Exhibit 99.2

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

| VEREIT Supplemental Information | |

| September 30, 2018 | |

| Section | Page |  |

| Company Overview | ||

| Financial Summary | ||

| Financial and Operations Statistics and Ratios | ||

| Key Balance Sheet Metrics and Capital Structure | ||

| Balance Sheets | ||

| Statements of Operations | ||

| Funds From Operations (FFO) | ||

| Adjusted Funds From Operations (AFFO) | ||

| EBITDA and Normalized EBITDA | ||

| Net Operating Income |  | |

| Same Store Contract Rental Revenue | ||

| Debt and Preferred Equity Summary | ||

| Mortgage Notes Payable | ||

| Credit Facility and Corporate Bond Covenants | ||

| Acquisitions and Dispositions | ||

| Diversification Statistics | ||

| Top 10 Concentrations | ||

| Tenants Comprising Over 1% of Annualized Rental Income | ||

| Tenant Industry Diversification | ||

| Property Geographic Diversification |  | |

| Lease Expirations | ||

| Lease Summary | ||

| Diversification by Property Type | ||

| Definitions | ||

| ||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 2

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

| About the Data |

This data and other information described herein are as of and for the three months ended September 30, 2018, unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with the financial statements and the Management's Discussion and Analysis of Financial Condition and Results of Operations sections contained in VEREIT, Inc.'s (the "Company," "VEREIT," "us," "our" and "we") Annual Report on Form 10-K for the year ended December 31, 2017 and Quarterly Reports on Form 10-Q for the periods ended September 30, 2018, June 30, 2018, March 31, 2018, and September 30, 2017.

Prior to the fourth quarter of 2017, the Company operated through two business segments, the real estate investment segment and the investment management segment, Cole Capital. On February 1, 2018, the Company completed the sale of Cole Capital. Substantially all of the Cole Capital segment is presented as discontinued operations and the Company's remaining financial results are reported as a single segment for all periods presented. The Company's continuing operations represent primarily those of the real estate investment segment.

Forward-Looking Statements

Information set forth herein contains “forward-looking statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended), which reflect VEREIT’s expectations regarding future events and plans, VEREIT's future financial condition, results of operations and business. The forward-looking statements involve a number of assumptions, risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward-looking statements. Generally, the words “expects,” “anticipates,”“assumes,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” "may," "will," "should," "could," "continues," variations of such words and similar expressions identify forward-looking statements. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, most of which are difficult to predict and many of which are beyond VEREIT’s control. If a change occurs, VEREIT’s business, financial condition, liquidity and results of operations may vary materially from those expressed in or implied by the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: VEREIT’s plans, market and other expectations, objectives, intentions and other statements that are not historical facts; VEREIT’s ability to meet its updated 2018 guidance; VEREIT’s ability to renew leases, lease vacant space or re-lease space as leases expire on favorable terms or at all; risks associated with tenant, geographic and industry concentrations with respect to VEREIT's properties; the impact of impairment charges in respect of certain of VEREIT's properties, goodwill and intangible assets and other assets; unexpected costs or unexpected liabilities that may arise from potential dispositions, including related to tenant-in-common and Delaware statutory trust real estate programs and VEREIT’s management with respect to such programs; competition in the acquisition and disposition of properties and in the leasing of its properties; the inability to acquire, dispose of, or lease properties on advantageous terms; risks associated with bankruptcies or insolvencies of tenants, from tenant defaults generally or from the unpredictability of the business plans and financial condition of VEREIT's tenants; risks associated with pending government investigations and litigations related to VEREIT's previously disclosed audit committee investigation, including the expense of such investigations and litigation and any potential payments upon resolution; risks associated with VEREIT’s substantial indebtedness, including that it may affect its ability to pay dividends and the terms and restrictions within the agreements governing its indebtedness may restrict its borrowing and operating flexibility; the ability to retain or hire key personnel; and continuation or deterioration of current market conditions. Additional factors that may affect future results are contained in VEREIT’s filings with the U.S. Securities and Exchange Commission (the SEC), which are available at the SEC’s website at www.sec.gov. VEREIT disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of changes in underlying assumptions or factors, new information, future events or otherwise, except as required by law.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 3

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Company Overview (unaudited) |

VEREIT is a real estate company incorporated in Maryland on December 2, 2010, which has elected to be taxed as a real estate investment trust ("REIT") for U.S. federal income tax purposes. On September 6, 2011, the Company completed its initial public offering.

VEREIT is a full-service real estate operating company which owns and manages one of the largest portfolios of single-tenant commercial properties in the U.S. VEREIT's business model provides equity capital to creditworthy corporations in return for long-term leases on their properties. The Company targets properties that are strategically located and essential to the business operations of the tenant, as well as retail properties that offer necessity- and value-oriented products or services. At September 30, 2018, approximately 42.7% of the Company's Annualized Rental Income was earned from Investment-Grade Tenants, Economic Occupancy Rate was 99.1% and the Weighted Average Remaining Lease Term was 8.9 years.

