Filed pursuant to Rule 424(b)(3)

Registration No. 333-216030

PROSPECTUS

11,444,204 Shares

Common Stock

This prospectus relates to the sale or other disposition from time to time of up to 11,444,204 shares of our common stock, $0.001 par value per share, held by the selling stockholders named in this prospectus. We are not selling any shares of common stock under this prospectus and will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders.

The selling stockholders may sell or otherwise dispose of the shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell or otherwise dispose of their shares of common stock in the section entitled “Plan of Distribution” on page 64. The selling stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees and commissions and similar expenses) relating to the registration of the shares with the Securities and Exchange Commission.

Our common stock is listed on the OTCQB Venture Market operated by OTC Markets Group, Inc. (or OTCQB) under the ticker symbol “CTXR.QB.” On March 30, 2017, the last reported sale price of our common stock on the OTCQB was $0.45.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 11, 2017.

|

| Page |

| |

|

| 1 |

| |

|

|

|

|

|

|

| 8 |

| |

|

|

|

|

|

|

| 9 |

| |

|

|

|

|

|

|

| 28 |

| |

|

|

|

|

|

|

| 29 |

| |

|

|

|

|

|

|

| 29 |

| |

|

|

|

|

|

|

| 31 |

| |

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

|

| 32 |

|

|

|

|

|

|

|

| 41 |

| |

|

|

|

|

|

|

| 51 |

| |

|

|

|

|

|

|

| 62 |

| |

|

|

|

|

|

|

| 64 |

| |

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

| 66 |

|

|

|

|

|

|

|

| 68 |

| |

|

|

|

|

|

|

| 71 |

| |

|

|

|

|

|

|

| 71 |

| |

|

|

|

|

|

|

| 71 |

| |

|

|

|

|

|

|

| F-1 |

| |

i |

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not, and the selling stockholders have not, authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the common stock being offered.

Unless the context indicates otherwise, as used in this prospectus, the terms “Citius,” “we,” “us,” “our,” “our company” and “our business” refer to Citius Pharmaceuticals, Inc.

We own or have rights to various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including Mino-Lok™. All other trade names, trademarks and service marks appearing in this prospectus are the property of their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such terms, when first mentioned in this prospectus, appear with the trade name, trademark or service mark notice and then throughout the remainder of this prospectus without trade name, trademark or service mark notices for convenience only and should not be construed as being used in a descriptive or generic sense.

ii |

| Table of Contents |

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 9, and the financial statements and related notes included in this prospectus.

Company Overview

Citius Pharmaceuticals, Inc. (“Citius” or the “Company”) headquartered in Cranford, New Jersey, is a specialty pharmaceutical company dedicated to the development and commercialization of critical care products targeting important medical needs with a focus on anti-infective products, adjunctive cancer care, and unique prescription products. Our goal is to achieve leading market positions in our targeted markets by providing therapeutic products that address unmet medical needs. New formulations of previously approved drugs with substantial safety and efficacy data is a core focus as we seek to reduce development and clinical risks associated with drug development. Our strategy keys on products that have intellectual property and regulatory exclusivity protection, while providing competitive advantages over other existing therapeutic approaches.

The Company was founded as Citius Pharmaceuticals, LLC, a Massachusetts limited liability company, on January 23, 2007. On September 12, 2014, Citius Pharmaceuticals, LLC entered into a Share Exchange and Reorganization Agreement, with Citius Pharmaceuticals, Inc. (formerly Trail One, Inc.), a publicly traded company incorporated under the laws of the State of Nevada. Citius Pharmaceuticals, LLC became a wholly-owned subsidiary of Citius. On March 30, 2016, Citius acquired Leonard-Meron Biosciences, Inc. (“LMB”) as a wholly-owned subsidiary. LMB was a pharmaceutical company focused on the development and commercialization of critical care products with a concentration on anti-infectives.

Since its inception, the Company has devoted substantially all of its efforts to business planning, research and development, recruiting management and technical staff, and raising capital. We are developing two proprietary products: Mino-Lok™, an antibiotic lock solution used to treat patients with catheter-related bloodstream infections by salvaging the infected catheter, and a Hydrocortisone-Lidocaine topical formulation that is intended to provide anti-inflammatory and anesthetic relief to persons suffering from hemorrhoids. We believe the markets for our products are large, growing, and underserved by current prescription products or procedures.

References to “we,” “us,” “our” and similar words refer to the Company and its wholly-owned subsidiaries Citius Pharmaceuticals LLC and LMB, taken as a whole. References to “Trail One” refer to the Company and its business prior to the Reverse Acquisition.

Strategy

Our goal is to build a successful specialty pharmaceutical company through the commercialization of innovative, efficacious and cost-effective mid- to late-term development products that address compelling market opportunities in the critical care field. We will seek to achieve this goal by:

| · | identifying new drug product candidates that are typically prescribed and used by a small, identified number of specialists, which we believe can therefore be successfully commercialized by a small, specialty sales force, and a focused educational program for innovation adoption; | |

|

| |

| · | obtaining licenses for the most relevant and advanced technologies in critical care medicine that address unmet or urgent medical needs for underserved markets with limited competition and have at least 10 years of intellectual property protection; | |

|

| |

| · | leveraging our in-house clinical and regulatory expertise to advance the development of product candidates in our pipeline more rapidly and take advantage of expedited regulatory pathways; | |

|

| |

| · | leveraging our commercialization and marketing expertise in prescription drugs and critical care medicine to develop and monetize markets that are in need of new product solutions; and | |

|

| |

| · | managing our business in a financially disciplined and cost-conscious manner. |

| 1 |

| Table of Contents |

Our Business

We seek to achieve our business objectives by utilizing the U.S. Food and Drug Administration’s, or FDA’s, 505(b)(2) pathway for our new drug approvals. We believe this pathway is faster, has lower risk and is less expensive than the FDA’s traditional new drug approval pathway. In addition to focusing on new drug approvals, we focus on obtaining intellectual property protection with the objective of listing relevant patents in the FDA Orange Book in order to limit generic competition.

By using previously approved drugs with substantial safety and efficacy data already available, we seek to reduce the risks associated with pharmaceutical product development. We have two development candidates. Our Mino-Lok product for the treatment of catheter related bloodstream infections, or CRBSIs, has completed Phase 2b and is entering Phase 3 trials. We are also developing a topical product containing both hydrocortisone and lidocaine (Hydro-Lido) for the treatment of mild to moderate hemorrhoids. We are reformulating this product and will be entering Phase 2b trials in 2017.

In July 2016, the Company decided to discontinue Suprenza, its FDA-approved phentermine-based product for weight loss, due to a strategic change in direction following the acquisition of LMB and the Mino-Lok product. In September 2016, Citius notified the FDA of its decision to voluntarily withdraw both the Investigative New Drug Application and New Drug Application for commercial reasons and not due to safety concerns, effective immediately. The Company had received no royalties from Suprenza and believed costs associated with the ongoing regulatory expenses were depleting resources from our more promising Mino-Lok and Hydro-Lido product candidates.

