Exhibit (c)-(2)

Project Bonita Presentation to the Independent Committee 13 - Dec - 2015 Strictly Confidential

Table of Contents __________________________________________ 1. Transaction Overview 2. Valuation Analysis Appendix

Transaction Overview

Background ; On 12 - Jun - 2015, Chairman Yu, Sequoia Capital China I LP (“Sequoia”) and Fosun International Limited (“Fosun”) (altogether, the “ Original Buyer Consortium”) submitted a preliminary non - binding take - private proposal to acquire the remaining outstanding shares of Bona Film Group Limited (“Bona” or the "Company”) not already owned by the Original Buyer Consortium, at a price of $13.70 per ADS (1) (the “Proposed Transaction”) ; The Original Buyer Consortium collectively owned 53.2% of ordinary shares in Bona as at the time of announcement of the Propo sed Transaction ; The Original Buyer Consortium executed a consortium agreement (“June 12 Consortium Agreement”) pursuant to which members of t he Original Buyer Consortium agreed to work exclusively with each other for 9 months to implement the Proposed Transaction and to vote against any competing proposal ; On 13 - Jul - 2015, Barclays was appointed by the Independent Committee of the Board of Directors of Bona (the “Independent Committe e”) to act as its sole financial advisor in connection with the Company’s receipt of a going - private transaction from the Original Buyer Consortium. Barclays was requested by the Independent Committee to assist with reviewing and evaluating the proposal from the Original Buyer Consortium ; On 2 - Dec - 2015, legal counsel of the Original Buyer Consortium circulated a draft merger agreement, confirming the Original Buyer Consortium’s intention to consummate the Proposed Transaction at an offer price of US$13.70 per ADS; on 6 - Dec - 2015, Barclays was provided with the updated consortium structure ("Updated Buyer Consortium") and the new equity investors’ names ; Based on the latest structure, the Updated Buyer Consortium collectively owned 60.7% of the ordinary shares of Bona, and the rem aining shares will be acquired by Chairman Yu, Uranus Connection (a wholly - owned subsidiary of CITIC Securities), Alibaba Pictures, Tencent and All Gain Ventur es (private investor) ; Barclays’ focus is to evaluate the fairness of the per share acquisition consideration from a financial point of view and to the shareholders of the Company, other than the Updated Buyer Consortium Transaction Overview ___________________________ Note: 1. Two American Depository Shares (ADSs) are equivalent to one ordinary shares. Process Overview (As of 12 - Dec - 2015) ; From Barclays' engagement onwards, representatives of Barclays had multiple interactions with the Original Buyer Consortium / Co mpany, including the following: ; On 22 - Jul - 2015, representatives of Barclays and Shearman held a call with Chairman Yu. During the call, Chairman Yu affirmed tha t he will not consider selling his shares in the Company and expressed his desire to raise ownership in the surviving entity post merger; Chairman Yu also c onf irmed that he is in the process of arranging financing for the Proposed Transaction ; On 28 - Jul - 2015, representatives of Barclays had an in - person due diligence session with CFO and representatives of the finance a nd investor relations department of the Company regarding the Company's strategy and operations ; On 8 - Aug - 2015, Sequoia informed Barclays that Sequoia would not consider selling their shares in the Company and did not have pl an for any alternative transaction ; On 11 - Aug - 2015, Fosun informed Barclays that Fosun intended to comply with the contractual obligations under the June 12 Consort ium Agreement ; On 26 - Oct - 2015, Skillgreat Limited (wholly owned by Chairman Yu) completed the purchase of certain ADSs and ordinary shares, alt ogether accounting for 14.4% of ordinary shares of the Company, from affiliates of Fosun (Peak Reinsurance and Fidelidade Companhia) at US$13.70 per ADS. Pos t t he share transfer, Chairman Yu's ownership in Bona increased from 27.2% to 41.6% of ordinary shares outstanding of Bona ; On 2 - Dec - 2015, legal counsel of the Updated Buyer Consortium circulated a draft merger agreement, confirming the Updated Buyer C onsortium’s intention to consummate the Proposed Transaction at an offer price of US$13.70 per ADS; on 4 - Dec - 2015, Barclays and Shearman held a call with the Independent Committee and agreed to commence negotiation of the merger agreement with the Updated Buyer Consortium ; On 6 - Dec - 2015, Company provided management financial projections to Barclays; on the same day, Barclays conducted a due diligenc e call to go through the financial projections with the Company's CFO and finance manager ; On 6 - Dec - 2015, the Updated Buyer Consortium provided the final consortium structure and investors’ names to Barclays ; On 9 - Dec - 2015, Barclays presented preliminary valuation analysis to the Independent Committee; the Independent Committee conclud ed that there is basis for the Updated Buyer Consortium to consider an improvement on the offer price of $13.70 per ADS ; On 10 - Dec - 2015, Barclays, on behalf of the Independent Committee, held a call with Citic Securities, financial advisor to the Up dated Buyer Consortium, to invite the Updated Buyer Consortium to consider a revised proposal with a higher offer price ; On 10 - Dec - 2015, legal counsel of the Updated Buyer Consortium, responded via email that the Updated Buyer Consortium would not b e able to increase the proposed offer price; instead, on 11 - Dec - 2015, the Updated Buyer Consortium agreed to concede on a number of merger agreement terms ; On 12 - Dec - 2015, Barclays conducted a follow - up due diligence call with Company’s CFO in relation to the financial projections, p articularly around their views on nature of the film business and some practical issues around developing the business plan 1

(In US$ millions, except for per ADS) Buyer Consortium's Proposal ADS Price 13.70 Diluted ADSs Outstanding (million) 72.79 Market Capitalization $997.2 +Total Debt 153.5 -Cash & Cash Equivalent 150.9 =Financial Net Debt 2.6 +Minority Interest 1.6 Implied Enterprise Value $1,001.3 Implied Premium to Historical Stock Prices ADS Price Premium Current Trading (10-Dec-15) $12.52 9.4% Prior to Announcement of Proposal (11-Jun-15) 12.86 6.5% 30-Days VWAP Prior to 11-Jun-15 11.37 20.4% 60-Days VWAP Prior to 11-Jun-15 10.64 28.7% 90-Days VWAP Prior to 11-Jun-15 10.18 34.6% 180-Days VWAP Prior to 11-Jun-15 9.42 45.5% 52-Week High Prior to 11-Jun-15 12.86 6.5% 52-Week Low Prior to 11-Jun-15 5.70 140.4% Implied Trading Multiples based on Management Projections Metrics Multiples EV / EBITDA 2016E 44.8 / 60.8 22.4x / 16.5x EV / EBITDA 2017E 80.1 / 96.1 12.5x / 10.4x Equity / Net Income 2016E 19.5 / 35.5 51.1x / 28.1x Equity / Net Income 2017E 46.7 / 62.7 21.3x / 15.9x Transaction Valuation Summary ___________________________ Source: Company filings, Factset and Management Projections (provided on 6 - Dec - 2015). Note: 1. Diluted ADS outstanding calculated based on treasury stock method, including all vested and unvested options and restricted s har e units. 2. As at 30 - Sep - 2015. 3. Denotes unadjusted figures / figures adjusted for stock - based compensation. (1) (2) (2) (2) (3) (3) 2

Overview of Sources & Uses / Shareholding Structure ___________________________ Source: Company filings, management. Note: 1. Based on merger agreement and consortium agreement. 2. Excludes transaction expenses as most of them will be borne by the Company. 3. Vested in - the - money options, unless agreed to be rolled - over, to be cashed out by surviving company’s cash; assume other holders (except Chairman Yu) of vested in - the - money options elect to not roll - over. 4. Includes Chairman Yu’s ESOP, unvested options and restricted share units. 5. Based on support agreement, all ESOP held by Chairman Yu will be rolled - over. Indicative Sources & Uses (US$mm) Sources of Funds Uses of Funds Rollover Shareholders' equity $521.9 Consideration for ordinary shares / ADSs $859.8 Chairman Yu 357.5 Consideration for vested in-the-money options 20.3 SAIF 64.5 Rollover ESOP 117.0 Fosun 54.8 Sequoia Capital China 45.1 Additional Equity Sources 337.9 Chairman Yu 97.7 Alibaba Pictures 86.0 Uranus Connection (Wholly-owned subsidiary of CITIC Securities) 79.9 Tencent 60.2 Private Investor 14.2 Company's Cash 20.3 Rollover ESOP 117.0 Total $997.2 Total $997.2 Shareholding Structure Pre-Transaction Post-Transaction Shares (mm) % Shareholding Shares (mm) % Shareholding Rollover Shareholders Chairman Yu 13.0 41.6% 16.6 52.9% Fosun 2.0 6.4% 2.0 6.4% Sequoia Capital China 1.6 5.2% 1.6 5.2% SAIF Partners 2.4 7.5% 2.4 7.5% New Investors Uranus Connection (Wholly-owned subsidiary of CITIC Securities) 0.0 0.0% 2.9 9.3% Alibaba Pictures 0.0 0.0% 3.1 10.0% Tencent 0.0 0.0% 2.2 7.0% Private Investor 0.0 0.0% 0.5 1.7% Total Buyer Consortium 19.0 60.7% 31.4 100.0% Public shareholders 12.3 39.3% 0.0 Total Basic Shares Outstanding 31.4 100.0% 31.4 100.0% Rollover ESOP 5.0 4.3 Total Diluted Shares Outstanding 36.4 35.7 (1) (2) (3) (4) (5) (4) (5) 3

