Exhibit 4.1

EXECUTION COPY

WARRANT AGREEMENT

Dated as of May 25, 2012

among

KINDER MORGAN, INC.,

COMPUTERSHARE INC.

and

COMPUTERSHARE TRUST COMPANY, N.A.,

as Warrant Agent

Warrants for

Common Stock

TABLE OF CONTENTS

| | | | | | |

| | | | | Page | |

ARTICLE I ISSUANCE AND EXERCISE OF WARRANTS | | | 1 | |

SECTION 1.1 | | Form of Warrant | | | 1 | |

SECTION 1.2 | | Countersignature of Warrant Certificates | | | 2 | |

SECTION 1.3 | | Exercise Number; Exercise Price | | | 2 | |

SECTION 1.4 | | Term of Warrants | | | 2 | |

SECTION 1.5 | | Exercise of Warrants | | | 2 | |

SECTION 1.6 | | Payment of Exercise Price | | | 3 | |

SECTION 1.7 | | Registry of Warrants | | | 3 | |

SECTION 1.8 | | Exchange of Warrant Certificates | | | 3 | |

SECTION 1.9 | | Cancellation of Warrant Certificates | | | 3 | |

SECTION 1.10 | | No Fractional Shares or Scrip | | | 4 | |

SECTION 1.11 | | Lost, Stolen, Destroyed or Mutilated Warrants | | | 4 | |

SECTION 1.12 | | Transferability and Assignment | | | 4 | |

SECTION 1.13 | | Issuance of Warrant Certificates or Warrant Statements | | | 5 | |

SECTION 1.14 | | Issuance of Warrant Shares | | | 5 | |

SECTION 1.15 | | Charges, Taxes and Expenses | | | 5 | |

SECTION 1.16 | | Issued Warrant Shares | | | 5 | |

SECTION 1.17 | | Reservation of Sufficient Warrant Shares | | | 5 | |

SECTION 1.18 | | Registration and Listing | | | 6 | |

SECTION 1.19 | | No Impairment | | | 6 | |

SECTION 1.20 | | CUSIP Numbers | | | 6 | |

SECTION 1.21 | | Purchase of Warrants by the Company; Cancellation | | | 6 | |

SECTION 1.22 | | No Rights as Stockholders | | | 6 | |

ARTICLE II ANTIDILUTION PROVISIONS | | | 7 | |

SECTION 2.1 | | Adjustments and Other Rights | | | 7 | |

SECTION 2.2 | | Stock Splits, Subdivisions, Reclassifications or Combinations | | | 7 | |

SECTION 2.3 | | Other Distributions | | | 7 | |

SECTION 2.4 | | Certain Repurchases of Common Stock | | | 8 | |

SECTION 2.5 | | Business Combinations or Reclassifications of Common Stock | | | 8 | |

-i-

| | | | | | |

SECTION 2.6 | | Rounding of Calculations; Minimum Adjustments | | | 9 | |

SECTION 2.7 | | Timing of Issuance of Additional Common Stock Upon Certain Adjustments | | | 9 | |

SECTION 2.8 | | Other Events; Provisions of General Applicability | | | 9 | |

SECTION 2.9 | | Statement Regarding Adjustments | | | 10 | |

SECTION 2.10 | | Notice of Adjustment Event | | | 10 | |

SECTION 2.11 | | Proceedings Prior to Any Action Requiring Adjustment | | | 10 | |

SECTION 2.12 | | Adjustment Rules | | | 10 | |

SECTION 2.13 | | Prohibited Actions | | | 11 | |

SECTION 2.14 | | Adjustment to Warrant Certificate or Warrant Statement | | | 11 | |

