|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

| |

| ARCP Supplemental Information | |

| March 31, 2015 | |

|

| | |

| Section | Page | |

| | |

| Company Overview | |

| | |

| Financial Information | |

| Financial Summary | |

| Financial and Operations Statistics and Ratios | |

| Key Balance Sheet Metrics and Capital Structure | |

| Business Model | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| FFO, AFFO and Per Share Information | | |

| Consolidated EBITDA and Normalized EBITDA | | |

| | |

| Real Estate Investments | |

| Statements of Operations | |

| EBITDA and Normalized EBITDA | |

| FFO, AFFO and Per Share Information | |

| GAAP and Cash NOI | |

| Debt and Preferred Equity Summary | |

| Mortgage Notes Payable | |

| Credit Facility and Corporate Bond Covenants | |

| Acquisitions and Dispositions | | |

| Same Store Rental Revenue | | |

| Top 10 Concentrations | | |

| Tenants Comprising Over 1% of Annualized Rental Revenue | |

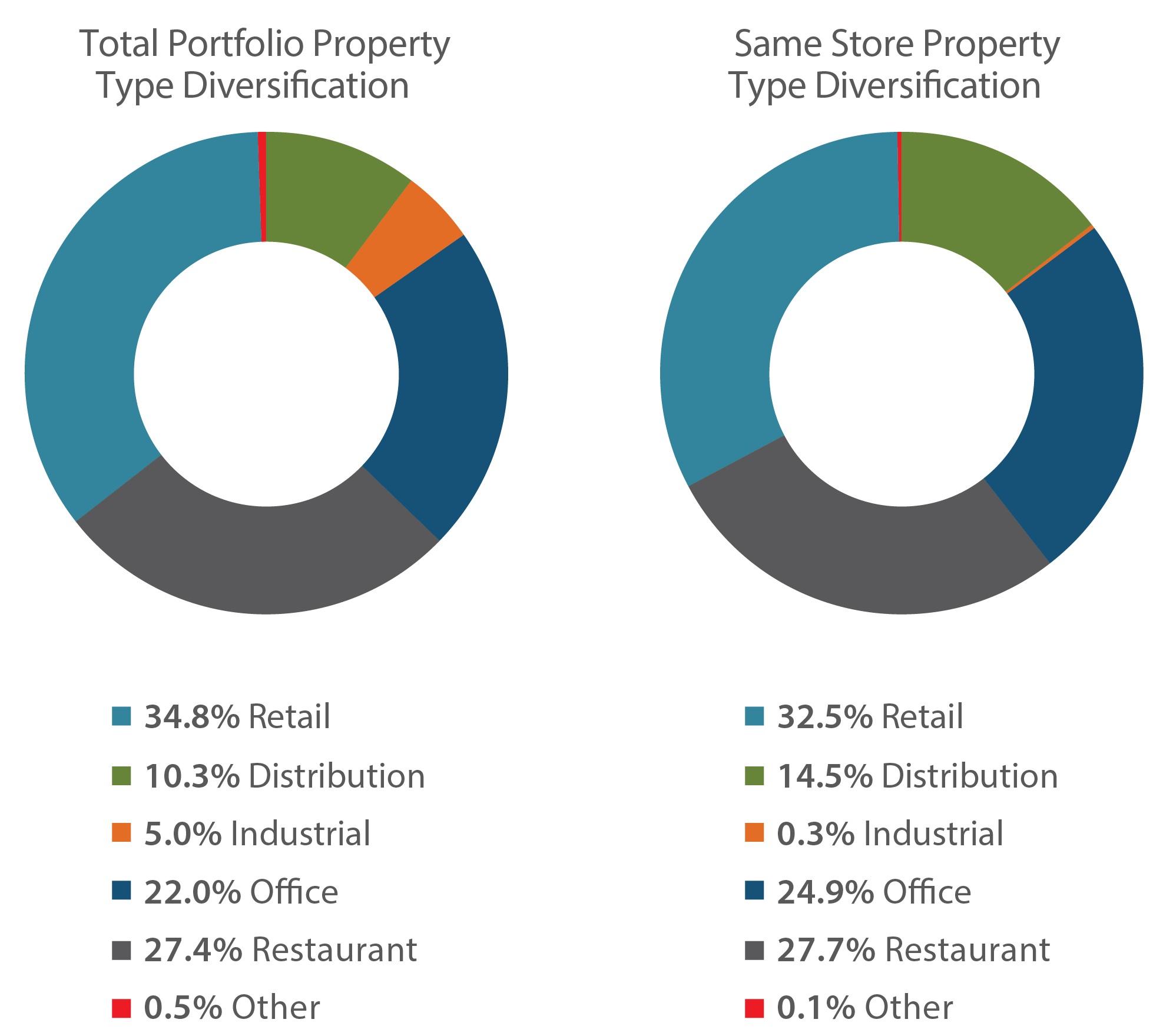

| Diversification | |

| Lease Expirations | |

| Unconsolidated Joint Venture Investment Summary | |

| Red Lobster Highlights | |

| | |

| Cole Capital | |

| Statements of Operations | |

| EBITDA and Normalized EBITDA | | |

| FFO, AFFO and Per Share Information | | |

| Net G&A | | |

| Program Development Costs | | |

| Managed Programs | | |

| Definitions | | |

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

This data and other information described herein are as of and for the three-month period ended March 31, 2015 unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with the financial statements and the management's discussion and analysis of financial condition and results of operations section contained in ARCP's Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Reports on Form 10-Q for the three months ended March 31, 2015 and September 30, 2014 and Form 10-Q/A for the three months ended June 30, 2014 and March 31, 2014. |

| |

| Forward-Looking Statements |

| Certain statements contained herein may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). ARCP intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about ARCP's plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of ARCP's performance in future periods. Such forward-looking statements can generally be identified by ARCP's use of forward-looking terminology such as "may," "will," "would," "could," "should," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. ARCP makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements contained herein, and does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Factors and risks that could cause actual results to differ materially from expectations are disclosed from time to time in greater detail in ARCP's filings with the U.S. Securities and Exchange Commission including, but not limited to, ARCP's Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and 10-Q/A, as well as its press releases. |

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

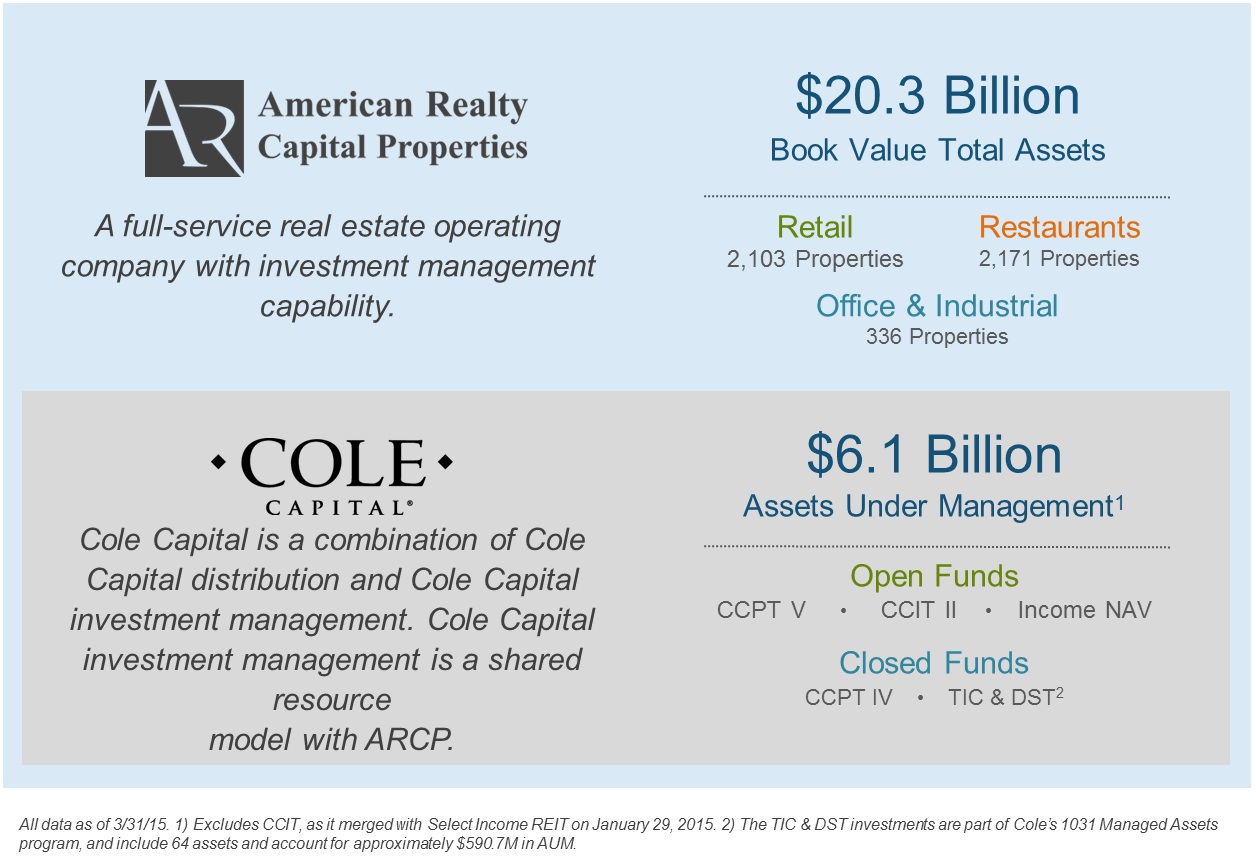

Company Overview (unaudited) |

| |

American Realty Capital Properties, Inc. (the "Company," "us," "our" and "we") is a self-managed and self-administered real estate company, incorporated in Maryland on December 2, 2010 which has elected to be taxed, and currently qualifies as a real estate investment trust ("REIT") for U.S. federal income tax purposes. On September 6, 2011, the Company completed its initial public offering.

Our business operates in two business segments, Real Estate Investment ("REI") and Cole Capital®, the Company's private capital management segment ("Cole Capital"). Through our REI segment, we acquire, own and operate single-tenant, freestanding, commercial real estate properties, primarily subject to long-term net leases with high credit quality tenants. We seek to acquire net lease assets by self-originating individual or small portfolio acquisitions, by executing sale-leaseback transactions, and in connection with build-to-suit or forward take-out opportunities, to the extent they are appropriate in terms of capitalization rate and scale. Our high-quality property portfolio is generally net leased to corporate tenants. At March 31, 2015, approximately 47% of our rental revenues were delivered from investment grade tenants, occupying properties located at the corner of "Main & Main" and in other strategic locations. Cole Capital is contractually responsible for raising capital for, managing the affairs of and identifying and making acquisitions and investments on behalf of non-traded REITs and other real estate programs sponsored by Cole Capital (the "Managed Programs") on a day-to-day basis. We receive compensation and reimbursement for services relating to the Managed Programs' offerings and the investment, management, financing and disposition of their respective assets, as applicable. Cole Capital allows us to generate earnings without the corresponding need to invest capital in that business or incur balance sheet debt in order to fund or expand operations. Cole Capital also develops new REIT offerings and coordinates receipt of regulatory approvals from the SEC, the Financial Industry Regulatory Authority, Inc. and various jurisdictions for such offerings. At the appropriate time, Cole Capital recommends to each of the Managed Program's respective board of directors an approach for providing investors with liquidity.