Valuation Analysis

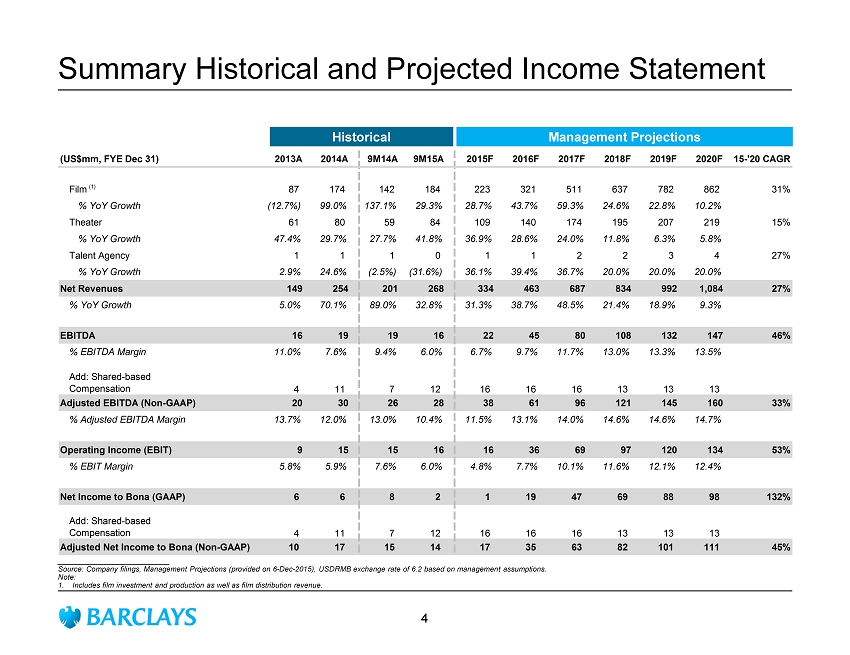

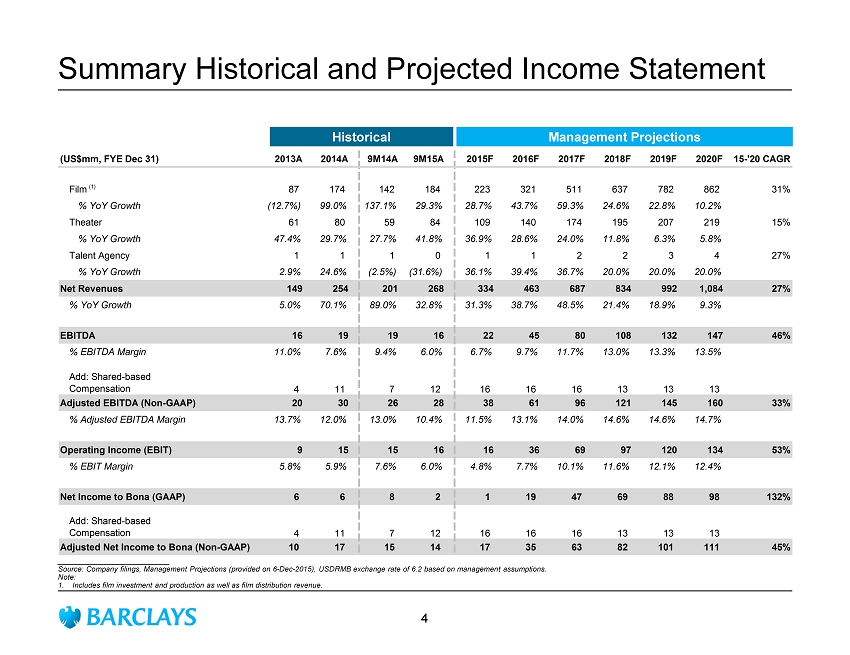

(US$mm, FYE Dec 31) 2013A 2014A 9M14A 9M15A 2015F 2016F 2017F 2018F 2019F 2020F 15-'20 CAGR Film 87 174 142 184 223 321 511 637 782 862 31% % YoY Growth (12.7%) 99.0% 137.1% 29.3% 28.7% 43.7% 59.3% 24.6% 22.8% 10.2% Theater 61 80 59 84 109 140 174 195 207 219 15% % YoY Growth 47.4% 29.7% 27.7% 41.8% 36.9% 28.6% 24.0% 11.8% 6.3% 5.8% Talent Agency 1 1 1 0 1 1 2 2 3 4 27% % YoY Growth 2.9% 24.6% (2.5%) (31.6%) 36.1% 39.4% 36.7% 20.0% 20.0% 20.0% Net Revenues 149 254 201 268 334 463 687 834 992 1,084 27% % YoY Growth 5.0% 70.1% 89.0% 32.8% 31.3% 38.7% 48.5% 21.4% 18.9% 9.3% EBITDA 16 19 19 16 22 45 80 108 132 147 46% % EBITDA Margin 11.0% 7.6% 9.4% 6.0% 6.7% 9.7% 11.7% 13.0% 13.3% 13.5% Add: Shared-based Compensation 4 11 7 12 16 16 16 13 13 13 Adjusted EBITDA (Non-GAAP) 20 30 26 28 38 61 96 121 145 160 33% % Adjusted EBITDA Margin 13.7% 12.0% 13.0% 10.4% 11.5% 13.1% 14.0% 14.6% 14.6% 14.7% Operating Income (EBIT) 9 15 15 16 16 36 69 97 120 134 53% % EBIT Margin 5.8% 5.9% 7.6% 6.0% 4.8% 7.7% 10.1% 11.6% 12.1% 12.4% Net Income to Bona (GAAP) 6 6 8 2 1 19 47 69 88 98 132% Add: Shared-based Compensation 4 11 7 12 16 16 16 13 13 13 Adjusted Net Income to Bona (Non-GAAP) 10 17 15 14 17 35 63 82 101 111 45% Summary Historical and Projected Income Statement ___________________________ Source: Company filings, Management Projections (provided on 6 - Dec - 2015), USDRMB exchange rate of 6.2 based on management assump tions. Note: 1. Includes film investment and production as well as film distribution revenue. Historical Management Projections (1) 4

Management Projections Benchmarking Analysis 334 463 687 834 991 1,084 315 477 492 649 781 874 2015F 2016F 2017F 2018F 2019F 2020F ( US$mm) Management Projections Broker Projections Bona Management Projections vs. Broker Forecasts – Revenue ___________________________ Source: Management Projections (provided on 6 - Dec - 2015), Factset, Broker research, Entgroup. Note: 1. Based on median of Wall Street broker estimates published in 2015, to the extent adjusted EBITDA is available (including Bank of America Merrill Lynch, Macquarie and Cowen &Co.). 2. Based on consensus broker forecast from Factset, dated 10 - Dec - 2015. 3. Based on Entgroup projections for PRC Box Office available from IMAX China Prospectus dated 24 - Sep - 2015. 38 61 96 121 145 160 29 39 81 81 145 169 2015F 2016F 2017F 2018F 2019F 2020F (US$mm) Management Projections Broker Projections Bona Management Projections vs. Broker Forecasts – Adjusted EBITDA (1) (1) Bona Management Projections vs. Chinese Comps – 2015 - 2017E Revenue CAGR 44% 31% 27% 25% 35% 35% Bona Management Projections Enlight Media Huayi Brothers Hualu Baina Huace Film & TV China Box Office Growth Rate (3) (2) (2) (2) (2) 5.9% - 3.0% 39.6% 28.5% 26.9% 24.0% 34.3% 57.1% 18.9% 49.9% - 0.1% - 5.5% % Management vs. Broker Projections % Management vs. Broker Projections 5

