Bankwell Financial Group 1Q19 Investor Presentation

Safe Harbor This presentation may contain certain forward-looking statements about the Company. Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. 2

1Q19 Performance

1Q19 Highlights • Reported Net Income of $5.1 million, or $0.65 earnings per share • The orderly resolution of the “Quarry Loans”1 progressing according to plan • Loan originations remain strong at $93 million • Loan growth impacted by elevated prepayments • Net Interest Margin (“NIM”) benefiting from prepayment activity • Heated competition for deposits continues into 2019 • The Company’s Board of Directors declared a 2Q19 dividend of $0.13 per share 1 See BWFG’s 4Q’18 Earnings Release and related Investor Presentation for “Quarry Loans” background 4

1Q19 Results • $5.1 million Net Income • 1.10% Return on Average Assets Profitability • 11.60% Return on Average Equity • $22.38 Tangible Book Value • $1.6 billion of gross loans, 3% growth year over year Growth • $1.5 billion of deposits, 7% growth year over year • $13 million of assets per FTE • 1Q19 dividend of $0.13 per share • Considered “Well Capitalized” with Stability • 10.53% Tier 1 Leverage • 12.00% CET1 / RWA • 12.94% Total Capital / RWA 5

1Q Consolidated Statement of Income 1 Dollars in millions 2019 2018 QoQ Notes Total Interest Income $21.5 $18.6 $2.9 Net Interest Income Total Interest Expense $7.2 $4.9 $2.3 • Loan growth year over year along with incremental fees from Net Interest Income $14.3 $13.7 $0.6 prepayments driving favorability Provision/(Credit) for Loan Losses $0.2 $0.0 $(0.2) • Rising deposit costs partially offsetting Interest Income growth Net Interest Income after Provision $14.1 $13.7 $0.4 Non Interest Expense Non Interest Income $1.3 $1.3 $(0.0) • Decrease in salaries and employee benefits expense, driven by Non Interest Expense $9.0 $9.2 $0.2 reduction in full time equivalent employees and an increase in Pre-Tax Income $6.4 $5.8 $0.6 deferred loan origination costs as a result of higher loan volume Income Tax Expense $1.3 $1.2 $(0.1) • Decrease in professional services expense as a result of reduced Reported Net Income (Loss) $5.1 $4.6 $0.5 audit-related fees EPS $0.65 $0.59 $0.06 1 Variances are rounded based on actual whole dollar amounts 6

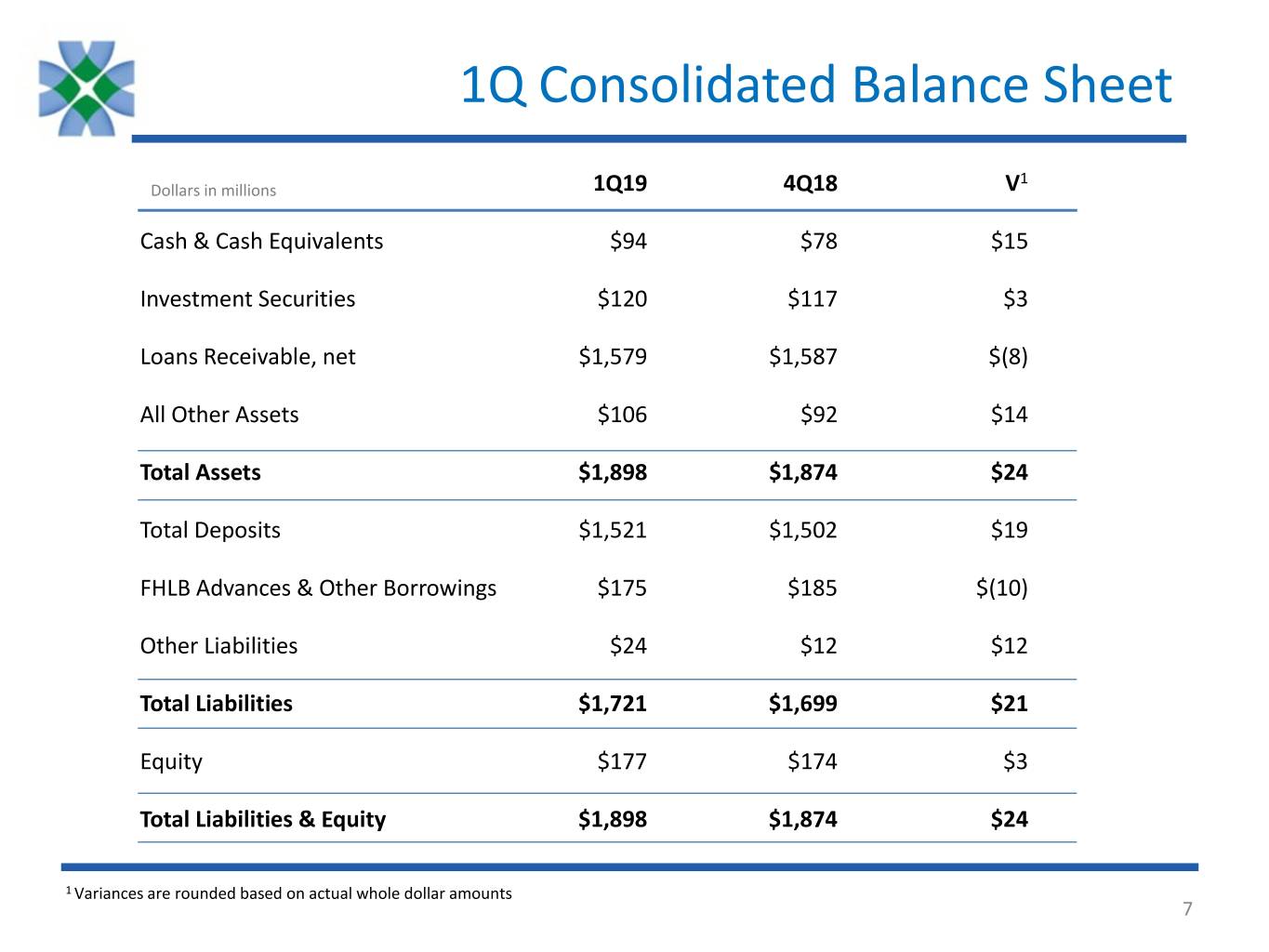

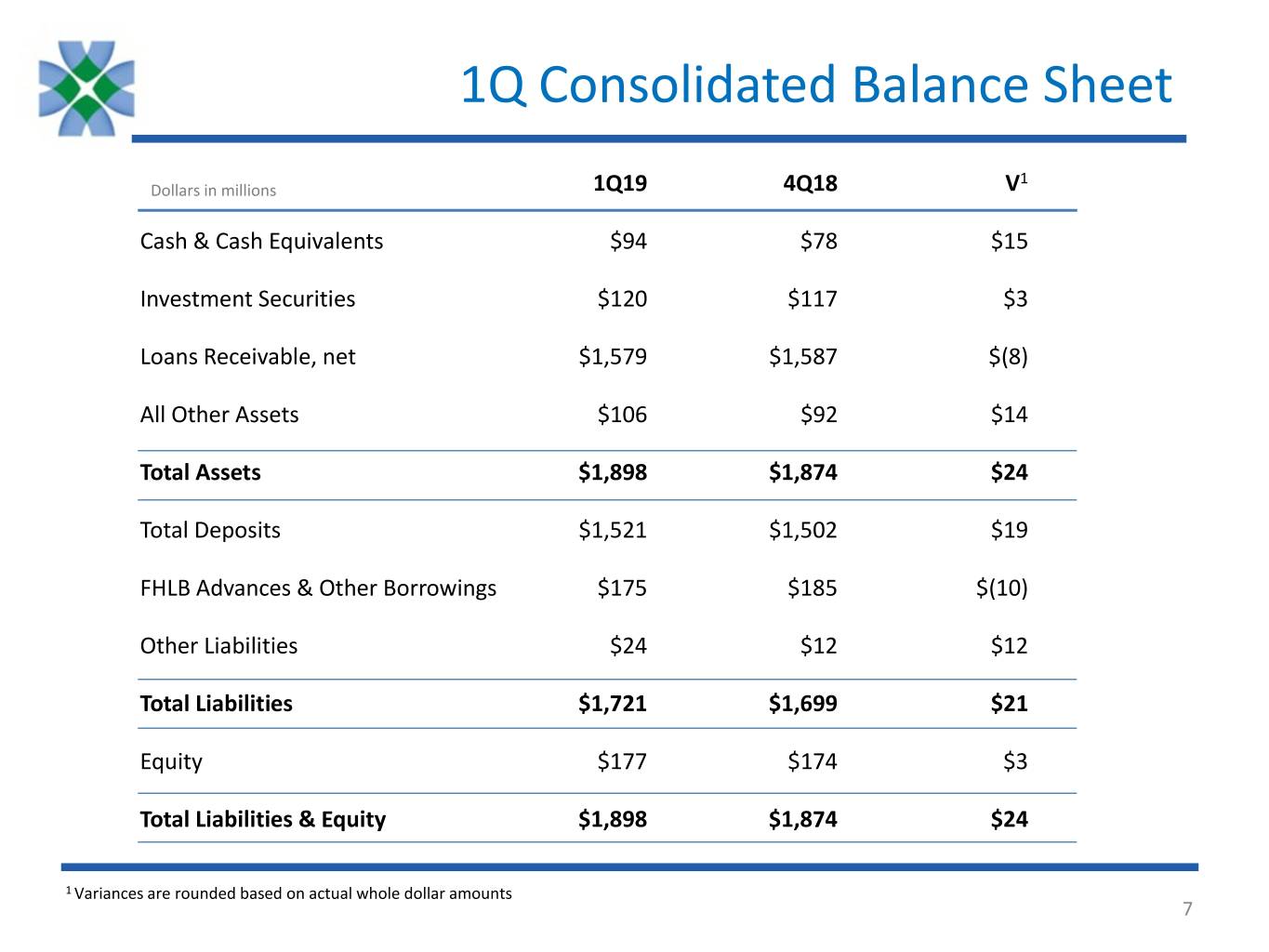

1Q Consolidated Balance Sheet 1 Dollars in millions 1Q19 4Q18 V Cash & Cash Equivalents $94 $78 $15 Investment Securities $120 $117 $3 Loans Receivable, net $1,579 $1,587 $(8) All Other Assets $106 $92 $14 Total Assets $1,898 $1,874 $24 Total Deposits $1,521 $1,502 $19 FHLB Advances & Other Borrowings $175 $185 $(10) Other Liabilities $24 $12 $12 Total Liabilities $1,721 $1,699 $21 Equity $177 $174 $3 Total Liabilities & Equity $1,898 $1,874 $24 1 Variances are rounded based on actual whole dollar amounts 7

