operations, including our sales of crude oil, condensate, natural gas liquids, refined products, ethanol, and biodiesel, our processing of wastewater, and transportation and risk management activities;

- •

- the costs and effects of legal and administrative proceedings;

- •

- any reduction or the elimination of the Renewable Fuels Standard;

- •

- the operational and financial success of our joint ventures; and

- •

- changes in the jurisdictional characteristics of, or the applicable regulatory policies with respect to, our joint venture's pipeline assets.; and

- •

- other risks and uncertainties, including those described under "Risk Factors."

All readers are cautioned that the forward-looking statements contained in this prospectus are not guarantees of future performance, and our expectations may not be realized or the forward-looking events and circumstances may not occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors described elsewhere in this prospectus, including under the heading "Risk Factors" in this prospectus. You should not put undue reliance on any forward-looking statements. All forward-looking statements included in this prospectus are made only as of the date hereof. Except as required by state and federal securities laws, we undertake no obligation to update or revise any forward-looking statements as a result of information, future events or otherwise.

iv

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information included in this prospectus. It does not contain all of the information that may be important to you. You should read carefully this entire prospectus for a more complete understanding of our business and the terms of this offering, as well as the tax and other considerations that are important to you in making your investment decision.

Unless the context otherwise requires, references to "NGL Energy Partners," "NGL," "we," "us," "our" and similar terms, as well as references to the "Partnership," are to NGL Energy Partners LP and all of its subsidiaries. Our "general partner" refers to NGL Energy Holdings LLC.

NGL Energy Partners LP

Overview

We are a Delaware limited partnership formed in September 2010 by several investors. As part of our formation, we acquired and combined the assets and operations of NGL Supply, Inc., primarily a wholesale propane and terminalling business founded in 1967, and Hicksgas, LLC and Hicksgas Gifford, Inc., primarily a retail propane business founded in 1940. Subsequent to our formation, we significantly expanded our operations through numerous business combinations, including with High Sierra Energy, LP in 2012, as a result of which we entered the crude oil logistics and water services businesses, and Gavilon, LLC in December 2013, as a result of which we entered the refined products marketing and renewables businesses.

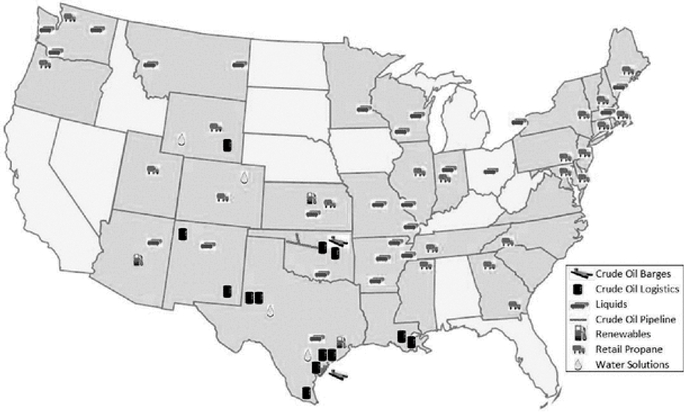

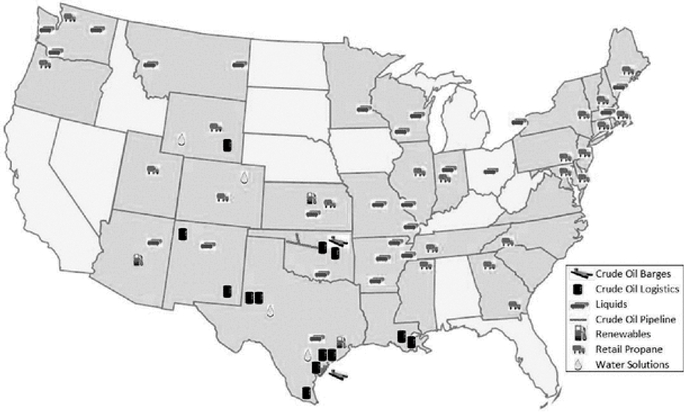

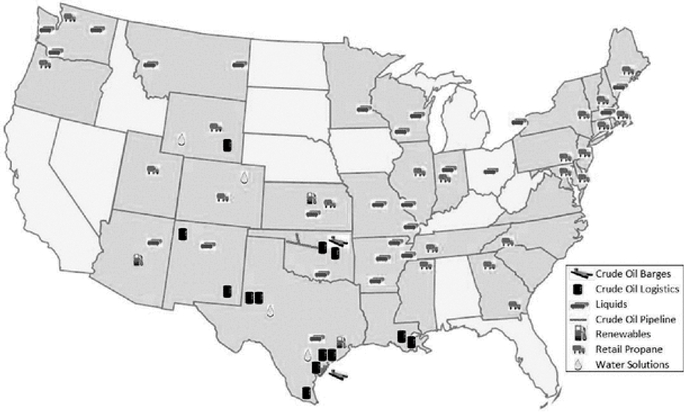

At September 30, 2014, our operations include:

- •

- Ourcrude oil logistics segment, the assets of which include owned and leased crude oil storage terminals, pipeline injection stations, a fleet of trucks, a fleet of leased and owned railcars, and a fleet of barges and towboats, and a 50% interest in a crude oil pipeline. Our crude oil logistics segment purchases crude oil from producers and transports it for resale at owned and leased pipeline injection points, storage terminals, barge loading facilities, rail facilities, refineries, and other trade hubs.

- •

- Ourwater solutions segment, the assets of which include water treatment and disposal facilities. Our water solutions segment generates revenues from the treatment and disposal of wastewater generated from crude oil and natural gas production, and from the sale of recycled water and recovered hydrocarbons.

- •

- Ourliquids segment, which supplies natural gas liquids to retailers, wholesalers, refiners, and petrochemical plants throughout the United States and in Canada, and which provides natural gas liquids terminaling services through its 22 terminals throughout the United States and railcar transportation services through its fleet of leased and owned railcars. Our liquids segment purchases propane, butane, and other products from refiners, processing plants, producers, and other parties, and sells the product to retailers, refiners, petrochemical plants, and other participants in the wholesale markets.

- •

- Ourretail propane segment, which sells propane, distillates, and equipment and supplies to end users consisting of residential, agricultural, commercial, and industrial customers and to certain re-sellers in more than 20 states.