Our Product Candidates

Product |

| Indication |

| Current Status |

| Patent Expiry; Patent Number |

|

|

|

|

|

|

|

Mino-Lok |

| Antibiotic Lock Therapy |

| Phase 3 study upcoming |

| June 7, 2024; 7,601,731 |

|

|

|

|

|

|

|

Mino-Lok |

| Antibiotic Lock Therapy |

| Enhanced Stability |

| Pending |

|

|

|

|

|

|

|

Hydrocortisone-Lidocaine Cream |

| Hemorrhoids |

| Phase 2b study upcoming |

| Patent to be filed upon finalization of formulation. |

Mino-LokTM

Overview

Mino-Lok is a patented solution containing minocycline, disodium ethylenediaminetetraacetic acid (edetate), and ethyl alcohol, all of which act synergistically to treat and salvage infected central venous catheters (“CVCs”) in patients with catheter related bloodstream infections (“CRBIs”). Mino-Lok breaks down biofilm barriers formed by bacterial colonies, eradicate the bacteria, and provide anti-clotting properties to maintain patency in CVCs.

The administration of Mino-Lok consists of filling the lumen of the catheter with 0.8 ml to 2.0 ml of Mino-Lok solution, with a lock (dwell-time) of two hours while the catheter is not in use. If the catheter has multiple lumens, all lumens may be locked with the Mino-Lok solution either simultaneously or sequentially. If patients are receiving continuous infusion therapy, the catheters alternate between being locked with the Mino-Lok solution and delivering therapy. The Mino-Lok therapy is two hours per day for at least five days, usually with additional locks in the subsequent two weeks. After locking the catheter for two hours, the Mino-Lok solution is aspirated, and the catheter is flushed with normal saline. At that time, either the infusion will be continued, or will be locked with the standard-of-care lock solution until further use of the catheter is required. In a clinical study conducted by MD Anderson Cancer Center (“MDACC”), there were no serum levels of either minocycline or edetate detected in the sera of several patients who underwent daily catheter lock solution with minocycline and edetate (“M-EDTA”) at the concentration level proposed in Mino-Lok treatment. Thus, it has been demonstrated that the amount of either minocycline or edetate that leaks into the serum is very low or none at all.

| 2 |

| Table of Contents |

Phase 2b Results

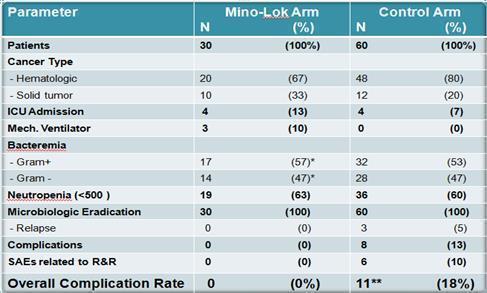

From April 2013 to July 2014, 30 patients with CVC-related bloodstream infection were enrolled at MDACC in a prospective Phase 2b study. Patients received Mino-Lok therapy for two hours once daily for a minimum of five days within the first week followed by two additional locks within the next two weeks. Patients were followed for one month post lock therapy. Demographic information, clinical characteristics, laboratory data, therapy, as well as adverse events and outcome were collected for each patient. Median age at diagnosis was 56 years (range: 21-73 years). In all patients, prior to the use of lock therapy, systemic treatment with a cultured-directed, first-line intravenous was started. Microbiological eradication was achieved in all cases. None of the patients experienced any serious adverse event related to the lock therapy.

The active arm was then compared to 60 patients in a matched cohort that experienced removal and replacement of their CVCs within the same contemporaneous timeframe. The patients were matched for cancer type, infecting organism, and level of neutropenia. All patients were cancer patients and treated at the MDACC. The efficacy of Mino-Lok therapy was 100% in salvaging CVCs, demonstrating equal effectiveness to removing the infected CVC and replacing with a new catheter.

However, the main purpose of the study was to show that Mino-Lok therapy was at least as safe as the removal and replacement of CVCs when CRBSIs are present, and that the complications of removing an infected catheter and replacing with a new one could be avoided. In addition to having a 100% efficacy rate with all CVCs being salvaged, Mino-Lok therapy had no significant adverse events (“SAEs”), compared to an 18% serious adverse event rate in the matched cohort where patients had the infected CVCs removed and replaced (“R&R”). There were no overall complication rates in the Mino-Lok arm group compared to 11 events (18%) in the control group. These events included bacterial relapse (5%) and a number of complications associated with mechanical manipulation in the removal or replacement procedure for the catheter (10%) or development of deep seated infections such as septic thrombophlebitis and osteomyelitis (8%). It was noted that six (6) patients had more than one (1) complication in the control arm group.

Phase 3 Initiation

In November 2016, the Company initiated site recruitment for Phase 3 clinical trials. It is expected that patient enrollment will commence in the Company’s third quarter 2017.

Market Opportunity

In spite of best clinical practice, catheters contribute to approximately 70% of blood stream infections that occur in the ICU, or are associated with hemodialysis or cancer patients (approximately 470,000 per year). Bacteria enter the catheter either from the skin or intraluminally through the catheter hub. Once in the catheter, bacteria tend to form hard biofilm on the surface of the catheter that is resistant to most antimicrobial solutions. The most frequently used maintenance flush, heparin, actually stimulates biofilm formation. Heparin is widely used as a prophylactic lock solution, in spite of the evidence that it contributes to the promotion of biofilm formation. The formation of bacterial biofilm usually precedes CRBSIs.

The standard of care (SOC) in the management of CRBSI patients consists of removing the infected CVC and replacing it with a new catheter at a different vascular access site. However, in cancer and hemodialysis patients with long-term surgically implantable silicone catheters, removal of the CVC and reinsertion of a new one at a different site might be difficult, or even impossible, because of the unavailability of other accessible vascular sites and the need to maintain infusion therapy. Furthermore, critically ill patients with short-term catheters often have underlying coagulopathy, which makes reinsertion of a new CVC at a different site, in the setting of CRBSIs, risky in terms of mechanical complications, such as pneumothorax, misplacement, or arterial puncture. Studies have also revealed that CRBSI patients may be associated with serious complications, including septic thrombosis, endocarditis and disseminated infection, particularly if caused by Staphylococcus aureus or Candida species. Furthermore, catheter retention in patients with CRBSIs is associated with a higher risk of relapse and poor response to antimicrobial therapy.

According to Maki et al., published in the Mayo Clinic Proceedings in 2006, there are approximately 250,000 CRBSIs annually in the U.S. Subsequent to this study, our estimates have ranged upwards to over 450,000 central line-associated blood stream infections (“CLABSIs”) annually (see analysis in the table below). CRBSIs are associated with a 12% to 35% mortality rate and an attributable cost of $35,000 to $56,000 per episode.

| 3 |

| Table of Contents |

We estimate that the potential market for Mino-Lok in the U.S. to be approximately $500 million to $1 billion as shown in the table below.

| Short-Term CVC | Long-Term CVC | Total |

No. of Catheters | 3 million | 4 million | 7 million |

Avg. Duration (Days) | 12 | 100 | N/A |

Catheter Days | 36 million | 400 million | 436 million |

Infection Rate | 2/1,000 days | 1/1,000 days | N/A |

Catheters Infected | 72,000 | 400,000 | 472,000 |

Flushes/Catheter | 5 | 7 | 6.7 |

Total Salvage Flushes | 360,000 | 2,800,000 | 3,160,000 |

Sources: Ann Intern Med 2000; 132:391–402, Clev Clin J Med 2011; 78(1):10-17, JAVA 2007; 12(1):17-27, J Inf Nurs 2004;27(4):245-250, Joint Commission website Monograph, CLABSI and Internal Estimates.

