BWFG | LISTED | NASDAQ 3Q21 Investor Presentation October 27th, 2021

2 BWFG LISTED NASDAQ BWFG LISTED NASDAQ This presentation may contain certain forward-looking statements about Bankwell Financial Group, Inc. (the “Company”). Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. The COVID-19 pandemic continues to affect Bankwell Financial Group, its customers, counterparties, employees, and third party service providers, and the ultimate extent of the impacts on its business, financial position, results of operations, liquidity, and prospects is unknown. Safe Harbor

3 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Table of Contents • 3Q21 Performance • Trends • ALLL & Non-Performing Loans • Loan Portfolio • Capital • Bankwell History & Overview

BWFG | LISTED | NASDAQ 3Q21 Performance

5 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 3Q21 Summary • $6.85 million reported net income, or $0.87 earnings per share • Pre-tax, pre-provision net revenue (“PPNR”)1 of $8.79 million; 96% year-over-year increase • Quarterly loan growth of $92 million, or 5%, excluding PPP loan balances ̶ Year-to-date total loan growth of ~$232 million, or 19% annualized • Return on Average Assets and Return on Average Equity were 1.22% and 14.09%, respectively for the quarter, and 1.12% and 13.29% year-to-date • 8 basis point linked quarter deposit cost reduction to 50 basis points • 3Q21 Net Interest Margin (“NIM”) of 3.39%, year-to-date NIM of 3.08% • Repurchased 52,277 shares at an average price of $27.26 per share ̶ Authorized an additional 200 thousand shares, for a total of ~376 thousand shares available for repurchase • The Company declared a 4Q21 dividend of $0.18 per share • Subsequent to September 30th, 2021, Bankwell issued $35 million of subordinated notes at 3.25%; proceeds will be used for: ̶ Repayment of $15.5 million of existing subordinated notes ̶ General corporate purposes 1 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense

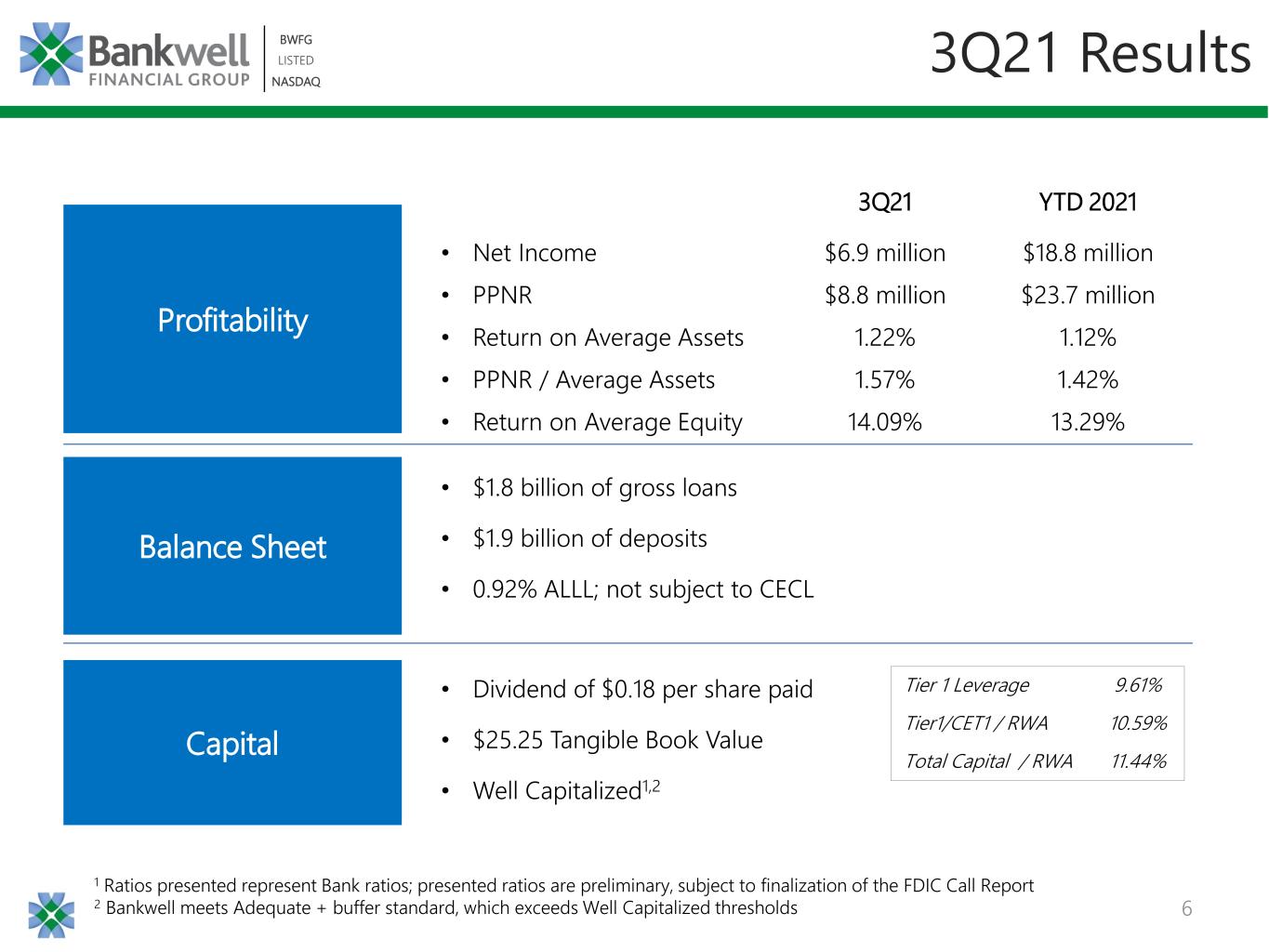

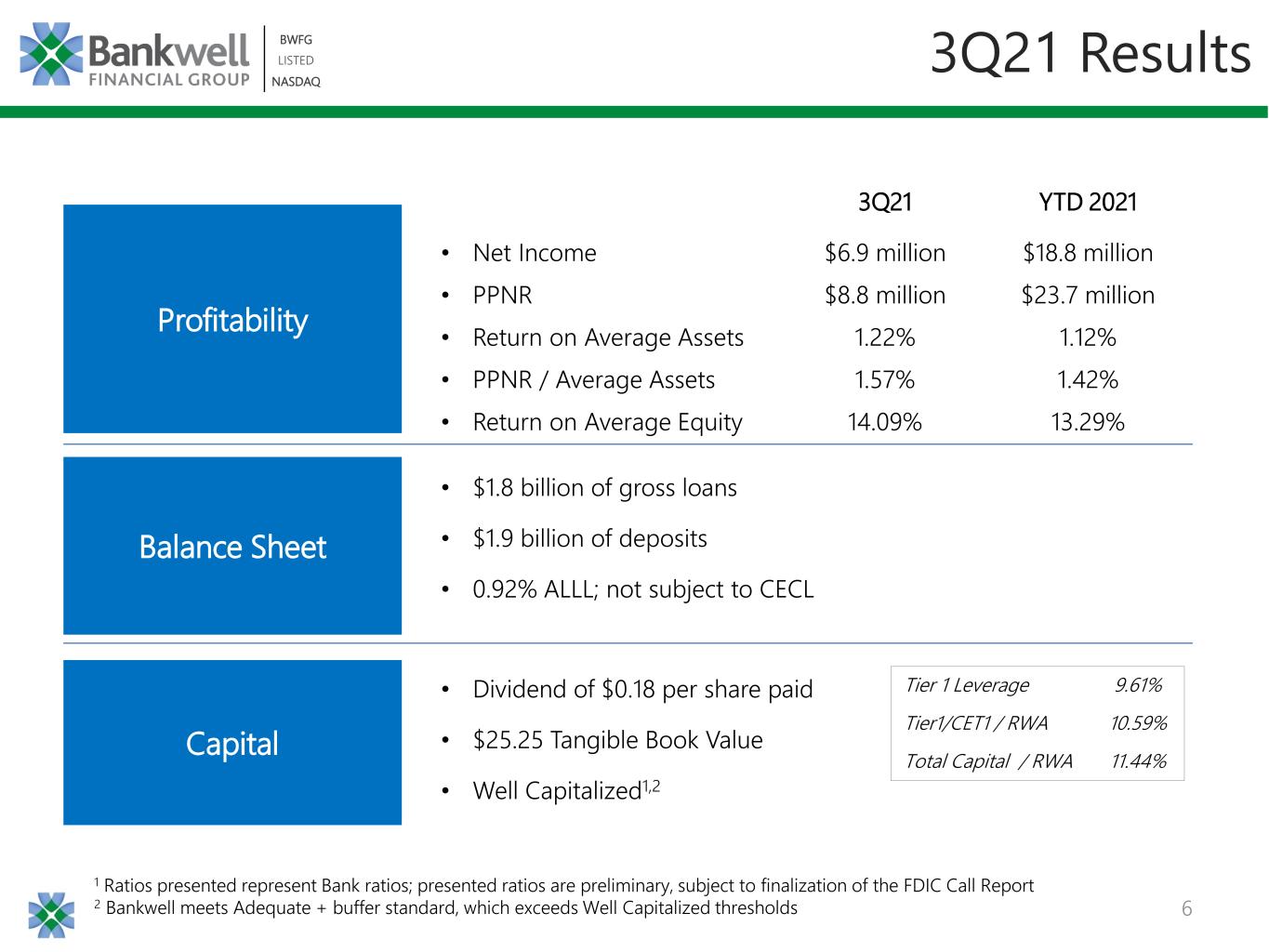

6 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 3Q21 Results 1 Ratios presented represent Bank ratios; presented ratios are preliminary, subject to finalization of the FDIC Call Report 2 Bankwell meets Adequate + buffer standard, which exceeds Well Capitalized thresholds Profitability Balance Sheet Capital • $1.8 billion of gross loans • $1.9 billion of deposits • 0.92% ALLL; not subject to CECL • Dividend of $0.18 per share paid • $25.25 Tangible Book Value • Well Capitalized1,2 Tier 1 Leverage 9.61% Tier1/CET1 / RWA 10.59% Total Capital / RWA 11.44% 3Q21 YTD 2021 • Net Income $6.9 million $18.8 million • PPNR $8.8 million $23.7 million • Return on Average Assets 1.22% 1.12% • PPNR / Average Assets 1.57% 1.42% • Return on Average Equity 14.09% 13.29%

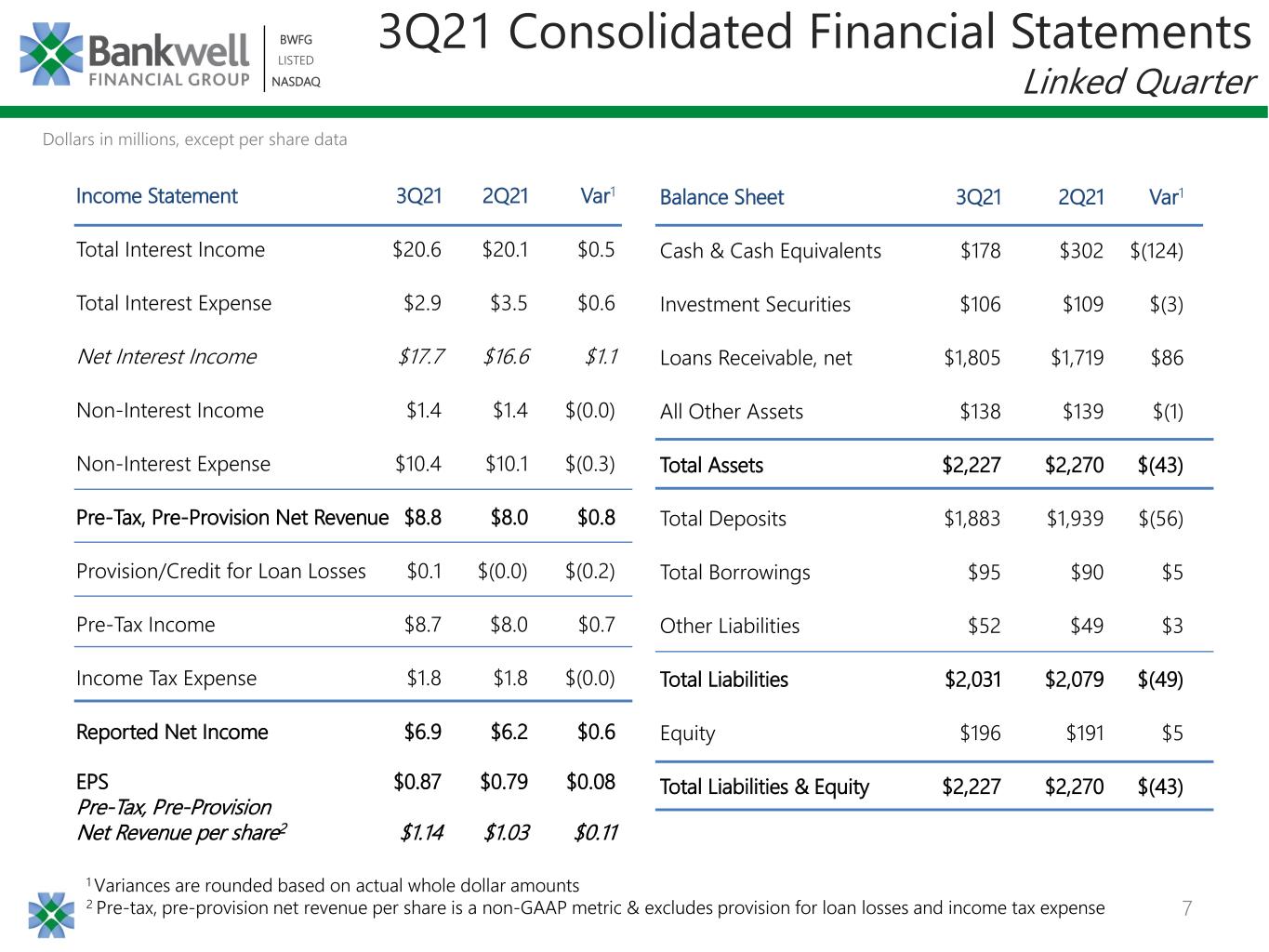

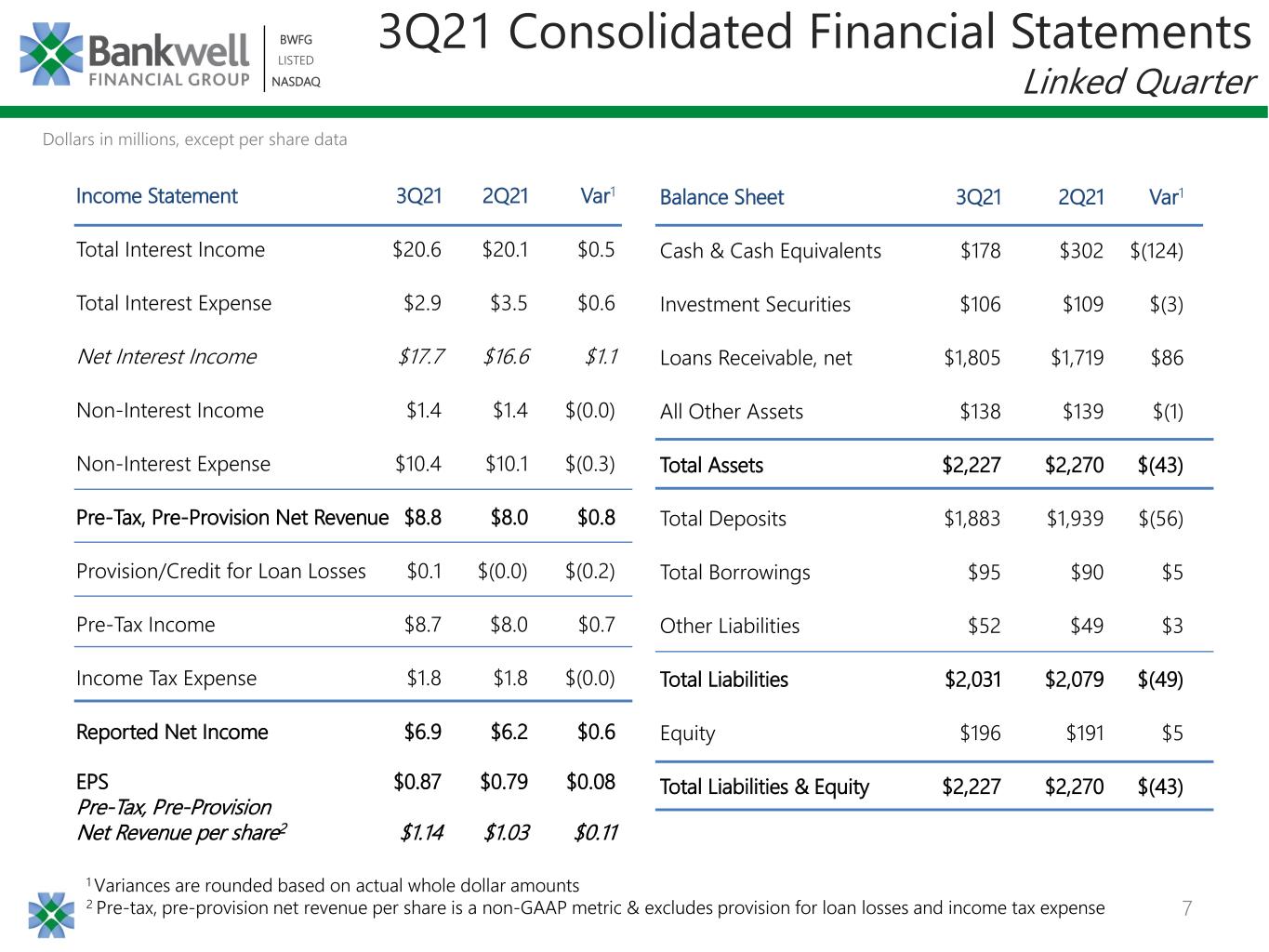

7 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Income Statement 3Q21 2Q21 Var1 Total Interest Income $20.6 $20.1 $0.5 Total Interest Expense $2.9 $3.5 $0.6 Net Interest Income $17.7 $16.6 $1.1 Non-Interest Income $1.4 $1.4 $(0.0) Non-Interest Expense $10.4 $10.1 $(0.3) Pre-Tax, Pre-Provision Net Revenue $8.8 $8.0 $0.8 Provision/Credit for Loan Losses $0.1 $(0.0) $(0.2) Pre-Tax Income $8.7 $8.0 $0.7 Income Tax Expense $1.8 $1.8 $(0.0) Reported Net Income $6.9 $6.2 $0.6 EPS $0.87 $0.79 $0.08 Pre-Tax, Pre-Provision Net Revenue per share2 $1.14 $1.03 $0.11 1 Variances are rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense Dollars in millions, except per share data Balance Sheet 3Q21 2Q21 Var1 Cash & Cash Equivalents $178 $302 $(124) Investment Securities $106 $109 $(3) Loans Receivable, net $1,805 $1,719 $86 All Other Assets $138 $139 $(1) Total Assets $2,227 $2,270 $(43) Total Deposits $1,883 $1,939 $(56) Total Borrowings $95 $90 $5 Other Liabilities $52 $49 $3 Total Liabilities $2,031 $2,079 $(49) Equity $196 $191 $5 Total Liabilities & Equity $2,227 $2,270 $(43) 3Q21 Consolidated Financial Statements Linked Quarter

