MainGate MLP Fund

Class A (AMLPX)

Class C (MLCPX)

Class I (IMLPX)

6075 Poplar Avenue, Suite 720 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

Semi-Annual Report

May 31, 2023

(Unaudited)

SEMI-ANNUAL REPORT 2023 ● 3

Dear Shareholder,

The MainGate MLP Fund had the following performance as of May 31, 2023 compared to the S&P 500 Index and the Alerian MLP Total Return Index.

| | | CUMULATIVE RETURNS | | AVERAGE ANNUAL RETURNS |

| | | Inception

Date | | Fiscal

YTD | | Since

Inception | | 3

Year | | 5

Year | | 10

Year | | Since

Inception |

| MainGate MLP Fund – Class A without load | | 2/17/11 | | -3.13% | | 50.54% | | 25.30% | | 3.38% | | 1.44% | | 3.39% |

| MainGate MLP Fund – Class A with 5.75% maximum front-end load | | 2/17/11 | | -8.67% | | 41.89% | | 22.89% | | 2.16% | | 0.84% | | 2.89% |

| MainGate MLP Fund – Class I | | 2/17/11 | | -2.98% | | 55.29% | | 25.65% | | 3.63% | | 1.70% | | 3.65% |

| S&P 500 Index | | 2/17/11 | | 3.33% | | 296.88% | | 12.92% | | 11.01% | | 11.99% | | 11.88% |

| Alerian MLP Total Return Index | | 2/17/11 | | 0.39% | | 45.24% | | 25.47% | | 4.97% | | 0.80% | | 3.09% |

| MainGate MLP Fund – Class C without load | | 3/31/14 | | -3.39% | | -7.09% | | 24.40% | | 2.57% | | NA | | -0.80% |

| MainGate MLP Fund – Class C with 1.00% Contingent Deferred Sales Charge | | 3/31/14 | | -4.33% | | -7.09% | | 24.40% | | 2.57% | | NA | | -0.80% |

| S&P 500 Index | | 3/31/14 | | 3.33% | | 165.65% | | 12.92% | | 11.01% | | NA | | 11.25% |

| Alerian MLP Total Return Index | | 3/31/14 | | 0.39% | | -1.33% | | 25.47% | | 4.97% | | NA | | -0.15% |

Expense Ratios (Gross/Net): A Shares = 1.69%/1.69% | C Shares = 2.44%/2.44% | I Shares = 1.44%/1.44%. Net expense ratios represent the percentages paid by investors and reflect a 0.00% deferred income tax expense which represents the performance impact of accrued deferred tax liabilities across the Fund, not individual share classes, for the fiscal year ended November 30, 2022 (the Fund did not have a current tax expense or benefit due to a valuation allowance). The Fund’s adviser has contractually agreed to cap the Fund’s total annual operating expenses (excluding brokerage fees and commissions; Class A 12b-1 fees; borrowing costs, such as interest and dividend expenses on securities sold short; taxes, such as Deferred Income Tax Expense; and extraordinary expenses) at 1.50% through March 31, 2024. The performance data shown for Class C with load reflects the Class C maximum deferred sales charge of 1.00%. Deferred income tax expense/(benefit) represents an estimate of the Fund’s potential tax expense/(benefit) if it were to recognize the unrealized gains/(losses) in the portfolio. An estimate of deferred income tax expense/(benefit) depends upon the Fund’s net investment income/(loss) and realized and unrealized gains/(losses) on its portfolio, which may vary greatly on a daily, monthly and annual basis depending on the nature of the Fund’s investments and their performance. An estimate of deferred income tax expenses/(benefit) cannot be reliably predicted from year to year.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the information quoted. To obtain performance information current to the most recent month-end please call 855.MLP.FUND (855.657.3863). Performance data shown for Class A shares with load reflects the maximum sales charge of 5.75%. Performance data shown for Class C shares with load reflects the maximum deferred sales charge of 1.00%. Performance data shown for Class I shares does not reflect the deduction of a sales load or fee. Performance data shown “Without Load” does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

SEMI-ANNUAL REPORT 2023 ● 5

Solid total return quarter; further de-coupling from crude oil

Midstream delivered another strong total return this calendar quarter as the Alerian MLP Total Return Index (AMZX)1 rose 5.4%, despite WTI crude oil registering a -6.65% decline, the index’s second positive returning calendar quarter in a row versus WTI’s second negative returning calendar quarter in a row. Calendar year-to-date (YTD) through June 30th, the AMZX has risen 9.7% versus WTI declining -12.0%. We’ll offer some new thoughts later in this shareholder letter on the historical narrative that Midstream needs crude oil “to work” for the sector to generate positive returns. Spoiler alert: we believe there are several reasons Midstream can continue to de-couple going forward.

Some key highlights during the calendar quarter as it relates to the Fund’s holdings:

| • | Sixteen of twenty names beat consensus earnings before interest, taxes, depreciation and amortization (EBITDA)2 expectations by 5.6% on a weighted average3 basis, one had no estimates4, and the three that missed, missed by an average of ~1%; |

| • | EBITDA increased 2.4% quarter over quarter (Q/Q) and 15.9% year over year (Y/Y), weighted average; |

| • | Distributable cash flow5 per unit (DCF/u) increased 8.1% Q/Q and 14.5% Y/Y, weighted average. |

Our expectations for the upcoming quarter are fairly balanced. Second quarter results are typically a seasonal low point for most Midstream companies due mostly to the transition of the seasons when demand, particularly for natural gas, is strongest in the winter. Additionally, given the aforementioned poor performance of WTI in Q2 and its knock-on negative effect on natural gas liquids (NGLs) prices, this could also lead to fewer tailwinds for commodity-linked volumes quarter over quarter (Q/Q). We’ve seen a plethora of analyst estimate updates these past few weeks and expect more going into earnings, which could hopefully dampen any volatility around beats (misses).

But this does not mean companies are without other tools to positively manage their business, returns to unitholders, and sentiment around their equity prices. During the Q2 earnings season, there was some investor dissatisfaction (mostly from short-term owners/hedge funds) that there were few full year “guidance” raises, even though the quarterly results were strong. We attributed this incongruence to management teams not getting too far in front of expectations with seven months remaining in the year. We believe we could see some full-year guidance raises this earnings season, which could allow investors to focus more long-term – something that was missing during April/May’s investor myopia. Several management teams of portfolio companies have been active in repurchasing their company’s units during May’s volatility, and therefore, expect at least consistency with Q1’s $1 billion of repurchase activity. Between the potential for guidance raises and the continuing increase of capital returns through distributions, dividends, and buybacks, we believe the set up for positive total returns remains strong going forward.