ARCP's common shares and Series F preferred shares trade on the NASDAQ Global Select Market under the tickers symbol "ARCP" and "ARCPP," respectively.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 4

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

| | |

| Senior Management | | Board of Directors |

| | | |

| Glenn J. Rufrano, Chief Executive Officer | | Hugh R. Frater, Non-Executive Chairman |

| | | |

| Richard A. Silfen, Executive Vice President, General Counsel and Secretary | | Thomas A. Andruskevich, Independent Director |

| | | |

| Michael J. Sodo, Executive Vice President, Chief Financial Officer and Treasurer | | Bruce D. Frank, Independent Director |

| | | |

| Gavin B. Brandon, Senior Vice President and Chief Accounting Officer | | Julie G. Richardson, Independent Director |

| | | |

| | | William G. Stanley, Independent Director |

| | | |

| | | Glenn J. Rufrano, Executive Director |

| | | |

Corporate Offices and Contact Information

|

| | |

| 2325 E. Camelback Road, Suite 1100 | | 1065 Avenue of the Americas, Floor 23 |

| Phoenix, AZ 85016 | | New York, NY 10018 |

| 800-606-3610 | | 212-413-9100 |

| www.arcpreit.com | | |

Trading Symbols: ARCP, ARCPP

Stock Exchange Listing: NASDAQ Global Select Market

Transfer Agent

Computershare Trust Company, N.A.

250 Royall Street

Canton, MA 02021

800-736-3001

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 5

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Financial Summary (unaudited, dollars in thousands, except per share amounts) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | Q1 2015 | | Q4 2014 | | Q3 2014 | | Q2 2014 | | Q1 2014 | |

| CONSOLIDATED FINANCIAL RESULTS | | | | | | | | | | |

| Revenue | $ | 393,968 |

| | $ | 418,807 |

| | $ | 457,118 |

| | $ | 382,178 |

| | $ | 321,154 |

| |

| Net loss | $ | (30,693 | ) | | $ | (360,427 | ) | | $ | (288,047 | ) | | $ | (56,598 | ) | | $ | (305,840 | ) | |

| Normalized EBITDA | $ | 316,057 |

| | $ | 322,328 |

| | $ | 363,875 |

| | $ | 297,449 |

| | $ | 208,875 |

| |

| Funds from operations (FFO) | $ | 195,030 |

| | $ | (58,825 | ) | | $ | 195,798 |

| | $ | 156,967 |

| | $ | (144,804 | ) | |

| FFO per diluted share | $ | 0.21 |

| | $ | (0.06 | ) | | $ | 0.21 |

| | $ | 0.18 |

| | $ | (0.24 | ) | |

| Adjusted funds from operations (AFFO) | $ | 200,135 |

| | $ | 205,459 |

| | $ | 244,549 |

| | $ | 185,934 |

| | $ | 114,772 |

| |

| AFFO per diluted share | $ | 0.22 |

| | $ | 0.22 |

| | $ | 0.26 |

| | $ | 0.21 |

| | $ | 0.19 |

| |

| Dividends paid per common share | $ | — |

| | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.25 |

| | $ | 0.33 |

| |

| | | | | | | | | | | |

| REAL ESTATE INVESTMENTS | | | | | | | | | | |

| Revenue | $ | 366,474 |

| | $ | 366,525 |

| | $ | 397,321 |

| | $ | 344,956 |

| | $ | 266,897 |

| |

| Net loss | $ | (30,607 | ) | | $ | (82,458 | ) | | $ | (289,133 | ) | | $ | (46,124 | ) | | $ | (296,218 | ) | |

| Normalized EBITDA | $ | 306,695 |

| | $ | 305,380 |

| | $ | 333,107 |

| | $ | 287,105 |

| | $ | 208,935 |

| |

| FFO | $ | 195,116 |

| | $ | 219,144 |

| | $ | 194,712 |

| | $ | 167,441 |

| | $ | (135,182 | ) | |

| FFO per diluted share | $ | 0.21 |

| | $ | 0.24 |

| | $ | 0.21 |

| | $ | 0.19 |

| | $ | (0.23 | ) | |

| AFFO | $ | 195,073 |

| | $ | 193,934 |

| | $ | 214,991 |

| | $ | 168,188 |

| | $ | 108,664 |

| |

| AFFO per diluted share | $ | 0.21 |

| | $ | 0.21 |

| | $ | 0.23 |

| | $ | 0.19 |

| | $ | 0.18 |

| |

| Properties owned | 4,647 |

| | 4,648 |

| | 4,714 |

| | 3,966 |

| | 3,809 |

| |

| Rentable square feet (in thousands) | 102,133 |

| | 103,149 |

| | 113,801 |

| | 106,800 |

| | 101,800 |

| |

| Occupancy rate | 98.4 | % | | 99.3 | % | | 99.2 | % | | 98.8 | % | | 98.9 | % | |

| Weighted-average remaining lease term (years) | 11.7 |

| | 11.8 |

| | 11.5 |

| | 10.4 |

| | 10.8 |

| |

| Weighted-average portfolio credit rating | BBB- |

| | BBB- |

| | BBB- |

| | BBB |

| | BBB |

| |

| | | | | | | | | | | |

| COLE CAPITAL | | | | | | | | | | |

| Revenue | $ | 27,494 |

| | $ | 52,282 |

| | $ | 59,797 |

| | $ | 37,222 |

| | $ | 54,257 |

| |

| Net (loss) income | $ | (86 | ) | | $ | (277,969 | ) | | $ | 1,086 |

| | $ | (10,474 | ) | | $ | (9,622 | ) | |

| Normalized EBITDA | $ | 9,362 |

| | $ | 16,948 |

| | $ | 30,768 |

| | $ | 10,344 |

| | $ | (60 | ) | |

| FFO | $ | (86 | ) | | $ | (277,969 | ) | | $ | 1,086 |

| | $ | (10,474 | ) | | $ | (9,622 | ) | |

| FFO per diluted share | $ | — |

| | $ | (0.30 | ) | | $ | — |

| | $ | (0.01 | ) | | $ | (0.02 | ) | |

| AFFO | $ | 5,062 |

| | $ | 11,525 |

| | $ | 29,558 |

| | $ | 17,746 |

| | $ | 6,108 |

| |

| AFFO per diluted share | $ | 0.01 |

| | $ | 0.01 |

| | $ | 0.03 |

| | $ | 0.02 |

| | $ | 0.01 |

| |

| Capital raised on behalf of Managed Programs, excluding DRIP | $ | 29,770 |

| | $ | 128,282 |

| | $ | 218,270 |

| | $ | 113,241 |

| | $ | 452,956 |

| (1) |

| Purchase price of property acquisitions on behalf of Manged Programs | $ | 225,319 |

| | $ | 942,818 |

| | $ | 1,111,900 |

| | $ | 754,612 |

| | $ | 235,275 |

| (1) |

Assets under management (2) | $ | 6,084,979 |

| | $ | 8,563,540 |

| | $ | 7,705,703 |

| | $ | 6,565,984 |

| | $ | 5,976,257 |

| |

________________________________________________

(1) Reflects amounts for the period from the Cole Acquisition Date of February 7, 2014 to March 31, 2014.

(2) Cole Corporate Income Trust, Inc. ("CCIT") merged on January 29, 2015 with Select Income REIT. Prior to the sale, Cole Capital had managed $2.7 billion of assets on behalf of CCIT. As such, Q1 2015 excludes CCIT's assets under management.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 6

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Financial and Operations Statistics and Ratios (unaudited, dollars in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| INTEREST COVERAGE RATIO | | | | | | | | | | |

| Interest expense | | $ | 91,658 |

| | $ | 91,620 |

| | $ | 97,333 |

| | $ | 97,500 |

| | $ | 81,087 |

|

| Normalized EBITDA | | 316,057 |

| | 322,328 |

| | 363,875 |

| | 297,449 |

| | 208,875 |

|

| Interest coverage ratio | | 3.45x |

| | 3.52x |

| | 3.74x |

| | 3.05x |

| | 2.58x |

|

| | | | | | | | | | | |

| FIXED CHARGE COVERAGE RATIO | | | | | | | | | | |

| Interest expense | | $ | 91,658 |

| | $ | 91,620 |

| | $ | 97,333 |

| | $ | 97,500 |

| | $ | 81,087 |

|

| Secured debt principal amortization | | 10,999 |

| | 8,993 |

| | 6,938 |

| | 6,789 |

| | 16,508 |

|

| Dividends attributable to preferred shares | | 17,973 |

| | 17,973 |

| | 36,282 |

| | 22,016 |

| | 22,427 |

|

| Total fixed charges | | 120,630 |

| | 118,586 |

| | 140,553 |

| | 126,305 |

| | 120,022 |

|

| Normalized EBITDA | | 316,057 |

| | 322,328 |

| | 363,875 |

| | 297,449 |

| | 208,875 |

|

| Fixed charge coverage ratio | | 2.62x |

| | 2.72x |

| | 2.59x |

| | 2.36x |

| | 1.74x |

|

| | | | | | | | | | | |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| NET DEBT RATIOS | | | | | | | | | | |

| Total debt | | $ | 10,333,173 |

| | $ | 10,469,121 |

| | $ | 11,551,644 |

| | $ | 9,672,412 |

| | $ | 10,196,967 |

|

| Less: cash and cash equivalents | | 788,739 |

| | 416,711 |

| | 145,310 |

| | 195,529 |

| | 83,216 |

|

| Net debt | | 9,544,434 |

| | 10,052,410 |

| | 11,406,334 |

| | 9,476,883 |

| | 10,113,751 |

|

| Normalized EBITDA annualized | | 1,264,228 |

| | 1,289,312 |

| | 1,455,500 |

| | 1,189,796 |

| | 835,500 |

|

| Net debt to Normalized EBITDA annualized ratio | | 7.55x |

| | 7.80x |

| | 7.84x |

| | 7.97x |

| | 12.11x |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net debt | | $ | 9,544,434 |

| | $ | 10,052,410 |

| | $ | 11,406,334 |

| | $ | 9,476,883 |

| | $ | 10,113,751 |

|

| Gross real estate and related assets | | 17,904,710 |

| | 18,211,712 |

| | 20,369,206 |

| | 18,281,837 |

| | 17,503,502 |

|

| Net debt leverage ratio | | 53.31 | % | | 55.20 | % | | 56.00 | % | | 51.84 | % | | 57.78 | % |

| | | | | | | | | | | |

| UNENCUMBERED ASSETS/REAL ESTATE ASSETS | | | | | | | | | | |

| Unencumbered gross real estate and related assets | | $ | 11,187,797 |

| | $ | 11,570,474 |

| | $ | 12,602,273 |

| | $ | 10,374,329 |

| | $ | 9,506,936 |

|

| Gross real estate and related assets | | 17,904,710 |

| | 18,211,712 |

| | 20,369,206 |

| | 18,281,837 |

| | 17,503,502 |

|

| Unencumbered asset ratio | | 62.5 | % | | 63.5 | % | | 61.9 | % | | 56.7 | % | | 54.3 | % |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 7

