Table of Contents

As filed with the Securities and Exchange Commission on December 23, 2010

Registration No. 333-170376

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN RENAL HOLDINGS INC.

(Exact name of Registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| Delaware | 8090 | 04-3477845 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

66 Cherry Hill Drive,

Beverly, Massachusetts 01915

(978) 922-3080

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael R. Costa

Vice President and General Counsel

American Renal Holdings Inc.

66 Cherry Hill Drive,

Beverly, Massachusetts 01915

(978) 922-3080

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Stephan J. Feder, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000

Approximate date of commencement of proposed exchange offers: As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit (1) | Proposed maximum aggregate offering price (1) | Amount of registration fee | ||||

8.375% Senior Secured Notes due 2018 | $250,000,000 | 100% | $250,000,000 | $17,825(2) | ||||

Guarantees of 8.375% Senior Secured Notes due 2018 (3) | N/A | N/A | N/A | N/A(4) | ||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Previously paid. |

| (3) | See inside facing page for table of registrant guarantors. |

| (4) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant Guarantor as | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | Address and Telephone Number | |||||

C.P. Atlas Intermediate Holdings, LLC | Delaware | 27-2170865 | 375 Park Avenue 12th Floor, New York, NY 10152, (212) 672-5000 | |||||

American Renal Associates LLC | Delaware | 84-1694930 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

American Renal Management LLC | Delaware | 04-3527505 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

AKC Holding LLC | Delaware | 01-0833124 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

JKC Holding LLC | Delaware | 01-0833133 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

ARA-Boca Raton Holding LLC | Delaware | 55-0885438 | 1905 Clint Moore Road, Boca Raton, FL 33496, (561) 893-6878 | |||||

ARA-Ohio Holdings LLC | Delaware | 88-0519793 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

ARA-Rhode Island Dialysis II LLC | Delaware | 05-0598781 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

Texas-ARA LLC | Delaware | 04-3537394 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

American Renal Texas L.P. | Texas | 04-3535002 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

American Renal Texas II, L.P. | Texas | 83-0438331 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

Acute Dialysis Services-ARA LLC | Delaware | 26-1148649 | 66 Cherry Hill Drive, Beverly, Massachusetts 01915, (978) 922-3080. | |||||

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 23, 2010

PRELIMINARY PROSPECTUS

$250,000,000

American Renal Holdings Inc.

Offer to Exchange all outstanding $250,000,000 8.375% Senior Secured Notes due 2018 (the “outstanding notes”) for an equal amount of 8.375% Senior Secured Notes due 2018, which have been registered under the Securities Act of 1933, as amended (the “exchange notes”).

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered notes for freely tradable notes that have been registered under the Securities Act of 1933, as amended.

The Exchange Offer

| • | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| • | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| • | The exchange offer expires at 11:59 p.m., New York City time, on , 2011, unless extended. We do not currently intend to extend the expiration date. |

| • | The exchange of outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| • | The exchange notes are being offered in order to satisfy certain of our obligations under the registration rights agreement entered into in connection with the placement of the outstanding notes. |

| • | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

| • | The parent and certain subsidiaries of American Renal Holdings Inc. initially jointly and severally, irrevocably and unconditionally guaranteed, on a secured senior basis, the performance and full and punctual payment when due, whether at maturity, by acceleration or otherwise, of all obligations of American Renal Holdings Inc. under the outstanding notes, exchange notes and the indenture governing the notes. |

Resales of Exchange Notes

| • | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act of 1933, as amended, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act of 1933, as amended, and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act of 1933, as amended.

You should consider carefully therisk factors beginning on page 21 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010.

Table of Contents

| Page | ||||

| ii | ||||

| ii | ||||

| 1 | ||||

| 21 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 51 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 56 | |||

| 84 | ||||

| 103 | ||||

| 107 | ||||

| 118 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 119 | |||

| 120 | ||||

| 122 | ||||

| 124 | ||||

| 134 | ||||

| 135 | ||||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE EXCHANGE OFFER | 200 | |||

| 201 | ||||

| 203 | ||||

| 204 | ||||

| 204 | ||||

| 204 | ||||

| F-1 | ||||

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any exchange notes offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the offer contained herein and, if given or made, such information or representations must not be relied upon as having been authorized by American Renal Holdings Inc. Neither the delivery of this prospectus nor any sales made hereunder shall under any circumstances create an implication that there has been no change in our affairs or that of our subsidiaries since the date hereof.

i

Table of Contents

AmericanRenal, American Renal Associates, ARA®, the American Renal Associates logo and other trademarks or service marks of American Renal appearing in this prospectus are our property. All trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

Certain market data and other statistical information used throughout this prospectus are based on the 2009 Annual Data Report prepared by the United States Renal Data System (“USRDS”) and information from the Centers for Medicare and Medicaid Services (“CMS”). Some data are also based on our good faith estimates, which are derived from management’s review of internal data and information, as well as the independent sources such as independent industry publications, government publications, reports by market research firms or other published independent sources. Although we believe these sources are reliable, we have not independently verified the information contained therein and cannot guarantee its accuracy and completeness.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary is not complete and may not contain all of the information that you should consider to make your decisions regarding the exchange offer. You should carefully read the entire prospectus, including the section entitled “Risk Factors.”

Unless the context otherwise requires it or as otherwise indicated, “we,” “us,” “our” and similar terms, as well as references to the “Company,” “American Renal” and “ARA” refer to C.P. Atlas Intermediate Holdings, LLC and its consolidated subsidiaries.

The financial and performance information throughout this prospectus includes amounts derived from our non-guarantor joint venture subsidiaries. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates,” Note Q of “Audited Financial Statements for the years December 31, 2009, 2008 and 2007—Notes to Consolidated Financial Statements” and Note K of “Unaudited Financial Statements for the periods ended September 30, 2010 and 2009—Notes to Unaudited Consolidated Financial Statements.”

Our Company

We are a national provider of kidney dialysis services for patients suffering from chronic kidney failure, also known as end stage renal disease, or ESRD. As of September 30, 2010, we owned and operated 88 dialysis clinics treating more than 6,100 patients in 17 states and the District of Columbia. Our operating model is based on shared ownership of our facilities with physicians, known as nephrologists, who specialize in kidney-related diseases in the local market served by the clinic. Each clinic is maintained as a separate joint venture, or JV, in which we own a controlling interest and our local nephrologist partners own noncontrolling interests.