Further de-coupling from WTI – too early to call it?

Most investors and potential investors we’ve engaged with for the past dozen-and-a-half years have started with the investment premise that Midstream would perform admirably in rising commodity environments, while providing better downside protection should commodity prices fall. That has not always been the case or the experience recently. But, the YTD divergence in total returns of the AMZX and WTI could be an indicator that we’re breaking with recent history, and we believe all the factors are in place to resume a less correlated6 total return performance to commodities and Energy equities.

(1) Alerian MLP Index: A capitalization-weighted index of the most prominent energy Master Limited Partnerships. Visit http://www.alerian.com/indices/amz-index for more information, including performance. You cannot invest directly in an index. (2) Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): Essentially net income with interest, taxes, depreciation, and amortization added back to it; can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. (3) Weighted Average: A calculation in which each quantity to be averaged is assigned a weight that represents its relative importance.(4) DCP Midstream LP (DCP) was in a pending merger with Phillips 66 Corp (PSX), which closed on June 14, 2023. (5) Distributable Cash Flow: Measured as earnings before interest, taxes, depreciation and amortization (EBITDA) available to pay unitholders after reserving for maintenance capital expenditures and payment of interest expense. (6) Correlation: The measure of the relationship between two data sets of variables.

6 | MainGate mlp fund

At any point in the past 5+ years, if someone would have told us WTI would be down 12% calendar YTD through June 30th, we would have a hard time arguing against this negative macro factor weighing on Midstream equities as well, despite cash flow7 consistency and other positive characteristics of the Midstream operating model. To wit, the 54% correlation calendar YTD through June 30th8 has been around historical norms, but focusing on this similar pattern would’ve prevented one from seeing what’s going on under the surface, and why we think a divergence is at hand. We believe the reasons why that narrative might have changed are becoming more evident, which would have Midstream equities be less sensitive to technicals as they have in the past, and, if so, we could be re-entering a period of less sensitivity between equity prices and the oil price similar to what existed in the 2000s.

As it pertains to the commodity itself, there is reason to believe the Organization of the Petroleum Exporting Countries plus Russia (OPEC+)9 is seeking to curtail extreme price volatility, and, at a minimum, raise the floor on the price of oil allowing for more consistent production forecasts within those countries. Our collective read from all manner of analysts and intelligence reports is OPEC+ is resolute on avoiding repeats of price declines experienced similar to 2014 and 2020 because low prices disincentivize their own production as much as global players outside their organization. Therefore, if forecasting is more difficult for OPEC+, given the large reliance on petroleum revenues these member countries retain, this is an untenable scenario. Various price scenarios for the bottom end of the range continue to be put forth depending on each analyst’s perspective, but we think the median of the low end is ~$65 per barrel versus June 30th’s close of $70.64.

When thinking about the high end of the long-term range, we think it’s logical to assume $100 per barrel, not based on any explicit models or forecasts but based on geopolitics. China remains the incremental buyer (with India increasingly right behind them) in the marketplace and is enacting their own measures to keep the ceiling at or around that $100 target.

However, we remain capacity short from a production capability standpoint, and swings above $100 could be beyond China’s control. As seen in Figure 1, JP Morgan estimates, even after accounting for a blue-sky scenario in renewables supply growth, global demand is projected to exceed global supply of all energy by 16% in 203010. Given that hydrocarbons remain the most readily accessible form of energy, the potential for spikes remains ever present. Patrick Pouyanne, CEO of TotalEnergies SE (TOT), remarked recently, “If we don’t invest enough, the [oil] price will not be $75 per barrel, it will be $150 or $200 and all consumers will be super unhappy and our life will be a nightmare”11. Companies and countries prefer not to have nightmares – as do equity holders!

Source: JP Morgan, “Global Energy Outlook”, May 18, 2023

(7) Cash Flow: A measurement of the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income. (8) Bloomberg LP 6/30/23. (9) OPEC (Organization of the Petroleum Exporting Countries): An international organization and economic cartel whose mission is to coordinate the policies of the oil-producing countries. The goal is to secure a steady income to the member states and to collude in influencing world oil prices through economic means. (10) JP Morgan, “Global Energy Outlook”, May 18, 2023. (11) CNBC, “‘Life is like it is’: TotalEnergies CEO defends strategy despite calls to cut fossil fuel production”, July 6, 2023.

SEMI-ANNUAL REPORT 2023 ● 7

The summary of the crude specific discussion is that the top end of the crude oil forecast is debatable, but we believe there is more confidence around the bottom end of the range. That is positive for all energy equities including Midstream.

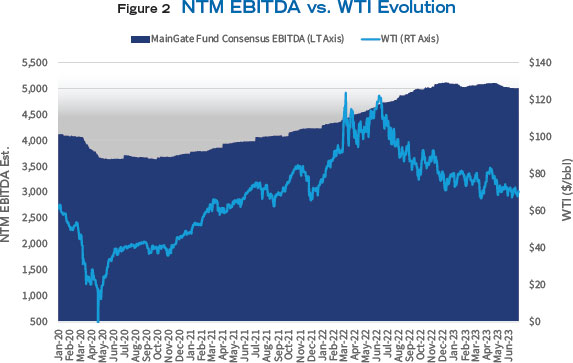

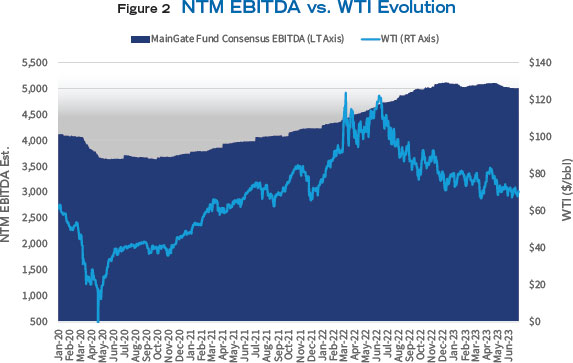

As it pertains to Midstream equities de-coupling from WTI, we remind our readers of the consistency of cash flow with little sensitivity to commodity prices as shown in Figure 2.

Bloomberg, LP at 6/30/23. All figures shown for current MainGate Fund weights and holdings. EBITDA is the consensus estimate

at each point in time for the weighted sum of each portfolio holding for the next twelve months (NTM).

