Washington, D.C.

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Breath eCig Corp.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock as of the last practical date: 276,352,667 shares of common stock, $0.001 par value as of April 6, 2015.

None.

Table of Contents

Corporate History

Breathe eCig Corp. is a Nevada corporation organized June 2, 2006. Our original name was Celtic Capital, Inc. On October 20, 2008, we changed our name to Entertainment Education Arts Inc. On May 12, 2010, we changed our name to DNA Precious Metals, Inc. On March 5, 2015 pursuant to an agreement and plan of merger, the Company changed its name to Breathe eCig Corp. (Breathe eCig Corp. may also be referred to as “Breathe”, “we”, “us” or the “Company”)

From May 2010 through December 31, 2014, we were an exploration stage mining company. The Company’s focus was the development of the the Montauban Mining Project, located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (“Montauban Mine Property” or “Property”). Recognizing the need to secure significant additional capital to put the Property into production, management began to focus its attention on other business opportunities which would not require the significant capital required to expand the Property. In furtherance thereof, on January 16, 2015 the Company entered into a share exchange agreement with Breathe LLC, a Tennessee limited liability company, whereby the Company acquired all of the issued and outstanding membership interests in Breathe LLC in consideration for the issuance of 150,000,000 shares of the Company’s common stock to the members of Breathe, LLC

In connection with the acquisition of Breath LLC, on March 5, 2015 we entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Company merged with its wholly owned subsidiary, Breathe eCig Corp., the sole purpose of the Merger was to effect a change of the Company's name from DNA Precious Metals, Inc. to Breathe eCig Corp. This name change more accurately reflects the Company’s current operations.

With the acquisition of Breathe LLC, it was contemplated that the Company would spin-off the operations of its mining operations which were being conducted through the Company’s wholly owned subsidiary, DNA Canada, Inc (“DNAC”). Effective February 3, 2015, we declared a stock dividend whereby each of the Company’s shareholders on the record date (February 3. 2015) would receive one share of DNAC for every two shares of the Company’s common stock owned on the record date.

On February 3, 2015, the Company declared a stock dividend of its wholly owned subsidiary, DNA Canada, Inc. (“DNAC”) to the shareholders of record on February 3, 2015 whereby each shareholder of record received one share of DNAC for every two shares of DNA owned as of the record date. The former members of Breathe LLC tendered their shares of DNAC for redemption by the Company.

With the completion of the spin-off, the Company is no longer in the mining field and its sole and exclusive business operations will be marketing its electronic cigarettes and related vapor devices.

Our Operations during the Fiscal Year ended December 31, 2014.

The following discussion does not include a material change in our business which occurred with the acquisition of Breathe LLC following our year end. We are no longer an exploration stage mining company nor do we have any interest in any mining operations. The following discussion relates to our operations during 2014. We are no longer in the mining field. To better understand our current operations you are urged to review the business description disclosed under the heading “Subsequent Events”.

During 2014 we were an exploration stage mining company whose business objective was to identify proven reserves of gold and silver, construct a mill, build out the Property’s infrastructure and place the mine into production. The Montauban Mining Project is located in the Montauban and Chavigny townships near Grondines-West in Portneauf County, Quebec, Canada (“Montauban Mine Property” or “Property”). The Montauban Mine Property does not contain any known ore reserves according to the definition of ore reserves under Industry Guide 7 promulgated by the Securities and Exchange Commission (“SEC”). Further work is required on the Property before a final determination as to the economic and legal feasibility of a mining venture can be made. There is no assurance that a commercially viable deposit will be proven through our exploration efforts. The funds expended on our properties may not be successful in leading to the delineation of ore reserves that meet the criteria established under SEC guidelines.

THE PROPERTY

The Property is composed of 122 mining claims, a mining lease and mining concession totaling 4183 hectares located in the Montauban-les-Mines sector of the Notre-Dame-de-Montauban municipality, in the Montauban Township, Portneuf County, Province of Quebec, Canada. The Property is located 120 km east of Quebec City and 80 km north of Trois-Rivières. The Property is located one kilometer west of Montauban-les-Mines with multiple land accesses. Manpower, water and electric power are easily available within the very same distance.

Mining Claims Previously Acquired

The Company acquired ten (10) mining claims, which became fifteen (15) mining claims under new government regulations, on June 9, 2011 through the issuance of 5,000,000 common shares with a valuation of $15,000. The mining claims are located in the Montauban and Chavigny townships near Grondines-West in the Portneuf County of Quebec, Canada (“Montauban Mine Property” or “Property”).

On October 30, 2013 and November 27, 2013, the Company entered into binding agreements for the asset acquisitions of an undivided one hundred percent (100%) interest in certain mineral claims and mining assets located in the Province of Quebec’s Montauban and Chavigny townships near Grondines West, in the county of Portneuf, specifically Mining Lease BM 748 and Mining Concession Miniere CM 410. The purchase price was CDN$75,000 together with the issuance of 1,050,000 common shares of the Company. The common shares for the acquisition were valued at their fair market value on the day they were issued which totaled $496,860. In connection with the asset purchase, the Company also issued 40,000 shares of common stock to a former supplier of the vendor for mining related information of the assets purchased valued at $20,000 along with cash consideration of CDN$20,000. The total cost of the acquisition amounted to $612,431. The Company had been awaiting confirmation of the contemplated transaction from a bankruptcy court in Montreal, Quebec over viewing the financial restructuring of the vendor. The bankruptcy court approved the transaction on April 17, 2014 and has been included in mining rights on the consolidated balance sheet as at June 30, 2014.

On January 10, 2014, the Company entered into an asset purchase agreement for an undivided one hundred percent (100%) interest in certain mineral claims located in the Province of Quebec’s Montauban and Chavigny townships near Grondines West, in the county of Portneuf, including claims, rights, concessions and leases.

The purchase price was CDN$70,000, 1,000,000 common shares of the Company and a one percent (1%) net smelter return (“NSR”). The Company paid CDN$10,000 upon the signing of the asset purchase agreement with the cash balance due, along with the common shares, upon the closing of the asset purchase agreement and transfer of the mineral claims in the name of the Company. The transfer of the mineral claims was completed in February 2014 whereby the remaining cash balance due and the common shares were released to the vendor. The common shares for the acquisition will be valued at their fair market value on the day they were issued which totaled $340,000. The total cost of the acquisition amounts to $403,840.

On April 14, 2014, the Company entered into an asset purchase agreement for an undivided one hundred percent (100%) interest in fifty seven (57) mining claims located in the Province of Quebec’s Montauban and Chavigny townships near Grondines West, in the county of Portneuf. The purchase price was CDN$5,000 (U.S. $4,547). The transfer of the mining claims has been completed by the Province of Quebec in the name of the Company.

