UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

[X] Definitive Proxy Statement.

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to § 240.14a-12.

(Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

LoCorr Investment Trust

687 Excelsior Blvd

Excelsior, MN 55331

December 5, 2022

Dear Shareholder:

The Board of Trustees of LoCorr Investment Trust (the “Trust”) has called a special joint meeting of shareholders concerning each series of the Trust listed below (each, a “Fund,” and together, the “Funds”):

| | |

| LoCorr Macro Strategies Fund |

| LoCorr Long/Short Commodities Strategy Fund |

| LoCorr Market Trend Fund |

| LoCorr Dynamic Opportunity Fund |

| LoCorr Spectrum Income Fund |

The special joint meeting of shareholders will be held at the offices of the Funds’ investment adviser, LoCorr Fund Management, LLC, located at 687 Excelsior Blvd, Excelsior, MN 55331 on Friday, January 20, 2023 at 9:00 a.m. Central time, or any adjournments or postponements thereof (the “Special Meeting”). The purpose of the Special Meeting is to elect the Board of Trustees (the “Board”) of the Trust. We intend to hold the Special Meeting in person. You are encouraged to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed Proxy Card, in advance of the Special Meeting.

At the Special Meeting, shareholders of the Funds will be asked to elect the Board, including the current Trustees and three new nominees, Dan O’Lear, Jeff Place and Catie Tobin (the “Nominees”), to the Board. The Board, including all of the Trustees who are not “interested persons” of the Trust (each, an “Independent Trustee”) as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), has approved an increase in the size of the Board from five Trustees to eight, as well as the nomination of each of Dan O’Lear, Jeff Place and Catie Tobin to join the Board as Trustees.

If you are a shareholder of record of a Fund as of the close of business on November 30, 2022, you are entitled to vote at the Special Meeting and at any adjournment or postponement thereof.

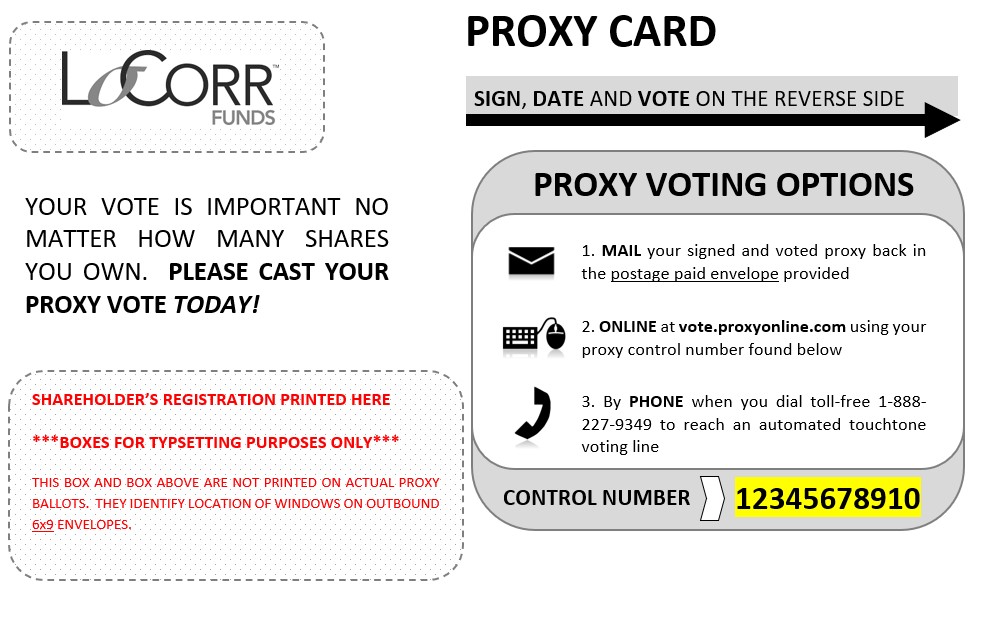

Enclosed you will find a Notice of Special Joint Meeting of Shareholders, Proxy Statement and a Proxy Card. These materials contain important information about the matters to be considered at the Special Meeting, including the qualifications of each current Trustee and Nominee, and the voting process for shareholders of the Funds. Please read the materials carefully and vote promptly. There are several ways to vote, including by returning your proxy card in the postage-paid envelope. You also may vote over the internet or by telephone. Please refer to the Proxy Card for further instruction on how to vote. If you have any questions, please contact the Funds at the toll-free number: 1-855-LCFUNDS (1-855-523-8637).

Your vote is very important regardless of the number of Fund shares you own. The Board of Trustees of the Trust has unanimously approved the proposals and recommends that you read the enclosed materials carefully and vote in favor of each proposal.

Thank you for your continued support.

Sincerely,

Jon C. Essen

Secretary

Voting is quick and easy. Delay may cause the Funds to incur additional expenses to solicit votes for the Special Meeting. Everything you need is enclosed. To cast your vote:

•MAIL: Complete the enclosed Proxy Card. BE SURE TO SIGN THE PROXY CARD before mailing it in the postage-paid envelope.

•PHONE: Call the toll-free number on the enclosed Proxy Card. Enter the control number on the Proxy Card and follow the instructions.

•INTERNET: Visit the website indicated on the enclosed Proxy Card. Enter the control number on the Proxy Card and follow the instructions.

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON

January 20, 2023

LoCorr Investment Trust

687 Excelsior Blvd

Excelsior, MN 55331

NOTICE IS HEREBY GIVEN that a special joint meeting of shareholders of each series of LoCorr Investment Trust (the “Trust”) listed below (each, a “Fund,” and together, the “Funds”) will be held at the offices of the Funds’ investment adviser, LoCorr Fund Management, LLC, located at 687 Excelsior Blvd, Excelsior, MN 55331 on Friday, January 20, 2023, or any adjournments or postponements thereof (the “Special Meeting”):

| | |

| LoCorr Macro Strategies Fund |

| LoCorr Long/Short Commodities Strategy Fund |

| LoCorr Market Trend Fund |

| LoCorr Dynamic Opportunity Fund |

| LoCorr Spectrum Income Fund |

We intend to hold the Special Meeting in person. You are encouraged to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed Proxy Card, in advance of the Special Meeting.