Historically, Midstream sold off during sharp oil price declines for exogenous and endogenous reasons. Factors relatively outside its control included being part of broader energy investment portfolios that were liquidated or sold “short” during downward spikes; uncertainty regarding upstream producer health12; and spillover from commodity sensitive MLPs which entangled Midstream companies organized as MLPs that were thought of as being similar. Today, exploration and production (E&P)13 customers are debt free or have very low leverage so their balance sheets are less susceptible to commodity price volatility. This newfound corporate vitality for E&Ps has increased many of their credit ratings, which incidentally only makes the pipelines receiving the volumes more creditworthy and valuable. Lastly, the commodity sensitive MLP companies have all but disappeared, which is a positive for the remaining companies utilizing the MLP tax election.

The primary factor under Midstream companies’ control was elevated debt leverage typically measured by debt/EBITDA14. Increased capital expenditures needed to complete the re-plumbing of existing infrastructure, new connections, and export delivery points for U.S. hydrocarbons led to term and bank debt balances remaining elevated for longer than credit rating agency analysts and investors expected. It was a painful process to expedite the de-leveraging process for several companies, but with the majority of large project expansions now complete, we do not forecast elevated capital expenditures that could affect balance sheet leverage significantly. We believe debt/EBITDA leverage should remain below historical averages, and, for our portfolio, in the current, bottom quartile of its historical ranking.

(12) After a decade of producers seeking contract relief in bankruptcy processes, and this being a perpetual “short” thesis, we are not aware of a final decision where the sanctity of the Midstream contract did not survive “as is”, or was not re-worked in favor of the Midstream service provider. (13) Exploration & Production (E&P): The finding, augmenting, producing and merchandising of different types of oil and gas. (14) Debt to EBITDA: A measurement of leverage, calculated as a company’s interest-bearing liabilities minus cash or cash equivalents, divided by its Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA).

8 | MainGate mlp fund

Summarizing, we think that a fissure in the more recent Midstream/crude oil relationship could be developing, thus being another factor potentially setting up Midstream for strong relative total returns similar to what we witnessed from 2000 to 2011. We expect a tighter range for crude oil which should lead to lower energy equity volatility. It also stands to reason that if the floor has been raised for the WTI price, Midstream companies that can make higher profits during periods of commodity strength should see their equity returns keep pace with earnings growth even if there is no change in valuation15, like what we saw in 2022’s ~33% total return. We also believe companies will keep debt/EBITDA leverage low, thus minimizing this topic as an existential thesis, which was a tedious exercise in disproving a negative for both corporates and long-term investors from 2015 to 2020.

Midstream relative to the Market YTD

The crisis that engulfed many banks in Q1 and Q2 required the Fed to inject nearly $100 billion of liquidity into the system just as they are trying to withdraw liquidity through interest rate policy. Equity markets in turn rushed for names with the highest liquidity, and then placed themes on them with the latest being the recent discovery (tongue firmly in cheek) of artificial intelligence (“AI”) technology. Human investors will conjure up any theory they can to play along with how computers may be driving markets, and, make no mistake, programmatic trading followed the Fed liquidity program to follow their own signals and push the “S&P 7” to dramatic heights16. Ironically, these programmatic trading arms are in and of themselves AI (though not the coveted theme of “generative AI”). So, are they just buying these names because they’re excited about themselves?

We turn back to you, the rational investor, whether you are new to investing or have the scars to prove your experience. Does chasing over-valued market beta17 feel like a good second half strategy or should you be continuing to actively allocate to other asset classes which have suffered in this mini (hopefully!) bubble? For instance, calendar YTD through June 30th, the S&P 50018 price to earnings ratio (P/E) has risen from 17x to 20x while consensus earnings per share (EPS) have declined from $59 to $5319. Conversely, the AMZX’s price to distributable cash flow20 remains near historical lows at 5.9x, though has behaved somewhat “rationally” rising ~8%, essentially in-line with the YTD total return.

Midstream potpourri

Several notable events occurred during Q2:23 that bear some mentioning.

M & A

Company consolidation was topical during the quarter, when, on May 14th, ONEOK Inc (OKE) offered to acquire Magellan Midstream Partners LP (MMP) in cash and stock for $18.8 billion of total enterprise value (EV), representing a 22% premium to the previous MMP closing price. Most market participants were surprised by the deal between these Tulsa neighbors; however, once the S-4 filing was released it was evident that talks between the two companies had been going on as far back as 2019. We see merits and detractions from the proposed combination, which is likely how the market appears to be viewing the deal as well given the spread between MMP’s trading price and proposed offer price was a 5.8% discount as of 6/30/23. We continue to monitor the potential ramifications of both a “yes” and a “no” vote, and are happy to hear from our investors if they have thoughts they’d like to share.

As to the broader topic of further Midstream M&A, we don’t foresee an upcoming wave of deals, although there were some smaller consolidation announcements that also occurred during the quarter. One of the reasons why we don’t expect more large deals gets back to valuation. With many companies trading near historically low trading multiples they either do not want to sell too cheaply, or, if they were to be the acquirer, risk dilution to their cost of capital from an “expensive” deal or a market re-rating due to sentiment. Lastly, as we’ve said in the past, our process has always focused on fundamental investing, and any proposed combinations would merely be “sweeteners” to the thesis.

(15) Valuation: The process of determining the current worth of an asset or a company. (16) You’d have to be living under a rock to not know that ~80% of the S&P 500’s YTD total return is driven by seven large capitalization technology stocks. (17) Beta: Measures of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), a model that calculates the expected return of an asset based on its beta and expected market returns. (18) S&P 500: A free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. (19) Bloomberg LP. (20) Price to Distributable Cash Flow (P/DCF): Market cap of the MLP divided by a full year of distributable cash flow, which is measured as earnings before interest, taxes, depreciation and amortization (EBITDA) available to pay unitholders after reserving for maintenance capital expenditures and payment of interest expense.

SEMI-ANNUAL REPORT 2023 ● 9

Mountain Valley Pipeline (MVP)

On June 2nd, as part of the broader agreement to raise the United States debt ceiling limit, the completion of MVP was secured allowing a sweeping Federal mandate to overcome any further potential challenges from lower courts. Long time readers may remember this pipeline’s completion was originally scheduled for 2018 but has been held up until now for various, politically motivated reasons.