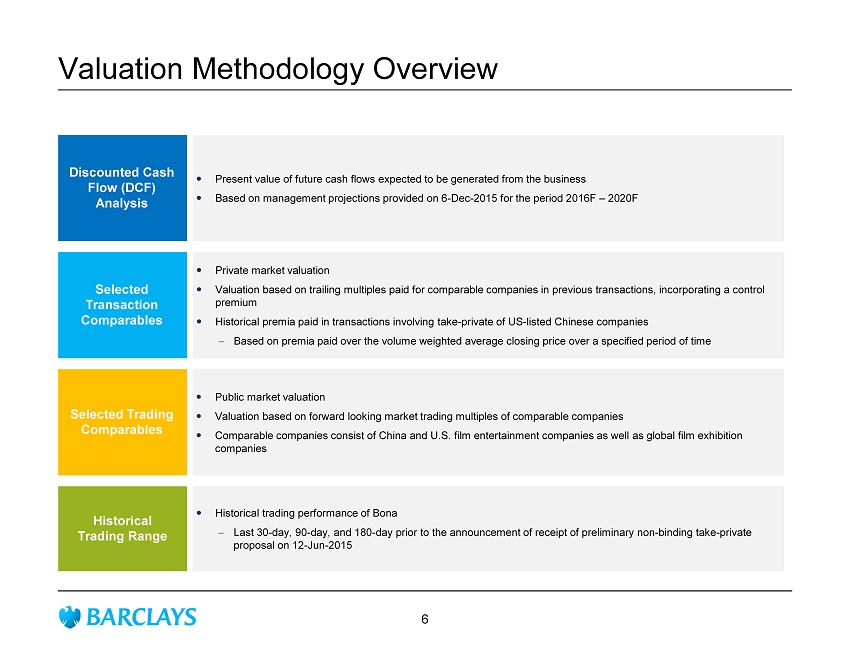

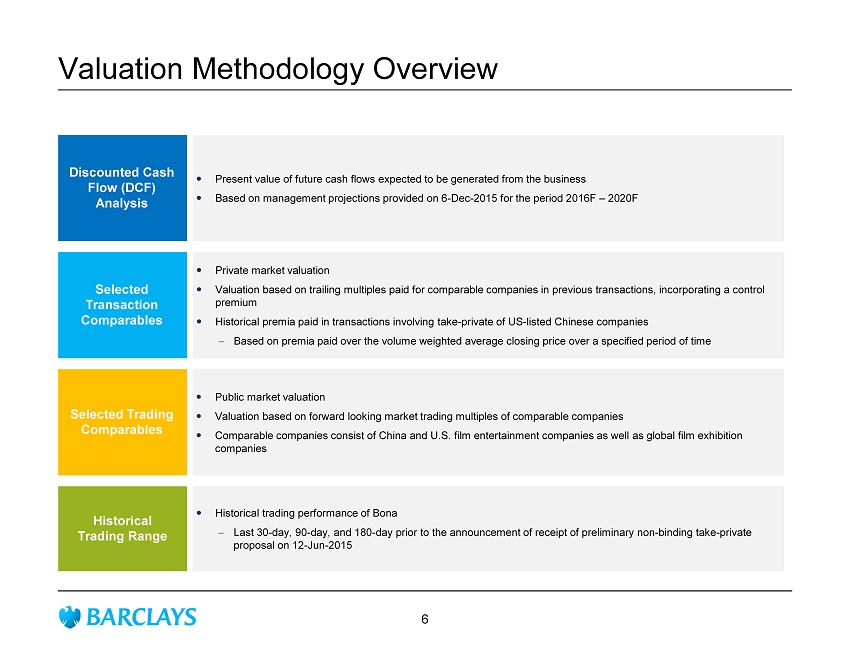

Valuation Methodology Overview Discounted Cash Flow (DCF) Analysis · Present value of future cash flows expected to be generated from the business · Based on management projections provided on 6 - Dec - 2015 for the period 2016F – 2020F Selected Trading Comparables · Public market valuation · Valuation based on forward looking market trading multiples of comparable companies · Comparable companies consist of China and U.S. film entertainment companies as well as global film exhibition companies Selected Transaction Comparables · Private market valuation · Valuation based on trailing multiples paid for comparable companies in previous transactions, incorporating a control premium · Historical premia paid in transactions involving take - private of US - listed Chinese companies · Based on premia paid over the volume weighted average closing price over a specified period of time Historical Trading Range · Historical trading performance of Bona · Last 30 - day, 90 - day, and 180 - day prior to the announcement of receipt of preliminary non - binding take - private proposal on 12 - Jun - 2015 6

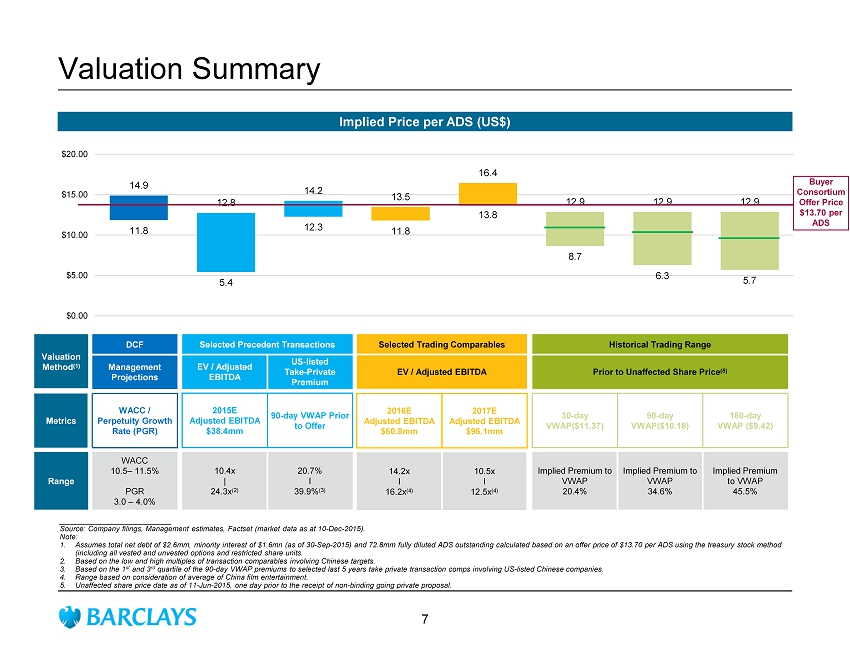

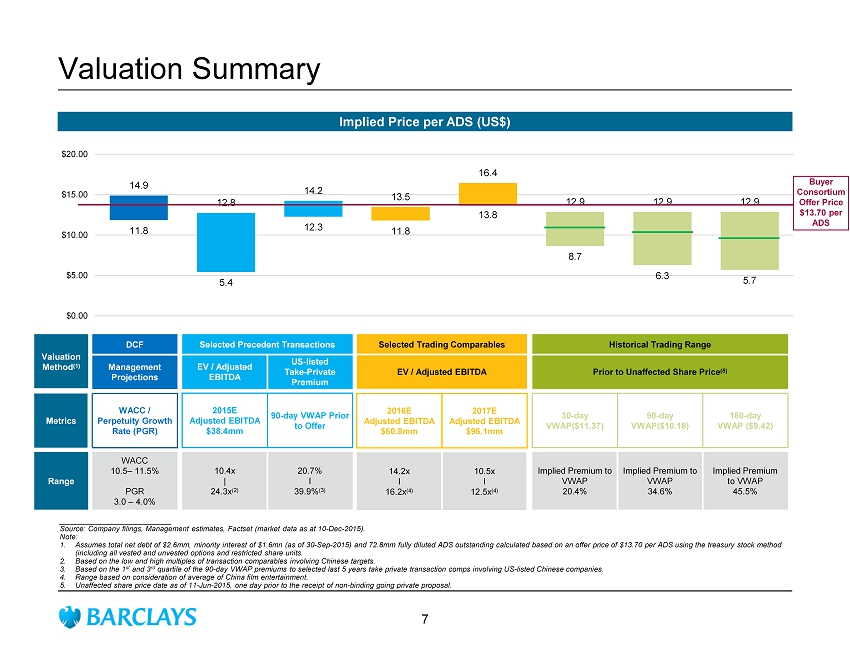

11.8 5.4 12.3 11.8 13.8 8.7 6.3 5.7 14.9 12.8 14.2 13.5 16.4 12.9 12.9 12.9 $0.00 $5.00 $10.00 $15.00 $20.00 Valuation Summary Buyer Consortium Offer Price $13.70 per ADS Implied Price per ADS (US$) Selected Precedent Transactions EV / Adjusted EBITDA US - listed Take - Private Premium 2015E Adjusted EBITDA $38.4mm 90 - day VWAP Prior to Offer 10.4x | 24.3x (2) 20.7% I 39.9% (3) Selected Trading Comparables EV / Adjusted EBITDA 2016E Adjusted EBITDA $60.8mm 2017E Adjusted EBITDA $96.1mm 14.2x I 16.2 x (4) 10.5x I 12.5x (4) Valuation Method (1) DCF Management Projections Metrics WACC / Perpetuity Growth Rate (PGR) Range WACC 10.5 – 11.5% PGR 3.0 – 4.0% Historical Trading Range Prior to Unaffected Share Price (5) 30 - day VWAP($11.37) 90 - day VWAP($10.18) 180 - day VWAP ($9.42) Implied Premium to VWAP 20.4% Implied Premium to VWAP 34.6% Implied Premium to VWAP 45.5% ___________________________ Source: Company filings, Management estimates, Factset (market data as at 10 - Dec - 2015). Note: 1. Assumes total net debt of $2.6mm, minority interest of $1.6mn (as of 30 - Sep - 2015) and 72.8mm fully diluted ADS outstanding calcu lated based on an offer price of $13.70 per ADS using the treasury stock method (including all vested and unvested options and restricted share units. 2. B ased on the low and high multiples of transaction comparables involving Chinese targets. 3. Based on the 1 st and 3 rd quartile of the 90 - day VWAP premiums to selected last 5 years take private transaction comps involving US - listed Chinese compan ies. 4. Range b ased on consideration of average of China film entertainment. 5. Unaffected share price date as of 11 - Jun - 2015, one day prior to the receipt of non - binding going private proposal . 7

