Filed by Teranga Gold Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed under the Securities Exchange Act of 1934

Subject Company: Oromin Explorations Ltd.

Commission File No.: 333- 189465

| CREATING THE PREEMINENT SENEGALESE GOLD STORY JUNE 2013 |

| This presentation contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”) and includes statements relating to the timing and the terms and benefits of the Offer. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Teranga, or developments in Teranga’s business or in its industry, or with respect to the Offer, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, future economic conditions and courses of action, and assumptions related to government approvals, the co-operation of the other OJVG shareholders and anticipated costs and expenditures. The words “poised”, “gives”, “expect”, “its vision”, “plan”, “support”, “assist”, “commit to”, “will not”, “intend”, “intends to” and similar expressions identify forward looking statements. Forward-looking statements may also include, without limitation, any statement relating to future events, conditions or circumstances. Teranga cautions you not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. There is no guarantee that the terms and conditions to the Offer will be met or that the anticipated benefits of the Offer will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, co-operation of each of the OJVG shareholders; and other risks detailed from time to time in Teranga’s filings with Canadian provincial securities regulators. Forward-looking statements are based on management's current plans, estimates, projections, beliefs and opinions, and, except as required by law, Teranga does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Nothing in this presentation should be construed as either an offer to sell or a solicitation to buy or sell Teranga securities. Forward looking information and other information contained herein concerning mineral exploration and management’s general expectations concerning the mineral exploration industry are based on estimates prepared by management using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which management believes to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While management is not aware of any misstatements regarding any industry data presented herein, mineral exploration involves risks and uncertainties and industry data is subject to change based on various factors. In addition, please note that statements relating to “reserves” or “resources” are deemed to be forward looking information as they involve the implied assessment, based on certain estimates and assumptions, that the resources and reserves described can be profitably mined in the future. While management has confidence in its projections based on exploration work done to date, the potential quantity and grade disclosed herein is conceptual in nature, and there has been insufficient exploration to define a mineral resource, therefore it is uncertain if further exploration will result in the targets being delineated as a mineral resource. This presentation does not constitute in any way an offer or invitation to subscribe for securities in Teranga pursuant to the Corporations Act 2001 (Cth). NOTICE TO U.S. SHAREHOLDERS: Please see important information contained in the section labeled "Jurisdictions" at the back of this presentation. Note: any terms not defined herein have the meaning ascribed thereto in the press release of the Company dated June 20, 2013. CAUTIONARY STATEMENT |

| OUR VISION To become a preeminent gold producer in West Africa while setting the benchmark for responsible mining in Senegal Phase 1: Become a mid-tier gold producer in Senegal with 250,000 to 350,000oz. of annual gold production leveraging off existing infrastructure 2011 production of 131,461oz. at cash costs of $782/oz. 2012 production of 214,310oz. at cash costs of $627/oz. 2013 forecast production of 190,000 – 210,000oz. at cash costs of $650-$700/oz. 2014 forecast production of 200,000 – 250,000oz. pending the timing of Gora production 2015 - 2020 the Sabodala mill has design capacity to produce 275,000 – 300,000oz. per year based on the combined P&P open pit reserves of TGZ and OJVG (based on TGZ and OJVG NI 43-101 reports) Phase 2: Increase annual gold production to 400,000 to 500,000 oz. with mill expansion as reserves increase |

| Strengthened the operating team (Sabodala and corporate) to de-risk the operations Expanded mill - increasing annual production from 130,000oz. to over 200,000oz. Reduced operating costs Eliminated hedge book and strengthened the balance sheet Expanded reserves adding ~729koz. and extending the mine life by ~4 years. (Increased M&I by 1.23Moz. and Inferred by 1.10Moz.) Established a regional exploration program and drill tested over 50 targets, developing a pipeline of prospective targets Improved community relations Negotiated global agreement with the new Government to allow among other items – asset consolidation Focused on the Oromin and subsequent OJVG transactions to enhance and protect shareholder value Teranga is continuing to make significant progress toward becoming a preeminent gold producer in West Africa TERANGA’S ACHIEVEMENTS SINCE IPO |

| THE OFFER |

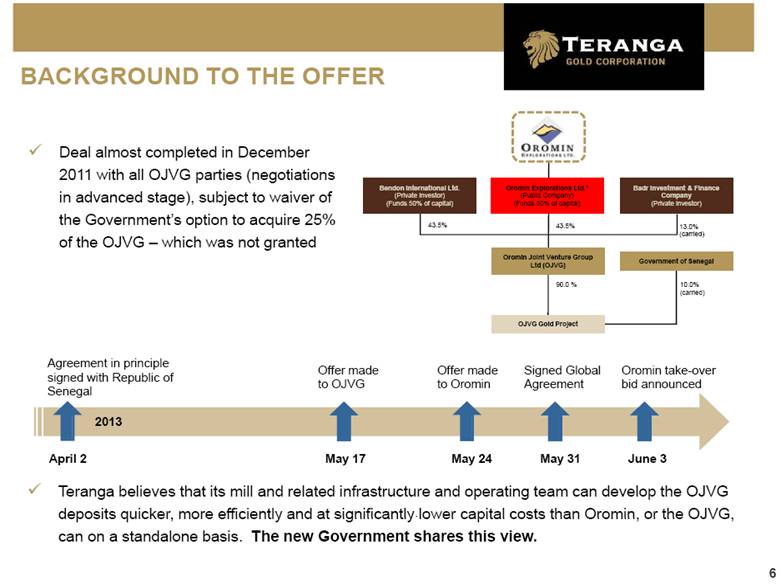

| Teranga believes that its mill and related infrastructure and operating team can develop the OJVG deposits quicker, more efficiently and at significantly lower capital costs than Oromin, or the OJVG, can on a standalone basis. The new Government shares this view. Deal almost completed in December 2011 with all OJVG parties (negotiations in advanced stage), subject to waiver of the Government’s option to acquire 25% of the OJVG – which was not granted May 17 Offer made to Oromin May 24 May 31 Offer made to OJVG April 2 Agreement in principle signed with Republic of Senegal Signed Global Agreement June 3 Oromin take-over bid announced Bendon International Ltd. (Private investor) (Funds 50% of capital) Oromin Explorations Ltd.1 (Public Company) (Funds 50% of capital) Badr Investment & Finance Company (Private investor) Oromin Joint Venture Group Ltd (OJVG) Government of Senegal OJVG Gold Project 43.5% 43.5% 13.0% (carried) 10.0% (carried) 90.0 % BACKGROUND TO THE OFFER 2013 |

