BWFG | LISTED | NASDAQ 2Q24 Investor Presentation July 24, 2024

2 BWFG LISTED NASDAQ BWFG LISTED NASDAQ This presentation may contain certain forward-looking statements about Bankwell Financial Group, Inc. (the “Company”). Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. Safe Harbor

3 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Table of Contents • 2Q24 Results • Credit Quality • Loans • Bankwell History & Overview

BWFG | LISTED | NASDAQ 2Q24 Results

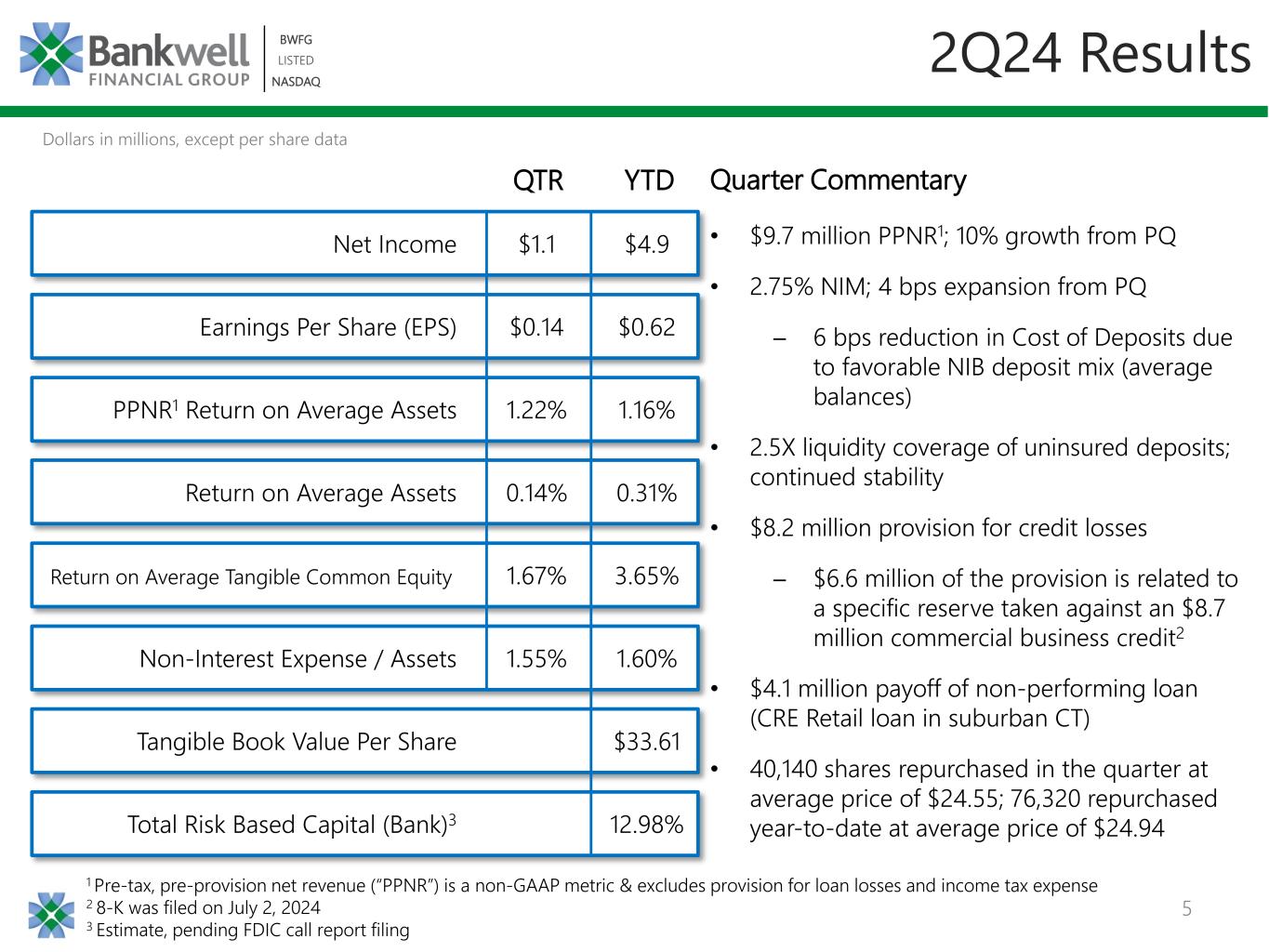

5 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Return on Average Tangible Common Equity 1.67% 3.65% Total Risk Based Capital (Bank)3 12.98% Tangible Book Value Per Share $33.61 2Q24 Results Net Income $1.1 $4.9 Earnings Per Share (EPS) $0.14 $0.62 PPNR1 Return on Average Assets 1.22% 1.16% Return on Average Assets 0.14% 0.31% Non-Interest Expense / Assets 1.55% 1.60% Dollars in millions, except per share data YTD Quarter Commentary • $9.7 million PPNR1; 10% growth from PQ • 2.75% NIM; 4 bps expansion from PQ ─ 6 bps reduction in Cost of Deposits due to favorable NIB deposit mix (average balances) • 2.5X liquidity coverage of uninsured deposits; continued stability • $8.2 million provision for credit losses ─ $6.6 million of the provision is related to a specific reserve taken against an $8.7 million commercial business credit2 • $4.1 million payoff of non-performing loan (CRE Retail loan in suburban CT) • 40,140 shares repurchased in the quarter at average price of $24.55; 76,320 repurchased year-to-date at average price of $24.94 1 Pre-tax, pre-provision net revenue (“PPNR”) is a non-GAAP metric & excludes provision for loan losses and income tax expense 2 8-K was filed on July 2, 2024 3 Estimate, pending FDIC call report filing QTR

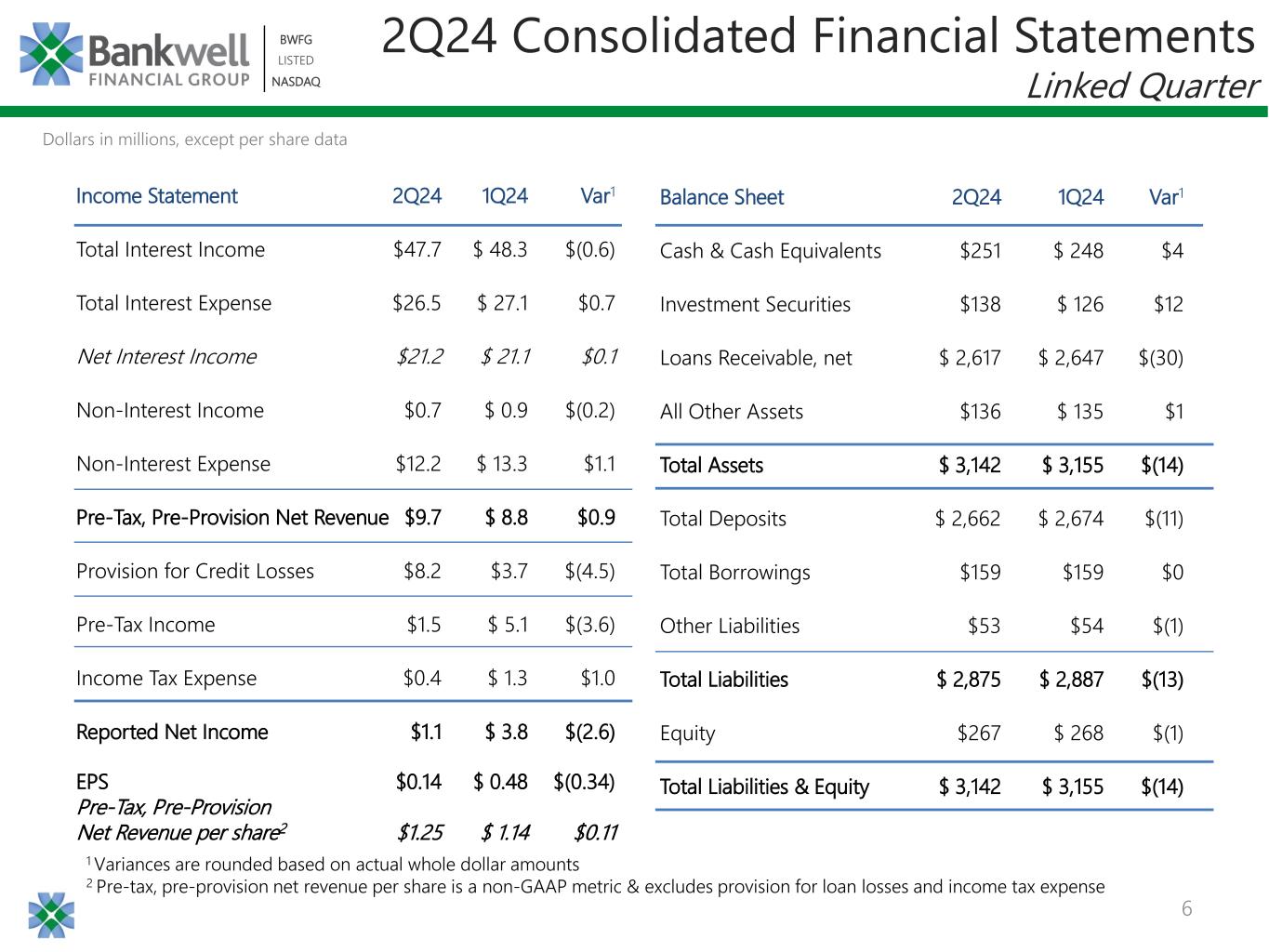

6 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Income Statement 2Q24 1Q24 Var1 Total Interest Income $47.7 $ 48.3 $(0.6) Total Interest Expense $26.5 $ 27.1 $0.7 Net Interest Income $21.2 $ 21.1 $0.1 Non-Interest Income $0.7 $ 0.9 $(0.2) Non-Interest Expense $12.2 $ 13.3 $1.1 Pre-Tax, Pre-Provision Net Revenue $9.7 $ 8.8 $0.9 Provision for Credit Losses $8.2 $3.7 $(4.5) Pre-Tax Income $1.5 $ 5.1 $(3.6) Income Tax Expense $0.4 $ 1.3 $1.0 Reported Net Income $1.1 $ 3.8 $(2.6) EPS $0.14 $ 0.48 $(0.34) Pre-Tax, Pre-Provision Net Revenue per share2 $1.25 $ 1.14 $0.11 1 Variances are rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense Dollars in millions, except per share data Balance Sheet 2Q24 1Q24 Var1 Cash & Cash Equivalents $251 $ 248 $4 Investment Securities $138 $ 126 $12 Loans Receivable, net $ 2,617 $ 2,647 $(30) All Other Assets $136 $ 135 $1 Total Assets $ 3,142 $ 3,155 $(14) Total Deposits $ 2,662 $ 2,674 $(11) Total Borrowings $159 $159 $0 Other Liabilities $53 $54 $(1) Total Liabilities $ 2,875 $ 2,887 $(13) Equity $267 $ 268 $(1) Total Liabilities & Equity $ 3,142 $ 3,155 $(14) 2Q24 Consolidated Financial Statements Linked Quarter