At the Special Meeting, shareholders of the Funds will be asked to consider and approve the following proposals, which are more fully described in the accompanying Proxy Statement:

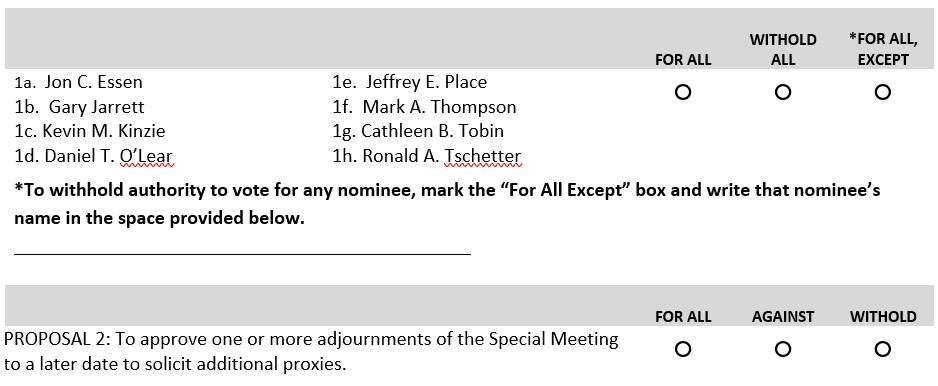

PROPOSAL 1: To approve the election of the Trustees to the Board of Trustees of the Trust to serve until his or her successor is elected and qualified.

PROPOSAL 2: To approve one or more adjournments of the Special Meeting to a later date to solicit additional proxies.

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

A shareholder of record of a Fund as of the close of business on November 30, 2022 is entitled to vote at the Special Meeting and at any adjournment or postponement thereof.

Please read the accompanying Proxy Statement. Your vote is very important regardless of the number of Fund shares you own. Shareholders who do not expect to attend the Special Meeting are requested to complete, sign and promptly return the enclosed Proxy Card so that a quorum will be present and a maximum number of shares may be voted for each respective Fund. In the alternative, please call the toll-free number on the enclosed Proxy Card to vote by telephone or go to the website shown on the enclosed Proxy Card to vote over the internet. You may revoke your proxy prior to the Special Meeting by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting by delivering a subsequently dated Proxy Card by any of the methods described above, or by voting in-person at the Special Meeting.

By order of the Board of Trustees of the Trust:

Jon C. Essen

Secretary

LoCorr Investment Trust

December 5, 2022

LoCorr Investment Trust

687 Excelsior Blvd

Excelsior, MN 55331

PROXY STATEMENT

December 5, 2022

FOR THE SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 20, 2023

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (the “Board”) of LoCorr Investment Trust (the “Trust”) of proxies to be voted at the special joint meeting of shareholders of the Trust to be held in person at the offices of the Funds’ investment adviser, LoCorr Fund Management, LLC (the “Adviser”), located at 687 Excelsior Blvd, Excelsior, MN 55331 on Friday, January 20, 2023 at 9:00 a.m. Central time, or any adjournments or postponements thereof (the “Special Meeting”).

PROPOSAL 1: To approve the election of the Trustees to the Board of Trustees of the Trust to serve until his or her successor is elected and qualified.

PROPOSAL 2: To approve one or more adjournments of the Special Meeting to a later date to solicit additional proxies.

Shareholders of record at the close of business on the record date, November 30, 2022 (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting. The Notice of Special Joint Meeting of Shareholders (the “Notice”), this Proxy Statement and the enclosed Proxy Card are being mailed to Shareholders on or after December 8, 2022.

The Trust is an Ohio Business Trust organized on November 15, 2010, and is registered with the U.S. Securities and Exchange Commission (“SEC”) as an open-end management investment company. The Trust is governed by its Board of Trustees (the “Board” or “Trustees”). The Trust is composed of five series, as listed below, (each, a “Fund,” and collectively, the “Funds”). Each Fund is separate diversified series of the Trust, and each has its own investment objective and policies. The following is a list of the Funds in the Trust being solicited to vote on the Proposals in this Proxy Statement:

| | |

| LoCorr Macro Strategies Fund |

| LoCorr Long/Short Commodities Strategy Fund |

| LoCorr Market Trend Fund |

| LoCorr Dynamic Opportunity Fund |

| LoCorr Spectrum Income Fund |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting

This Proxy Statement is available on the internet at https://vote.proxyonline.com/locorrfunds/docs/2023.pdf. You may request a copy by mail (LoCorr Investment Trust, c/o U.S. Bank Global Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701). You may also call toll-free at 1-855-LCFUNDS (1-855-523-8637) for information on how to obtain directions to be able to attend the Special Meeting and vote in person.

Shareholders may obtain copies of the applicable Annual Report or Semi-Annual Report free of charge by writing to the Trust, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, or by calling toll-free at 1-855-LCFUNDS (1-855-523-8637).

PROPOSAL 1 – ELECTION OF THE BOARD OF TRUSTEES

At the Special Meeting, shareholders of the Funds will be asked to elect the Trust’s Board of Trustees. Currently, the Board is composed of five Trustees (the “Incumbent Trustees”), including three Trustees who are not “interested persons” of the Trust (“Independent Trustees”) as defined by the Investment Company Act of 1940, as amended (the “1940 Act”) – Mr. Gary Jarrett, Mr. Mark A. Thompson, and Mr. Ronald A. Tschetter — and two Trustees who are “interested persons” of the Trust – Mr. Jon C. Essen and Mr. Kevin M. Kinzie. At a meeting of the Board held on November 21, 2022, the Board voted unanimously to increase the size of the Board to eight Trustees, and nominated Mr. Daniel T. (“Dan”) O’Lear, Mr. Jeffrey (“Jeff”) E. Place and Ms. Cathleen (“Catie”) B. Tobin (each, a “Nominee,” and collectively, the “Nominees”) to join the Board.