There are mining residues, or tailings, (“Montauban Tailings”) located on the Montauban Property which are considered by the Quebec Provincial Government as toxic wastes. There are no environmental liabilities as such to our Company. However, the Company will have to obtain the necessary permits from the Quebec Government Authorities to realize any further fieldwork having an impact on the environment, especially if re-mobilization of mining residues is contemplated.

DRILLING SUMMARY

A systematical sampling program was developed to provide an accurate and homogeneous grid of data to estimate the Montauban Tailings potential. A 24-hole percussion drilling campaign was performed totaling 143.1 meters. This percussion drilling campaign was considered part of completing a previous 25-hole drilling campaign performed earlier. A total of 49 holes totaling 302.3 meters of drilling were completed. No proven or indicated reserves were identified.

PROPERTY DESCRIPTION AND LOCATION

The Property is composed of 122 mining claims, a mining lease and mining concession totaling 4183 hectares located in the Montauban-les-Mines sector of the Notre-Dame-de-Montauban municipality, in the Montauban Township, Portneuf County, Province of Quebec, Canada. The Property is located 120 km east of Quebec City and 80 km north of Trois-Rivières. The Property is located one kilometer west of Montauban-les-Mines with multiple land accesses. Manpower, water and electric power are easily available within the very same distance

ACCESS, CLIMATE, LOCAL INFRASTRUCTURES AND PHYSIOGRAPHY

The Montauban municipality is accessible by route 363 from highway 40 linking Quebec City (120 km to the east) and Trois-Rivières (80 km to the southeast). Access to railway is also available less than 10 km to the northeast in Notre-Dame-des-Anges. The Montauban Mine Property is located one kilometer west of Montauban-les-Mines with multiple land accesses.

Manpower, water and electric power are easily available within one-kilometer distance from the Montauban-les-Mines village. The region is rural, most of the farmers growing potatoes and corn. The equipment and personnel specialized in quarries are available within a 30 km radius from the Montauban Tailings in the surrounding municipalities (Notre-Dame-de-Montauban, St-Ubalde, Lac-aux-Sables, St-Casimir, St-Marc-des-Carrières and Ste-Thècle).

The area’s physiography is characterized by argilitic and sandy plateaus forming the foothills of the Laurentides. The Montauban Mine Property is limited to the North West by the Batiscan River, which is the main effluent in the area draining most of the Property towards the south to the St-Lawrence River. The topography consists of numerous small hills reaching an altitude of up to 220 m above the sea level from the valleys standing in average at 160 m elevation.

GEOLOGY

Regional geology consists of three main rock groups: the basement crust, the supracrustal rocks and the intrusive rocks which were respectively identified as the Mekinac Group, the Montauban Group and the La Bostonnais Complex.

The Montauban Group is composed of Helikian supracrustal rocks. Those are various gneiss, quartzites, amphibolites, metabasalts and calcosilicated rocks reaching less than 2 kilometers in thickness. The Montauban deposit is located in the upper part of this unit.

The Montauban Group is bordered to the East by the La Bostonnais Complex, an intrusive rocks complex formed of basic, tonalitic and felsic igneous rocks. To the West, the Montauban Group is in contact with the Mekinac Group mostly composed of charnockitic migmatites.

The Montauban Deposit is a three-kilometer long mineralized formation with a geology that is fairly complex being located within an extensively folded sequence of amphibolite facies rocks that are sandwiched between intrusions of granodioritic to gabbroic composition. In the mine area, these metamorphic rocks strike roughly North-South and dip ±60° to the East and consist of migmatitic biotite gneiss, amphibolite, quartzofeldspathic biotite gneiss and quartzite.

MINERALIZATION

The base metal mineralization found in Montauban is massive to semi-massive sulphides, coarsely grained and mostly composed of sphalerite, galena, pyrrhotite, pyrite and chalcopyrite with minor quantities of cubanite, tetrahedrite and molybdenite.

The gold bearing mineralization is marginal and consists of disseminated pyrrhotite, galena, sphalerite and chalcopyrite with a large range of minor sulphides, sulphosalts and native minerals.

MONTAUBAN TAILINGS

The Montauban Mine Property covers a total area of 53,093 m² and amounts to a total volume of 250,750 m³. Since this volume is composed of tailings and that the water table is located within most of the blocks derived from each hole, the specific gravity of the material had to be evaluated to estimate the tonnage that is present on site.

Montauban Mine Property View Looking South

DRILLING RESULTS

The distribution of metals within the tailings is not homogeneous. It was demonstrated with the 49 holes drilled on the Montauban Mine Property that recoveries dropped from 81 to less than 64 % below the 4,6 m (15 ft.) horizon, which is more or less the location of the water table within the Tailings. The impact is seen on metal content when gold is 67 % richer over this horizon, silver is up 73 %, Copper also up 63 %, and the winner being lead with a jump of 149 %. The only one being evenly distributed is zinc.

MILL CONSTRUCTION

We are constructing a mill to process mining residues. Our focus was to produce gold and silver concentrate in addition to the mica product. By extracting mica and producing the gold and silver concentrate, we will reduce the sulphide content of the tailings and thus lowering the environmental impact and cost for the project closure at the end of the operation.

The on-site mill production equipment to be constructed and installed will incorporate cyanization circuit and separation equipment consisting of spiral classifiers and Nelson concentrators in addition to other equipment. Test work to date has indicated that this configuration will effectively segregate the mica and produce a gold/silver concentrate.

To keep expenditures as low as possible, we use refurbished milling equipment when possible. Our larger expenses include the mill building, electrical distribution, pumps, pipe valves, spiral classifiers, Nelson concentrators, table separator, trommel, loader and a conveyor.

PROPERTY DEVELOPMENT

The Company has completed construction of all access roads to and from the new milling facility. The hydropower source to the milling facility totaling 1.3 kilometers has been completed. The main power line consists of 2,500 amperes total output power and has been brought inside the newly erected 16,000 sq/ft. steel structure building.

We have also secured the necessary mining permits. The two (2) Certificates of Authorization issued to us will allow for the construction and installation of equipment facilities to recuperate mica (phlogorite) and precious metals (gold and silver) from the mining residues (tailings) located on the Montauban Mine Tailings.

Total mining rights as of December 31, 2014 and 2013 were $1,035,818 and $15,000, respectively.

DNA CRYTO CORP.

On June 20, 2014, DNA Crypto Corp. (“DNAC”), a wholly-owned subsidiary of DNA Precious Metals, Inc., signed a definitive Asset Purchase Agreement with Lynx Mining LLC, a Texas limited liability company (“Lynx”), whereby DNAC acquired the assets of Lynx, being its intellectual property rights. On September 15, 2014 we terminated for cause the Asset Purchase Agreement.

SUBSEQUENT EVENTS

Breathe Acquisition and Spin-off of DNA Canada, Inc.

