Filed pursuant to Rule 424(b)(4)

Registration No. 333-217956

PROSPECTUS

| |

| 1,648,484 Shares of Common Stock | |

| Warrants to Purchase 1,648,484 Shares of Common Stock | |

| |

This is a firm commitment public offering of 1,648,484 shares of our common stock and warrants to purchase up to an aggregate 1,648,484 shares of our common stock at a public offering price of $4.125 per share and $0.01 per warrant. Each share of our common stock is being sold together with a warrant to purchase one share of our common stock. Each warrant will have an exercise price of $4.125 per share (100% of the public offering price of our common stock), will be exercisable upon issuance and will expire five years from the date of issuance. The shares of our common stock and the warrants are immediately separable and will be issued separately, but will be purchased together in this offering.

Our common stock and warrants are approved for listing on the Nasdaq Capital Market under the symbols “CTXR” and “CTXRW”, respectively. On August 2, 2017, the last reported sale price of our common stock on the OTCQB Venture Market operated by OTC Markets Group, Inc. (or “OTCQB”) was $4.44.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 12 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share | | | Per Warrant | | | Total | |

Public offering price | | $ | 4.125 | | | $ | 0.01 | | | $ | 4.135 | |

Underwriting discounts and commissions(1) | | $ | 0.28875 | | | $ | 0.0007 | | | $ | 0.28945 | |

Proceeds to us, before expenses | | $ | 3.83625 | | | $ | 0.0093 | | | $ | 3.84555 | |

_______________

| (1) | The underwriters will receive compensation in addition to the underwriting discount and commissions. See “Underwriting”, beginning on page 79 for a full description of compensation payable to the underwriters. |

| |

We have granted a 45-day option to the underwriters to purchase up to 247,272 additional shares of common stock and/or warrants to purchase up to 247,272 shares of common stock from us solely to cover over-allotments, if any. The underwriters expect to deliver the shares and warrants on or about August 8, 2017. |

Sole Book-Running Manager

Aegis Capital Corp

_________________________

Co - Manager

Dawson James Securities, Inc.

The date of this prospectus is August 3, 2017.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

You should rely only on the information contained in this prospectus, as supplemented and amended. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

We urge you to read carefully this prospectus, as supplemented and amended, before deciding whether to invest in any of the securities being offered.

We own or have rights to various U.S. federal trademark registrations and applications, and unregistered trademarks and servicemarks, including Mino-Lok™. All other trade names, trademarks and service marks appearing in this prospectus are the property of their respective owners. We have assumed that the reader understands that all such terms are source-indicating. Accordingly, such terms, when first mentioned in this prospectus, appear with the trade name, trademark or service mark notice and then throughout the remainder of this prospectus without trade name, trademark or service mark notices for convenience only and should not be construed as being used in a descriptive or generic sense.

| | |

| | |

| PROSPECTUS SUMMARY This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our securities, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 12, and the financial statements and related notes included in this prospectus. Company Overview Citius Pharmaceuticals, Inc. (“Citius” or the “Company”) headquartered in Cranford, New Jersey, is a specialty pharmaceutical company dedicated to the development and commercialization of critical care products targeting important medical needs with a focus on anti-infective products, adjunctive cancer care, and unique prescription products. Our goal is to achieve leading market positions in our targeted markets by providing therapeutic products that address unmet medical needs. New formulations of previously approved drugs with substantial safety and efficacy data are a core focus as we seek to reduce development and clinical risks associated with drug development. Our strategy centers on products that have intellectual property and regulatory exclusivity protection, while providing competitive advantages over other existing therapeutic approaches. The Company was founded as Citius Pharmaceuticals, LLC, a Massachusetts limited liability company, on January 23, 2007. On September 12, 2014, Citius Pharmaceuticals, LLC entered into a Share Exchange and Reorganization Agreement, with Citius Pharmaceuticals, Inc. (formerly Trail One, Inc.), a publicly traded company incorporated under the laws of the State of Nevada (the “Reverse Acquisition”). Citius Pharmaceuticals, LLC became a wholly-owned subsidiary of Citius. On March 30, 2016, Citius acquired Leonard-Meron Biosciences, Inc. (“LMB”) as a wholly-owned subsidiary. LMB was a pharmaceutical company focused on the development and commercialization of critical care products with a concentration on anti-infectives. Since its inception, the Company has devoted substantially all of its efforts to business planning, research and development, recruiting management and technical staff, and raising capital. We are developing two proprietary products: Mino-Lok™, an antibiotic lock solution used to treat patients with catheter-related bloodstream infections by salvaging the infected catheter, and a hydrocortisone-lidocaine topical formulation, which we call Hydro-Lido, that is intended to provide anti-inflammatory and anesthetic relief to persons suffering from hemorrhoids. We believe the markets for our products are large, growing, and underserved by current prescription products or procedures. References to “we,” “us,” “our” and similar words refer to the Company and its wholly-owned subsidiaries Citius Pharmaceuticals LLC and LMB, taken as a whole. References to “Trail One” refer to the Company and its business prior to the Reverse Acquisition. Strategy Our goal is to build a successful, specialty pharmaceutical company through the commercialization of innovative, efficacious and cost-effective mid- to late-term development products that address compelling market opportunities in the critical care field. We will seek to achieve this goal by: | |

| | | | |

| | · | identifying new drug product candidates that are typically prescribed and used by a small, identified number of specialists, which we believe can therefore be successfully commercialized by a small, specialty sales force, and a focused educational program for innovation adoption; | |

| | | | |

| | · | obtaining licenses for the most relevant and advanced technologies in critical care medicine that address unmet or urgent medical needs for underserved markets with limited competition and have at least 10 years of intellectual property protection; | |

| | | | |

1 |

| | | | |

| | | | |

| | · | leveraging our in-house clinical and regulatory expertise to advance the development of product candidates in our pipeline more rapidly and take advantage of expedited regulatory pathways; | |

| | | | | | | | | | |

| | · | leveraging our commercialization and marketing expertise in prescription drugs and critical care medicine to develop and monetize markets that are in need of new product solutions; and | |

| | | | | | | | | | |

| | · | managing our business in a financially disciplined and cost-conscious manner. | |

| | | | | | | | | | |

| Our Business We seek to achieve our business objectives by utilizing the U.S. Food and Drug Administration’s (the “FDA”), 505(b)(2) pathway for our new drug approvals. We believe this pathway is faster, has lower risk and is less expensive than the FDA’s traditional new drug approval pathway. In addition to focusing on new drug approvals, we focus on obtaining intellectual property protection with the objective of listing relevant patents in the FDA Orange Book in order to limit generic competition. By using previously approved drugs with substantial safety and efficacy data already available, we seek to reduce the risks associated with pharmaceutical product development. We have two development candidates currently. Our Mino-Lok product for the treatment of catheter related bloodstream infections (“CRBSIs”), has completed Phase 2b and is entering Phase 3 trials. We are also developing a topical product containing both hydrocortisone and lidocaine (Hydro-Lido) for the treatment of mild to moderate hemorrhoids. We are reformulating this product and will be entering Phase 2b trials in 2017. In July 2016, the Company decided to discontinue Suprenza, its FDA-approved phentermine-based product for weight loss, due to a strategic change in direction following the acquisition of LMB and the Mino-Lok product. In September 2016, Citius notified the FDA of its decision to voluntarily withdraw both the Investigative New Drug Application and New Drug Application for commercial reasons and not due to safety concerns, effective immediately. The Company had received no royalties from Suprenza and believed costs associated with the ongoing regulatory expenses were depleting resources from its more promising Mino-Lok and Hydro-Lido product candidates. Our Product Candidates | |

| | | | | | | | | | |

| Product | | Indication | | Current Status | | Patent Expiry; Patent or Patent Application Number | |

| | | | | | | | | | |

| Mino-Lok | | Antibiotic Lock Therapy | | Phase 3 study upcoming | | June 7, 2024; 7,601,731 June 7, 2024; 9,078,441 | |

| | | | | | | | | | |

| Mino-Lok1 | | Antibiotic Lock Therapy | | Enhanced Stability | | Filed: November 4, 2016 Application Number 15/344,113 Publication Number US 2017/0151373 A1 | |

| | | | | | | | | | |

| Hydrocortisone-Lidocaine Cream | | Hemorrhoids | | Phase 2b study upcoming* | | | |

| | | | | | | | | | |

| * Formulation is being finalized prior to Phase 2b study.