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

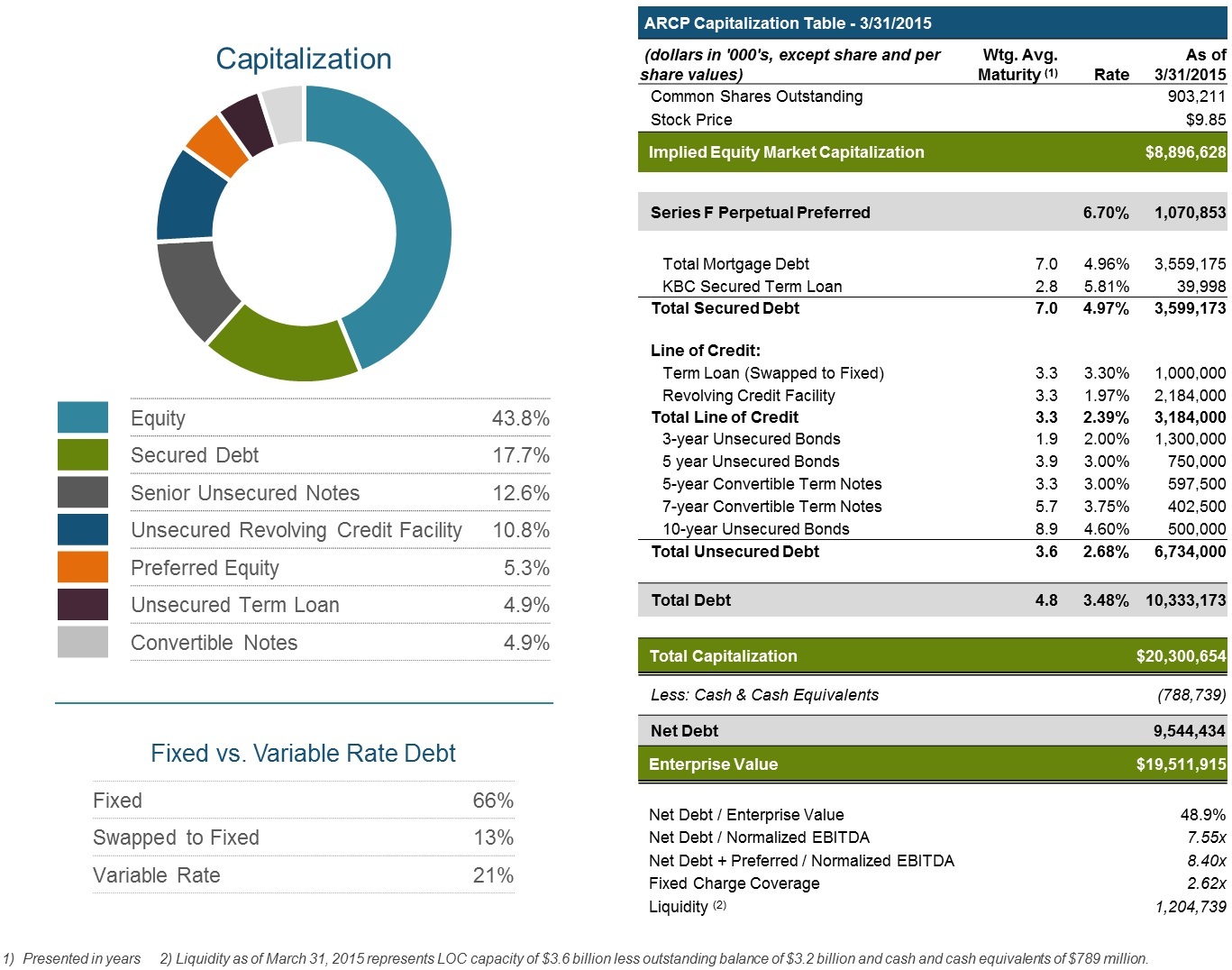

Key Balance Sheet Metrics and Capital Structure (unaudited) |

| |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 8

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Business Model (unaudited) |

| |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 9

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Consolidated Balance Sheets (unaudited, in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| ASSETS | | | | | | | | | | |

| Real estate investments, at cost: | | | | | | | | | | |

| Land | | $ | 3,434,414 |

| | $ | 3,472,298 |

| | $ | 3,487,824 |

| | $ | 3,343,235 |

| | $ | 3,224,257 |

|

| Buildings, fixtures and improvements | | 12,081,061 |

| | 12,307,758 |

| | 12,355,029 |

| | 12,420,626 |

| | 11,836,655 |

|

| Land and construction in progress | | 83,284 |

| | 77,450 |

| | 86,973 |

| | 62,594 |

| | 40,459 |

|

| Intangible lease assets | | 2,386,904 |

| | 2,435,054 |

| | 2,424,076 |

| | 2,227,393 |

| | 2,209,902 |

|

| Total real estate investments, at cost | | 17,985,663 |

| | 18,292,560 |

| | 18,353,902 |

| | 18,053,848 |

| | 17,311,273 |

|

| Less: accumulated depreciation and amortization | | 1,238,320 |

| | 1,034,122 |

| | 828,624 |

| | 660,617 |

| | 428,566 |

|

| Total real estate investments, net | | 16,747,343 |

| | 17,258,438 |

| | 17,525,278 |

| | 17,393,231 |

| | 16,882,707 |

|

| Investment in unconsolidated entities | | 95,390 |

| | 98,053 |

| | 100,762 |

| | 102,047 |

| | 105,775 |

|

| Investment in direct financing leases, net | | 54,822 |

| | 56,076 |

| | 57,441 |

| | 62,094 |

| | 65,723 |

|

| Investment securities, at fair value | | 56,493 |

| | 58,646 |

| | 59,131 |

| | 219,204 |

| | 213,803 |

|

| Loans held for investment, net | | 41,357 |

| | 42,106 |

| | 96,981 |

| | 97,587 |

| | 98,185 |

|

| Cash and cash equivalents | | 788,739 |

| | 416,711 |

| | 145,310 |

| | 195,529 |

| | 83,216 |

|

| Restricted cash | | 64,578 |

| | 62,651 |

| | 72,754 |

| | 69,544 |

| | 55,559 |

|

| Intangible assets, net | | 142,851 |

| | 150,359 |

| | 323,332 |

| | 347,618 |

| | 371,634 |

|

| Deferred costs and other assets, net | | 400,884 |

| | 389,922 |

| | 446,606 |

| | 418,199 |

| | 303,432 |

|

| Goodwill | | 1,871,114 |

| | 1,894,794 |

| | 2,096,450 |

| | 2,293,020 |

| | 2,298,677 |

|

| Due from affiliates | | 58,457 |

| | 86,122 |

| | 55,666 |

| | 73,686 |

| | 8,719 |

|

| Assets held for sale | | — |

| | 1,261 |

| | 1,887,872 |

| | 38,737 |

| | 665 |

|

| Total assets | | $ | 20,322,028 |

| | $ | 20,515,139 |

| | $ | 22,867,583 |

| | $ | 21,310,496 |

| | $ | 20,488,095 |

|

| | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | |

| Mortgage notes payable and other debt, net | | $ | 3,672,496 |

| | $ | 3,805,761 |

| | $ | 3,830,994 |

| | $ | 4,373,652 |

| | $ | 4,382,883 |

|

| Corporate bonds, net | | 2,546,701 |

| | 2,546,499 |

| | 2,546,294 |

| | 2,546,089 |

| | 2,545,884 |

|

| Convertible debt, net | | 978,769 |

| | 977,521 |

| | 976,251 |

| | 975,003 |

| | 973,737 |

|

| Credit facility | | 3,184,000 |

| | 3,184,000 |

| | 4,259,000 |

| | 1,896,000 |

| | 2,415,800 |

|

| Below-market lease liabilities, net | | 304,754 |

| | 317,838 |

| | 318,494 |

| | 281,954 |

| | 286,579 |

|

| Accounts payable and accrued expenses | | 160,129 |

| | 163,025 |

| | 180,338 |

| | 174,942 |

| | 149,542 |

|

| Deferred rent, derivative and other liabilities | | 139,241 |

| | 127,611 |

| | 195,256 |

| | 223,419 |

| | 206,105 |

|

| Distributions payable | | 9,959 |

| | 9,995 |

| | 9,927 |

| | 10,779 |

| | 11,233 |

|

| Due to affiliates | | 547 |

| | 559 |

| | 2,757 |

| | 3,184 |

| | 2,614 |

|

| Liabilities associated with assets held for sale | | — |

| | — |

| | 545,382 |

| | — |

| | — |

|

| Total liabilities | | 10,996,596 |

| | 11,132,809 |

| | 12,864,693 |

| | 10,485,022 |

| | 10,974,377 |

|

| Series D preferred stock | | — |

| | — |

| | — |

| | 269,299 |

| | 269,299 |

|

| Series F preferred stock | | 428 |

| | 428 |

| | 428 |

| | 427 |

| | 427 |

|

| Common stock | | 9,051 |

| | 9,055 |

| | 9,080 |

| | 9,079 |

| | 7,699 |

|

| Additional paid-in capital | | 11,919,358 |

| | 11,920,253 |

| | 11,905,338 |

| | 11,901,675 |

| | 10,302,168 |

|

| Accumulated other comprehensive income | | (4,136 | ) | | 2,728 |

| | 8,600 |

| | 7,058 |

| | 8,463 |

|

| Accumulated deficit | | (2,826,524 | ) | | (2,778,576 | ) | | (2,182,731 | ) | | (1,639,208 | ) | | (1,358,743 | ) |

