October 28, 2024 Third Quarter 2024 Investor Presentation

Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “intend,” "target,” “outlook,” “project,” “guidance,” “forecast,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. Forward Looking Statement 2

Third Quarter 2024 Results 3 Reduced brokered deposit balances by $24.2 million LQ Reported net interest margin of 2.72%, down -3 bps LQ, future margin expansion still expected Continued progress on strategic initiatives in pipeline Strong growth in Bankwell Direct deposit channel, up $85 million LQ $8.2 million charge off on single CRE Office loan; 8k filed October 11, 2024 Capital build in consolidated CET1; modest buy backs

Third Quarter 2024 Financial Summary 4 EPS PPNR Loans Deposits Capital • Fully diluted EPS of $0.24 includes $0.79 from $8.2 million charge off • Lower EPS versus PYQ a function of higher provision and lower margin • PPNR of $9.0 million, or $1.17 per share, declined -7% LQ • Net interest income of $20.7 adversely impacted by non-accrual loan and calling costs on brokered CDs, minimal benefit of deposit repricing during quarter • Non-interest expense rose 5% LQ, largely driven by investment in strategic initiatives • Loan balances fell $34 million LQ due to prepayments and charge offs; originations remain strong at ~$140 million in the quarter • Provision of $6.3 million included $8.2 million charge off on CRE Office Loan • Deposits increased $25.8 million, brokered deposits fell $24.2 million (both LQ) • Loan to deposit ratio remains stable at 97.4% as asset base relatively flat • Tangible book value of $33.76, up $0.15 versus LQ and up 4% versus PYQ • Consolidated CET1 ratio grew to 9.71%; Bank Total Capital ratio ended at 12.83%1 1 Estimates, pending FDIC call report filing.

Third Quarter 2024 GAAP Results 5 Bankwell Financial Group, Inc. ($ in millions, except per share data) Q3 2024 Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Net Interest Income $ 20.7 $ 21.2 $ 21.1 $ 22.2 $ 22.7 $ 24.0 $ 25.5 $ 26.8 $ 24.6 Provision for Credit Losses 6.3 8.2 3.7 (1.0) (1.6) 2.6 0.8 4.3 2.4 Total Noninterest Income 1.2 0.7 0.9 1.1 0.8 1.4 1.5 0.5 0.4 Total Revenue 21.9 21.9 22.1 23.4 23.5 25.4 27.1 27.3 25.0 Total Noninterest Expenses 12.9 12.2 13.3 12.9 12.2 12.6 12.7 12.5 11.0 Income before Taxes 2.7 1.5 5.1 11.5 12.9 10.2 13.6 10.6 11.6 Net Income 1.9 1.1 3.8 8.5 9.8 8.0 10.4 8.0 9.2 Diluted Earnings Per Share 0.24 0.14 0.48 1.09 1.25 1.02 1.33 1.04 1.18 Total Assets 3,161.1 3,141.7 3,155.3 3,215.5 3,249.8 3,252.7 3,252.3 3,252.4 2,723.0 Gross Loans Receivable (ex. HFS) 2,619.3 2,652.8 2,674.7 2,713.2 2,764.5 2,767.3 2,752.5 2,668.8 2,281.6 Allowance for Credit Losses on Loans & Leases (27.8) (36.1) (28.0) (27.9) (29.3) (30.7) (28.0) (22.4) (18.2) All Other Assets 514.0 452.8 452.6 474.3 456.0 454.7 471.8 561.2 423.2 Total Liabilities 2,893.2 2,874.7 2,887.2 2,949.7 2,991.9 3,003.9 3,010.0 3,014.0 2,491.5 Total Deposits 2,688.2 2,662.4 2,673.5 2,736.8 2,768.6 2,788.9 2,798.3 2,800.8 2,286.7 Borrowings 159.4 159.3 159.3 159.2 159.1 159.1 159.0 159.0 158.9 Other Liabilities 45.6 53.0 54.5 53.8 64.1 55.9 52.7 54.2 45.9 Total Shareholders’ Equity 267.9 267.0 268.0 265.8 257.9 248.8 242.3 238.5 231.5 Net Interest Margin 2.72% 2.75% 2.71% 2.81% 2.85% 3.07% 3.24% 3.70% 4.12% PPNR ROAA 1.13% 1.22% 1.10% 1.27% 1.37% 1.58% 1.80% 1.98% 2.23% Effective Tax Rate 29% 24% 26% 26% 24% 22% 23% 24% 21% Noninterest Expense to Average Assets 1.62% 1.55% 1.66% 1.56% 1.48% 1.56% 1.59% 1.66% 1.76%

Maintaining our Strong Balance Sheet 6 $1,115 $566 $291 $111 Liquidity Uninsured Deposits 2.7X Liquidity Coverage $1,517 Unencumbered Securities Unencumbered Cash Borrowing Capacity1 1 Bank lines, including FHLB & FRB 2 TCE/TA consolidated ratio; all others Bank ratios. Regulatory ratios are estimates, pending FDIC call report filing. • $2,122 million total insured deposits includes: ‒ $2,006 million FDIC-insured deposits ‒ $116 million deposits secured by FHLB LOCs (municipal deposits) • 12.6% liquidity on balance sheet (Cash & Securities) • Stable insured deposit base • Additional 3Q24 ratios: ‒ 382% CRE Concentration Ratio ‒ 45% Construction Concentration Ratio • 85,990 shares repurchased year to date at an average price of $24.82 ‒ New 250,000 share repurchase plan authorized Abundant Excess Liquidity Building Excess Capital 11.80% 10.24% 12.83% 8.40% CET1 Leverage Total Risk Based TCE / TA Well Above Capital Minimums Minimum + buffer 2 Dollars in millions

