The global leader in developing LAG-3 therapeutics 2020 AGM Presentation Marc Voigt, CEO Exhibit 99.1

The purpose of the presentation is to provide an update of the business of Immutep Limited ACN 009 237 889 (ASX:IMM; NASDAQ:IMMP). These slides have been prepared as a presentation aid only and the information they contain may require further explanation and/or clarification. Accordingly, these slides and the information they contain should be read in conjunction with past and future announcements made by Immutep and should not be relied upon as an independent source of information. Please refer to the Company's website and/or the Company’s filings to the ASX and SEC for further information. The views expressed in this presentation contain information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. Any forward-looking statements in this presentation have been prepared based on a number of assumptions which may prove incorrect and the current intentions, plans, expectations and beliefs about future events are subject to risks, uncertainties and other factors, many of which are outside Immutep’s control. Important factors that could cause actual results to differ materially from assumptions or expectations expressed or implied in this presentation include known and unknown risks. Because actual results could differ materially to assumptions made and Immutep’s current intentions, plans, expectations and beliefs about the future, you are urged to view all forward-looking statements contained in this presentation with caution. This presentation should not be relied on as a recommendation or forecast by Immutep. Nothing in this presentation should be construed as either an offer to sell or a solicitation of an offer to buy or sell shares in any jurisdiction. Notice: Forward Looking Statements

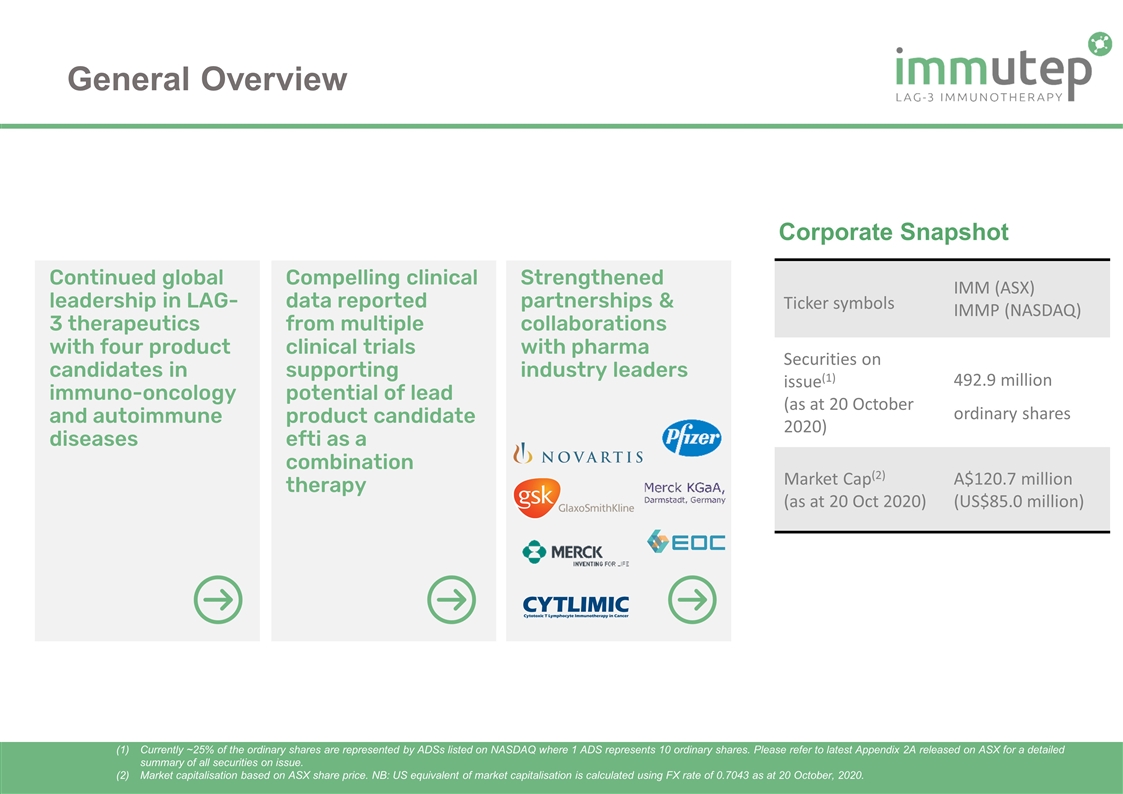

Continued global leadership in LAG-3 therapeutics with four product candidates in immuno-oncology and autoimmune diseases Compelling clinical data reported from multiple clinical trials supporting potential of lead product candidate efti as a combination therapy Strengthened partnerships & collaborations with pharma industry leaders General Overview Corporate Snapshot Currently ~25% of the ordinary shares are represented by ADSs listed on NASDAQ where 1 ADS represents 10 ordinary shares. Please refer to latest Appendix 2A released on ASX for a detailed summary of all securities on issue. Market capitalisation based on ASX share price. NB: US equivalent of market capitalisation is calculated using FX rate of 0.7043 as at 20 October, 2020. Ticker symbols IMM (ASX) IMMP (NASDAQ) Securities on issue(1) (as at 20 October 2020) 492.9 million ordinary shares Market Cap(2) (as at 20 Oct 2020) A$120.7 million (US$85.0 million)

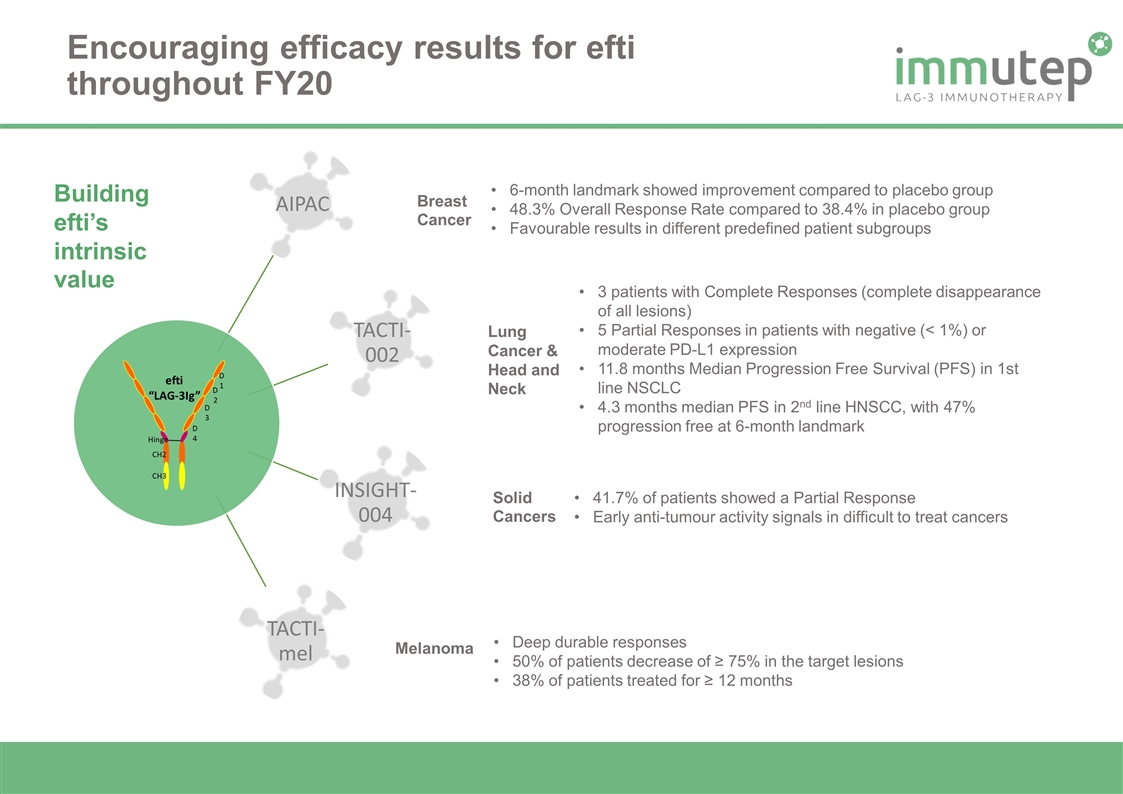

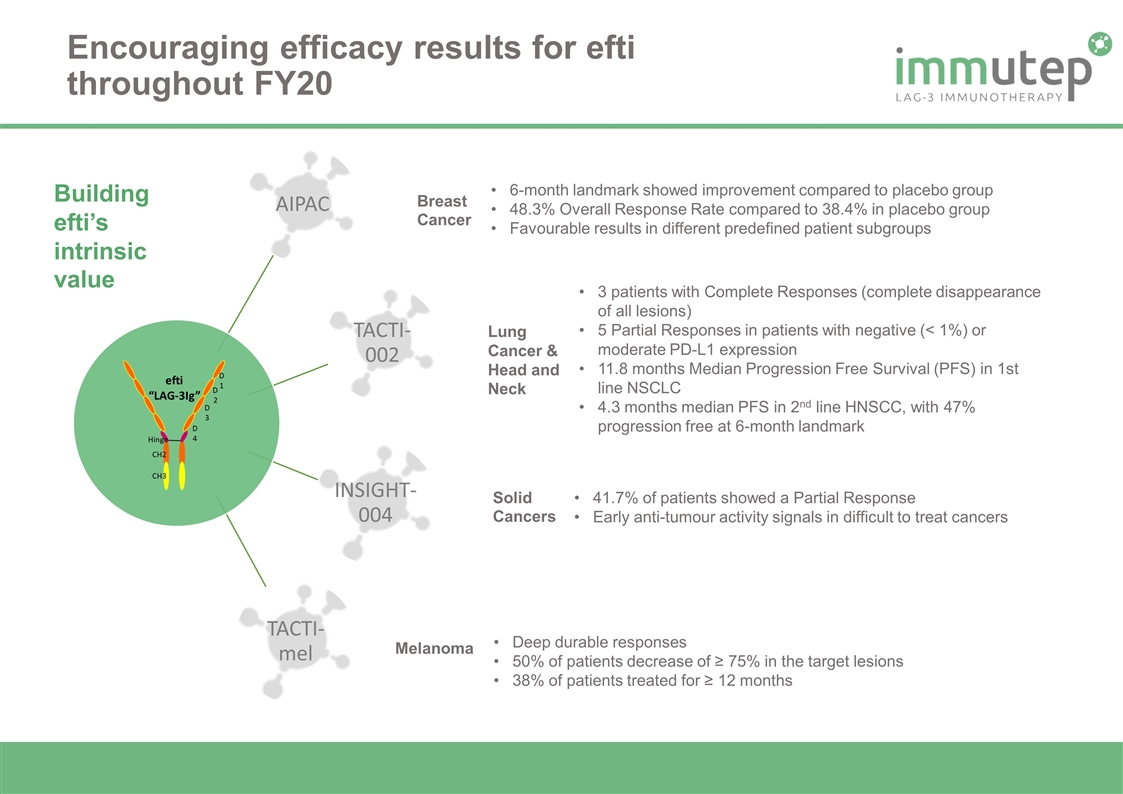

Encouraging efficacy results for efti throughout FY20 6-month landmark showed improvement compared to placebo group 48.3% Overall Response Rate compared to 38.4% in placebo group Favourable results in different predefined patient subgroups Deep durable responses 50% of patients decrease of ≥ 75% in the target lesions 38% of patients treated for ≥ 12 months 3 patients with Complete Responses (complete disappearance of all lesions) 5 Partial Responses in patients with negative (< 1%) or moderate PD-L1 expression 11.8 months Median Progression Free Survival (PFS) in 1st line NSCLC 4.3 months median PFS in 2nd line HNSCC, with 47% progression free at 6-month landmark 41.7% of patients showed a Partial Response Early anti-tumour activity signals in difficult to treat cancers Breast Cancer Lung Cancer & Head and Neck Melanoma Solid Cancers Building efti’s intrinsic value AIPAC TACTI-002 INSIGHT-004 TACTI-mel