Section 16(a) of the 1940 Act provides that the Board may appoint a new Trustee without a shareholder election only if, after such appointment, at least two-thirds of the Trustees have been elected by the shareholders. Additionally, if at any time less than a majority of the Board is composed of Trustees who have been elected by the shareholders, the Fund is required by Section 16(a) of the 1940 Act to hold a shareholder meeting for the purpose of electing Trustees to fill any vacancies. Messrs. Tschetter, Essen and Kinzie were previously elected by shareholders of the Trust in 2011. Mr. Thompson and Mr. Jarrett were appointed as Trustees by the Board in November 2011 and May 2016, respectively, and have not been previously elected by shareholders. Accordingly, the addition of the Nominees requires that a shareholder election be held to ensure at least two-thirds of the Trustees have been elected by shareholders. The Board believes that it is in the best interests of the Funds to elect the entire Board at this time in order to provide maximum flexibility in the future to maintain the Board’s size and help avoid the costs associated with additional shareholder meetings.

The persons named as proxies intend to vote FOR the election of the Incumbent Trustees and the Nominees as Trustees of the Trust unless such authority has been withheld on the proxy card. Each Incumbent Trustee and Nominee has agreed to be named in this Proxy Statement and to serve if elected. The Board has no reason to believe that any Incumbent Trustee or Nominee will become unavailable for election as a Trustee. However, if that should occur before the Special Meeting, your proxy will be voted for the Nominees recommended by the Board to fill the vacancies.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE TRUST VOTE “FOR” THE ELECTION OF EACH INCUMBENT TRUSTEE AND NOMINEE TO THE BOARD OF THE TRUST.

Trustees and Officers

The business of the Trust is managed under the direction of the Board in accordance with the Agreement and Declaration of Trust and the Trust’s By-laws, which have been filed with the SEC and are available upon request. The Board consists of five individuals, three of whom are not “interested persons” (as defined under the 1940 Act) of the Trust and the Adviser (“Independent Trustees”). Pursuant to the governing documents of the Trust, the Board shall elect officers including a President, a Secretary, a Treasurer, a Principal Executive Officer and a Principal Accounting Officer. The Board retains the power to conduct, operate and carry on the business of the Trust and has the power to incur and pay any expenses, which, in the opinion of the Board, are necessary or incidental to carry out any of the Trust's purposes. The Trustees, officers, employees and agents of the Trust, when acting in such capacities, shall not be subject to any personal liability except for his or her own bad faith, willful misfeasance, gross negligence or reckless disregard of his or her duties.

During the year ended December 31, 2021, the Board held four regular meetings. All of the incumbent Trustees attended 100% of the Board meetings and the meetings of the Board committees on which they served. The Trust does not have a policy with respect to Board members’ attendance at shareholder meetings.

Following is a list of the Incumbent Trustees and executive officers of the Trust, and the Nominees, and their principal occupation over the last five years. Unless otherwise noted, the address of each is c/o LoCorr Fund Management, LLC, 687 Excelsior Boulevard, Excelsior, MN 55331.

| | | | | | | | | | | | | | | | | |

| Name and Year of Birth | Position(s) Held with the Trust* | Term of Office and Length of Time Served | Number of Portfolios in the Fund Complex** Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

| Independent Trustees |

Gary Jarrett

Year of Birth: 1954 | Trustee | May 2016 to present | 5 | Chief Executive Officer, Black River Asset Management LLC, investment subsidiary of Cargill, Inc., June 2002 to August 2015. | None

|

Mark A. Thompson

Year of Birth: 1959 | Trustee | December 2011 to present | 5 | Chairman and Chief Manager, Riverbridge Partners, LLC (investment management), 1987 to present. | None

|

Ronald A. Tschetter

Year of Birth: 1941 | Trustee | January 2011 to present | 5 | Mr. Tschetter is presently retired from his principal occupation; Director of the U.S. Peace Corps, September 2006 to January 2009. | None |

| Interested Trustees and Officers |

Jon C. Essen1 Year of Birth: 1963 | Treasurer, Secretary, Chief Financial Officer | January 2011 to present; Trustee/November, 2010 to present | 5 | LoCorr Fund Management, LLC: Chief Operating Officer (2010-2016), Chief Compliance Officer (2010-2017); LoCorr Distributors, LLC (broker/dealer): Principal, Chief Financial Officer, and Registered Representative (2008 to present), Chief Compliance Officer (2008-2017). Chief Financial Officer and Principal of Steben & Company, LLC, 2020 to present. | None |

| | | | | | | | | | | | | | | | | |

| Name and Year of Birth | Position(s) Held with the Trust* | Term of Office and Length of Time Served | Number of Portfolios in the Fund Complex** Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

Kevin M. Kinzie2 Year of Birth: 1956 | President, Trustee | January 2011 to present | 5 | Chief Executive Officer of LoCorr Fund Management, LLC, November 2010 to present; President and Chief Executive Officer of LoCorr Distributors, LLC (broker/dealer), March 2002 to present. President and CEO of Steben & Company, LLC, 2019 to present. | None |

Brian Hull

Year of Birth: 1968 | Chief Compliance Officer | November 2019 to present | 5 | Steben & Company, Inc. (broker/dealer): Chief Compliance Officer 2002-2007 and 2012 to Present; Financial & Operations Principal (FINOP) 2002-Present; Registered Representative 2002-Present. | None |

| Nominees for Independent Trustee |

Dan T. O’Lear

Year of Birth: 1961 | Trustee Nominee | N/A | N/A | Mr. O’Lear is presently retired (since 2021); President, Franklin Templeton Distributors, 2018-2021; Head of Retail Distribution, Franklin Templeton Distributors, 2014-2018. | None |

Jeff E. Place

Year of Birth: 1953 | Trustee Nominee | N/A | N/A | Mr. Place is presently retired (since 2016) from his principal occupation as a distribution fund executive. | None |

Catie B. Tobin

Year of Birth: 1958 | Trustee Nominee | N/A | N/A | Ms. Tobin is presently retired (since 2021); Senior Vice President, Director, Field Development & Effectiveness, Wells Fargo Advisors, 2017-2021. | None |

* The term of office for each Trustee listed above will continue indefinitely.