Tenants, Trademarks and Logos

VEREIT is not affiliated with, is not endorsed by, does not endorse and is not sponsored by or a sponsor of the products or services pictured or mentioned. The names, logos and all related product and service names, design marks and slogans are the trademarks or service marks of their respective companies.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 4

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

| Company Overview (cont.) |

| Senior Management | Board of Directors | |

| Glenn J. Rufrano, Chief Executive Officer | Hugh R. Frater, Non-Executive Chairman | |

| Michael J. Bartolotta, Executive Vice President and Chief Financial Officer | David B. Henry, Independent Director | |

| Lauren Goldberg, Executive Vice President, General Counsel and Secretary | Mary Hogan Preusse, Independent Director | |

| Paul H. McDowell, Executive Vice President and Chief Operating Officer | Richard J. Lieb, Independent Director | |

| Thomas W. Roberts, Executive Vice President and Chief Investment Officer | Mark S. Ordan, Independent Director | |

| Gavin B. Brandon, Senior Vice President and Chief Accounting Officer | Eugene A. Pinover, Independent Director | |

| Julie G. Richardson, Independent Director | ||

| Glenn J. Rufrano, Chief Executive Officer | ||

Corporate Offices and Contact Information

| 2325 E. Camelback Road, Suite 1100 | 5 Bryant Park, 23rd Floor | |

| Phoenix, AZ 85016 | New York, NY 10018 | |

| 800-606-3610 | 212-413-9100 | |

| www.VEREIT.com | ||

Trading Symbols: VER, VER PRF

Stock Exchange Listing: New York Stock Exchange

Transfer Agent

Computershare Trust Company, N.A.

250 Royall Street

Canton, MA 02021

800-736-3001

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 5

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Quarterly Financial Summary (unaudited, dollars in thousands, except share and per share amounts) |

The following table summarizes the Company's quarterly financial results and portfolio metrics. Data presented includes both continuing operations, which primarily represent the Company's real estate operations, and discontinued operations, which represent substantially all of Cole Capital, except as otherwise indicated.

| Three Months Ended | |||||||||||||||||||

| Financial Results | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||

Revenue (1) | $ | 313,866 | $ | 315,664 | $ | 315,074 | $ | 316,599 | $ | 306,543 | |||||||||

| (Loss) income from continuing operations | $ | (73,942 | ) | $ | (74,691 | ) | $ | 29,036 | $ | (2,479 | ) | $ | 12,489 | ||||||

| Income (loss) from discontinued operations | — | 224 | 3,501 | (30,613 | ) | 4,005 | |||||||||||||

Net (loss) income (2) | $ | (73,942 | ) | $ | (74,467 | ) | $ | 32,537 | $ | (33,092 | ) | $ | 16,494 | ||||||

| Basic and diluted (loss) income from continuing operations per share attributable to common stockholders and limited partners | $ | (0.09 | ) | $ | (0.09 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Basic and diluted income (loss) from discontinued operations per share attributable to common stockholders and limited partners | — | 0.00 | 0.00 | (0.03 | ) | 0.00 | |||||||||||||

Basic and diluted net (loss) income per share attributable to common stockholders and limited partners (2) | $ | (0.09 | ) | $ | (0.09 | ) | $ | 0.01 | $ | (0.05 | ) | $ | (0.00 | ) | |||||

| Normalized EBITDA from continuing operations | $ | 261,084 | $ | 259,387 | $ | 262,362 | $ | 258,578 | $ | 257,996 | |||||||||

| Normalized EBITDA from discontinued operations | — | — | 2,761 | 9,132 | 9,123 | ||||||||||||||

| Normalized EBITDA | $ | 261,084 | $ | 259,387 | $ | 265,123 | $ | 267,710 | $ | 267,119 | |||||||||

FFO attributable to common stockholders and limited partners from continuing operations (2) | $ | 38,055 | $ | 77,019 | $ | 164,691 | $ | 164,500 | $ | 173,708 | |||||||||

| FFO attributable to common stockholders and limited partners from discontinued operations | — | 224 | 3,501 | (30,613 | ) | 4,005 | |||||||||||||

| FFO attributable to common stockholders and limited partners | $ | 38,055 | $ | 77,243 | $ | 168,192 | $ | 133,887 | $ | 177,713 | |||||||||

FFO attributable to common stockholders and limited partners from continuing operations per diluted share (2) | $ | 0.038 | $ | 0.078 | $ | 0.165 | $ | 0.165 | $ | 0.174 | |||||||||

| FFO attributable to common stockholders and limited partners from discontinued operations per diluted share | — | 0.000 | 0.004 | (0.031 | ) | 0.004 | |||||||||||||

| FFO attributable to common stockholders and limited partners per diluted share | $ | 0.038 | $ | 0.078 | $ | 0.169 | $ | 0.134 | $ | 0.178 | |||||||||

| AFFO attributable to common stockholders and limited partners from continuing operations | $ | 178,529 | $ | 178,794 | $ | 180,854 | $ | 175,807 | $ | 174,774 | |||||||||

| AFFO attributable to common stockholders and limited partners from discontinued operations | — | — | 3,202 | 3,913 | 16,086 | ||||||||||||||

| AFFO attributable to common stockholders and limited partners | $ | 178,529 | $ | 178,794 | $ | 184,056 | $ | 179,720 | $ | 190,860 | |||||||||

| AFFO attributable to common stockholders and limited partners from continuing operations per diluted share | $ | 0.180 | $ | 0.180 | $ | 0.182 | $ | 0.176 | $ | 0.175 | |||||||||

| AFFO attributable to common stockholders and limited partners from discontinued operations per diluted share | — | — | 0.003 | 0.004 | 0.016 | ||||||||||||||

| AFFO attributable to common stockholders and limited partners per diluted share | $ | 0.180 | $ | 0.180 | $ | 0.185 | $ | 0.180 | $ | 0.191 | |||||||||

| Dividends declared per common share | $ | 0.1375 | $ | 0.1375 | $ | 0.1375 | $ | 0.1375 | $ | 0.1375 | |||||||||

| Weighted-average shares outstanding - diluted | 991,924,017 | 992,100,138 | 996,773,442 | 998,513,154 | 998,425,771 | ||||||||||||||

| Portfolio Metrics | |||||||||||||||||||

| Operating Properties | 4,021 | 4,033 | 4,063 | 4,091 | 4,093 | ||||||||||||||

| Rentable Square Feet (in thousands) | 93,856 | 94,592 | 94,666 | 94,418 | 92,228 | ||||||||||||||

| Economic Occupancy Rate | 99.1 | % | 98.8 | % | 98.7 | % | 98.8 | % | 99.0 | % | |||||||||

| Weighted Average Remaining Lease Term (years) | 8.9 | 9.1 | 9.3 | 9.5 | 9.5 | ||||||||||||||

