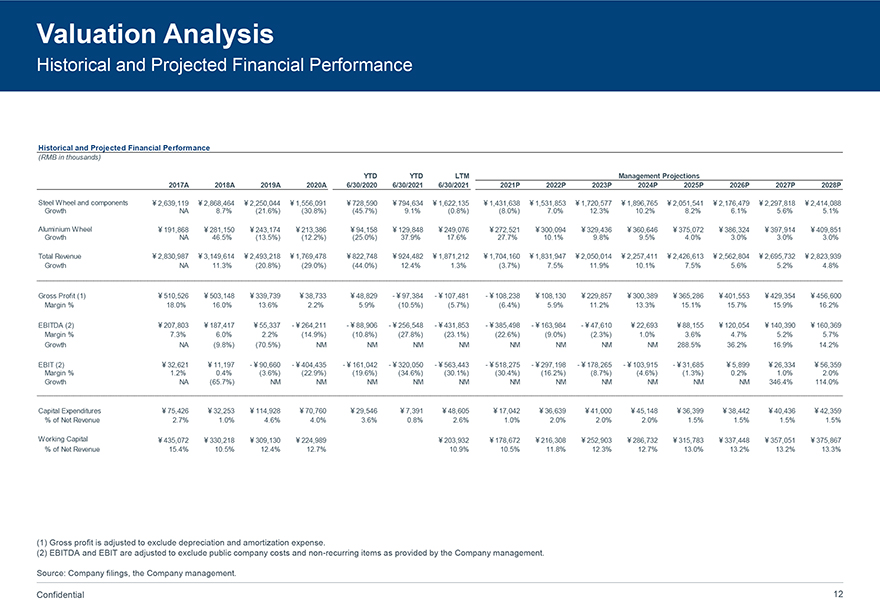

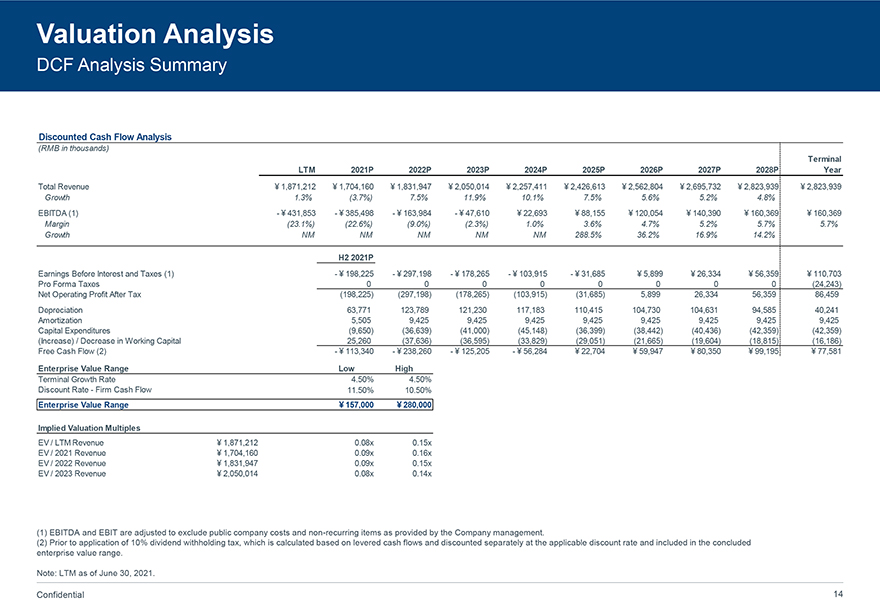

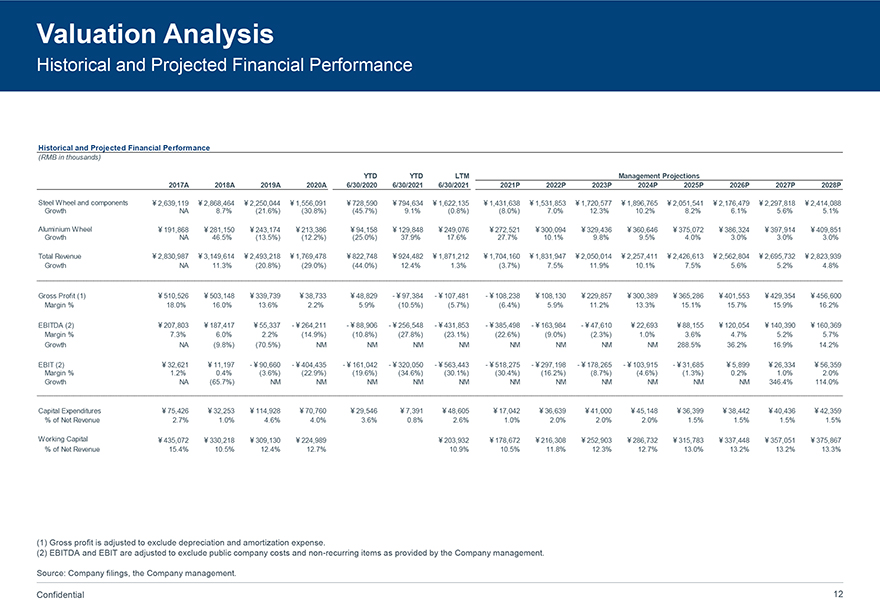

Valuation Analysis Historical and Projected Financial Performance Historical and Projected Financial Performance (RMB in thousands) YTD YTD LTM Management Projections 2017A 2018A 2019A 2020A 6/30/2020 6/30/2021 6/30/2021 2021P 2022P 2023P 2024P 2025P 2026P 2027P 2028P Steel Wheel and components ¿¥2,639,119 ¿¥2,868,464 ¿¥2,250,044 ¿¥1,556,091 ¿¥728,590 ¥794,634 ¥1,622,135 ¥1,431,638 ¥1,531,853 ¥1,720,577 ¥1,896,765 ¥2,051,541 ¥2,176,479 ¥2,297,818 ¥2,414,088 Growth NA 8.7% (21.6%) (30.8%) (45.7%) 9.1% (0.8%) (8.0%) 7.0% 12.3% 10.2% 8.2% 6.1% 5.6% 5.1% Aluminium Wheel ¥191,868 ¥281,150 ¥243,174 ¥213,386 ¥94,158 ¥129,848 ¥249,076 ¥272,521 ¥300,094 ¥329,436 ¥360,646 ¥375,072 ¥386,324 ¥397,914 ¥409,851 Growth NA 46.5% (13.5%) (12.2%) (25.0%) 37.9% 17.6% 27.7% 10.1% 9.8% 9.5% 4.0% 3.0% 3.0% 3.0% Total Revenue ¥2,830,987 ¥3,149,614 ¥2,493,218 ¥1,769,478 ¥822,748 ¥924,482 ¥1,871,212 ¥1,704,160 ¥1,831,947 ¥2,050,014 ¥2,257,411 ¥2,426,613 ¥2,562,804 ¥2,695,732 ¥2,823,939 Growth NA 11.3% (20.8%) (29.0%) (44.0%) 12.4% 1.3% (3.7%) 7.5% 11.9% 10.1% 7.5% 5.6% 5.2% 4.8% Gross Profit (1) ¥510,526 ¥503,148 ¥339,739 ¥38,733 ¥48,829 - ¥97,384 - ¥107,481 - ¥108,238 ¥108,130 ¥229,857 ¥300,389 ¥365,286 ¥401,553 ¥429,354 ¥456,600 Margin % 18.0% 16.0% 13.6% 2.2% 5.9% (10.5%) (5.7%) (6.4%) 5.9% 11.2% 