** The term “Fund Complex”refers to the LoCorr Investment Trust.

1 Mr. Essen is an interested Trustee because he is an officer of the Adviser.

2 Mr. Kinzie is an interested Trustee because he is an officer and indirect controlling interest holder of the Adviser.

Role of the Board

The Board of Trustees provides oversight of the management and operations of the Trust. Like all funds, the day-to-day responsibility for the management and operation of the Trust is the responsibility of various service providers to the Trust and its individual series. The Board is also responsible for appointing officers of the Trust, who are responsible for monitoring and reporting to the Board on the Trust’s day-to-day operations. The Board has also appointed a Chief Compliance Officer who reports directly to the Board and administers the Trust’s compliance program.

Board Leadership Structure

The Trust is led by Kevin M. Kinzie, who has served as the Chairman of the Board and President since the Trust was organized in 2011. Mr. Kinzie is an “interested person” as defined in the 1940 Act by virtue of his indirect controlling interest in and his status as an officer of the Adviser. The Board is currently comprised of Mr. Kinzie and four other Trustees, three of whom are Independent Trustees. The Independent Trustees have not selected a Lead Independent Trustee. Additionally, under certain 1940 Act governance guidelines that apply to the Trust, the Independent Trustees will meet in executive session, at least quarterly. Under the Trust’s Declaration of Trust, By-Laws and governance guidelines, the Chairman of the Board is generally responsible for (a) chairing board meetings, (b) setting the agendas for these meetings and (c) providing information to board members in advance of each board meeting and between board meetings. The Trust does not have a Nominating Committee, but the Audit Committee performs the duties of a nominating committee when and if necessary. The Audit Committee will not consider nominees recommended by shareholders, except as required under the 1940 Act and rules thereunder. Generally, the Trust believes it best to have a single leader who is seen by shareholders, business partners and other stakeholders as providing strong leadership. The Trust believes that its Chairman/President together with the Audit Committee (with an independent chairman), and, as an entity, the full Board of Trustees, provide effective leadership that is in the best interests of the Trust, its Funds and each shareholder because of the Board’s collective business acumen and strong understanding of the regulatory framework under which investment companies must operate.

Board Risk Oversight

The Board is responsible for overseeing risk management, and the full Board regularly engages in discussions of risk management and receives compliance reports that inform its oversight of risk management from Brian Hull, the Trust’s Chief Compliance Officer. The Chief Compliance Officer reports at quarterly Board meetings and on an ad hoc basis, when and if necessary. The Audit Committee, which has an independent chairman, considers financial and reporting the risk within its area of responsibilities. Generally, the Board believes that its oversight of material risks is adequately maintained through the compliance-reporting chain where the Chief Compliance Officer is the primary recipient and communicator of such risk-related information.

Board Committees

The Board has an Audit Committee that consists of all the Trustees who are not “interested persons” of the Trust within the meaning of the 1940 Act. Mr. Gary Jarrett has been designated as the Audit Committee Financial Expert. The Audit Committee's responsibilities include: (i) recommending to the Board the selection, retention or termination of the Trust’s independent auditors; (ii) reviewing with the independent auditors the scope, performance and anticipated cost of their audit; (iii) discussing with the independent auditors certain matters relating to the Trust's financial statements, including any adjustment to such financial statements recommended by such independent auditors, or any other results of any audit; (iv) reviewing on a periodic basis a formal written statement from the independent auditors with respect to their independence, discussing with the independent auditors any relationships or services disclosed in the statement that may impact the objectivity and independence of the Trust's independent auditors and recommending that the Board take appropriate action in response thereto to satisfy itself of the auditor's independence; and (v) considering the comments of the independent auditors and management's responses thereto with respect to the quality and adequacy of the Trust's accounting and financial reporting policies and practices and

internal controls. The Audit Committee operates pursuant to an Audit Committee Charter. During the Trust’s most recent fiscal year ended December 31, 2021, the Audit Committee met two times.

Information about Each Trustee’s Qualification, Experience, Attributes or Skills

The Board believes that each of the Trustees has the qualifications, experience, attributes and skills appropriate to his continued service as a Trustee of the Trust in light of the Trust’s business and structure. The Trustees have substantial business and professional backgrounds that indicate they have the ability to critically review, evaluate and assess information provided to them. Certain of these business and professional experiences are set forth in detail in the table above. In addition, the Trustees have substantial board experience and, in their service to the Trust, have gained substantial insight as to the operation of the Trust.

In addition to the information provided in the table above, below is certain additional information concerning each individual Trustee. The information provided below, and in the table above, is not all-inclusive. Many of the Trustees’ qualifications to serve on the Board involve intangible elements, such as intelligence, integrity, work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment, the ability to ask incisive questions, and commitment to shareholder interests. Generally, the Trust believes that each Trustee is competent to serve because of their individual overall merits including (i) experience, (ii) qualifications, (iii) attributes and (iv) skills. The Trust does not believe any one factor is determinative in assessing a Trustee’s qualifications, but that the collective experience of each Trustee makes the Board highly effective.

Mr. Kevin M. Kinzie has more than 25 years of experience in the financial services field, including experience as President and Chief Executive Officer of a FINRA-registered broker/dealer, President and Chief Executive Officer of a financial services marketing firm and as founder of a loan sourcing network serving a group of bank lenders. Mr. Kinzie also holds a Bachelor of Science degree in business and marketing from the University of Colorado. Mr. Kinzie’s background in financial services management and his leadership skills as a financial executive bring practical knowledge to Board discussions regarding the operations of the Funds and the Trust.

