Results of operations for the year ended December 31, 2010 compared to the year ended December 31, 2009

The following tables present our consolidated results of operations for the year ended December 31, 2010 as compared to the year ended December 31, 2009, broken down among our four banking subsidiaries and adjusted to reflect intercompany eliminations and our contribution as the holding company.

| | | For the year ended December 31, 2010 | |

| | | | | | | | | | | | | | | Grupo Aval and eliminations | | | | |

| | | (in Ps billions) | |

Total interest income | | | 3,345.6 | | | | 1,403.9 | | | | 1,276.2 | | | | 683.1 | | | | (166.2 | ) | | | 6,542.6 | |

Total interest expense | | | (902.1 | ) | | | (457.2 | ) | | | (325.3 | ) | | | (142.8 | ) | | | (86.4 | ) | | | (1,913.8 | ) |

Net interest income | | | 2,443.5 | | | | 946.7 | | | | 950.9 | | | | 540.3 | | | | (252.6 | ) | | | 4,628.8 | |

| Total provisions (reversals), net | | | (610.6 | ) | | | (192.3 | ) | | | (101.6 | ) | | | (122.4 | ) | | | (0.0 | ) | | | (1,026.9 | ) |

| Total fees and other services income, net | | | 1,155.1 | | | | 186.6 | | | | 136.1 | | | | 140.5 | | | | (0.6 | ) | | | 1,617.7 | |

| Total other operating income | | | 582.4 | | | | 316.7 | | | | 42.0 | | | | 9.7 | | | | (165.3 | ) | | | 785.5 | |

Total operating income | | | 3,570.3 | | | | 1,257.6 | | | | 1,027.5 | | | | 568.1 | | | | (418.5 | ) | | | 6,005.1 | |

Total operating expenses | | | (1,757.9 | ) | | | (764.4 | ) | | | (558.3 | ) | | | (389.8 | ) | | | (49.5 | ) | | | (3,520.0 | ) |

Net operating income | | | 1,812.4 | | | | 493.2 | | | | 469.2 | | | | 178.4 | | | | (468.0 | ) | | | 2,485.1 | |

| Total non-operating income (expense), net | | | 96.0 | | | | 21.4 | | | | 53.0 | | | | 16.2 | | | | (9.6 | ) | | | 176.9 | |

| Income before income tax expense and non-controlling interest | | | 1,908.3 | | | | 514.6 | | | | 522.2 | | | | 194.5 | | | | (477.6 | ) | | | 2,662.1 | |

Income tax expense | | | (510.0 | ) | | | (126.2 | ) | | | (156.8 | ) | | | (49.9 | ) | | | 11.8 | | | | (831.0 | ) |

| Income before non-controlling interest | | | 1,398.3 | | | | 388.4 | | | | 365.4 | | | | 144.7 | | | | (465.8 | ) | | | 1,831.1 | |

Non-controlling interest | | | (483.4 | ) | | | (2.0 | ) | | | (3.8 | ) | | | (0.4 | ) | | | (384.7 | ) | | | (874.2 | ) |

| Net income attributable to shareholders | | | 914.9 | | | | 386.4 | | | | 361.6 | | | | 144.3 | | | | (850.4 | ) | | | 956.9 | |

| | | For the year ended December 31, 2009 | |

| | | | | | | | | | | | | | | Grupo Aval and eliminations | | | | |

| | | (in Ps billions) | |

Total interest income | | | 3,614.1 | | | | 1,821.7 | | | | 1,453.1 | | | | 789.1 | | | | 2.1 | | | | 7,680.0 | |

Total interest expense | | | (1,297.1 | ) | | | (732.0 | ) | | | (514.2 | ) | | | (217.0 | ) | | | (93.7 | ) | | | (2,854.0 | ) |

Net interest income | | | 2,317.0 | | | | 1,089.7 | | | | 938.8 | | | | 572.1 | | | | (91.6 | ) | | | 4,826.0 | |

| Total provisions (reversals), net | | | (347.8 | ) | | | (257.3 | ) | | | (94.5 | ) | | | (188.0 | ) | | | (0.0 | ) | | | (887.6 | ) |

| Total fees and other services income, net | | | 1,075.6 | | | | 216.6 | | | | 143.2 | | | | 143.3 | | | | 4.7 | | | | 1,583.5 | |

| Total other operating income | | | 492.1 | | | | 282.0 | | | | 29.4 | | | | 4.3 | | | | (123.6 | ) | | | 684.1 | |

Total operating income | | | 3,536.9 | | | | 1,331.0 | | | | 1,017.0 | | | | 531.6 | | | | (210.5 | ) | | | 6,205.9 | |

Total operating expenses | | | (1,585.3 | ) | | | (764.7 | ) | | | (536.5 | ) | | | (377.8 | ) | | | (28.1 | ) | | | (3,292.4 | ) |

Net operating income | | | 1,951.6 | | | | 566.2 | | | | 480.4 | | | | 153.9 | | | | (238.6 | ) | | | 2,913.5 | |

| Total non-operating income (expense), net | | | 78.0 | | | | 12.8 | | | | (42.3 | ) | | | 12.6 | | | | 6.6 | | | | 67.7 | |

| Income before tax expense and non-controlling interest | | | 2,029.6 | | | | 579.0 | | | | 438.1 | | | | 166.5 | | | | (232.0 | ) | | | 2,981.2 | |

Income tax expense | | | (522.7 | ) | | | (152.0 | ) | | | (132.5 | ) | | | (55.4 | ) | | | (1.7 | ) | | | (864.3 | ) |

| Income before non-controlling interest | | | 1,506.9 | | | | 427.0 | | | | 305.6 | | | | 111.1 | | | | (233.7 | ) | | | 2,116.9 | |

Non-controlling interest | | | (551.1 | ) | | | (44.9 | ) | | | (2.1 | ) | | | (0.4 | ) | | | (453.1 | ) | | | (1,051.5 | ) |

| Net income attributable to shareholders | | | 955.8 | | | | 382.1 | | | | 303.6 | | | | 110.7 | | | | (686.8 | ) | | | 1,065.4 | |

| | | | |

| | | | |

| | | | | | | |

| | | | |

Total interest income | | | (1,137.4 | ) | | | (14.8 | ) |

Total interest expense | | | (940.2 | ) | | | (32.9 | ) |

Net interest income | | | (197.2 | ) | | | (4.1 | ) |

Total provisions (reversals), net | | | 139.3 | | | | 15.7 | |

Total fees and other services income, net | | | 34.2 | | | | 2.2 | |

Total other operating income | | | 101.5 | | | | 14.8 | |

Total operating income | | | (200.8 | ) | | | (3.2 | ) |

Total operating expenses | | | 227.6 | | | | 6.9 | |

Net operating income | | | (428.4 | ) | | | (14.7 | ) |

Total non-operating income (expense), net | | | 109.3 | | | | 161.5 | |

| Income before income tax expense and non-controlling interest | | | (319.1 | ) | | | (10.7 | ) |

Income tax expense | | | (33.3 | ) | | | (3.9 | ) |

Income before non-controlling interest | | | (285.8 | ) | | | (13.5 | ) |

Non-controlling interest | | | (177.3 | ) | | | (16.9 | ) |

Net income attributable to shareholders | | | (108.5 | ) | | | (10.2 | ) |

Grupo Aval

Overview

Our net income attributable to our shareholders in 2010 decreased by 10.2%, or Ps 108.5 billion, to Ps 956.9 billion. The primary driver of this decrease in net income was the decline in total interest income, due to the overall declining interest rate environment in Colombia, which was only partially offset by a decrease in total interest expense. Despite the improvement in credit quality, our total provisions increased as a result of the Ps 298.0 billion increase in net provisions for foreclosed assets and other assets, which was principally due to provisions established by Corficolombiana associated with the realization of income from several of its equity security investments. The slight 6.9% increase in operating expense, due principally to higher administrative and other expenses and salaries and employee benefits, was consistent with the organic growth of the business and reflects BAC Credomatic’s December 2010 expenses. As a result of these factors, our efficiency ratio (which we calculate as total operating expenses minus depreciation and amortization, divided by total operating income plus net provisions) deteriorated from 42.9% in 2009 to 46.6% in 2010.

The following discussion describes the principal drivers of our consolidated results of operations for 2010 and 2009. Further detail is provided in the discussions of the results of operations of each of our banking subsidiaries, Porvenir and Corficolombiana.

Net interest income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

| Interest income: | | | | | | | | | | | | | |

Interest on loans | | | 4,627.3 | | | | 5,418.5 | | | | (791.2 | ) | | | (14.6 | ) |

Interest on investment securities | | | 1,452.7 | | | | 1,676.9 | | | | (224.3 | ) | | | (13.4 | ) |

Interbank and overnight funds | | | 99.0 | | | | 148.9 | | | | (49.9 | ) | | | (33.5 | ) |

Financial leases | | | 363.6 | | | | 435.7 | | | | (72.1 | ) | | | (16.5 | ) |

Total interest income | | | 6,542.6 | | | | 7,680.0 | | | | (1,137.4 | ) | | | (14.8 | ) |

| Interest expense: | | | | | | | | | | | | | | | | |

Checking accounts | | | (29.5 | ) | | | (53.2 | ) | | | (23.7 | ) | | | (44.5 | ) |

Time deposits | | | (679.1 | ) | | | (1,219.0 | ) | | | (539.9 | ) | | | (44.3 | ) |

Savings deposits | | | (640.8 | ) | | | (925.3 | ) | | | (284.5 | ) | | | (30.7 | ) |

Total interest expense on deposits | | | (1,349.4 | ) | | | (2,197.5 | ) | | | (848.1 | ) | | | (38.6 | ) |

Borrowings from banks and others | | | (177.0 | ) | | | (291.5 | ) | | | (114.5 | ) | | | (39.3 | ) |

| Interbank and overnight funds (expenses) | | | (109.3 | ) | | | (111.7 | ) | | | (2.4 | ) | | | (2.1 | ) |

Long-term debt (bonds) | | | (278.1 | ) | | | (253.4 | ) | | | 24.7 | | | | 9.8 | |

Total interest expense | | | (1,913.8 | ) | | | (2,854.0 | ) | | | (940.2 | ) | | | (32.9 | ) |

Net interest income | | | 4,628.8 | | | | 4,826.0 | | | | (197.2 | ) | | | (4.1 | ) |

Our net interest income decreased by 4.1% to Ps 4,628.8 billion in 2010, primarily due to a Ps 863.3 billion decrease in interest income on loans and financial leases and a Ps 224.3 billion decline in interest income on investment securities, partially offset by a Ps 940.2 billion decrease in total interest expense.