| Total stockholders' equity | | 9,098,177 |

| | 9,153,888 |

| | 9,740,715 |

| | 10,279,031 |

| | 8,960,014 |

|

| Non-controlling interests | | 227,255 |

| | 228,442 |

| | 262,175 |

| | 277,144 |

| | 284,405 |

|

| Total equity | | 9,325,432 |

|

| 9,382,330 |

| | 10,002,890 |

| | 10,556,175 |

| | 9,244,419 |

|

| Total liabilities and equity | | $ | 20,322,028 |

| | $ | 20,515,139 |

| | $ | 22,867,583 |

| | $ | 21,310,496 |

| | $ | 20,488,095 |

|

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 10

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Consolidated Statements of Operations (unaudited, in thousands, except per share data) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Revenues: | | | | | | | | | | |

| Rental income | | $ | 342,759 |

| | $ | 346,928 |

| | $ | 365,712 |

| | $ | 314,519 |

| | $ | 244,415 |

|

| Direct financing lease income | | 741 |

| | 791 |

| | 625 |

| | 1,181 |

| | 1,006 |

|

| Operating expense reimbursements | | 22,974 |

| | 18,806 |

| | 30,984 |

| | 29,256 |

| | 21,476 |

|

| Cole Capital revenue | | 27,494 |

| | 52,282 |

| | 59,797 |

| | 37,222 |

| | 54,257 |

|

| Total revenues | | 393,968 |

| | 418,807 |

| | 457,118 |

| | 382,178 |

| | 321,154 |

|

| Operating expenses: | | | | | | | | | | |

| Cole Capital reallowed fees and commissions | | 2,031 |

| | 9,326 |

| | 15,398 |

| | 7,068 |

| | 34,436 |

|

| Acquisition related | | 2,182 |

| | 4,215 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,162 |

| | 7,632 |

| | 7,422 |

| | 160,298 |

|

| Property operating | | 30,999 |

| | 27,723 |

| | 40,977 |

| | 39,286 |

| | 29,755 |

|

| Management fees to affiliates | | — |

| | — |

| | — |

| | — |

| | 13,888 |

|

| General and administrative | | 33,106 |

| | 44,622 |

| | 30,213 |

| | 37,224 |

| | 55,369 |

|

| Depreciation and amortization | | 219,141 |

| | 226,272 |

| | 265,150 |

| | 250,739 |

| | 173,842 |

|

| Impairments | | — |

| | 406,136 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Total operating expenses | | 303,882 |

| | 743,456 |

| | 375,667 |

| | 350,496 |

| | 481,005 |

|

| Operating income (loss) | | 90,086 |

| | (324,649 | ) | | 81,451 |

| | 31,682 |

| | (159,851 | ) |

| Other (expense) income: | | | | | | | | | | |

| Interest expense, net | | (95,699 | ) | | (126,157 | ) | | (101,643 | ) | | (103,897 | ) | | (120,951 | ) |

| Extinguishment of debt, net | | 429 |

| | (605 | ) | | (5,396 | ) | | (6,469 | ) | | (9,399 | ) |

| Other income, net | | 8,961 |

| | 65,848 |

| | 8,687 |

| | 4,442 |

| | 3,975 |

|

| (Loss) gain on derivative instruments, net | | (1,028 | ) | | (172 | ) | | (17,484 | ) | | 14,207 |

| | (7,121 | ) |

| Loss on held for sale assets and disposition of real estate, net | | (31,368 | ) | | (1,263 | ) | | (256,894 | ) | | (1,269 | ) | | (17,605 | ) |

| Gain on sale of investments | | — |

| | — |

| | 6,357 |

| | — |

| | — |

|

| Total other expenses, net | | (118,705 | ) | | (62,349 | ) | | (366,373 | ) | | (92,986 | ) | | (151,101 | ) |

| Loss before income and franchise taxes | | (28,619 | ) | | (386,998 | ) | | (284,922 | ) | | (61,304 | ) | | (310,952 | ) |

| (Provision for) benefit from income and franchise taxes | | (2,074 | ) | | 26,571 |

| | (3,125 | ) | | 4,706 |

| | 5,112 |

|

| Net loss | | (30,693 | ) | | (360,427 | ) | | (288,047 | ) | | (56,598 | ) | | (305,840 | ) |

| Net loss attributable to non-controlling interests | | 723 |

| | 9,804 |

| | 7,649 |

| | 1,878 |

| | 14,396 |

|

| Net loss attributable to the Company | | $ | (29,970 | ) | | $ | (350,623 | ) | | $ | (280,398 | ) | | $ | (54,720 | ) | | $ | (291,444 | ) |

| | | | | | | | | | | |

| Basic and diluted net loss per share attributable to common stockholders | | $ | (0.05 | ) | | $ | (0.41 | ) | | $ | (0.35 | ) | | $ | (0.10 | ) | | $ | (0.58 | ) |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 11

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Consolidated Funds from Operations and Adjusted Funds from Operations (unaudited, in thousands, except share and per share data) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Net loss | | $ | (30,693 | ) | | $ | (360,427 | ) | | $ | (288,047 | ) | | $ | (56,598 | ) | | $ | (305,840 | ) |

| Dividends on non-convertible preferred stock | | (17,973 | ) | | (17,973 | ) | | (17,974 | ) | | (17,773 | ) | | (17,374 | ) |

| Loss on held for sale assets and disposition of real estate assets, net | | 31,368 |

| | 1,263 |

| | 256,894 |

| | 1,269 |

| | 17,605 |

|

| Depreciation and amortization of real estate assets | | 210,770 |

| | 219,080 |

| | 240,046 |

| | 225,940 |

| | 159,461 |

|

| Impairment of real estate assets | | — |

| | 96,692 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Proportionate share of adjustments for unconsolidated entities | | 1,558 |

| | 2,540 |

| | 2,580 |

| | 2,573 |

| | 1,344 |

|

| FFO | | $ | 195,030 |

| | $ | (58,825 | ) | | $ | 195,798 |

| | $ | 156,967 |

| | $ | (144,804 | ) |

| | | | | | | | | | | |

| Acquisition related | | 2,182 |

| | 4,215 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,162 |

| | 7,632 |

| | 7,422 |

| | 160,298 |

|

| Impairment of intangible assets | | — |

| | 309,444 |

| | — |

| | — |

| | — |

|

| Legal settlements and insurance proceeds | | (1,250 | ) | | (60,720 | ) | | (3,275 | ) | | — |

| | — |

|

| Gain on sale and unrealized gains of investment securities | | (233 | ) | | — |

| | (6,357 | ) | | — |

| | — |

|

| Loss (gain) on derivative instruments, net | | 1,028 |

| | 172 |

| | 17,484 |

| | (14,207 | ) | | 7,121 |

|

| Amortization of net premiums on debt and investments | | (3,858 | ) | | 11,461 |

| | (8,106 | ) | | (4,606 | ) | | (5,198 | ) |

| Amortization of below-market lease liabilities, net of amortization of above-market lease assets | | 1,007 |

| | 1,475 |

| | 1,934 |

| | 2,103 |

| | 388 |

|

| Net direct financing lease adjustments | | 495 |

| | 448 |

| | 620 |

| | 137 |

| | 390 |

|

| Amortization and write off of deferred financing costs | | 7,929 |

| | 23,475 |

| | 12,486 |

| | 10,985 |

| | 44,976 |

|

| Amortization of management contracts | | 7,510 |

| | 6,233 |

| | 24,288 |

| | 24,024 |

| | 13,992 |

|

Deferred tax benefit(1) | | (3,972 | ) | | (33,324 | ) | | — |

| | — |

| | — |

|

| (Gain) loss on early extinguishment of debt and forgiveness of debt, net | | (5,302 | ) | | 605 |

| | 5,396 |

| | 6,469 |

| | 9,399 |

|

| Straight-line rent | | (19,107 | ) | | (25,367 | ) | | (24,871 | ) | | (17,413 | ) | | (7,520 | ) |

Equity-based compensation expense, net of forfeiture(2) | | 818 |

| | (980 | ) | | 5,541 |

| | 5,690 |

| | 21,574 |

|

| Other amortization and non-cash charges | | 753 |

| | 895 |

| | 713 |

| | 698 |

| | 421 |

|

| Proportionate share of adjustments for unconsolidated entities | | 682 |

| | 1,090 |

| | 1,268 |

| | 464 |

| | 318 |

|

| AFFO | | $ | 200,135 |

| | $ | 205,459 |

| | $ | 244,549 |

| | $ | 185,934 |

| | $ | 114,772 |

|

| | | | | | | | | | | |

| Weighted-average shares outstanding - basic | | 902,996,270 |

|

| 902,528,136 |

|

| 902,096,102 |

|

| 815,406,408 |

|

| 547,470,457 |

|

| Effect of dilutive securities | | 26,157,663 |

|

| 29,629,740 |

|

| 44,970,255 |

|

| 52,613,117 |

|

| 51,151,928 |

|

Weighted-average shares outstanding - diluted(3) | | 929,153,933 |

| | 932,157,876 |

| | 947,066,357 |

| | 868,019,525 |

| | 598,622,385 |

|

| | | | | | | | | | | |

| FFO per diluted share | | $ | 0.21 |

| | $ | (0.06 | ) | | $ | 0.21 |

| | $ | 0.18 |

| | $ | (0.24 | ) |

| AFFO per diluted share | | $ | 0.22 |

| | $ | 0.22 |

| | $ | 0.26 |

| | $ | 0.21 |

| | $ | 0.19 |

|

_______________________________________________

| |

| (1) | This adjustment represents the non-current portion of the provision or benefit in order to show only the current portion of the benefit as an impact to AFFO. |

| |

| (2) | During the three months ended December 31, 2014, the Company reversed certain equity-based compensation amounts previously recorded due to the resignation of certain executives. |

| |

| (3) | Weighted-average shares for all periods presented excludes the effect of the convertible debt as the effect would be antidilutive. |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 12