Its approval is positive in a variety of ways. First, we believe this restores a semblance of rationality and, hopefully, balance to the overall permitting processes for all infrastructure assets, not just energy. Continuing to harp on our “capacity short” theme, the U.S. needs to get beyond emotional politics and understand there are bigger issues at hand for keeping the U.S. energy secure. Secondly, this is modestly positive for gas growth out of the Marcellus Shale; by providing an additional outline to the Gulf, MVP helps to underscore the long-lived resource base of America’s largest natural gas-focused basin. Lastly, it remains unfortunate that U.S. customers who need this cleaner, less expensive source of energy to the north of the pipeline have to watch the gas flow south, where it is more likely to reach international customers through liquefied natural gas (LNG) exports, rather than be consumed domestically as an economic competitive advantage.

As a we are writing this shareholder letter, on July 10th, the Fourth Circuit Court of Appeals issued a stay on MVP construction for the section of the pipeline that crosses through the Jefferson National Forest. The stay was issued to allow the Court to hear the opposition’s argument regarding the recent legislation passed by Congress to allow the resumption of construction. However, the legislation specified that all appeals were to be heard in the DC Circuit Court and not the Fourth Circuit Court. While we would expect an appeal from MVP, potentially to the Supreme Court, this ruling could negatively affect the timing of completion for the pipeline. While the Federal mandate would appear to hold, clearly this remains an unresolved situation.

LNG

Speaking of LNG growth, there was an important announcement as well as encouraging trends for growth in the near-term that occurred in Q2. On June 21st, Cheniere Energy Inc (LNG) signed a 1.75 million tonnes per annum (MTPA) agreement with the Norwegian energy giant Equinor ASA to deliver LNG cargoes for a 15-year term that will commence at the end of this decade. A few important points from this deal are that this expands the current relationship with Equinor; the start and completion date imply this contract extends into the 2040s; and while the term is slightly shorter than typical 20-year terms, we expect LNG received better economics for a relatively shorter term.

From a macro standpoint, it also shows the willingness of some European buyers to be competitive for LNG cargoes as they understand the role gas needs to play for a longer energy transition in a marketplace where Asia remains the strongest international contractor, particularly China, which is on track to be the largest importer of LNG in 2023. New contracts there continue to be executed for terms of at least 20 years as China clearly sees access to LNG cargoes as part of a broader energy security play21.

Conclusion

Thank you to our investors. Witnessing how Midstream continued to perform positively when crude price volatility may have suggested otherwise gives us confidence that the sector maintains its quite attractive risk-adjusted total return profile. We remained active in seeing clients and prospects during the quarter, and do reach out if you’d like to have a fulsome in person discussion in the coming months.

Sincerely,

|  |

| | |

| Geoffrey P. Mavar, Chairman | Matthew G. Mead, CEO |

(21) Bloomberg, LP “China Is Buying Gas Like There’s Still an Energy Crisis”, July 1, 2023.

10 | MainGate mlp fund

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

The information contained in this report is authorized for use when preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

The Fund will invest in Master Limited Partnerships (MLPs) which concentrate investments in the natural resource sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment.

MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. When the Fund invests in MLPs that operate energy-related businesses, its return on investment will be highly dependent on energy prices, which can be highly volatile.

Tax Risks: An investment in the Fund does not receive the same tax advantages as a direct investment in the MLP. The Fund is treated as a regular corporation or “C” corporation and is therefore subject to U.S. federal income tax on its taxable income at rates applicable to corporations (currently at a rate of 21%) as well as state and local income taxes. MLP Funds accrue deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investments. This deferred tax liability is reflected in the daily NAV and as a result the MLP Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked. The potential tax benefits from investing in MLPs depend on them being treated as partnerships for federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal. Past performance is no guarantee of future results. This is not an offer or solicitation with respect to the purchase or sale of any security.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Opinions expressed are those of Chickasaw Capital Management, LLC and are subject to change, are not guaranteed, and should not be considered investment advice.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the schedule of investments for a complete listing of Fund holdings.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achievereturns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “AlerianMLP Total Return Index”, “AMZ” and “AMZX” are service marks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian makes no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

S&P 500 Total Return Index tracks the total return of the S&P 500 Index, an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. Dividends are reinvested. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

SEMI-ANNUAL REPORT 2023 ● 11

Cash Flow is a revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities – financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. Cash flow can be attributed to a specific project, or to a business as a whole. Cash flow can be used as an indication of a company’s financial strength.

Correlation measures the extent of linear association of two variables.

Distributable Cash Flow (DCF) is calculated as net income plus depreciation and other noncash items, less maintenance capital expenditure requirements. Distributable cash flow (DCF) data is CCM calculated consensus of Wall Street estimates. The estimated consensus weighted average distributable cash flow (DCF) per unit growth rate for the AMZ and the fund’s portfolio incorporates market expectations by using the average annual growth rate using rolling-forward 24-month data. DCF growth rate is not a forecast of the portfolio’s future performance. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio.

Distributions are quarterly payments, similar to dividends, made to Limited Partner (LP) and General Partner (GP) investors. These amounts are set by the GP and are supported by an MLP’s operating cash flows.

Enterprise Value (EV) measures a company’s total value, often used as a more comprehensive alternative to market capitalization. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt and any cash or cash equivalents on the company’s balance sheet.

EBITDA is earnings before interest rates taxes depreciation and amortization.

Growth Capital Expenditures or Growth CapEx or GCX refers to the aggregate of all capital expenditures undertake to further growth prospects and/or expand operations and excludes any maintenance and regulatory capital expenditures.

Net Debt To EBITDA Ratio is a measurement of leverage, calculated as a company’s interest-bearing liabilities minus cash or cash equivalents, divided by its EBITDA. The net debt to EBITDA ratio is a debt ratio that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. If a company has more cash than debt, the ratio can be negative.

OPEC+ is a loosely affiliated entity consisting of the countries that are members of the Organization of the Petroleum Exporting Countries (OPEC), plus several of the world’s major non-OPEC oil-exporting nations, most notably Russia, with the goal of exerting a degree of control over the price of crude oil.

Price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

West Texas Intermediate (WTI) , also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of Chicago Mercantile Exchange’s oil futures contracts.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

Investment Advisor: Chickasaw Capital Management, LLC | 6075 Poplar Avenue, Memphis, Tennessee 38119 | p 901.537.1866 or 800.743.5410, f 901.537.1890 | info@chickasawcap.com

Portfolio Managers: Geoffrey P. Mavar, Principal | Matthew G. Mead, Principal

Earnings Growth is not a measure of the Fund’s future performance.

Distributed by Quasar Distributors, LLC.