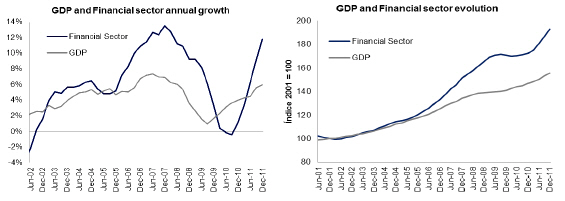

Average interest-earning assets grew slightly faster than average interest-bearing liabilities, which resulted in the ratio of average interest-earning assets to average interest-bearing liabilities increasing from 1.16 in 2009 to 1.18 in 2010. The increase in this ratio reflects the 16.7% growth of our average interest-earning assets from Ps 54,841.2 billion in 2009 to Ps 63,978.9 billion in 2010. However, the spread between the yield earned on our interest-earning assets and the interest rate paid on our interest-bearing liabilities decreased by 126 basis points, from 8.0% in 2009 to 6.7% in 2010, which was primarily a result of the decrease in yield from our loans and financial leases. The spread between the yield earned on loans and financial leases and the cost of interest-bearing liabilities decreased by 102 basis points from 8.8% in 2009 to 7.8% in 2010, because our loans and financial leases, especially our commercial loans, repriced faster than our liabilities in a declining interest rate environment. The deterioration of the spread between interest-earning assets and interest-bearing liabilities also resulted from a decrease in the yield of our investment securities portfolio, due primarily to the fact that while 2010 presented a favorable environment for fixed income securities, 2009 was even more favorable and the same results were not repeated. The decrease in income from the compression of the spread between the yield earned on our interest-earning assets and the interest rate paid on our interest-bearing liabilities was only partially offset by the increase in income resulting from the slight growth in the ratio of average interest-earning assets to average interest-bearing liabilities, and as a result, our net interest income decreased in 2010. Ultimately, our net interest margin declined from 8.8% in 2009 to 7.2% in 2010.

The primary driver of the decrease in net interest income was a Ps 863.3 billion, or 14.7%, decrease in interest income from loans and financial leases, primarily due to a decline in average yield, partly offset by an increase in average balances. Average yields for loans and financial leases decreased from 14.9% in 2009 to 11.3% in 2010. This reduction in yield was consistent with the 265 basis point decline in the average DTF rate (from a weekly average of 6.33% for 2009 to a weekly average of 3.68% for 2010, representing a 41.9% decrease). The DTF rate is the 90-day time deposit benchmark interest rate in Colombia and the rate most commonly used by banks to index the majority of their domestic interest-earning assets (excluding investment securities) and their deposits. However, our subsidiary banks’ results in 2010 indicate that the decrease in yield from loans and financial leases was not uniform across all loan types, with the percentage decrease in the yield from commercial loans being considerably higher than that for consumer loans. While commercial loans and interest-bearing liabilities are predominantly indexed to the DTF, consumer loans are usually indexed to industry averages and are set at rates close to the Tasa Usura (the legal limit for all loans other than microcredit loans). For 2010, the average Tasa Usura was approximately 22.7%,

compared to an average Tasa Usura of approximately 28.8% for 2009, which represented a 21.0% decrease in the average Tasa Usura for 2010 as compared to 2009. This decrease was less than the decrease in commercial loan yield, which much more closely resembled the 41.9% decrease in the average weekly DTF rate. This rate dynamic is typically observed, as movements in the Tasa Usura tend to exhibit a lag and the rate is initially less sensitive to increases / decreases in general interest rates. The decline of the average interest rate on loans and financial leases generated a Ps 1,341.3 billion decrease in interest income on a period-over-period basis. This decrease was partially offset by the 11.7% growth of the average balance of our loan and financial lease portfolio to Ps 43,977.1 billion, primarily due to the growth of commercial loans, and was responsible for producing a Ps 477.9 billion increase in interest income. See “Item 4. Information on the Company—B. Business overview—Selected statistical data.”

A Ps 224.3 billion decrease in interest income from investment securities also contributed to the decline in net interest income. Under Colombian Banking GAAP, interest income from investment securities includes accrued interest on debt instruments, valuation adjustments and gains (losses) realized on debt and equity securities that are accounted for as “available for sale,” gains (losses) on repurchase transactions (i.e., repos), gains (losses) realized on the sale of debt securities, and mark-to-market gains (losses) on the trading securities portfolio.

Our fixed income portfolio, which yielded Ps 946.0 billion of income in 2010, accounted for 65.1% of our earnings on investment securities for the year. These fixed income earnings were 17.5%, or Ps 200.3 billion, less than the fixed income earnings generated in 2009, reflecting the fact that in 2009 interest rates declined significantly and at a steady pace, while in 2010 interest rates were more volatile and ultimately declined less. However, it is important to note that fixed income earnings in 2010 were nonetheless 23.6% higher than in 2008, illustrating that 2010 presented a favorable environment for fixed income securities, but that 2009 was even better. During 2009, the interest rate on the Colombian Treasury Bond due in 2020, a benchmark for tracking the movement of fixed income rates, decreased by 216 basis points and closed December 31, 2009 at 8.47%. On the other hand, in 2010, the same benchmark index decreased by 85 basis points to 7.70%. Moreover, in January and February of 2010, this benchmark rate increased 61 basis points — at one point reaching 9.16%. This increase in rates proved particularly deleterious for Banco de Occidente, as 53.8% of its fixed income security investments were classified as “for trading” (compared to 29.8%, 12.4%, and 32.1% for Banco de Bogotá, Banco Popular and Banco AV Villas, respectively) at December 31, 2009 and thus the corresponding mark-to-market losses flowed to its income statement and reduced its income from investment securities. Following this increase in rates, a significant portion of each bank’s fixed income investments was reclassified as available for sale, as evidenced by the fact that at December 31, 2010 the percent of fixed income securities classified as “for trading” at each bank was 16.2%, 32.8%, 12.7%, and 42.0% for Banco de Bogotá, Banco de Occidente, Banco Popular and Banco AV Villas, respectively. While this risk management action sought to provide greater insulation for the banks in case of a further increase in rates, it also resulted in less income being generated for the remainder of 2010 when rates once again began to decline.

The income yielded by our equity securities portfolio in 2010 also decreased, but only by 4.6% to Ps 506.3 billion. This represented 34.9% of our income from investment securities in 2010. Income from the equity securities portfolio was almost entirely driven by Banco de Bogotá and, more specifically, Corficolombiana. As further explained in the Corficolombiana 2010-2009 discussion, this decrease primarily reflected the fact that the income realized by Corficolombiana related to the appreciation of its investments was lower in 2010 as compared to 2009.

The decrease in total interest expense partially offset the decrease in total interest income, reflecting a 250 basis point decrease in the average interest rate paid on interest-bearing liabilities from 6.0% in 2009 to 3.5% in 2010. The reduction in funding costs was consistent with the aforementioned decrease in the average DTF rate. The decrease in interest expense was primarily due to the 298 basis point decline in the average interest rate paid on time deposits, from 7.2% in 2009 to 4.3% in 2010, and the 189 basis point decline in average interest rate on savings deposits, from 4.6% in 2009 to 2.7% in 2010. The decline in interest rates paid on interest-bearing liabilities resulted in a Ps 1,147.4 billion decrease in interest expense.

The decline in funding costs was partially offset by the 14.4% increase in the average balance of interest-bearing liabilities to Ps 54,015.2 billion. This growth was primarily a result of the 17.1% increase in the average balance of savings deposits to Ps 23,362.1 billion, the 63.5% increase in the average balance of long-term debt to Ps 4,358.2 billion, and the 64.9% increase in the average balance of interbank and overnight funds to Ps 3,920.4 billion.

Only time deposits saw their average balance decrease, by 5.2% to Ps 15,970.4. The increase in the average balances of savings deposits, long-term debt, and interbank and overnight funds, as well as the decrease in the average balance of time deposits, was primarily the result of our banks searching for cheaper sources of funding in 2010. The overall increase in the average balance of interest-bearing liabilities was responsible for generating a Ps 207.1 billion increase in interest expense in 2010.

Provisions

Our total net provisions increased by 15.7% to Ps 1,026.9 billion in 2010. This increase was mainly attributable to the Ps 298.0 billion increase in net provisions for foreclosed assets and other assets to Ps 315.6 billion. The primary reason for this increase was a cautionary Ps 245.1 billion market risk provision established by Corficolombiana in December, after discussion with the Superintendency of Finance, in order to cover risks associated with potential future fluctuations of the share prices of its equity investments. Additionally, Corficolombiana established a Ps 69.8 billion net provision for foreclosed assets and other assets, with the permission of the Superintendency of Finance, related to the realization of income stemming from its investment in Sociedad de Inversiones en Energía S.A. (SIE) (further explained in the Corficolombiana 2010-2009 discussion).

Despite the increase in net provisions, our net provisions for loan and financial lease losses, accrued interest and other receivables decreased by 13.9% to Ps 820.3 billion. The main component of this line item, net provisions for loans and financial leases, decreased by 6.9% to Ps 764.5 billion (including BAC Credomatic financial data, which added Ps 0.7 billion in net provisions for loan and financial lease losses). The largest decrease in net provisions for loan and financial lease losses was recorded by Banco AV Villas, where provisions declined by Ps 58.7 billion or 28.8%. By contrast, Banco Popular’s net provisions for loan and financial lease losses increased by Ps 34.3 billion to Ps 128.6 billion due primarily to the deterioration of the credit quality of certain loans throughout the fourth quarter that were ultimately charged-off (further explained in the Banco Popular 2010-2009 discussion).