Under various plausible pricing scenarios, we believe that Mino-Lok would be cost saving to the healthcare system given that the removal of an infected CVC and replacement of a new catheter in a different venous access site is estimated by the Company to cost between $8,000 and $10,000. Furthermore, there are potential additional medical benefits and reduction in patient discomfort with the Mino-Lok approach. We believe there will be an economic argument to enhance the adoption of Mino-Lok by infection control committees at acute care institutions.

In January of 2017, the Company commissioned a third party survey of 31 physicians to qualify the need for catheter salvage in patients with infected, indwelling central venous lines, especially when the catheter is a tunneledor an implanted port. There were 19 Infection Disease experts and 12 Intensivists surveyed who all agreed that salvage would be preferable to catheter exchange to avoid catheter misplacements, blood clots, or vessel punctures that can potentially occur during reinsertion. Most were also concerned that viable venous access may not be available in patients who were vitally dependenton a central line.

Hydro-Lido

Overview

Hydro-Lido is a topical formulation of hydrocortisone and lidocaine that is intended for the treatment of hemorrhoids. To our knowledge, there are currently no FDA-approved prescription drug products for the treatment of hemorrhoids. Some physicians are known to prescribe topical steroids for the treatment of hemorrhoids. In addition, there are various strengths of topical combination prescription products containing hydrocortisone along with lidocaine or pramoxine, each a topical anesthetic, that are prescribed by physicians for the treatment of hemorrhoids. These products contain drugs that were in use prior to the start of the Drug Efficacy Study Implementation (DESI) program and are commonly referred to as DESI drugs. However, none of these single-agent or combination prescription products have been clinically evaluated for safety and efficacy and approved by the FDA for the treatment of hemorrhoids. Further, many hemorrhoid patients use over the counter (OTC) products as their first line therapy. OTC products contain any one of several active ingredients including glycerin, phenylephrine, pramoxine, white petrolatum, shark liver oil and/or witch hazel, for symptomatic relief.

Development of Hemorrhoids Drugs

Hemorrhoids are a common gastrointestinal disorder, characterized by anal itching, pain, swelling, tenderness, bleeding and difficulty defecating. In the U.S., hemorrhoids affect nearly 5% of the population, with approximately 10 million persons annually admitting to having symptoms of hemorrhoidal disease. Of these persons, approximately one third visit a physician for evaluation and treatment of their hemorrhoids. The data also indicate that for both sexes a peak of prevalence occurs from age 45 to 65 years with a subsequent decrease after age 65 years. Caucasian populations are affected significantly more frequently than African Americans, and increased prevalence rates are associated with higher socioeconomic status in men but not women. Development of hemorrhoids before age 20 is unusual. In addition, between 50% and 90% of the general U.S., Canadian and European population will experience hemorrhoidal disease at least once in life. Although hemorrhoids and other anorectal diseases are not life-threatening, individual patients can suffer from agonizing symptoms which can limit social activities and have a negative impact on the quality of life.

Hemorrhoids are defined as internal or external according to their position relative to the dentate line. Classification is important for selecting the optimal treatment for an individual patient. Accordingly, physicians use the following grading system:

Grade I | Hemorrhoids not prolapsed but bleeding. |

Grade II | Hemorrhoids prolapse and reduce spontaneously with or without bleeding. |

Grade III | Prolapsed hemorrhoids that require reduction manually. |

Grade IV | Prolapsed and cannot be reduced including both internal and external hemorrhoids that are confluent from skin tag to inner anal canal. |

Development Activities to Date

In the fall of 2015, we completed dosing patients in a double-blind dose ranging placebo controlled Phase 2 study where six different formulations containing hydrocortisone and lidocaine in various strengths were tested against the vehicle control. The objectives of this study were to: 1) demonstrate the safety and efficacy of the formulations when applied twice daily for two weeks in subjects with Grade I or II hemorrhoids and 2) assess the potential contribution of lidocaine hydrochloride and hydrocortisone acetate, alone or in combination for the treatment of symptoms of Goligher’s Classification Grade I or II hemorrhoids.

| 4 |

| Table of Contents |

Symptom improvement was observed based on a global score of disease severity (“GSDS”), and based on some of the individual signs and symptoms of hemorrhoids, specifically itching and overall pain and discomfort. Within the first few days of treatment, the combination products (containing both hydrocortisone and lidocaine) were directionally favorable versus the placebo and their respective individual active treatment groups (e.g., hydrocortisone or lidocaine alone) in achieving ‘almost symptom free’ or ‘symptom free’ status according to the GSDS scale. These differences suggest the possibility of a benefit for the combination product formulation.

Overall, results from adverse event reporting support the safety profile of all test articles evaluated in this study and demonstrate similar safety profiles as compared to the vehicle. The safety findings were unremarkable. There was a low occurrence of adverse events and a similar rate of treatment related adverse events across all treatment groups. The majority of adverse events were mild and only one was severe. None of the adverse events were serious and the majority of adverse events were recovered/resolved at the end of the study. There were only two subjects who were discontinued from the study due to adverse events.

In addition to the safety and dose-ranging information, information was obtained relating to the use of the GSDS as an assessment tool for measuring the effectiveness of the test articles. Individual signs and symptoms were also assessed but can vary from patient to patient. Therefore, the goal of the GSDS was to provide an assessment tool that could be used for all patients regardless of which signs and symptoms they are experiencing. The GSDS proved to be a more effective tool for assessing the severity of the disease and the effectiveness of the drug when compared to the assessment of the individual signs and symptoms. Citius believes that we can continue to develop this assessment tool as well as other patient reported outcome endpoints for use in the next trials.

Information was also obtained about the formulation of the drug and the vehicle. As a result of this study, we believe that the performance of the active arms of the study relative to the vehicle can be improved by re-formulating our topical preparation. Therefore, we have initiated work on vehicle formulation and evaluation of higher potency steroids.

We recently conducted primary market research to better understand the symptoms that are most bothersome to patients. We also learned about the factors that drive patients to seek medical attention for hemorrhoids in an effort to understand the disease impact on quality of life. The results of this survey are able to help us develop patient reported outcome evaluation tools. These tools can be used in clinical trials to evaluate the patients’ conditions and to assess the performance of the test articles.

A Phase 2b study will begin once the new formulation is completed and the updated evaluation tools are developed. This study will be a 300 patient four arm study. The cost is estimated at approximately $3.0 – 5.0 million and is expected to require approximately one year to complete.

Market Opportunity

The current market for OTC and topical DESI formulations of hydrocortisone and lidocaine is highly fragmented, and includes approximately 20 million units of OTC hemorrhoid products and over 4 million prescriptions for non-approved prescription treatments. Several topical combination prescription products for the treatment of hemorrhoids are available containing hydrocortisone in strengths ranging from 0.5% to 3.0%, combined with lidocaine in strengths ranging from 1.0% to 3.0%. The various topical formulations include creams, ointments, gels, lotions, enemas, pads, and suppositories. The most commonly prescribed topical combination gel, is sold as a branded generic product and contains 2.5% hydrocortisone and 3.0% lidocaine.