Investment-Grade Tenants (3) | 42.7 | % | 42.7 | % | 42.9 | % | 39.6 | % | 40.1 | % | |||||||||

| (1) | Represents revenue from continuing operations as presented on the statement of operations in accordance with GAAP. There was no revenue from discontinued operations for the three months ended September 30, 2018 and June 30, 2018. Revenue from discontinued operations was $7.8 million, $25.0 million, and $27.0 million, for the three months ended March 31, 2018, December 31, 2017, and September 30, 2017, respectively. |

| (2) | During the three months ended September 30, 2018, the Company accrued $127.5 million of litigation settlement costs, which was paid subsequent to September 30, 2018. During the three months ended June 30, 2018, the Company expensed and paid a litigation settlement of $90.0 million. |

| (3) | The weighted-average credit rating of our investment-grade tenants was BBB+ as of September 30, 2018. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 6

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Financial and Operations Statistics and Ratios (unaudited, dollars in thousands) |

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Interest Coverage Ratio | ||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) | $ | 66,445 | $ | 65,202 | $ | 64,741 | $ | 65,097 | $ | 65,821 | ||||||||||

Normalized EBITDA (2) | 261,084 | 259,387 | 265,123 | 267,710 | 267,119 | |||||||||||||||

| Interest Coverage Ratio | 3.93x | 3.98x | 4.10x | 4.11x | 4.06x | |||||||||||||||

| Fixed Charge Coverage Ratio | ||||||||||||||||||||

Interest Expense, excluding non-cash amortization (1) | $ | 66,445 | $ | 65,202 | $ | 64,741 | $ | 65,097 | $ | 65,821 | ||||||||||

| Secured debt principal amortization | 3,007 | 2,457 | 2,676 | 3,257 | 2,981 | |||||||||||||||

Dividends attributable to preferred shares | 17,973 | 17,973 | 17,973 | 17,973 | 17,973 | |||||||||||||||

| Total fixed charges | 87,425 | 85,632 | 85,390 | 86,327 | 86,775 | |||||||||||||||

Normalized EBITDA (2) | 261,084 | 259,387 | 265,123 | 267,710 | 267,119 | |||||||||||||||

| Fixed Charge Coverage Ratio | 2.99 | x | 3.03 | x | 3.10 | x | 3.10 | x | 3.08 | x | ||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Net Debt Ratios | ||||||||||||||||||||

Adjusted Principal Outstanding (3) | $ | 5,975,107 | $ | 6,067,593 | $ | 6,022,255 | $ | 6,089,838 | $ | 5,936,439 | ||||||||||

| Less: cash and cash equivalents | 25,264 | 18,434 | 28,435 | 34,176 | 51,891 | |||||||||||||||

| Less: cash and cash equivalents related to discontinued operations | — | — | — | 2,198 | 2,472 | |||||||||||||||

| Net Debt | 5,949,843 | 6,049,159 | 5,993,820 | 6,053,464 | 5,882,076 | |||||||||||||||

Normalized EBITDA annualized (2) | 1,044,336 | 1,037,548 | 1,060,492 | 1,070,840 | 1,068,476 | |||||||||||||||

| Net Debt to Normalized EBITDA annualized ratio | 5.70 | x | 5.83 | x | 5.65 | x | 5.65 | x | 5.51 | x | ||||||||||

| Net Debt | $ | 5,949,843 | $ | 6,049,159 | $ | 5,993,820 | $ | 6,053,464 | $ | 5,882,076 | ||||||||||

| Gross Real Estate Investments | 15,385,925 | 15,477,098 | 15,509,117 | 15,511,683 | 15,336,016 | |||||||||||||||

| Net Debt Leverage Ratio | 38.7 | % | 39.1 | % | 38.6 | % | 39.0 | % | 38.4 | % | ||||||||||

| Unencumbered Assets/Real Estate Assets | ||||||||||||||||||||

| Unencumbered Gross Real Estate Investments | $ | 11,507,837 | $ | 11,376,971 | $ | 11,325,512 | $ | 11,296,918 | $ | 11,073,165 | ||||||||||

| Gross Real Estate Investments | 15,385,925 | 15,477,098 | 15,509,117 | 15,511,683 | 15,336,016 | |||||||||||||||

| Unencumbered Asset Ratio | 74.8 | % | 73.5 | % | 73.0 | % | 72.8 | % | 72.2 | % | ||||||||||

___________________________________

| (1) | Refer to the Statements of Operations section for interest expense calculated in accordance with GAAP and to the Definitions section for the required reconciliation to the most directly comparable GAAP financial measure. |

| (2) | Includes continued and discontinued operations. |

| (3) | Refer to the Balance Sheets section for total debt calculated in accordance with GAAP and to the Definitions section for the required reconciliation to the most directly comparable GAAP financial measure. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 7