ARTICLE III WARRANT AGENT | | | 11 | |

SECTION 3.1 | | Appointment of Warrant Agent | | | 11 | |

SECTION 3.2 | | Liability of Warrant Agent | | | 11 | |

SECTION 3.3 | | Performance of Duties | | | 11 | |

SECTION 3.4 | | Disposition of Proceeds on Exercise of Warrants | | | 11 | |

SECTION 3.5 | | Reliance on Counsel | | | 12 | |

SECTION 3.6 | | Reliance on Documents | | | 12 | |

SECTION 3.7 | | Validity of Agreement | | | 12 | |

SECTION 3.8 | | Instructions from Company | | | 12 | |

SECTION 3.9 | | Proof of Actions Taken | | | 12 | |

SECTION 3.10 | | Compensation | | | 13 | |

SECTION 3.11 | | Indemnity | | | 13 | |

SECTION 3.12 | | Legal Proceedings | | | 13 | |

SECTION 3.13 | | Other Transactions in Securities of Company | | | 13 | |

SECTION 3.14 | | Identity of Transfer Agent | | | 14 | |

SECTION 3.15 | | Company to Provide and Maintain Warrant Agent | | | 14 | |

SECTION 3.16 | | Resignation and Removal | | | 14 | |

SECTION 3.17 | | Company to Appoint Successor | | | 14 | |

SECTION 3.18 | | Successor to Expressly Assume Duties | | | 15 | |

SECTION 3.19 | | Successor by Merger | | | 15 | |

ARTICLE IV MISCELLANEOUS | | | 15 | |

SECTION 4.1 | | Notices | | | 15 | |

SECTION 4.2 | | Supplements and Amendments | | | 16 | |

-ii-

| | | | | | |

SECTION 4.3 | | Successors | | | 16 | |

SECTION 4.4 | | Rights Offering | | | 16 | |

SECTION 4.5 | | Governing Law; Jurisdiction | | | 16 | |

SECTION 4.6 | | Benefits of this Agreement | | | 17 | |

SECTION 4.7 | | Counterparts | | | 17 | |

SECTION 4.8 | | Table of Contents; Headings | | | 17 | |

SECTION 4.9 | | Severability | | | 17 | |

SECTION 4.10 | | Availability of Agreement | | | 17 | |

SECTION 4.11 | | Saturdays, Sundays, Holidays, etc | | | 17 | |

SECTION 4.12 | | Damages | | | 17 | |

SECTION 4.13 | | Confidentiality | | | 17 | |

SECTION 4.14 | | Definitions | | | 18 | |

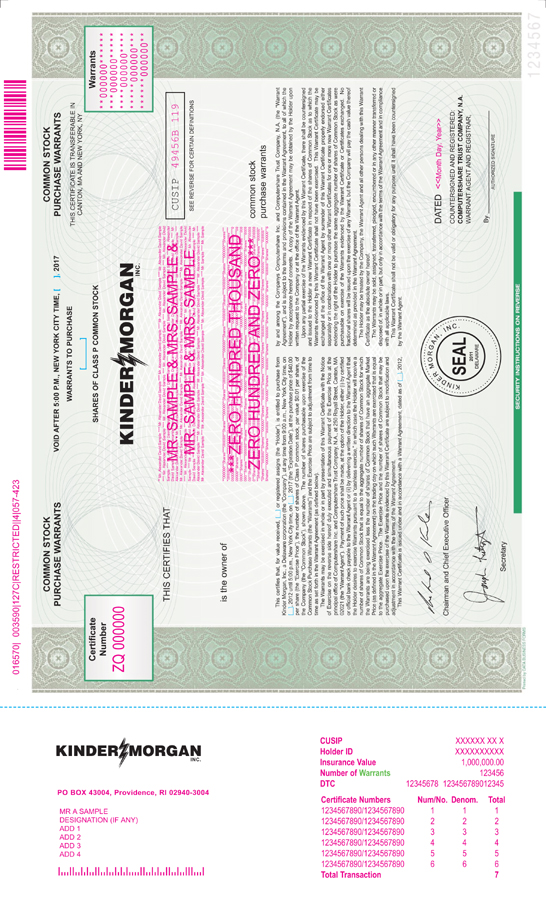

Exhibit A – Form of Warrant Certificate

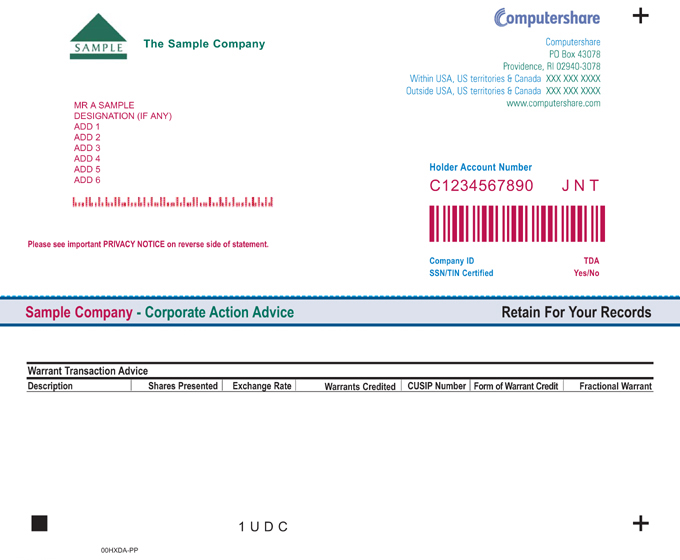

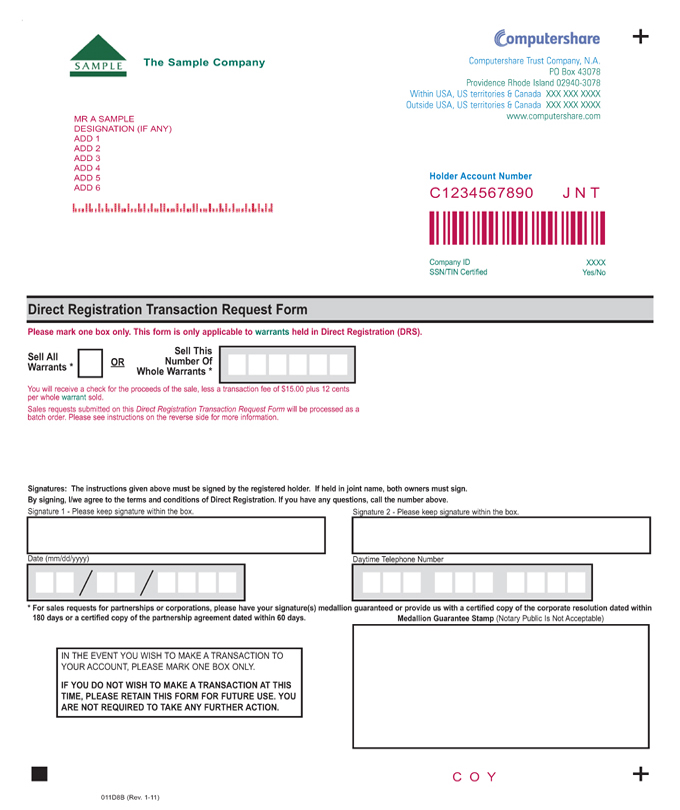

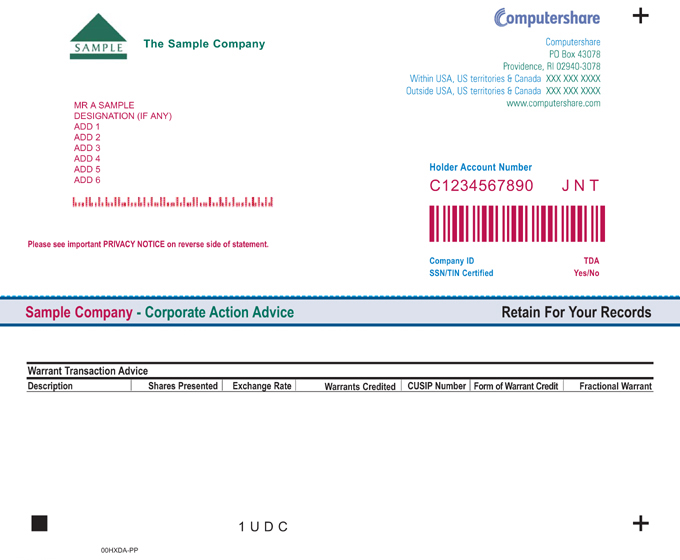

Exhibit B –Form of Warrant Statement

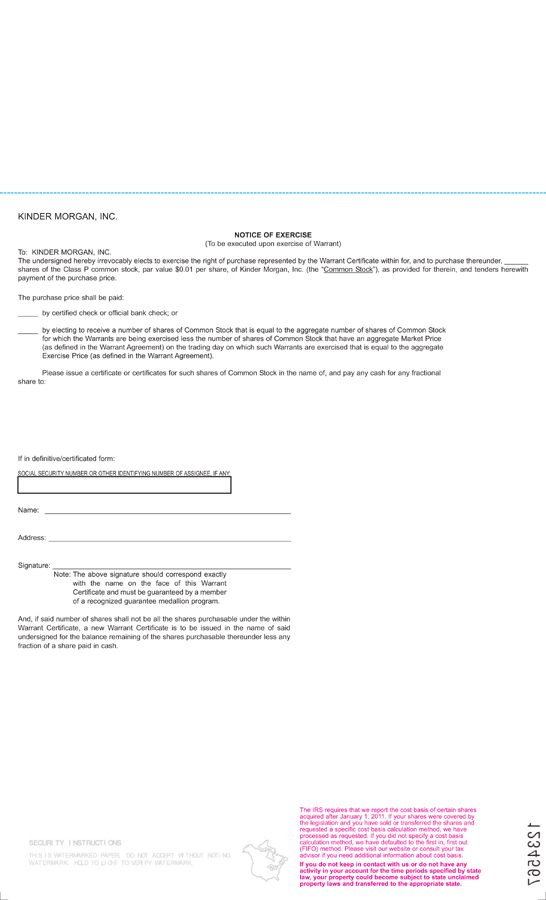

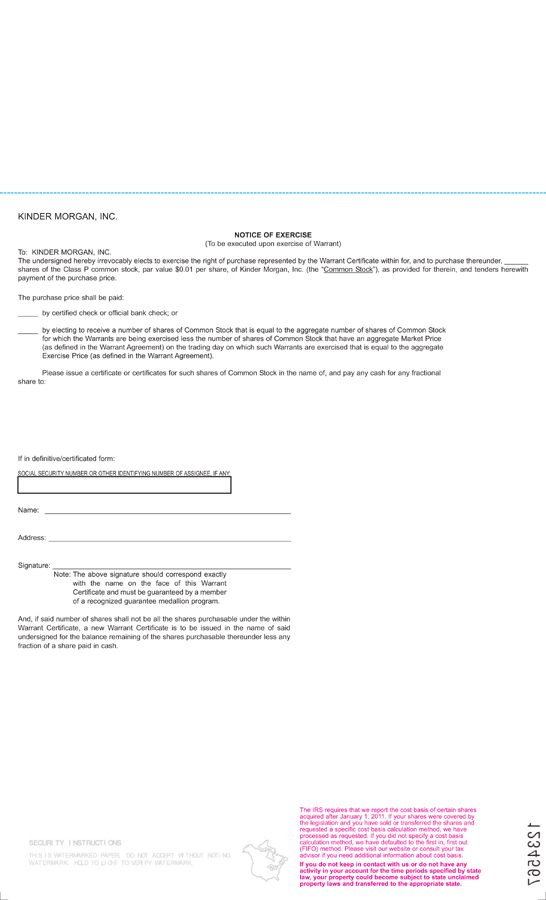

Exhibit C – Form of Notice of Exercise

-iii-

WARRANT AGREEMENT (this “Agreement”), dated as of May 25, 2012, among Kinder Morgan, Inc., a Delaware corporation (the “Company”), Computershare Inc., a Delaware corporation and its wholly owned subsidiary, Computershare Trust Company, N.A., a federally chartered, limited purpose trust company (collectively, the “Warrant Agent” or individually, “Computershare” and the “Trust Company,” respectively).

WHEREAS, the Company, Sherpa Merger Sub, Inc., a Delaware corporation, Sherpa Acquisition, LLC, a Delaware limited liability company, El Paso Corporation, a Delaware corporation (formerly Sirius Holdings Merger Corporation) (“El Paso”), and El Paso LLC, a Delaware limited liability company (formerly a Delaware corporation known as El Paso Corporation and successor in interest to Sirius Merger Corporation), entered into an Agreement and Plan of Merger, dated as of October 16, 2011 (the “Merger Agreement”), providing for, among other things, the acquisition of El Paso by the Company through the consummation of the Transactions (as defined in the Merger Agreement), as a result of which, El Paso will become a wholly owned subsidiary of the Company;

WHEREAS, in partial consideration of the merger and other transactions contemplated by the Merger Agreement, the Company has agreed to issue warrants (each, a “Warrant” and collectively, the “Warrants”) to purchase shares of Class P common stock, par value $0.01 per share, of the Company (the “Common Stock”), to the stockholders of El Paso;

WHEREAS, the Company desires that the Warrant Agent act on behalf of the Company, and the Warrant Agent is willing to so act, in connection with the issuance, transfer, exchange, replacement, cancellation and exercise of the Warrants; and

WHEREAS, the Company desires to provide for the form and provisions of the Warrants, the terms upon which the Warrants shall be issued and exercised and the respective rights and obligations of the Company, the Warrant Agent and the registered owners of the Warrants (each, a “Holder” and collectively, the “Holders”).

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration given to each party hereto, the receipt of which is hereby acknowledged, the Company and the Warrant Agent agree as follows:

ARTICLE I

ISSUANCE AND EXERCISE OF WARRANTS

SECTION 1.1 Form of Warrant. Each Warrant shall be in either (i) physical certificated form substantially in the form attached hereto asExhibit A;provided, however, that no Warrant may be issued in physical certificated form without the prior written consent of the Company (each, a “Warrant Certificate” and collectively, “Warrant Certificates”) or (ii) book-entry registration on the books and records of the Warrant Agent, which book-entry registration shall be reflected on warrant statements, substantially in the form attached hereto asExhibit B(each, a “Warrant Statement” and collectively, the “Warrant Statements”). Each Warrant Certificate and Warrant Statement, as applicable, shall have such insertions as are required or permitted by this Agreement and may have such letters, numbers or other marks of identification and such legends and endorsements, stamped, printed, lithographed

or engraved thereon, as may be required to comply with this Agreement, any applicable law or any rule of any securities exchange on which the Warrants may be listed. Each Warrant Certificate and Warrant Statement, as applicable, shall have attached thereto or be accompanied by, if and when provided to any Holder, a notice of exercise in the form attached hereto asExhibit C(a “Notice of Exercise”). Each Warrant Certificate shall be executed on behalf of the Company by its Chairman of the Board of Directors, Chief Executive Officer, Chief Financial Officer or one of its Executive Vice Presidents, under its corporate seal reproduced thereon and attested by its Secretary or an Assistant Secretary. The signature of any such officers on the Warrant Certificates may be manual or facsimile. Warrant Certificates bearing the manual or facsimile signatures of individuals who were at any time the proper officers of the Company shall bind the Company, notwithstanding that such individuals or any one of them shall have ceased to hold such offices prior to the delivery of such Warrants or did not hold such offices on the date of this Agreement.

SECTION 1.2 Countersignature of Warrant Certificates. Each Warrant Certificate, to the extent issued, shall be countersigned by the Warrant Agent (or any successor to the Warrant Agent then acting as warrant agent under this Agreement) by manual or facsimile signature and shall not be valid for any purpose unless and until so countersigned. Warrant Certificates, to the extent issued, may be countersigned and delivered, notwithstanding the fact that the persons or any one of them who countersigned the Warrants shall have ceased to be proper signatories prior to the delivery of such Warrants or were not proper signatories on the date of this Agreement. Each Warrant Certificate, to the extent issued, shall be dated as of the date of its countersignature by the Warrant Agent. The Warrant Agent’s countersignature shall be conclusive evidence that the Warrant Certificate so countersigned has been duly authenticated and issued under this Agreement.