On January 16, 2015 the Company entered into a share exchange agreement with Breathe LLC, a Tennessee limited liability company, whereby the Company acquired all of the issued and outstanding membership interests in Breathe LLC in consideration for the issuance of 150,000,000 shares of the Company’s common stock to the members of Breathe, LLC

As a result of the transaction effected by the Exchange Agreement, at closing Breathe LLC. became a wholly owned subsidiary of the Company, with the former Breathe LLC members owning approximately 56% of the then issued and outstanding common stock of the Company.

The operations of Breathe:

ABOUT BREATHE SMART CIGARETTE

Breathe, LLC was formed in October 2013 and Breathe eCigs. Corp. was formed on December 31, 2014. On December 31, 2014, Breathe, LLC entered into a Bill of Sale to transfer 100% of the assets to Breathe eCigsCorp.

Since formation, Breathe has operated as a development stage company, with the intentions of designing marketing and distributing electronic cigarettes (“E-cigarettes”), vaporizers, e-liquids (i.e., liquid nicotine) and related accessories. As of December 31, 2014 Breathe had no revenues and limited assets.

E-cigarettes and vaporizers are replacements for traditional cigarettes allowing smokers to reproduce the smoking experience. Although they do contain nicotine, E-cigarettes and vaporizers do not burn tobacco and are not smoking cessation devices.

Breathe’s initial line of products will focus on E-cigarettes. The present day E-Cigarette is a smokeless, battery-powered device that vaporizes liquid nicotine for delivery via inhalation by the user. The E-Cigarette does not contain tobacco, only nicotine derived from the tobacco plant and trace amounts of secondary chemical ingredients. The component parts of an E-Cigarette are the nicotine cartridge; the atomizer (which vaporizes the liquid nicotine); the rechargeable battery that powers it; and a light-emitting diode (LED) indicator at the end that is activated when the user draws in air (collectively referred to as the “Component Parts”). Breathe will partner with manufacturers in the United States who will be responsible for producing the liquid nicotine filling the nicotine cartridge with liquid nicotine; thereby ensuring a safe and high standard process for producing a consumer product.

Market Opportunity For E-Cigarettes

Breathe operates within the rapidly growing and global e-cigarette industry, an emerging product category that is taking market share from the $783 billion global tobacco industry. The American Cancer Society estimates that there are 1.3 billion tobacco smokers in the world, consuming approximately 6 trillion cigarettes per year, or 190 thousand cigarettes per second. Tobacco use is the leading cause of preventable illness and death, causing more than 5 million annual deaths across the globe according to the CDC. We believe e-cigarettes offer an alternative for current smokers of traditional cigarettes.

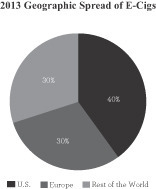

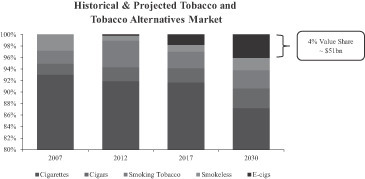

Still in the early stages of its market penetration, the e-cigarette industry is highly fragmented with approximately 250 brands worldwide according to the CDC. Primarily propelled by the cannibalization of the traditional tobacco industry, the global e-cigarette industry has recently experienced dramatic growth. According to Euromonitor, e-cigarettes accounted for approximately $3.5 billion in 2013 global retail sales, with approximately 40% of sales generated in the U.S., 30% of sales generated in Europe, and 30% of sales generated in the rest of the world. Euromonitor estimated that significant market growth was achieved from 2012 to 2013 with the U.S., Europe and the rest of the world generating growth rates of 180%, 160%, and 150%, respectively. Euromonitor also projects e-cigarette sales to represent approximately $51 billion, or 4% of the global tobacco and tobacco alternatives market by 2030. We believe that we are well positioned to benefit from, and take advantage of, these attractive market trends in the coming years.

Source: Euromonitor International 2013.

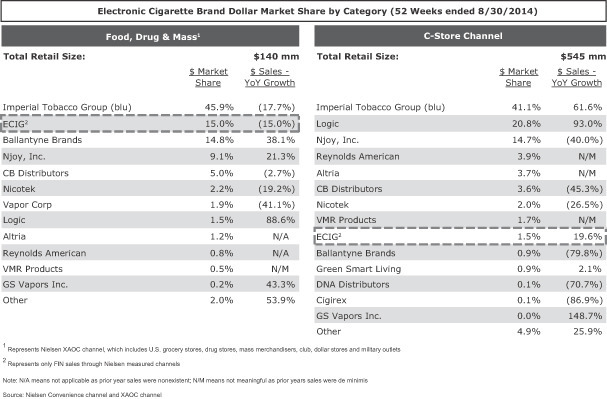

Below is a table presenting the market shares in the United States of various e-cigarette brands for the 52 weeks ended August 30, 2014:

BUSINESS STRATEGY

Breathe’s strategic goal is to profitably expand its operations. The business strategies employed by Breathe to achieve this goal are defined succinctly through the Company’s mission statement of creating Socially Responsible Innovation in the E-Cigarette and Vaporizer industries and by fulfilling the following objectives:

| | ● | Building a strong brand through a concentration of operational focus on the design, market and distribution of exceptional quality electronic cigarettes and vaporizers. |

| | ● | Specializing in the development of great tasting proprietary organic and naturally flavored e-liquids with nicotine from Tennessee-sourced Tobacco plants. |

| | ● | Exceptional Packaging – The Company’s high-end products will comprise high quality packaging, unique and customizable labeling for specific customers and retailers. |

| | ● | Age Verification A commitment to verifying and ensuring that all Breathe customers are at least 21 years old, through specific product labeling and marketing efforts focused on the adult population age 21 and older. |

| | ● | Environmentally Conscious Production and Disposal Process A commitment to establishing an environmentally aware production and disposal process, which shall include a special recycling program for eligible retailers where (a) said retailers will be provided with a self-mailer option to ship expended lithium batteries and other recyclables to a designated facility and (b) where proceeds from these eligible recyclables will then be shared with the respective retailers. |

| | ● | Developing Our Organizational Capability Continuing to develop our organizational capability through recruiting, retaining and rewarding highly capable people and through performance management. |

| | ● | Pursuing Growth Opportunities Focusing on pursuing growth opportunities after launching our current product offerings and seeking brands, other products, and partnerships to complement our high-end quality products. |

| | ● | Maximizing our financial performance Continuing to drive our business activities to deliver improved financial performance. |

| | ● | Developing a global distribution platform with the emphasis of serving customers throughout the entire world. |

License to Intellectual Property and Brand Portfolio

Breathe has the exclusive licensing rights to sell the following product lines:

| | ● | Mini e-cigarette Pack – a standard e-cigarette pack designed for vending machines and convenience stores. |

| | ● | Original non CP – a standard rechargeable single unit without the child protective device. |

| | ● | Original with CP - a standard rechargeable single unit with the child protective device. |

| | ● | Smart e-cigarette PCC – Smart e-cigarette carrying case, 2 rechargeable mini-e-cigarettes with 5cartridges and iPhone chargeable connections. |

| | ● | 5 Pack mini Ref – 5 mini cartridges for the mini size e-cigarette. |

| | ● | 5 pack Standard Ref – 5 refillable cartridges for the mini-size e-cigarettes. |

Pricing, Sales Model; e-Commerce and Retail

Breathe plans to offer its Products at prices, determined based on pricing strategies that are developed by the Company from time to time and which management believes to be best suited to achieve the Company’s goals at such time. These pricing strategies are expected to be developed based on a number of factors, including the needs and behaviors of customers, purchase volumes, market specific criteria, and the Company’s costs of goods.