Discounted Cash Flow Analysis Indicative Discounted Free Cash Flows Summary ___________________________ Source: Management Projections (provided on 6 - Dec - 2015). Note: 1. Assumes valuation date as of 31 - Dec - 2015. DCF uses end of year convention. USD/RMB exchange rate of 6.2 per management assumptio ns. 2. Refer to Appendix “Weighted Average Cost of Capital” for details. 3. Includes Cash and Cash Equivalent and Restricted Cash, based on Bona 3Q2015 filings as at 30 - Sep - 2015. 4. Includes Bank Borrowings, Other Borrowings and Non - Controlling Interests, based on Bona 3Q2015 filings as at 30 - Sep - 2015. 5. Equivalent ADS based on 36.4mm diluted shares outstanding. Diluted shares outstanding calculated using the treasury Stock Met hod (including all vested and unvested options and restricted shares). 6. Excludes issued but unvested share - based compensation expenses as part of the 2010 Management Incentive Plan and as such issued employees shares incentives instruments have been accounted for in the diluted ADS outstanding. 7. Based on effective tax rate per Management Projections. Valuation Summary (1) Implied Terminal LTM Multiple Implied ADS Price (USD) (2) (4) (3) (7) (5) (6) WACC 11.0% Perpetuity Growth Rate 3.5% (US$mm, FYE Dec 31) 2016F 2017F 2018F 2019F 2020F NPV of 2016F - 2020F Cash Flows 168.3 Adjusted EBITDA 60.8 96.1 121.4 144.8 159.6 NPV of Terminal Value 792.5 Less: Share-based Compensation (13.0) (13.0) (13.0) Enterprise Value 960.9 Less: Taxes (Unlevered Basis) (13.7) (19.8) (24.6) (28.7) (33.4) Add: Cash and Cash Equivalent 150.9 Less: Capex (32.3) (29.0) (15.8) (2.9) (2.9) Less: Total Debt (153.5) Less: Change in Net Working Capital (25.4) (27.8) (7.1) (8.8) (13.5) Equity Value 958.3 Unlevered Free Cash Flow (10.5) 19.4 60.9 91.4 96.8 Diluted ADS outstanding (million) 72.8 Discount Factor 90.1% 81.1% 73.1% 65.9% 59.3% Implied Price per Share $13.17 Discounted Free Cash Flow (9.5) 15.7 44.5 60.2 57.4 WACC $13.17 10.0% 10.5% 11.0% 11.5% 12.0% 2.5% $13.06 $12.39 $11.79 $11.26 $10.79 3.0% $13.89 $13.11 $12.44 $11.84 $11.31 3.5% $14.84 $13.94 $13.17 $12.49 $11.89 4.0% $15.95 $14.90 $14.00 $13.22 $12.54 4.5% $17.27 $16.02 $14.96 $14.06 $13.27 Perpetuity Growth Rate WACC 10.0% 10.5% 11.0% 11.5% 12.0% 2.5% 8.0x 7.5x 7.1x 6.7x 6.3x 3.0% 8.6x 8.0x 7.5x 7.1x 6.7x 3.5% 9.3x 8.7x 8.1x 7.6x 7.1x 4.0% 10.2x 9.4x 8.7x 8.1x 7.6x 4.5% 11.1x 10.2x 9.4x 8.7x 8.2x Perpetuity Growth Rate 8

Selected Transaction Comparables ___________________________ Source: Company filings, Press, exchange rate based on announcement date provided by Factset. Note: 1. Based on Jiangsu Yaolai’s 1H14 and FY13 EBITDA adjusted for timing difference. 2. Based on Cinema City Holding’s operating profit before depreciation and amortisation, and transaction and reorganisation cost s f or the 12 months ended 30 - Sep - 2013 per public transaction filings. 3. Based on Vue Entertainment’s Pro - forma Adjusted EBITDA for the 53 week period ended 4 - Apr - 2013 per public transaction filings. 4. Pre - synergy multiple of approximately 5.9 times cash flow per Regal Entertainment’s press release. 5. Based on Adjusted EBITDA per public filings. 6. Based on CinemaxX AG’s FY11 EBITDA per most recent filing with cash flow disclosures. 7. Based on Vue Entertainment’s Adjusted EBITDA for the 52 week period ended 25 - Nov - 2010 per public transaction filings. 8. Based on SMG Pictures’ FY14 EBITDA forecast per BesTV – Oriental Pearl Group transaction circular. 9. EBITDA based on Perfect Pictures & Media’s Jan - Apr 2014 and FY13 operating profit, adjusted for timing differences per public fi lings; EV based on firm valuation disclosed, assuming 0 net debt. 10. Based on ChinaVision’s FY13 EBITDA per company filing; equity value calculated by issued price (HK$0.5 per share) and number of new shares (12,488mn), adjusted for % sought; enterprise value adjusted for cash raised through new shares issuance to Alibaba. 11. Based on Great Wall’s FY13 and Jan - Apr 2014 operating profit, adjusted for timing difference, per the filing (transaction report ) of Jiangsu Hongbao Hardware 12. Based on Croton’s FY12 and Jan - Mar 2013 EBITDA, adjusted for timing difference, per company filings. 13. Based on Classic Media’s operating profit for the 12 months ended 29 - Feb - 2012 per press release disclosure. (1) (8) (2) (3) (6) (7) (4) (4) (5) (5) (9) (9) (10) (11) (12) (13) (10) ($ in millions except per share values) Date Target Equity Enterprise LTM Announced Acquiror Target Nationality Value Value EV/EBITDA Film Exhibition 13/08/2014 SongLiao Automobile Jiangsu Yaolai Cinema Management China 384 381 23.2x 10/01/2014 Cineworld Group Cinema City Holding Poland 840 840 9.3x 10/06/2013 OMERS Private Equity Vue Entertainment UK 592 1,452 8.5x 19/02/2013 Regal Entertainment Hollywood Theaters US 191 238 5.9x 16/11/2012 Cinemark Rave Cinemas US NA 240 5.8x 01/10/2012 Carmike Cinemas Rave Reviews Cinemas (16 Theaters) US 19 119 5.1x 10/07/2012 Doughty Hanson & Co CinemaxX AG Germany 214 260 9.9x 18/05/2012 Dalian Wanda Group AMC Entertainment US 2,600 2,328 7.6x 05/11/2010 Doughty Hanson & Co Vue Entertainment UK NA 729 7.3x Film Exhibition Mean 9.2x Film Exhibition Median 7.6x Production / Distribution 21/11/2014 BesTV New Media SMG Pictures China 274 274 14.5x 29/08/2014 Zhejiang Jinlei Refractories Perfect Pictures & Media China 446 446 13.7x 24/06/2014 Alibaba Investment ChinaVision Media Group China 1,358 529 24.3x 07/08/2013 Jiangsu Hongbao Hardware Great Wall Film & TV China 374 366 16.2x 22/07/2013 Huace Film & TV Croton Cultural Media China 269 263 10.4x 20/07/2012 DreamWorks Classic Media US NA 156 8.1x 27/07/2011 Walt Disney UTV Software Communications India 920 1,112 37.9x 31/08/2009 Walt Disney Marvel Entertainment US 3,900 3,779 11.9x 24/01/2006 Walt Disney Pixar US 7,002 5,962 23.3x 09/12/2005 Viacom / Paramount DreamWorks US 775 1,600 16.0x Production / Distribution Mean 17.6x Production / Distribution Median 15.3x China Mean 17.1x China Median 15.4x Global Mean 13.6x Global Median 10.4x 9