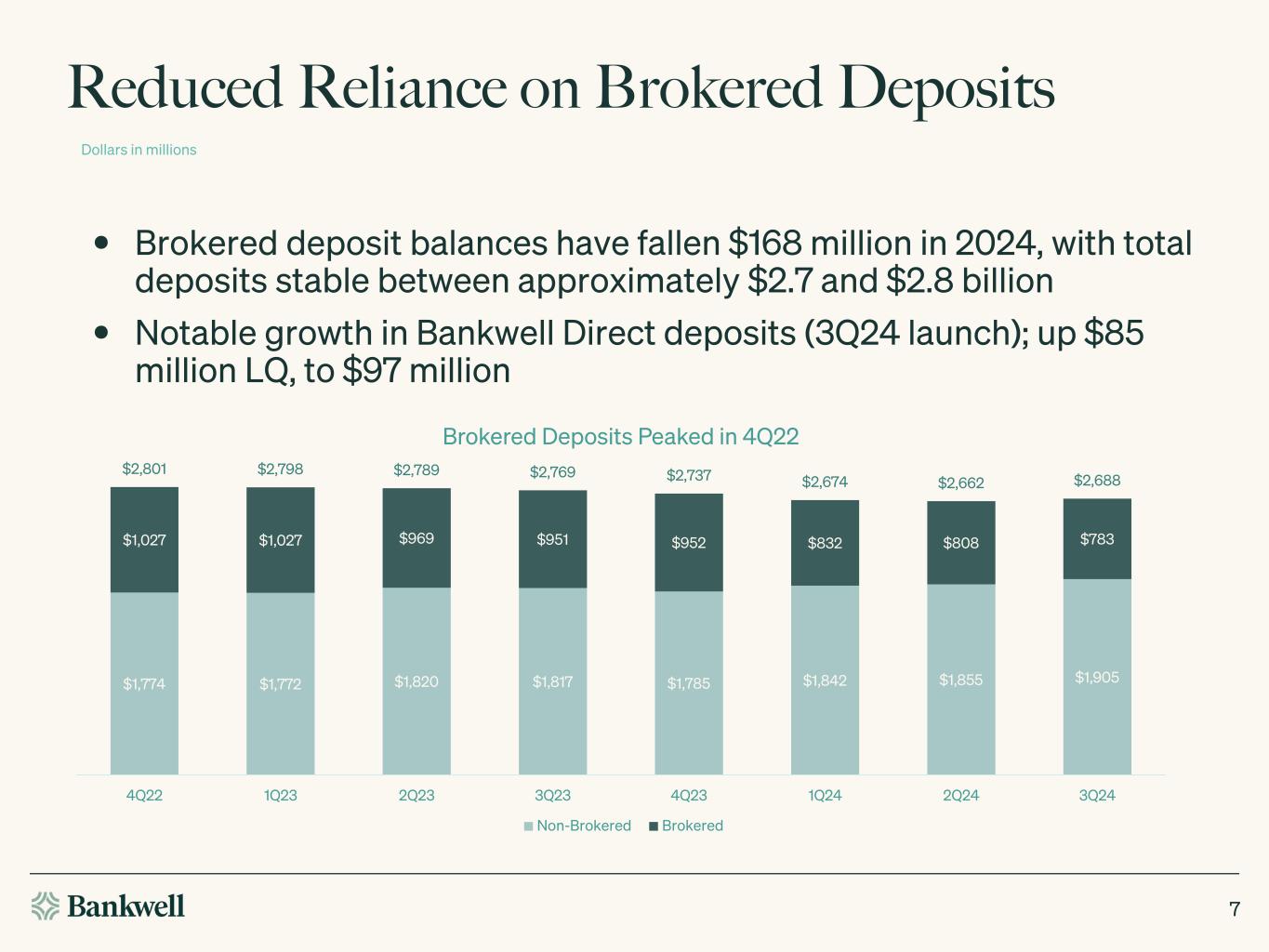

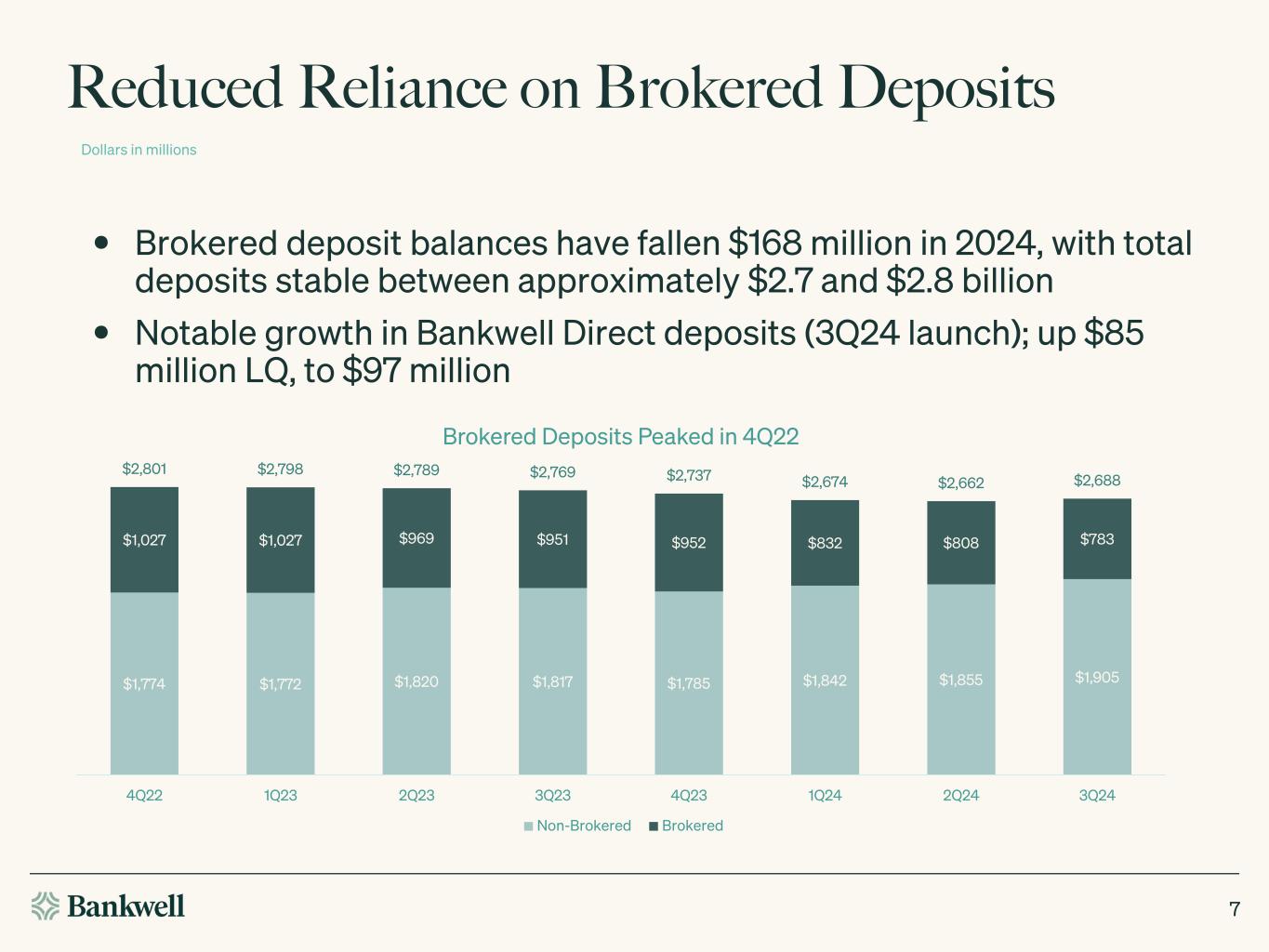

Reduced Reliance on Brokered Deposits • Brokered deposit balances have fallen $168 million in 2024, with total deposits stable between approximately $2.7 and $2.8 billion • Notable growth in Bankwell Direct deposits (3Q24 launch); up $85 million LQ, to $97 million $1,774 $1,772 $1,820 $1,817 $1,785 $1,842 $1,855 $1,905 $1,027 $1,027 $969 $951 $952 $832 $808 $783 $2,801 $2,798 $2,789 $2,769 $2,737 $2,674 $2,662 $2,688 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Brokered Deposits Peaked in 4Q22 Non-Brokered Brokered Dollars in millions 7