We believe we are the largest dialysis services provider in the United States founded and operating exclusively on a joint venture model. We have invested significantly in the development of our senior and field level core management function and operating procedures, and we believe we are well-positioned to continue to realize the benefits of platform scalability, which will allow us to add clinics without significant incremental operating costs. As a result, our revenue and earnings growth will be driven primarily by the growth in the number of our JV clinics and treatment growth at our existing clinics. Since our founding, we have opened 66 new clinics (“de novo clinics”) and have acquired 22 clinics from third parties (“acquired clinics”) that we subsequently converted to our JV model. In 2009 we opened 10 clinics, seven of which are de novo clinics and three are acquired clinics. We plan to continue the expansion of our operations with the use of the JV model primarily through the redeployment of free cash flow to create de novo clinics, to expand existing clinics and to selectively acquire clinics.

We believe our JV model is attractive to the nephrologist community because it provides a platform for favorable clinical outcomes and superior financial results while enabling our nephrologist partners to focus on providing the highest quality of patient care rather than the administration of corporate-directed treatments and protocols. Through our wholly-owned subsidiary, American Renal Management, LLC (“ARM”), we provide our nephrologist partners with the managerial, accounting, financial, technological and administrative support necessary to operate our clinics. In particular, our management services focus on critical revenue cycle management for each patient, which encompasses patient registration, insurance and benefit verification, medical treatment documentation and coding, bill preparation and collections. In addition, our corporate clinical advisory team, which includes our National Medical Director and clinical and regulatory advisors, assists our nephrologist partners in establishing clinical objectives, while our operating model allocates to our nephrologist partners autonomy over the clinical protocols used to achieve those objectives.

According to the United States Renal Data System, or USRDS, the number of dialysis patients in the U.S. is expected to continue growing faster than increases in the general population, primarily due to an aging

1

Table of Contents

population with increased life expectancies. As a result, we believe there will be an increasing need for dialysis clinics. In addition, we believe that the JV model will continue to be one of the fastest growing operating models for dialysis clinics and will represent an increasing percentage of the dialysis clinic industry. We believe that our JV model, with its clinic level autonomy for the physician, together with the comprehensive management services that we have developed, enhance the clinical and operating performance of our clinics and make us a preferred dialysis partner for nephrologists. We believe this will lead to additional JV opportunities with nephrologists seeking the corporate support we provide.

Dialysis Services Industry Overview

End Stage Renal Disease, or ESRD, is characterized by the loss of kidney functionality and is normally irreversible and fatal unless treated. ESRD most commonly results from complications associated with diabetes, hypertension, renal and hereditary diseases, old age and a combination of other risk factors. ESRD requires continued dialysis treatments or a kidney transplant to sustain life. Absent transplantation, the average life expectancy for an ESRD patient on dialysis is approximately five years following diagnosis, according to the USRDS. Scarcity of compatible kidneys has limited the option for transplants, causing most patients suffering from ESRD to rely on dialysis. Dialysis is the removal of toxins and fluids from the blood of ESRD patients by artificial means. Patients suffering from ESRD generally require dialysis at least three times per week, amounting to approximately 156 treatments per year, for the remainder of their lives.

There are two primary methods of dialysis commonly used today, hemodialysis and peritoneal dialysis. Hemodialysis, or the removal of toxins and fluid from the blood through a specially designed filter, is the most common form of ESRD treatment and represented approximately 92% of all dialysis treatments in the United States in 2007. Hemodialysis is typically performed in outpatient dialysis clinics and lasts approximately 3.5 hours per treatment. Treatments are usually performed by teams of licensed nurses and trained technicians pursuant to a physician’s instructions. Almost all patients receive hemodialysis in our outpatient dialysis clinics as their primary ESRD treatment, although we also provide such services in the home. Peritoneal dialysis uses the patient’s peritoneal, or abdominal, cavity to eliminate fluid and toxins. A patient generally performs peritoneal dialysis at home. We also provide peritoneal dialysis services to patients who prefer and are able to receive that form of treatment.

Large, Growing Market for Outpatient Dialysis Services

The total annual cost of providing healthcare services to ESRD patients in the U.S. in 2007 has been estimated by the USRDS to be approximately $35 billion, of which we believe approximately $18 billion represents our currently addressable market. According to the most recent report by the USRDS, there were approximately 527,000 ESRD patients in the United States as of December 31, 2007, with the number of ESRD patients expected to grow at an annual rate consistent with the historical rate of 3-4%, outpacing general population growth. Aside from a relatively small number of individuals who qualify for and successfully undergo kidney transplants, the vast majority of ESRD patients require three dialysis treatments per week, on average, for the remainder of their lives. USRDS data indicates that the prevalence rate in patients ages 65 to 74 increased 24% from 2000 to 2007; while, in patients ages 75 and older the prevalence rate increased 28% over the same period.

According to the USRDS, the increasing percentage of the U.S. population afflicted with ESRD has been primarily caused by:

| • | aging of the general population; |

| • | improved treatment and increased survival rate of patients with diabetes, hypertension and other illnesses that lead to ESRD; |

2

Table of Contents

| • | growth rates of minority populations with higher than average incidence rates of ESRD; and |

| • | improved dialysis technology, that has enabled older patients and those who previously could not tolerate dialysis due to other illnesses, to benefit from this treatment. |

Reimbursement Environment

A majority of reimbursement for dialysis services is provided by the federal government’s Medicare ESRD program based on rates established by the Centers for Medicare and Medicaid Services, or CMS. The coverage criteria for dialysis centers under Medicare are well defined and, as a result, Medicare reimbursement for dialysis services has historically been more predictable than reimbursements for most other services and procedures. ESRD has been classified as a chronic disability since 1972 and patients are entitled to treatment and Medicare benefits regardless of age or financial circumstances. Generally, if a patient does not have employer-sponsored health coverage, Medicare becomes the primary payor either immediately or after a three-month waiting period. For a patient with employer-sponsored health coverage, Medicare generally becomes the primary payor after 33 months, which includes a three-month coordination of benefits period, or earlier if the patient’s employer-sponsored health coverage terminates. Additional sources of reimbursement for dialysis services include other government agencies such as state Medicaid programs as well as private pay options.

Currently, Medicare reimburses dialysis providers separately for treatments and ancillaries. Recently approved Medicare legislation, however, will establish a “bundled” Medicare rate for dialysis reimbursement, starting in 2011. This new bundled rate will combine the current payments for composite rate and the separately billable dialysis services into a single base rate. This rate will include all services such as certain drugs and laboratory tests which are currently billed separately. The initial 2011 bundled rate will be set based on a 2% reduction in the payment rate that providers would have received under the historical fee for service payment methodology and based on the lowest average industry pharmaceutical utilization from 2007 to 2009. Beginning in 2012, the new single bundled payment base rate will be adjusted annually for inflation based upon a market basket index, less a productivity adjustment based on a 10-year moving average of productivity as projected by the Secretary of Health and Human Services. The bundled payment rate will be determined by the Secretary of Health and Human Services, who will have discretion to determine the base payment rate based on the goods and services included in the bundled rate. Dialysis providers, including us, will have the option to move fully to the bundled payment system in 2011 or to phase in the payment system over four years on a facility by facility basis. We believe that the move to bundled payment, together with the introduction of automatic annual rate increases, will result in greater predictability of rates and stability of revenue for the Company. The Congressional Budget Office estimates that these changes will result in an additional $1.5 billion in government payments to the dialysis industry over the next 10 years.