8 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Income Statement 3Q21 YTD 3Q20 YTD Var1 Total Interest Income $59.5 $58.3 $1.1 Total Interest Expense $10.5 $17.8 $7.3 Net Interest Income $49.0 $40.5 $8.4 Non-Interest Income2 $4.8 $2.3 $2.6 Non-Interest Expense $30.1 $29.1 $(1.0) Pre-Tax, Pre-Provision Net Revenue $23.7 $13.7 $10.0 Credit/Provision for Loan Losses $(0.2) $6.9 $7.1 Pre-Tax Income $23.9 $6.8 $17.1 Income Tax Expense $5.1 $1.2 $(3.9) Reported Net Income $18.8 $5.6 $13.2 EPS $2.37 $0.71 $1.66 Pre-Tax, Pre-Provision Net Revenue per share3 $3.06 $1.77 $1.29 1 Variances are rounded based on actual whole dollar amounts 2 2021 includes the one-time benefit for the federal payroll tax credit for COVID-19-impacted small businesses 3 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense Dollars in millions, except per share data 3Q21 YTD Consolidated Income Statement Prior Year

BWFG | LISTED | NASDAQ Trends

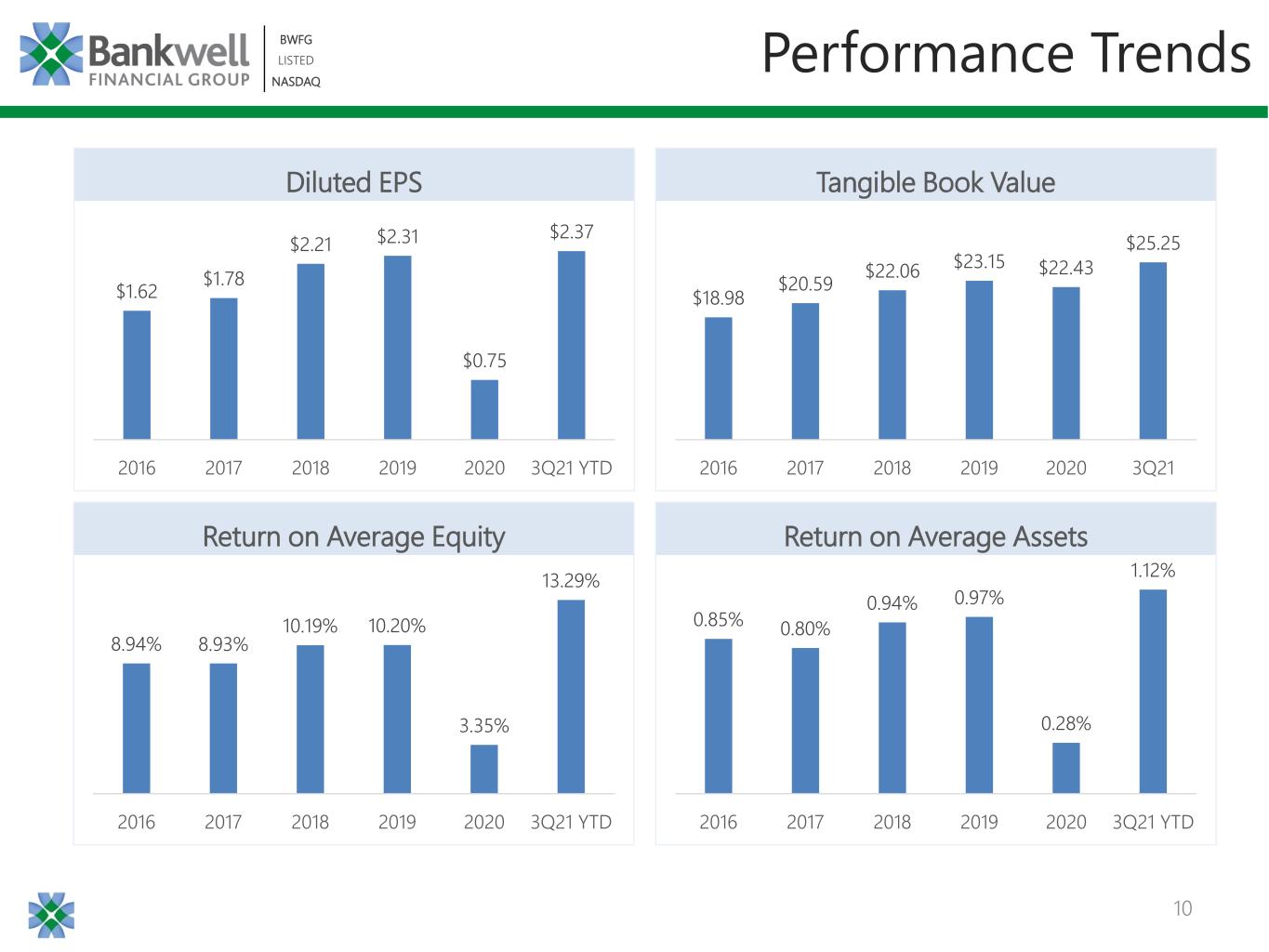

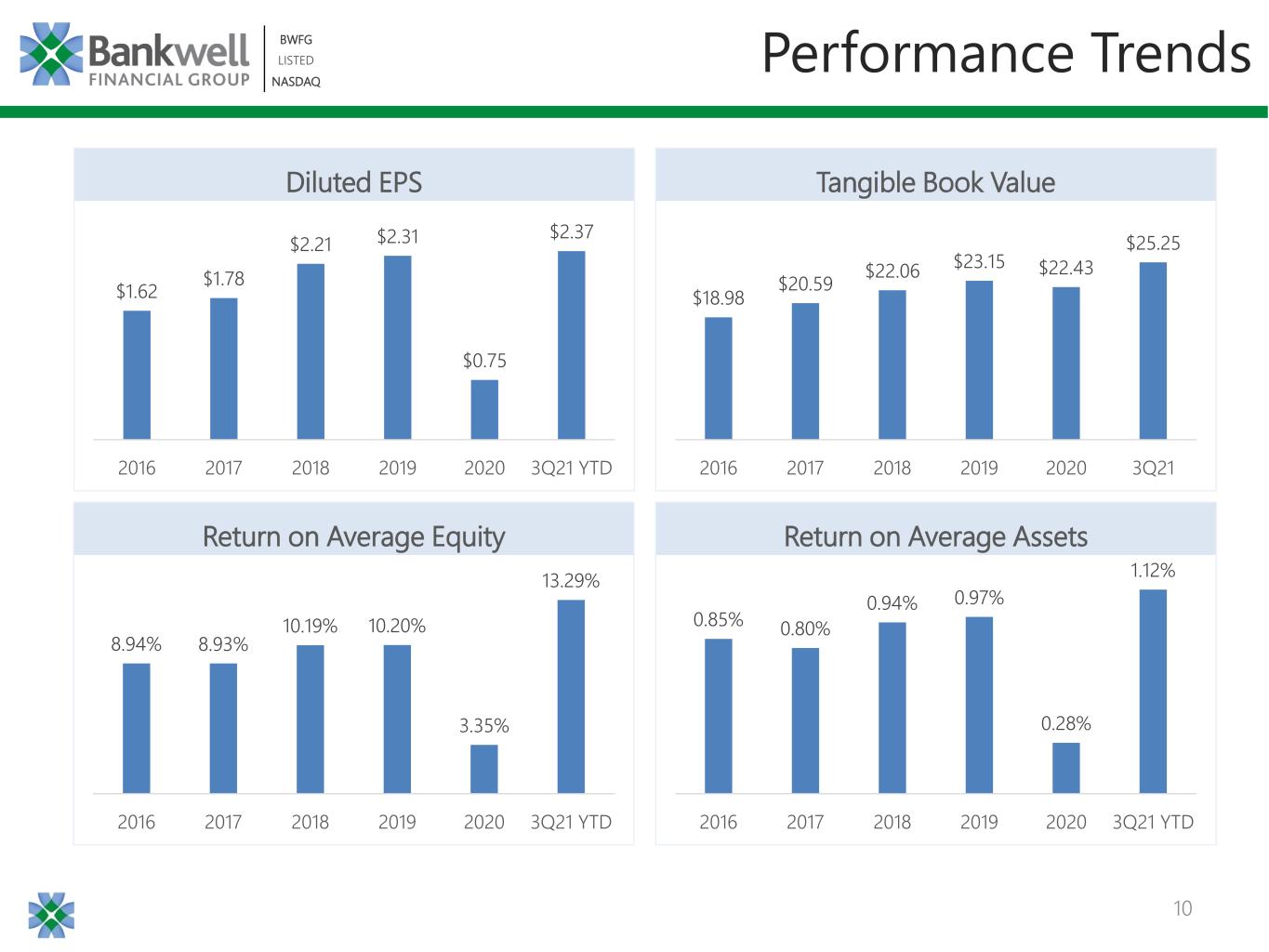

10 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Performance Trends $18.98 $20.59 $22.06 $23.15 $22.43 $25.25 2016 2017 2018 2019 2020 3Q21 Tangible Book Value $1.62 $1.78 $2.21 $2.31 $0.75 $2.37 2016 2017 2018 2019 2020 3Q21 YTD Diluted EPS 0.85% 0.80% 0.94% 0.97% 0.28% 1.12% 2016 2017 2018 2019 2020 3Q21 YTD Return on Average Assets 8.94% 8.93% 10.19% 10.20% 3.35% 13.29% 2016 2017 2018 2019 2020 3Q21 YTD Return on Average Equity

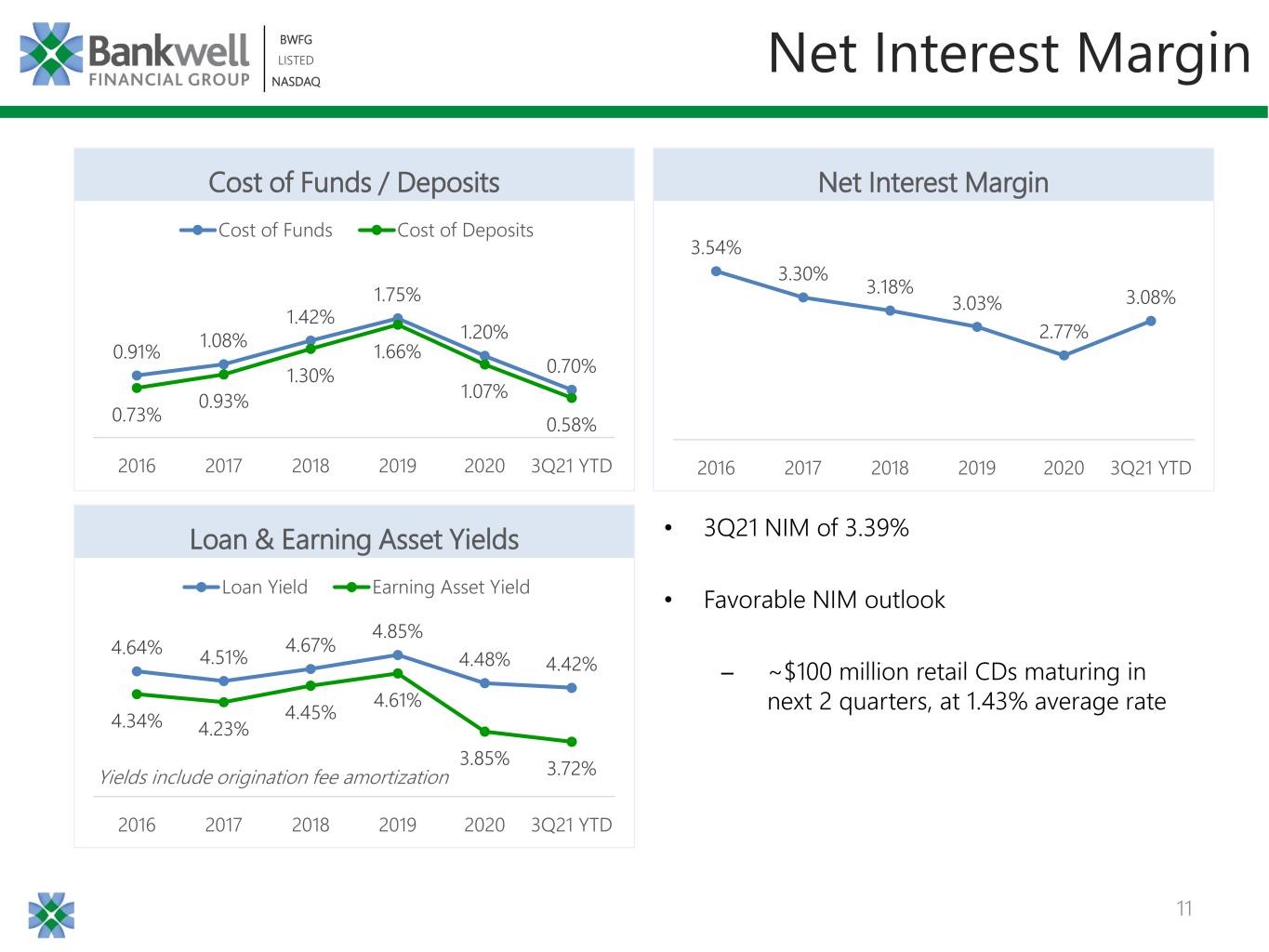

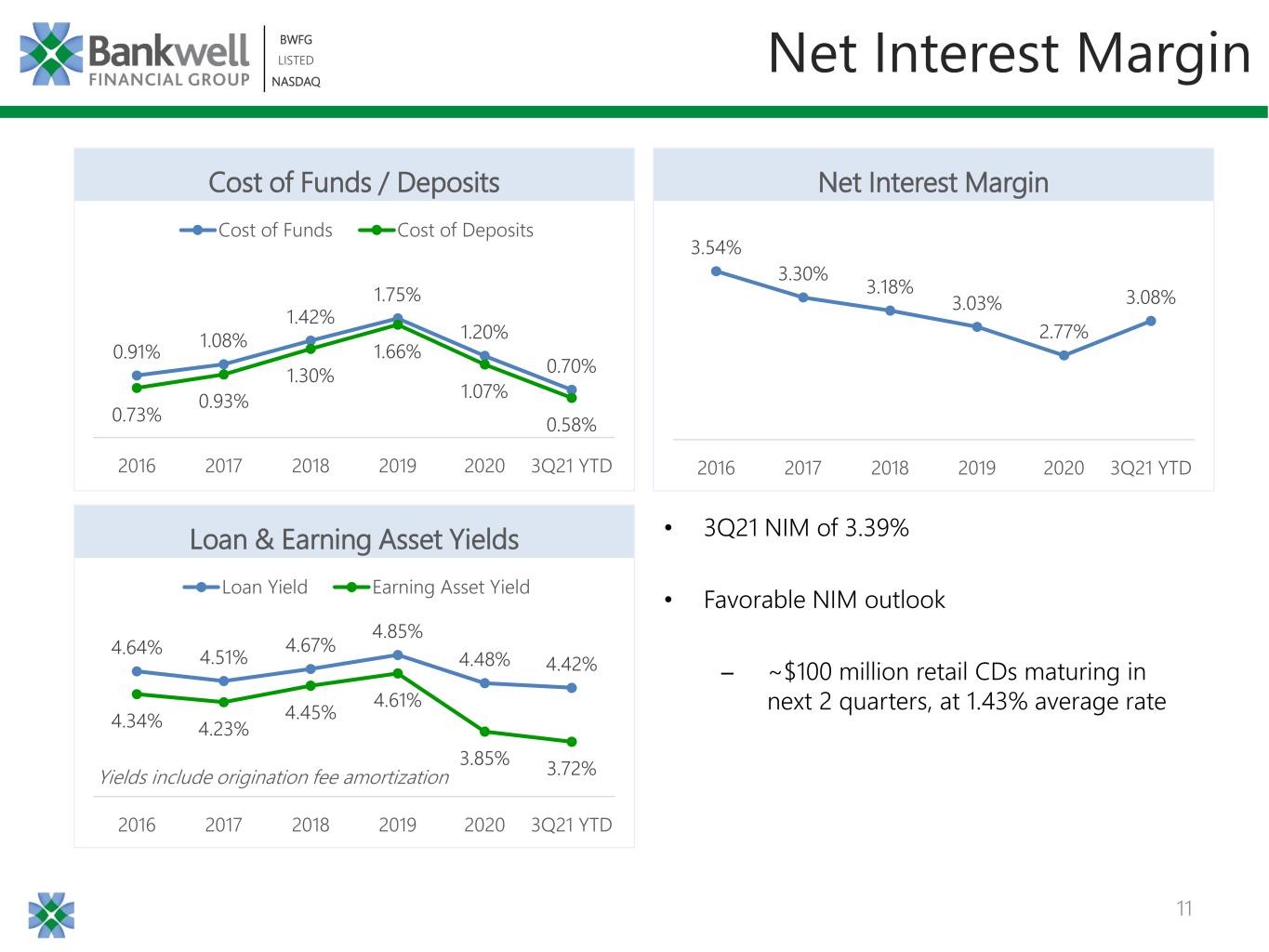

11 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Net Interest Margin 3.54% 3.30% 3.18% 3.03% 2.77% 3.08% 2016 2017 2018 2019 2020 3Q21 YTD Net Interest Margin • 3Q21 NIM of 3.39% • Favorable NIM outlook ̶ ~$100 million retail CDs maturing in next 2 quarters, at 1.43% average rate 0.91% 1.08% 1.42% 1.75% 1.20% 0.70% 0.73% 0.93% 1.30% 1.66% 1.07% 0.58% 2016 2017 2018 2019 2020 3Q21 YTD Cost of Funds / Deposits Cost of Funds Cost of Deposits 4.64% 4.51% 4.67% 4.85% 4.48% 4.42% 4.34% 4.23% 4.45% 4.61% 3.85% 3.72% 2016 2017 2018 2019 2020 3Q21 YTD Loan & Earning Asset Yields Loan Yield Earning Asset Yield Yields include origination fee amortization