Well Positioned Balance Sheet For Lower Rates • Liability sensitive, with $1.3 billion of time deposits maturing in next twelve months: ‒ $656 million Retail time repricing an average ~29 basis points lower based on current rates; annualized savings of $1.85 million of interest expense ‒ $639 million Brokered time repricing an average ~23 basis points lower based on current rates; annualized savings of $1.50 million of interest expense • A total $3.35 million annualized savings is ~$0.33 benefit to EPS and 10+ basis points on Net interest margin, assuming no further movement in Fed Funds and stable asset yields Maturity Quarter Balance Maturity Rate Current Rate V 4Q24 $206 5.20% 4.80% -0.40% 1Q25 $277 5.18% 4.80% -0.38% 2Q25 $110 4.85% 4.80% -0.05% 3Q25 $63 4.70% 4.80% 0.10% Total Retail $656 5.09% 4.80% -0.29% Dollars in millions 8 Maturity Quarter Balance Maturity Rate Current Rate V 4Q24 $229 4.31% 4.40% 0.09% 1Q25 $135 5.28% 4.50% -0.78% 2Q25 $105 4.88% 4.50% -0.38% 3Q25 $170 4.64% 4.50% -0.14% Total Brokered $639 4.69% 4.46% -0.23% Retail Time Deposits Brokered Time Deposits 1 Includes $85 million called in September 2024 with a settle date in October 2024; full term maturity dates were in Apr-25 and May-25 1

Managing CRE Concentration Lower • No single relationship greater than 4% • Expansion into Residential Care diversifying loan portfolio Dollars in millions $1,046 $1,224 $1,228 $1,204 $310 $697 $720 $684$351 $522 $501 $491 $98 $155 $183 $160 $89 $77 $87 $84 $1,895 $2,675 $2,719 $2,623 454% 425% 397% 382% 300% 320% 340% 360% 380% 400% 420% 440% 460% 480% 500% - 500 1,000 1,500 2,000 2,500 4Q21 4Q22 4Q23 3Q24 CRE Investor CRE Owner Occupied C&I Construction Residential / Other CRE Concentration 9