| A new Government in Senegal was elected in April 2012 The Government is committed to putting a new stamp on Senegal Relationships with former government officials are unhelpful Senior Management has met with the President of Senegal 6 times in the last few months Strong relationships of trust have been established between the Ministry of Energy and Mines and the Senior Management team of Teranga The new Government has made it clear that the Senior Management team of Teranga has earned their trust and the social license to operate Government support is critical to ensuring that the Oromin transaction and subsequent negotiations with Bendon are successful, as well as the integration of the operations to capture the synergies. GOVERNMENT SUPPORT IS CRITICAL TO SUCCESS OF THE DEAL |

| TERANGA’S MANAGEMENT TEAM HAS FULL GOVERNMENT SUPPORT "I am delighted with the long-term Agreement which has been signed in the mutual interests of both parties between the Republic of Senegal and Teranga. This Agreement will contribute to the economic and social development of Senegal as well as being particularly beneficial to the local population and to the region of Kedougou. The mining industry is of great importance to Senegal. My wish is that the Agreement with Teranga Gold will serve to reinforce the climate for foreign investment in Senegal so as to make our country a favoured destination for investment, and always in a spirit of 'win-win‘." President Macky Sall of Senegal - April 2, 2013 “I am delighted with this long-term agreement as its expeditious conclusion demonstrates the level of partnership and trust established between the Canadian management team of Teranga and the Government.” President Macky Sall of Senegal - May 31, 2013 “I wish to emphasize that the success of these agreements in large part the result of the close working relationships that have been established between yourself [referring to Alan Hill] and the Senior Management of Teranga and the Government of Senegal as well as the considerable improvement in relations between the population of the village of Sabodala and the Company since Teranga acquired control of the Project.” Minister of Mines and Energy - May 31, 2013 |

| PROPOSED TERMS OF THE OFFER Teranga is proposing the acquisition of 100% of the outstanding shares of Oromin for total consideration of 80M shares of Teranga, including the shares already owned by Teranga. A net total of 69.1M treasury shares would be issued by Teranga. Share exchange ratio of 0.582 based on total current shares outstanding of 137.4M for Oromin Implies a premium of 50.0% based on 20-day volume weighted average prices, for the period ended May 31, 2013, (the last trading day before Teranga’s announcement of its intention to make the bid), and 68.7% based on May 31, 2013 closing prices Deal is subject to approval by both Teranga and Oromin shareholders With IAMGOLD’s shares, Teranga currently has 25% locked up Teranga’s annual and special shareholders meeting to approve the transaction, among other business, is scheduled for July 18, 2013 Oromin’s special shareholder meeting is expected to be held at the end of July 2013 Deal is also contingent on (among other things): There not being any pending or threatened legal action prohibiting or restricting it Oromin not deploying certain defensive tactics No material adverse effect and Teranga not becoming aware of any material non-desclosed information |

| BENEFITS TO TERANGA SHAREHOLDERS Significant capital and operational synergies by leveraging our existing mill and infrastructure Improvement of financial metrics Expanded reserves with significant additional upside potential Increased production profile – one of largest (open pit) gold complex’s in West Africa Only mill in Senegal – Strategic Regional Advantage The transaction expected to significantly add to shareholder value |

| VALUE CREATION Capital and Operating Synergies Proximity of deposits to existing mill and infrastructure are expected to result in very low incremental increases in capital expenditure and LOM sustaining capital to produce ~1.445Moz. Operating synergies in equipment, personnel and support result in seamless integration of operations Financial Metrics Significantly Strengthened at $1,400 Gold Full life free cash flow expected to increase by approximately 50% NAV expected to increase by approximately 50% Earnings expected to increase by approximately 300% Teranga expects to charge OJVG a toll milling fee in line with Teranga's depreciation cost per ounce These financial metrics are based on the following assumptions: Open pit proven and probable mineral reserves of the OJVG contained in the OJVG 43-101 Report Operating cost assumptions based on Sabodala actual costs No change in the operator of the OJVG, and mining, processing and site administrative costs charged to the OJVG based on actual costs plus on a nominal margin Teranga charging the OJVG an equipment rental fee in line with Teranga's depreciation cost per ounce and as a result OJVG would not be expected to incur any future capital costs Otherwise based on the terms and conditions regarding distributions contained in the OJVG shareholders agreement (as publicly filed on SEDAR) |

| THE COMBINED ASSET BASE Source: OJVG Golouma Gold Project Updated Feasibility Study Technical Report, January 30, 2013 The Sabodala mill and complex at design capacity is capable of processing 275,000 to 300,000oz. per year during the period 2015 to 2020 Teranga’s share of the expected combined annual production from 2015 to 2020 would be approximately 63%(1) Bendon and Teranga’s share in the OJVG ore production would increase to approximately 47%, after recovery of initial investments by the two majority shareholders(2) Based on total proven and probable reserves of Teranga and of the OJVG (based on the open-pit mineral reserve estimates contained in the OJVG 43-101 Report). Based on life of mine cash flows at a US$1,400 gold price assumption |