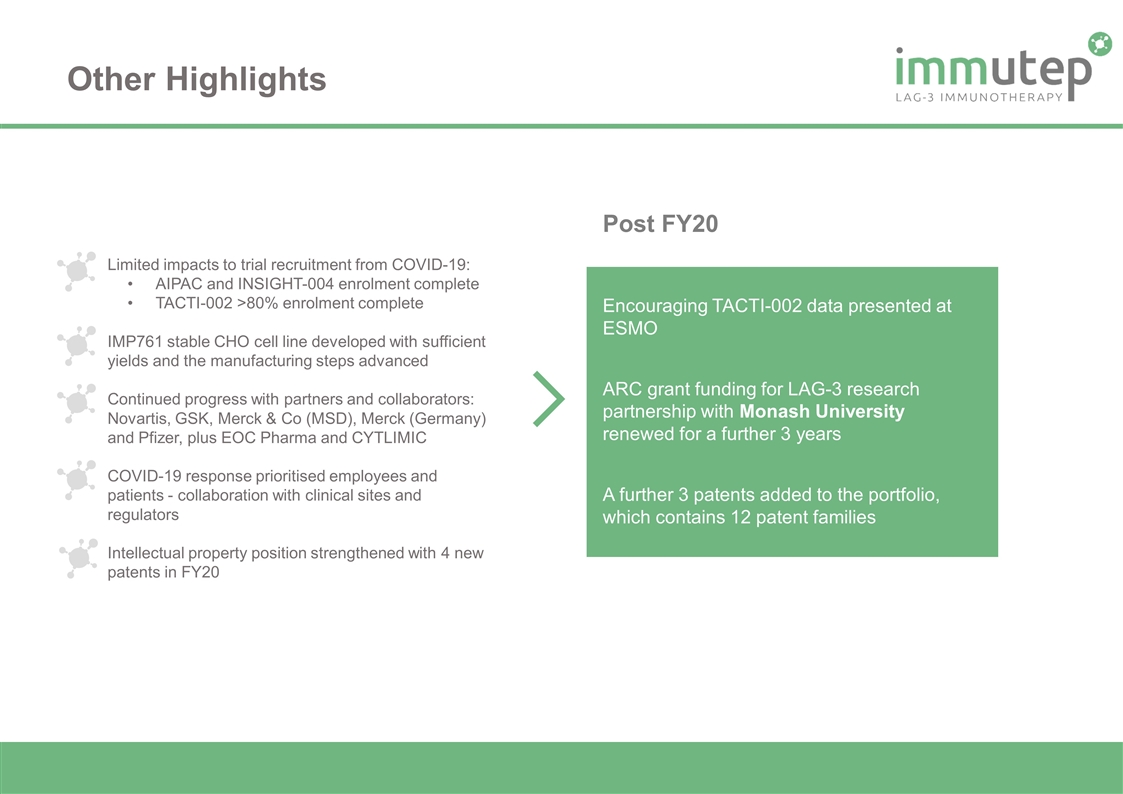

Other Highlights Limited impacts to trial recruitment from COVID-19: AIPAC and INSIGHT-004 enrolment complete TACTI-002 >80% enrolment complete IMP761 stable CHO cell line developed with sufficient yields and the manufacturing steps advanced Continued progress with partners and collaborators: Novartis, GSK, Merck & Co (MSD), Merck (Germany) and Pfizer, plus EOC Pharma and CYTLIMIC COVID-19 response prioritised employees and patients - collaboration with clinical sites and regulators Intellectual property position strengthened with 4 new patents in FY20 Encouraging TACTI-002 data presented at ESMO ARC grant funding for LAG-3 research partnership with Monash University renewed for a further 3 years A further 3 patents added to the portfolio, which contains 12 patent families Post FY20

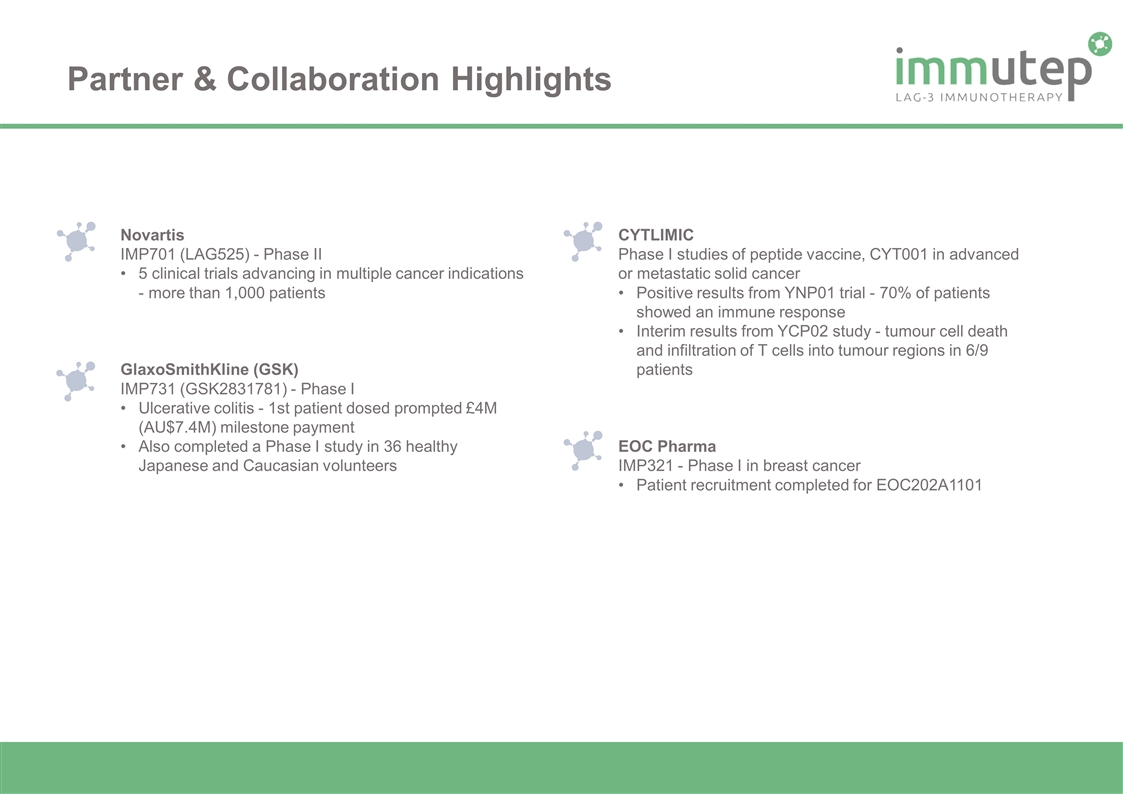

Partner & Collaboration Highlights Novartis IMP701 (LAG525) - Phase II 5 clinical trials advancing in multiple cancer indications - more than 1,000 patients GlaxoSmithKline (GSK) IMP731 (GSK2831781) - Phase I Ulcerative colitis - 1st patient dosed prompted £4M (AU$7.4M) milestone payment Also completed a Phase I study in 36 healthy Japanese and Caucasian volunteers CYTLIMIC Phase I studies of peptide vaccine, CYT001 in advanced or metastatic solid cancer Positive results from YNP01 trial - 70% of patients showed an immune response Interim results from YCP02 study - tumour cell death and infiltration of T cells into tumour regions in 6/9 patients EOC Pharma IMP321 - Phase I in breast cancer Patient recruitment completed for EOC202A1101