- •

- Ourrefined products and renewables segment, which conducts gasoline, diesel, ethanol, and biodiesel marketing operations. We also own the 2.0% general partner interest and a 19.7% limited partner interest in TransMontaigne Partners L.P. ("TLP"), which conducts refined products terminaling operations. TLP also owns a 42.5% interest in Battleground Oil Specialty Terminal Company LLC ("BOSTCO") and a 50% interest in Frontera Brownsville LLC, which are entities that own refined products storage facilities.

1

Table of Contents

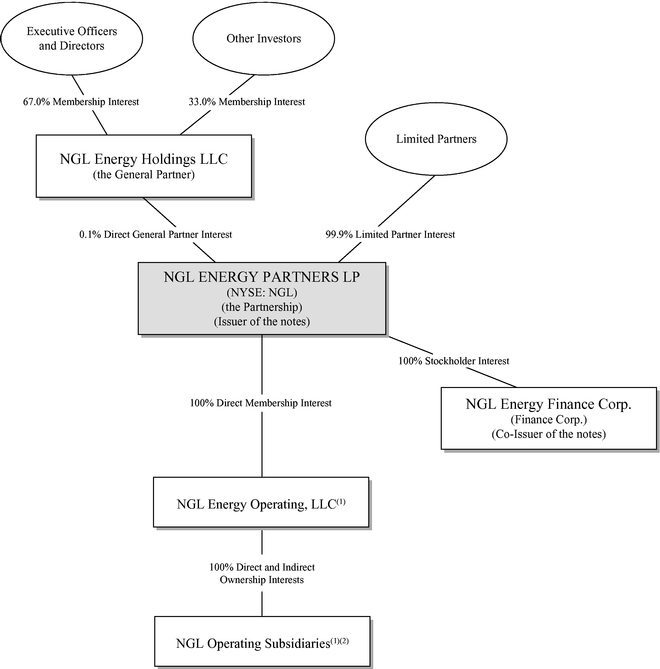

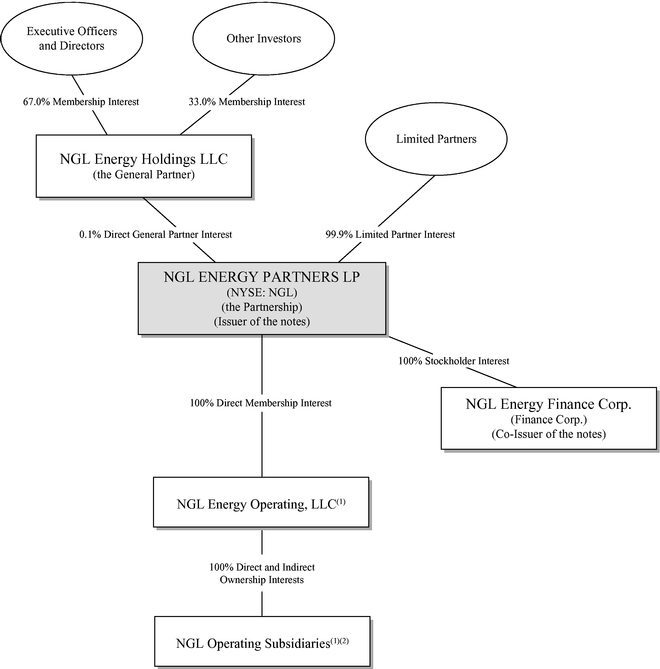

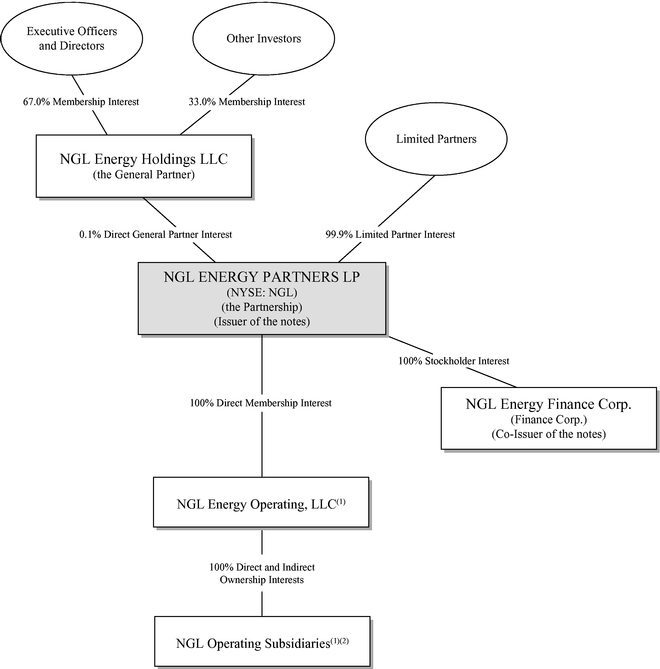

Our Ownership and Organizational Structure

The following chart provides a simplified overview of our organizational structure as of September 30, 2014:

- (1)

- The notes are currently guaranteed by all of our restricted subsidiaries (other than NGL Energy Finance Corp.) that are obligors under certain of our indebtedness, including our Credit Agreement. See "Description of Notes—Note Guarantees" and "—Additional Note Guarantees."

- (2)

- Includes (i) NGL Crude Logistics, LLC which includes the operations of our crude oil logistics, refined products and renewables business, (ii) NGL Water Solutions, LLC, which includes the operations of our water solutions business, (iii) NGL Liquids, LLC, which includes the operations of our liquids business and (iv) NGL Propane, LLC, which includes the operations of our retail propane business.

2

Table of Contents

Recent Developments

Grand Mesa Acquisition

On November 26, 2014, NGL Crude Terminals, LLC ("NGL Crude"), a subsidiary of NGL Energy Partners LP (the "Partnership"), entered into a Membership Interest Purchase Agreement (the "Purchase Agreement") with Rimrock Midstream, LLC ("Rimrock"), its 50% joint venture partner in the ownership of Grand Mesa Pipeline, LLC ("Grand Mesa"). Pursuant to the Purchase Agreement, NGL Crude agreed to acquire from Rimrock the remaining 50% membership interest in Grand Mesa in exchange for $310.0 million in cash. The Purchase Agreement contains provisions regarding contingencies as well as customary representations and warranties, covenants and agreements. NGL Crude completed the purchase on December 1, 2014.