12 | MainGate mlp fund

Expense Example | unaudited As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 1, 2022 to May 31, 2023. Actual Expenses For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Hypothetical Example for Comparison Purposes For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or exchange fees. Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher. |

| |

| | | Beginning

Account Value

(12/01/22) | | Ending

Account Value

(5/31/23) | | Expenses Paid

During Period(1)

(12/01/22 – 5/31/23) | | Net Annualized

Expense Ratio(2) | |

| Class A Actual | | $1,000.00 | | $968.70 | | $8.44 | | 1.72% | |

Class A Hypothetical

(5% return before expenses) | | $1,000.00 | | $1,016.36 | | $8.65 | | 1.72% | |

| Class C Actual | | $1,000.00 | | $966.10 | | $12.11 | | 2.47% | |

Class C Hypothetical

(5% return before expenses) | | $1,000.00 | | $1,012.62 | | $12.39 | | 2.47% | |

| Class I Actual | | $1,000.00 | | $970.20 | | $7.22 | | 1.47% | |

Class I Hypothetical

(5% return before expenses) | | $1,000.00 | | $1,017.60 | | $7.39 | | 1.47% | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182 days (the number of days in the most recent period)/365 days (to reflect the period), for Class A, Class C and Class I. |

| (2) | Annualized expense ratio excludes current and deferred income and franchise tax expense. |

SEMI-ANNUAL REPORT 2023 • 13

Allocation of Portfolio Assets

May 31, 2023 | unaudited

(expressed as a percentage of total investments)

Natural Gas Gathering/Processing* Natural Gas Gathering/Processing* | 36.8% |

Crude/Refined Products Pipelines and Storage* Crude/Refined Products Pipelines and Storage* | 36.7% |

Natural Gas/Natural Gas Liquid Pipelines and Storage* Natural Gas/Natural Gas Liquid Pipelines and Storage* | 26.5% |

*Master Limited Partnerships and Related Companies

| Schedule of Investments | May 31, 2023 | unaudited |

| |

| Master Limited Partnerships and Related Companies - 98.4%(1) | Shares | | Fair Value |

| Crude/Refined Products Pipelines and Storage - 36.1%(1) | | | |

| Canada - 0.4%(1) | | | |

| Enbridge, Inc. | 80,000 | | $2,816,000 |

| United States - 35.7%(1) | | | |

| Genesis Energy, L.P. | 1,675,000 | | 16,163,750 |

| Magellan Midstream Partners, L.P. | 1,200,000 | | 72,252,000 |

| MPLX, L.P. | 2,600,000 | | 86,684,000 |

| Phillips 66 | 215,000 | | 19,696,150 |

| Plains All American Pipeline, L.P. | 2,300,000 | | 29,716,000 |

| Plains GP Holdings, L.P. | 2,175,000 | | 29,580,000 |

| | | | 254,091,900 |

| Total Crude/Refined Products Pipelines and Storage | | | 256,907,900 |

| | | | |

| Natural Gas/Natural Gas Liquid Pipelines and Storage - 26.1%(1) | | | |

| United States - 26.1%(1) | | | |

| Cheniere Energy, Inc. | 190,000 | | 26,556,300 |

| DT Midstream, Inc. | 75,000 | | 3,409,500 |

| Energy Transfer, L.P. | 6,350,000 | | 78,740,000 |

| Enterprise Products Partners, L.P. | 2,000,000 | | 50,660,000 |

| Kinder Morgan, Inc. | 419,000 | | 6,750,090 |

| ONEOK, Inc. | 110,000 | | 6,232,600 |

| Williams Companies, Inc. | 475,000 | | 13,613,500 |

| Total Natural Gas/Natural Gas Liquid Pipelines and Storage | | | 185,961,990 |

| | | | |

| Natural Gas Gathering/Processing - 36.2%(1) | | | |

| United States - 36.2%(1) | | | |

| Antero Midstream Corporation | 675,000 | | 6,891,750 |

| Crestwood Equity Partners, L.P. | 375,000 | | 9,622,500 |

| DCP Midstream, L.P. | 170,000 | | 7,070,300 |

| Enlink Midstream, LLC | 6,600,000 | | 64,416,000 |

| Targa Resources Corporation | 1,200,000 | | 81,660,000 |

| Western Midstream Partners, L.P. | 3,500,000 | | 88,340,000 |

| Total Natural Gas Gathering/Processing | | | 258,000,550 |

| | | | |

| Total Master Limited Partnerships and Related Companies (Cost $279,626,574) | | | 700,870,440 |

| Total Investments - 98.4% (Cost $279,626,574)(1) | | | 700,870,440 |

| Other Assets in Excess of Liabilities - 1.6%(1) | | | 11,701,999 |

| Net Assets - 100.0%(1) | | | $712,572,439 |

| (1) | Calculated as a percentage of net assets. |

| 14 | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. | |

Statement of Assets and Liabilities

May 31, 2023 | unaudited

Assets

| Investments at fair value (cost $279,626,574) | $700,870,440 |

| Cash(1) | 12,937,411 |

| Receivable for Fund shares sold | 384,188 |

| Dividends receivable | 335,622 |

| Prepaid expenses | 260,954 |

| Total assets | 714,788,615 |

| Liabilities | |

| Payable for Fund shares redeemed | 1,099,318 |

| Payable to Adviser(2) | 775,862 |

| Payable for 12b-1 distribution fee(2) | 43,662 |

| Payable to Trustees | 23,868 |

| Payable to Custodian(2) | 5,039 |

| Accrued expenses and other liabilities | 268,427 |

| Total liabilities | 2,216,176 |

| Net assets | $712,572,439 |

| Net Assets Consist of | |

| Additional paid-in capital | $952,181,662 |

| Total accumulated losses, net of deferred taxes | (239,609,223) |

| Net assets | $712,572,439 |

| (1) | Concentration Risk (See Note 4) |

| (2) | Agreements, Contingencies and Related Party Transactions (See Note 5) |

| Unlimited shares authorized, no par value | Class A | Class C | Class I |

| Net assets | $32,776,738 | $17,749,174 | $662,046,527 |

| Shares issued and outstanding | 5,036,587 | 2,964,430 | 96,684,752 |

| Net asset value, redemption price and minimum offering price per share | $6.51 | $5.99 | $6.85 |

| Maximum offering price per share (Net asset value/0.9425) | $6.91 | NA | NA |

Statement of Operations

For the Six Months Ended May 31, 2023 | unaudited

Investment Income

| Distributions received from master limited partnerships | $23,770,125 |

| Less: return of capital on distributions from master limited partnerships | (23,770,125) |