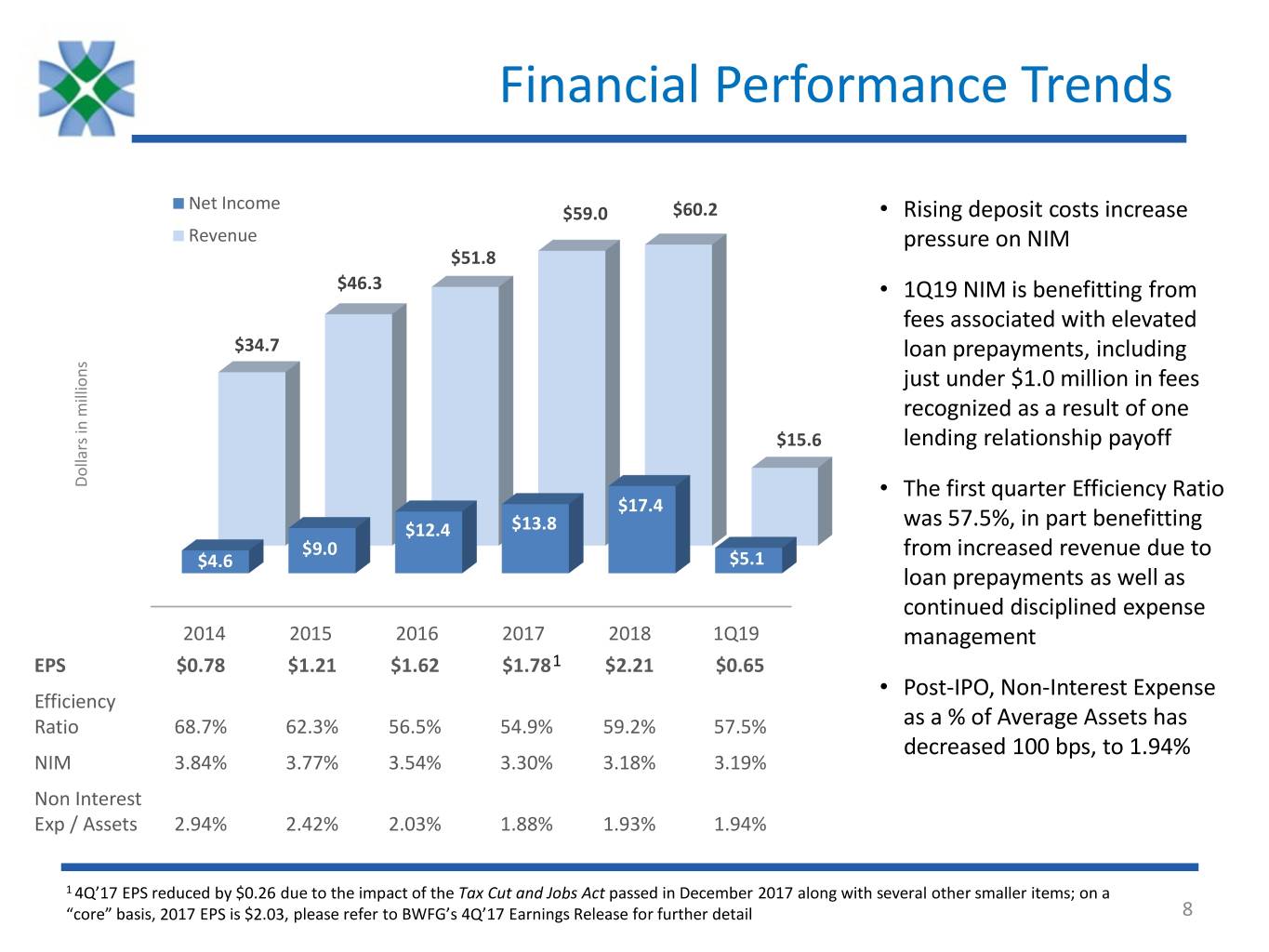

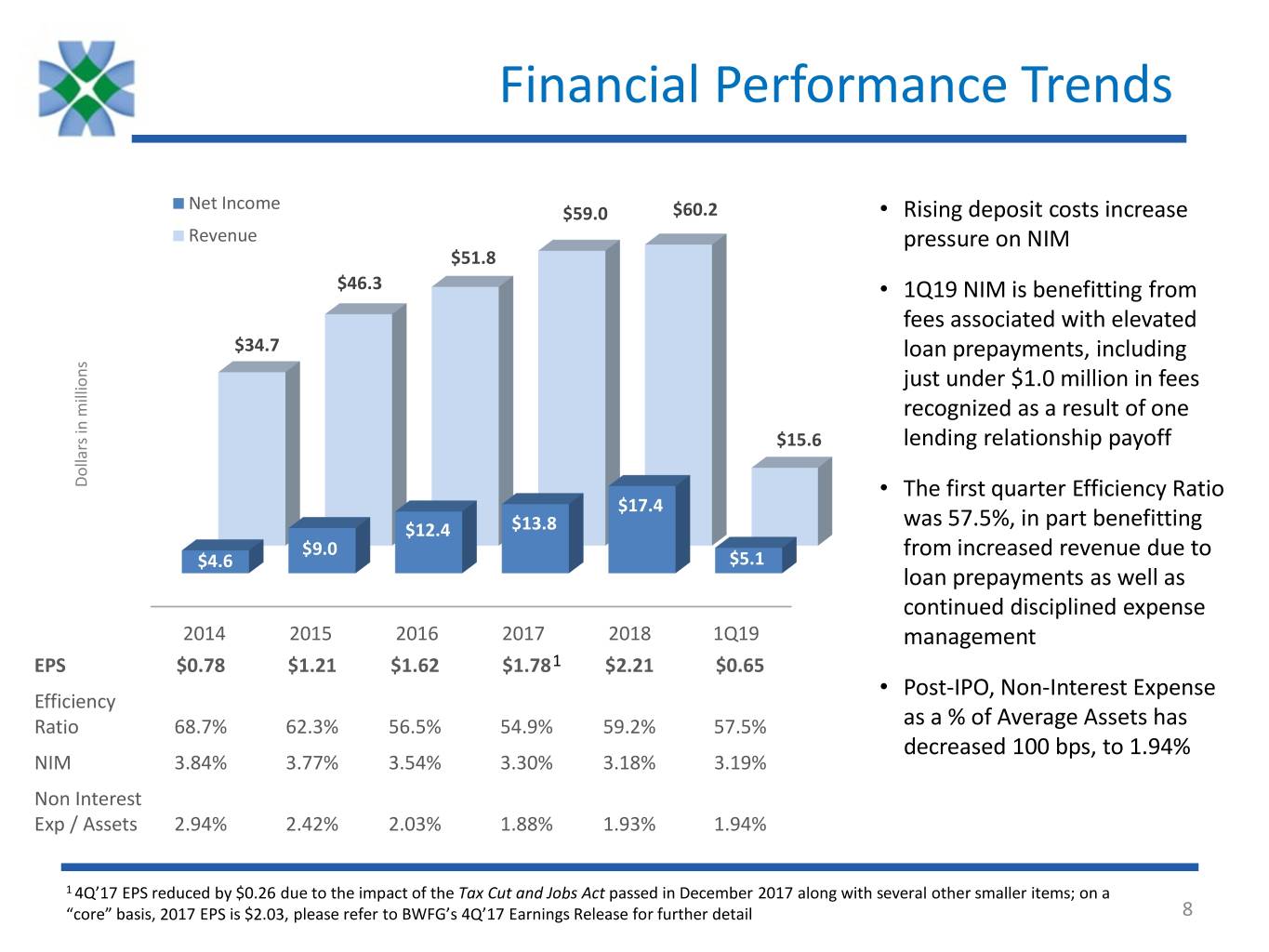

Financial Performance Trends Net Income $59.0 $60.2 • Rising deposit costs increase Revenue pressure on NIM $51.8 $46.3 • 1Q19 NIM is benefitting from fees associated with elevated $34.7 loan prepayments, including just under $1.0 million in fees recognized as a result of one $15.6 lending relationship payoff Dollars in millions • The first quarter Efficiency Ratio $17.4 $12.4 $13.8 was 57.5%, in part benefitting $9.0 from increased revenue due to $4.6 $5.1 loan prepayments as well as continued disciplined expense 2014 2015 2016 2017 2018 1Q19 management EPS $0.78 $1.21 $1.62 $1.781 $2.21 $0.65 • Post-IPO, Non-Interest Expense Efficiency Ratio 68.7% 62.3% 56.5% 54.9% 59.2% 57.5% as a % of Average Assets has decreased 100 bps, to 1.94% NIM 3.84% 3.77% 3.54% 3.30% 3.18% 3.19% Non Interest Exp / Assets 2.94% 2.42% 2.03% 1.88% 1.93% 1.94% 1 4Q’17 EPS reduced by $0.26 due to the impact of the Tax Cut and Jobs Act passed in December 2017 along with several other smaller items; on a “core” basis, 2017 EPS is $2.03, please refer to BWFG’s 4Q’17 Earnings Release for further detail 8

Loan Pricing Trends Dollars in millions Total Loan Portfolio $1,800 4.66% 5.00% 4.48% 4.64% 4.38% 4.50% $1,700 $1,605 $1,596 4.00% $1,600 $1,543 3.50% $1,500 3.00% Loan Balance $1,400 $1,366 2.50% 1 Portfolio Yield 2.00% $1,300 1.50% $1,200 1.00% $1,100 0.50% $1,000 0.00% 2016 2017 2018 1Q19 Current market rates imply further portfolio yield increases for 2019 1 Weighted average yield based on active loans as of 12-31-16, 12-31-17, 12-31-18 & 3-31-19, respectively 9