On December 1, 2014, NGL Energy Operating, LLC, in its capacity as borrowers' agent and a wholly-owned subsidiary of the Partnership, entered into a Facility Increase Agreement (the "Agreement") with Deutsche Bank Trust Company Americas, as administrative agent and the other financial institutions party thereto. The Agreement increases the working capital revolving commitments under the Partnership's revolving credit facility by an additional $103.0 million.

We are a limited partnership formed under the laws of the State of Delaware. Our executive offices are located at 6120 South Yale Avenue, Suite 805, Tulsa, Oklahoma 74136. Our telephone number is (918) 481-1119. We maintain a website at http://www.nglenergypartners.com. Information contained on this website, however, is not incorporated into or otherwise a part of this prospectus.

3

Table of Contents

The Exchange Offer

On October 16, 2013 we completed a private offering of the old notes. We entered into a registration rights agreement with the initial purchasers in the private offering pursuant to which we agreed to deliver to you this prospectus and to use commercially reasonable efforts to cause the registration statement of which his prospectus forms a part to be declared effective by the SEC on or before October 16, 2014.

| | |

Old Notes | | $450 million aggregate principal amount of 6.875% Senior Notes due 2021, issued pursuant to Rule 144A and Regulation S promulgated under the Securities Act. Transfer restrictions apply to the old notes. |

New Notes | | Up to $450 million aggregate principal amount of 6.875% Senior Notes due 2021. The terms of the new notes are identical to the terms of the old notes, except that the new notes will be registered under the Securities Act, and will not have restrictions on transfer, registration rights or provisions for additional interest. |

| | Except as provided below, we believe that the new notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Actprovided that: |

| | • the new notes are being acquired in the ordinary course of business, |

| | • you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate in the distribution of the new notes issued to you in the exchange offer, |

| | • you are not our affiliate, and |

| | • you are not a broker-dealer tendering old notes acquired directly from us for your account. |

| | Our belief is based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties that are not related to us. The SEC has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the SEC would make similar determinations with respect to this exchange offer. If any of these conditions are not satisfied, or if our belief is not accurate, and you transfer any new notes issued to you in the exchange offer without delivering a resale prospectus meeting the requirements of the Securities Act or without an exemption from registration of your new notes from those requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. Each broker-dealer that receives new notes for its own account in exchange for old notes, where the old notes were acquired by such broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See "Plan of Distribution." |

| | |

4

Table of Contents

| | |

Exchange Offer | | We are offering to issue freely tradable new notes in exchange for the same principal amount of old notes. The old notes may be tendered only in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. We will issue new notes in exchange for all old notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer. We will cause the exchange to be effected promptly after the expiration date of the exchange offer. |

| | The new notes will evidence the same debt as the old notes and will be issued under and entitled to the benefits of the same indenture that governs the old notes. Because we have registered the offers and sales of the new notes, the new notes will not be subject to transfer restrictions, and holders of old notes that have tendered and had their outstanding notes accepted in the exchange offer will have no further registration rights. |

Expiration Date | | The exchange offer will expire at 5:00 p.m., New York City time, on , 20 , unless we decide to extend it. |

Conditions to the Exchange Offer | | The registration rights agreement does not require us to accept old notes for exchange if the exchange offer, or the making of any exchange by a holder of the old notes, would violate any applicable law or interpretation of the staff of the Securities and Exchange Commission. The exchange offer is not conditioned on a minimum aggregate principal amount of old notes being tendered. Please read "Exchange Offer—Conditions to the Exchange Offer" for more information about the conditions to the exchange offer. |

Procedures for Tendering Old Notes | | To participate in the exchange offer, you must follow the procedures established by The Depository Trust Company, or DTC, for tendering notes held in book-entry form. These procedures for using DTC's Automated Tender Offer Program, or ATOP, require that (i) the exchange agent receive, prior to the expiration date of the exchange offer, a computer generated message known as an "agent's message" that is transmitted through ATOP, and (ii) DTC confirms that: |

| | • DTC has received your instructions to exchange your notes; and |

| | • you agree to be bound by the terms of the letter of transmittal. |

| | By transmitting an agent's message, you will represent to us that, among other things: |

| | • the new notes you receive will be acquired in the ordinary course of your business; |

| | • you are not participating, and you have no arrangement with any person or entity to participate, in the distribution of the new notes; |

5

Table of Contents

| | |

| | • you are not our "affiliate," as defined in Rule 405 under the Securities Act, or a broker-dealer tendering old notes acquired directly from us for resale pursuant to Rule 144A or any other available exemption under the Securities Act; and |

| | • if you are not a broker-dealer, that you are not engaged in and do not intend to engage in the distribution of the new notes. |

| | For more information on tendering your old notes, please refer to the section in this prospectus entitled "Exchange Offer—Terms of the Exchange Offer," "—Procedures for Tendering," and "Description of Notes—Book-Entry, Delivery and Form." |

Guaranteed Delivery Procedures | | None. |

Withdrawal of Tenders | | You may withdraw your tender of old notes at any time prior to the expiration date. To withdraw, you must submit a notice of withdrawal to the exchange agent using ATOP procedures before 5:00 p.m., New York City time, on the expiration date of the exchange offer. Please refer to the section in this prospectus entitled "Exchange Offer—Withdrawal of Tenders." |

Acceptance of Old Notes and Delivery of New Notes | | If you fulfill all conditions required for proper acceptance of old notes, we will accept any and all old notes that you properly tender in the exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any old notes that we do not accept for exchange to you without expense promptly after the expiration date and acceptance of the old notes for exchange. Please refer to the section in this prospectus entitled "Exchange Offer—Terms of the Exchange Offer." |

Fees and Expenses | | We will bear expenses related to the exchange offer. Please refer to the section in this prospectus entitled "Exchange Offer—Fees and Expenses." |

Use of Proceeds | | The issuance of the new notes will not provide us with any new proceeds. We are making this exchange offer solely to satisfy our obligations under the registration rights agreement entered into in connection with the initial issuance of the old notes. |

6

Table of Contents

| | |

Consequences of Failure to Exchange Old Notes | | If you do not exchange your old notes in this exchange offer, you will no longer be able to require us to register the old notes under the Securities Act, except in limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the old notes unless we have registered the old notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

U.S. Federal Income Tax Considerations | | The exchange of old notes for new notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read "Certain U.S. Federal Income Tax Consequences." |

Exchange Agent | | We have appointed U.S. Bank National Association as exchange agent for the exchange offer. You should direct questions and requests for assistance, as well as requests for additional copies of this prospectus or the letter of transmittal, to the exchange agent addressed as follows: U.S. Bank National Association, Corporate Trust Services, Attention: Specialized Finance Department, 111 Fillmore Ave. E., St. Paul, MN 55107. Eligible institutions may make requests by facsimile at (651) 466-7372, and may confirm facsimile delivery by calling (800) 934-6802. |

7

Table of Contents

Terms of the New Notes

The new notes will be identical to the old notes, except that the new notes are registered under the Securities Act and will not have restrictions on transfer, registration rights or provisions for additional interest. The new notes will evidence the same debt as the old notes, and the same indenture will govern the new notes and the old notes.