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Consolidated EBITDA and Normalized EBITDA (unaudited, in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Total revenues | | $ | 393,968 |

| | $ | 418,807 |

| | $ | 457,118 |

| | $ | 382,178 |

| | $ | 321,154 |

|

| Less: total operating expenses | | 303,882 |

| | 743,456 |

| | 375,667 |

| | 350,496 |

| | 481,005 |

|

| Operating income (loss) | | 90,086 |

| | (324,649 | ) | | 81,451 |

| | 31,682 |

| | (159,851 | ) |

| Total other (expenses), net | | (118,705 | ) | | (62,349 | ) | | (366,373 | ) | | (92,986 | ) | | (151,101 | ) |

| Loss before income and franchise taxes | | (28,619 | ) | | (386,998 | ) | | (284,922 | ) | | (61,304 | ) | | (310,952 | ) |

| (Provision for) benefit from income and franchise taxes | | (2,074 | ) | | 26,571 |

| | (3,125 | ) | | 4,706 |

| | 5,112 |

|

| Net loss | | (30,693 | ) | | (360,427 | ) | | (288,047 | ) | | (56,598 | ) | | (305,840 | ) |

| Adjustments: | | | | | | | | | | |

| Interest expense | | 95,699 |

| | 126,157 |

| | 101,643 |

| | 103,897 |

| | 120,951 |

|

| Depreciation and amortization | | 219,141 |

| | 226,272 |

| | 265,150 |

| | 250,739 |

| | 173,842 |

|

| Provision for (benefit from) income and franchise taxes | | 2,074 |

| | (26,571 | ) | | 3,125 |

| | (4,706 | ) | | (5,112 | ) |

| Proportionate share of adjustments for unconsolidated entities | | 2,661 |

| | 3,402 |

| | 3,433 |

| | 3,453 |

| | 2,096 |

|

| EBITDA | | $ | 288,882 |

| | $ | (31,167 | ) | | $ | 85,304 |

| | $ | 296,785 |

| | $ | (14,063 | ) |

| Management adjustments: | | | | | | | | | | |

| Loss on held for sale assets and disposition of real estate, net | | 31,368 |

| | 1,263 |

| | 256,894 |

| | 1,269 |

| | 17,605 |

|

| Impairments | | — |

| | 406,136 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Acquisition related | | 2,182 |

| | 4,215 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,162 |

| | 7,632 |

| | 7,422 |

| | 160,298 |

|

| Equity-based compensation | | 818 |

| | (980 | ) | | 5,541 |

| | 5,690 |

| | 21,574 |

|

| Gain on sale and unrealized gains of investment securities | | (233 | ) | | — |

| | (6,357 | ) | | — |

| | — |

|

| Loss (gain) on derivative instruments, net | | 1,028 |

| | 172 |

| | 17,484 |

| | (14,207 | ) | | 7,121 |

|

| Amortization of below-market lease liabilities, net of amortization of above-market lease assets | | 1,007 |

| | 1,475 |

| | 1,934 |

| | 2,103 |

| | 388 |

|

| (Gain) loss on early extinguishment of debt and forgiveness of debt, net | | (5,302 | ) | | 605 |

| | 5,396 |

| | 6,469 |

| | 9,399 |

|

| Net direct financing lease adjustments | | 495 |

| | 448 |

| | 620 |

| | 137 |

| | 390 |

|

| Straight-line rent | | (19,107 | ) | | (25,367 | ) | | (24,871 | ) | | (17,413 | ) | | (7,520 | ) |

| Legal settlement and insurance proceeds | | (1,250 | ) | | (60,720 | ) | | (3,275 | ) | | — |

| | — |

|

| Proportionate share of adjustments for unconsolidated entities | | (254 | ) | | 1,086 |

| | 1,276 |

| | 437 |

| | 266 |

|

| Normalized EBITDA | | $ | 316,057 |

| | $ | 322,328 |

| | $ | 363,875 |

| | $ | 297,449 |

| | $ | 208,875 |

|

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 13

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Statements of Operations - REI Segment (unaudited, in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Revenues: | | | | | | | | | | |

| Rental income | | $ | 342,759 |

| | $ | 346,928 |

| | $ | 365,712 |

| | $ | 314,519 |

| | $ | 244,415 |

|

| Direct financing lease income | | 741 |

| | 791 |

| | 625 |

| | 1,181 |

| | 1,006 |

|

| Operating expense reimbursements | | 22,974 |

| | 18,806 |

| | 30,984 |

| | 29,256 |

| | 21,476 |

|

| Total real estate investment revenues | | 366,474 |

| | 366,525 |

| | 397,321 |

| | 344,956 |

| | 266,897 |

|

| Operating expenses: | | | | | | | | | | |

| Acquisition related | | 1,723 |

| | 853 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,139 |

| | 7,613 |

| | 5,999 |

| | 159,794 |

|

| Property operating | | 30,999 |

| | 27,723 |

| | 40,977 |

| | 39,286 |

| | 29,755 |

|

| Management fees to affiliate | | — |

| | — |

| | — |

| | — |

| | 13,888 |

|

| General and administrative | | 15,370 |

| | 13,586 |

| | 12,948 |

| | 15,189 |

| | 34,538 |

|

| Depreciation and amortization | | 210,788 |

| | 219,222 |

| | 240,073 |

| | 225,965 |

| | 159,483 |

|

| Impairment of real estate | | — |

| | 96,692 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Total operating expenses | | 275,303 |

| | 383,215 |

| | 317,908 |

| | 295,196 |

| | 410,875 |

|

| Operating income (loss) | | 91,171 |

| | (16,690 | ) | | 79,413 |

| | 49,760 |

| | (143,978 | ) |

| Other (expense) income: | | | | | | | | | | |

| Interest expense, net | | (95,699 | ) | | (126,157 | ) | | (101,643 | ) | | (103,897 | ) | | (120,951 | ) |

| Extinguishment of debt, net | | 429 |

| | (605 | ) | | (5,396 | ) | | (6,469 | ) | | (9,399 | ) |

| Other income, net | | 7,742 |

| | 63,837 |

| | 8,508 |

| | 4,332 |

| | 3,959 |

|

| Loss on derivative instruments, net | | (1,028 | ) | | (172 | ) | | (17,484 | ) | | 14,207 |

| | (7,121 | ) |

| Loss on held for sale assets and disposition of real estate assets, net | | (31,368 | ) | | (1,263 | ) | | (256,894 | ) | | (1,269 | ) | | (17,605 | ) |

| Gain on sale of investments | | — |

| | — |

| | 6,357 |

| | — |

| | — |

|

| Total other expenses, net | | (119,924 | ) | | (64,360 | ) | | (366,552 | ) | | (93,096 | ) | | (151,117 | ) |

| Loss before income and franchise taxes | | (28,753 | ) |

| (81,050 | ) | | (287,139 | ) | | (43,336 | ) | | (295,095 | ) |

| Provision for income and franchise taxes | | (1,854 | ) | | (1,408 | ) | | (1,994 | ) | | (2,788 | ) | | (1,123 | ) |

| Net loss | | $ | (30,607 | ) | | $ | (82,458 | ) | | $ | (289,133 | ) | | $ | (46,124 | ) | | $ | (296,218 | ) |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 15

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

EBITDA and Normalized EBITDA - REI Segment (unaudited, in thousands)

|

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Net loss | | $ | (30,607 | ) | | $ | (82,458 | ) | | $ | (289,133 | ) | | $ | (46,124 | ) | | $ | (296,218 | ) |

| Adjustments: | | | | | | | | | | |

| Interest expense | | 95,699 |

| | 126,157 |

| | 101,643 |

| | 103,897 |

| | 120,951 |

|

| Depreciation and amortization | | 210,788 |

| | 219,222 |

| | 240,073 |

| | 225,965 |

| | 159,483 |

|

| Provision for income and franchise taxes | | 1,854 |

| | 1,408 |

| | 1,994 |

| | 2,788 |

| | 1,123 |

|

| Proportionate share of adjustments for unconsolidated entities | | 2,661 |

| | 3,402 |

| | 3,433 |

| | 3,453 |

| | 2,096 |

|

| EBITDA | | $ | 280,395 |

| | $ | 267,731 |

| | $ | 58,010 |

| | $ | 289,979 |

| | $ | (12,565 | ) |

| Management adjustments: | | | | | | | | | | |

| Loss on held for sale assets and disposition of real estate, net | | 31,368 |

| | 1,263 |

| | 256,894 |

| | 1,269 |

| | 17,605 |

|

| Impairments | | — |

| | 96,692 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Acquisition related | | 1,723 |

| | 853 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,139 |

| | 7,613 |

| | 5,999 |

| | 159,794 |

|

| Equity-based compensation | | 402 |

| | (3,997 | ) | | 2,086 |

| | 3,575 |

| | 20,640 |

|

| Gain on sale and unrealized gains of investment securities | | (233 | ) | | — |

| | (6,357 | ) | | — |

| | — |

|

| Loss (gain) on derivative instruments, net | | 1,028 |

| | 172 |

| | 17,484 |

| | (14,207 | ) | | 7,121 |

|

| Amortization of below-market lease liabilities, net of amortization of above-market lease assets | | 1,007 |

| | 1,475 |

| | 1,934 |

| | 2,103 |

| | 388 |

|

| (Gain) loss on early extinguishment of debt and forgiveness of debt, net | | (5,302 | ) | | 605 |

| | 5,396 |

| | 6,469 |

| | 9,399 |

|

| Net direct financing lease adjustments | | 495 |

| | 448 |

| | 620 |

| | 137 |

| | 390 |

|

| Straight-line rent | | (19,107 | ) | | (25,367 | ) | | (24,871 | ) | | (17,413 | ) | | (7,520 | ) |

| Legal settlement and insurance proceeds | | (1,250 | ) | | (60,720 | ) | | (3,275 | ) | | — |

| | — |

|

| Proportionate share of adjustments for unconsolidated entities | | (254 | ) | | 1,086 |

| | 1,276 |

| | 437 |

| | 266 |

|

| Normalized EBITDA | | $ | 306,695 |

| | $ | 305,380 |

| | $ | 333,107 |

| | $ | 287,105 |

| | $ | 208,935 |

|

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 16

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Funds from Operations and Adjusted Funds from Operations - REI Segment (unaudited, in thousands, except share and per share data) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

| Net loss | | $ | (30,607 | ) | | $ | (82,458 | ) | | $ | (289,133 | ) | | $ | (46,124 | ) | | $ | (296,218 | ) |

| Dividends on non-convertible preferred stock | | (17,973 | ) | | (17,973 | ) | | (17,974 | ) | | (17,773 | ) | | (17,374 | ) |

| Loss on held for sale assets and disposition of real estate, net | | 31,368 |

| | 1,263 |

| | 256,894 |

| | 1,269 |

| | 17,605 |

|

| Depreciation and amortization of real estate assets | | 210,770 |

| | 219,080 |

| | 240,046 |

| | 225,940 |

| | 159,461 |

|

| Impairment of real estate | | — |

| | 96,692 |

| | 2,299 |

| | 1,556 |

| | — |

|

| Proportionate share of adjustments for unconsolidated entities | | 1,558 |

| | 2,540 |

| | 2,580 |

| | 2,573 |

| | 1,344 |

|

| FFO | | $ | 195,116 |

| | $ | 219,144 |

| | $ | 194,712 |

| | $ | 167,441 |

| | $ | (135,182 | ) |

| | | | | | | | | | | |

| Acquisition related | | 1,723 |

| | 853 |

| | 13,998 |

| | 7,201 |

| | 13,417 |

|

| Merger and other non-routine transactions | | 16,423 |

| | 25,139 |

| | 7,613 |

| | 5,999 |

| | 159,794 |

|

| Legal settlement and insurance proceeds | | (1,250 | ) | | (60,720 | ) | | (3,275 | ) | | — |

| | — |

|

| Gain on sale and unrealized gains of investment securities | | (233 | ) | | — |

| | (6,357 | ) | | — |

| | — |

|

| Loss (gain) on derivative instruments, net | | 1,028 |

| | 172 |

| | 17,484 |

| | (14,207 | ) | | 7,121 |

|

| Amortization of premiums and discounts on debt and investments | | (3,858 | ) | | 11,461 |

| | (8,106 | ) | | (4,606 | ) | | (5,198 | ) |

| Amortization of below-market lease liabilities, net of amortization of above-market lease assets | | 1,007 |

| | 1,475 |

| | 1,934 |

| | 2,103 |

| | 388 |

|

| Net direct financing lease adjustments | | 495 |

| | 448 |

| | 620 |

| | 137 |

| | 390 |

|

| Amortization and write off of deferred financing costs | | 7,929 |

| | 23,475 |

| | 12,486 |

| | 10,985 |

| | 44,976 |

|

| (Gain) loss on early extinguishment of debt and forgiveness of debt, net | | (5,302 | ) | | 605 |

| | 5,396 |

| | 6,469 |

| | 9,399 |

|

| Straight-line rent | | (19,107 | ) | | (25,367 | ) | | (24,871 | ) | | (17,413 | ) | | (7,520 | ) |