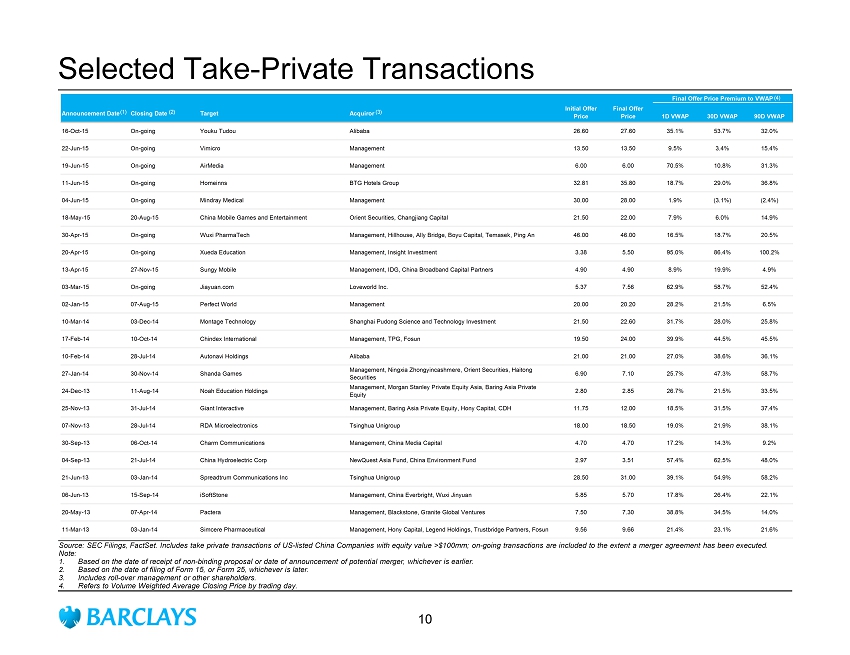

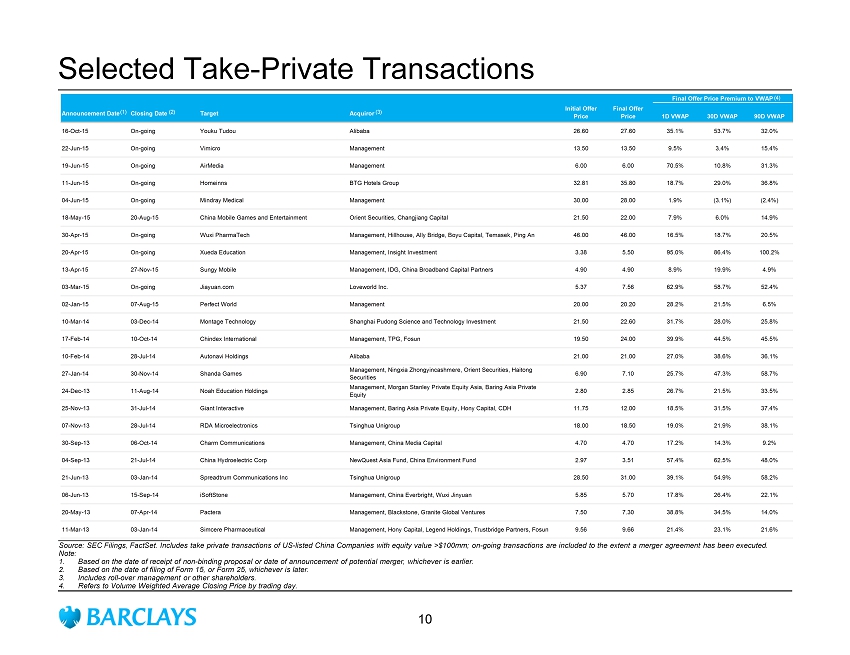

Final Offer Price Premium to VWAP Announcement Date Closing Date Target Acquiror Initial Offer Price Final Offer Price 1D VWAP 30D VWAP 90D VWAP 16-Oct-15 On-going Youku Tudou Alibaba 26.60 27.60 35.1% 53.7% 32.0% 22-Jun-15 On-going Vimicro Management 13.50 13.50 9.5% 3.4% 15.4% 19-Jun-15 On-going AirMedia Management 6.00 6.00 70.5% 10.8% 31.3% 11-Jun-15 On-going Homeinns BTG Hotels Group 32.81 35.80 18.7% 29.0% 36.8% 04-Jun-15 On-going Mindray Medical Management 30.00 28.00 1.9% (3.1%) (2.4%) 18-May-15 20-Aug-15 China Mobile Games and Entertainment Orient Securities, Changjiang Capital 21.50 22.00 7.9% 6.0% 14.9% 30-Apr-15 On-going Wuxi PharmaTech Management, Hillhouse, Ally Bridge, Boyu Capital, Temasek, Ping An 46.00 46.00 16.5% 18.7% 20.5% 20-Apr-15 On-going Xueda Education Management, Insight Investment 3.38 5.50 95.0% 86.4% 100.2% 13-Apr-15 27-Nov-15 Sungy Mobile Management, IDG, China Broadband Capital Partners 4.90 4.90 8.9% 19.9% 4.9% 03-Mar-15 On-going Jiayuan.com Loveworld Inc. 5.37 7.56 62.9% 58.7% 52.4% 02-Jan-15 07-Aug-15 Perfect World Management 20.00 20.20 28.2% 21.5% 6.5% 10-Mar-14 03-Dec-14 Montage Technology Shanghai Pudong Science and Technology Investment 21.50 22.60 31.7% 28.0% 25.8% 17-Feb-14 10-Oct-14 Chindex International Management, TPG, Fosun 19.50 24.00 39.9% 44.5% 45.5% 10-Feb-14 28-Jul-14 Autonavi Holdings Alibaba 21.00 21.00 27.0% 38.6% 36.1% 27-Jan-14 30-Nov-14 Shanda Games Management, Ningxia Zhongyincashmere, Orient Securities, Haitong Securities 6.90 7.10 25.7% 47.3% 58.7% 24-Dec-13 11-Aug-14 Noah Education Holdings Management, Morgan Stanley Private Equity Asia, Baring Asia Private Equity 2.80 2.85 26.7% 21.5% 33.5% 25-Nov-13 31-Jul-14 Giant Interactive Management, Baring Asia Private Equity, Hony Capital, CDH 11.75 12.00 18.5% 31.5% 37.4% 07-Nov-13 28-Jul-14 RDA Microelectronics Tsinghua Unigroup 18.00 18.50 19.0% 21.9% 38.1% 30-Sep-13 06-Oct-14 Charm Communications Management, China Media Capital 4.70 4.70 17.2% 14.3% 9.2% 04-Sep-13 21-Jul-14 China Hydroelectric Corp NewQuest Asia Fund, China Environment Fund 2.97 3.51 57.4% 62.5% 48.0% 21-Jun-13 03-Jan-14 Spreadtrum Communications Inc Tsinghua Unigroup 28.50 31.00 39.1% 54.9% 58.2% 06-Jun-13 15-Sep-14 iSoftStone Management, China Everbright, Wuxi Jinyuan 5.85 5.70 17.8% 26.4% 22.1% 20-May-13 07-Apr-14 Pactera Management, Blackstone, Granite Global Ventures 7.50 7.30 38.8% 34.5% 14.0% 11-Mar-13 03-Jan-14 Simcere Pharmaceutical Management, Hony Capital, Legend Holdings, Trustbridge Partners, Fosun 9.56 9.66 21.4% 23.1% 21.6% Selected Take - Private Transactions ___________________________ Source: SEC Filings, FactSet. Includes take private transactions of US - listed China Companies with equity value >$100mm; on - goin g transactions are included to the extent a merger agreement has been executed. Note: 1. Based on the date of receipt of non - binding proposal or date of announcement of potential merger, whichever is earlier. 2. Based on the date of filing of Form 15, or Form 25, whichever is later. 3. Includes roll - over management or other shareholders. 4. Refers to Volume Weighted Average Closing Price by trading day. (1) (2) (4) (3) 10

Final Offer Price Premium to VWAP Announcement Date Closing Date Target Acquiror Initial Offer Price Final Offer Price 1D VWAP 30D VWAP 90D VWAP 02-Oct-12 09-Jul-13 Feihe International Management, Morgan Stanley Private Equity Asia 7.40 7.40 21.3% 23.6% 22.9% 15-Oct-12 07-Jul-14 Yongye International Management, Morgan Stanley Private Equity Asia, Private Investor 6.60 7.10 48.2% 58.3% 83.3% 27-Sep-12 19-Nov-12 China Kanghui Medtronic 30.75 30.75 25.5% 25.0% 34.3% 26-Sep-12 18-Jul-13 7 Days Group Management, Carlyle, Sequoia, Actis 12.70 13.80 30.6% 43.2% 42.5% 12-Sep-12 09-Jun-13 3SBio Inc Management, CITIC PE 15.00 16.70 44.1% 45.7% 33.8% 13-Aug-12 03-Jun-13 Focus Media Management, Carlyle, FountainVest, CITIC Capital, China Everbright, Fosun 27.00 27.50 17.6% 36.6% 28.2% 06-Jul-12 15-Apr-13 ShangPharma Management, TPG 8.50 - 9.50 9.00 30.8% 44.8% 20.4% 09-May-12 20-Feb-13 China Nuokang Bio-Pharmaceutical Inc Management 5.80 5.80 56.8% 74.0% 102.9% 02-Apr-12 12-Nov-12 Winner Medical Group Inc Management 4.30 4.50 32.3% 29.2% 46.4% 27-Mar-12 08-Jul-13 Zhongpin Management, China Wealth Growth Fund 13.50 13.50 46.6% 46.5% 40.3% 21-Feb-12 13-Nov-12 China Transinfo Technology Corp Management, SAIF Partner 5.65 5.80 12.6% 26.6% 52.6% 20-Jan-12 21-Jan-14 Asiainfo-Linkage Management, CITIC Capital, China Broadband Capital Partners, AlpInvest Partners, Qatar Investment 11.5 12.00 21.0% 50.8% 38.7% 17-Oct-11 24-Feb-12 Shanda Interactive Management 41.35 41.35 23.5% 26.6% 20.6% 25-Jul-11 27-Jul-11 Soko fitness & spa group Management, IDG 4.50 4.50 21.6% 35.7% 20.0% 27-Jun-11 16-Aug-11 Tiens Biotech Group Management 1.72 1.72 67.0% 44.2% 27.6% 25-Mar-11 26-Aug-11 Funtalk China Management, ARC Capital, Golden Meditech, PAG Asia 7.10 7.20 17.1% 34.2% 26.7% 07-Mar-11 04-Nov-11 China Fire & Security Management, Bain Capital 9.00 9.00 43.8% 52.4% 28.1% 28-Jan-11 26-Sep-11 China Security & Surveillance Technology Management 6.50 6.50 58.5% 39.1% 30.3% 11-Nov-10 29-Aug-11 Chemspec International Management, Primavera Capital 8.00 8.10 28.2% 29.2% 22.8% 03-Nov-10 09-Jan-13 Fushi Copperweld Management, Abax Capital 11.50 9.50 4.4% 1.6% 9.4% 11-Oct-10 14-Nov-11 Harbin Electric Management, Abax Capital 24.00 24.00 20.2% 36.3% 37.7% 08-Apr-10 21-Apr-11 Tongjitang Chinese Medicine Management, Fosun 4.50 4.50 19.0% 22.3% 21.0% Mean 31.0% 34.3% 33.7% Median 26.2% 32.9% 30.8% Selected Take - Private Transactions (cont’d) ___________________________ Source: SEC Filings, FactSet. Includes take private transactions of US - listed China Companies with equity value >$100mn; on - goin g transactions are included to the extent a merger agreement has been executed. Note: 1. Based on the date of receipt of non - binding proposal or date of announcement of potential merger, whichever is earlier. 2. Based on the date of filing of Form 15, or Form 25, whichever is later. 3. Includes roll - over management or other shareholders. 4. Refers to Volume Weighted Average Closing Price by trading day. 5. On 28 - Jan - 2011, Chairman Mr. Tu Guoshen requested the opportunity to receive information and otherwise work further in order to develop a take - private proposal. (1) (2) (4) (3) (5) 11