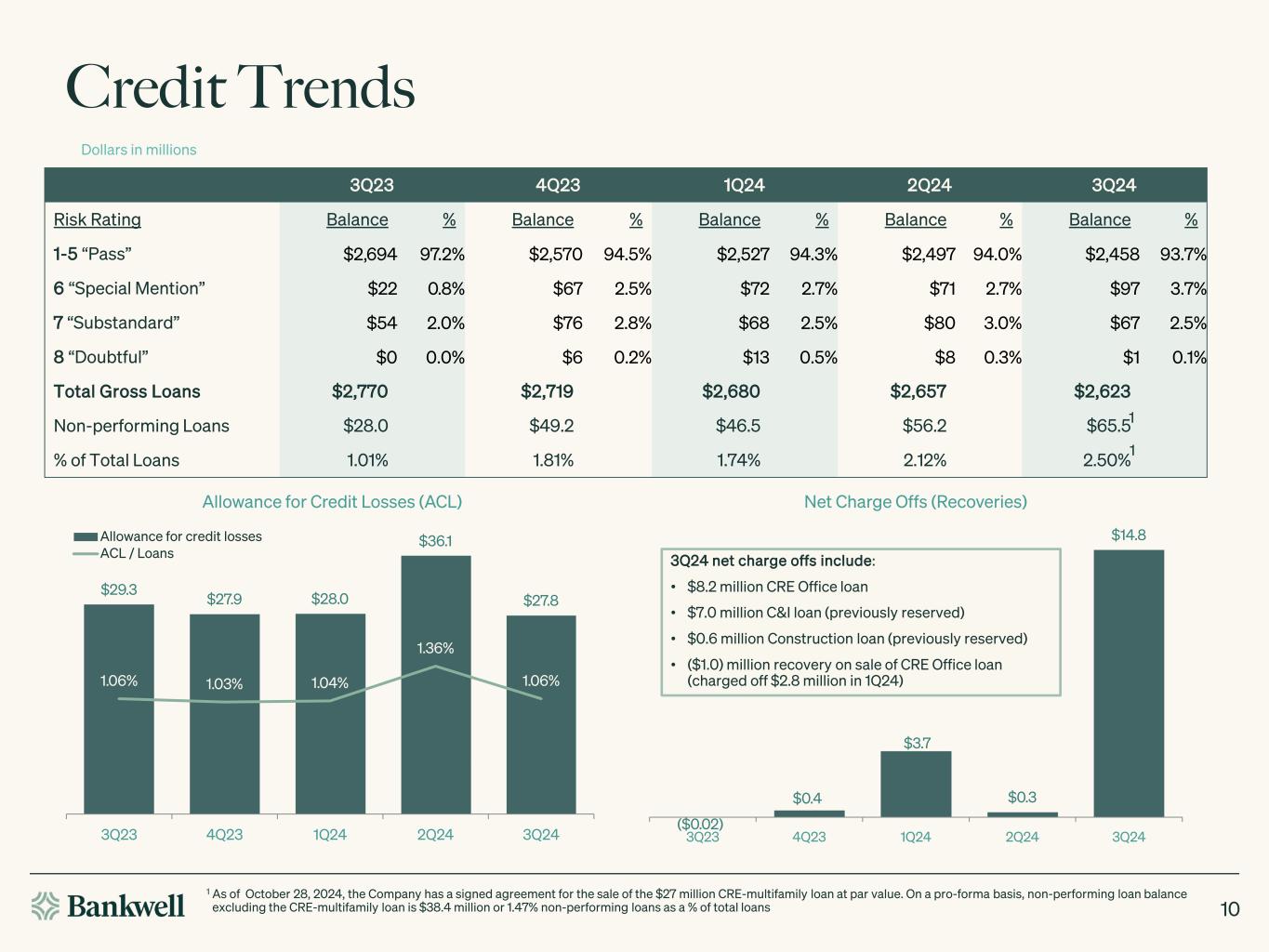

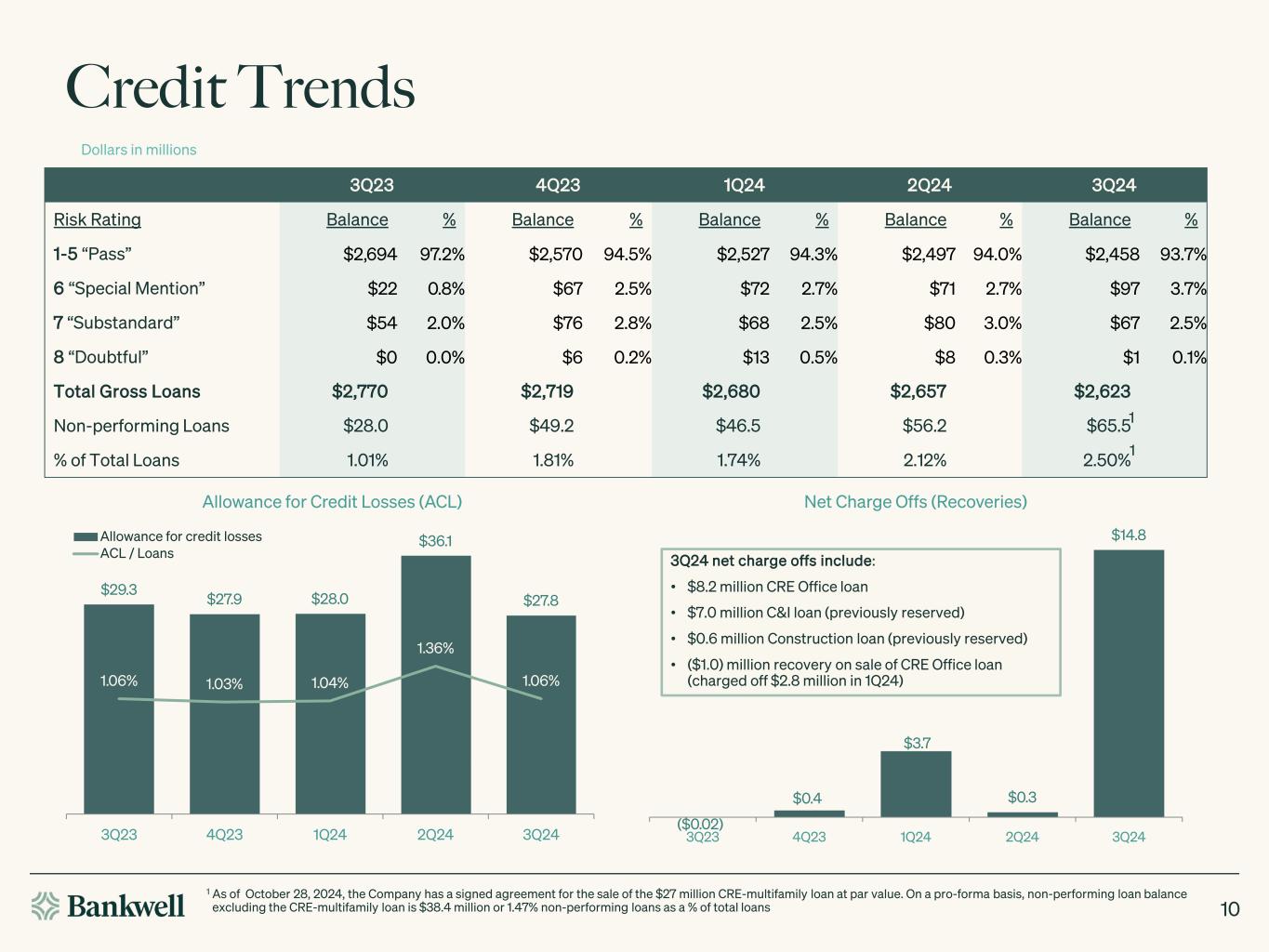

Credit Trends 3Q23 4Q23 1Q24 2Q24 3Q24 Risk Rating Balance % Balance % Balance % Balance % Balance % 1-5 “Pass” $2,694 97.2% $2,570 94.5% $2,527 94.3% $2,497 94.0% $2,458 93.7% 6 “Special Mention” $22 0.8% $67 2.5% $72 2.7% $71 2.7% $97 3.7% 7 “Substandard” $54 2.0% $76 2.8% $68 2.5% $80 3.0% $67 2.5% 8 “Doubtful” $0 0.0% $6 0.2% $13 0.5% $8 0.3% $1 0.1% Total Gross Loans $2,770 $2,719 $2,680 $2,657 $2,623 Non-performing Loans $28.0 $49.2 $46.5 $56.2 $65.5 % of Total Loans 1.01% 1.81% 1.74% 2.12% 2.50% $29.3 $27.9 $28.0 $36.1 $27.8 1.06% 1.03% 1.04% 1.36% 1.06% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $5 $10 $15 $20 $25 $30 $35 3Q23 4Q23 1Q24 2Q24 3Q24 Allowance for Credit Losses (ACL) Allowance for credit losses ACL / Loans 3Q24 net charge offs include: • $8.2 million CRE Office loan • $7.0 million C&I loan (previously reserved) • $0.6 million Construction loan (previously reserved) • ($1.0) million recovery on sale of CRE Office loan (charged off $2.8 million in 1Q24) Dollars in millions 10 1 1 As of October 28, 2024, the Company has a signed agreement for the sale of the $27 million CRE-multifamily loan at par value. On a pro-forma basis, non-performing loan