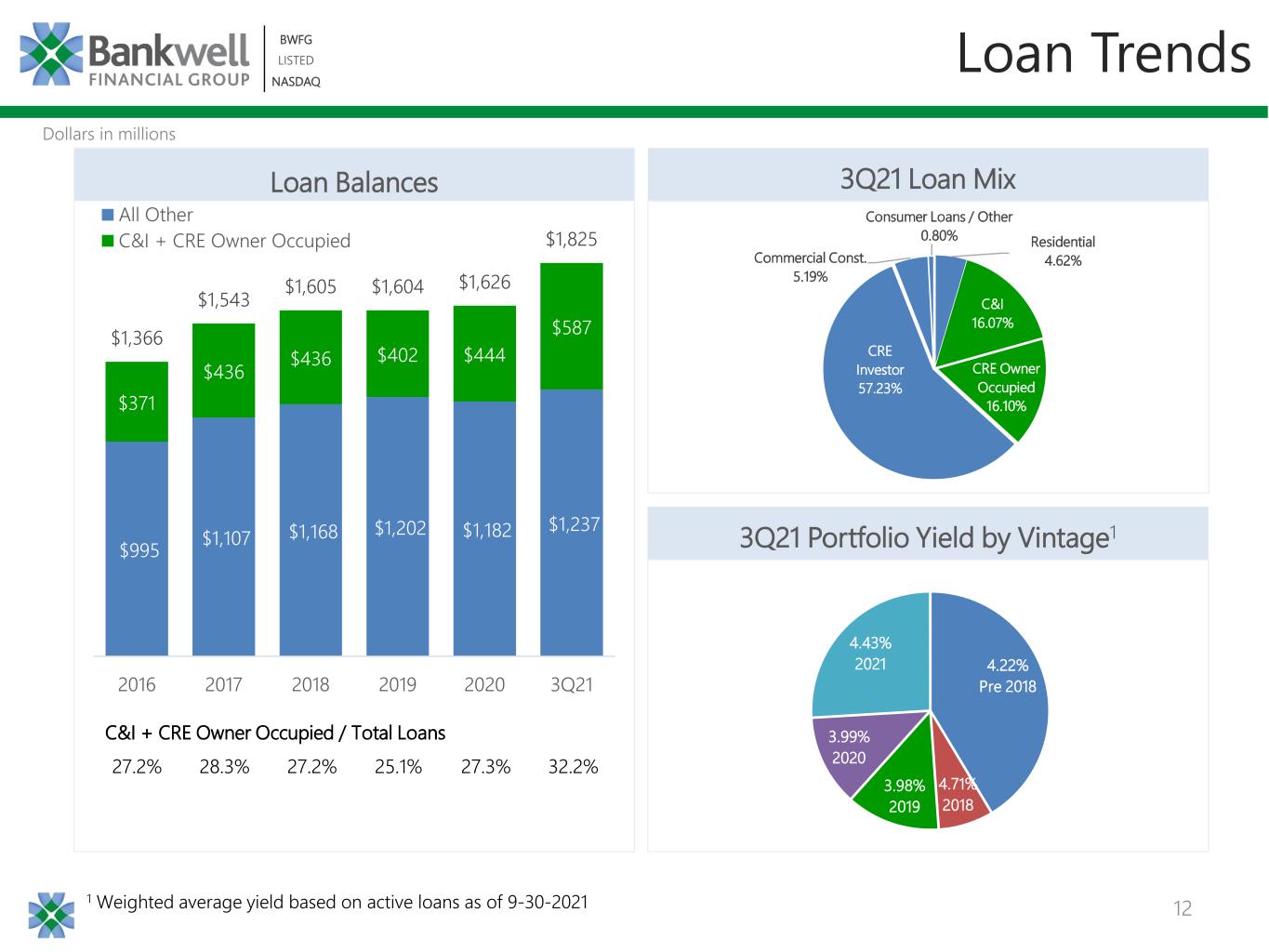

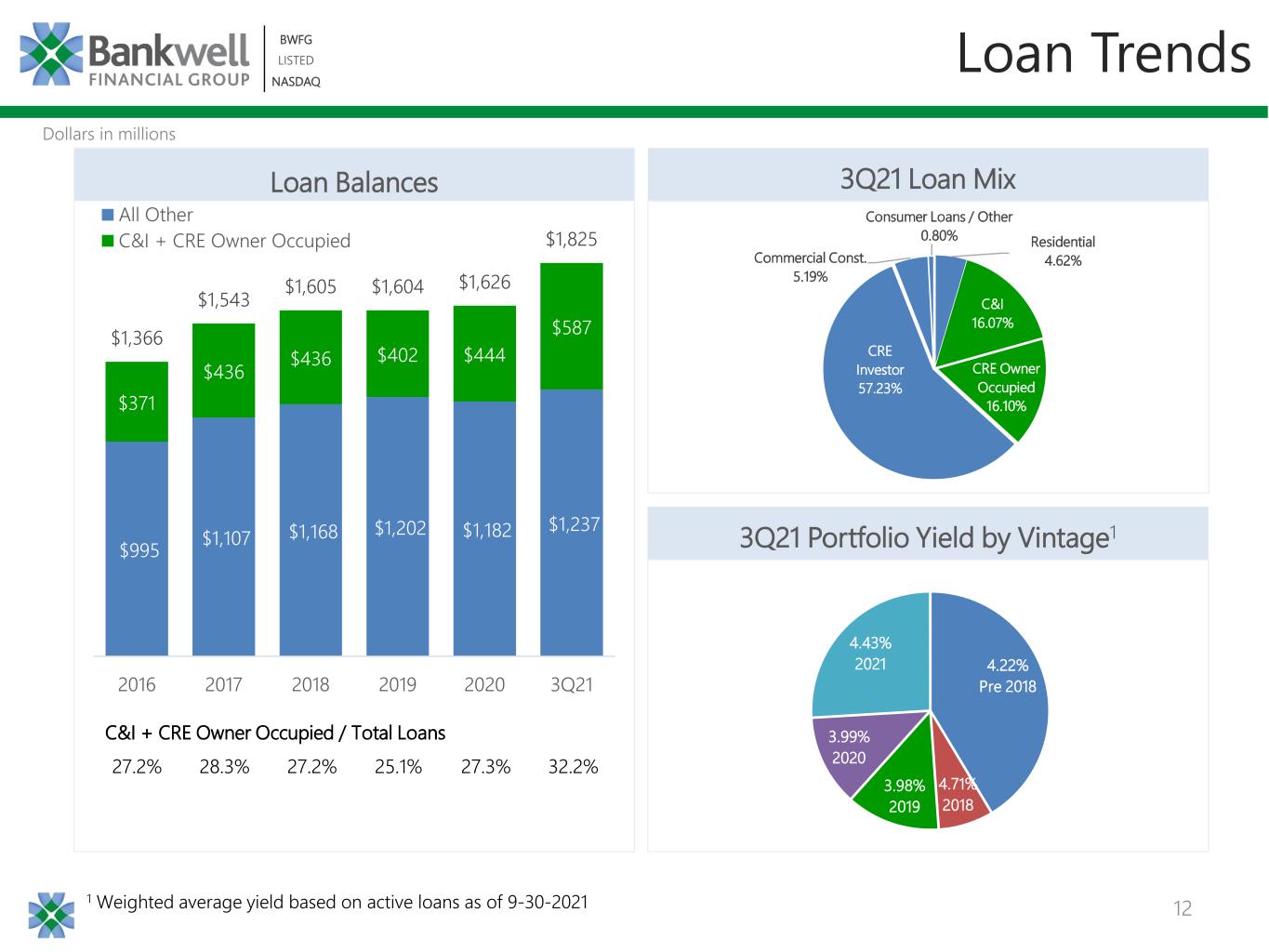

12 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Loan Trends $995 $1,107 $1,168 $1,202 $1,182 $1,237 $371 $436 $436 $402 $444 $587 $1,366 $1,543 $1,605 $1,604 $1,626 $1,825 2016 2017 2018 2019 2020 3Q21 Loan Balances All Other C&I + CRE Owner Occupied 3Q21 Loan Mix 3Q21 Portfolio Yield by Vintage1 C&I + CRE Owner Occupied / Total Loans 27.2% 28.3% 27.2% 25.1% 27.3% 32.2% 1 Weighted average yield based on active loans as of 9-30-2021 4.22% Pre 2018 4.71% 2018 3.98% 2019 3.99% 2020 4.43% 2021 Residential 4.62% C&I 16.07% CRE Owner Occupied 16.10% CRE Investor 57.23% Commercial Const. 5.19% Consumer Loans / Other 0.80% Dollars in millions

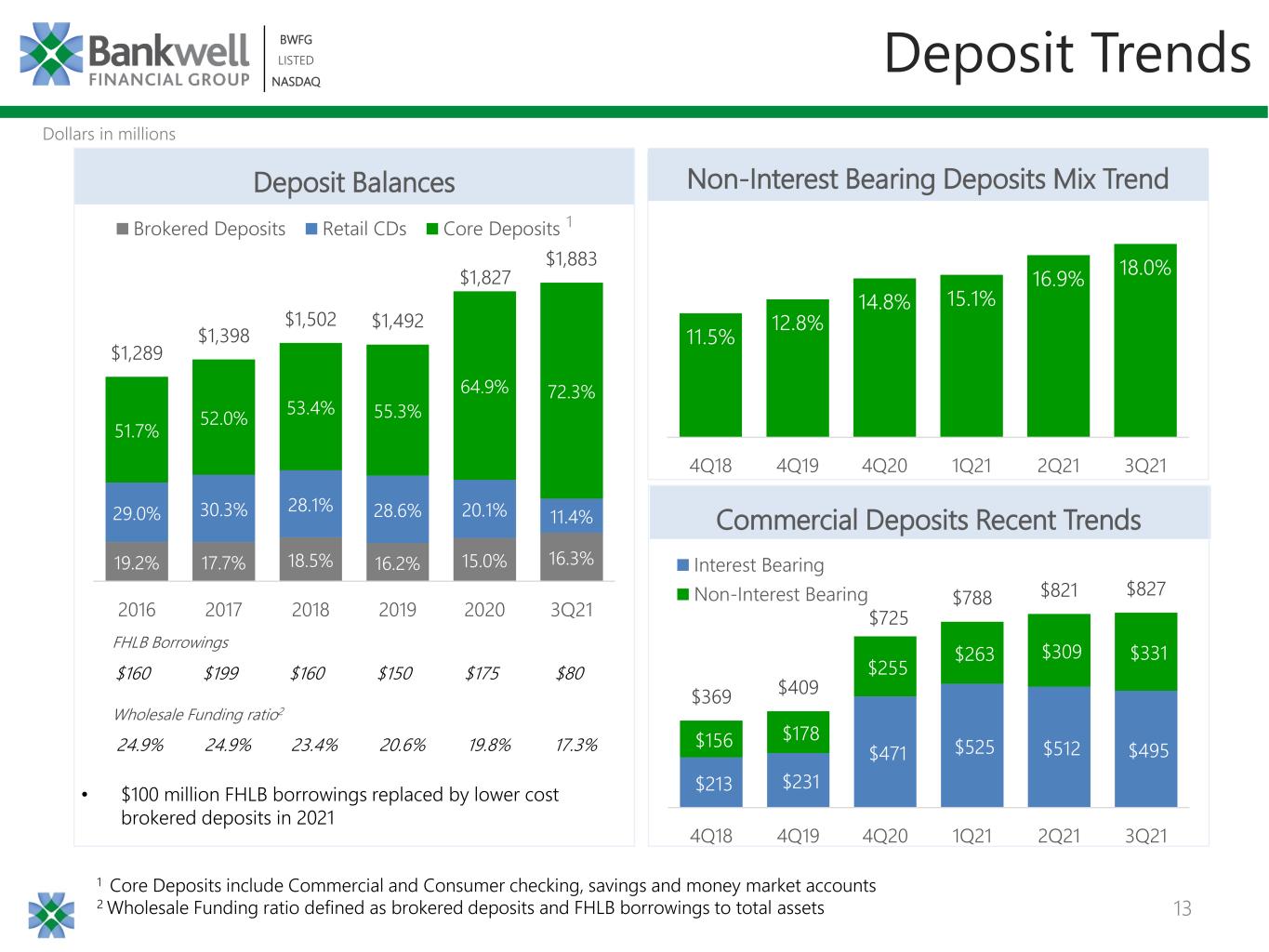

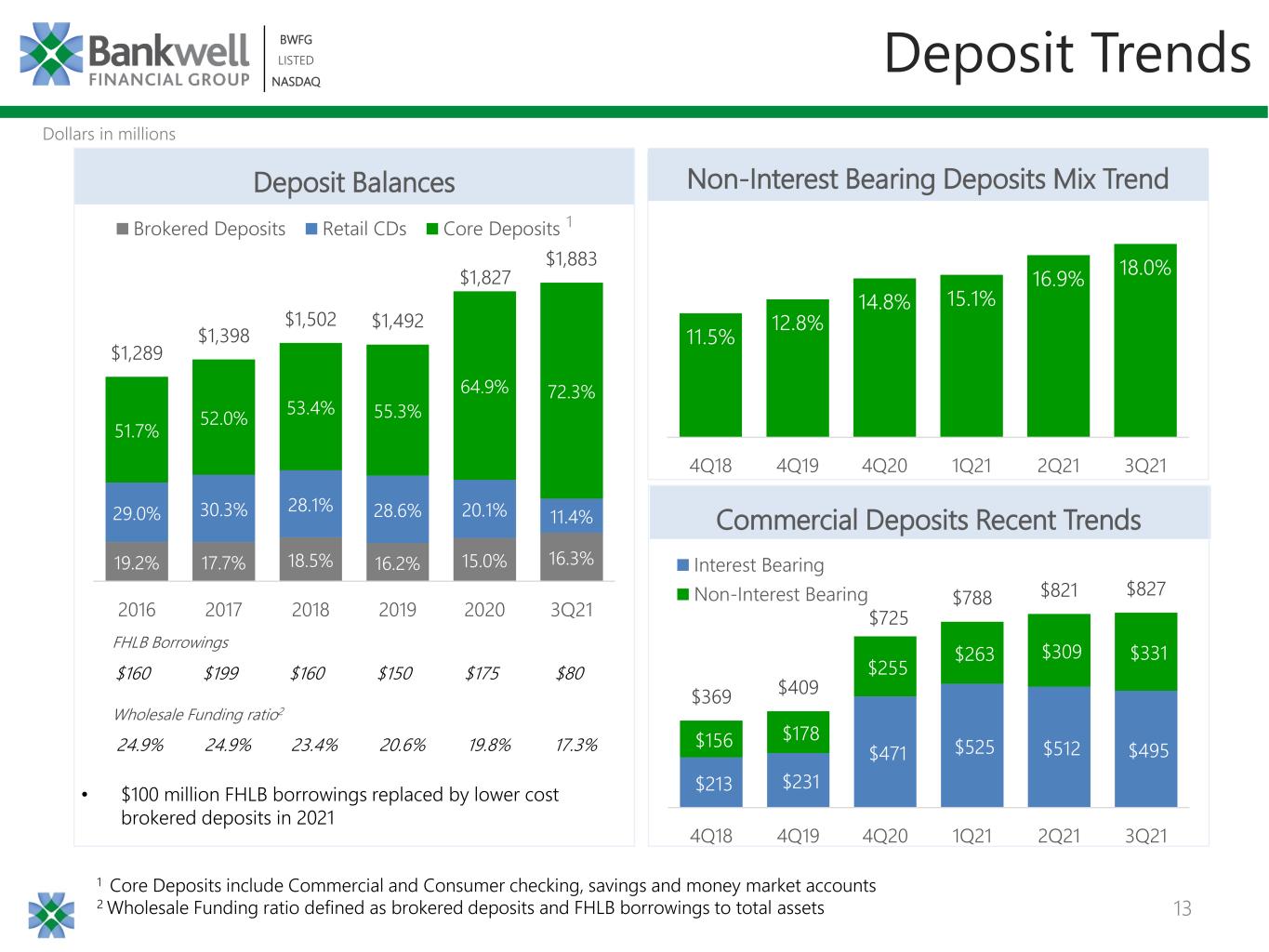

13 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 11.5% 12.8% 14.8% 15.1% 16.9% 18.0% 4Q18 4Q19 4Q20 1Q21 2Q21 3Q21 Deposit Trends 18.5% 16.2% 12.4% 14.1% 15.9% 1 1 Core Deposits include Commercial and Consumer checking, savings and money market accounts 2 Wholesale Funding ratio defined as brokered deposits and FHLB borrowings to total assets Non-Interest Bearing Deposits Mix Trend 19.2% 17.7% 18.5% 16.2% 15.0% 16.3% 29.0% 30.3% 28.1% 28.6% 20.1% 11.4% 51.7% 52.0% 53.4% 55.3% 64.9% 72.3% $1,289 $1,398 $1,502 $1,492 $1,827 $1,883 2016 2017 2018 2019 2020 3Q21 Deposit Balances Brokered Deposits Retail CDs Core Deposits $213 $231 $471 $525 $512 $495 $156 $178 $255 $263 $309 $331 $369 $409 $725 $788 $821 $827 4Q18 4Q19 4Q20 1Q21 2Q21 3Q21 Commercial Deposits Recent Trends Interest Bearing Non-Interest Bearing • $100 million FHLB borrowings replaced by lower cost brokered deposits in 2021 24.9% 24.9% 23.4% 20.6% 19.8% 17.3% Wholesale Funding ratio2 FHLB Borrowings Dollars in millions $160 $199 $160 $150 $175 $80

