UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22495 |

|

Curian Series Trust |

(Exact name of registrant as specified in charter) |

|

7601 Technology Way, Denver, Colorado | | 80237 |

(Address of principal executive offices) | | (Zip code) |

|

Daniel W. Koors Jackson National Asset Management, LLC 225 West Wacker Drive, Suite 1200 Chicago, Illinois 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 338-5800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2013 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Report to Shareholders.

ANNUAL REPORT | October 31, 2013 |

Curian/PIMCO Income Fund

Curian/PIMCO Total Return Fund

Curian/WMC International Equity Fund

Curian Series Trust

October 31, 2013

Table of Contents

President’s Letter | 1 |

Management’s Discussion and Fund Performance | 2 |

Schedules of Investments | 5 |

Statements of Assets and Liabilities | 26 |

Statements of Operations | 27 |

Statements of Changes in Net Assets | 28 |

Financial Highlights | 30 |

Notes to Financial Statements | 31 |

Report of Independent Registered Public Accounting Firm | 46 |

Additional Disclosures | 47 |

Trustees and Officers Information | 49 |

Investment Advisory and Sub-Advisory Agreements | 55 |

Curian Series Trust

October 31, 2013

President’s Letter

Dear Fellow Investor,

Enclosed is the annual report for the Curian Series Trust for the year ended October 31, 2013, together with Management’s Discussion of Fund Performance for each of the “Funds”.

From an economic perspective, most global economies showed signs of improvement during the period from November 2012 through October 2013, including the Eurozone, which climbed out of recession during the second quarter of 2013. However, Europe’s recovery was quite weak, with the Eurozone gross domestic product (“GDP”) posting quarterly, non-annualized growth of only 0.3% during the second quarter and 0.1% during the third quarter (secondary estimate). In contrast, the U.S. economy delivered stronger growth during 2013, with GDP expanding over the prior quarter at an annual rate of 2.5% during the second quarter and, according to an advance estimate, 3.6% in the third quarter. China’s economy also showed improved growth during the third quarter of 2013, with year over year GDP growth rebounding to 7.8% from 7.5% during the second quarter.

In the U.S., investors appeared to focus more on fundamentals rather than the political impasse in Washington that partially shut down the federal government and brought the country uncomfortably close to the debt ceiling. Strong increases in home prices, steadily improving unemployment data and the decision by the U.S. Federal Reserve to delay the tapering of their bond buying program helped support a remarkable equity market rally.

Domestic equity markets delivered impressive returns during the 12-month period ended October 31, 2013, with the S&P 500® Index and the Dow Jones Industrial Average (“DJIA”) reaching new all-time closing highs. The S&P 500 Index and the DJIA gained 27.18% and 21.82%, respectively, during the period, while the Nasdaq Composite Index rose 33.54%.

International stocks also performed strongly as a result of improving economic conditions, particularly in Europe and Japan. The Morgan Stanley Capital International (“MSCI”) EAFE Index posted a gain of 26.88% over the 12-month period ended October 31, 2013, while the MSCI Emerging Markets Index returned 6.53%.

As for the fixed income markets, overall bond performance was challenged by rising interest rates during 2013. Despite achieving positive results during September and October 2013, most fixed income sectors posted declines during the 12-month period, with the exception of high yield corporate and preferred stock. Over the 12-month period, the Barclays U.S. Corporate High Yield Bond Index returned 8.87%, while the Barclays U.S. Corporate Investment Grade Bond Index declined -1.40% and the Barclays U.S. Treasury Bond Index fell -1.45%.

Compared to the traditional stock and bond market returns, the performance of the alternatives markets reflected similar tendencies during the 12-month period, with equity based asset classes and strategies performing stronger than other sectors. Investors often consider incorporating alternative asset classes and strategies into their portfolios due to their diversifying influences, often behaving differently from traditional assets under the same market conditions. For example, during the 12-month period, volatile trend patterns negatively impacted the performance of alternative funds focused on commodities and currencies. On the other hand, listed private equity was the standout in the alternatives market, with returns among the best of any asset class.

In summary, investors were rewarded handsomely from increasing their risk exposure during the 12-month period ended October 31, 2013, with domestic and global equities delivering particularly strong returns.

For the 12-month period ended October 31, 2013, all three of the Curian Series Trust Funds outperformed their respective benchmark index. The Curian/WMC International Equity Fund gained 22.36%, while the MSCI All Country World Index ex. US Index returned 20.28%. In contrast, the Curian/PIMCO Total Return Fund declined -0.46% over the period, compared to a decline of -1.08% for the Barclays Capital U.S. Aggregate Bond Index. The Curian/PIMCO Income Fund fell -0.66%, outperforming the Barclays Capital U.S. Credit Index, which declined -1.58%.

Through your financial professional, Curian provides a comprehensive array of goals based investment portfolios designed to help you reach your financial goals. Thank you for choosing Curian for your investment needs.

Michael A. Bell

President and Chief Executive Officer

Curian Series Trust

Pacific Investment Management Company LLC (Unaudited)

Market Summary: In a largely status quo election, Americans voted President Barack Obama to a second term in office at the end of 2012. Market participants then quickly turned their attention to the uncertainty surrounding the impending fiscal cliff. Ultimately, hopes of a grand bargain abated and gave way to a short term deal, thus opening the door to further fiscal negotiations, most notably on a debt ceiling increase and spending cuts in 2013.

Despite the rhetoric surrounding the fiscal cliff and the damage from Hurricane Sandy, there was positive economic data released during the quarter. According to gross domestic product data, in 2012 the U.S. economy grew at a higher than expected 3.1% annual rate during the third quarter, up from 1.3% during the second quarter. Additionally, the housing market continued to show improvement during the fourth quarter amid record low mortgage rates.

During the first quarter of 2013, U.S. equity indices reached new highs and Treasuries sold off across the curve during the quarter as signs of renewed momentum in the world's largest economy fueled risk appetite. Investors discounted negative fiscal policy developments — including Congress' failure to reach a deal on sequestration and instead focused on positive news out of the housing and labor markets.

Conditions in financial markets then deteriorated during the second quarter as investors reacted to signals by the U.S. Federal Reserve ("Fed") that it would begin to slow the pace of asset purchases later this year. The shift in tone fueled a broad based sell off of fixed income assets, undermining market liquidity, and sending yields higher across the risk spectrum.

While the Fed's choice to later eschew market consensus in the third quarter and delay tapering left investors in a state of disbelief, a few key factors guided its hand. Chief among them was economic data. Ever since the Fed began hinting at tapering this spring, headline indicators of economic growth have been unconvincing. The question many are asking now is to what extent the economy's current bout of cyclical weakness is of the Fed's own doing.

The Fed is also keeping a wary eye on the uncertain fiscal policy landscape. The economy is unlikely to escape both a government shutdown and another debt ceiling debate unscathed. Against this backdrop of elevated economic and fiscal policy uncertainty, the Fed continues to enhance one source of certainty for investors: the Fed Funds rate. The Fed will not begin raising rates until a "considerable time" after the third quantitative easing ("QE3") has been wound down; the longer the withdrawal from QE3 is delayed, the further the Fed pushes out the eventual first rate hike.

Portfolio Composition†:

Financials | | | 29.2 | % | |

Energy | | | 13.4 | | |

Government Securities | | | 8.7 | | |

Non-U.S. Government Agency ABS | | | 6.6 | | |

Telecommunication Services | | | 5.1 | | |

Consumer Discretionary | | | 4.5 | | |

Health Care | | | 3.8 | | |

Materials | | | 3.7 | | |

Utilities | | | 3.6 | | |

Consumer Staples | | | 3.4 | | |

U.S. Government Agency MBS | | | 3.3 | | |

Industrials | | | 3.1 | | |

Information Technology | | | 1.8 | | |

Purchased Options | | | 0.1 | | |

Short Term Investments | | | 9.7 | | |

Total Investments | | | 100.0 | % | |

†Total Investments at October 31, 2013

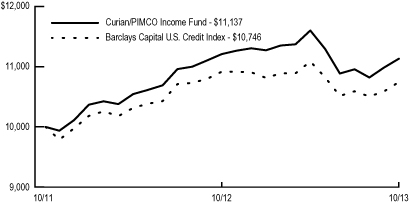

Portfolio Manager Commentary: For the year ended October 31, 2013 Curian/PIMCO Income Fund outperformed its benchmark by posting a return of -0.66% compared to -1.58% for the Barclays Capital U.S. Credit Index.

The investment concentration differences relative to the benchmark included an underweight to investment grade credit and an allocation to

emerging markets ("EM"), with U.S. government exposure fluctuating around the benchmark over the year. The Fund also had out of index exposure to mortgages, high yield and non U.S. developed corporate bonds. During the year, the Fund decreased exposure to investment grade corporates, while increasing exposure to mortgages, high yield and municipal bonds.

The net outperformance relative to the benchmark resulted from several strategies. Curve positioning, particularly an underweight to longer dated maturities, was positive for performance as the yield curve steepened over the year. Interest rate exposure to specific developed economies, such as Spain and Italy, also added to returns as yields fell across the curve. Conversely, tactical exposure to select EM local rates, such as Brazil, detracted from performance as yields rose. Within investment grade corporate bonds, an emphasis on banks, which outperformed the broader market, also contributed to outperformance. In high yield, an emphasis on the bonds of financial and industrial companies contributed to returns. Within mortgages, an out of benchmark allocation to non-agency mortgages added to returns, as they benefitted from the ongoing housing recovery. Lastly, the Fund's exposure to U.S. dollar denominated EM debt detracted from returns

as taper talk and increasing yields domestically impacted the sector negatively.

Derivatives were used in the Fund and are instrumental in attaining specific exposures targeted to gain from anticipated market developments. The Fund's U.S. duration positioning, which was positive for returns, was partly facilitated through the use of interest rate swaps. The allocation to EM local debt, which detracted from relative performance, included exposure to local debt in Brazil that was implemented using zero coupon interest rate swaps. Additionally, investment grade corporate exposure was positive for performance, and was implemented partially through the use of credit default swaps.

PIMCO expects the global economy to grow at a real rate of 2.25% to 2.75% over the year ahead. While PIMCO expects a step up in U.S. growth, we think that it will fall short of highly optimistic consensus expectations. Eurozone growth will also improve but disappoint relative to consensus, managing a minor acceleration from a low base. Japan's cyclical momentum will continue to rely heavily on implementation of aggressive fiscal and monetary policies. Finally, on the inflation front, an environment of muted inflation will likely persist over the next six to nine months.

Total Return*

| 1 Year | | | -0.66 | % | |

Since Inception | | | 5.54 | | |

(Inception date November 2, 2011) | |

Expense Ratios**

Net Expense Ratio | |

Prospectus | | | 0.85 | % | |

Year ended October 31, 2013 | | | 0.85 | | |

Gross Expense Ratio | |

Prospectus | | | 1.03 | % | |

Year ended October 31, 2013 | | | 1.02 | | |

*Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, however, performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

**The prospectus expense ratios are from the Fund's prospectus dated February 28, 2013. Net expense ratio is net of contractual waivers.

The Fund's investment adviser waived/reimbursed certain expenses of the Fund. Performance results shown reflect the waiver, without which they would have been lower.