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Key Balance Sheet Metrics and Capital Structure (unaudited, dollars and shares in thousands, except per share amounts) |

| Common equity | 50.7% | ||

| Corporate bonds | 19.9% | ||

| Secured debt | 13.5% | ||

| Preferred equity | 7.5% | ||

| Revolving credit facility | 5.6% | ||

| Convertible notes | 2.8% | ||

Fixed vs. Variable Rate Debt

Fixed (5) | 85.6 | % |

| Swapped to Fixed | 0.9 | % |

Variable (5) | 13.5 | % |

| VEREIT Capitalization Table | ||||||||

Wtd. Avg. Maturity (Years) | Rate (1) | September 30, 2018 | ||||||

| Diluted shares outstanding | 994,354 | |||||||

| Stock price | $ | 7.26 | ||||||

| Implied Equity Market Capitalization | $ | 7,219,010 | ||||||

Series F Perpetual Preferred (2) | 6.70 | % | $ | 1,073,025 | ||||

| Total secured debt | 3.7 | 4.93 | % | $ | 1,929,607 | |||

Revolving credit facility (5) | 3.6 | 3.44 | % | $ | 793,000 | |||

| 2019 corporate bonds | 0.4 | 3.00 | % | 750,000 | ||||

| 2020 convertible notes | 2.2 | 3.75 | % | 402,500 | ||||

| 2021 corporate bonds | 2.7 | 4.13 | % | 400,000 | ||||

| 2024 corporate bonds | 5.4 | 4.60 | % | 500,000 | ||||

| 2026 corporate bonds | 7.7 | 4.88 | % | 600,000 | ||||

| 2027 corporate bonds | 8.9 | 3.95 | % | 600,000 | ||||

| Total unsecured debt | 4.4 | 3.89 | % | $ | 4,045,500 | |||

| Total Adjusted Principal Outstanding | 4.2 | 4.22 | % | $ | 5,975,107 | |||

| Total Capitalization | $ | 14,267,142 | ||||||

| Less: Cash and cash equivalents | 25,264 | |||||||

| Enterprise Value | $ | 14,241,878 | ||||||

| Net Debt/Enterprise Value | 41.8 | % | ||||||

Net Debt/Normalized EBITDA Annualized (3) (5) | 5.70 | x | ||||||

Net Debt + Preferred/Normalized EBITDA Annualized (3) | 6.72 | x | ||||||

| Fixed Charge Coverage Ratio | 2.99 | x | ||||||

Liquidity (4) (5) | $ | 2,132,264 | ||||||

(1)Weighted average interest rate for variable rate debt represents the interest rate in effect as of September 30, 2018.

(2)Balance represents 42.8 million shares of Series F Preferred Stock (and 42.8 million corresponding general partner Series F Preferred Units) and 86,874 limited partner Series F Preferred Units outstanding at September 30, 2018, multiplied by the liquidation preference of $25 per share.

(3)Normalized EBITDA annualized includes continued and discontinued operations.

(4)Liquidity represents cash and cash equivalents of $25.3 million, $1.2 billion available capacity on our revolving credit facility and $900.0 million available on our delayed-draw term loan.

(5)On October 16, 2018, the Company closed a senior note offering, consisting of $550.0 million aggregate principal amount of the operating partnership’s 4.625% senior notes due 2025, for net proceeds of $541.3 million. Assuming this transaction had closed on September 30, 2018, (i) fixed rate and variable rate debt would represent 94.7% and 4.4% of Adjusted Principal Outstanding, respectively, (ii) the outstanding balance under the revolving credit facility would have been $251.7 million, (iii) Net Debt/Normalized EBITDA Annualized would have been 5.71x and (iv) liquidity would have been $2.7 billion.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 8

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Balance Sheets (unaudited, in thousands) |

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Real estate investments, at cost: | ||||||||||||||||||||

| Land | $ | 2,847,393 | $ | 2,859,265 | $ | 2,871,533 | $ | 2,865,855 | $ | 2,866,305 | ||||||||||

| Buildings, fixtures and improvements | 10,652,578 | 10,714,456 | 10,753,190 | 10,711,845 | 10,585,796 | |||||||||||||||

| Intangible lease assets | 2,019,718 | 2,024,014 | 2,035,004 | 2,037,675 | 2,027,304 | |||||||||||||||

| Total real estate investments, at cost | 15,519,689 | 15,597,735 | 15,659,727 | 15,615,375 | 15,479,405 | |||||||||||||||

| Less: accumulated depreciation and amortization | 3,323,990 | 3,206,336 | 3,059,955 | 2,908,028 | 2,784,481 | |||||||||||||||

| Total real estate investments, net | 12,195,699 | 12,391,399 | 12,599,772 | 12,707,347 | 12,694,924 | |||||||||||||||

| Investment in unconsolidated entities | 34,293 | 33,972 | 33,736 | 39,520 | 40,311 | |||||||||||||||

| Cash and cash equivalents | 25,264 | 18,434 | 28,435 | 34,176 | 51,891 | |||||||||||||||

| Restricted cash | 27,449 | 27,078 | 28,049 | 27,662 | 27,797 | |||||||||||||||

| Rent and tenant receivables and other assets, net | 412,053 | 423,067 | 408,911 | 389,060 | 420,687 | |||||||||||||||

| Goodwill | 1,337,773 | 1,337,773 | 1,337,773 | 1,337,773 | 1,337,773 | |||||||||||||||

| Due from affiliates, net | — | — | — | 6,041 | 5,884 | |||||||||||||||

| Assets related to real estate assets held for sale and discontinued operations, net | 24,349 | 29,884 | 15,113 | 163,999 | 157,466 | |||||||||||||||

| Total assets | $ | 14,056,880 | $ | 14,261,607 | $ | 14,451,789 | $ | 14,705,578 | $ | 14,736,733 | ||||||||||

| Liabilities and Equity | ||||||||||||||||||||

| Mortgage notes payable and other debt, net | $ | 1,936,586 | $ | 2,031,171 | $ | 2,078,593 | $ | 2,082,692 | $ | 2,115,633 | ||||||||||

