SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

BRANDYWINEGLOBAL – GLOBAL INCOME OPPORTUNITIES FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

Your Vote Is Important Brandywine GLOBAL A LEGG MASON COMPANY

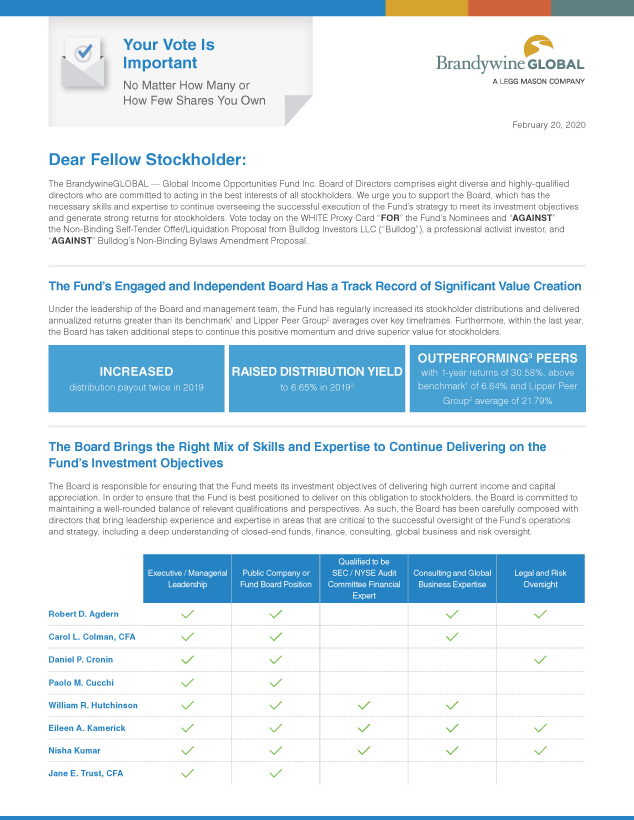

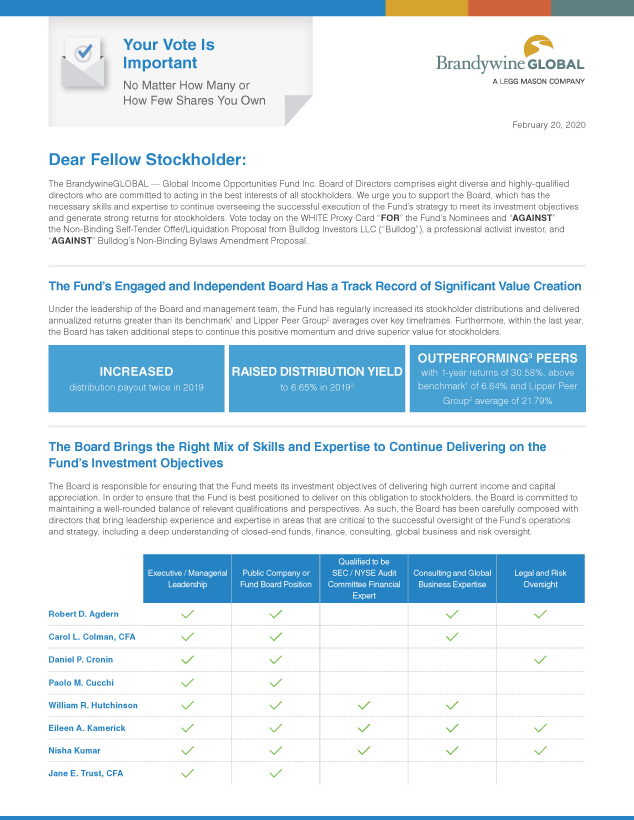

No Matter How Many or How Few Shares You Own February 20, 2020 Dear Fellow Stockholder: The BrandywineGLOBAL — Global Income Opportunities Fund Inc. Board of Directors comprises eight diverse and highly-qualified directors who are committed to acting in the best interests of all stockholders. We urge you to support the Board, which has the necessary skills and expertise to continue overseeing the successful execution of the Fund’s strategy to meet its investment objectives and generate strong returns for stockholders. Vote today on the WHITE Proxy Card “FOR” the Fund’s Nominees and “AGAINST” the Non-Binding Self-Tender Offer/Liquidation Proposal from Bulldog Investors LLC (“Bulldog”), a professional activist investor, and “AGAINST” Bulldog’s Non-Binding Bylaws Amendment Proposal. The Fund’s Engaged and Independent Board Has a Track Record of Significant Value Creation Under the leadership of the Board and management team, the Fund has regularly increased its stockholder distributions and delivered annualized returns greater than its benchmark1 and Lipper Peer Group2 averages over key timeframes. Furthermore, within the last year, the Board has taken additional steps to continue this positive momentum and drive superior value for stockholders.