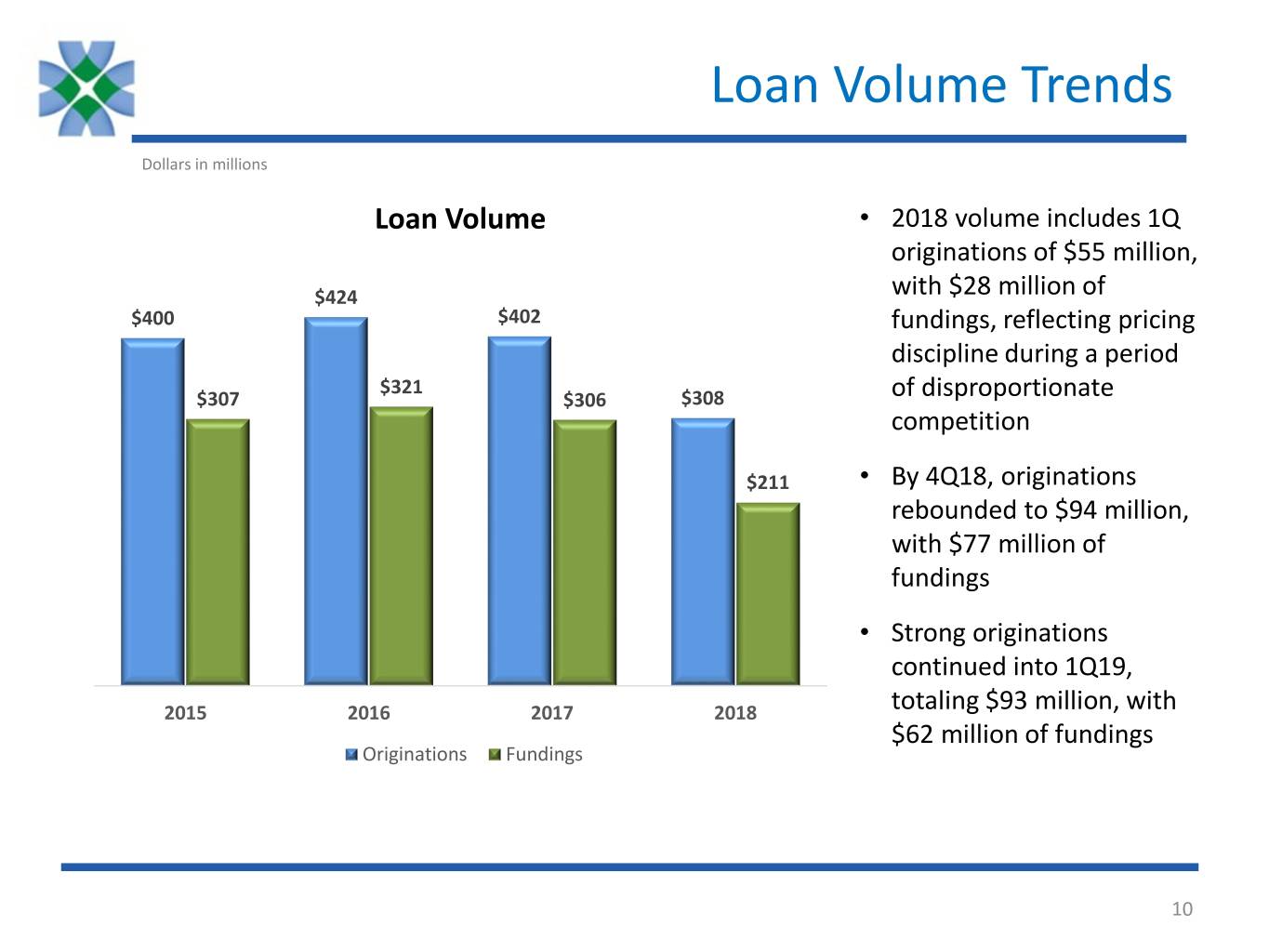

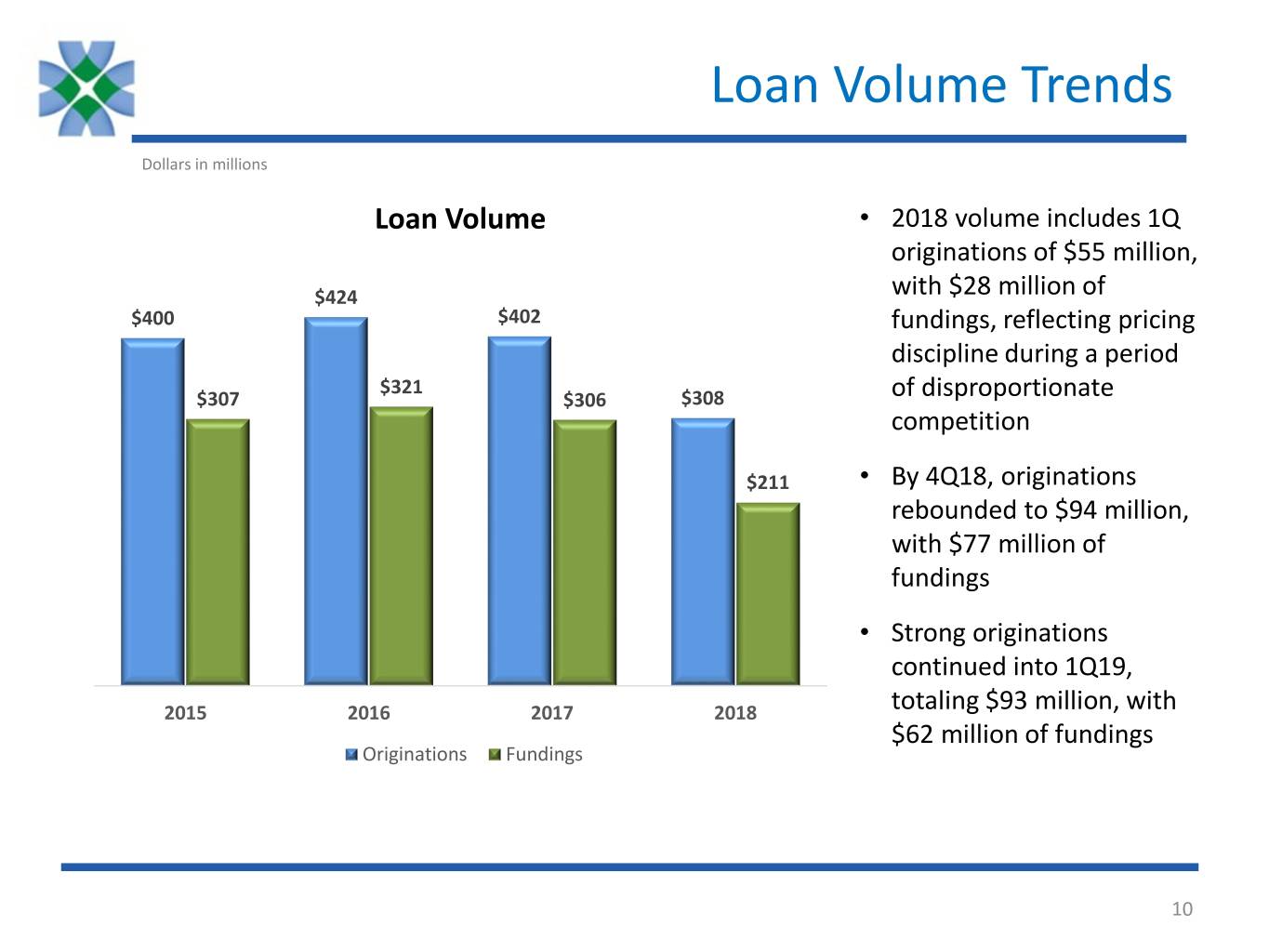

Loan Volume Trends Dollars in millions Loan Volume • 2018 volume includes 1Q originations of $55 million, $424 with $28 million of $400 $402 fundings, reflecting pricing discipline during a period $321 $307 $306 $308 of disproportionate competition $211 • By 4Q18, originations rebounded to $94 million, with $77 million of fundings • Strong originations continued into 1Q19, 2015 2016 2017 2018 totaling $93 million, with $62 million of fundings Originations Fundings 10

Bankwell Overview

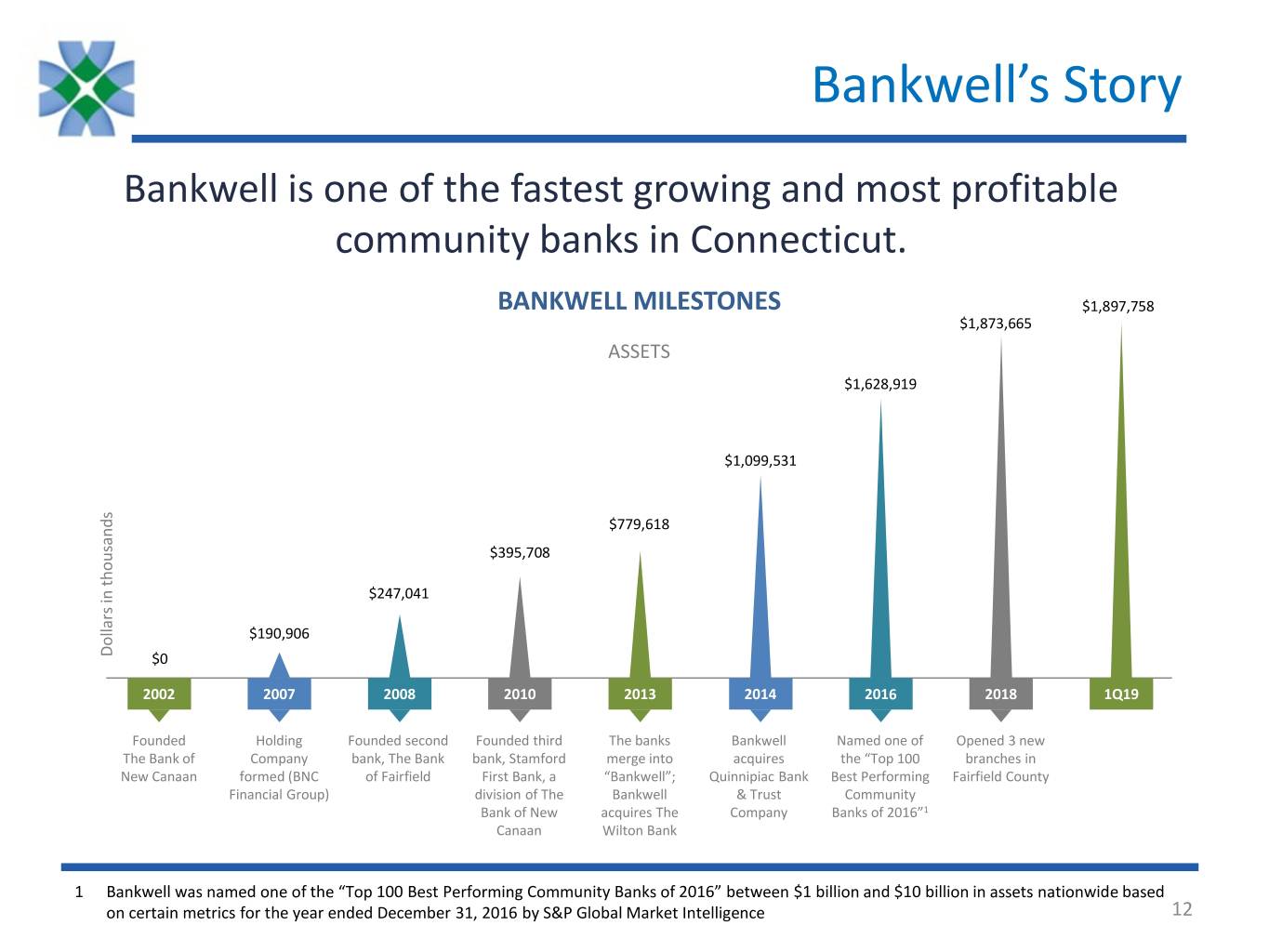

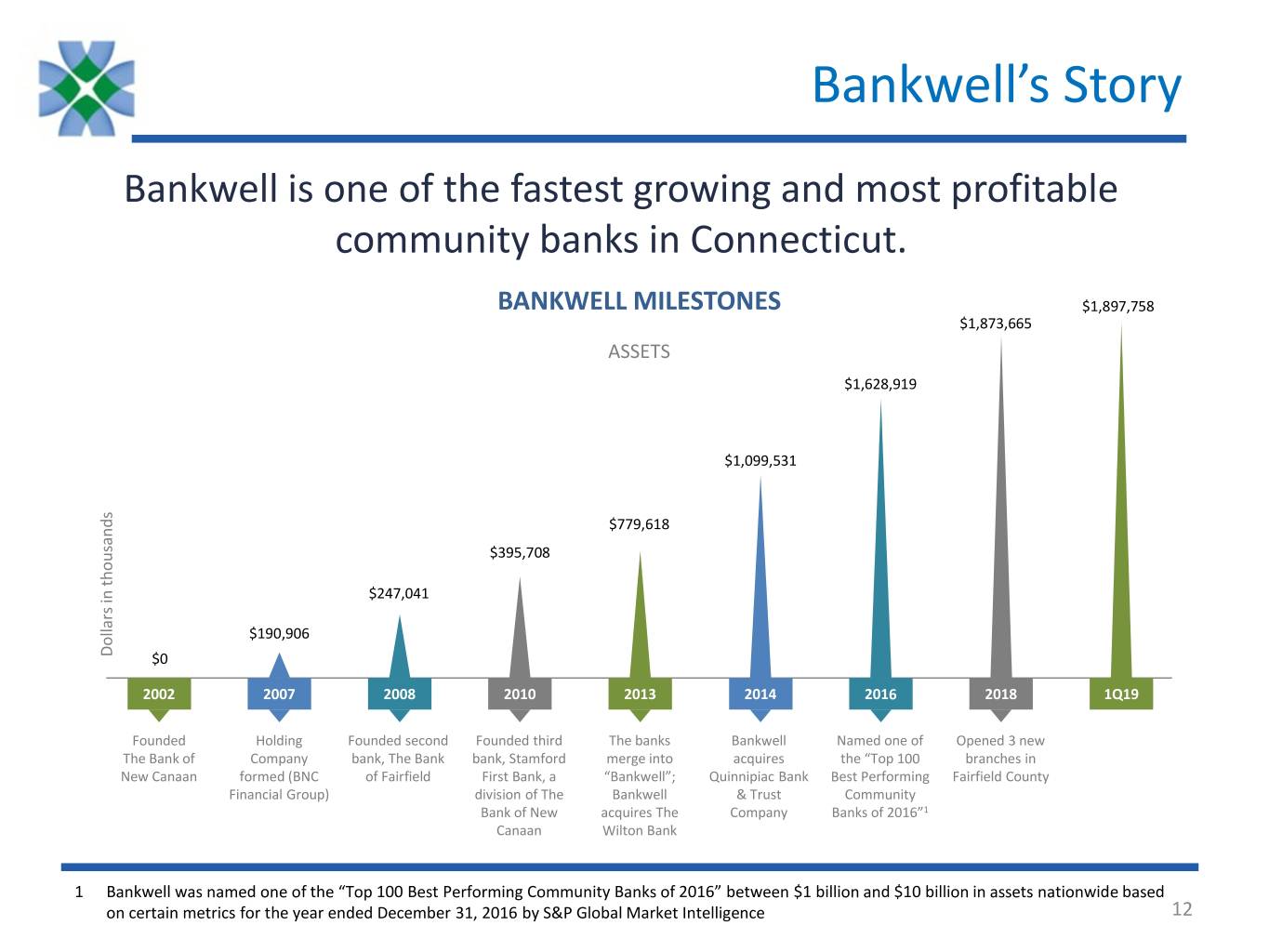

Bankwell’s Story Bankwell is one of the fastest growing and most profitable community banks in Connecticut. BANKWELL MILESTONES $1,897,758 $1,873,665 ASSETS $1,628,919 $1,099,531 $779,618 $395,708 $247,041 $190,906 Dollars in thousands in Dollars $0 2002 2007 2008 2010 2013 2014 2016 2018 1Q19 Founded Holding Founded second Founded third The banks Bankwell Named one of Opened 3 new The Bank of Company bank, The Bank bank, Stamford merge into acquires the “Top 100 branches in New Canaan formed (BNC of Fairfield First Bank, a “Bankwell”; Quinnipiac Bank Best Performing Fairfield County Financial Group) division of The Bankwell & Trust Community Bank of New acquires The Company Banks of 2016”1 Canaan Wilton Bank 1 Bankwell was named one of the “Top 100 Best Performing Community Banks of 2016” between $1 billion and $10 billion in assets nationwide based on certain metrics for the year ended December 31, 2016 by S&P Global Market Intelligence 12