Equity-based compensation expense, net of forfeitures(1) | | 402 |

| | (3,997 | ) | | 2,086 |

| | 3,575 |

| | 20,640 |

|

| Other amortization and non-cash charges | | 18 |

| | 156 |

| | 3 |

| | 40 |

| | 121 |

|

| Proportionate share of adjustments for unconsolidated entities | | 682 |

| | 1,090 |

| | 1,268 |

| | 464 |

| | 318 |

|

| AFFO | | $ | 195,073 |

| | $ | 193,934 |

| | $ | 214,991 |

| | $ | 168,188 |

| | $ | 108,664 |

|

| | | | | | | | | | | |

| Weighted-average shares outstanding - basic | | 902,996,270 |

|

| 902,528,136 |

|

| 902,096,102 |

|

| 815,406,408 |

|

| 547,470,457 |

|

| Effect of dilutive securities | | 26,157,663 |

|

| 29,629,740 |

|

| 44,970,255 |

|

| 52,613,117 |

|

| 51,151,928 |

|

| Weighted-average shares outstanding - diluted | | 929,153,933 |

| | 932,157,876 |

| | 947,066,357 |

| | 868,019,525 |

| | 598,622,385 |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

| FFO per diluted share | | $ | 0.21 |

| | $ | 0.24 |

| | $ | 0.21 |

| | $ | 0.19 |

| | $ | (0.23 | ) |

| AFFO per diluted share | | $ | 0.21 |

| | $ | 0.21 |

| | $ | 0.23 |

| | $ | 0.19 |

| | $ | 0.18 |

|

_______________________________________________

| |

| (1) | During the three months ended December 31, 2014, the Company reversed certain equity-based compensation amounts previously recorded due to the resignation of certain executives. |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 17

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

GAAP and Cash NOI (unaudited, in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31, 2015 | | December 31, 2014 | | September 30, 2014 | | June 30, 2014 | | March 31, 2014 |

Rental income - as reported(1) | | $ | 342,759 |

| | $ | 346,928 |

| | $ | 365,712 |

| | $ | 314,519 |

| | $ | 244,415 |

|

| Operating expense reimbursements - as reported | | 22,974 |

| | 18,806 |

| | 30,984 |

| | 29,256 |

| | 21,476 |

|

| Property operating expense - as reported | | (30,999 | ) | | (27,723 | ) | | (40,977 | ) | | (39,286 | ) | | (29,755 | ) |

| GAAP NOI | | 334,734 |

| | 338,011 |

| | 355,719 |

| | 304,489 |

| | 236,136 |

|

| Adjustments: | | | | | | | | | | |

| Straight line rent | | (19,107 | ) | | (25,367 | ) | | (24,871 | ) | | (17,413 | ) | | (7,520 | ) |

| Amortization of below-market lease liabilities, net of amortization of above-market lease assets | | 1,007 |

| | 1,475 |

| | 1,934 |

| | 2,103 |

| | 388 |

|

| Cash NOI | | $ | 316,634 |

| (2) | $ | 314,119 |

| | $ | 332,782 |

| | $ | 289,179 |

| | $ | 229,004 |

|

_____________________________________

| |

| (1) | Rental income includes percentage rent of $2.6 million, $1.6 million, $1.9 million, $2.7 million and $1.4 million for the three months ended March 31, 2015, December 31, 2014, September 30, 2014, June 30, 2014 and March 31, 2014, respectively. |

| |

| (2) | Estimated annualized normalized Cash NOI is $1.3 billion, calculated as shown in the table below. For properties acquired or build-to-suits completed during the three months ended March 31, 2015, the adjustments for intra-quarter acquisitions and dispositions replaces cash NOI for the partial period with an amount estimated to be equivalent to cash NOI for the full period. For properties disposed of during the three months ended March 31, 2015, the adjustment eliminates cash NOI for the period. |

|

| | | | |

| | | March 31, 2015 |

| Cash NOI | | $ | 316,634 |

|

Adjustments for intra-quarter acquisitions and dispositions (2) | | (2,228 | ) |

| Normalized Cash NOI | | $ | 314,406 |

|

| Annualized Normalized Cash NOI | | $ | 1,257,624 |

|

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 18

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Debt and Preferred Equity Summary (unaudited, dollars in thousands) |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Principal Payments Due | | Total | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 | | Thereafter |

| Mortgage notes payable | | $ | 3,559,175 |

| | $ | 56,042 |

| | $ | 251,816 |

| | $ | 457,903 |

| | $ | 220,153 |

| | $ | 295,956 |

| | $ | 2,277,305 |

|

| Unsecured credit facility | | 3,184,000 |

| | — |

| | — |

| | — |

| | 3,184,000 |

| | — |

| | — |

|

| Corporate bonds | | 2,550,000 |

| | — |

| | — |

| | 1,300,000 |

| | — |

| | 750,000 |

| | 500,000 |

|

| Convertible debt | | 1,000,000 |

| | — |

| | — |

| | — |

| | 597,500 |

| | — |

| | 402,500 |

|

| Other debt | | 39,998 |

| | 6,535 |

| | 12,516 |

| | 7,680 |

| | 13,267 |

| | — |

| | — |

|

| Total | | $ | 10,333,173 |

| | $ | 62,577 |

| | $ | 264,332 |

| | $ | 1,765,583 |

| | $ | 4,014,920 |

| | $ | 1,045,956 |

| | $ | 3,179,805 |

|

|

| | | | | | | | | |

| Debt Type | | Percentage of Total Debt | | Weighted-Average Effective Interest Rate | | Weighted-Average Years to Maturity |

| Mortgage notes payable | | 34.4 | % | | 4.96 | % | | 7.0 |

|

| Unsecured credit facility | | 30.8 | % | | 2.39 | % | | 3.2 |

|

| Corporate bonds | | 24.7 | % | | 2.80 | % | | 3.8 |

|

| Convertible debt | | 9.7 | % | | 3.30 | % | | 4.3 |

|

| Other debt | | 0.4 | % | | 5.81 | % | | 2.8 |

|

| Total | | 100.0 | % | | 3.48 | % | | 4.8 |

|

|

| | | | | | | | | |

| Debt Type | | Percentage of Total Debt | | Weighted-Average Effective Interest Rate | | Weighted-Average Years to Maturity |

| Total unsecured debt | | 65.2 | % | | 2.68 | % | | 3.6 |

|

| Total secured debt | | 34.8 | % | | 4.97 | % | | 7.0 |

|

| Total | | 100.0 | % | | 3.48 | % | | 4.8 |

|

| | | | | | | |

| Total fixed rate debt | | 78.9 | % | | 3.86 | % | | 5.2 |

|

| Total floating rate debt | | 21.1 | % | | 2.03 | % | | 3.2 |

|

| Total | | 100.0 | % | | 3.48 | % | | 4.8 |

|

|

| | | | | | | | | | |

| Preferred Equity | | Amount Outstanding | | Percent of Total Preferred Equity | | Dividend Rate |

| Series F preferred stock | | $ | 1,070,853 |

| | 100.00 | % | | 6.7 | % |

Represents balloon payments at maturity and excludes monthly scheduled principal amortization.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 19

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Mortgage Notes Payable (unaudited, dollars in thousands) |

| |

|

| | | | | | | | | | | | | | |

| Lender | | Maturity | | Outstanding Balance as of March 31, 2015 | | Coupon Rate | | Effective Rate (1) | | Payment Terms (2) |