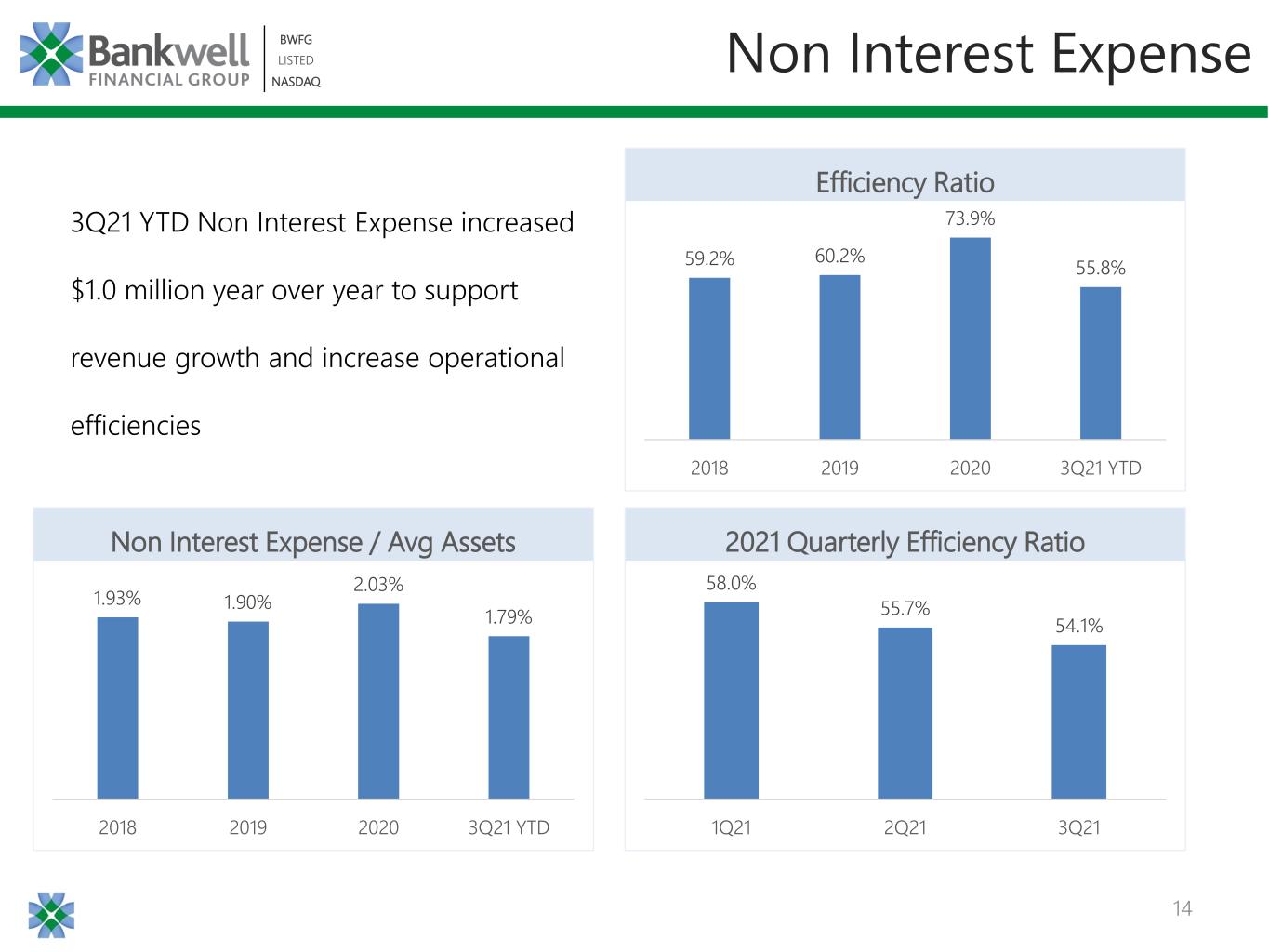

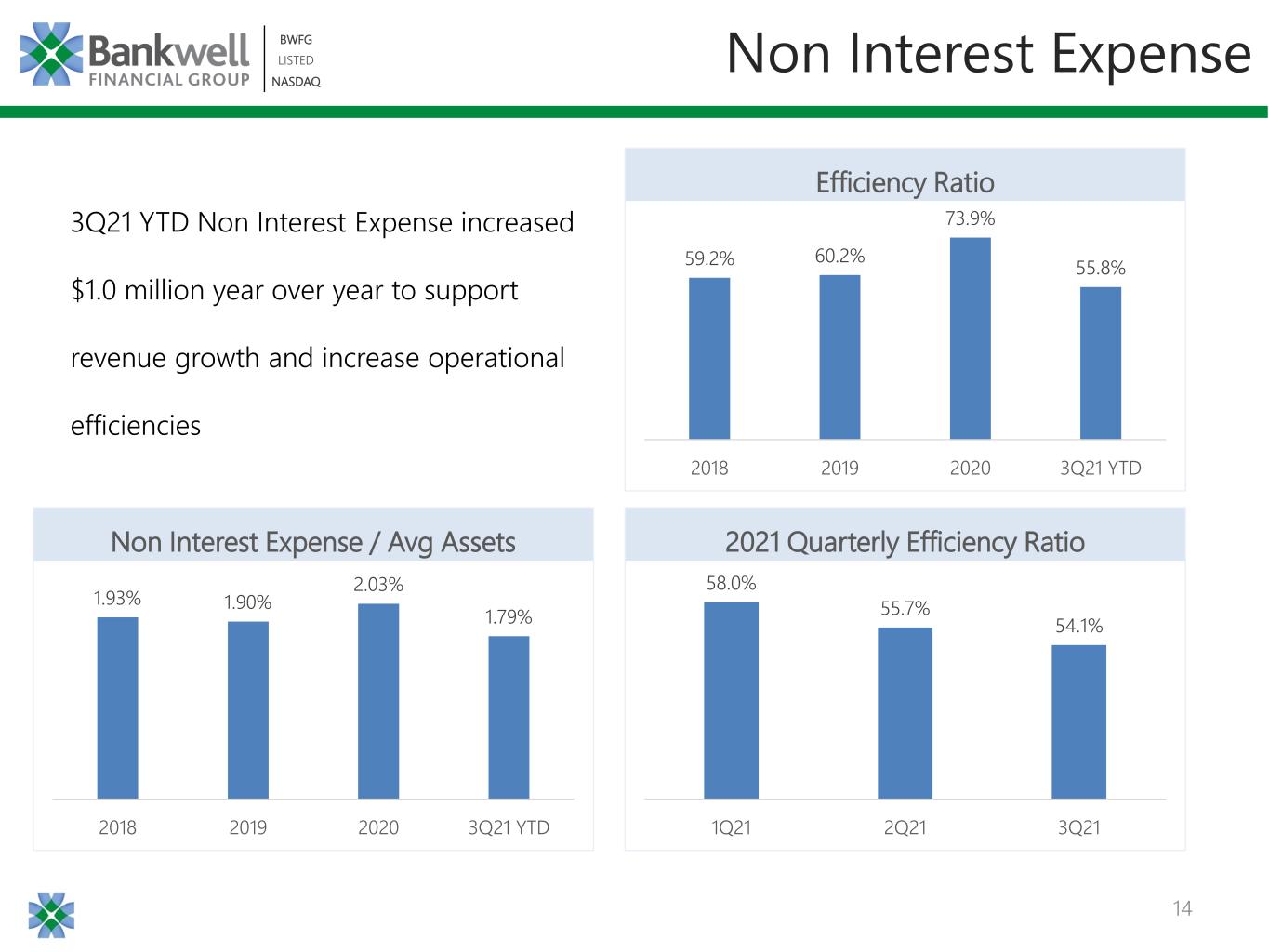

14 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Non Interest Expense 3Q21 YTD Non Interest Expense increased $1.0 million year over year to support revenue growth and increase operational efficiencies 58.0% 55.7% 54.1% 1Q21 2Q21 3Q21 2021 Quarterly Efficiency Ratio 1.93% 1.90% 2.03% 1.79% 2018 2019 2020 3Q21 YTD Non Interest Expense / Avg Assets 59.2% 60.2% 73.9% 55.8% 2018 2019 2020 3Q21 YTD Efficiency Ratio

BWFG | LISTED | NASDAQ ALLL & Non-Performing Loans

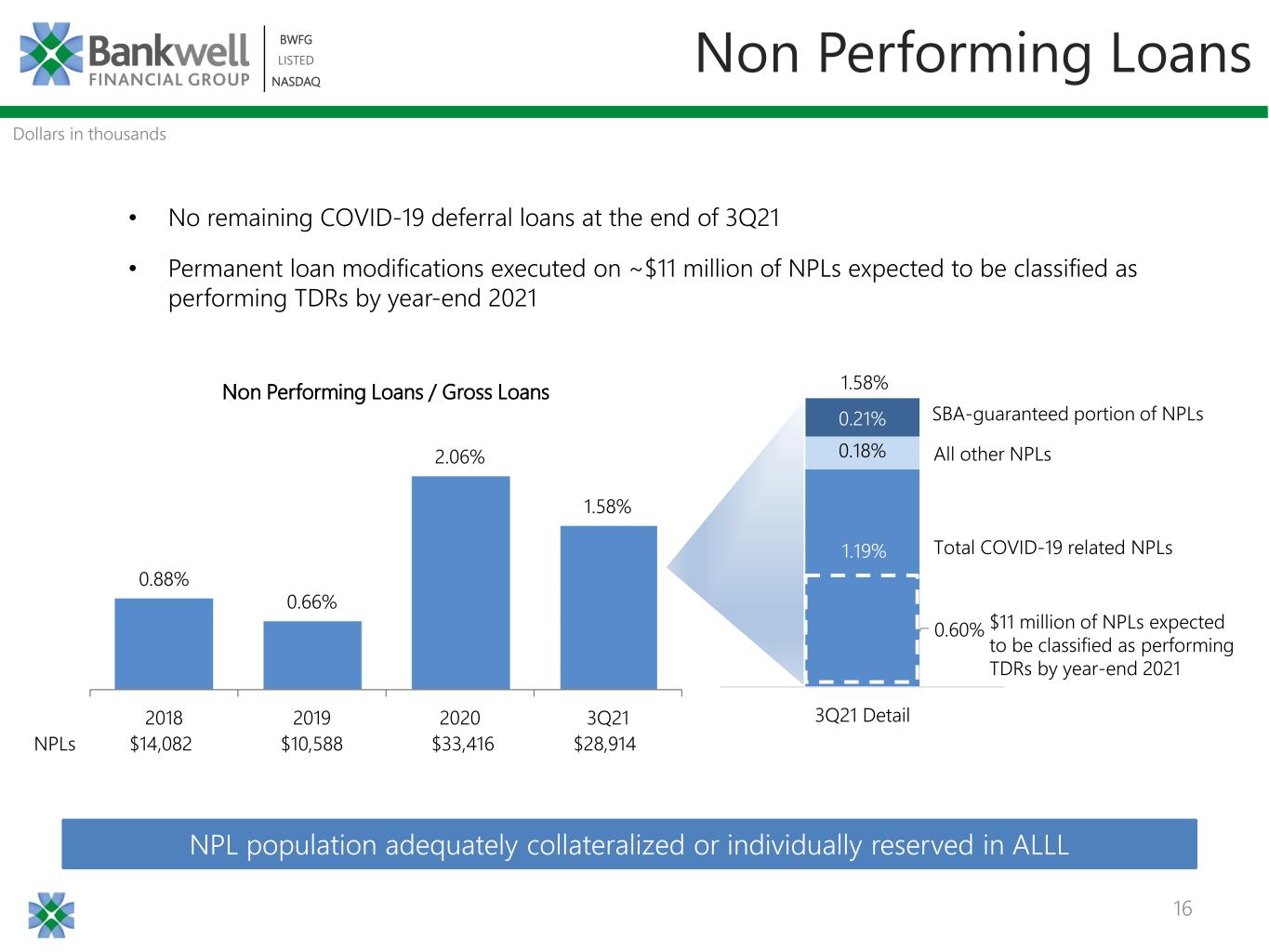

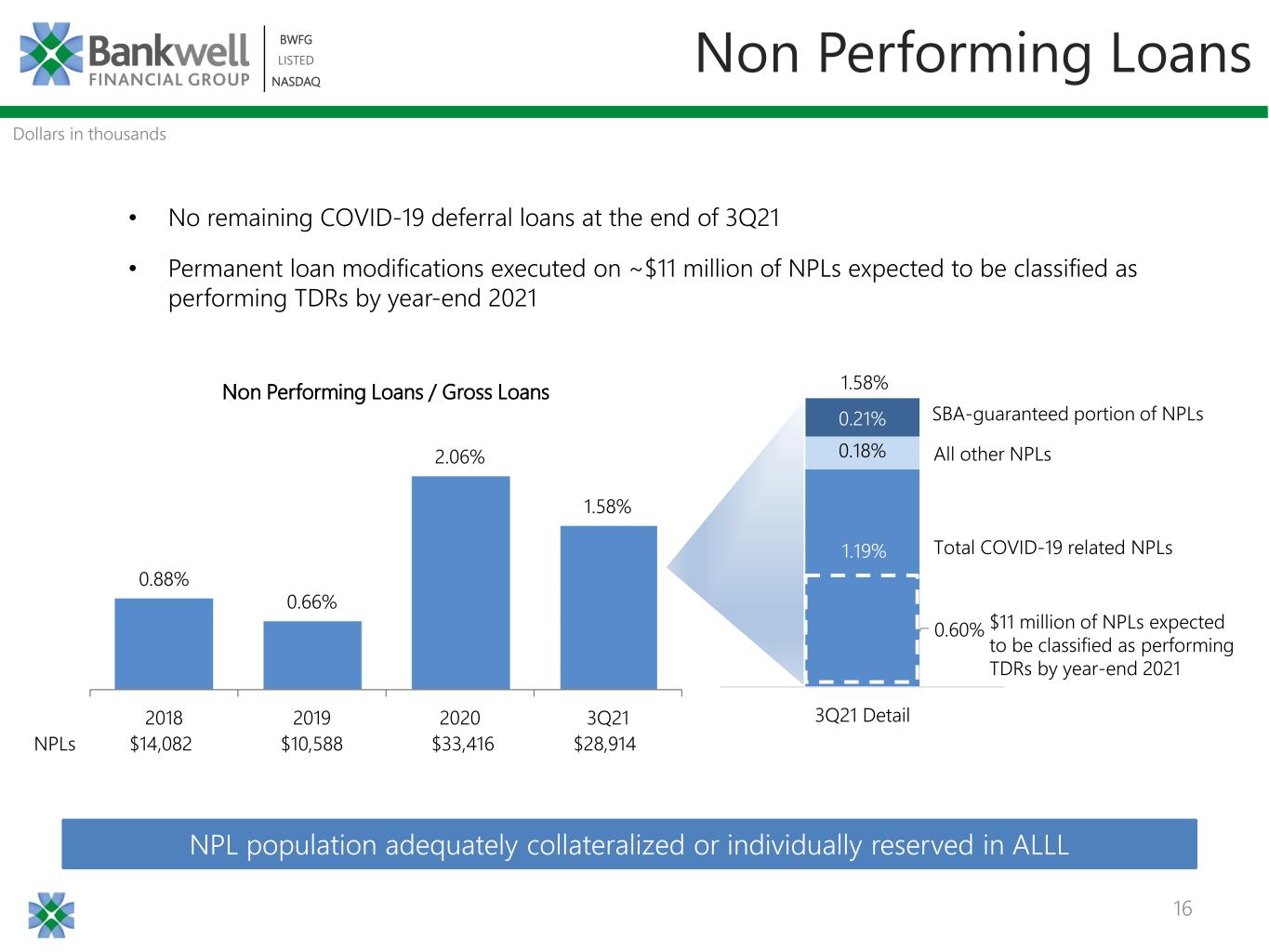

16 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Non Performing Loans 0.88% 0.66% 2.06% 1.58% 2018 2019 2020 3Q21 Non Performing Loans / Gross Loans NPLs $14,082 $10,588 $33,416 $28,914 0.60% 1.19% 0.18% 0.21% 3Q21 Detail 1.58% SBA-guaranteed portion of NPLs All other NPLs NPL population adequately collateralized or individually reserved in ALLL Total COVID-19 related NPLs Dollars in thousands $11 million of NPLs expected to be classified as performing TDRs by year-end 2021 • No remaining COVID-19 deferral loans at the end of 3Q21 • Permanent loan modifications executed on ~$11 million of NPLs expected to be classified as performing TDRs by year-end 2021