Before Medicare becomes the primary payor, a patient’s commercial insurance plan, if any, is responsible for payment of the dialysis services provided. Although commercial payment rates vary significantly, average commercial payment rates are generally significantly higher than Medicare rates and often include price increases. Payment methods from commercial payors include a single lump-sum per treatment, referred to as bundled rates, and separate payments for ancillary treatments and pharmaceuticals, if used as part of the dialysis treatment, referred to as fee for service rates. We believe commercial payors are generally sensitive to the special circumstances and challenges faced by ESRD patients, particularly because they are responsible for primary coverage for a relatively limited number of ESRD patients for a finite 30-month period of time. We also believe commercial payors are incentivized to facilitate quality dialysis care because patients who do not regularly receive dialysis treatment typically require hospitalization and other more costly acute care treatment. For the year ended December 31, 2009, we derived approximately 43% of our net operating revenues from commercial payors, which represented approximately 14% of the treatments performed. The source of the balance of our treatments and net operating revenues come from Medicare and other governmental payors.

3

Table of Contents

Our Competitive Strengths

Focus On Core Values Leading to Patient Satisfaction and Strong Patient Base

We believe our core values, including our focus on patient satisfaction, have contributed to our loyal patient base, which is the key to stable and dependable revenues. Our values state our commitment to excellent patient care, providing the nephrologists autonomy to make decisions and practice as he/she deems appropriate and treating our clinic staff members as a critical and valuable asset. We believe the satisfaction of our employees encourages them to provide a comfortable environment and better treatment for patients. We also maintain a strong focus on revenue cycle management so that patients may maximize insurance coverage. We believe we provide value to patients by assisting them in navigating the complex healthcare reimbursement climate, and through our knowledge and application of health insurance rules, to consistently obtain high quality insurance coverage for patients.

Differentiated Business Model Attracts Nephrologists, Aligns Interests and Enhances Clinic Level Performance

We seek to partner with leading nephrologists within their local community. To date, none of our nephrologist partners has sought our consent to divest his or her joint venture ownership interest. We believe that our JV business model aligns the interests of the clinic owners with that of the patients and physicians better than the more traditional model of wholly-owned corporate ownership of a clinic. By having an investment in the clinics where their patients are treated, our nephrologist partners have a vested stake in the quality, reputation and performance of the clinics. Through ARM, we provide operational and managerial support to our clinics with rigorous individual patient focus. We strive to maintain the high quality of these support services through the development and implementation of patient care policies and procedures, education, mentoring and audits at each of our clinics. We also invest in state-of-the-art facilities, equipment, and amenities at our clinics. We believe that these management services substantially ease the burden of back-office responsibilities and enable our nephrologist partners to focus on providing the highest quality of patient care, which in turn drives high levels of patient satisfaction and financial performance.

Disciplined Approach to Maintaining Efficient Operations

We maintain a disciplined approach to enhancing performance in key areas such as revenue cycle management. We work to improve our processes with regard to patient registration, facilitation and verification of insurance, payor interaction and arrangements, and billing and collections in an effort to maximize our revenue per treatment. We believe our efforts have resulted in strong revenue per treatment rates, as well as low days’ sales outstanding and bad debt expense. In addition, we believe the rigorous management policies and procedures that we have consistently put in place at each clinic that we own and operate have resulted in operating expenses per treatment that are among the lowest in the industry as well as low general and administrative expenses per treatment.

Experience in Establishing De Novo Clinics and Selectively Completing Acquisitions

Our de novo clinic strategy encompasses all facets of development, from site review to personnel hiring. We have never had a survey deficiency delay Medicare certification for one of our de novo clinics, and we typically achieve EBITDA positive operations within 12 months of opening a de novo clinic. We believe our established de novo clinic model offers turnkey solutions to nephrologist partners who are interested in establishing de novo clinics with us.

In addition, we selectively pursue acquisitions of existing dialysis clinics which we restructure as JVs. Although acquisition costs for an existing dialysis clinic are typically much higher than the cost to develop a de novo clinic, we believe our management policies and procedures for acquiring clinics have allowed us to achieve

4

Table of Contents

significant improvements in key operating metrics in a relatively short period of time. We believe that as a result of our experience with acquiring and restructuring existing dialysis clinics, those clinics have enjoyed improved clinical outcomes and financial performance.

Consistent Financial Performance and Strong Free Cash Flow Generation

We believe our favorable revenue per treatment rates and our focus on efficiency of operations in a stable and growing industry has resulted in consistent, strong financial performance. From 2005 to 2009, we have achieved compound annual net revenue growth of 26%. In addition, from 2007 to 2009, our non-guarantor joint venture subsidiaries achieved compound annual net revenue growth of 24%. As a result, our free cash flow generation has been strong. During 2005 to 2009, we had on average non-acquired treatment growth of approximately 19% annually. We have also been able to increase our Adjusted EBITDA margin to 26% of net sales. We believe this increase in margin illustrates the benefits that are achieved by growing our portfolio of dialysis clinics on our management services platform. In addition, our existing clinics typically require minimal maintenance capital expenditure consisting of less than 2% of net revenues in 2009. In the year ended December 31, 2009, the Company generated $51.3 million in cash flows from operating activities, primarily from distributions from JV shares and management services fees, $13.3 million of which was derived from the issuer and its subsidiary guarantors, and the remaining $38.0 million of which was derived from our non-guarantor joint venture subsidiaries.

Experienced Management Team Supported by Strong Equity Sponsorship

Most of our executive and senior management team has held multiple positions with one or more of our competitors and have strong contacts throughout the dialysis services industry with providers, clinical staff, payors, vendors and other parties. One of our three founding executives and the Chairman of our Board of Directors, Christopher T. Ford, is also the current chairman of the Kidney Care Council. We believe this breadth and depth of experience gives our leadership team the knowledge and resources to manage more effectively relations with our nephrologist partners and other personnel, enhance operating results and promote growth.

We benefit from the sponsorship of Centerbridge Capital Partners, L.P., our majority investor following the close of the Transactions, as described below. Centerbridge Partners, L.P., a private investment firm with over $11 billion of capital under management in Centerbridge Capital Partners, L.P. and certain affiliated entities (“Centerbridge”), is focused on making value-oriented investments in select industries in partnership with strong management teams.