| Cantor Commercial Real Estate Lending, L.P. | | 1/6/2024 | | $ | 465,000 |

| | 4.97 | % | | 4.97 | % | | I/O |

| Wells Fargo Bank, National Association | | 8/10/2036 | | 279,437 |

| | 4.16 | % | | 4.16 | % | | P&I |

| Cantor Commercial Real Estate Lending, L.P. | | 1/6/2024 | | 155,000 |

| | 4.97 | % | | 4.97 | % | | I/O |

| Wells Fargo Bank, National Association | | 1/1/2018 | | 133,025 |

| | 5.61 | % | | 5.61 | % | | I/O through 02/01/2016, then P&I |

| The Royal Bank of Scotland Plc | | 5/1/2023 | | 124,300 |

| | 3.84 | % | | 3.84 | % | | I/O |

| JPMorgan Chase Bank, N.A. | | 9/1/2020 | | 103,642 |

| | 5.55 | % | | 5.55 | % | | P&I |

| Bank of America, N.A. | | 1/1/2017 | | 94,884 |

| | 6.30 | % | | 6.30 | % | | I/O |

| Wells Fargo Bank, National Association | | 3/1/2023 | | 74,250 |

| | 4.23 | % | | 4.23 | % | | I/O |

| Wells Fargo Bank, National Association | | 7/1/2022 | | 68,110 |

| | 4.54 | % | | 4.54 | % | | I/O |

| Wells Fargo Bank, National Association | | 1/1/2023 | | 66,000 |

| | 4.24 | % | | 4.24 | % | | I/O |

| Goldman Sachs Commercial Mortgage Capital, L.P. | | 6/6/2020 | | 63,600 |

| | 5.73 | % | | 5.73 | % | | I/O through 07/06/2015, then P&I |

| Wells Fargo Bank, National Association | | 5/1/2021 | | 60,450 |

| | 5.54 | % | | 5.54 | % | | I/O |

| PNC Bank, National Association | | 1/1/2019 | | 59,500 |

| | 4.10 | % | | 4.10 | % | | I/O |

| New York State Teachers' Retirement System | | 3/1/2019 | | 55,000 |

| | 4.41 | % | | 4.41 | % | | I/O |

| Citigroup Global Markets Realty Corp | | 5/6/2022 | | 54,300 |

| | 6.05 | % | | 6.05 | % | | I/O |

| US Bank National Association | | 11/11/2029 | | 51,997 |

| | 7.23 | % | | 7.23 | % | | I/O |

| Bank of America, N.A. | | 1/1/2017 | | 51,836 |

| | 5.90 | % | | 5.90 | % | | I/O |

| Capital One, N.A. | | 11/20/2019 | | 51,400 |

| | 1mo. Libor + 1.95% |

| (3) | 5.22 | % | | I/O through 11/01/2017, then P&I |

| American General Life Insurance Company | | 11/1/2021 | | 51,250 |

| | 5.25 | % | | 5.25 | % | | I/O |

| Wells Fargo Bank, National Association | | 2/1/2017 | | 48,500 |

| | 1mo. Libor + 2.47% |

| (3) | 3.75 | % | | I/O |

| JPMorgan Chase Bank, N.A. | | 5/1/2021 | | 46,910 |

| | 5.53 | % | | 5.53 | % | | I/O |

| Goldman Sachs Commercial Mortgage Capital, L.P. | | 5/6/2021 | | 46,670 |

| | 5.92 | % | | 5.92 | % | | I/O |

| US Bank National Association | | 7/11/2016 | | 43,700 |

| | 6.03 | % | | 6.03 | % | | I/O |

| People's United Bank | | 4/1/2021 | | 42,500 |

| | 5.55 | % | | 5.55 | % | | I/O through 05/01/2016, then P&I |

| JPMorgan Chase Bank, N.A. | | 6/1/2020 | | 41,610 |

| | 5.71 | % | | 5.71 | % | | I/O through 07/01/2015, then P&I |

| Wells Fargo Bank, National Association | | 6/1/2022 | | 41,000 |

| | 4.73 | % | | 4.73 | % | | I/O |

| Morgan Stanley Mortgage Capital Holdings LLC | | 1/1/2023 | | 40,800 |

| | 4.46 | % | | 4.46 | % | | I/O |

| US Bank National Association | | 7/1/2015 | | 39,147 |

| | 5.10 | % | | 5.10 | % | | P&I |

| JPMorgan Chase Bank, N.A. | | 11/1/2019 | | 38,500 |

| | 4.10 | % | | 4.10 | % | | I/O |

| LaSalle Bank National Association | | 1/1/2016 | | 38,051 |

| | 10.68 | % | (4) | 10.68 | % | | P&I |

| JPMorgan Chase Bank, N.A. | | 11/1/2017 | | 38,315 |

| | 6.34 | % | | 6.34 | % | | I/O |

| Wells Fargo Bank, National Association | | 3/1/2017 | | 36,600 |

| | 1mo. Libor + 2.50% |

| (3) | 3.76 | % | | I/O |

| The Royal Bank of Scotland Plc | | 1/1/2021 | | 34,000 |

| | 5.48 | % | | 5.48 | % | | I/O |

| Goldman Sachs Mortgage Company | | 12/6/2020 | | 31,500 |

| | 5.25 | % | | 5.25 | % | | I/O |

| BOKF, NA dba Bank of Oklahoma | | 7/29/2018 | | 29,764 |

| | 1mo. Libor + 2.75% |

| (3) | 4.10 | % | | I/O |

| Oritani Bank | | 5/1/2024 | | 30,050 |

| | 3.25 | % | | 3.25 | % | | I/O through 05/01/2019, then P&I |

| Goldman Sachs Mortgage Company | | 12/6/2020 | | 30,000 |

| | 5.25 | % | | 5.25 | % | | I/O |

| Jackson National Life Insurance Company | | 10/1/2021 | | 29,450 |

| | 4.25 | % | | 4.25 | % | | I/O through 11/01/2018, then P&I |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 20

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Mortgage Notes Payable (cont.) (dollars in thousands) |

| |

|

| | | | | | | | | | | | | | |

| Lender | | Maturity | | Outstanding Balance as of March 31, 2015 | | Coupon Rate | | Effective Rate (1) | | Payment Terms (2) |

| German American Capital Corporation | | 10/6/2022 | | $ | 29,160 |

| | 4.48 | % | | 4.48 | % | | I/O |

| PNC Bank, National Association | | 9/1/2022 | | 28,676 |

| | 4.00 | % | | 4.00 | % | | P&I |

| LaSalle Bank National Association | | 1/1/2016 | | 28,654 |

| | 5.69 | % | | 5.69 | % | | I/O through 02/01/2015, then P&I |

| German American Capital Corporation | | 10/6/2022 | | 28,440 |

| | 4.48 | % | | 4.48 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 7/31/2017 | | 28,350 |

| | 1mo. Libor + 2.20% |

| (3) | 3.28 | % | | I/O |

| PNC Bank, National Association | | 6/1/2022 | | 27,750 |

| | 4.22 | % | | 4.22 | % | | I/O |

| GS Commercial Real Estate LP | | 8/6/2019 | | 27,725 |

| | 4.73 | % | | 4.73 | % | | I/O |

| Jackson National Life Insurance Company | | 7/1/2019 | | 27,200 |

| | 3.10 | % | | 3.10 | % | | I/O |

| LaSalle Bank National Association | | 1/1/2017 | | 25,620 |

| | 5.81 | % | | 5.81 | % | | I/O |

| Bank of America, N.A. | | 9/1/2017 | | 24,781 |

| | 5.28 | % | | 5.28 | % | | P&I |

| John Hancock Life Insurance Company | | 10/1/2022 | | 22,500 |

| | 4.04 | % | | 4.04 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 12/31/2018 | | 21,766 |

| | 1mo. Libor + 1.80% |

| (3) | 3.57 | % | | I/O |

| German American Capital Corp | | 6/6/2022 | | 19,796 |

| | 4.60 | % | | 4.60 | % | | P&I |

| Aviva Life and Annuity Company | | 7/1/2021 | | 19,600 |

| | 5.02 | % | | 5.02 | % | | I/O through 08/01/2019, then P&I |

| The Variable Annuity Life Insurance Company | | 1/1/2023 | | 19,525 |

| | 4.00 | % | | 4.00 | % | | I/O |

| Morgan Stanley Mortgage Capital Holdings LLC | | 5/10/2021 | | 19,513 |

| | 5.67 | % | | 5.67 | % | | I/O |

| Oritani Bank | | 5/1/2024 | | 18,889 |

| | 3.25 | % | | 3.25 | % | | I/O through 05/01/2019, then P&I |

| The Royal Bank of Scotland Plc | | 3/1/2021 | | 18,100 |

| | 5.88 | % | | 5.88 | % | | I/O |

| US Bank National Association | | 12/11/2016 | | 17,500 |

| | 5.55 | % | | 5.55 | % | | I/O |

| JPMorgan Chase Bank, National Association | | 5/1/2021 | | 16,520 |

| | 5.54 | % | | 5.54 | % | | P&I |

| BOKF, NA dba Bank of Texas | | 7/31/2017 | | 16,555 |

| | 1mo. Libor + 2.20% |

| (3) | 3.28 | % | | I/O |

| US Bank National Association | | 1/11/2017 | | 16,200 |

| | 5.48 | % | | 5.48 | % | | I/O |

| Wachovia Bank, National Association | | 12/11/2016 | | 16,043 |

| | 5.63 | % | | 5.63 | % | | I/O |

| Wells Fargo Bank, National Association | | 3/20/2023 | | 15,106 |

| | 3.23 | % | | 3.23 | % | | I/O |

| Oritani Bank | | 1/1/2023 | | 15,000 |

| | 3.75 | % | | 3.75 | % | | I/O through 01/01/2018, then P&I |

| US Bank National Association | | 5/1/2016 | | 14,870 |

| | 5.84 | % | | 5.84 | % | | P&I |

| BOKF, NA dba Bank of Texas | | 12/31/2018 | | 14,150 |

| | 1mo. Libor + 1.80% |

| (3) | 3.57 | % | | I/O |

| Wells Fargo Bank, National Association | | 3/1/2016 | | 13,500 |

| | 5.17 | % | | 5.17 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 12/31/2020 | | 13,420 |

| | 1mo. Libor + 1.85% |

| (3) | 4.25 | % | | I/O |

| US Bank National Association | | 7/1/2016 | | 13,005 |

| | 6.05 | % | | 6.05 | % | | P&I |

| BOKF, NA dba Bank of Texas | | 7/13/2017 | | 12,725 |

| | 1mo. Libor + 2.25% |

| (3) | 3.43 | % | | I/O |

| Goldman Sachs Commercial Mortgage Capital, L.P. | | 9/6/2017 | | 12,270 |

| | 3.70 | % | | 3.70 | % | | I/O |

| Customers Bank | | 12/1/2016 | | 11,895 |

| | 3.75 | % | | 3.75 | % | | I/O |

| JPMorgan Chase Bank, N.A. | | 7/1/2020 | | 11,375 |

| | 5.50 | % | | 5.50 | % | | I/O through 08/01/2015, then P&I |

| US Bank National Association | | 2/11/2017 | | 10,332 |

| | 5.68 | % | | 5.68 | % | | I/O |

| US Bank National Association | | 11/11/2016 | | 10,138 |

| | 5.50 | % | | 5.50 | % | | I/O |

| 40/86 Mortgage Capital, Inc. | | 1/1/2019 | | 10,050 |

| | 5.00 | % | | 5.00 | % | | I/O |

| Monumental Life Insurance Company | | 4/1/2023 | | 9,838 |

| | 3.95 | % | | 3.95 | % | | I/O through 05/01/2014, then P&I |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 21