| Corporate bonds, net | 2,825,541 | 2,824,176 | 2,822,830 | 2,821,494 | 2,820,164 | |||||||||||||||

| Convertible debt, net | 393,961 | 989,901 | 987,071 | 984,258 | 981,490 | |||||||||||||||

| Credit facility | 793,000 | 195,000 | 120,000 | 185,000 | — | |||||||||||||||

| Below-market lease liabilities, net | 179,192 | 187,352 | 193,703 | 198,551 | 204,051 | |||||||||||||||

| Accounts payable and accrued expenses | 269,150 | 141,746 | 126,724 | 136,474 | 143,735 | |||||||||||||||

| Deferred rent and other liabilities | 51,663 | 66,123 | 68,718 | 62,985 | 63,876 | |||||||||||||||

| Distributions payable | 183,913 | 180,734 | 177,645 | 175,301 | 172,129 | |||||||||||||||

| Due to affiliates | — | — | — | 66 | 8 | |||||||||||||||

| Liabilities related to discontinued operations | — | — | — | 15,881 | 8,678 | |||||||||||||||

| Total liabilities | 6,633,006 | 6,616,203 | 6,575,284 | 6,662,702 | 6,509,764 | |||||||||||||||

| Series F preferred stock | 428 | 428 | 428 | 428 | 428 | |||||||||||||||

| Common stock | 9,674 | 9,674 | 9,681 | 9,742 | 9,742 | |||||||||||||||

| Additional paid-in capital | 12,612,407 | 12,609,145 | 12,611,006 | 12,654,258 | 12,648,967 | |||||||||||||||

| Accumulated other comprehensive loss | (1,031 | ) | (4,290 | ) | (4,284 | ) | (3,569 | ) | (3,330 | ) | ||||||||||

| Accumulated deficit | (5,343,368 | ) | (5,120,240 | ) | (4,896,349 | ) | (4,776,581 | ) | (4,592,533 | ) | ||||||||||

| Total stockholders' equity | 7,278,110 | 7,494,717 | 7,720,482 | 7,884,278 | 8,063,274 | |||||||||||||||

| Non-controlling interests | 145,764 | 150,687 | 156,023 | 158,598 | 163,695 | |||||||||||||||

| Total equity | 7,423,874 | 7,645,404 | 7,876,505 | 8,042,876 | 8,226,969 | |||||||||||||||

| Total liabilities and equity | $ | 14,056,880 | $ | 14,261,607 | $ | 14,451,789 | $ | 14,705,578 | $ | 14,736,733 | ||||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 9

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Statements of Operations (unaudited, in thousands, except per share data) |

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Rental income | $ | 289,033 | $ | 290,641 | $ | 290,631 | $ | 290,564 | $ | 282,717 | ||||||||||

| Operating expense reimbursements | 24,833 | 25,023 | 24,443 | 26,035 | 23,826 | |||||||||||||||

| Total revenues | 313,866 | 315,664 | 315,074 | 316,599 | 306,543 | |||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Acquisition-related | 810 | 909 | 777 | 1,120 | 909 | |||||||||||||||

| Litigation and other non-routine costs, net of insurance recoveries | 138,595 | 107,087 | 21,740 | 11,167 | 9,507 | |||||||||||||||

| Property operating | 31,893 | 31,436 | 30,565 | 32,429 | 30,645 | |||||||||||||||

| General and administrative | 15,186 | 16,287 | 15,240 | 18,274 | 13,221 | |||||||||||||||

| Depreciation and amortization | 157,181 | 164,235 | 166,152 | 175,259 | 172,383 | |||||||||||||||

| Impairments | 18,382 | 11,664 | 6,036 | 19,691 | 6,363 | |||||||||||||||

| Total operating expenses | 362,047 | 331,618 | 240,510 | 257,940 | 233,028 | |||||||||||||||

| Operating (loss) income | (48,181 | ) | (15,954 | ) | 74,564 | 58,659 | 73,515 | |||||||||||||

| Other (expense) income: | ||||||||||||||||||||

| Interest expense | (69,310 | ) | (70,320 | ) | (70,425 | ) | (70,694 | ) | (71,708 | ) | ||||||||||

| Gain (loss) on extinguishment and forgiveness of debt, net | 90 | 5,249 | — | (318 | ) | 9,756 | ||||||||||||||

| Other (expense) income, net | (1,016 | ) | 1,215 | 7,436 | 1,989 | 1,131 | ||||||||||||||

| Equity in income and gain on disposition of unconsolidated entities | 252 | 327 | 1,065 | 1,958 | 374 | |||||||||||||||

| Gain on derivative instruments, net | 69 | 105 | 273 | 266 | 1,294 | |||||||||||||||

| Gain (loss) on disposition of real estate and held for sale assets, net | 45,295 | 5,821 | 17,335 | 7,104 | (688 | ) | ||||||||||||||

| Total other expenses, net | (24,620 | ) | (57,603 | ) | (44,316 | ) | (59,695 | ) | (59,841 | ) | ||||||||||

| (Loss) income before taxes | (72,801 | ) | (73,557 | ) | 30,248 | (1,036 | ) | 13,674 | ||||||||||||

| Provision for income taxes from continuing operations | (1,141 | ) | (1,134 | ) | (1,212 | ) | (1,443 | ) | (1,185 | ) | ||||||||||

| (Loss) income from continuing operations | (73,942 | ) | (74,691 | ) | 29,036 | (2,479 | ) | 12,489 | ||||||||||||

| Income (loss) from discontinued operations, net of tax | — | 224 | 3,501 | (30,613 | ) | 4,005 | ||||||||||||||

| Net (loss) income | (73,942 | ) | (74,467 | ) | 32,537 | (33,092 | ) | 16,494 | ||||||||||||