Mino-LokTM

Overview Mino-Lok is a patented solution containing minocycline, disodium ethylenediaminetetraacetic acid (edetate), and ethyl alcohol, all of which act synergistically to treat and salvage infected central venous catheters (“CVCs”) in patients with CRBSIs. Mino-Lok breaks down biofilm barriers formed by bacterial colonies, eradicates the bacteria, and provides anti-clotting properties to maintain patency in CVCs.

_____________

1 In October 2015, the Company signed a license amendment with NAT to include an enhanced stability patent on the existing Mino-Lok Development Project. | |

| | | | | | | | | | |

2 |

| | |

| | |

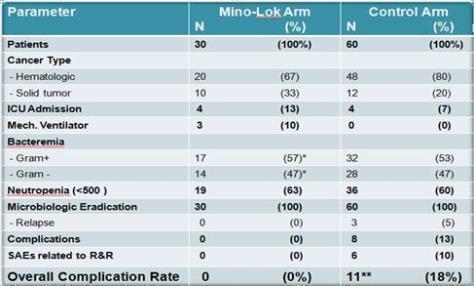

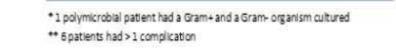

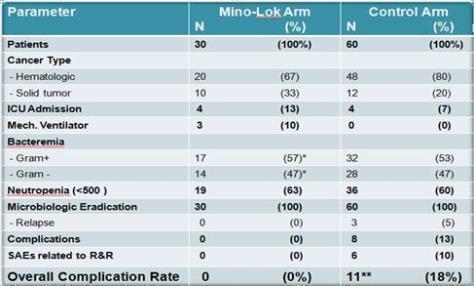

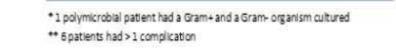

| The administration of Mino-Lok consists of filling the lumen of the catheter with 0.8 ml to 2.0 ml of Mino-Lok solution, with a lock (dwell-time) of two hours while the catheter is not in use. If the catheter has multiple lumens, all lumens may be locked with the Mino-Lok solution either simultaneously or sequentially. If patients are receiving continuous infusion therapy, the catheters alternate between being locked with the Mino-Lok solution and delivering therapy. The Mino-Lok therapy consists of treatment for two hours per day for at least five days, usually with additional locks in the subsequent two weeks. After locking the catheter for two hours, the Mino-Lok solution is aspirated, and the catheter is flushed with normal saline. At that time, either the infusion will be continued, or will be locked with the standard-of-care lock solution until further use of the catheter is required. In a clinical study conducted by MD Anderson Cancer Center (“MDACC”), there were no serum levels of either minocycline or edetate detected in the sera of several patients who underwent daily catheter lock solution with minocycline and edetate (“M-EDTA”) at the concentration level proposed in Mino-Lok treatment. Thus, it has been demonstrated that the amount of either minocycline or edetate that leaks into the serum is very low or none at all. Phase 2b Results From April 2013 to July 2014, 30 patients with CVC-related bloodstream infection were enrolled at MDACC in a prospective Phase 2b study. Patients received Mino-Lok therapy for two hours once daily for a minimum of five days within the first week followed by two additional locks within the next two weeks. Patients were followed for one month post lock therapy. Demographic information, clinical characteristics, laboratory data, therapy, as well as adverse events and outcome were collected for each patient. Median age at diagnosis was 56 years (range: 21-73 years). In all patients, prior to the use of lock therapy, systemic treatment with a culture-directed, first-line intravenous antibiotic was started. Microbiological eradication was achieved in all cases. None of the patients experienced any serious adverse event related to the lock therapy. The active arm, which is the Mino-Lok treated group of patients, was then compared to 60 patients in a matched cohort that experienced removal and replacement of their CVCs within the same contemporaneous timeframe. The patients were matched for cancer type, infecting organism, and level of neutropenia. All patients were cancer patients and treated at the MDACC. The efficacy of Mino-Lok therapy was 100% in salvaging CVCs, demonstrating equal effectiveness to removing the infected CVC and replacing with a new catheter. However, the main purpose of the study was to show that Mino-Lok therapy was at least as safe as the removal and replacement of CVCs when CRBSIs are present, and that the complications of removing an infected catheter and replacing with a new one could be avoided. In addition to having a 100% efficacy rate with all CVCs being salvaged, Mino-Lok therapy had no significant adverse events (“SAEs”), compared to an 18% SAE rate in the matched cohort where patients had the infected CVCs removed and replaced (“R&R”) with a fresh catheter. There were no overall complication rates in the Mino-Lok arm group compared to 11 patients with events (18%) in the control group. These events included bacterial relapse (5%) and a number of complications associated with mechanical manipulation in the removal or replacement procedure for the catheter (10%) or development of deep seated infections such as septic thrombophlebitis and osteomyelitis (8%). It was noted that six (6) patients had more than one (1) complication in the control arm group. Phase 3 Initiation In November 2016, the Company initiated site recruitment for Phase 3 clinical trials. It is expected that patient enrollment will commence in the Company’s fourth quarter 2017. Market Opportunity In spite of best clinical practice, catheters contribute to approximately 70% of blood stream infections that occur in the ICU, or are associated with hemodialysis or cancer patients (approximately 470,000 per year). Bacteria enter the catheter either from the skin or intraluminally through the catheter hub. Once in the catheter, bacteria tend to form a protective biofilm on the interior surface of the catheter that is resistant to most antimicrobial solutions. The most frequently used maintenance flush, heparin, actually stimulates biofilm formation. Heparin is widely used as a prophylactic lock solution, in spite of the evidence that it contributes to the promotion of biofilm formation. The formation of bacterial biofilm usually precedes CRBSIs. | |