2

Pacific Investment Management Company LLC (Unaudited)

Curian/PIMCO Total Return Fund

Portfolio Composition†:

U.S. Government Agency MBS | | | 28.5 | % | |

Government Securities | | | 24.9 | | |

Financials | | | 10.5 | | |

Non-U.S. Government Agency ABS | | | 7.8 | | |

Health Care | | | 1.4 | | |

Industrials | | | 0.9 | | |

Energy | | | 0.4 | | |

Telecommunication Services | | | 0.4 | | |

Materials | | | 0.1 | | |

Utilities | | | 0.0 | | |

Short Term Investments | | | 25.1 | | |

Total Investments | | | 100.0 | % | |

†Total Investments at October 31, 2013

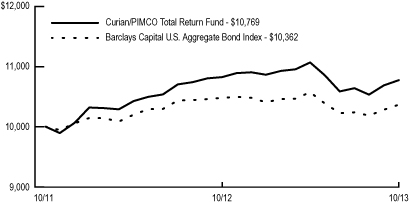

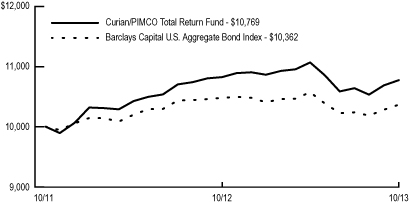

Portfolio Manager Commentary: For the year ended October 31, 2013 Curian/PIMCO Total Return Fund outperformed its benchmark by posting a return of -0.46% compared to -1.08% for the Barclays Capital U.S. Aggregate Bond Index.

The investment concentration differences relative to the benchmark included an overweight to mortgages and an underweight to investment grade credit and U.S. government. The Fund also

had out of index exposure to high yield, emerging markets ("EM") and non U.S. developed corporate bonds. During the year, the Fund decreased exposure to investment grade corporates and non U.S. developed corporate bonds, while increasing exposure to mortgages.

The net outperformance relative to the benchmark resulted from several strategies. Curve positioning, particularly an underweight to longer dated maturities, was positive for performance as the yield curve steepened over the year. Interest rate exposure to specific developed economies, such as Spain and Italy, also added to returns as yields fell across the curve. Within investment grade corporate bonds, an emphasis on banks, which outperformed the broader market, also contributed to outperformance. In high yield, an emphasis on the bonds of financial and industrial companies contributed to returns. Within mortgages, an out of benchmark allocation to non-agency mortgages added to returns, as they benefitted from the ongoing housing recovery. Lastly, the Fund's holdings of Treasury Inflation Protected Securities detracted from returns as taper talk and increasing yields domestically impacted the sector negatively.

Derivatives were used in the Fund and are instrumental in attaining specific exposures targeted to gain from anticipated market developments. The Fund's U.S. duration positioning, which was positive for returns, was partly facilitated through the use of interest rate swaps. An allocation to EM local debt, which was additive to relative performance, included exposure to local debt in Brazil that was implemented using zero coupon interest rate swaps. Additionally, investment grade corporate exposure was positive for performance, and was implemented partially through the use of credit default swaps.

PIMCO expects the global economy to grow at a real rate of 2.25% to 2.75% over the year ahead. While PIMCO expects a step up in U.S. growth, we think that it will fall short of highly optimistic consensus expectations. Eurozone growth will also improve but disappoint relative to consensus, managing a minor acceleration from a low base. Japan's cyclical momentum will continue to rely heavily on implementation of aggressive fiscal and monetary policies. Finally, on the inflation front, an environment of muted inflation will likely persist over the next six to nine months.

Total Return*

| 1 Year | | | -0.46 | % | |

Since Inception | | | 3.78 | | |

(Inception date November 2, 2011) | |

Expense Ratios**

Net Expense Ratio | |

Prospectus | | | 0.80 | % | |

Year ended October 31, 2013 | | | 0.80 | | |

Gross Expense Ratio | |

Prospectus | | | 1.02 | % | |

Year ended October 31, 2013 | | | 0.99 | | |

*Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, however, performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

**The prospectus expense ratios are from the Fund's prospectus dated February 28, 2013. Net expense ratio is net of contractual waivers.

The Fund's investment adviser waived/reimbursed certain expenses of the Fund. Performance results shown reflect the waiver, without which they would have been lower.

3

Wellington Management Company, LLP (Unaudited)

Market Summary: Global equities finished 2012 on a strong note despite concerns about the looming U.S. fiscal cliff, tepid corporate revenue results, and economic malaise in Europe. Investors bid up risk assets amid signs of a recovery in China and a strengthening U.S. housing market. Enthusiasm for stocks continued through the first quarter of 2013. Global equities surged on the back of solid corporate earnings results and favorable global liquidity dynamics. Further monetary easing by the Bank of Japan and a steadily improving U.S. economy also fueled the rally, which continued at a more modest pace in the second quarter. Solid gains in April and the first part of May paused following comments by U.S. Federal Reserve ("Fed") Chairman Ben Bernanke that suggested the Fed might begin to slow quantitative easing sooner than investors anticipated. Nonetheless, equities continued their advance in the third quarter as the surprising "no taper" decision by the Federal Open Market Committee eased near term concerns about rapidly

rising interest rates derailing the recovery. Additionally, accommodative rhetoric from the European Central Bank, along with encouraging data in China, further evidence of a European economic recovery and solid corporate earnings contributed to a broad based global rally. The quarter, however, ended on a sour note stemming from concerns about an imminent U.S. government shutdown and an even more contentious debt ceiling battle in October. After the U.S. Congress reached a temporary agreement to end the shutdown, equities resumed their ascent and finished October on a strong note.

In this environment, the MSCI All Country World ex. U.S. Index recorded a positive return of 20.28%. Within the index, nine out of ten sectors posted positive returns. Consumer discretionary, health care and telecommunication services were the strongest performing sectors, while materials declined and energy and utilities lagged the broader index.

Curian/WMC International Equity Fund

Portfolio Composition†:

Financials | | | 26.0 | % | |

Industrials | | | 15.3 | | |

Consumer Discretionary | | | 13.1 | | |

Health Care | | | 11.6 | | |

Consumer Staples | | | 9.3 | | |

Information Technology | | | 8.2 | | |

Energy | | | 4.3 | | |

Materials | | | 4.2 | | |

Utilities | | | 2.7 | | |

Telecommunication Services | | | 1.0 | | |

Investment Companies | | | 1.4 | | |

Short Term Investments | | | 2.9 | | |

Total Investments | | | 100.0 | % | |

†Total Investments at October 31, 2013

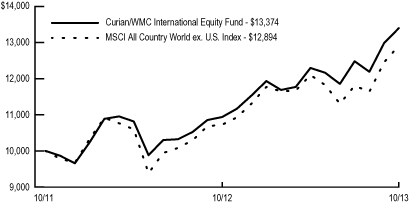

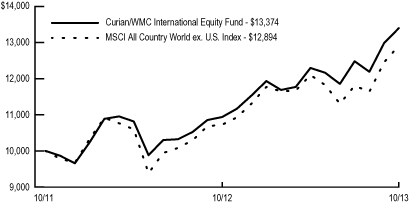

Portfolio Manager Commentary: For the year ended October 31, 2013, Curian/WMC International Equity Fund outperformed its benchmark by posting a return of 22.36% compared to 20.28% for the MSCI All Country World ex. U.S. Index. Stock selection was the primary driver of outperformance during the period. Allocation among sectors, a residual of the bottom-up stock

selection process, also modestly contributed to positive relative performance.

The Fund benefitted from strong security selection within materials, financials, industrials and information technology. Partially offsetting positive relative results was the Fund's weak selection within energy and consumer staples. Sector allocation benefited from an underweight to materials and energy, as well as an overweight to industrials. An underweight to telecommunication services and overweight to health care as well as a modest cash position in a rising equity market partially offset positive results. From a regional perspective, security selection was strongest within Developed Europe (ex UK) and Developed North America but weakest in the UK and Japan. An underweight to emerging markets ("EM") and overweight exposure to Developed Europe (ex UK) contributed most to relative performance. Partially offsetting positive results was an overweight to Japan, which lagged in the third quarter of 2013 and through the end of October.

Top contributors to relative performance during the year included France based global insurance and investment management company AXA SA, Swiss based pharmaceutical and diagnostics holding company Roche Holding AG and large France based bank BNP Paribas SA. Top detractors from relative performance included Brazil based water utility company Cia de Saneamento Basico do Estado de Sao Paulo, Japan based real estate and construction company Daito Trust Construction Co. Ltd. and Luxembourg based mining and steel company ArcelorMittal S.A.

The Fund ended the year with overweight exposures to industrials, particularly capital goods companies, health care and consumer discretionary stocks. The Fund was most underweight to energy, telecommunication services and materials at the end of the year. Regionally, the Fund ended the year most overweight Developed Europe (ex UK) and Japan, while most underweight EM and Pacific Developed (ex Japan).

Total Return*

| 1 Year | | | 22.36 | % | |

Since Inception | | | 15.67 | | |

(Inception date November 2, 2011) | |

Expense Ratios**

Net Expense Ratio | |

Prospectus | | | 1.32 | % | |

Year ended October 31, 2013 | | | 1.32 | | |

Gross Expense Ratio

Prospectus | | | 1.48 | % | |

Year ended October 31, 2013 | | | 1.46 | | |

*Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Fund operating expenses, however, performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

**The prospectus expense ratios are from the Fund's prospectus dated February 28, 2013. Net expense ratio is net of contractual waivers.

The Fund's investment adviser waived/reimbursed certain expenses of the Fund. Performance results shown reflect the waiver, without which they would have been lower.

4

Curian Series Trust

Schedules of Investments

October 31, 2013

| | Shares/Par † | | Value | |

Curian/PIMCO Income Fund | | | | | |

NON-U.S. GOVERNMENT AGENCY ASSET-BACKED SECURITIES - 7.8% | | | | | |

Asset Backed Securities Corp. Home Equity Loan Trust REMIC, 0.80%, 09/25/34 (a) | | $ | 430,949 | | $ | 389,034 | |

Asset-Backed Pass-Through Certificates REMIC, 0.62%, 04/25/35 (a) | | 1,468,281 | | 1,439,298 | |

Banc of America Large Loan Trust REMIC, 2.47%, 11/15/15 (a) (b) | | 3,079,724 | | 3,080,411 | |

Banc of America Mortgage Trust REMIC, 2.75%, 09/25/34 (a) | | 1,308,868 | | 1,297,605 | |

Bear Stearns Asset Backed Securities Trust REMIC | | | | | |

0.66%, 07/25/35 (a) | | 367,897 | | 359,978 | |

1.37%, 01/25/45 (a) | | 554,214 | | 433,042 | |

Citigroup Mortgage Loan Trust REMIC, 5.74%, 09/25/37 (a) | | 409,662 | | 342,349 | |

Continental Airlines Pass-Through Trust | | | | | |

5.50%, 10/29/20 | | 1,300,000 | | 1,316,250 | |

4.00%, 10/29/24 | | 1,000,000 | | 986,000 | |

Countrywide Asset-Backed Certificates REMIC | | | | | |

1.03%, 08/25/34 (a) | | 1,100,000 | | 1,020,649 | |

0.82%, 06/25/35 (a) | | 600,000 | | 590,194 | |

Countrywide Home Loans Inc. Alternative Loan Trust REMIC, 3.40%, 08/25/18 | | 1,155,211 | | 1,161,277 | |

CVS Pass-Through Trust, 5.93%, 01/10/34 (b) | | 1,438,741 | | 1,588,150 | |

Delta Air Lines Inc. Pass-Through Trust | | | | | |

7.75%, 12/17/19 | | 571,379 | | 651,372 | |

6.72%, 01/02/23 | | 829,285 | | 916,360 | |

Federal Express Corp. Pass-Through Trust, 2.63%, 01/15/18 (c) | | 1,238,924 | | 1,251,561 | |