balance excluding the CRE-multifamily loan is $38.4 million or 1.47% non-performing loans as a % of total loans ($0.02) $0.4 $3.7 $0.3 $14.8 3Q23 4Q23 1Q24 2Q24 3Q24 Net Charge Offs (Recoveries) 1

Criticized and Classified Loans • $95 million of Performing Criticized and Classified Loans down $8 million LQ, with improved performance in Residential Care borrowers ‒ 2 Special Mention (“6”) relationships upgraded to “Pass” in CQ, totaling $14 million ‒ 2 Substandard (“7”) relationships upgraded to Special Mention (“6”) rating in CQ, totaling $28 million • Total Criticized and Classified Loans up $5 million LQ, including downgrade of a $27 million CRE- multifamily loan (RR7, non-performing) ‒ As of October 28, 2024, the Company has a signed agreement for the sale of the $27 million CRE- multifamily loan at par value. ‒ Excluding CRE-multifamily loan, Criticized and Classified Loans down $22 million LQ Risk Rating Performing CQ LQ V 6 Yes $88 $69 $20 7 Yes -- $28 ($28) Total $88 $97 ($8) Risk Rating Performing CRE C&I Construction 1-4 Family Residential Total 6 Yes $87 $9 $0 $0 $97 7 Yes $0 $0 $0 $2 $3 7 No $45 $9 $9 $1 $64 8 No $1 $0 $0 $0 $1 Total $133 $19 $9 $4 $165 Dollars in millions LQ $71 $33 $48 $8 $160 Residential Care Criticized & Classified 11