| Distribution income received in excess of return of capital from master limited partnerships | — |

| Dividends from common stock(3,4) | 4,333,520 |

| Total Investment Income | 4,333,520 |

| (3) | The return of capital amount from C-Corporations was $616,485. (See Note 2) |

| (4) | Net of foreign withholding tax of $21,665. |

Expenses

| Advisory fees(2) | 4,883,781 |

| Administrator fees(2) | 260,062 |

| Professional fees | 228,519 |

| Insurance expense | 109,329 |

| Transfer agent expense(2) | 93,858 |

| Trustees’ fees | 47,868 |

| Registration fees | 37,990 |

| Reports to shareholders | 36,876 |

| Compliance fees | 34,292 |

| Custodian fees and expenses(2) | 20,760 |

| Fund accounting fees(2) | 498 |

| 12b-1 distribution fee - Class A(2) | 42,748 |

| 12b-1 distribution fee - Class C(2) | 93,979 |

| Total Expenses | 5,890,560 |

| Net Investment Loss, before taxes | (1,557,040) |

| Current and deferred tax benefit/(expense)(5) | — |

| Net Investment Loss, net of taxes | (1,557,040) |

| Realized and Unrealized Gain/(Loss) on Investments | |

| Net realized gain on investments, before taxes | 41,392,680 |

| Current and deferred tax benefit/(expense)(5) | — |

| Net realized gain on investments, net of taxes | 41,392,680 |

| Net change in unrealized appreciation/depreciation on investments, before taxes | (62,593,468) |

| Deferred tax benefit/(expense)(5) | — |

| Net change in unrealized appreciation/depreciation on investments, net of taxes | (62,593,468) |

| Net Realized and Unrealized Gain/(Loss) on investments | (21,200,788) |

| Decrease in Net Assets Resulting from Operations | $(22,757,828) |

| (5) | Any tax benefit/(expense) was fully offset by a valuation allowance recorded as of May 31, 2023. |

| The accompanying notes are an integral part of the financial statements. | SEMI-ANNUAL REPORT 2023 • 15 |

Statements of Changes in Net Assets

| Operations | For the Six Months | | |

| | Ended May 31, 2023 | unaudited | Year Ended November 30, 2022 |

| Net investment gain/(loss), net of deferred tax benefit/(expense) | $(1,557,040) | | $(3,635,802) | |

| Net realized gain/(loss) on investments, net of deferred tax benefit/(expense) | 41,392,680 | | 62,162,401 | |

| Net change in unrealized appreciation/depreciation on investments, net of deferred tax benefit/(expense) | (62,593,468) | | 228,151,750 | |

| Increase/(Decrease) in net assets resulting from operations | (22,757,828) | | 286,678,349 | |

| Dividends and Distributions to Class A Shareholders | | | | |

| Net investment income | (998,158) | | (325,794) | |

| Return of capital | (29,910) | | (1,846,166) | |

| Dividends and Distributions to Class C Shareholders | | | | |

| Net investment income | (583,299) | | (195,319) | |

| Return of capital | (17,479) | | (1,106,806) | |

| Dividends and Distributions to Class I Shareholders | | | | |

| Net investment income | (20,122,940) | | (6,838,738) | |

| Return of capital | (602,994) | | (38,752,847) | |

| Total dividends and distributions to Fund shareholders | (22,354,780) | | (49,065,670) | |

| Capital Share Transactions (Note 8) | | | | |

| Proceeds from shareholder subscriptions | 32,521,378 | | 113,304,189 | |

| Dividend reinvestments | 18,290,437 | | 40,671,841 | |

| Payments for redemptions | (131,400,949) | | (286,531,714) | |

| Decrease in net assets from capital share transactions | (80,589,134) | | (132,555,684) | |

| Total increase/(decrease) in net assets | (125,701,742) | | 105,056,995 | |

| Net Assets | | | | |

| Beginning of period | 838,274,181 | | 733,217,186 | |

| End of period | $712,572,439 | | $838,274,181 | |

| 16 | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. | |

Financial Highlights: Class A Shares

| Per Share Data(1) | For The

Six Months

Ended May 31,

2023 | unaudited | Year Ended

November 30,

2022 | Year Ended

November 30,

2021 | Year Ended

November 30,

2020 | Year Ended

November 30,

2019 | Year Ended

November 30,

2018 |

| Net Asset Value, beginning of period | $6.92 | $5.15 | $3.91 | $5.65 | $7.17 | $8.25 |

| | | | | | | |

| Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.02) | (0.04) | (0.07) | (0.06) | (0.05) | (0.09) |

| Net realized and unrealized gain (loss) on investments | (0.19) | 2.21 | 1.71 | (1.22) | (0.84) | (0.36) |

| Total increase (decrease) from investment operations | (0.21) | 2.17 | 1.64 | (1.28) | (0.89) | (0.45) |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.19) | (0.06) | (0.06) | - | - | - |

| Return of capital | (0.01) | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) |

| Net Asset Value, end of period | $6.51 | $6.92 | $5.15 | $3.91 | $5.65 | $7.17 |

| Total Investment Return | (3.13)%(3) | 43.28% | 42.66% | (22.61)% | (13.71)% | (6.24)% |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | $32,776,738 | $36,109,479 | $30,569,903 | $28,693,359 | $60,839,754 | $93,423,336 |

| Ratio of Expenses to Average Net Assets(4,5,6) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | - | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.72% | 1.69% | 1.68% | 1.72% | 1.69% | 1.66% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.72% | 1.69% | 1.68% | 1.72% | 1.69% | 1.66% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.72% | 1.69% | 1.70% | 1.73% | 1.70% | 1.66% |

| Net Fund Expenses(4,5,6) | 1.72% | 1.69% | 1.70% | 1.73% | 1.70% | 1.66% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.61)% | (0.67)% | (1.44)% | (1.32)% | (0.71)% | (1.05)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (0.61)% | (0.67)% | (1.44)% | (1.32)% | (0.71)% | (1.05)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.61)% | (0.67)% | (1.46)% | (1.33)% | (0.72)% | (1.05)% |

| Net Investment Income (Loss)(4,5,6) | (0.61)% | (0.67)% | (1.46)% | (1.33)% | (0.72)% | (1.05)% |

| Portfolio turnover rate(7) | 3.48% | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class A for the entire period.

(2) Calculated using average shares outstanding method.

(3) Not annualized.

(4) Annualized for periods less than one year.