First Franklin Mortgage Loan Trust REMIC, 0.65%, 05/25/35 (a) | | 1,200,000 | | 1,082,932 | |

Home Equity Asset Trust REMIC, 1.27%, 07/25/35 (a) | | 1,950,000 | | 1,703,029 | |

HomeBanc Mortgage Trust REMIC, 0.44%, 10/25/35 (a) | | 744,311 | | 636,549 | |

Inwood Park CDO Ltd., 0.47%, 01/20/21 (a) (b) | | 152,259 | | 151,148 | |

Morgan Stanley ABS Capital I Inc. Trust REMIC, 0.78%, 03/25/35 (a) | | 1,000,000 | | 804,795 | |

New Century Home Equity Loan Trust REMIC, 0.45%, 10/25/35 (a) | | 2,420,774 | | 2,357,296 | |

Park Place Securities Inc. Asset-Backed Pass-Through Certificates REMIC | | | | | |

1.16%, 09/25/34 (a) | | 2,051,741 | | 1,804,572 | |

0.67%, 07/25/35 (a) | | 1,200,000 | | 1,127,952 | |

Progress Trust, 4.12%, 06/18/44 (a), AUD | | 994,952 | | 955,588 | |

Residential Asset Securities Corp. Trust REMIC, 0.61%, 01/25/36 (a) | | 1,500,000 | | 1,321,129 | |

SBA Tower Trust | | | | | |

4.25%, 04/15/15 (c) | | 1,000,000 | | 1,018,240 | |

5.10%, 04/17/17 (b) | | 1,000,000 | | 1,081,320 | |

REMIC, 3.60%, 04/15/18 (b) | | 2,300,000 | | 2,302,079 | |

Structured Asset Investment Loan Trust REMIC, 1.15%, 10/25/33 (a) | | 3,015,644 | | 2,873,966 | |

Structured Asset Securities Corp. Mortgage Pass-Through Certificates REMIC, 2.45%, 09/25/33 (a) | | 1,011,409 | | 992,123 | |

United Air Lines Inc. Pass-Through Trust | | | | | |

10.40%, 11/01/16 | | 931,319 | | 1,052,391 | |

9.75%, 01/15/17 | | 527,100 | | 606,165 | |

Washington Mutual Mortgage Pass-Through Certificates REMIC, 2.43%, 01/25/35 (a) | | 945,116 | | 932,445 | |

Wells Fargo Mortgage Backed Securities Trust REMIC | | | | | |

2.62%, 01/25/35 (a) | | 1,733,595 | | 1,719,121 | |

5.50%, 01/25/36 | | 57,773 | | 54,549 | |

WG Horizons CLO, 0.52%, 05/24/19 (a) (b) | | 621,645 | | 611,774 | |

Total Non-U.S. Government Agency Asset-Backed Securities (cost $41,577,801) | | | | 42,012,693 | |

| | | | | |

CORPORATE BONDS AND NOTES - 80.3% | | | | | |

CONSUMER DISCRETIONARY - 5.1% | | | | | |

Cablevision Systems Corp. Term Loan B, 2.67%, 04/15/20 (a) | | 798,000 | | 790,770 | |

Clear Channel Worldwide Holdings Inc., 6.50%, 11/15/22 | | 1,000,000 | | 1,050,000 | |

Corp. GEO SAB de CV, 8.88%, 03/27/22 (b) | | 800,000 | | 120,000 | |

COX Communications Inc., 6.25%, 06/01/18 (b) | | 2,000,000 | | 2,280,544 | |

D.R. Horton Inc., 4.75%, 05/15/17 | | 1,400,000 | | 1,480,500 | |

DISH DBS Corp., 5.88%, 07/15/22 | | 1,000,000 | | 1,023,750 | |

MCE Finance Ltd., 5.00%, 02/15/21 (b) | | 1,000,000 | | 990,000 | |

MGM Resorts International Term Loan B, 3.50%, 12/20/19 (a) | | 1,588,000 | | 1,585,443 | |

NBCUniversal Enterprise Inc., 5.25%, (callable at 100 beginning 03/19/21) (b) (d) | | 400,000 | | 396,000 | |

NBCUniversal Media LLC, 5.15%, 04/30/20 | | 3,000,000 | | 3,429,111 | |

Pearson Funding Five Plc, 3.25%, 05/08/23 (b) | | 1,000,000 | | 926,247 | |

Time Warner Cable Inc., 6.75%, 07/01/18 | | 2,000,000 | | 2,254,226 | |

Toll Brothers Finance Corp., 6.75%, 11/01/19 (e) | | 2,000,000 | | 2,255,000 | |

Viacom Inc. | | | | | |

4.25%, 09/01/23 | | 1,000,000 | | 1,021,388 | |

4.50%, 02/27/42 | | 2,000,000 | | 1,748,092 | |

Volkswagen International Finance NV | | | | | |

0.86%, 11/20/14 (a) (b) (e) | | 1,500,000 | | 1,506,410 | |

1.60%, 11/20/17 (c) | | 1,500,000 | | 1,490,235 | |

Whirlpool Corp., 4.70%, 06/01/22 | | 300,000 | | 316,247 | |

Wynn Las Vegas LLC, 5.38%, 03/15/22 (e) | | 1,209,000 | | 1,243,831 | |

Wynn Macau Ltd., 5.25%, 10/15/21 (c) | | 1,500,000 | | 1,533,750 | |

| | | | 27,441,544 | |

CONSUMER STAPLES - 3.6% | | | | | |

Altria Group Inc. | | | | | |

7.75%, 02/06/14 (f) | | 1,000,000 | | 1,018,077 | |

9.70%, 11/10/18 (f) | | 338,000 | | 453,760 | |

9.25%, 08/06/19 (f) | | 338,000 | | 450,995 | |

Anheuser-Busch InBev Worldwide Inc., 7.75%, 01/15/19 | | 4,000,000 | | 5,064,212 | |

Diageo Capital Plc, 4.83%, 07/15/20 | | 2,000,000 | | 2,250,016 | |

Kraft Foods Group Inc., 6.13%, 08/23/18 | | 2,700,000 | | 3,188,568 | |

PepsiCo Inc., 0.44%, 07/30/15 (a) | | 1,500,000 | | 1,500,881 | |

SABMiller Holdings Inc., 1.85%, 01/15/15 (b) | | 2,200,000 | | 2,227,735 | |

Tesco Plc, 2.00%, 12/05/14 (b) | | 1,500,000 | | 1,519,257 | |

Wesfarmers Ltd., 2.98%, 05/18/16 (b) | | 1,000,000 | | 1,047,250 | |

Woolworths Ltd., 2.55%, 09/22/15 (b) | | 519,000 | | 534,958 | |

| | | | 19,255,709 | |

| | | | | | | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

ENERGY - 15.2% | | | | | |

AK Transneft OJSC Via TransCapitalInvest Ltd., 5.67%, 03/05/14 | | 1,400,000 | | 1,422,540 | |

Anadarko Petroleum Corp., 8.70%, 03/15/19 | | 3,000,000 | | 3,893,076 | |

Arch Coal Inc. | | | | | |

7.25%, 10/01/20 (e) | | 600,000 | | 456,750 | |

7.25%, 06/15/21 (e) | | 1,100,000 | | 838,750 | |

BG Energy Capital Plc, 4.00%, 10/15/21 (b) | | 3,000,000 | | 3,124,611 | |

BP AMI Leasing Inc., 5.52%, 05/08/19 (b) | | 3,610,000 | | 4,128,847 | |

Canadian Oil Sands Ltd., 4.50%, 04/01/22 (b) | | 100,000 | | 101,686 | |

CNOOC Curtis Funding No. 1 Pty Ltd, 4.50%, 10/03/23 (b) | | 700,000 | | 715,330 | |

CNOOC Finance 2013 Ltd. | | | | | |

1.75%, 05/09/18 | | 800,000 | | 786,057 | |

3.00%, 05/09/23 | | 1,800,000 | | 1,638,851 | |

Concho Resources Inc., 5.50%, 04/01/23 | | 1,500,000 | | 1,556,250 | |

Continental Resources Inc., 5.00%, 09/15/22 | | 1,100,000 | | 1,145,375 | |

Devon Energy Corp., 3.25%, 05/15/22 | | 400,000 | | 388,398 | |

EP Energy LLC, 6.88%, 05/01/19 | | 300,000 | | 322,500 | |

Gazprom OAO Via Gaz Capital SA | | | | | |

8.13%, 07/31/14 (b) | | 1,300,000 | | 1,367,210 | |

8.15%, 04/11/18 (b) | | 600,000 | | 706,500 | |

9.25%, 04/23/19 | | 1,000,000 | | 1,247,500 | |

Harvest Operations Corp., 6.88%, 10/01/17 | | 620,000 | | 665,725 | |

KazMunayGas National Co. JSC, 4.40%, 04/30/23 (b) (e) | | 600,000 | | 569,220 | |

Kinder Morgan Energy Partners LP, 6.00%, 02/01/17 | | 2,300,000 | | 2,612,844 | |

Lukoil International Finance BV, 3.42%, 04/24/18 (b) | | 1,100,000 | | 1,108,250 | |

MarkWest Energy Partners LP | | | | | |

5.50%, 02/15/23 | | 1,300,000 | | 1,345,500 | |

4.50%, 07/15/23 | | 1,900,000 | | 1,843,000 | |

Midcontinent Express Pipeline LLC, 6.70%, 09/15/19 (c) | | 2,100,000 | | 2,046,540 | |

Midstates Petroleum Co. Inc., 10.75%, 10/01/20 | | 1,250,000 | | 1,350,000 | |

Nabors Industries Inc., 2.35%, 09/15/16 (c) | | 500,000 | | 506,666 | |

NGPL PipeCo LLC | | | | | |

7.12%, 12/15/17 (b) (e) | | 2,600,000 | | 2,457,000 | |

9.63%, 06/01/19 (b) | | 2,000,000 | | 2,000,000 | |

Noble Holding International Ltd., 3.95%, 03/15/22 (e) | | 1,500,000 | | 1,486,374 | |

Northwest Pipeline LLC, 6.05%, 06/15/18 | | 2,000,000 | | 2,344,694 | |

Novatek OAO via Novatek Finance Ltd., 4.42%, 12/13/22 (b) | | 1,600,000 | | 1,522,000 | |

OGX Austria GmbH | | | | | |

8.50%, 06/01/18 (b) (e) (g) (h) | | 2,500,000 | | 237,500 | |

8.38%, 04/01/22 (b) (g) (h) | | 1,000,000 | | 95,000 | |

ONEOK Partners LP | | | | | |

3.38%, 10/01/22 | | 800,000 | | 760,014 | |

5.00%, 09/15/23 | | 1,100,000 | | 1,175,089 | |

Pacific Rubiales Energy Corp., 5.13%, 03/28/23 (b) | | 400,000 | | 383,000 | |

Petrofac Ltd., 3.40%, 10/10/18 (c) | | 700,000 | | 710,884 | |

Petrohawk Energy Corp., 6.25%, 06/01/19 | | 2,000,000 | | 2,192,042 | |

Pioneer Natural Resources Co. | | | | | |

5.88%, 07/15/16 | | 600,000 | | 669,575 | |

6.88%, 05/01/18 | | 500,000 | | 595,911 | |

7.50%, 01/15/20 | | 1,600,000 | | 1,983,842 | |

Plains All American Pipeline LP | | | | | |

8.75%, 05/01/19 | | 1,000,000 | | 1,290,903 | |

5.00%, 02/01/21 | | 1,510,000 | | 1,653,781 | |

Pride International Inc. | | | | | |

8.50%, 06/15/19 | | 900,000 | | 1,148,621 | |

6.88%, 08/15/20 | | 700,000 | | 839,593 | |

Rockies Express Pipeline LLC | | | | | |

3.90%, 04/15/15 (b) | | 600,000 | | 600,000 | |

6.00%, 01/15/19 (b) (e) | | 2,450,000 | | 2,174,375 | |

Rosneft Finance SA | | | | | |

7.50%, 07/18/16 (b) | | 1,300,000 | | 1,457,625 | |

7.88%, 03/13/18 | | 1,000,000 | | 1,161,250 | |

Rosneft Oil Co. via Rosneft International Finance Ltd. | | | | | |

3.15%, 03/06/17 (b) | | 1,000,000 | | 1,007,500 | |

4.20%, 03/06/22 (b) | | 600,000 | | 562,500 | |

Southern Natural Gas Co. LLC, 4.40%, 06/15/21 | | 2,000,000 | | 2,096,238 | |

Southwestern Energy Co., 4.10%, 03/15/22 | | 1,125,000 | | 1,136,972 | |

Statoil ASA, 6.70%, 01/15/18 | | 1,500,000 | | 1,775,755 | |

Sunoco Logistics Partners Operations LP, 3.45%, 01/15/23 | | 500,000 | | 471,666 | |