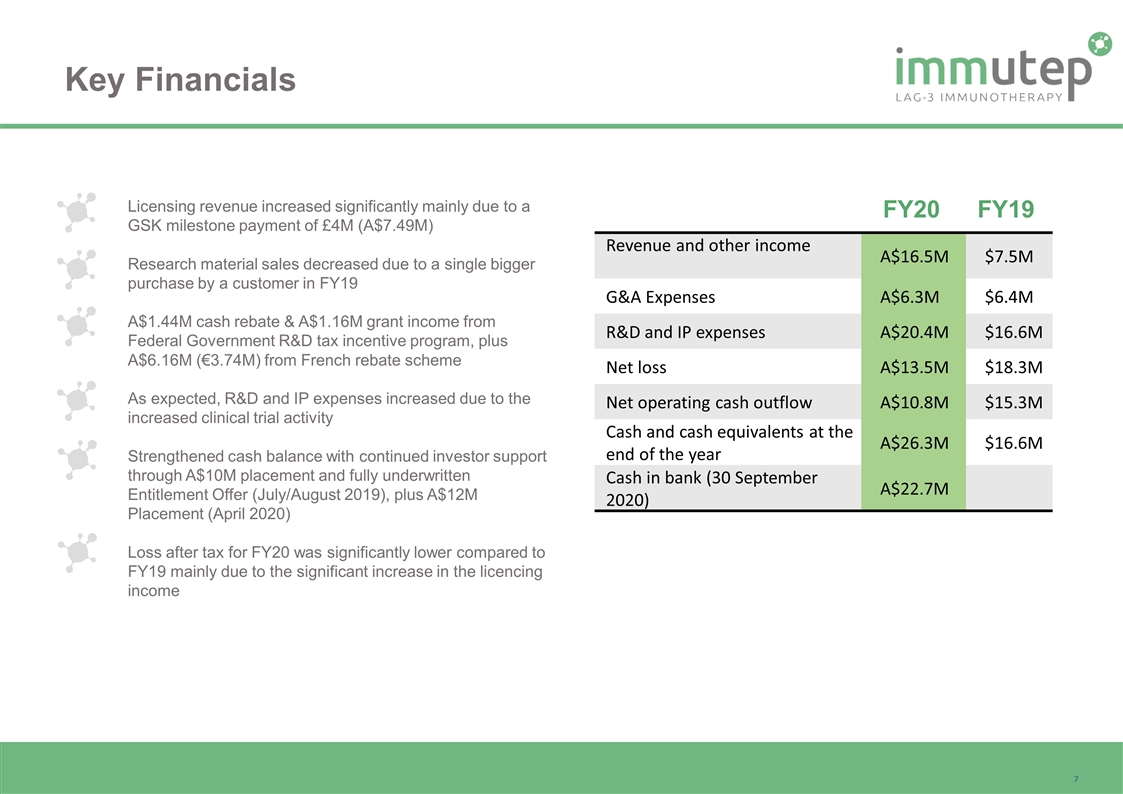

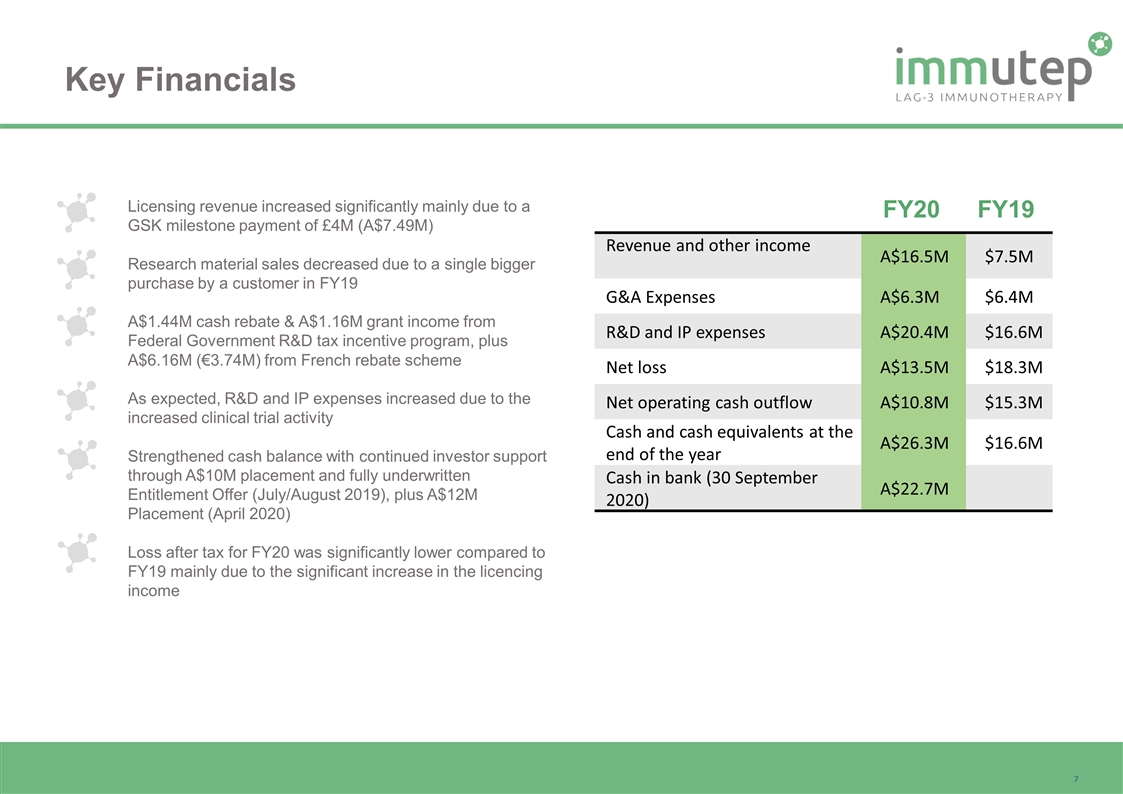

Licensing revenue increased significantly mainly due to a GSK milestone payment of £4M (A$7.49M) Research material sales decreased due to a single bigger purchase by a customer in FY19 A$1.44M cash rebate & A$1.16M grant income from Federal Government R&D tax incentive program, plus A$6.16M (€3.74M) from French rebate scheme As expected, R&D and IP expenses increased due to the increased clinical trial activity Strengthened cash balance with continued investor support through A$10M placement and fully underwritten Entitlement Offer (July/August 2019), plus A$12M Placement (April 2020) Loss after tax for FY20 was significantly lower compared to FY19 mainly due to the significant increase in the licencing income Key Financials Revenue and other income A$16.5M $7.5M G&A Expenses A$6.3M $6.4M R&D and IP expenses A$20.4M $16.6M Net loss A$13.5M $18.3M Net operating cash outflow A$10.8M $15.3M Cash and cash equivalents at the end of the year A$26.3M $16.6M Cash in bank (30 September 2020) A$22.7M FY20 FY19

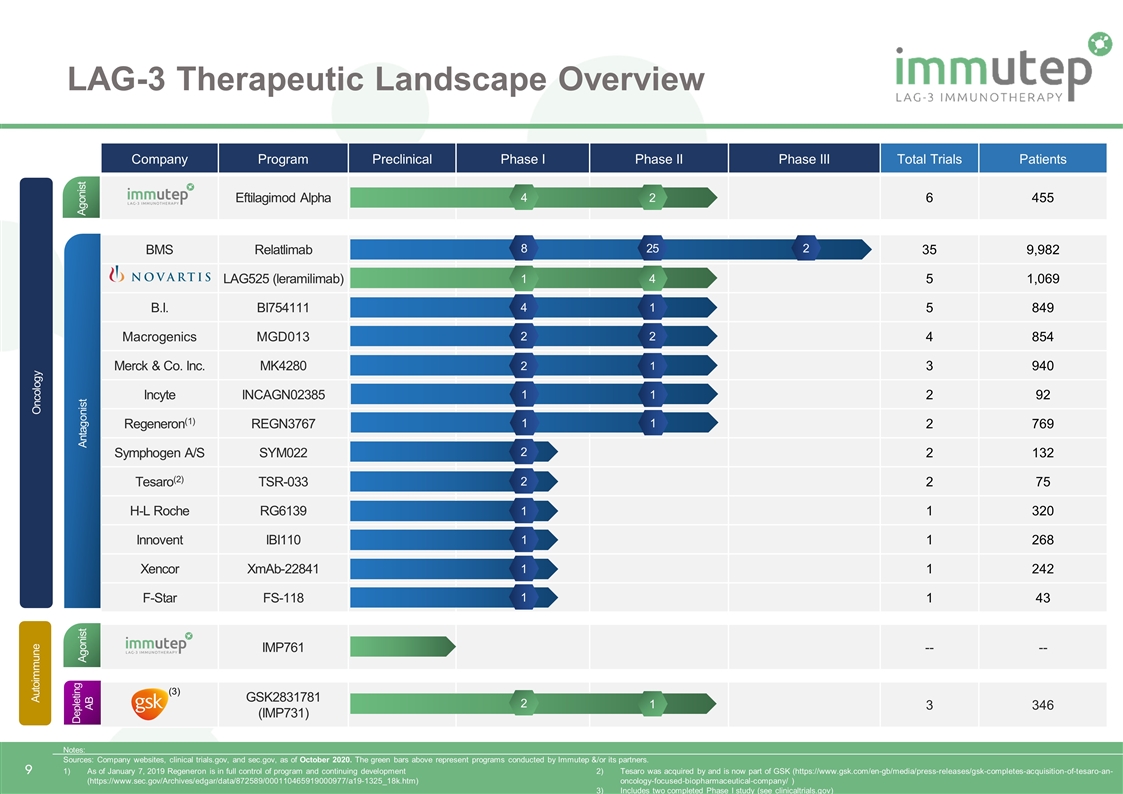

Immutep Pipeline Update

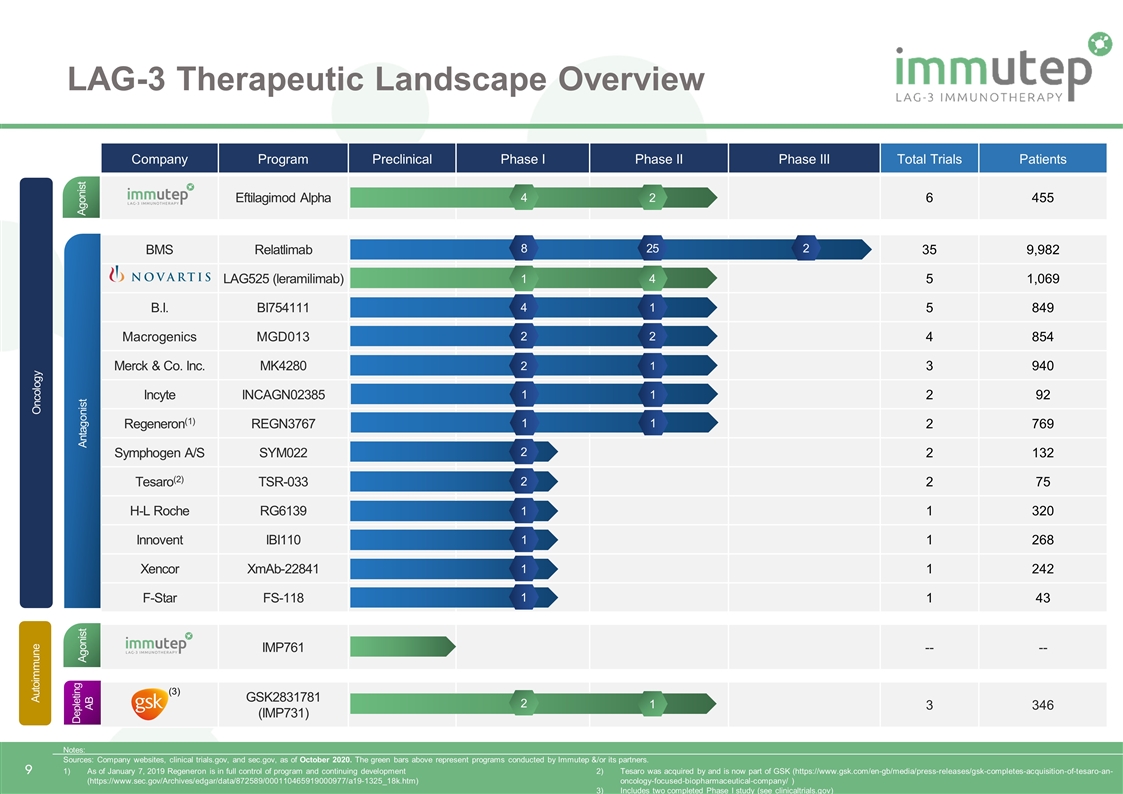

LAG-3 Therapeutic Landscape Overview Eftilagimod Alpha 3 2 424 NovartisLAG525 (IMP701) 1 4 1,122 Merck & Co. Inc,MK4280 2 1 910 B.I. BI754111 4 1 699 Regeneron(1)REGN3767 546 1 Tesaro(2) TSR-033 260 1 Macrogenics MGD013 255 1 Xencor XmAb-22841 230 1 1 1 347 Company Program Preclinical Phase I Phase II Phase III Total Trials Patients Eftilagimod Alpha 6 455 BMS Relatlimab 35 9,982 LAG525 (leramilimab) 5 1,069 B.I. BI754111 5 849 Macrogenics MGD013 4 854 Merck & Co. Inc. MK4280 3 940 Incyte INCAGN02385 2 92 Regeneron(1) REGN3767 2 769 Symphogen A/S SYM022 2 132 Tesaro(2) TSR-033 2 75 H-L Roche RG6139 1 320 Innovent IBI110 1 268 Xencor XmAb-22841 1 242 F-Star FS-118 1 43 IMP761 -- -- GSK2831781 (IMP731) 3 346 Antagonist Agonist Agonist Depleting AB Autoimmune Oncology 4 2 1 4 2 1 8 25 2 2 4 1 2 2 2 1 Notes: Sources: Company websites, clinical trials.gov, and sec.gov, as of October 2020. The green bars above represent programs conducted by Immutep &/or its partners. 1 2 1 (3) 1 1 As of January 7, 2019 Regeneron is in full control of program and continuing development (https://www.sec.gov/Archives/edgar/data/872589/000110465919000977/a19-1325_18k.htm) Tesaro was acquired by and is now part of GSK (https://www.gsk.com/en-gb/media/press-releases/gsk-completes-acquisition-of-tesaro-an-oncology-focused-biopharmaceutical-company/ ) Includes two completed Phase I study (see clinicaltrials.gov) 1 1 1 1