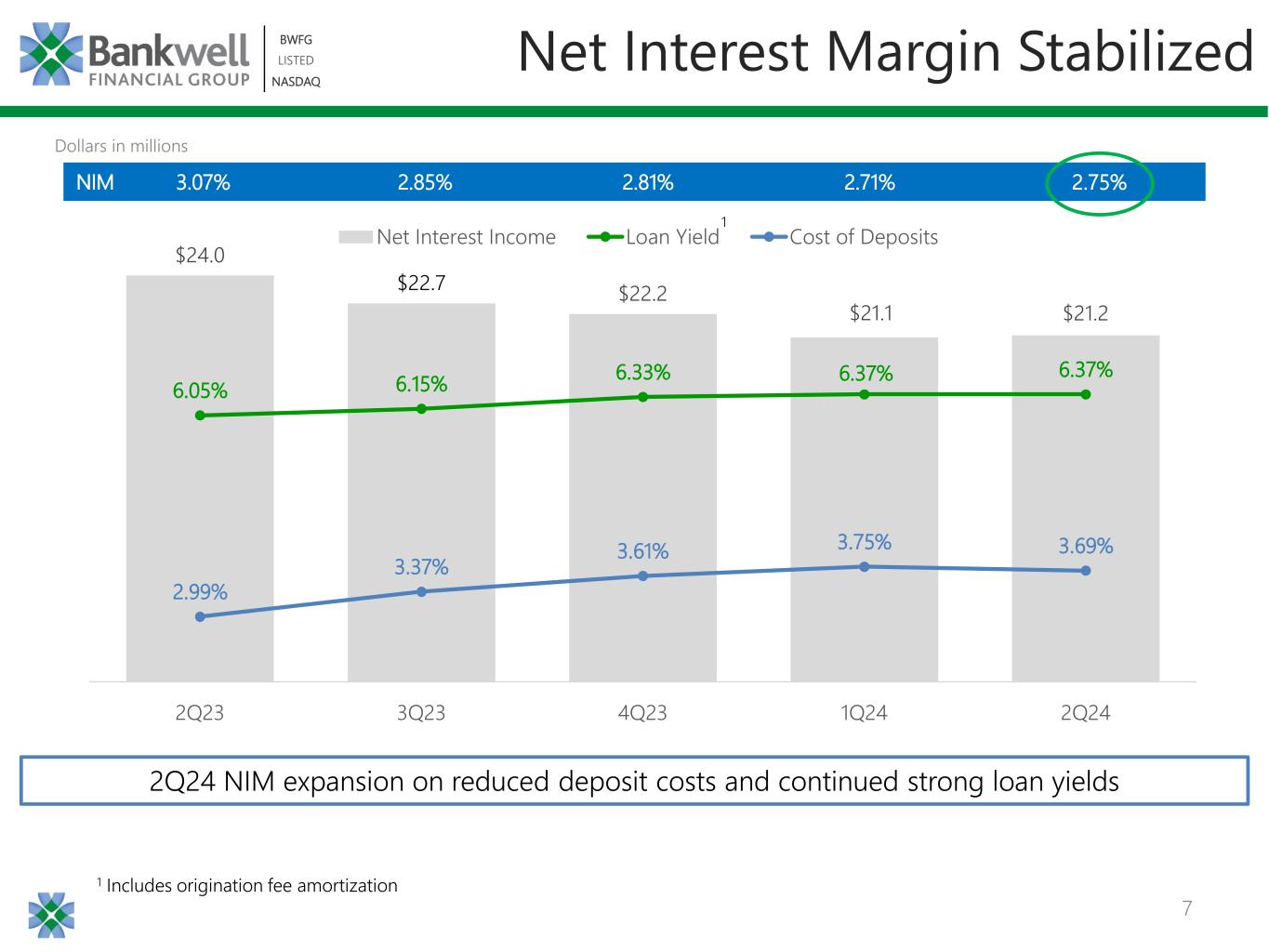

7 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $24.0 $22.7 $22.2 $21.1 $21.2 6.05% 6.15% 6.33% 6.37% 6.37% 2.99% 3.37% 3.61% 3.75% 3.69% $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 $21.0 $23.0 $25.0 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2Q23 3Q23 4Q23 1Q24 2Q24 Net Interest Income Loan Yield Cost of Deposits Net Interest Margin Stabilized 1 Includes origination fee amortization 1 NIM 3.07% 2.85% 2.81% 2.71% 2.75% 2Q24 NIM expansion on reduced deposit costs and continued strong loan yields Dollars in millions

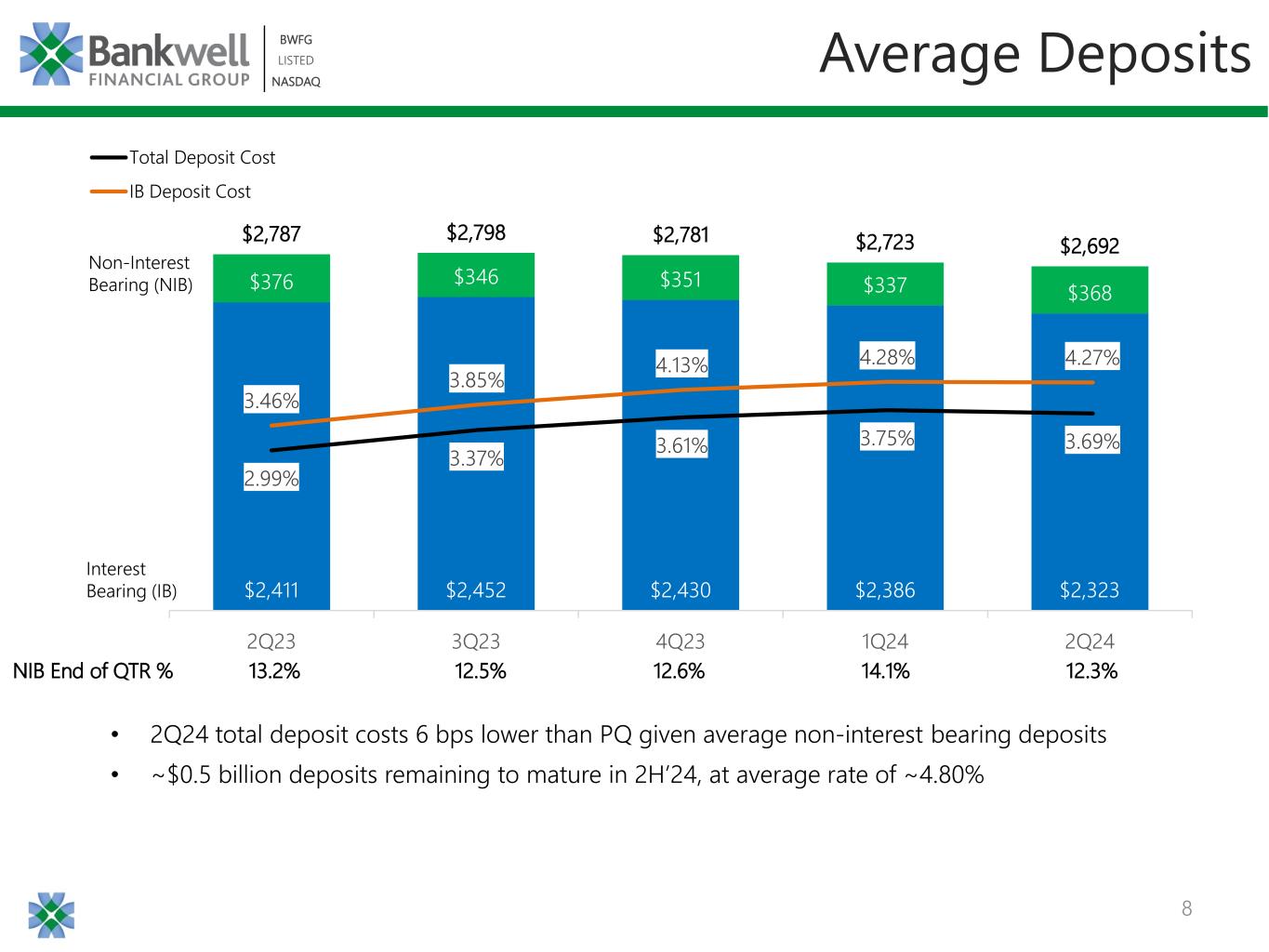

8 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $2,411 $2,452 $2,430 $2,386 $2,323 $376 $346 $351 $337 $368 $2,787 $2,798 $2,781 $2,723 $2,692 2Q23 3Q23 4Q23 1Q24 2Q24 2.99% 3.37% 3.61% 3.75% 3.69% 3.46% 3.85% 4.13% 4.28% 4.27% Total Deposit Cost IB Deposit Cost Average Deposits • 2Q24 total deposit costs 6 bps lower than PQ given average non-interest bearing deposits • ~$0.5 billion deposits remaining to mature in 2H’24, at average rate of ~4.80% NIB End of QTR % 13.2% 12.5% 12.6% 14.1% 12.3% Non-Interest Bearing (NIB) Interest Bearing (IB)

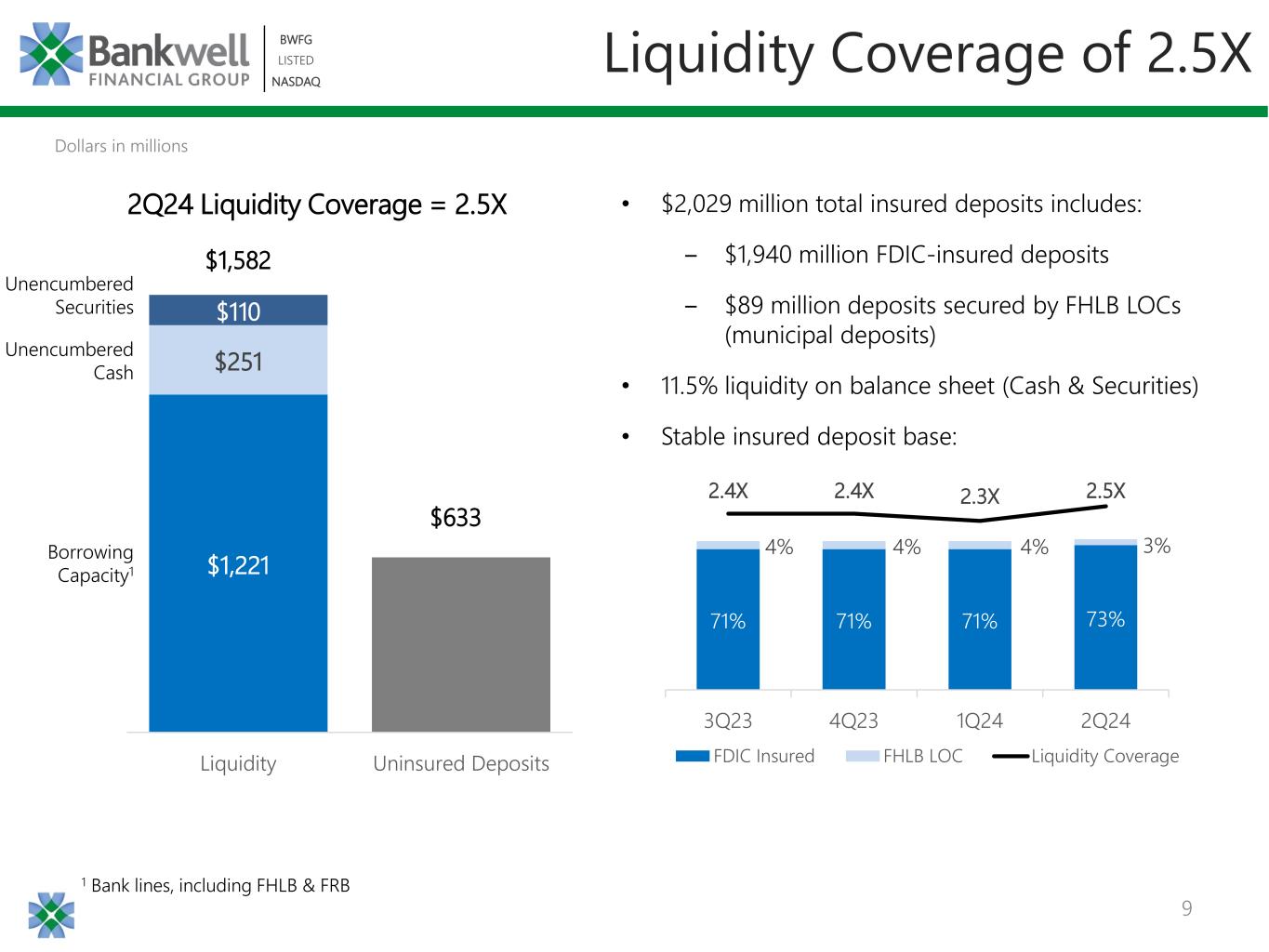

9 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Liquidity Coverage of 2.5X $1,221 $251 $110 Liquidity Uninsured Deposits 2Q24 Liquidity Coverage = 2.5X $1,582 $633 Borrowing Capacity1 Unencumbered Cash Unencumbered Securities 1 Bank lines, including FHLB & FRB 71% 71% 71% 73% 4% 4% 4% 3% 2.4X 2.4X 2.3X 2.5X 0.0X 0.5X 1.0X 1.5X 2.0X 2.5X 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3Q23 4Q23 1Q24 2Q24 FDIC Insured FHLB LOC Liquidity Coverage • $2,029 million total insured deposits includes: ‒ $1,940 million FDIC-insured deposits ‒ $89 million deposits secured by FHLB LOCs (municipal deposits) • 11.5% liquidity on balance sheet (Cash & Securities) • Stable insured deposit base: Dollars in millions