Targa Resources Partners LP | | | | | |

6.88%, 02/01/21 | | 50,000 | | 53,875 | |

6.38%, 08/01/22 | | 1,725,000 | | 1,837,125 | |

5.25%, 05/01/23 | | 1,030,000 | | 1,030,000 | |

Total Capital Canada Ltd., 0.62%, 01/15/16 (a) | | 1,200,000 | | 1,206,695 | |

Total Capital International SA, 0.83%, 08/10/18 (a) | | 1,500,000 | | 1,508,436 | |

Transocean Inc., 6.00%, 03/15/18 | | 2,500,000 | | 2,827,550 | |

Walter Energy Inc., 9.88%, 12/15/20 (b) (e) | | 610,000 | | 539,850 | |

Western Gas Partners LP, 4.00%, 07/01/22 | | 1,000,000 | | 992,295 | |

| | | | 81,873,506 | |

FINANCIALS - 32.6% | | | | | |

Ally Financial Inc., 4.50%, 02/11/14 | | 500,000 | | 503,750 | |

American Campus Communities Operating Partnership LP, 3.75%, 04/15/23 | | 650,000 | | 624,493 | |

American Express Co., 6.15%, 08/28/17 | | 2,200,000 | | 2,567,635 | |

American Express Credit Corp., 0.75%, 07/29/16 (a) | | 1,200,000 | | 1,205,908 | |

American Tower Corp., 4.50%, 01/15/18 | | 2,000,000 | | 2,151,044 | |

Banco Continental SA via Continental Senior Trustees II Cayman Ltd., 5.75%, 01/18/17 (b) (e) | | 1,000,000 | | 1,085,000 | |

Banco de Credito del Peru, 4.25%, 04/01/23 (b) (e) | | 800,000 | | 762,000 | |

Banco de Credito e Inversiones, 4.00%, 02/11/23 (b) | | 400,000 | | 373,454 | |

Banco del Estado de Chile, 2.00%, 11/09/17 (b) | | 1,850,000 | | 1,816,463 | |

Banco do Brasil SA, 3.88%, 10/10/22 | | 900,000 | | 819,000 | |

Banco Santander Brasil SA | | | | | |

4.50%, 04/06/15 (b) | | 1,000,000 | | 1,035,000 | |

4.25%, 01/14/16 (b) | | 2,000,000 | | 2,077,000 | |

4.63%, 02/13/17 (b) (e) | | 1,700,000 | | 1,785,000 | |

Bank of America Corp. | | | | | |

0.00%, 01/04/17 (i) | | 3,200,000 | | 3,036,256 | |

7.63%, 06/01/19 | | 8,500,000 | | 10,593,388 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

Banque PSA Finance SA | | | | | |

2.14%, 04/04/14 (a) (c) | | 200,000 | | 199,440 | |

4.38%, 04/04/16 (b) | | 1,700,000 | | 1,756,707 | |

Barclays Bank Plc, 14.00%, (callable at 100 beginning 12/15/19) (d), GBP | | 1,200,000 | | 2,631,199 | |

BBVA US Senior SAU, 4.66%, 10/09/15 | | 1,900,000 | | 2,000,506 | |

Bear Stearns Cos. LLC, 6.40%, 10/02/17 | | 1,300,000 | | 1,519,990 | |

Biomed Realty LP, 4.25%, 07/15/22 | | 1,200,000 | | 1,178,648 | |

BPCE SA, 5.70%, 10/22/23 (c) | | 800,000 | | 820,118 | |

Caterpillar Financial Services Corp., 5.45%, 04/15/18 | | 2,000,000 | | 2,306,046 | |

CIT Group Inc., 4.25%, 08/15/17 | | 700,000 | | 734,125 | |

Citigroup Inc. | | | | | |

5.50%, 10/15/14 | | 445,000 | | 464,887 | |

1.04%, 04/01/16 (a) (e) | | 5,000,000 | | 5,019,300 | |

1.20%, 07/25/16 (a) | | 600,000 | | 605,508 | |

5.95% (callable at 100 beginning 01/30/23) (d) | | 1,300,000 | | 1,239,875 | |

Countrywide Financial Corp., 6.25%, 05/15/16 | | 400,000 | | 443,068 | |

Credit Suisse AG, 6.50%, 08/08/23 (c) | | 700,000 | | 747,180 | |

Eksportfinans ASA | | | | | |

2.38%, 05/25/16 | | 500,000 | | 487,250 | |

5.50%, 05/25/16 | | 1,540,000 | | 1,612,380 | |

5.50%, 06/26/17 | | 700,000 | | 733,600 | |

Experian Finance Plc, 2.38%, 06/15/17 (b) | | 1,200,000 | | 1,194,937 | |

Fidelity National Financial Inc., 5.50%, 09/01/22 | | 900,000 | | 954,865 | |

First American Financial Corp., 4.30%, 02/01/23 | | 1,100,000 | | 1,070,449 | |

Ford Motor Credit Co. LLC | | | | | |

8.00%, 06/01/14 | | 200,000 | | 208,524 | |

1.36%, 08/28/14 (a) | | 1,300,000 | | 1,307,933 | |

8.70%, 10/01/14 | | 2,300,000 | | 2,464,537 | |

2.75%, 05/15/15 | | 1,700,000 | | 1,745,065 | |

12.00%, 05/15/15 | | 1,050,000 | | 1,221,731 | |

2.50%, 01/15/16 | | 1,400,000 | | 1,436,865 | |

Goldman Sachs Group Inc., 5.95%, 01/18/18 | | 10,600,000 | | 12,165,132 | |

HSBC Finance Corp. | | | | | |

0.69%, 06/01/16 (a) (e) | | 600,000 | | 598,340 | |

6.68%, 01/15/21 | | 3,900,000 | | 4,531,047 | |

ICICI Bank Ltd. | | | | | |

5.50%, 03/25/15 | | 500,000 | | 519,033 | |

4.75%, 11/25/16 (b) | | 682,000 | | 709,557 | |

ING Bank NV, 2.00%, 09/25/15 (c) | | 1,000,000 | | 1,015,710 | |

International Lease Finance Corp., 6.75%, 09/01/16 (b) | | 4,000,000 | | 4,445,000 | |

Intesa Sanpaolo SpA, 3.13%, 01/15/16 | | 3,500,000 | | 3,569,003 | |

Itau Unibanco Holding SA, 6.20%, 12/21/21 (b) (e) | | 600,000 | | 622,500 | |

JPMorgan Chase & Co., 0.96%, 03/31/16 (a) | | 1,500,000 | | 1,479,884 | |

JPMorgan Chase Bank NA | | | | | |

0.58%, 06/13/16 (a) | | 1,000,000 | | 990,528 | |

5.38%, 09/28/16, GBP | | 1,000,000 | | 1,760,081 | |

0.89%, 05/31/17 (a), EUR | | 3,500,000 | | 4,685,612 | |

6.00%, 07/05/17 | | 1,000,000 | | 1,142,708 | |

6.00%, 10/01/17 | | 7,000,000 | | 8,067,395 | |

Korea Development Bank, 3.00%, 09/14/22 (e) | | 1,000,000 | | 960,786 | |

Korea Exchange Bank, 3.13%, 06/26/17 (b) | | 1,100,000 | | 1,134,719 | |

Lazard Group LLC, 7.13%, 05/15/15 | | 2,800,000 | | 3,023,798 | |

LBG Capital No.1 Plc | | | | | |

7.59%, 05/12/20, GBP | | 900,000 | | 1,518,832 | |

8.00% (callable at 100 beginning 06/15/20) (b) (d) | | 1,000,000 | | 1,062,500 | |

LBG Capital No.2 Plc | | | | | |

7.63%, 12/09/19, GBP | | 300,000 | | 496,272 | |

15.00%, 12/21/19, EUR | | 500,000 | | 1,006,436 | |

LeasePlan Corp. NV, 2.50%, 05/16/18 (c) | | 3,000,000 | | 2,955,963 | |

Lloyds Bank Plc, 12.00%, (callable at 100 beginning 12/16/24) (b) (d) | | 1,200,000 | | 1,614,000 | |

Merrill Lynch & Co. Inc., 6.88%, 04/25/18 | | 2,500,000 | | 2,968,498 | |

Moody’s Corp., 4.88%, 02/15/24 | | 3,400,000 | | 3,442,616 | |

Morgan Stanley | | | | | |

5.95%, 12/28/17 | | 1,000,000 | | 1,143,237 | |

7.30%, 05/13/19 | | 2,100,000 | | 2,563,846 | |

5.63%, 09/23/19 | | 1,300,000 | | 1,482,936 | |

Nationstar Mortgage LLC | | | | | |

9.63%, 05/01/19 | | 150,000 | | 169,125 | |

7.88%, 10/01/20 | | 150,000 | | 160,313 | |

6.50%, 07/01/21 | | 300,000 | | 294,750 | |

Nippon Life Insurance Co., 5.00%, 10/18/42 (a) (b) | | 600,000 | | 609,000 | |

NYSE Euronext, 2.00%, 10/05/17 | | 1,500,000 | | 1,507,461 | |

Piper Jaffray Cos., 4.25%, 05/31/14 (a) (c) | | 700,000 | | 700,909 | |

QBE Insurance Group Ltd., 2.40%, 05/01/18 (b) | | 1,100,000 | | 1,079,392 | |

RCI Banque SA, 3.50%, 04/03/18 (c) (e) | | 1,100,000 | | 1,131,837 | |

RPI Finance Trust Term Loan B, 3.50%, 05/09/18 (a) | | 1,454,962 | | 1,467,692 | |

Sberbank of Russia Via SB Capital SA | | | | | |

5.40%, 03/24/17 | | 800,000 | | 863,000 | |

5.18%, 06/28/19 | | 1,500,000 | | 1,591,650 | |

SL Green Realty Corp., 4.50%, 12/01/22 | | 1,500,000 | | 1,461,920 | |

SLM Corp. | | | | | |

5.38%, 05/15/14 | | 1,300,000 | | 1,327,625 | |

6.25%, 01/25/16 | | 2,300,000 | | 2,504,125 | |

8.45%, 06/15/18 | | 2,900,000 | | 3,385,750 | |

SSIF Nevada LP, 0.94%, 04/14/14 (a) (b) | | 1,500,000 | | 1,504,149 | |

SteelRiver Transmission Co. LLC, 4.71%, 06/30/17 (c) | | 239,261 | | 249,007 | |

Sydney Airport Finance Co. Pty Ltd., 5.13%, 02/22/21 (b) (f) | | 1,560,000 | | 1,667,195 | |