| THE COMBINED COMPANY TGZ – Pre TGZ – Post Combined Company Shares Outstanding (fully diluted) 246M 315M ~78% TGZ Post Ownership Fully Diluted “In The Money” Market Cap(1) ~C$174M ~C$216M TGZ - Pre OLE - Pre Combined Company Reserves (P+P)(2) 1.65Moz. 0.91Moz.(3) Possible increase in reserves by 55% Resources (M+I) 2.70Moz. 1.86Moz.(3) Possible increase in resources by 69% As of May 31, 2013 Based on total proven and probable reserves of Teranga and of the OJVG (based on the open-pit mineral reserve estimatss contained in the OJVG 43-101 Report After taking account of OLE’s 43.5% ownership in OJVG and the Government’s 10% carried interest. Based on OJVG’s NI 43-101 Report. Note: OJVG reserves and resources chart included in the appendix. Anticipated toll milling revenues of ~$250/oz. for mining/processing the un-owned OJVG portion enhances financial metrics At $1,400 gold TGZ realizes about 75% of the cash flow from OJVG. |

| (1) Including both TGZ and OJVG production Notes: All data above provided by Cormark Securities as of May 31, 2013 C$/US$ = 0.9668, A$/US$=0.9593, £/US$=1.5164 Reserves and resources are based on publicly disclosed NI 43-101 (and/or JORC) compliant numbers, on an attributable basis Total resource is an estimate that includes M+I resources, plus inferred resources, on an attributable basis POST-ACQUISITION PEER GROUP |

| REQUIREMENTS FOR TERANGA SHAREHOLDER VALUE CREATION While transformational, this transaction is merely the first step in value creation. Expected next steps are: Complete the acquisition of Oromin Negotiate toll milling agreement with JV partners (Bendon and Badr) Develop and integrate OJVG deposits into Teranga’s operations Increase production and generate greater free cash flow. Most important element is maintaining the social license to operate and the trust and support of the new Government |

| PROXY |

| Integration of Oromin and subsequently the OJVG Reliance on Oromin’s public disclosure Change in the composition of the Board and Management Board and Management need to remain focused on managing the complicated situation and leveraging the work that has been done to date RISKS TO THE DEAL/BUSINESS PLAN |

| MDL’S CLAIMS Share price underperformance Teranga has performed in line with its African peers Excessive exploration spend ~$90/oz discovery cost, in line with industry average High general and administrative costs 2012 costs are below our African peer average Self-dealing and Governance concerns We have a highly experienced, independent board all with public Co Board experience Governance and oversight level is high Compensation Top 2 executives have personally invested ~$4M Top 2 executives in line with peers; 2012 compensation was agreed to at YE (Share price was $2.26 - up 9% in 2012, record profit) |

| SHARE PRICE PERFORMANCE Teranga has performed in line with its African peers despite MDL’s 40 million share “overhang” that it has publicly committed to disposing of by the end of 2013. Shares Held by the Executive Directors Alan R. Hill (household) 1,549,100 Richard Young 558,030 Together Alan Hill (household) and Richard Young have invested over $4 million to date, much at the IPO price *Average does not include Teranga or MDL. *Share prices taken as of June 18, 2013. - 38% - 62% - 64% - 65% - 70% - 70% - 71% - 72% - 73% - 76% - 80% - 81% - 94% -100% -90% -80% -70% -60% -50% -40% -30% -20% -10% 0% Share Price Performance Since 52 - Week Highs |

| EXPLORATION SPEND Money has been spent on a systematic program laid out by AMC in IPO prospectus (>100 anomalies) We have now narrowed our targets Mineralization encountered on every target Significant ounces added and we remain optimistic Teranga Exploration Expenditure – IPO to Q1 2013 Exploration $34.5M Reserve Development $42.8M Gora $20.3M Spending to Q1’13 $97.6M Increase in Mineralized Inventory since July 2010 Our Finding Cost Reserves 0.729 Moz. $87 per reserve ounce M+I Resources 1.225 Moz. $42 per resource ounce Inferred Resources 1.100 Moz. Oromin Exploration Expenditure OJVG’s Finding Cost Exploration Expenditure $163M $116 per reserve ounce Open Pit Reserves 1.4Moz. Note: Reserve replacement costs on an industry wide basis was $117/oz (2009-2011). (Source: Mineral Economics Group) |

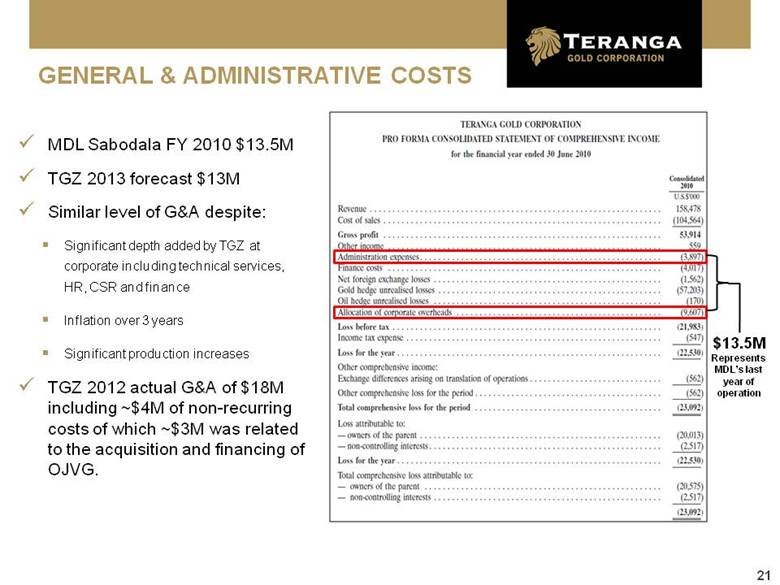

| GENERAL & ADMINISTRATIVE COSTS MDL Sabodala FY 2010 $13.5M TGZ 2013 forecast $13M Similar level of G&A despite: Significant depth added by TGZ at corporate including technical services, HR, CSR and finance Inflation over 3 years Significant production increases TGZ 2012 actual G&A of $18M including ~$4M of non-recurring costs of which ~$3M was related to the acquisition and financing of OJVG. $13.5M Represents MDL’s last year of operation |