The following summary contains basic information about the new notes and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of the new notes, please refer to the section of this prospectus entitled "Description of Notes."

| | |

Issuers | | NGL Energy Partners LP and NGL Energy Finance Corp. |

| | NGL Energy Finance Corp., a Delaware corporation, is a 100% owned subsidiary of NGL Energy Partners LP that was organized for the sole purpose of being a co-issuer of certain of our indebtedness, including the new notes. NGL Energy Finance Corp. has no operations and no revenue other than as may be incidental to its activities as co-issuer of our indebtedness. |

Notes Offered | | $450 million aggregate principal amount of 6.875% Senior Notes due 2021. |

Maturity Date | | October 15, 2021. |

Interest | | Interest on the new notes will accrue from April 15, 2014 at a rate of 6.875% per annum (calculated using a 360-day year). |

| | Interest on the new notes is payable on April 15 and October 15 of each year. |

Ranking | | Like the old notes, the new notes will be the unsecured senior obligations of each of the Issuers. Accordingly, they will rank: |

| | • pari passu in right of payment with all existing and future unsecured senior indebtedness of each of the Issuers; |

| | • senior in right of payment to any future subordinated indebtedness of each of the Issuers; |

| | • structurally subordinated to all obligations of any of our subsidiaries; and |

| | • effectively junior in right of payment to all existing and future secured indebtedness of each of the Issuers, including indebtedness under the our revolving credit agreement (the "Credit Agreement") and our 6.65% Senior Secured Notes due 2022 (the "Existing Senior Secured Notes"), which are secured by substantially all of the assets of NGL Energy, to the extent of the value of the assets of the Issuers constituting collateral securing such indebtedness. |

| | See "Risk Factors—Risks Related to the Notes—The notes and the guarantees are unsecured and effectively subordinated to our and our subsidiary guarantors' existing and future secured indebtedness.." |

8

Table of Contents

| | |

| | As of September 30, 2014, we had $2,442.4 million of total long-term indebtedness, $1,329.5 million of which was secured indebtedness, and we had $904.3 million of remaining borrowing capacity under our Credit Agreement (net of $209.2 million of outstanding letters of credit). |

| | The guarantees will rank: |

| | • pari passu in right of payment with all existing and future unsecured senior indebtedness of each guarantor; |

| | • senior in right of payment to any future subordinated indebtedness of each guarantor; and |

| | • effectively junior in right of payment to all existing and future secured indebtedness of each guarantor, including indebtedness under the Credit Agreement and the Existing Senior Secured Notes, to the extent of the value of the assets of each guarantor constituting collateral securing such indebtedness. |

Optional Redemption | | Beginning on October 15, 2016, we may redeem some or all of the new notes at the redemption prices listed under "Description of Notes—Optional Redemption" plus accrued and unpaid interest, if any, on the notes to the date of redemption. |

| | At any time prior to October 15, 2016, we may, at our option, redeem up to 35% of the new notes with a cash amount equal to the net proceeds of certain equity offerings at a redemption price equal to 106.875% of the aggregate principal amount, plus accrued and unpaid interest, if any, to the redemption date. We may make that redemption only if, after the redemption, at least 65% of the aggregate principal amount of the new notes issued on the initial issue date remains outstanding and the redemption occurs within 180 days of the closing of the equity offering. Please see "Description of Notes—Optional Redemption." |

| | We may, from time to time prior to October 15, 2016, redeem all or a part of the new notes, at a redemption price equal to 100% of the aggregate principal amount of the new notes redeemed, plus a "make-whole" premium and accrued and unpaid interest, if any, to the redemption date. |

Change of Control | | If we experience certain kinds of changes of control, we must give holders of the new notes the opportunity to sell us their new notes at 101% of their principal amount, plus accrued and unpaid interest, if any. |

Certain Covenants | | The indenture governing the new notes contains certain covenants limiting our ability and the ability of our restricted subsidiaries to, under certain circumstances: |

| | • pay distributions on, purchase or redeem our common equity or purchase or redeem our subordinated debt; |

9

Table of Contents

| | |

| | • incur or guarantee additional indebtedness or issue preferred units; |

| | • create or incur certain liens; |

| | • enter into agreements that restrict distributions or other payments from our restricted subsidiaries to us; |

| | • consolidate, merge or transfer all or substantially all of our assets; and |

| | • engage in transactions with affiliates. |

| | These covenants are subject to important exceptions and qualifications as described in this prospectus under the caption "Description of Notes—Covenants." In addition, certain of the covenants listed above will terminate before the new notes mature if any two of the three specified rating agencies assign the new notes an investment grade rating in the future and no events of default exist under the indenture. Any covenants that cease to apply to us as a result of achieving investment grade ratings will not be restored, even if the credit ratings assigned to the new notes later fall below investment grade. |

Absence of Established Market for the New Notes | | The new notes generally will be freely transferable, but will also be new securities for which there will not initially be a market. There can be no assurance as to the development or liquidity of any market for the new notes. |

| | We do not intend to apply for a listing of the new notes on any securities exchange or for the inclusion of the new notes on any automated dealer quotation system. |

Ratio of Earnings to Fixed Charges

The following table presents the ratios of earnings to fixed charges of the Partnership for the periods indicated. For purposes of computing the ratios of earnings to fixed charges, earnings consist of income (loss) from continuing operations before income taxes plus fixed charges and loss (income) from continuing operations before income taxes attributable to noncontrolling interests. Fixed charges consists of interest expense plus loss on early extinguishment of debt and the portion of rental expense estimated to relate to interest. The portion of rental expense estimated to relate to interest represents one-third of total operating lease rental expense, which is the portion estimated to represent interest.