(5) For the period from December 1, 2022 to May 31, 2023, the Fund accrued zero dollars in franchise tax expense. For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $532 is attributable to Class A. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $5,904 is attributable to Class A. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $3,733 is attributable to Class A. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $5,253 is attributable to Class A. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,982 is attributable to Class A.

(6) The Fund did not accrue a deferred tax expense or benefit.

(7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| The accompanying notes are an integral part of the financial statements. | SEMI-ANNUAL REPORT 2023 • 17 |

Financial Highlights: Class C Shares

| Per Share Data(1) | For The Six Months

Ended May 31,

2023 | unaudited | Year Ended

November 30,

2022 | Year Ended

November 30,

2021 | Year Ended

November 30,

2020 | Year Ended

November 30,

2019 | Year Ended

November 30,

2018 |

| Net Asset Value, beginning of period | $6.40 | $4.82 | $3.72 | $5.43 | $6.97 | $8.09 |

| | | | | | | |

| Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.04) | (0.08) | (0.10) | (0.08) | (0.10) | (0.14) |

| Net realized and unrealized gain (loss) on investments | (0.17) | 2.06 | 1.60 | (1.17) | (0.81) | (0.35) |

| Total increase (decrease) from investment operations | (0.21) | 1.98 | 1.50 | (1.25) | (0.91) | (0.49) |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.19) | (0.06) | (0.06) | - | - | - |

| Return of capital | (0.01) | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) |

| Net Asset Value, end of period | $5.99 | $6.40 | $4.82 | $3.72 | $5.43 | $6.97 |

| Total Investment Return | (3.39)%(3) | 42.25% | 41.02% | (22.99)% | (14.42)% | (6.88)% |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | $17,749,174 | $19,980,563 | $17,119,406 | $16,108,024 | $33,310,916 | $52,049,211 |

| Ratio of Expenses to Average Net Assets(4,5,6) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | - | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.47% | 2.44% | 2.43% | 2.46% | 2.44% | 2.41% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 2.47% | 2.44% | 2.43% | 2.46% | 2.44% | 2.41% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.47% | 2.44% | 2.45% | 2.47% | 2.45% | 2.41% |

| Net Fund Expenses(4,5,6) | 2.47% | 2.44% | 2.45% | 2.47% | 2.45% | 2.41% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (1.36)% | (1.42)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (1.36)% | (1.42)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (1.36)% | (1.42)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% |

| Net Investment Income (Loss)(4,5,6) | (1.36)% | (1.42)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% |

| Portfolio turnover rate(7) | 3.48% | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class C for the entire period.

(2) Calculated using average shares outstanding method.

(3) Not annualized.

(4) Annualized for periods less than one year.

(5) For the period from December 1, 2022 to May 31, 2023, the Fund accrued zero dollars in franchise tax expense. For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $297 is attributable to Class C. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $3,367 is attributable to Class C. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $2,149 is attributable to Class C. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $2,996 is attributable to Class C. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,007 is attributable to Class C.

(6) The Fund did not accrue a deferred tax expense or benefit.

(7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| 18 | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. | |

Financial Highlights: Class I Shares

| Per Share Data(1) | For The Six Months

Ended May 31,

2023 | unaudited | Year Ended

November 30,

2022 | Year Ended

November 30,

2021 | Year Ended

November 30,

2020 | Year Ended

November 30,

2019 | Year Ended

November 30,

2018 |

| Net Asset Value, beginning of period | $7.26 | $5.37 | $4.06 | $5.83 | $7.36 | $8.43 |

| | | | | | | |

| Income from Investment Operations | | | | | | |

| Net investment loss(2) | (0.01) | (0.03) | (0.06) | (0.05) | (0.03) | (0.07) |

| Net realized and unrealized gain (loss) on investments | (0.20) | 2.32 | 1.77 | (1.26) | (0.87) | (0.37) |

| Total increase (decrease) from investment operations | (0.21) | 2.29 | 1.71 | (1.31) | (0.90) | (0.44) |

| Less Distributions to Shareholders | | | | | | |

| Net investment income | (0.19) | (0.06) | (0.06) | - | - | - |

| Return of capital | (0.01) | (0.34) | (0.34) | (0.46) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.40) | (0.46) | (0.63) | (0.63) |

| Net Asset Value, end of period | $6.85 | $7.26 | $5.37 | $4.06 | $5.83 | $7.36 |

| Total Investment Return | (2.98)%(3) | 43.74% | 42.82% | (22.42)% | (13.48)% | (5.98)% |

| | | | | | | |

| Supplemental Data and Ratios | | | | | | |

| Net assets, end of period | $662,046,527 | $782,184,139 | $685,527,877 | $747,728,099 | $967,800,549 | $1,220,133,792 |

| Ratio of Expenses to Average Net Assets(4,5,6) | | | | | | |

| Net deferred income and franchise tax (benefit) expense | - | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.47% | 1.44% | 1.43% | 1.46% | 1.44% | 1.41% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.47% | 1.44% | 1.43% | 1.46% | 1.44% | 1.41% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.47% | 1.44% | 1.45% | 1.47% | 1.45% | 1.41% |

| Net Fund Expenses(4,5,6) | 1.47% | 1.44% | 1.45% | 1.47% | 1.45% | 1.41% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | | | | | | |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.36)% | (0.42)% | (1.19)% | (1.07)% | (0.46)% | (0.80)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (0.36)% | (0.42)% | (1.19)% | (1.07)% | (0.46)% | (0.80)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.36)% | (0.42)% | (1.21)% | (1.08)% | (0.47)% | (0.80)% |

| Net Investment Income (Loss)(4,5,6) | (0.36)% | (0.42)% | (1.21)% | (1.08)% | (0.47)% | (0.80)% |

| Portfolio turnover rate(7) | 3.48% | 3.26% | 20.80% | 36.65% | 66.39% | 44.57% |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class I for the entire period

(2) Calculated using average shares outstanding method.

(3) Not annualized.

(4) Annualized for periods less than one year.

(5) For the period from December 1, 2022 to May 31, 2023, the Fund accrued zero dollars in franchise tax expense. For the year ended November 30, 2022, the Fund accrued $12,466 in franchise tax expense, of which $11,637 is attributable to Class I. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $140,654 is attributable to Class I. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $81,437 is attributable to Class I. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $76,851 is attributable to Class I. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $23,914 is attributable to Class I.

(6) The Fund did not accrue a deferred tax expense or benefit.