The decrease in provisions for loan and financial lease losses reflected the improvement in the quality of our loan and financial lease portfolio, which was consistent with the recovery of the Colombian economy. According to DANE, in 2010 Colombia’s real GDP grew 4.3%, as compared to 1.5% in 2009.

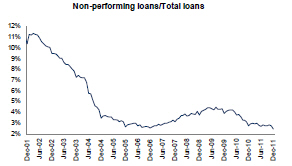

Past due loans and financial leases rose by 3.9% to Ps 1,569.7 billion at December 31, 2010; however, this increase was due to the BAC Credomatic acquisition, as our Colombian operations’ past due loans and financial leases decreased by 16.9% to Ps 1,255.8 billion at December 31, 2010. Our delinquency ratio (calculated as the ratio of loans and financial leases at least 31 days past due to total gross loans and financial leases) decreased from 3.6% at December 31, 2009 to 2.7% at December 31, 2010. Our delinquency ratio for our Colombian operations at December 31, 2010 was 2.6%. The decrease in past due loans and financial leases in our Colombian operations, by volume, was concentrated primarily in commercial loans past due, which decreased by 19.5% to Ps 538.7 billion (with its delinquency ratio declining from 2.6% to 1.7%) and consumer loans past due, which decreased by 10.8% to Ps 502.9 billion (with its delinquency ratio declining from 4.9% to 3.9%). Financial leases past due also decreased significantly, declining by 25.2% to Ps 117.8 billion (with its delinquency ratio declining from 4.9% to 3.3%). Incorporating the impact of BAC, our delinquency ratios for commercial, consumer, and financial leases at December 31, 2010 were 1.8%, 4.0%, and 3.2%, respectively.

At the subsidiary level, Banco Popular had the lowest delinquency ratio (2.5% at December 31, 2010, as compared to 3.7% at December 31, 2009), while Banco AV Villas continued to have the highest delinquency ratio (4.5% at December 31, 2010, as compared to 5.5% at December 31, 2009). The delinquency ratio at Banco AV Villas reflects its exposure to mortgage and traditional consumer loans, which generally have higher delinquency ratios. At December 31, 2010, 13.2% of Banco AV Villas’ total gross loans were mortgage loans (compared to 0.2%, 0.1%, and 1.2% at Banco de Bogotá excluding the effect of the BAC Credomatic acquisition, Banco de Occidente, and Banco Popular, respectively, at December 31, 2010), while 44.2% of its total gross loans were consumer loans (compared to 16.9% and 19.3% at Banco de Bogotá excluding the effect of the impact of BAC and Banco de Occidente acquisition, respectively. Banco de Bogotá with BAC holds 9.4% of its total gross loans as mortgage loans and 23.0% of its total gross loans as consumer loans. Although Banco Popular has a higher proportion of consumer loans, 99.7% of these loans are payroll loans (compared to an equivalent figure of approximately 40.0% for Banco AV Villas), which are of a much higher credit quality than traditional consumer loans.

Provisions for loans and financial lease losses decreased slightly less than past due loans and financial leases primarily as a result of an increase in charge-offs, for which we record provisions of 100% before they are charged-off. For further information, see “Item 4. Information on the Company—B. Business overview—Selected statistical data—Movements in allowances for credit losses—Charge-offs.” In 2010, charge-offs increased by 21.4% to Ps 677.6 billion (including BAC Credomatic’s impact, which contributed Ps 17.5 billion in charge-offs). As a result of the increase in charge-offs, which was due to the write-off of several loans by our subsidiary banks’ primarily related to the fact that with the recovery of the economy it became clear certain loans were going to be unrecoverable (for further detail refer to our subsidiary banks’ 2010 – 2009 discussions), our charge-off to average loan ratio increased by 14 basis points to 1.50%. In our Colombian operations, our charge-offs increased by 18.2%, while our charge-off to average loan ratio increased by 13 basis points to 1.49%.

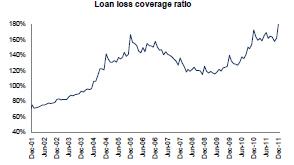

The higher level of our net provisions for loan and financial lease losses relative to our charge-offs resulted in the 16.1% growth of our allowance for loan and financial lease losses to Ps 2,183.9 billion at December 31, 2010. For our Colombian operations, our allowance increased by 5.1% to Ps 1,977.6 billion. The growth of our allowance for loan and financial lease losses, combined with the slight increase in our past due loans due to the BAC Credomatic acquisition, resulted in an increase in our coverage ratio (defined as our allowance for loan and financial lease losses to loans at least 31 days past due) from 124.5% at December 31, 2009 to 139.1% at December 31, 2010. The coverage ratio for our Colombian operations was 157.5% at December 31, 2010. The lower coverage ratio incorporating the impact of BAC is due to the fact that proportionately BAC contributed more in past due loans than in allowance, which was expected considering 30.3% of BAC’s gross loan portfolio was concentrated in mortgage loans (which require less allowance than other types of loans).

Net provisions for accrued interest and other receivables decreased by 57.6% to Ps 55.9 billion in 2010, which was primarily a result of the improvement in the Colombian economy described above and a change in provisioning requirements mandated by the Superintendency of Finance in 2009. Prior to June 30, 2009, when any of our institutions suspended the accrual of interest on interest-earning assets, the interest accrued up to that time was provisioned for based on the ratio calculated by the commercial and consumer reference models. See “Item 11. Quantitative and Qualitative Disclosures About Risk——Risk management—Credit risk.” Effective as of July 1, 2009, the Superintendency of Finance required that financial institutions provision 100% of such accrued interest, which resulted in considerably higher provisioning for these accounts in the remainder of 2009. Following the initial increase in provisions to 100% of accrued interest and other receivables in 2009, our institutions were required to increase or decrease provisions based on marginal changes, and thus, the provision expense in 2010 decreased as compared to the provision expense for in 2009.

The recovery of charged-off assets increased by Ps 25.7 billion to Ps 109.0 billion, primarily as a result of higher charge-offs and a more effective recovery effort.

Total fees and other services income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

| Fees and other services income: | | | | | | | | | | | | | |

| Commissions from banking services | | | 916.0 | | | | 866.0 | | | | 50.0 | | | | 5.8 | |

Branch network services | | | 22.2 | | | | 19.5 | | | | 2.6 | | | | 13.5 | |

Credit card merchant fees | | | 165.6 | | | | 97.8 | | | | 67.8 | | | | 69.4 | |

Checking fees | | | 69.5 | | | | 70.7 | | | | (1.1 | ) | | | (1.6 | ) |

Warehouse services | | | 147.5 | | | | 149.7 | | | | (2.2 | ) | | | (1.5 | ) |

Fiduciary activities | | | 146.9 | | | | 137.6 | | | | 9.2 | | | | 6.7 | |

Pension plan administration | | | 409.9 | | | | 400.2 | | | | 9.7 | | | | 2.4 | |

Other | | | 103.3 | | | | 119.8 | | | | (16.5 | ) | | | (13.8 | ) |

| Total fees and other services income | | | 1,980.9 | | | | 1,861.3 | | | | 119.6 | | | | 6.4 | |

Fees and other services expenses | | | (363.1 | ) | | | (277.8 | ) | | | 85.3 | | | | 30.7 | |

| Total fees and other services income, net | | | 1,617.7 | | | | 1,583.5 | | | | 34.2 | | | | 2.2 | |

Total fees and other services income, net increased by 2.2% to Ps 1,617.7 billion in 2010. Gross total fees and other services income increased by Ps 119.6 billion to Ps 1,980.9 billion, while fees and other services expenses increased by Ps 85.3 billion to Ps 363.1 billion. As explained in more detail in the Banco de Occidente 2010-2009 discussion below, one of the main reasons for the increase in both credit card merchant fees and fee expenses was due to a reclassification of certain accounts stemming from the fact that Banco de Occidente previously recorded credit card merchant fees net of expenses. A second reclassification, which is further explained in the Banco AV Villas 2010-2009 discussion, is an important reason for the increase in commissions from banking services and the decrease in “Other.”

These reclassifications aside, the acquisition of BAC Credomatic, and the 30 days of its income consolidated in our 2010 results, explains a number of these increases. BAC Credomatic is particularly strong in the generation of fee income, contributing: approximately Ps 37.9 billion in commissions from banking services, Ps 18.6 billion in credit card merchant fees, and Ps 5.7 billion in “Other” fees, while adding approximately Ps 7.2 billion in fee expense.

Furthermore, fiduciary activity fees increased by 6.7% to Ps 146.9 billion, principally due to higher returns generated by Banco de Bogotá and Banco de Occidente’s fiduciary subsidiaries, while pension plan administration fees increased by 2.4% to Ps 409.9 billion due to higher fees contributed by Porvenir.