The price of the brand portfolio of products are broken down as follows, with prices varying based on product type and distribution channel (e-commerce vs. retail):

| Product | Mini e-Cig Pack | Original non CP | Original with CP | Smart E-Cig PCC | 5 Pack mini Ref. | 5 pack Standard Ref. |

E-Commerce Price | 19.95 | 19.95 | 19.95 | 38.00 | 19.95 | 19.95 |

| Retail Price | 10.00 | 10.00 | 10.50 | 25.00 | 10.50 | 10.50 |

| | | | | | | |

Management believes that the elegant design of the packaging, along with high quality products which feature excellent tasting, proprietary and handcrafted flavors justifies the costs and increases the margins.

Production and Supply for e-cigarette Lines

The launch of a new E-Cigarette line involves input from many different sources, from the manufacturer to the customer.

The stages of the development, manufacturing, production and distribution process of the E-cigarette can be summarized as follows:

| ● | Discussions with designers and creators (includes analysis and factory trends, target clientele and market communication); |

| ● | Produce mock-ups for final acceptance of unit device, packaging and flavoring; |

| ● | Receive bids from component suppliers; |

| ● | Schedule production and packaging; |

| ● | Issue component part purchase orders; |

| ● | Follow quality control procedures for incoming components; |

| ● | Follow packaging and inventory control procedures; |

| ● | Engage U.S. based FDA certified e-liquid manufacturer to produce and fill nicotine cartridges after receiving Component Parts; and |

| ● | Production specialists who carry out packaging or logistics for storage, order preparation and shipment. |

Procurement and Distribution

In launching E-Cigarette lines, the Company must be able to coordinate procuring the Component Parts, manufacturing the product, packaging the product, storage, distribution and order processing. The Company has been in discussions with a Canadian-based and Chinese based manufacturer who will produce the pen devices. The Company has been in discussions with a U.S. based manufacturer who will produce the e-liquids and who will also fill the cartridges with the e-liquids, which in turn will allow all of the Company’s consumables to be U.S. oriented. Therefore, after the pen devices are manufactured overseas, the e-liquid filled cartridges will be inserted in the U.S. and ready for distribution.

The Company has been in discussions with a distribution center and warehouse located in Knoxville, TN who will procure the component goods from the manufacturers and other suppliers, package the Company’s products for distribution, manage purchase orders and the electronic data interchange.

Additionally, the distribution partner, under the supervision of the Company’s leadership, will be responsible for negotiate pricing and payment terms with suppliers, manufacture and package the products and coordinate payment to the suppliers.

Finally, the Company’s experienced leadership team will be responsible for all component costs, transportation, assembly costs and a management fee paid to the Distribution and Manufacturer.

Market Opportunity

The e-cigarette industry is booming – approximately 3.5 million Americans regularly use e-cigarettes, according to a 2013 study done by Mary Diduch. The Centers for Disease Control show that e-cigarette use quadrupled in a single year from 2009 to 2010. Based on 2011 numbers alone, 21% of adult smokers in the United States have used e-cigarettes, 6% of all adults have tried e-cigarettes, and general awareness of e-cigarettes rose to 60% of all adults, up from 40% from 2010 according to a 2013 study published by the CDC. The co-founder of the Tobacco Vapor Electronic Cigarette Association stated in March 2012 that nearly 20 million e-cigarette cartridges are sold in the United States, per week.

Moreover, there is currently a favorable regulatory environment with certain federal, local and state regulation focused at advertising, age verification and use bans in public areas.

Marketing and Growth Strategies

In order to increase brand awareness, the Company began to focus its marketing initiatives and efforts through the development of a proprietary system that has accumulated over 20 million individuals that have the potential to see very advertisement and social media post produced by the Company. In addition to hosting a secure web portal, www.breathecig.com, that promotes the Company’s products and will handle orders, the Company has also been marketed on major social media platforms: LinkedIn, Facebook, Twitter, Instagram, Google and Pinterest. Because of this successful initial marketing effort:

| | ● | The Company has already received hundreds of requests for more information on its products. |

| | ● | These initial efforts have been cost effective and have not involved a substantial drive to promote sales. |

| | ● | The Company’s website has received over 600,000 visitors during the last 18 months. |

| | ● | The Company has received numerous requests from customers interested in purchasing Breathe’s products including but not limited to major retail groups, Hotel Chains, Restaurants and Club Owners. |

Retail and Wholesale Distribution:

The Company is developing unique and distinct brands for its E-cigarette Products for purposes of marketing and selling such branded E-cigarette Products, initially in North America, China, Africa, and Europe, through retail and wholesale distribution channels, including convenience stores, retail chains, wholesale trade, pharmacies, gas stations, hotels, industrial customers, clubs, casinos and duty free stores.

In addition, the Company intends to enter into exclusive agreements with various distributors providing them with exclusivity on certain brands of Product in defined territories and markets worldwide.

E-Commerce:

The Company intends to distribute its branded Products through its website, www.breathecig.com, and other online sales platforms. Through its e-commerce sales initiatives, the Company hopes to generate recurring purchases of its exclusive brands of E-cigarettes from customers who are legally allowed to purchase cigarettes in the United States and other regions. Management expects that its marketing strategy will include various forms of social media as a key element in its marketing strategies and in further establishing and growing the Company’s business.

White Label/Private Brand Distribution:

The Company is actively pursuing opportunities and relationships to develop and offer its Products on a “white label”, private branded basis. Management of the Company believes that there is an opportunity to supply Products on a custom branded basis to a variety of customers for purposes of resale. These potential customers may include wholesale and retail customers that have or wish to develop a private customizable label.

Government Regulations

A recent United States Federal Court decision permits the United States Food and Drug Administration to regulate electronic cigarettes as “tobacco products” under the Family Smoking Prevention and Tobacco Control Act of 2009 and the United States Food and Drug Administration has indicated that it intends to do so.