Our Business Strategy

Key components of our business strategy include:

Continued Focus on Achieving Superior Clinical Outcomes

We believe our reputation for providing quality care is a key factor in attracting patients and physicians and in securing contracts with healthcare plans. Our clinical team works routinely with individual physicians, clinic managers and dieticians, and our corporate management team promotes a patient- and physician-focused corporate culture in order to optimize clinical outcomes, improve operating performance, and ensure compliance with applicable laws and regulations. In addition, we engage in organized and systematic efforts through our quality of care management programs to monitor and improve the quality of services we deliver. These efforts include the development and implementation of patient care policies and procedures, clinical education and training programs, education and mentoring related to our clinical guidelines and protocols and audits of the quality of services rendered at each of our centers.

Recruitment and Retention of Leading Physicians

Our effective recruitment of leading nephrologist partners is critical to achieving our growth objectives. We believe we enjoy a strong and growing reputation among the nephrologist community, ensuring that nephrologists who contemplate a migration to the shared-ownership model strongly consider us. We will continue to leverage our market position and reputation to identify, screen and recruit experienced nephrologists.

5

Table of Contents

We enjoy strong retention rates. We believe this is due in large part to nephrologist partner satisfaction with our JV model, which gives nephrologists autonomy over clinical protocols and allows them to focus on providing high quality patient care. Since inception, none of our nephrologist partners have asked for our consent to a transfer of their ownership interests in our clinics. Further, although certain of our nephrologist partners had the option of requiring us to purchase their equity interests as a result of the Transactions, none chose to do so. We believe our existing network of nephrologist partners will be a key resource for us in creating future JVs with nephrologists who are not currently associated with us.

Further Implementation of Rigorous Management Services

A critical component of our business strategy is to enable our nephrologist partners to focus on providing superior individual patient care while we manage the daily operations of the clinic in support of the nephrologist partners. As dialysis clinics begin to implement the new bundled payment rate and other procedures to be adopted pursuant to recently passed healthcare legislation, we believe the administrative services that we provide to our nephrologist partners will be of even greater value. By offering the management services of a large corporation combined with the responsiveness of an entrepreneurial enterprise, we believe we help our clinics achieve desirable clinical outcomes, growth and profitability. These management services are provided under long-term renewable management services agreements and include, among others, operations management, negotiating pricing of products from vendors, coordinating outsourced clinical laboratory testing services, reporting and benchmarking of clinical outcomes, implementing revenue cycle management practices, training and education for our staff, performing back-office finance, accounting and payroll functions, managing compliance programs, and administering human resources support.

Utilization of Internally Generated Cash Flow to Support Expansion

We intend to leverage our JV model and our reputation in the nephrology community to continue the development of de novo clinics in the U.S., both in new and existing markets. Our streamlined approach to opening de novo clinics delivers attractive financial returns to us and our nephrologist partners. Our substantial free cash flow generation provides for a significant portion of the funding for continued expansion. Additionally, nephrologist partners have reinvested a portion of their return on capital from existing sites to expand those sites or invest in de novo clinics together with us. De novo clinics typically reach positive EBITDA results within 12 months of opening, which we believe results in attractive returns on our investment. As a result of our substantial expertise in opening de novo clinics, we have never had a survey deficiency delay Medicare certification for one of our de novo clinics, and further, we have not experienced delays to our development timeline as a result of delays in certification.

Because the acquisition cost for an existing dialysis clinic is typically much higher than the cost to develop a de novo clinic, we typically acquire existing dialysis clinics in very selective situations. We pursue acquisitions that we believe to be an effective use of invested capital, or in situations where other factors we believe to be important, such as our desire to enter a new market and use the acquired clinic as the base from which to open additional de novo clinics in that market, favor such acquisitions. We intend to continue to pursue acquisitions of existing clinics with reputations for strong quality and service as well as leading local market shares. In making these acquisitions, we intend to continue to restructure the ownership of the acquired clinic as a joint venture in accordance with our JV model. In applying our management policies and procedures to acquired clinics, we believe we have been able to achieve significant improvements in key operating metrics in a relatively short period of time, which have resulted in improved clinical outcomes and financial performance at those clinics.

6

Table of Contents

Summary of the Transactions

On March 22, 2010, American Renal Holdings Inc. (“ARH”) entered into a Contribution and Merger Agreement (the “Merger Agreement”) with C.P. Atlas Holdings, Inc. (the “Parent”), C.P. Atlas Intermediate Holdings, LLC, C.P. Atlas Acquisition Corp., certain of ARH’s stockholders party thereto and Pamlico Capital I, L.P. (formerly known as Wachovia Capital Partners GP I, LLC) (“Sellers’ Representative”), pursuant to which ARH agreed that C.P. Atlas Acquisition Corp. shall merge with and into ARH (the “Merger”) and, after which, ARH became the surviving entity and a wholly owned subsidiary of C.P. Atlas Intermediate Holdings, LLC, which is in turn a wholly owned subsidiary of the Parent. The parties agreed to consummate the Merger, subject to the terms and conditions set forth in the Merger Agreement, for an aggregate purchase price of $415 million, subject to adjustments including, without limitation, for working capital, indebtedness, certain specified liabilities and certain tax savings. ARH agreed that $2.5 million of the purchase price be placed into a third-party escrow account as security for working capital adjustments and that $27.5 million of the purchase price be placed into a third-party escrow account as security for indemnification claims that may be made by the Parent or its affiliates.

As of the effective time of the Merger, holders of shares of ARH’s common stock have no further ownership interest in ARH and instead received cash and the right to receive certain future payments from the Sponsor, ARH and/or the escrow agent pursuant to the Merger Agreement (in the case of the escrow agent, in respect of the unused portion of the third-party escrow accounts, if any) (with the exception of certain members of senior management and certain other employees who have agreed not to have certain of their equity interests cashed out in the Merger and holders who perfect their appraisal rights under Delaware law).

In connection with the Merger:

| • | Centerbridge made an aggregate cash equity investment of $161.5 million in the Parent, subject to certain adjustments, and in exchange, received 87% of the common stock of the Parent immediately following the Merger. |

| • | Certain members of ARH’s management exchanged $19.9 million of proceeds that they received from the Transaction for 878,571 newly issued shares of common stock of the Parent and options to purchase 93,186 shares of common stock of the Parent. |

| • | ARH entered into a $25 million revolving credit facility (the “New Revolving Credit Facility”). |

| • | ARH offered the outstanding notes being exchanged hereby. |

The Merger and the financing transactions described above are collectively referred to herein as the “Transactions.”