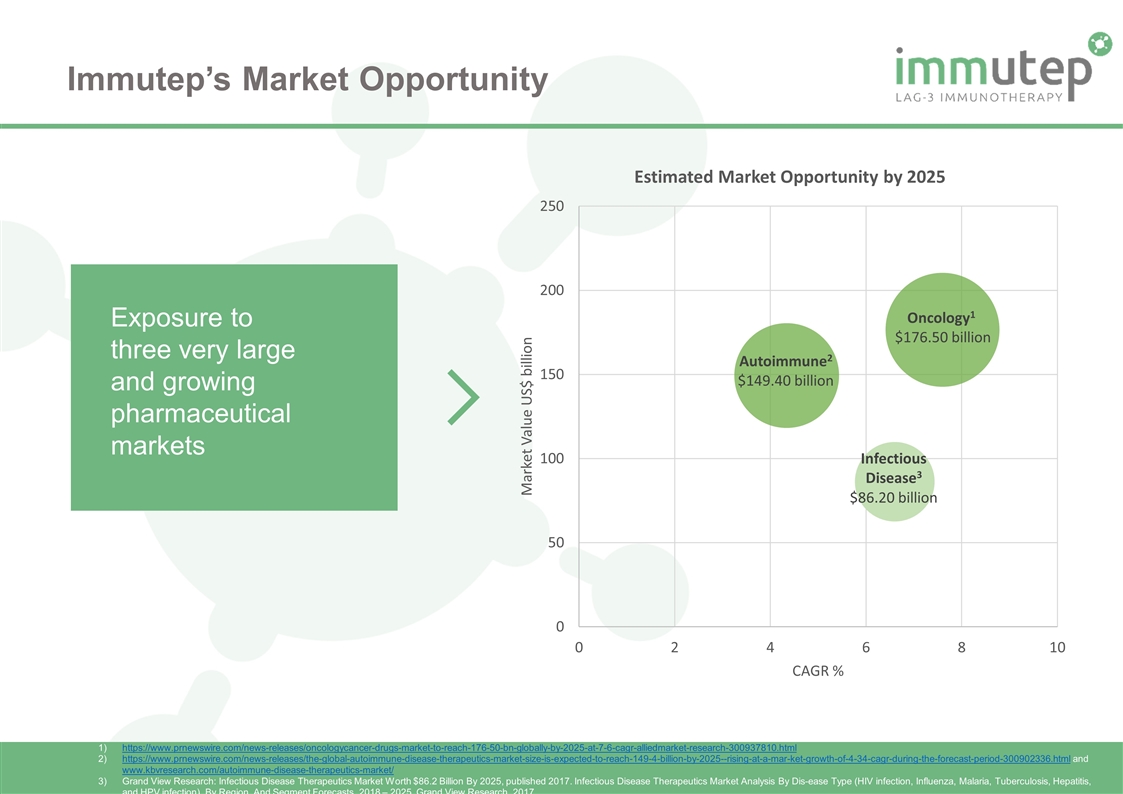

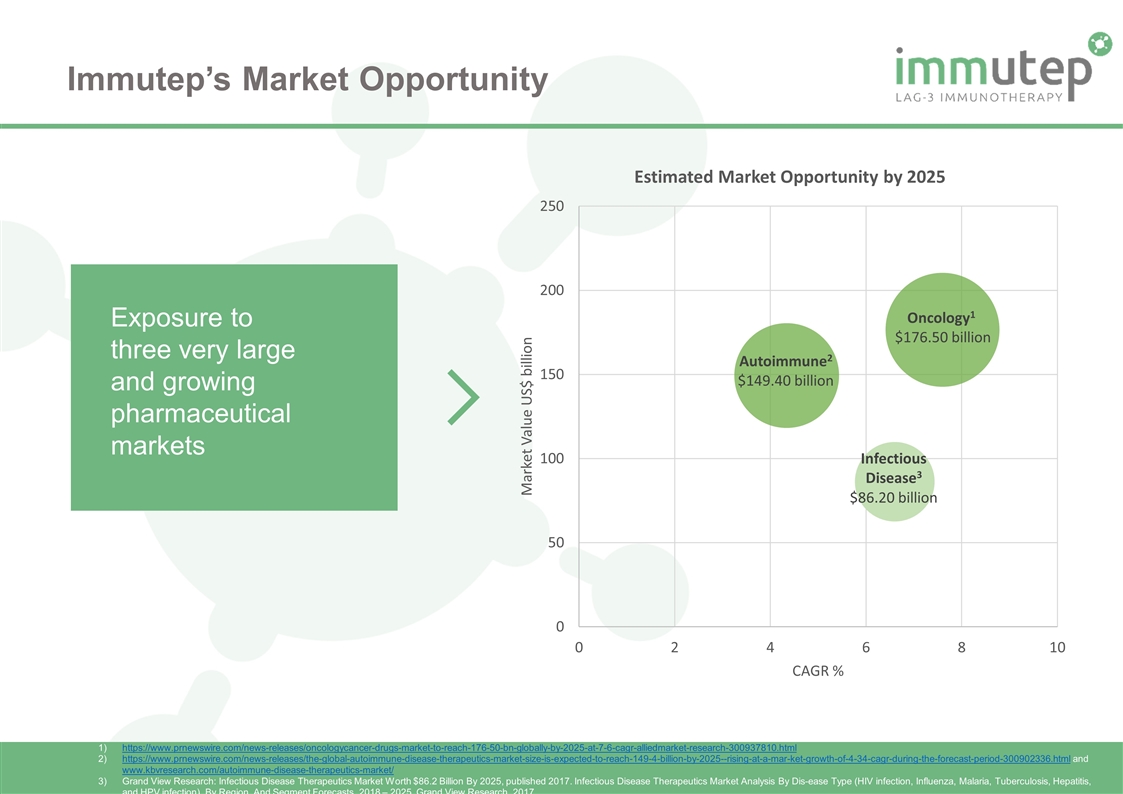

Immutep’s Market Opportunity Exposure to three very large and growing pharmaceutical markets https://www.prnewswire.com/news-releases/oncologycancer-drugs-market-to-reach-176-50-bn-globally-by-2025-at-7-6-cagr-alliedmarket-research-300937810.html https://www.prnewswire.com/news-releases/the-global-autoimmune-disease-therapeutics-market-size-is-expected-to-reach-149-4-billion-by-2025--rising-at-a-mar-ket-growth-of-4-34-cagr-during-the-forecast-period-300902336.html and www.kbvresearch.com/autoimmune-disease-therapeutics-market/ Grand View Research: Infectious Disease Therapeutics Market Worth $86.2 Billion By 2025, published 2017. Infectious Disease Therapeutics Market Analysis By Dis-ease Type (HIV infection, Influenza, Malaria, Tuberculosis, Hepatitis, and HPV infection), By Region, And Segment Forecasts, 2018 – 2025. Grand View Research. 2017.

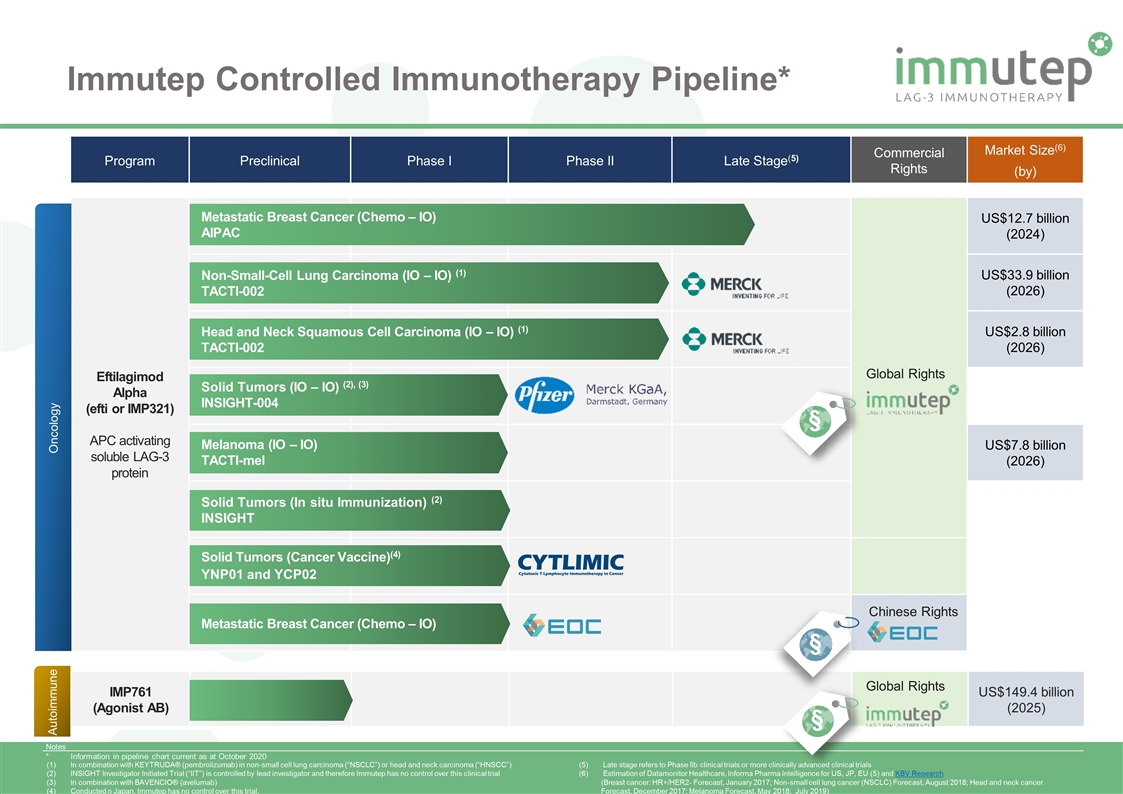

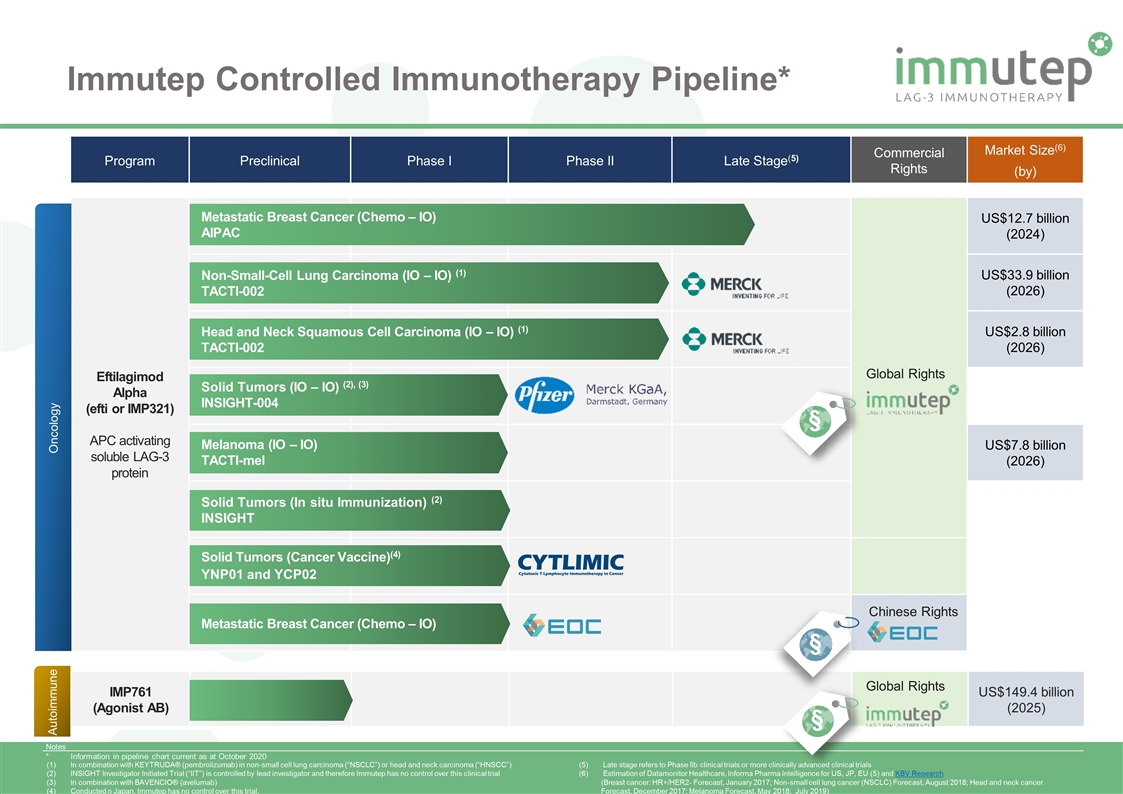

Immutep Controlled Immunotherapy Pipeline* Program Preclinical Phase I Phase II Late Stage(5) Commercial Rights Market Size(6) (by) Eftilagimod Alpha (efti or IMP321) APC activating soluble LAG-3 protein US$12.7 billion (2024) US$33.9 billion (2026) US$2.8 billion (2026) US$7.8 billion (2026) Oncology Non-Small-Cell Lung Carcinoma (IO – IO) (1) TACTI-002 Head and Neck Squamous Cell Carcinoma (IO – IO) (1) TACTI-002 Solid Tumors (IO – IO) (2), (3) INSIGHT-004 Melanoma (IO – IO) TACTI-mel Solid Tumors (In situ Immunization) (2) INSIGHT Metastatic Breast Cancer (Chemo – IO) AIPAC Global Rights Notes * Information in pipeline chart current as at October 2020 Metastatic Breast Cancer (Chemo – IO) Chinese Rights IMP761 (Agonist AB) US$149.4 billion (2025) Autoimmune Global Rights In combination with KEYTRUDA® (pembrolizumab) in non-small cell lung carcinoma (“NSCLC”) or head and neck carcinoma (“HNSCC”) INSIGHT Investigator Initiated Trial (“IIT”) is controlled by lead investigator and therefore Immutep has no control over this clinical trial In combination with BAVENCIO® (avelumab) Conducted n Japan. Immutep has no control over this trial. Late stage refers to Phase IIb clinical trials or more clinically advanced clinical trials Estimation of Datamonitor Healthcare, Informa Pharma Intelligence for US, JP, EU (5) and KBV Research (Breast cancer: HR+/HER2- Forecast, January 2017; Non-small cell lung cancer (NSCLC) Forecast, August 2018; Head and neck cancer Forecast, December 2017; Melanoma Forecast, May 2018; July 2019) § § § Solid Tumors (Cancer Vaccine)(4) YNP01 and YCP02