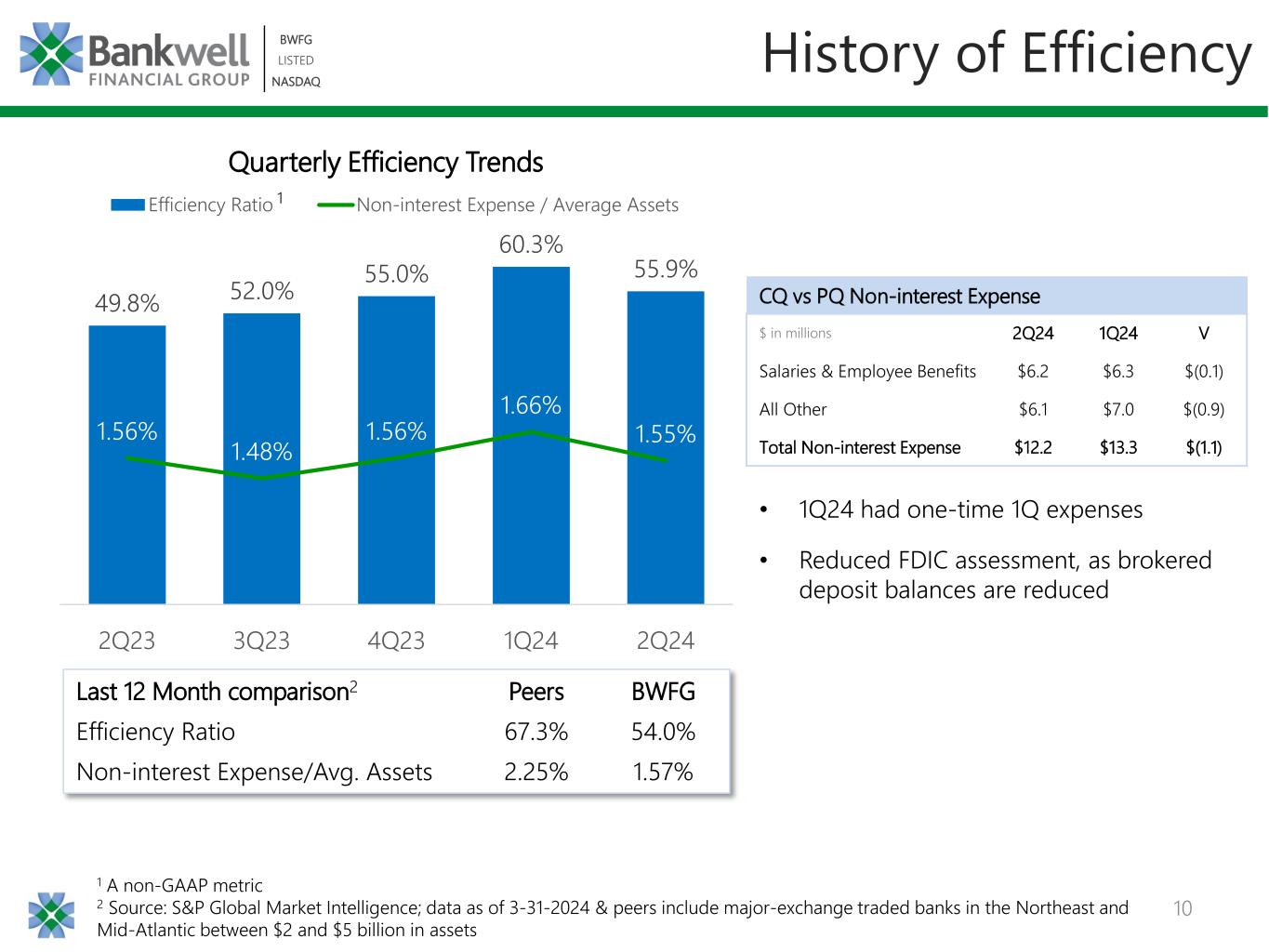

10 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 49.8% 52.0% 55.0% 60.3% 55.9% 1.56% 1.48% 1.56% 1.66% 1.55% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 2Q23 3Q23 4Q23 1Q24 2Q24 Efficiency Ratio Non-interest Expense / Average Assets 1 A non-GAAP metric 2 Source: S&P Global Market Intelligence; data as of 3-31-2024 & peers include major-exchange traded banks in the Northeast and Mid-Atlantic between $2 and $5 billion in assets 1 History of Efficiency • 1Q24 had one-time 1Q expenses • Reduced FDIC assessment, as brokered deposit balances are reduced Quarterly Efficiency Trends $ in millions 2Q24 1Q24 V Salaries & Employee Benefits $6.2 $6.3 $(0.1) All Other $6.1 $7.0 $(0.9) Total Non-interest Expense $12.2 $13.3 $(1.1) CQ vs PQ Non-interest Expense Last 12 Month comparison2 Peers BWFG Efficiency Ratio 67.3% 54.0% Non-interest Expense/Avg. Assets 2.25% 1.57%

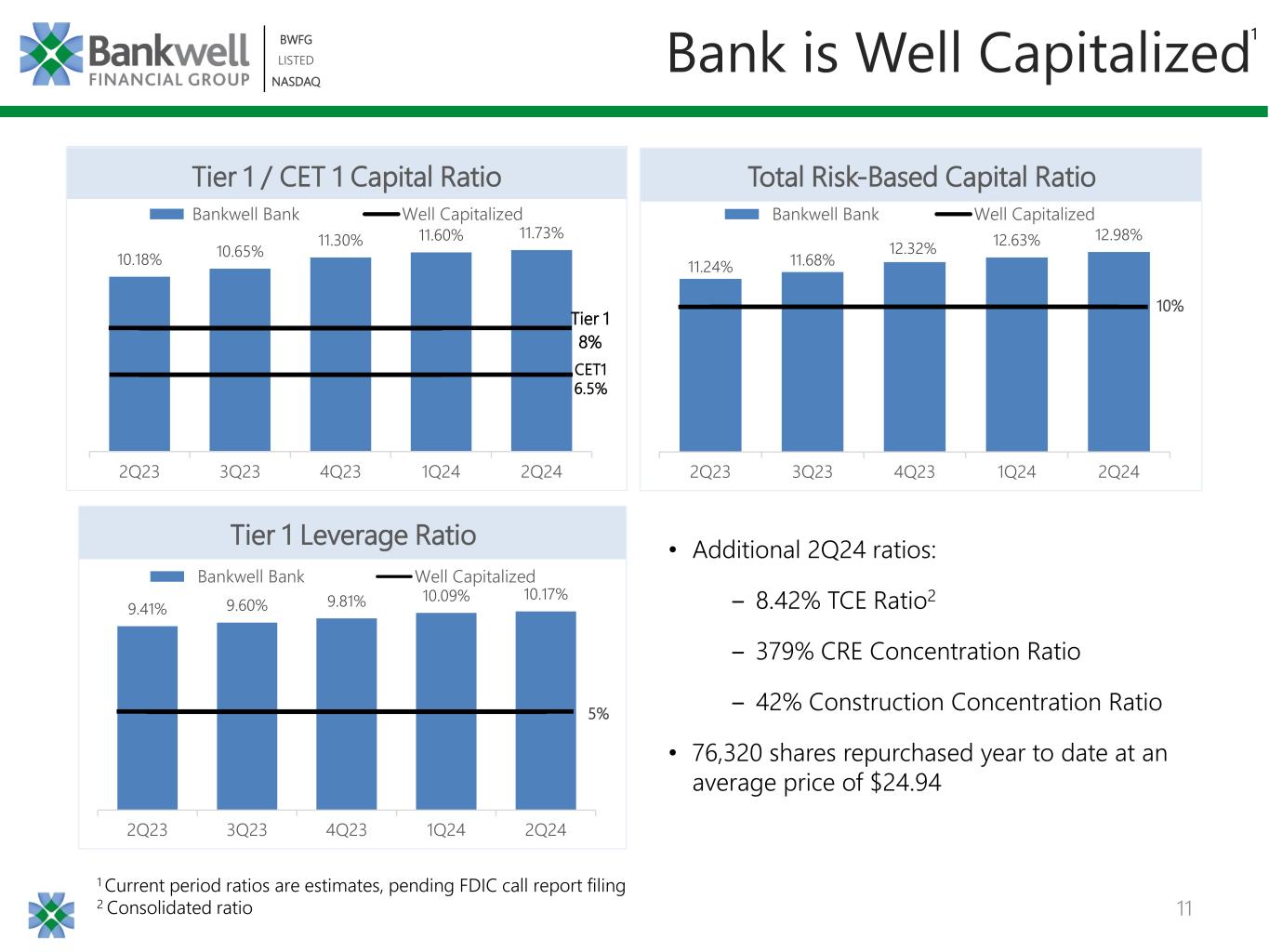

11 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Bank is Well Capitalized 9.41% 9.60% 9.81% 10.09% 10.17% 5% 2Q23 3Q23 4Q23 1Q24 2Q24 Tier 1 Leverage Ratio Bankwell Bank Well Capitalized 1 Current period ratios are estimates, pending FDIC call report filing 2 Consolidated ratio 10.18% 10.65% 11.30% 11.60% 11.73% Tier 1 8% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 2Q23 3Q23 4Q23 1Q24 2Q24 Tier 1 / CET 1 Capital Ratio Bankwell Bank Well Capitalized • Additional 2Q24 ratios: ‒ 8.42% TCE Ratio2 ‒ 379% CRE Concentration Ratio ‒ 42% Construction Concentration Ratio • 76,320 shares repurchased year to date at an average price of $24.94 1 CET1 6.5% 11.24% 11.68% 12.32% 12.63% 12.98% 10% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 2Q23 3Q23 4Q23 1Q24 2Q24 Total Risk-Based Capital Ratio Bankwell Bank Well Capitalized

BWFG | LISTED | NASDAQ Credit Quality

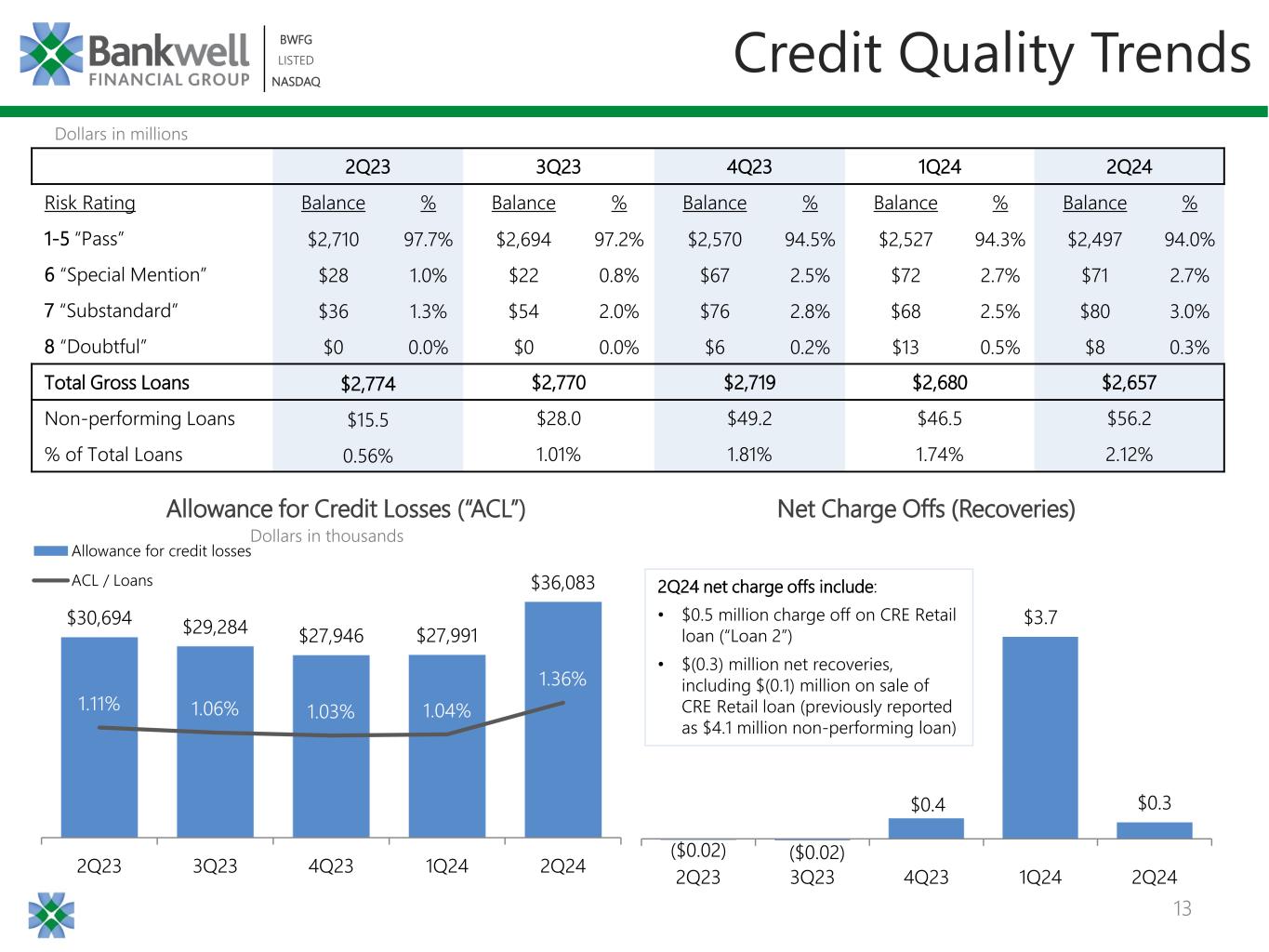

13 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Credit Quality Trends 2Q23 3Q23 4Q23 1Q24 2Q24 Risk Rating Balance % Balance % Balance % Balance % Balance % 1-5 “Pass” $2,710 97.7% $2,694 97.2% $2,570 94.5% $2,527 94.3% $2,497 94.0% 6 “Special Mention” $28 1.0% $22 0.8% $67 2.5% $72 2.7% $71 2.7% 7 “Substandard” $36 1.3% $54 2.0% $76 2.8% $68 2.5% $80 3.0% 8 “Doubtful” $0 0.0% $0 0.0% $6 0.2% $13 0.5% $8 0.3% Total Gross Loans $2,774 $2,770 $2,719 $2,680 $2,657 Non-performing Loans $15.5 $28.0 $49.2 $46.5 $56.2 % of Total Loans 0.56% 1.01% 1.81% 1.74% 2.12% Dollars in millions $30,694 $29,284 $27,946 $27,991 $36,083 1.11% 1.06% 1.03% 1.04% 1.36% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2Q23 3Q23 4Q23 1Q24 2Q24 Allowance for credit losses ACL / Loans Allowance for Credit Losses (“ACL”) Dollars in thousands ($0.02) ($0.02) $0.4 $3.7 $0.3 2Q23 3Q23 4Q23 1Q24 2Q24 Net Charge Offs (Recoveries) 2Q24 net charge offs include: • $0.5 million charge off on CRE Retail loan (“Loan 2”) • $(0.3) million net recoveries, including $(0.1) million on sale of CRE Retail loan (previously reported as $4.1 million non-performing loan)