UBS AG, 7.63%, 08/17/22 | | 1,200,000 | | 1,367,639 | |

Union Bank NA, 1.00%, 09/26/16 (a) | | 500,000 | | 503,866 | |

Wachovia Corp., 5.75%, 02/01/18 | | 5,400,000 | | 6,300,855 | |

Walter Investment Management Corp. Term Loan B, 5.75%, 12/01/17 (a) | | 1,924,051 | | 1,940,482 | |

Weyerhaeuser Co., 7.38%, 10/01/19 | | 2,800,000 | | 3,429,882 | |

Woodside Finance Ltd., 4.60%, 05/10/21 (b) | | 2,000,000 | | 2,137,598 | |

| | | | 175,571,315 | |

HEALTH CARE - 4.3% | | | | | |

AbbVie Inc., 1.20%, 11/06/15 | | 1,900,000 | | 1,913,285 | |

Amgen Inc. | | | | | |

2.30%, 06/15/16 | | 4,850,000 | | 5,009,672 | |

4.50%, 03/15/20 | | 1,400,000 | | 1,517,473 | |

4.10%, 06/15/21 | | 200,000 | | 208,934 | |

3.88%, 11/15/21 | | 1,100,000 | | 1,138,612 | |

3.63%, 05/15/22 | | 700,000 | | 707,323 | |

5.15%, 11/15/41 | | 600,000 | | 604,393 | |

Gilead Sciences Inc., 2.40%, 12/01/14 | | 1,900,000 | | 1,935,524 | |

HCA Inc. Term Loan B-4, 2.93%, 05/01/18 (a) | | 2,500,000 | | 2,502,825 | |

Hospira Inc., 6.05%, 03/30/17 | | 1,200,000 | | 1,323,755 | |

Mylan Inc., 1.80%, 06/24/16 (c) | | 700,000 | | 705,061 | |

Sanofi, 2.63%, 03/29/16 | | 3,000,000 | | 3,134,346 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

Teva Pharmaceutical Finance Co. BV, 3.65%, 11/10/21 | | 1,500,000 | | 1,491,875 | |

Valeant Pharmaceuticals Term Loan BD, 3.75%, 02/13/19 (a) | | 987,500 | | 995,212 | |

| | | | 23,188,290 | |

INDUSTRIALS - 3.5% | | | | | |

AABS Ltd. Term Loan A, 4.88%, 01/10/38 (a) (c) (j) | | 953,125 | | 962,919 | |

ADT Corp. | | | | | |

3.50%, 07/15/22 | | 100,000 | | 87,656 | |

4.13%, 06/15/23 | | 600,000 | | 540,836 | |

Asciano Finance Ltd., 4.63%, 09/23/20 (b) | | 1,000,000 | | 1,018,025 | |

Aviation Capital Group Corp. | | | | | |

3.88%, 09/27/16 (c) | | 1,700,000 | | 1,720,789 | |

4.63%, 01/31/18 (c) | | 1,400,000 | | 1,427,286 | |

7.13%, 10/15/20 (b) | | 1,000,000 | | 1,109,196 | |

AWAS Aviation Capital Ltd., 7.00%, 10/17/16 (b) | | 712,000 | | 738,700 | |

Burlington Northern Santa Fe LLC | | | | | |

5.40%, 06/01/41 | | 2,500,000 | | 2,640,870 | |

4.38%, 09/01/42 | | 1,000,000 | | 916,444 | |

CSX Corp., 4.75%, 05/30/42 | | 500,000 | | 488,508 | |

Heathrow Funding Ltd., 2.50%, 06/25/15 (b) | | 1,100,000 | | 1,114,938 | |

Masco Corp. | | | | | |

6.13%, 10/03/16 | | 1,000,000 | | 1,115,000 | |

7.13%, 03/15/20 | | 1,000,000 | | 1,140,000 | |

Penske Truck Leasing Co. LP | | | | | |

3.75%, 05/11/17 (b) | | 1,000,000 | | 1,049,489 | |

3.38%, 03/15/18 (b) | | 1,000,000 | | 1,029,755 | |

USG Corp., 7.88%, 03/30/20 (c) (e) | | 800,000 | | 880,000 | |

Verisk Analytics Inc., 4.13%, 09/12/22 | | 975,000 | | 969,685 | |

| | | | 18,950,096 | |

INFORMATION TECHNOLOGY - 2.0% | | | | | |

Activision Blizzard Inc. Term Loan B, 3.25%, 09/15/20 (a) | | 400,000 | | 401,216 | |

Autodesk Inc., 1.95%, 12/15/17 | | 1,200,000 | | 1,180,007 | |

Baidu Inc., 3.25%, 08/06/18 | | 2,400,000 | | 2,451,171 | |

Dell Inc Term Loan B, 3.50%, 03/24/20 (a) | | 1,600,000 | | 1,590,160 | |

Hewlett-Packard Co. | | | | | |

0.66%, 05/30/14 (a) | | 2,000,000 | | 2,000,586 | |

1.80%, 09/19/14 (a) | | 1,700,000 | | 1,715,866 | |

Symantec Corp., 3.95%, 06/15/22 | | 1,400,000 | | 1,389,984 | |

| | | | 10,728,990 | |

MATERIALS - 4.1% | | | | | |

Anglo American Capital Plc, 2.63%, 04/03/17 (b) | | 1,050,000 | | 1,057,422 | |

Barrick North America Finance LLC, 4.40%, 05/30/21 | | 2,500,000 | | 2,400,447 | |

Building Materials Corp. of America, 6.75%, 05/01/21 (b) | | 1,230,000 | | 1,337,625 | |

Cemex SAB de CV | | | | | |

9.50%, 06/15/18 (b) | | 400,000 | | 455,000 | |

5.88%, 03/25/19 (b) | | 1,200,000 | | 1,174,500 | |

Cliffs Natural Resources Inc., 4.88%, 04/01/21 (k) | | 1,500,000 | | 1,474,910 | |

Dow Chemical Co., 8.55%, 05/15/19 (f) | | 300,000 | | 388,170 | |

Ecolab Inc. | | | | | |

2.38%, 12/08/14 | | 800,000 | | 814,130 | |

4.35%, 12/08/21 | | 2,000,000 | | 2,121,918 | |

EuroChem Mineral & Chemical Co. OJSC via EuroChem GI Ltd., 5.13%, 12/12/17 (b) | | 600,000 | | 605,250 | |

Freeport-McMoRan Copper & Gold Inc. | | | | | |

1.40%, 02/13/15 | | 2,000,000 | | 2,010,152 | |

3.88%, 03/15/23 | | 700,000 | | 662,292 | |

Georgia-Pacific LLC, 5.40%, 11/01/20 (b) | | 500,000 | | 565,099 | |

LyondellBasell Industries NV, 5.75%, 04/15/24 | | 600,000 | | 686,773 | |

Mongolian Mining Corp., 8.88%, 03/29/17 (b) (e) | | 700,000 | | 572,250 | |

New Gold Inc., 6.25%, 11/15/22 (b) | | 900,000 | | 886,500 | |

OJSC Novolipetsk Steel via Steel Funding Ltd., 4.45%, 02/19/18 (c) | | 700,000 | | 700,000 | |

Rock Tenn Co., 3.50%, 03/01/20 | | 1,000,000 | | 997,787 | |

Walter Energy Inc., 8.50%, 04/15/21 (b) (e) | | 575,000 | | 487,313 | |

Westlake Chemical Corp., 3.60%, 07/15/22 | | 1,200,000 | | 1,157,395 | |

Xstrata Finance Canada Ltd., 2.70%, 10/25/17 (c) | | 1,700,000 | | 1,707,662 | |

| | | | 22,262,595 | |

TELECOMMUNICATION SERVICES - 5.8% | | | | | |

CC Holdings GS V LLC, 2.38%, 12/15/17 | | 550,000 | | 544,318 | |

Crown Castle Towers LLC, 5.50%, 01/15/17 (b) | | 1,500,000 | | 1,657,328 | |

Deutsche Telekom International Finance BV, 3.13%, 04/11/16 (b) | | 2,600,000 | | 2,718,453 | |

Intelsat Jackson Holdings SA Term Loan B-1, 4.25%, 04/02/18 (a) | | 1,342,495 | | 1,348,925 | |

MetroPCS Wireless Inc., 6.25%, 04/01/21 (b) | | 1,100,000 | | 1,150,875 | |

Telecom Italia Capital SA | | | | | |

5.25%, 11/15/13 | | 200,000 | | 200,297 | |

6.18%, 06/18/14 | | 650,000 | | 667,767 | |

Telefonica Emisiones SAU | | | | | |

5.43%, 02/03/14, EUR | | 450,000 | | 618,166 | |

4.67%, 02/07/14, EUR | | 450,000 | | 617,313 | |

4.97%, 02/03/16, EUR | | 1,000,000 | | 1,461,305 | |

6.42%, 06/20/16 | | 500,000 | | 556,664 | |

Telstra Corp. Ltd., 4.80%, 10/12/21 (b) | | 2,000,000 | | 2,193,206 | |

Verizon Communications Inc. | | | | | |

4.50%, 09/15/20 | | 1,200,000 | | 1,298,302 | |

5.15%, 09/15/23 | | 6,600,000 | | 7,157,878 | |

6.55%, 09/15/43 | | 3,000,000 | | 3,478,734 | |

Verizon Wireless Capital LLC, 8.50%, 11/15/18 | | 3,000,000 | | 3,858,963 | |

Vimpel Communications Via VIP Finance Ireland Ltd. OJSC, 7.75%, 02/02/21 (b) | | 700,000 | | 766,500 | |

Virgin Media Secured Finance Plc, 5.38%, 04/15/21 (b) | | 800,000 | | 804,000 | |

| | | | 31,098,994 | |

UTILITIES - 4.1% | | | | | |

Appalachian Power Co., 5.00%, 06/01/17 | | 2,000,000 | | 2,202,380 | |

CMS Energy Corp., 5.05%, 02/15/18 | | 1,500,000 | | 1,664,017 | |

Dominion Resources Inc., 5.15%, 07/15/15 | | 4,850,000 | | 5,197,726 | |

Duquesne Light Holdings Inc., 5.90%, 12/01/21 (b) | | 1,400,000 | | 1,576,903 | |

Energy Future Intermediate Holding Co. LLC, 6.88%, 08/15/17 (b) (e) | | 2,000,000 | | 2,045,000 | |

ENN Energy Holdings Ltd., 6.00%, 05/13/21 | | 400,000 | | 429,134 | |

IPALCO Enterprises Inc., 7.25%, 04/01/16 (b) | | 1,400,000 | | 1,540,000 | |

Jersey Central Power & Light Co., 4.80%, 06/15/18 | | 3,000,000 | | 3,224,478 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

MidAmerican Energy Holdings Co., 5.95%, 05/15/37 | | 1,500,000 | | 1,675,711 | |

Puget Energy Inc., 6.50%, 12/15/20 | | 1,500,000 | | 1,710,372 | |

Tokyo Electric Power Co. Inc., 4.50%, 03/24/14, EUR | | 500,000 | | 680,982 | |

| | | | 21,946,703 | |

| | | | | |

Total Corporate Bonds and Notes (cost $428,974,334) | | | | 432,317,742 | |

| | | | | |

GOVERNMENT AND AGENCY OBLIGATIONS - 13.5% | | | | | |

GOVERNMENT SECURITIES - 9.8% | | | | | |

Municipals - 1.6% | | | | | |

City of New York, GO, 5.97%, 03/01/36 | | 1,000,000 | | 1,134,720 | |

Los Angeles Community College District, GO, 6.75%, 08/01/49 | | 1,165,000 | | 1,479,666 | |