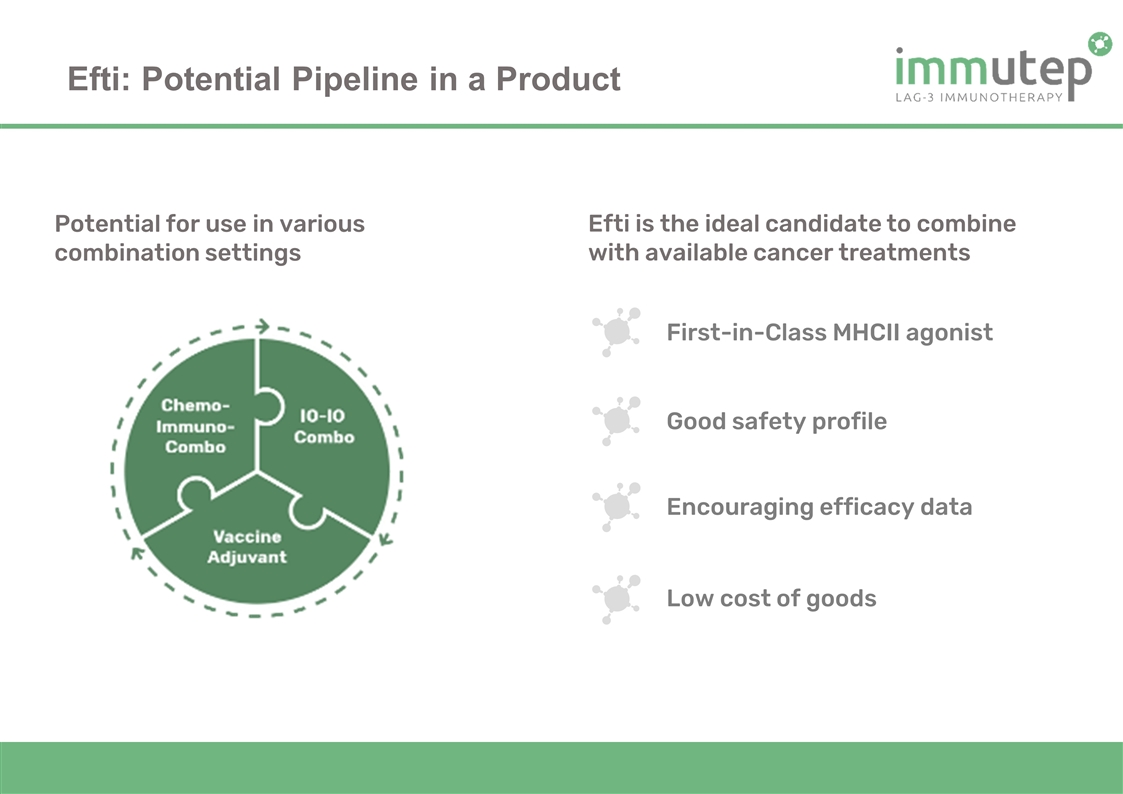

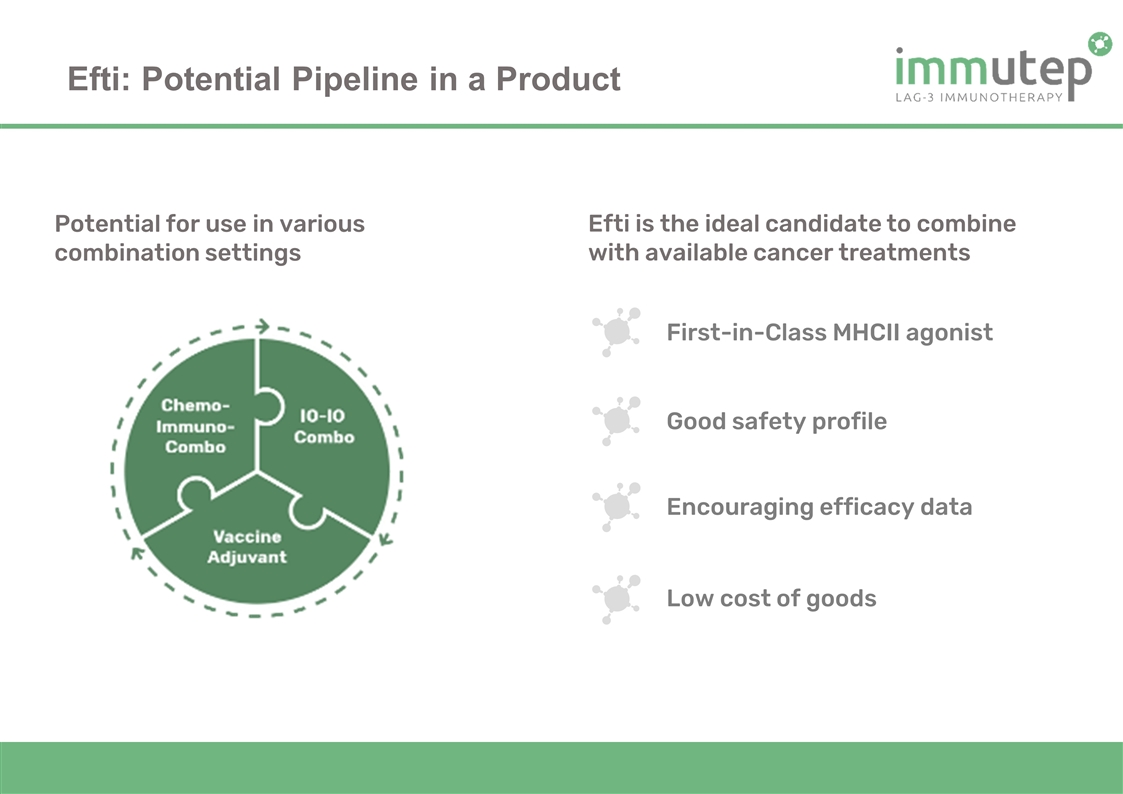

Efti: Potential Pipeline in a Product Efti is the ideal candidate to combine with available cancer treatments Potential for use in various combination settings Good safety profile First-in-Class MHCII agonist Encouraging efficacy data Low cost of goods

EOC, an Eddingpharm spin-off holding the Chinese rights for efti, Phase I study in MBC ongoing Milestone and royalty bearing partnership Spin off from NEC, Japan: aims to develop cancer drugs discovered by artificial intelligence à mainly cancer vaccines Clinical Trial Collaboration (up to US$5 million for IMM); Phase I completed Other Eftilagimod Alpha Partnerships Strategic supply partnership for the manufacture of efti Through WuXi, Immutep was the first company to use a Chinese manufactured biologic in a European clinical trial