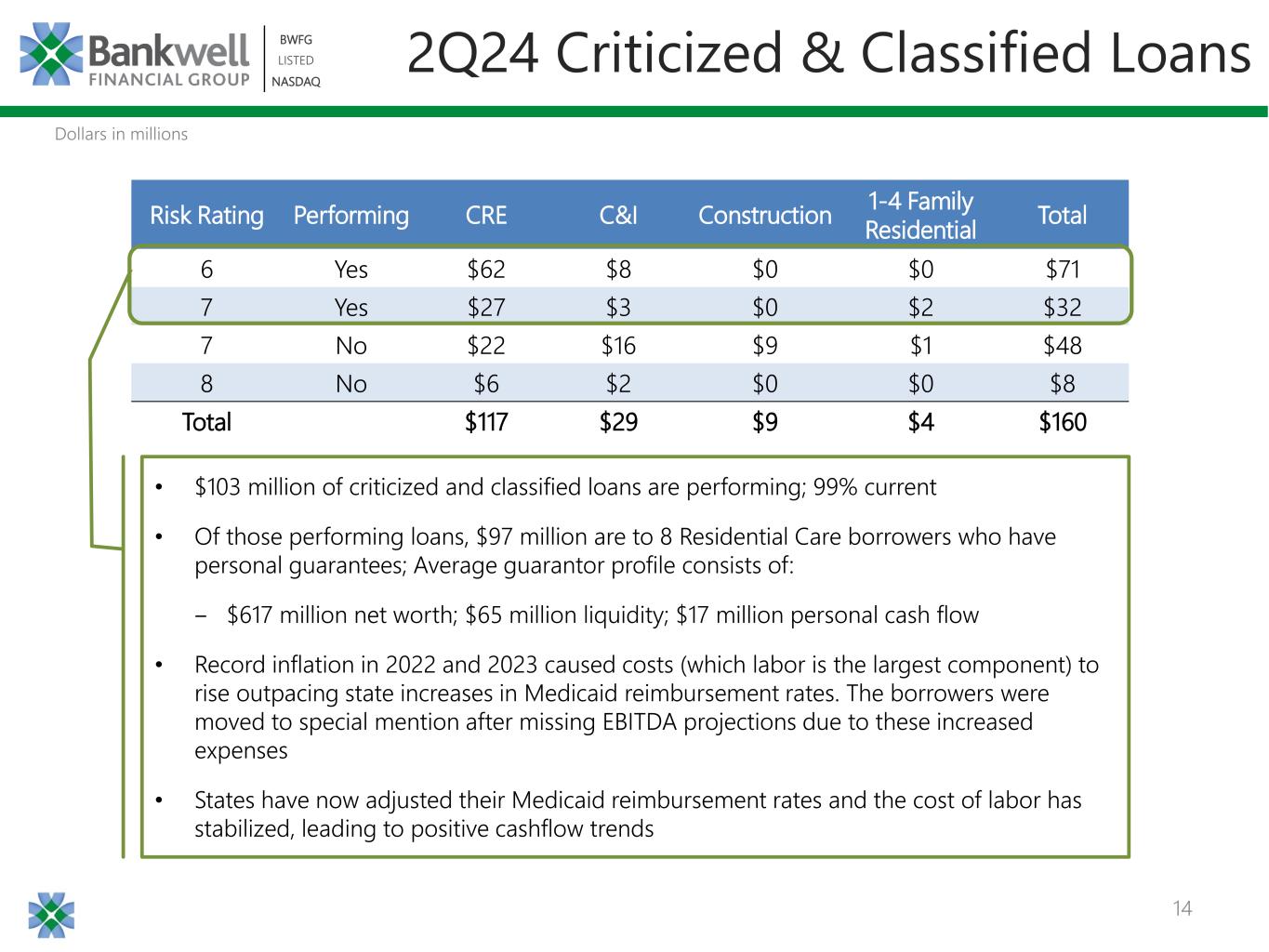

14 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 2Q24 Criticized & Classified Loans Risk Rating Performing CRE C&I Construction 1-4 Family Residential Total 6 Yes $62 $8 $0 $0 $71 7 Yes $27 $3 $0 $2 $32 7 No $22 $16 $9 $1 $48 8 No $6 $2 $0 $0 $8 Total $117 $29 $9 $4 $160 • $103 million of criticized and classified loans are performing; 99% current • Of those performing loans, $97 million are to 8 Residential Care borrowers who have personal guarantees; Average guarantor profile consists of: ‒ $617 million net worth; $65 million liquidity; $17 million personal cash flow • Record inflation in 2022 and 2023 caused costs (which labor is the largest component) to rise outpacing state increases in Medicaid reimbursement rates. The borrowers were moved to special mention after missing EBITDA projections due to these increased expenses • States have now adjusted their Medicaid reimbursement rates and the cost of labor has stabilized, leading to positive cashflow trends Dollars in millions

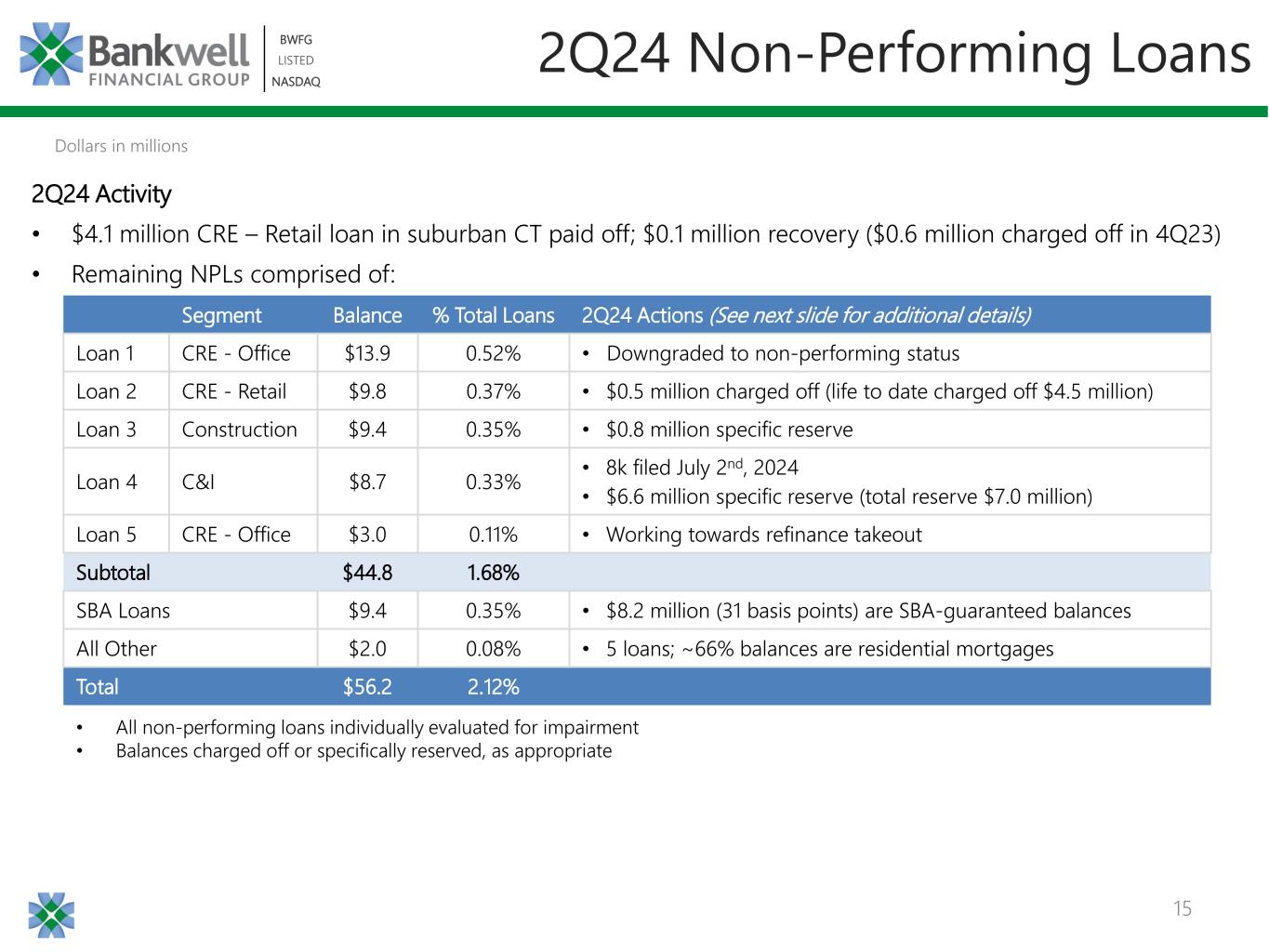

15 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 2Q24 Non-Performing Loans Segment Balance % Total Loans 2Q24 Actions (See next slide for additional details) Loan 1 CRE - Office $13.9 0.52% • Downgraded to non-performing status Loan 2 CRE - Retail $9.8 0.37% • $0.5 million charged off (life to date charged off $4.5 million) Loan 3 Construction $9.4 0.35% • $0.8 million specific reserve Loan 4 C&I $8.7 0.33% • 8k filed July 2nd, 2024 • $6.6 million specific reserve (total reserve $7.0 million) Loan 5 CRE - Office $3.0 0.11% • Working towards refinance takeout Subtotal $44.8 1.68% SBA Loans $9.4 0.35% • $8.2 million (31 basis points) are SBA-guaranteed balances All Other $2.0 0.08% • 5 loans; ~66% balances are residential mortgages Total $56.2 2.12% Dollars in millions • All non-performing loans individually evaluated for impairment • Balances charged off or specifically reserved, as appropriate 2Q24 Activity • $4.1 million CRE – Retail loan in suburban CT paid off; $0.1 million recovery ($0.6 million charged off in 4Q23) • Remaining NPLs comprised of:

