UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Pinterest, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | | | | |

| Our mission | |

| | | | | |

| Our mission is to bring everyone

the inspiration to create a life they love | |

| | | | | |

| | | | | |

| | | | | |

| Our core values Our core values bring Pinterest to life | |

| | | | | |

| | | Because we aim to achieve our ambitious goal of inspiring the world, our everyday work is grounded in core values that reflect the beliefs and principles we cherish most. This includes doing right by our users, making big bets and taking smart risks, maintaining a high standard of excellence and innovation, collaborating closely, and creating a culture of belonging. | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

Letter from the CEO

| | | | | | | | |

| | Dear fellow stockholders: At Pinterest, we are deeply committed to our mission to bring everyone the inspiration to create a life they love. I am thrilled to share with you the progress we’ve made in 2023 and our plans to double-down on our momentum. Our work has never been more important than it is today, as more users turn to Pinterest as a respite from the negativity and the toxicity from the broader social media ecosystem. It is our intention to make our platform a positive and inspiring place for everyone — especially young people — and we believe our efforts are paying off. Our results over the past year are proving that a business model focused on positivity can be successful. We had a transformative year in 2023. Despite macroeconomic challenges and uncertainty around the outlook for digital advertising, we rallied behind a strategy that works: growing users, deepening engagement, and improving monetization, which enabled us to grow through the downturn and achieve double-digit revenue growth in the back half of 2023. As a result, we achieved strong growth in 2023. Pinterest delivered $3 billion in full year revenue for the first time ever, up 9 percent year-over-year, with an all-time high of 498 million monthly active users as of the end of 2023, up 11 percent versus 2022. We have also continued to deepen user engagement by focusing our strategy on what makes Pinterest so beloved and unique: human curation at scale, and a personalized and relevant experience, powered by AI. 2023 was also our most productive year yet. We made Pinterest more shoppable while accelerating product velocity across our most important priorities, fueling our growth and laying the foundation for the future. The company is committed to our environmental, social and governance (“ESG”) goals with oversight from the Board’s Nominating and Corporate Governance Committee. We are pleased to be making progress in our ESG efforts by prioritizing the wellbeing of our employees, users, and the broader communities we serve. Last year, Pinterest was the founding signatory of the Inspired Internet Pledge – a call to action for tech companies and the broader industry to come together to make the internet a safer and healthier place for everyone. We have also invested $20 million to date in more than 60 organizations around the world that are working to advance youth mental health and emotional wellbeing. Our next ESG Impact Report, launching later this year, will provide additional information about our priorities and progress. As we enter into our fifth year as a public company, we are stronger and more efficient than ever before. We believe we are poised for continued growth and innovation and are executing on multiple compelling growth levers by focusing on product innovation to deepen monetization and margin expansion. With a seasoned and world-class management team, which includes several leaders who joined in 2023, I firmly believe our best days are yet to come. In closing, I’m grateful for our talented employees as well as our users, advertisers, partners and stockholders for their ongoing support and continued belief in our mission. It’s an exciting time, and I am confident that the future of Pinterest is brighter than ever. Sincerely, Bill Ready Chief Executive Officer |

| |

| "As we enter into our fifth year as a public company, we are stronger and more efficient than ever before. We believe we are poised for continued growth and innovation and are executing on multiple compelling growth levers by focusing on product innovation to deepen monetization and margin expansion." | |

| | | | | |

| Pinterest 2024 Proxy Statement | 1 |

| | | | | |

| 2 | Pinterest 2024 Proxy Statement |

Business and strategic highlights | | | | | | | | | | | | | | |

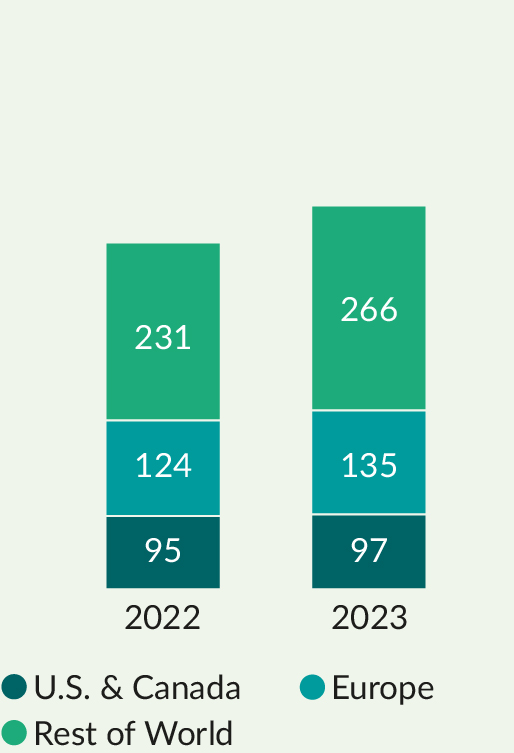

Overview of 2023 results Our key financial and operating results as of and for the year ended December 31, 2023, are as follows: | | | | |

| Monthly active users

(in millions) | | Revenue

(in millions) |

| | | |

| | | |

| | |

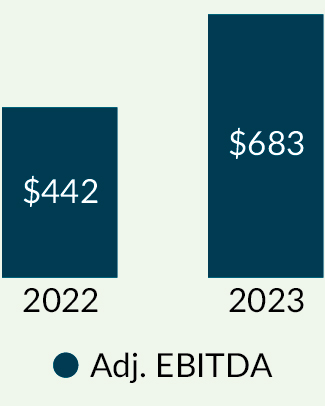

Revenue $3,055M Global Monthly active users (“MAUs”)(1) 498M Average revenue per user ("ARPU")(2) $6.44 Net income (loss) $(36)M Adjusted EBITDA(3) $683M | | |

| | | |

| | | |

| Net income (loss)

(in millions) | | Adjusted EBITDA

(in millions) |

| | | |

| | | |

| |

| | |

| | | | |

| | | | |

| | | | Average revenue per user |

| | | | |

(1)We define a monthly active user as an authenticated Pinterest user who visits our website, opens our mobile application or interacts with Pinterest through one of our browser or site extensions, such as the Save button, at least once during the 30-day period ending on the date of measurement. The number of MAUs do not include Shuffles users unless they would otherwise qualify as MAUs. We present MAUs based on the number of MAUs measured on the last day of the current period. (2)We measure monetization of our platform through our average revenue per user metric. We define ARPU as our total revenue in a given geography during a period divided by average MAUs in that geography during the period. We calculate average MAUs based on the average of the number of MAUs measured on the last day of the current period and the last day prior to the beginning of the current period. We calculate ARPU by geography based on our estimate of the geography in which revenue-generating activities occur. (3)We define Adjusted EBITDA, a non-GAAP measure, as net income (loss) adjusted to exclude depreciation and amortization expense, share-based compensation expense, interest income (expense), net, other income (expense), net, provision for income taxes, restructuring charges and non-cash charitable contributions. See Appendix A to this Proxy Statement for information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. | | |

|

|

| | | | | |

| Pinterest 2024 Proxy Statement | 3 |

Table of contents

Note about our websites and reports and forward-looking statements:

Website references are provided in this Proxy Statement for convenience only. The content of any referenced websites or reports, including any other websites or reports referenced or discussed in this Proxy Statement, are not deemed to be part of, nor incorporated by reference into, this Proxy Statement. We assume no liability for the content contained on the referenced websites.

This Proxy Statement may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are subject to substantial risks and uncertainties and are based on estimates and assumptions as of filing. All statements other than statements of historical facts included in the Proxy Statement, including statements about the company’s goals, progress or expectations with respect to corporate responsibility, sustainability, corporate governance, executive compensation and other matters, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "believes," "estimates," "expects," "projects," "may," "will," "can," "intends," "plans," "targets," "forecasts," "anticipates," or and similar expressions, or the negative of these terms, and similar expressions intended to identify forward-looking statements.

These statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the forward-looking statements expressed or implied in this Proxy Statement. Such risks, uncertainties and other factors include those risks described in “Risk factors” and “Management’s discussion and analysis of financial condition and results of operations” in the company’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) and other subsequent documents we file with the SEC. The inclusion of information related to our corporate responsibility efforts is not an indication that such topics are material to investors or the Company’s results of operation, financial condition, or strategy as defined under U.S. and global laws or regulations.

