ISSUER FREE WRITING PROSPECTUS

Dated June 5, 2012

Filed Pursuant to Rule 433

Registration No. 333-181686

AMERICAN REALTY CAPITAL PROPERTIES, INC.

FREE WRITING PROSPECTUS

American Realty Capital Properties, Inc. (the “Company”) filed a registration statement on Form S-11 (including a prospectus) with the SEC on May 25, 2012. The registration statement has not yet become effective. This communication relates to such offering. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site atwww.sec.gov. The preliminary prospectus, dated May 25, 2012, is available on the SEC Web site at

http://sec.gov/Archives/edgar/data/1507385/000114420412031826/v314528_s11.htm.

Alternatively, the Company or any underwriter participating in the offering will arrange to send you the prospectus and/or supplements thereto if you request them by calling toll-free 1-877-373-2522.

Attached hereto is a copy of the Company’s June 2012 Investor Presentation.

American Realty Capital Properties, Inc. (NASDAQ: ARCP) Company Overview / Follow - On Offering June 2012 1

American Realty Capital Properties, Inc. Introductory Notes The data and other information described in these slides are of the date of the slides or an earlier date as indicated . Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This presentation contains certain statements that are the Company’s and Management’s hopes, intentions, beliefs, expectations, or projections of the future and might be considered to be forward - looking statements under Federal Securities laws. Prospective investors are cautioned that any such forward - looking statements are not guarantees of future performance, and involve risks and uncertainties. The Company’s actual future results may differ significantly from the matters discussed in these forward - looking statements, and we may not release revisions to these forward - looking statements to reflect changes after we’ve made the statements. Factors and risks that could cause actual results to differ materially from expectations are disclosed from time to time in greater detail in the Company’s filings with the Securities and Exchange Commission (the "SEC") including, but not limited to, the Company’s report on Form 10 - K, the Company's Quarterly Report on Form 10 - Q filed with the SEC, as well as Company press releases. 2

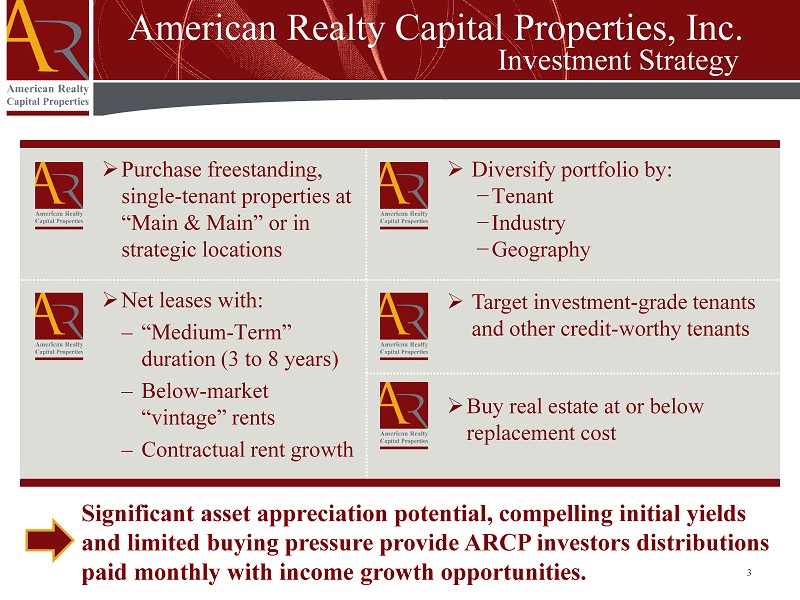

American Realty Capital Properties, Inc. Investment Strategy » Net leases with: – “Medium - Term” duration (3 to 8 years) – Below - market “vintage” rents – Contractual rent growth » Purchase freestanding , single - tenant properties at “Main & Main” or in strategic locations » Diversify portfolio by: − Tenant − Industry − Geography » Target investment - grade tenants and other credit - worthy tenants » Buy real estate at or below replacement cost 3 Significant asset appreciation potential, compelling initial yields and limited buying pressure provide ARCP investors distributions paid monthly with income growth opportunities.