The aggregate purchase price of approximately $415 million for the Merger, plus related fees and expenses, was funded by the equity investment by Centerbridge and from certain members of management and the net proceeds from the offering of the outstanding notes. See “Use of Proceeds,” “Description of Other Indebtedness,” and “The Transactions.” In connection with the Merger, all of ARH’s debt and preferred stock that existed prior to the closing date of the Merger was repaid or redeemed, except for $11.9 million aggregate amount of third-party debt as of December 31, 2009. Other third-party debt of ARH’s JVs was refinanced through secured intercompany loans. The secured intercompany loans, which total $36.3 million as of December 31, 2009, on a pro forma basis as if the Transactions had occurred on that date, were pledged as collateral for our New Revolving Credit Facility and for the outstanding notes being exchanged hereby. Although certain of ARH’s nephrologist partners had the right to require us to repurchase some or all of the equity interests in certain clinics as a result of the Transactions, these rights were waived.

7

Table of Contents

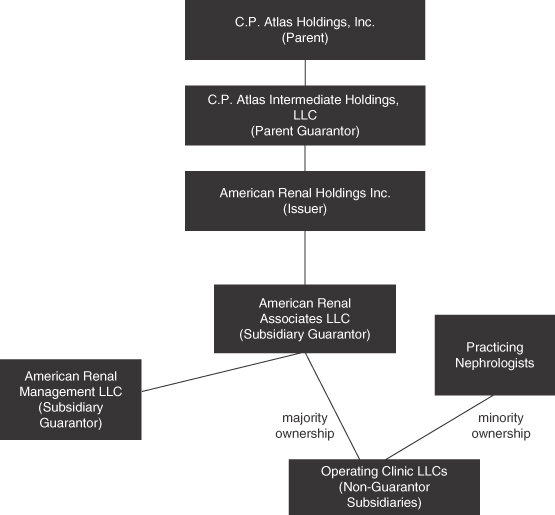

Ownership Structure and Organizational Chart

The following chart summarizes our organizational structure, equity ownership and our principal indebtedness as of the date of this prospectus. This chart is provided for illustrative purposes only and does not represent all legal entities of the Company and its consolidated subsidiaries or all obligations of such entities.

8

Table of Contents

Our Sponsor

Centerbridge Partners, L.P., established in 2005, is a private investment firm that sponsors and manages funds that make traditional private equity investments, distressed investments and other credit investments.

The firm is dedicated to partnering with world-class management teams to invest throughout a company’s capital structure and to employ various strategies to help companies achieve their operating and financial objectives. Through Centerbridge Capital Partners, L.P., the firm has made investments in companies that vary in size and geography and span a broad range of industries. The firm’s professionals have significant experience investing in healthcare companies.

Centerbridge’s limited partners include many prominent financial institutions, university endowments, public and corporate pensions and sovereign wealth funds, as well as foundations and other charitable trusts.

Our Corporate Information

American Renal Holdings Inc. was incorporated in Delaware on July 19, 1999. Our principal executive offices are located at 66 Cherry Hill Drive, Beverly, Massachusetts 01915 and our telephone number is (978) 922-3080. Our corporate website address is www.americanrenal.com. Information contained on our website is not a part of this prospectus.

9

Table of Contents

The Exchange Offer

On May 7, 2010, we completed the private offering of $250,000,000 aggregate principal amount of our 8.375% Senior Secured Notes due 2018, which we refer to in this prospectus as the “outstanding notes.” The term “exchange notes” refers to the 8.375% Senior Secured Notes due 2018 as registered under the Securities Act of 1933, as amended (the “Securities Act”). References to the “notes” in this prospectus are references to both the outstanding notes and the exchange notes. This prospectus is part of a registration statement covering the exchange of the outstanding notes for the exchange notes.

General | American Renal Holdings Inc. and the guarantors of the notes entered into a registration rights agreement with the initial purchasers in the private offering in which American Renal Holdings Inc. and the guarantors of the notes agreed to deliver to you this prospectus as part of the exchange offer and agreed to use all commercially reasonable efforts to have the registration statement covering the exchange to be declared effective on or prior to the date 210 days after the closing of the private offering. You are entitled to exchange in the exchange offer your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except: |

| • | the exchange notes have been registered under the Securities Act; |

| • | the exchange notes are not entitled to certain registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

| • | certain special interest rate provisions in the registration rights agreement are no longer applicable. |

The Exchange Offer | We are offering to exchange up to $250,000,000 aggregate principal amount of our 8.375% Senior Secured Notes due 2018, which have been registered under the Securities Act, for up to $250,000,000 aggregate principal amount of our existing 8.375% Senior Secured Notes due 2018. Outstanding notes may be exchanged only in denominations of $2,000 and integral multiples of $1,000 in excess of $2,000. |

Resale | Based on an interpretation by the staff of the Securities and Exchange Commission (the “SEC”) set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for the outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

10

Table of Contents

If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.”

Any holder of outstanding notes who:

| • | is our affiliate; |

| • | does not acquire exchange notes in the ordinary course of its business; or |

| • | tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes; |

cannot rely on the position of the staff of the SEC enunciated inMorgan Stanley & Co. Incorporated(available June 5, 1991) andExxon Capital Holdings Corporation(available May 13, 1988), as interpreted inShearman & Sterling(available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes.

Expiration Date; Withdrawal of Tender | The exchange offer will expire at 11:59 p.m., New York City time, on , 2011, unless extended by us. We do not currently intend to extend the expiration date. You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. See “The Exchange Offer—Conditions to the Exchange Offer” of this prospectus for more information. |

Procedures for Tendering Outstanding Notes | If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with your outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of

11

Table of Contents

DTC by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| • | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| • | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| • | you are acquiring the exchange notes in the ordinary course of your business; and |

| • | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes which are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender such outstanding notes in the exchange offer, you should contact such registered holder promptly and instruct such registered holder to tender on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

Effect on Holders of Outstanding Notes | As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offer, we and the guarantors will have fulfilled a covenant contained in the registration rights agreement and, accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you are a holder of outstanding notes and you do not tender your outstanding notes in the exchange offer, you will continue to hold |

12

Table of Contents

such outstanding notes and you will be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except we and the guarantors will not have any further obligations to you to provide for the exchange and registration of untendered outstanding notes under the registration rights agreement. To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes that are not so tendered and accepted could be adversely affected. |

Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer provided for in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we and the guarantors do not currently anticipate that we will register the outstanding notes under the Securities Act. |

Material U.S. Federal Income Tax Consequences | The exchange of outstanding notes for exchange notes in the exchange offer will not constitute a taxable event for U.S. federal income tax purposes. See “Material U.S. Federal Income Tax Consequences of the Exchange Offer.” |

Accounting Treatment | We will record the exchange notes in our accounting records at the same carrying value as the outstanding notes, which is the aggregate principal amount as reflected in our accounting records on the date of exchange. |

Regulatory Approvals | Other than compliance with the Securities Act and qualification of the indentures governing the notes under the Trust Indenture Act, there are no federal or state regulatory requirements that must be complied with or approvals that must be obtained in connection with the exchange offers. |

Use of Proceeds | We will not receive any cash proceeds from the issuance of exchange notes pursuant to the exchange offer. See “Use of Proceeds.” |

Exchange Agent | Wilmington Trust FSB is the exchange agent for the exchange offer. The address and telephone number of the exchange agent are set forth in the section captioned “The Exchange Offer—Exchange Agent” of this prospectus. |

13

Table of Contents

The Exchange Notes

The following summary is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus, including a more detailed summary of the terms of the notes under “Description of the Exchange Notes” beginning on page 135. In this section, “we” or the “Company” refers to American Renal Holdings Inc. and not to any of its subsidiaries.