Mr. Jon C. Essen has more than 25 years of experience in the financial services field, including experience as Senior Vice President and Chief Operating Officer of a FINRA-registered broker/dealer, Chief Operating Officer of a commercial finance enterprise, Chief Financial Officer of an investment adviser and Treasurer of two mutual fund complexes. Mr. Essen holds a Bachelor of Science degree in business administration from Mankato State University and holds the Certified Public Accountant (inactive) designation. Mr. Essen’s background in investment management and accounting, his leadership skills as a chief financial officer, and his experience with other mutual funds bring context and insight to Board discussions and decision-making regarding the Trust’s operations and dialogue with the Fund's auditors.

Mr. Gary Jarrett has more than 30 years of experience in investment management. Prior to his retirement in September of 2015, Mr. Jarrett was the Chief Executive Officer of Black River Asset Management, LLC, an investment management firm focused on hedge funds and private equity funds. Mr. Jarrett worked for Black River Asset Management, LLC from 2002 to 2015.

Mr. Mark A. Thompson has more than 30 years of experience in investment management, including co-founding Riverbridge Partners, LLC (“Riverbridge”), an investment management firm. At Riverbridge, Mr. Thompson chairs the Executive Committee, which is responsible for the strategic decision making and overall management of the firm. Mr. Thompson also serves as Chief Investment Officer of Riverbridge, and he is responsible for coordinating the efforts of the firm’s investment team and overall portfolio compliance. Mr. Thompson holds a Bachelor’s degree in finance from the University Of Minnesota Carlson School Of Management and is a member of the CFA Institute and the CFA Society of Minnesota.

Mr. Ronald A. Tschetter has more than 30 years of experience in the financial services field, including experience as President of a FINRA-registered broker/dealer and has several years of experience in financial matters based on his service to non-profit organizations. Mr. Tschetter holds a Bachelor’s degree in psychology and social studies from Bethel University. Additionally, Mr. Tschetter served as the Director of the U.S. Peace Corps.

Information about Each Nominee’s Qualification, Experience, Attributes or Skills

Mr. Dan O’Lear has more than 26 years of experience in investment management, including experience serving in several roles at Franklin Templeton Investments and Franklin Templeton Distributors, Inc. At Franklin Templeton Investments, Mr. O’Lear was responsible for investment solutions for retail investors throughout the United States. His role included maintaining relationships with senior management executives at all major clients to negotiate selling agreements between Franklin Templeton Investments and the broker dealer community, as well as liaising with internal leadership of product development, marketing, investment management, legal and compliance, operations and transfer agency. For over ten years, he presented to three independent Franklin Templeton fund boards on share class trends, mutual fund/asset class flows, revenue sharing, distribution strategies, and regulatory issues/proposals on a quarterly basis. Mr. O’Lear currently holds FINRA Series 7 and 24 licenses.

Mr. Jeff Place has over 39 years of experience in the financial services field, including experience as Senior Vice President and Head of Sales for Ivy Funds, Managing Director of U.S. Retail Sales for AllianceBernstein, and Senior Vice President and Head of Sales & National Accounts for WM Funds. As a Senior Distribution Executive, Mr. Place worked very closely with all facets of the broader asset management business including: finance, legal compliance, operations/technology, marketing, fund boards, sub-advisors, offshore funds and closed-end funds. In his role as a former senior executive Mr. Place held FINRA Series 7, 24 and 51 licenses.

Ms. Catie B. Tobin has over 40 years in the financial services field, including banking, credit cards, investments, retail brokerage, wealth management as well as clearing and custody services with RBC Wealth Management, Wells Fargo Advisors and Citicorp. Ms. Tobin was previously active in the Securities Industry and Financial Markets Association (SIFMA), served as a member of the industry’s Public Trust and Confidence Committee, Chaired the Investor Education Committee and represented her firm on many industry-related committees and task forces. Ms. Tobin has a strong understanding of broker dealer and registered investment advisor operations, including all stages of the product development process from launch, marketing, profitability, IT, compliance oversight and risk management. Ms. Tobin has solid knowledge of the industry’s different distribution strategies and how to successfully introduce products and services through advisor led business channels. Ms. Tobin previously held FINRA Series 7, 8, 24, 31 and 53 licenses.

Ownership of Securities

The following table indicates the dollar range of equity securities that each Incumbent Trustee and Nominee beneficially owned in each Fund as of October 31, 2022.

Amount Invested Key:

A.$0

B.$1-$10,000

C.$10,001-$50,000

D.$50,001-$100,000

E.Over $100,000

| | | | | | | | | | | | | | | | | | | | |

| Name of Trustee | Dollar Range of Equity Securities in the Funds | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee in Family of Investment Companies |

| Macro Strategies Fund | Commodities Strategy Fund | Dynamic Opportunity Fund | Spectrum Income Fund | Market Trend Fund |

| Jon C. Essen | E | C | C | C | C | E |

| Kevin M. Kinzie | E | C | D | E | E | E |

| Gary Jarrett | A | A | A | A | A | A |

| Mark A. Thompson | E | E | E | A | A | E |

| Ronald A. Tschetter | E | A | A | A | A | E |

| Dan O’Lear | A | A | A | A | A | A |

| Jeff Place | A | A | A | A | A | A |

| Catie Tobin | A | A | A | A | A | A |

As of October 31, 2022, the Trustees, Nominees and officers, as a group, owned less than 1% of the outstanding shares of any class of any of the Funds.

Compensation

Each Trustee who is not affiliated with the Trust or Adviser receives an annual fee of $80,000, as well as reimbursement for any reasonable expenses incurred attending the meetings. Prior to November 21, 2022, each Trustee received an annual fee of $60,000 as well as reimbursement for any reasonable expenses incurred attending the meetings. The “interested persons” who serve as Trustees of the Trust receive no compensation for their services as Trustees. None of the executive officers receive compensation from the Trust.