American Realty Capital Properties, Inc. Company Highlights » Single tenant, net lease real estate investment company focused on credit - rated tenants and medium - term remaining leases » High quality portfolio comprised of approx. 2 million square feet 1 − 100% occupied − 99% investment - grade rated − 7.1 years average remaining primarily lease term − Minimal near - term lease expirations » Substantial portfolio g rowth since September 2011 IPO 1 − 82% increase in assets − 100% increase in revenue − 163% increase in square feet » Monthly dividend of $0.885 per share, annualized (raised $0.01 since IPO) 4 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012, as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

American Realty Capital Properties, Inc. Portfolio Growth 5 At IPO Pro Forma Portfolio 1 % Increase Net Operating Income (NOI) $9 million $ 18 million 100% Purchase Price $ 119 million $ 216 million 82% Square Feet 0.76 million 2.00 million 163% Tenants 3 11 367% Industries 2 9 450% States 16 21 31% % Investment Grade (Based on rental rents) 100% 99% In only eight months, ARCP has more than doubled the size of its portfolio by square feet and NOI. 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

American Realty Capital Properties, Inc. (3) Portfolio and Earnings Growth 6 (1) AFFO per share components : n et income of $0.04 plus depreciation and amortization of $0.91. (2) AFFO per share components: net income of $0.03 plus depreciation and amortization of $0.90 and acquisition and transaction costs of $0.03. (3) AFFO per share components: net income of $0.18 plus depreciation and amortization of $0.75, loss from discontinued operations of $0.08, amortization of deferred financing costs of $0.06, non - cash equity compensation expense of $0.05, less straight - line rent per share of $0.07. (4) AFFO depicted post - June 2012 follow - on offering reflects $10 million of assumed additional acquisitions. IPO Follow - On Oct 2011 Follow - On June 2012 Cumulative Properties 61 90 120 Cumulative Purchase Price $119mm $145mm $216mm Cumulative Square Feet 0.8mm 1.0mm 2.0mm Shares Outstanding 5.6mm 7.3mm 10.9mm Shares Outstanding AFFO/Share $0.95 (1) $0.96 (2) $1.05 (3) Distributions Per Share $0.875 $0.880 $0.885 AFFO Coverage 1.09x 1.09x 1.19x AFFO Growth $0.95 $0.96 $1.05 $1.09 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $1.15 IPO Follow On (Oct 2011) Follow On (May 2012) Post Follow- on (June 2012) ( 2) (4) (1) AFFO Per Share Portfolio & Earnings Growth 15% AFFO Growth Since IPO (3)

