Exhibit 10.1

AMENDMENT NO.1

TO

CONSENT AND WAIVER AGREEMENT

This Amendment No. 1 to Consent and Waiver Agreement (“Agreement”) is made and entered into as of October 3, 2012, by and among DecisionPoint Systems, Inc., a Delaware corporation (the “Company”), Sigma Opportunity Fund II, LLC (“Sigma Opportunity Fund”), Sigma Capital Advisors (“Sigma Advisors”) and Donald W. Rowley. Capitalized terms used herein without definition shall have the meaning set forth in the Waiver Agreement.

WHEREAS, the parties hereto are parties to a Consent and Waiver Agreement dated as of June 4, 2012 (the “Waiver Agreement”);

WHEREAS, the parties desire to amend the Waiver Agreement as set forth herein.

WHEREAS, Section 3 of the Waiver Agreement provides that the parties shall negotiate in good faith regarding the amendment of the Certificate of Designations.

NOW, THEREFORE, in exchange for good and valuable consideration the receipt of which has been received, the Company, Sigma Opportunity Fund, Sigma Advisors and Donald W. Rowley agree as follows:

| 1. | Certificate of Designations. (a) The Certificate of Designations shall be amended as set forth in Exhibit A hereto within two business days after the date hereof so that the Dividend Rate (as defined in the Certificate of Designations) shall be 20% effective as of the closing for the SPA (as defined in the Waiver Agreement) and the definition of Breach Event included in the Certificate of Designations shall be revised as set forth in the Waiver Agreement. The parties agree that no further changes shall be made to the Certificate of Designations based upon the negotiations referred to in Section 3 of the Waiver Agreement. In the event that the Company does not redeem on a pro rata basis for cash at least $2,206,000 in Stated Value (as defined in the Certificate of Designations) of the Series C Preferred Stock on or before October 31, 2012, then the parties shall negotiate in good faith until November 15, 2012 relating to changes to the Certificate of Designations and other related matters that the parties may wish to agree upon in order to protect the interest of the holders of Series C Preferred Stock and shall file the amended Certificate of Designations within two weeks thereafter. If the Company and a majority in interest of the Series C Preferred Stock are unable to agree upon revised terms by November 15, 2012, the Company shall file an amendment to the Certificate of Designations no later than close of business on November 15, 2012 to provide that the Conversion Value shall be equal to the lower of (i) the Conversion Value then in effect, (ii) $1.20 per share or (iii) the closing price of the Common Stock on October 31, 2012 (in each case subject to the continuing antidilution provisions contained in the Certificate of Designations). |

(b) The holders of Series C Preferred Stock hereby waive the applicability of Section 5(h) of the Certificate of Designations as it relates to the issuance of the following shares of Common Stock:

| ● | 617,284 shares issued to Macrosolve in conjunction with acquisition of Illume Mobile assets and up to 100,000 shares in conjunction with future earn outs related to this transaction. |

| ● | Up to 200,000 shares underlying options issued to Nicholas Toms and/or Ralph Hubregsen in conjunction with their 2012 compensation plans. Such options to be issued at a price to exceed $1.20 strike price and to be issued before March 31st, 2013. |

| ● | the issuance of securities pursuant to this Agreement. |

(c) The reference in Section 3 of the Waiver to August 15, 2012 is hereby changed to October 3, 2012 and Section 1(a) fulfills the parties obligations under Section 3 of the Waiver Agreement to negotiate in good faith.

| 2. | Issuance of Common Stock. In consideration of the agreements set forth herein, the Company shall issue to the holders of Series C Preferred Stock a number of shares of Common Stock calculated as set forth in Exhibit B hereto. |

| 3. | Full Force and Effect. Except as expressly and specifically set forth herein, this Agreement shall not be deemed to be a waiver, amendment or modification of any provisions of the Waiver Agreement, Exchange Agreement, Certificate of Designations, the Investor Rights Agreement or the Advisory Services Agreement or any right, power or remedy of Sigma or constitute a waiver of any provision of these Agreements or Certificate of Designations (except to the extent expressly and specifically herein set forth), or any other document, instrument and/or agreement executed or delivered in connection therewith and any other agreement to which the parties to this Agreement may be parties to, in each case whether arising before or after the date hereof or as a result of performance hereunder or thereunder. |

| 4. | Counterparts. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to any other party, it being understood that all parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature were an original thereof. |

| 5. | Governing Law. This Agreement will be governed by and interpreted in accordance with the laws of the State of New York without giving effect to the rules governing the conflicts of law. |

| 6. | Amendments. This Agreement and any term hereof may be changed, waived, discharged or terminated only by an instrument in writing signed by the party against which enforcement of such change, waiver, discharge or termination is sought. |

| 7. | Severability. The invalidity or unenforceability of any provision hereof will in no way affect the validity or enforceability of any other provision. |

| 8. | Expenses. The reasonable costs and reasonable expenses (including legal fees) incurred by Sigma Opportunity Fund or Sigma Advisors in connection with this Agreement and the transactions contemplated hereby shall be paid by the Company promptly after demand therefor. |

IN WITNESS WHEREOF, the Company and the undersigned have caused this Amendment No. 1 to Consent and Waiver Agreement to be executed as of the date first written above.

| | DECISIONPOINT SYSTEMS, INC. | |

| | | | |

| | By: | /s/ Nicholas R. Toms | |

| | | Nicholas R. Toms | |

| | | Chief Executive Officer | |

| | SIGMA OPPORTUNITY FUND II, LLC | |

| | | | |

| | By: | Sigma Capital Advisors, LLC | |

| | | Its managing member | |

| | By: | /s/ Thom Waye | |

| | | Thom Waye | |

| | | Manager | |

| | | | |

| | SIGMA CAPITAL ADVISORS, LLC | |

| | | | |

| | By: | /s/ Thom Waye | |

| | | Thom Waye | |

| | | Manager | |

| | | /s/ Donald W. Rowley | |

| | | Donald W. Rowley | |

| | | | |

| | | | |

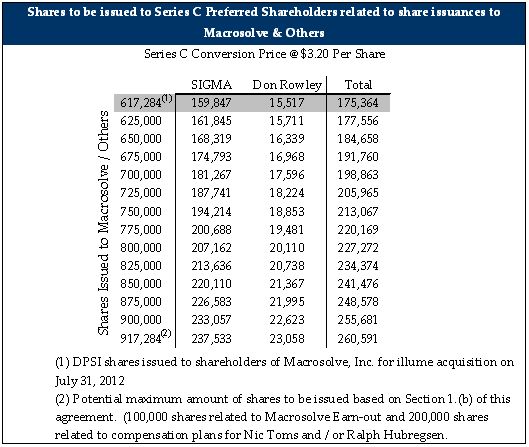

EXHIBIT B

The aggregate number of shares to be issued shall be calculated as set forth below. The shares shall be issued pro rata to the holders of the Series C Preferred Stock based upon the Stated Value of Series C Preferred Stock then held by each holder. The shares shall be issued on November 15, 2012.

For each share of Common Stock or option to purchase Common Stock listed in Section 1(b) that is issued, the aggregate number of shares to be issued shall be 0.284, assuming a Conversion Value of $3.20 per share (in each case subject to adjustment for stock splits, stock dividends, recapitalizations, and the like). Set forth below is an illustration of the calculation.

In the event that any portion of the Stated Value of the Series C Preferred Stock is repaid by the Company, the above calculation shall be adjusted on a pro rata basis based upon the percentage of the Stated Value of the Series C Preferred Stock so repaid.

4