The table below details the amount of compensation the Incumbent Trustees received from the Trust for the fiscal year ended December 31, 2021. The Trust does not have a bonus, profit sharing, pension or retirement plan.

| | | | | | | | | | | | | | | | | | | | |

| Name of Trustee | Macro Strategies Fund | Commodities Strategies Fund | Dynamic Opportunity Fund | Spectrum Income Fund | Market Trend Fund | Total Compensation From Trust and Fund Complex Paid to Trustees |

| Jon C. Essen (Interested Trustee) | $0 | $0 | $0 | $0 | $0 | $0 |

| Kevin M. Kinzie (Interested Trustee) | $0 | $0 | $0 | $0 | $0 | $0 |

| Gary Jarrett (Independent Trustee) | $34,953 | $15,835 | $542 | $1,495 | $7,175 | $60,000 |

| Mark A. Thompson (Independent Trustee) | $34,953 | $15,835 | $542 | $1,495 | $7,175 | $60,000 |

| Ronald A. Tschetter (Independent Trustee) | $34,953 | $15,835 | $542 | $1,495 | $7,175 | $60,000 |

PROPOSAL 2 – ADJOURNMENTS OF THE SPECIAL MEETING

The purpose of this Proposal 2 is to authorize the holder of proxies solicited under this Proxy Statement to vote the shares represented by the proxies in favor of the adjournment of the Special Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Special Meeting to constitute a quorum.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE TRUST

VOTE “FOR” APPROVAL OF ADJOURNMENTS.

GENERAL INFORMATION

Solicitation of Proxies

Proxies will be solicited by the Trust primarily by mail. The solicitation may also include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trust, none of whom will be paid for these services, or by a third-party proxy solicitation firm. The Trust has retained AST Fund Solutions, LLC to assist in the solicitation of proxies. The costs (including the costs of printing, mailing, tabulating, and soliciting proxies) associated with the Special Meeting will be paid by the Trust and the Adviser and are estimated to be approximately $280,000 in the aggregate. The Trust may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The Trust may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of a Fund.

If sufficient votes are not received by the date of the Special Meeting, a person named as proxy may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies.

Householding

If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate Proxy Cards. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call the Funds at 1-855-523-8637 on days the Funds are open for business or contact your financial institution. The Funds will begin sending you individual copies thirty days after receiving your request.

Voting Proxies

You should read the entire Proxy Statement before voting. If you sign and return the accompanying Proxy Card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Special Meeting. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card intend to vote “FOR” the Proposals and may vote at their discretion with respect to other matters not now known to the Board that may be presented at the Special Meeting. Attendance by a shareholder at the Special Meeting does not, in itself, revoke a proxy.

Quorum Required

The Trust must have a quorum of shares represented at the Special Meeting, in person or by proxy, to take action on any matter relating to the Trust. A quorum is constituted by the presence in person or by proxy of at least a majority of the aggregate number of outstanding shares of the Trust entitled to vote on a Proposal at the Special Meeting. Broker non-votes, described under “Required Vote” below, have no effect and will not be counted toward quorum.

Adjournment

One or more adjournments of the Special Meeting may be made without notice other than an announcement at the Special Meeting, to the extent permitted by applicable law and the Trust’s governing documents. Any adjournment of the Special Meeting must be held within a reasonable time after the date set for the Special Meeting. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow the Trust’s shareholders who have already sent in their proxies to revoke them at any time before their use at the Special Meeting, as adjourned.

Required Vote

Votes will be counted by the inspector of election appointed for the Special Meeting, who will separately count “For” and “Against” votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). Broker non-votes have no effect and will not be counted toward the vote total for the Proposal.

Proposal 1: The election of the Nominees will be voted upon separately by shareholders of the Funds of the Trust in the aggregate; that is, regardless of the Fund in which you are a shareholder, you have the right to vote for or to withhold your vote for each Nominee on a one vote per share basis without differentiation between the separate Funds. The Incumbent Trustees and Nominees will be elected as Trustees if they receive the affirmative vote of a plurality of votes cast by all shares of the Trust in the aggregate at the Special Meeting at which a quorum is present. A plurality vote means that the Incumbent Trustees and Nominees that receive the largest number of votes will be elected as Trustees. Because the Incumbent Trustees and Nominees are running unopposed, all Incumbent Trustees and Nominees are expected to be elected as Trustees, as all Incumbent Trustees and Nominees who receive votes in favor will be elected, while votes not cast or abstentions will have no effect on the election outcome.

Proposal 2: The approval of any adjournment(s) of the Special Meeting requires the vote of a majority of the votes cast, either in person or by proxy, at the Special Meeting, even if the number of votes cast is fewer than the number required for a quorum.

OTHER INFORMATION ABOUT THE FUNDS

Information About Investment Adviser to the Funds

LoCorr Funds Management, LLC, located at 687 Excelsior Blvd., Excelsior, MN 55331, serves as the investment adviser to the Funds.

Information about Other Service Providers to the Funds

The Funds are distributed by Quasar Distributors, LLC, located at 111 East Kilbourn Avenue, Suite 2200, Milwaukee, Wisconsin 53202.

The Funds’ administrator, transfer agent and dividend disbursing agent is U.S. Bancorp Fund Services, LLC (doing business as U.S. Bank Global Fund Services), 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Information About the Independent Public Accounting Firms for the Funds

Cohen & Company, Ltd. (“Cohen”), 1350 Euclid Avenue, Suite 800, Cleveland, Ohio 44115, serves as the independent registered public accounting firm for the LoCorr Funds.

Further information about Cohen (also referred to as the “Auditor”) can be found in Exhibit A to this proxy statement. Representatives of the Auditor are not expected to be in attendance at the Special Meeting.

Outstanding Shares of the Funds and Shareholders Entitled to Vote

The Funds are the only current series of the Trust. The record holders of outstanding shares of each series of the Trust are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Special Meeting with respect to the Trust and not any individual series of the Trust, including the Proposals. Shareholders of the Trust at the close of business on the Record Date, November 30, 2022, will be entitled to be present and vote at the Special Meeting. As of that date, there were 451,923,073 shares of the Trust outstanding and entitled to vote, representing total net assets of approximately $4,670,548,336 of the Trust.