Based on the December 2010 U.S. Court of Appeals for the D.C. Circuit’s decision in Sottera, Inc. v. Food & Drug Administration, 627 F.3d 891 (D.C. Cir. 2010), the United States Food and Drug Administration (the “FDA”) is permitted to regulate electronic cigarettes as “tobacco products” under the Family Smoking Prevention and Tobacco Control Act of 2009 (the “Tobacco Control Act”).

Under this Court decision, the FDA is not permitted to regulate electronic cigarettes as “drugs” or “devices” or a “combination product” under the Federal Food, Drug and Cosmetic Act unless they are marketed for therapeutic purposes.

Because we do not market our electronic cigarettes for therapeutic purposes, our electronic cigarettes are subject to being classified as “tobacco products” under the Tobacco Control Act. The Tobacco Control Act grants the FDA broad authority over the manufacture, sale, marketing and packaging of tobacco products, although the FDA is prohibited from issuing regulations banning all cigarettes or all smokeless tobacco products, or requiring the reduction of nicotine yields of a tobacco product to zero. Among other measures, the Tobacco Control Act (under various deadlines):

| | ● | Increases the number of health warnings required on cigarette and smokeless tobacco products, increases the size of warnings on packaging and in advertising, requires the FDA to develop graphic warnings for cigarette packages and grants the FDA authority to require new warnings; |

| | ● | Requires practically all tobacco product advertising to eliminate color and imagery and instead consist solely of black text on white background; |

| | ● | Imposes new restrictions on the sale and distribution of tobacco products, including significant new restrictions on tobacco product advertising and promotion as well as the use of brand and trade names; |

| | ● | Bans the use of “light,” “mild,” “low” or similar descriptors on tobacco products; |

| | ● | Gives the FDA the authority to impose tobacco product standards that are appropriate for the protection of the public health (by, for example, requiring reduction or elimination of the use of particular constituents or components, requiring product testing, or addressing other aspects of tobacco product construction, constituents, properties or labeling); |

| | ● | Requires manufacturers to obtain FDA review and authorization for the marketing of certain new or modified tobacco products; |

| | ● | Requires pre-market approval by the FDA for tobacco products represented (through labels, labeling, advertising, or other means) as presenting a lower risk of harm or tobacco-related disease; |

| | ● | Requires manufacturers to report ingredients and harmful constituents and requires the FDA to disclose certain constituent information to the public; |

| | ● | Mandates that manufacturers test and report on ingredients and constituents identified by the FDA as requiring such testing to protect the public health, and allows the FDA to require the disclosure of testing results to the public; |

| | ● | Requires manufacturers to submit to the FDA certain information regarding the health, toxicological, behavioral or physiologic effects of tobacco products; |

| | ● | Prohibits use of tobacco containing a pesticide chemical residue at a level greater than allowed under federal law; |

| | ● | Requires the FDA to establish “good manufacturing practices” to be followed at tobacco manufacturing facilities; |

| | ● | Requires tobacco product manufacturers (and certain other entities) to register with the FDA; and |

| | ● | Grants the FDA the regulatory authority to impose broad additional restrictions. |

The Tobacco Control Act also requires establishment, within the FDA’s new Center for Tobacco Products, of a Tobacco Products Scientific Advisory Committee to provide advice, information and recommendations with respect to the safety, dependence or health issues related to tobacco products. As indicated above, the Tobacco Control Act imposes significant new restrictions on the advertising and promotion of tobacco products. For example, the law requires the FDA to finalize certain portions of regulations previously adopted by the FDA in 1996 (which were struck down by the Supreme Court in 2000 as beyond the FDA’s authority). As written, these regulations would significantly limit the ability of manufacturers, distributors and retailers to advertise and promote tobacco products, by, for example, restricting the use of color, graphics and sound effects in advertising, limiting the use of outdoor advertising, restricting the sale and distribution of non-tobacco items and services, gifts, and sponsorship of events and imposing restrictions on the use for cigarette or smokeless tobacco products of trade or brand names that are used for non-tobacco products. The law also requires the FDA to issue future regulations regarding the promotion and marketing of tobacco products sold or distributed over the internet, by mail order or through other non-face-to-face transactions in order to prevent the sale of tobacco products to minors.

It is likely that the Tobacco Control Act could result in a decrease in tobacco product sales in the United States, including sales of our electronic cigarettes.

While the FDA has not yet mandated electronic cigarettes be regulated as tobacco products, the FDA issued proposed regulations on April 25, 2014 seeking to regulate electronic cigarettes as tobacco products. Under these proposed rules, products meeting the statutory definition of “tobacco products,” except accessories of a proposed deemed tobacco product, would be subject to the Federal Food, Drug, and Cosmetic Act (the FD&C Act), as amended by the Family Smoking Prevention and Tobacco Control Act (Tobacco Control Act). The Tobacco Control Act provides FDA authority to regulate cigarettes, cigarette tobacco, roll-your-own tobacco, smokeless tobacco, and any other tobacco products that the Agency by regulation deems to be subject to the law. Option 1 of the proposed rule would extend the Agency's “tobacco product” authorities in the FD&C Act to all other categories of products, except accessories of a proposed deemed tobacco product, that meet the statutory definition of “tobacco product” in the FD&C Act. Option 2 of the proposed rule would extend the Agency's “tobacco product” authorities to all other categories of products, except premium cigars and the accessories of a proposed deemed tobacco product, that meet the statutory definition of “tobacco product” in the FD&C Act. FDA also is proposing to prohibit the sale of “covered tobacco products” to individuals under the age of 18 and to require the display of health warnings on cigarette tobacco, roll-your own tobacco, and covered tobacco product packages and in advertisements. Further, the FDA proposed to extend its authority to cover additional products that meet the definition of a tobacco product under the proposed rule: Tobacco Products Deemed To Be Subject to the Food, Drug & Cosmetic Act (Deeming). Currently FDA regulates cigarettes, cigarette tobacco, roll-your-own tobacco and smokeless tobacco. Proposed newly “deemed” products would include: electronic cigarettes, cigars, pipe tobacco, certain dissolvables that are not “smokeless tobacco,” gels and water pipe tobacco.

If electronic cigarettes are regulated as proposed, the FDA will implement new rules to govern the labeling of electronic cigarettes, including smokeless tobacco product warning labels and “light,” “low,” “mild” or similar descriptors for tobacco products. These new laws are expected to have a significant public health impact by decreasing the number of people using tobacco products, resulting in lives saved, increased life expectancy, and lower medical costs. In addition, the FDA will also restrict the way electronic cigarette manufacturers, retailers, and distributers can advertise and promote cigarettes and smokeless tobacco products, especially marketing efforts designed to appeal to youth. Such restrictions relating to marketing, advertising, and promotion will include: prohibiting tobacco brand name sponsorship of any athletic, musical, or other social or cultural event, or any team or entry in those events, requiring that audio ads use only words with no music or sound effects, prohibiting the sale or distribution of items, such as hats and tee shirts, with cigarette and smokeless tobacco brands or logos and requiring that manufacturers receive a written order from FDA permitting the legal marketing of a new tobacco product. The FDA’s traditional “safe and effective” standard for evaluating medical products does not currently apply to tobacco. FDA evaluates new tobacco products based on a public health standard that considers the risks and benefits of the tobacco product on the population as a whole, including users and non-users. To legally market new tobacco products, a written order from FDA must be received permitting its marketing in the United States.