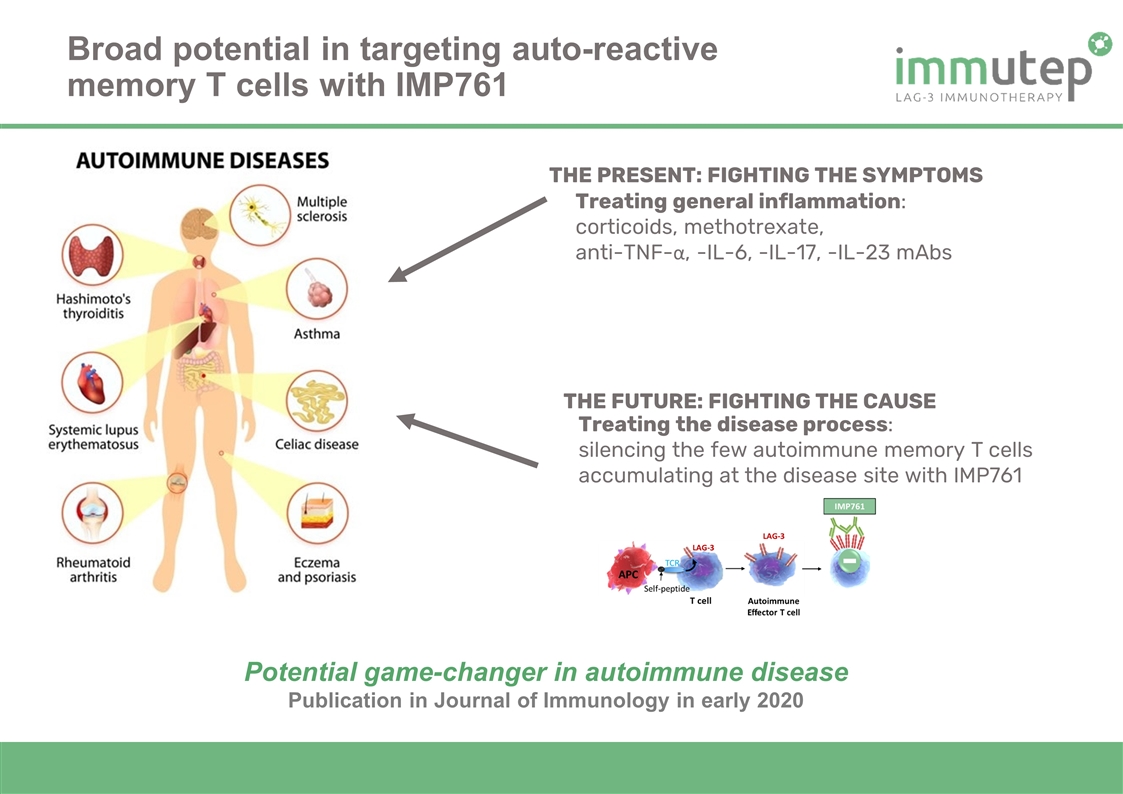

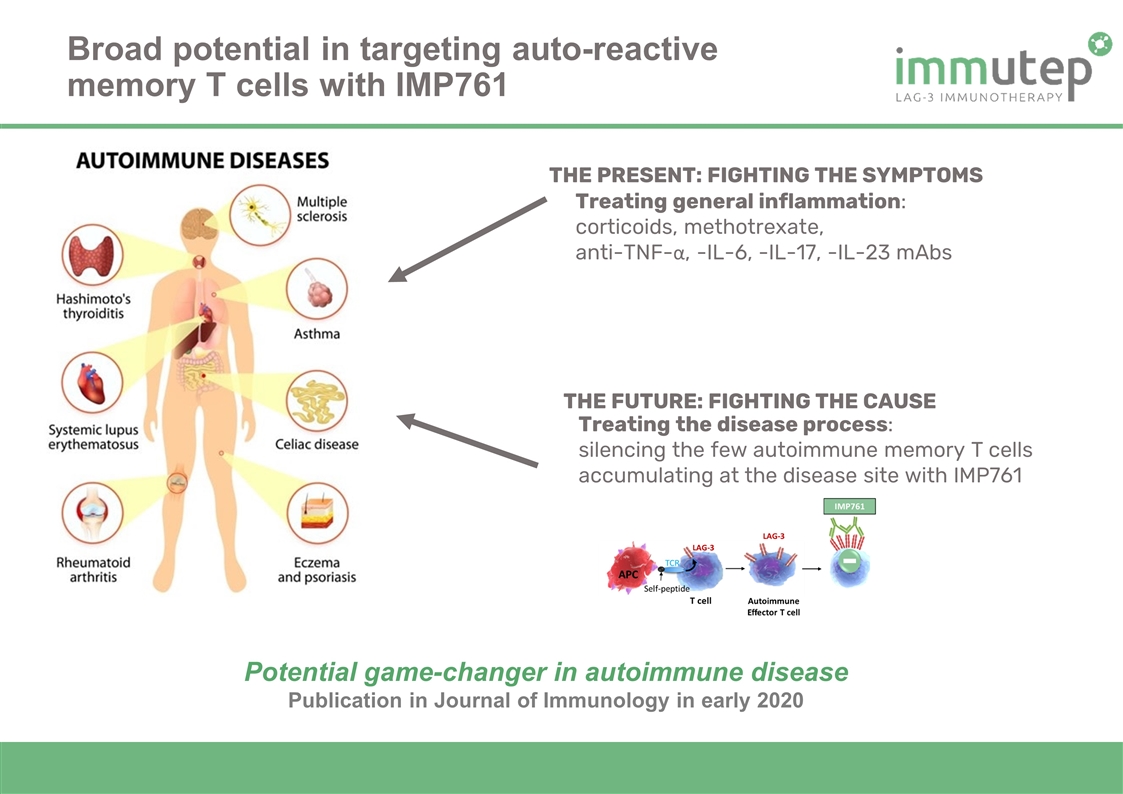

Treating general inflammation: corticoids, methotrexate, anti-TNF-α, -IL-6, -IL-17, -IL-23 mAbs Treating the disease process: silencing the few autoimmune memory T cells accumulating at the disease site with IMP761 THE PRESENT: FIGHTING THE SYMPTOMS THE FUTURE: FIGHTING THE CAUSE Broad potential in targeting auto-reactive memory T cells with IMP761 Potential game-changer in autoimmune disease Publication in Journal of Immunology in early 2020

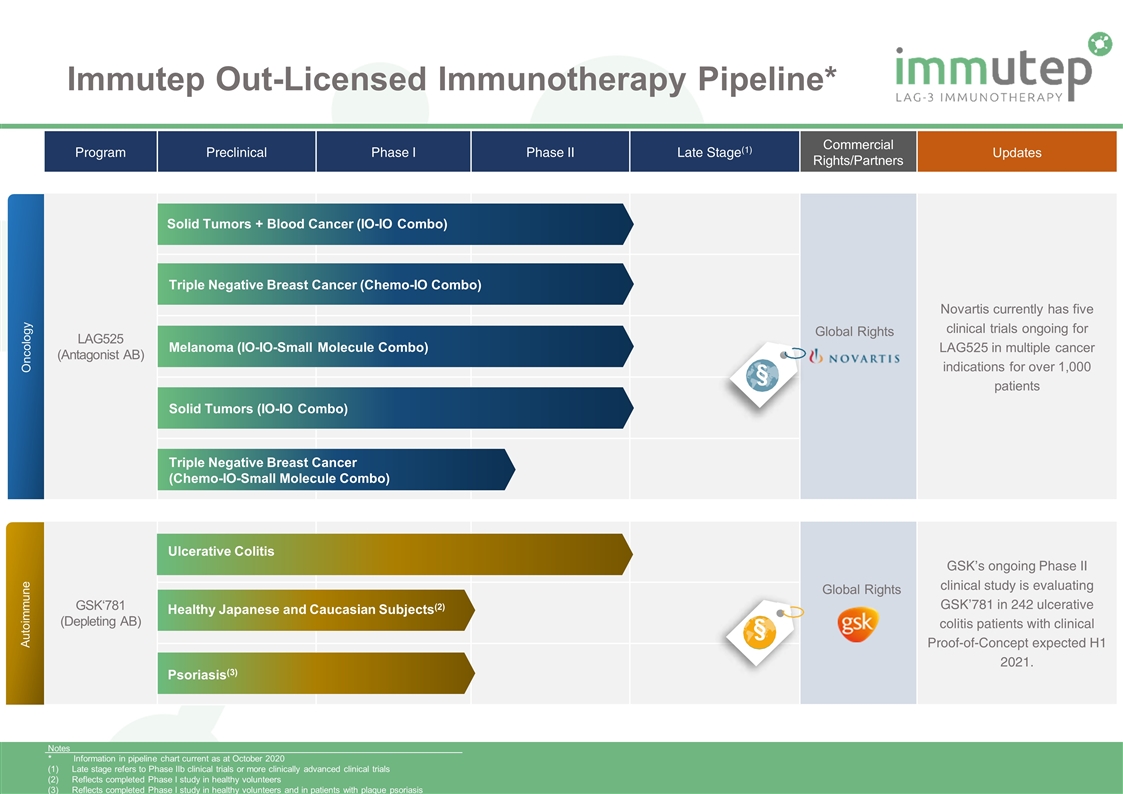

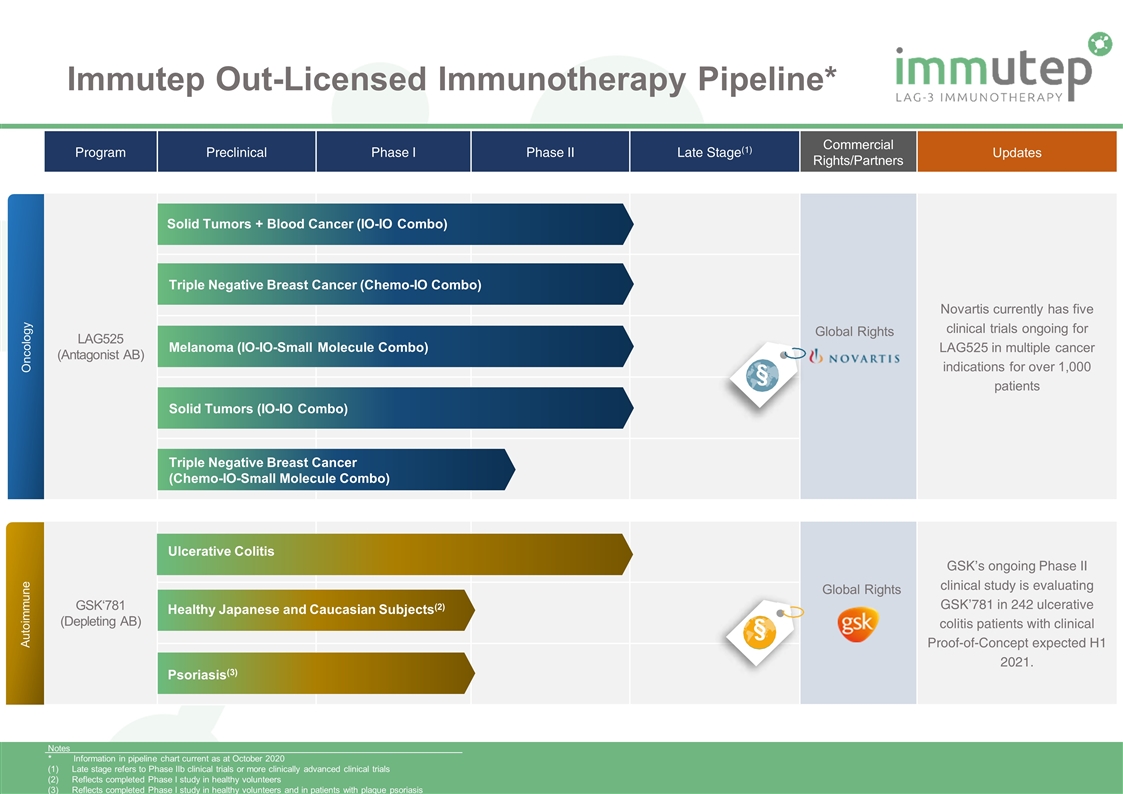

Immutep Out-Licensed Immunotherapy Pipeline* Program Preclinical Phase I Phase II Late Stage(1) Commercial Rights/Partners Updates LAG525 (Antagonist AB) Novartis currently has five clinical trials ongoing for LAG525 in multiple cancer indications for over 1,000 patients GSK‘781 (Depleting AB) GSK’s ongoing Phase II clinical study is evaluating GSK’781 in 242 ulcerative colitis patients with clinical Proof-of-Concept expected H1 2021. Solid Tumors + Blood Cancer (IO-IO Combo) Oncology Autoimmune Triple Negative Breast Cancer (Chemo-IO Combo) Melanoma (IO-IO-Small Molecule Combo) Solid Tumors (IO-IO Combo) Triple Negative Breast Cancer (Chemo-IO-Small Molecule Combo) Ulcerative Colitis Psoriasis(3) Global Rights Global Rights Notes * Information in pipeline chart current as at October 2020 Late stage refers to Phase IIb clinical trials or more clinically advanced clinical trials Reflects completed Phase I study in healthy volunteers Reflects completed Phase I study in healthy volunteers and in patients with plaque psoriasis Healthy Japanese and Caucasian Subjects(2) § §