The number of shares outstanding of each class of each Fund on the Record Date was as follows:

| | | | | | | | | | | |

| Name of the Fund | Class A | Class C | Class I |

LoCorr Macro Strategies Fund

| 8,991,668.4750 | 6,062,235.4580 | 247,540,248.8520 |

LoCorr Long/Short Commodities Strategy Fund

| 14,152,424.1980 | 1,318,317.0860 | 108,220,479.3650 |

LoCorr Market Trend Fund

| 2,009,688.3480 | 1,361,682.2730 | 35,798,819.3630 |

LoCorr Dynamic Opportunity Fund

| 323,922.0900 | 287,087.3670 | 6,100,112.5820 |

LoCorr Spectrum Income Fund

| 2,734,347.2100 | 2,573,816.6230 | 14,448,223.9940 |

Principal Holders of the Funds

A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledged the existence of control. Kevin M. Kinzie may be deemed to control the Fund indirectly because of his controlling interest in the parent company of the Adviser. Shareholders with a controlling interest could affect the outcome of voting or the direction of management of the Funds. A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding shares of a Fund. As of the Record Date, the following shareholders were considered to be principal shareholders of the Funds:

| | | | | | | | | | | | | | | | | |

| Fund and Class | Name and Address | %

Ownership | Parent Company | State of Jurisdiction | Type of

Ownership |

| | | | | |

| Macro Strategies Fund – Class A | Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 28.53% | Schwab Holdings, Inc. | DE | Record |

| American Enterprise Investment Services, Inc.

707 2nd Ave. S.

Minneapolis, MN 55402-2405 | 18.47% | Investors Syndicate Development Corp. | DE | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the

Exclusive Benefit of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 12.51% | Wells Fargo Advisors, LLC | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 10.39% | Fidelity Brokerage Company | DE | Record |

| Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 7.89% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| | | | |

| Macro Strategies Fund – Class C | Wells Fargo Clearing Services LLC

Special Custody Account for the

Exclusive Benefit of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 27.65% | Wells Fargo Advisors, LLC | DE | Record |

| Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 18.63% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| | | | | | | | | | | | | | | | | |

| Fund and Class | Name and Address | %

Ownership | Parent Company | State of Jurisdiction | Type of

Ownership |

| American Enterprise Investment Services, Inc.

707 2nd Ave. S.

Minneapolis, MN 55402-2405 | 17.13% | Investors Syndicate Development Corp. | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 12.62% | Schwab Holdings, Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 8.53% | Fidelity Brokerage Company | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 5.80% | LPL Financial Holdings Inc. | DE | Record |

| Macro Strategies Fund – Class I | American Enterprise Investment Services, Inc.

707 2nd Ave. S.

Minneapolis, MN 55402-2405 | 21.57% | Investors Syndicate Development Corp. | DE | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the

Exclusive Benefit of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 16.05% | Wells Fargo Advisors, LLC | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 15.14% | LPL Financial Holdings Inc. | DE | Record |

| Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 14.38% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| NFS LLC

For the Exclusive Benefit of

AssetMark Trust Company

3200 N Central Ave., FL 7

Phoenix, AZ 85012-2425 | 11.01% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 6.39% | Schwab Holdings, Inc. | DE | Record |

Commodities Strategy Fund – Class A

| National Financial Services LLC

499 Washington Boulevard, 4th Floor

Jersey City, NJ 07310-1995 | 73.98% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 13.52% | Schwab Holdings, Inc. | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 1.84% | LPL Financial Holdings Inc. | DE | Record |

| | | | | | | | | | | | | | | | | |

| Fund and Class | Name and Address | %

Ownership | Parent Company | State of Jurisdiction | Type of

Ownership |

Commodities Strategy Fund – Class C

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 32.34% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 24.47% | Schwab Holdings, Inc. | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 23.67% | LPL Financial Holdings Inc. | DE | Record |

| Pershing LLC

1 Pershing Plaza, FL 14

Jersey City, NJ 07399-0002 | 13.99% | The Bank of New York Mellon Corporation | DE | Record |

| Dynamic Opportunity Fund – Class A | National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 27.03% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 26.46% | Schwab Holdings, Inc. | DE | Record |

| c/o Reliance Trust Company WI

Maril & Co. FBO NA

4900 W. Brown Deer Rd.

Milwaukee, WI 53223-2422 | 11.18% | N/A | N/A | Record |

| American Enterprise Investment Services, Inc.

707 2nd Ave. S.

Minneapolis, MN 55402-2405 | 6.81% | Investors Syndicate Development Corp. | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 3.92%% | LPL Financial Holdings Inc. | DE | Record |

Dynamic Opportunity Fund – Class C

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 56.73% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 12.53% | Schwab Holdings, Inc. | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 11.04% | LPL Financial Holdings Inc. | DE | Record |

| American Enterprise Investment Services, Inc.

707 2nd Ave. S.

Minneapolis, MN 55402-2405 | 6.07% | Investors Syndicate Development Corp. | DE | Record |

| Dynamic Opportunity Fund – Class I | LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 42.04% | LPL Financial Holdings Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 37.15% | Fidelity Brokerage Company | DE | Record |

| | | | | | | | | | | | | | | | | |

| Fund and Class | Name and Address | %

Ownership | Parent Company | State of Jurisdiction | Type of

Ownership |

| Charles Schwab & Co., Inc.

Special Custody Acct FBO Customers

Attn: Mutual Funds

211 Main St

San Francisco, CA 94105-1905 | 5.91% | Schwab Holdings, Inc. | DE | Record |

Spectrum Income Fund – Class A

| Charles Schwab & Co., Inc.