| | | | | | | | | | | | | | | | | | | | | | |

| | NGL Energy Partners LP | | NGL Supply, Inc. | |

|---|

| | Six

Months

Ended

September 30,

2014 | | Year

Ended

March 31,

2014 | | Year

Ended

March 31,

2013 | | Year

Ended

March 31,

2012 | | Six

Months

Ended

March 31,

2011 | | Six

Months

Ended

September 30,

2010 | | Year

Ended

March 31,

2010 | |

|---|

Ratio of earnings to fixed charges | | | | (a) | | 1.53x | | | 1.75x | | | 1.91x | | | 5.59x | | | | (b) | | 6.32x | |

- (a)

- Due to NGL Energy Partners LP's loss for the period, the ratio was less than 1:1 for the six months ended September 30, 2014. NGL Energy Partners LP would have needed to generate an additional $60.1 million of earnings to achieve a ratio of 1:1.

- (b)

- Due to NGL Supply, Inc.'s loss for the period, the ratio was less than 1:1 for the six months ended September 30, 2010. NGL Supply, Inc. would have needed to generate an additional $3.9 million of earnings to achieve a ratio of 1:1.

10

Table of Contents

RISK FACTORS

An investment in the notes is subject to numerous risks, including those listed below. You should carefully consider the following risks as well as the information provided elsewhere in this prospectus. While these are the risks and uncertainties we believe are most important for you to consider, you should know that they are not the only risks or uncertainties facing us or which may adversely affect our business. These risks could materially affect our ability to meet our obligations under the notes. You could lose all or part of your investment in and fail to achieve the expected return on the notes

Risks Related to Investing in the New Notes

Our leverage and debt service obligations may adversely affect our financial condition, results of operations and business prospects and our ability to make payments on the notes.

As of September 30, 2014, we had $2,442.4 million of total long-term indebtedness, including $1,079.5 million of debt outstanding under our Credit Agreement and approximately $250 million aggregate principal amount of our senior secured notes, and we had additional borrowing capacity of $904.3 million under our Credit Agreement (net of $209.2 million of outstanding letters of credit). Our level of indebtedness could affect our operations in several ways, including the following:

- •

- requiring us to dedicate a substantial portion of our cash flow from operations to service our existing debt, thereby reducing the cash available to finance our operations and other business activities and limiting our flexibility in planning for or reacting to changes in our business and the industry in which we operate;

- •

- increasing our vulnerability to economic downturns and adverse developments in our business;

- •

- limiting our ability to access the capital markets to raise capital on favorable terms or to obtain additional financing for working capital, capital expenditures or acquisitions or to refinance existing indebtedness;

- •

- placing restrictions on our ability to obtain additional financing, make investments, lease equipment, sell assets and engage in business combinations;

- •

- placing us at a competitive disadvantage relative to competitors with lower levels of indebtedness in relation to their overall size or less restrictive terms governing their indebtedness; and

- •

- making it more difficult for us to satisfy our obligations under the notes or other debt and increasing the risk that we may default on our debt obligations.

Our leverage could have important consequences to investors in the notes. We will require substantial cash flow to meet our principal and interest obligations with respect to the notes and our other indebtedness. Our ability to make scheduled payments, to refinance our obligations with respect to our indebtedness or our ability to obtain additional financing in the future will depend on our financial and operating performance, which, in turn, is subject to prevailing economic conditions and to financial, business and other factors. We believe that we will have sufficient cash flow from operations and available borrowings under our Credit Agreement to service our indebtedness. However, a significant downturn in our business or other development adversely affecting our cash flow could materiallyimpair our ability to service our indebtedness. If our cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to refinance all or a portion of our debt or sell assets. We cannot assure you that we would be able to refinance our existing indebtedness or sell assets on terms that are commercially reasonable.

11

Table of Contents

We have a holding company structure in which our subsidiaries conduct our operations and own our operating assets.

We are a holding company, and our operating subsidiaries conduct all of our operations and own all of our operating assets. We have no significant assets other than our interest in our operating subsidiaries. As a result, our ability to make required payments on the notes depends on the performance of our operating subsidiaries and their ability to distribute funds to us. The ability of our subsidiaries to make distributions to us may be restricted by, among other things, our Credit Agreement and the purchase agreement governing our Existing Senior Secured Notes and applicable state partnership laws and other laws and regulations. If we are unable to obtain the funds necessary to pay the principal amount at maturity of the notes, or to repurchase the notes upon the occurrence of a change of control, we may be required to adopt one or more alternatives, such as a refinancing of the notes or a sale of assets. We may not be able to refinance the notes or sell assets on acceptable terms, or at all.

Despite our current level of indebtedness, we may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial indebtedness.

We may be able to incur substantial additional indebtedness in the future, subject to certain limitations, including under our Credit Agreement and under the indenture for the notes. If new debt is added to our current debt levels, the related risks that we now face could increase. Our level of indebtedness could, for instance, prevent us from engaging in transactions that might otherwise be beneficial to us or from making desirable capital expenditures. This could put us at a competitive disadvantage relative to other less leveraged competitors that have more cash flow to devote to their operations. In addition, the incurrence of additional indebtedness could make it more difficult to satisfy our existing financial obligations, including those relating to the notes.

The notes and the guarantees are unsecured and effectively subordinated to our and our subsidiary guarantors' existing and future secured indebtedness.

The notes and the guarantees are general unsecured senior obligations ranking effectively junior in right of payment to all existing and future secured debt of ours and that of any subsidiary guarantors, including obligations under our Credit Agreement and our Existing Senior Secured Notes, to the extent of the value of the collateral securing the debt. If we or any subsidiary guarantor is declared bankrupt, becomes insolvent or is liquidated or reorganized, any secured debt of ours or of such subsidiary guarantor will be entitled to be paid in full from our assets or the assets of such subsidiary guarantor, as applicable, securing that debt before any payment may be made with respect to the notes or the affected guarantees. Holders of the notes will participate ratably with all holders of our other unsecured indebtedness that does not rank junior to the notes, including all of our other general creditors, based upon the respective amounts owed to each holder or creditor, in our remaining assets. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of the notes would likely receive less, ratably, than holders of secured indebtedness.