| | | | | |

| 4 | Pinterest 2024 Proxy Statement |

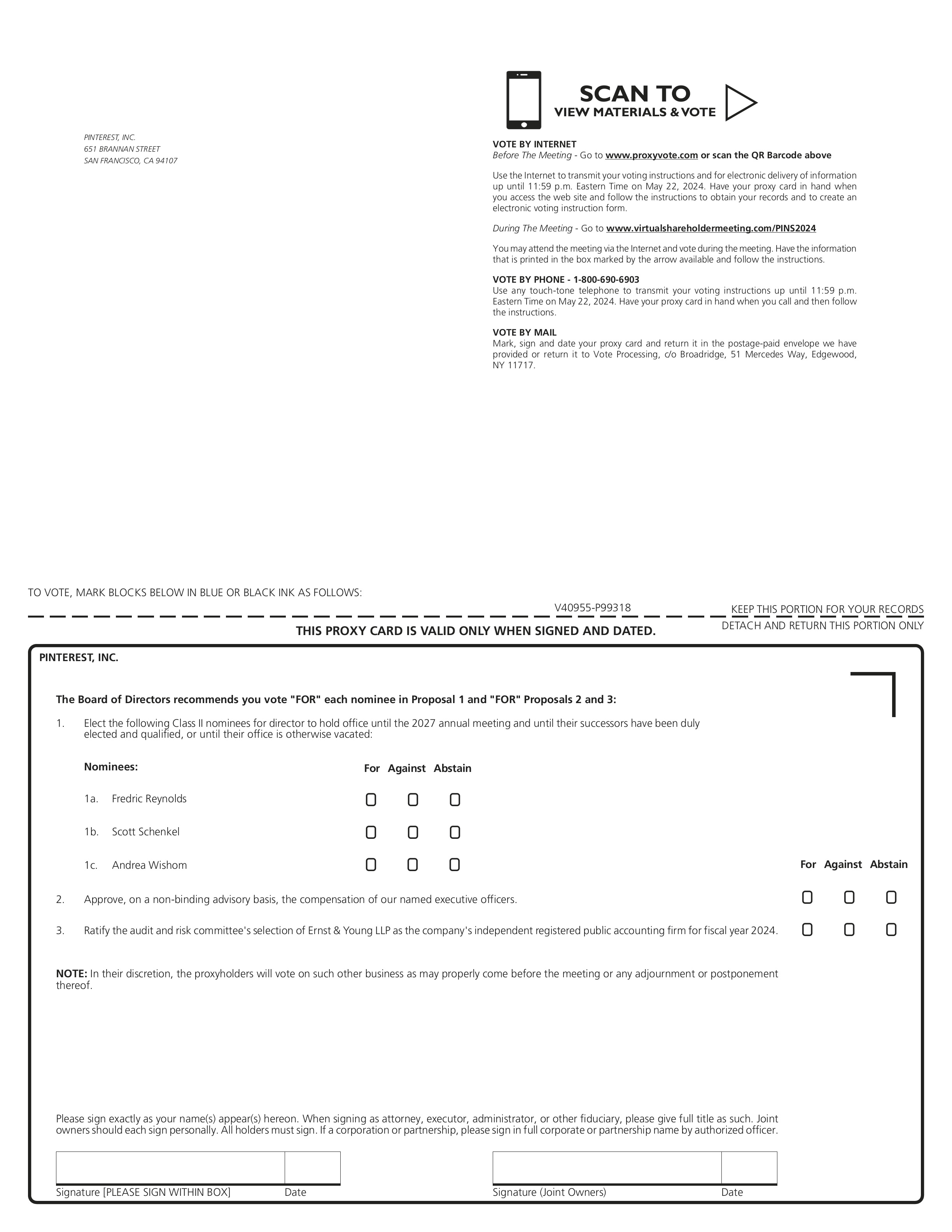

Notice of annual meeting

of stockholders

You are cordially invited to attend the 2024 annual meeting of stockholders ("annual meeting") on Thursday, May 23, 2024, at 8:00 a.m. Pacific Time, which we are holding exclusively online via live webcast at www.virtualshareholdermeeting.com/PINS2024. Whether or not you expect to attend the annual meeting, please vote, as instructed in these materials, as promptly as possible in order to ensure your representation at the annual meeting. Even if you have voted by proxy, you may still vote at the virtual annual meeting by following the instructions under “Voting and annual meeting information.”

| | | | | | | | | | | | | | | | | |

| | | | | |

| Voting items | | Date and Time

Thursday, May 23, 2024, at 8:00 a.m. Pacific Time Location

www.virtualshareholder meeting.com/PINS2024 Who Can Vote

Stockholders as of March 27, 2024 are entitled to vote How to Vote Internet

www.proxyvote.com Phone

1-800-690-6903 Mail

Complete, sign and date the enclosed proxy card or voting instruction card and return it promptly in the envelope provided |

| | | | |

| Proposals | Board Vote Recommendation | For Further Details | |

| | | | |

| 1 | To elect the three Class II nominees for director named in the accompanying Proxy Statement to hold office until the 2027 annual meeting of stockholders and until their successors have been duly elected and qualified, or until their office is otherwise vacated. | “FOR” each director nominee | | |

| | | | |

| | | | |

| 2 | To approve, on a non-binding advisory basis, the compensation of our named executive officers (“say-on-pay”). | “FOR” | | |

| | | | |

| | | | |

| 3 | To ratify the audit and risk committee’s selection of Ernst & Young LLP as the company’s independent registered public accounting firm for fiscal year 2024. | “FOR” | | |

| | | | |

| | | | |

We will also conduct any other business properly brought before the annual meeting. These proposals, as well as instructions for accessing the virtual annual meeting, are more fully described in the accompanying Proxy Statement. The record date for the annual meeting is March 27, 2024. Only stockholders of record at the close of business on that date may vote at the annual meeting or any adjournment thereof. We expect to begin mailing a notice of internet availability of proxy materials on or about April 10, 2024, to all stockholders of record entitled to vote at the annual meeting. By Order of the Board of Directors Wanji Walcott

Chief Legal & Business Affairs Officer and Corporate Secretary

San Francisco, California

April 10, 2024 Important notice regarding the availability of proxy materials for Pinterest’s 2024 annual meeting of stockholders: The notice, proxy statement and annual report are available at www.proxyvote.com. | |

| | | | | |

| | | | | |

| Pinterest 2024 Proxy Statement | 5 |

Proxy summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

2024 annual meeting of stockholders

| | | | | | | | | | | | | | |

| | | | |

| Date and Time To Be Held Online at

8:00 a.m. Pacific Time on

Thursday, May 23, 2024 | | Location www.virtualshareholdermeeting.com/PINS2024 | |

| | | | |

This Proxy Statement is furnished in connection with the solicitation of your proxy by our board of directors (‘‘board’’) to vote at the 2024 annual meeting of stockholders (‘‘annual meeting’’), including at any adjournments or postponements of the annual meeting. This Proxy Statement contains information to be voted on at the annual meeting and certain other information required by Securities and Exchange Commission (‘‘SEC’’) rules. In accordance with SEC rules, we are making our proxy materials available at www.proxyvote.com with an option to request a printed set be mailed to you. We expect to begin mailing a notice of internet availability of proxy materials on or about April 10, 2024, to all stockholders of record entitled to vote at the annual meeting. This notice contains instructions for viewing the proxy materials and voting online and requesting a printed set of proxy materials.

You are cordially invited to attend the annual meeting on Thursday, May 23, 2024, at 8:00 a.m. Pacific Time, which we are holding exclusively online via live webcast at www.virtualshareholdermeeting.com/PINS2024. Whether or not you expect to attend the annual meeting, please vote, as instructed in these materials, as promptly as possible in order to ensure your representation at the annual meeting. Even if you have voted by proxy, you may still vote at the virtual annual meeting by following the instructions under ‘‘Voting and annual meeting information’’.

| | | | | | | | | | | |

| Agenda |

| | | |

| Proposals | Board Vote Recommendation | For Further Details |

| | | |

| 1 | To elect the three Class II nominees for director named in the accompanying Proxy Statement to hold office until the 2027 annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until their office is otherwise vacated. | “FOR” each director nominee | |

| | | |

| | | |

| 2 | To approve, on a non-binding advisory basis, the compensation of our named executive officers (“say-on-pay”). | “FOR” | |

| | | |

| | | |

| 3 | To ratify the audit and risk committee’s selection of Ernst & Young LLP as the company’s independent registered public accounting firm for fiscal year 2024. | “FOR” | |

| | | |

| | | |

| | | | | |

| 6 | Pinterest 2024 Proxy Statement |

Our board of directors

The following table provides summary information about each of our continuing directors, including the three nominees for election at the annual meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Name | Principal Occupation | Age | Director

Since | Independent | Committee Memberships |

| | | | | | Fredric Reynolds | Former EVP & CFO,

CBS Corporation | 73 | 2017 | Yes | Audit Committee* |

| | | | Scott Schenkel | Former CFO & Interim CEO, eBay | 56 | 2023 | Yes | Audit Committee (chair) |

| | | | Andrea Wishom Lead Independent Director | President, Skywalker Holdings | 54 | 2020 | Yes | Compensation Committee** |

| | | | | | Leslie Kilgore | Former Chief Marketing

Officer, Netflix | 58 | 2019 | Yes | Compensation

Committee (chair) |

| | | | Bill Ready | Chief Executive

Officer, Pinterest | 44 | 2022 | No | None |

| | | | Benjamin Silbermann | Co-Founder and non-Executive Chair, Pinterest | 41 | 2008 | No | None |

| | | | Salaam Coleman Smith | Former EVP, ABC Family | 54 | 2020 | Yes | Audit Committee;

Governance Committee*** |

| | | | | Jeffrey Jordan | Managing Partner,

Andreessen Horowitz | 65 | 2011 | Yes | Governance Committee |

| | | | Jeremy Levine | Partner, Bessemer

Venture Partners | 50 | 2011 | Yes | Governance

Committee (chair) |

| | | | Gokul Rajaram | Former Corporate Development and

Strategy Lead, DoorDash | 49 | 2020 | Yes | Compensation Committee |

| | | | Marc Steinberg | Senior Portfolio

Manager, Elliott

Management Corporation | 34 | 2022 | Yes | Audit Committee |

* Our audit and risk committee is referred to as "audit committee" throughout this Proxy Statement. Mr. Schenkel became chair of the Audit Committee in February 2024.

** Our talent development and compensation committee is referred to as “compensation committee” throughout this Proxy Statement.