The application of the Tobacco Control Act to electronic cigarettes could impose, among other things, restrictions on the content of nicotine in electronic cigarettes, the advertising, marketing and sale of electronic cigarettes, the use of certain flavorings and the introduction of new products. We cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial condition.

In this regard, total compliance and related costs are not possible to predict and depend substantially on the future requirements imposed by the FDA under the Tobacco Control Act. Costs, however, could be substantial and could have a material adverse effect on our business, results of operations and financial condition. In addition, failure to comply with the Tobacco Control Act and with FDA regulatory requirements could result in significant financial penalties and could have a material adverse effect on our business, financial condition and results of operations and ability to market and sell our products. At present, we are not able to predict whether the Tobacco Control Act will impact us to a greater degree than competitors in the industry, thus affecting our competitive position.

Competition

Competition in the electronic cigarette industry is intense. We compete with other sellers of electronic cigarettes, most notably Lorillard, Inc., Altria Group, Inc. and Reynolds American Inc., big tobacco companies, through their electronic cigarettes business segments; the nature of our competitors is varied as the market is highly fragmented and the barriers to entry into the business are low.

We compete primarily on the basis of product quality, brand recognition, brand loyalty, service, marketing, advertising and price. We are subject to highly competitive conditions in all aspects of our business. The competitive environment and our competitive position can be significantly influenced by weak economic conditions, erosion of consumer confidence, competitors’ introduction of low-priced products or innovative products, cigarette excise taxes, higher absolute prices and larger gaps between price categories, and product regulation that diminishes the ability to differentiate tobacco products.

Our principal competitors are “big tobacco”, U.S. cigarette manufacturers of both conventional tobacco cigarettes and electronic cigarettes like Altria Group, Inc., Lorillard, Inc. and Reynolds American Inc. We compete against “big tobacco” who offers not only conventional tobacco cigarettes and electronic cigarettes but also smokeless tobacco products such as “snus” (a form of moist ground smokeless tobacco that is usually sold in sachet form that resembles small tea bags), chewing tobacco and snuff. Furthermore, we believe that “big tobacco” will devote more attention and resources to developing and offering electronic cigarettes as the market for electronic cigarettes grows. Because of their well-established sales and distribution channels, marketing expertise and significant resources, “big tobacco” is better positioned than small competitors like us to capture a larger share of the electronic cigarette market. We also compete against numerous other smaller manufacturers or importers of cigarettes. There can be no assurance that we will be able to compete successfully against any of our competitors, some of whom have far greater resources, capital, experience, market penetration, sales and distribution channels than us. If our major competitors were, for example, to significantly increase the level of price discounts offered to consumers, we could respond by offering price discounts, which could have a materially adverse effect on our business, results of operations and financial condition.

With the acquisition of Breathe, management determined that it would be in the best interest of the Company and its shareholders to operate each company separate and independently of each other. The operation of DNA Canada, Inc. and Breathe were inconsistent. Breathe is a manufacturer and distributor of e-cigarette and related products while DNA Canada, Inc. is an exploration stage mining company. The spin-off of DNA Canada, Inc. will allow each company to focus on its principal business activity and facilitate capital formation.

On March 5, 2015, the Company entered into an Agreement and Plan of Merger pursuant to which the Company merged with its wholly owned subsidiary, Breathe eCig Corp., a Nevada corporation with no material operations and created for the sole purpose of affecting a name change pursuant to Chapter 92A.180 of the Nevada Revised Statutes. Upon the consummation of the Merger on March 11, 2015, the separate existence of Breathe eCig Corp. ceased, and the shareholders of the Company became shareholders of the surviving company, named Breathe eCig Corp. As permitted under Nevada law, the sole purpose of the Merger was to effect a change to the Company’s name from DNA Precious Metals, Inc. to Breathe eCig Corp. This change to the Amended Articles of Incorporation and name change took effect on March 11, 2015.

Spinoff of Mining operations:

The Company declared a stock dividend to its shareholders of record as of February 3, 2015 of its wholly owned subsidiary, DNA Canada, Inc. Each shareholder of record on this date received one share of DNA Canada, Inc. for every two shares of DNA Precious Metals Inc. owned by the shareholder on this date. All stock dividends will be rounded up to the next whole number. With the completion of the stock dividend, the Company, no longer has an equity interest in DNA Canada, Inc.

The former shareholders of Breathe participating in the stock dividend were required to tender for redemption any shares of DNA Canada, Inc. common stock received pursuant to the stock dividend in accordance with the Exchange Agreement.

The following table represents the approximate value of the assets transferred and liabilities assumed by DNAC in connection with the spinoff:

| Net Assets Spun-off | |

| | Cash | $25,514 |

| | Prepaid expenses | 137,919 |

| | Sales tax receivable | 17,097 |

| | Fixed assets | 138,124 |

| | Mining rights | 1,035,818 |

| | Accounts payable | (127,640) |

| | Asset retirement obligation | (107,749) |

| | Note payable | (127,523) |

| | Accumulated comprehensive income | 108,337 |

| | Due to DNAP | (5,288,703) |

| Adjustment to Additional Paid in Capital | $(4,188,806) |

The $5,288,703 represents the receivable that the Company would be due from DNAC following the stock dividend. This amount is not expected to be received as DNA Canada, Inc. does not have sufficient cash to repay the balance due. The Company will write off this receivable balance against the additional paid in capital of $4,188,806, and the remaining $1,099,897 will be reflected as a dividend.

Risks related to our mining operations in 2014. The following does not represent our current operations. You should read the risk factors following this discussion to identify those risks associated with Breathe.

We are an exploration stage company and our business plan is unproven. We have generated no revenues from our operations and incurred operating losses since our inception. The Company as a going concern is in doubt.

We are an exploration stage company, our business plan is unproven, and we cannot assure you that we will ever achieve profitability or, if we achieve profitability, that it will be sustainable. We are subject to all of the risks inherent in a new business. We have not generated any revenues to date. At December 31, 2014 we have a working deficit of $165,472 and an accumulated deficit of $7,770,337. We require additional capital to finance our mining activities. We currently have no commitment for additional funding and there can be no assurance that we will be able to secure additional funding, or if available, available on terms acceptable to us.