| | |

3

|

| | | | | | | | | | |

| | | | | | | | | | |

| The standard of care (“SOC”) in the management of CRBSI patients consists of removing the infected CVC and replacing it with a new catheter at a different vascular access site. However, in cancer and hemodialysis patients with long-term surgically implantable silicone catheters, removal of the CVC and reinsertion of a new one at a different site might be difficult, or even impossible, because of the unavailability of other accessible vascular sites and the need to maintain infusion therapy. Furthermore, critically ill patients with short-term catheters often have underlying coagulopathy, which makes reinsertion of a new CVC at a different site, in the setting of CRBSIs, risky in terms of mechanical complications, such as pneumothorax, misplacement, or arterial puncture. Studies have also revealed that CRBSI patients may be associated with serious complications, including septic thrombosis, endocarditis and disseminated infection, particularly if caused by Staphylococcus aureus or Candida species. Furthermore, catheter retention in patients with CRBSIs is associated with a higher risk of relapse and poor response to antimicrobial therapy. According to Maki et al., published in the Mayo Clinic Proceedings in 2006, there are approximately 250,000 CRBSIs annually in the U.S. Subsequent to this study, our estimates have ranged upwards to over 450,000 central line-associated blood stream infections (“CLABSIs”) annually (see analysis in the table below). CRBSIs are associated with a 12% to 35% mortality rate and an attributable cost of $35,000 to $56,000 per episode. We estimate that the potential market for Mino-Lok in the U.S. to be approximately $500 million to $1 billion as shown in the table below. | |

| | | | | | | | | | |

| | | Short-Term CVC | | | Long-Term CVC | | | Total | |

| | | | | | | | | | |

| No. of Catheters | | 3 million | | | 4 million | | | 7 million | |

| Avg. Duration (Days) | | | 12 | | | | 100 | | | | N/A | |

| Catheter Days | | 36 million | | | 400 million | | | | 436 million | |

| Infection Rate | | | 2/1,000 days | | | | 1/1,000 days | | | | N/A | |

| Catheters Infected | | | 72,000 | | | | 400,000 | | | | 472,000 | |

| Flushes/Catheter | | | 5 | | | | 7 | | | | 6.7 | |

| Total Salvage Flushes | | | 360,000 | | | | 2,800,000 | | | | 3,160,000 | |

| | | | | | | | | | | | | |

| Sources: Ann Intern Med 2000; 132:391-402, Clev Clin J Med 2011; 78(1):10-17, JAVA 2007; 12(1):17-27, J Inf Nurs 2004;27(4):245-250, Joint Commission website Monograph, CLABSI and Internal Estimates. Under various plausible pricing scenarios, we believe that Mino-Lok would be cost saving to the healthcare system given that the removal of an infected CVC and replacement of a new catheter in a different venous access site is estimated by the Company to cost between $8,000 and $10,000. Furthermore, there are potential additional medical benefits, a reduction in patient discomfort and avoidance of serious adverse events with the Mino-Lok approach since the catheter remains in place and is not subject to manipulation. We believe there will be an economic argument to enhance the adoption of Mino-Lok by infection control committees at acute care institutions. In January of 2017 the company procured and initiated a primary market research study with MEDACore, a subsidiary of Leerink, a healthcare focused network with more than 35,000 healthcare professionals, including key opinion leaders, experienced practitioners and other healthcare professionals throughout North America, Europe, Asia and other locations around the world. This network includes approximately 55 clinical specialties, 21 basic sciences and 20 business specialties. As part of this market research project, Company commissioned a third party survey of 31 physicians to qualify the need for catheter salvage in patients with infected, indwelling central venous lines, especially when the catheter is a tunneled or an implanted port. There were 19 infectious disease experts and 12 intensivists surveyed who all agreed that salvage would be preferable to catheter exchange to avoid catheter misplacements, blood clots, or vessel punctures that can potentially occur during reinsertion. Most were also concerned that viable venous access may not be available in patients who were vitally dependent on a central line. | |

| | | | | | | | | | | | | |

4 |

| | | |

| | | |

| Hydro-Lido Overview Hydro-Lido is a topical formulation of hydrocortisone and lidocaine that is intended for the treatment of hemorrhoids. To our knowledge, there are currently no FDA-approved prescription drug products for the treatment of hemorrhoids. Some physicians are known to prescribe topical steroids for the treatment of hemorrhoids. In addition, there are various strengths of topical combination prescription products containing hydrocortisone along with lidocaine or pramoxine, each a topical anesthetic, that are prescribed by physicians for the treatment of hemorrhoids. These products contain drugs that were in use prior to the start of the Drug Efficacy Study Implementation (“DESI”) program and are commonly referred to as DESI drugs. However, none of these single-agent or combination prescription products have been clinically evaluated for safety and efficacy and approved by the FDA for the treatment of hemorrhoids. Further, many hemorrhoid patients use over the counter (“OTC”) products as their first line therapy. OTC products contain any one of several active ingredients including glycerin, phenylephrine, pramoxine, white petrolatum, shark liver oil and/or witch hazel, for symptomatic relief. Development of Hemorrhoids Drugs Hemorrhoids are a common gastrointestinal disorder, characterized by anal itching, pain, swelling, tenderness, bleeding and difficulty defecating. In the U.S., hemorrhoids affect nearly 5% of the population, with approximately 10 million persons annually admitting to having symptoms of hemorrhoidal disease. Of these persons, approximately one third visit a physician for evaluation and treatment of their hemorrhoids. The data also indicate that for both sexes, a peak of prevalence occurs from age 45 to 65 years with a subsequent decrease after age 65 years. Caucasian populations are affected significantly more frequently than African Americans, and increased prevalence rates are associated with higher socioeconomic status in men but not women. Development of hemorrhoids before age 20 is unusual. In addition, between 50% and 90% of the general U.S., Canadian and European population will experience hemorrhoidal disease at least once in life. Although hemorrhoids and other anorectal diseases are not life-threatening, individual patients can suffer from agonizing symptoms which can limit social activities and have a negative impact on the quality of life. Hemorrhoids are defined as internal or external according to their position relative to the dentate line. Classification is important for selecting the optimal treatment for an individual patient. Accordingly, physicians commonly use the following grading system referred to as the Goligher’s classification of internal hemorrhoids: | |

| | | |

| Grade I | Hemorrhoids not prolapsed but bleeding. | |

| Grade II | Hemorrhoids prolapse and reduce spontaneously with or without bleeding. | |

| Grade III | Prolapsed hemorrhoids that require reduction manually. | |

| Grade IV | Prolapsed and cannot be reduced including both internal and external hemorrhoids that are confluent from skin tag to inner anal canal. | |

| | | |

| Development Activities to Date In the fall of 2015, we completed dosing patients in a double-blind dose ranging placebo controlled Phase 2 study where six different formulations containing hydrocortisone and lidocaine in various strengths were tested against the vehicle control. The objectives of this study were to: (1) demonstrate the safety and efficacy of the formulations when applied twice daily for two weeks in subjects with Grade I or II hemorrhoids and (2) assess the potential contribution of lidocaine hydrochloride and hydrocortisone acetate, alone or in combination for the treatment of symptoms of Goligher’s Classification Grade I or II hemorrhoids. Symptom improvement was observed based on a global score of disease severity (“GSDS”), and based on some of the individual signs and symptoms of hemorrhoids, specifically itching and overall pain and discomfort. Within the first few days of treatment, the combination products (containing both hydrocortisone and lidocaine) were directionally favorable versus the placebo and their respective individual active treatment groups (e.g., hydrocortisone or lidocaine alone) in achieving ‘almost symptom free’ or ‘symptom free’ status according to the GSDS scale. These differences suggest the possibility of a benefit for the combination product formulation. | |