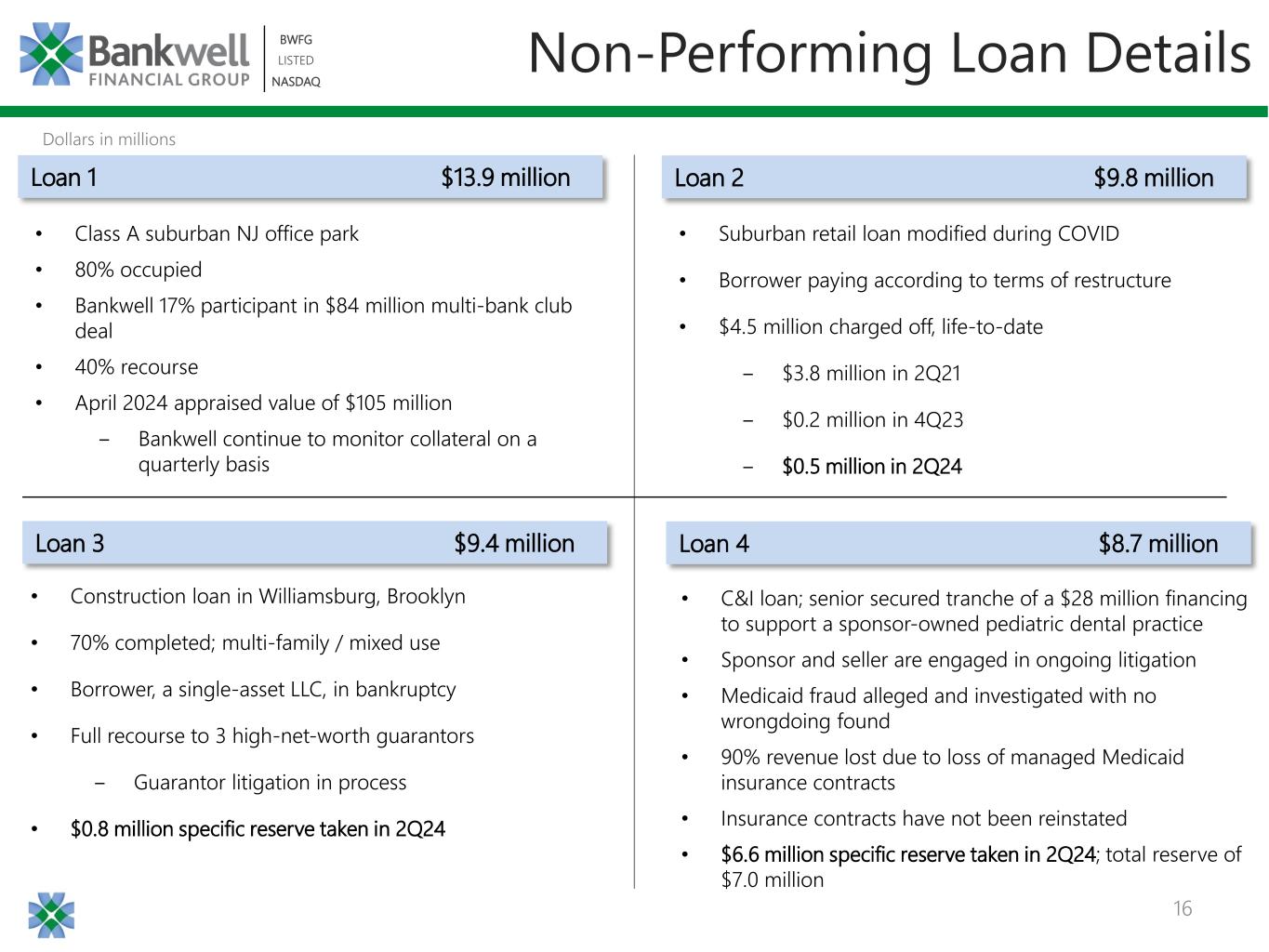

16 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Non-Performing Loan Details • Class A suburban NJ office park • 80% occupied • Bankwell 17% participant in $84 million multi-bank club deal • 40% recourse • April 2024 appraised value of $105 million ‒ Bankwell continue to monitor collateral on a quarterly basis Loan 1 $13.9 million Loan 2 $9.8 million Dollars in millions • Suburban retail loan modified during COVID • Borrower paying according to terms of restructure • $4.5 million charged off, life-to-date ‒ $3.8 million in 2Q21 ‒ $0.2 million in 4Q23 ‒ $0.5 million in 2Q24 Loan 3 $9.4 million Loan 4 $8.7 million • Construction loan in Williamsburg, Brooklyn • 70% completed; multi-family / mixed use • Borrower, a single-asset LLC, in bankruptcy • Full recourse to 3 high-net-worth guarantors ‒ Guarantor litigation in process • $0.8 million specific reserve taken in 2Q24 • C&I loan; senior secured tranche of a $28 million financing to support a sponsor-owned pediatric dental practice • Sponsor and seller are engaged in ongoing litigation • Medicaid fraud alleged and investigated with no wrongdoing found • 90% revenue lost due to loss of managed Medicaid insurance contracts • Insurance contracts have not been reinstated • $6.6 million specific reserve taken in 2Q24; total reserve of $7.0 million

BWFG | LISTED | NASDAQ Loans

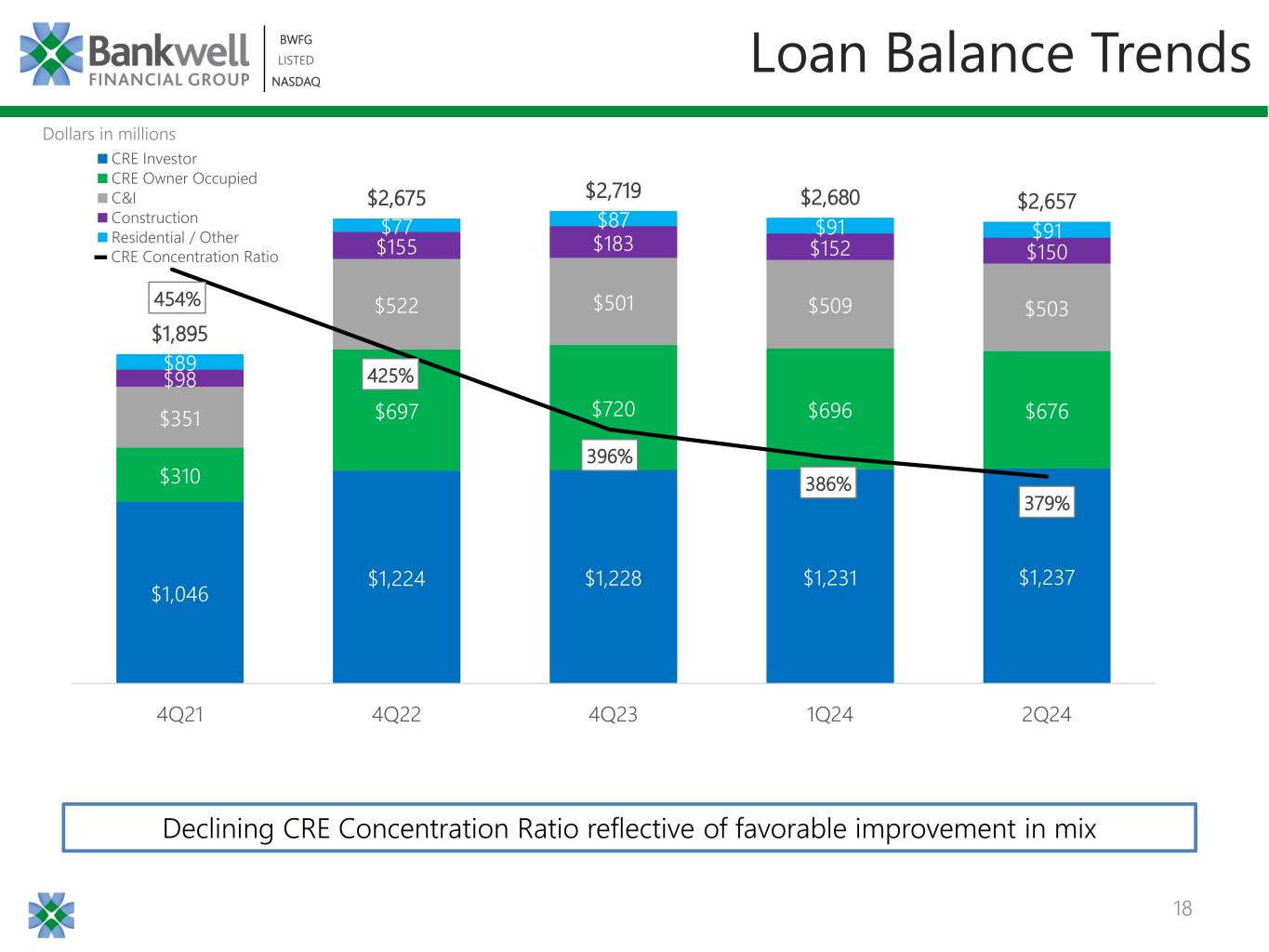

18 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $1,046 $1,224 $1,228 $1,231 $1,237 $310 $697 $720 $696 $676$351 $522 $501 $509 $503 $98 $155 $183 $152 $150 $89 $77 $87 $91 $91 $1,895 $2,675 $2,719 $2,680 $2,657 4Q21 4Q22 4Q23 1Q24 2Q24 CRE Investor CRE Owner Occupied C&I Construction Residential / Other Loan Balance Trends Dollars in millions Declining CRE Concentration Ratio reflective of favorable improvement in mix 454% 425% 396% 386% 379% CRE Concentration Ratio

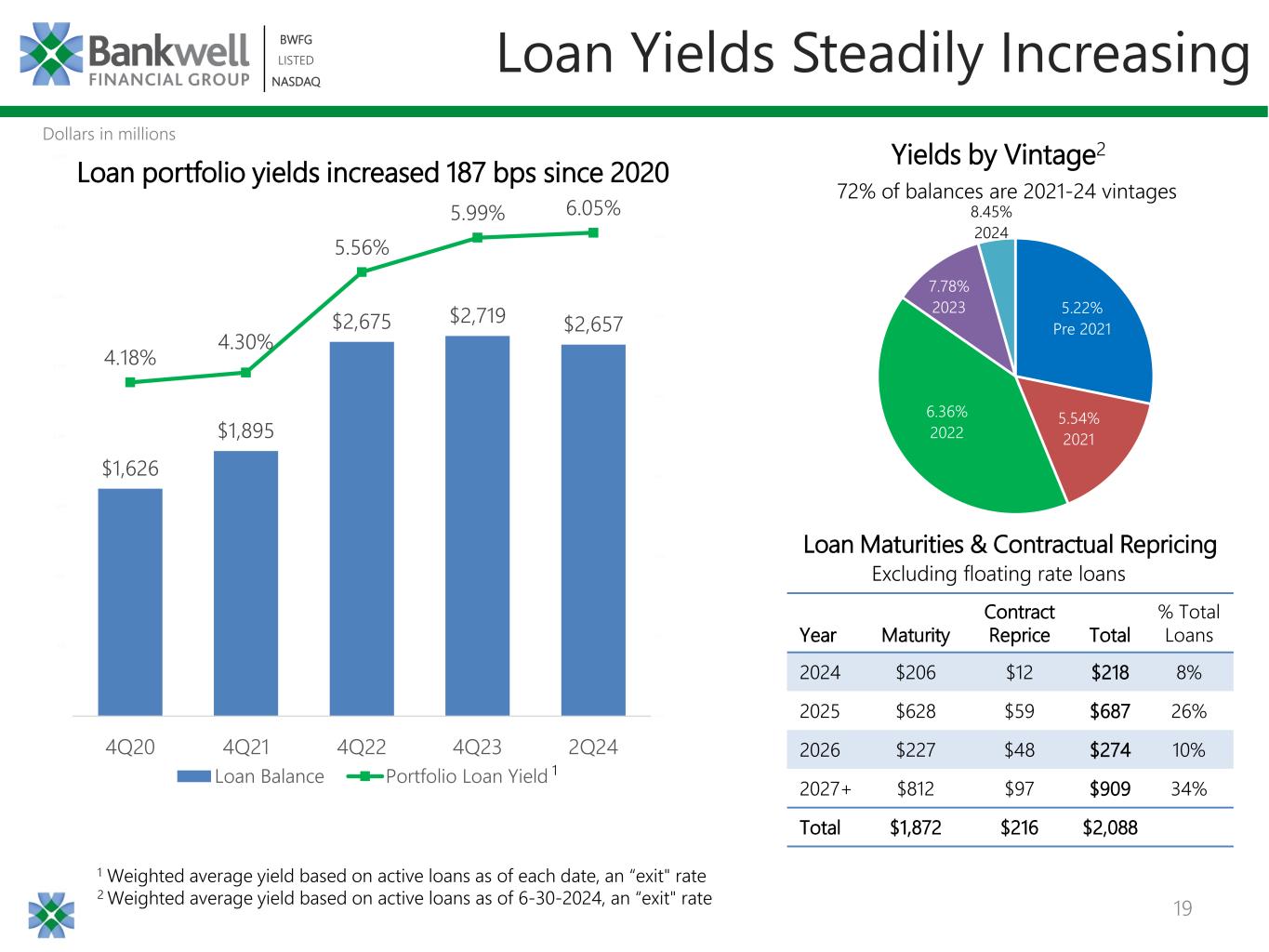

19 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $1,626 $1,895 $2,675 $2,719 $2,657 4.18% 4.30% 5.56% 5.99% 6.05% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4Q20 4Q21 4Q22 4Q23 2Q24 Loan Balance Portfolio Loan Yield Loan Yields Steadily Increasing 1 Weighted average yield based on active loans as of each date, an “exit" rate 2 Weighted average yield based on active loans as of 6-30-2024, an “exit" rate 1 Dollars in millions Loan portfolio yields increased 187 bps since 2020 72% of balances are 2021-24 vintages Yields by Vintage2 Loan Maturities & Contractual Repricing Year Maturity Contract Reprice Total % Total Loans 2024 $206 $12 $218 8% 2025 $628 $59 $687 26% 2026 $227 $48 $274 10% 2027+ $812 $97 $909 34% Total $1,872 $216 $2,088 Excluding floating rate loans 5.22% Pre 2021 5.54% 2021 6.36% 2022 7.78% 2023 8.45% 2024