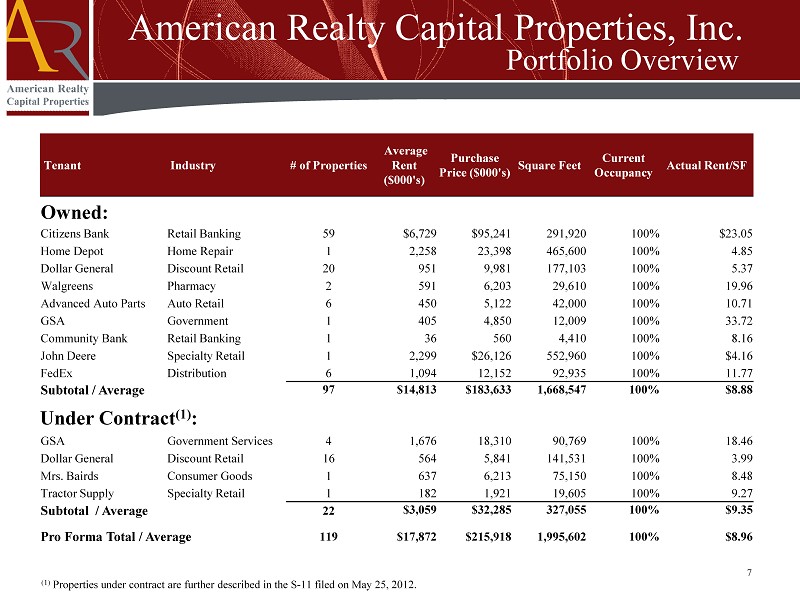

American Realty Capital Properties, Inc. Portfolio Overview 7 Tenant Industry # of Properties Average Rent ($000's) Purchase Price ($000's) Square Feet Current Occupancy Actual Rent/SF Citizens Bank Retail Banking 59 $6,729 $95,241 291,920 100% $23.05 Home Depot Home Repair 1 2,258 23,398 465,600 100% 4.85 Dollar General Discount Retail 20 951 9,981 177,103 100% 5.37 Walgreens Pharmacy 2 591 6,203 29,610 100% 19.96 Advanced Auto Parts Auto Retail 6 450 5,122 42,000 100% 10.71 GSA Government 1 405 4,850 12,009 100% 33.72 Community Bank Retail Banking 1 36 560 4,410 100% 8.16 John Deere Specialty Retail 1 2,299 $26,126 552,960 100% $4.16 FedEx Distribution 6 1,094 12,152 92,935 100% 11.77 Subtotal / Average 97 $ 14,813 $ 183,633 1,668,547 100% $8.88 GSA Government Services 4 1,676 18,310 90,769 100% 18.46 Dollar General Discount Retail 16 564 5,841 141,531 100% 3.99 Mrs. Bairds Consumer Goods 1 637 6,213 75,150 100% 8.48 Tractor Supply Specialty Retail 1 182 1,921 19,605 100% 9.27 Subtotal / Average 22 $3,059 $32,285 327,055 100% $9.35 Pro Forma Total / Average 119 $ 17,872 $ 215,918 1,995,602 100% $ 8.96 (1) Properties under contract are further described in the S - 11 filed on May 25, 2012. Owned: Under Contract (1) :

American Realty Capital Properties, Inc. Portfolio Transformation » ARCP has significantly diversified its tenant concentration. » Citizens Bank’s concentration has decreased from 75% to 37% of rents. » Since IPO, eight new credit tenants have been added to the portfolio. Tenant Concentration – At IPO (% of Average Annual Rent) Tenant Concentration – Pro Forma Portfolio (1) (% of Average Annual Rent) 74.6% 0.4% 25.0% Citizens Bank Community Bank Home Depot 37.3% 12.5% 2.5% 8.4% 3.3% 11.5% 13.7% 6.1% 0.2% 3.5% 1.0% Citizens Bank Home Depot Advanced Auto Dollar General Walgreens GSA John Deere FedEx Community Bank Mrs. Bairds Tractor Supply 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