(7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| The accompanying notes are an integral part of the financial statements. | SEMI-ANNUAL REPORT 2023 • 19 |

Notes to Financial Statements

May 31, 2023 | unaudited

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end, non-diversified investment company. The Trust was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. Class A and Class I commenced operations on February 17, 2011. Class C commenced operations on March 31, 2014.

The Fund offers three classes of shares: Class A, Class C and Class I. Depending on the size of the initial purchase, Class A shares are subject to a maximum 5.75% front-end sales charge or a 1.00% contingent deferred sales charge if shares are redeemed within 18 months. Class C shares have no front-end sales charge, but are subject to a 1.00% contingent deferred sales charge within 12 months of redemption. Class I shares have no sales charge. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the six-month period ended May 31, 2023, contingent deferred sales charges of $0 and $295 were incurred by Class A and Class C shareholders, respectively.

2. Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Board Codification Topic 946 Financial Services—Investment Companies.

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recognition of distribution income and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. Fund investments are recognized at fair value, and subsequent changes in fair value are recognized in unrealized appreciation/(depreciation) on investments in the Statement of Operations. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, a fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| ● | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| ● | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| ● | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. Chickasaw Capital Management, LLC (the “Adviser”) also monitors for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income and Expenses. Security transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”), including MLP general partnership interests, generally are comprised of ordinary income and return of capital. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

| 20 | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. | |

For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

The Fund estimates the allocation of investment income and return of capital for the distributions received from MLPs within the Statement of Operations. For the six-month period ended May 31, 2023, the Fund has estimated approximately 100% of the distributions from MLPs taxed as partnerships to be return of capital. Distributions from common stocks may also include income and return of capital. The Fund records the character of distributions received during the year based on estimates available. The characterization of distributions received by the Fund may be subsequently revised based on the information received from the MLPs and common stock after their tax reporting periods conclude.

Expenses are recorded on the accrual basis.

D. Dividends and Distributions to Shareholders. The Fund intends to make quarterly distributions from net income, which include the amount received as cash distributions from MLPs and common stock dividends. These activities are reported in the Statements of Changes in Net Assets.

Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends are reinvested in the Fund unless specifically instructed otherwise by a shareholder. The character of dividends and distributions to shareholders made during the period may differ from their ultimate characterization for federal income tax purposes. For the six-month period ended May 31, 2023, the Fund’s dividends and distributions were expected to be comprised of 97% income and 3% return of capital. The tax character of distributions paid for the six-month period ended May 31, 2023 will be determined in early 2024.

E. Federal Income Taxation. The Fund, taxed as a corporation, is obligated to pay federal and state income tax on its taxable income. Currently, the federal income tax rate for a corporation is 21%.

The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund reports its allocable share of the MLP’s taxable income in computing its own taxable income. The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is recognized if, based on the weight of available evidence, it is more likely than not that some portion or all of the deferred income tax asset will not be realized.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes as an income tax expense on the Statement of Operations. For the six-month period ended May 31, 2023, the Fund did not have interest or penalties associated with underpayment of income taxes.

F. Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred, and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts.

G. Cash. Cash consists of deposits held with a bank.

3. Fair Value Measurements

Various inputs that are used in determining the fair value of the Fund’s investments are summarized in the three broad levels listed below:

| ● | Level 1: unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access |

| ● | Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

These inputs are summarized in the three broad levels that follow.

SEMI-ANNUAL REPORT 2023 ● 21

| | | | | Fair Value Measurements at Reporting Date Using: |

| | | | | |

| Description | | Fair Value at

May 31, 2023 | | Quoted Prices in Active

Markets for Identical

Assets (Level 1) | | Significant Other

Observable

Inputs (Level 2) | | Significant

Unobservable

Inputs (Level 3) |

| Equity Securities | | | | | | | | |

| Master Limited Partnerships and and Related Companies(1) | | $700,870,440 | | $700,870,440 | | $— | | $— |

| Total | | $700,870,440 | | $700,870,440 | | $— | | $— |

(1) All other industry classifications are identified in the Schedule of Investments.

4. Concentration Risk

The Fund seeks to achieve its investment objective by investing at least 80% of its net assets (plus any borrowings for investment purposes) in MLP interests under normal circumstances as determined in the prospectus. The investment objectives are included within the Schedule of Investments.

Credit Risk. The Fund maintains cash in bank accounts which, at times, may exceed United States federally insured limits.

5. Agreements, Contingencies and Related Party Transactions

The Trust has entered into an Investment Advisory Agreement (the “Agreement”) with the Adviser. Under the terms of the Agreement, the Fund pays the Adviser a fee, payable at the end of each calendar month, at an annual rate equal to 1.25% of the average daily net assets of the Fund.

The Adviser has agreed to waive its advisory fee and/or reimburse certain operating expenses of the Fund, until at least March 31, 2024, but only to the extent necessary so that the Fund’s total annual expenses, excluding brokerage fees and commissions; borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short); taxes, including deferred income tax expense/(benefit) and franchise taxes; any indirect expenses, such as acquired fund fees and expenses; Class A 12b-1 fees, Class C 12b-1 fees, and extraordinary expenses, do not exceed 1.50% of the average daily net assets of each class of the Fund. Any payment by the Adviser of the Fund’s operating, organizational and offering expenses are subject to repayment by the Fund in the three fiscal years following the fiscal year in which the payment was made; provided that the Fund is able to make the repayment without exceeding the 1.50% expense limitation.

Waived fees and reimbursed Fund expenses, including prior year expenses, are subject to potential recoupment by year of expiration. During the six-month period ended May 31, 2023, the Fund did not waive or recoup expenses. At May 31, 2023, there were no prior year amounts subject to potential recoupment.

Certain Trustees and Officers of the Trust/Fund are also Officers of the Adviser or Vigilant Compliance, LLC (“Vigilant”).

The Fund has engaged Vigilant to provide compliance services including the appointment of the Fund’s Chief Compliance Officer. Effective October 1, 2015, the Fund pays Vigilant a monthly fee of $4,728 for net assets up to $1.7 billion, $5,228 for net assets between $1.7 billion and $2.0 billion, $5,728 for net assets between $2.0 billion and $2.5 billion, and $6,000 for net assets above $2.5 billion with each rate subject to a 2% annual increase.

Quasar Distributors, LLC (“Quasar”) serves as the Fund’s distributor. The Fund has adopted a plan of distribution under Rule 12b-1 of the 1940 Act applicable to Class A and Class C shares. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the six-month period ended May 31, 2023, 12b-1 distribution expenses of $42,748 and $93,979 were accrued by Class A and Class C shares, respectively.