| BREAKDOWN OF 2012 G&A COSTS 2012 G&A costs excluding non-recurring items Objective is to maintain G&A at this level Recurring items Corporate office 8,406 Audit fees 391 Listing fees 226 D&O insurance 158 Depreciation 550 9,731 Recurring items - discretionary Dakar office 754 Social community 1,558 Professional & consulting fees 558 Legal & other 1,340 4,210 13,941 Non-recurring items Oromin acquisiton and financing 3,075 Recruitment costs (now in-house) 313 Pronto & Taleo IT systems (set up costs) 310 Insurance (now charged back to site) 292 3,990 Total administration costs 17,931 |

| 1) Base salary plus bonus 2) Nicholas Limb and Jeff Williams were both paid $400,000 each as part of a consulting agreement with TGZ signed as a part of the spin out SELF-DEALING & GOVERNANCE 2012 Cash Compensation Percentile Rankings vs. Comparator Group Salary Percentile Bonus Percentile Alan Hill – Executive Chairman 63 50 Richard Young – President and CEO 50 40 Navin Dyal – Vice President and CFO 50 50 Mark English – Vice President, Sabodala Operations 50 75 Paul Chawrun – Vice President, Technical Services 50 50 Pay for performance where fixed elements of pay such as salary are positioned at market median levels (50th percentile) for the comparator group but this may vary above or below the median depending on scope of responsibility, experience, market compensation, annual performance assessments, overall market demand for a role and overall compensation. Comparator Group Includes: Argonaut Gold Inc., Asanko Gold Inc., Aurcana Corp., Banro Corp., Centamin plc, Endeavour Mining Corp., Fortuna Silver Mines Inc., Golden Star Resources Ltd., Goldgroup Mining Inc., Katanga Mining Ltd., Iberian Minerals Corp., International Minerals Corp., Luna Gold Corp., Nevsun Resources Ltd., Perseus Mining Ltd., PMI Gold Corp., Primero Mining Corp., Rio Alto Mining Ltd., Semafo Inc Remuneration TGZ vs. MDL(1) 2011/12 Salary ($M) Consulting Fees ($M) Total ($M) Alan Hill & Richard Young 2.7 0 2.7 Nicholas Limb (Jeff Williams or Rick Sharp) 2.7 0.8(2) 3.5 |

| SELF-DEALING & GOVERNANCE 2012 Performance Incentive Metrics Target Achievement 210,000 to 225,000 oz. production 214,310oz. $600-$659/oz. cash cost $627/oz. cash cost Share price increase 9% increase on TSX / 16% increase on ASX Successful mill expansion, increasing throughput and availability Expansion complete and increased throughput and availability Increase resource gold inventory (2.5-3.5 Moz. over next 12-18 months) Target not met Positive EPS $0.33/share Deliver 100,000oz. into hedge 114,711oz. delivered into hedge Less than 4.18 LTI / Mhrs worked 1.73 LTI / Mhrs worked Increase in human and financial commitment (CSR) Education, water and sanitation project funded 2012 bonus increased from 25% to 50% of base salary because the below pre-defined metrics were largely met Alan Hill and Richard Young have invested over $4 million in TGZ since IPO Employment agreements approved/disclosed as part of the IPO and are standard for mining industry, although not as broad as MDL’s agreements |

| MDL PLAN PUTS SHAREHOLDER VALUE AT RISK MDL jeopardizes execution of OJVG integration MDL has ~16% of shares yet is seeking Board control while not offering a control premium to shareholders Replacing independent board members with MDL employees No plan or rationale have been put forward by MDL MDL has publicly stated that they are a seller by end of 2013 making their takeover motives appear self-serving Change in the Board or Management team is a review event under loan facilities with the risk of accelerated repayment within 90 days No clear path to enhancing shareholder value What is MDL’s motive? |

| VOTE THE BLUE PROXY TO REALIZE SHAREHOLDER VALUE Current Board and Management team have successfully laid the ground work to build TGZ into a preeminent gold producer in West Africa IPO strategy remains clear and simple – the acquisition of OLE and the integration of the OJVG to generate significant shareholder value Change in Board and Management puts shareholder value at risk because MDL does not have the trust of the Government of Senegal Current Board and Management team are best positioned to integrate and realize the benefits of the Oromin transation for shareholders |