We believe there are currently no FDA-approved prescription drug products for the treatment of hemorrhoids. Although there are numerous prescription and OTC products commonly used to treat hemorrhoids, none possess proven safety and efficacy data generated from rigorously conducted clinical trials. We believe that a novel topical formulation of hydrocortisone and lidocaine designed to provide anti-inflammatory and anesthetic relief and which has an FDA-approved label specifically claiming the treatment of hemorrhoids will become an important treatment option for physicians who want to provide their patients with a therapy that has demonstrated safety and efficacy in treating this uncomfortable and often recurring disease. We believe that our Hydro-Lido product represents an attractive, low-risk product opportunity with meaningful upside potential.

Market Exclusivity

We believe that we will be the first company to conduct rigorous clinical trials and receive FDA approval of a topical hydrocortisone-lidocaine combination product for the treatment of hemorrhoids. If we receive FDA approval, we will qualify for 3 years of market exclusivity for our dosage strength and formulation. In addition, we will also be the only product on the market specifically proven to be safe and effective for the treatment of hemorrhoids. Generally, if a company conducts clinical trials and receives FDA approval of a product for which there are similar, but non FDA-approved, prescription products on the market, the manufacturers of the unapproved but marketed products are required to withdraw them from the market. However, the FDA has significant latitude in determining how to enforce its regulatory powers in these circumstances. We have not had any communication with the FDA regarding this matter and cannot predict what action, if any, the FDA will take with respect to the unapproved products.

| 5 |

| Table of Contents |

We believe that should our product receive an FDA approval and demonstrate, proven safety and efficacy data, and if our products obtain 3 years of market exclusivity based on our dosage strength and formulation, Citius is likely to have a meaningful advantage in its pursuit of achieving a significant position in the market for topical combination prescription products for the treatment of hemorrhoids.

Recent Developments

The Company issued demand promissory notes in favor of Leonard Mazur, Chairman of the Board, from 2016 through March 30, 2017 in the aggregate principal amount of $1,850,000 (collectively, the “Notes”). The Notes mature on the earlier of December 31, 2017 or demand by the lender and accrue interest at the prime rate plus 1%.

In February 2017, the Company completed an offering (the “2016 Offering”) and sold 1,920,250 units (the “2016 Offering Units”), each 2016 Offering Unit consists of (i) one share of common stock and (ii) a warrant to purchase one share of common stock (the “2016 Offering Warrants”) for gross proceeds of $768,100. Each 2016 Offering Unit was sold at a negotiated price of $0.40. Each 2016 Offering Warrant has an exercise price of $0.55 and is exercisable for a period of five years from the date of issuance. The Placement Agent received a 10% cash commission on the gross proceeds of each sale of the 2016 Offering Units. In addition, the Placement Agent also received (i) an expense allowance equal to 3% of the proceeds of the sale, and (ii) warrants to purchase a number of shares of common stock equal to 10% of the 2016 Offering Units sold at an exercise price of $0.55 per share.

On January 17, 2017, the Company issued 445,932 shares of common stock to IRTH Communications for services related to strategic consulting and investor relations.

On January 17, 2017, we issued an option to purchase 20,000 shares of common stock to each of Dr. Mark Rupp and Dr. Robert Sheretz, both members of our scientific advisory boards, that vests over twenty-four (24) months. Also on this same date, the Company issued an option to purchase 40,000 shares of common stock to the chairman of the scientific advisory board, Dr. Issam Raad, that vests over thirty-six (36) months. The exercise price for each of these options is $0.67 per share.

On January 17, 2017, we issued an option to purchase 50,000 shares of common stock to consultant Dr. Howard Maibach that vests over twelve (12) months and has an exercise price of $0.67 per share.

Risk Factors

Our business is subject to a number of risks you should be aware of before making an investment decision. These risks and others related to the purchase of the Securities are discussed more fully in “Risk Factors” beginning on page 9 and include:

| · | we have no source of revenue, had an accumulated deficit of $19,512,145 as of December 31, 2016, may never become profitable and may incur substantial and increasing net losses for the foreseeable future as we seek development, regulatory approval and commercialization of our products and any future product candidates; | |

|

| |

| · | we may need to obtain additional capital to complete the development of existing products, acquire new products, and to continue operations; | |

|

| |

| · | our success is primarily dependent on the successful completion of the upcoming Mino-Lok Phase 3 trial, our second registration trial and regulatory approval by the FDA, and the upcoming Hydro-Lido Phase 2b trial; | |

|

| |

| · | we are subject to regulatory approval processes that are lengthy, time consuming and inherently unpredictable; we may not obtain approval for our current products or any of our future product candidates from the FDA or any foreign regulatory authorities; | |

|

| |

| · | it is difficult and costly to protect our intellectual property rights; | |

|

| |

| · | we may be unable to recruit or retain key employees, including our senior management team; and | |

|

| |

| · | we depend on the performance of third parties, including contract research organizations and manufacturers, for the clinical testing and production of Mino-Lok, our Hydro-Lido formulation and any other product candidates. |

| 6 |

| Table of Contents |

Corporate Information

The Company was founded as Citius Pharmaceuticals, LLC, a Massachusetts limited liability company, on January 23, 2007. On September 12, 2014, Citius Pharmaceuticals, LLC entered into a Share Exchange and Reorganization Agreement, with Citius Pharmaceuticals, Inc. (formerly Trail One, Inc.), a publicly traded company incorporated under the laws of the State of Nevada. Citius Pharmaceuticals, LLC became a wholly-owned subsidiary of Citius. On March 30, 2016, Citius acquired Leonard-Meron Biosciences, Inc. (“LMB”) as a wholly-owned subsidiary. LMB was a pharmaceutical company focused on the development and commercialization of critical care products with a concentration on anti-infectives.

The Company’s principal executive offices are located at 11 Commerce Drive, Cranford, New Jersey 07016 and its telephone number is (908) 976-6677.

SUMMARY CONSOLIDATED FINANCIAL DATA

The following selected financial information is derived from the Company's Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company's Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus. The results indicated below are not necessarily indicative of our future performance.

You should read this information together with the sections entitled "Capitalization", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes included elsewhere in this prospectus.