| Net loss (income) attributable to non-controlling interests | 1,825 | 1,797 | (742 | ) | 970 | (400 | ) | |||||||||||||

| Net (loss) income attributable to the General Partner | $ | (72,117 | ) | $ | (72,670 | ) | $ | 31,795 | $ | (32,122 | ) | $ | 16,094 | |||||||

| Basic and diluted net (loss) income per share from continuing operations attributable to common stockholders and limited partners | $ | (0.09 | ) | $ | (0.09 | ) | $ | 0.01 | $ | (0.02 | ) | $ | (0.01 | ) | ||||||

| Basic and diluted net income (loss) per share from discontinued operations attributable to common stockholders and limited partners | — | 0.00 | 0.00 | (0.03 | ) | 0.00 | ||||||||||||||

| Basic and diluted net (loss) income per share attributable to common stockholders and limited partners | $ | (0.09 | ) | $ | (0.09 | ) | $ | 0.01 | $ | (0.05 | ) | $ | (0.00 | ) | ||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 10

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Funds From Operations (FFO) (unaudited, in thousands, except share and per share data) |

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Net (loss) income | $ | (73,942 | ) | $ | (74,467 | ) | $ | 32,537 | $ | (33,092 | ) | $ | 16,494 | |||||||

| Dividends on non-convertible preferred stock | (17,973 | ) | (17,973 | ) | (17,973 | ) | (17,973 | ) | (17,973 | ) | ||||||||||

| (Gain) loss on disposition of real estate assets, including joint ventures, net | (45,226 | ) | (5,821 | ) | (18,036 | ) | (7,104 | ) | 688 | |||||||||||

| Depreciation and amortization of real estate assets | 156,527 | 163,551 | 165,182 | 173,829 | 171,576 | |||||||||||||||

| Impairment of real estate | 18,382 | 11,664 | 6,036 | 19,691 | 6,363 | |||||||||||||||

| Proportionate share of adjustments for unconsolidated entities | 287 | 289 | 446 | (1,464 | ) | 565 | ||||||||||||||

| FFO attributable to common stockholders and limited partners | $ | 38,055 | $ | 77,243 | $ | 168,192 | $ | 133,887 | $ | 177,713 | ||||||||||

| FFO attributable to common stockholders and limited partners from continuing operations | 38,055 | 77,019 | 164,691 | 164,500 | 173,708 | |||||||||||||||

| FFO attributable to common stockholders and limited partners from discontinued operations | — | 224 | 3,501 | (30,613 | ) | 4,005 | ||||||||||||||

| Weighted-average shares outstanding - basic | 967,798,401 | 968,192,162 | 972,663,193 | 974,212,874 | 974,167,088 | |||||||||||||||

Limited Partner OP Units and effect of dilutive securities (1) | 24,125,616 | 23,907,976 | 24,110,249 | 24,300,280 | 24,258,683 | |||||||||||||||

Weighted-average shares outstanding - diluted (2) | 991,924,017 | 992,100,138 | 996,773,442 | 998,513,154 | 998,425,771 | |||||||||||||||

FFO attributable to common stockholders and limited partners per diluted share (3) | $ | 0.038 | $ | 0.078 | $ | 0.169 | $ | 0.134 | $ | 0.178 | ||||||||||

FFO attributable to common stockholders and limited partners from continuing operations per diluted share (3) | 0.038 | 0.078 | 0.165 | 0.165 | 0.174 | |||||||||||||||

FFO attributable to common stockholders and limited partners from discontinued operations per diluted share (3) | — | 0.000 | 0.004 | (0.031 | ) | 0.004 | ||||||||||||||

| (1) | Dilutive securities include unvested restricted shares of common stock and unvested restricted stock units. |

| (2) | Weighted-average shares for all periods presented exclude the effect of the convertible debt as the Company would expect to settle the debt in cash, and any shares underlying restricted stock units that are contingently issuable which are not issuable based on the Company’s level of achievement of certain performance targets through the respective reporting period. |

| (3) | Refer to the Statements of Operations section for basic and diluted net (loss) income per share attributable to common stockholders. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 11

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Adjusted Funds From Operations (AFFO) (unaudited, in thousands, except share and per share data) |

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| FFO attributable to common stockholders and limited partners | $ | 38,055 | $ | 77,243 | $ | 168,192 | $ | 133,887 | $ | 177,713 | ||||||||||

| Acquisition-related expenses | 810 | 909 | 777 | 1,120 | 909 | |||||||||||||||

| Litigation and other non-routine costs, net of insurance recoveries | 138,595 | 107,087 | 21,086 | 14,969 | 9,507 | |||||||||||||||

| Loss on disposition and held for sale loss on discontinued operations | — | (224 | ) | 2,009 | 20,027 | — | ||||||||||||||

| Loss (gain) on investments | 3,336 | — | (5,638 | ) | — | — | ||||||||||||||

| Gain on derivative instruments, net | (69 | ) | (105 | ) | (273 | ) | (266 | ) | (1,294 | ) | ||||||||||

| Amortization of premiums and discounts on debt and investments, net | (1,123 | ) | (603 | ) | (606 | ) | (627 | ) | (1,442 | ) | ||||||||||

| Amortization of above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities | 1,058 | 688 | 1,487 | 1,148 | 1,210 | |||||||||||||||

| Net direct financing lease adjustments | 483 | 503 | 539 | 517 | 491 | |||||||||||||||

| Amortization and write-off of deferred financing costs | 3,926 | 5,650 | 5,875 | 5,834 | 6,028 | |||||||||||||||

| Amortization of management contracts | — | — | — | 2,076 | 4,146 | |||||||||||||||