| APPENDIX |

| Table 1: Mineral Reserves as at 31 March 2013 PROVEN PROBABLE PROVEN AND PROBABLE MM Grade MM oz MM Grade MM oz MM Grade MM oz tonnes g/t Au Au tonnes g/t Au Au tonnes g/t Au Au SABODALA 7.19 1.60 0.37 9.66 1.51 0.47 16.85 1.55 0.84 NIAKAFIRI 0.23 1.69 0.01 7.58 1.12 0.27 7.81 1.14 0.29 STOCKPILE 7.91 0.96 0.24 - - - 7.91 0.96 0.24 GORA 0.57 4.07 0.07 1.53 4.27 0.21 2.10 4.22 0.28 TOTAL 15.90 1.37 0.70 18.77 1.58 0.95 34.67 1.48 1.65 Notes: CIM definitions were followed for Mineral Reserves. Mineral Reserves for Sabodala include Sutuba. Mineral Reserve cut off grades for Sabodala are 0.30 g/t Au for oxide and 0.5 g/t Au for fresh. Mineral Reserve cut off grades for Niakafiri are 0.35 g/t Au for oxide and 0.5 g/t Au for fresh. Mineral Reserve cut off grade for Gora is 0.5 g/t Au for oxide and fresh. Gold price of USD 1,400 per ounce and March/13 operating costs for Sabodala reserves. Proven Reserves include stockpiles which total 7.91 Mt at 0.96 g/t Au for 0.24 Moz. Sum of individual amounts may not equal due to rounding. Dilution from resource estimated at 14% at Sabodala Table 2: Measured and Indicated Mineral Resources as at 31 March 2013 MEASURED INDICATED MEASURED AND INDICATED MM Grade MM oz MM Grade MM oz MM Grade MM oz tonnes g/t Au Au tonnes g/t Au Au tonnes g/t Au Au SABODALA 24.75 1.38 1.10 23.35 1.32 1.08 50.10 1.35 2.18 NIAKAFIRI 0.30 1.74 0.02 10.50 1.10 0.37 10.70 1.12 0.39 GORA 0.49 5.27 0.08 1.84 4.93 0.29 2.32 5.00 0.37 TOTAL 25.54 1.46 1.20 37.69 1.44 1.74 63.23 1.45 2.94 Notes: CIM definitions were followed for Mineral Resources. Mineral Resources for Sabodala include Sutuba. Mineral Resource cut off grades for Sabodala are 0.2 g/t Au for oxide and 0.35 g/t Au for fresh. Mineral Resource cut off grades for Niakafiri are 0.3 g/t Au for oxide and 0.5 g/t Au for fresh. Mineral Resource cut off grade for Gora is 0.5 g/t Au for oxide and fresh. Mineral Resource cut off grade for Niakafiri West and Soukhoto is 0.3 g/t Au for oxide and fresh. Mineral Resource cut off grade for Diadiako and Majiva is 0.2 g/t Au for oxide and fresh. Mineral Resource cut off grade for Masato is 0.35 g/t for fresh. Measured Resources include stockpiles which total 7.91 Mt at 0.96 g/t Au for 0.24 Mozs. High grade assays were capped at 10 g/t and 15 g/t Au at Sabodala, 20 g/t to 70 g/t Au at Gora, 10 g/t Au at Soukhoto and 20 g/t Au at Masato. The figures above are “Total” Mineral Resources and include Mineral Reserves. Sum of individual amounts may not equal due to rounding. Table 3: Inferred Mineral Resources as at 31 March 2013 INFERRED MM tonnes Grade g/t Au MM oz Au SABODALA 18.11 0.95 0.55 NIAKAFIRI 7.20 0.88 0.21 NIAKAFIRI WEST 7.10 0.82 0.19 SOUKHOTO 0.60 1.32 0.02 GORA 0.21 3.38 0.23 DIADIAKO 2.90 1.27 0.12 MAJIVA 2.60 0.64 0.05 Masato 19.18 1.15 0.71 TOTAL 57.90 1.00 1.87 Note: Please see Sabodala Technical Report, June 7, 2012 and Competent Persons Statement on page 37 of this presentation TERANGA RESOURCE SUMMARY |

| Mineral Reserves PROVEN PROBABLE PROVEN AND PROBABLE MM Grade MM oz MM Grade MM oz MM Grade MM oz Tonnes g/t Au Au Tonnes g/t Au Au Tonnes g/t Au Au GOLOUMA DEPOSITS (OPEN PIT) 2.902 2.38 0.222 2.902 2.38 0.222 GOLOUMA DEPOSITS (UNDERGROUND) 6.122 4.52 0.890 6.122 4.52 0.890 MASATO DEPOSIT 18.987 2.00 1.223 18.987 2.00 1.223 TOTAL 28.011 2.59 2.335 28.011 2.59 2.335 Measured , Indicated and Inferred Mineral Resources MM Grade MM oz Tonnes g/t Au Au MEASURED - - - INDICATED 75.2 1.56 3.78 INFERRED 17.3 1.73 0.96 Sources: For resources - OJVG Golouma Project Exploration Program Technical Report, Senegal, West Africa, dated, Effective Date January 30, 2012 (please see Oromin press release dated October 1, 2012; For reserves - OJVG Sabodala Feasibility Study, dated January 30, 2013 (please see Oromin press release dated January 31, 2013) OJVG RESOURCE SUMMARY |

| Includes 106koz. on stockpile at 1.26g/t Note: Please see Sabodala Technical Report, June 7, 2012 and Competent Persons Statement on page 37 of this presentation ALMOST 730koz. OF RESERVES ADDED Reserves at July 1/2010 Proven Probable Proven and Probable Tonnes Grade Au Tonnes Grade Au Tonnes Grade Au (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) Sabodala 18.66 1.60 0.96 4.01 1.75 0.23 22.67 1.62 1.18 Niakafiri 0.23 1.76 0.01 6.98 1.17 0.26 7.21 1.19 0.28 Total 18.89 1.60 0.97 10.99 1.38 0.49 29.88 1.52 1.46(1) Reserves at March 31/2013 Proven Probable Proven and Probable Tonnes Grade Au Tonnes Grade Au Tonnes Grade Au (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) Sabodala 7.19 1.60 0.37 9.66 1.51 0.47 16.85 1.55 0.84 Niakafiri 0.23 1.69 0.01 7.58 1.12 0.27 7.81 1.14 0.29 Stockpile 7.91 0.96 0.24 - - - 7.91 0.96 0.24 Gora 0.57 4.07 0.07 1.53 4.27 0.21 2.10 4.22 0.28 Total 15.90 1.37 0.70 18.77 1.58 0.95 34.67 1.48 1.65 Contained ounces produced since July 1, 2010 of 539koz. and an increase of 190koz. in P&P means the addition of ~729koz. in reserves |