We have no proven reserves.

The Property does not have known reserves of commercial gold or silver. Our long-term success will be related to the cost and success our exploration and mining programs. Mining for gold and silver and base metals is a highly speculative business, involving a high degree of risk. Few properties that are explored are ultimately developed into producing mines. There is no assurance that our exploration program will result in any discoveries of commercial quantities of gold or silver. There is also no assurance that, even if commercial quantities of gold or silver are discovered, a mine can be brought into commercial production. Production/discovery of gold and silver is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mine is also dependent upon a number of factors, many of which are beyond our control, such as the worldwide economy, the price of gold and silver, government regulations, including regulations relating to royalties, allowable production and environmental protection.

During our operations unexpected events may occur, including labor unrest, changes in government regulations, fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may impede our exploration activities, raise costs and otherwise reduce the commercial viability of the Property.

We may not identify proven reserves and our estimates may be inaccurate.

There is no certainty that any expenditures made in our exploration program will result in discoveries of commercially recoverable quantities of gold, silver or any base metal. Most exploration projects do not result in the discovery of commercially extractable deposits of gold or silver and no assurance can be given that any particular level of recovery will in fact be realized or that any identified leasehold interest will ever qualify as a commercially developed. Estimates of mineralization, reserves, deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in estimated reserves, exploration and mining costs may affect the economic viability of any project.

We will be required to locate mineral reserves for our long-term success.

Mines have limited lives based on proven and probable mineral reserves that are depleted in the course of production. To ensure continued viability we must offset depleted reserves by replacing and expanding our mineral reserves, through further exploration at the Property and/or the acquisition of new properties. Even if additional reserves are discovered, the process from exploration to production can take many years, during which the economic feasibility of production may change. Therefore, our ability to maintain or increase annual production of gold and other base or precious metals once mining activities commence, if at all, will be dependent almost entirely on our ability to bring new mines into production.

Mining is inherently dangerous and subject to conditions or events beyond our control, which could have a material adverse effect on our business.

Mining involves various types of risks and hazards, including:

| | • | environmental hazards; |

| | • | power outages; |

| | • | metallurgical and other processing problems; |

| | • | unusual or unexpected geological formations; |

| | • | flooding, fire, explosions, cave-ins, landslides and rock-bursts; |

| | • | inability to obtain suitable or adequate machinery, equipment, or labor; |

| | • | metals losses; and |

| | • | periodic interruptions due to inclement or hazardous weather conditions. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability.

Exploration for economic deposits of gold and silver is speculative.

Our business is very speculative since there is generally no way to recover any of the funds expended on exploration unless the existence of commercially exploitable reserves are established and the Company can exploit those reserves by either commencing mining operations, selling or leasing its interest in the property, or entering into a joint venture with a larger company that can further develop the property. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold and other metals and minerals produced from our mineral properties. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

| | • | expectations with respect to the rate of inflation; |

| | • | the relative strength of the U.S. dollar and certain other currencies; |

| | • | interest rates; |

| | • | global or regional political, financial, or economic conditions; |

| | • | supply and demand for jewelry and industrial products containing metals; and |

| | • | sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the above factors. |

A decrease in the market price of gold and other metals could affect the commercial viability of our Montauban Mine Property and our anticipated development and production assumptions. Lower gold prices could also adversely affect our ability to finance future development at the Montauban Mine Property, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

Our estimates of resources are subject to uncertainty.

Estimates of resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use drilling results to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold or silver that can be economically processed and mined by us.

The mineralization estimates are based on interpretation and assumptions and may yield less mineral production, if any, under actual conditions than is currently estimated.

We have relied on independent geologists to conduct drilling samples on the Property. When making determinations whether to continue any project, we must rely upon such estimated calculations as to the mineral reserves and grades of mineralization on the Property. Until ore is actually mined and processed, mineral reserves and grades of mineralization must be considered as estimates only.

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that:

| | • | these estimates will be accurate; |

| | • | reserve or other mineralization estimates will be accurate; or |

| | • | this mineralization can be mined or processed profitably. |

Any material changes in mineral reserve estimates and grades of mineralization may affect the economic viability of placing a property into production and a property’s return on capital. Because we have not started mining operations at the Property and have not commenced actual production, mineralization estimates may require adjustments or downward revisions based upon further drilling and/or actual production experience.

In addition, the grade of ore ultimately mined, if any, may differ from that indicated by our testing results to date. There can be no assurance that minerals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production scale. Declines in market prices for gold and silver may render portions of our mineralization, reserve estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of the Property. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

Our exploration activities at the Montauban Mine Property may not be successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to identify proven reserves and mine the Property and any other properties we may acquire, if any. Exploration activities are highly speculative in nature, which involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of our exploration program is determined in part by the following factors:

| | • | the identification of potential gold mineralization based on surficial analysis; |

| | • | availability of government-granted exploration permits; |

| | • | the quality of our management and our geological and technical expertise; and |

| | • | the capital available for exploration. |

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at the Property. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. We cannot assure you that we will discover mineralized resources in sufficient quantities on the Property to commence commercial development.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there is no assurance that our development activities will result in profitable mining operations.

We plan to estimate operating and capital costs for the Property based on information available to us and that we believe to be accurate. However, costs for labor, regulatory compliance, energy, mine and plant equipment and materials needed for mine development and construction may fluctuate significantly. In light of these factors, actual costs related to our proposed mine development and construction may exceed any estimates we may make. We do not have an operating history upon which we can base estimates of future operating costs related to the Property. We intend to rely upon our analysis of the future economic feasibility of the project and any estimates that may be contained therein. Studies derive estimates of cash operating costs based upon, among other things:

| | · | anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed; |

| | · | anticipated recovery rates of gold and other metals from the ore; |

| | · | cash operating costs of comparable facilities and equipment; and |

| | · | anticipated climatic conditions. |

Capital and operating costs, production and economic returns, and other estimates may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs will not be higher than anticipated or disclosed.

In addition, any calculations of cash costs and cash cost per ounce may differ from similarly titled measures of other companies and are not intended to be an indicator of projected operating profit.

There can be no assurance that we will be successful in establishing mining operations or profitably exploiting mineral deposits.

We are subject to all of the risks associated with establishing new mining operations and business enterprises including:

| | • | the timing and cost, which can be considerable, of the construction of mining and processing facilities; |

| | • | the ability to find sufficient gold reserves to support a mining operation; |

| | • | the availability and costs of skilled labor and mining equipment; |

| | • | the availability and cost of appropriate smelting and/or refining arrangements; |

| | • | compliance with environmental and other governmental approval and permit requirements; |

| | • | the availability of funds to finance construction and development activities; |

| | • | potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; and |

| | • | potential increases in construction and operating costs due to changes in the cost of fuel, power, materials, supplies, and other costs. |

It is common in new mining operations to experience unexpected problems and delays during construction, development and mine start-up; delays in the commencement of mineral production often occur. Accordingly, we cannot assure you that our activities will result in profitable mining operations or that we will successfully establish mining operations or profitably extract gold or silver at the Property.

Historical production at the Property may not be indicative of the potential for future development.

We currently have no commercial production at the Property and have never recorded any revenues from gold or silver production. You should not rely on the fact that there were historical mining operations at the Property as an indication that we will ever have future successful commercial operations at the Property. We expect to continue to incur losses unless and until such time, if ever, as the Property enters into commercial production and generates sufficient revenues to fund our continuing operations. The development of new mining operations requires the commitment of substantial resources for operating expenses and capital expenditures, which may increase in subsequent years as needed consultants, personnel and equipment associated with advancing exploration, development and commercial production are added. The amount and timing of expenditures will depend on the progress of ongoing exploration and development, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners and other factors, many of which are beyond our control.

We have no history as a Company engaged in the mining business.

We have no history of earnings or cash flow from mining activities. If we identify proven reserves and are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in the prices of gold and silver, the cost of construction and operating a mining operation, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration as well as the costs of protection of the environment.

We face many operating hazards.

The development and operation of a mining property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages.

A shortage of critical equipment, supplies and resources could adversely affect our operations.

We are dependent on equipment, supplies and resources to carry out our mining operations, including input commodities, drilling equipment and skilled labor. A shortage in the market for any of these factors could cause unanticipated cost increases and delays in delivery times, which could in turn adversely impact production schedules and costs.

Operations at the Property will require a significant amount of water. Successful mining and processing will require careful control of project water usage and efficient reclamation of project solutions in the process.

Current global financial conditions have made access to financing more difficult.

Since the fall of 2008 there has been severe deterioration in global credit and equity markets. This has resulted in the need for government intervention in major banks, financial institutions and insurers, and has also led to greater volatility, increased credit losses and tighter credit conditions. These unprecedented disruptions in the credit and financial markets have had a significant adverse impact on a number of financial institutions and have limited access to capital and credit for many companies. These disruptions could, among other things, make it more difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations.

We do not insure against all risks to which we may be subject in our planned operations.

Any insurance that we secure will in all likelihood not cover all of the potential risks associated with a mining company’s operations, and we may be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not be available or may not be adequate to cover any resulting liability. Moreover, we expect that insurance against certain hazards as a result of exploration and production may be prohibitively expensive to obtain for a company of our size and financial means.

We might also become subject to liability for pollution or other hazards which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to us or to other companies within the mining industry.

Losses from events that are not covered by our insurance policies may cause us to incur significant costs that could negatively affect our financial condition and ability to fund our activities on the Property. A significant loss could force us to terminate our operations.

Drilling operations are hazardous, raise environmental concerns and raise insurance risks.

We intend to conduct our business in a way that safeguards public health and the environment and in compliance with applicable laws and regulations. Environmental hazards may exist on properties in which we hold an interest which are unknown to us and may have been caused by prior owners. Changes to drilling and mining laws and regulations could require additional capital expenditures and increase operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain operations uneconomic.

Local infrastructure may impact our exploration activities and results of operations.

Our activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges and power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomenon, sabotage or government or other interference in the maintenance of such infrastructure could adversely affect our activities.

We are subject to significant governmental regulations.

The Montauban Mine Property is located in Quebec, Canada and is subject to extensive federal, provincial, and local laws and regulations governing various matters, including:

| | • | environmental protection; |

| | • | management and use of toxic substances and explosives; |

| | • | management of natural resources; |

| | • | labor standards and occupational health and safety, including mine safety; and |

| | • | historic and cultural preservation. |

Noncompliance may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations will be more stringent which could cause additional expense, capital expenditures, restrictions on our operations and delays in the development of the Property.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All of our exploration and potential development and production activities are in the province of Quebec, Canada and are subject to regulation by governmental agencies under various environmental laws. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations.

Additionally, our operations will result in emissions of greenhouse gases, which may be subject to increased regulation in the future. In general, environmental legislation is evolving and the trend has been towards stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations requires significant capital outlays, and future changes in these laws and regulations may cause material changes or delays in our financial position, operations and future activities. More stringent regulation may cause us to re-evaluate our activities.

Land reclamation requirements for the Property may be burdensome.

Land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long-term effects of land disturbance.

Reclamation may include requirements to:

| | • | control dispersion of potentially deleterious effluents; and |

| | • | reasonably re-establish pre-disturbance landforms and vegetation. |

In order to carry out reclamation obligations we will have to allocate a portion of our financial resources that might otherwise be spent on further exploration and development programs. Unanticipated reclamation work will adversely impact our operations.

We may not be able to comply with permitting requirements.

We have obtained required permitting to commence production activities. Maintaining the permits may require us to comply with more stringent government regulation or new regulatory controls may be instituted which will require us to implement more stringent controls and procedures over our production activities. There can be no assurance that we will be able to comply with more stringent government regulations or that additional costs will be required to remain compliant. This may result in production delays and impact our budgeted resources.

We may experience difficulty attracting and retaining qualified management.

We are dependent on the services of our executive officers. We will have to hire other highly skilled and experienced consultants. Due to our relatively small size, the loss of these persons or our inability to attract and retain highly skilled employees may have a material adverse effect on our business or future operations. We do not maintain key-man life insurance on any of our officers or directors.

We compete with larger, better-capitalized competitors in the mining industry.

The mining industry is intensely competitive in all of its phases, including financing, technical resources, personnel and property acquisition. It requires significant capital, technical resources, personnel and operational experience to effectively compete in the mining industry. Larger companies with significant resources have an advantage over us. Competition for resources at all levels is very intense, particularly affecting the availability of manpower, drill rigs, mining equipment and production equipment. As a result, we may be unable to maintain or acquire financing, personnel or technical resources.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Since our operations are in Canada, resource estimates disseminated outside the United States are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements. These practices are different from the practices used to report reserve and resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred resources, which are generally not permitted in filings with the SEC. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, “inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically.

Our directors and officers may have conflicts of interest as a result of their relationships with other companies.

Our directors and officers may serve as officers or directors for other companies engaged in natural resource exploration and development. The directors and officers owe us a fiduciary obligation. We have not yet established a policy to deal with potential conflicts of interest.

Compliance with SEC reporting requirements can be costly.

We do not have any employees to segregate responsibilities and may be unable to afford increasing our staff or engaging outside consultants or professionals to overcome our lack of employees. During the course of our operations, we may identify other deficiencies that we may not be able to remedy in time to satisfy the requirements imposed by the Sarbanes-Oxley Act for compliance with that Section 404. If we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information.

Legislation, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.