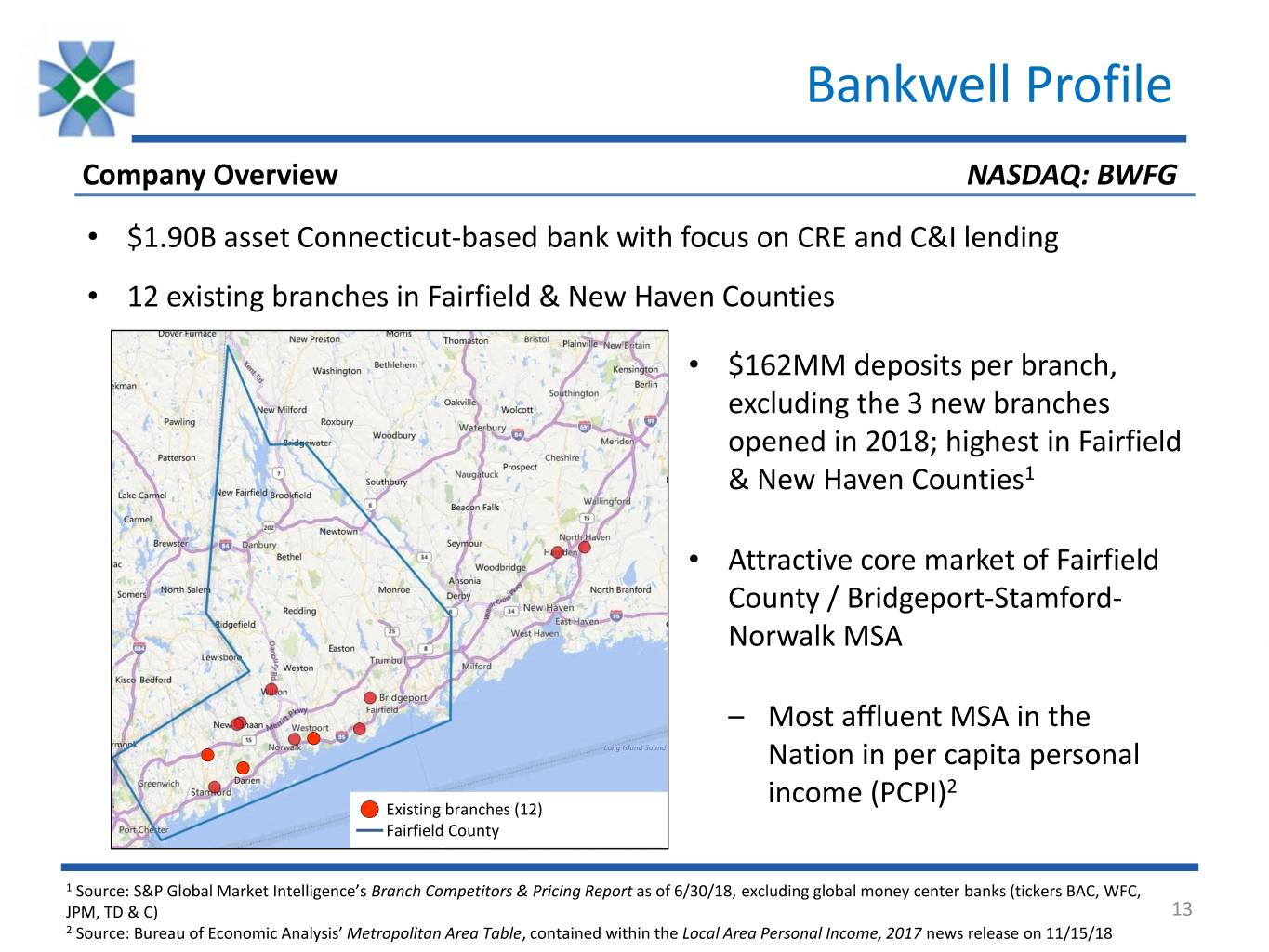

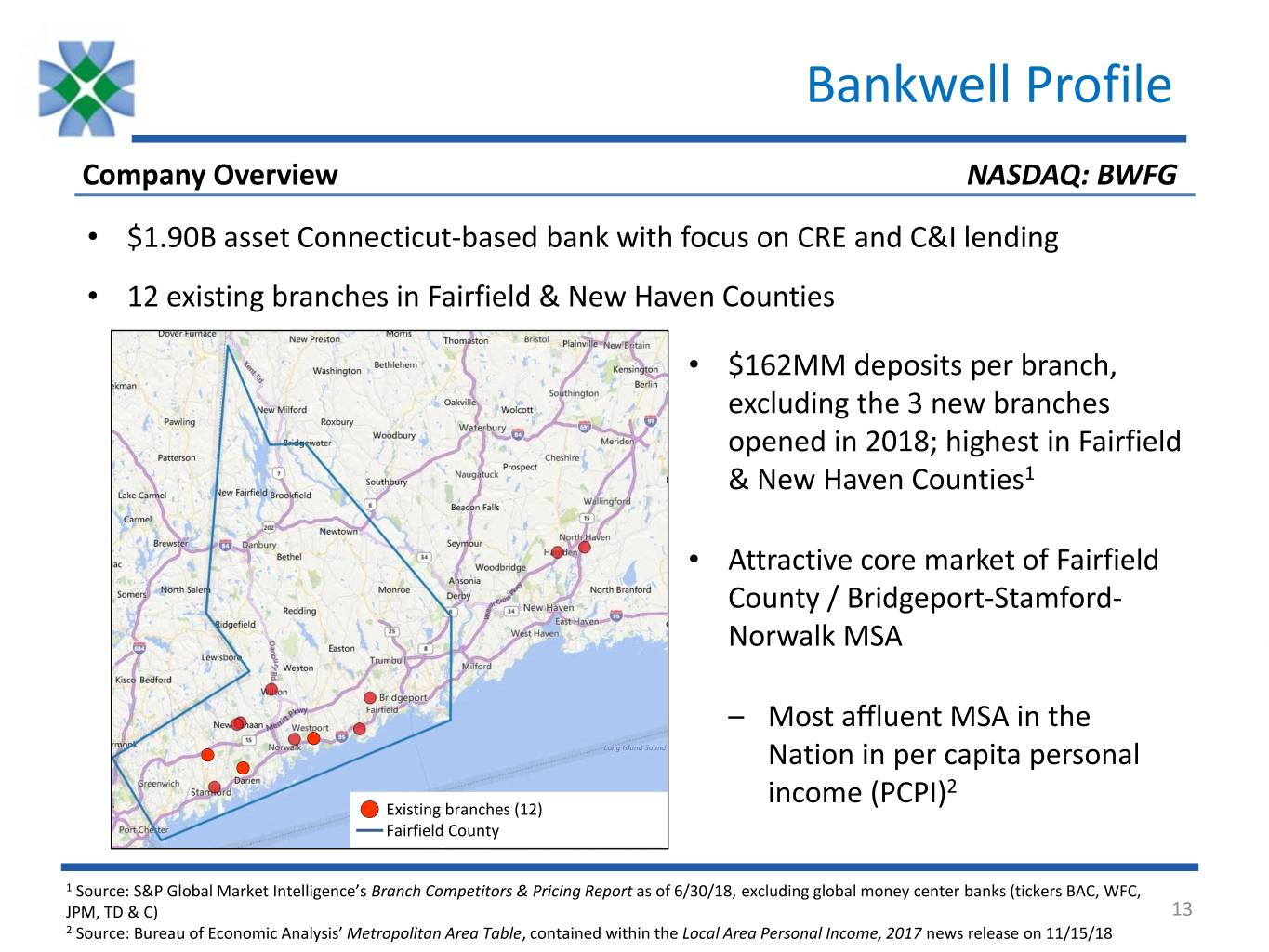

Bankwell Profile Company Overview NASDAQ: BWFG • $1.90B asset Connecticut-based bank with focus on CRE and C&I lending • 12 existing branches in Fairfield & New Haven Counties • $162MM deposits per branch, excluding the 3 new branches opened in 2018; highest in Fairfield & New Haven Counties1 • Attractive core market of Fairfield County / Bridgeport-Stamford- Norwalk MSA – Most affluent MSA in the Nation in per capita personal 2 Existing branches (12) income (PCPI) Fairfield County 1 Source: S&P Global Market Intelligence’s Branch Competitors & Pricing Report as of 6/30/18, excluding global money center banks (tickers BAC, WFC, JPM, TD & C) 13 2 Source: Bureau of Economic Analysis’ Metropolitan Area Table, contained within the Local Area Personal Income, 2017 news release on 11/15/18

Why Bankwell? • Proven track record of quality loan originations Growth • Tangible Book Value growth of 37% since 2014 IPO • Operates in premiere markets • Strong credit culture; prudent, conservative credit standards Risk • Historically low NPLs / NPAs with low charge-offs Management • Diverse product experience in CRE, C&I, Residential & Consumer • Bankwell stock price increased 62% since May 2014 IPO1 Performance • Strong Net Income growth; quarterly dividends paid since 4Q’15 • Capital ratios put BWFG well above “well capitalized” • Performance-driven, highly experienced Management Team Management • Strong BOD comprised of a broad cross-section of Subject Matter Experts • ~16% “Insider Ownership” of the Bank1 Outperformed KBW Regional Banking Index by 19% since ‘14 IPO1 1 as of March 29th, 2019 14