*** Our nominating and corporate governance committee is referred to as “governance committee” throughout this Proxy Statement.

| | | | | |

| Pinterest 2024 Proxy Statement | 7 |

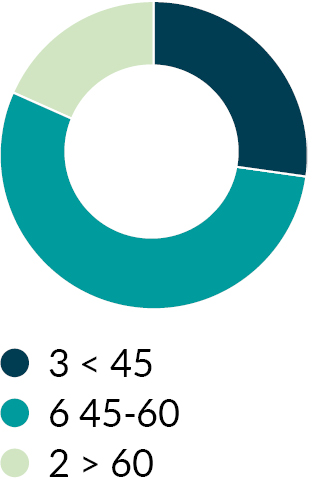

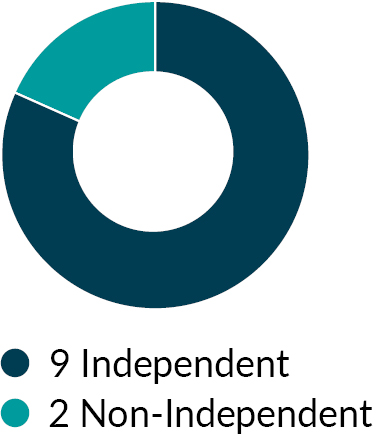

Board snapshot

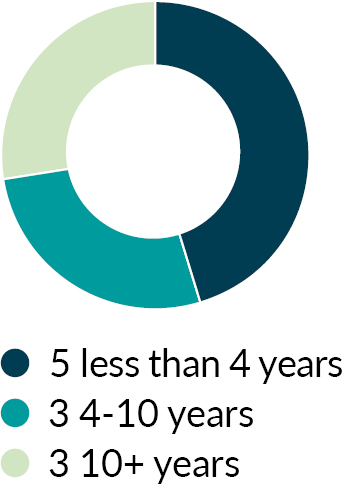

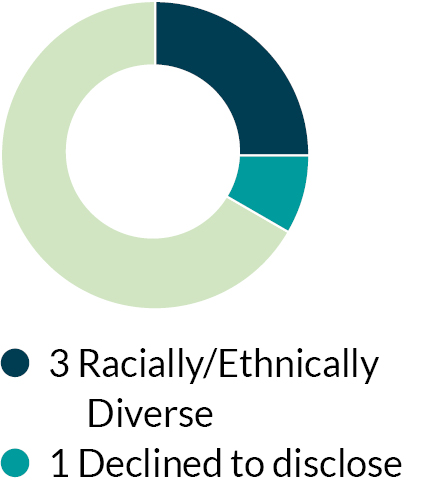

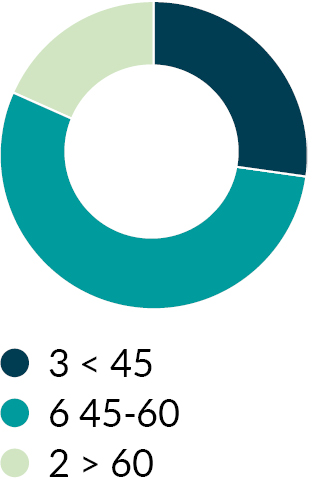

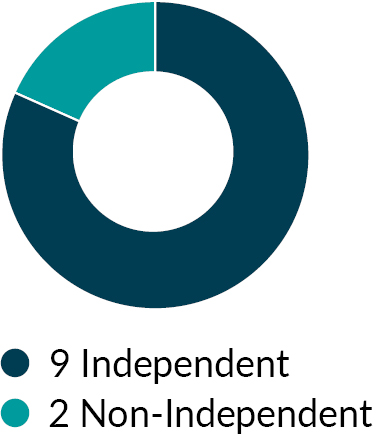

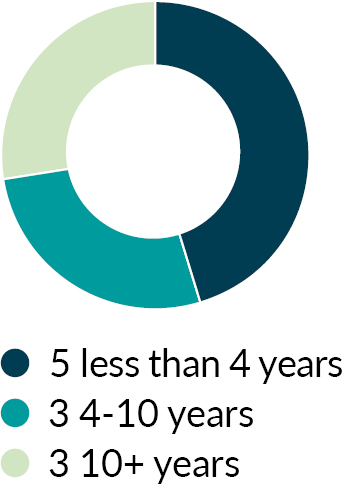

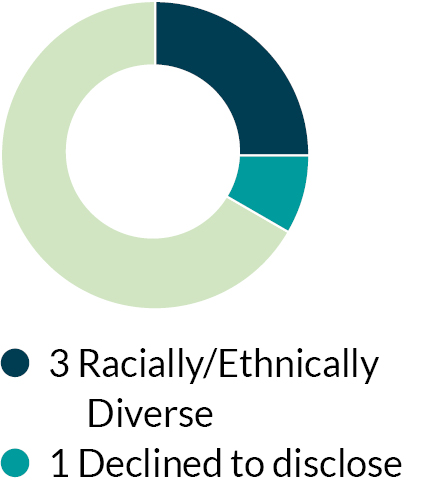

The following charts reflect the age, independence, tenure, gender and race/ethnicity of the members of our board continuing in office following the annual meeting, assuming the election of all nominees:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Age | | Independence | | Tenure | | Gender | | Race/Ethnicity |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jeffrey Jordan | Leslie Kilgore | Jeremy Levine | Gokul Rajaram | Bill Ready | Frederic Reynolds | Scott Schenkel | Ben Silbermann | Salaam Coleman Smith | Marc Steinberg | Andrea Wishom |

Governance | l | l | l | l | l | l | | | l | l | l |

Management | l | l | | l | l | l | l | l | l | l | l |

Technology or Cybersecurity | l | l | l | l | l | l | l | l | | l | |

Finance | l | l | l | | | l | l | | l | l | l |

Sales and marketing | l | l | | | | l | | | l | | l |

Global companies | l | l | l | l | l | l | l | l | l | | l |

Media & content | l | l | | l | | l | | l | l | l | l |

E-commerce | l | l | l | l | l | | l | | l | l | |

Other public company board | l | l | l | l | l | l | l | | l | l | l |

Public company CEO | l | | | | l | | l | l | | | |

| | | | | |

| 8 | Pinterest 2024 Proxy Statement |

Election of directors

| | |

|

Proposal 1 Election of directors |

|

Our board is currently comprised of twelve members. In accordance with our amended and restated certificate of incorporation (our "certificate of incorporation"), our board is divided into three staggered classes of directors. At the annual meeting, three Class II directors will stand for election for a three-year term. Each director’s term continues until the election and qualification of their respective successor or until their office is otherwise vacated.

Evan Sharp, a current Class II director, is not standing for re-election and will retire from the board at the annual meeting, at which point the size of the board will be reduced to eleven directors, and the number of Class II directors will be reduced to three. Mr. Sharp’s departure is not the result of any disagreement with the Company, the board or the management team. The board thanks Mr. Sharp for his dedicated service and many contributions to the Company, including co-founding Pinterest and leading its creative, product and design teams for over a decade.

Each of the nominees standing for election at the annual meeting currently serves as a director. Two of the three director nominees, Fredric Reynolds and Andrea Wishom, were most recently elected by our stockholders at the 2021 annual meeting of stockholders. In September 2023, our board appointed Scott Schenkel as a Class II director, who was recommended to the governance committee by a third party search firm.

Upon recommendation by our governance committee, the board has nominated each of them for election for a term of three years (through the 2027 annual meeting of stockholders) and until their respective successors have been duly elected and qualified, or until their office is otherwise vacated. Although Mr. Reynolds would be over the age of 72 at the time of the election at the annual meeting, our board, on the recommendation of our governance committee, has determined that it is in the best interests of the company and our stockholders to nominate Mr. Reynolds for reelection to the board because of his extensive audit expertise and knowledge of our business, and to provide continuity on the board during this upcoming year.

| | |

|

The board recommends a vote FOR each director nominee |

|

| | | | | |

| 10 | Pinterest 2024 Proxy Statement |

Our board of directors

Board diversity

Our continuing board is composed of a diverse group of individuals, with diverse backgrounds, experience and skills relevant to our company. We believe the diversity, skills and experience of our directors provide us with a diverse range of perspectives and judgment necessary to guide our strategies and monitor their execution. Many of the directors have senior leadership experience at major U.S. and international companies. In these positions, they have also gained experience in areas such as management, financial planning, public company governance, sales and marketing, media and content, e-commerce, cyber security and international business. Many of our directors have experience serving on boards and board committees of other public companies and have an understanding of corporate governance practices and trends and different business processes, challenges and strategies. Further, our directors also have other experience that makes them valuable members of the board, including experience in established or growing technology companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Age | | Independence | | Tenure | | Gender | | Race/Ethnicity |

| | | | | | | | |

| | | | | | | | |

| | | | | |

| Pinterest 2024 Proxy Statement | 11 |

Board experience and expertise

The following reflects the experience and expertise of the members of our board continuing in office following the annual meeting, assuming the election of all nominees:

| | | | | | | | | | | |

Governance

Governance experience supports our emphasis on strong board and management accountability, transparency, protection of stockholder interests and long-term value creation. | Management

Leadership and management experience enables our board to provide advice, guidance and assess the performance of our own management and workforce. | Technology or Cyber Security

Experience in the technology sector is valuable to effectively oversee and understand our product strategy, and expertise in cybersecurity/privacy matters helps our board oversee these risks. | Finance