| | | |

5

|

| | |

| | |

| Overall, results from adverse event reporting support the safety profile of all test articles evaluated in this study and demonstrate similar safety profiles as compared to the vehicle. The safety findings were unremarkable. There was a low occurrence of adverse events and a similar rate of treatment related adverse events across all treatment groups. The majority of adverse events were mild and only one was severe. None of the adverse events were serious and the majority of adverse events were recovered/resolved at the end of the study. There were only two subjects who were discontinued from the study due to adverse events. In addition to the safety and dose-ranging information, information was obtained relating to the use of the GSDS as an assessment tool for measuring the effectiveness of the test articles. Individual signs and symptoms were also assessed but can vary from patient to patient. Therefore, the goal of the GSDS was to provide an assessment tool that could be used for all patients regardless of which signs and symptoms they are experiencing. The GSDS proved to be a more effective tool for assessing the severity of the disease and the effectiveness of the drug when compared to the assessment of the individual signs and symptoms. The Company believes that we can continue to develop this assessment tool as well as other patient reported outcome endpoints for use in the next trials. Information was also obtained about the formulation of the drug and the vehicle. As a result of this study, we believe that the performance of the active arms of the study relative to the vehicle can be improved by re-formulating our topical preparation. Therefore, we have initiated work on vehicle formulation and evaluation of higher potency steroids. In June and July of 2016 the Company engaged the Dominion Group, a leading provider of healthcare and pharmaceutical marketing research services, to conduct primary market research to understand the symptoms that are most bothersome to patients better. We also learned about the factors that drive patients to seek medical attention for hemorrhoids in an effort to understand the disease impact on quality of life. The results of this survey are able to help us develop patient reported outcome evaluation tools. These tools can be used in clinical trials to evaluate the patients’ conditions and to assess the performance of the test articles. A Phase 2b study will begin once the new formulation is completed and the updated evaluation tools are developed. This study will be a 300 patient four arm study. The cost is estimated at approximately $3.0-5.0 million and is expected to require approximately one year to complete. Market Opportunity The current market for OTC and topical DESI formulations of hydrocortisone and lidocaine is highly fragmented, and includes approximately 20 million units of OTC hemorrhoid products and over 4 million prescriptions for non-approved prescription treatments. Several topical combination prescription products for the treatment of hemorrhoids are available containing hydrocortisone in strengths ranging from 0.5% to 3.0%, combined with lidocaine in strengths ranging from 1.0% to 3.0%. The various topical formulations include creams, ointments, gels, lotions, enemas, pads, and suppositories. The most commonly prescribed topical combination gel, is sold as a branded generic product and contains 2.5% hydrocortisone and 3.0% lidocaine. We believe there are currently no FDA-approved prescription drug products for the treatment of hemorrhoids. Although there are numerous prescription and OTC products commonly used to treat hemorrhoids, none possess proven safety and efficacy data generated from rigorously conducted clinical trials. We believe that a novel topical formulation of hydrocortisone and lidocaine designed to provide anti-inflammatory and anesthetic relief and which has an FDA-approved label specifically claiming the treatment of hemorrhoids will become an important treatment option for physicians who want to provide their patients with a therapy that has demonstrated safety and efficacy in treating this uncomfortable and often recurring disease. We believe that our Hydro-Lido product represents an attractive, low-risk product opportunity with meaningful upside potential. | |

| | |

6 |

| | |

| | |

| Market Exclusivity We believe that we will be the first company to conduct rigorous clinical trials and receive FDA approval of a topical hydrocortisone-lidocaine combination product for the treatment of hemorrhoids. If we receive FDA approval, we will qualify for 3 years of market exclusivity for our dosage strength and formulation. In addition, we will also be the only product on the market specifically proven to be safe and effective for the treatment of hemorrhoids. Generally, if a company conducts clinical trials and receives FDA approval of a product for which there are similar, but non FDA-approved, prescription products on the market, the manufacturers of the unapproved but marketed products are required to withdraw them from the market. However, the FDA has significant latitude in determining how to enforce its regulatory powers in these circumstances. We have not had any communication with the FDA regarding this matter and cannot predict what action, if any, the FDA will take with respect to the unapproved products. We believe that should our product receive an FDA approval and demonstrate, proven safety and efficacy data, and if our products obtain 3 years of market exclusivity based on our dosage strength and formulation, we are likely to have a meaningful advantage in its pursuit of achieving a significant position in the market for topical combination prescription products for the treatment of hemorrhoids. Recent Developments The Company issued demand promissory notes in favor of Leonard Mazur, its Executive Chairman, during 2016 and through April 2017 in the aggregate principal amount of $2,500,000 (collectively, the “Notes”). In May 2017, the Company entered into a conversion agreement (the "Conversion Agreement") with Mr. Mazur, pursuant to which the Company and Mr. Mazur consolidated the Notes and converted them into a convertible promissory note (the “A&R Note”). The A&R Note matures on June 30, 2018. The A&R Note is convertible into shares of the Company’s common stock, at the sole discretion of Mr. Mazur, at a conversion price equal to 75% of the price of the shares of the Company’s common stock sold in the Company’s securities offering pursuant to the S-1 registration statement filed with the U.S. Securities and Exchange Commission (the “Securities Offering”) of which this prospectus forms a part. In the third quarter the Company completed two bridge financing transactions pursuant to which it issued two unsecured future advance convertible promissory notes in the aggregate principal amount of up to $2,500,000 (the “Bridge Notes”) to Mr. Mazur. The Company may draw on the Bridge Notes as needed up to the $2,500,000 principal amount. Mr. Mazur has extended advances to the Company totaling $2,210,000 under the Bridge Notes, which is the only amount outstanding under the Bridge Notes as of August 2, 2017. The Bridge Notes are due and payable on December 31, 2017. They bear interest at the rate of the Wall Street Journal prime rate plus one percent per year, compounded annually, and are convertible into shares of the Company’s common stock at a conversion price equal to 75% of the price per share paid by investors in the Securities Offering. In addition, in the event the Company enters into a debt financing with a third party on terms better than those of the Bridge Notes while the Bridge Notes remain outstanding, the Company will notify Mr. Mazur of such terms and he may elect, in his sole discretion, to amend the Bridge Notes to incorporate such terms. In addition, the Company has engaged Paulson Investment Company, LLC to secure additional debt financing. | |