Portfolio Metrics

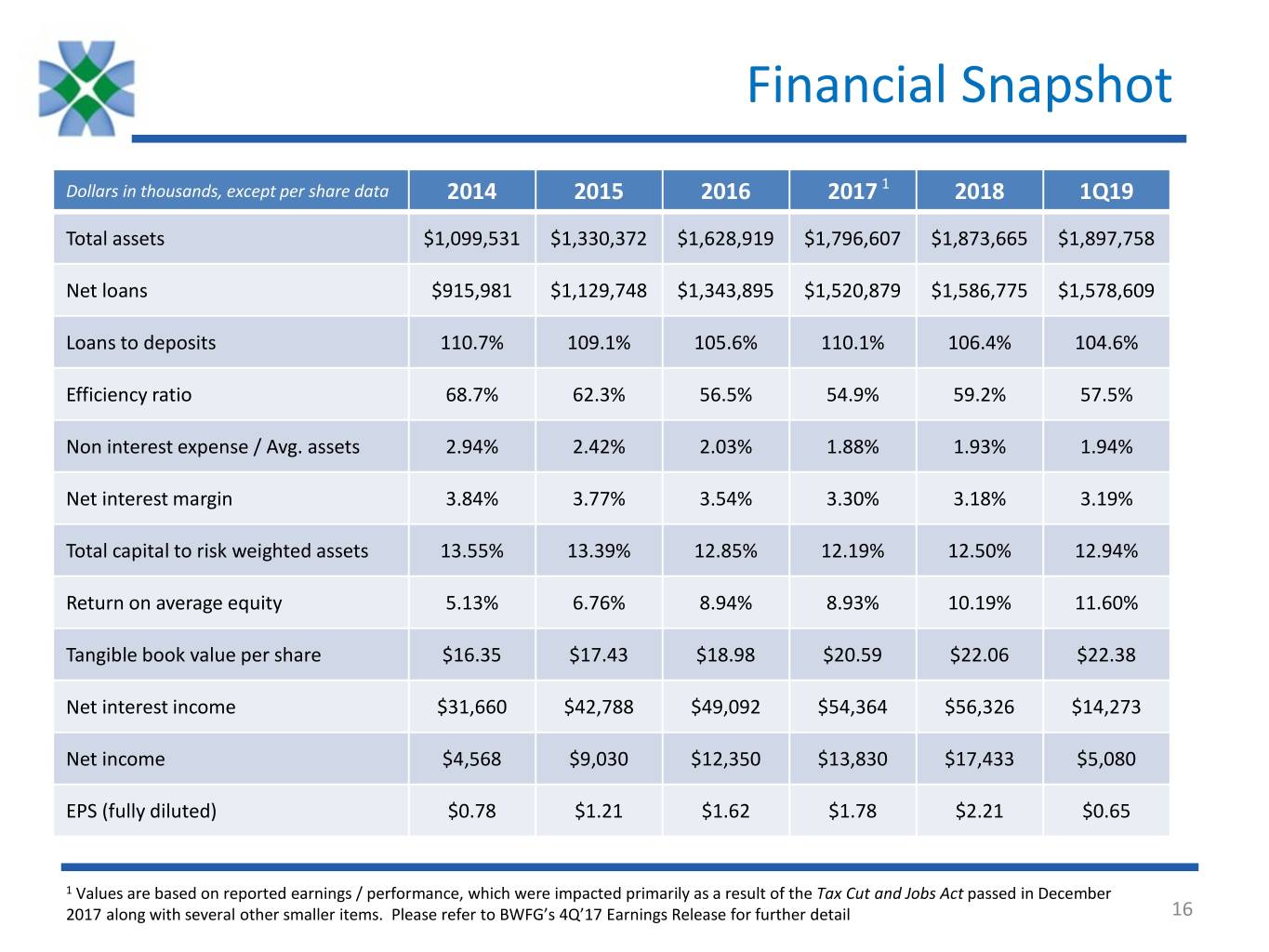

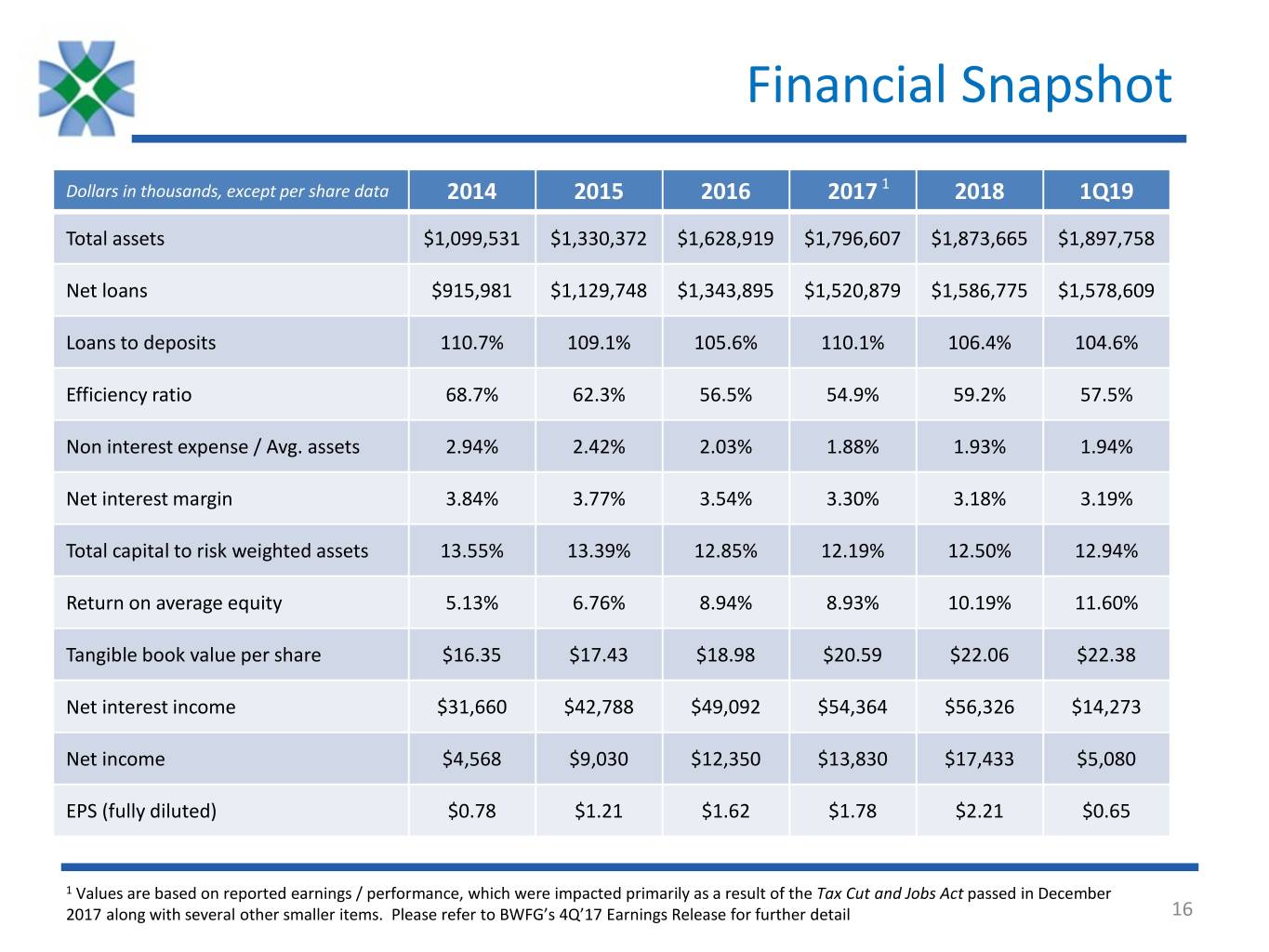

Financial Snapshot Dollars in thousands, except per share data 2014 2015 2016 2017 1 2018 1Q19 Total assets $1,099,531 $1,330,372 $1,628,919 $1,796,607 $1,873,665 $1,897,758 Net loans $915,981 $1,129,748 $1,343,895 $1,520,879 $1,586,775 $1,578,609 Loans to deposits 110.7% 109.1% 105.6% 110.1% 106.4% 104.6% Efficiency ratio 68.7% 62.3% 56.5% 54.9% 59.2% 57.5% Non interest expense / Avg. assets 2.94% 2.42% 2.03% 1.88% 1.93% 1.94% Net interest margin 3.84% 3.77% 3.54% 3.30% 3.18% 3.19% Total capital to risk weighted assets 13.55% 13.39% 12.85% 12.19% 12.50% 12.94% Return on average equity 5.13% 6.76% 8.94% 8.93% 10.19% 11.60% Tangible book value per share $16.35 $17.43 $18.98 $20.59 $22.06 $22.38 Net interest income $31,660 $42,788 $49,092 $54,364 $56,326 $14,273 Net income $4,568 $9,030 $12,350 $13,830 $17,433 $5,080 EPS (fully diluted) $0.78 $1.21 $1.62 $1.78 $2.21 $0.65 1 Values are based on reported earnings / performance, which were impacted primarily as a result of the Tax Cut and Jobs Act passed in December 2017 along with several other smaller items. Please refer to BWFG’s 4Q’17 Earnings Release for further detail 16

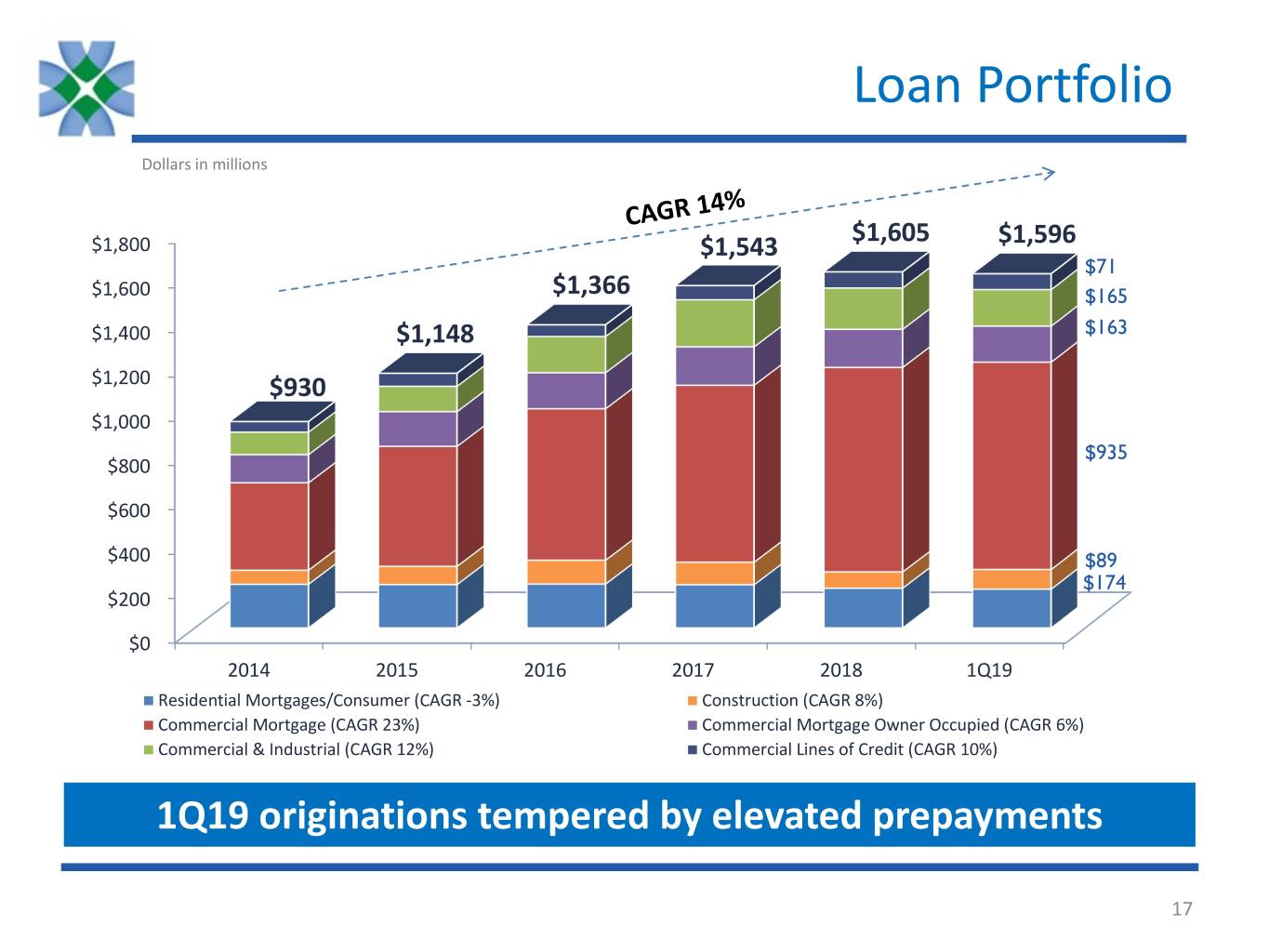

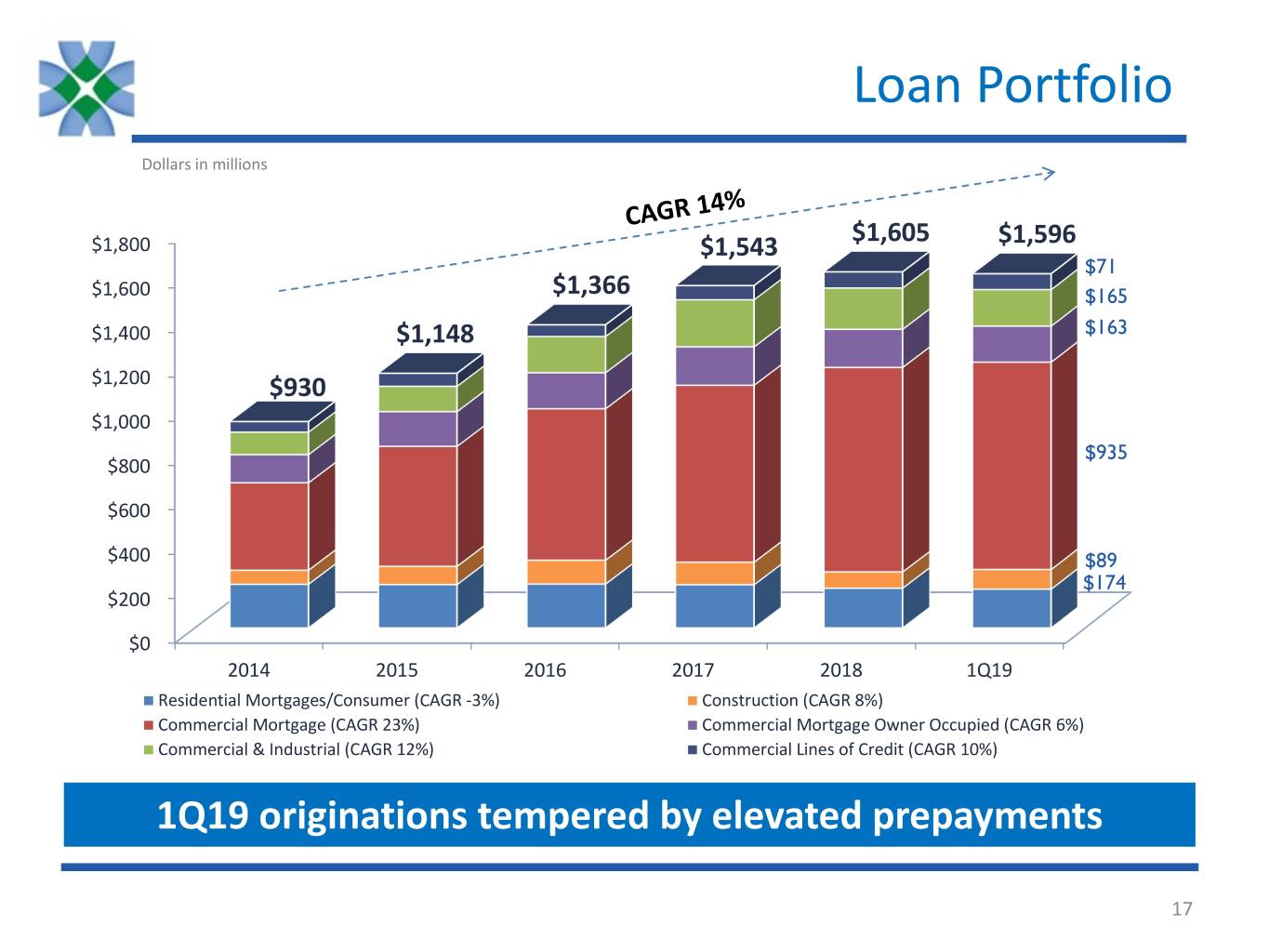

Loan Portfolio Dollars in millions $1,605 $1,800 $1,543 $1,596 $71 $1,600 $1,366 $165 $1,400 $1,148 $163 $1,200 $930 $1,000 $935 $800 $600 $400 $89 $174 $200 $0 2014 2015 2016 2017 2018 1Q19 Residential Mortgages/Consumer (CAGR -3%) Construction (CAGR 8%) Commercial Mortgage (CAGR 23%) Commercial Mortgage Owner Occupied (CAGR 6%) Commercial & Industrial (CAGR 12%) Commercial Lines of Credit (CAGR 10%) 1Q19 originations tempered by elevated prepayments 17