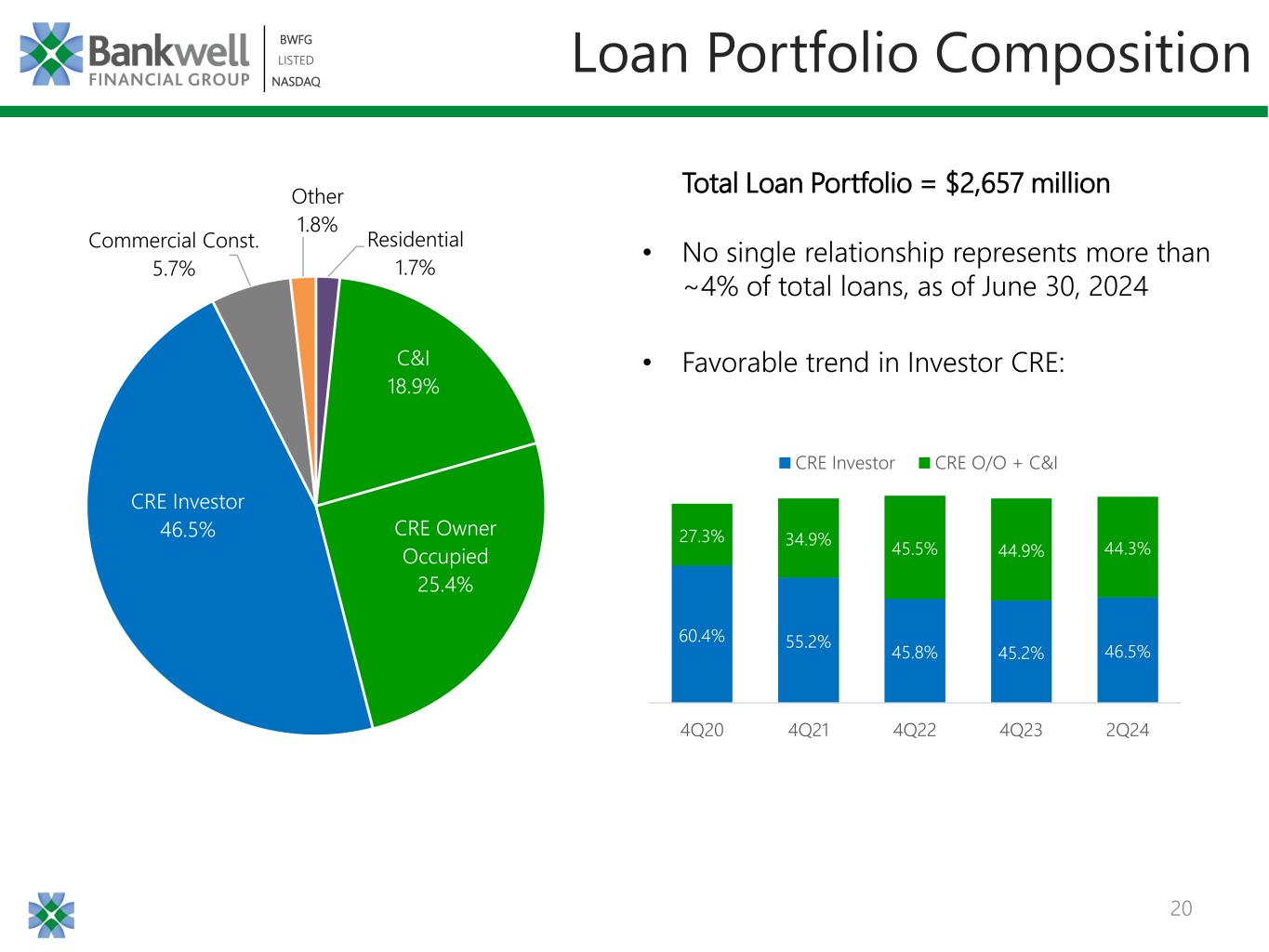

20 BWFG LISTED NASDAQ BWFG LISTED NASDAQ • No single relationship represents more than ~4% of total loans, as of June 30, 2024 • Favorable trend in Investor CRE: Total Loan Portfolio = $2,657 million Loan Portfolio Composition Residential 1.7% C&I 18.9% CRE Owner Occupied 25.4% CRE Investor 46.5% Commercial Const. 5.7% Other 1.8% 60.4% 55.2% 45.8% 45.2% 46.5% 27.3% 34.9% 45.5% 44.9% 44.3% 4Q20 4Q21 4Q22 4Q23 2Q24 CRE Investor CRE O/O + C&I

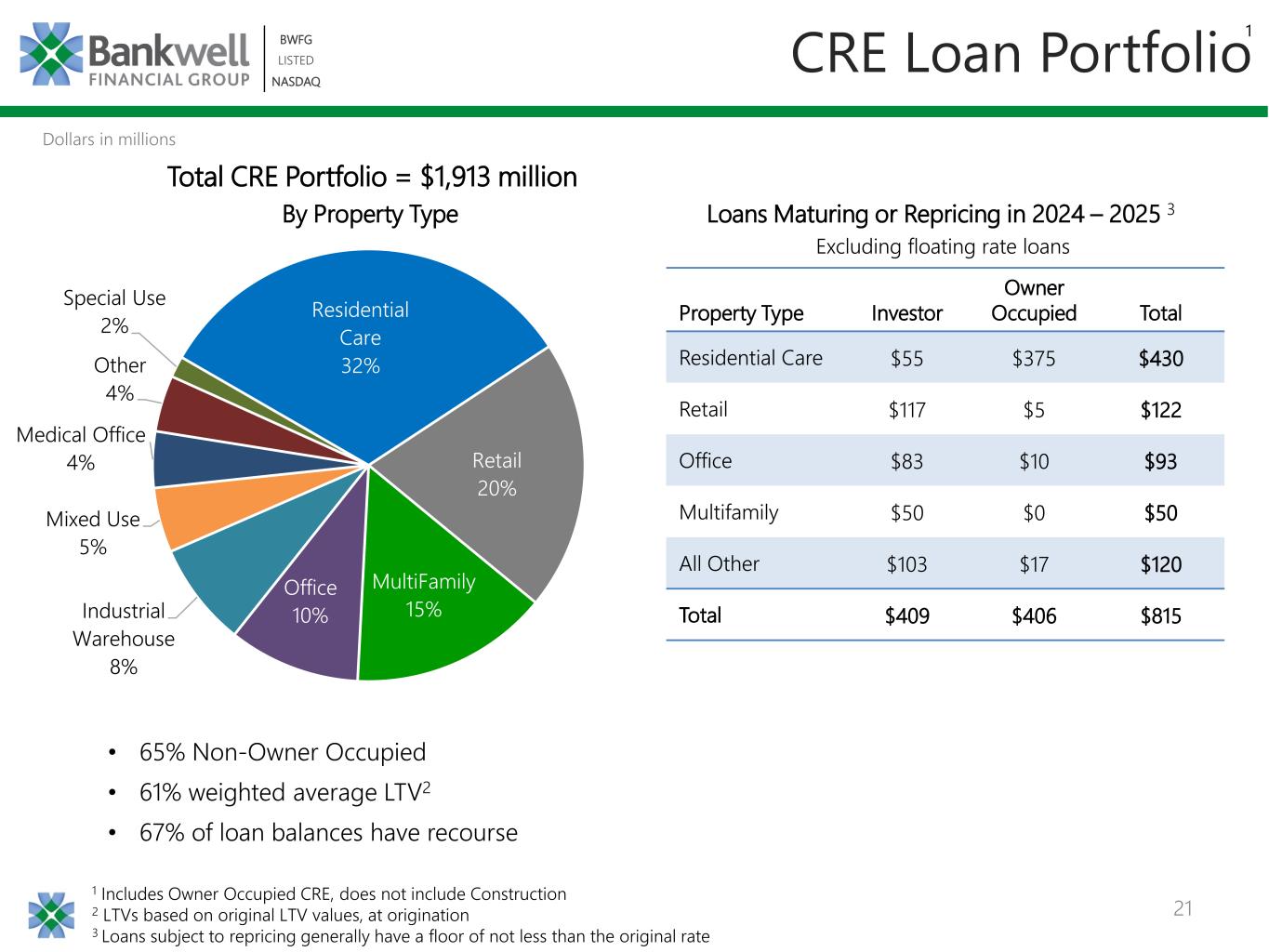

21 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Total CRE Portfolio = $1,913 million 1 Includes Owner Occupied CRE, does not include Construction 2 LTVs based on original LTV values, at origination 3 Loans subject to repricing generally have a floor of not less than the original rate CRE Loan Portfolio • 65% Non-Owner Occupied • 61% weighted average LTV2 • 67% of loan balances have recourse Dollars in millions 1 Property Type Investor Owner Occupied Total Residential Care $55 $375 $430 Retail $117 $5 $122 Office $83 $10 $93 Multifamily $50 $0 $50 All Other $103 $17 $120 Total $409 $406 $815 By Property Type Loans Maturing or Repricing in 2024 – 2025 3 Excluding floating rate loans Residential Care 32% Retail 20% MultiFamily 15% Office 10%Industrial Warehouse 8% Mixed Use 5% Medical Office 4% Other 4% Special Use 2%

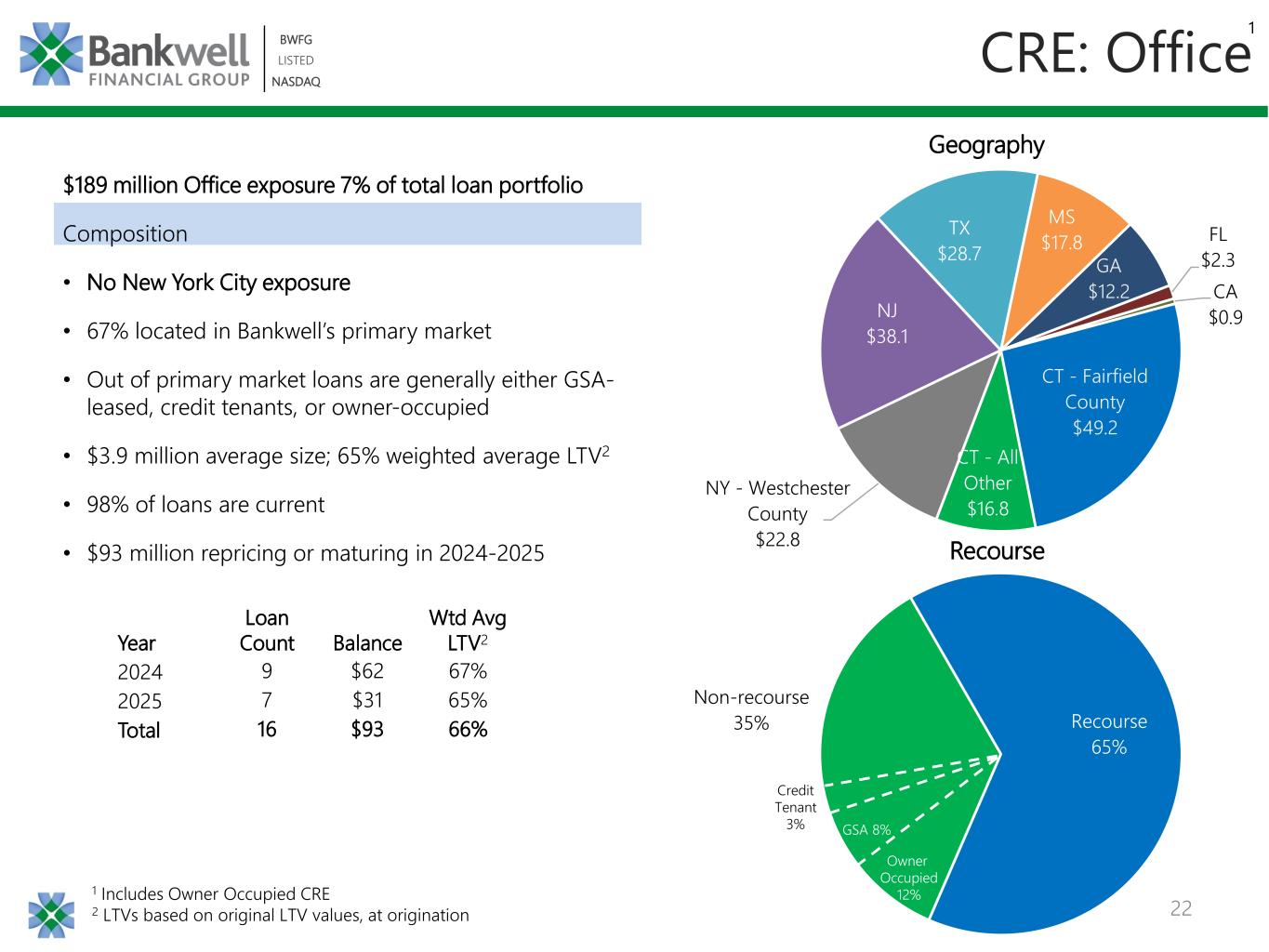

22 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $189 million Office exposure 7% of total loan portfolio Composition • No New York City exposure • 67% located in Bankwell’s primary market • Out of primary market loans are generally either GSA- leased, credit tenants, or owner-occupied • $3.9 million average size; 65% weighted average LTV2 • 98% of loans are current • $93 million repricing or maturing in 2024-2025 Recourse 65% Non-recourse 35% CRE: Office 1 1 Includes Owner Occupied CRE 2 LTVs based on original LTV values, at origination Geography Recourse Owner Occupied 12% GSA 8% Credit Tenant 3% Year Loan Count Balance Wtd Avg LTV2 2024 9 $62 67% 2025 7 $31 65% Total 16 $93 66% CT - Fairfield County $49.2 CT - All Other $16.8 NY - Westchester County $22.8 NJ $38.1 TX $28.7 MS $17.8 GA $12.2 FL $2.3 CA $0.9