___________________________ Source: Company filings, Factset (market data as at 10 - Dec - 2015). The Chinese A share listed comparables are not included due to the closed nature of the Chinese A - share market to international investors. Note: Bona multiples based on Management Projections (provided on 6 - Dec - 2015). 1. EBITDA and net income on adjusted basis, excluding share - based compensation expenses. Selected Trading Comparables (1) (1) Listing Price Mkt Cap EV EV / Revenue EV / EBITDA P / E Company name Venue LC 10-Dec-15 US$mm US$mm 2015F 2016F 2017F 2015F 2016F 2017F 2015F 2016F 2017F Bona Film NASDAQ USD 12.52 910 914 2.7x 2.0x 1.3x 23.8x 15.0x 9.5x 52.1x 25.6x 14.5x Bona Film (Pre-announcement) NASDAQ USD 12.86 922 961 2.9x 2.1x 1.4x 25.0x 15.8x 10.0x 52.8x 26.0x 14.7x China Film Entertainment Alibaba Picture Hong Kong HKD 1.85 6,023 3,846 na na na na na na na na na IMAX China Hong Kong HKD 54.10 2,481 2,391 22.5x 16.5x 13.6x 49.4x 29.1x 22.2x nm 43.2x 32.2x SMI Hong Kong HKD 0.91 1,482 1,532 3.7x 2.6x 1.8x 13.1x 7.9x 6.0x 33.5x 22.2x 13.2x Mei Ah Hong Kong HKD 0.82 628 590 na na na na na na na na na Orange Sky Hong Kong HKD 0.61 216 263 1.4x 1.1x 0.8x 14.5x 8.6x 6.2x nm 18.9x 10.8x Mean: 9.2x 6.7x 5.4x 25.7x 15.2x 11.5x 33.5x 28.1x 18.7x Median: 3.7x 2.6x 1.8x 14.5x 8.6x 6.2x 33.5x 22.2x 13.2x US Film Entertainment Walt Disney NYSE USD 110.76 186,054 203,251 3.9x 3.6x 3.4x 13.1x 11.5x 10.9x 22.1x 19.3x 17.6x Time Warner NYSE USD 67.84 58,138 79,320 2.8x 2.6x 2.5x 10.3x 9.5x 8.8x 14.6x 12.9x 11.1x 21st Century Fox NASDAQ USD 28.23 55,988 70,759 2.5x 2.4x 2.3x 10.5x 9.7x 8.7x 10.0x 14.1x 11.4x Viacom NASDAQ USD 43.93 17,605 29,664 2.2x 2.2x 2.1x 8.0x 7.0x 6.7x 8.8x 7.4x 6.8x Lionsgate NYSE USD 35.25 5,477 6,932 2.8x 2.6x 2.5x 22.1x 17.1x 15.2x 30.7x 22.4x 19.2x DreamWorks NASDAQ USD 25.48 3,031 3,382 3.9x 3.3x 3.2x 48.2x 25.4x 21.8x nm 39.2x 31.9x Mean: 3.0x 2.8x 2.7x 18.7x 13.4x 12.0x 17.2x 19.2x 16.3x Median: 2.8x 2.6x 2.5x 11.8x 10.6x 9.8x 14.6x 16.7x 14.5x Global Exhibition Cinemark NYSE USD 33.56 3,895 5,437 1.9x 1.8x 1.7x 8.1x 7.8x 7.1x 17.4x 15.5x 13.7x Regal Entertainment NYSE USD 18.57 2,933 5,183 1.7x 1.6x 1.6x 8.6x 8.4x 7.9x 17.5x 16.5x 14.8x Cineplex Inc Toronto CAD 47.99 2,247 2,544 2.6x 2.4x 2.2x 14.2x 12.0x 10.8x 31.5x 23.3x 19.9x CJ CGV Korea KRW 123,500 2,212 2,557 2.5x 2.2x 1.8x 18.3x 15.3x 12.4x 44.9x 34.7x 25.6x Major Cineplex Thailand THB 31.25 777 897 3.6x 3.2x 2.9x 12.7x 11.3x 10.3x 21.9x 20.4x 17.8x Carmike Cinemas NASDAQ USD 21.46 540 876 1.1x 1.0x 1.0x 7.2x 6.3x 5.8x 57.4x 25.6x 18.8x PVR Ltd BSE India INR 752.70 467 510 1.9x 1.6x 1.3x 11.1x 8.6x 7.3x 34.6x 22.4x 18.5x Mean: 2.2x 2.0x 1.8x 11.5x 10.0x 8.8x 32.2x 22.6x 18.5x Median: 1.9x 1.8x 1.7x 11.1x 8.6x 7.9x 31.5x 22.4x 18.5x Global Mean ex A-share: 3.8x 3.2x 2.8x 16.8x 12.2x 10.5x 26.5x 22.4x 17.7x Global Median ex A-share: 2.5x 2.4x 2.2x 12.9x 9.6x 8.7x 22.1x 21.3x 17.7x 12

Selected Trading Comparables (cont’d) ___________________________ Source: Company filings, Factset (market data as at 10 - Dec - 2015). The Chinese A share listed comparables are not included due to the closed nature of the Chinese A - share market to international investors. Note: Bona statistics based on Management Projections (provided on 6 - Dec - 2015). 1. EBITDA and net income on adjusted basis, excluding share - based compensation expenses. (1) Price Mkt Cap EV Revenue Growth EBITDA Margin EBIT Margin Net Margin Company name Listing Venue LC 10-Dec-15 US$mm US$mm FY15-16 FY16-17 2015F 2016F 2017F 2015F 2016F 2017F 2015F 2016F 2017F Bona Film NASDAQ US$ $12.52 910 914 38.7% 48.5% 11.5% 13.1% 14.0% 4.2% 7.7% 10.1% 5.1% 7.5% 9.0% China Film Entertainment Alibaba Picture Hong Kong HKD 1.85 6,023 3,846 na na na na na na na na na na na IMAX China Hong Kong HKD 54.10 2,481 2,391 36.2% 21.6% 45.5% 56.6% 61.2% 44.1% 51.4% 56.6% (41.0%) 40.7% 44.5% SMI Hong Kong HKD 0.91 1,482 1,532 41.3% 46.1% 28.0% 32.6% 29.4% 17.0% 17.4% 21.9% 8.7% 11.5% 13.6% Mei Ah Hong Kong HKD 0.82 628 590 na na na na na na na na na na na Orange Sky Hong Kong HKD 0.61 216 263 28.7% 24.9% 9.3% 12.3% 13.7% (1.2%) 3.4% 5.9% 0.8% 3.4% 4.4% Mean: 35.4% 30.9% 27.6% 33.9% 34.8% 20.0% 24.1% 28.1% (10.5%) 18.5% 20.8% Median: 36.2% 24.9% 28.0% 32.6% 29.4% 17.0% 17.4% 21.9% 0.8% 11.5% 13.6% US Film Entertainment Walt Disney NYSE USD 110.76 186,054 203,251 7.4% 5.4% 29.5% 31.1% 31.4% 25.2% 28.0% 28.3% 16.2% 16.9% 17.1% Time Warner NYSE USD 67.84 58,138 79,320 5.0% 5.3% 26.9% 27.9% 28.6% 24.6% 25.7% 26.5% 13.1% 13.9% 14.5% 21st Century Fox NASDAQ USD 28.23 55,988 70,759 1.8% 6.9% 23.6% 25.1% 26.2% 21.3% 22.8% 23.8% 20.9% 13.2% 14.2% Viacom NASDAQ USD 43.93 17,605 29,664 3.0% 3.3% 27.8% 31.0% 31.0% 26.1% 29.4% 29.5% 15.1% 16.8% 16.8% Lionsgate NYSE USD 35.25 5,477 6,932 7.2% 5.0% 12.6% 15.2% 16.2% 8.7% 10.9% 11.2% 7.1% 9.1% 9.7% DreamWorks NASDAQ USD 25.48 3,031 3,382 18.5% 4.1% 8.1% 13.0% 14.5% (2.2%) 9.3% 11.2% (9.8%) 5.5% 6.4% Mean: 7.2% 5.0% 21.4% 23.9% 24.7% 17.3% 21.0% 21.7% 10.4% 12.6% 13.1% Median: 6.1% 5.2% 25.3% 26.5% 27.4% 22.9% 24.3% 25.1% 14.1% 13.6% 14.3% Global Exhibition Cinemark NYSE USD 33.56 3,895 5,437 3.6% 6.6% 23.3% 23.3% 24.2% 15.4% 15.7% 16.7% 7.7% 8.3% 8.9% Regal Entertainment NYSE USD 18.57 2,933 5,183 1.5% 2.7% 19.3% 19.5% 20.3% 10.7% 11.4% 12.0% 4.9% 5.5% 6.1% Cineplex Inc Toronto CAD 47.99 2,247 2,544 9.0% 6.1% 18.1% 19.6% 20.5% 11.4% 13.0% 14.0% 7.1% 8.5% 9.6% CJ CGV Korea KRW 123,500 2,212 2,557 16.5% 18.9% 13.7% 14.1% 14.6% 6.1% 7.2% 8.0% 5.2% 5.4% 6.0% Major Cineplex Thailand THB 31.25 777 897 12.7% 8.8% 28.3% 28.3% 28.4% 14.6% 15.1% 15.5% 14.4% 14.1% 14.3% Carmike Cinemas NASDAQ USD 21.46 540 876 7.5% 6.4% 15.3% 16.3% 16.8% 7.3% 8.8% 9.8% (0.6%) 2.3% 3.0% PVR Ltd BSE India INR 752.70 467 510 24.2% 18.2% 17.5% 18.3% 18.2% 10.7% 11.1% 11.3% 5.4% 6.7% 7.1% Mean: 10.7% 9.7% 19.4% 19.9% 20.4% 10.9% 11.8% 12.5% 6.3% 7.3% 7.8% Median: 9.0% 6.6% 18.1% 19.5% 20.3% 10.7% 11.4% 12.0% 5.4% 6.7% 7.1% Global Mean ex A-share: 14.0% 11.9% 21.7% 24.0% 24.7% 15.0% 17.5% 18.9% 4.7% 11.4% 12.3% Global Median ex A-share: 8.2% 6.5% 21.3% 21.5% 22.3% 13.0% 14.0% 14.7% 7.1% 8.8% 9.6% 13