SECTION 1.3 Exercise Number; Exercise Price. Each Warrant initially entitles its Holder to purchase from the Company one (1) (the “Exercise Number”) share of Common Stock (such share or shares of Common Stock issued or issuable upon exercise of any Warrant or Warrants, each, a “Warrant Share” and collectively, the “Warrant Shares”) for a purchase price per share of Common Stock of $40.00 (the “Exercise Price”). The Exercise Number and the Exercise Price are subject to adjustment as provided in Article II, and all references to “Exercise Number” and “Exercise Price” in this Agreement shall be deemed to include any such adjustment or series of adjustments.

SECTION 1.4 Term of Warrants. All or a portion of the Warrants are exercisable by the Holder at any time and from time to time on or after the date of this Agreement until 5:00 p.m., New York City time, on the five (5)-year anniversary of the date of this Agreement (the “Expiration Date”).

SECTION 1.5 Exercise of Warrants. (i) In the case of a Holder who holds Warrant Certificates, a Warrant may be exercised by surrender of the Warrant Certificate or Certificates evidencing such Warrant to be exercised and by delivery to the Warrant Agent (or to such other office or agency of the Company in the United States as the Company may designate by notice in writing to the Holders pursuant to Section 4.1) a Notice of Exercise, duly completed and signed, which signature shall be guaranteed by a member of a recognized guarantee medallion program, together with payment of the Exercise Price for the

-2-

Warrant Shares thereby purchased in accordance with Section 1.6 and (ii) in the case of a Holder who holds Book-Entry Warrants, a Warrant may be exercised by delivery to the Warrant Agent (or to such other office or agency of the Company in the United States as the Company may designate by notice in writing to the Holders pursuant to Section 4.1) a Notice of Exercise, duly completed and signed, which signature shall be guaranteed by a member of a recognized guarantee medallion program, together with payment of the Exercise Price for the Warrant Shares thereby purchased in accordance with Section 1.6. As promptly as practicable after receiving a Notice of Exercise to purchase Warrant Shares, the Warrant Agent shall notify the Company.

SECTION 1.6 Payment of Exercise Price. Payment of the aggregate Exercise Price for all Warrant Shares purchased may be made, at the option of the Holder, either (a) by certified or official bank check payable to Computershare or (b) by delivering a written direction to the Warrant Agent that the Holder desires to exercise the Warrants pursuant to a “cashless exercise,” in which case the Holder will receive a number of Warrant Shares that is equal to the aggregate number of Warrant Shares for which the Warrants are being exercised less the number of Warrant Shares that have an aggregate Market Price on the trading day on which such Warrants are exercised that is equal to the aggregate Exercise Price for such Warrant Shares. For the avoidance of doubt, if Warrants are exercised such that the aggregate Exercise Price would exceed the aggregate value (as measured by the Market Price) of the Warrant Shares issuable upon exercise, no amount shall be due and payable by the Holder to the Company, and such exercise shall be null and void and no Warrant Shares shall thereupon be issued and the Warrants shall continue in effect.

The Company acknowledges that the bank accounts maintained by Computershare in connection with the services provided under this Agreement will be in its name and that Computershare may receive investment earnings in connection with the investment at Computershare’s risk and for its benefit of funds held in those accounts from time to time. Neither the Company nor the Holders will receive interest on any deposits or Exercise Price.

SECTION 1.7 Registry of Warrants. The Company or an agent duly appointed by the Company (which initially shall be the Warrant Agent) shall maintain a registry (the “Warrant Registry”) showing the names and addresses of the respective Registered Holders and the date and number of Warrants held by each such Registered Holder. Except as otherwise provided in this Agreement, in any Warrant Certificate or Warrant Statement, the Company and the Warrant Agent may deem and treat any Registered Holder of a Warrant as the absolute owner thereof (notwithstanding any notation of ownership or other writing thereon made by anyone).

SECTION 1.8 Exchange of Warrant Certificates. Subject to Section 1.1, each Warrant Certificate may be exchanged for another Warrant Certificate or Certificates of like tenor and representing the same aggregate number of Warrants. Any Holder desiring to exchange a Warrant Certificate or Certificates shall deliver a written request to the Warrant Agent and shall properly endorse and surrender the Warrant Certificate or Certificates to be so exchanged. Thereupon, the Warrant Agent shall countersign and deliver to the Holder a new Warrant Certificate or Certificates, as so requested, in such name or names as such Holder shall designate. Upon the request of any Holder of Book-Entry Warrants, the Warrant Agent shall deliver to the Holder a new Warrant Statement or Statements, as so requested.

SECTION 1.9 Cancellation of Warrant Certificates. If and when any Warrant Certificate has been exercised in full, the Warrant Agent shall promptly cancel such Warrant Certificate following its receipt from the Holder or, to the extent required by applicable law, retain such Warrant Certificate. Upon exercise of a Warrant Certificate in part

-3-

and not in full, the Warrant Agent shall, subject to Section 1.1, issue and deliver or shall cause to be issued and delivered to the Holder a new Warrant Certificate or Certificates evidencing the Holder’s remaining Warrants. If requested by the Company, at the Company’s discretion, the Warrant Agent shall deliver to the Company the cancelled Warrant Certificates. The Warrant Agent and no one else may cancel Warrant Certificates surrendered for transfer, exchange, replacement, cancellation or exercise. The Company may not issue new Warrant Certificates to replace cancelled Warrant Certificates that have been exercised or purchased by it. If and when any Book Entry Warrant has been exercised, whether in part or in full, the Warrant Agent shall promptly reflect such exercise on the books and records of the Warrant Agent in book-entry form and deliver or cause to be delivered to the Holder a new Warrant Statement or Warrant Statements. For the avoidance of doubt, upon any exercise of Warrants, whether by a Holder of Book-Entry Warrants or by a Holder of Warrant Certificates, the Warrant Registry shall be updated to reflect such exercise in accordance with Section 1.7.

SECTION 1.10 No Fractional Shares or Scrip. No fractional Warrant Shares or scrip representing fractional Warrant Shares shall be issued upon any exercise of Warrants. In lieu of any fractional Warrant Shares that would otherwise be issued to a Holder upon exercise of any Warrants, such Holder shall receive a cash payment equal to the Market Price of the Common Stock on the trading day on which such Warrants are exercised representing such fractional Warrant Share.

SECTION 1.11 Lost, Stolen, Destroyed or Mutilated Warrants. If any of the Warrant Certificates shall be mutilated, lost, stolen or destroyed, the Warrant Agent shall countersign and deliver, in exchange and substitution for, and upon cancellation of the mutilated Warrant Certificate, or in lieu of and substitution for the Warrant Certificate lost, stolen or destroyed, a new Warrant Certificate of like tenor and representing an equivalent number of Warrants, but only upon receipt of evidence reasonably satisfactory to the Warrant Agent of the loss, theft or destruction of such Warrant Certificate and an affidavit and the posting of an open penalty bond satisfactory to it. Applicants for such substitute Warrant Certificates shall also comply with such other reasonable regulations and pay such other reasonable charges as the Warrant Agent may prescribe and as required by Section 8-405 of the Uniform Commercial Code as in effect in the State of Delaware.

SECTION 1.12 Transferability and Assignment. At the option of the Holder thereof, the Warrants and all rights attached thereto may be sold, assigned, transferred, pledged, encumbered or in any other manner transferred or disposed of, in whole or in part, by the Registered Holder or by duly authorized attorney, and one or more new Warrant Certificates or Warrant Statements, as applicable, shall be made and delivered and registered in the name of one or more transferees, upon surrender in accordance with Section 1.5 and upon compliance with all applicable laws and subject to the Holder’s presenting due evidence of authority to transfer which shall include a signature guarantee from an eligible guarantor institution participating in a signature guarantee program approved by the Securities Transfer Association, and any other reasonable evidence of authority that may be required by the Warrant Agent.

-4-

SECTION 1.13 Issuance of Warrant Certificates or Warrant Statements. When any Holder, transferee of a Holder or other designee of a Holder is entitled to receive a new or replacement Warrant Certificate or Warrant Statement, as applicable, whether pursuant to Section 1.8, 1.9, 1.11 or 1.12, the Warrant Agent shall issue or shall cause to be issued such new or replacement Warrant Certificate or Warrant Statement, as applicable, as promptly as reasonably practicable.

SECTION 1.14 Issuance of Warrant Shares. Upon the exercise of any Warrants, the Warrant Agent shall deliver or shall cause to be delivered the number of full Warrant Shares to which such Holder shall be entitled, together with any cash to which such Holder shall be entitled in respect of fractional Warrant Shares pursuant to Section 1.10, as promptly as reasonably practicable. All Warrant Shares shall be issued in such name or names as the exercising Holder may designate and delivered to the exercising Holder or its nominee or nominees.

SECTION 1.15 Charges, Taxes and Expenses. The Company shall pay all documentary stamp taxes, if any, attributable to the initial issuance of Warrant Shares upon the exercise of Warrants; provided, however, the Company shall not be required to pay any tax or taxes which may be payable in respect of any transfer involved in the issue or delivery of any Warrants or certificates (if any) for Warrant Shares in a name other than that of the registered holder of such Warrants.

SECTION 1.16 Issued Warrant Shares. The Company hereby represents and warrants that all Warrant Shares issued in accordance with the terms of this Agreement will be duly and validly authorized and issued, fully paid and nonassessable and free from all taxes, liens and charges (other than liens or charges created by a Holder, income and franchise taxes incurred in connection with the exercise of the Warrant or taxes in respect of any transfer occurring contemporaneously therewith). The Company agrees that the Warrant Shares so issued will be deemed to have been issued to a Holder as of the close of business on the date on which the Warrants were duly exercised, notwithstanding that the stock transfer books of the Company may then be closed or certificates (if any) representing such Warrant Shares may not be actually delivered on such date.