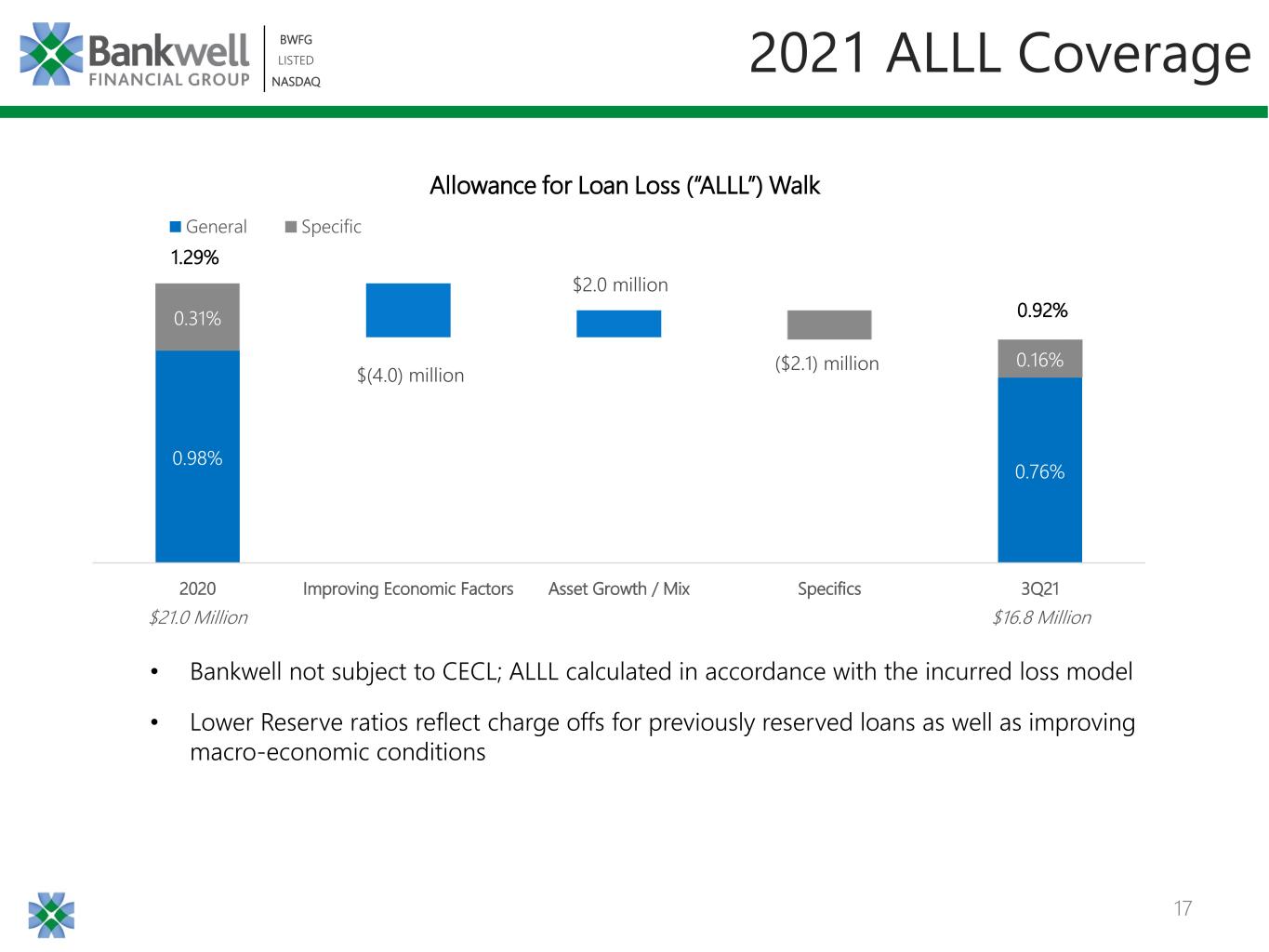

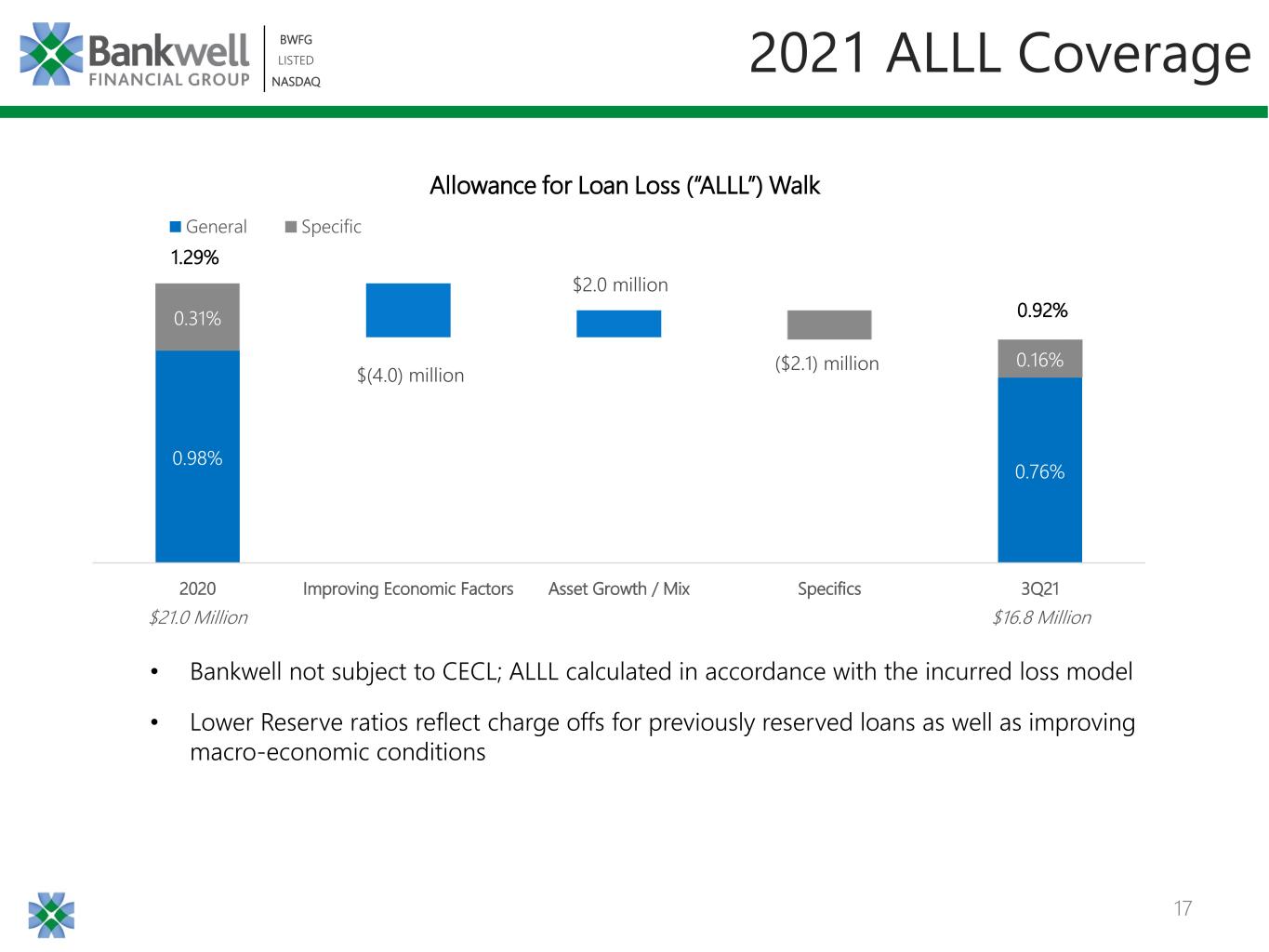

17 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 0.98% 0.76% 0.31% $(4.0) million $2.0 million ($2.1) million 0.16% 2020 Improving Economic Factors Asset Growth / Mix Specifics 3Q21 General Specific 2021 ALLL Coverage Allowance for Loan Loss (“ALLL”) Walk 1.29% 0.92% • Bankwell not subject to CECL; ALLL calculated in accordance with the incurred loss model • Lower Reserve ratios reflect charge offs for previously reserved loans as well as improving macro-economic conditions $21.0 Million $16.8 Million

BWFG | LISTED | NASDAQ Loan Portfolio

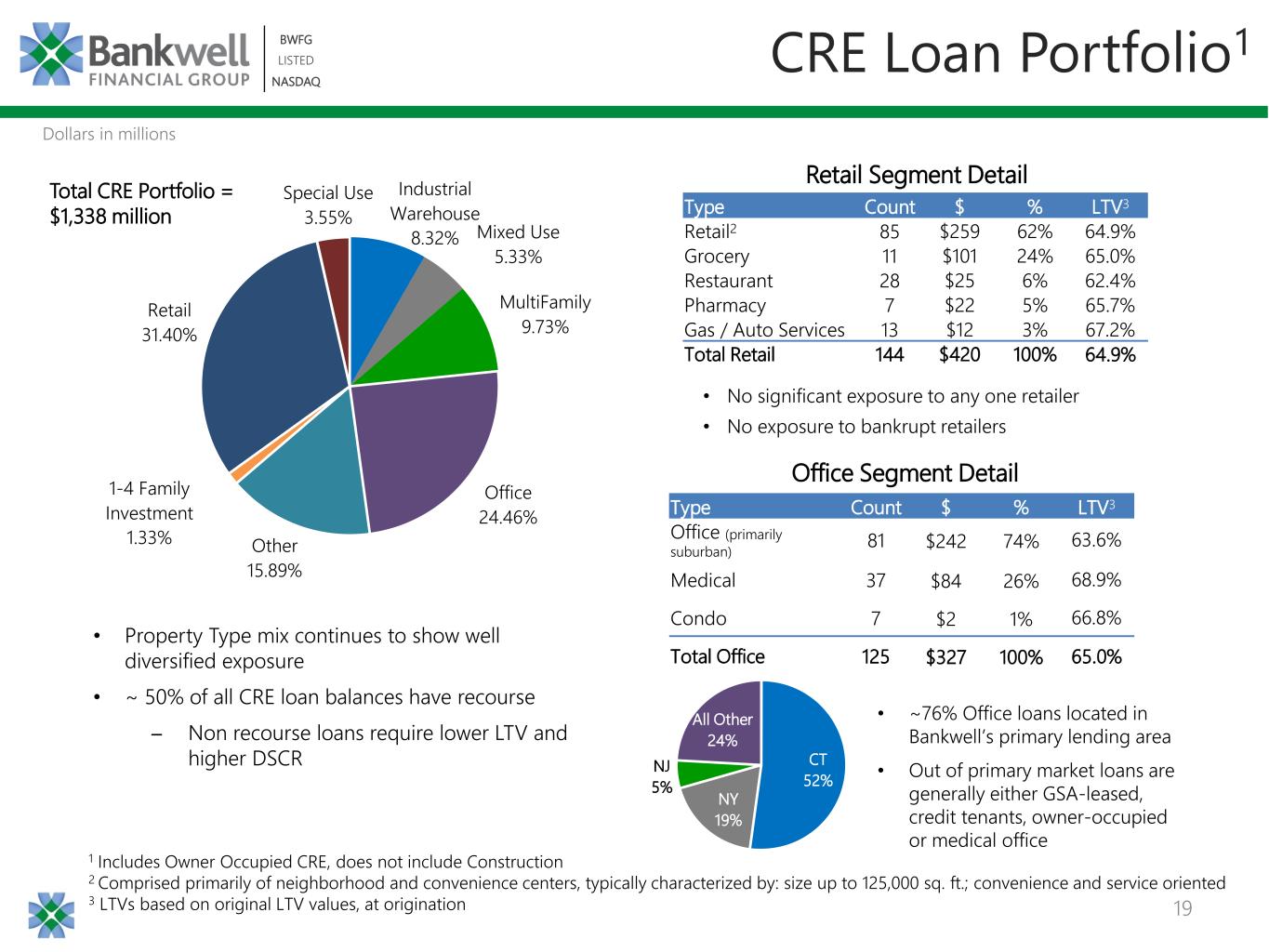

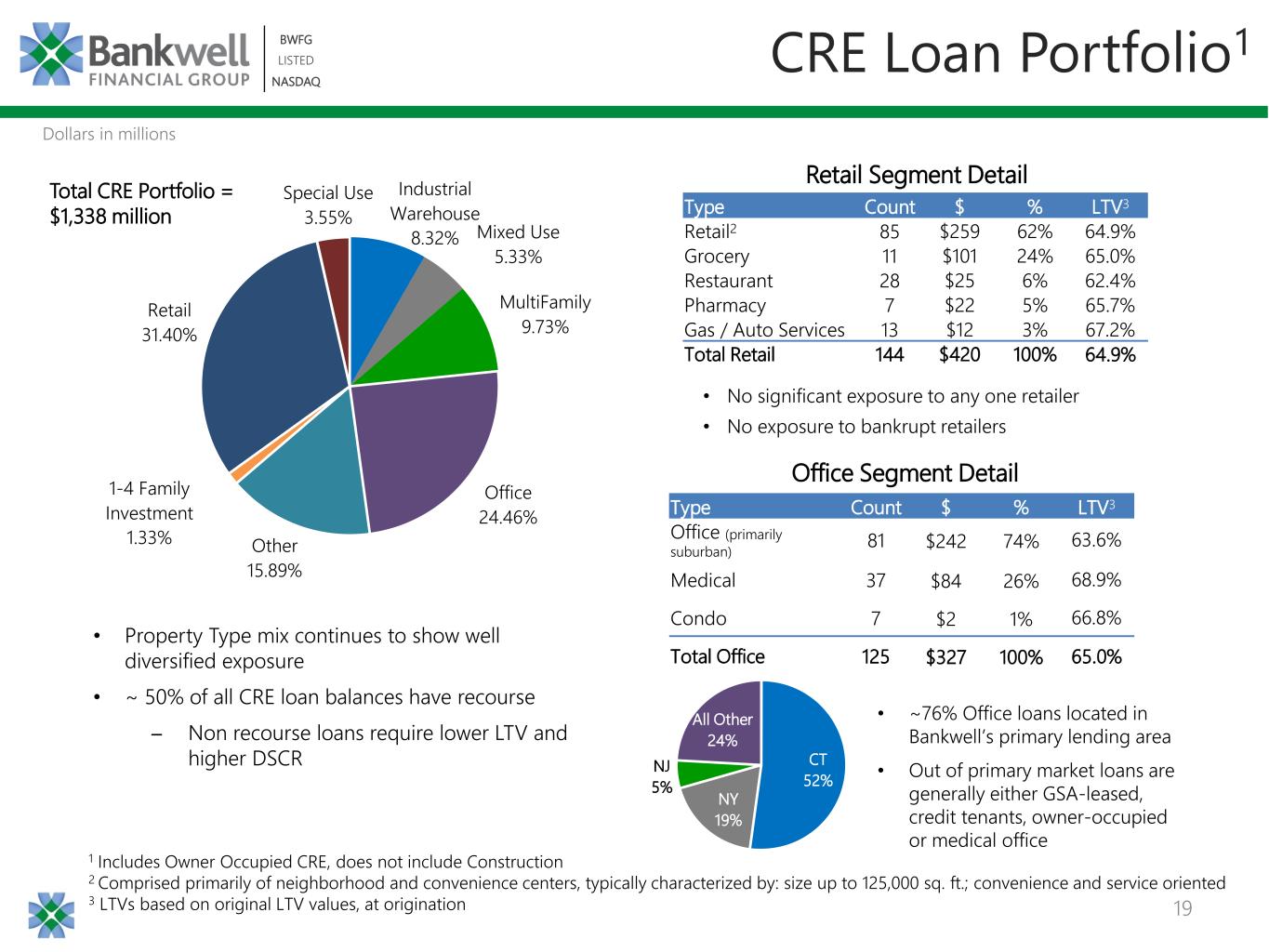

19 BWFG LISTED NASDAQ BWFG LISTED NASDAQ CT 52% NY 19% NJ 5% All Other 24% Industrial Warehouse 8.32% Mixed Use 5.33% MultiFamily 9.73% Office 24.46% Other 15.89% 1-4 Family Investment 1.33% Retail 31.40% Special Use 3.55% • Property Type mix continues to show well diversified exposure • ~ 50% of all CRE loan balances have recourse ̶ Non recourse loans require lower LTV and higher DSCR Total CRE Portfolio = $1,338 million Type Count $ % LTV3 Retail2 85 $259 62% 64.9% Grocery 11 $101 24% 65.0% Restaurant 28 $25 6% 62.4% Pharmacy 7 $22 5% 65.7% Gas / Auto Services 13 $12 3% 67.2% Total Retail 144 $420 100% 64.9% Retail Segment Detail • No significant exposure to any one retailer • No exposure to bankrupt retailers 1 Includes Owner Occupied CRE, does not include Construction 2 Comprised primarily of neighborhood and convenience centers, typically characterized by: size up to 125,000 sq. ft.; convenience and service oriented 3 LTVs based on original LTV values, at origination Office Segment Detail • ~76% Office loans located in Bankwell’s primary lending area • Out of primary market loans are generally either GSA-leased, credit tenants, owner-occupied or medical office Type Count $ % LTV3 Office (primarily suburban) 81 $242 74% 63.6% Medical 37 $84 26% 68.9% Condo 7 $2 1% 66.8% Total Office 125 $327 100% 65.0% CRE Loan Portfolio1 Dollars in millions