23 BWFG LISTED NASDAQ BWFG LISTED NASDAQ C&I Loan Portfolio Loans by Industry Type Total C&I Portfolio = $503 million 1 Does not Include Owner Occupied CRE 1 • 98% of C&I portfolio has recourse • 93% of Healthcare loans have recourse - Primarily consists of working capital lines secured by government accounts receivable • Insurance lending primarily to brokers of home and auto insurance Health Care & Social Assistance 39% Insurance (Primarily Brokers) 22% Finance 13% Real Estate and Rental/Leasing 9% Admin & Support, Waste Mgmt, Remediation Svcs 4% Retail Trade 3% Arts, Entertainment & Recreation 2% Manufacturing 2% Other 6%

24 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Skilled Nursing Facilities 76% Assisted Living 14% Recovery 5% Other 5% Healthcare Portfolio Composition CRE Skilled Nursing Facility By State 1 Includes Physicians 1 $789 million combined Healthcare portfolio • Consists primarily of skilled nursing facilities located across the US • Healthcare lending team has more than 15 years of industry experience • High touch service model attracts desirable ultra-high net worth Healthcare borrowers • 100% of Skilled Nursing Lending has recourse • Focused on originating Healthcare loans in the most desirable states with: – Higher average occupancy – Low denial of payment rates for Medicaid – Strong senior demographic trends – Certificate of need programs FL 47% OH 13% NY 12% AL 4% PA 4% NJ 4% IA 2% Other 13% Combined Healthcare Exposure (CRE and C&I)

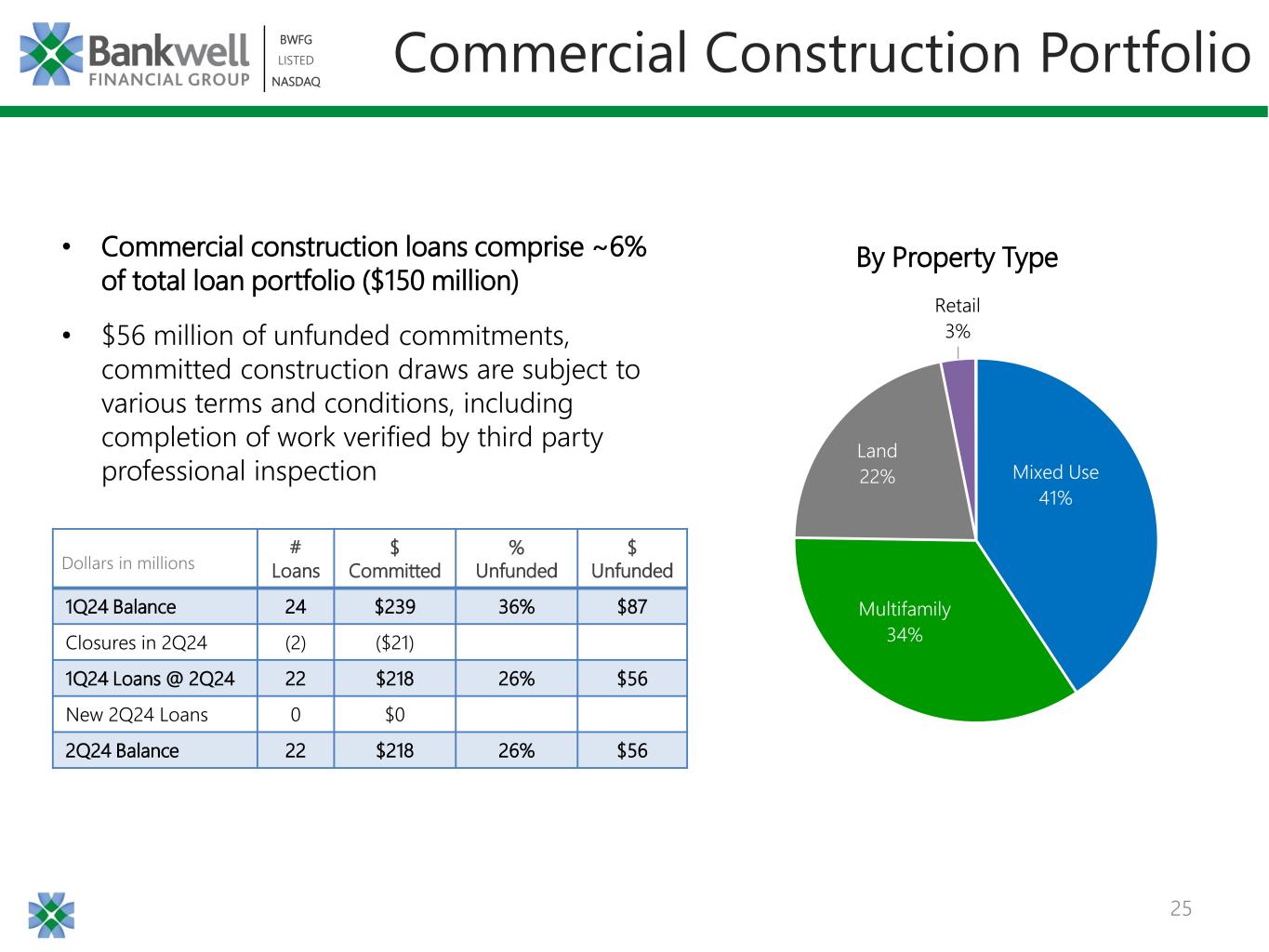

25 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Commercial Construction Portfolio • Commercial construction loans comprise ~6% of total loan portfolio ($150 million) • $56 million of unfunded commitments, committed construction draws are subject to various terms and conditions, including completion of work verified by third party professional inspection Dollars in millions By Property Type # Loans $ Committed % Unfunded $ Unfunded 1Q24 Balance 24 $239 36% $87 Closures in 2Q24 (2) ($21) 1Q24 Loans @ 2Q24 22 $218 26% $56 New 2Q24 Loans 0 $0 2Q24 Balance 22 $218 26% $56 Mixed Use 41% Multifamily 34% Land 22% Retail 3%

BWFG | LISTED | NASDAQ History & Overview

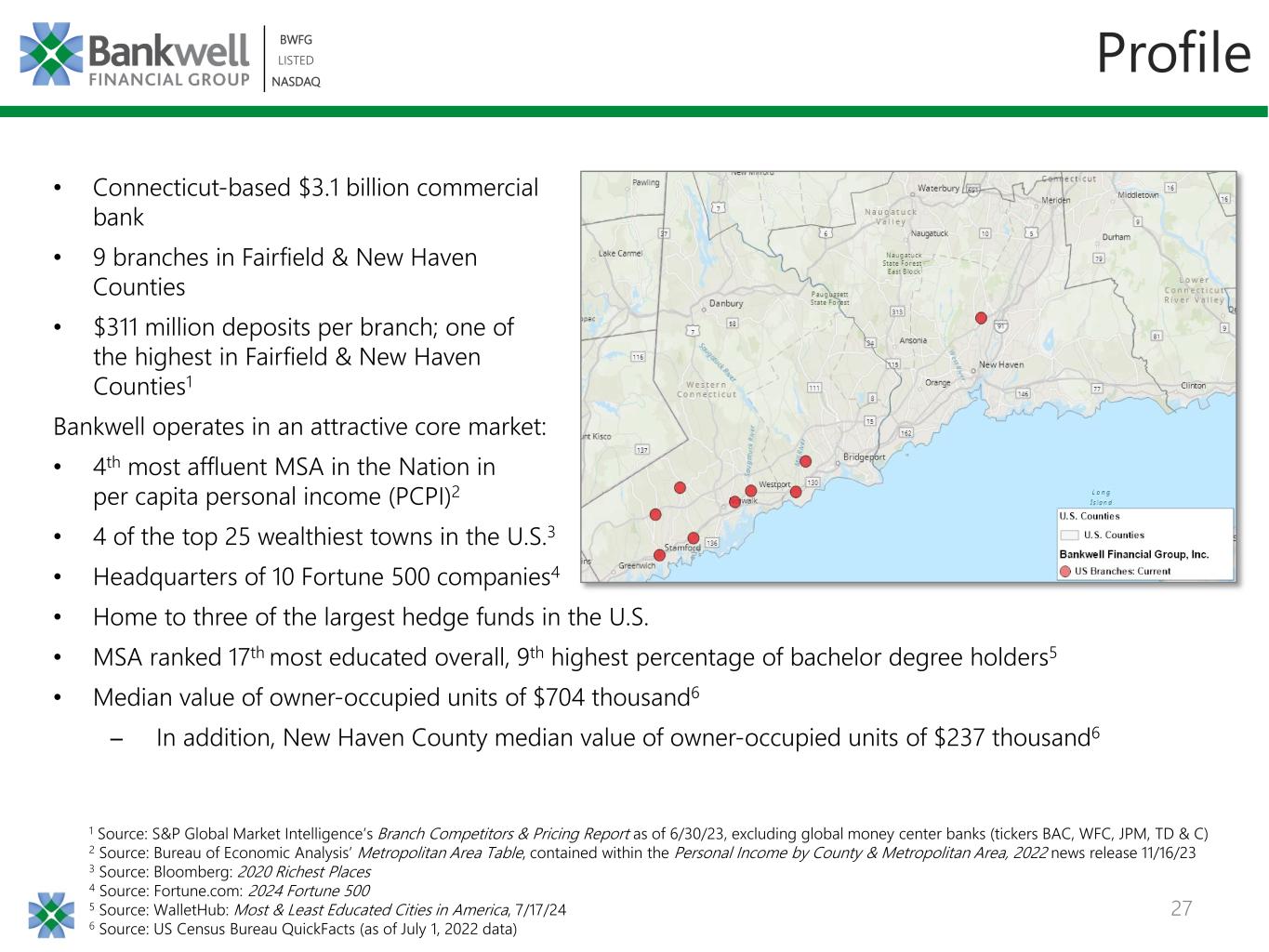

27 BWFG LISTED NASDAQ BWFG LISTED NASDAQ • Connecticut-based $3.1 billion commercial bank • 9 branches in Fairfield & New Haven Counties • $311 million deposits per branch; one of the highest in Fairfield & New Haven Counties1 Bankwell operates in an attractive core market: • 4th most affluent MSA in the Nation in per capita personal income (PCPI)2 • 4 of the top 25 wealthiest towns in the U.S.3 • Headquarters of 10 Fortune 500 companies4 • Home to three of the largest hedge funds in the U.S. • MSA ranked 17th most educated overall, 9th highest percentage of bachelor degree holders5 • Median value of owner-occupied units of $704 thousand6 ̶ In addition, New Haven County median value of owner-occupied units of $237 thousand6 1 Source: S&P Global Market Intelligence’s Branch Competitors & Pricing Report as of 6/30/23, excluding global money center banks (tickers BAC, WFC, JPM, TD & C) 2 Source: Bureau of Economic Analysis’ Metropolitan Area Table, contained within the Personal Income by County & Metropolitan Area, 2022 news release 11/16/23 3 Source: Bloomberg: 2020 Richest Places 4 Source: Fortune.com: 2024 Fortune 500 5 Source: WalletHub: Most & Least Educated Cities in America, 7/17/24 6 Source: US Census Bureau QuickFacts (as of July 1, 2022 data) Profile

28 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 0.70% 1.49% 2.05% 1.50% 1.16% 2020 2021 2022 2023 2Q24 YTD PPNR Return on Average Assets Performance Trends $0.75 $3.36 $4.79 $4.67 $0.62 2020 2021 2022 2023 2Q24 YTD Diluted EPS 0.28% 1.17% 1.44% 1.13% 0.31% 2020 2021 2022 2023 2Q24 YTD Return on Average Assets 3.40% 14.05% 16.91% 14.70% 3.65% 2020 2021 2022 2023 2Q24 YTD Return on Average Tangible Common Equity 1 Pre-tax, pre-provision net revenue is a non-GAAP metric & excludes provision for loan losses and income tax expense 1