SECTION 1.17 Reservation of Sufficient Warrant Shares. There have been reserved, and the Company shall at all times through the Expiration Date keep reserved, out of its authorized but unissued Common Stock, solely for the purpose of the issuance of Warrant Shares in accordance with the terms of this Agreement, a number of shares of Common Stock sufficient to provide for the exercise of the rights of purchase represented by the outstanding Warrants. The transfer agent for the Common Stock and every subsequent transfer agent for any shares of the Company’s capital stock issuable upon the exercise of any of the rights of purchase aforesaid shall be irrevocably authorized and directed at all times to reserve such number of authorized shares as shall be required for such purpose. If applicable, the Company shall supply such transfer agents with duly executed stock certificates for such purposes and shall provide or otherwise make available any cash that may be payable upon exercise of Warrants in respect of fractional Warrant Shares pursuant to Section 1.10. The Company shall furnish such transfer agent with a copy of all notices of adjustments and certificates related thereto, transmitted to each Holder pursuant to Section 4.1.

-5-

SECTION 1.18 Registration and Listing. The Company shall register or shall cause to be registered any and all shares of its Common Stock (including the Warrant Shares) and all the Warrants under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, and the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the “Exchange Act”), and the Company shall use commercially reasonable efforts to maintain such registration of such shares of its Common Stock (including the Warrant Shares) and all the Warrants. The Company shall use reasonable best efforts to (a) procure, or cause to be procured, at its sole expense, the listing of the Warrant Shares and the Warrants, subject to issuance or notice of issuance, on the New York Stock Exchange or, if prior to the closing of the Merger the New York Stock Exchange will not approve the listing of the Warrants on the New York Stock Exchange, then on the NASDAQ Stock Exchange or, if prior to the closing of the Merger the NASDAQ Stock Exchange will not approve the listing of the Warrants on the NASDAQ Stock Exchange, another stock exchange reasonably agreed by the Company and El Paso, and (b) maintain such listings at all times until the Expiration Date. The Company shall use reasonable best efforts to ensure that the Warrant Shares and the Warrants may be issued without violation of any applicable law or regulation or of any requirement of any securities exchange on which such shares of its Common Stock (including the Warrant Shares) and the Warrants are listed or traded.

SECTION 1.19 No Impairment. The Company will not, and the Company will cause its subsidiaries not to, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed by the Company under this Agreement. The Company shall at all times in good faith assist in the carrying out of all provisions of this Agreement and in the taking of all such action as may be necessary or appropriate in order to protect the rights of the Holders.

SECTION 1.20 CUSIP Numbers. The Company, in issuing the Warrants, may use “CUSIP” numbers (if then generally in use) and, if so, the Warrant Agent shall use “CUSIP” numbers in notices as a convenience to Holders;provided,however, that any such notice may state that no representation is made as to the correctness of such numbers either as printed on the Warrant Certificates or Warrant Statements or as contained in any notice and that reliance may be placed only on the other identification numbers printed on the Warrant Certificates or Warrant Statements.

SECTION 1.21 Purchase of Warrants by the Company; Cancellation. The Company shall have the right, except as limited by law, other agreements or as provided herein, to purchase or otherwise acquire Warrants at such times, in such manner and for such consideration as it and the applicable Holder may deem appropriate. In the event the Company shall purchase or otherwise acquire Warrants, the same shall thereupon be delivered to the Warrant Agent and retired and, for the avoidance of doubt, if the approval of Holders is required to take any action, the Company’s (or any of its subsidiaries’ or affiliates’) ownership in any Warrants shall not be considered in calculating whether the requisite number of Warrants have approved such action.

SECTION 1.22 No Rights as Stockholders. A Warrant shall not, prior to its exercise, confer upon its Holder or such Holder’s transferee, in such Holder’s or such transferee’s capacity as a Warrant Holder, the right to vote or receive dividends, or consent or receive notice as stockholders in respect of any meeting of stockholders for the election of directors of the Company or any other matter, or any rights whatsoever as stockholders of the Company.

-6-

ARTICLE II

ANTIDILUTION PROVISIONS

SECTION 2.1 Adjustments and Other Rights. The Exercise Price and the Exercise Number shall be subject to adjustment from time to time as provided by this Article II;provided,however, that if more than one section of this Article II is applicable to a single event, the section shall be applied that produces the largest adjustment, and no single event shall cause an adjustment under more than one section of this Article II so as to result in duplication.

SECTION 2.2 Stock Splits, Subdivisions, Reclassifications or Combinations. If the Company shall (a) declare and pay a dividend or make a distribution on its Common Stock in shares of Common Stock, (b) subdivide or reclassify the outstanding shares of Common Stock into a greater number of shares, or (c) combine or reclassify the outstanding shares of Common Stock into a smaller number of shares, the Exercise Number at the time of the record date for such dividend or distribution or the effective date of such subdivision, combination or reclassification shall be adjusted by multiplying the Exercise Number effective immediately prior to such event by a fraction (x) the numerator of which shall be the total number of outstanding shares of Common Stock immediately after such event and (y) the denominator of which shall be the total number of outstanding shares of Common Stock immediately prior to such event. In such event, the Exercise Price per share of Common Stock in effect immediately prior to the record date for such dividend or distribution or the effective date of such subdivision, combination or reclassification shall be adjusted by multiplying such Exercise Price by a fraction (i) the numerator of which shall be the Exercise Number immediately prior to such adjustment and (ii) the denominator of which shall be the new Exercise Number determined pursuant to the immediately preceding sentence.

SECTION 2.3 Other Distributions. If the Company shall fix a record date for the making of a distribution to all holders of shares of its Common Stock of securities, evidences of indebtedness, assets, cash, rights or warrants (excluding Ordinary Cash Dividends, dividends of its Common Stock and other dividends or distributions referred to in Section 2.2), in each such case, the Exercise Price in effect prior to such record date shall be reduced immediately upon occurrence of the record date to the price determined by multiplying the Exercise Price in effect immediately prior to the reduction by the quotient of (x) the Market Price of the Common Stock on the last trading day preceding the first date on which the Common Stock trades regular way on the principal national securities exchange on which the Common Stock is listed or admitted to trading without the right to receive such distribution, minus the amount of cash and/or the Fair Market Value of the securities, evidences of indebtedness, assets, rights or warrants to be so distributed in respect of one share of Common Stock (such subtracted amount and/or Fair Market Value, the “Per Share Fair Market Value”) divided by (y) such Market Price on such date specified in clause (x); such adjustment shall be made successively whenever such a record date is fixed. In such event, the Exercise Number shall be increased to the number obtained by multiplying the Exercise Number immediately prior

-7-

to such adjustment by the quotient of (x) the Exercise Price in effect immediately prior to the distribution giving rise to this adjustment divided by (y) the new Exercise Price determined in accordance with the immediately preceding sentence. In the case of adjustment for a cash dividend that is, or is coincident with, a regular quarterly cash dividend, the Per Share Fair Market Value would be reduced by the per share amount of the portion of the cash dividend that would constitute an Ordinary Cash Dividend.

SECTION 2.4 Certain Repurchases of Common Stock.If the Company effects a Pro Rata Repurchase of Common Stock, then the Exercise Price shall be reduced to the price determined by multiplying the Exercise Price in effect immediately prior to the Effective Date of such Pro Rata Repurchase by a fraction of which (a) the numerator shall be (i) the product of (x) the number of shares of Common Stock outstanding immediately before such Pro Rata Repurchase and (y) the Market Price of a share of Common Stock on the trading day immediately preceding the first public announcement by the Company or any of its Affiliates of the intent to effect such Pro Rata Repurchase, minus (ii) the aggregate purchase price of the Pro Rata Repurchase, and of which (b) the denominator shall be the product of (i) the number of shares of Common Stock outstanding immediately prior to such Pro Rata Repurchase minus the number of shares of Common Stock so repurchased and (ii) the Market Price per share of Common Stock on the trading day immediately preceding the first public announcement by the Company or any of its Affiliates of the intent to effect such Pro Rata Repurchase. In such event, the Exercise Number shall be increased to the number obtained by multiplying the Exercise Number immediately prior to such adjustment by the quotient of (x) the Exercise Price in effect immediately prior to the Pro Rata Repurchase giving rise to this adjustment divided by (y) the new Exercise Price determined in accordance with the immediately preceding sentence. For the avoidance of doubt, no increase to the Exercise Price or decrease in the Exercise Number shall be made pursuant to this Section 2.4.

SECTION 2.5 Business Combinations or Reclassifications of Common Stock. In case of any Business Combination or reclassification of Common Stock (other than a reclassification of Common Stock referred to in Section 2.2), a Holder’s right to receive shares upon exercise of a Warrant shall be converted into the right to exercise such Warrant to acquire the number of shares of stock or other securities or property (including cash) that the Common Stock issuable (at the time of such Business Combination or reclassification) upon exercise of such Warrant immediately prior to such Business Combination or reclassification would have been entitled to receive upon consummation of such Business Combination or reclassification; and in any such case, if necessary, the provisions set forth herein with respect to the rights and interests thereafter of the Holder shall be appropriately adjusted so as to be applicable, as nearly as may reasonably be, to such Holder’s right to exercise a Warrant in exchange for any shares of stock or other securities or property pursuant to this section. In determining the kind and amount of stock, securities or the property receivable upon exercise of a Warrant following the consummation of such Business Combination, if the holders of Common Stock have the right to elect the kind or amount of consideration receivable upon consummation of such Business Combination, then the consideration that a Holder shall be entitled to receive upon exercise shall be deemed to be the types and amounts of consideration received by the majority of all holders of the shares of Common Stock that affirmatively make an election (or of all such holders if none make an election). For purposes of determining any amount to be withheld in the case of a “cashless exercise” pursuant to Section 1.6 from stock,

-8-

securities or the property that would otherwise be delivered to a Holder upon exercise of Warrants following any Business Combination, the amount of such stock, securities or property to be withheld shall have a Market Price equal to the aggregate Exercise Price as to which such Warrants are so exercised, based on the fair market value of such stock, securities or property on the trading day on which such Warrants are exercised and the Notice of Exercise is delivered to the Warrant Agent;provided,however, that in the case of any property that is not a security, the Market Price of such property shall be deemed to be its fair market value as determined in good faith by the Board of Directors in reliance on an opinion of a nationally recognized independent investment banking firm retained by the Company for this purpose;provided,further, that if making such determination requires the conversion of any currency other than U.S. dollars into U.S. dollars, such conversion shall be done in accordance with customary procedures based on the rate for conversion of such currency into U.S. dollars displayed on the relevant page by Bloomberg L.P. (or any successor or replacement service) on or by 4:00 p.m., New York City time, on such exercise date.