Issuer | American Renal Holdings Inc. |

Notes Offered | $250,000,000 aggregate principal amount of 8.375% Senior Secured Notes due 2018. |

Maturity Date | May 15, 2018. |

Interest Payment Dates | May 15 and November 15, commencing November 15, 2010. |

Guarantees | The notes are guaranteed, jointly and severally, by our direct parent and all of our existing and future wholly owned domestic restricted subsidiaries, other than certain excluded subsidiaries. Our majority owned subsidiaries, which operate the clinics, will not guarantee the notes. |

Collateral | The notes and the guarantees are secured by a first-priority lien (pari passu, subject to the intercreditor agreement described below, with the liens granted under the New Revolving Credit Facility and subject to certain exceptions and permitted liens) on substantially all of our and our guarantors’ tangible and intangible assets, which are valued at approximately $542 million as of September 30, 2010 (such assets, the “Collateral”). With respect to the Collateral, the indebtedness and obligations under the notes, our New Revolving Credit Facility and certain other first lien obligations permitted under the indenture governing the notes have first-priority liens. Under the terms of the intercreditor agreement, however, in the event of a foreclosure on the Collateral or insolvency proceedings, the holders of the notes will receive proceeds from the Collateral only after debt under the New Revolving Credit Facility as well as obligations under certain hedging and cash management arrangements owed to lenders or their affiliates under the New Revolving Credit Facility have been repaid. See “Description of the Exchange Notes—Collateral.” As of the time of the filing of this prospectus, the New Revolving Credit Facility is undrawn and the Company does not have any other obligations that would have priority over the notes pursuant to the intercreditor agreement. |

Ranking | The notes and the guarantees rank: |

| • | pari passu with our and the guarantors’ obligations that are secured by first priority liens, except obligations under our New Revolving Credit Facility and obligations under certain hedging and cash management arrangements will be entitled to proceeds of the Collateral prior to the notes in the event of a foreclosure or in any insolvency proceeding; |

| • | equal in right of payment to all of our and our guarantors’ unsubordinated obligations; |

14

Table of Contents

| • | effectively senior in right of payment to all of our and our guarantors’ existing and future unsecured obligations to the extent of the value of the Collateral; |

| • | senior in right of payment to all of our and our guarantors’ future obligations that are expressly subordinated in right of payment to the notes; |

| • | structurally junior to all obligations of our subsidiaries that are not guarantors except, with respect to any subsidiary, to the extent of any intercompany loans owing by such subsidiary that constitute Collateral. These obligations of non-guarantor subsidiaries totaled approximately $8.2 million as of September 30, 2010. |

The indenture governing the notes permits additional indebtedness or other obligations to be secured by the Collateral either on a pari passu or on a junior priority basis relative to the notes, subject to limitations.

Intercreditor Agreement | The trustee and the collateral agent under the indenture governing the notes and the administrative agent and collateral agent under the New Revolving Credit Facility have entered into an intercreditor agreement as to the relative priorities of their respective entitlement to proceeds of the assets securing the notes and borrowings under the New Revolving Credit Facility and other first-priority lien secured obligations upon a foreclosure or bankruptcy and certain other matters relating to the administration of security interests. See “Description of the Exchange Notes—Intercreditor Agreement.” As of the time of the filing of this prospectus, the New Revolving Credit Facility is undrawn and the Company does not have any other obligations that would have priority over the notes pursuant to the intercreditor agreement. |

Use of Proceeds | There will be no cash proceeds to us from the exchange offer. |

Optional Redemption | On or after May 15, 2013, we may redeem some or all of the notes at any time at the redemption prices specified under “Description of the Exchange Notes—Optional Redemption.” Prior to May 15, 2013, we may redeem some or all of the notes at a redemption price of 100% of the principal amount of each note to be redeemed plus a “make-whole” premium described in “Description of the Exchange Notes—Optional Redemption.” |

In addition, prior to May 15, 2013, we will have the option to redeem, during each 12 month period commencing on the issue date, up to 10% of the aggregate principal amount of the notes at 103% of the aggregate principal amount of the notes redeemed plus accrued and unpaid interest to the date of redemption.

Furthermore, at any time prior to May 15, 2013, we may redeem up to 35% of the notes with the net cash proceeds from specified equity

15

Table of Contents

offerings at a redemption price equal to 108.375% of the principal amount of each Note to be redeemed, plus accrued and unpaid interest, if any, to the date of redemption. |

Change of Control | Upon a change of control, we must offer to repurchase the notes at 101% of the principal amount, plus accrued interest to the purchase date. See “Description of the Exchange Notes—Change of Control.” |

Certain Covenants | The indenture governing the notes contains covenants that, among other things, limit our ability and ability of our restricted subsidiaries to: |

| • | incur additional indebtedness or liens; |

| • | pay dividends or make distributions on our capital stock or repurchase our capital stock; |

| • | make certain investments or other restricted payments; |

| • | place restrictions on the ability of subsidiaries to pay dividends or make other distributions to us; |

| • | sell certain assets or merge with or into other companies; and |

| • | enter into certain types of transactions with shareholders and affiliates. |

These covenants are subject to important exceptions and qualifications, which are described in “Description of the Exchange Notes—Certain Covenants.”

Voting | The exchange notes will be treated along with the outstanding notes as a single class for voting purposes. |

No Prior Market | The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you whether a market for the exchange notes will develop or as to the liquidity of any such market that may develop. The initial purchasers of the outstanding notes have informed us that they currently intend to make a market in the exchange notes; however, they are not obligated to do so, and they may discontinue any such market-making activities at any time without notice. |

Risk Factors | Potential investors in the notes should carefully consider the matters set forth under the caption “Risk Factors” prior to making an investment decision with respect to the notes. |

16

Table of Contents

Summary Historical and Pro Forma Consolidated Financial and Other Data

Set forth below is our summary historical and pro forma consolidated financial data at the dates and for the periods indicated. The statement of income and other financial data for each of the years in the three-year period ended December 31, 2009 and the balance sheet data as of December 31, 2008 and 2009 have been derived from our historical consolidated financial statements included elsewhere in this prospectus, which have been audited by Grant Thornton LLP.