Financial expertise provides our board with the financial acumen necessary to inform its oversight of our financial performance and reporting, internal controls and long-term strategic planning. |

| | | |

9 Directors | 10 Directors | 9 Directors | 8 Directors |

| | | |

| | | |

Sales & Marketing

Experience in sales and marketing enables the directors to provide valuable advice and oversight over our ads business, sales and marketing activities and growth strategy. | Global

Experience leading large, global companies and teams helps the directors to advise us on our international growth and expansion. | Media & Content

Experience in the media industry and/or with content focused companies enables directors to meaningfully oversee long term strategy on content. | E-commerce

Experience with e-commerce supports us in developing and strengthening the shopping initiatives on our platform. |

| | | |

5 Directors | 10 Directors | 8 Directors | 8 Directors |

| | | |

| | | |

Other Public Company Board

Experience on other public company boards helps directors understand the operations of a public company and the applicable legal and regulatory risks. | Public Company CEO

Experience as a public company CEO and expertise in public company dynamics helps our management team with strategy, performance, prioritization and leadership. | |

|

| | | |

10 Directors | 4 Directors | |

|

| | | |

| | | | | |

| 12 | Pinterest 2024 Proxy Statement |

Class II director nominees for election at the 2024 annual meeting of stockholders

| | | | | |

| |

Fredric Reynolds

Former Executive Vice President and Chief Financial Officer, CBS Corporation

Director since 2017 | |

|

| | | | | |

| Fredric Reynolds served as Executive Vice President and Chief Financial Officer of CBS Corporation, a mass media company, from 2006 to 2009. From 2001 to 2005, he served as President and Chief Executive Officer of Viacom Television Stations Group and as Executive Vice President and Chief Financial Officer of Viacom Inc., a mass media company, from 2000 to 2001. He also served as Executive Vice President and Chief Financial Officer of Westinghouse Electric Corporation, a predecessor of CBS Corporation. Prior to that, Mr. Reynolds held several positions at PepsiCo, a food and beverage corporation, for twelve years, including Chief Financial Officer or Financial Officer at Pizza Hut, Pepsi-Cola International, Kentucky Fried Chicken Worldwide and Frito-Lay. Mr. Reynolds served on the board of directors of Hess Corporation from 2013 to 2019, MGM Corporation from 2010 to 2022 and Mondelez International, Inc. from 2007 to 2022. | Our committees •Audit Committee (member) Other current public boards •RTX Corporation (formerly Raytheon Technologies) (lead director, member of governance and public policy committee and human capital and compensation committee) Education •Bachelor in Business Administration, University of Miami •Certified Public Accountant Relevant experience Extensive financial, leadership and media expertise, management experience in a broad range of companies and service on the board of public companies |

| | | | | |

| Pinterest 2024 Proxy Statement | 13 |

| | | | | |

| |

Scott Schenkel

Former Interim Chief Executive Officer and Chief Financial Officer, eBay Inc.

Director since 2023 | |

|

| | | | | |

Scott Schenkel has more than 30 years of global business and financial leadership expertise across e-commerce, healthcare, and technology businesses. As an operationally focused CFO, Mr. Schenkel’s experience spans company, business unit and functional leadership with extensive knowledge in financial planning, analytics, strategy, audit, mergers and acquisitions, acquisition integration, Six Sigma and process improvement. He most recently served as the Interim CEO of eBay Inc., a multinational e-commerce company, from September 2019 through April 2020 and its Senior Vice President and Chief Financial Officer, leading finance, analytics and information technology, as well as eBay’s Classifieds business unit from 2015 to 2019. Prior to the eBay CFO role, Mr. Schenkel spent six years as Senior Vice President and Chief Financial Officer of eBay Marketplace, where he was responsible for overseeing finance, analytics, strategy and innovation across the business. He joined eBay in 2007 as Vice President of Global Financial Planning and Analytics. Prior to eBay, Mr. Schenkel spent nearly 17 years at General Electric Company in a variety of financial leadership roles. Mr. Schenkel's last role at GE was the Chief Financial Officer of GE Healthcare Clinical Systems, a global healthcare equipment and clinical information technology solutions provider. In addition to his public company boards, Mr. Schenkel has served on the board of directors of Forter since early 2022. He also serves on the TCU Neeley School of Business Board of Advisors. | Our committees •Audit Committee (chair) Other current public boards •NetApp (chair of talent & compensation committee) Education •Bachelor of Science in Finance, Virginia Polytechnic Institute and State University's Pamplin College of Business Relevant experience Extensive financial, leadership and industry expertise, management experience in a broad range of companies and service on the board of public companies |

| | | | | |

| 14 | Pinterest 2024 Proxy Statement |

| | | | | |

| |

Andrea Wishom

President, Skywalker Holdings LLC

Director since 2020; Lead Independent Director | |

|

| | | | | |

| Andrea Wishom has served as President of Skywalker Holdings, LLC, a multi billion dollar diversified private holding company and family office since 2017. She oversees over a billion dollars in assets for various business units, human resources, finance, and all philanthropic and creative aspects for the company. Before joining Skywalker, Ms. Wishom spent over 20 years at Harpo Productions, an American multimedia production company. At Harpo Productions she held various production, programming, development and executive roles for The Oprah Winfrey Show, Harpo Studios and OWN: The Oprah Winfrey Network and most recently as the Executive Vice President. Ms. Wishom previously served on the board of directors of Nextdoor Holdings, Inc. from 2021 to 2023. She currently serves on the board of directors of several private companies, including Tory Burch LLC and Inflection AI. | Our committees •Compensation Committee (member) Other current public boards •None Education •Bachelor of Arts in English, University of California, Berkeley Relevant experience Extensive experience in media industry and C-suite-level management experience |

| | | | | |

| Pinterest 2024 Proxy Statement | 15 |

Class III directors continuing in office until the 2025 annual meeting of stockholders

| | | | | |

| |

Leslie Kilgore

Former Chief Marketing Officer, Netflix, Inc.

Director since 2019 | |

|

| | | | | |

| Leslie Kilgore served as Chief Marketing Officer of Netflix, Inc., an online entertainment service, from 2000 to 2012. From 1999 to 2000, she served as Director of Marketing of Amazon.com, Inc., an online retail company. Ms. Kilgore held various positions, including Brand Manager, at The Procter & Gamble Company, a manufacturer and marketer of consumer products, from 1992 to 1999. Ms. Kilgore currently serves on the board of directors of Netflix, Inc. In addition to her public company boards, she serves on the board of directors of Discord Inc. She previously served on the board of directors of Nextdoor Holdings, Inc. from 2021 to 2023 and Medallia, Inc. from 2015 to 2021. | Our committees •Compensation Committee (chair) Other current public boards •Netflix, Inc. (member of audit committee) Education •Master of Business Administration, Stanford University Graduate School of Business •Bachelor of Science, Wharton School of Business at the University of Pennsylvania Relevant experience Extensive experience as a marketing executive with internet retailers and consumer product companies and experience as a board member of public and private companies |

| | | | | |

| 16 | Pinterest 2024 Proxy Statement |

| | | | | |

| |

Bill Ready

CEO, Pinterest

Director since 2022 | |

|

| | | | | |

| Bill Ready has served as our Chief Executive Officer and as a director on our board since June 2022. Previously he was the president of commerce, payments & next billion users at Alphabet Inc., a technology company, from January 2020 until June 2022. Prior to joining Alphabet, Inc., Mr. Ready was executive vice president and chief operating officer of PayPal Holdings, Inc., an internet-based payment system company, from October 2016 through July 2019 and continued as executive vice president through December 2019 during the transition until he departed PayPal. Prior to that, he was PayPal’s senior vice president, global head, product & engineering from July 2015 to September 2016 and he continued to lead Braintree and Venmo operations while in various roles at PayPal following PayPal’s acquisition of Braintree (parent company of Venmo) in December 2013. From October 2011 to December 2013, he was the chief executive officer of Braintree, a mobile and web payment systems company acquired by PayPal. Prior to Braintree, Mr. Ready was executive in residence at Accel Partners, a leading Silicon Valley venture capital and growth equity firm. Mr. Ready also served as president of iPay Technologies from 2008 to 2011. He also worked as a strategy consultant for McKinsey & Company, where he advised leading financial technology companies. In addition to his public company boards, Mr. Ready is a senior advisor and limited partner of Silversmith Capital Partners. | Our committees •None Other current public boards •Williams Sonoma, Inc. (member of audit and finance committee and compensation committee) •Automatic Data Processing, Inc. (member of audit committee and corporate development and technology advisory committee) Education •Master of Business Administration, Harvard Business School •Bachelor of Science in Information Systems and Finance, University of Louisville Relevant experience Extensive experience as a C-suite-level officer and director of various technology companies |

| | | | | |

| Pinterest 2024 Proxy Statement | 17 |

| | | | | |

| |

Benjamin Silbermann

Co-Founder, non-Executive Chair, Pinterest

Director since 2008 | |

|

| | | | | |

| Benjamin Silbermann is a Co-Founder and non-Executive Chair of Pinterest. He previously served as our Chief Executive Officer from 2008 and as President from 2012 until June 2022. Prior to co-founding Pinterest, Mr. Silbermann worked at Alphabet Inc., a technology company, from 2006 to 2008. He currently serves on the board of non-profit organizations, including The How We Feel Project and Resolve to Save Lives. | Our committees •None Other current public boards •None Education •Bachelor of Arts in Political Science, Yale University Relevant experience Deep knowledge and understanding of our company, strategy and business as our former President and CEO and experience with product development |