Deferred and other tax (benefit) expense (1) | — | — | (1,855 | ) | 5,063 | 6,277 | ||||||||||||||

| (Gain) loss on extinguishment and forgiveness of debt, net | (90 | ) | (5,249 | ) | — | 318 | (9,756 | ) | ||||||||||||

| Straight-line rent, net of bad debt expense related to straight-line rent | (8,720 | ) | (11,402 | ) | (11,260 | ) | (11,281 | ) | (9,955 | ) | ||||||||||

| Equity-based compensation | 3,003 | 3,716 | 2,774 | 5,528 | 3,664 | |||||||||||||||

| Other adjustments, net | (726 | ) | 566 | 514 | 566 | 739 | ||||||||||||||

| Proportionate share of adjustments for unconsolidated entities | (9 | ) | (27 | ) | 12 | 277 | (2 | ) | ||||||||||||

| Adjustment for Excluded Properties | — | 42 | 423 | 564 | 2,625 | |||||||||||||||

| AFFO attributable to common stockholders and limited partners | $ | 178,529 | $ | 178,794 | $ | 184,056 | $ | 179,720 | $ | 190,860 | ||||||||||

| AFFO attributable to common stockholders and limited partners from continuing operations | 178,529 | 178,794 | 180,854 | 175,807 | 174,774 | |||||||||||||||

| AFFO attributable to common stockholders and limited partners from discontinued operations | — | — | 3,202 | 3,913 | 16,086 | |||||||||||||||

| Weighted-average shares outstanding - basic | 967,798,401 | 968,192,162 | 972,663,193 | 974,212,874 | 974,167,088 | |||||||||||||||

Limited Partner OP Units and effect of dilutive securities (2) | 24,125,616 | 23,907,976 | 24,110,249 | 24,300,280 | 24,258,683 | |||||||||||||||

Weighted-average shares outstanding - diluted (3) | 991,924,017 | 992,100,138 | 996,773,442 | 998,513,154 | 998,425,771 | |||||||||||||||

AFFO attributable to common stockholders and limited partners per diluted share (4) | $ | 0.180 | $ | 0.180 | $ | 0.185 | $ | 0.180 | $ | 0.191 | ||||||||||

AFFO attributable to common stockholders and limited partners from continuing operations per diluted share (4) | 0.180 | 0.180 | 0.182 | 0.176 | 0.175 | |||||||||||||||

AFFO attributable to common stockholders and limited partners from discontinued operations per diluted share (4) | — | — | 0.003 | 0.004 | 0.016 | |||||||||||||||

| (1) | This adjustment represents the non-current portion of the provision for or benefit from income taxes in order to show only the current portion of the provision for or benefit from income taxes as an impact to AFFO. For the three months ended December 31, 2017, this adjustment is net of an accelerated current tax benefit attributable to the expected change to the Company’s future effective tax rate. |

| (2) | Dilutive securities include unvested restricted shares of common stock and unvested restricted stock units. |

| (3) | Weighted-average shares for all periods presented exclude the effect of the convertible debt as the Company would expect to settle the debt in cash, and any shares underlying restricted stock units that are contingently issuable which are not issuable based on the Company’s level of achievement of certain performance targets through the respective reporting period. |

| (4) | Refer to the Statements of Operations section for basic and diluted net (loss) income per share attributable to common stockholders. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 12

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

EBITDA and Normalized EBITDA (unaudited, in thousands) |

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

| Net (loss) income | $ | (73,942 | ) | $ | (74,467 | ) | $ | 32,537 | $ | (33,092 | ) | $ | 16,494 | |||||||

| Adjustments: | ||||||||||||||||||||

| Interest expense | 69,310 | 70,320 | 70,425 | 70,694 | 71,708 | |||||||||||||||

| Depreciation and amortization | 157,181 | 164,235 | 166,152 | 177,329 | 176,523 | |||||||||||||||

| Provision for (benefit from) income taxes | 1,141 | 1,134 | (883 | ) | 11,843 | 2,053 | ||||||||||||||

| Proportionate share of adjustments for unconsolidated entities | 286 | 289 | 619 | 756 | 845 | |||||||||||||||

| EBITDA | $ | 153,976 | $ | 161,511 | $ | 268,850 | $ | 227,530 | $ | 267,623 | ||||||||||

| (Gain) loss on disposition of real estate assets, including joint ventures, net | (45,226 | ) | (5,821 | ) | (18,036 | ) | (7,104 | ) | 688 | |||||||||||

| Impairments | 18,382 | 11,664 | 6,036 | 19,691 | 6,363 | |||||||||||||||

| Loss on disposition and held for sale loss on discontinued operations | — | (224 | ) | 2,009 | 20,027 | — | ||||||||||||||

| Acquisition-related expenses | 810 | 909 | 777 | 1,120 | 909 | |||||||||||||||

| Litigation and other non-routine costs, net of insurance recoveries | 138,595 | 107,087 | 21,086 | 14,969 | 9,507 | |||||||||||||||

| Loss (gain) on investments | 3,336 | — | (5,638 | ) | — | — | ||||||||||||||

| Gain on derivative instruments, net | (69 | ) | (105 | ) | (273 | ) | (266 | ) | (1,294 | ) | ||||||||||

| Amortization of above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities | 1,058 | 688 | 1,487 | 1,148 | 1,210 | |||||||||||||||

| (Gain) loss on extinguishment and forgiveness of debt, net | (90 | ) | (5,249 | ) | — | 318 | (9,756 | ) | ||||||||||||

| Net direct financing lease adjustments | 483 | 503 | 539 | 517 | 491 | |||||||||||||||

| Straight-line rent, net of bad debt expense related to straight-line rent | (8,720 | ) | (11,402 | ) | (11,260 | ) | (11,281 | ) | (9,955 | ) | ||||||||||