| Note: Please see Sabodala Technical Report, June 7, 2012 and Competent Persons Statement on page 37 of this presentation OVER 2.3Moz. OF RESOURCES ADDED M&I Resources at July 1/2010 Measured Indicated Measured and Indicated Tonnes Grade Au Tonnes Grade Au Tonnes Grade Au (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) Sabodala 28.52 1.41 1.30 13.37 1.34 0.58 41.90 1.39 1.87 Niakafiri 0.28 1.74 0.02 10.46 1.10 0.37 10.74 1.12 0.38 Total 28.81 1.41 1.31 23.84 1.23 0.94 52.63 1.33 2.25 M&I Resources at March 31/2013 Measured Indicated Measured and Indicated Tonnes Grade Au Tonnes Grade Au Tonnes Grade Au (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) (Mt) (g/t) (Moz) Sabodala 24.75 1.38 1.10 25.35 1.32 1.08 50.10 1.35 2.18 Niakafiri 0.30 1.74 0.02 10.50 1.10 0.37 10.70 1.12 0.39 Gora 0.49 5.27 0.08 1.84 4.93 0.29 2.32 5.00 0.37 Total 25.54 1.46 1.20 37.69 1.44 1.74 63.23 1.45 2.94 Contained ounces produced since July 1, 2010 of 539koz. and an increase of 690koz. in M&I means an addition of 1.225Moz. in Measured and Indicated Resources Additional >1.1Moz Inferred Resources added (0.26Moz. at Sabodala & 0.71Moz. at Masato) |

| Note: Please see Sabodala Technical Report, June 7, 2012 and Competent Persons Statement on page 37 of this presentation OUNCES ADDED TO MINE LICENSE SINCE JULY 2010 Sabodala 625koz. reserves increase 850koz. Increase in measured and indicated resources Mineralized extension at depth was aggressively defined in 2011/12 ~500koz. of global M&I resource identified below current pit Orientation now understood at depth; underground potential Economic pit outlines have changed since IPO due to operating costs Masato Drilling program in 2011/12 to determine synergy with OJVG Masato 710koz. inferred resource defined on Teranga mine lease Results provide for further optimization of a combined Teranga/OJVG economic pit limit |

| INDEPENDENT DIRECTORS Christopher Lattanzi – Mr. Lattanzi is currently a director of Argonaut Gold Inc. and Spanish Mountain Gold Ltd. Mr. Lattanzi is an associate consultant for Micon International Limited (“Micon”). He was the founding member of Micon in 1988 and served as its president from formation until mid-2005. Prior to 1988, Mr. Lattanzi was a consultant with David Robertson and Associates, Micon’s predecessor firm. As a consultant, Mr. Lattanzi has gained invaluable experience in property valuation, scoping, feasibility studies and project monitoring on a global basis. Mr. Lattanzi was appointed a director of Meridian Gold Inc. (“Meridian”) in 1999 and from mid-2004 until December 2006 he was the chairman of the board of Meridian. Mr. Lattanzi holds a B.Eng (Mining) from Melbourne University. He has worked within the mineral industry for more than 50 years. Alan R. Thomas – Mr. Thomas has been a director/trustee of Labrador Iron Ore Royalty Corporation (formerly Labrador Iron Ore Trust) since 2004 and Chief Financial Officer since 2006. Mr. Thomas served on the board of directors of Gabriel Resources Ltd. from June 2006 until June 2010. Prior to retiring, Mr. Thomas held the position of Chief Financial Officer of ShawCor Ltd., an energy services firm headquartered in Toronto with manufacturing and service operations around the world, from 2000 to 2006. Prior to serving with ShawCor Ltd., Mr. Thomas was the CFO of Noranda Inc. from 1987 to 1998. Mr. Thomas is a chartered accountant and graduate of the University of Toronto. Frank Wheatley – Mr. Wheatley was the Executive Director — Corporate Affairs and Strategy of Talison Lithium Limited, from January 2010 until March 31, 2013 when it was acquired by Chengdu Tianqi Industry (Group) Co. Mr. Wheatley was the Vice-President and General Counsel of Gabriel Resources Ltd. (“Gabriel”), from 2000 to 2009, and prior to which, the President and Chief Operating Officer of Gabriel from March 1999 to October 2000. Before joining Gabriel, Mr. Wheatley was Vice President, Legal Affairs of Eldorado Gold Corporation. Mr. Wheatley has 28 years’ experience as a director and senior officer of, and legal counsel to, a number of Canadian public mining companies and has extensive legal and business experience in the mineral industry, particularly in the areas of public financing, project debt financing, permitting of large scale mining projects, and strategic mergers and acquisitions in the international minerals industry. Mr. Wheatley received his Bachelor of Commerce and LL.B. degrees from the University of British Columbia. |

| NEW DIRECTOR NOMINEES Edward S. Goldenberg – Mr. Goldenberg is a senior partner at the law firm of Bennett Jones LLP where he has a corporate practice, advising clients on governance issues, public policy and government relations. Mr. Goldenberg has a distinguished background working with the Government of Canada, having been the Senior Policy Advisor to the Prime Minister of Canada (1993-2003) and the Prime Minister's Chief of Staff (2003). During his long involvement with the Prime Minister's office, he was heavily involved in the preparation of 10 federal budgets, meetings between the Prime Minister and the provincial premiers, meetings with the heads of government of numerous countries, including all of the G-8 countries, Team Canada trade missions and cabinet committee meetings. Prior to these roles, Mr. Goldenberg acted in various capacities in the federal government, including in all the major economic departments and as Special Constitutional Advisor to the Minister of Justice (1980-1982). He is one of the authors of the Charter of Rights and Freedoms. Mr. Goldenberg was awarded an Honourary Doctorate of Laws from McGill University in 2004. Mr. Goldenberg is a board member of the Canadian International Council, a non-partisan, nationwide council established to strengthen Canada's role in international affairs. Mr. Goldenberg holds a BA, MA and BCL from McGill University and studied at the Institut d'Études Politiques de Paris (France). Nicholas J. Limb – Mr. Limb is Executive Chairman of MDL from March 1997 to the present. Mr. Limb was retained by Teranga in a consultancy capacity from December 2010 to December 2011. Mr. Limb is also a non-executive Chairman of FAR Limited. Mr. Limb has a technical background in gold mining and management of gold companies, and has public company experience at the director level in the mining industry. He also has a 10 years history in Senegal and exposure to its political and administrative processes. Mr. Limb received his Bachelor of Science (Geology) in 1975 from the Adelaide University, his Bachelor of Science (Honours) (Geology) in 1976 from Flinders University and a Graduate Diploma of Applied Finance and Investment in 1988 from the Securities Institute of Australia. All disclosure contained in this Presentation in respect of Mr. Limb is based on information provided to Teranga by MDL pursuant to Teranga’s Advance Notice By-Law. Neither MDL nor Mr. Limb have reviewed this document or confirmed the accuracy and completeness of the information in respect of Mr. Limb contained in this document. Although Teranga has no knowledge that would indicate that any information or statements contained in this document concerning Mr. Limb contain any untrue statement of a material fact or omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made, neither Teranga nor any of its directors or officers has verified, nor do they assume any responsibility for, the accuracy or completeness of such information or statements or for any failure by MDL or Mr. Limb to disclose events or facts which may have occurred or which may affect the significance or accuracy of any such information or statements but which are unknown to Teranga. |