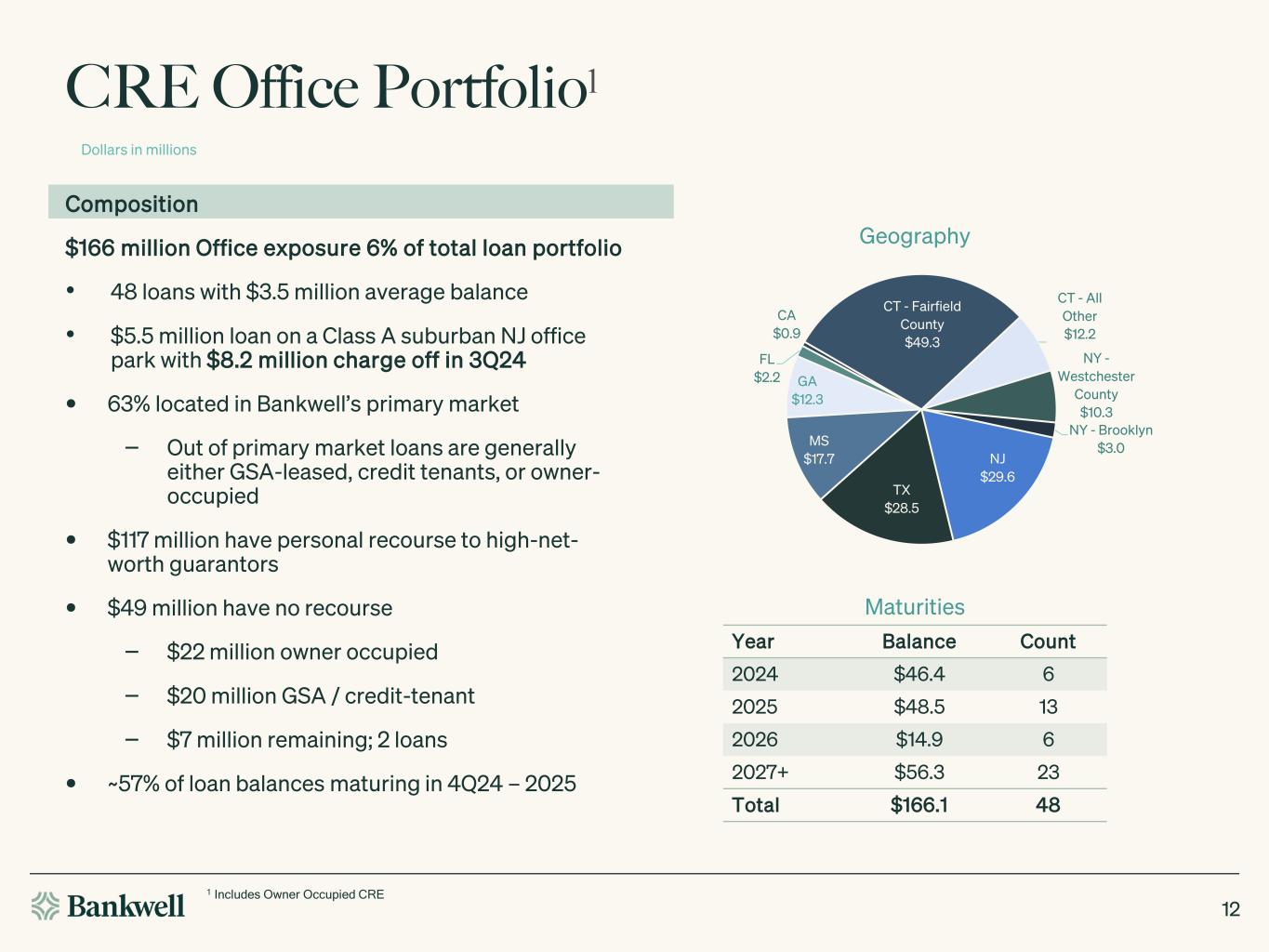

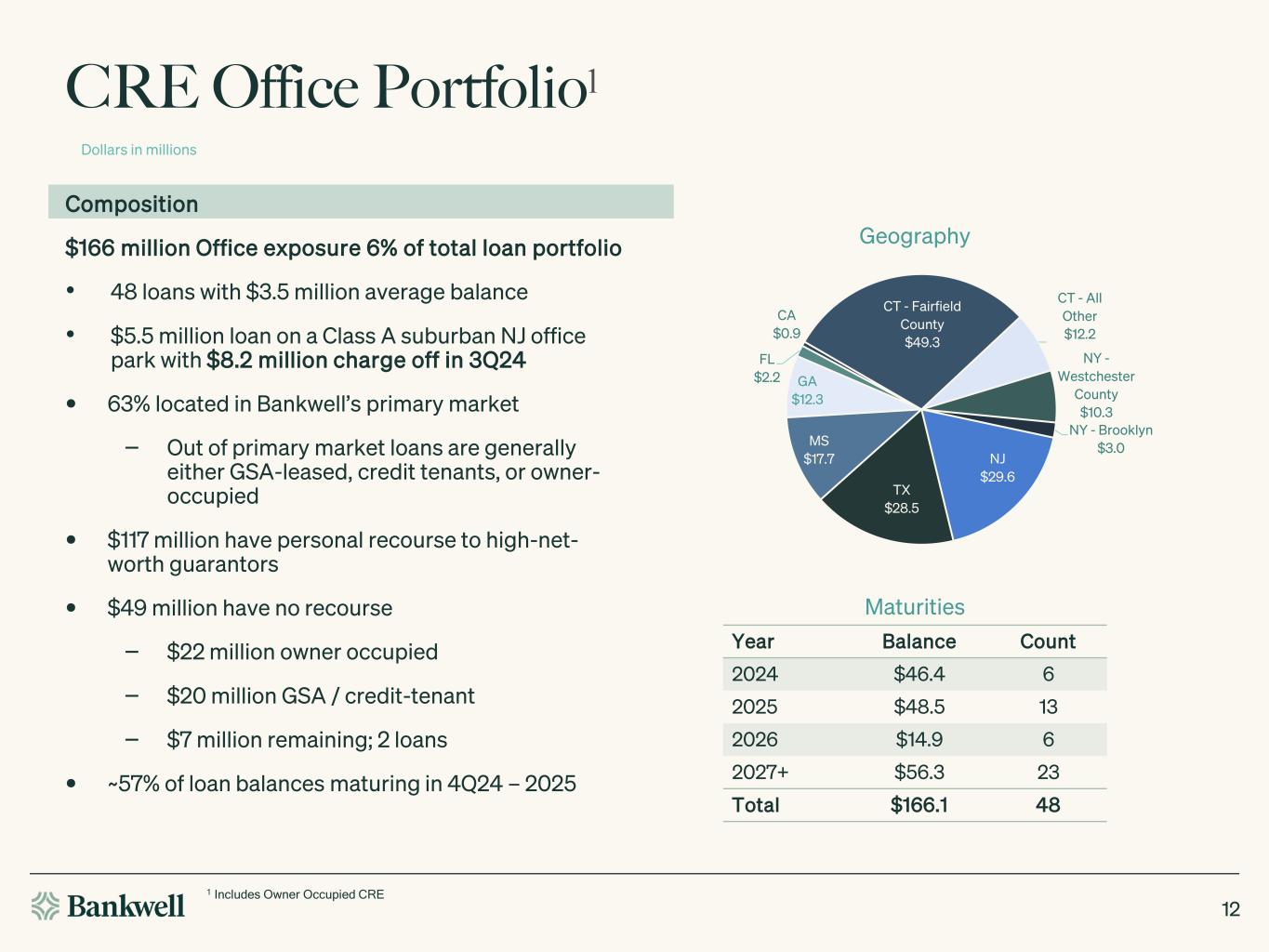

CRE Office Portfolio1 1 Includes Owner Occupied CRE 12 Geography Dollars in millions CT - Fairfield County $49.3 CT - All Other $12.2 NY - Westchester County $10.3 NY - Brooklyn $3.0 NJ $29.6 TX $28.5 MS $17.7 GA $12.3 FL $2.2 CA $0.9 Composition $166 million Office exposure 6% of total loan portfolio • 48 loans with $3.5 million average balance • $5.5 million loan on a Class A suburban NJ office park with $8.2 million charge off in 3Q24 • 63% located in Bankwell’s primary market ‒ Out of primary market loans are generally either GSA-leased, credit tenants, or owner- occupied • $117 million have personal recourse to high-net- worth guarantors • $49 million have no recourse ‒ $22 million owner occupied ‒ $20 million GSA / credit-tenant ‒ $7 million remaining; 2 loans • ~57% of loan balances maturing in 4Q24 – 2025 Maturities Year Balance Count 2024 $46.4 6 2025 $48.5 13 2026 $14.9 6 2027+ $56.3 23 Total $166.1 48

Bankwell Strategic Update 13

14 Strategic Themes Embrace Innovation Invest in Risk Management Elite Customer Experience Specialized Lending Verticals

How Residential Care Lending Works 15 HNW, Experienced Sponsor Finds Skilled Nursing Facility (SNF) to Purchase Bankwell Approves Loan Refinance Bridge to HUD Loan Sends Bankwell underwriting details, bank issues term sheet Bank underwrites both SNF and Sponsor business portfolio and personal wherewithal Bridge to HUD mortgage and HUD compliant working capital line to support accounts receivable Sponsor opens all depository accounts for SNF at Bankwell (typically equals one- third of loan amounts) Sponsor improves SNF performance over 12-36 months Bankwell earns an exit fee when SNF refinances to long- term HUD loans Line of credit, deposit accounts, and treasury management fees stay at Bankwell

16 $230 $657 $693 $717 5.08% 6.66% 7.15% 7.19% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% $0 $100 $200 $300 $400 $500 $600 $700 $800 2021 2022 2023 3Q24 Loan Balances $ in millions Balance Yield Residential Care Lending A highly efficient, differentiated platform with off-balance sheet growth opportunities Portfolio is over a third self-funded as of 3Q24 Zero Charge-offs since portfolio’s inception Average yield on new originations in 3Q24 was 8.50% Total cost of funds of 2.15% Off-balance sheet growth opportunities Significant growth opportunities in HUD and loan sale fees

Small Business; Last Unclaimed Segment 17 Bankwell has been originating SBA 7(a) loans 10+ years Preferred lender program (“PLP”) member Recently appointed new leadership, with plans to add additional BDOs Liquid secondary market, balance sheet light Utilizing technology and partnerships to create an unfair advantage Significant fee growth opportunity

Utilizing Innovation + Talent to Differentiate 18 Pivotal moment for technology and banking Embrace innovation and technology Talent is key differentiator Risk Management culture Be nimble, be flexible Pilots Prioritize the Client Do more with less