| | |

7 |

| | | | |

| | | | |

| On April 7, 2017, the Company issued a Unit Purchase Option Agreement (the “Unit Agreement”) to Protean Consulting (the “Consultant”) under which for a period of three years the Consultant will have an option to purchase 38,000 units (the “Units”) at a purchase price of $9.00 per Unit, with each Unit consisting of one share of common stock and a warrant to purchase one share of common stock at an exercise price of $9.00 per share. On June 9, 2017, the Company effected a reverse stock split of our common stock at an exchange ratio of 15-to-1 (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every fifteen shares of common stock outstanding immediately prior to the effectiveness of the Reverse Stock Split were combined and converted into one share of common stock immediately thereafter without any change in the per share par value or the number of authorized shares of the common stock. All share and per share data in this prospectus have been adjusted retroactively to reflect the Reverse Stock Split. On June 7, 2017, the Company and Garden State Securities, Inc. (“GSS”) entered into a Release Agreement (the “GSS Release”). The Company retained GSS as an exclusive placement agent in connection with a private placement completed in February 2017 (the “Private Offering”). Pursuant to the GSS Release, GSS (i) consented to any future financings of the Company, thereby waiving certain covenants included in the Unit Purchase Agreements (the “Unit Purchase Agreements”) entered into in connection with the Private Offering that restricted the Company from selling debt or equity securities, at fixed or variable prices or any combination thereof, at a price below $6.00 per share (the “Price Limit”), the price of the units sold in the Private Offering as adjusted for the Reverse Stock Split (the “Restrictions”); and (ii) upon the closing of a public financing that lists the Company on a national stock exchange (the “Uplisting Financing”), released the Company from its obligation to pay GSS a cash fee of ten percent (10%) of the amount raised in any future financing from any investors contacted by GSS during the Private Offering. As consideration to GSS for entering into the GSS Release, the Company issued 6,667 shares of restricted common stock to GSS. On June 8, 2017, the Company and the investors in the Private Offering entered into Release Agreements (the pursuant to which each investor agreed to release the Company from the Restrictions set forth in the Unit Purchase Agreements. In exchange, the Company agreed that (i) in the event that an Uplisting Financing is conducted at a price per share or price per unit lower than the Price Limit (the “Lower Recent Price”), then the Company will issue additional shares to each investor sufficient to effectively reprice the sale of units to the Lower Recent Price; (ii) in the event that the Uplisting Financing is conducted at a price per share or price per unit of less than the exercise price of the warrants issued in the Private Offering ($8.25 per share as adjusted for the Reverse Stock Split), then the exercise price shall be reduced to the Lower Recent Price; and (iii) the Company will give each investor no less than 6 hours of notice before the closing of any subsequent financing, through and including the Uplisting Financing, and each investor shall have a 6-hour option to purchase up to 20% of the securities sold in such offering. In June 2017, the Company was notified that US Patent Application 15/344,113 has been published by the US Patent Office with a publication date of June 1, 2017. This patent is a step forward for Mino-Lok as it overcomes limitations in mixing antimicrobial solutions where components may precipitate because of physical and/or chemical factors, thus limiting the stability of the post-mix solutions. The Company holds an exclusive worldwide license to technology under this patent application. In June 2017, the Company amended warrants associated with the Leonard-Meron Biosciences, Inc. 2015 private placement offering with Fordham Financial Management Inc. The warrant amendments removed the exercise price reset provisions, adjusted the exercise price of the warrants to $7.50 per share and extended the term of the warrants by three years. As of August 2, 2017, approximately 90% of the 53,145 warrants issued in the offering have been amended per the above terms. Risk Factors Our business is subject to a number of risks you should be aware of before making an investment decision. These risks and others related to the purchase of the Securities are discussed more fully in “Risk Factors” beginning on page 9 and include: | |

| | | | |

| | · | we have no source of revenue, had an accumulated deficit of $22,255,508 as of March 31, 2017, may never become profitable and may incur substantial and increasing net losses for the foreseeable future as we seek development, regulatory approval and commercialization of our products and any future product candidates; | |

| | | | |

| | · | we may need to obtain additional capital to complete the development of existing products, acquire new products, and to continue operations; | |

| | | | |

| | · | our success is primarily dependent on the successful completion of the upcoming Mino-Lok Phase 3 trial, our second registration trial and regulatory approval by the FDA, and the upcoming Hydro-Lido Phase 2b trial; | |

| | | | |

| | · | we are subject to regulatory approval processes that are lengthy, time consuming and inherently unpredictable; we may not obtain approval for our current products or any of our future product candidates from the FDA or any foreign regulatory authorities; | |

| | | | |

| | · | it is difficult and costly to protect our intellectual property rights; | |

| | | | |

| | · | we may be unable to recruit or retain key employees, including our senior management team; and | |

| | | | |

| | · | we depend on the performance of third parties, including contract research organizations and manufacturers, for the clinical testing and production of Mino-Lok, our Hydro-Lido formulation and any other product candidates. | |

| | | | |

| Corporate Information The Company was founded as Citius Pharmaceuticals, LLC, a Massachusetts limited liability company, on January 23, 2007. On September 12, 2014, Citius Pharmaceuticals, LLC entered into a Share Exchange and Reorganization Agreement, with Citius Pharmaceuticals, Inc. (formerly Trail One, Inc.), a publicly traded company incorporated under the laws of the State of Nevada. Citius Pharmaceuticals, LLC became a wholly-owned subsidiary of Citius. On March 30, 2016, Citius acquired Leonard-Meron Biosciences, Inc. as a wholly-owned subsidiary. LMB was a pharmaceutical company focused on the development and commercialization of critical care products with a concentration on anti-infectives. The Company’s principal executive offices are located at 11 Commerce Drive, Cranford, New Jersey 07016 and its telephone number is (908) 976-6677. | |

| | | | |

8

|

| | | | |

| | | | |

| THE OFFERING | |

| | | | |

| Common stock offered by us | | 1,648,484 shares of our common stock (or 1,895,756 shares if the underwriters exercise their over-allotment option in full). | |

| | | | |

| Warrants offered by us | | Warrants to purchase up to 1,648,484 shares of our common stock (or 1,895,756 shares if the underwriters exercise their over-allotment option in full). Each warrant will have an exercise price of $4.125 per share (100% of the public offering price of our common stock), will be exercisable upon issuance and will expire five years from the date of issuance. | |

| | | | |

| Over-allotment option | | We have granted the underwriters an option for a period of up to 45 days to purchase up to 247,272 additional shares of common stock and/or warrants to purchase up to 247,272 shares of common stock to cover over-allotments, if any. | |

| | | | |

| Common stock to be outstanding immediately after this offering | | 6,705,731 shares (or 6,953,003 shares if the underwriters exercise their over-allotment option in full). | |

| | | | |

| Use of proceeds | | We estimate that the net proceeds from this offering will be approximately $6.25 million, or approximately $7.2 million if the underwriters exercise their over-allotment option in full, at an initial public offering price of $4.125 per share, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use substantially all of the net proceeds from this offering primarily towards the research and development of our products and product candidates and the remainder for capital expenditures, working capital and other general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| | | | |

| Representative’s warrants | | The registration statement of which this prospectus is a part also registers for sale warrants to purchase up to 65,940 shares of our common stock to the representative of the underwriters as a portion of the underwriting compensation payable to the underwriters in connection with this offering. The warrants will be exercisable during a period commencing at six months from the effective date of the offering and ending five years from the effective date of the offering at an exercise price equal to 110% of the public offering price of the common stock. Please see “Underwriting - Representative’s Warrants” for a description of these warrants. | |

| | | | |

| Risk Factors | | You should read the “Risk Factors” section of this prospectus beginning on page 12 for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| | | | |

| Nasdaq Capital Market trading symbol | | Our common stock and warrants have been approved for listing on the Nasdaq Capital Market under the symbol “CTXR” and “CTXRW”, respectively. | |

| | | | |

9 |

| | | | |

| | | | |

| The number of shares of our common stock that will be outstanding immediately after this offering is based on 5,057,247 shares of our common stock outstanding as of August 2, 2017 and excludes: | |

| | | | |

| | · | 1,648,484 shares issuable upon the exercise of warrants in this offering; | |

| | | | |

| | · | 1,385,245 shares of common stock issuable upon the exercise of warrants outstanding as of August 2, 2017, with a weighted average price of $8.49 per share; | |

| | | | |

| | · | 586,039 shares of our common stock issuable upon the exercise of options outstanding as of August 2, 2017 as part of our 2014 Stock Incentive Plan with a weighted average price of $8.21 per share. | |

| | | | |

| | · | 275,816 shares of our common stock reserved for future issuance under our 2014 Stock Incentive Plan; | |

| | | | |

| | · | 100,667 shares of common stock and warrants to purchase 100,667 shares of common stock, at an exercise price of $9.00 per share, each issued or issuable pursuant to certain units, in the form of a unit purchase option agreement, with a price of $9.00 per unit; | |

| | | | |

| | · | 1,547,067 shares from the conversion of the Bridge Notes and the A&R Note held by Executive Chairman Leonard Mazur (based on $4,786,240 in principal and interest outstanding as of August 2, 2017 under the Bridge Notes and the A&R Note); and | |

| | | | |

| | · | 65,940 shares of common stock issuable upon exercise of the warrants issued to the representative in connection with this offering. | |

| | | | |

| Except as otherwise stated herein, the information in this prospectus assumes no exercise by the underwriters of their option to purchase up to an additional shares of common stock and/or warrants to cover over-allotments, if any. | |

| | | | |

| | | | |

| 10 | |

SUMMARY CONSOLIDATED FINANCIAL DATA

The following selected financial information is derived from the Company’s Financial Statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company’s Financial Statements, including the notes thereto, appearing elsewhere in this Prospectus. The results indicated below are not necessarily indicative of our future performance.