Other operating income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Foreign exchange gains (losses), net | | | 49.5 | | | | (141.5 | ) | | | 191.0 | | | | 135.0 | |

Gains on derivative operations, net | | | 92.9 | | | | 287.5 | | | | (194.6 | ) | | | (67.7 | ) |

| Gains on sales of investments in equity securities, net | | | 87.5 | | | | 4.0 | | | | 83.4 | | | | 2066.9 | |

| Income from non-financial sector, net (1) | | | 294.8 | | | | 231.2 | | | | 63.6 | | | | 27.5 | |

Dividend income | | | 43.5 | | | | 68.9 | | | | (25.4 | ) | | | (36.9 | ) |

Other | | | 217.4 | | | | 233.9 | | | | (16.5 | ) | | | (7.1 | ) |

Total other operating income | | | 785.5 | | | | 684.1 | | | | 101.5 | | | | 14.8 | |

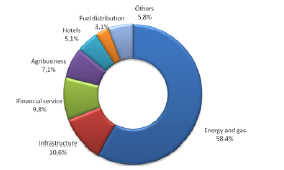

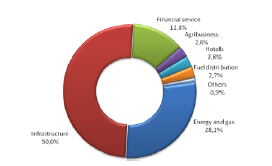

| (1) | Income from non-financial sector reflects Corficolombiana’s (Banco de Bogotá’s subsidiary) operating results in its consolidated investments in companies not related to the financial sector such as Epiandes, Hoteles Estelar and Organización Pajonales, among others. This result is net of the following operating and administrative expenses for 2010 and 2009: Ps 644.3 billion and Ps 549.2 billion, respectively. For a description of these investments, see “Item 4. Information on the Company—Business overview—Corficolombiana—Equity investment portfolio.” |

Total other operating income increased by 14.8% to Ps 785.5 billion in 2010, primarily due to a Ps 83.4 billion increase in net gains on sales of investments in equity securities. This was principally due to Corficolombiana’s sale of a portion of its stake in Banco de Occidente in October and December 2010 and its entire position in Colombina S.A. (further explained in the Corficolombiana 2010-2009 discussion). The second major driver in the increase in other operating income was 27.5% increase in net income from the non-financial sector to Ps 294.8 billion, which was due almost entirely to greater income generated by Corficolombiana’s investments in the non-financial sector (further explained in the Corficolombiana 2010-2009 discussion).

Partially offsetting these increases in income was a 36.9% decrease in dividend income to Ps 43.5 billion, principally reflecting an accounting convention regarding how dividend income for certain of Corficolombiana’s unconsolidated investments is recorded (see Corficolombiana 2010 – 2009 discussion for further information). The 7.1% decrease in “Other” income to Ps 217.4 billion is primarily attributable to the decrease in income generated by a few of Fidubogotá’s, Banco de Bogotá’s fiduciary subsidiary, jointly-managed fiduciary contracts (further

explained in the Banco de Bogotá 2010-2009 discussion). Finally, the Ps 194.6 billion decrease in net gains on derivative operations was almost entirely offset by the Ps 191.0 billion increase in related net foreign exchange gains. In the ordinary course of business, we enter into forward contracts and other derivative transactions in foreign currency through our treasury department almost entirely for hedging purposes and on behalf of clients.

Operating expenses

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Salaries and employee benefits | | | (1,262.4 | ) | | | (1,183.9 | ) | | | 78.5 | | | | 6.6 | |

Bonus plan payments | | | (45.1 | ) | | | (42.5 | ) | | | 2.6 | | | | 6.2 | |

Termination payments | | | (11.6 | ) | | | (7.2 | ) | | | 4.4 | | | | 61.5 | |

Administrative and other expenses | | | (1,817.1 | ) | | | (1,675.3 | ) | | | 141.8 | | | | 8.5 | |

Deposit security, net | | | (133.1 | ) | | | (126.8 | ) | | | 6.3 | | | | 5.0 | |

Charitable and other donation expenses | | | (7.2 | ) | | | (8.1 | ) | | | (0.9 | ) | | | (11.1 | ) |

Depreciation | | | (214.8 | ) | | | (205.2 | ) | | | 9.6 | | | | 4.7 | |

Goodwill amortization | | | (28.6 | ) | | | (43.5 | ) | | | (14.9 | ) | | | (34.2 | ) |

Total operating expenses | | | (3,520.0 | ) | | | (3,292.4 | ) | | | 227.6 | | | | 6.9 | |

Total operating expenses increased by 6.9% to Ps 3,520.0 billion in 2010. This increase was primarily due to an 8.5% rise in administrative and other expenses to Ps 1,817.1 billion and a 6.6% increase in salaries and employee benefits to Ps 1,262.4 billion, which were in line with the organic growth of the business and reflect the addition of BAC Credomatic’s December expenses. Salaries customarily are increased on a yearly basis using the previous year’s Consumer Price Index, or “CPI,” which was 2.0% in 2009, as a benchmark. Total headcount increased from 36,976 at December 31, 2009 to 53,485 at December 31, 2010, which includes the addition of 15,775 employees from BAC Credomatic. Our headcount in our Colombian operations increased 2.0% to 37,710. at December 31, 2010.

Because our total operating expenses before depreciation and amortization grew at 7.6%, while our operating income before provisions decreased by 0.9%, our efficiency ratio slightly deteriorated in 2010 as compared to 2009, rising from 42.9% in 2009 to 46.6% in 2010. Despite this increase, our efficiency ratio remains one of the best in the financial industry in Colombia.

Non-operating income (expense)

Total net non-operating income (expense) for 2010 was Ps 176.9 billion, which represents a Ps 109.3 billion increase from total net non-operating income of Ps 67.7 billion in 2009. Total non-operating income decreased marginally, by 0.8% to Ps 364.6 billion, while total non-operating expense decreased by 37.4% to Ps 187.6 billion between 2009 and 2010. The decrease in total non-operating expense is primarily explained by a decline in this line item for Banco de Bogotá and Banco Popular (further explained in the Banco de Bogotá and Banco Popular 2010-2009 discussions). The rise in non-operating income was primarily due to an increase at Banco Popular, due to the reversal of a portion of their provisions for employee pension plans and the recovery of charged-off loans from the Fondo Nacional de Garantías (further explained in the Banco Popular 2010-2009 discussion).

Income tax expense

Income before income tax expense and non-controlling interest decreased 10.7% from Ps 2,981.2 billion in 2009 to Ps 2,662.1 billion in 2010. Despite a slight increase in our effective tax rate, from 29.0% in 2009 to 31.2% in 2010, our income tax expense decreased by 3.9% to Ps 831.0 billion in 2010, reflecting the lower income before tax expense and non-controlling interest in 2010.

Non-controlling interest

Our non-controlling interest decreased by 16.9% to Ps 874.2 billion in 2010. This decrease was primarily due to the performance of Corficolombiana, of which our banking subsidiaries own 56.4% (funds managed by Porvenir own an additional 3.3% of Corficolombiana, which are not consolidated into Porvenir or us). In 2009, Corficolombiana represented a greater percentage of our consolidated net income before non-controlling interest as compared to our consolidated net income before non-controlling interest in 2010.

Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010

Banco de Bogotá

Overview

Banco de Bogotá’s net income attributable to its shareholders in the year ended December 31, 2011 increased by 25.2%, or Ps 230.8 billion, to Ps 1,145.7 billion. Banco de Bogota’s operations excluding LB Panama contributed Ps 814.7 billion and LB Panama’s operation contributed Ps 331.0 billion.

Net income from Banco de Bogotá’s operations excluding LB Panama decreased by 5.5%, or Ps 47.2 billion, in the year ended December 31, 2011. The primary reasons for this decrease were a decrease in income from investment securities, an increase in interest expense and an increase in operating expenses only partially offset by higher income from loans and financial leases, lower net provisions (indicating a recovery) and higher net fee income.

The following discussion describes the principal drivers of Banco de Bogotá’s consolidated results of operations for the years ended December 31, 2011 and 2010. Further detail is provided in the discussion of the results of operations of LB Panama, Porvenir and Corficolombiana.

Banco de Bogotá’s results of operations in 2011 include 12 months of BAC Credomatic operations whereas the 2010 results include only one month of BAC Credomatic operations. In order to provide a meaningful comparison, we present in the following tables information that shows “Banco de Bogota’s consolidated”, “Banco de Bogotá consolidated excluding LB Panama” and “ LB Panama’s” results. “Banco de Bogotá consolidated excluding LB Panama” is the result of subtracting “LB Panama” results from “Banco de Bogotá consolidated” results.

| | | Banco de Bogotá consolidated | |

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Total interest income | | | 4,395.9 | | | | 3,345.6 | | | | 1,050.3 | | | | 31.4 | |

Total interest expense | | | (1,459.2 | ) | | | (902.1 | ) | | | 557.1 | | | | 61.8 | |

Net interest income | | | 2,936.7 | | | | 2,443.5 | | | | 493.2 | | | | 20.2 | |

Total provisions (reversals), net | | | (139.0 | ) | | | (610.6 | ) | | | (471.6 | ) | | | (77.2 | ) |

Total fees and other services income, net | | | 1,756.8 | | | | 1,155.1 | | | | 601.7 | | | | 52.1 | |

Total other operating income | | | 758.1 | | | | 582.4 | | | | 175.8 | | | | 30.2 | |

Total operating income | | | 5,312.6 | | | | 3,570.3 | | | | 1,742.3 | | | | 48.8 | |

Total operating expenses | | | (2,968.0 | ) | | | (1,757.9 | ) | | | 1,210.0 | | | | 68.8 | |

Net operating income | | | 2,344.6 | | | | 1,812.4 | | | | 532.2 | | | | 29.4 | |

Total non-operating income (expense), net | | | 68.5 | | | | 96.0 | | | | (27.5 | ) | | | (28.6 | ) |

| Income before income tax expense and non-controlling interest | | | 2,413.1 | | | | 1,908.3 | | | | 504.8 | | | | 26.5 | |

Income tax expense | | | (737.2 | ) | | | (510.0 | ) | | | 227.2 | | | | 44.5 | |

Income before non-controlling interest | | | 1,675.9 | | | | 1,398.3 | | | | 277.6 | | | | 19.8 | |

Non-controlling interest | | | (530.2 | ) | | | (483.4 | ) | | | 46.8 | | | | 9.7 | |

Net income attributable to shareholders | | | 1,145.7 | | | | 914.9 | | | | 230.8 | | | | 25.2 | |

| | | Banco de Bogotá excl. LB Panama | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | # | | | | | | | 2011 | | | | 2010 | | | | # | |

| | | (in Ps billions) | | | | | | (in Ps billions) | |

Total interest income | | | 2,981.0 | | | | 3,226.6 | | | | (245.7 | ) | | | (7.6 | ) | | | 1,415.0 | | | | 119.0 | | | | 1,296.0 | |

Total interest expense | | | (1,124.1 | ) | | | (873.2 | ) | | | 250.9 | | | | 28.7 | | | | (335.1 | ) | | | (29.0 | ) | | | 306.2 | |