SECTION 2.6 Rounding of Calculations; Minimum Adjustments. All calculations under this Article II shall be made to the nearest one-tenth (1/10th) of a cent or to the nearest one-hundredth (1/100th) of a share, as the case may be. Any provision of this Article II to the contrary notwithstanding, no adjustment in the Exercise Price or the Exercise Number shall be made if the amount of such adjustment would be less than $0.01 or one-tenth (1/10th) of a share of Common Stock, but any such amount shall be carried forward and an adjustment with respect thereto shall be made at the time of and together with any subsequent adjustment which, together with such amount and any other amount or amounts so carried forward, shall aggregate $0.01 or 1/10th of a share of Common Stock, or more, or on exercise of a Warrant if it shall earlier occur.

SECTION 2.7 Timing of Issuance of Additional Common Stock Upon Certain Adjustments. In any case in which the provisions of this Article II shall require that an adjustment shall become effective immediately after a record date for an event, the Company may defer until the occurrence of such event (a) issuing to a Holder of Warrants exercised after such record date and before the occurrence of such event the additional shares of Common Stock issuable upon such exercise by reason of the adjustment required by such event over and above the shares of Common Stock issuable upon such exercise before giving effect to such adjustment and (b) paying to such Holder any amount of cash in lieu of a fractional share of Common Stock;provided,however, that the Company upon request shall deliver to such Holder a due bill or other appropriate instrument evidencing such Holder’s right to receive such additional shares, and such cash, upon the occurrence of the event requiring such adjustment, subject to any retroactive readjustment in accordance with Section 2.8(b).

SECTION 2.8 Other Events; Provisions of General Applicability.

(a) Neither the Exercise Price nor the Exercise Number shall be adjusted in the event of (i) a change in the par value of the Common Stock, (ii) a change in the jurisdiction of incorporation of the Company or (iii) any conversion of shares of any other class of common stock of the Company outstanding as of the date of this Agreement into shares of Common Stock in accordance with the conversion mechanisms set forth in the Company’s certificate of incorporation as of the date of this Agreement.

-9-

(b) In the event that any dividend or distribution described in this Article II is not so made, the Exercise Price and the Exercise Number then in effect shall be readjusted, effective as of the date when the Board of Directors determines not to distribute such shares, evidences of indebtedness, assets, rights, cash or warrants, as the case may be, to the Exercise Price and the Exercise Number that would then be in effect if such record date had not been fixed.

SECTION 2.9 Statement Regarding Adjustments. Whenever the Exercise Price or the Exercise Number shall be adjusted as provided in this Article II, the Company shall forthwith file at the principal office of the Company a statement showing in reasonable detail the facts requiring such adjustment and the Exercise Price that shall be in effect and the Exercise Number after such adjustment. The Company shall deliver to the Warrant Agent a copy of such statement and shall cause a copy of such statement to be sent or communicated to the Holders pursuant to Section 4.1.

SECTION 2.10 Notice of Adjustment Event. In the event that the Company shall propose to take any action of the type described in this Article II (but only if the action of the type described in this Article II would result in an adjustment in the Exercise Price or the Exercise Number or a change in the type of securities or property to be delivered upon exercise of a Warrant), the Company shall deliver to the Warrant Agent a notice and shall cause such notice to be sent or communicated to the Holders in the manner set forth in Section 4.1, which notice shall specify the record date, if any, with respect to any such action and the approximate date on which such action is to take place. Such notice shall also set forth the facts with respect thereto as shall be reasonably necessary to indicate the effect on the Exercise Price and the number, kind or class of shares or other securities or property which shall be deliverable upon exercise of a Warrant. In the case of any action which would require the fixing of a record date, such notice shall be given at least ten (10) days prior to the date so fixed, and in case of all other action, such notice shall be given at least fifteen (15) days prior to the taking of such proposed action. Failure to give such notice, or any defect therein, shall not affect the legality or validity of any such action.

SECTION 2.11 Proceedings Prior to Any Action Requiring Adjustment. As a condition precedent to the taking of any action which would require an adjustment pursuant to this Article II, the Company shall take any action which may be necessary, including obtaining regulatory, New York Stock Exchange, NASDAQ Stock Market or other applicable national securities exchange or stockholder approvals or exemptions, in order that the Company may thereafter validly and legally issue as fully paid and nonassessable all Warrant Shares that a Holder is entitled to receive upon exercise of a Warrant pursuant to this Article II.

SECTION 2.12 Adjustment Rules. Any adjustments pursuant to this Article II shall be made successively whenever an event referred to herein shall occur. If an adjustment in Exercise Price made under this Agreement would reduce the Exercise Price per share of Common Stock to an amount below par value of the Common Stock, then such adjustment in Exercise Price made under this Agreement shall reduce the Exercise Price per share of Common Stock to the par value of the Common Stock.

-10-

SECTION 2.13 Prohibited Actions. The Company agrees that it will not take any action which would entitle a Holder to an adjustment of the Exercise Price if the total number of shares of Common Stock issuable after such action upon exercise of the Warrants, together with all shares of Common Stock then outstanding and all shares of Common Stock then issuable upon the exercise of all outstanding options, warrants, conversion and other rights, would exceed the total number of shares of Common Stock then authorized by its certificate of incorporation.

SECTION 2.14 Adjustment to Warrant Certificate or Warrant Statement. The form of Warrant Certificate or Warrant Statement need not be changed because of any adjustment made pursuant to this Agreement, and Warrant Certificates or Warrant Statements issued after such adjustment may state the same Exercise Price and the same Exercise Number as are stated in the Warrant Certificates or Warrant Statements initially issued pursuant to this Agreement. The Company, however, may at any time in its sole discretion make any change in the form of Warrant Certificate that it may deem appropriate to give effect to such adjustments and that does not affect the substance of the Warrant Certificate, and any Warrant Certificate thereafter issued or countersigned, whether in exchange or substitution for an outstanding Warrant Certificate or otherwise, may be in the form as so changed.

ARTICLE III

WARRANT AGENT

SECTION 3.1 Appointment of Warrant Agent. The Company hereby appoints the Warrant Agent to act as agent for the Company with respect to the Warrants and in accordance with the provisions of this Agreement, and the Warrant Agent hereby accepts such appointment.

SECTION 3.2 Liability of Warrant Agent. The Warrant Agent shall act under this Agreement solely as agent, and its duties shall be determined solely by the provisions of this Agreement. The Warrant Agent shall not be liable for anything that it may do or refrain from doing in connection with this Agreement, except for its own willful misconduct, gross negligence or bad faith.

SECTION 3.3 Performance of Duties. The Warrant Agent may execute and exercise any of the rights or powers hereby vested in it or perform any duty under this Agreement either itself or by or through its attorneys or agents (which shall not include its employees).

SECTION 3.4 Disposition of Proceeds on Exercise of Warrants. The Warrant Agent shall account as promptly as practicable to the Company with respect to Warrants exercised and shall concurrently pay to the Company all monies received by the Warrant Agent for the purchase of Warrant Shares through the exercise of such Warrants. If the Warrant Agent shall receive any notice, demand or other document addressed to the Company by a Holder with respect to the Warrants, the Warrant Agent shall as promptly as practicable forward such notice, demand or other document to the Company.

-11-

SECTION 3.5 Reliance on Counsel. The Warrant Agent may consult at any time with legal counsel satisfactory to it (who may be counsel to the Company), and the Warrant Agent shall incur no liability or responsibility for any action taken, suffered or omitted by it under this Agreement in reasonable reliance on and in accordance with the advice of such counsel.

SECTION 3.6 Reliance on Documents. The Warrant Agent will not incur any liability or responsibility for any action taken in reasonable reliance on any notice, written statement, resolution, waiver, consent, order, certificate or other paper, document or instrument reasonably believed by it to be genuine and to have been signed, sent, presented or made by the proper party or parties. The statements contained herein and in the Warrants shall be taken as statements of the Company, and the Warrant Agent assumes no responsibility for the correctness of any of the same, except as set forth by the Warrant Agent or as evidenced by action taken by the Warrant Agent.

SECTION 3.7 Validity of Agreement. The Warrant Agent shall not be responsible for the validity, execution or delivery of this Agreement (except the due execution of this Agreement by the Warrant Agent) or for the validity, execution or delivery of any Warrant (except the due countersignature of such Warrant Certificate by the Warrant Agent), and the Warrant Agent shall not by any act under this Agreement be deemed to make any representation or warranty as to the authorization or reservation of any Warrant Shares (or other stock) to be issued pursuant to this Agreement or any Warrant, or as to whether any Warrant Shares (or other stock) will, pursuant to this Agreement or any Warrant, when issued, be validly issued, fully paid and nonassessable.

SECTION 3.8 Instructions from Company. The Warrant Agent is hereby authorized and directed to accept instructions with respect to the performance of its duties under this Agreement from the Chairman of the Board of Directors, Chief Executive Officer, Chief Financial Officer, one of its Executive Vice Presidents or Vice Presidents, the Treasurer or the Controller of the Company, and to make an application to such officers for advice or instructions in connection with its duties, and the Warrant Agent shall not be liable for any action taken or suffered to be taken by it in reasonable reliance and in accordance with instructions of any such officer. The Warrant Agent shall not be liable for any action taken by, or omission of any action by, the Warrant Agent in accordance with a proposal included in any such application to such officers on or after the date specified in such application (which date shall not be less than five (5) business days after the date any such officer of the Company actually receives such application, unless any such officer shall have consented in writing to an earlier date) unless, prior to taking any such action (or the effective date in the case of an omission), the Warrant Agent shall have received written instructions in response to such application specifying the action to be taken or omitted.