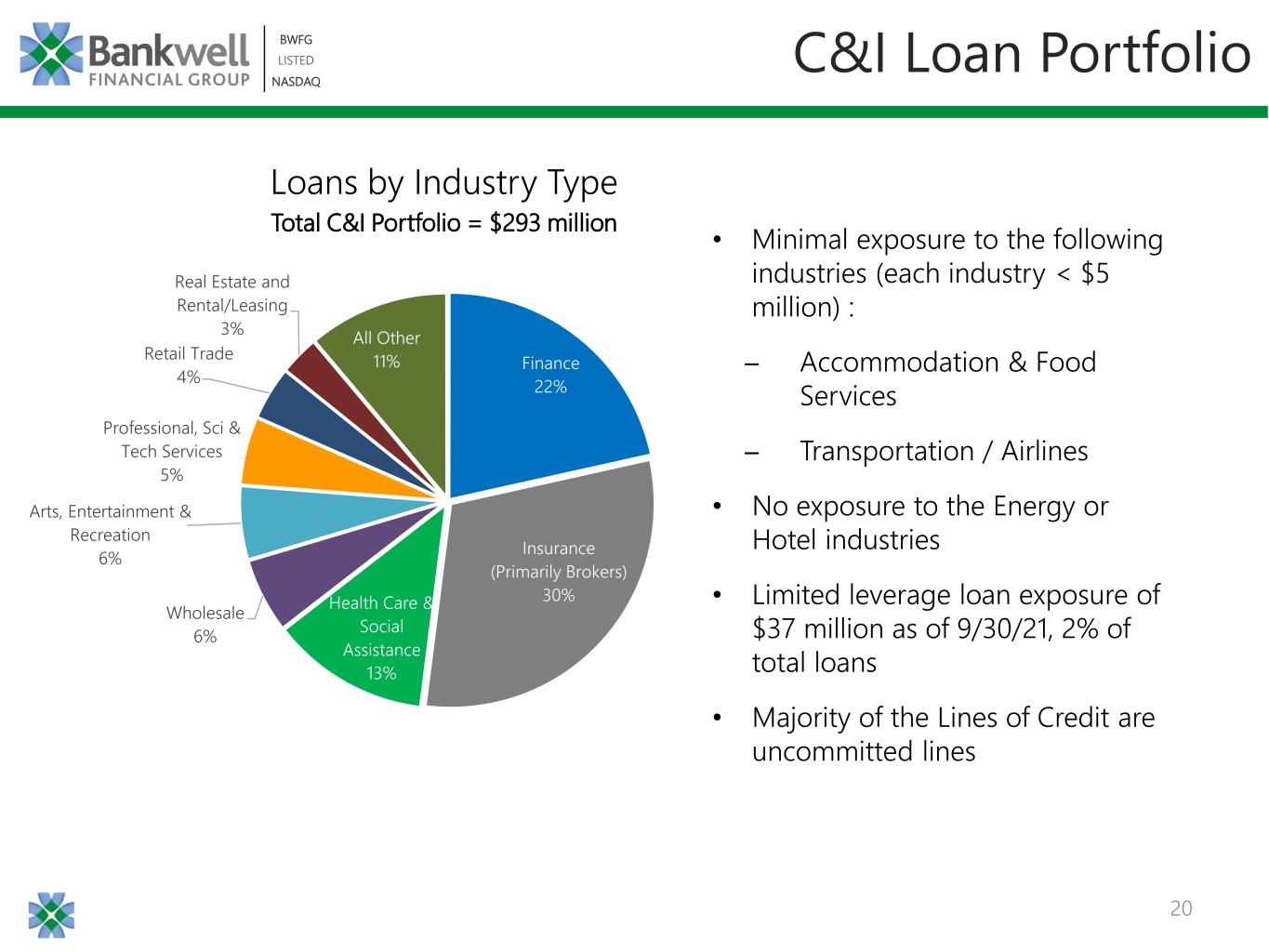

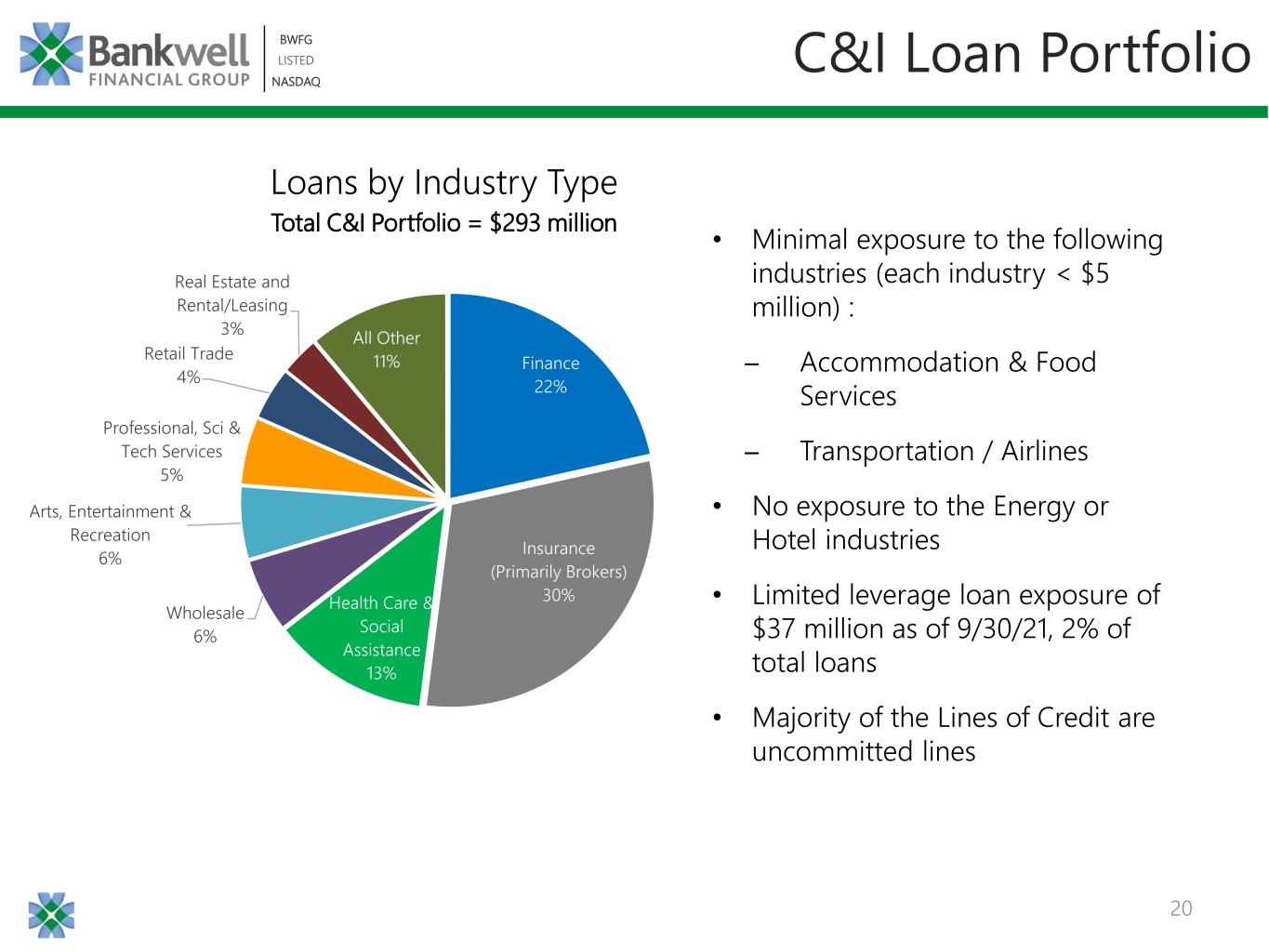

20 BWFG LISTED NASDAQ BWFG LISTED NASDAQ C&I Loan Portfolio Loans by Industry Type Total C&I Portfolio = $293 million • Minimal exposure to the following industries (each industry < $5 million) : ̶ Accommodation & Food Services ̶ Transportation / Airlines • No exposure to the Energy or Hotel industries • Limited leverage loan exposure of $37 million as of 9/30/21, 2% of total loans • Majority of the Lines of Credit are uncommitted lines Finance 22% Insurance (Primarily Brokers) 30%Health Care & Social Assistance 13% Wholesale 6% Arts, Entertainment & Recreation 6% Professional, Sci & Tech Services 5% Retail Trade 4% Real Estate and Rental/Leasing 3% All Other 11%

BWFG | LISTED | NASDAQ Capital

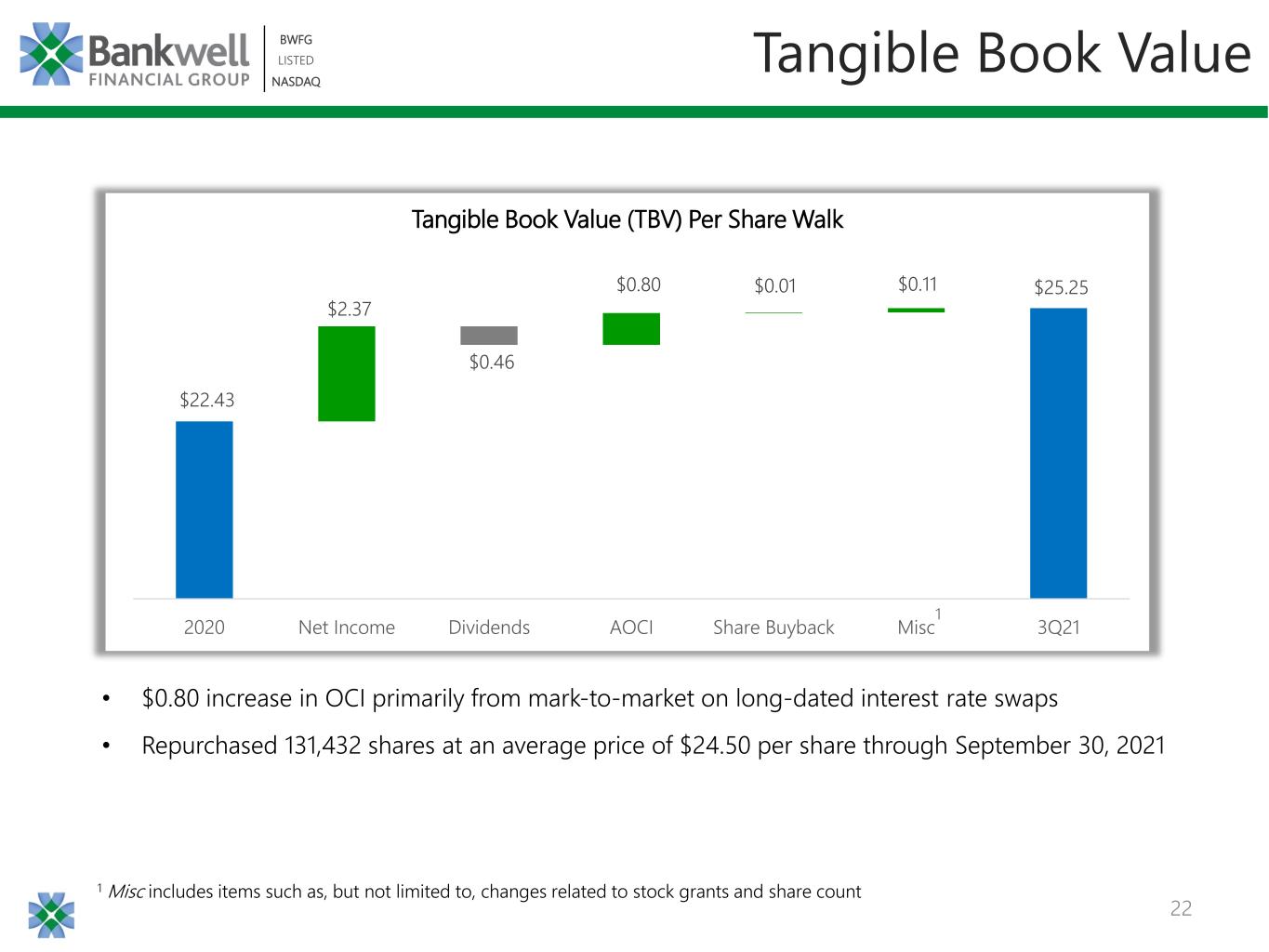

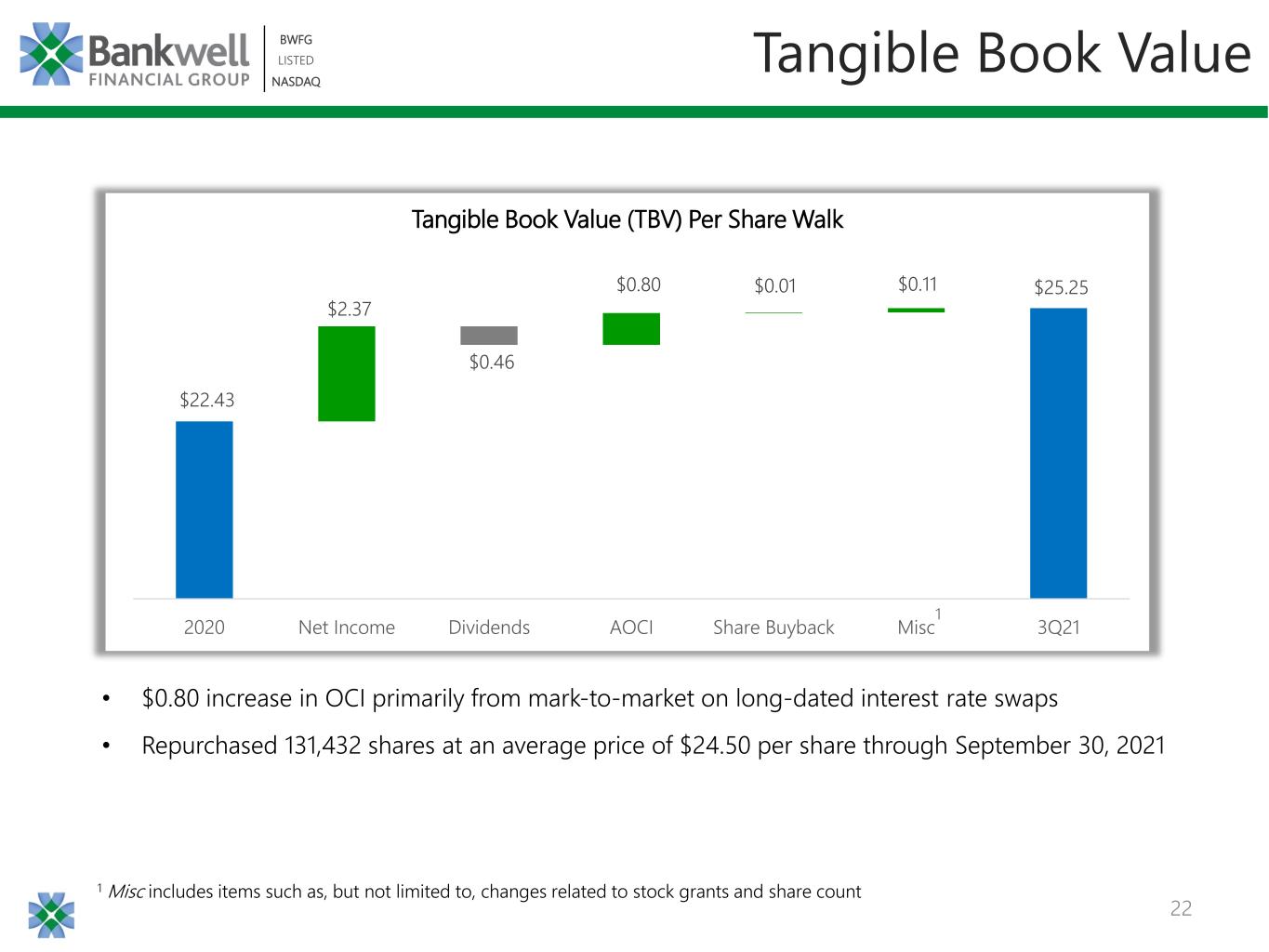

22 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Tangible Book Value Tangible Book Value (TBV) Per Share Walk • $0.80 increase in OCI primarily from mark-to-market on long-dated interest rate swaps • Repurchased 131,432 shares at an average price of $24.50 per share through September 30, 2021 1 Misc includes items such as, but not limited to, changes related to stock grants and share count 1 $22.43 $25.25 $2.37 $0.46 $0.80 $0.01 $0.11 2020 Net Income Dividends AOCI Share Buyback Misc 3Q21