Net interest income | | | 1,856.9 | | | | 2,353.5 | | | | (496.6 | ) | | | (21.1 | ) | | | 1,079.8 | | | | 90.0 | | | | 989.8 | |

| Total provisions (reversals), net | | | 26.0 | | | | (608.3 | ) | | | (634.3 | ) | | | (104.3 | ) | | | (165.0 | ) | | | (2.3 | ) | | | 162.7 | |

| Total fees and other services income, net | | | 1,157.4 | | | | 1,100.0 | | | | 57.4 | | | | 5.2 | | | | 599.3 | | | | 55.1 | | | | 544.3 | |

| Total other operating income | | | 661.7 | | | | 565.1 | | | | 96.6 | | | | 17.1 | | | | 96.5 | | | | 17.3 | | | | 79.2 | |

Total operating income | | | 3,701.9 | | | | 3,410.2 | | | | 291.8 | | | | 8.6 | | | | 1,610.6 | | | | 160.1 | | | | 1,450.5 | |

Total operating expenses | | | (1,833.4 | ) | | | (1,643.9 | ) | | | 189.5 | | | | 11.5 | | | | (1,134.5 | ) | | | (114.0 | ) | | | 1,020.5 | |

Net operating income | | | 1,868.5 | | | | 1,766.3 | | | | 102.2 | | | | 5.8 | | | | 476.1 | | | | 46.1 | | | | 430.0 | |

| Total non-operating income (expense), net | | | 65.6 | | | | 67.7 | | | | (2.1 | ) | | | (3.0 | ) | | | 2.9 | | | | 28.3 | | | | (25.4 | ) |

| Income before income tax expense and non-controlling interest | | | 1,934.1 | | | | 1,833.9 | | | | 100.2 | | | | 5.5 | | | | 479.0 | | | | 74.4 | | | | 404.6 | |

Income tax expense | | | (589.3 | ) | | | (488.6 | ) | | | 100.7 | | | | 20.6 | | | | (147.9 | ) | | | (21.4 | ) | | | 126.5 | |

| Income before non-controlling interest | | | 1,344.8 | | | | 1,345.4 | | | | (0.5 | ) | | | (0.0 | ) | | | 331.1 | | | | 53.0 | | | | 278.1 | |

Non-controlling interest | | | (530.1 | ) | | | (483.4 | ) | | | 46.7 | | | | 9.7 | | | | (0.1 | ) | | | (0.0 | ) | | | 0.1 | |

| Net income attributable to shareholders | | | 814.7 | | | | 862.0 | | | | (47.2 | ) | | | (5.5 | ) | | | 331.0 | | | | 53.0 | | | | 278.0 | |

| (1) | LB Panama’s financial information is prepared in accordance with Colombian Banking GAAP and primarily reflects BAC Credomatic’s consolidated results, which are consolidated in LB Panama’s results from December 1, 2010. At December 31, 2011, LB Panama had Ps 2,017.3 billion of goodwill associated with the BAC Credomatic acquisition and Ps 524.5 billion of indebtedness that it incurred to finance, in part, the BAC Credomatic acquisition. Goodwill amortization and interest expense associated with the BAC Credomatic acquisition for the year ended December 31, 2011 were Ps 49.1 billion and Ps 19.4 billion, respectively. |

Net interest income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

| Interest income: | | | | | | | | | | | | | |

Interest on loans | | | 3,618.6 | | | | 2,040.9 | | | | 1,577.6 | | | | 77.3 | |

Interest on investment securities | | | 552.2 | | | | 1,156.7 | | | | (604.5 | ) | | | (52.3 | ) |

Interbank and overnight funds | | | 98.2 | | | | 67.8 | | | | 30.3 | | | | 44.7 | |

Financial leases | | | 127.0 | | | | 80.1 | | | | 46.9 | | | | 58.6 | |

Total interest income | | | 4,395.9 | | | | 3,345.6 | | | | 1,050.3 | | | | 31.4 | |

| Interest expense: | | | | | | | | | | | | | | | | |

Checking accounts | | | (66.0 | ) | | | (22.4 | ) | | | 43.6 | | | | 194.3 | |

Time deposits | | | (571.7 | ) | | | (374.0 | ) | | | 197.8 | | | | 52.9 | |

Savings deposits | | | (421.7 | ) | | | (290.4 | ) | | | 131.3 | | | | 45.2 | |

Total interest expense from deposits | | | (1,059.4 | ) | | | (686.8 | ) | | | 372.7 | | | | 54.3 | |

Borrowing from banks and others | | | (204.0 | ) | | | (62.2 | ) | | | 141.9 | | | | 228.1 | |

Interbank and overnight funds (expenses) | | | (111.1 | ) | | | (86.6 | ) | | | 24.5 | | | | 28.3 | |

Long-term debt (bonds) | | | (84.6 | ) | | | (66.6 | ) | | | 18.1 | | | | 27.1 | |

Total interest expense | | | (1,459.2 | ) | | | (902.1 | ) | | | 557.1 | | | | 61.8 | |

Net interest income | | | 2,936.7 | | | | 2,443.5 | | | | 493.2 | | | | 20.2 | |

| | | Banco de Bogotá excl. LB Panama | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | # | | | | | | | 2011 | | | | 2010 | | | | # | |

| | | (in Ps billions) | | | | | | (in Ps billions) | |

| Interest income: | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest on loans | | | 2,299.5 | | | | 1,929.5 | | | | 370.0 | | | | 19.2 | | | | 1,319.0 | | | | 111.4 | | | | 1,207.6 | |

| Interest on investment securities | | | 499.4 | | | | 1,152.6 | | | | (653.3 | ) | | | (56.7 | ) | | | 52.8 | | | | 4.1 | | | | 48.7 | |

| Interbank and overnight funds | | | 75.2 | | | | 65.9 | | | | 9.3 | | | | 14.0 | | | | 23.0 | | | | 1.9 | | | | 21.1 | |

Financial leases | | | 106.9 | | | | 78.5 | | | | 28.4 | | | | 36.1 | | | | 20.1 | | | | 1.6 | | | | 18.6 | |

Total interest income | | | 2,981.0 | | | | 3,226.6 | | | | (245.7 | ) | | | (7.6 | ) | | | 1,415.0 | | | | 119.0 | | | | 1,296.0 | |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Checking accounts | | | (36.4 | ) | | | (22.4 | ) | | | 14.0 | | | | 62.4 | | | | (29.6 | ) | | | — | | | | 29.6 | |

Time deposits | | | (406.8 | ) | | | (358.9 | ) | | | 48.0 | | | | 13.4 | | | | (164.9 | ) | | | (15.1 | ) | | | 149.8 | |

Savings deposits | | | (390.2 | ) | | | (285.2 | ) | | | 105.0 | | | | 36.8 | | | | (31.5 | ) | | | (5.2 | ) | | | 26.3 | |

| Total interest expense from deposits | | | (833.5 | ) | | | (666.5 | ) | | | 167.0 | | | | 25.1 | | | | (226.0 | ) | | | (20.3 | ) | | | 205.7 | |

| Borrowing from banks and others | | | (120.7 | ) | | | (55.7 | ) | | | 65.0 | | | | 116.7 | | | | (83.4 | ) | | | (6.5 | ) | | | 76.9 | |

| Interbank and overnight funds (expenses) | | | (104.1 | ) | | | (86.2 | ) | | | 17.9 | | | | 20.8 | | | | (7.0 | ) | | | (0.4 | ) | | | 6.6 | |

Long-term debt (bonds) | | | (65.9 | ) | | | (64.8 | ) | | | 1.1 | | | | 1.7 | | | | (18.7 | ) | | | (1.8 | ) | | | 17.0 | |

Total interest expense | | | (1,124.1 | ) | | | (873.2 | ) | | | 250.9 | | | | 28.7 | | | | (335.1 | ) | | | (29.0 | ) | | | 306.2 | |

Net interest income | | | 1,856.9 | | | | 2,353.5 | | | | (496.6 | ) | | | (21.1 | ) | | | 1,079.8 | | | | 90.0 | | | | 989.8 | |

| (1) | LB Panama’s financial information is prepared in accordance with Colombian Banking GAAP and primarily reflects BAC Credomatic’s consolidated results, which are consolidated in LB Panama’s results from December 1, 2010. At December 31, 2011, LB Panama had Ps 2,017.3 billion of goodwill associated with the BAC Credomatic acquisition and Ps 524.5 billion of indebtedness that it incurred to finance, in part, the BAC Credomatic acquisition. Goodwill amortization and interest expense associated with the BAC Credomatic acquisition for the year ended December 31, 2011 were Ps 49.1 billion and Ps 19.4 billion, respectively. |

Banco de Bogotá’s net interest income increased by 20.2% from Ps 2,443.5 billion in the year ended December 31, 2010 to Ps 2,936.7 billion in the year ended December 31, 2011. Banco de Bogotá’s operations excluding LB Panama contributed Ps 1,856.9 billion (a decrease of 21.1% or Ps 496.6 billion from Ps 2,353.5 billion for the year ended December 31, 2010) and LB Panama contributed Ps 1,079.8 billion. The decrease in Banco de Bogotá’s operations excluding LB Panama was driven by a 7.6%, or Ps 245.7 billion, decrease in total interest income to Ps 2,981.0 billion for the year ended December 31, 2011 and a 28.7%, or Ps 250.9 billion, increase in total interest expense to Ps 1,124.1 billion for the year ended December 31, 2011.

Total interest income increased by 31.4%, from Ps 3,345.6 billion in the year ended December 31, 2010 to Ps 4,395.9 billion in the year ended December 31, 2011, primarily due to an increase in interest income from loans and financial leases, which rose by Ps 1,624.6 billion to Ps 3,745.6 billion in the year ended December 31, 2011. Of the total interest income from loans and financial leases for the year ended December 31, 2011, Ps 2,406.4 billion were contributed by Banco de Bogotá’s operations excluding LB Panama (an increase of 19.8% or Ps 398.4 billion from Ps 2,008.0 billion for the year ended December 31, 2010) and Ps 1,339.2 billion were contributed by LB Panama’s operations.