Summary of Statements of Operations

|

| Three Months Ended |

|

| Three Months Ended |

|

| Year Ended September 30, 2016 |

|

| Year Ended September 30, 2015 |

| ||||

|

| (unaudited) |

|

| (unaudited) |

|

|

|

|

|

|

| ||||

Revenues |

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

Loss from operations |

| $ | (2,784,856 | ) |

| $ | (1,244,676 | ) |

| $ | (7,449,291 | ) |

| $ | (3,229,929 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

| $ | 608,958 |

|

| $ | 23,955 |

|

| $ | (846,407 | ) |

| $ | 327,661 |

|

Net loss |

| $ | (2,175,898 | ) |

| $ | (1,220,721 | ) |

| $ | (8,295,698 | ) |

| $ | (2,902,268 | ) |

Net loss per common share-basic and diluted |

| $ | (0.03 | ) |

| $ | (0.04 | ) |

| $ | (0.15 | ) |

| $ | (0.09 | ) |

Weighted average number of common shares outstanding – basic and diluted |

|

| 73,551,357 |

|

|

| 34,414,988 |

|

|

| 54,348,120 |

|

|

| 31,835,440 |

|

Summary Balance Sheet Information

|

| December 31, |

|

| September 30, |

|

| September 30, |

| |||

|

| 2016 |

|

| 2016 |

|

| 2015 |

| |||

|

| (unaudited) |

|

|

|

|

|

|

| |||

Cash and cash equivalents |

| $ | 46,764 |

|

| $ | 294,351 |

|

| $ | 676,137 |

|

Total Assets |

| $ | 21,482,323 |

|

| $ | 21,950,341 |

|

| $ | 741,538 |

|

Current Liabilities |

| $ | 6,318,711 |

|

| $ | 5,183,958 |

|

| $ | 1,376,751 |

|

Long-Term Debt |

| $ | - |

|

| $ | - |

|

| $ | - |

|

Stockholders' Equity (Deficit) |

| $ | 15,163,612 |

|

| $ | 16,766,383 |

|

| $ | (635,213 | ) |

| 7 |

| Table of Contents |

This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to 11,444,204 shares of our common stock, as follows:

Common stock offered by the selling stockholders | 11,444,204 shares | ||

Common stock outstanding before the offering (1) (2) | 75,504,242 shares | ||

Common stock to be outstanding after the offering (2) | 75,504,242 shares | ||

Common stock OTCQB Symbol | CTXR.QB | ||

______________ |

|

| |

(1) Based on the number of shares outstanding as of February 28, 2017. |

|

| |

(2) Does not include up to 9,523,954 shares of common stock issuable on exercise of the warrants. |

|

| |

Use of Proceeds

The 11,444,204 shares that are being offered for resale by the selling stockholders represent 1,920,250 currently outstanding shares and 9,523,954 shares underlying currently outstanding warrants, and will be sold for the accounts of the selling stockholders named in this prospectus. As a result, all proceeds from the sales of the 11,444,204 shares of common stock and offered for resale hereby will go to the selling stockholders and we will not receive any proceeds from the resale of those shares of common stock by the selling stockholders.

We may receive up to a total of $5,618,360 in gross proceeds if all of the warrants are exercised hereunder for cash. However, as we are unable to predict the timing or amount of potential exercises of the warrants, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds are allocated to working capital. It is possible that the warrants may expire and may never be exercised.

After the exercise of any of the warrants, we would not receive any proceeds from the resale of those shares by the selling stockholders because those shares will be sold for the accounts of the selling stockholders named in this prospectus.

We will incur all costs associated with this registration statement and prospectus.

Dividend Policy

We have never paid dividends on our capital stock and do not anticipate paying any dividends for the foreseeable future. See “Dividend Policy.”

| 8 |

| Table of Contents |

Investing in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider carefully the specific factors discussed below, together with all of the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our common stock to decline and could cause you to lose all or part of your investment.

Risks related to our Business and our Industry

Citius has a history of net losses and expects to incur losses for the foreseeable future. We may never generate revenues or, if we are able to generate revenues, achieve profitability.

Citius was formed as a limited liability company in 2007 and since its inception has incurred net loss in each of its previous operating years. Our ability to become profitable depends upon our ability to generate revenues from sales of our product candidates. Citius has been focused on product development and has not generated any revenues to date. Citius has incurred losses in each period of our operations, and we expect to continue to incur losses for the foreseeable future. These losses are likely to continue to adversely affect our working capital, total assets and shareholders’ equity (deficit). The process of developing our products requires significant clinical, development and laboratory testing and clinical trials. In addition, commercialization of our product candidates will require that we obtain necessary regulatory approvals and establish sales, marketing and manufacturing capabilities, either through internal hiring or through contractual relationships with others. We expect to incur substantial losses for the foreseeable future as a result of anticipated increases in our research and development costs, including costs associated with conducting preclinical testing and clinical trials, and regulatory compliance activities. Citius incurred net losses of $2,175,898 for the three months ended December 31, 2016, $8,295,698 and $2,902,268 for the years ended September 30, 2016 and 2015, respectively, and a net loss of $737,727 for the nine months ended September 30, 2014. At December 31, 2016, Citius had stockholders’ equity of $15,163,612 and an accumulated deficit of $19,512,145. Citius’ net cash used for operating activities was $1,314,792 for the three months ended December 31, 2016, $5,900,421 and $2,385,416 for the years ended September 30, 2016 and 2015, respectively, and $183,164 for the nine months ended September 30, 2014.

Our ability to generate revenues and achieve profitability will depend on numerous factors, including success in:

| · | developing and testing product candidates; | |

|

| |

| · | receiving regulatory approvals; | |

|

| |

| · | commercializing our products; | |

|

| |

| · | manufacturing commercial quantities of our product candidates at acceptable cost levels; and | |

|

| |

| · | establishing a favorable competitive position. |

Many of these factors will depend on circumstances beyond our control. We cannot assure you that any of our products will be approved by the FDA, that we will successfully bring any product to market or, if so, that we will ever become profitable.

Our auditors have issued a “going concern” audit opinion.

Our independent registered accountants have indicated, in their report on our September 30, 2016 financial statements, that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Currently, we do not have sufficient capital to continue our operations for the next twelve months. You should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

| 9 |

| Table of Contents |

We need to secure additional financing.

We anticipate that we will incur operating losses for the foreseeable future. We have received gross proceeds of approximately $7.8 million from our private placement offerings through February 2017. Additionally, in connection with the acquisition of LMB our Executive Chairman Leonard Mazur made an equity investment of $3.0 million in March 2016. Additionally, Leonard Mazur has loaned the Company $1,850,000 in the form of demand promissory notes. We may need to seek additional financing, including from affiliates, to continue our clinical programs and manufacturing for clinical programs.

The amount and timing of our future funding requirements will depend on many factors, including, but not limited to:

| · | the rate of progress and cost of our trials and other product development programs for our product candidates; | |

|

| |

| · | the costs and timing of obtaining licenses for additional product candidates or acquiring other complementary technologies; | |

|

| |

| · | the timing of any regulatory approvals of our product candidates; | |

|

| |

| · | the costs of establishing sales, marketing and distribution capabilities; and | |

|

| |

| · | the status, terms and timing of any collaborative, licensing, co-promotion or other arrangements. |

We will need to access the capital markets in the future for additional capital for research and development and for operations. Traditionally, pharmaceutical companies have funded their research and development expenditures through raising capital in the equity markets. Declines and uncertainties in these markets over the past several years have severely restricted raising new capital and have affected companies’ ability to continue to expand or fund existing research and development efforts. If these economic conditions continue or become worse, our future cost of equity or debt capital and access to the capital markets could be adversely affected. If we are not successful in securing additional financing, we may be required to delay significantly, reduce the scope of or eliminate one or more of our research or development programs, downsize our general and administrative infrastructure, or seek alternative measures to avoid insolvency, including arrangements with collaborative partners or others that may require us to relinquish rights to certain of our technologies or product candidates.

We are a late-stage development company with an unproven business strategy and may never achieve commercialization of our therapeutic products or profitability.