The notes and the guarantees are structurally subordinated to all liabilities of our non-guarantor subsidiaries.

The notes are structurally subordinated to the indebtedness and other liabilities of our subsidiaries that are not guaranteeing the notes. These non-guarantor subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the notes, or to make any funds available therefor, whether by loans, distributions or other payments. Any right that we or the subsidiary guarantors have to receive any assets of any of the non-guarantor subsidiaries upon the liquidation or reorganization of those non-guarantor subsidiaries, and the consequent rights of

12

Table of Contents

holders of notes to realize proceeds from the sale of any of those non-guarantor subsidiaries' assets, will be effectively subordinated to the claims of those non-guarantor subsidiaries' creditors, including trade creditors and holders of preferred equity interests of those non-guarantor subsidiaries. Accordingly, in the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, these non-guarantor subsidiaries will pay the holders of their debts, holders of preferred equity interests and their trade creditors before they will be able to distribute any of their assets to us. As of September 30, 2014, our non-guarantor subsidiaries (as the term "Subsidiary" is defined pursuant to the indenture governing the notes) had no material indebtedness outstanding.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under our Credit Agreement bear interest at variable rates and expose us to interest rate risk. If interest rates increase and we are unable to effectively hedge our interest rate risk, our debt service obligations on the variable rate indebtedness would increase even if the amount borrowed remained the same, and our cash available for servicing our indebtedness would decrease. A 1.0% increase in interest rates on the debt outstanding under our facility as of September 30, 2014 would have cost us approximately $10.8 million in additional annual interest expense.

We may not have the funds necessary to finance the repurchase of the notes in connection with a change of control offer required by the indenture.

Upon the occurrence of specific kinds of change of control events, the indenture governing the notes requires us to make an offer to repurchase all such notes at 101% of the principal amount thereof, plus accrued and unpaid interest (and liquidated damages, if any) to the date of repurchase. However, it is possible that we will not have sufficient funds, or the ability to raise sufficient funds, at the time of the change of control to make the required repurchase of the notes. In addition, restrictions under our Credit Agreement and the Existing Senior Secured Notes may not allow us to make such a repurchase upon a change of control. If we could not refinance our Credit Agreement or Existing Senior Secured Notes or otherwise obtain a waiver from the holders of such debt, we would be prohibited from repurchasing the notes, which would constitute an event of default under the indenture. In addition, certain important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a "Change of Control" under the indenture. Because the definition of change of control under our Credit Agreement differs from that under the indenture, there may be a change of control and resulting default under our Credit Agreement at a time when no change of control has occurred under the indenture. Please read "Description of Notes—Repurchase at the Option of Holders—Change of Control."

Holders of the notes may not be able to determine when a change of control giving rise to their right to have the notes repurchased has occurred following a sale of "substantially all" of our assets.

The definition of change of control in the indenture governing the notes includes a phrase relating to the direct or indirect sale, lease, transfer, conveyance or other disposition of "all or substantially all" of the properties or assets of the Partnership and its subsidiaries taken as a whole. Although there is a limited body of case law interpreting the phrase "substantially all," there is no precise established definition of the phrase under applicable law. Accordingly, the ability of a holder of notes to require us to repurchase its notes as a result of a sale, lease, transfer, conveyance or other disposition of less than all of the assets of the Partnership and its subsidiaries taken as a whole to another person or group may be uncertain.

13

Table of Contents

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require noteholders to return payments received from subsidiary guarantors.

Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee of the notes could be voided, or claims in respect of a guarantee could be subordinated to all other debts of that subsidiary guarantor, if, among other things, the subsidiary guarantor, at the time it incurred the debt evidenced by its guarantee:

- •

- received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee;

- •

- was insolvent or rendered insolvent by reason of such incurrence; was engaged in a business or transaction for which the subsidiary guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature.

In addition, any payment by that subsidiary guarantor pursuant to its guarantee could be voided and required to be returned to the subsidiary guarantor, or to a fund for the benefit of our creditors or the creditors of the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a subsidiary guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets;

- •

- if the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as

- •

- they become absolute and mature; or

- •

- it could not pay its debts as they become due.

On the basis of historical financial information, recent operating history and other factors, we believe that each subsidiary guarantor, after giving effect to its guarantee of the notes, will not be insolvent, will not have unreasonably small capital for the business in which it is engaged and will not have incurred debts beyond its ability to pay such debts as they mature. We cannot assure you, however, as to what standard a court would apply in making these determinations or that a court would agree with our conclusions in this regard.

If an active trading market does not develop for the new notes you may not be able to resell them.

Prior to this offering, there was no trading market for the new notes, and we cannot assure you that an active trading market will develop. If no active trading market develops, you may not be able to resell your notes at their fair market value or at all. Future trading prices of the notes will depend on many factors, including, among other things, our ability to consummate this exchange offer, prevailing interest rates, our operating results and the market for similar securities. We do not intend to apply to list the notes on any securities exchange.

14

Table of Contents

Many of the covenants contained in the indenture will terminate if the notes are rated investment grade by any two of Standard & Poor's Ratings Services, Moody's Investor Service, Inc. and Fitch Ratings, Inc. and no default has occurred and is continuing.

Many of the covenants in the indenture governing the notes will terminate if the notes are rated investment grade by any two of Standard & Poor's, Moody's, and Fitch provided that at such time no default has occurred and is continuing. The covenants restrict, among other things, our ability to pay distributions, incur debt and to enter into certain other transactions. There can be no assurance that the notes will ever be rated investment grade. However, termination of these covenants would allow us to engage in certain transactions that would not have been permitted while these covenants were in force, and the effects of any such transactions will be permitted to remain in place even if the notes are subsequently downgraded below investment grade. See "Description of Notes—Certain Covenants—Covenant Termination."

The tax treatment of publicly traded partnerships could be subject to potential legislative, judicial or administrative changes and differing interpretations, possibly on a retroactive basis.

The present U.S. federal income tax treatment of publicly traded partnerships, including us, may be modified by administrative, legislative or judicial interpretation at any time. For example, from time to time, members of the U.S. Congress propose and consider substantive changes to the existing federal income tax laws that affect certain publicly traded partnerships. We are unable to predict whether any such proposals will ultimately be enacted. However, it is possible that a change in law could affect us and may be applied retroactively. Any such changes could cause a material reduction in our anticipated cash flow, which could materially and adversely affect our ability to make payments on the notes and our other debt obligations and could cause a reduction in the value of the notes.