| | | | | |

| |

Salaam Coleman Smith

Former EVP, The Walt Disney’s ABC Television Group

Director since 2020 | |

|

| | | | | |

Salaam Coleman Smith served as Executive Vice President at The Walt Disney’s ABC Television Group, a multinational broadcast television group from 2014 to 2016, overseeing Strategy and Programming for ABC Family’s Freeform channel. Prior to joining The Walt Disney Company, Ms. Smith worked at Comcast NBCUniversal, a multinational media company since 2003, where she served as President of Style Network from 2008 to 2013. Prior to joining Comcast NBCUniversal, Ms. Smith worked at Viacom Inc., a multinational mass media conglomerate for nearly ten years where she served as a senior executive within MTV Networks International Division and helped oversee Nickelodeon’s global expansion in Europe, Asia, and Latin America. Ms. Smith has served as a board member for several non-profit organizations, including Women in Cable Telecommunications and Dress For Success. In addition to her public boards, she also serves on the board of Scopely, an online gaming company since December 2021. | Our committees •Audit Committee (member) •Governance Committee (member) Other current public boards •Gap, Inc. (member of compensation and management development committee) Education •Bachelor of Science in Industrial Engineering, Stanford University Relevant experience Strong expertise in global media, multi-platform content, brand development, strategic planning, financial management, consumer-centric insights and C-level management |

| | | | | |

| 18 | Pinterest 2024 Proxy Statement |

Class I directors continuing in office until the 2026

annual meeting of stockholders

| | | | | |

| |

Jeffrey Jordan

Managing Partner, Andreessen Horowitz

Director since 2011 | |

|

| | | | | |

| Jeffrey Jordan has served as a general partner at Andreessen Horowitz, a venture capital firm, since 2011. Previously, Mr. Jordan served as President and Chief Executive Officer of OpenTable, Inc., an online restaurant reservation service company, from 2007 to 2011. He served as President of PayPal, Inc., an internet-based payment system company then owned by internet retail company eBay Inc., from 2004 to 2006, and as Senior Vice President and General Manager of eBay North America from 1999 to 2004. He also served as Chief Financial Officer of Hollywood Entertainment, a video rental company and as President of its subsidiary, Reel. com. Previously, Mr. Jordan served in various capacities at The Walt Disney Company, an entertainment company, for eight years, most recently as Senior Vice President and Chief Financial Officer of The Disney Store Worldwide. Prior to that, he worked for the Boston Consulting Group, Inc., a management consulting firm. In addition to his public company boards, Mr. Jordan currently serves on the board of directors of several private companies, including Foodology and Incredible Health. | Our committees •Governance Committee (member) Other current public boards •Airbnb, Inc. (chair of nominating and corporate governance committee and member of the audit, risk and compliance committee) •Accolade, Inc. (member of compensation committee) •Maplebear, Inc. (d/b/a Instacart) Education •Master of Business Administration, Stanford University Graduate School of Business •Bachelor of Arts in Political Science and Psychology, Amherst College Relevant experience Extensive experience as a C-suite-level officer and director of technology companies and as a venture capitalist |

| | | | | |

| |

Jeremy Levine

Partner, Bessemer Venture Partners

Director since 2011 | |

|

| | | | | |

| Jeremy Levine is a partner at Bessemer Venture Partners, a venture capital and private equity firm, which he joined in 2001. His activities at Bessemer are focused on entrepreneurial startups and high growth companies primarily in the technology industry. In addition to his current public company boards, Mr. Levine previously served on the board of directors of other public companies, including Yelp from 2005 to 2019 . Mr. Levine currently serves on the board of directors of several private companies. | Our committees •Governance Committee (chair) Other current public boards •Shopify, Inc. (member of nominating and corporate governance committee) Education •Bachelor of Science, Duke University Relevant experience Extensive experience with technology companies, serving on the boards of directors of public and private companies, and experience as a venture capitalist |

| | | | | |

| Pinterest 2024 Proxy Statement | 19 |

| | | | | |

| |

Gokul Rajaram

Former Corporate Development and Strategy Lead, DoorDash, Inc.

Director since 2020 | |

|

| | | | | |

| Gokul Rajaram invests in and advises technology companies. He served in various leadership roles at DoorDash, a food ordering service, from 2019 to 2024, most recently as Corporate Development and Strategy Lead. Previously, from 2013 to 2019, Mr. Rajaram served on the executive team of Block, Inc. previously named Square, Inc.) and led several product development teams, most recently as the lead for Caviar, a food delivery service. Prior to Block, Inc., Mr. Rajaram served as Product Director of Ads at Meta, Inc. (previously named Facebook, Inc.), a social media company. Prior to that, Mr. Rajaram was Product Management Director for Google AdSense, an online advertising product. Mr. Rajaram serves on two other public company boards - Coinbase and The Trade Desk - as well as a few late stage private company boards. | Our committees •Compensation Committee (member) Other current public boards •The Trade Desk Inc. (member of compensation committee and audit committee) •Coinbase Global Inc. (member of compensation committee) Education •Master of Computer Science, University of Texas •Master of Business Administration, The Massachusetts Institute of Technology •Bachelor of Computer Science, Indian Institute of Technology, Kanpur Relevant experience Extensive experience with product development and as an officer and director of technology companies, including public companies |

| | | | | |

| |

Marc Steinberg

Partner, Elliott Management Corporation

Director since 2022 | |

|

| | | | | |

| Marc Steinberg is a Senior Portfolio Manager at Elliott Management Corporation, an investment management firm. He is responsible for public and private equity investments across a range of industries, including the technology, media and telecommunications sectors. In addition to his public company boards, Mr. Steinberg currently serves on the board of directors of three private companies: Nielsen, a global leader in audience insights, data and analytics, Syneos Health, a fully integrated biopharmaceutical solutions organization and Cubic, a technology-driven provider of solutions for public transit and defense applications. Prior to joining Elliott in 2015, Mr. Steinberg worked at investment bank Centerview Partners. Mr. Steinberg was appointed to our board pursuant to the cooperation agreement entered into by and among the company, Elliott Associates, L.P. and Elliott International L.P. A description and a copy of the cooperation agreement is available on the Form 8-K filed with the SEC on December 6, 2022. | Our committees •Audit Committee (member) Other current public boards •Etsy, Inc. Education •Bachelor of Arts in Economics, Harvard College Relevant experience Strong experience in financial management and industry expertise as a strategic advisor to technology companies |

| | | | | |

| 20 | Pinterest 2024 Proxy Statement |

Director selection and recruitment

The governance committee is responsible for, among other things, overseeing succession planning for directors and ensuring that we have a qualified board to oversee management’s execution of the company’s strategy and safeguard the long-term interests of stockholders. In this regard, the governance committee is charged with identifying, evaluating and recommending potential director candidates.

| | | | | |

1

Identify | •In identifying potential candidates for board membership, the governance committee considers recommendations from directors, stockholders, management and others, including, from time to time, executive search firms to assist it in locating qualified candidates. •The governance committee does not distinguish between nominees recommended by stockholders and other nominee recommendations. |

|

| |

| |

2

Evaluate | •Once potential director candidates are identified, the governance committee, with the assistance of management, undertakes an extensive vetting process that considers each candidate’s diverse background, experience, qualifications, independence and fit with the board’s priorities. •As part of this vetting process, the governance committee, as well as other members of the board and the CEO, conduct a series of interviews with the candidates. |

|

| |

| |

3

Recommend | •If the governance committee determines that a potential candidate meets the needs of the board and the company and has the desired qualifications and experiences, it recommends the candidate’s nomination or appointment to the full board for consideration. |

The governance committee strives to maintain an engaged, independent board with broad and diverse experience and judgment that is committed to representing the long-term interests of our stockholders. The governance committee considers a wide range of factors when selecting and recruiting director candidates, including achieving:

•an experienced and qualified board. The governance committee seeks directors with a record of accomplishment in their chosen fields that are relevant to our company and its industry.

•diversity. The governance committee seeks candidates representing a diversity of occupational and personal backgrounds, knowledge, skills, qualifications and viewpoints so that the board provides effective oversight of the management of the company. The governance committee reviews the board’s effectiveness in balancing these considerations when assessing the composition of the board.

•board refreshment. We believe that Pinterest benefits from fostering a mix of experienced directors with a deep understanding of the company and its industry and those who bring fresh perspectives. We have regularly refreshed our board since our initial public offering ("IPO") in April 2019, including the addition of six new directors over the past five years.

•ideal board size. The board currently has twelve directors (eleven following the annual meeting) and three classes of directors. The board believes this size works well as it provides a sufficient number of directors to achieve an appropriate mix of experience and meet its oversight responsibilities while promoting accountability and efficiency.

•a board with strong personal attributes. We believe that all of our directors should possess the following personal attributes: high integrity and good judgment, absence of legal or regulatory impediments, independence of mind and strength of character to effectively represent the best interests of all stockholders and provide practical insights and diverse perspectives, ability to act in an oversight capacity, appreciation for the issues confronting a public company, adequate time to devote to the board and its committees, and willingness to assume broad, fiduciary responsibilities on behalf of all stockholders.

| | | | | |

| Pinterest 2024 Proxy Statement | 21 |

Stockholder recommendations of director candidates

The governance committee considers director candidates recommended by stockholders. Stockholders may recommend a candidate by writing to the Corporate Secretary at the company’s address listed on page 60 of this Proxy Statement and including all information that our amended and restated bylaws (our "bylaws") require for director nominations. Stockholder proxy access right

We have adopted proxy access. Our bylaws permit stockholders (either individually or in a group of up to 20 stockholders) that have owned 3% or more of Pinterest' outstanding shares continuously for at least three years to submit director nominees (the greater of two directors or up to 20% of our board) for inclusion in our proxy materials. For additional information, see "Stockholder proposals for the 2025 annual meeting of stockholders."