Our strategy of using collaborative partners to assist us in the development of our therapeutic products is unproven. Our success will depend upon our ability to enter into additional collaboration agreements on favorable terms and to select an appropriate commercialization strategy for each potential therapeutic product we and our collaborators choose to pursue. If we are not successful in implementing our strategy to commercialize our potential therapeutic products, we may never achieve, maintain or increase profitability. Our ability to successfully commercialize any of our products or product candidates will depend, among other things, on our ability to:

| · | successfully complete our clinical trials; | |

|

| |

| · | produce, through a validated process, sufficiently large quantities of our drug compound(s) to permit successful commercialization; | |

|

| |

| · | receive marketing approvals from the FDA and similar foreign regulatory authorities; | |

|

| |

| · | establish commercial manufacturing arrangements with third-party manufacturers; | |

|

| |

| · | build and maintain strong sales, distribution and marketing capabilities sufficient to launch commercial sales of the drug(s) or establish collaborations with third parties for such commercialization; | |

|

| |

| · | secure acceptance of the drug(s) from physicians, health care payers, patients and the medical community; and | |

|

| |

| · | manage our spending as costs and expenses increase due to clinical trials, regulatory approvals and commercialization. |

| 10 |

| Table of Contents |

There are no guarantees that we will be successful in completing these tasks. If we are unable to successfully complete these tasks, we may not be able to commercialize any of our product candidates in a timely manner, or at all, in which case we may be unable to generate sufficient revenues to sustain and grow our business. If we experience unanticipated delays or problems, our development costs could substantially increase and our business, financial condition and results of operations will be adversely affected.

We may fail to realize any of the anticipated benefits of the recent merger.

The success of our recent merger with Leonard-Meron Biosciences, Inc. (“LMB”) will depend on, among other things, our ability to realize anticipated benefits and to combine the businesses of the Company and LMB in a manner that achieves synergy and a shared strategy but that does not materially disrupt the existing activities of the companies. If we are not able to successfully achieve these objectives, the anticipated benefits of the merger may not be realized fully, if at all, or may take longer to realize than expected.

We face significant risks in our product candidate development efforts.

Our business depends on the successful development and commercialization of our product candidates. We are not permitted to market any of our product candidates in the United States until we receive approval of an NDA from the FDA, or in any foreign jurisdiction until we receive the requisite approvals from such jurisdiction. The process of developing new drugs and/or therapeutic products is inherently complex, unpredictable, time-consuming, expensive and uncertain. We must make long-term investments and commit significant resources before knowing whether our development programs will result in drugs that will receive regulatory approval and achieve market acceptance. Product candidates that appear to be promising at all stages of development may not reach the market for a number of reasons that may not be predictable based on results and data of the clinical program. Product candidates may be found ineffective or may cause harmful side effects during clinical trials, may take longer to progress through clinical trials than had been anticipated, may not be able to achieve the pre-defined clinical endpoints due to statistical anomalies even though clinical benefit may have been achieved, may fail to receive necessary regulatory approvals, may prove impracticable to manufacture in commercial quantities at reasonable cost and with acceptable quality, or may fail to achieve market acceptance.

We cannot predict whether or when we will obtain regulatory approval to commercialize our product candidates that are under development and will be further developed using the proceeds of our private placements and we cannot, therefore, predict the timing of any future revenues from these product candidates, if any. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example, the FDA:

| · | could determine that we cannot rely on Section 505(b)(2) for any of our product candidates; | |

|

| |

| · | could determine that the information provided by us was inadequate, contained clinical deficiencies or otherwise failed to demonstrate the safety and effectiveness of any of our product candidates for any indication; | |

|

| |

| · | may not find the data from clinical trials sufficient to support the submission of an NDA or to obtain marketing approval in the United States, including any findings that the clinical and other benefits of our product candidates outweigh their safety risks; | |

|

| |

| · | may disagree with our trial design or our interpretation of data from preclinical studies or clinical trials, or may change the requirements for approval even after it has reviewed and commented on the design for our trials; | |

|

| |

| · | may determine that we have identified the wrong reference listed drug or drugs or that approval of our Section 505(b)(2) application for any of our product candidates is blocked by patent or non-patent exclusivity of the reference listed drug or drugs; | |

|

| |

| · | may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the manufacturing of our product candidates; | |

|

| |

| · | may approve our product candidates for fewer or more limited indications than we request, or may grant approval contingent on the performance of costly post-approval clinical trials; | |

|

| |

| · | may change its approval policies or adopt new regulations; or | |

|

| |

| · | may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of our product candidates. |

Any failure to obtain regulatory approval of our product candidates would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

| 11 |

| Table of Contents |

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current product candidates may not have favorable results in later studies or trials.

Pre-clinical studies and Phase 1 and Phase 2 clinical trials are not primarily designed to test the efficacy of a product candidate in the general population, but rather to test initial safety, to study pharmacokinetics and pharmacodynamics, to study limited efficacy in a small number of study patients in a selected disease population, and to identify and attempt to understand the product candidate’s side effects at various doses and dosing schedules. Success in pre-clinical studies or completed clinical trials does not ensure that later studies or trials, including continuing pre-clinical studies and large-scale clinical trials, will be successful nor does it necessarily predict future results. Favorable results in early studies or trials may not be repeated in later studies or trials, and product candidates in later stage trials may fail to show acceptable safety and efficacy despite having progressed through earlier trials. In addition, the placebo rate in larger studies may be higher than expected.

We may be required to demonstrate through large, long-term outcome trials that our product candidates are safe and effective for use in a broad population prior to obtaining regulatory approval.

There is typically a high rate of attrition from the failure of product candidates proceeding through clinical trials. In addition, certain subjects in our clinical trials may respond positively to placebo treatment - these subjects are commonly known as “placebo responders” - making it more difficult to demonstrate efficacy of the test drug compared to placebo. This effect is likely to be observed in the treatment of hemorrhoids. If any of our product candidates fail to demonstrate sufficient safety and efficacy in any clinical trial, we will experience potentially significant delays in, or may decide to abandon development of that product candidate. If we abandon or are delayed in our development efforts related to any of our product candidates, we may not be able to generate any revenues, continue our operations and clinical studies, or become profitable. Our reputation in the industry and in the investment community would likely be significantly damaged. It may not be possible for us to raise funds in the public or private markets, and our stock price would likely decrease significantly.

If we are unable to file for approval under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act or if we are required to generate additional data related to safety and efficacy in order to obtain approval under Section 505(b)(2), we may be unable to meet our anticipated development and commercialization timelines.