SECTION 3.9 Proof of Actions Taken. Whenever in the performance of its duties under this Agreement the Warrant Agent shall deem it necessary or desirable that any fact or matter be proved or established by the Company prior to taking or

-12-

suffering or omitting any action under this Agreement, such fact or matter (unless other evidence in respect thereof be herein specifically prescribed) may be deemed conclusively to be proved and established by a certificate signed by the Chairman of the Board of Directors, Chief Executive Officer, Chief Financial Officer, one of its Executive Vice Presidents or Vice Presidents, the Treasurer or the Controller of the Company and delivered to the Warrant Agent, and such certificate shall be full authorization to the Warrant Agent for any action taken or suffered in good faith by it under the provisions of this Agreement in reliance upon any such certificate.

SECTION 3.10 Compensation. The Company agrees to pay the Warrant Agent reasonable compensation for all services rendered by the Warrant Agent in the performance of its duties under this Agreement, to reimburse the Warrant Agent for all reasonable expenses, taxes and governmental charges and other charges incurred by the Warrant Agent in the performance of its duties under this Agreement.

SECTION 3.11 Indemnity. The Company shall indemnify the Warrant Agent and save it harmless from and against any and all liabilities, including judgments, costs and counsel fees, for anything done or omitted by the Warrant Agent in the performance of its duties under this Agreement, except as a result of the Warrant Agent’s willful misconduct, gross negligence or bad faith. The Warrant Agent shall indemnify the Company and save it harmless from and against any and all liabilities, including judgments, costs and counsel fees, for anything arising out of or attributable to the Warrant Agent’s refusal or failure to comply with the terms of this Agreement or which arise out of the Warrant Agent’s willful misconduct, gross negligence or bad faith;provided,however, that the Warrant Agent’s aggregate liability under this Agreement with respect to, arising from or arising in connection with this Agreement, whether in contract, in tort or otherwise, is limited to and shall not exceed the amounts paid under this Agreement by the Company to the Warrant Agent as fees and charges, but not including reimbursable expenses. The Warrant Agent shall notify the Company promptly of any claim for which it may seek indemnity, and the Company shall notify the Warrant Agent promptly of any claim for which it may seek indemnity.

SECTION 3.12 Legal Proceedings. The Warrant Agent shall be under no obligation to institute any action, suit or legal proceeding or to take any other action likely to involve expense unless the Company or any one or more Holders shall furnish the Warrant Agent with reasonable security and indemnity for any costs and expenses that may be incurred, but this provision shall not affect the power of the Warrant Agent to take such action as the Warrant Agent may consider proper, whether with or without any such security or indemnity. All rights of action under this Agreement or under any of the Warrants may be enforced by the Warrant Agent without the possession of any of the Warrants or the production thereof at any trial or other proceeding relative thereto, and any such action, suit or proceeding instituted by the Warrant Agent shall be brought in its name as warrant agent, and any recovery of judgment shall be for the ratable benefit of the Holders, as their respective rights or interests may appear.

SECTION 3.13 Other Transactions in Securities of Company. The Warrant Agent and any stockholder, director, officer or employee of the Warrant Agent may buy, sell or deal in any of the Warrants or other securities of the Company, or become pecuniarily interested in any transaction in which the Company may be interested, or contract

-13-

with or lend money to the Company or otherwise act as fully and freely as though it were not the Warrant Agent under this Agreement. Nothing in this Agreement shall preclude the Warrant Agent from acting in any other capacity for the Company or for any other legal entity.

SECTION 3.14 Identity of Transfer Agent. Upon the appointment of any subsequent transfer agent for the Common Stock, or any other shares of the Company’s capital stock issuable upon the exercise of the Warrants, the Company shall file with the Warrant Agent a statement setting forth the name and address of such subsequent transfer agent.

SECTION 3.15 Company to Provide and Maintain Warrant Agent. The Company agrees for the benefit of the Holders that there shall at all times be a Warrant Agent under this Agreement until all the Warrants have been exercised or cancelled or are no longer exercisable.

SECTION 3.16 Resignation and Removal. The Warrant Agent may at any time resign by giving written notice to the Company of such intention on its part, specifying the date on which its desired resignation shall become effective. The Warrant Agent under this Agreement may be removed at any time by the filing with it of an instrument in writing signed by or on behalf of the Company and specifying such removal and the date when it shall become effective. Any removal under this Section 3.16 shall take effect upon the appointment by the Company as hereinafter provided of a successor Warrant Agent (which shall be (a) a bank or trust company, (b) organized under the laws of the United States or one of the states thereof, (c) authorized under the laws of the jurisdiction of its organization to exercise corporate trust powers, (d) having a combined capital and surplus of at least $50,000,000 (as set forth in its most recent reports of condition published pursuant to law or to the requirements of any United States federal or state regulatory or supervisory authority) and (e) having an office in the Borough of Manhattan, The City of New York) and the acceptance of such appointment by such successor Warrant Agent.

SECTION 3.17 Company to Appoint Successor. If at any time the Warrant Agent shall resign, shall be removed, shall become incapable of acting, shall be adjudged bankrupt or insolvent or shall commence a voluntary case under the federal bankruptcy laws, as now or hereafter constituted, or under any other applicable federal or state bankruptcy, insolvency or similar law or shall consent to the appointment of or the taking possession by a receiver, custodian, liquidator, assignee, trustee, sequestrator (or other similar official) of the Warrant Agent or its property or affairs, or shall make an assignment for the benefit of creditors, or shall admit in writing its inability to pay its debts generally as they become due, or shall take corporate action in furtherance of any such action, or a decree or order for relief by a court having jurisdiction in the premises shall have been entered in respect of the Warrant Agent in an involuntary case under the federal bankruptcy laws, as now or hereafter constituted, or any other applicable federal or state bankruptcy, insolvency or similar law, or a decree or order by a court having jurisdiction in the premises shall have been entered for the appointment of a receiver, custodian, liquidator, assignee, trustee, sequestrator (or similar official) of the Warrant Agent or of its property or affairs, or any public officer shall take charge or control of the Warrant Agent or of its property or affairs for the purpose of rehabilitation, conservation, winding up or liquidation, a successor Warrant Agent, qualified as aforesaid, shall be appointed by the

-14-

Company by an instrument in writing, filed with the successor Warrant Agent. In the event that a successor Warrant Agent is not appointed by the Company, a successor Warrant Agent, qualified as aforesaid, may be appointed by the Warrant Agent or the Warrant Agent may petition a court to appoint a successor Warrant Agent. Upon the appointment as aforesaid of a successor Warrant Agent and acceptance by the successor Warrant Agent of such appointment, the Warrant Agent shall cease to be Warrant Agent under this Agreement;provided,however, that in the event of the resignation of the Warrant Agent under this Section 3.17, such resignation shall be effective on the earlier of (i) the date specified in the Warrant Agent’s notice of resignation and (ii) the appointment and acceptance of a successor Warrant Agent under this Agreement.

SECTION 3.18 Successor to Expressly Assume Duties. Any successor Warrant Agent appointed under this Agreement shall execute, acknowledge and deliver to its predecessor and to the Company an instrument accepting such appointment under this Agreement, and thereupon such successor Warrant Agent, without any further act, deed or conveyance, shall become vested with all the rights and obligations of such predecessor with like effect as if originally named as the Warrant Agent under this Agreement, and such predecessor, upon payment of its charges and disbursements then unpaid, shall thereupon become obligated to transfer, deliver and pay over, and such successor Warrant Agent shall be entitled to receive, all monies, securities and other property on deposit with or held by such predecessor, as the Warrant Agent under this Agreement.

SECTION 3.19 Successor by Merger. Any entity into which the Warrant Agent may be merged or consolidated, or any entity resulting from any merger or consolidation to which the Warrant Agent shall be a party, or any entity to which the Warrant Agent shall sell or otherwise transfer all or substantially all of its assets and business, shall be the successor Warrant Agent under this Agreement without the execution or filing of any paper or any further act on the part of any of the parties hereto;provided,however, that it shall be qualified as aforesaid.

ARTICLE IV

MISCELLANEOUS

SECTION 4.1 Notices. Any notice pursuant to this Agreement by the Company or by any Holder to the Warrant Agent, or by the Warrant Agent or by any Holder to the Company, shall be in writing and shall be delivered by facsimile transmission, or mailed first class, postage prepaid, (a) to the Company, at its offices at 500 Dallas Street, Suite 1000, Houston, Texas 77002, Attention: General Counsel, or (b) to the Warrant Agent, at its offices at 250 Royall Street, Canton, Massachusetts 02021, Attn. Corporate Actions Department. Each party to this Agreement may from time to time change the address to which notices to it are to be delivered or mailed by notice to the other party. Any notice mailed pursuant to this Agreement by the Company or the Warrant Agent to the Holders shall be in writing and shall be mailed first class, postage prepaid, or otherwise delivered, to such Holders at their respective addresses on the registry of the Warrant Agent.

-15-

SECTION 4.2 Supplements and Amendments. The Company and the Warrant Agent may from time to time supplement or amend this Agreement without the approval of any Holder in order to cure any ambiguity or to correct or supplement any provision contained in this Agreement that may be defective or inconsistent with any other provision in this Agreement, or to make any other provisions in regard to matters or questions arising under this Agreement that the Company and the Warrant Agent may deem necessary or desirable;provided,however, that no such supplement or amendment to this Agreement shall be made that adversely affects the interests or rights of any of the Holders in any respect. Notwithstanding the foregoing, a supplement or amendment to this Agreement may be made by one or more substantially concurrent written instruments duly signed by the Holders of a majority of the then outstanding Warrants and delivered to the Company;provided,however, that the consent of each Holder affected thereby shall be required for any amendment pursuant to which: (a) the Exercise Price would be increased or the Exercise Number would be decreased (in each case, other than pursuant to adjustments in accordance with Article II), (b) the time period during which the Warrants are exercisable would be shortened or (c) the antidilution provisions set forth in Article II would be changed in such a way as to adversely affect such Holder. In determining whether the Holders of the required number of outstanding Warrants have approved any supplement or amendment to this Agreement, Warrants owned by the Company or its controlled Affiliates, if any, shall be disregarded and deemed not to be outstanding.