Special Custody Acct FBO Customers

Attn: Mutual Funds

211 Main St

San Francisco, CA 94105-1905 | 21.23% | Schwab Holdings, Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 20.09% | Fidelity Brokerage Company | DE | Record |

| Pershing LLC

1 Pershing Plaza, FL 14

Jersey City, NJ 07399-0002 | 14.25% | The Bank of New York Mellon Corporation | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 12.36% | LPL Financial Holdings Inc. | DE | Record |

| Spectrum Income Fund – Class C | LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 32.44% | LPL Financial Holdings Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 29.71% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 15.75% | Schwab Holdings, Inc. | DE | Record |

| Pershing LLC

1 Pershing Plaza, FL 14

Jersey City, NJ 07399-0002 | 9.02% | The Bank of New York Mellon Corporation | DE | Record |

Spectrum Income Fund – Class I

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 44.91% | LPL Financial Holdings Inc. | DE | Record |

| Pershing LLC

1 Pershing Plaza, FL 14

Jersey City, NJ 07399-0002 | 18.64% | The Bank of New York Mellon Corporation | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 16.17% | Fidelity Brokerage Company | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 7.05% | Schwab Holdings, Inc. | DE | Record |

| | | | | | | | | | | | | | | | | |

| Fund and Class | Name and Address | %

Ownership | Parent Company | State of Jurisdiction | Type of

Ownership |

Market Trend Fund – Class A

| Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 59.57% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 12.83% | Schwab Holdings, Inc. | DE | Record |

| UBS Financial Services Incorporated

1000 Harbour Blvd, FL 8

Compliance Department

Weehawken, NJ 07086-6727 | 7.88% | UBS Group | DE | Record |

Market Trend Fund – Class C

| Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 41.54% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 16.48% | Schwab Holdings, Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 10.10% | Fidelity Brokerage Company | DE | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the

Exclusive Benefit of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 6.57% | Wells Fargo Advisors, LLC | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 5.35% | LPL Financial Holdings Inc. | DE | Record |

| Market Trend Fund – Class I | Morgan Stanley Smith Barney LLC

For the Exclusive Benefit of Its Customers

1 New York Plaza, FL 39

New York, NY 10004-1932 | 48.21% | Morgan Stanley Domestic Holdings Inc. | DE | Record |

| National Financial Services LLC

499 Washington Blvd, FL 4th

Jersey City, NJ 07310-1995 | 11.45% | Fidelity Brokerage Company | DE | Record |

| LPL Financial

Omnibus Customer Account

Attn: Lindsay O'Toole

4707 Executive Drive

San Diego, CA 92121-3091 | 7.08% | LPL Financial Holdings Inc. | DE | Record |

| Charles Schwab & Co., Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main St.

San Francisco, CA 94105-1901 | 6.90% | Schwab Holdings, Inc. | DE | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the

Exclusive Benefit of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 6.21% | Wells Fargo Advisors, LLC | DE | Record |

Other Business

The Board does not intend to present any other business at the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the accompanying Proxy Card will vote thereon in accordance with their judgment.

Unless otherwise required by the 1940 Act or SEC rules and regulations, the Trust is not required to hold annual meetings of shareholders and currently does not intend to hold such meetings. Any shareholder proposal intended to be presented at any future meeting of shareholders must be received by the Trust at its principal office a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in the proxy statement relating to such meeting.

Communication with Trustees

Shareholders wishing to communicate with the Board or individual Trustees should send such correspondence care of the Secretary of the Trust, 687 Excelsior Boulevard, Excelsior, MN 55331.

Legal Proceedings

The Board is not aware of any legal proceedings involving the Trustees, Nominees or officers of the Trust to which such person has a material interest adverse to any Fund or the Trust, nor is the Board aware of any legal proceeding involving the Trustees, the Nominees or officers of the Trust that would be material to the evaluation of the ability or integrity of such person such that disclosure would be required.

Exhibit A

Audit Fees

The Trust has engaged Cohen as its principal accountant to perform audit services for the Funds’ financial statements for the two most recent fiscal years ended in 2020 and 2021, respectively. Aggregate fees billed to the Trust by Cohen for audit services were $135,000 and $130,000, respectively.

Audit-Related Fees

Cohen did not perform any assurance or services related to the performance of the audits of the Funds’ financial statements for the two most recent fiscal years ended in 2020 or 2021, respectively.

Tax Fees

Cohen prepared federal and state income tax returns for each of the Funds, as applicable, for the two most recent fiscal years ended in 2020 and 2021, respectively. Aggregate fees billed to the Trust by Cohen for professional services for tax compliance, tax advice and tax planning were $30,000 and $30,000, respectively.

All Other Fees

“Other services” provided by the principal accountant of $6,500 and $5,000 represent a cursory review of the semi-annual report for LoCorr Investment Trust for the periods ended June 30, 2021 and June 30, 2020, respectively.

Pre-Approval of Certain Services

The Audit Committee Charter requires pre-approval by the Trust of all auditing and permissible non-audit services to be provided to the Trust by Cohen, respectively, including fees. Accordingly, all of these non-audit services were required to be pre-approved, and all of these non-audit services were pre-approved by the Audit Committee.

Non-Audit Fees Paid by the Investment Adviser and Its Affiliates

The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $0 for 2021 and $0 for 2020.

[FUND NAME INSERTED HERE]

A SERIES OF LOCORR INVESTMENT TRUST

PROXY FOR A JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JANUARY 20, 2023

The undersigned, revoking prior proxies, hereby appoints Name, Name and Name, and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the special joint meeting of the above named Fund (the “Fund”) offices of the Funds’ investment adviser, LoCorr Fund Management, LLC, located at 687 Excelsior Blvd, Excelsior, MN 55331 on Friday, January 20, 2023 at 9:00 a.m. Central time, or at any adjournment thereof, upon the proposals described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on January 20, 2023. The proxy statement for this meeting is available at:

https://vote.proxyonline.com/locorrfunds/docs/2023.pdf

This proxy is solicited on behalf of the Company’s Board of Trustees. Each of the trustee nominees has been unanimously approved by the Board of Trustees and recommended for election as a trustee by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the election of all of the trustee nominees if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ discretion as to any other matters that may properly come before the joint special meeting or any postponement or adjournment thereof.

THE BOARD OF TRUSTEES OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” ALL OF THE NOMINEES FOR TRUSTEE.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: l

PROPOSAL 1: To approve the election of the Trustees to the Board of Trustees of the Trust to serve until his or her successor is elected and qualified.

THANK YOU FOR VOTING