Our current plans for filing additional NDAs for our product candidates include efforts to minimize the data we will be required to generate in order to obtain marketing approval for our additional product candidates and therefore possibly obtain a shortened review period for the applications. The timeline for filing and review of our NDAs is based upon our plan to submit those NDAs under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, wherein we will rely in part on data in the public domain or elsewhere. Depending on the data that may be required by the FDA for approval, some of the data may be related to products already approved by the FDA. If the data relied upon is related to products already approved by the FDA and covered by third-party patents we would be required to certify that we do not infringe the listed patents or that such patents are invalid or unenforceable. As a result of the certification, the third party would have 45 days from notification of our certification to initiate an action against us. In the event that an action is brought in response to such a certification, the approval of our NDA could be subject to a stay of up to 30 months or more while we defend against such a suit. Approval of our product candidates under Section 505(b)(2) may therefore be delayed until patent exclusivity expires or until we successfully challenge the applicability of those patents to our product candidates. Alternatively, we may elect to generate sufficient additional clinical data so that we no longer rely on data which triggers a potential stay of the approval of our product candidates. Even if no exclusivity periods apply to our applications under Section 505(b)(2), the FDA has broad discretion to require us to generate additional data on the safety and efficacy of our product candidates to supplement third-party data on which we may be permitted to rely. In either event, we could be required, before obtaining marketing approval for any of our product candidates, to conduct substantial new research and development activities beyond those we currently plan to engage in order to obtain approval of our product candidates. Such additional new research and development activities would be costly and time consuming.

| 12 |

| Table of Contents |

We may not be able to obtain shortened review of our applications, and the FDA may not agree that our products qualify for marketing approval. If we are required to generate additional data to support approval, we may be unable to meet our anticipated development and commercialization timelines, may be unable to generate the additional data at a reasonable cost, or at all, and may be unable to obtain marketing approval of our product candidates. In addition, notwithstanding the approval of many products by the FDA pursuant to Section 505(b)(2), over the last few years, some pharmaceutical companies and others have objected to the FDA’s interpretation of Section 505(b)(2). If the FDA changes its interpretation of Section 505(b)(2), or if the FDA’s interpretation is successfully challenged in court, this could delay or even prevent the FDA from approving any Section 505(b)(2) application that we submit.

Even if we receive regulatory approval to commercialize our product candidates, post-approval marketing and promotion of products is highly regulated by the FDA, and marketing campaigns which violate FDA standards may result in adverse consequences including regulatory enforcement action by the FDA as well as follow-on actions filed by consumers and other end-payers, which could result in substantial fines, sanctions and damage awards against us, any of which could harm our business.

Post-approval marketing and promotion of drugs, standards and regulations for direct-to-consumer advertising, dissemination of off-label product information, industry-sponsored scientific and educational activities and promotional activities via the Internet are heavily scrutinized and regulated by the FDA. Drugs may only be marketed for approved indications and in accordance with provisions of the FDA approved labels. Failure to comply with such requirements may result in adverse publicity, warning letters issued by the FDA, and civil or criminal penalties.

In the event the FDA discovers new violations, we could face penalties in the future including the FDA’s issuance of a cease and desist order, impounding of our products, and civil or criminal penalties. As a follow-on to such governmental enforcement activities, consumers and other end-payers of the product may initiate action against us claiming, among other things, fraudulent misrepresentation, civil RICO, unfair competition, violation of various state consumer protection statues and unjust enrichment. If the plaintiffs in such follow-on actions are successful, we could be subject to various damages, including compensatory damages, treble damages, punitive damages, restitution, disgorgement, prejudgment and post-judgment interest on any monetary award, and the reimbursement of the plaintiff’s legal fees and costs, any of which could have an adverse effect on our revenue, business and financial prospects.

Even if we receive regulatory approval to commercialize our product candidates, our ability to generate revenues from any resulting drugs will be subject to a variety of risks, many of which are out of our control.

Even if our product candidates obtain regulatory approval, those drugs may not gain market acceptance among physicians, patients, healthcare payers or the medical community. The indication may be limited to a subset of the population or we may implement a distribution system and patient access program that is limited. Coverage and reimbursement of our product candidates by third-party payers, including government payers, generally is also necessary for optimal commercial success. We believe that the degree of market acceptance and our ability to generate revenues from such drugs will depend on a number of factors, including:

| · | timing of market introduction of competitive drugs; | |

|

| |

| · | prevalence and severity of any side effects; | |

|

| |

| · | results of any post-approval studies of the drug; | |

|

| |

| · | potential or perceived advantages or disadvantages over alternative treatments including generics; | |

|

| |

| · | the relative convenience and ease of administration and dosing schedule; | |

|

| |

| · | strength of sales, marketing and distribution support; | |

|

| |

| · | price of any future drugs, if approved, both in absolute terms and relative to alternative treatments; |

| 13 |

| Table of Contents |

| · | the effectiveness of our or any future collaborators’ sales and marketing strategies; | |

|

| |

| · | the effect of current and future healthcare laws on our product candidates; | |

|

| |

| · | availability of coverage and reimbursement from government and other third-party payers; | |

|

| |

| · | patient access programs that require patients to provide certain information prior to receiving new and refill prescriptions; | |

|

| |

| · | requirements for prescribing physicians to complete certain educational programs for prescribing drugs; | |

|

| |

| · | the willingness of patients to pay out of pocket in the absence of government or third-party coverage; and | |

|

| |

| · | product labeling or product insert requirements of the FDA or other regulatory authorities. |

If approved, our product candidates may fail to achieve market acceptance or generate significant revenue to achieve or sustain profitability. In addition, our efforts to educate the medical community and third-party payers on the benefits of our product candidates may require significant resources and may never be successful.

Even if approved for marketing by applicable regulatory bodies, we will not be able to create a market for any of our products if we fail to establish marketing, sales and distribution capabilities, or fail to enter into arrangements with third parties.

Our strategy with our product candidates is to outsource to third parties, all or most aspects of the product development process, as well as marketing, sales and distribution activities. Currently, we do not have any sales, marketing or distribution capabilities. In order to generate sales of any product candidates that receive regulatory approval, we must either acquire or develop an internal marketing and sales force with technical expertise and with supporting distribution capabilities or make arrangements with third parties to perform these services for us. The acquisition or development of a sales and distribution infrastructure would require substantial resources, which may divert the attention of our management and key personnel and defer our product development efforts. To the extent that we enter into marketing and sales arrangements with other companies, our revenues will depend on the efforts of others. These efforts may not be successful. If we fail to develop sales, marketing and distribution channels, or enter into arrangements with third parties, we will experience delays in product sales and incur increased costs.

The markets in which we operate are highly competitive and we may be unable to compete successfully against new entrants or established companies.

Competition in the pharmaceutical and medical products industries is intense and is characterized by costly and extensive research efforts and rapid technological progress. We are aware of several pharmaceutical companies also actively engaged in the development of therapies for the same conditions we are targeting. Many of these companies have substantially greater research and development capabilities as well as substantially greater marketing, financial and human resources than we do. In addition, many of these companies have significantly greater experience than us in undertaking pre-clinical testing, human clinical trials and other regulatory approval procedures. Our competitors may develop technologies and products that are more effective than those we are currently marketing or researching and developing. Such developments could render our products, if approved, less competitive or possibly obsolete. We are also competing with respect to marketing capabilities and manufacturing efficiency, areas in which we have limited experience. Mergers, acquisitions, joint ventures and similar events may also significantly increase the competition. New developments, including the development of other drug technologies and methods of preventing the incidence of disease, occur in the pharmaceutical and medical technology industries at a rapid pace. These developments may render our products and product candidates obsolete or noncompetitive. Compared to us, many of our potential competitors have substantially greater:

| 14 |

| Table of Contents |

| · | research and development resources, including personnel and technology; | |

|

| |

| · | regulatory experience; | |

|

| |

| · | product candidate development and clinical trial experience; | |

|

| |

| · | experience and expertise in exploitation of intellectual property rights; and | |

|

| |

| · | access to strategic partners and capital resources. |

As a result of these factors, our competitors may obtain regulatory approval of their products more rapidly than we can or may obtain patent protection or other intellectual property rights that limit our ability to develop or commercialize our product candidates. Our competitors may also develop drugs or surgical approaches that are more effective, more useful and less costly than ours and may also be more successful in manufacturing and marketing their products. In addition, our competitors may be more effective than us in commercializing their products and as a result, our business and prospects might be materially harmed.