Metropolitan Transportation Authority, RB, 6.81%, 11/15/40 | | 1,000,000 | | 1,218,010 | |

New Jersey State Turnpike Authority, RB, 7.10%, 01/01/41 | | 1,420,000 | | 1,832,425 | |

Port Authority of New York & New Jersey, RB, 4.93%, 10/01/51 | | 1,000,000 | | 973,320 | |

Sacramento Municipal Utility District, RB, 6.16%, 05/15/36 | | 1,000,000 | | 1,099,000 | |

Triborough Bridge & Tunnel Authority, RB, 5.50%, 11/15/39 | | 1,000,000 | | 1,045,910 | |

| | | | 8,783,051 | |

Sovereign - 1.8% | | | | | |

Autonomous Community of Valencia, Spain, 4.38%, 07/16/15, EUR | | 200,000 | | 275,624 | |

Italy Buoni Poliennali Del Tesoro, 3.50%, 06/01/18, EUR | | 2,700,000 | | 3,788,380 | |

Junta de Castilla y Leon, 6.51%, 03/01/19, EUR | | 400,000 | | 622,835 | |

Xunta de Galicia, 5.76%, 04/03/17, EUR | | 3,400,000 | | 5,032,994 | |

| | | | 9,719,833 | |

U.S. Treasury Securities - 6.4% | | | | | |

U.S. Treasury Bond | | | | | |

3.13%, 02/15/42 (k) | | 20,000,000 | | 18,203,120 | |

3.00%, 05/15/42 (k) (l) | | 3,600,000 | | 3,189,377 | |

2.75%, 08/15/42 (k) | | 600,000 | | 502,875 | |

2.75%, 11/15/42 (k) (l) | | 6,200,000 | | 5,186,684 | |

U.S. Treasury Note, 1.63%, 11/15/22 (k) (l) | | 7,700,000 | | 7,185,063 | |

| | | | 34,267,119 | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 3.7% | | | | | |

Federal National Mortgage Association - 3.7% | | | | | |

Federal National Mortgage Association | | | | | |

4.00%, 01/01/41 - 05/01/42 (k) | | 6,005,514 | | 6,329,059 | |

3.00%, 12/15/42, TBA (l) | | 14,000,000 | | 13,770,312 | |

| | | | 20,099,371 | |

| | | | | |

Total Government and Agency Obligations (cost $72,991,389) | | | | 72,869,374 | |

| | | | | |

COMMON STOCKS - 0.0% | | | | | |

SFX Entertainment Inc. (h) | | 433 | | 3,715 | |

Total Common Stocks (cost $5,629) | | | | 3,715 | |

| | | | | |

PREFERRED STOCKS - 0.4% | | | | | |

FINANCIALS - 0.4% | | | | | |

CoBank ACB, 6.25%, (callable at 100 beginning 10/01/22) (c) (d) | | 20,000 | | 1,981,250 | |

Total Preferred Stocks (cost $2,125,000) | | | | 1,981,250 | |

| | | | | |

PURCHASED OPTIONS - 0.1% | | | | | |

Interest Rate Put Swaption, 3 month LIBOR versus 3.45% fixed, Expiration 09/21/15, DUB | | 50 | | 628,971 | |

Total Purchased Options (cost $396,342) | | | | 628,971 | |

| | | | | |

SHORT TERM INVESTMENTS - 11.0% | | | | | |

Certificates of Deposit - 0.5% | | | | | |

Itau Unibanco NY, 1.33%, 03/03/14 | | $ | 2,500,000 | | 2,487,380 | |

Commercial Paper - 4.7% | | | | | |

BP Capital Markets Plc, 0.09%, 11/21/13 | | 7,000,000 | | 6,999,650 | |

E. I. du Pont de Nemours & Co., 0.08%, 12/04/13 | | 2,000,000 | | 1,999,853 | |

Electricite de France SA, 0.12%, 11/21/13 | | 4,000,000 | | 3,999,733 | |

Ford Motor Credit Co. LLC, 1.00%, 11/22/13 | | 1,000,000 | | 999,425 | |

Philip Morris International Inc., 0.17%, 11/20/13 | | 2,500,000 | | 2,499,776 | |

Sanofi, 0.09%, 11/27/13 | | 3,000,000 | | 2,999,805 | |

Toyota Motor Credit Corp., 0.11%, 11/01/13 | | 3,000,000 | | 2,999,990 | |

Wal-Mart Stores Inc., 0.18%, 11/25/13 | | 2,500,000 | | 2,499,708 | |

| | | | 24,997,940 | |

Federal Home Loan Mortgage Corp. - 1.9% (m) | | | | | |

Federal Home Loan Mortgage Corp., 0.11%, 07/11/14 | | 10,400,000 | | 10,393,448 | |

Securities Lending Collateral - 3.5% | | | | | |

Fidelity Institutional Money Market Portfolio, 0.08% (n) | | 10,000,000 | | 10,000,000 | |

Repurchase Agreement with DUB, 0.10% (Collateralized by $4,712,910 U.S. Treasury Bond Strip, due 08/15/20-11/15/42, value $2,910,660, $4,377,284 U.S. Treasury Note, 0.75-3.75%, due 05/31/14-01/15/20, value $4,800,679, $728,459 U.S. Treasury Bond, 2.75-8.75%, due 08/15/20-08/15/42, value $952,369, and $69,310 U.S. Treasury Inflation Indexed Note, 3.38%, due 04/15/32, value $128,821) acquired on 10/31/13, due 11/01/13 at $8,620,149 | | $ | 8,620,125 | | 8,620,125 | |

| | | | 18,620,125 | |

Treasury Securities - 0.4% | | | | | |

U.S. Treasury Bill | | | | | |

0.04%, 01/02/14 (k) | | 2,026,000 | | 2,025,913 | |

0.11%, 05/01/14 (k) | | 23,000 | | 22,991 | |

0.14%, 08/21/14 (k) | | 285,000 | | 284,820 | |

See accompanying Notes to Financial Statements.

| | Shares/Par † | | Value | |

0.00%, 10/16/14 (k) | | 43,000 | | 42,961 | |

| | | | 2,376,685 | |

Total Short Term Investments (cost $58,875,258) | | | | 58,875,578 | |

| | | | | |

Total Investments - 113.1% (cost $604,945,753) | | | | 608,689,323 | |

Total Forward Sales Commitments - (1.0%) (proceeds $5,228,906) | | | | (5,266,406 | ) |

Other Assets and Liabilities, Net - (12.1%) | | | | (65,058,539 | ) |

Total Net Assets - 100.0% | | | | $ | 538,364,378 | |

| | | | | |

FORWARD SALES COMMITMENTS - 1.0% | | | | | |

GOVERNMENT AND AGENCY OBLIGATIONS - 1.0% | | | | | |

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 1.0% | | | | | |

Federal National Mortgage Association - 1.0% | | | | | |

Federal National Mortgage Association, 4.00%, 11/15/43 , TBA (l) | | $ | 5,000,000 | | $ | 5,266,406 | |

| | | | | |

Total Government and Agency Obligations - 1.0% (proceeds $5,228,906) | | | | $ | 5,266,406 | |

| | | | | | | |

(a) | | Variable rate security. Rate stated was in effect as of October 31, 2013. |

(b) | | Rule 144A, Section 4(2) of the Securities Act of 1933 or other security which is restricted to resale to institutional investors. The Sub-Adviser has deemed these securities to be liquid based on procedures approved by the Trust’s Board of Trustees. As of October 31, 2013, the value of Rule 144A and Section 4(2) liquid securities was $101,345,786. |

(c) | | Rule 144A, Section 4(2) of the Securities Act of 1933 or other security which is restricted to resale to institutional investors. The Sub-Adviser has not deemed these securities to be liquid based on procedures approved by the Trust’s Board of Trustees. See Restricted Securities Note in these Schedules of Investments. |

(d) | | Perpetual maturity security. |

(e) | | All or portion of the security was on loan. |

(f) | | The interest rate for this security is inversely affected by upgrades or downgrades to the credit rating of the issuer. |

(g) | | Security is in default relating to principal, dividends and/or interest. |

(h) | | Non-income producing security. |

(i) | | Security issued with a zero coupon. Income is recognized through the accretion of discount. |

(j) | | Security fair valued in good faith in accordance with the procedures approved by the Trust’s Board of Trustees. Good faith fair valued securities may be classified as Level 2 or Level 3 for Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820 “Fair Value Measurements and Disclosures” based on the applicable valuation inputs. See FASB ASC Topic 820 “Fair Value Measurements and Disclosures” in the Notes to the Financial Statements. |

(k) | | All or a portion of the securities is pledged or segregated as collateral. See Pledged or Segregated Collateral note in the Notes to the Financial Statements. |

(l) | | All or a portion of the investment was purchased on a delayed delivery basis. As of October 31, 2013, the total cost of investments purchased on a delayed delivery basis was $29,347,239. |

(m) | | The securities in this category are direct debt of the agency and not collateralized by mortgages. |

(n) | | Yield changes daily to reflect current market conditions. Rate was the quoted yield as of October 31, 2013. |

Investments by Country* | | Percentage of Total

Long-Term

Investments | |

Australia | | 2.0 | % |

Belgium | | 0.9 | |

Brazil | | 1.2 | |

Canada | | 1.1 | |

Cayman Islands | | 0.1 | |

Chile | | 0.4 | |

China | | 1.3 | |

Colombia | | 0.1 | |

France | | 1.8 | |

Germany | | 1.1 | |

India | | 0.2 | |

Ireland | | 0.1 | |

Israel | | 0.3 | |

Italy | | 1.5 | |

Japan | | 0.2 | |

Kazakhstan | | 0.1 | |

Luxembourg | | 0.2 | |

Macau | | 0.3 | |

Mexico | | 0.3 | |

Mongolia | | 0.1 | |

Netherlands | | 0.7 | |

Norway | | 0.9 | |

Peru | | 0.3 | |

Russian Federation | | 2.7 | |

South Korea | | 0.4 | |

Spain | | 2.1 | |

Switzerland | | 0.4 | |

United Kingdom | | 3.9 | |

United States | | 75.3 | |

Total Long-Term Investments | | 100.0 | % |

* The country table is presented for this Fund because its strategy includes investment in non-U.S. securities as deemed significant by the Fund’s Adviser.

See accompanying Notes to Financial Statements.