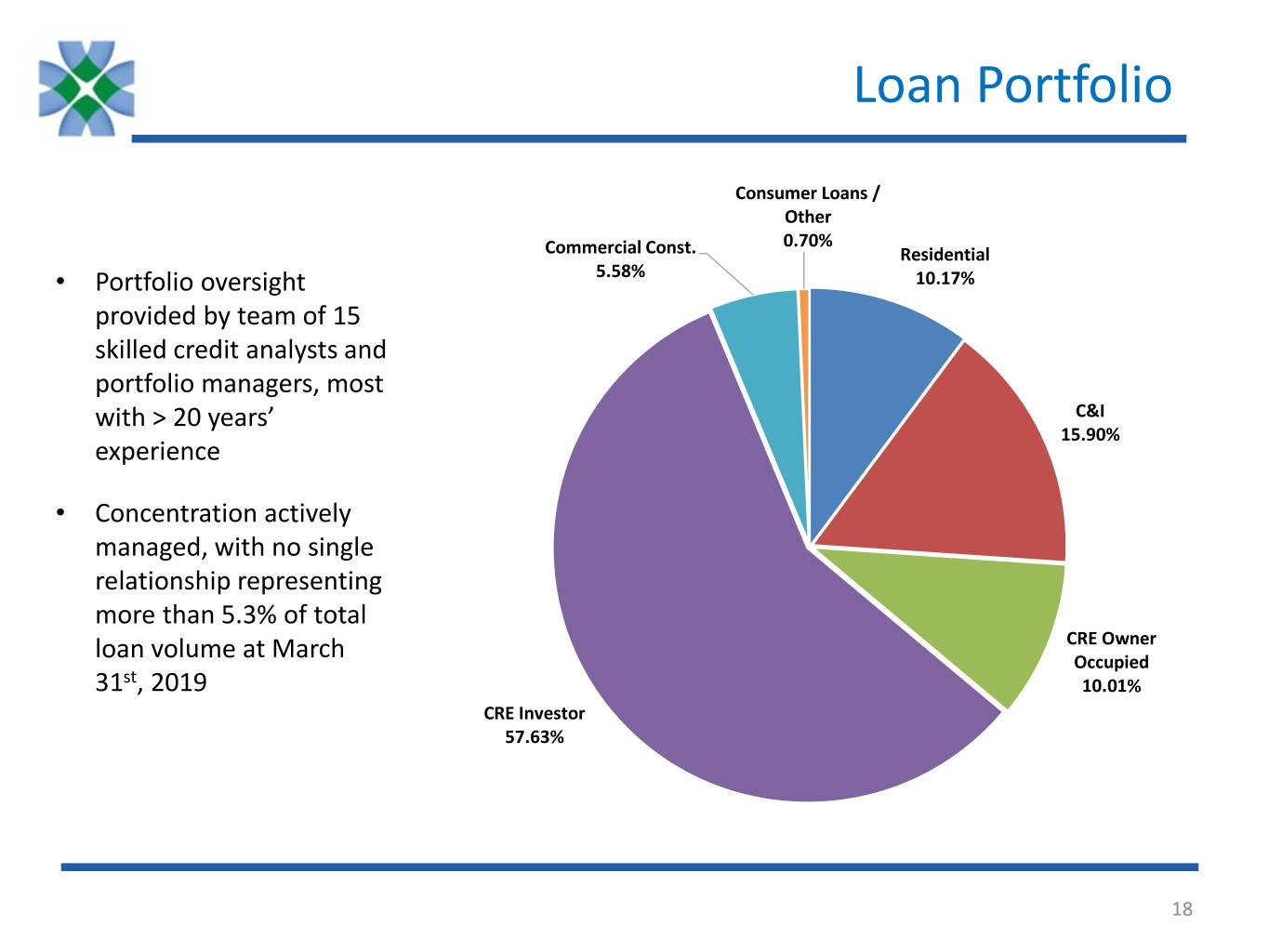

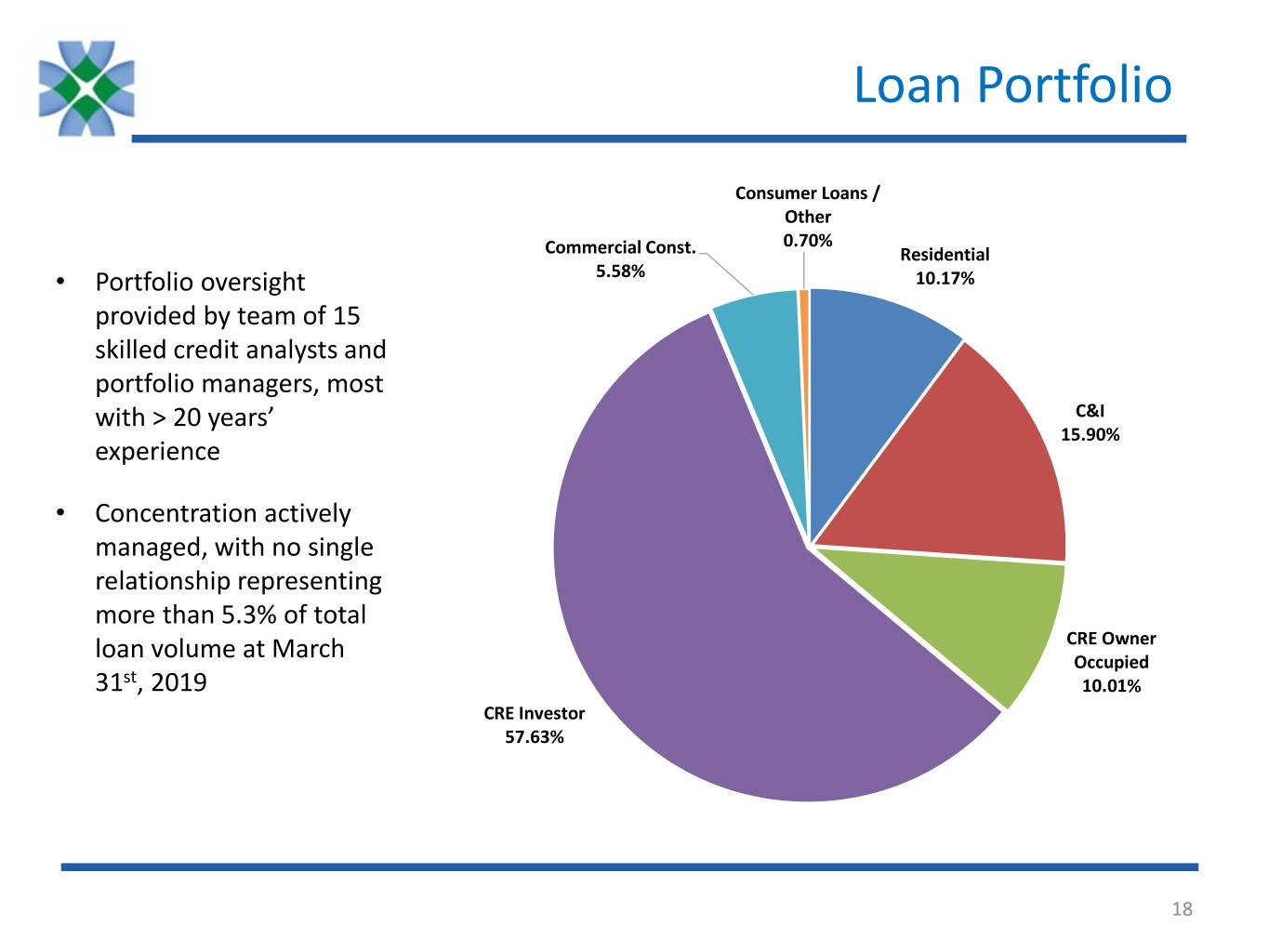

Loan Portfolio Consumer Loans / Other 0.70% Commercial Const. Residential • Portfolio oversight 5.58% 10.17% provided by team of 15 skilled credit analysts and portfolio managers, most with > 20 years’ C&I 15.90% experience • Concentration actively managed, with no single relationship representing more than 5.3% of total CRE Owner loan volume at March Occupied 31st, 2019 10.01% CRE Investor 57.63% 18