19 Bankwell is On the Move… Bankwell Brand Refresh Launched September 2024

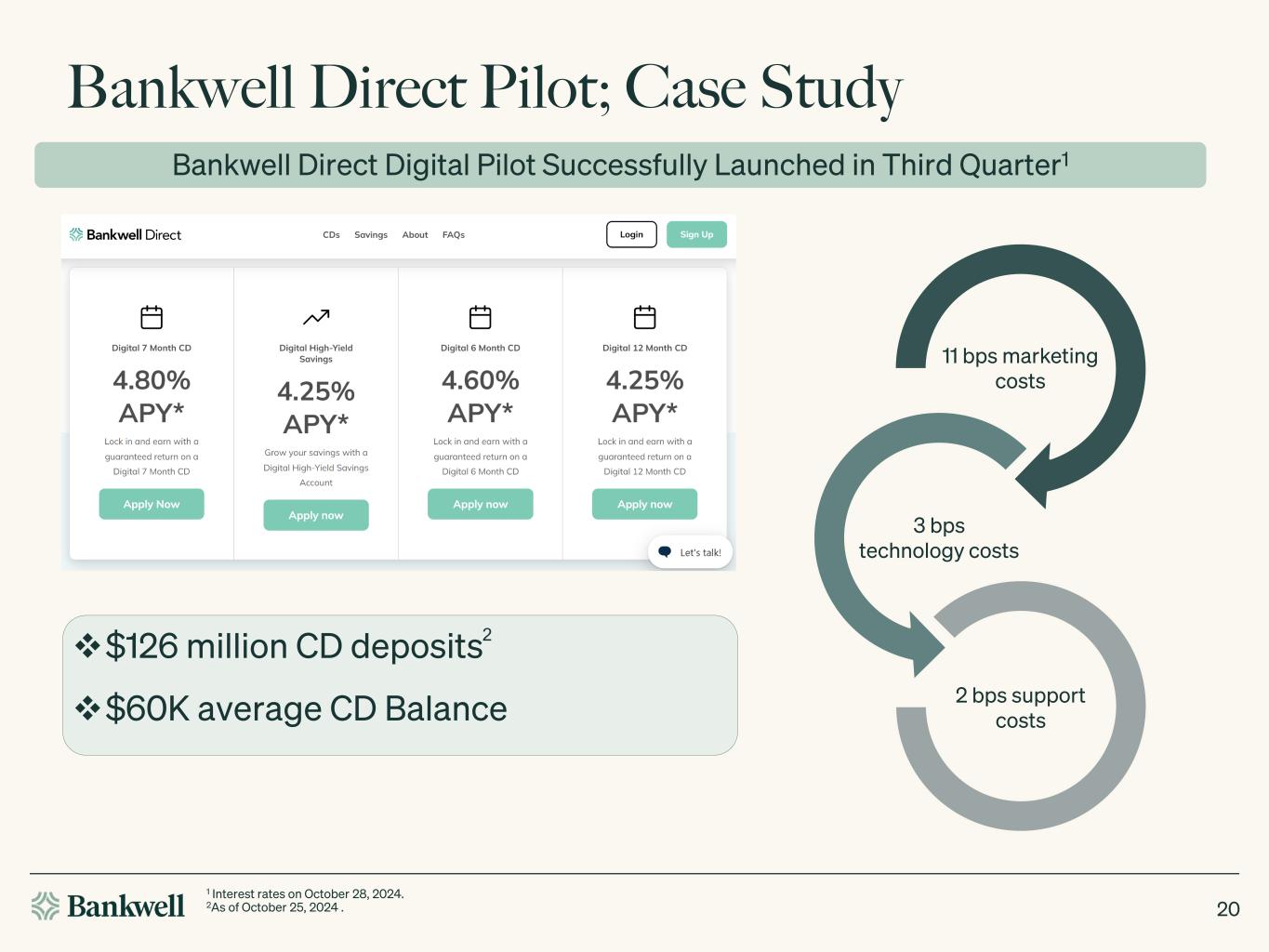

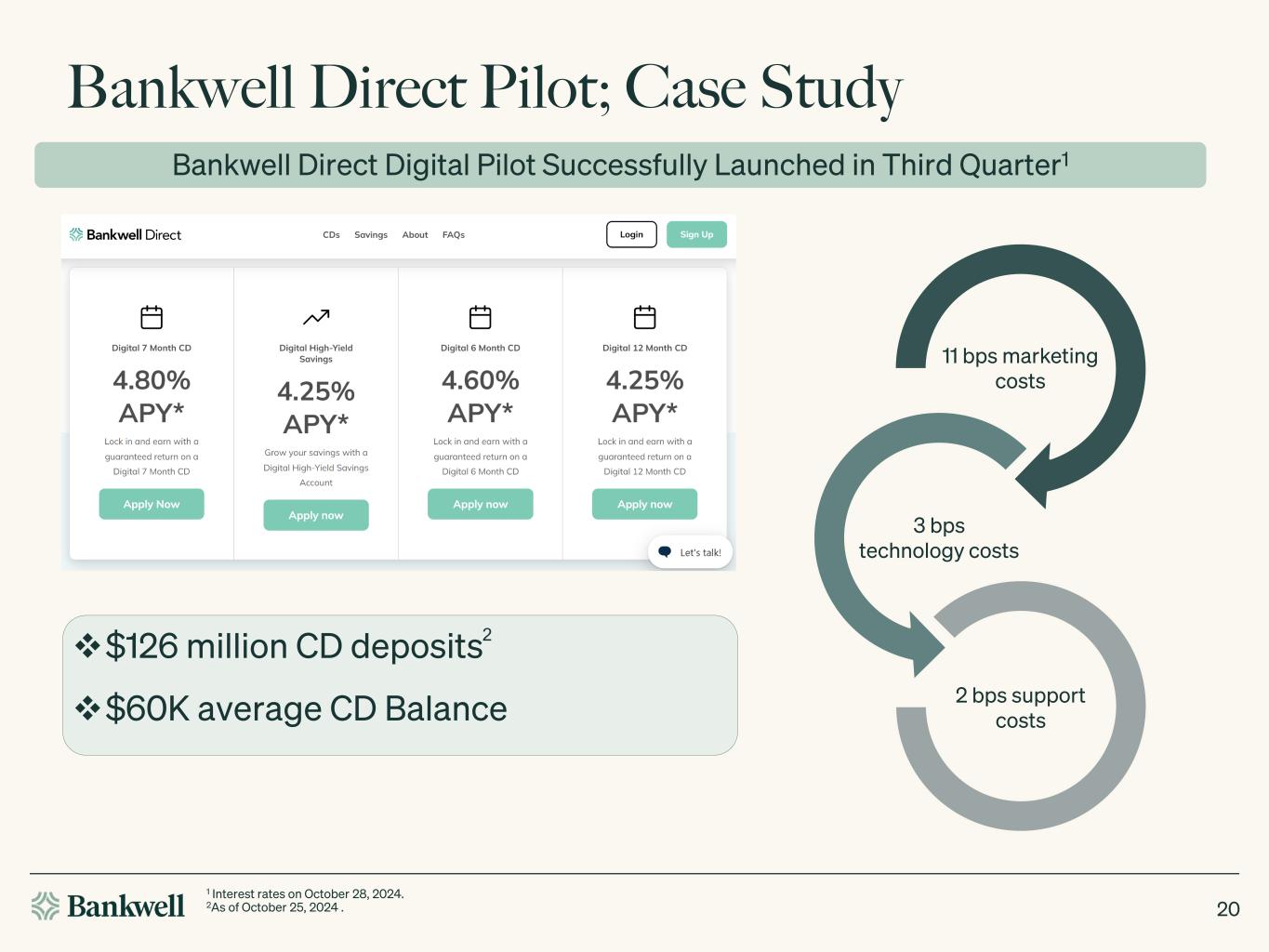

Bankwell Direct Pilot; Case Study 20 Bankwell Direct Digital Pilot Successfully Launched in Third Quarter1 11 bps marketing costs 3 bps technology costs 2 bps support costs $126 million CD deposits $60K average CD Balance 1 Interest rates on October 28, 2024. 2As of October 25, 2024 . 2

Small Business Pilots; New Products with Broad Audiences 21 Connecticut Growth Loan Product; five-minute application, closes-up to same day. Launched in August 2024 Lendio Partnership (Launched - September 2024) Spire, Business Banking Digital Product Suite (Launched – October 2024

Dedicated to making a difference. 22 Financial Outlook Stable total assets near-term Continued NIM expansion Improved credit outlook Additional reductions in brokered deposits Growing regulatory capital Unchanged focus on efficiency

23 Questions?

Appendix 24

Average Deposits & NIM; Recent Trends Dollars in millions 25 $2,452 $2,430 $2,386 $2,323 $2,365 $346 $351 $337 $368 $303 $2,798 $2,781 $2,723 $2,692 $2,668 3.85% 4.13% 4.28% 4.27% 4.30% 3.37% 3.61% 3.75% 3.69% 3.81% 2.85% 2.81% 2.71% 2.75% 2.72% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 3Q23 4Q23 1Q24 2Q24 3Q24 Average Interest Bearing Average Non-Interest Bearing IB Deposit Cost Total Deposit Cost NIM