Risks Related to our Business

Our future financial performance and growth may be limited by our ability to successfully complete accretive acquisitions on economically acceptable terms.

Our ability to consummate acquisitions on economically acceptable terms may be limited by various factors, including, but not limited to:

- •

- increased competition for attractive acquisitions;

- •

- covenants in our Credit Agreement, the purchase agreement governing our outstanding 6.65% senior secured notes due 2022 (the "Note Purchase Agreement") and indentures governing our outstanding 6.875% senior notes due 2021 and our outstanding 5.125% Senior Notes due 2019 (the "Indentures") that limit the amount and types of indebtedness that we may incur to finance acquisitions and which may adversely affect our ability to service our debt obligations, including the notes;

- •

- lack of available cash or external capital or limitations on our ability to issue equity to pay for acquisitions; and

- •

- possible unwillingness of prospective sellers to accept our common units as consideration and the potential dilutive effect to our existing unitholders caused by an issuance of common units in an acquisition.

There can be no assurance that we will identify attractive acquisition candidates in the future, that we will be able to acquire such businesses on economically acceptable terms, that any acquisitions will not be dilutive to earnings and distributions or that any additional debt that we incur to finance an acquisition will not affect our ability to service our debt obligations, including the notes. Furthermore, if we consummate any future acquisitions, our capitalization and results of operations may change

15

Table of Contents

significantly, and investors will not have the opportunity to evaluate the economic, financial and other relevant information that we will consider in determining the application of these funds and other resources.

The propane industry is a mature industry. We anticipate only limited growth in total national demand for propane in the near future. Increased competition from alternative energy sources has limited growth in the propane industry, and year-to-year industry volumes are primarily impacted by fluctuations in weather and economic conditions. In addition, our retail propane business concentrates on sales to residential customers, but because of longstanding customer relationships that are typical in the retail residential propane industry, the inconvenience of switching tanks and suppliers, we may have difficulty in increasing our retail customer base other than through acquisitions. Therefore, while our business strategy includes expanding our existing retail propane operations through internal growth, our ability to grow within the retail propane business will depend principally on acquisitions.

We may be subject to substantial risks in connection with the integration and operation of acquired businesses, in particular those businesses with operations that are distinct and separate from our existing operations.

Any acquisitions we make in pursuit of our growth strategy are subject to potential risks, including, but not limited to:

- •

- the inability to successfully integrate the operations of recently acquired businesses;

- •

- the assumption of known or unknown liabilities, including environmental liabilities;

- •

- limitations on rights to indemnity from the seller;

- •

- mistaken assumptions about the overall costs of equity or debt or synergies;

- •

- unforeseen difficulties operating in new geographic areas or in new business segments;

- •

- the diversion of management's and employees' attention from other business concerns;

- •

- customer or key employee loss from the acquired businesses; and

- •

- a potential significant increase in our indebtedness and related interest expense.

We undertake due diligence efforts in our assessment of acquisitions, but may be unable to identify or fully plan for all issues and risks attendant to a particular acquisition. Even when an issue or risk is identified, we may be unable to obtain adequate contractual protection from the seller. The realization of any of these risks could have a material adverse effect on the success of a particular acquisition or our financial condition, results of operations or future growth.

As part of our growth strategy, we may expand our operations into businesses that differ from our existing operations. Integration of new businesses is a complex, costly and time-consuming process and may involve assets with which we have limited operating experience. Failure to timely and successfully integrate acquired businesses into our existing operations may have a material adverse effect on our business, financial condition or results of operations. In addition to the risks set forth above, new businesses will subject us to additional business and operating risks, increased interest expense related to debt we incur to make such acquisitions or an inability to successfully integrate those operations into our overall business operation. The realization of any of these risks could have a material adverse effect on our financial condition or results of operations.

16

Table of Contents

Debt we have incurred or will incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities.

Our level of debt could have important consequences to us, including the following:

- •

- our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired or such financing may not be available on favorable terms;

- •

- our funds available for operations, future business opportunities and to service our debt obligations, including the notes, will be reduced by that portion of our cash flow required to make principal and interest payments on our debt;

- •

- we may be more vulnerable to competitive pressures or a downturn in our business or the economy generally; and

- •

- our flexibility in responding to changing business and economic conditions may be limited.

Our ability to service our debt will depend on, among other things, our future financial and operating performance, which will be affected by prevailing economic and weather conditions and financial, business, regulatory and other factors, some of which are beyond our control. If our operating results are not sufficient to service our future indebtedness, we would be forced to take actions such as reducing distributions, reducing or delaying our business activities, acquisitions, investments or capital expenditures, selling assets or seeking additional equity capital. We may be unable to effect any of these actions on satisfactory terms or at all. The agreements governing our indebtedness permit us to incur additional debt under certain circumstances, and we will likely need to incur additional debt in order to implement our growth strategy. We may experience adverse consequences from increased levels of debt.

Increases in interest rates could adversely impact our unit price, our ability to issue equity or incur debt for acquisitions or other purposes, and our ability to make cash distributions at our intended levels.

Interest rates may increase in the future. As a result, interest rates on our existing and future credit facilities and debt offerings could be higher than current levels, causing our financing costs to increase accordingly. As with other yield-oriented securities, our unit price will be impacted by our level of cash distributions and implied distribution yield. The distribution yield is often used by investors to compare and rank yield-oriented securities for investment decision making purposes. Therefore, changes in interest rates, either positive or negative, may affect the yield requirements of investors who invest in our units, and a rising interest rate environment could have an adverse impact on our unit price and our ability to issue equity or incur debt for acquisitions or other purposes and to make payments on our debt obligations and cash distributions at our intended levels.

Our business depends on the availability of supply of crude oil and natural gas liquids in the United States and Canada, which is dependent on the ability and willingness of other parties to explore for and produce crude oil and natural gas. Spending on crude oil and natural gas exploration and production may be adversely affected by industry and financial market conditions that are beyond our control including, without limitation, (1) prices for crude oil, condensate, and natural gas liquids, (2) crude oil and natural gas producers having success in their operations, (3) continued commercially viable areas in which to explore and produce crude oil and natural gas, (4) the availability of liquids-rich natural gas needed to produce natural gas liquids, and (5) the availability of pipeline transportation and storage capacity.