You should read this information together with the sections entitled “Dilution”, “Capitalization”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

Summary of Statements of Operations

| | Six Months Ended March 31, 2017 | | | Six Months Ended March 31, 2016 | | | Year Ended September 30, 2016 | | | Year Ended September 30, 2015 | |

| | (unaudited) | | | (unaudited) | | | | | | | |

Revenues | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

Loss from operations | | $ | (5,328,572 | ) | | $ | (1,916,287 | ) | | $ | (7,449,291 | ) | | $ | (3,229,929 | ) |

| | | | | | | | | | | | | | | | |

Other income (expense), net | | $ | 409,311 | | | $ | 173,888 | | | $ | (846,407 | ) | | $ | 327,661 | |

Net loss | | $ | (4,919,261 | ) | | $ | (2,090,175 | ) | | $ | (8,295,698 | ) | | $ | (2,902,268 | ) |

Net loss per common share-basic and diluted | | $ | (0.99 | ) | | $ | (0.88 | ) | | $ | (2.29 | ) | | $ | (1.37 | ) |

Weighted average common shares outstanding - basic and diluted | | | 4,947,945 | | | | 2,388,098 | | | | 3,623,208 | | | | 2,122,363 | |

Summary Balance Sheet Information

| | March 31, | | | September 30, | | | September 30, | |

| | 2017 | | | 2016 | | | 2015 | |

| | (unaudited) | | | | | | | |

Cash and cash equivalents | | $ | 61,110 | | | $ | 294,351 | | | $ | 676,137 | |

Total Assets | | $ | 21,334,608 | | | $ | 21,950,341 | | | $ | 741,538 | |

Current Liabilities | | $ | 7,342,498 | | | $ | 5,183,958 | | | $ | 1,376,751 | |

Long-Term Debt | | $ | - | | | $ | - | | | $ | - | |

Stockholders’ Equity (Deficit) | | $ | 13,992,110 | | | $ | 16,766,383 | | | $ | (635,213 | ) |

RISK FACTORS

Investing in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider carefully the specific factors discussed below, together with all of the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our common stock to decline and could cause you to lose all or part of your investment.

Risks related to our Business and our Industry

Citius has a history of net losses and expects to incur losses for the foreseeable future. We may never generate revenues or, if we are able to generate revenues, achieve profitability.

Citius was formed as a limited liability company in 2007 and since its inception has incurred net loss in each of its previous operating years. Our ability to become profitable depends upon our ability to generate revenues from sales of our product candidates. Citius has been focused on product development and has not generated any revenues to date. Citius has incurred losses in each period of our operations, and we expect to continue to incur losses for the foreseeable future. These losses are likely to continue to adversely affect our working capital, total assets and shareholders’ equity (deficit). The process of developing our products requires significant clinical, development and laboratory testing and clinical trials. In addition, commercialization of our product candidates will require that we obtain necessary regulatory approvals and establish sales, marketing and manufacturing capabilities, either through internal hiring or through contractual relationships with others. We expect to incur substantial losses for the foreseeable future as a result of anticipated increases in our research and development costs, including costs associated with conducting preclinical testing and clinical trials, and regulatory compliance activities. Citius incurred net losses of $4,919,261 for the six months ended March 31, 2017, $8,295,698 and $2,902,268 for the years ended September 30, 2016 and 2015, respectively, and a net loss of $737,727 for the nine months ended September 30, 2014. At March 31, 2017, Citius had stockholders’ equity of $13,992,110 and an accumulated deficit of $22,255,508. Citius’ net cash used for operating activities was $2,139,393 for the six months ended March 31, 2017, $5,900,421 and $2,385,416 for the years ended September 30, 2016 and 2015, respectively, and $183,164 for the nine months ended September 30, 2014.

Our ability to generate revenues and achieve profitability will depend on numerous factors, including success in:

| · | developing and testing product candidates; |

| | |

| · | receiving regulatory approvals; |

| | |

| · | commercializing our products; |

| | |

| · | manufacturing commercial quantities of our product candidates at acceptable cost levels; and |

| | |

| · | establishing a favorable competitive position. |

Many of these factors will depend on circumstances beyond our control. We cannot assure you that any of our products will be approved by the FDA, that we will successfully bring any product to market or, if so, that we will ever become profitable.

Our auditors have issued a “going concern” audit opinion.

Our independent registered accountants have indicated, in their report on our September 30, 2016 financial statements, that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Currently, we do not have sufficient capital to continue our operations for the next twelve months. You should not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

We need to secure additional financing.

We anticipate that we will incur operating losses for the foreseeable future. We have received gross proceeds of approximately $7.8 million from our private placement offerings through February 2017. Additionally, in connection with the acquisition of LMB our Executive Chairman, Leonard Mazur, made an equity investment of $3.0 million in March 2016. Mr. Mazur has also loaned the Company $2,500,000 pursuant to the A&R Note, which is convertible into shares of common stock at a price equal to the price per share in this offering less a discount of twenty-five percent (25%). The Board has approved two bridge financing transactions with Mr. Mazur that would allow for the issuance of up to an additional $2,500,000 under two Bridge Notes that may be converted into shares of common stock at a price equal to the price per share in this offering less a discount of twenty-five percent (25%). Mr. Mazur has extended advances totaling $2,210,000 to the Company under the Bridge Notes, which is the only amount outstanding under the Bridge Notes as of August 2, 2017. The Company has also engaged Paulson Investment Company, LLC to secure debt financing. We may need to seek additional financing, including from affiliates, to continue our clinical programs and manufacturing for clinical programs.

The amount and timing of our future funding requirements will depend on many factors, including, but not limited to:

| · | the rate of progress and cost of our trials and other product development programs for our product candidates; |

| | |

| · | the costs and timing of obtaining licenses for additional product candidates or acquiring other complementary technologies; |

| | |

| · | the timing of any regulatory approvals of our product candidates; |

| | |

| · | the costs of establishing sales, marketing and distribution capabilities; and |

| | |

| · | the status, terms and timing of any collaborative, licensing, co-promotion or other arrangements. |

We will need to access the capital markets in the future for additional capital for research and development and for operations. Traditionally, pharmaceutical companies have funded their research and development expenditures through raising capital in the equity markets. Declines and uncertainties in these markets over the past several years have severely restricted raising new capital and have affected companies’ ability to continue to expand or fund existing research and development efforts. If these economic conditions continue or become worse, our future cost of equity or debt capital and access to the capital markets could be adversely affected. If we are not successful in securing additional financing, we may be required to delay significantly, reduce the scope of or eliminate one or more of our research or development programs, downsize our general and administrative infrastructure, or seek alternative measures to avoid insolvency, including arrangements with collaborative partners or others that may require us to relinquish rights to certain of our technologies or product candidates.