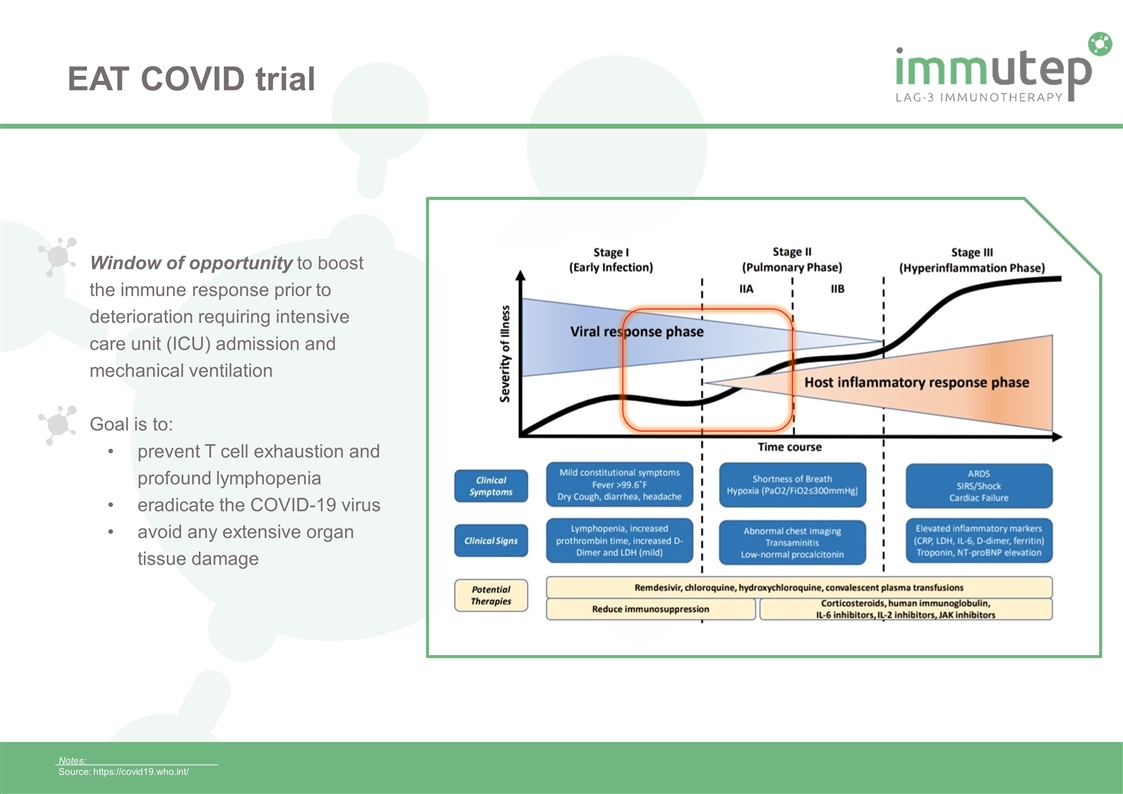

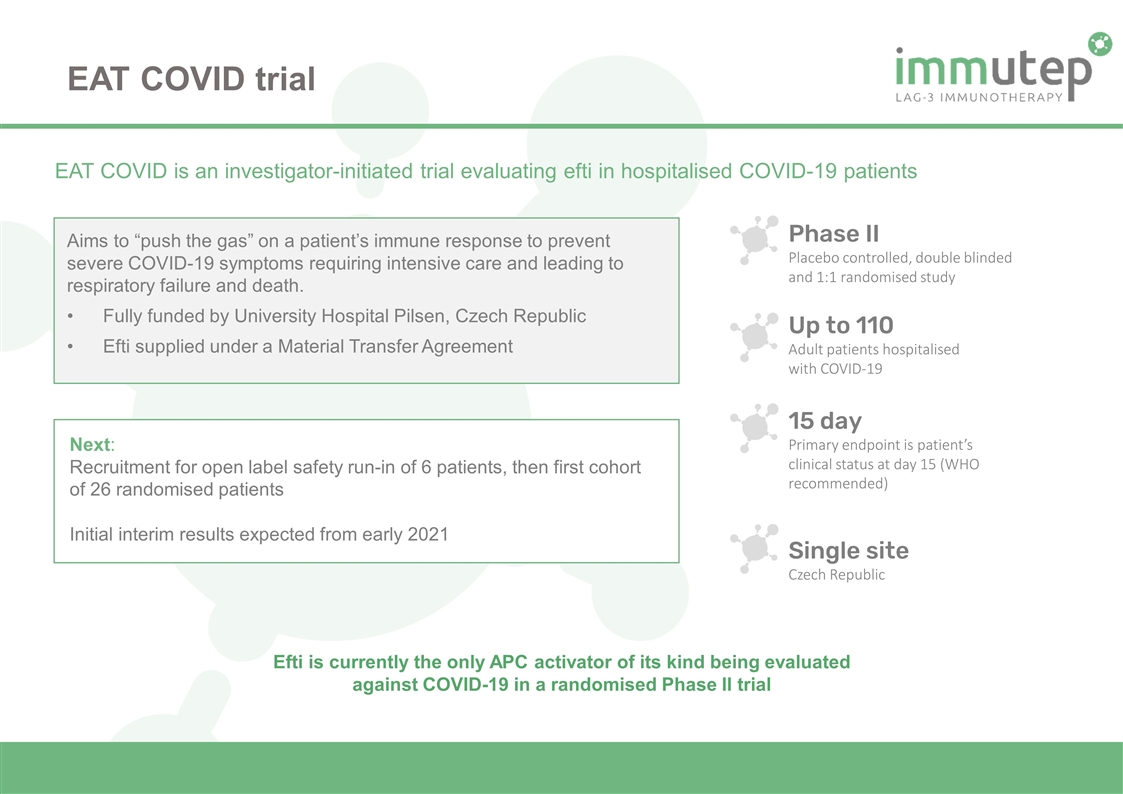

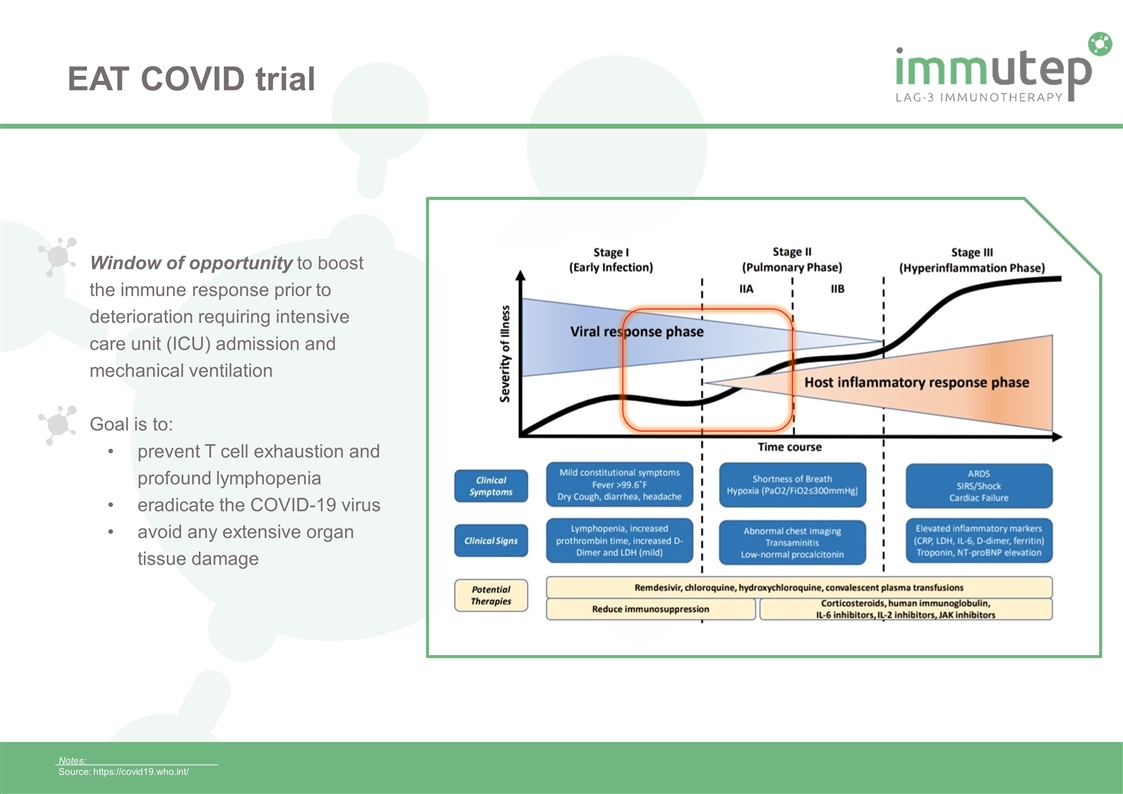

Notes: Source: https://covid19.who.int/ Window of opportunity to boost the immune response prior to deterioration requiring intensive care unit (ICU) admission and mechanical ventilation Goal is to: prevent T cell exhaustion and profound lymphopenia eradicate the COVID-19 virus avoid any extensive organ tissue damage EAT COVID trial

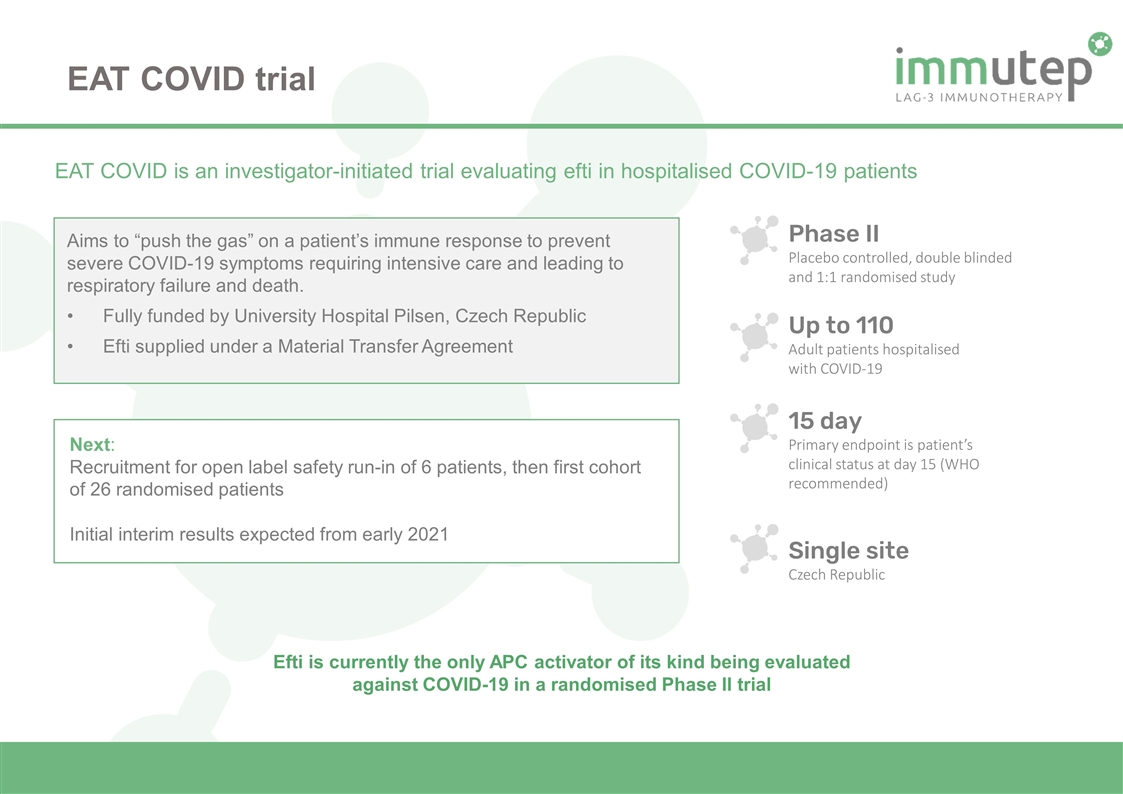

Up to 110 Adult patients hospitalised with COVID-19 Phase II Placebo controlled, double blinded and 1:1 randomised study 15 day Primary endpoint is patient’s clinical status at day 15 (WHO recommended) Single site Czech Republic EAT COVID is an investigator-initiated trial evaluating efti in hospitalised COVID-19 patients Aims to “push the gas” on a patient’s immune response to prevent severe COVID-19 symptoms requiring intensive care and leading to respiratory failure and death. Fully funded by University Hospital Pilsen, Czech Republic Efti supplied under a Material Transfer Agreement Next: Recruitment for open label safety run-in of 6 patients, then first cohort of 26 randomised patients Initial interim results expected from early 2021 Efti is currently the only APC activator of its kind being evaluated against COVID-19 in a randomised Phase II trial EAT COVID trial

