Exhibit 10.1

AGREEMENT

This Agreement (“Agreement”) is made and entered into as of November 15, 2012, by and among DecisionPoint Systems, Inc., a Delaware corporation (the “Company”), Sigma Opportunity Fund II, LLC (“Sigma Opportunity Fund”), in its capacity as holder of a majority in interest of the Series C Cumulative Convertible Preferred Stock (“Preferred Stock”) of the Company, and Sigma Capital Advisors, LLC (“Sigma Advisors”), the managing member of Sigma Opportunity Fund II, LLC. Capitalized terms used herein without definition shall have the meaning set forth in the Waiver Agreement.

WHEREAS, pursuant to a Consent and Waiver Agreement, dated as of June 4, 2012, as amended by Amendment No. 1 to Consent and Waiver Agreement, dated as of October 3, 2012 (the “Waiver Agreement”), the parties were to negotiate in good faith relating to changes to the Certificate of Designations for the Preferred Stock and other related matters in order to protect the interest of the holders of the Preferred Stock;

WHEREAS, the parties desire to set forth herein the agreements reached as a result of such negotiations.

NOW, THEREFORE, in exchange for good and valuable consideration the receipt of which has been received, the parties agree as follows:

| 1. | Certificate of Designations. The Certificate of Designations shall be amended as set forth in Exhibit A hereto within two business days after the date hereof. |

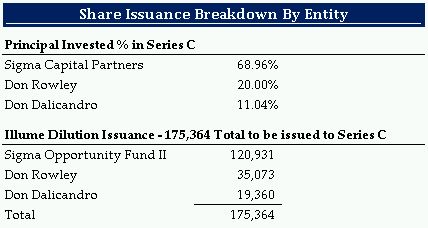

| 2. | Issuance of Common Stock; Fee; Standstill. The Company shall issue on the date hereof to the holders of Series C Preferred Stock, on a pro rata basis in accordance the aggregate Stated Value of Preferred Stock held by each holder, the shares of Common Stock as set forth on Exhibit B. The Company shall pay to Sigma Advisors an administrative fee of $150,000 in cash and issue as an antidilution adjustment the additional shares of Common Stock as set forth on Exhibit B. The cash fee shall be netted against amounts otherwise owing to Sigma Advisors by the Company in connection with any services provided or money owed to Sigma Advisors by the Company by December 31, 2012. Sigma Opportunity Fund and Sigma Capital Advisors agree not to, and to cause their respective affiliates (as defined under Rule 405 under the Securities Act of 1933, as amended) not to, directly or indirectly, from the date hereof through December 31, 2012, (i) offer, sell, offer to sell, contract to sell, hedge, pledge, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase or sell (or announce any offer, sale, offer of sale, contract of sale, hedge, pledge, sale of any option or contract to purchase, purchase of any option or contract of sale, grant of any option, right or warrant to purchase or other sale or disposition except for required Form 4 and 13D filings related to the issuance of stock contemplated hereby), or otherwise transfer or dispose of (or enter into any transaction or device that is designed to, or could be expected to, result in the disposition by any person at any time in the future), any securities of the Company (including but not limited to capital stock of the Company or any securities convertible into or exercisable or exchangeable for capital stock of the Company (each a “Company Security”), beneficially owned, within the meaning of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), by Sigma Opportunity Fund, Sigma Capital Advisors, or any of their respective affiliates, on the date hereof or (ii) enter into any swap or other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of any Company Security, whether or not any such swap or transaction described in clause (i) or (ii) above is to be settled by delivery of any Company Security, without the prior written consent of the Company. Sigma Opportunity Fund and Sigma Advisors represent and warrant to the Company that they do not beneficially own any securities of the Company as of the date hereof except as set forth in the Form 4 filed by Sigma Opportunity Fund with the Securities and Exchange Commission on November 2, 2012 and as contemplated hereby. |

1

| 3. | Full Force and Effect. Except as expressly and specifically set forth herein, this Agreement shall not be deemed to be a waiver, amendment or modification of any provisions of the Waiver Agreement, Exchange Agreement, Certificate of Designations, the Investor Rights Agreement or the Advisory Services Agreement or any right, power or remedy of Sigma or constitute a waiver of any provision of these Agreements or Certificate of Designations (except to the extent expressly and specifically herein set forth), or any other document, instrument and/or agreement executed or delivered in connection therewith and any other agreement to which the parties to this Agreement may be parties to, in each case whether arising before or after the date hereof or as a result of performance hereunder or thereunder. |

| 4. | Counterparts. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to any other party, it being understood that all parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) the same with the same force and effect as if such facsimile signature were an original thereof. |

| 5. | Governing Law. This Agreement will be governed by and interpreted in accordance with the laws of the State of New York without giving effect to the rules governing the conflicts of law. |

| 6. | Amendments. This Agreement and any term hereof may be changed, waived, discharged or terminated only by an instrument in writing signed by the party against which enforcement of such change, waiver, discharge or termination is sought. |

| 7. | Severability. The invalidity or unenforceability of any provision hereof will in no way affect the validity or enforceability of any other provision. |

| 8. | Expenses. The reasonable costs and reasonable expenses (including legal fees) incurred by Sigma Opportunity Fund or Sigma Advisors in connection with this Agreement and the transactions contemplated hereby shall be paid by the Company promptly after demand therefor. |

2

IN WITNESS WHEREOF, the Company and the undersigned have caused this Agreement to be executed as of the date first written above.

| DECISIONPOINT SYSTEMS, INC. | |||

| By: | /s/ Nicholas R. Toms | ||

| Nicholas R. Toms | |||

| Chief Executive Officer | |||

| SIGMA OPPORTUNITY FUND II, LLC | |||

| By: | Sigma Capital Advisors, LLC | ||

| Its managing member | |||

| By: | /s/ Thom Waye | ||

| Thom Waye | |||

| Manager |

| SIGMA CAPITAL ADVISORS, LLC | |||

| By: | /s/ Thom Waye | ||

| Thom Waye | |||

| Manager | |||

3

Exhibit A

(see Exhibit 3.1)

4

Exhibit B

5