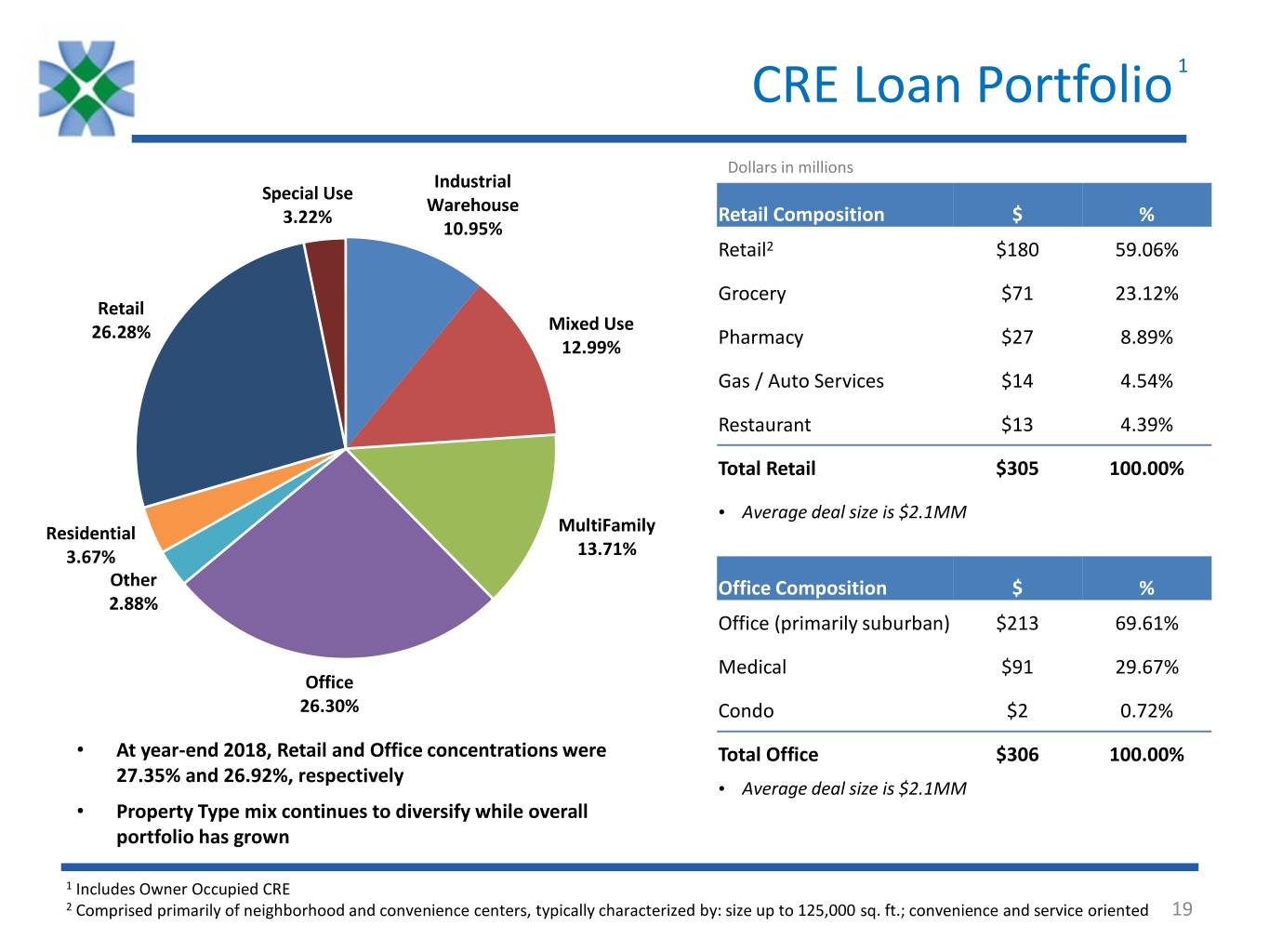

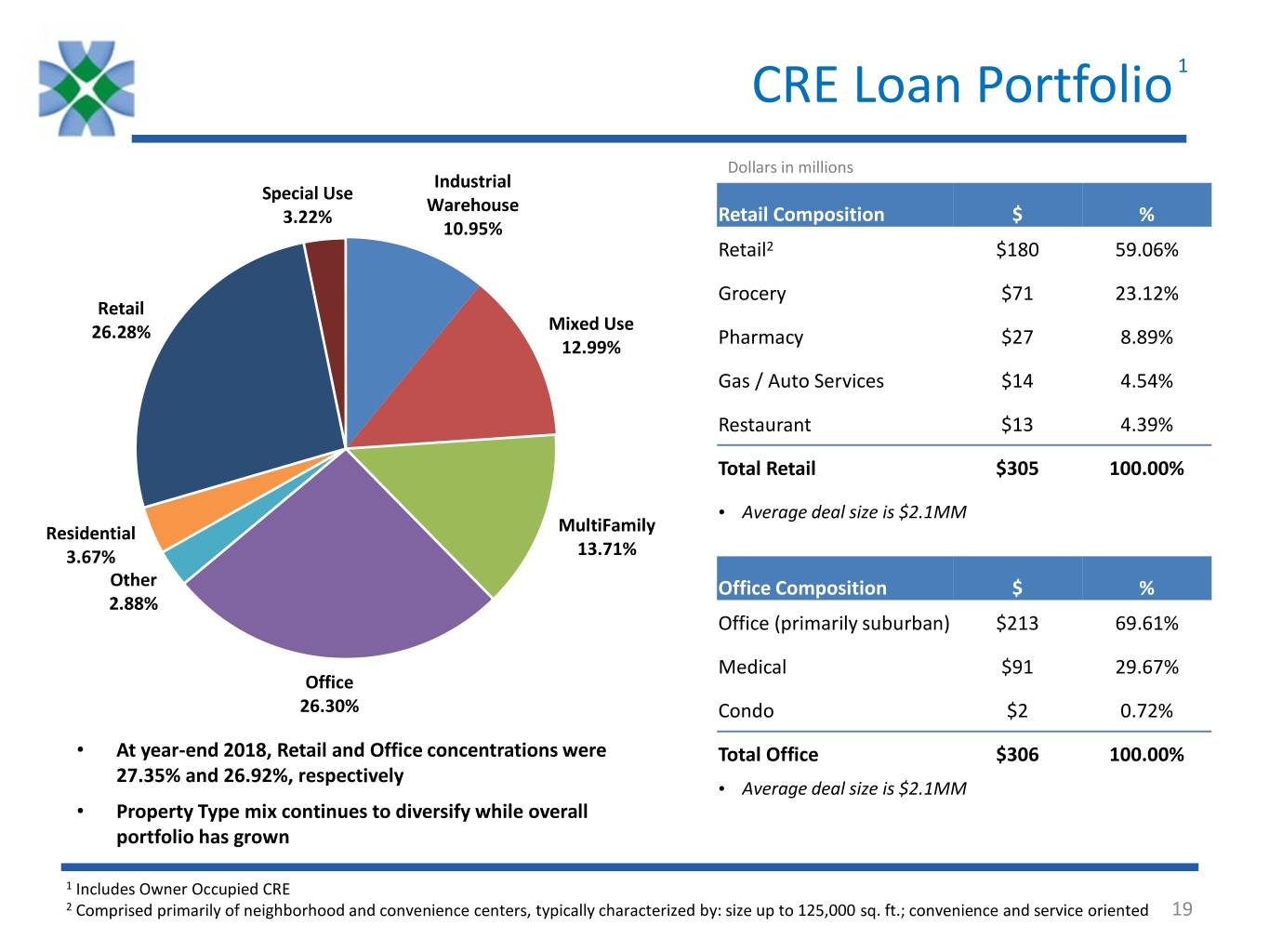

CRE Loan Portfolio 1 Dollars in millions Industrial Special Use Warehouse 3.22% Retail Composition $ % 10.95% Retail2 $180 59.06% Grocery $71 23.12% Retail 26.28% Mixed Use 12.99% Pharmacy $27 8.89% Gas / Auto Services $14 4.54% Restaurant $13 4.39% Total Retail $305 100.00% • Average deal size is $2.1MM Residential MultiFamily 3.67% 13.71% Other Office Composition $ % 2.88% Office (primarily suburban) $213 69.61% Medical $91 29.67% Office 26.30% Condo $2 0.72% • At year-end 2018, Retail and Office concentrations were Total Office $306 100.00% 27.35% and 26.92%, respectively • Average deal size is $2.1MM • Property Type mix continues to diversify while overall portfolio has grown 1 Includes Owner Occupied CRE 2 Comprised primarily of neighborhood and convenience centers, typically characterized by: size up to 125,000 sq. ft.; convenience and service oriented 19

CRE Loan Portfolio 1 Geography Distribution CRE to Risk Based Capital Ratio MA 480% TX GA 1.38% 471% 470% 1.49% 1.63% All Other 440% PA 8.77% 2.07% NY 14.28% CT 70.37% 2016 2017 2018 1Q19 • Proven track record as CRE Lender with strong risk management practices in place • Continued focus in primary market of the tri- • CRE Retail loans have an average LTV of 59% and an state area (CT/NY/NJ) but maintaining average DSCR of 1.66x diversification by following strongest customers • No significant exposure to any one retailer and no to growth markets exposure to bankrupt retailers 1 Includes Owner Occupied CRE 20

Deposits Dollars in millions $1,502 $1,521 $1,600 $1,398 $1,289 $1,400 $1,047 $650 $1,200 $1,000 $835 $800 $469 $600 $400 $179 $224 $200 $0 2014 2015 2016 2017 2018 1Q19 Checking Savings Money Market Time Deposits 21