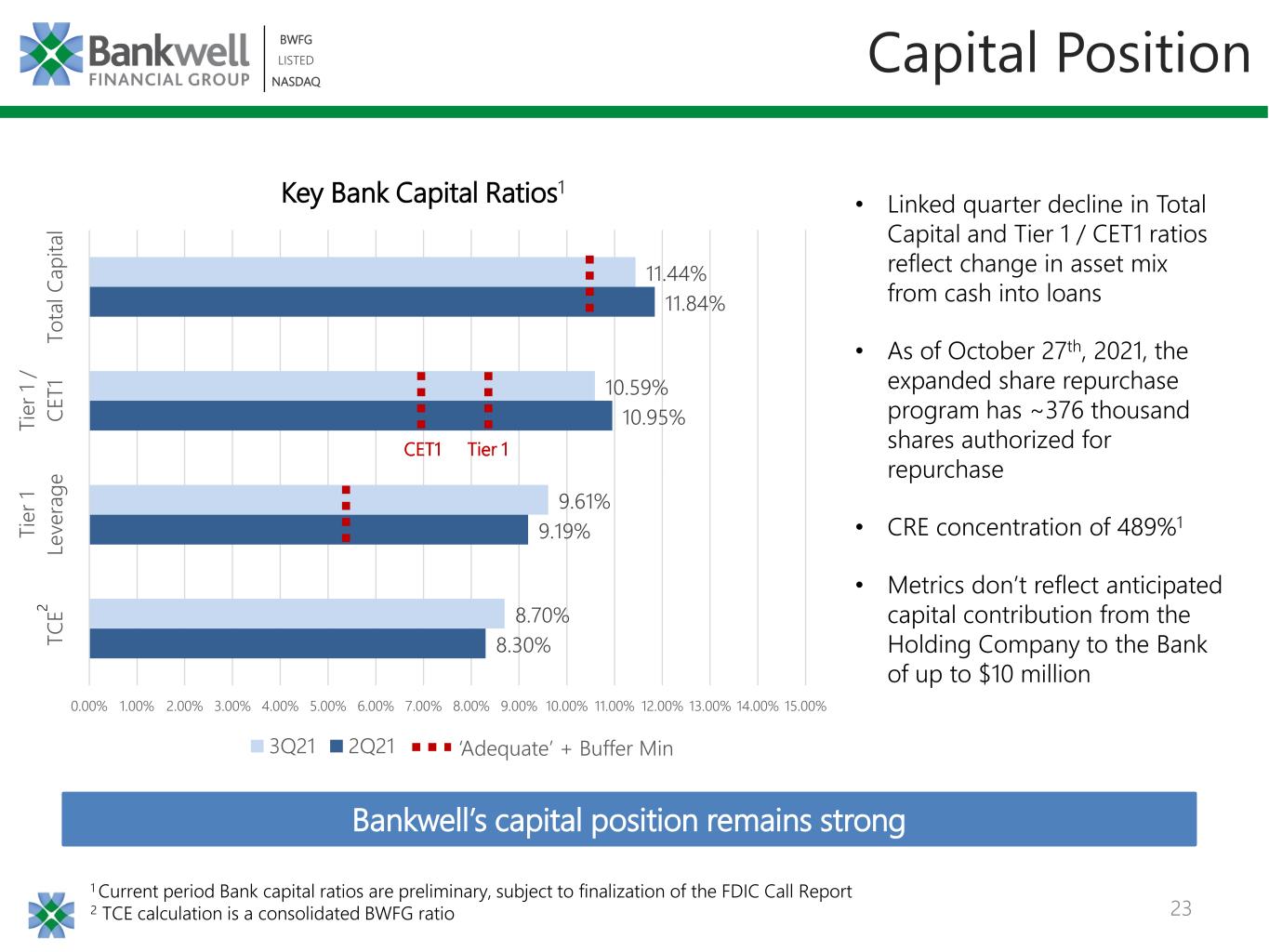

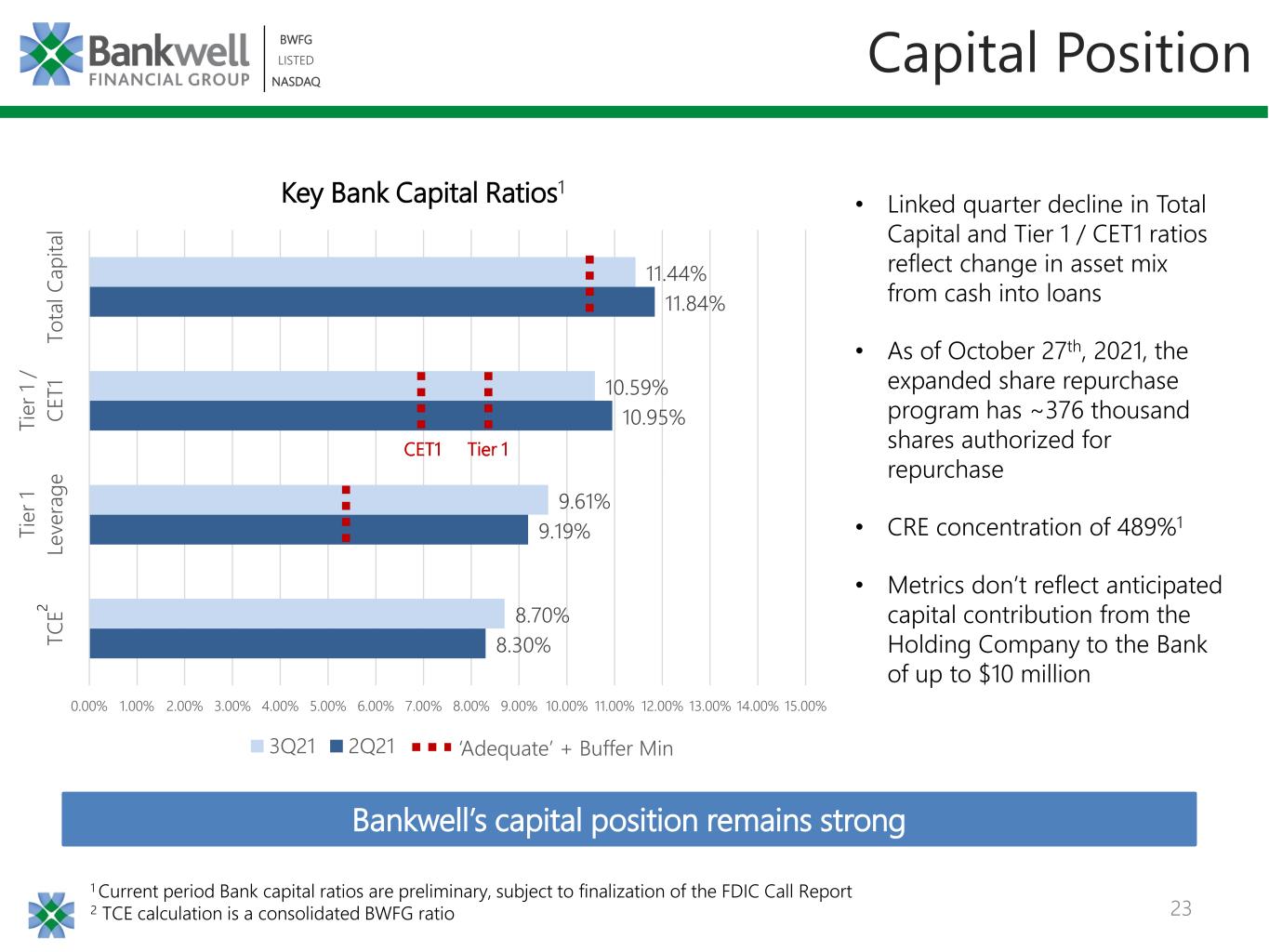

23 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Capital Position 8.30% 9.19% 10.95% 11.84% 8.70% 9.61% 10.59% 11.44% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% TC E Ti er 1 Le ve ra ge Ti er 1 / CE T1 To ta l C ap ita l 3Q21 2Q21 ‘Adequate’ + Buffer Min Bankwell’s capital position remains strong 2 Tier 1CET1 • Linked quarter decline in Total Capital and Tier 1 / CET1 ratios reflect change in asset mix from cash into loans • As of October 27th, 2021, the expanded share repurchase program has ~376 thousand shares authorized for repurchase • CRE concentration of 489%1 • Metrics don’t reflect anticipated capital contribution from the Holding Company to the Bank of up to $10 million 1 Current period Bank capital ratios are preliminary, subject to finalization of the FDIC Call Report 2 TCE calculation is a consolidated BWFG ratio Key Bank Capital Ratios1

BWFG | LISTED | NASDAQ History & Overview

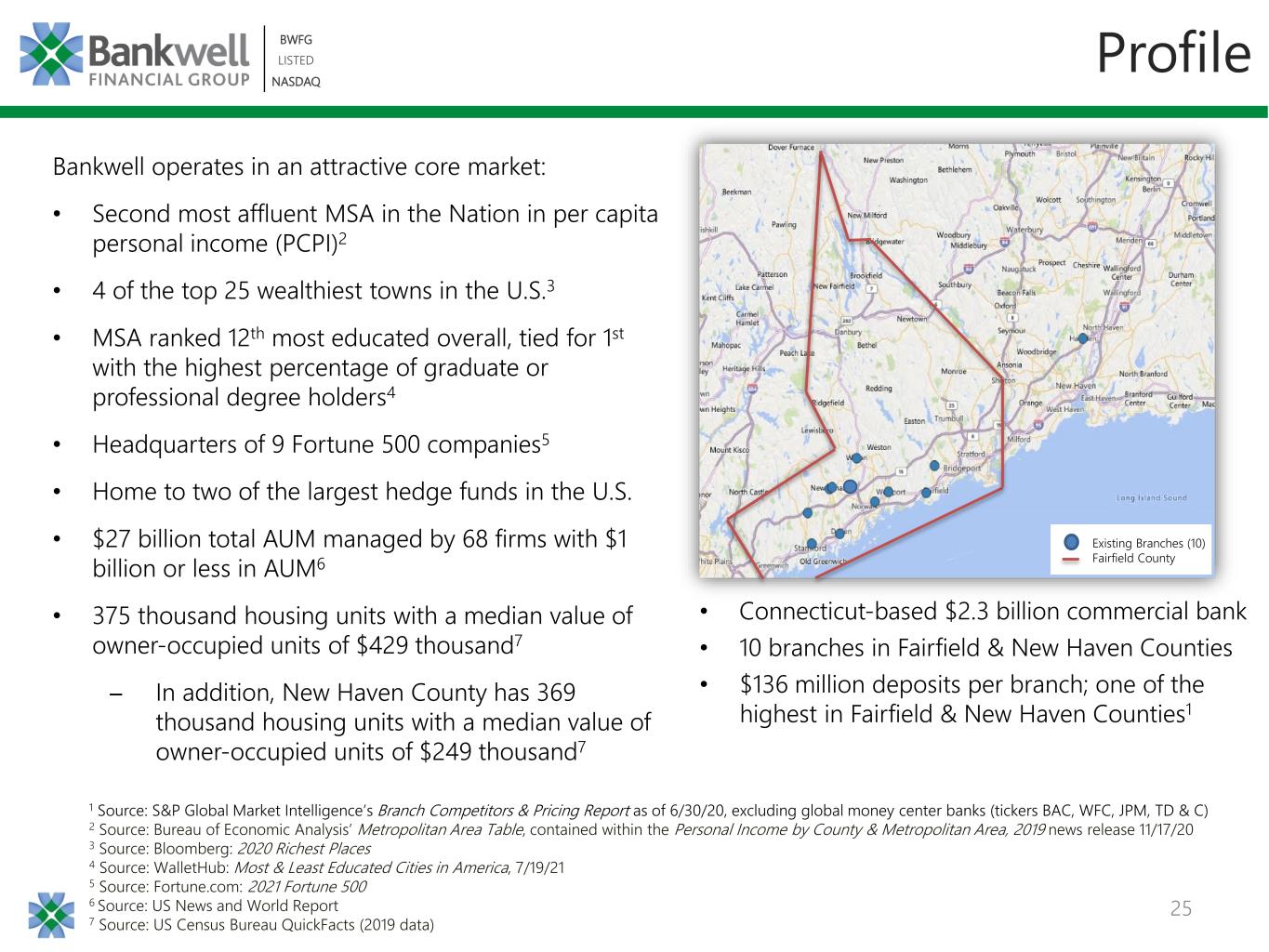

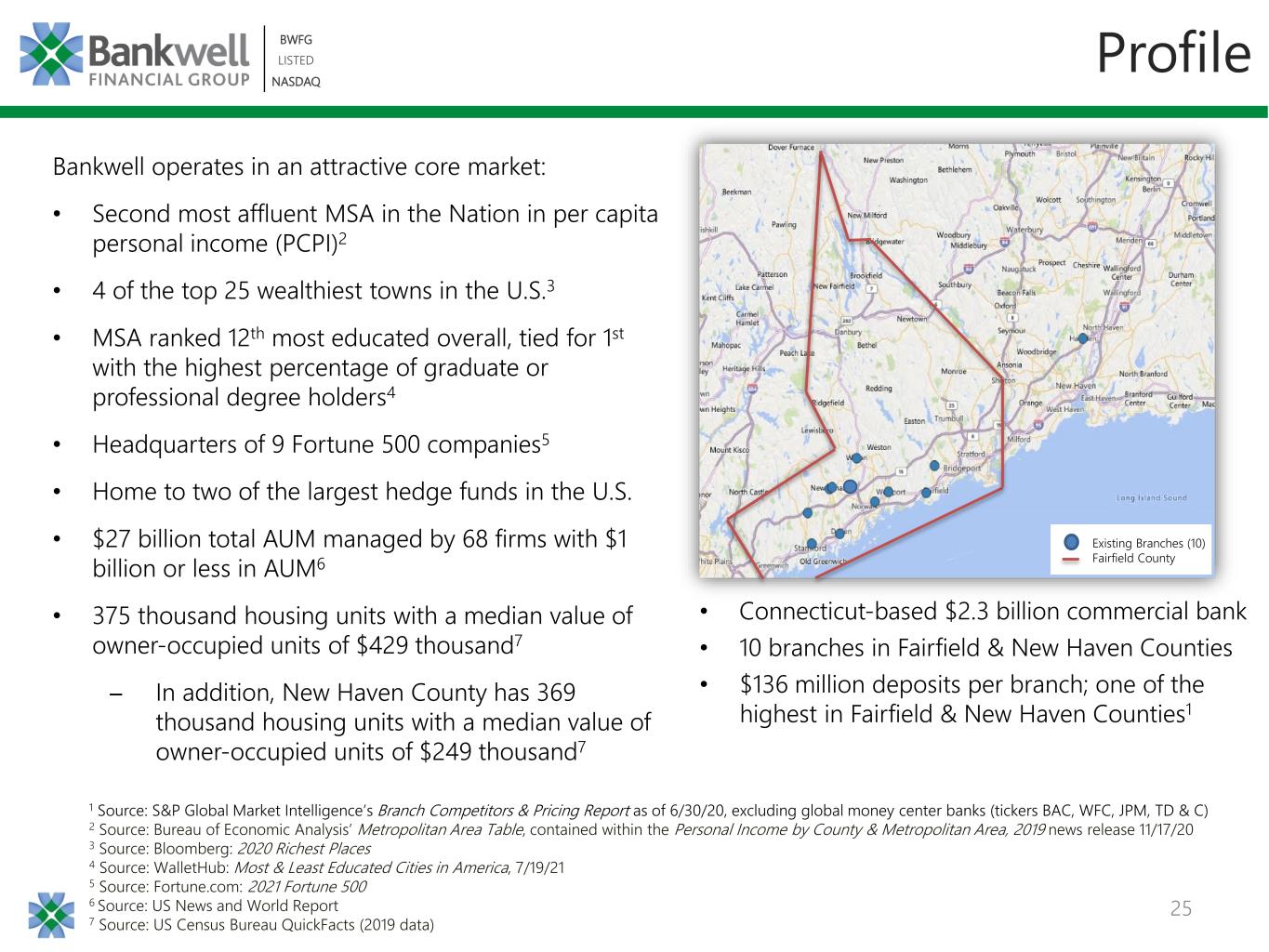

25 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Bankwell operates in an attractive core market: • Second most affluent MSA in the Nation in per capita personal income (PCPI)2 • 4 of the top 25 wealthiest towns in the U.S.3 • MSA ranked 12th most educated overall, tied for 1st with the highest percentage of graduate or professional degree holders4 • Headquarters of 9 Fortune 500 companies5 • Home to two of the largest hedge funds in the U.S. • $27 billion total AUM managed by 68 firms with $1 billion or less in AUM6 • 375 thousand housing units with a median value of owner-occupied units of $429 thousand7 ̶ In addition, New Haven County has 369 thousand housing units with a median value of owner-occupied units of $249 thousand7 1 Source: S&P Global Market Intelligence’s Branch Competitors & Pricing Report as of 6/30/20, excluding global money center banks (tickers BAC, WFC, JPM, TD & C) 2 Source: Bureau of Economic Analysis’ Metropolitan Area Table, contained within the Personal Income by County & Metropolitan Area, 2019 news release 11/17/20 3 Source: Bloomberg: 2020 Richest Places 4 Source: WalletHub: Most & Least Educated Cities in America, 7/19/21 5 Source: Fortune.com: 2021 Fortune 500 6 Source: US News and World Report 7 Source: US Census Bureau QuickFacts (2019 data) Existing Branches (10) Fairfield County Profile • Connecticut-based $2.3 billion commercial bank • 10 branches in Fairfield & New Haven Counties • $136 million deposits per branch; one of the highest in Fairfield & New Haven Counties1