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Mortgage Notes Payable (cont.) (dollars in thousands) |

| |

|

| | | | | | | | | | | | | | |

| Lender | | Maturity | | Outstanding Balance as of March 31, 2015 | | Coupon Rate | | Effective Rate (1) | | Payment Terms (2) |

| Wachovia Bank, National Association | | 6/11/2016 | | $ | 8,625 |

| | 6.56 | % | | 6.56 | % | | I/O |

| Transamerica Life Insurance Company | | 8/1/2030 | | 7,665 |

| | 5.57 | % | | 5.57 | % | | P&I |

| Transamerica Life Insurance Company | | 8/1/2030 | | 6,845 |

| | 5.32 | % | | 5.32 | % | | P&I |

| US Bank National Association | | 5/11/2017 | | 6,262 |

| | 5.45 | % | | 5.45 | % | | I/O |

| Customers Bank | | 8/16/2017 | | 5,500 |

| | 3.63 | % | | 3.63 | % | | I/O |

| Amegy Bank, National Association | | 8/31/2016 | | 7,951 |

| | 1mo. Libor + 2.95% |

| | 3.12 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 10/31/2016 | | 5,060 |

| | 1mo. Libor + 2.25% |

| (3) | 3.70 | % | | I/O |

| Wells Fargo Bank, National Association | | 3/1/2017 | | 4,800 |

| | 1mo. Libor + 2.50% |

| (3) | 3.76 | % | | I/O |

| US Bank National Association | | 4/15/2019 | | 1,875 |

| | 5.40 | % | | 5.40 | % | | I/O |

| Capital Lease Funding, LLC | | 7/15/2018 | | 1,863 |

| | 7.20 | % | | 7.20 | % | | P&I |

| Bear Stearns Commercial Mortgage, Inc. | | 9/1/2017 | | 1,678 |

| | 5.88 | % | | 5.88 | % | | I/O |

| US Bank National Association | | 12/11/2016 | | 1,447 |

| | 6.18 | % | | 6.18 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 4/12/2018 | | 1,562 |

| | 1mo. Libor + 2.45% |

| (3) | 3.39 | % | | I/O |

| US Bank National Association | | 12/11/2015 | | 508 |

| | 5.83 | % | | 5.83 | % | | I/O |

| BOKF, NA dba Bank of Texas | | 4/12/2018 | | 562 |

| | 1mo. Libor + 2.45% |

| (3) | 3.39 | % | | I/O |

| Transamerica Life Insurance Company | | 8/1/2030 | | 387 |

| | 5.93 | % | | 5.93 | % | | P&I |

| | | | | $ | 3,559,175 |

| | | | 4.96 | % | | |

_______________________________________________

(1) Represents interest rate in effect at March 31, 2015. For loans subject to interest rate swaps, this represents the all-in fixed interest rate.

(2) I/O means interest only is due monthly with the principal due at maturity. P&I means both principal and interest are due monthly.

(3) Variable-rate loan fixed by way of interest rate swap agreement.

(4) On March 6, 2015, the Company received a notice of default from the lender of a loan with a principal balance of $38.1 million due to the Company

failing to pay a reserve payment required per the loan agreement. Due to the default, the Company is currently accruing interest at the default rate of interest

of 10.68% per annum.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 22

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Credit Facility and Corporate Bond Covenants (unaudited) |

| |

The following is a summary of key financial covenants for the Company's unsecured credit facility and corporate bonds, as defined and calculated per the terms of the facility's credit agreement and the notes governing document, respectively. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show that the Company is in compliance with the covenants and are not measures of our liquidity or performance. As of March 31, 2015, the Company believes it is in compliance with these covenants based on the covenant limits and calculations in place at that time.

|

| | | | |

| Unsecured Credit Facility Key Covenants | | Required | | March 31, 2015 |

| Maximum leverage ratio | | ≤ 60% | | 46.3% |

| Minimum fixed charge coverage ratio | | ≥ 1.5x | | 2.32x |

| Secured leverage ratio | | ≤ 45% | | 14.9% |

| Total unencumbered asset value ratio | | ≤ 60% | | 47.2% |

| Minimum tangible net worth covenant | | ≥ $5.50B | | $8.59B |

| Minimum unencumbered interest coverage ratio | | ≥ 1.75x | | 4.34x |

|

| | | | |

| Senior Notes Key Covenants | | Required | | March 31, 2015 |

| Limitation on incurrence of total debt | | ≤ 65% | | 53.8% |

| Limitation on incurrence of secured debt | | ≤ 40% | | 18.6% |

| Debt service coverage ratio | | ≥ 1.5x | | 2.32x |

| Maintenance of total unencumbered assets | | ≥ 150% | | 209.1% |

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 23

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Acquisitions (unaudited, dollars in thousands) |

| |

Acquisitions

The following table shows properties that were purchased(1)(2) during the three months ended March 31, 2015 |

| | | | | | | | | | | | | | | |

| Property | | Location | | Square Feet | | Purchase Price | | Cash Cap Rate | | Remaining Lease Term (Years) (3) |

| Family Dollar | | Huntsville, AL | | 8,320 |

| | $ | 1,699 |

| | 6.6 | % | | 14.9 |

|

| Family Dollar | | Columbia, SC | | 8,000 |

| | 1,579 |

| | 6.7 | % | | 15.0 |

|

| Family Dollar | | Wolcott, NY | | 8,320 |

| | 1,417 |

| | 6.4 | % | | 15.0 |

|

| Family Dollar | | North, SC | | 8,320 |

| | 1,294 |

| | 6.7 | % | | 15.0 |

|

| Total / Weighted Average | | | | 32,960 |

| | $ | 5,989 |

| | 6.6 | % | | |

_______________________________________________

(1) Also during the three months ended March 31, 2015, six land parcels were purchased for a total purchase price of $1.6 million. Budgeted total construction costs to complete these development projects is $8.0 million, of which the Company has paid $1.0 million. The expected average cash cap rate based on budgeted construction costs and preliminary lease terms is 7.3%.

(2) In addition, the Company completed six build-to-suit properties that were placed into service during the three months ended March 31, 2015, with an average cash cap rate of 7.3%.

(3) Remaining lease term from March 31, 2015.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 24

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Dispositions (unaudited, dollars in thousands) |

| |

Dispositions

The following table shows the 11 properties that were disposed of during the three months ended March 31, 2015, of which two were vacant at the date of disposition:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | | Location | | Square Feet | | Remaining Lease Term (Years)(1) | | Cash Cap Rate | | Sale Price | | Real Estate Gain (Loss) (2) | | Goodwill Allocation (3) | | GAAP Gain (Loss) (4) | |

| Apollo Group | | Phoenix, AZ | | 599,664 |

| | 16.2 |

| | 7.1 | % | | $ | 183,000 |

| | $ | (5,082 | ) | | $ | (16,360 | ) | | $ | (21,442 | ) | |

| AT&T | | Dallas, TX | | 206,040 |

| | 6.9 |

| | 8.0 | % | | 33,500 |

| | (361 | ) | | (2,911 | ) | | (3,272 | ) | |

| Long John Silver's / A&W | | Clarksville, TN | | 3,039 |

| | 3.2 |

| | 7.3 | % | | 850 |

| | 150 |

| | (5) |

| | 81 |

| |

| Long John Silver's / A&W | | Murfreesboro, TN | | 3,050 |

| | 10.5 |

| | 6.5 | % | | 550 |

| | 98 |

| | (5) |

| | 57 |

| |

| Portfolio Sale | | | | | | | | | | | | | | | | | |

Breakfast Pointe(6) | | Panama City Beach, FL | | 97,938 |

| | 8.2 |

| |

|

| | | | | | | | | |

Falcon Valley(6) | | Lenexa, KS | | 76,784 |

| | 11.7 |

| |

|

| | | | | | | | | |

Lakeshore Crossing(6) | | Gainesville, GA | | 123,948 |

| | 8.9 |

| |

|

| | | | | | | | | |

Kohl's(6) | | Onalaska, WI | | 86,432 |

| | 9.0 |

| |

|

| | | | | | | | | |

CVS(6) | | Lake Wales, FL | | 11,220 |

| | 9.3 |

| |

|

| | | | | | | | | |

| Total Portfolio | | | | 396,322 |

| | 9.4 |

| | 6.7 | % | | 52,335 |

| | (2,356 | ) | | (4,257 | ) | | (6,613 | ) | |

| | | | | | | | | | | | | | | | | | |

| Vacant | | Various | | 9,551 |

| | — |

| | — |

| | 1,540 |

| | 49 |

| | (152 | ) | | (103 | ) | |

| Total Dispositions | | | | 1,217,666 | | 13.6 |

| | 7.1 | % | | $ | 271,775 |

| (7) | $ | (7,502 | ) | | $ | (23,680 | ) | | $ | (31,292 | ) | (8) |

_______________________________________________

(1) Represents the remaining lease term from the date of sale. For multi-tenant retail properties, total portfolio and total dispositions, represents the weighted-average remaining lease term from the date of disposition, based on annualized rental revenue.

(2) Equals sale price less GAAP net book value and selling costs.

(3) In accordance with GAAP, the Company allocated a portion of the Real Estate Investment segment goodwill to the sold property to calculate the GAAP gain(loss). See Note 2 - Summary of Significant Accounting Policies of our Quarterly Report on From 10-Q for the three months ended March 31, 2015 for allocation methodology.

(4) Equals sale price less GAAP net book value, goodwill allocation and selling costs.

(5) Properties classified as held for sale as of December 31, 2014. During the three months ended December 31, 2014, goodwill of $69,000 and $41,000, respectively, was allocated to the cost basis of each property.

(6) Sold as a portfolio to a single buyer.

(7) Excludes NIH building in Bethesda, MD, which foreclosed on January 13, 2015. The Company elected to stop making debt service payments on the related loan with an outstanding balance of $53.8 million as of December 31, 2014.

(8) Loss on dispositions of real estate, net in the consolidated financial statements includes $76,000 of real estate disposition costs that are either not related to a single property or are residual disposition costs related to prior year dispositions.

See the Definitions section for a description of the Company's non-GAAP and other financial measures.

American Realty Capital Properties, Inc. | WWW.ARCPREIT.COM | 25

|

| |

| Q1 2015 SUPPLEMENTAL INFORMATION |

|

|

| |

Same Store Rental Revenue (unaudited, dollars in thousands) |

| |

The Company reviews the stabilized operating results from properties that were owned for the entirety of both the current and prior year reporting periods, referred to as "same store." The following tables show the Company's same store portfolio statistics, which included 2,524 properties acquired prior to January 1, 2014 and owned though March 31, 2015:

|

| | | | | | | | | | | | | | | |

| | | Quarter Ended March 31, | | Increase/(Decrease) |

| | | 2015 | | 2014 | | $ Change | | % Change |

| Base rental revenue | | $ | 137,544 |

| | $ | 136,134 |

| | $ | 1,410 |

| | 1.0 | % |

|

| | | | | | | | | | | | | | | | | | |

| | | | | Base Rental Revenue |

| | | Number of | | Quarter Ended March 31, | | Increase/(Decrease) |

| | | Properties | | 2015 | | 2014 | | $ Change | | % Change |

| Distribution | | 69 |

| | $ | 19,903 |

| | $ | 19,708 |

| | $ | 195 |

| | 1.0 | % |

| Industrial | | 5 |