Director independence

At least a majority of our board members, including all members of our audit, compensation and governance committees, are required to be independent under New York Stock Exchange (“NYSE”) listing rules. The board, with the assistance of the governance committee, considers all relevant facts and circumstances when making its independence determinations. A substantial majority of our board—nine out of eleven continuing directors—is independent.

The board has affirmatively determined that Mr. Jordan, Ms. Kilgore, Mr. Levine, Mr. Rajaram, Mr. Reynolds, Mr. Schenkel Ms. Smith, Mr. Steinberg and Ms. Wishom do not have relationships that would interfere with the exercise of their independent judgment in carrying out the responsibilities as a director and each of these directors is “independent” as that term is defined under the listing standards of the NYSE. In making these determinations, the board considered the current and prior relationships that each of these directors has with our company and all other facts and circumstances our board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director (and any investor with which they are affiliated) and the transactions involving them. The board also took into account that Pinterest from time to time engages in business in the ordinary course with entities where our directors are employed, serve on the board or otherwise provide services to such entities.

| | | | | |

| 22 | Pinterest 2024 Proxy Statement |

Corporate governance

Board structure and role

Our board is currently comprised of twelve directors and is divided into three classes, with each class having a three-year term.

Board leadership structure

The board regularly reviews its leadership structure to evaluate whether the structure remains appropriate for the company, and the directors annually elect the chair of the board. Currently, the roles of board chair and CEO are separate. Since June 2022, Bill Ready has served as our CEO, and Benjamin Silbermann has served as our chair. In August 2023, Mr. Silbermann transitioned from executive chair to non-executive chair. We believe the board continues to benefit from Mr. Silbermann’s deep understanding of our business and culture, as well as his leadership in shaping and driving the company’s strategic priorities and business plans.

Our corporate governance guidelines provide that if the chair is not otherwise independent, the independent directors will select one of our independent directors to serve as our lead independent director. Andrea Wishom continues to serve as lead independent director following Mr. Silbermann’s transition. We have structured the lead independent director role in a manner that we believe reinforces the independence of the board and continues to best serve the long-term interests of our stockholders. A summary of the roles and responsibilities of the board chair and lead independent director is provided below.

| | | | | | | | | | | |

| Benjamin Silbermann

Non-Executive Chair | | Andrea Wishom

Lead Independent Director |

| | | |

Primary responsibilities •presiding over meetings of the board; •advising and supporting the CEO and senior management on the company’s long-term strategy-planning and capability-building; •approving the agenda for board meetings in consultation with the lead independent director and the CEO; •consulting with the lead independent director on the annual board evaluation, at the direction of the governance committee; •being involved in the maintenance of key strategic relationships and stakeholder communications, as appropriate; •consulting with the governance committee, as needed, in connection with the committee’s evaluation and recommendation of candidates for election to the board; and •being available to the CEO and the board to assume additional responsibilities, as may be requested from time to time. | Primary responsibilities •serving as liaison between the CEO, non-executive chair and the independent directors •presiding over meetings of the board at which the non-executive chair is not present, including executive sessions of our independent directors; •approving the agenda for board meetings in consultation with the CEO and non-executive chair; •ensuring the board receives adequate and timely information; •providing feedback to the CEO regarding his performance; •conducting the annual board evaluation in consultation with the non-executive chair, at the direction of the governance committee; •being available for consultations and communications with major stockholders upon request; •calling special meetings of the board and stockholders; and •calling executive sessions of the independent directors. |

| | | |

The board believes that its selection of the current leadership structure is not impacted by the board’s risk oversight function and the board is effective in overseeing risk, as described in the “Board’s role in risk oversight” section below, under a variety of leadership frameworks.

| | | | | |

| Pinterest 2024 Proxy Statement | 23 |

Board committees

Our board has established three standing committees—an audit committee, a compensation committee and a governance committee. The composition and responsibilities of each are described below.

The board has determined that each member of each committee is independent and meets the NYSE and SEC independence standards for serving on such committee, as applicable. The board also has determined that, in accordance with the SEC and NYSE rules, each member of the audit committee is financially literate and each of Mr. Schenkel and Mr. Reynolds is an audit committee financial expert. Members serve on these committees until their resignation or until otherwise determined by the board. The board has adopted written charters for each of the audit committee, compensation committee and governance committee which are available at https://investor.pinterestinc.com/ governance/governance-documents. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The board may establish other committees as it deems necessary or appropriate from time to time.

| | | | | |

| |

Audit and risk committee Current members: Scott Schenkel (chair)

Fredric Reynolds

Salaam Coleman Smith Marc Steinberg Number of meetings held in 2023: 10 | The audit committee is primarily responsible for: •overseeing the company’s financial and accounting reporting processes, including disclosure controls, internal audit function, internal controls and audits and review of the company’s consolidated financial statements; •appointing or changing the company’s auditors and reviewing their independence, qualification and performance; •overseeing significant financial matters, including tax planning, treasury policies, financial risk exposure, dividends and share issuances and repurchases; and •overseeing the company’s enterprise risk management program and compliance with applicable legal and regulatory requirements as well as overseeing risk programs in areas such as information security, data protection and privacy. |

| |

| | | | | |

| |

Talent development and compensation committee Current members: Leslie Kilgore (chair)

Gokul Rajaram

Andrea Wishom Number of meetings held in 2023: 6 | The compensation committee is primarily responsible for: •overseeing the compensation of the company’s directors and employees; •establishing, reviewing and administering the compensation of our executive officers; •administering the company’s equity-based plans and certain other compensation plans; •evaluating the post service arrangements and benefits of our executive officers, including the CEO; •overseeing the implementation and administration of our compensation recoupment or clawback policy; •reviewing the operation and structure of the company’s compensation program; and •evaluating the company’s programs and practices relating to talent and leadership development and management, including matters relating to the attraction, development and retention of a diverse and talented workforce. |

| |

| | | | | |

| 24 | Pinterest 2024 Proxy Statement |

| | | | | |

| |

Nominating and corporate governance committee Current members: Jeremy Levine (chair)

Jeffrey Jordan

Salaam Coleman Smith Number of meetings held in 2023: 3 | The governance committee is responsible for: •evaluating the size, composition, organization and governance of the board and its committees; •assisting the board in identifying and evaluating candidates qualified to be appointed as a board member; •recommending potential candidates to the board for its approval to propose such candidates to the stockholders for election to the board; •reviewing and recommending to the board the independence determinations of the directors as well as recommending to the board the composition of each committee; •reviewing the company’s environmental, social and governance strategy, goals, initiatives and reporting on ESG matters; and •reviewing the performance and annual self-evaluation of the board and each of its committees. |

| |

Board’s role

The board is elected to oversee management and safeguard stockholders’ long-term interests. A key function of the board is reviewing, approving (where appropriate) and actively monitoring management’s execution of the company’s long-term strategic goals. The board actively engages on Pinterest matters throughout the year, including at quarterly board meetings and regular meetings of each committee, where they receive updates from key management personnel. The board and committees also have meetings as needed in between their regular meetings. Directors also regularly engage with and provide counsel to management through informal calls and meetings.

Our board oversees management’s performance on behalf of our stockholders. The primary responsibilities of the board include:

| | | | | |

| |

reviewing and overseeing the company’s strategic direction and objectives reviewing and overseeing the company’s strategic direction and objectives overseeing the company’s legal and regulatory compliance overseeing the company’s legal and regulatory compliance succession planning for the CEO and key executives succession planning for the CEO and key executives monitoring the company’s accounting and financial reporting practices and controls monitoring the company’s accounting and financial reporting practices and controls |  overseeing the company’s risk exposure overseeing the company’s risk exposure evaluating the board’s composition, performance and effectiveness evaluating the board’s composition, performance and effectiveness overseeing the company’s talent development and management overseeing the company’s talent development and management |

| |

Board’s role in strategy

Our board recognizes the importance of ensuring that our overall business strategy is designed to create long-term, sustainable value for our stockholders. Our board has an oversight role in helping management formulate, plan and implement our company's strategy. The board has a robust annual strategic planning process that includes developing and reviewing elements of our business, strategic and financial plans with our executive leadership team. The board gets updates on the company's strategy progress and challenges, as well as related risks, throughout the year.

| | | | | |

| Pinterest 2024 Proxy Statement | 25 |

Board’s role in risk oversight

Our board is responsible for overseeing how we manage risk at Pinterest. This is carried out both at the full board level and through each of the standing committees.