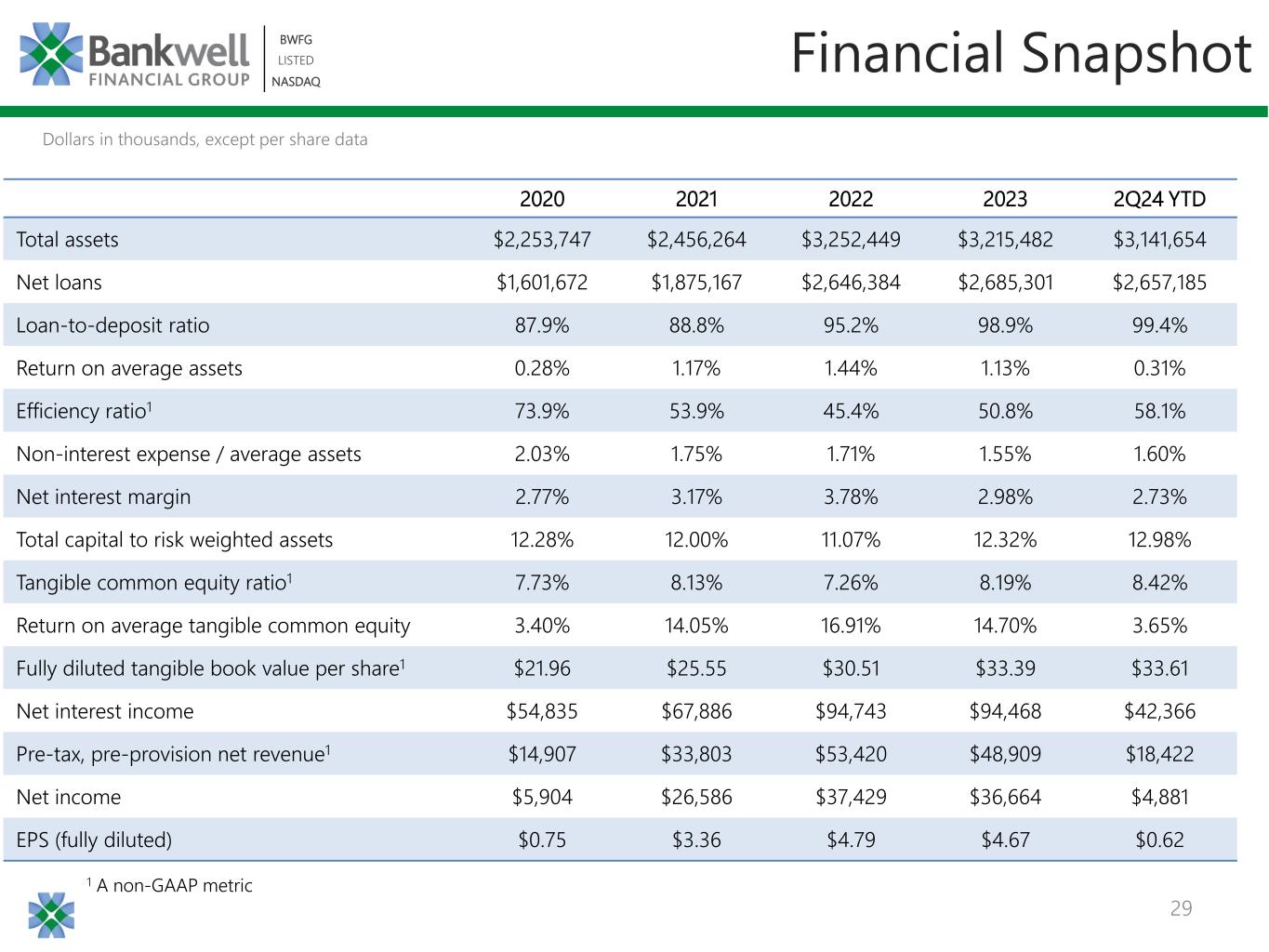

29 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Financial Snapshot 2020 2021 2022 2023 2Q24 YTD Total assets $2,253,747 $2,456,264 $3,252,449 $3,215,482 $3,141,654 Net loans $1,601,672 $1,875,167 $2,646,384 $2,685,301 $2,657,185 Loan-to-deposit ratio 87.9% 88.8% 95.2% 98.9% 99.4% Return on average assets 0.28% 1.17% 1.44% 1.13% 0.31% Efficiency ratio1 73.9% 53.9% 45.4% 50.8% 58.1% Non-interest expense / average assets 2.03% 1.75% 1.71% 1.55% 1.60% Net interest margin 2.77% 3.17% 3.78% 2.98% 2.73% Total capital to risk weighted assets 12.28% 12.00% 11.07% 12.32% 12.98% Tangible common equity ratio1 7.73% 8.13% 7.26% 8.19% 8.42% Return on average tangible common equity 3.40% 14.05% 16.91% 14.70% 3.65% Fully diluted tangible book value per share1 $21.96 $25.55 $30.51 $33.39 $33.61 Net interest income $54,835 $67,886 $94,743 $94,468 $42,366 Pre-tax, pre-provision net revenue1 $14,907 $33,803 $53,420 $48,909 $18,422 Net income $5,904 $26,586 $37,429 $36,664 $4,881 EPS (fully diluted) $0.75 $3.36 $4.79 $4.67 $0.62 1 A non-GAAP metric Dollars in thousands, except per share data

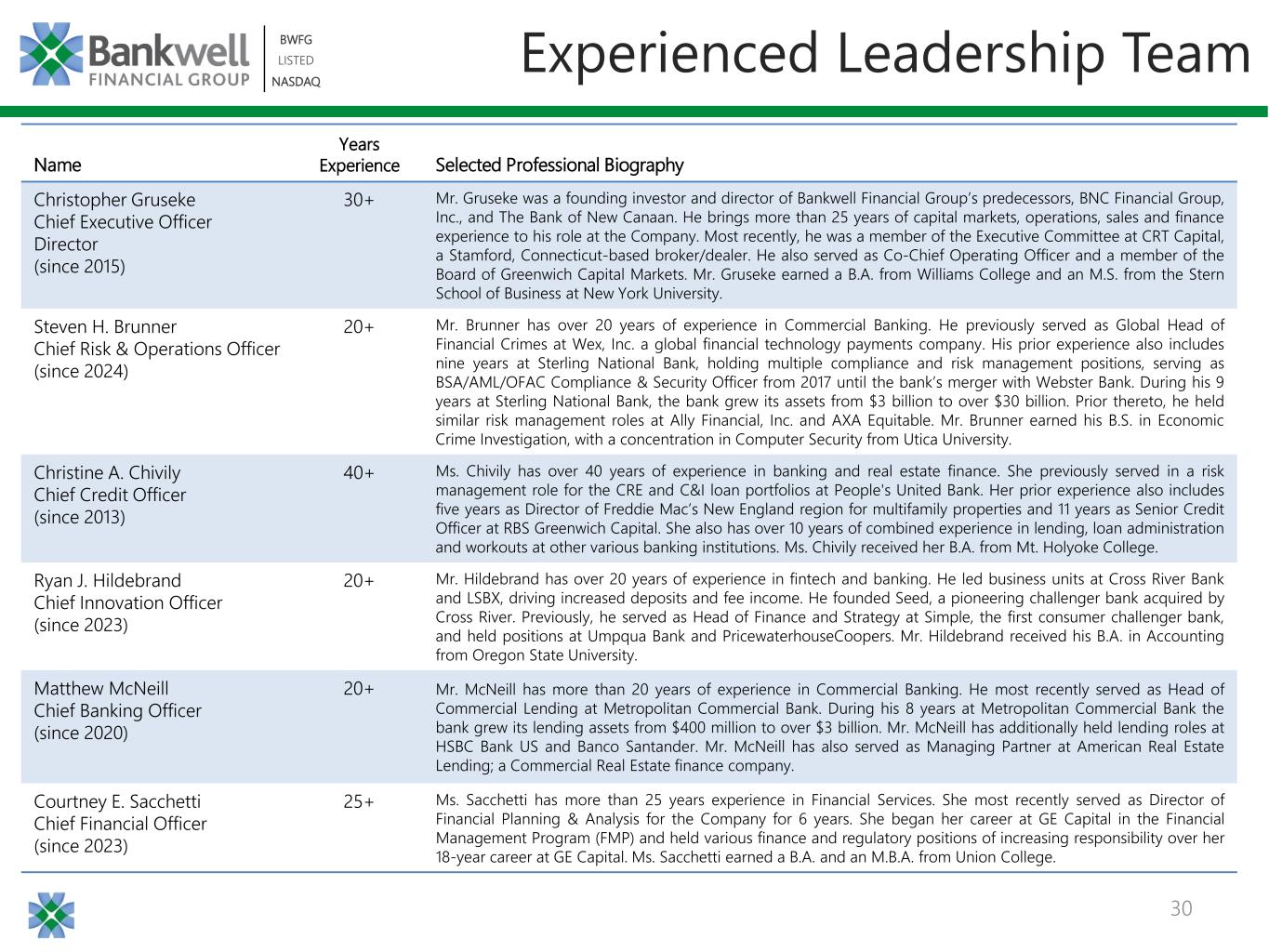

30 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Name Years Experience Selected Professional Biography Christopher Gruseke Chief Executive Officer Director (since 2015) 30+ Mr. Gruseke was a founding investor and director of Bankwell Financial Group’s predecessors, BNC Financial Group, Inc., and The Bank of New Canaan. He brings more than 25 years of capital markets, operations, sales and finance experience to his role at the Company. Most recently, he was a member of the Executive Committee at CRT Capital, a Stamford, Connecticut-based broker/dealer. He also served as Co-Chief Operating Officer and a member of the Board of Greenwich Capital Markets. Mr. Gruseke earned a B.A. from Williams College and an M.S. from the Stern School of Business at New York University. Steven H. Brunner Chief Risk & Operations Officer (since 2024) 20+ Mr. Brunner has over 20 years of experience in Commercial Banking. He previously served as Global Head of Financial Crimes at Wex, Inc. a global financial technology payments company. His prior experience also includes nine years at Sterling National Bank, holding multiple compliance and risk management positions, serving as BSA/AML/OFAC Compliance & Security Officer from 2017 until the bank’s merger with Webster Bank. During his 9 years at Sterling National Bank, the bank grew its assets from $3 billion to over $30 billion. Prior thereto, he held similar risk management roles at Ally Financial, Inc. and AXA Equitable. Mr. Brunner earned his B.S. in Economic Crime Investigation, with a concentration in Computer Security from Utica University. Christine A. Chivily Chief Credit Officer (since 2013) 40+ Ms. Chivily has over 40 years of experience in banking and real estate finance. She previously served in a risk management role for the CRE and C&I loan portfolios at People's United Bank. Her prior experience also includes five years as Director of Freddie Mac’s New England region for multifamily properties and 11 years as Senior Credit Officer at RBS Greenwich Capital. She also has over 10 years of combined experience in lending, loan administration and workouts at other various banking institutions. Ms. Chivily received her B.A. from Mt. Holyoke College. Ryan J. Hildebrand Chief Innovation Officer (since 2023) 20+ Mr. Hildebrand has over 20 years of experience in fintech and banking. He led business units at Cross River Bank and LSBX, driving increased deposits and fee income. He founded Seed, a pioneering challenger bank acquired by Cross River. Previously, he served as Head of Finance and Strategy at Simple, the first consumer challenger bank, and held positions at Umpqua Bank and PricewaterhouseCoopers. Mr. Hildebrand received his B.A. in Accounting from Oregon State University. Matthew McNeill Chief Banking Officer (since 2020) 20+ Mr. McNeill has more than 20 years of experience in Commercial Banking. He most recently served as Head of Commercial Lending at Metropolitan Commercial Bank. During his 8 years at Metropolitan Commercial Bank the bank grew its lending assets from $400 million to over $3 billion. Mr. McNeill has additionally held lending roles at HSBC Bank US and Banco Santander. Mr. McNeill has also served as Managing Partner at American Real Estate Lending; a Commercial Real Estate finance company. Courtney E. Sacchetti Chief Financial Officer (since 2023) 25+ Ms. Sacchetti has more than 25 years experience in Financial Services. She most recently served as Director of Financial Planning & Analysis for the Company for 6 years. She began her career at GE Capital in the Financial Management Program (FMP) and held various finance and regulatory positions of increasing responsibility over her 18-year career at GE Capital. Ms. Sacchetti earned a B.A. and an M.B.A. from Union College. Experienced Leadership Team

BWFG | LISTED | NASDAQ Thank You & Questions