We are a late-stage development company with an unproven business strategy and may never achieve commercialization of our therapeutic products or profitability.

Our strategy of using collaborative partners to assist us in the development of our therapeutic products is unproven. Our success will depend upon our ability to enter into additional collaboration agreements on favorable terms and to select an appropriate commercialization strategy for each potential therapeutic product we and our collaborators choose to pursue. If we are not successful in implementing our strategy to commercialize our potential therapeutic products, we may never achieve, maintain or increase profitability. Our ability to successfully commercialize any of our products or product candidates will depend, among other things, on our ability to:

| · | successfully complete our clinical trials; |

| | |

| · | produce, through a validated process, sufficiently large quantities of our drug compound(s) to permit successful commercialization; |

| | |

| · | receive marketing approvals from the FDA and similar foreign regulatory authorities; |

| · | establish commercial manufacturing arrangements with third-party manufacturers; |

| | |

| · | build and maintain strong sales, distribution and marketing capabilities sufficient to launch commercial sales of the drug(s) or establish collaborations with third parties for such commercialization; |

| | |

| · | secure acceptance of the drug(s) from physicians, health care payers, patients and the medical community; and |

| | |

| · | manage our spending as costs and expenses increase due to clinical trials, regulatory approvals and commercialization. |

There are no guarantees that we will be successful in completing these tasks. If we are unable to successfully complete these tasks, we may not be able to commercialize any of our product candidates in a timely manner, or at all, in which case we may be unable to generate sufficient revenues to sustain and grow our business. If we experience unanticipated delays or problems, our development costs could substantially increase and our business, financial condition and results of operations will be adversely affected.

We may fail to realize any of the anticipated benefits of the recent merger.

The success of our recent merger with Leonard-Meron Biosciences, Inc. will depend on, among other things, our ability to realize anticipated benefits and to combine the businesses of the Company and LMB in a manner that achieves synergy and a shared strategy but that does not materially disrupt the existing activities of the companies. If we are not able to successfully achieve these objectives, the anticipated benefits of the merger may not be realized fully, if at all, or may take longer to realize than expected.

We face significant risks in our product candidate development efforts.

Our business depends on the successful development and commercialization of our product candidates. We are not permitted to market any of our product candidates in the United States until we receive approval of an NDA from the FDA, or in any foreign jurisdiction until we receive the requisite approvals from such jurisdiction. The process of developing new drugs and/or therapeutic products is inherently complex, unpredictable, time-consuming, expensive and uncertain. We must make long-term investments and commit significant resources before knowing whether our development programs will result in drugs that will receive regulatory approval and achieve market acceptance. Product candidates that appear to be promising at all stages of development may not reach the market for a number of reasons that may not be predictable based on results and data of the clinical program. Product candidates may be found ineffective or may cause harmful side effects during clinical trials, may take longer to progress through clinical trials than had been anticipated, may not be able to achieve the pre-defined clinical endpoints due to statistical anomalies even though clinical benefit may have been achieved, may fail to receive necessary regulatory approvals, may prove impracticable to manufacture in commercial quantities at reasonable cost and with acceptable quality, or may fail to achieve market acceptance.

We cannot predict whether or when we will obtain regulatory approval to commercialize our product candidates that are under development and will be further developed using the proceeds of our private placements and we cannot, therefore, predict the timing of any future revenues from these product candidates, if any. The FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. For example, the FDA:

| · | could determine that we cannot rely on Section 505(b)(2) for any of our product candidates; |

| | |

| · | could determine that the information provided by us was inadequate, contained clinical deficiencies or otherwise failed to demonstrate the safety and effectiveness of any of our product candidates for any indication; |

| · | may not find the data from clinical trials sufficient to support the submission of an NDA or to obtain marketing approval in the United States, including any findings that the clinical and other benefits of our product candidates outweigh their safety risks; |

| | |

| · | may disagree with our trial design or our interpretation of data from preclinical studies or clinical trials, or may change the requirements for approval even after it has reviewed and commented on the design for our trials; |

| | |

| · | may determine that we have identified the wrong reference listed drug or drugs or that approval of our Section 505(b)(2) application for any of our product candidates is blocked by patent or non-patent exclusivity of the reference listed drug or drugs; |

| | |

| · | may identify deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for the manufacturing of our product candidates; |

| | |

| · | may approve our product candidates for fewer or more limited indications than we request, or may grant approval contingent on the performance of costly post-approval clinical trials; |

| | |

| · | may change its approval policies or adopt new regulations; or |

| | |

| · | may not approve the labeling claims that we believe are necessary or desirable for the successful commercialization of our product candidates. |

Any failure to obtain regulatory approval of our product candidates would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current product candidates may not have favorable results in later studies or trials.

Pre-clinical studies and Phase 1 and Phase 2 clinical trials are not primarily designed to test the efficacy of a product candidate in the general population, but rather to test initial safety, to study pharmacokinetics and pharmacodynamics, to study limited efficacy in a small number of study patients in a selected disease population, and to identify and attempt to understand the product candidate’s side effects at various doses and dosing schedules. Success in pre-clinical studies or completed clinical trials does not ensure that later studies or trials, including continuing pre-clinical studies and large-scale clinical trials, will be successful nor does it necessarily predict future results. Favorable results in early studies or trials may not be repeated in later studies or trials, and product candidates in later stage trials may fail to show acceptable safety and efficacy despite having progressed through earlier trials. In addition, the placebo rate in larger studies may be higher than expected.

We may be required to demonstrate through large, long-term outcome trials that our product candidates are safe and effective for use in a broad population prior to obtaining regulatory approval.

There is typically a high rate of attrition from the failure of product candidates proceeding through clinical trials. In addition, certain subjects in our clinical trials may respond positively to placebo treatment - these subjects are commonly known as “placebo responders” - making it more difficult to demonstrate efficacy of the test drug compared to placebo. This effect is likely to be observed in the treatment of hemorrhoids. If any of our product candidates fail to demonstrate sufficient safety and efficacy in any clinical trial, we will experience potentially significant delays in, or may decide to abandon development of that product candidate. If we abandon or are delayed in our development efforts related to any of our product candidates, we may not be able to generate any revenues, continue our operations and clinical studies, or become profitable. Our reputation in the industry and in the investment community would likely be significantly damaged. It may not be possible for us to raise funds in the public or private markets, and our stock price would likely decrease significantly.

If we are unable to file for approval under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act or if we are required to generate additional data related to safety and efficacy in order to obtain approval under Section 505(b)(2), we may be unable to meet our anticipated development and commercialization timelines.