OUTPERFORMING3 PEERS INCREASED RAISED DISTRIBUTION YIELD with 1-year returns of 30.58%, above distribution payout twice in 2019 to 6.65% in 20193 benchmark1 of 6.84% and Lipper Peer Group2average of 21.79% The Board Brings the Right Mix of Skills and Expertise to Continue Delivering on the Fund’s Investment Objectives The Board is responsible for ensuring that the Fund meets its investment objectives of delivering high current income and capital appreciation. In order to ensure that the Fund is best positioned to deliver on this obligation to stockholders, the Board is committed to maintaining a well-rounded balance of relevant qualifications and perspectives. As such, the Board has been carefully composed with directors that bring leadership experience and expertise in areas that are critical to the successful oversight of the Fund’s operations and strategy, including a deep understanding of closed-end funds, finance, consulting, global business and risk oversight. Qualified to be Executive / Managerial Public Company or SEC / NYSE Audit Consulting and Global Legal and Risk Leadership Fund Board Position Committee Financial Business Expertise Oversight Expert Robert D. Agdern Carol L. Colman, CFA Daniel P. Cronin Paolo M. Cucchi William R. Hutchinson Eileen A. Kamerick Nisha Kumar Jane E. Trust, CFA

Meet the Fund’s Nominees, Who are Critical to its Ongoing Success

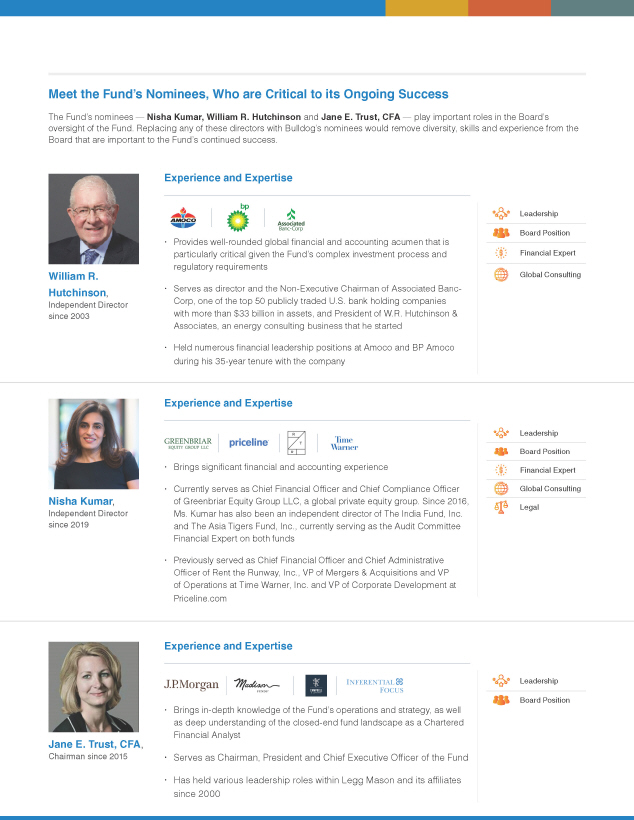

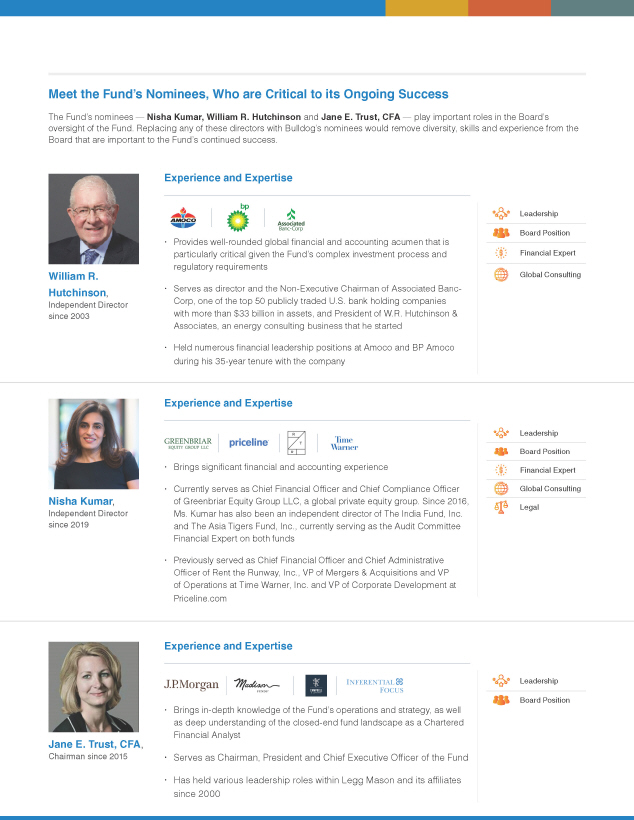

The Fund’s nominees — Nisha Kumar, William R. Hutchinson and Jane E. Trust, CFA — play important roles in the Board’s oversight of the Fund. Replacing any of these directors with Bulldog’s nominees would remove diversity, skills and experience from the Board that are important to the Fund’s continued success. Experience and Expertise William R. Hutchinson, Independent Director since 2003