Through our enterprise risk assessment ("ERA") process, we maintain a defined approach to assessing and managing risks and circumstances that could impact our ability to achieve strategic objectives. We refresh our ERA process annually, using the previous year’s ERA results as a baseline, researching potential emerging risks and interviewing relevant stakeholders to gather perspectives on the company’s top enterprise risks. These insights help direct ongoing risk management conversations with management and the board, including expanding management awareness and oversight on newly identified risks.

| | |

|

Board of directors The full board is responsible for monitoring and assessing strategic risk exposure, including determining the nature and level of risk appropriate for the company, and the committees are responsible for monitoring and assessing risks inherent in their respective oversight functions as follows: |

|

| | | | | | | | | | | | | | |

| | | | |

Audit committee oversees our enterprise risk management program and significant financial risk exposures and certain legal, regulatory and operational risk exposures, including with respect to disclosure controls and procedures, information security, data protection and privacy. | | Compensation committee oversees significant compensation and other talent-related risk exposures, including risks and exposures associated with leadership assessment, management succession planning, executive compensation programs and arrangements and talent and leadership development and management, including matters relating to the attraction, development and retention of a diverse and talented workforce. | | Governance committee oversees significant governance risk exposures, including with respect to corporate governance, ESG matters, board effectiveness and board succession planning. |

| | | | |

| | |

|

Management Management meets periodically with the board and each committee to review risk oversight matters and periodically provides reports to them on these matters. |

|

| | | | | |

| 26 | Pinterest 2024 Proxy Statement |

Board engagement

Attendance at board and committee meetings

We encourage all our directors to attend and actively participate in all meetings of the board and any committees on which they serve. In 2023, the board held 5 meetings, and each director attended 75% or more of the aggregate number of meetings of the board and of the committees on which he or she served during the year. Directors are also encouraged to attend the annual stockholders’ meetings. All the directors then serving on the board attended the 2023 annual stockholders’ meeting.

Director orientation and education

New directors participate in an orientation program, which generally addresses the company’s strategic plans, significant risk exposures and compliance programs (including its Code of Business Conduct & Ethics and other applicable policies). The directors and the company are committed to providing all directors with an orientation and adequate and consistent continuing education.

Board evaluation

The lead independent director and the governance committee oversee the performance and annual self-evaluation process for the board and each standing committee. We conduct interviews of each board member for their observations and suggestions on the effectiveness of the board. The governance committee chair and lead independent director, along with any applicable consultants, discuss results with the board and may make recommendations to the chair of the board on any changes as they deem necessary.

ESG impact

Our mission is to give people the inspiration to create a life they love. We have ongoing efforts to address environmental, social, and governance priorities to further our mission and help deliver sustainable long-term value to our stockholders. We are working to be a positive force for good across our business, with a particular focus on four main areas: people, product, planet and governance.

In February 2023, we released our ESG Impact Report, which is available on our investor relations website under “Impact Reports.” This section also contains our Inclusion and Diversity report. We also regularly post company initiatives and information at https://investor.pinterestinc.com.

Below we describe highlights of our on-going ESG efforts.

Our employees make Pinterest the success that it is. We are committed to meeting their real-world needs and championing emotional wellbeing so they can bring their best selves to work.

Benefits that meet real-world needs. In 2022, we introduced PinFlex, a flexible work model that gives our employees the freedom to work at an office, from home or at another virtual location within their country of employment. Eligible employees can even work outside their country for up to three months.

We strive to give all employees choices that are best for their careers and their lives with a comprehensive suite of medical, dental, disability and mental health benefits. For example, offer new parents at least 20 weeks of leave globally.

Employee wellbeing. We offer our employees access to mental health and wellbeing resources, including services like Lyra, Ginger, Calm and Cleo. In 2023, we further evolved our employee resource groups, which we call Pinspiration Groups, and which are centered around a common cause, such as sustainability or emotional wellbeing. One of our Pinspiration Groups, Pinside Out, uniquely creates space for colleagues to connect on mental health topics and activities. It activates peer-to-peer support through monthly healthy hours (open forums and guided discussions) and group meditations. In addition, to promote financial wellbeing, we also offer programs like financial planning and investment services.

| | | | | |

| Pinterest 2024 Proxy Statement | 27 |

Building a diverse and inclusive workplace. We are committed to creating a workplace where everyone feels a sense of belonging and sees themselves represented. We believe that a diverse applicant pool is critical to this goal. Our Diverse Slates Approach is designed to help ensure we consider candidates from underrepresented backgrounds during our hiring process, including at the leadership level. Targeted recruitment efforts through AfroTech, Lesbians Who Tech & Allies and historically black colleges and universities also open the door to a wider pool of talent.

While it is every employee’s responsibility to make Pinterest an inclusive workplace, it is also the responsibility of our management and the board. We seek inclusion and diversity at the highest level in our organization. As described in this Proxy Statement, our board as well as our leadership team is diverse in terms of gender, race, skills, expertise and experience. Our compensation committee oversees our inclusion and diversity ("I&D") initiatives, and management regularly updates the compensation committee on our progress in reaching our I&D goals, including pay equity, any impediments, and broader industry trends and observations.

Caring for communities. Pinterest aims to have a positive and inspiring impact on the communities we serve. That ranges from emergency and disaster response efforts, through employee volunteer service and donation matching contributions, to the provision of pro bono legal services, to local business and vendor support, alongside other efforts aimed at contributing to strong and vibrant communities.

We have also invested $20 million to date in more than more than 60 organizations around the world that provide preventative mental health support, including through art and creative expression, social connection and tech for wellbeing. Through our philanthropic efforts and partnerships, we now support the work of nonprofit organizations advancing emotional wellbeing in over 30 countries including Peer Health Exchange, The Art Therapy Project and Jack.org. Last year we also launched Pinterest Impact Lab, a capacity and leadership strengthening program with an emphasis on supporting emerging stage organizations and diverse leaders.

In June 2023, Pinterest announced its support of the Inspired Internet Pledge. The pledge, created by the Digital Wellness Lab at Boston Children's Hospital in collaboration with Pinterest, is a call to action for technology companies and the broader digital ecosystem to come together to make the internet a safer and healthier place for everyone, especially young people.

We are intentional in our efforts to create a positive, welcoming, and inspiring corner of the internet.

A positive corner of the internet. Delivering a positive platform starts with proactive content guidelines that prioritize user wellbeing. Community guidelines govern what we expect on Pinterest. They outline what we expect of users in order to nurture a positive, honest, welcoming and—above all—inspiring corner of the internet. Comprehensive advertising guidelines make it clear what can be promoted on our platform. We work hard to keep these guidelines up-to-date and strive to remove violating content or content that negatively impacts users’ emotional wellbeing.

These comprehensive community and advertising guidelines are constantly re-evaluated and updated to address the latest issues and developments online.

Whether it is enhancing teen safety or creating a more inclusive online experience, we are deliberate about improving our platform through policy decisions and product developments. Examples of our longstanding commitment to delivering a positive platform include product updates that are designed to protect our users’ personal space, including the launch of private profiles as well as features that give users more control over their followers, improved options for collaborating only with people they know, and the ability for parents to easily opt in and out of a parental passcodes for teens.

A place of inclusion. Building a positive corner of the internet means trying to make sure everyone feels welcome and supported when they come to our platform. We continue to evolve our features for greater diversity and inclusion. For example, in September 2023, Pinterest introduced a new body type technology to its suite of inclusive Artificial Intelligence ("AI") innovations — a technology that uses shape, size, and form to identify various body types in over 5 billion images on the platform. Pinterest is leveraging this body type technology and previously launched skin tone technology to shape how its algorithms increase representation across related feeds and search results for women’s fashion and wedding-related content. These inclusive AI efforts help make Pinterest a more positive place online — a place where we believe everyone can see themselves reflected.

| | | | | |

| 28 | Pinterest 2024 Proxy Statement |

Prioritizing data privacy. We want to give people easy-to-access information on how their data is used by maintaining a clear, regularly updated online privacy policy. We maintain an information security team to oversee all data and business security areas, including: enterprise security, product security, security operations, infrastructure security, intrusion detection and response, and governance, risk and compliance. While we have a dedicated team, we also emphasize the shared responsibility of our workforce to support ongoing product and company security. This is communicated during employee onboarding, and every year after, with all employees required to complete periodic security awareness and compliance training.

When it comes to protecting the planet, we believe everyone has a role to play. At Pinterest, we’re committed to inspiring action—across our platform, within our operations and throughout our communities—starting with reducing our own greenhouse emissions.

Partnering for Earth. Addressing climate change requires global, cross-industry collaboration. It is why we maintain memberships with organizations such as Business for Social Responsibility and Project Drawdown Drawdown Labs initiative – entities that exist to activate shared responsibility for realizing a healthier planet.

Tracking our emissions. In 2022, we committed to set near-term emissions reduction targets for Scope 1 and 2 emissions in line with the Science Based Targets initiative and achieve 100% renewable electricity in our global offices in 2023. We achieved both these commitments in 2023. We remain committed to reducing our operational emissions and investing in renewable energy.

Additionally, we believe our environmental impacts go beyond emissions so we also monitor water use and waste streams, seeking to do more with less to protect precious natural resources.

Collaborating for a more sustainable cloud. At Pinterest, most emissions are Scope 3 (i.e., indirect emissions from our upstream and downstream value chain), including emissions from cloud computing that makes our platform possible. We’ve worked with our cloud computing partner, Amazon Web Services, since 2018 to better understand our indirect carbon footprint and their goals for reducing their emissions.

PinPlanet. PinPlanet is our employee resource group whose mission is to create a sustainable future for all by inspiring climate action. Throughout 2023, PinPlanet leaders hosted workshops, created community action opportunities for employees, and worked with creators and advertisers to develop content on living a more sustainable life.

It is not just what we do that matters but how we do it. Good corporate governance drives accountability, transparency and decision-making that strengthens stakeholder confidence. Our board oversees and reviews the company's strategic direction and objectives, considering (among other things) risk profile and exposure and key stakeholder relationships. Three standing board committees have distinct responsibilities, including ESG-specific responsibilities. The governance committee is responsible for reviewing our ESG strategy, goals, initiatives and reporting on ESG matters. Our management regularly updates the committee on ESG matters. In addition, the compensation committee is responsible for overseeing our inclusion and diversity efforts, including receiving regular progress updates against our inclusion and diversity goals. Our corporate governance practices are further described throughout this Proxy Statement.