SECTION 4.3 Successors. All the covenants and provisions of this Agreement by or for the benefit of the Company or the Warrant Agent shall bind and inure to the benefit of the respective successors and assigns of the Company or the Warrant Agent under this Agreement.

SECTION 4.4 Rights Offering. Prior to the Expiration Date, the Company shall not effect any rights offering for the sale of Common Stock to substantially all of the holders of Common Stock if the per share price payable in such rights offering is less than the Market Price on the trading day immediately prior to the pricing of such rights offering.

SECTION 4.5 Governing Law; Jurisdiction. THIS AGREEMENT AND EACH WARRANT ISSUED UNDER THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE, WITHOUT GIVING EFFECT TO PRINCIPLES OF CONFLICT OF LAWS. IN CONNECTION WITH ANY ACTION, SUIT OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE WARRANTS, THE PARTIES HERETO AND EACH HOLDER IRREVOCABLY SUBMIT TO THE EXCLUSIVE JURISDICTION OF ANY FEDERAL OR STATE COURT LOCATED WITHIN THE COUNTY OF WILMINGTON, STATE OF DELAWARE. NOTICE MAY BE SERVED UPON THE COMPANY AT THE ADDRESS SET FORTH IN SECTION 4.1 AND UPON ANY HOLDER AT THE ADDRESS FOR SUCH HOLDER SET FORTH IN THE REGISTRY MAINTAINED BY THE COMPANY OR WARRANT AGENT PURSUANT TO SECTION 1.7. TO THE EXTENT PERMITTED BY APPLICABLE LAW, EACH OF THE PARTIES HERETO AND EACH HOLDER HEREBY UNCONDITIONALLY WAIVES TRIAL BY JURY IN ANY LEGAL ACTION OR PROCEEDING RELATING TO THIS AGREEMENT OR THE WARRANTS.

-16-

SECTION 4.6 Benefits of this Agreement. This Agreement shall be for the sole and exclusive benefit of the Company, the Warrant Agent and the Holders. Nothing in this Agreement shall be construed to give to any Person other than the Company, the Warrant Agent and the Holders any legal or equitable right, remedy or claim under this Agreement.

SECTION 4.7 Counterparts. This Agreement may be executed in any number of counterparts, and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument.

SECTION 4.8 Table of Contents; Headings. The table of contents and headings of the Articles and Sections of this Agreement have been inserted for convenience of reference only, are not intended to be considered a part of this Agreement and shall not modify or restrict any of the terms or provisions of this Agreement.

SECTION 4.9 Severability. The provisions of this Agreement are severable, and if any clause or provision shall be held invalid, illegal or unenforceable in whole or in part in any jurisdiction, then such invalidity or unenforceability shall affect in that jurisdiction only such clause or provision, or part thereof, and shall not in any manner affect such clause or provision in any other jurisdiction or any other clause or provision of this Agreement in any jurisdiction.

SECTION 4.10 Availability of Agreement. The Warrant Agent shall keep copies of this Agreement and any notices given or received under this Agreement shall be made available for inspection by the Holders during normal business hours at its principal office in Massachusetts. The Company shall supply the Warrant Agent from time to time with such numbers of copies of this Agreement as the Warrant Agent may request.

SECTION 4.11 Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a business day, then such action may be taken or such right may be exercised on the next succeeding day that is a business day.

SECTION 4.12 Damages. Neither party to this Agreement shall be liable to the other party for any consequential, indirect, special or incidental damages under any provisions of this Agreement or for any consequential, indirect, penal, special or incidental damages arising out of any act or failure to act hereunder even if that party has been advised of or has foreseen the possibility of such damages.

SECTION 4.13 Confidentiality. The Warrant Agent and the Company agree that all books, records, information and data pertaining to the business of the other party, including personal, non-public warrant holder information, which are exchanged or received pursuant to the negotiation or the carrying out of the obligations under this Agreement including the fees for services set forth in the attached schedule shall remain confidential, and shall not be voluntarily disclosed to any other person, except as may be required by law or, as determined by the Company, the rules and regulations of any stock exchange, electronic trading network or trading platform applicable to the Company and/or the Warrants.

-17-

SECTION 4.14 Definitions. As used in this Agreement, the following terms having the meanings ascribed thereto below:

“Affiliate” means, with respect to any Person, any Person directly or indirectly controlling, controlled by or under common control with, such other Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”) when used with respect to any Person, means the possession, directly or indirectly, of the power to cause the direction of management and/or policies of such Person, whether through the ownership of voting securities by contract or otherwise.

“Agreement” has the meaning set forth in the preamble.

“Board of Directors” means the board of directors of the Company, including any duly authorized committee thereof.

“Book-Entry Warrant” means Warrants issued in book-entry registration in the books and records of the Warrant Agent.

“Business Combination” means a merger, consolidation, statutory share exchange or similar transaction that requires the approval of the Company’s stockholders.

“business day” means any day except Saturday, Sunday and (i) at any time when the Warrants are listed on the NASDAQ Stock Market or the New York Stock Exchange, any day on which the NASDAQ Stock Market or the New York Stock Exchange, as applicable, is authorized or required by law or other governmental actions to close or (ii) at any time when the Warrants are not listed on the NASDAQ Stock Market or the New York Stock Exchange, any day on which banking institutions in the State of New York are authorized or required by law or other governmental actions to close.

“Common Stock” has the meaning set forth in the recitals.

“Company” has the meaning set forth in the preamble.

“El Paso” has the meaning set forth in the recitals.

“Exchange Act” has the meaning set forth in Section 1.18.

“Exercise Number” has the meaning set forth in Section 1.3.

“Exercise Price” has the meaning set forth in Section 1.3.

“Expiration Date” has the meaning set forth in Section 1.4.

-18-

“Fair Market Value” means, with respect to any security or other property, the fair market value of such security or other property as determined by the Board of Directors, acting in good faith.

“Holder” and “Holders” has the meaning set forth in the recitals.

“Issue Date” means the date of this Agreement.

“Market Price” means, with respect to a particular security, on any given day, the last reported sale price regular way or, in case no such reported sale takes place on such day, the average of the last closing bid and ask prices regular way, in either case on the principal national securities exchange on which the applicable securities are listed or admitted to trading (the “Principal Exchange”), or if not listed or admitted to trading on any national securities exchange, the average of the closing bid and ask prices as furnished by two (2) members of the Financial Industry Regulatory Authority, Inc. selected from time to time by the Company for that purpose. “Market Price” shall be determined without reference to after hours or extended hours trading. If such security is not listed and traded in a manner that the quotations referred to above are available for the period required under this Agreement, the Market Price per share of Common Stock shall be deemed to be the fair market value per share of such security as determined in good faith by the Board of Directors in reliance on an opinion of a nationally recognized independent investment banking corporation retained by the Company for such purpose;provided,however, that if any such security is listed or traded solely on a non-U.S. market, such fair market value shall be determined by reference to the closing price of such security as of the end of the most recently ended business day in such market prior to the date of determination;provided,further, that if making such determination requires the conversion of any currency other than U.S. dollars into U.S. dollars, such conversion shall be done in accordance with customary procedures based on the rate for conversion of such currency into U.S. dollars displayed on the relevant page by Bloomberg L.P. (or any successor or replacement service) on or by 4:00 p.m., New York City time, on such exercise date. For the purposes of determining the Market Price of the Common Stock on the “trading day” preceding, on or following the occurrence of an event, (i) that trading day shall be deemed to commence immediately after the regular scheduled closing time of trading on the Principal Exchange or, if trading is closed at an earlier time, such earlier time and (ii) that trading day shall end at the next regular scheduled closing time, or if trading is closed at an earlier time, such earlier time (for the avoidance of doubt, and as an example, if the Market Price is to be determined as of the last trading day preceding a specified event and the closing time of trading on a particular day is 4:00 p.m. and the specified event occurs at 5:00 p.m. on that day, the Market Price would be determined by reference to such 4:00 p.m. closing price).

“Merger Agreement” has the meaning set forth in the recitals.

“Notice of Exercise” has the meaning set forth in Section 1.1.

-19-

“Ordinary Cash Dividends” means a regular quarterly cash dividend on shares of Common Stock legally available therefor;provided,however, that Ordinary Cash Dividends shall not include any cash dividends paid subsequent to the Issue Date to the extent the aggregate per share dividends paid on the outstanding Common Stock in any quarter exceed (i) $0.50 per share of Common Stock in any quarter during the fiscal year ended December 31, 2012, (ii) $0.60 per share of Common Stock in any quarter during the fiscal year ended December 31, 2013, (iii) $0.70 per share of Common Stock in any quarter during the fiscal year ended December 31, 2014, (iv) $0.80 per share of Common Stock in any quarter during the fiscal year ended December 31, 2015, (v) $0.90 per share of Common Stock in any quarter during the fiscal year ended December 31, 2016 and (vi) $1.00 per share of Common Stock in any quarter during the fiscal year ended December 31, 2017, in each case, as adjusted for any stock split, stock dividend, reverse stock split, reclassification or similar transaction.

“Per Share Fair Market Value” has the meaning set forth in Section 2.3.

“Person” has the meaning given to it in Section 3(a)(9) of the Exchange Act and as used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act.

“Pro Rata Repurchase” means any purchase of shares of Common Stock by the Company or any Affiliate thereof pursuant to (i) any tender offer or exchange offer made to substantially all holders of Common Stock subject to Section 13(e) or 14(e) of the Exchange Act or Regulation 14E promulgated thereunder or (ii) any other offer available to substantially all holders of Common Stock, in the case of both (i) and (ii), whether for cash, shares of Common Stock of the Company, other securities of the Company, evidences of indebtedness of the Company or any other Person or any other property (including, without limitation, shares of Common Stock, other securities or evidences of indebtedness of a subsidiary), or any combination thereof, effected while any Warrants are outstanding. The “Effective Date” of a Pro Rata Repurchase shall mean the date of acceptance of shares for purchase or exchange by the Company under any tender or exchange offer which is a Pro Rata Repurchase or the date of purchase with respect to any Pro Rata Repurchase that is not a tender or exchange offer.