Our current plans for filing additional NDAs for our product candidates include efforts to minimize the data we will be required to generate in order to obtain marketing approval for our additional product candidates and therefore possibly obtain a shortened review period for the applications. The timeline for filing and review of our NDAs is based upon our plan to submit those NDAs under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, wherein we will rely in part on data in the public domain or elsewhere. Depending on the data that may be required by the FDA for approval, some of the data may be related to products already approved by the FDA. If the data relied upon is related to products already approved by the FDA and covered by third-party patents we would be required to certify that we do not infringe the listed patents or that such patents are invalid or unenforceable. As a result of the certification, the third party would have 45 days from notification of our certification to initiate an action against us. In the event that an action is brought in response to such a certification, the approval of our NDA could be subject to a stay of up to 30 months or more while we defend against such a suit. Approval of our product candidates under Section 505(b)(2) may therefore be delayed until patent exclusivity expires or until we successfully challenge the applicability of those patents to our product candidates. Alternatively, we may elect to generate sufficient additional clinical data so that we no longer rely on data which triggers a potential stay of the approval of our product candidates. Even if no exclusivity periods apply to our applications under Section 505(b)(2), the FDA has broad discretion to require us to generate additional data on the safety and efficacy of our product candidates to supplement third-party data on which we may be permitted to rely. In either event, we could be required, before obtaining marketing approval for any of our product candidates, to conduct substantial new research and development activities beyond those we currently plan to engage in order to obtain approval of our product candidates. Such additional new research and development activities would be costly and time consuming.

We may not be able to obtain shortened review of our applications, and the FDA may not agree that our products qualify for marketing approval. If we are required to generate additional data to support approval, we may be unable to meet our anticipated development and commercialization timelines, may be unable to generate the additional data at a reasonable cost, or at all, and may be unable to obtain marketing approval of our product candidates. In addition, notwithstanding the approval of many products by the FDA pursuant to Section 505(b)(2), over the last few years, some pharmaceutical companies and others have objected to the FDA’s interpretation of Section 505(b)(2). If the FDA changes its interpretation of Section 505(b)(2), or if the FDA’s interpretation is successfully challenged in court, this could delay or even prevent the FDA from approving any Section 505(b)(2) application that we submit.

Even if we receive regulatory approval to commercialize our product candidates, post-approval marketing and promotion of products is highly regulated by the FDA, and marketing campaigns which violate FDA standards may result in adverse consequences including regulatory enforcement action by the FDA as well as follow-on actions filed by consumers and other end-payers, which could result in substantial fines, sanctions and damage awards against us, any of which could harm our business.

Post-approval marketing and promotion of drugs, standards and regulations for direct-to-consumer advertising, dissemination of off-label product information, industry-sponsored scientific and educational activities and promotional activities via the Internet are heavily scrutinized and regulated by the FDA. Drugs may only be marketed for approved indications and in accordance with provisions of the FDA approved labels. Failure to comply with such requirements may result in adverse publicity, warning letters issued by the FDA, and civil or criminal penalties.

In the event the FDA discovers new violations, we could face penalties in the future including the FDA’s issuance of a cease and desist order, impounding of our products, and civil or criminal penalties. As a follow-on to such governmental enforcement activities, consumers and other end-payers of the product may initiate action against us claiming, among other things, fraudulent misrepresentation, civil RICO, unfair competition, violation of various state consumer protection statues and unjust enrichment. If the plaintiffs in such follow-on actions are successful, we could be subject to various damages, including compensatory damages, treble damages, punitive damages, restitution, disgorgement, prejudgment and post-judgment interest on any monetary award, and the reimbursement of the plaintiff’s legal fees and costs, any of which could have an adverse effect on our revenue, business and financial prospects.

Even if we receive regulatory approval to commercialize our product candidates, our ability to generate revenues from any resulting drugs will be subject to a variety of risks, many of which are out of our control.

Even if our product candidates obtain regulatory approval, those drugs may not gain market acceptance among physicians, patients, healthcare payers or the medical community. The indication may be limited to a subset of the population or we may implement a distribution system and patient access program that is limited. Coverage and reimbursement of our product candidates by third-party payers, including government payers, generally is also necessary for optimal commercial success. We believe that the degree of market acceptance and our ability to generate revenues from such drugs will depend on a number of factors, including:

| · | prevalence and severity of any side effects; |

| | |

| · | results of any post-approval studies of the drug; |

| | |

| · | potential or perceived advantages or disadvantages over alternative treatments including generics; |

| | |

| · | the relative convenience and ease of administration and dosing schedule; |

| | |

| · | strength of sales, marketing and distribution support; |

| | |

| · | price of any future drugs, if approved, both in absolute terms and relative to alternative treatments; |

| | |

| · | the effectiveness of our or any future collaborators’ sales and marketing strategies; |

| | |

| · | the effect of current and future healthcare laws on our product candidates; |

| | |

| · | availability of coverage and reimbursement from government and other third-party payers; |

| | |

| · | patient access programs that require patients to provide certain information prior to receiving new and refill prescriptions; |

| | |

| · | requirements for prescribing physicians to complete certain educational programs for prescribing drugs; |

| | |

| · | the willingness of patients to pay out of pocket in the absence of government or third-party coverage; and |

| | |

| · | product labeling or product insert requirements of the FDA or other regulatory authorities. |

If approved, our product candidates may fail to achieve market acceptance or generate significant revenue to achieve or sustain profitability. In addition, our efforts to educate the medical community and third-party payers on the benefits of our product candidates may require significant resources and may never be successful.

Even if approved for marketing by applicable regulatory bodies, we will not be able to create a market for any of our products if we fail to establish marketing, sales and distribution capabilities, or fail to enter into arrangements with third parties.

Our strategy with our product candidates is to outsource to third parties, all or most aspects of the product development process, as well as marketing, sales and distribution activities. Currently, we do not have any sales, marketing or distribution capabilities. In order to generate sales of any product candidates that receive regulatory approval, we must either acquire or develop an internal marketing and sales force with technical expertise and with supporting distribution capabilities or make arrangements with third parties to perform these services for us. The acquisition or development of a sales and distribution infrastructure would require substantial resources, which may divert the attention of our management and key personnel and defer our product development efforts. To the extent that we enter into marketing and sales arrangements with other companies, our revenues will depend on the efforts of others. These efforts may not be successful. If we fail to develop sales, marketing and distribution channels, or enter into arrangements with third parties, we will experience delays in product sales and incur increased costs.

The markets in which we operate are highly competitive and we may be unable to compete successfully against new entrants or established companies.

Competition in the pharmaceutical and medical products industries is intense and is characterized by costly and extensive research efforts and rapid technological progress. We are aware of several pharmaceutical companies also actively engaged in the development of therapies for the same conditions we are targeting. Many of these companies have substantially greater research and development capabilities as well as substantially greater marketing, financial and human resources than we do. In addition, many of these companies have significantly greater experience than us in undertaking pre-clinical testing, human clinical trials and other regulatory approval procedures. Our competitors may develop technologies and products that are more effective than those we are currently marketing or researching and developing. Such developments could render our products, if approved, less competitive or possibly obsolete. We are also competing with respect to marketing capabilities and manufacturing efficiency, areas in which we have limited experience. Mergers, acquisitions, joint ventures and similar events may also significantly increase the competition. New developments, including the development of other drug technologies and methods of preventing the incidence of disease, occur in the pharmaceutical and medical technology industries at a rapid pace. These developments may render our products and product candidates obsolete or noncompetitive. Compared to us, many of our potential competitors have substantially greater:

| · | research and development resources, including personnel and technology; |

| | |

| · | regulatory experience; |

| | |

| · | product candidate development and clinical trial experience; |

| | |

| · | experience and expertise in exploitation of intellectual property rights; and |

| | |

| · | access to strategic partners and capital resources. |