The increase generated in Banco de Bogotá’s operations excluding LB Panama primarily reflected a 23.7%, or Ps 4,883.6 billion growth of the combined average of the loans and financial leases portfolios from Ps 20,638.2 billion in 2010 to Ps 25,521.9 billion in 2011, which increased interest income by Ps 440.8 billion. Partly offsetting this increase was a decrease in the annualized yield on loans and financial leases of Banco de Bogotá’s operations excluding LB Panama from 9.7% in the year ended December 31, 2010 to 9.4% in the same period in 2011, which decreased interest income from loans and financial leases by Ps 42.4 billion. The decrease in the yield on loans and financial leases in Banco de Bogotá’s operations excluding LB Panama primarily reflects a declining interest

rate environment in the second half of 2010 and early 2011 together with the strong growth of our loan portfolio during 2011. The average interest yield on loans and financial leases for Banco de Bogotá excluding LB Panama was 10.0% during the last quarter of 2011. The reasons for the decrease in the average yield on loans and financial leases are further discussed under “—Results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Grupo Aval Net interest income.”

During 2011, the average portfolio loans and financial leases for LB Panama was Ps 9,961.3 billion and the annualized yield on its loans and financial leases was 13.4%.

Partially offsetting the increase in interest income from loans and from financial leases was a 52.3% decrease in income from investment securities, from Ps 1,156.7 billion to Ps 552.2 billion for the years ended December 31, 2010 and 2011 respectively. Under Colombian Banking GAAP, interest income from investment securities includes accrued interest on debt instruments, valuation adjustments and gains (losses) realized on debt and equity securities that are accounted for as “available for sale,” gains (losses) on repurchase transactions (i.e., repos), gains (losses) realized on the sale of debt securities, and mark-to-market gains (losses) on the trading securities portfolio.

Of the Ps 552.2 billion of interest income from investment securities, Banco de Bogotá’s operations excluding LB Panama contributed Ps 499.4 billion (a decrease of 56.7% or Ps 653.3 billion from Ps 1,152.6 billion for the year ended December 31, 2010) while LB Panama contributed Ps 52.8 billion.

Interest income from equity investments from Banco de Bogotá’s operations excluding LB Panama decreased by Ps 662.9 billion, or 97.5%, to Ps 17.0 billion mainly as a result of Corficolombiana having realized mark-to-market gains on its investments in Sociedad de Inversiones en Energía S.A. or “SIE,” Banco de Occidente, Empresa de Energía de Bogotá or “EEB” and Promigas during 2010 and realizing mark-to-market losses for those investments during 2011(further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana—Net interest income”). Interest income derived from the fixed income portfolio of Banco de Bogotá’s operations excluding LB Panama increased by 2.0% or Ps 9.6 billion driven by an increase in the average fixed income investment portfolio.

Total interest expense in Banco de Bogotá increased by Ps 557.1 billion or 61.8% from Ps 902.1 billion in the same period in 2010 to Ps 1,459.2 billion in the year ended December 31, 2011 out of which Ps 1,124.1 billion was incurred by Banco de Bogotá’s operations excluding LB Panama (an increase of Ps 250.9 billion or 28.7% from Ps 873.2 billion in the year ended December 31, 2010) and Ps 335.1 billion was incurred by LB Panama.

Total interest expense in Banco de Bogotá’s operations excluding LB Panama increased due to the combined effect of a 20.3%, or Ps 5,450.3 billion, increase in the average balance of interest-bearing liabilities increasing to Ps 32,334.6 billion at December 31, 2011, and an increase in the average cost of funding from 3.2% in the year ended December 31, 2010 to 3.5% in the year ended December 31, 2011. The main reason for the increase in the average cost of funding in Banco de Bogotá’s operations excluding LB Panama was increase of the average DTF as discussed under “—Results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Grupo Aval.”

During 2011, the average balance of interest-bearing liabilities for LB Panama was Ps 13,286.5 billion and the annualized cost of funds was 2.5%.

Banco de Bogotá’s net interest margin (calculated as net interest income divided by total average interest-earning assets) decreased from 7.4% in the year ended December 31, 2010 to 6.0% in the same period in 2011. The net interest margin of Banco de Bogotá’s operations excluding LB Panama decreased from 7.3% to 5.0%, mainly driven by a decrease in the annualized yield of its investment portfolio from 11.7% in 2010 to 4.8% in 2011 due to Corficolombiana’s equity investments results, as discussed above and further explained under “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana.” LB Panama’s net interest margin was 8.8% for the year ended December 31, 2011.

Provisions

Total net provisions decreased by 77.2% to Ps 139.0 billion in the year ended December 31, 2011, driven primarily by a Ps 613.4 billion decrease in net provisions for foreclosed assets and other assets. This decrease was driven by a Ps 306.9 billion decrease in provision expense and a Ps 306.5 billion increase in recovery of provisions in the year ended December 31, 2011. These changes are associated with Corficolombiana’s gross provision made during 2010 for covering risk associated with potential future fluctuations on the share price of its equity investment and the gross provision made during 2010 on its investment in SIE, both provisions were reversed during 2011 (further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana—Provisions”).

Partially offsetting the decrease in total net provisions for foreclosed assets and other assets was the increase in net provisions for loan and financial lease losses which increased by Ps 147.8 billion from Ps 286.6 billion for the year ended December 31, 2010 to Ps 434.4 billion for the year ended December 31, 2011.

Out of the Ps 434.4 billion of net provisions for loans and financial leases for the year ended December 31, 2011, Ps 273.0 billion were generated by Banco de Bogotá’s operations excluding LB Panama (a decrease of 4.5% or Ps 12.9 billion from Ps 285.9 billion for the year ended December 31, 2010) and Ps 161.4 billion was generated by LB Panama’s operations.

Banco de Bogotá’s past due loans at December 31, 2011 decreased by 5.6% to Ps 780.4 billion and its delinquency ratio improved by 60 basis points from 2.5% at December 31, 2010 to 1.9% at December 31, 2011. Banco de Bogota’s delinquency ratio excluding LB Panama was 1.6% at December 31, 2011, and LB Panama’s was 2.8% at December 31, 2011. LB Panama’s higher delinquency ratio is due to a greater concentration of consumer loans in BAC Credomatic’s business (including credit cards) than in Banco de Bogota’s operations excluding LB Panama.

Banco de Bogotá’s charge-offs increased by Ps 131.9 billion from Ps 245.7 billion in December 31, 2010 to Ps 377.5 billion in December 31, 2011. Out of the Ps 377.5 billion of charge-offs for the year ended December 31, 2011, Ps 212.5 billion were generated by Banco de Bogotá’s operations excluding LB Panama (a decrease of 6.9% or Ps 15.7 billion from Ps 228.2 for the year ended December 31, 2010) and Ps 165.1 billion was generated by LB Panama’s operations.

Banco de Bogotá’s charge-offs to average loan ratio decreased from 1.1% in December 31, 2010 to 1.0% in December 31, 2011. Banco de Bogotá’s operations excluding LB Panama charge-offs to average loan ratio decreased from 1.1% in December 31, 2010 to 0.8% in December 31, 2011.

Banco de Bogotá’s allowance for loans and financial leases increased by Ps 68.6 billion to Ps 1,099.4 billion at December 31, 2011 increasing Banco de Bogotá’s coverage ratio from 124.6% at December 31, 2010 to 140.9% at December 31, 2011.

In its Banco de Bogotá’s operations excluding LB Panama, Banco de Bogotá’s net provisions for loan and financial lease losses were greater than its charge-offs, which resulted in a 7.5% increase in its allowance for loan financial lease losses to Ps 885.9 billion at December 31, 2011. This growth combined with the decrease in past due loans resulted in an increase in its coverage ratio from 160.7% at December 31, 2010 to 197.5% at December 31, 2011.

LB Panama’s coverage ratio for the year ended December 31, 2011 was 64.3% compared to 65.7.% for the year ended December 31, 2010.

Banco de Bogotá’s net provisions for accrued interest and other receivables increased by Ps 16.6 billion, or 50.3%, to Ps 49.5 billion, Ps 10.4 billion of this increase was driven by Banco de Bogotá’s operations excluding LB Panama and Ps 6.2 billion was driven by LB Panama’s operations. The recovery of charged-off assets increased by Ps 22.6 billion, or 76.3%, to Ps 52.2 billion primarily as a result of a more successful recovery effort by Banco de Bogotá.

Total fees and other services income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

| Fees and other services income: | | | | | | | | | | | | | |

Commissions from banking services | | | 943.1 | | | | 557.9 | | | | 385.2 | | | | 69.0 | |

Branch network services | | | 35.0 | | | | 22.2 | | | | 12.8 | | | | 57.9 | |

Credit card merchant fees | | | 228.6 | | | | 70.3 | | | | 158.4 | | | | 225.4 | |

Checking fees | | | 42.4 | | | | 42.0 | | | | 0.5 | | | | 1.1 | |

Warehouse services | | | 114.7 | | | | 92.2 | | | | 22.5 | | | | 24.4 | |

Fiduciary activities | | | 99.7 | | | | 98.3 | | | | 1.3 | | | | 1.4 | |

Pension plan administration | | | 457.1 | | | | 408.3 | | | | 48.8 | | | | 11.9 | |

Other | | | 90.1 | | | | 37.1 | | | | 52.9 | | | | 142.5 | |

Total fees and other services income | | | 2,010.6 | | | | 1,328.2 | | | | 682.4 | | | | 51.4 | |

Fees and other services expenses | | | (253.8 | ) | | | (173.2 | ) | | | 80.7 | | | | 46.6 | |

Total fees and other services income, net | | | 1,756.8 | | | | 1,155.1 | | | | 601.7 | | | | 52.1 | |

| | | Banco de Bogotá’s operations excluding LB Panama | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | # | | | | | | | 2011 | | | | 2010 | | | | # | |

| | | (in Ps billions) | | | | | | (in Ps billions) | |

| Fees and other services income: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commissions from banking services | | | 526.8 | | | | 519.9 | | | | 6.9 | | | | 1.3 | | | | 416.2 | | | | 37.9 | | | | 378.3 | |