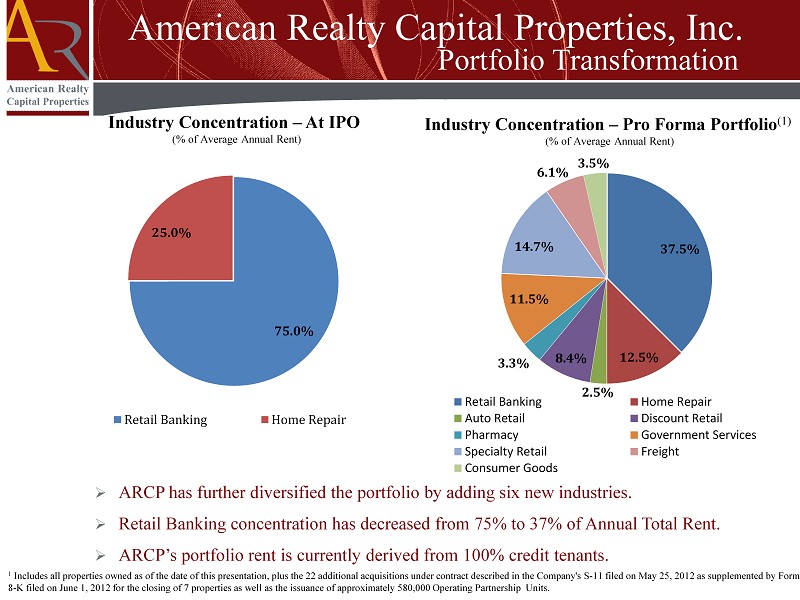

American Realty Capital Properties, Inc. Portfolio Transformation » ARCP has further diversified the portfolio by adding six new industries. » Retail Banking concentration has decreased from 75% to 37% of A nnual T otal Rent. » ARCP’s portfolio rent is currently derived from 100% credit tenants. 75.0% 25.0% Retail Banking Home Repair Industry Concentration – At IPO (% of Average Annual Rent) Industry Concentration – Pro Forma Portfolio (1) (% of Average Annual Rent) 37.5% 12.5% 2.5% 8.4% 3.3% 11.5% 14.7% 6.1% 3.5% Retail Banking Home Repair Auto Retail Discount Retail Pharmacy Government Services Specialty Retail Freight Consumer Goods 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

American Realty Capital Properties, Inc. Tenant Credit Ratings Tenant Credit Rating Investment Grade Pre - Offering A verage Rent (%) Post - Offering Average Rent (%) Citizens Bank A Yes 59% 38% John Deere (1) A Yes 13% Home Depot (2) A - Yes 20% 12% GSA AA+ Yes 4% 11% Dollar General BBB - Yes 8% 9% FedEx (1) BBB Yes 6% Mrs. Baird’s (1) BBB Yes 4% Walgreens A Yes 5% 3% Advance Auto Parts BBB - Yes 4% 3% Tractor Supply (1) NR 1 % Community Bank BBB+ Yes <1% <1% 10 99% of Rents Derived From Investment Grade Tenants (1 ) Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units. (2) The tenant of our property leased to Home Depot is an unrated wholly - owned subsidiary, Home Depot USA, Inc . For purposes of this presentation, we have attributed the rating of the parent company to its wholly - owned subsidiary.

American Realty Capital Properties, Inc. Lease Maturity (By Average Annualized Rent) 11 0.2% 3.0% 3.3% $- $1,000 $2,000 $3,000 $4,000 2012 2013 2014 2015 2016 Average Annualized Rent Year LEASE MATURITY By Average Annualized Rent ($000's) (2012 - 2016) Limited Near - Term Lease Rollover

American Realty Capital Properties, Inc. Overview (1) Portfolio Map Pro Forma Portfolio Overview (1) • 99% investment grade tenants • 100% occupancy • High quality portfolio diversified by tenant, industry, property type and geography Number of Properties 119 Total Square Feet 2 million Occupancy 100 % Avg. Remaining Primary Lease Term 7.1 years % Investment Grade (By GAAP NOI) 99% Number of Tenants 11 States 21 Annualized Rent $18 m illion 12 Portfolio Highlights Pro Forma 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

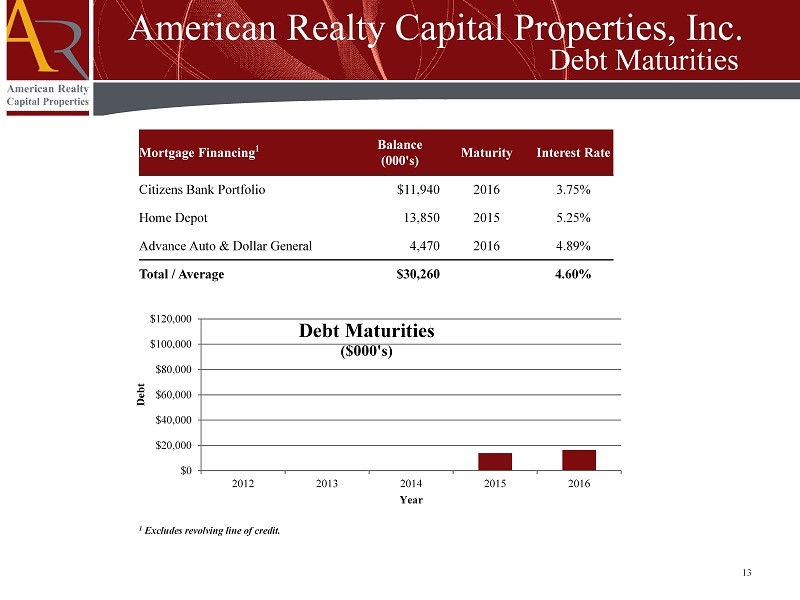

American Realty Capital Properties, Inc. Debt Maturities Mortgage Financing 1 Balance (000's) Maturity Interest Rate Citizens Bank Portfolio $11,940 2016 3.75% Home Depot 13,850 2015 5.25% Advance Auto & Dollar General 4,470 2016 4.89% Total / Average $30,260 4.60% $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2012 2013 2014 2015 2016 Debt Year Debt Maturities ($000's) 1 Excludes revolving line of credit. 13