Restricted Securities - Restricted securities are often purchased in private placement transactions and cannot be sold without prior registration unless the sale is pursuant to an exemption under the Securities Act of 1933, as amended. The following table details restricted securities, including Rule 144A securities that have not been deemed liquid, held by the Fund at October 31, 2013.

| | Initial

Acquisition

Date | | Cost | | Ending

Value | | Percent of

Net Assets | |

AABS Ltd. Term Loan A, 4.88%, 01/10/38 | | 01/28/2013 | | $ | 962,656 | | $ | 962,919 | | 0.2 | % |

Aviation Capital Group Corp., 3.88%, 09/27/16 | | 09/25/2013 | | 1,700,000 | | 1,720,789 | | 0.3 | |

Aviation Capital Group Corp., 4.63%, 01/31/18 | | 02/12/2013 | | 1,422,797 | | 1,427,286 | | 0.3 | |

BPCE SA, 5.70%, 10/22/23 | | 10/16/2013 | | 798,675 | | 820,118 | | 0.2 | |

Banque PSA Finance SA, 2.14%, 04/04/14 | | 02/20/2013 | | 199,520 | | 199,440 | | — | |

CoBank ACB, 6.25%, (callable at 100 beginning 10/01/22) | | 06/03/2013 | | 2,125,000 | | 1,981,250 | | 0.4 | |

Credit Suisse AG, 6.50%, 08/08/23 | | 08/23/2013 | | 701,727 | | 747,180 | | 0.1 | |

Federal Express Corp. Pass-Through Trust, 2.63%, 01/15/18 | | 01/23/2012 | | 1,238,924 | | 1,251,561 | | 0.2 | |

ING Bank NV, 2.00%, 09/25/15 | | 09/19/2012 | | 998,151 | | 1,015,710 | | 0.2 | |

LeasePlan Corp. NV, 2.50%, 05/16/18 | | 05/08/2013 | | 2,987,230 | | 2,955,963 | | 0.6 | |

Midcontinent Express Pipeline LLC, 6.70%, 09/15/19 | | 12/12/2011 | | 2,255,205 | | 2,046,540 | | 0.4 | |

Mylan Inc., 1.80%, 06/24/16 | | 10/22/2013 | | 706,930 | | 705,061 | | 0.1 | |

Nabors Industries Inc., 2.35%, 09/15/16 | | 10/22/2013 | | 506,432 | | 506,666 | | 0.1 | |

OJSC Novolipetsk Steel via Steel Funding Ltd., 4.45%, 02/19/18 | | 02/12/2013 | | 700,000 | | 700,000 | | 0.1 | |

Petrofac Ltd., 3.40%, 10/10/18 | | 10/04/2013 | | 697,418 | | 710,884 | | 0.1 | |

Piper Jaffray Cos., 4.25%, 05/31/14 | | 11/30/2012 | | 700,000 | | 700,909 | | 0.1 | |

RCI Banque SA, 3.50%, 04/03/18 | | 03/26/2013 | | 1,098,478 | | 1,131,837 | | 0.2 | |

SBA Tower Trust, 4.25%, 04/15/15 | | 12/12/2011 | | 1,022,315 | | 1,018,240 | | 0.2 | |

SteelRiver Transmission Co. LLC, 4.71%, 06/30/17 | | 01/20/2012 | | 245,292 | | 249,007 | | — | |

USG Corp., 7.88%, 03/30/20 | | 01/15/2013 | | 897,698 | | 880,000 | | 0.2 | |

Volkswagen International Finance NV, 1.60%, 11/20/17 | | 11/14/2012 | | 1,495,614 | | 1,490,235 | | 0.3 | |

Wynn Macau Ltd., 5.25%, 10/15/21 | | 10/10/2013 | | 1,500,000 | | 1,533,750 | | 0.3 | |

Xstrata Finance Canada Ltd., 2.70%, 10/25/17 | | 10/19/2012 | | 1,697,695 | | 1,707,662 | | 0.3 | |

| | | | $ | 26,657,757 | | $ | 26,463,007 | | 4.9 | % |

Schedule of Written Options

| | Expiration

Date | | Exercise

Price | | Contracts | | Value | |

Index Options | | | | | | | | | |

CDX.NA.IG-20 Call Option, BOA | | 12/18/2013 | | 0.65 | | 65 | | $ | (9,564 | ) |

CDX.NA.IG-20 Put Option, BNP | | 12/18/2013 | | 1.00 | | 40 | | (445 | ) |

CDX.NA.IG-20 Put Option, BOA | | 12/18/2013 | | 0.90 | | 52 | | (1,307 | ) |

CDX.NA.IG-20 Put Option, BOA | | 12/18/2013 | | 1.00 | | 93 | | (1,035 | ) |

CDX.NA.IG-20 Put Option, BOA | | 12/18/2013 | | 1.10 | | 39 | | (203 | ) |

CDX.NA.IG-20 Put Option, MSS | | 12/18/2013 | | 1.00 | | 96 | | (1,069 | ) |

CDX.NA.IG-20 Put Option, MSS | | 12/18/2013 | | 1.10 | | 39 | | (203 | ) |

| | | | | | 424 | | $ | (13,826 | ) |

Interest Rate Swaptions | | | | | | | | | |

Call Swaption, 3 month EURIBOR versus 0.40% fixed, BBP | | 03/14/2014 | | N/A | | 18 | | $ | (2,952 | ) |

Call Swaption, 3 month EURIBOR versus 0.40% fixed, BOA | | 03/12/2014 | | N/A | | 65 | | (10,746 | ) |

Call Swaption, 3 month EURIBOR versus 0.40% fixed, DUB | | 03/12/2014 | | N/A | | 38 | | (6,282 | ) |

Call Swaption, 3 month EURIBOR versus 0.40% fixed, GSB | | 03/12/2014 | | N/A | | 20 | | (3,306 | ) |

Call Swaption, 3 month LIBOR versus 1.30% fixed, GSB | | 03/17/2014 | | N/A | | 452 | | (65,708 | ) |

Put Swaption, 3 month EURIBOR versus 0.40% fixed, BBP | | 03/14/2014 | | N/A | | 18 | | (1,050 | ) |

Put Swaption, 3 month EURIBOR versus 0.40% fixed, BOA | | 03/12/2014 | | N/A | | 65 | | (3,790 | ) |

Put Swaption, 3 month EURIBOR versus 0.40% fixed, DUB | | 03/14/2014 | | N/A | | 38 | | (2,216 | ) |

Put Swaption, 3 month EURIBOR versus 0.40% fixed, GSB | | 03/12/2014 | | N/A | | 20 | | (1,166 | ) |

Put Swaption, 3 month LIBOR versus 1.90% fixed, GSB | | 03/17/2014 | | N/A | | 452 | | (206,871 | ) |

Put Swaption, 3 month LIBOR versus 2.00% fixed, GSB | | 03/31/2014 | | N/A | | 1,414 | | (164,019 | ) |

Put Swaption, 3 month LIBOR versus 2.50% fixed, DUB | | 09/21/2015 | | N/A | | 208 | | (588,332 | ) |

| | | | | | 2,808 | | $ | (1,056,438 | ) |

See accompanying Notes to Financial Statements.

Summary of Written Options

| | Contracts | | Premiums | |

Options outstanding at October 31, 2012 | | 896 | | $ | 1,128,390 | |

Options written during the year | | 3,805,636 | | 1,640,181 | |

Options closed during the year | | (1,900,580 | ) | (439,525 | ) |

Options expired during the year | | (1,902,720 | ) | (1,369,785 | ) |

Options outstanding at October 31, 2013 | | 3,232 | | $ | 959,261 | |

Schedule of Open Futures Contracts

| | Expiration | | Contracts

Long | | Unrealized

Appreciation | |

90-Day Eurodollar Future | | December 2014 | | 47 | | $ | 11,480 | |

90-Day Eurodollar Future | | March 2015 | | 625 | | 154,744 | |

90-Day Eurodollar Future | | June 2015 | | 599 | | 229,959 | |

Euro-Bund Future | | December 2013 | | 5 | | 26,969 | |

U.S. Treasury Note Future, 10-Year | | December 2013 | | 172 | | 725,433 | |

| | | | | | $ | 1,148,585 | |

Schedule of Open Forward Foreign Currency Contracts

Purchased/

Sold | | Settlement

Date | | CounterParty | | Notional

Amount | | Value | | Unrealized

Gain/(Loss) | |

BRL/USD | | 11/04/2013 | | CSI | | BRL | 5,693,874 | | $ | 2,541,681 | | $ | 89,328 | |

BRL/USD | | 12/03/2013 | | MSC | | BRL | 5,693,874 | | 2,523,933 | | (82,854 | ) |

EUR/USD | | 11/04/2013 | | UBS | | EUR | 1,053,000 | | 1,429,716 | | 8,453 | |

EUR/USD | | 11/04/2013 | | MSC | | EUR | 1,879,000 | | 2,551,221 | | (7,772 | ) |

EUR/USD | | 11/04/2013 | | BCL | | EUR | 13,754,000 | | 18,674,560 | | (271,575 | ) |

GBP/USD | | 12/12/2013 | | BNP | | GBP | 1,554,000 | | 2,490,973 | | 13,081 | |

GBP/USD | | 12/12/2013 | | BCL | | GBP | 577,000 | | 924,898 | | (6,085 | ) |

MXN/USD | | 12/17/2013 | | DUB | | MXN | 18,051,880 | | 1,378,785 | | (21,215 | ) |

MXN/USD | | 12/17/2013 | | BOA | | MXN | 6,535,500 | | 499,175 | | (825 | ) |

USD/AUD | | 11/04/2013 | | UBS | | AUD | (1,688,000 | ) | (1,595,418 | ) | (24,734 | ) |

USD/AUD | | 11/04/2013 | | BNP | | AUD | (112,000 | ) | (105,857 | ) | (154 | ) |

USD/AUD | | 12/03/2013 | | BNP | | AUD | (1,576,000 | ) | (1,486,736 | ) | 9,282 | |

USD/BRL | | 11/04/2013 | | CSI | | BRL | (5,693,874 | ) | (2,541,681 | ) | 82,224 | |

USD/CAD | | 12/23/2013 | | DUB | | CAD | (354,000 | ) | (339,089 | ) | 5,659 | |

USD/EUR | | 11/04/2013 | | CSI | | EUR | (195,000 | ) | (264,762 | ) | 3,741 | |

USD/EUR | | 11/04/2013 | | UBS | | EUR | (68,000 | ) | (92,327 | ) | (622 | ) |

USD/EUR | | 11/04/2013 | | GSC | | EUR | (16,423,000 | ) | (22,298,407 | ) | (72,849 | ) |

USD/EUR | | 12/03/2013 | | BCL | | EUR | (13,754,000 | ) | (18,675,785 | ) | 271,684 | |

USD/GBP | | 12/12/2013 | | CSI | | GBP | (5,999,000 | ) | (9,616,053 | ) | (200,382 | ) |

USD/JPY | | 11/18/2013 | | MSC | | JPY | (17,800,000 | ) | (181,036 | ) | (883 | ) |

USD/MXN | | 12/17/2013 | | GSC | | MXN | (9,700,703 | ) | (740,930 | ) | (4,465 | ) |

USD/RUB | | 01/15/2014 | | UBS | | RUB | (425,600 | ) | (13,097 | ) | (156 | ) |

ZAR/USD | | 01/15/2014 | | DUB | | ZAR | 1,274,818 | | 125,572 | | (4,765 | ) |

| | | | | | | | | $ | (24,810,664 | ) | $ | (215,884 | ) |

Schedule of Interest Rate Swap Agreements

Counterparty | | Floating Rate Index | | Fund Paying

Floating Rate | | Fixed Rate | | Expiration

Date | | Notional

Amount(1) | | Unrealized

Appreciation /

(Depreciation) | |

Over the Counter Interest Rate Swap Agreements | | | | | | | | | | |

BBP | | Mexican Interbank Rate | | Paying | | 5.50 | % | 09/13/2017 | | MXN | 16,200,000 | | $ | 29,158 | |

BOA | | Mexican Interbank Rate | | Paying | | 5.50 | % | 09/13/2017 | | MXN | 2,600,000 | | 4,874 | |

BOA | | Mexican Interbank Rate | | Paying | | 5.50 | % | 09/13/2017 | | MXN | 9,200,000 | | 15,424 | |

GSB | | Brazil Interbank Deposit Rate | | Paying | | 8.30 | % | 01/02/2017 | | BRL | 74,300,000 | | (2,134,562 | ) |