Branch network services | | | 35.0 | | | | 22.2 | | | | 12.8 | | | | 57.9 | | | | – | | | | – | | | | – | |

Credit card merchant fees | | | 55.2 | | | | 51.6 | | | | 3.6 | | | | 7.0 | | | | 173.4 | | | | 18.6 | | | | 154.8 | |

Checking fees | | | 42.4 | | | | 42.0 | | | | 0.5 | | | | 1.1 | | | | – | | | | – | | | | – | |

Warehouse services | | | 114.7 | | | | 92.2 | | | | 22.5 | | | | 24.4 | | | | – | | | | – | | | | – | |

Fiduciary activities | | | 99.7 | | | | 98.3 | | | | 1.3 | | | | 1.4 | | | | – | | | | – | | | | – | |

| Pension plan administration | | | 447.3 | | | | 408.3 | | | | 39.0 | | | | 9.6 | | | | 9.8 | | | | – | | | | 9.8 | |

Other | | | 35.1 | | | | 31.4 | | | | 3.7 | | | | 11.7 | | | | 55.0 | | | | 5.7 | | | | 49.3 | |

| Total fees and other services income | | | 1,356.2 | | | | 1,265.9 | | | | 90.3 | | | | 7.1 | | | | 654.4 | | | | 62.3 | | | | 592.1 | |

| Fees and other services expenses | | | (198.8 | ) | | | (166.0 | ) | | | 32.9 | | | | 19.8 | | | | (55.0 | ) | | | (7.2 | ) | | | 47.8 | |

| Total fees and other services income, net | | | 1,157.4 | | | | 1,100.0 | | | | 57.4 | | | | 5.2 | | | | 599.3 | | | | 55.1 | | | | 544.3 | |

| (1) | LB Panama’s financial information is prepared in accordance with Colombian Banking GAAP and primarily reflects BAC Credomatic’s consolidated results, which are consolidated in LB Panama’s results from December 1, 2010. At December 31, 2011, LB Panama had Ps 2,017.3 billion of goodwill associated with the BAC Credomatic acquisition and Ps 524.5 billion of indebtedness that it incurred to finance, in part, the BAC Credomatic acquisition. Goodwill amortization and interest expense associated with the BAC Credomatic acquisition for the year ended December 31, 2011 were Ps 49.1 billion and Ps 19.4 billion, respectively. |

Total net fees and other services income increased by 52.1% to Ps 1,756.8 billion in the year ended December 31, 2011, primarily as a result of higher commissions from banking services and increased credit card merchant fees

For the year ended December 31, 2011, Banco de Bogotá’s operations excluding LB Panama contributed Ps 1,157.4 billion in total fees and other income, net which includes Ps 526.8 billion in commissions from banking services and Ps 55.2 billion in credit card merchant fees. LB Panama, in turn, contributed Ps 599.3 billion in total fees and other income, net which includes Ps 416.2 billion in commissions from banking services and Ps 173.4 billion in credit card merchant fees.

The 11.9% (9.6% in Banco de Bogota’s operations excluding LB Panama) increase in pension plan administration fees is mainly as a result of higher fee income produced by Porvenir consisting of commissions earned on the administration of mandatory pension funds, severance funds, voluntary pension funds and third-party liability pension funds, further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Porvenir—Net income.”

The Ps 52.9 billion, or 142.5%, increase to Ps 90.1 billion in “Other” fees is primarily attributable to a Ps 49.3 billion increase in income generated by LB Panama, which includes insurance sales commissions, investment fund administration fees, travel agency fees and others.

Warehouse services fees increased by Ps 22.5 billion, or 24.4%, to Ps 114.7 billion due to fees contributed by Almaviva, Banco de Bogota’s warehouse subsidiary. This rise in the income of warehouse services resulted from greater imports / exports from existing clients and the addition of new clients.

Other operating income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Foreign exchange gains (losses), net | | | 186.9 | | | | 32.6 | | | | 154.3 | | | | 473.8 | |

Gains (losses) on derivative operations, net | | | (22.8 | ) | | | 63.6 | | | | (86.4 | ) | | | (135.9 | ) |

| Gains on sales of investments in equity securities, net | | | 41.8 | | | | 112.1 | | | | (70.3 | ) | | | (62.7 | ) |

Income from non-financial sector, net (2) | | | 431.8 | | | | 289.8 | | | | 142.0 | | | | 49.0 | |

Dividend income | | | 78.7 | | | | 44.1 | | | | 34.6 | | | | 78.4 | |

Other | | | 41.8 | | | | 40.3 | | | | 1.5 | | | | 3.8 | |

Other operating income | | | 758.1 | | | | 582.4 | | | | 175.8 | | | | 30.2 | |

| | | Banco de Bogotá’s operations excluding LB Panama | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | # | | | | | | | 2011 | | | | 2010 | | | | # | |

| | | (in Ps billions) | | | | | | (in Ps billions) | |

| Foreign exchange gains (losses), net | | | 86.0 | | | | 17.3 | | | | 68.8 | | | | 398.4 | | | | 100.9 | | | | 15.3 | | | | 85.5 | |

| Gains (losses) on derivative operations, net | | | (18.3 | ) | | | 61.5 | | | | (79.8 | ) | | | (129.7 | ) | | | (4.6 | ) | | | 2.0 | | | | (6.6 | ) |

| Gains on sales of investments in equity securities, net | | | 41.8 | | | | 112.1 | | | | (70.3 | ) | | | (62.7 | ) | | | – | | | | (0.0 | ) | | | 0.0 | |

| Income from non-financial sector, net | | | 431.8 | | | | 289.8 | | | | 142.0 | | | | 49.0 | | | | – | | | | – | | | | – | |

Dividend income | | | 78.7 | | | | 44.1 | | | | 34.6 | | | | 78.4 | | | | – | | | | – | | | | – | |

| Other | | | 41.6 | | | | 40.3 | | | | 1.3 | | | | 3.3 | | | | 0.2 | | | | 0.0 | | | | 0.2 | |

Other operating income | | | 661.7 | | | | 565.1 | | | | 96.6 | | | | 17.1 | | | | 96.5 | | | | 17.3 | | | | 79.2 | |

| (1) | LB Panama’s financial information is prepared in accordance with Colombian Banking GAAP and primarily reflects BAC Credomatic’s consolidated results, which are consolidated in LB Panama’s results from December 1, 2010. At December 31, 2011, LB Panama had Ps 2,017.3 billion of goodwill associated with the BAC Credomatic acquisition and Ps 524.5 billion of indebtedness that it incurred to finance, in part, the BAC Credomatic acquisition. Goodwill amortization and interest expense associated with the BAC Credomatic acquisition for the year ended December 31, 2011 were Ps 49.1 billion and Ps 19.4 billion, respectively. |

| (2) | Income from non-financial sector reflects the operating results of Corficolombiana in its consolidated investments in companies not related to the financial sector such as Epiandes, Hoteles Estelar and Organización Pajonales, among others. This result is net of the following operating and administrative expenses in the year ended December 31, 2011 and 2010: Ps 852.7 billion and Ps 644.3 billion, respectively. For a description of these investments, see “Item 4. Information on the Company—Business overview—Corficolombiana—Equity investment portfolio.” |

Total other operating income, net increased by 30.2% to Ps 758.1 billion in the year ended December 31, 2011 due primarily to a Ps 142.0 billion increase in income from the non-financial sector, which reflected the net income growth of non-financial companies consolidated by Corficolombiana further explained in the Corficolombiana 2011-2010 discussion.

Also contributing to the increase in other operating income was a Ps 67.9 billion increase in net foreign exchange and derivative operations. Foreign exchange gains (losses) and gains on derivative operations, which are related as Banco de Bogotá employs derivative operations to hedge foreign exchange risk, netted a gain of Ps 164.0 billion for the year ended December 31, 2011 as compared to Ps 96.1 billion for the year ended December 31, 2010. Net foreign exchange and derivative operations for Banco de Bogotá’s operations excluding LB Panama decreased by Ps 11.0 billion from Ps 78.8 billion for the year ended December 31, 2010 to Ps 67.8 billion for the year ended December 31, 2011. During 2011, LB Panama’s operations netted a gain of Ps 96.3 billion.

The increase in dividend income of Ps 34.6 billion was mainly attributable to dividend income from Promigas, a non-consolidated company of Corficolombiana which in 2010 was classified as “trading” and thus its dividend income was registered as interest income from investment securities (further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana”).

Partially offsetting the increase in other operating income was a Ps 70.3 billion decrease in gains on sales of equity securities, resulting from Corficolombiana’s gains from the sale of part of its stake in Banco de Occidente and Proenergía in 2010 (further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana—Other operating income”).