Loan Composition Dollars in millions Total Loan Portfolio = $2,623 million Favorable long-term trends in Investor CREResidential 1.7% C&I 18.7% CRE Owner Occupied 26.1% CRE Investor 45.9% Commercial Const. 6.1% Other 1.5% 60.4% 55.2% 45.8% 45.2% 45.9% 27.3% 34.9% 45.5% 44.9% 44.8% 4Q20 4Q21 4Q22 4Q23 3Q24 CRE Investor CRE O/O + C&I 26

Loan Yields Dollars in millions 27 $1,626 $1,895 $2,675 $2,719 $2,623 4.18% 4.30% 5.56% 5.99% 6.08% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4Q20 4Q21 4Q22 4Q23 3Q24 Loan Balance Portfolio Loan Yield Loan portfolio yields increased 190 bps since 2020 1 September 2024 Yield2 by Vintage 1 Weighted average yield based on active loans as of each date, an “exit" rate 2 Weighted average yield based on active loans as of 9-30-2024, an “exit" rate 73% of balances are 2021-2024 vintages Year Maturity Rate Reset Total % Total Loans 2024 $169 $6 $175 7% 2025 $618 $62 $679 26% 2026 $216 $48 $263 10% 2027+ $849 $94 $944 36% Total $1,851 $210 $2,061 Loan Maturities & Contractual Repricing Excluding floating rate loans 5.26% Pre 2021 5.81% 2021 6.40% 2022 7.64% 2023 8.07% 2024

CRE Loan Portfolio1 • 64% Non-Owner Occupied • 61% weighted average LTV2 • 68% of loan balances have recourse Dollars in millions Residential Care 33% Retail 20% Multifamily 15% Office 9%Industrial Warehouse 7% Mixed Use 5% Medical Office 5% 1-4 Family Investment 3% All Other 3% Property Type Investor Owner Occupied Total Residential Care $31 $365 $396 Retail $112 $5 $117 Office $84 $10 $94 Multifamily $49 $0 $49 All Other $96 $16 $111 Total $372 $396 $768 Loans Maturing or Repricing in 2024 – 2025 3 Excluding floating rate loans Total CRE Portfolio = $1,887 million By Property Type 1 Includes Owner Occupied CRE, does not include Construction 2 LTVs based on original LTV values, at origination 3 Loans subject to repricing generally have a floor of not less than the original rate 28

C&I Loan Portfolio 29 By Industry Type Total Portfolio = $492 million Health Care & Social Assistance 39% Insurance (Primarily Brokers) 22% Finance 13% Real Estate and Rental/Leasing 9% Admin & Support, Waste Mgmt, Remediation Svcs 4%Retail Trade 3% Arts, Entertainment & Recreation 2% Manufacturing 2% Other 6% • 98% of C&I portfolio has recourse • 97% of Healthcare loans have recourse – Primarily consists of working capital lines secured by government accounts receivable • Insurance lending primarily to brokers of home and auto insurance

Combined Healthcare Dollars in millions 30 Skilled Nursing Facilities 77% Assisted Living 14% Recovery 5% Other 4% $791 million combined Healthcare portfolio • Consists primarily of skilled nursing facilities located across the US • Healthcare lending team has more than 15 years of industry experience • High touch service model attracts desirable ultra-high net worth Healthcare borrowers • 100% of Skilled Nursing Lending has recourse • Focused on originating Healthcare loans in the most desirable states with: – Higher average occupancy – Low denial of payment rates for Medicaid – Strong senior demographic trends – Certificate of need programs 1 Healthcare Portfolio Composition CRE Skilled Nursing Facility By State FL 50% OH 16% NY 10% NJ 4% AL 2% IA 2% TN 2% IL 2% All Other 11%

3Q24 Non-Performing Loans Segment Balance % Total Loans 3Q24 Activity (See next slide for additional details) Loan 1 CRE - Multifamily $27.1 1.03% • Downgraded to Substandard (RR7), non-performing • As of October 28, 2024, signed agreement for sale at par value Loan 2 CRE - Retail $9.7 0.37% Loan 3 Construction $8.8 0.33% • $0.6 million charged off (previously reserved) Loan 4 CRE - Office $5.5 0.21% • $8.2 million charged off (8K filed on October 11, 2024) Loan 5 C&I $1.7 0.06% • $7.0 million charged off (previously reserved) Subtotal $52.7 2.01% SBA Guaranteed Balances $6.4 0.24% • $1.7 million SBA guarantee received All Other $6.4 0.25% Total $65.5 2.50% Dollars in millions • All non-performing loans individually evaluated for impairment • Balances charged off or specifically reserved, as appropriate 3Q24 Activity • $3.0 million CRE – Office loan in suburban CT paid off; $1.0 million recovery ($2.8 million charged off in 1Q24) • Remaining NPLs comprised of: 31

3Q24 Non-Performing Loans Details 32 Segment Balance % Total Loans Loan 1 CRE - Multifamily $27.1 1.03% • CRE Multifamily property in Hartford County, CT • As of October 28, 2024, signed agreement for sale at par value Loan 2 CRE - Retail $9.7 0.37% • Suburban retail loan in Westchester County, NY modified during COVID • Borrower paying according to terms of restructure • 1Q25 maturity • $4.5 million charged off, life-to-date Loan 3 Construction $8.8 0.33% • Construction loan in Williamsburg, Brooklyn • 70% completed; multi-family / mixed use • Borrower, a single-asset LLC, in bankruptcy • Full recourse to 3 high-net-worth guarantors ‒ Guarantor litigation in process • $0.6 million charge off in 3Q24 (previously reserved) Loan 4 CRE - Office $5.5 0.21% • Class A suburban NJ office park • Bankwell 17% participant in $84 million multi-bank club deal • 80% occupied; 40% recourse • 1Q25 maturity • $8.2 million charge off in 3Q24 (8K filed on October 11, 2024) Loan 5 C&I $1.7 0.06% • Senior secured tranche of a $28 million financing to support a sponsor-owned pediatric dental practice • Entity filed bankruptcy in Florida • Bank working to liquidate collateral • $7.0 million charge off in 3Q24 (previously reserved)

Bankwell Financial Group (Nasdaq: BWFG) $3.2B Total Assets $2.6B Loans $0.27B Equity $2.7B Deposits 1.62% Non-interest Exp / Assets ~140 Employees 8.40% TCE Ratio 9.71% CET1 Ratio C&I & CREOO 45% CRE Inv 46% All Other 9% Loans Core 63% Time > $250k 8% Brokered 29% Deposits 33 1 1 Estimate, pending FDIC call report filing.

34