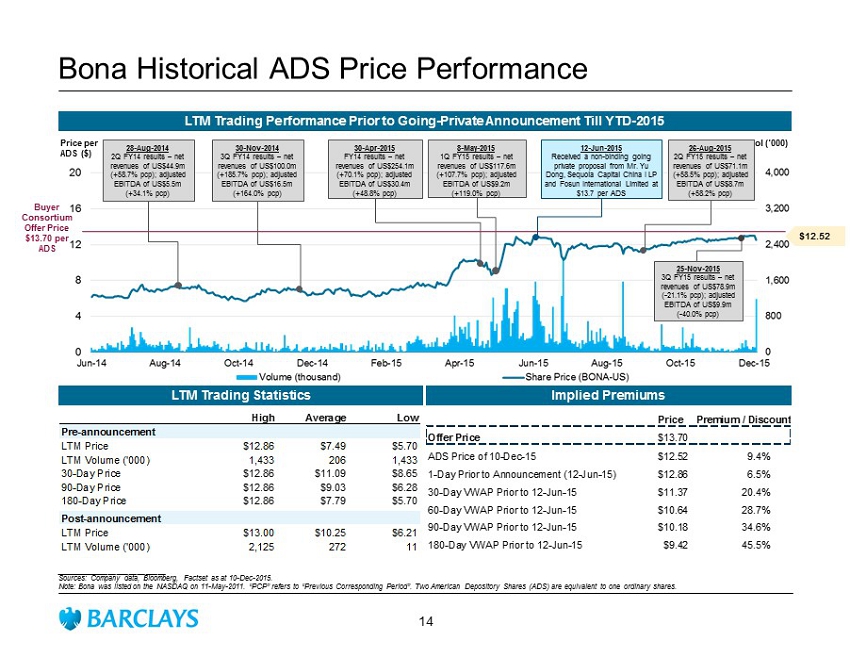

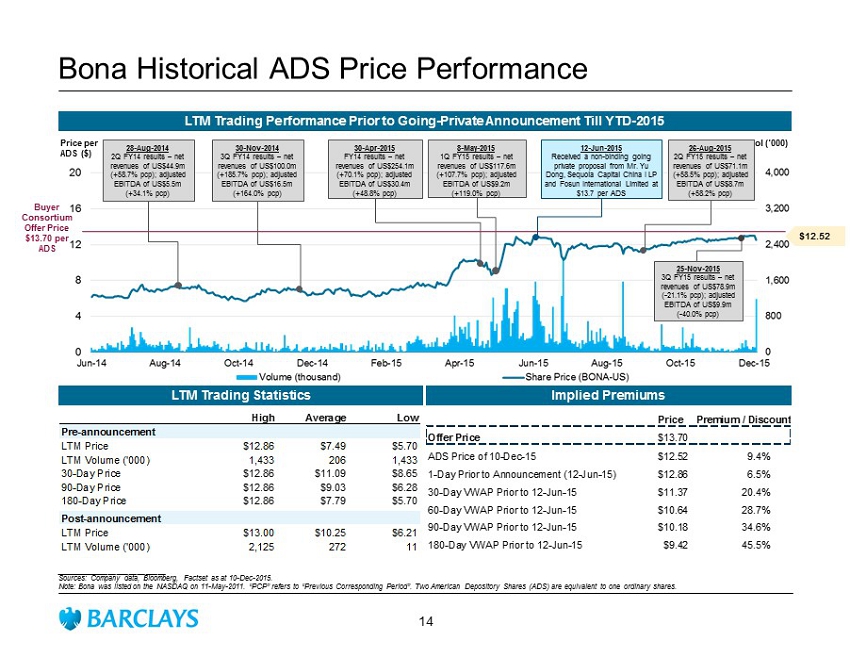

0 800 1,600 2,400 3,200 4,000 0 4 8 12 16 20 Jun-14 Aug-14 Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 Aug-15 Oct-15 Dec-15 Volume (thousand) Share Price (BONA-US) Bona Historical ADS Price Performance LTM Trading Performance Prior to Going - Private Announcement Till YTD - 2015 ___________________________ Sources: Company data, Bloomberg, Factset as at 10 - Dec - 2015 . Note: Bona was listed on the NASDAQ on 11 - May - 2011. “PCP” refers to “Previous Corresponding Period”. Two American Depository Shares (ADS) are equivalent to one ordinary shares. Vol (‘000) 12 - Jun - 2015 Received a non - binding going private proposal from Mr. Yu Dong, Sequoia Capital China I LP and Fosun International Limited at $13.7 per ADS Buyer Consortium Offer Price $13.70 per ADS 30 - Apr - 2015 FY14 results – net revenues of US$254.1m (+70.1% pcp); adjusted EBITDA of US$30.4m (+48.8% pcp) 8 - May - 2015 1Q FY15 results – net revenues of US$117 .6m (+ 107.7 % pcp); adjusted EBITDA of US$9.2m (+119.0% pcp) Implied Premiums LTM Trading Statistics 30 - Nov - 2014 3 Q FY14 results – net revenues of US$100.0m (+ 185.7 % pcp); adjusted EBITDA of US$16.5m (+164.0% pcp) Price per ADS ($) $12.52 28 - Aug - 2014 2 Q FY14 results – net revenues of US$44.9m (+ 58.7 % pcp); adjusted EBITDA of US$5.5m (+34.1% pcp) 26 - Aug - 2015 2Q FY15 results – net revenues of US$71.1m (+ 58.5 % pcp); adjusted EBITDA of US$8.7m (+58.2% pcp) 25 - Nov - 2015 3 Q FY15 results – net revenues of US$78.9m ( - 21.1% pcp); adjusted EBITDA of US$9.9m ( - 40.0% pcp) Price Premium / Discount Offer Price $13.70 ADS price of 10-Dec-2015 $12.52 9.4% 1-Day prior to offer (11-Jun-2015) $12.86 6.5% 30-Day VWAP prior to offer $11.37 20.4% 60-Day VWAP prior to offer $10.64 28.7% 90-Day VWAP prior to offer $10.18 34.6% 180-Day VWAP prior to offer $9.42 45.5% High Average Low Pre-announcement LTM Price $12.86 $7.49 $5.70 LTM Volume ('000) 1,433 206 1,433 30-Days Price $12.86 $11.09 $8.65 90-Days Price $12.86 $9.03 $6.28 180-Days Price $12.86 $7.79 $5.70 Post-announcement LTM Price $13.00 $10.25 $6.21 LTM Volume ('000) 2,125 272 11 14