| Alan R. Hill Executive Chairman Mining engineer with over 20 years experience globally in project evaluations, acquisitions and mine development as Executive VP of Barrick Gold Currently a Director of Gold Fields Former President and CEO of Gabriel Resources (2005 – 2009) and non-Executive Chairman of Alamos Gold (2004 – 2007) Richard S. Young President & CEO Over 10 years experience in mining finance, development, corporate development, and investor relations with Barrick Gold Former VP and CFO of Gabriel Resources (2005 – 2010) Mark English VP, Sabodala Operations Over 24 years experience in the gold mining industry Previously worked for several companies in Australia, East and West Africa being involved in operating mines and development, inclusive of greenfield start-ups Joined Mineral Deposits Ltd. in June 2006 Paul Chawrun VP, Technical Services Mining Engineer and geologist with over 23 years experience Former EVP Corporate Development for Chieftain Metals Former Director, Technical Services Detour Gold Navin Dyal VP & CFO Over 13 years in finance, most recently 7 years with Barrick Gold (2005 - 2012) Former Director of Finance, Global Copper Business Unit – Barrick Gold Chartered Accountant – Four years at major public accounting firm David Savarie VP, General Counsel & Corporate Secretary Over 10 years experience in the legal industry Former Deputy General Counsel and Corporate Secretary of Gabriel Resources Previously in private practice at Miller Thomson LLP Kathy Sipos VP, Investor & Stakeholder Relations 10 years experience in Corporate Communications and Investor Relations with Barrick Gold (1996 – 2006) Former VP of Corporate Communications and Investor Relations of Gabriel Resources (2006 – 2009) Macoumba Diop General Manager & Government Relations Manager Geological Engineer, Master of Science in Finance with over 12 years experience in the mining industry Previously spent 11 years in a consulting business and mineral project marketing and development Joined SGO in July 2011. MANAGEMENT |

| JURISDICTIONS This presentation does not constitute an offer of new ordinary shares, Chess Depositary Interests, Common Shares or Subscription Receipts ("New Securities") of the Company in any jurisdiction in which it would be unlawful. New Securities may not be offered or sold in any country outside Canada and Australia except to the extent permitted below. Hong Kong The New Securities have not been offered or sold and will not be offered or sold in Hong Kong, by means of any document other than (a) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances which do not result in the Offering Circular being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and no advertisement, invitation or document relating to the New Securities, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to New Securities which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and Futures Ordinance and any rules made under that Ordinance has been or will be issued, whether in Hong Kong or elsewhere. European Economic Area This Offering has been prepared on the basis that any offer of our New Securities in any Member State of the European Economic Area (the "EEA") which has implemented the Prospectus Directive (each, a "Relevant Member State") will be made pursuant to an exemption under the Prospectus Directive, as implemented in that Relevant Member State, from the requirement to publish a prospectus for offers of our New Securities. Accordingly any person making or intending to make any offer in that Relevant Member State of our New Securities which are subject to the Offering may only do so in circumstances in which no obligation arises for us or the Underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to the offer. Neither we nor the Underwriters have authorized, nor do we or they authorize, the making of any offer of our New Securities through any financial intermediary, other than offers made by the Underwriters, which constitute the final placement of our New Securities contemplated hereunder and which would oblige us or the Underwriters to publish or supplement a prospectus. The expression Prospectus Directive means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression 2010 PD Amending Directive means Directive 2010/73/EU. Each person in a Relevant Member State who receives any communication in respect of, or who acquires any of our New Securities under, the offers contemplated hereunder will be deemed to have represented, warranted and agreed to and with the Underwriters and us that: it is a qualified investor within the meaning of the law in that Relevant Member State implementing Article 2(1)(e) of the Prospectus Directive; and in the case of any New Securities acquired by it as a financial intermediary, as that term is used in Article 3(2) of the Prospectus Directive, (i) the New Securities acquired by it in the offer have not been acquired on behalf of, nor have they been acquired with a view to their offer or resale to, fewer than 100 or, if the Relevant Member State has implemented the relevant provisions of the 2010 PD Amending Directive, 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining prior consent of the Lead Underwriter; or (ii) where New Securities have been acquired by it on behalf of persons in any Relevant Member State other than qualified investors, the offer of those New Securities to it is not treated as having been made in any circumstances falling within Article 3(2) of the Prospectus Directive. For the purposes of this representation, the expression an “offer” in relation to any New Securities in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any New Securities to be offered so as to enable an investor to decide to purchase or subscribe for our New Securities, as the same may be varied in that Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State and the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in that Relevant Member State), and included any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU. |