Physicians and patients might not accept and use any of our products for which regulatory approval is obtained.

Even if the FDA approves one of our product candidates, physicians and patients might not accept and use it. Acceptance and use of our products will depend upon a number of factors, including:

| · | perceptions by members of the health care community, including physicians, about the safety and effectiveness of our products; | |

|

| |

| · | cost-effectiveness of our product relative to competing product or therapies; | |

|

| |

| · | availability of reimbursement for our product from government or other healthcare payers; and | |

|

| |

| · | effective marketing and distribution efforts by us and our licensees and distributors, if any. |

If our current product candidates are approved, we expect their sales to generate substantially all of our revenues for the foreseeable future, and as a result, the failure of these products to find market acceptance would harm our business and would require us to seek additional financing.

Our two product candidates, Mino-Lok and Hydro-Lido, are combination products consisting of components that have each been separately approved by the FDA for other indications and which are commercially available and marketed by other companies. Our approval under 505(b)(2) does not preclude physicians, pharmacists and patients from obtaining individual drug products and titrating the dosage of these drug products as close to our approved dose as possible.

Our Hydro-Lido product candidate for the treatment of hemorrhoids is a combination product consisting of two drugs, hydrocortisone and lidocaine, that have each been separately approved by the FDA for other indications and which are commercially available and marketed by other companies. Hydrocortisone creams are available from strengths ranging from 0.5% to 2.5% and lidocaine creams are also available in strengths up to 5%. From our market analysis and discussions with a limited number of physicians, we know that patients sometimes obtain two separate cream products and co-administer them as prescribed, giving them a combination treatment which could be very similar to what we intend to study and seek approval for. As a branded, FDA-approved product with safety and efficacy data, we intend to price our product substantially higher than the generically available individual creams. We will then have to convince third-party payers and pharmacy benefit managers of the advantages of our product and justify our premium pricing. We may encounter resistance from these entities and will then be dependent on patients’ willingness to pay the premium and not seek alternatives. In addition, pharmacists often suggest lower cost prescription treatment alternatives to both physicians and patients. Our 505(b)(2) approval and the market exclusivity we may receive will not guarantee that such alternatives will not exist, that substitution will not occur, or that there will be immediate acceptance to our pricing by payer formularies.

Our Mino-Lok solution contains minocycline, disodium ethylenediaminetetraacetic acid (edetate), and ethyl alcohol, all of which have been separately approved by the FDA for other indications, or are used as excipients in other parenteral products.

| 15 |

| Table of Contents |

Our ability to generate product revenues will be diminished if our products sell for inadequate prices or patients are unable to obtain adequate levels of reimbursement.

Our ability to commercialize our products, alone or with collaborators, will depend in part on the extent to which reimbursement will be available from:

| · | government and health administration authorities; | |

|

| |

| · | private health maintenance organizations and health insurers; and | |

|

| |

| · | other healthcare payers. |

Significant uncertainty exists as to the reimbursement status of newly approved healthcare products. Healthcare payers, including Medicare, are challenging the prices charged for medical products and services. Government and other healthcare payers increasingly attempt to contain healthcare costs by limiting both coverage and the level of reimbursement for drugs. Even if our product candidates are approved by the FDA, insurance coverage might not be available, and reimbursement levels might be inadequate, to cover our products. If government and other healthcare payers do not provide adequate coverage and reimbursement levels for our products, once approved, market acceptance of such products could be reduced. Proposals to modify the current health care system in the U.S. to improve access to health care and control its costs are continually being considered by the federal and state governments. In March 2010, the U.S. Congress passed landmark healthcare legislation. We cannot predict what impact on federal reimbursement policies this legislation will have in general or on our business specifically. Members of the U.S. Congress and some state legislatures are seeking to overturn at least portions of the legislation and we expect they will continue to review and assess this legislation and possibly alternative health care reform proposals. We cannot predict whether new proposals will be made or adopted, when they may be adopted or what impact they may have on us if they are adopted.

Health administration authorities in countries other than the U.S. may not provide reimbursement for our products at rates sufficient for us to achieve profitability, or at all. Like the U.S., these countries have considered health care reform proposals and could materially alter their government-sponsored health care programs by reducing reimbursement rates. Any reduction in reimbursement rates under Medicare or foreign health care programs could negatively affect the pricing of our products. If we are not able to charge a sufficient amount for our products, then our margins and our profitability will be adversely affected.

We rely exclusively on third parties to formulate and manufacture our product candidates.

We do not have and do not intend to establish our own manufacturing facilities. Consequently, we lack the physical plant to formulate and manufacture our own product candidates, which are currently being manufactured entirely by a commercial third party. If any additional product candidate we might develop or acquire in the future receives FDA approval, we will rely on one or more third-party contractors to manufacture our products. If, for any reason, we become unable to rely on our current source or any future source to manufacture our product candidates, either for clinical trials or, for commercial quantities, then we would need to identify and contract with additional or replacement third-party manufacturers to manufacture compounds for preclinical, clinical and commercial purposes. We might not be successful in identifying additional or replacement third-party manufacturers, or in negotiating acceptable terms with any that we do identify. If we are unable to secure and maintain third-party manufacturing capacity, the development and sales of our products and our financial performance might be materially affected.

| 16 |

| Table of Contents |

In addition, before any of our collaborators can begin to commercially manufacture our product candidates, each must obtain regulatory approval of the manufacturing facility and process. Manufacturing of drugs for clinical and commercial purposes must comply with the FDA’s Current Good Manufacturing Practices, or cGMP, and applicable non-U.S. regulatory requirements. The cGMP requirements govern quality control and documentation policies and procedures. Complying with cGMP and non-U.S. regulatory requirements will require that we expend time, money, and effort in production, recordkeeping, and quality control to assure that the product meets applicable specifications and other requirements. Our contracted manufacturing facilities must also pass a pre-approval inspection prior to FDA approval. Failure to pass a pre- approval inspection might significantly delay FDA approval of our products. If any of our collaborators fails to comply with these requirements, we would be subject to possible regulatory action which could limit the jurisdictions in which we are permitted to sell our products. As a result, our business, financial condition, and results of operations might be materially harmed.

Our reliance on a limited number of third-party manufacturers exposes us to the following risks:

| · | We might be unable to identify manufacturers for commercial supply on acceptable terms or at all because the number of potential manufacturers is limited and the FDA must approve any replacement contractor. This approval would generally require compliance inspections. In addition, a new manufacturer would have to be educated in, or develop substantially equivalent processes for, production of our products after receipt of FDA approval, if any; | |

|

| |

| · | Our third-party manufacturers might be unable to formulate and manufacture our drugs in the volume and of the quality required to meet our clinical and commercial needs, if any; | |

|

| |