“Registered Holder” means any registered holder of Book-Entry Warrants or Warrant Certificates in the Warrant Registry.

“Subsidiary” means any corporation, limited liability company, partnership, association, trust or other entity the accounts of which would be consolidated with those of such party in such party’s consolidated financial statements if such financial statements were prepared in accordance with U.S. GAAP, as well as any other corporation, limited liability company, partnership, association, trust or other entity of which securities or other ownership interests representing more than 50% of the equity or more than 50% of the ordinary voting power (or, in the case of a partnership, more than 50% of the general partnership interests or, in the case of a limited liability company, the managing member) are, as of such date, owned by such party or one or more Subsidiaries of such party or by such party and one or more Subsidiaries of such party. The term “Subsidiary” shall include Kinder Morgan Energy Partners, L.P.

-20-

“trading day” means (i) if the shares of Common Stock are not traded on any national or regional securities exchange or association or over-the-counter market, a business day or (ii) if the shares of Common Stock are traded on any national or regional securities exchange or association or over-the-counter market, a business day on which such relevant exchange or quotation system is scheduled to be open for business and on which the shares of Common Stock (x) are not suspended from trading on any national or regional securities exchange or association or over-the-counter market for any period or periods aggregating one half hour or longer; and (y) have traded at least once on the national or regional securities exchange or association or over-the-counter market that is the primary market for the trading of the shares of Common Stock. The term “trading day” with respect to any security other than the Common Stock shall have a correlative meaning based on the primary exchange or quotation system on which such security is listed or traded.

“U.S. GAAP” means United States generally accepted accounting principles.

“Warrant” and “Warrants” has the meaning set forth in the recitals.

“Warrant Agent” has the meaning set forth in the preamble.

“Warrant Certificate” and “Warrant Certificates” has the meaning set forth in Section 1.1.

“Warrant Registry” has the meaning set forth in Section 1.7.

“Warrant Statement” and “Warrant Statements” has the meaning set forth in Section 1.1.

“Warrant Share” and “Warrant Shares” has the meaning set forth in Section 1.3.

[Signature page follows]

-21-

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed, all as of the day and year first above written.

| | |

| KINDER MORGAN, INC. |

| |

| By: | | /s/ Joseph Listengart |

| | Name: Joseph Listengart Title: Vice President |

| | |

| COMPUTERSHARE INC. |

| |

| By | | /s/ Thomas Borbely |

| | Name: Thomas Borbely Title: Manager, Corporate Actions |

| | |

| COMPUTERSHARE TRUST COMPANY, N.A., |

| |

| By: | | /s/ Thomas Borbely |

| | Name: Thomas Borbely Title: Manager, Corporate Actions |

[Signature Page to the Warrant Agreement]

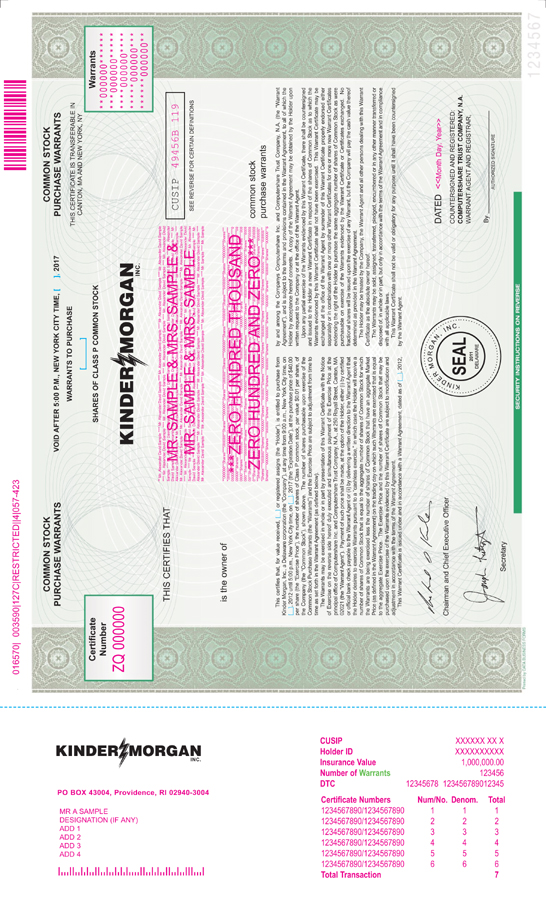

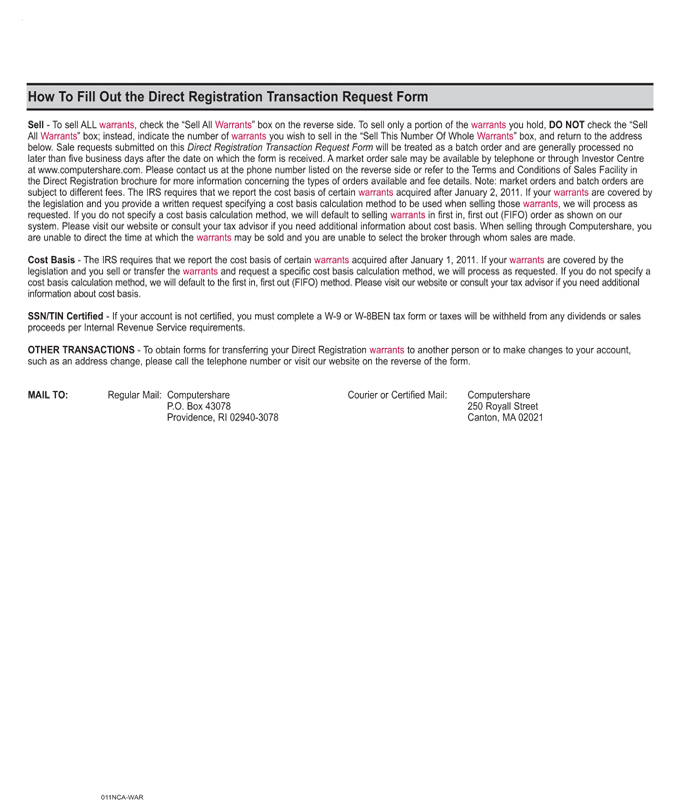

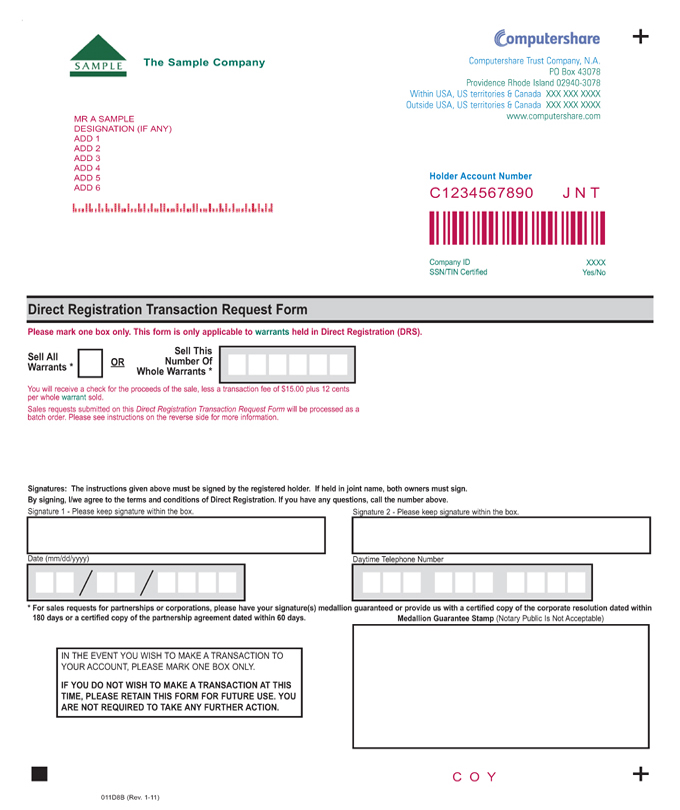

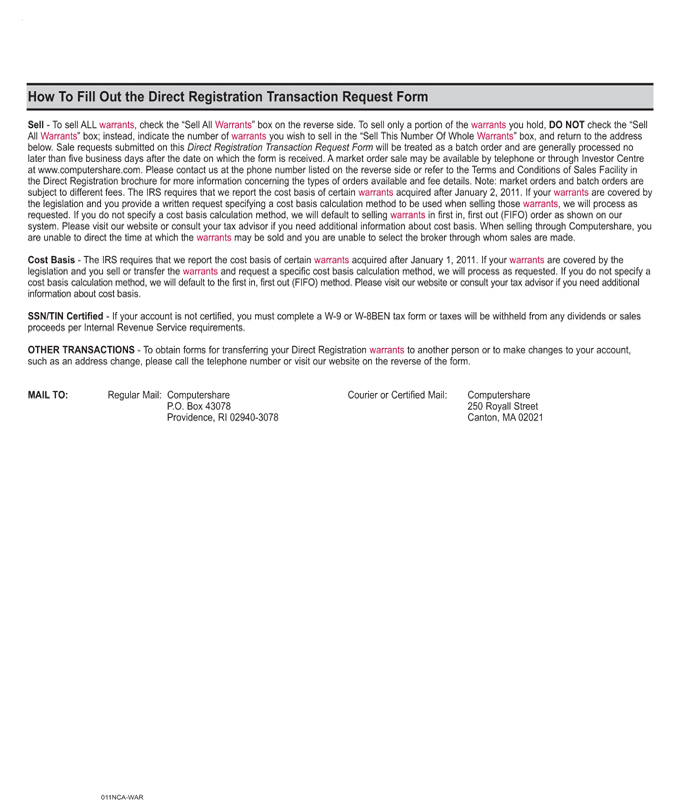

EXHIBIT A

FORM OF WARRANT CERTIFICATE

(See Attached)