GSB | | Mexican Interbank Rate | | Paying | | 5.50 | % | 09/13/2017 | | MXN | 9,300,000 | | 17,251 | |

GSB | | Mexican Interbank Rate | | Paying | | 5.00 | % | 02/22/2023 | | MXN | 50,000,000 | | (358,040 | ) |

MSC | | Mexican Interbank Rate | | Paying | | 5.60 | % | 09/06/2016 | | MXN | 47,500,000 | | 106,001 | |

| | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

Counterparty | | Floating Rate Index | | Fund

Paying/Receiving

Floating Rate | | Fixed Rate | | Expiration

Date | | Notional

Amount(1) | | Unrealized

Appreciation /

(Depreciation) | |

Over the Counter Interest Rate Swap Agreements (continued) | | | | | | | | |

MSC | | Mexican Interbank Rate | | Paying | | 5.00 | % | 09/13/2017 | | MXN | 20,000,000 | | $ | 8,886 | |

MSC | | Mexican Interbank Rate | | Paying | | 5.25 | % | 09/06/2019 | | MXN | 78,800,000 | | (66,792 | ) |

| | | | | | | | | | | | | $ | (2,377,800 | ) |

| | | | | | | | | | | | | | |

Centrally Cleared Interest Rate Swap Agreements | | | | | | | | | | |

N/A | | 3-Month LIBOR | | Paying | | 2.65 | % | 07/31/2023 | | | 1,400,000 | | $ | 635 | |

N/A | | 6-Month Australian Bank Bill | | Paying | | 4.00 | % | 03/15/2023 | | AUD | 10,100,000 | | (270,602 | ) |

N/A | | 6-Month EURIBOR | | Receiving | | 2.25 | % | 09/19/2024 | | EUR | 4,000,000 | | (138,640 | ) |

N/A | | British Bankers’ Association Yen LIBOR | | Receiving | | 1.00 | % | 09/18/2023 | | JPY | 770,000,000 | | (194,476 | ) |

| | | | | | | | | | | | | $ | (603,083 | ) |

Schedule of Credit Default Swap Agreements

Counterparty | | Reference Obligation | | Implied

Credit

Spread(3) | | Fixed

Rate(6) | | Expiration

Date | | Notional

Amount (1),(5) | | Value(4) | | Unrealized

Appreciation /

(Depreciation) | |

Over the Counter Credit Default Swap Agreements | | | | | | | | | | | |

Credit default swap agreements - sell protection (2) | | | | | | | | | | | |

CSI | | Devon Energy Corp., 7.95%, 04/15/2032 | | 0.68 | % | 1.00 | % | 06/20/2018 | | $ | (300,000 | ) | $ | 4,338 | | $ | 5,276 | |

DUB | | Devon Energy Corp., 7.95%, 04/15/2032 | | 0.68 | % | 1.00 | % | 06/20/2018 | | (300,000 | ) | 4,338 | | 5,570 | |

CSI | | Encana Corp., 4.75%, 10/15/2013 | | 0.94 | % | 1.00 | % | 03/20/2018 | | (2,000,000 | ) | 5,166 | | 33,991 | |

MSC | | Federated Republic of Brazil, 12.25%, 03/06/2030 | | 1.24 | % | 1.00 | % | 12/20/2016 | | (6,500,000 | ) | (49,049 | ) | 52,177 | |

BBP | | Ford Motor Co., 6.50%, 08/01/2018 | | 0.48 | % | 5.00 | % | 12/20/2015 | | (1,050,000 | ) | 101,663 | | 12,373 | |

CSI | | Glencore Finance Europe, 6.50%, 02/27/2019 | | 1.60 | % | 1.00 | % | 12/20/2018 | | (882,541 | ) | (25,813 | ) | (551 | ) |

DUB | | Goldman Sachs Group Inc., 5.95%, 01/18/2018 | | 0.31 | % | 1.00 | % | 06/20/2014 | | (1,900,000 | ) | 8,412 | | 1,763 | |

CSI | | HJ Heinz Co., 6.38%, 07/15/2028 | | 1.18 | % | 1.00 | % | 03/20/2018 | | (100,000 | ) | (762 | ) | 2,333 | |

BOA | | KB Home, 9.10%, 09/15/2017 | | 3.27 | % | 5.00 | % | 09/20/2018 | | (500,000 | ) | 38,589 | | 15,943 | |

GSI | | KB Home, 9.10%, 09/15/2017 | | 3.27 | % | 5.00 | % | 09/20/2018 | | (700,000 | ) | 54,024 | | 22,829 | |

BBP | | Kingdom of Spain, 5.50%, 07/30/2017 | | 1.82 | % | 1.00 | % | 12/20/2018 | | (500,000 | ) | (19,700 | ) | 10,322 | |

BOA | | Kingdom of Spain, 5.50%, 07/30/2017 | | 1.82 | % | 1.00 | % | 12/20/2018 | | (100,000 | ) | (3,940 | ) | 2,073 | |

BBP | | Metlife Inc., 4.75%, 02/08/2021 | | 0.87 | % | 1.00 | % | 12/20/2018 | | (3,000,000 | ) | 19,831 | | 23,331 | |

DUB | | Morgan Stanley, 6.00%, 04/28/2015 | | 0.30 | % | 1.00 | % | 06/20/2014 | | (2,500,000 | ) | 11,304 | | 3,659 | |

BOA | | NRG Energy Inc., 8.50%, 06/15/2019 | | 2.09 | % | 5.00 | % | 06/20/2017 | | (150,000 | ) | 15,328 | | 26,924 | |

BBP | | People’s Republic of China, 4.25%, 10/28/2014 | | 0.81 | % | 1.00 | % | 12/20/2018 | | (1,000,000 | ) | 12,780 | | 1,971 | |

GSI | | People’s Republic of China, 4.75%, 10/29/2013 | | 0.80 | % | 1.00 | % | 12/20/2018 | | (1,000,000 | ) | 9,903 | | (244 | ) |

BBP | | Petrobras International Finance Co., 8.38%, 12/10/2018 | | 0.92 | % | 1.00 | % | 03/20/2014 | | (3,800,000 | ) | 1,187 | | 14,754 | |

DUB | | Petrobras International Finance Co., 8.38%, 12/10/2018 | | 1.37 | % | 1.00 | % | 03/20/2015 | | (700,000 | ) | (3,628 | ) | 3,527 | |

DUB | | Petrobras International Finance Co., 8.38%, 12/10/2018 | | 1.50 | % | 1.00 | % | 06/20/2015 | | (1,200,000 | ) | (9,750 | ) | (4,915 | ) |

DUB | | Prudential Financial Inc., 6.10%, 06/15/2017 | | 0.93 | % | 1.00 | % | 12/20/2018 | | (2,500,000 | ) | 8,751 | | 11,668 | |

BNP | | Rio Tinto Finance USA Ltd., 6.50%, 07/15/2018 | | 0.60 | % | 1.00 | % | 03/20/2017 | | (2,000,000 | ) | 26,624 | | 86,582 | |

GSI | | Russia - Eurobond, 7.50%, 03/31/2030 | | 1.14 | % | 1.00 | % | 12/20/2016 | | (2,300,000 | ) | (9,795 | ) | 115,616 | |

BBP | | Sony Corporation, 1.57%, 06/19/2015 | | 1.25 | % | 1.00 | % | 03/20/2018 | | (101,698 | ) | (1,084 | ) | 6,126 | |

BOA | | Sony Corporation, 1.57%, 06/19/2015 | | 1.25 | % | 1.00 | % | 03/20/2018 | | (101,698 | ) | (1,084 | ) | 6,126 | |

DUB | | Sony Corporation, 1.57%, 06/19/2015 | | 1.25 | % | 1.00 | % | 03/20/2018 | | (101,698 | ) | (1,084 | ) | 6,365 | |

GSI | | Sony Corporation, 1.57%, 06/19/2015 | | 1.25 | % | 1.00 | % | 03/20/2018 | | (508,492 | ) | (5,418 | ) | 30,928 | |

BBP | | The Republic of Italy, 6.88%, 09/27/2023 | | 2.06 | % | 1.00 | % | 12/20/2018 | | (400,000 | ) | (20,100 | ) | 6,594 | |

BBP | | The Republic of Italy, 6.88%, 09/27/2023 | | 2.06 | % | 1.00 | % | 12/20/2018 | | (1,200,000 | ) | (60,300 | ) | 33,149 | |

GSI | | The Republic of Italy, 6.88%, 09/27/2023 | | 2.06 | % | 1.00 | % | 12/20/2018 | | (1,100,000 | ) | (55,275 | ) | 17,653 | |

MSS | | The Republic of Italy, 6.88%, 09/27/2023 | | 2.06 | % | 1.00 | % | 12/20/2018 | | (500,000 | ) | (25,125 | ) | 8,024 | |

BOA | | Tokyo Electric Power Co., 0.68%, 05/30/2013 | | 2.46 | % | 1.00 | % | 12/20/2013 | | (813,587 | ) | (1,647 | ) | 101,143 | |

DUB | | UK Gilt Treasury Bond, 4.25%, 06/07/2032 | | 0.14 | % | 1.00 | % | 12/20/2016 | | (3,000,000 | ) | 80,808 | | 75,274 | |

MSC | | United Mexican States, 5.95%, 03/19/2019 | | 0.65 | % | 1.00 | % | 12/20/2016 | | (6,000,000 | ) | 66,241 | | 153,888 | |

DUB | | Whirlpool Corp., 7.75%, 07/15/2016 | | 0.76 | % | 1.00 | % | 03/20/2018 | | (1,400,000 | ) | 14,628 | | 33,897 | |

| | | | | | | | | | $ | (50,209,714 | ) | $ | 190,361 | | $ | 926,139 | |

See accompanying Notes to Financial Statements.

Counterparty | | Reference Obligation | | Implied

Credit

Spread(3) | | Fixed

Rate(6) | | Expiration

Date | | Notional

Amount(1),(5) | | Value(4) | | Unrealized

Appreciation /

(Depreciation) | |

Centrally Cleared Credit Default Swap Agreements | | | | | | | | | |

Credit default swap agreements - sell protection (2) | | | | | | | | | |

N/A | | CDX.NA.IG-17 | | N/A | | 1.00 | % | 12/20/2016 | | $ | (4,830,000 | ) | $ | 92,705 | | $ | 18,067 | |

N/A | | CDX.NA.IG-17 | | N/A | | 1.00 | % | 12/20/2021 | | (75,000 | ) | (297 | ) | 638 | |

N/A | | CDX.NA.IG-18 | | N/A | | 1.00 | % | 12/20/2022 | | (3,200,000 | ) | (29,910 | ) | 62,111 | |

N/A | | CDX.NA.IG-19 | | N/A | | 1.00 | % | 12/20/2017 | | (8,000,000 | ) | 145,856 | | 57,887 | |

N/A | | CDX.NA.IG-21 | | N/A | | 1.00 | % | 12/20/2018 | | (10,000,000 | ) | 133,480 | | (16,390 | ) |

N/A | | iTraxx Europe Series 20 | | N/A | | 1.00 | % | 12/20/2018 | | (7,467,652 | ) | 61,003 | | 48,183 | |

| | | | | | | | | | $ | (33,572,652 | ) | $ | 402,837 | | $ | 170,496 | |

(1)Notional amount is stated in USD unless otherwise noted.

(2)If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay the buyer of protection an amount equal to the notional amount of the referenced obligation and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) pay a net settlement amount in the form of cash or securities equal to the notional amount of the swap agreement less the recovery value of the reference obligation or underlying securities comprising the referenced index.