The summary unaudited pro forma consolidated financial data as of and for the year ended December 31, 2009 and as of and for the nine months ended September 30, 2010 have been prepared to illustrate the estimated effects on our historical results of operations and financial condition of the following (the “Pro Forma Adjustments”):

| • | the Merger, including the cash equity investment by our Sponsor (net of transaction expenses); |

| • | the issuance of the notes being exchanged hereby; |

| • | the results of our four acquisitions in 2009; |

| • | the effect on noncontrolling interests resulting from the purchase and sale of such noncontrolling interests in various clinics; and |

| • | the purchase price allocation and related adjustments based on asset, liability and noncontrolling interest valuations. |

The summary unaudited pro forma consolidated statement of income data and other financial data give effect to the Pro Forma Adjustments as if they had occurred on January 1, 2009. The Pro Forma Adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma consolidated financial data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would have been had the Pro Forma Adjustments actually occurred on the dates indicated, and the data do not purport to project our results of operations or financial condition for any future period or as of any future date.

The ratios of earnings to fixed charges for the relevant periods appear in “Selected Consolidated Financial Data.”

17

Table of Contents

| Historical | Pro Forma | |||||||||||||||||||||||||||||||||||

| Predecessor Entity | Successor Entity | Year Ended December 31, 2009 | Nine Months Ended September 30, 2010 | |||||||||||||||||||||||||||||||||

| As of and for the Year Ended December 31, | As of and for the Nine Months Ended September 30, 2009 | As of May 7, 2010 and for the period from January 1, 2010 through May 7, 2010 | As of September 30, 2010 and for the period from May 8, 2010 through September 30, 2010 | |||||||||||||||||||||||||||||||||

(in thousands, except ratios | 2007 | 2008 | 2009 | |||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||||||||||||

Statement of Income Data: | ||||||||||||||||||||||||||||||||||||

Net patient service revenue | $ | 178,391 | $ | 217,777 | $ | 262,989 | $ | 193,109 | $ | 102,094 | $ | 120,833 | $ | 265,206 | $ | 222,927 | ||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||||||||||

Patient care costs | 115,058 | 141,810 | 170,826 | 125,098 | 66,042 | 78,335 | 172,353 | 142,737 | ||||||||||||||||||||||||||||

General and administrative expense | 18,595 | 19,944 | 24,819 | 17,423 | 10,016 | 14,991 | 25,557 | 22,750 | ||||||||||||||||||||||||||||

Merger and related expenses | — | — | — | — | 7,378 | 14,839 | — | — | ||||||||||||||||||||||||||||

Depreciation and amortization | 7,919 | 9,777 | 12,127 | 8,816 | 4,429 | 6,434 | 15,493 | 12,322 | ||||||||||||||||||||||||||||

Provision for doubtful accounts | 3,258 | 4,834 | 3,216 | 3,184 | (334 | ) | 1,021 | 3,280 | 687 | |||||||||||||||||||||||||||

Total operating expenses | 144,830 | 176,365 | �� | 210,988 | 154,521 | 87,531 | 115,620 | 216,683 | 178,496 | |||||||||||||||||||||||||||

Operating income | 33,561 | 41,412 | 52,001 | 38,588 | 14,563 | 5,213 | 48,523 | 44,431 | ||||||||||||||||||||||||||||

Interest expense, net | (13,695 | ) | (13,729 | ) | (14,948 | ) | (11,212 | ) | (5,717 | ) | (9,205 | ) | (22,588 | ) | (16,935 | ) | ||||||||||||||||||||

Income (loss) before income taxes | 19,866 | 27,683 | 37,053 | 27,376 | 8,846 | (3,992 | ) | 25,935 | 27,496 | |||||||||||||||||||||||||||

Income tax expense (benefit) | 4,409 | 6,860 | 9,524 | 7,036 | 2,264 | (649 | ) | 1,880 | 2,992 | |||||||||||||||||||||||||||

Net income (loss) | 15,457 | 20,823 | 27,529 | 20,340 | 6,582 | (3,343 | ) | 24,055 | 24,504 | |||||||||||||||||||||||||||

Less: Net income attributable to noncontrolling interests | (14,706 | ) | (17,179 | ) | (22,391 | ) | (15,823 | ) | (9,266 | ) | (10,949 | ) | (20,964 | ) | (19,583 | ) | ||||||||||||||||||||

Net income (loss) attributable to ARH | $ | 751 | $ | 3,644 | $ | 5,138 | $ | 4,517 | $ | (2,684 | ) | $ | (14,292 | ) | $ | 3,092 | $ | 4,921 | ||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||||||||||

Adjusted EBITDA (including noncontrolling interests) (1) | $ | 43,660 | $ | 52,671 | $ | 67,724 | $ | 49,161 | $ | 26,589 | $ | 31,193 | $ | 68,612 | $ | 57,929 | ||||||||||||||||||||

Adjusted EBITDA (1) | 28,954 | 35,492 | 45,333 | 33,338 | 17,323 | 20,244 | 47,198 | 38,346 | ||||||||||||||||||||||||||||

Capital expenditures (2) | 15,218 | 21,254 | 15,067 | 9,757 | 15,067 | 11,045 | ||||||||||||||||||||||||||||||

Operating Data: | ||||||||||||||||||||||||||||||||||||

Number of clinics (as of end of period) | 64 | 75 | 83 | 80 | 88 | 83 | 88 | |||||||||||||||||||||||||||||

Patients (as of end of period) | 3,740 | 4,545 | 5,405 | 5,235 | 6,119 | 5,405 | 6,119 | |||||||||||||||||||||||||||||

Number of treatments | 503,576 | 604,888 | 745,812 | 546,825 | 753,596 | 632,556 | ||||||||||||||||||||||||||||||

Non-acquired treatment growth (3) | 16.9 | % | 20.1 | % | 20.6 | % | 22.5 | % | 20.6 | % | 15.5 | % | ||||||||||||||||||||||||

Revenues per treatment (4) | $ | 354 | $ | 360 | $ | 353 | $ | 353 | $ | 352 | $ | 352 | ||||||||||||||||||||||||

Patient care costs per treatment (4) | $ | 228 | $ | 234 | $ | 229 | $ | 229 | $ | 229 | $ | 226 | ||||||||||||||||||||||||

General and administrative expenses per treatment (4) | $ | 37 | $ | 33 | $ | 33 | $ | 32 | $ | 34 | $ | 36 | ||||||||||||||||||||||||