Provides well-rounded global financial and accounting acumen that is particularly critical given the Fund’s complex investment process and regulatory requirements

Serves as director and the Non-Executive Chairman of Associated Banc- Corp, one of the top 50 publicly traded U.S. bank holding companies with more than $33 billion in assets, and President of W.R. Hutchinson & Associates, an energy consulting business that he started

Held numerous financial leadership positions at Amoco and BP Amoco during his 35-year tenure with the company Leadership Board Position Financial Expert Global Consulting

Nisha Kumar, Independent Director since 2019

Experience and Expertise

Brings significant financial and accounting experience

Currently serves as Chief Financial Officer and Chief Compliance Officer of Greenbriar Equity Group LLC, a global private equity group. Since 2016, Ms. Kumar has also been an independent director of The India Fund, Inc. and The Asia Tigers Fund, Inc., currently serving as the Audit Committee Financial Expert on both funds

Previously served as Chief Financial Officer and Chief Administrative Officer of Rent the Runway, Inc., VP of Mergers & Acquisitions and VP of Operations at Time Warner, Inc. and VP of Corporate Development at Priceline.com

Leadership Board Position Financial Expert Global Consulting Legal

Jane E. Trust, CFA, Chairman since 2015

Brings in-depth knowledge of the Fund’s operations and strategy, as well as deep understanding of the closed-end fund landscape as a Chartered Financial Analyst

Serves as Chairman, President and Chief Executive Officer of the Fund

Has held various leadership roles within Legg Mason and its affiliates since 2000

Leadership Board Position

Bulldog’s Nominees Would Decrease the Board’s Diversity and Not be Additive to the Board

Bulldog is a professional activist fund that has nominated representatives from within its own organization to stand for election to the Fund’s Board. Bulldog’s nominees have also each been routinely nominated by the activist fund in proxy contests with numerous other closed-end funds. If elected, Bulldog’s nominees would bring no new skills or experience that would be additive to the Fund’s Board. In fact, Bulldog’s nominees would, at a minimum, decrease the diversity of the Board and remove our current directors’ understanding of the Fund’s long-term strategy and operations, as well as other critical skills that would potentially derail the significant progress we have made under our current leadership.

The Board firmly believes that Bulldog’s nominees were selected based on their loyalty to the activist fund and willingness to implement actions, including the self-tender, which would quickly monetize the Fund’s assets to the detriment of long-term stockholders. The Board is committed to defending the Fund and all stockholders against Bulldog and its self-interested, short-term tactics.

Protect the Value of Your Investment — Vote the WHITE Proxy Card Today

The Fund’s Board has a proven track record of generating significant value and acting in the best interests of all stockholders. Conversely, Bulldog is seeking to implement initiatives intended to generate a short-term profit for themselves to the detriment of long-term holders. We believe these actions could derail the Fund’s ability to continue to enhance value for its stockholders who invest in the fund for long-term, sustainable returns.

No matter how many or how few shares you own, your vote is important. Whether you plan to attend the Annual Meeting, you have an opportunity to protect the value of your investment. We encourage you to vote FOR the Fund’s Nominees and AGAINST the Non-Binding Self-Tender Offer/Liquidation Proposal from Bulldog, and AGAINST Bulldog’s Non-Binding Bylaws Amendment Proposal on the WHITE Proxy Card today.

Thank you for your continued support.

Sincerely,

The BrandywineGLOBAL — Global Income Opportunities Fund Inc. Board of Directors

Brandywine GLOBAL A LEGG MASON COMPANY YOUR VOTE MATTERS PROTECET THE VALUE OF YOUR INVESGTMENT - VOTE THE WHITE PROXY CARD TODAY

Your Vote is Important, No Matter How Many or How Few Shares You Own

You can vote by internet, telephone or by signing and dating the WHITE Proxy Card and mailing it in the envelope provided.

If you have any questions about how to vote your shares or need additional assistance, please contact:

Innisfree M&A

Stockholders Call Toll Free: (877) 750-8197 Incorporated Banks and Brokers Call: (212) 750-5833

REMEMBER

We urge you NOT to vote using any green proxy card sent to you by Bulldog Investors, as doing so will revoke your vote on the WHITE Proxy Card.

Notes

1 The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world.

2 The Fund’s Lipper peer group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information.

3 Based on market price for the period ending December 31, 2019.

Forward Looking Statement

Past performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice.

All investments are subject to risk including the possible loss of principal. All benchmark performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in a benchmark.