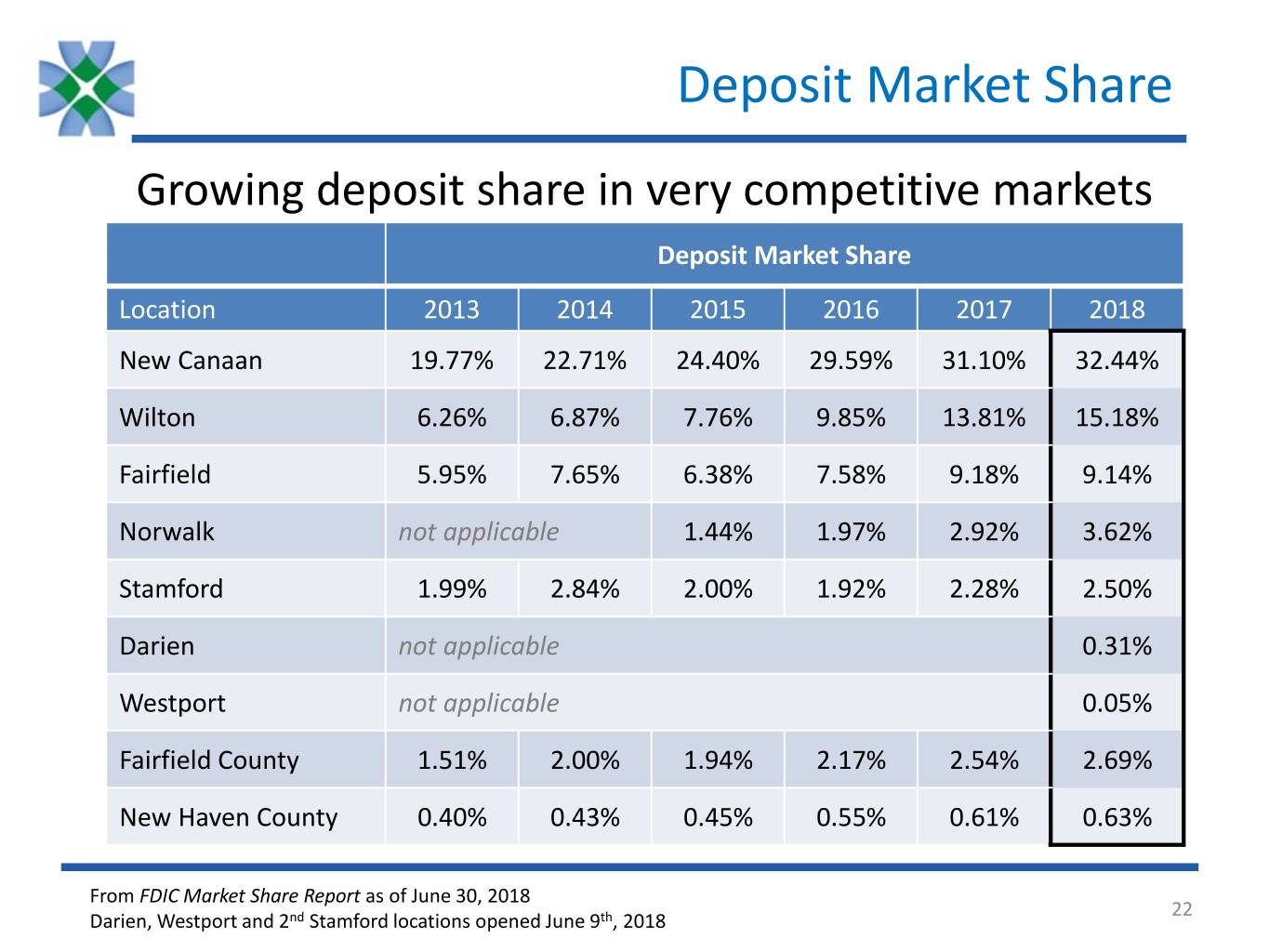

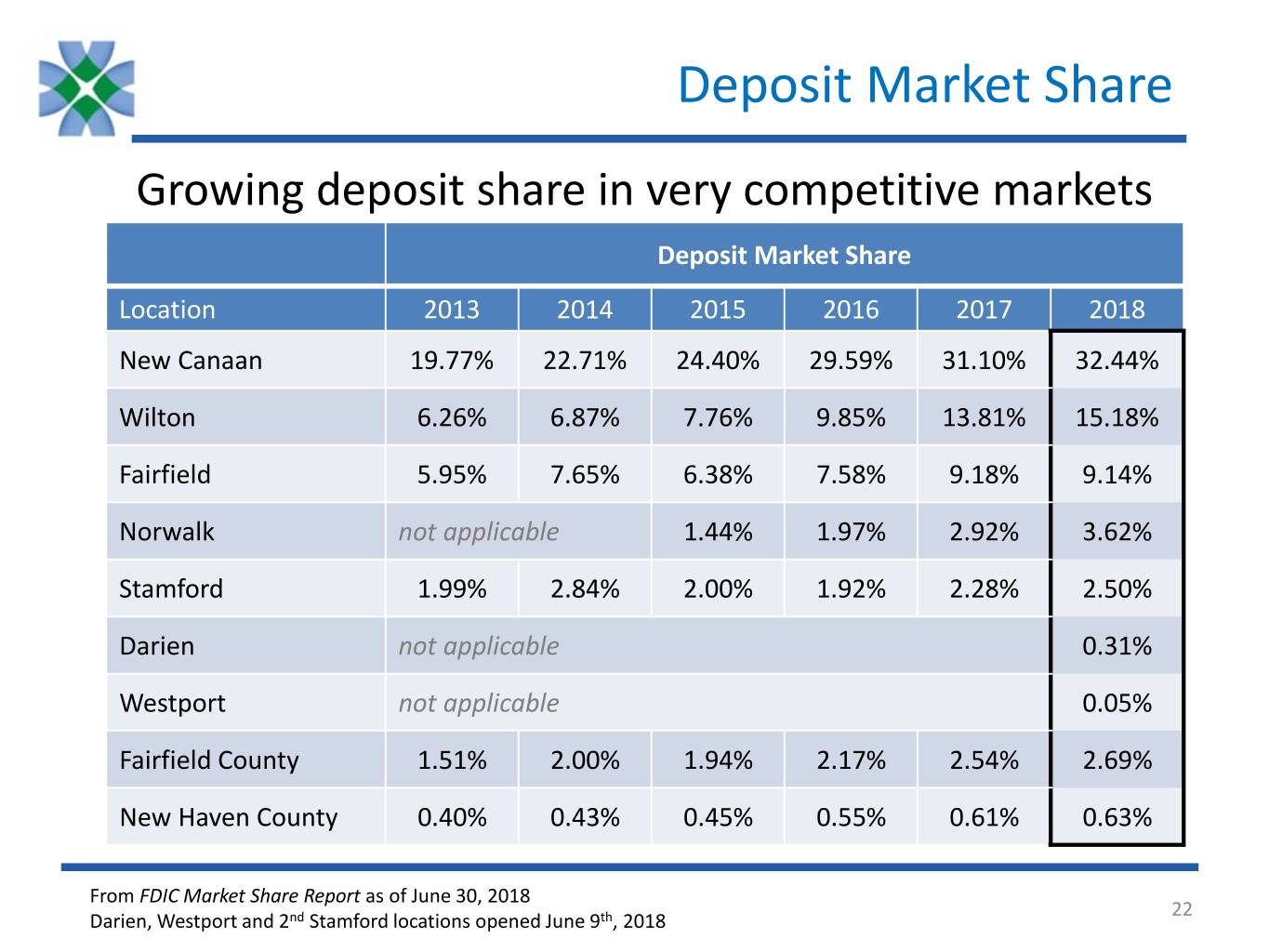

Deposit Market Share Growing deposit share in very competitive markets Deposit Market Share Location 2013 2014 2015 2016 2017 2018 New Canaan 19.77% 22.71% 24.40% 29.59% 31.10% 32.44% Wilton 6.26% 6.87% 7.76% 9.85% 13.81% 15.18% Fairfield 5.95% 7.65% 6.38% 7.58% 9.18% 9.14% Norwalk not applicable 1.44% 1.97% 2.92% 3.62% Stamford 1.99% 2.84% 2.00% 1.92% 2.28% 2.50% Darien not applicable 0.31% Westport not applicable 0.05% Fairfield County 1.51% 2.00% 1.94% 2.17% 2.54% 2.69% New Haven County 0.40% 0.43% 0.45% 0.55% 0.61% 0.63% From FDIC Market Share Report as of June 30, 2018 22 Darien, Westport and 2nd Stamford locations opened June 9th, 2018

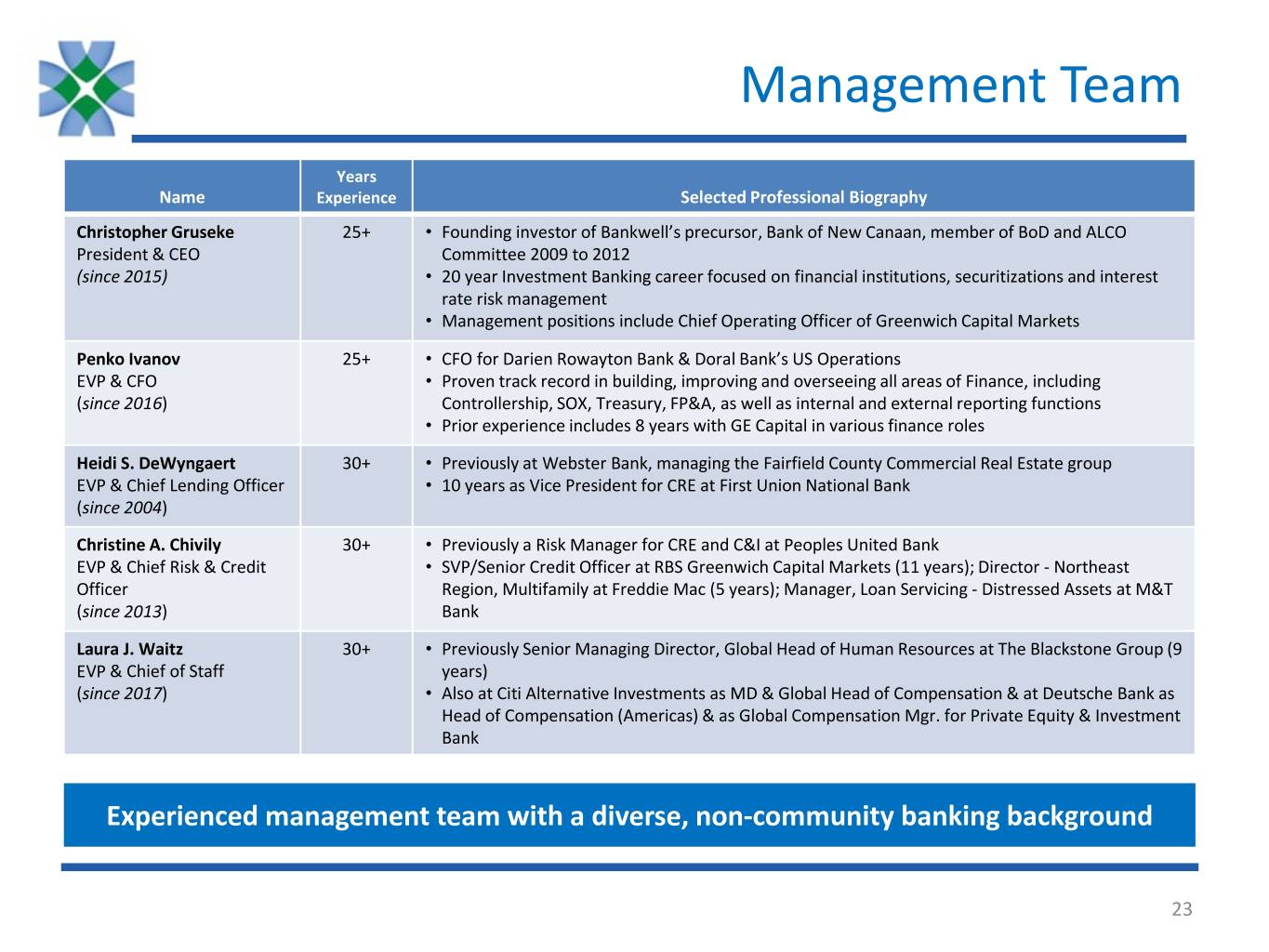

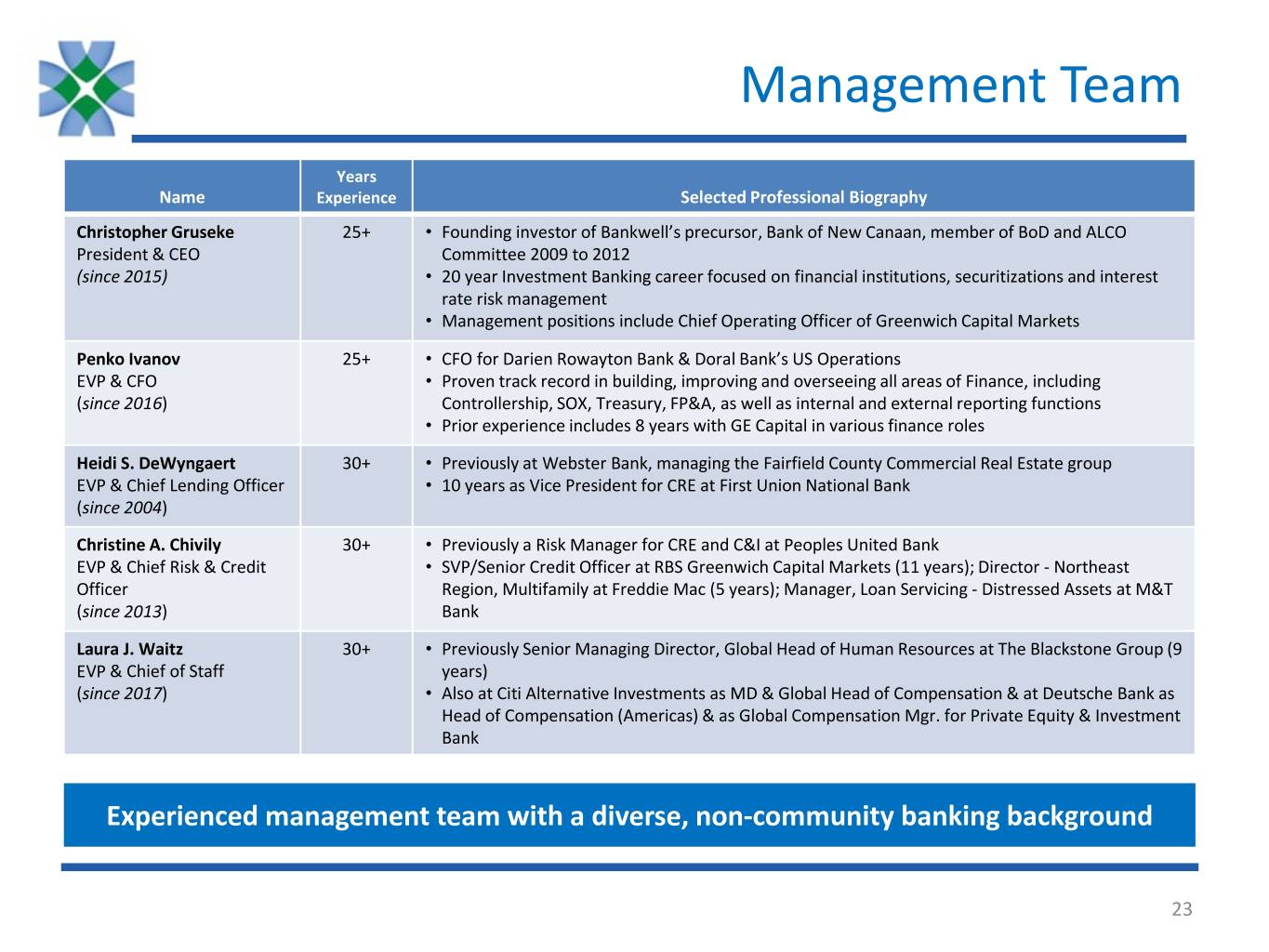

Management Team Years Name Experience Selected Professional Biography Christopher Gruseke 25+ • Founding investor of Bankwell’s precursor, Bank of New Canaan, member of BoD and ALCO President & CEO Committee 2009 to 2012 (since 2015) • 20 year Investment Banking career focused on financial institutions, securitizations and interest rate risk management • Management positions include Chief Operating Officer of Greenwich Capital Markets Penko Ivanov 25+ • CFO for Darien Rowayton Bank & Doral Bank’s US Operations EVP & CFO • Proven track record in building, improving and overseeing all areas of Finance, including (since 2016) Controllership, SOX, Treasury, FP&A, as well as internal and external reporting functions • Prior experience includes 8 years with GE Capital in various finance roles Heidi S. DeWyngaert 30+ • Previously at Webster Bank, managing the Fairfield County Commercial Real Estate group EVP & Chief Lending Officer • 10 years as Vice President for CRE at First Union National Bank (since 2004) Christine A. Chivily 30+ • Previously a Risk Manager for CRE and C&I at Peoples United Bank EVP & Chief Risk & Credit • SVP/Senior Credit Officer at RBS Greenwich Capital Markets (11 years); Director - Northeast Officer Region, Multifamily at Freddie Mac (5 years); Manager, Loan Servicing - Distressed Assets at M&T (since 2013) Bank Laura J. Waitz 30+ • Previously Senior Managing Director, Global Head of Human Resources at The Blackstone Group (9 EVP & Chief of Staff years) (since 2017) • Also at Citi Alternative Investments as MD & Global Head of Compensation & at Deutsche Bank as Head of Compensation (Americas) & as Global Compensation Mgr. for Private Equity & Investment Bank Experienced management team with a diverse, non-community banking background 23

Thank You & Questions