18

Table of Contents

| As of September 30, 2010 (unaudited) | ||||

| (dollars in thousands) | ||||

Consolidated Balance Sheet Data: | ||||

Cash and cash equivalents | $ | 27,579 | ||

Working capital (5) | 29,244 | |||

Total assets | 703,483 | |||

Total debt and capital lease obligations | 250,569 | |||

ARH Equity | 174,541 | |||

| (1) | Adjusted EBITDA is defined as net income attributable to ARH before income taxes, interest expense, depreciation and amortization, and we further adjust for non-cash charges, non-recurring charges and pro forma amounts for acquisitions as if they had been consummated on the first day of each period. We believe Adjusted EBITDA provides information useful for evaluating our businesses and understanding our operation performance in a manner similar to management. We believe Adjusted EBITDA is helpful in highlighting trends because Adjusted EBITDA excludes the results of decisions that are outside the control of operating management and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate and capital investments. In addition, we present Adjusted EBITDA because it is one of the components used in the calculations under the covenants contained in our revolving credit facility. Adjusted EBITDA is not a measure of operating performance computed in accordance with GAAP and should not be considered as a substitute for operating income, net income, cash flows from operations, or other statement of operations or cash flow data prepared in conformity with GAAP, or as measures of profitability or liquidity. In addition, Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA may not be indicative of historical operating results, and we do not mean for it to be predictive of future results of operations or cash flows. Adjusted EBITDA has limitations as an analytical tool, and you should not consider this item in isolation, or as a substitute for an analysis of our results as reported under GAAP. Some of these limitations are that Adjusted EBITDA: |

| • | does not include interest expense—as we have borrowed money for general corporate purposes, interest expense is a necessary element of our costs and ability to generate profits and cash flows; |

| • | does not include depreciation and amortization—because construction and operation of our dialysis clinics requires significant capital expenditures, depreciation and amortization are a necessary element of our costs and ability to generate profits; |

| • | does not include stock-based compensation expense; |

| • | does not reflect changes in, or cash requirements for, our working capital needs; and |

| • | does not include certain income tax payments that represent a reduction in cash available to us. |

You should not consider Adjusted EBITDA as an alternative to income from operations or net income, determined in accordance with GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with GAAP, as an indicator of cash flows or as a measure of liquidity.

19

Table of Contents

The following table presents the reconciliation from net income (loss) to Adjusted EBITDA for the periods indicated:

| Historical | Pro Forma | |||||||||||||||||||||||||||||||||||

| Predecessor Entity | Successor Entity | |||||||||||||||||||||||||||||||||||

| As of and for the Year Ended December 31, | For the Nine Months Ended September 30, 2009 | For the period from January 1, 2010 through May 7, 2010 | For the period from May 8, 2010 through September 30, 2010 | Year Ended December 31, 2009 | Nine Months Ended September 30, 2010 | |||||||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | ||||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||||||||||||

Net income (loss) | $ | 15,457 | $ | 20,823 | $ | 27,529 | $ | 20,340 | $ | 6,582 | $ | (3,343 | ) | $ | 24,055 | $ | 24,504 | |||||||||||||||||||

Add: | ||||||||||||||||||||||||||||||||||||

Stock-based compensation | 2,180 | 1,482 | 1,135 | 876 | 219 | 4,487 | 1,135 | 763 | ||||||||||||||||||||||||||||

Depreciation and amortization | 7,919 | 9,777 | 12,127 | 8,816 | 4,429 | 6,434 | 15,493 | 12,322 | ||||||||||||||||||||||||||||

Interest expense, net | 13,695 | 13,729 | 14,948 | 11,212 | 5,717 | 9,205 | 22,588 | 16,935 | ||||||||||||||||||||||||||||

Income tax expense (benefit) | 4,409 | 6,860 | 9,524 | 7,036 | 2,264 | (649 | ) | 2,192 | 2,992 | |||||||||||||||||||||||||||

Merger and related expenses | — | — | — | — | 7,378 | 14,839 | — | — | ||||||||||||||||||||||||||||

Initial public offering transaction expenses | — | — | 1,797 | 508 | — | — | 1,797 | — | ||||||||||||||||||||||||||||

Management fee | — | — | — | — | — | 220 | 550 | 413 | ||||||||||||||||||||||||||||

Specified legal costs | — | — | 664 | 373 | — | — | 664 | — | ||||||||||||||||||||||||||||

Adjusted EBITDA (including noncontrolling interests) | 43,660 | 52,671 | 67,724 | 49,161 | 26,589 | 31,193 | 68,612 | 57,929 | ||||||||||||||||||||||||||||

Less: Net income attributable to noncontrolling interests | (14,706 | ) | (17,179 | ) | (22,391 | ) | (15,823 | ) | (9,266 | ) | (10,949 | ) | (20,964 | ) | (19,583 | ) | ||||||||||||||||||||

Adjusted EBITDA | $ | 28,954 | $ | 35,492 | $ | 45,333 | $ | 33,338 | $ | 17,323 | $ | 20,244 | $ | 47,198 | $ | 38,346 | ||||||||||||||||||||

This presentation of Adjusted EBITDA may not be directly comparable to similarly titled measures of other companies, since not all companies use identical calculations.

| (2) | Includes the following capital expenditure by type: |

| Year Ended December 31, | Nine Months Ended September 30, 2009 | Pro Forma Nine Months Ended September 30, 2010 | ||||||||||||||||||

| 2007 | 2008 | 2009 | ||||||||||||||||||

Development capital expenditures | $ | 12,887 | $ | 18,764 | $ | 11,056 | $ | 9,020 | $ | 8,961 | ||||||||||

Maintenance capital expenditures | 2,331 | 2,490 | 4,011 | 737 | 2,084 | |||||||||||||||

Total capital expenditures | $ | 15,218 | $ | 21,254 | $ | 15,067 | $ | 9,757 | $ | 11,045 | ||||||||||

| (3) | We calculate non-acquired treatment growth by dividing the number of treatments performed during the applicable period by the number of treatments performed during the corresponding prior period, excluding the number of treatments performed at clinics acquired during the applicable period, and expressing the resulting number as a percentage. |

| (4) | We calculate revenues per treatment, patient care costs per treatment and general and administrative expenses per treatment by dividing net operating revenues, patient care costs and general and administrative expenses for the applicable period by the number of treatments performed in the applicable period. |

| (5) | Current assets minus current liabilities. |

20

Table of Contents

Investing in the notes involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the financial statements and the related notes appearing at the end of this prospectus, before making an investment decision. If any of the following risks actually occur, they may materially harm our business, prospects, financial condition and results of operations, which in turn could adversely affect our ability to repay the notes. You may lose all or part of your original investment.

Risks Related to the Exchange Offer

If you choose not to exchange your outstanding notes, the present transfer restrictions will remain in force and the market price of your outstanding notes could decline.

If you do not exchange your outstanding notes for exchange notes in the exchange offer, then you will continue to be subject to the transfer restrictions on the outstanding notes as set forth in the offering circular distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to “Summary—The Exchange Offer” and “The Exchange Offer” for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offer will reduce the principal amount of the outstanding notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market price of the outstanding notes due to reduction in liquidity.

Certain persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes.