Exhibit 7.02

November 23, 2013

The Board of Directors

China Zenix Auto International Limited

No. 1608, North Circle Road State Highway

Zhangzhou, Fujian Province 363000

People’s Republic of China

Dear Members of the Board of Directors,

We, Jianhui Lai (the“Founder”) and RichWise International Investment Group Limited and certain of its affiliated entities (“Richwise” and together with the Founder, the“Consortium Members”), are pleased to submit this preliminary non-binding proposal (the“Proposal”) for a business restructuring of China Zenix Auto International Limited (the“Company”) on the principal terms and conditions described in this letter. As of the date hereof, the Consortium Members in the aggregate own approximately 75% of the total outstanding ordinary shares of the Company.

The Company operates a wheel manufacturing business in China (the“Wheel Business”) and the Consortium Members operate an online vacation rental marketplace in China (the“Online Business”) through a holding company“Target HoldCo”). The business restructuring will involve (i) a reorganization of the shareholding in the holding company of the Wheel Business (the“Shareholding Reorganization”) along with an option grant and (ii) an acquisition of the Online Business by the Company via a share swap involving the shares of Target HoldCo (the“Share Swap Acquisition”), all of which will take place concurrently (together, the“Transaction”).

The Transaction, when consummated, will result in the Company owning 100% of the Online Business and approximately 30% of the Wheel Business, with the Founder owning the remainder. The Founder will remain the Company’s single largest shareholder.

We believe that our Proposal, as described further below, provides a very attractive opportunity to the Company and its public shareholders, given (i) the Company’s current financial performance and growth prospects in China’s challenging operating environment and (ii) the significant growth opportunities in China’s travel and vacationing industry and online marketplace /e-commerce businesses. The Consortium Members are currently only interested in pursuing the Transaction as contemplated herein and are not interested in selling their shares in any other transaction.

Set forth are the key terms of our Proposal.

1

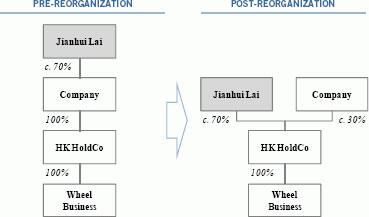

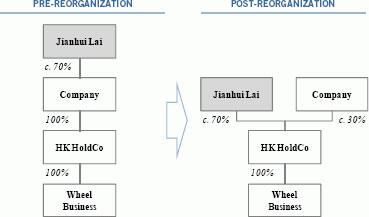

Shareholding Reorganization

The Founder will surrender his shares in the Company for cancellation in exchange for an approximate 70% direct ownership interest in the Company’s Hong Kong holding company of the Wheel Business.

The Company will also grant an option (the“Option Grant”) to the Founder to purchase its approximate 30% stake in the Hong Kong holding company of the Wheel Business at an exercise price of US$66 million. The exercise price implies a valuation of US$220 million for the entire Wheel Business and represents a significant premium over the Company’s market capitalization at the time of the grant. The following table summarizes the Company’s current and historical market capitalization as of 22 November 2013:

| | | | | | | | | | | | | | | | | | | | |

| | | Current | | | 30D VWAP | | | 60D VWAP | | | 90D VWAP | | | 120D VWAP | |

Market Capitalization | | US$ | 192 million | | | US$ | 198 million | | | US$ | 192 million | | | US$ | 169 million | | | US$ | 164 million | |

Premium | | | 15 | % | | | 11 | % | | | 15 | % | | | 30 | % | | | 34 | % |

Note: Company Market Capitalization as at 22 November 2013 (“Current”) and based on the Volume Weighted Average Price (“VWAP”) for the 30/60/90/120 consecutive trading days ending 22 November 2013; Source Bloomberg

The option will be exercisable in whole or in part and the exercise price can be settled in cash or shares at the Founder’s sole discretion during the two years following the Shareholding Reorganization.

2

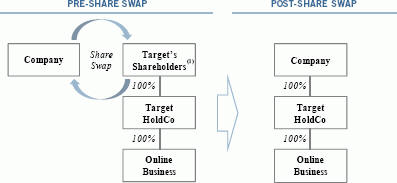

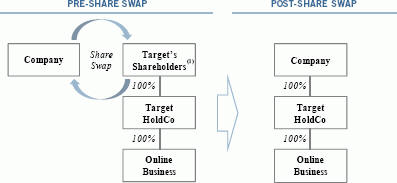

Share Swap Acquisition

The Company will acquire the Online Business for US$3001 million by issuing new shares valued at the Company’s 120-day VWAP of US$3.1703 in exchange for 100% of the shares of the Online Business’s holding company. We believe a 120-day VWAP is a logical, reliable and fair valuation benchmark as it is not overly influenced by daily fluctuations in share price.

Note 1: Jianhui Lai (including interest held by its affiliates) owns approximately 39% of the total outstanding ordinary shares of the Online Business

Upon the completion of the concurrent Shareholding Reorganization and Share Swap Acquisition, the shareholding structure of the Company will be as follows:

| 1 | The price of US$300 million is based on the Consortium Members’ valuation of the Online Business. |

3

| II. | Definitive Documentation |

Consummation of the Transaction will require negotiation and execution of a Restructuring and Share Exchange Agreement, as well as other customary agreements for a transaction of this nature, each containing terms and conditions appropriate for transactions of this type. We have retained K&L Gates LLP as our international legal counsel and are prepared to provide draft agreements promptly.

We intend to promptly file a joint Schedule 13D to disclose this proposal and our intention as set out in this proposal. However, we are sure you will agree that it is in all of our interests to ensure that we proceed in a confidential manner, unless otherwise required by law, until we have executed a definitive agreement or terminated our discussions.

As we have described herein, we believe that the Transaction as proposed will provide a very attractive value to the Company’s public shareholders. We recognize that the Board of Directors will evaluate the Proposal independently before it can make a decision to endorse it. Given our involvement in the Transaction, we would expect that the independent members of the Board of Directors will proceed to consider our Proposal and the Transaction.

This Proposal is not a binding offer, agreement or agreement to make a binding offer or agreement at any point in the future. This letter is a preliminary indication of interest by the Consortium Members and does not contain all matters upon which agreement must be reached in order to consummate the proposed Transaction, nor does it create any binding rights or obligations in favor of any person. The parties will be bound only upon the execution of mutually agreeable definitive documentation.

4

| | |

| Sincerely, |

|

| JIANHUI LAI |

| |

| By: | |

|

| |

| Date: | | 2013.11.23 |

RICHWISE INTERNATIONAL INVESTMENT GROUP LIMITED

5

| | |

| Sincerely, |

|

| JIANHUI LAI |

| |

| By: | | |

| |

| Date: | | |

RICHWISE INTERNATIONAL INVESTMENT GROUP LIMITED

| | |

| By: | |

|

| |

| Title: | | |

| |

| Date: | | |

6