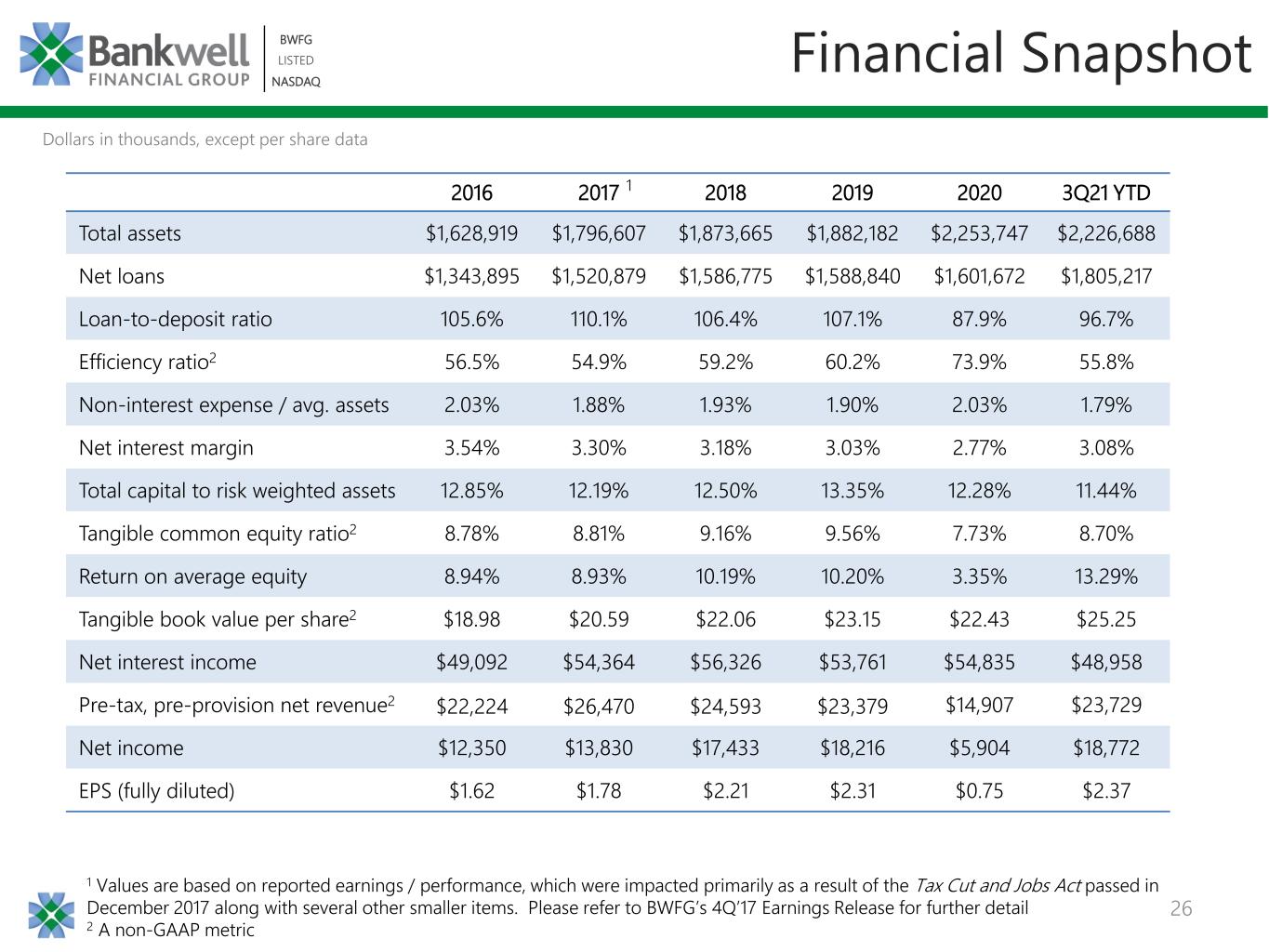

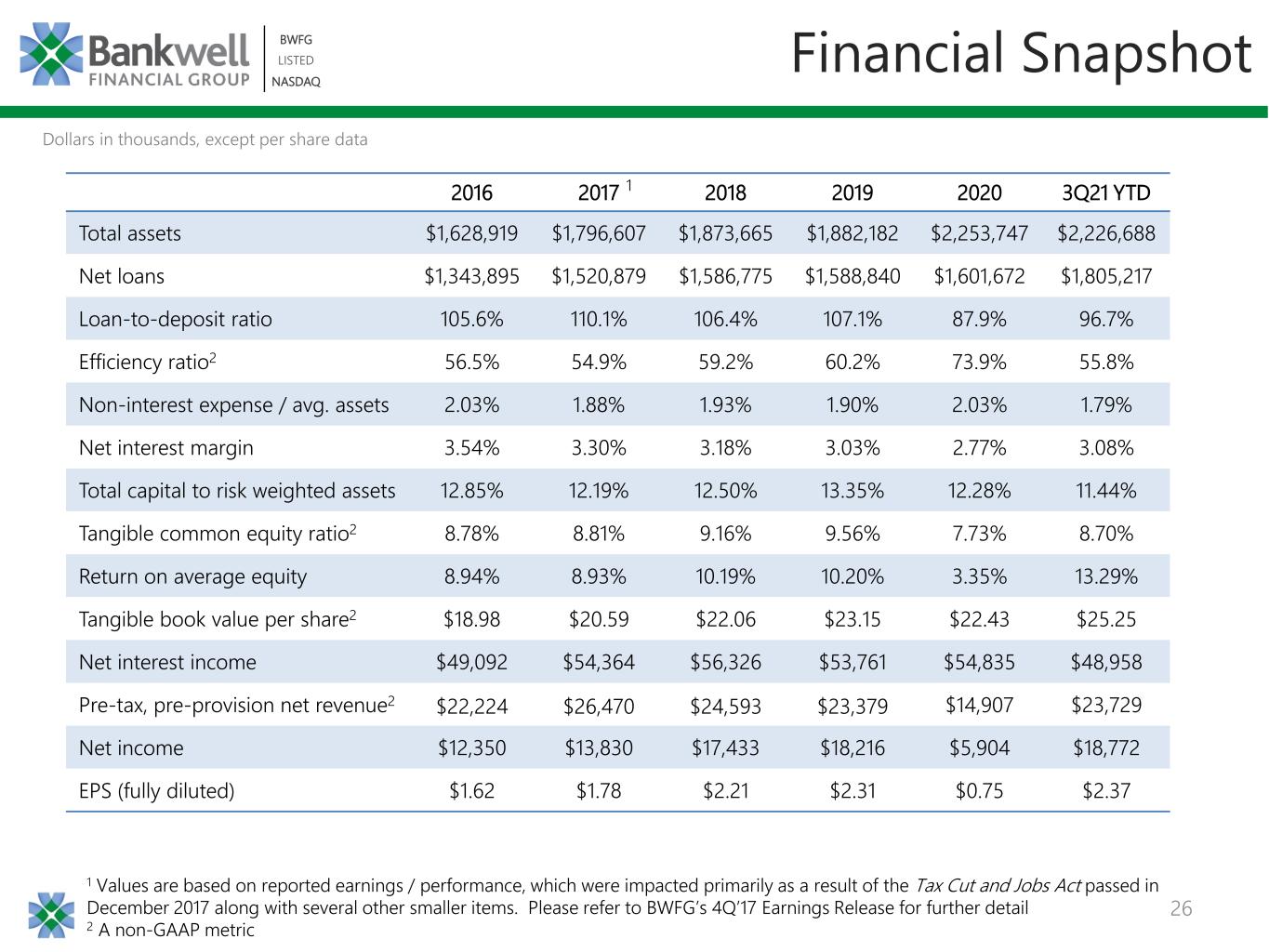

26 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Financial Snapshot 2016 2017 2018 2019 2020 3Q21 YTD Total assets $1,628,919 $1,796,607 $1,873,665 $1,882,182 $2,253,747 $2,226,688 Net loans $1,343,895 $1,520,879 $1,586,775 $1,588,840 $1,601,672 $1,805,217 Loan-to-deposit ratio 105.6% 110.1% 106.4% 107.1% 87.9% 96.7% Efficiency ratio2 56.5% 54.9% 59.2% 60.2% 73.9% 55.8% Non-interest expense / avg. assets 2.03% 1.88% 1.93% 1.90% 2.03% 1.79% Net interest margin 3.54% 3.30% 3.18% 3.03% 2.77% 3.08% Total capital to risk weighted assets 12.85% 12.19% 12.50% 13.35% 12.28% 11.44% Tangible common equity ratio2 8.78% 8.81% 9.16% 9.56% 7.73% 8.70% Return on average equity 8.94% 8.93% 10.19% 10.20% 3.35% 13.29% Tangible book value per share2 $18.98 $20.59 $22.06 $23.15 $22.43 $25.25 Net interest income $49,092 $54,364 $56,326 $53,761 $54,835 $48,958 Pre-tax, pre-provision net revenue2 $22,224 $26,470 $24,593 $23,379 $14,907 $23,729 Net income $12,350 $13,830 $17,433 $18,216 $5,904 $18,772 EPS (fully diluted) $1.62 $1.78 $2.21 $2.31 $0.75 $2.37 1 1 Values are based on reported earnings / performance, which were impacted primarily as a result of the Tax Cut and Jobs Act passed in December 2017 along with several other smaller items. Please refer to BWFG’s 4Q’17 Earnings Release for further detail 2 A non-GAAP metric Dollars in thousands, except per share data

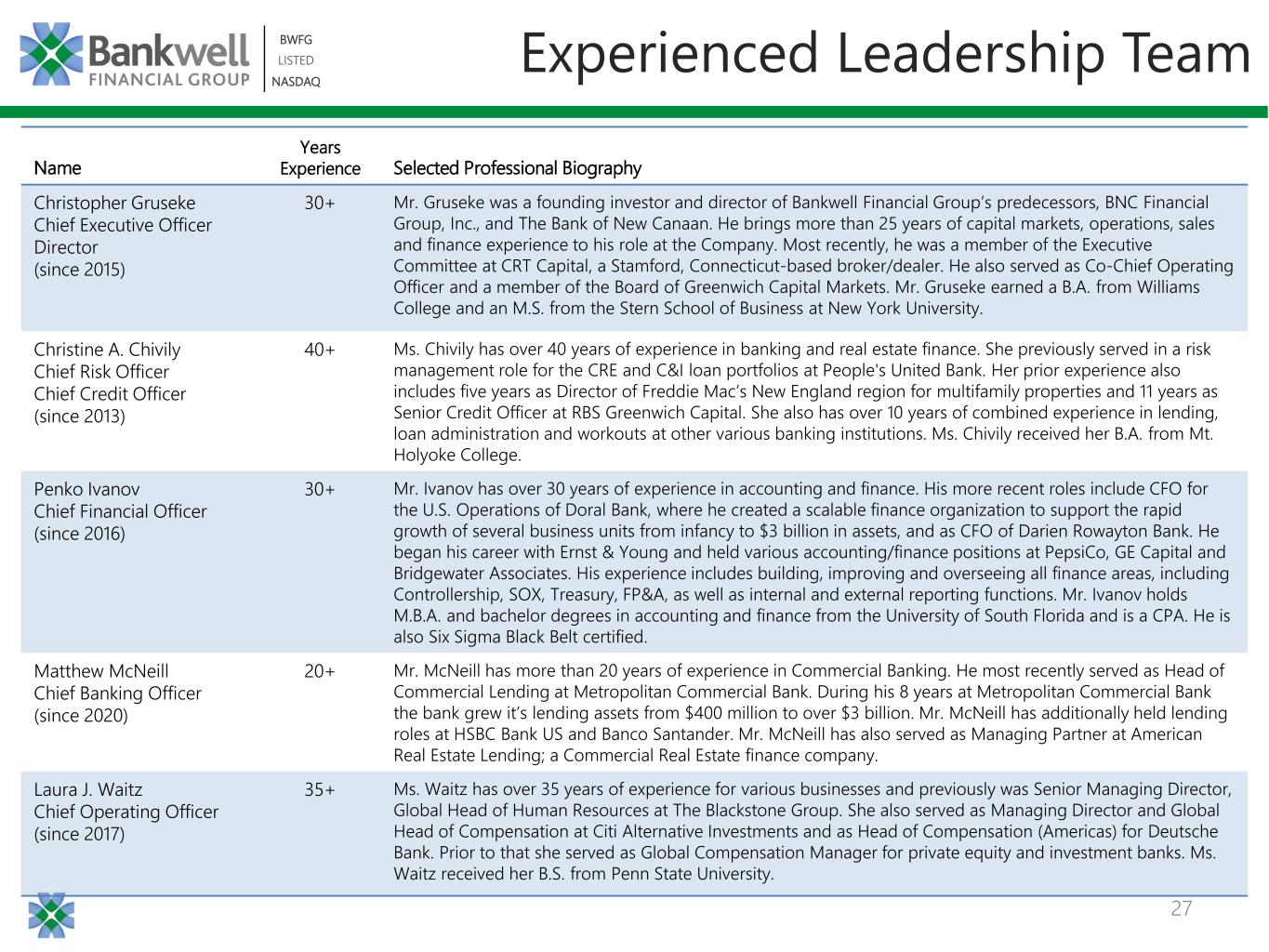

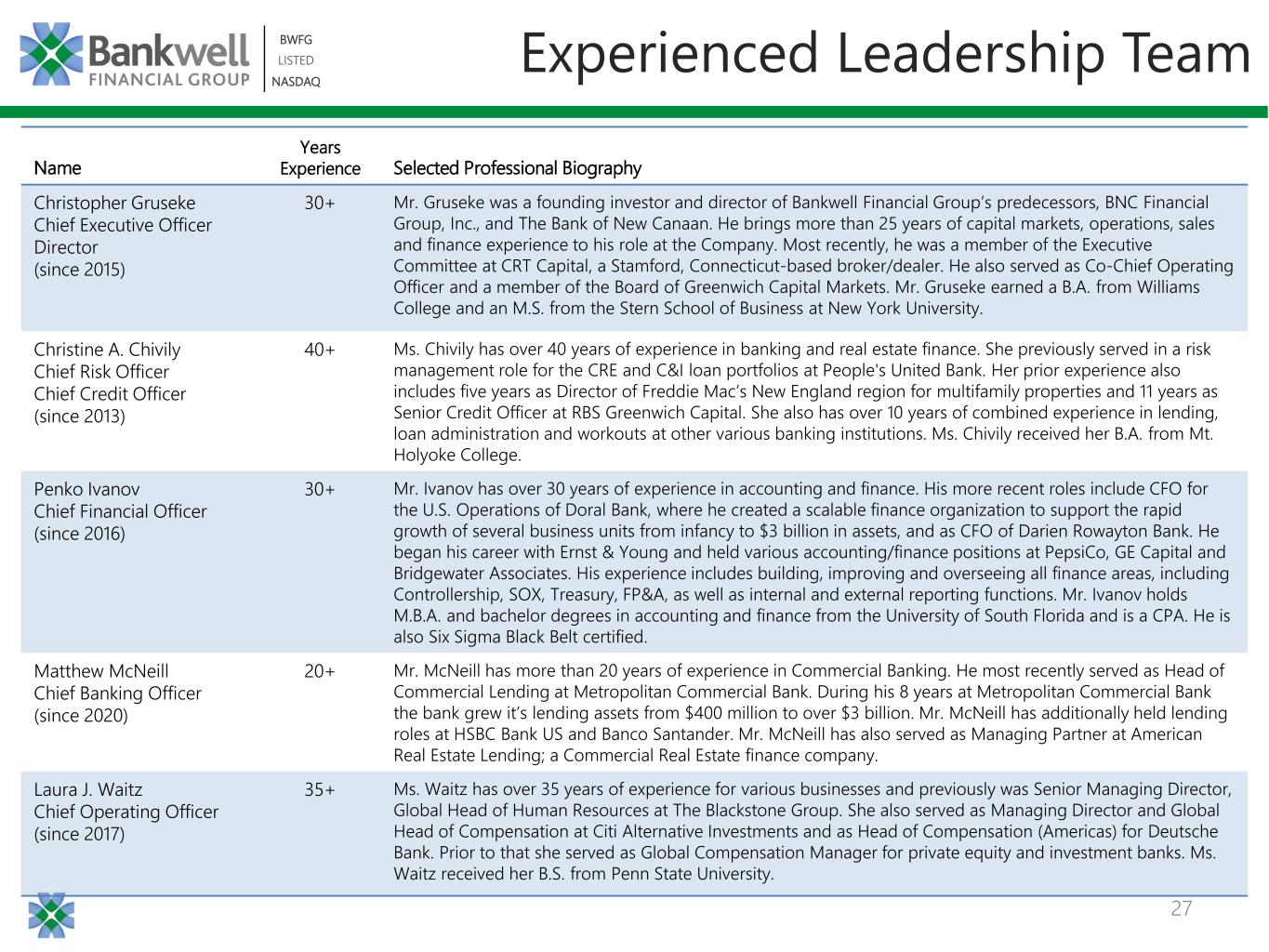

27 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Name Years Experience Selected Professional Biography Christopher Gruseke Chief Executive Officer Director (since 2015) 30+ Mr. Gruseke was a founding investor and director of Bankwell Financial Group’s predecessors, BNC Financial Group, Inc., and The Bank of New Canaan. He brings more than 25 years of capital markets, operations, sales and finance experience to his role at the Company. Most recently, he was a member of the Executive Committee at CRT Capital, a Stamford, Connecticut-based broker/dealer. He also served as Co-Chief Operating Officer and a member of the Board of Greenwich Capital Markets. Mr. Gruseke earned a B.A. from Williams College and an M.S. from the Stern School of Business at New York University. Christine A. Chivily Chief Risk Officer Chief Credit Officer (since 2013) 40+ Ms. Chivily has over 40 years of experience in banking and real estate finance. She previously served in a risk management role for the CRE and C&I loan portfolios at People's United Bank. Her prior experience also includes five years as Director of Freddie Mac’s New England region for multifamily properties and 11 years as Senior Credit Officer at RBS Greenwich Capital. She also has over 10 years of combined experience in lending, loan administration and workouts at other various banking institutions. Ms. Chivily received her B.A. from Mt. Holyoke College. Penko Ivanov Chief Financial Officer (since 2016) 30+ Mr. Ivanov has over 30 years of experience in accounting and finance. His more recent roles include CFO for the U.S. Operations of Doral Bank, where he created a scalable finance organization to support the rapid growth of several business units from infancy to $3 billion in assets, and as CFO of Darien Rowayton Bank. He began his career with Ernst & Young and held various accounting/finance positions at PepsiCo, GE Capital and Bridgewater Associates. His experience includes building, improving and overseeing all finance areas, including Controllership, SOX, Treasury, FP&A, as well as internal and external reporting functions. Mr. Ivanov holds M.B.A. and bachelor degrees in accounting and finance from the University of South Florida and is a CPA. He is also Six Sigma Black Belt certified. Matthew McNeill Chief Banking Officer (since 2020) 20+ Mr. McNeill has more than 20 years of experience in Commercial Banking. He most recently served as Head of Commercial Lending at Metropolitan Commercial Bank. During his 8 years at Metropolitan Commercial Bank the bank grew it’s lending assets from $400 million to over $3 billion. Mr. McNeill has additionally held lending roles at HSBC Bank US and Banco Santander. Mr. McNeill has also served as Managing Partner at American Real Estate Lending; a Commercial Real Estate finance company. Laura J. Waitz Chief Operating Officer (since 2017) 35+ Ms. Waitz has over 35 years of experience for various businesses and previously was Senior Managing Director, Global Head of Human Resources at The Blackstone Group. She also served as Managing Director and Global Head of Compensation at Citi Alternative Investments and as Head of Compensation (Americas) for Deutsche Bank. Prior to that she served as Global Compensation Manager for private equity and investment banks. Ms. Waitz received her B.S. from Penn State University. Experienced Leadership Team

BWFG | LISTED | NASDAQ Thank You & Questions