Operating expenses

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Salaries and employee benefits | | | (1,068.0 | ) | | | (612.3 | ) | | | 455.7 | | | | 74.4 | |

Bonus plan payments | | | (73.2 | ) | | | (19.6 | ) | | | 53.7 | | | | 274.0 | |

Termination payments | | | (19.5 | ) | | | (5.8 | ) | | | 13.7 | | | | 235.7 | |

Administrative and other expenses | | | (1,518.6 | ) | | | (968.3 | ) | | | 550.3 | | | | 56.8 | |

Deposit security, net | | | (85.0 | ) | | | (68.3 | ) | | | 16.7 | | | | 24.4 | |

Charitable and other donation expenses | | | (12.6 | ) | | | (4.0 | ) | | | 8.6 | | | | 217.0 | |

Depreciation | | | (116.0 | ) | | | (57.9 | ) | | | 58.1 | | | | 100.4 | |

Goodwill amortization | | | (75.2 | ) | | | (21.8 | ) | | | 53.3 | | | | 244.3 | |

Total operating expenses | | | (2,968.0 | ) | | | (1,757.9 | ) | | | 1,210.0 | | | | 68.8 | |

| | | Banco de Bogotá’s operations excluding LB Panama | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | # | | | | | | | 2011 | | | | 2010 | | | | # | |

| | | (in Ps billions) | | | | | | (in Ps billions) | |

| Salaries and employee benefits | | | (617.0 | ) | | | (576.6 | ) | | | 40.4 | | | | 7.0 | | | | (451.0 | ) | | | (35.7 | ) | | | 415.3 | |

Bonus plan payments | | | (19.3 | ) | | | (16.7 | ) | | | 2.6 | | | | 15.5 | | | | (53.9 | ) | | | (2.9 | ) | | | 51.1 | |

Termination payments | | | (2.2 | ) | | | (1.9 | ) | | | 0.3 | | | | 16.6 | | | | (17.3 | ) | | | (3.9 | ) | | | 13.4 | |

| Administrative and other expenses | | | (1,027.8 | ) | | | (905.0 | ) | | | 122.9 | | | | 13.6 | | | | (490.7 | ) | | | (63.3 | ) | | | 427.4 | |

Deposit security, net | | | (76.4 | ) | | | (67.5 | ) | | | 8.8 | | | | 13.1 | | | | (8.6 | ) | | | (0.7 | ) | | | 7.8 | |

| Charitable and other donation expenses | | | (10.9 | ) | | | (3.7 | ) | | | 7.1 | | | | 191.2 | | | | (1.7 | ) | | | (0.2 | ) | | | 1.5 | |

Depreciation | | | (59.1 | ) | | | (53.4 | ) | | | 5.6 | | | | 10.5 | | | | (56.9 | ) | | | (4.4 | ) | | | 52.5 | |

Goodwill amortization | | | (20.8 | ) | | | (19.0 | ) | | | 1.8 | | | | 9.5 | | | | (54.4 | ) | | | (2.8 | ) | | | 51.5 | |

Total operating expenses | | | (1,833.4 | ) | | | (1,643.9 | ) | | | 189.5 | | | | 11.5 | | | | (1,134.5 | ) | | | (114.0 | ) | | | 1,020.5 | |

| (1) | LB Panama’s financial information is prepared in accordance with Colombian Banking GAAP and primarily reflects BAC Credomatic’s consolidated results, which are consolidated in LB Panama’s results from December 1, 2010. At December 31, 2011, LB Panama had Ps 2,017.3 billion of goodwill associated with the BAC Credomatic acquisition and Ps 524.5 billion of indebtedness that it incurred to finance, in part, the BAC Credomatic acquisition. Goodwill amortization and interest expense associated with the BAC Credomatic acquisition for the year ended December 31, 2011 were Ps 49.1 billion and Ps 19.4 billion, respectively. |

Total operating expenses increased by 68.8% to Ps 2,968.0 billion in the year ended December 31, 2011 out of which Ps 1,833.4 billion were incurred by Banco de Bogotá’s operations excluding LB Panama and Ps 1,134.5 billion were incurred by LB Panama.

The increase in total operating expenses primarily reflected a 74.4% or Ps 455.7 billion and a 56.8% or Ps 550.3 billion increase in salaries and employee benefits, and administrative and other expenses, respectively. Salaries and employee benefits from Banco de Bogotá’s operations excluding LB Panama increased by 7.0% or Ps 40.4 billion to Ps 617.0 billion in the year ended December 31, 2011 due to an increase in personnel, while administrative and other expenses grew by 13.6% or Ps 122.9 billion to Ps 1,027.8 billion in the year ended December 31, 2011 due primarily to additional costs associated with growth of Banco de Bogotá’s loan portfolio and the increase in the Equity Tax (further explained in “Results of operations for the year ended December 31, 2011 compared to year ended December 31, 2010 – Grupo Aval – Net interest income”). LB Panama’s salaries and employee benefits and administrative and other expenses totaled Ps 451.0 billion and Ps 490.7 billion, respectively, for the year ended December 31, 2011.

Banco de Bogotá’s efficiency ratio deteriorated from 40.1% at December 31, 2010 to 50.9% at December 31, 2011. Banco de Bogotá’s efficiency ratio for its Banco de Bogotá’s operations excluding LB Panama deteriorated from 39.1% to 47.7% during these same periods and LB Panama’s efficiency ratio at December 31, 2011 was 57.6% associated with the contraction in net interest margin explained in the net interest subsection. Depreciation and goodwill amortization increased by Ps 111.4 billion from Ps 79.7 billion in the year ended December 31, 2010 to Ps 191.1 billion in the year ended December 31, 2011, primarily due to LB Panama’s acquisition which impacts LB Panama’s results. The ratio of operating expenses before depreciation and amortization as a percentage of average earning assets excluding LB Panama improved from 4.9% in 2010 to 4.7% in 2011.

Non-operating income (expense)

Total non-operating income (expense) decreased by Ps 27.5 from Ps 96.0 billion to Ps 68.5 billion in the year ended December 31, 2011 due to a decrease in reversals associated with LB Panama (further explained in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—LB Panama”).

Income tax expense

Income before income tax expense and non-controlling interest increased 26.5% from Ps 1,908.3 billion for the year ended December 31, 2010 to Ps 2,413.1 billion for the year ended December 31, 2011. Income tax expense, in turn, increased by 44.5% to Ps 737.2 billion for the year ended December 31, 2011. Accordingly, Banco de Bogotá’s effective tax rate increased from 26.7% for the year ended December 31, 2010 to 30.5% for the year ended December 31, 2011, due to an increase in non-tax deductible expenses in Banco de Bogotá’s operations excluding LB Panama, such as the increase in the Equity Tax (further explained in the “Results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010 – Grupo Aval”), and a higher effective tax rate of 30.9% in LB Panama’s operations.

Non-controlling interest

Banco de Bogotá’s non-controlling interest increased by Ps 46.8 billion, or 9.7%, in the year ended December 31, 2011. The increase in non-controlling interest was primarily a result of Corficolombiana achieving better results in the year ended December 31, 2011 as compared to the same period in 2010 (Ps 608.1 billion as compared to Ps 564.8 billion, respectively) as further described in “—Segment results of operations for the year ended December 31, 2011 compared to the year ended December 31, 2010—Banco de Bogotá subsidiary analysis—Corficolombiana.”

Banco de Bogotá subsidiary analysis

Banco de Bogotá’s results of operations are significantly affected by the results of operations of its subsidiaries, LB Panama, Corficolombiana and Porvenir. In order to fully disclose the effect of these subsidiaries on Banco de Bogotá, the following is an analysis of the results of operations of each of LB Panama, Corficolombiana and Porvenir in the year ended December 31, 2011 compared to the year ended December 31, 2010.

Corficolombiana

Net income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

Total interest income | | | 270.2 | | | | 858.3 | | | | (588.1 | ) | | | (68.5 | ) |

Total interest expense | | | (197.1 | ) | | | (161.8 | ) | | | 35.3 | | | | 21.8 | |

Net interest income | | | 73.1 | | | | 696.5 | | | | (623.3 | ) | | | (89.5 | ) |

Total provisions (reversals), net | | | 285.5 | | | | (321.6 | ) | | | (607.1 | ) | | | (188.8 | ) |

Total fees and other services income, net | | | 46.7 | | | | 43.6 | | | | 3.0 | | | | 7.0 | |

Total other operating income | | | 573.4 | | | | 435.2 | | | | 138.2 | | | | 31.8 | |

Total operating income | | | 978.7 | | | | 853.7 | | | | 125.0 | | | | 14.6 | |

Total operating expenses | | | (137.2 | ) | | | (118.8 | ) | | | 18.4 | | | | 15.5 | |

Net operating income | | | 841.5 | | | | 734.9 | | | | 106.6 | | | | 14.5 | |

Total non-operating income (expense), net | | | (6.3 | ) | | | (3.2 | ) | | | (3.2 | ) | | | (99.5 | ) |

| Income before income tax expense and non-controlling interest | | | 835.2 | | | | 731.8 | | | | 103.4 | | | | 14.1 | |

Income tax expense | | | (150.5 | ) | | | (104.2 | ) | | | 46.3 | | | | 44.4 | |

Income before non-controlling interest | | | 684.7 | | | | 627.6 | | | | 57.1 | | | | 9.1 | |

Non-controlling interest | | | (76.6 | ) | | | (62.8 | ) | | | 13.8 | | | | 22.0 | |

Net income attributable to shareholders | | | 608.1 | | | | 564.8 | | | | 43.3 | | | | 7.7 | |

Corficolombiana’s net income increased by 7.7% to Ps 608.1 billion in the year ended December 31, 2011 as compared to the year ended December 31, 2010. The most significant drivers of the increase in net income were the decrease of 89.5% or Ps 623.3 billion in net interest income, which was primarily due to a reduction in interest income from investment securities, was partially offset by a decrease of Ps 607.1 billion in total provisions (reversals), net (reflecting a recovery of Ps 285.5 billion in 2011) and an increase in total other operating income, which reflected an increase in dividend income and net income from the non-financial sector.

Net interest income

| | | | | | | |

| | | | | | | | | | # | | | | |

| | | (in Ps billions) | | | | |

| Interest income: | | | | | | | | | | | | | |

Interest on loans | | | 13.8 | | | | 10.6 | | | | 3.2 | | | | 30.0 | |

Interest on investment securities | | | 161.7 | | | | 753.9 | | | | (592.2 | ) | | | (78.5 | ) |

Interbank and overnight funds | | | 43.1 | | | | 43.0 | | | | 0.1 | | | | 0.3 | |

Financial leases | | | 51.6 | | | | 50.8 | | | | 0.8 | | | | 1.5 | |

Total interest income | | | 270.2 | | | | 858.3 | | | | (588.1 | ) | | | (68.5 | ) |

| Interest expense: | | | | | | | | | | | | | | | | |

Checking accounts | | | – | | | | – | | | | – | | | | – | |

Time deposits | | | (91.6 | ) | | | (74.7 | ) | | | 17.0 | | | | 22.7 | |

Savings deposits | | | (2.7 | ) | | | (5.5 | ) | | | (2.8 | ) | | | (51.4 | ) |