American Realty Capital Properties, Inc. » Externally managed by ARC Properties Advisors, LLC (an affiliate of American Realty Capital) » Fully - staffed professional management team » Total management fee limited to 50 bps on average adjusted book value » Management fee subordinated to full coverage of shareholder distributions from FFO, as adjusted » Incentive compensation performance - based Management Agreement 14

American Realty Capital Properties, Inc. Executive Management / Full - Integrated Services Platform ARC Advisory Services Group Operations IT Marketing Accounting Legal Human Resources Originations Due Diligence Investment Banking Investor Relations Financing 15 Brian S. Block Chief Financial Officer Nicholas S. Schorsch Chairman & CEO Michael Weil President & COO Peter M. Budko Chief Investment Officer Andrew Winer Senior VP, Debt Capital Markets

American Realty Capital Properties, Inc. » Insider Ownership : Over 20 % of Company owned by insiders » Fully - Integrated Services Platform: 95 professionals and support personnel provide all critical real estate and investment functions − Acquisition , asset management, operations, leasing and capital markets − Accounting, reporting, risk management, legal, investor relations » Deep net lease experience and expertise − $ 5 billion invested in net lease properties − Net lease investments in all major industry sectors » Long - standing relationships with key industry participants • Corporate Tenants • Financial Institutions • Developers • Advisors and Intermediaries Management Team 16

American Realty Capital Properties, Inc. External vs. Internal G&A Comparison for ARCP Property Type G&A/GAV Prison 2.7% Diversified 2.4% Outlet Center 1.7% Health Care 1.4% Specialty 1.2% Shopping Center 1.2% Cineplex Theater 1.0% Industrial 0.9% Manufactured home 0.9% Single - Tenant 0.9% Self - Storage 0.8% Office 0.7% Student Housing 0.6% Regional Mall 0.5% REITs 1.0% ARCP’s G&A is less than half of the industry average. 17 Source: SNL Financial as Q1 2012 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% G&A as % of Gross Asset Value ARCP (3bp) (50bp)

American Realty Capital Properties, Inc. Company Highlights » Annualized distributions of $0.885 per share, paid monthly, increased twice since IPO » 82 % (1) growth in size of investment portfolio since IPO » Increased portfolio diversification by tenant, industry and geography » High quality assets » 99% investment grade by GAAP NOI » Strong cash flows » Asset appreciation potential » Low operating cost structure » Experienced management team 18 1 Includes all properties owned as of the date of this presentation, plus the 22 additional acquisitions under contract described in the Company's S - 11 filed on May 25, 2012 as supplemented by Form 8 - K filed on June 1, 2012 for the closing of 7 properties as well as the issuance of approximately 580,000 Operating Partnership Units.

American Realty Capital Properties, Inc. 19 Shares Offered 3.0 million common shares Underwriters Baird, Ladenburg Thalmann , JMP Securities Use of Proceeds Property acquisitions, transaction expenses, working capital Investment Strategy Single tenant, free - standing properties net leased medium - term to tenants with strong credit profiles Property Acquisitions 22 properties, $32 million purchase price Impact to AFFO Per Share $0.96 /share as of October 2011 follow - on to $1.05/share as of June 2012 follow - on ($1.09 / share post June 2012 follow - on, including assumed additional acquisitions) Offering Summary

American Realty Capital Properties, Inc. (NASDAQ: ARCP) Brian S. Block T: (212) 415 - 6512 M: (215) 906 - 9122 bblock@arlcap.com Anthony J. DeFazio DeFazio Communications, LLC T: (484) 532 - 7783 M: (484) 410 - 1354 tony@defaziocommunications.com Press Inquiries: Investor Questions: Company Contacts 20