Outlook

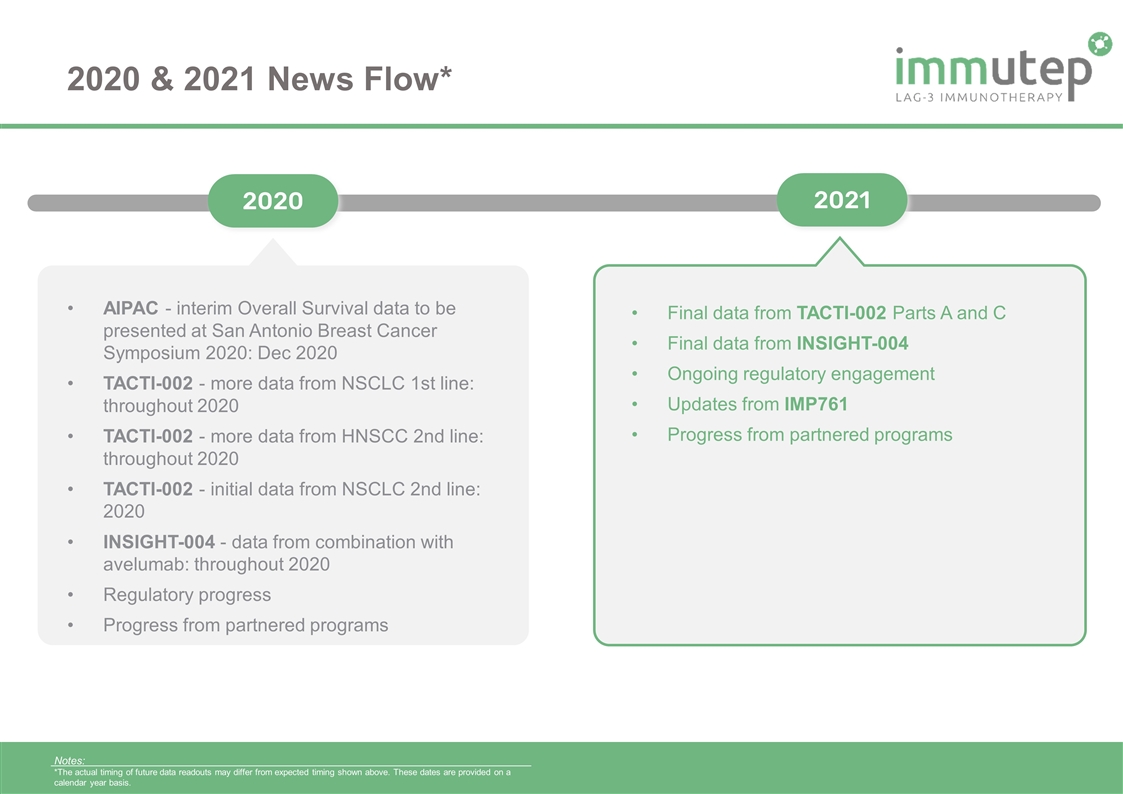

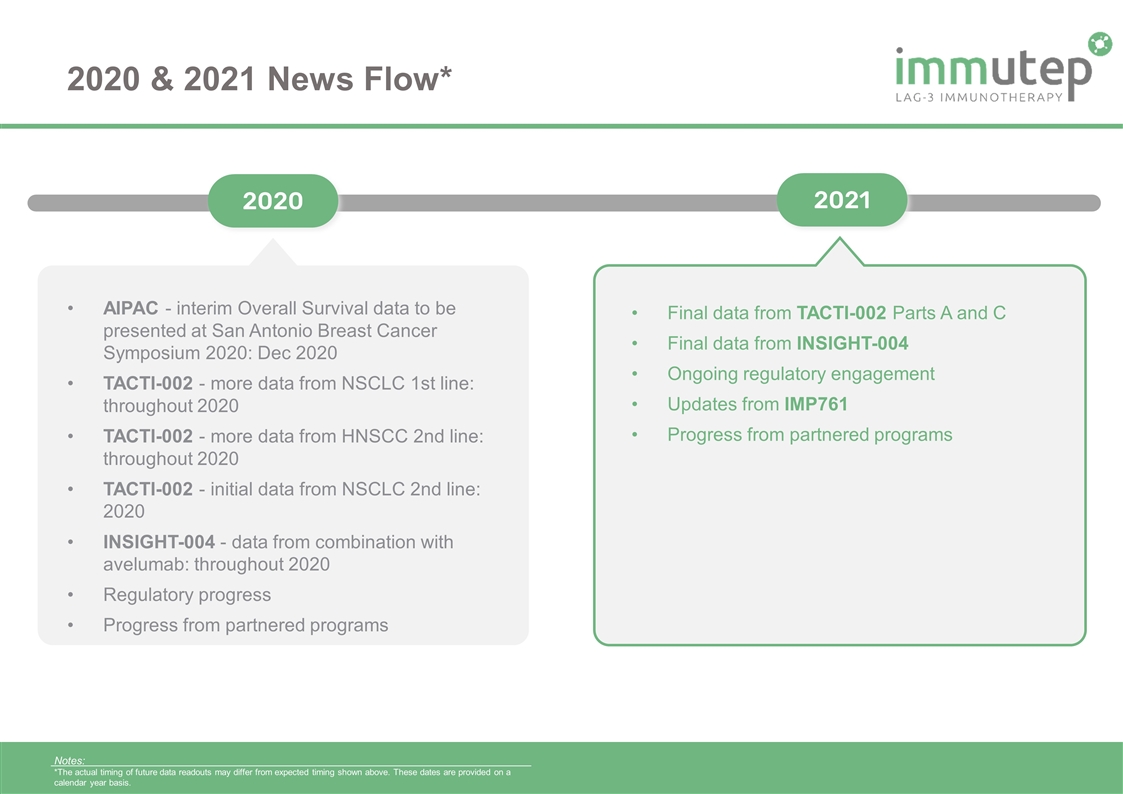

2020 & 2021 News Flow* Notes: *The actual timing of future data readouts may differ from expected timing shown above. These dates are provided on a calendar year basis. 2020 2021 AIPAC - interim Overall Survival data to be presented at San Antonio Breast Cancer Symposium 2020: Dec 2020 TACTI-002 - more data from NSCLC 1st line: throughout 2020 TACTI-002 - more data from HNSCC 2nd line: throughout 2020 TACTI-002 - initial data from NSCLC 2nd line: 2020 INSIGHT-004 - data from combination with avelumab: throughout 2020 Regulatory progress Progress from partnered programs Final data from TACTI-002 Parts A and C Final data from INSIGHT-004 Ongoing regulatory engagement Updates from IMP761 Progress from partnered programs

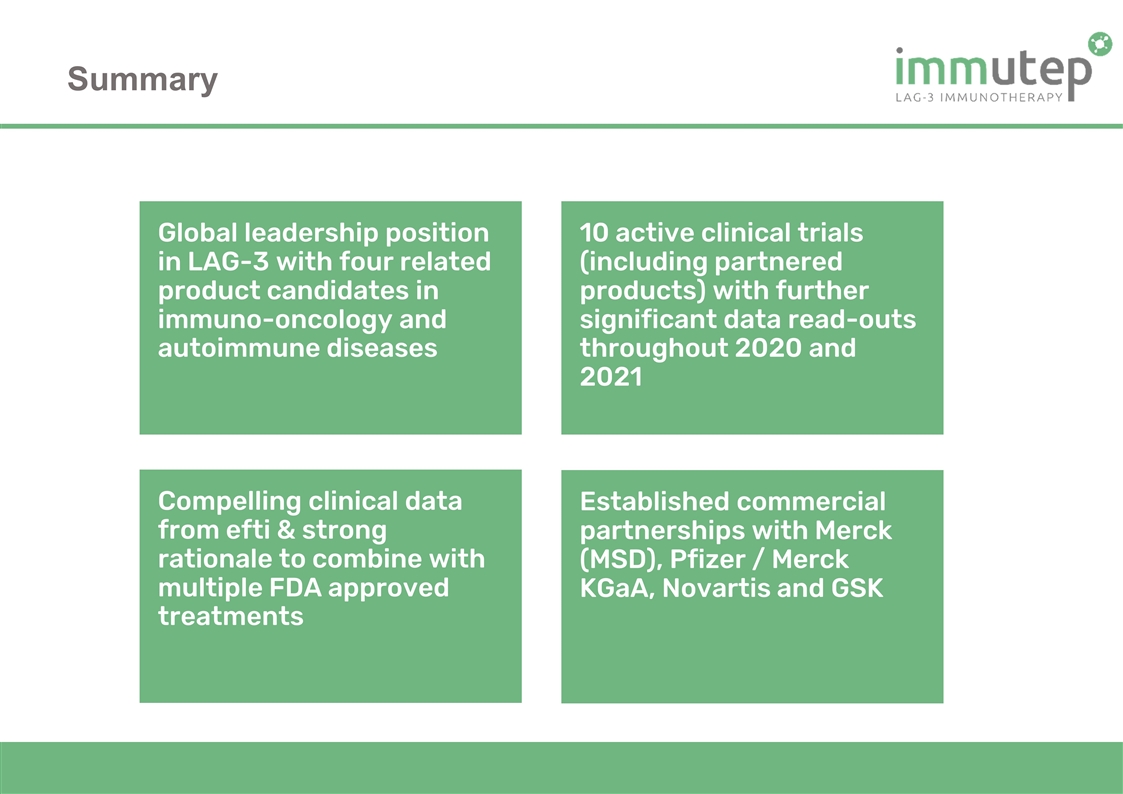

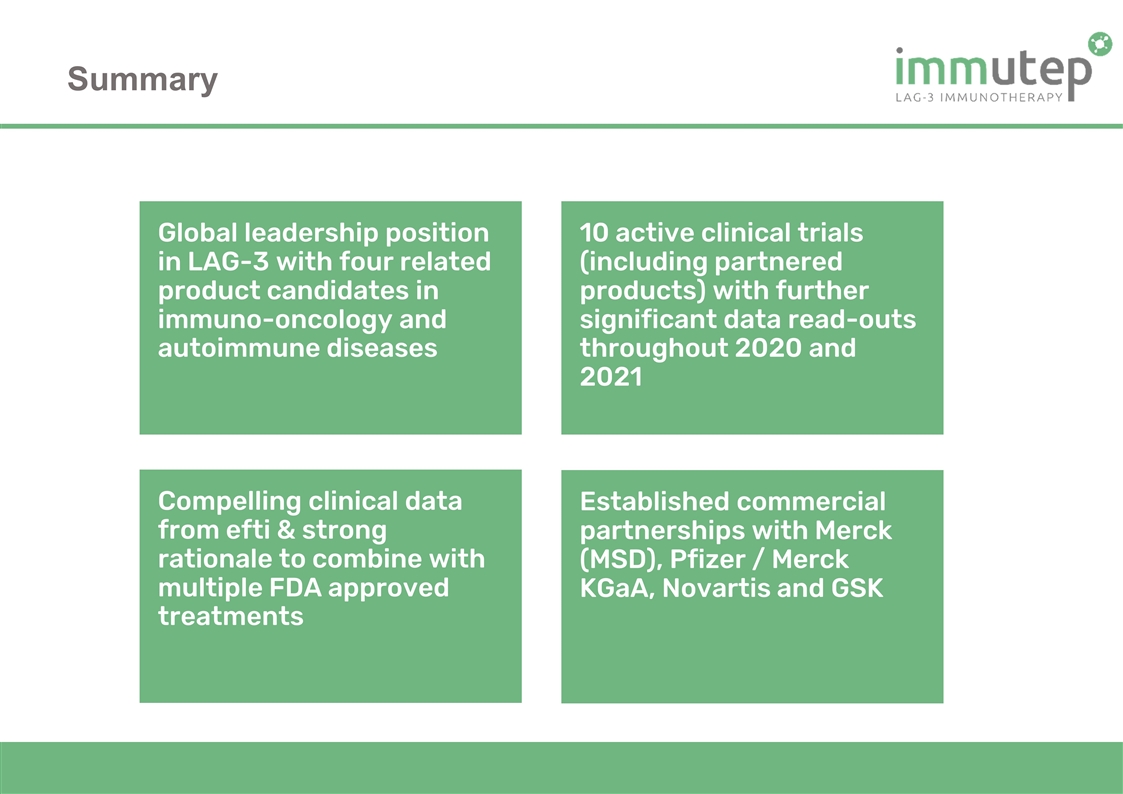

Summary Global leadership position in LAG-3 with four related product candidates in immuno-oncology and autoimmune diseases 10 active clinical trials (including partnered products) with further significant data read-outs throughout 2020 and 2021 Established commercial partnerships with Merck (MSD), Pfizer / Merck KGaA, Novartis and GSK Compelling clinical data from efti & strong rationale to combine with multiple FDA approved treatments

Thank you