Our business depends on domestic spending by the oil and natural gas industry, and this spending and our business have been, and may continue to be, adversely affected by industry and financial market conditions and existing or new regulations, such as those related to environmental matters, that are beyond our control.

17

Table of Contents

We depend on the ability and willingness of other entities to make operating and capital expenditures to explore for, develop, and produce oil and natural gas in the United States and Canada, and to extract natural gas liquids from natural gas as well as the availability of necessary pipeline transportation and storage capacity. Customers' expectations of lower market prices for oil and natural gas, as well as the availability of capital for operating and capital expenditures, may cause them to curtail spending, thereby reducing business opportunities and demand for our services and equipment. Actual market conditions and producers' expectations of market conditions for crude oil, condensate and natural gas liquids may also cause producers to curtail spending, thereby reducing business opportunities and demand for our services.

Industry conditions are influenced by numerous factors over which we have no control, such as the availability of commercially viable geographic areas in which to explore and produce oil and natural gas, the availability of liquids-rich natural gas needed to produce natural gas liquids, the supply of and demand for oil and natural gas, environmental restrictions on the exploration and production of oil and natural gas, such as existing and proposed regulation of hydraulic fracturing, domestic and worldwide economic conditions, political instability in oil and natural gas producing countries and merger and divestiture activity among our current or potential customers. The volatility of the oil and natural gas industry and the resulting impact on exploration and production activity could adversely impact the level of drilling activity. This reduction may cause a decline in business opportunities or the demand for our services, or adversely affect the price of our services. Reduced discovery rates of new oil and natural gas reserves in our market areas also may have a negative long-term impact on our business, even in an environment of stronger oil and natural gas prices, to the extent existing production is not replaced.

The oil and natural gas production industry tends to run in cycles and may, at any time, cycle into a downturn; if that occurs again, the rate at which it returns to former levels, if ever, will be uncertain. Prior adverse changes in the global economic environment and capital markets and declines in prices for oil and natural gas have caused many customers to reduce capital budgets for future periods and have caused decreased demand for oil and natural gas. Limitations on the availability of capital, or higher costs of capital, for financing expenditures have caused and may continue to cause customers to make additional reductions to capital budgets in the future even if commodity prices increase from current levels. These cuts in spending may curtail drilling programs and other discretionary spending, which could result in a reduction in business opportunities and demand for our services, the rates we can charge and our utilization. In addition, certain of our customers could become unable to pay their suppliers, including us. Any of these conditions or events could materially and adversely affect our operating results.

Our profitability could be negatively impacted by price and inventory risk related to our business.

The crude oil logistics, liquids, retail propane, refined products, and renewables businesses are "margin-based" businesses in which our realized margins depend on the differential of sales prices over our total supply costs. Our profitability is therefore sensitive to changes in product prices caused by changes in supply, pipeline transportation and storage capacity or other market conditions.

Generally, we attempt to maintain an inventory position that is substantially balanced between our purchases and sales, including our future delivery obligations. We attempt to obtain a certain margin for our purchases by selling our product to our customers, which include third-party consumers, other wholesalers and retailers, and others. However, market, weather or other conditions beyond our control may disrupt our expected supply of product, and we may be required to obtain supply at increased prices that cannot be passed through to our customers. In general, product supply contracts permit suppliers to charge posted prices at the time of delivery or the current prices established at major storage points, creating the potential for sudden and drastic price fluctuations. Sudden and extended wholesale price increases could reduce our margins and could, if continued over an extended period of

18

Table of Contents

time, reduce demand by encouraging retail customers to conserve or convert to alternative energy sources. Conversely, a prolonged decline in product prices could potentially result in a reduction of the borrowing base under our working capital facility, and we could be required to liquidate inventory that we have already pre-sold.

We are affected by competition from other midstream, transportation, terminaling and storage and retail marketing companies, some of which are larger and more firmly established and may have greater marketing and development budgets and capital resources than we do.

We experience competition in all of our segments. In our liquids segment, we compete for natural gas supplies and also for customers for our services. Our competitors include major integrated oil companies, interstate and intrastate pipelines and companies that gather, compress, treat, process, transport, store and market natural gas. Our natural gas liquids terminals compete with other terminaling and storage providers in the transportation and storage of natural gas liquids. Natural gas and natural gas liquids also compete with other forms of energy, including electricity, coal, fuel oil and renewable or alternative energy.

Our crude oil logistics segment faces significant competition for crude oil supplies and also for customers for our services. These operations also face competition from trucks for incremental and marginal volumes in the areas we serve. Further, our crude oil terminals compete with terminals owned by integrated petroleum companies, refining and marketing companies, independent terminal companies and distribution companies with marketing and trading operations.

Our water solutions segment is in direct and indirect competition with other businesses, including disposal and other wastewater treatment businesses.

We face strong competition in the market for the sale of retail propane. Our competitors vary from retail propane companies who are larger and have substantially greater financial resources than we do to small retail propane distributors, rural electric cooperatives and fuel oil distributors who have entered the market due to a low barrier to entry. The actions of our retail marketing competitors, including the impact of imports, could lead to lower prices or reduced margins for the products we sell, which could have an adverse effect on our business or results of operations.

Our refined products and renewables segments also face significant competition for refined products and renewables supplies and also for customers for our services.

We can make no assurances that we will be able to compete successfully in each of our lines of business. If a competitor attempts to increase market share by reducing prices, we may lose customers, which would reduce our revenues.

Our business would be adversely affected if service at our principal storage facilities or on the common carrier pipelines we use is interrupted.

We use third-party common carrier pipelines to transport crude oil and natural gas liquids and we use third-party facilities to store natural gas liquids and ethanol. Any significant interruption in the service at these storage facilities or on the common carrier pipelines we use would adversely affect our ability to obtain propane.

Our business would be adversely affected if service on the railroads we use is interrupted.

We transport crude oil, natural gas liquids, ethanol, and biodiesel by railcar. We do not own or operate the railroads on which these cars are transported. Any disruptions in the operations of these railroads could adversely impact our ability to deliver product to our customers.

19

Table of Contents

If we are unable to purchase product from our principal suppliers, our results of operations would be adversely affected.

If we are unable to purchase product from significant suppliers, our failure to obtain alternate sources of supply at competitive prices and on a timely basis would adversely affect our ability to satisfy customer demand, reduce our revenues and adversely affect our results of operations.