13.3% 15.1% 15.7% 15.9% 16.2% EBITDA (2) ¥207,803 ¥187,417 ¥55,337 - ¥264,211 - ¥88,906 - ¥256,548 - ¥431,853 - ¥385,498 - ¥163,984 - ¥47,610 ¥22,693 ¥88,155 ¥120,054 ¥140,390 ¥160,369 Margin % 7.3% 6.0% 2.2% (14.9%) (10.8%) (27.8%) (23.1%) (22.6%) (9.0%) (2.3%) 1.0% 3.6% 4.7% 5.2% 5.7% Growth NA (9.8%) (70.5%) NM NM NM NM NM NM NM NM 288.5% 36.2% 16.9% 14.2% EBIT (2) ¥32,621 ¥11,197 - ¥90,660 - ¥404,435 - ¥161,042 - ¥320,050 - ¥563,443 - ¥518,275 - ¥297,198 - ¥178,265 - ¥103,915 - ¥31,685 ¥5,899 ¥26,334 ¥56,359 Margin % 1.2% 0.4% (3.6%) (22.9%) (19.6%) (34.6%) (30.1%) (30.4%) (16.2%) (8.7%) (4.6%) (1.3%) 0.2% 1.0% 2.0% Growth NA (65.7%) NM NM NM NM NM NM NM NM NM NM NM 346.4% 114.0% Capital Expenditures ¥75,426 ¥32,253 ¥114,928 ¥70,760 ¥29,546 ¥7,391 ¥48,605 ¥17,042 ¥36,639 ¥41,000 ¥45,148 ¥36,399 ¥38,442 ¥40,436 ¥42,359 % of Net Revenue 2.7% 1.0% 4.6% 4.0% 3.6% 0.8% 2.6% 1.0% 2.0% 2.0% 2.0% 1.5% 1.5% 1.5% 1.5% Working Capital ¥435,072 ¥330,218 ¥309,130 ¥224,989 ¥203,932 ¥178,672 ¥216,308 ¥252,903 ¥286,732 ¥315,783 ¥337,448 ¥357,051 ¥375,867 % of Net Revenue 15.4% 10.5% 12.4% 12.7% 10.9% 10.5% 11.8% 12.3% 12.7% 13.0% 13.2% 13.2% 13.3% (1) Gross profit is adjusted to exclude depreciation and amortization expense. (2) EBITDA and EBIT are adjusted to exclude public company costs and non-recurring items as provided by the Company management. Source: Company filings, the Company management. Confidential 12