| JURISDICTIONS United Kingdom This presentation is being distributed and is only directed at persons who (i) are outside the United Kingdom, or (ii) are investment professionals under Article 19(5) of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005, or the Order, or (iii) are high net worth entities and other persons to whom it may lawfully be communicated, falling under Article 49(2)(a) to (d) of the Order, all such persons together being referred to as "relevant persons". The New Securities are only available to, and any invitation, offer or agreement to subscribe, purchase or acquire the New Securities will only be engaged in with relevant persons. Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Our New Securities may not be offered or sold to any person in the United Kingdom, other than to qualified investors (as defined in Section 86(7) of the Financial Services and Markets Act 2000 (as amended) ("FSMA")) or otherwise that do not require an approved prospectus to be made available to the public, as set out in Section 86 of FSMA. Persons within the United Kingdom who receive this communication (other than relevant persons as set out above) should not rely on or act upon this communication.” France Any document relating to the New Securities has been submitted to the clearance procedures of the Autorités des marches financiers in France. Euroz and Teranga has represented that it has not offered or sold and will not offer or sell, directly or indirectly, any New Securities to the public in France and it has not distributed or caused to be distributed and will not distribute or cause to be distributed to the public in France any offering material relating to the New Securities and such offers, sales and distributions have been and will be made in France only to (a) persons providing investment services relating to portfolio management for the account of third parties, and/or (b) qualified investors (investisseurs qualifiés), as defined in, and in accordance with, Articles L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code monétaire et financier.” United States CAUTIONARY NOTE TO U.S. INVESTORS REGARDING MINERAL REPORTING STANDARDS Teranga prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to mineral resources and mineral reserves in this presentation are defined in accordance with NI 43-101. The Securities and Exchange Commission (the “SEC”) permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Teranga uses certain terms, such as, “measured mineral resources”, “indicated mineral resources”, “inferred mineral resources” and “probable mineral reserves”, that the SEC does not recognize. INFORMATION CONCERNING U.S. REGISTRATION STATEMENT Teranga has filed with the SEC a Registration Statement on Form F-80 and a tender offer statement on Schedule 14D-1F, each of which includes the offer and take-over bid circular, and other documents and information. These documents are available free of charge at the SEC’s website at www.sec.gov and such documents will also be available for review on Teranga’s website at www.terangagold.com. IF YOU ARE ALSO AN OROMIN SHAREHOLDER, YOU ARE URGED TO READ THE REGISTRATION STATEMENT, THE SCHEDULE 14D-1F, THE OFFER AND TAKE-OVER BID CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The information contained herein does not constitute an offer to buy or an invitation to sell, or the solicitation of an offer to buy or invitation to sell, any securities. |

| This presentation is not a prospectus, product disclosure document or other offering document under Australian law or under any other law. It has been prepared for information purposes only. This presentation contains general summary information and does not take into account the investment objectives, financial situation and particular needs of any individual investor. It is not financial product advice and investors should obtain their own independent advice from qualified financial advisors having regarding to their objectives, financial situation and needs. Teranga nor any of its related bodies corporate is licensed to provide financial product advice. Any liability of the Company, its advisers, agents end employees to you or to any other person or entity arising out of this presentation including pursuant to the Australian Securities and Investments Commission Act 2001, Corporations Act 2001 and the Competition and Consumer Act 2011 or any other applicable law is, to the maximum extent permitted by law, expressly disclaimed and excluded. The distribution of this presentation may be restricted by law in certain jurisdictions. Recipients and any other persons who come into possession of this Presentation must inform themselves about, and observe such restrictions. |

| Teranga: The technical information contained in this presentation relating to the Mineral Resource estimate as presented in “Table 1: Mineral Reserves as at 31 March 2013” and “Table 2: Measured and Indicated Mineral Resources as at 31 March 2013” is based on information compiled by Patti Nakai-Lajoie, P. Geo., who is a Member of the Association of Professional Geoscientists of Ontario. Ms. Nakai-Lajoie is a full time employee of Teranga and is not “independent” within the meaning of National Instrument 43-101. Ms. Nakai-Lajoie has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which she is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Ms. Nakai-Lajoie is a “Qualified Person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Ms. Nakai-Lajoie has reviewed and accepts responsibility for the Mineral Resource estimate disclosed in this presentation and has consented to the inclusion of the matters based on her information in the form and context in which it appears in this presentation. The technical information contained in this presentation relating to the Mineral Reserve estimate for Sabodala as outlined in ‘Table 3 Mineral Reserve Estimate as at 31 March 2013” is based on information compiled by Paul Chawrun, P.Eng., who is a member of the Professional Engineers Ontario. Mr. Chawrun is a full time employee of Teranga and is not “independent” within the meaning of National Instrument 43-101. Mr. Chawrun has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr. Chawrun is a “Qualified Person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Chawrun has reviewed and accepts responsibility for the Mineral Reserve estimate for Sabodala disclosed in this presentation and has consented to the inclusion of the matters based on his information in the form and context in which it appears in this presentation. The technical information contained in this presentation relating to the Mineral Reserve estimates for Gora and Niakafiri as outlined in “Table 3: Mineral Reserve Estimate as at 31 March 2013” is based on information compiled by Julia Martin, P.Eng., MAusIMM (CP). Ms. Martin is a full time employee with AMC Mining Consultants (Canada) Ltd. and is “independent” within the meaning of National Instrument 43-101. Ms. Martin has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity she is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Ms. Martin is a “Qualified Person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Ms. Martin has reviewed and accepts responsibility for the Mineral Reserve estimates for Gora and Niakafiri disclosed in this presentation and has consented to the inclusion of the matters based on her information in the form and context in which it appears in this presentation. Oromin: The information in this presentation that relates to the exploration results, mineral resources or ore reserves of Oromin is based on information compiled by Mr. Doug Turnbull, P. Geo., who is a Member of the Association of Professional Engineers & Geoscientists of Ontario. Mr. Turnbull is a full-time employee of 2104244 Ontario Ltd. and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a "Competent Person" as defined in the 2004 Edition of the “Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” . Mr. Turnbull is a Qualified Person in accordance with NI 43-101 and consents to the inclusion in the presentation of the matters based on his information in the form and context in which it appears. COMPETENT PERSON STATEMENTS |