We maintain various publicly available company policies, including a Code of Business Conduct & Ethics that outlines the ethical, lawful conduct we expect from everyone at Pinterest. A Supplier Code of Conduct establishes expectations for suppliers working with Pinterest.

Every new hire must complete Ethics & Code of Conduct training and confirm they have read the code. Periodic communications and refresher trainings on this and related topics support our ongoing efforts to enhance employee understanding of these expectations.

| | | | | |

| Pinterest 2024 Proxy Statement | 29 |

Other governance practices

Corporate governance guidelines

The board has adopted corporate governance guidelines, which you can find on our website (https://investor.pinterestinc.com/governance/governance-documents), that we believe reflect the board’s commitment to governance practices that enhance corporate responsibility and accountability. The board annually reviews these guidelines, along with the charters for the board’s standing committees (the audit committee, compensation committee and governance committee), so that our policies and programs continue to reflect good corporate governance practices.

Code of ethics

We have adopted a Code of Business Conduct and Ethics applicable to our directors, employees and contractors, including our CEO, CFO and other executive officers and all persons performing similar functions. A copy of that code is available on our website (https://investor.pinterestinc.com/governance/governance-documents). We intend to disclose on our website any future amendments to, or material waivers from, the code to the extent applicable to our executive officers or directors and as required by law.

No compensation committee interlocks or insider participation

None of the members of the compensation committee is currently, or has been at any time, one of our officers or employees. None of our executive officers currently serve, or have served during the last year, as a member of a board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board or compensation committee.

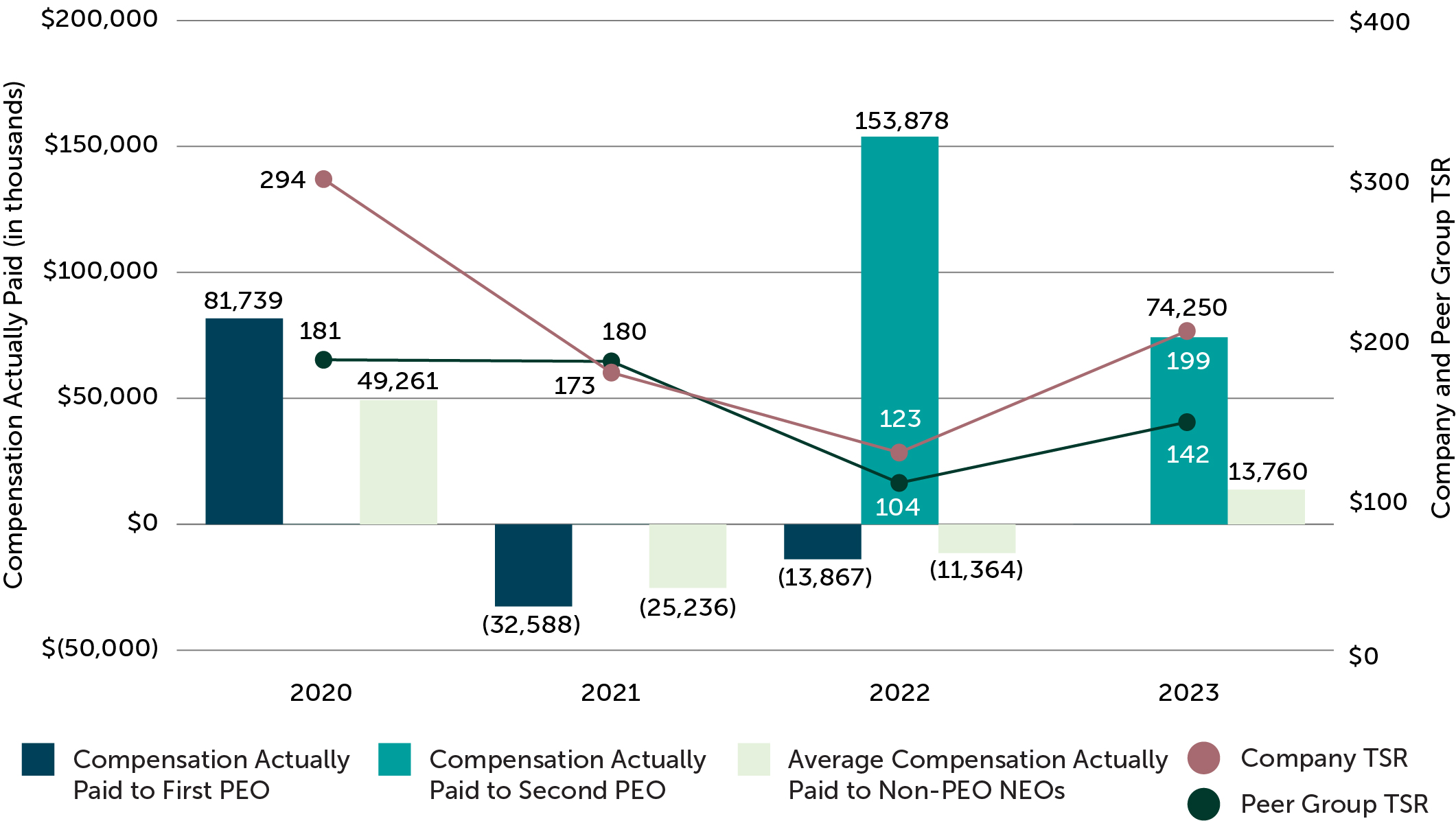

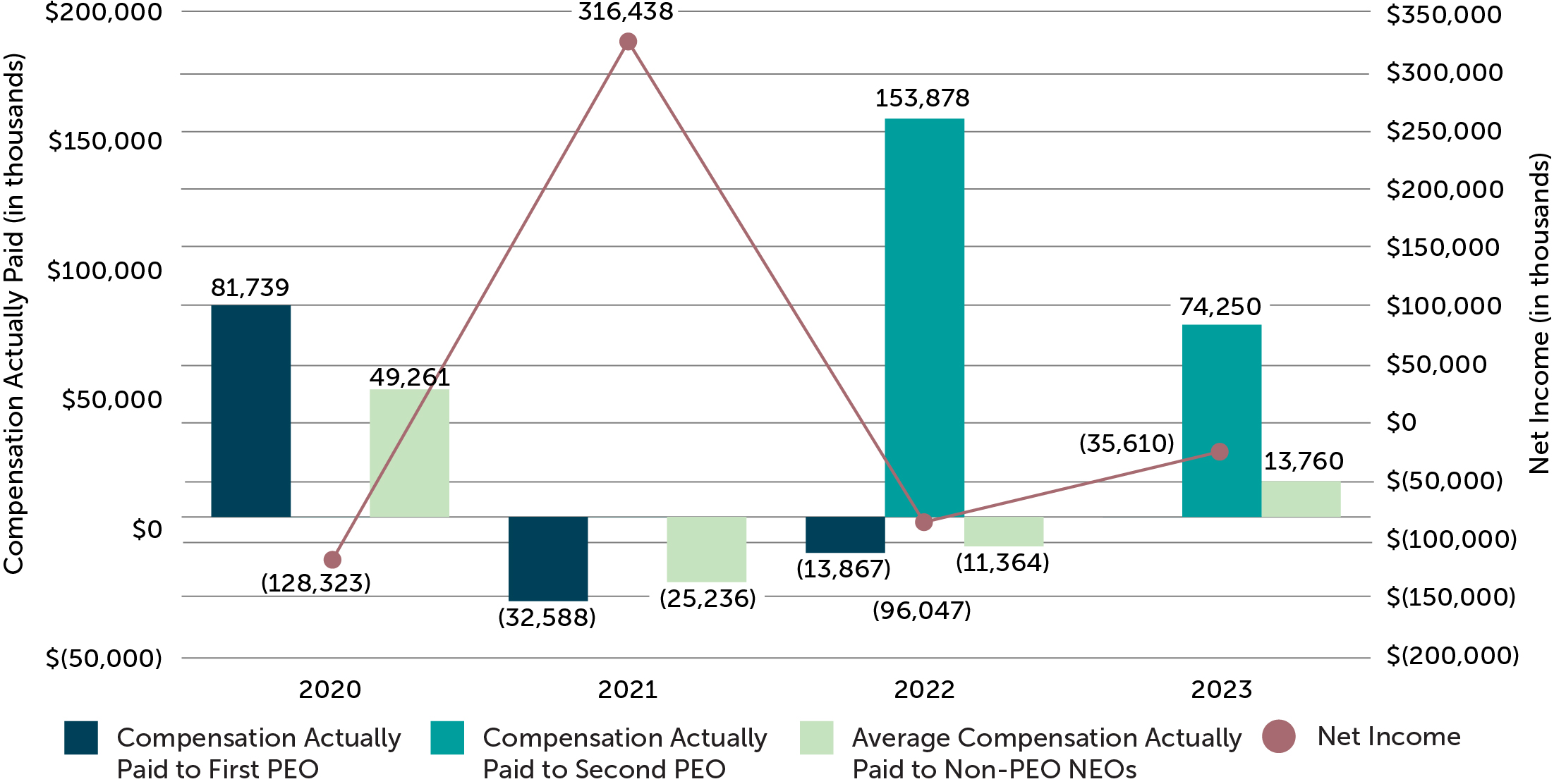

Communications with the board and stockholder engagement