Appendix

Bona Film 0.80 16.3% 25.0% 0.71 China Film Entertainment SMI 0.62 9.5% 16.5% 0.58 Mei Ah 0.59 0.2% 16.5% 0.58 Orange Sky 0.78 39.5% 16.5% 0.59 US Film Entertainment Walt Disney 1.14 9.5% 35.0% 1.07 Time Warner 1.04 44.3% 35.0% 0.81 21st Century Fox 1.18 39.0% 35.0% 0.94 Viacom 1.20 67.0% 35.0% 0.83 Lionsgate 0.69 29.8% 35.0% 0.58 DreamWorks 1.07 12.5% 35.0% 0.99 Global Exhibition Cinemark 0.90 52.2% 35.0% 0.67 Regal Entertainment 0.67 80.8% 35.0% 0.44 Cineplex Inc 0.23 14.1% 35.0% 0.21 CJ CGV 0.26 20.3% 22.0% 0.22 Major Cineplex 0.88 16.9% 20.0% 0.77 Carmike Cinemas 0.84 85.9% 35.0% 0.54 PVR Ltd 0.72 19.6% 30.0% 0.63 Global Median 0.81 25.1% 35.0% 0.61 Global Mean 0.80 33.8% 29.5% 0.65 Comparable Companies Levered Beta Debt / Equity Marginal Tax Rate Unlevered Beta Weighted Average Cost of Capital (“WACC”) ___________________________ Sources: Bloomberg, Company filings, Factset (market data as at 10 - Dec - 2015). Note: 1. Aswath Damodaran, ‘Country Default Spreads and Risk Premiums’, 2015. 2. Unlevered beta calculated by unlevering Bloomberg raw historical beta on 11 - June - 2015 (one day prior to the receipt of going - pri vate proposal) for BONA share price against S&P500 index (5 - year time horizon and weekly market data) using BONA’s current capital structure; levered beta calculated by levering unlevered beta with target ca pit al structure (assumed to be same as current capital structure as per management). 3. China risk - free rate based on China 20 - year government bond yield. 4. Based on 2014 Ibbotson market size premium for micro cap (9 - 10 decile) companies. 5. Weighted average interest rate on Bona bank loans provided by Management on 6 - Dec - 2015. 6. Based on target Debt / Equity ratio per Management. 7. Based on Bloomberg raw historical beta for respective company share price against local index (5 - year time horizon and weekly ma rket data). 8. Alibaba Pictures (ex ChinaVision Media) is excluded due to limited trading volume; IMAX China is excluded due to limited trad ing period post IPO. Comparable Company Beta Analysis WACC Assumptions Market Risk Premium (Rm - Rf) (1) 7.96% Unlevered Beta (2) 0.712 Multiply by: Levered Beta (2) 0.799 Adjusted Market Risk Premium 6.36% Plus: Risk - free Rate of Return (Rf) (3) 3.91% Cost of Equity (Ke) 10.27% Plus: Size Premium (4) 1.87% Adjusted Cost of Equity (Ke) 12.14% Multiply by: Target Equity / ( Debt + Equity) 86.0% Weighted Cost of Equity 10.44% Cost of debt (Kd) (5) 6.30 % Marginal Tax Rate 25.0% After - tax Cost of Debt 4.73% Multiply by Target Debt / (Debt + Equity) 14.0% Target Debt / Equity 16.3% Weighted Cost of Debt 0.66% Weighted Average Cost of Capital 11.10% WACC Analysis Based on Bona’s Historical Beta (1) (2) (3) (4) (5) (8) (2) (7) (6) 15

Disclaimer This document is being made available by Barclays Bank PLC ( “Barclays” ) for information purposes only and for the sole and exclusive use of the Independent Committee of the Board of Directors of Bona Film Group Limited (the “ Recipient ”). This document is incomplete without reference to, and should be assessed solely in conjunction with, the oral briefing provided by Barclays. This document is strictly confidential and remains the property of Barclays. The Recipient agrees that it shall only use this docu men t for the purpose of evaluating and considering the matter or possible transaction to which this document relates. This document may not be distributed, published, reproduced, o r d isclosed, in whole or in part, to any other person, nor relied upon by the Recipient or any other person, nor used for any other purpose at any time, in each case without the prior written co nsent of Barclays. Neither Barclays nor any of its subsidiaries or affiliates shall be obliged by having made this document available to you to pr ovide any financial advisory services (whether in relation to the matter or possible transaction to which this document relates or otherwise) or to sell, acquire, place or underwrite any secu rit ies or to lend moneys or to provide any other commitment, facility, product, risk management solution or service, nor does Barclays represent by providing this document to the Recipient that it wi ll be possible for Barclays to provide, arrange or undertake any of the aforementioned services, activities, products or solutions. Any commitment by Barclays to provide, arrange or undertake any of the aforementioned services, activities, products or solutions would be subject to Barclays signing appropriate documentation, obtaining all necessary internal approvals and comp let ing due diligence, in each case in a manner satisfactory to Barclays. This document does not constitute nor does it form part of an offer to sell or purchase, or the solicitation of an offer to s ell or purchase, any securities or any of the businesses or assets described herein or an offer or recommendation to enter into any transaction described herein nor does this document constitu te an offer or commitment to provide, arrange or underwrite any financing. The Recipient is responsible for making its own independent investigation and appraisal of the risks, benefits, ap pro priateness and suitability of any transaction or matter contemplated by this document and Barclays is not making any recommendation (personal or otherwise) or giving any investment adv ice and will have no liability with respect thereto. The decision to proceed with any transaction or action contemplated by this document must be made by the Recipient in the light o f i ts own commercial assessments and Barclays will not be responsible for such assessments. Neither Barclays nor any of its subsidiaries or affiliates, nor any of their respective officers, directors, employees or age nt s (Barclays together with such persons being the “Barclays Group”) accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising fr om the use of this document or its contents or any reliance on the information contained herein. Barclays Group is not responsible for any specialist advice, including legal, regulatory, accou nti ng, model accounting, tax, actuarial or other advice. This document was prepared on the basis of information and data, obtained from publicly available sources and, where applicab le, from the Recipient and/or any other entity that may be involved in any transaction or matter contemplated by this document (and/or any of the Recipient’s or the aforementioned enti tie s’ affiliates), in each case prior to or on the date hereof. The information in this document has not been independently verified by Barclays. Barclays has relied on any information provided by the Recipient or from third party or public sources as complete, true, fair, accurate and not misleading. With respect to any financial or operating forecasts and analyses provided to it, Barclays has assumed that they are achievable and have been reasonably and properly prepared on bases reflecting the best currently available information, estimates and judgments a s t o the future financial performance of the entity(ies) to which they relate and that such forecasts or analyses would be realised in the amounts and time periods contemplated thereby. No me mbe r of the Barclays Group, makes any warranty or representation, express or implied, as to the accuracy, completeness or reasonableness of the information (including projecti ons and assumptions) contained in this document whether obtained from or based upon third party or public sources or otherwise. This document is given as at the date hereof, may not be final, is based on information available to Barclays as at the date her eof, is subject to any assumptions set out therein and is subject to change without notice. Accordingly, this document may be based on (a) data and information that may no longer be current a nd (b) estimates that may involve highly subjective assessments. It should be understood that subsequent developments may affect this document and the Barclays Group does not un der take any obligation to provide any additional information or to update any of the information or the conclusions contained herein or to correct any inaccuracies which may become appar ent . Any data or information regarding, or based on, past performance is no indication of future performance. Members of the Barclays Group are involved in a wide range of commercial banking, investment banking and other activities out o f which conflicting interests or duties may arise. In the ordinary course of its business, the Barclays Group may provide services to any other entity or person whether or not a membe r o f the same group as the Recipient (a “Third Party”), engage in any transaction (whether on its own account, on behalf of any Third Party or otherwise, and including any transaction or matt er contemplated by this document), notwithstanding that such services, transactions or actions may be adverse to the Recipient or any member of the Recipient’s group, and the Barclays Gr oup may retain for its own benefit any related remuneration or profit. The Barclays Group operates in accordance with a conflicts of interest policy which identifies conflicts of interest it faces in the ordinary course of its business, and establishes organisational and procedural measures to manage those conflicts where it is reasonably able to do so. Neither Barclays nor a ny other part of the Barclays Group shall have any duty to disclose to the Recipient or utilise for the Recipient’s benefit any non - public information acquired in the course of providing services to any other person, engaging in any transaction (on its own account or otherwise) or otherwise carrying on its business. Barclays ’ research analysts and research departments are independent from its investment bank and are subject to certain regulations and internal policies. Barclays research analysts may hold opinions and make statements or investment recommendat ion s and/or publish research reports with respect to any company referred to herein, the transactions contemplated herein or any person or entity involved therein or related thereto tha t differ from or are inconsistent with the views or advice communicated by Barclays’ investment bank. Barclays is a full service securities firm and as such from time to time may effec t t ransactions for its own account or the account of its clients and hold long or short positions in debt, equity or other securities of the companies referred to herein. Barclays offers premier investment banking products and services to its clients through Barclays Bank PLC. Barclays Bank PLC is authorised in the United Kingdom by the UK Prudential Regulation Authority and regulated by the UK Finan cia l Conduct Authority and the UK Prudential Regulation Authority and is registered in England No. 1026167. Registered Office: 1 Churchill Place, London E14 5HP, United Kingdom . Copyright 2015, Barclays Bank PLC 16