| Program development costs write-off | — | — | — | 1,343 | 110 | |||||||||||||||

| Other adjustments, net | (1,442 | ) | (142 | ) | (488 | ) | 1,247 | (61 | ) | |||||||||||

| Proportionate share of adjustments for unconsolidated entities | (9 | ) | (27 | ) | (6 | ) | (1,721 | ) | (39 | ) | ||||||||||

| Adjustment for Excluded Properties | — | (5 | ) | 40 | 172 | 1,323 | ||||||||||||||

| Normalized EBITDA | $ | 261,084 | $ | 259,387 | $ | 265,123 | $ | 267,710 | $ | 267,119 | ||||||||||

| Normalized EBITDA from continuing operations | $ | 261,084 | $ | 259,387 | $ | 262,362 | $ | 258,578 | $ | 257,996 | ||||||||||

| Normalized EBITDA from discontinued operations | $ | — | $ | — | $ | 2,761 | $ | 9,132 | $ | 9,123 | ||||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 13

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Net Operating Income (unaudited, dollars in thousands) |

NOI and Cash NOI

| Three Months Ended | ||||||||||||||||||||

| September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||||

Rental income - as reported (1) | $ | 289,033 | $ | 290,641 | $ | 290,631 | $ | 290,564 | $ | 282,717 | ||||||||||

| Operating expense reimbursements - as reported | 24,833 | 25,023 | 24,443 | 26,035 | 23,826 | |||||||||||||||

| Property operating expense - as reported | (31,893 | ) | (31,436 | ) | (30,565 | ) | (32,429 | ) | (30,645 | ) | ||||||||||

| NOI | 281,973 | 284,228 | 284,509 | 284,170 | 275,898 | |||||||||||||||

| Adjustments: | ||||||||||||||||||||

| Straight-line rent, net of bad debt expense related to straight-line rent | (8,720 | ) | (11,402 | ) | (11,260 | ) | (11,281 | ) | (9,955 | ) | ||||||||||

| Amortization of above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities | 1,058 | 688 | 1,487 | 1,148 | 1,210 | |||||||||||||||

| Net direct financing lease adjustments | 483 | 503 | 539 | 517 | 491 | |||||||||||||||

| Adjustment for Excluded Properties | — | 22 | 40 | 172 | 1,323 | |||||||||||||||

| Cash NOI | $ | 274,794 | $ | 274,039 | $ | 275,315 | $ | 274,726 | $ | 268,967 | ||||||||||

| (1) | Rental income includes percentage rent of $1.2 million, $1.4 million, $1.7 million, $1.3 million and $1.6 million for the three months ended September 30, 2018, June 30, 2018, March 31, 2018, December 31, 2017, and September 30, 2017, respectively. |

Normalized Cash NOI

| Three Months Ended | ||||

| September 30, 2018 | ||||

| Cash NOI | $ | 274,794 | ||

Adjustments for intra-quarter acquisitions and dispositions (1) | (1,243 | ) | ||

| Normalized Cash NOI | $ | 273,551 | ||

___________________________________

| (1) | For properties acquired during the three months ended September 30, 2018, the adjustment eliminates Cash NOI for such properties and replaces Cash NOI for the partial period with an amount estimated to be equivalent to Cash NOI for the full period. For properties disposed of during the three months ended September 30, 2018, the adjustment eliminates Cash NOI for the period. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 14

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Same Store Contract Rental Revenue (unaudited, dollars in thousands) |

The Company reviews the stabilized operating results from properties that we refer to as "same store." In determining the same store property pool, we include Operating Properties that were owned for the entirety of both the current and prior reporting periods, except for properties that during the current or prior period were under development or redevelopment. The following tables show the Company's same store portfolio statistics, which for the three months ended September 30, 2018 included 3,946(1) Operating Properties, with 86.8 million aggregate square feet, acquired prior to July 1, 2017 and owned through September 30, 2018.

| Three Months Ended September 30, | Increase/(Decrease) | ||||||||||||||

| 2018 | 2017 | $ Change | % Change | ||||||||||||

| Contract Rental Revenue | $ | 266,115 | $ | 265,277 | $ | 838 | 0.3 | % | |||||||

| Economic Occupancy Rate | 99.0 | % | 99.3 | % | N/A | N/A | |||||||||

| Contract Rental Revenue | |||||||||||||||||||

| Number of | Three Months Ended September 30, | Increase/(Decrease) | |||||||||||||||||

| Properties | 2018 | 2017 | $ Change | % Change | |||||||||||||||

| Retail | 2,057 | $ | 110,424 | $ | 110,450 | $ | (26 | ) | — | % | |||||||||

| Restaurant | 1,657 | 58,891 | 58,165 | 726 | 1.2 | % | |||||||||||||

| Industrial | 140 | 42,214 | 41,714 | 500 | 1.2 | % | |||||||||||||

| Office | 83 | 54,453 | 54,817 | (364 | ) | (0.7 | )% | (3) | |||||||||||

Other (2) | 9 | 133 | 131 | 2 | 1.5 | % | |||||||||||||

| Total | 3,946 | $ | 266,115 | $ | 265,277 | $ | 838 | 0.3 | % | (3) | |||||||||

| (1) | Development and expansion properties are included in the same store population if the placed in service date was prior to July 1, 2017. |

| (2) | Other properties include billboards, land and parking lots. |

| (3) | Excluding the impact of an early office lease renewal executed in the fourth quarter of 2017, for the three months ended September 30, 2018, office same store rent would have been 2.0% and total same store rent would have been 0.9%. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 15

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Adjusted Principal Outstanding and Preferred Equity Summary (unaudited, dollars in thousands) |

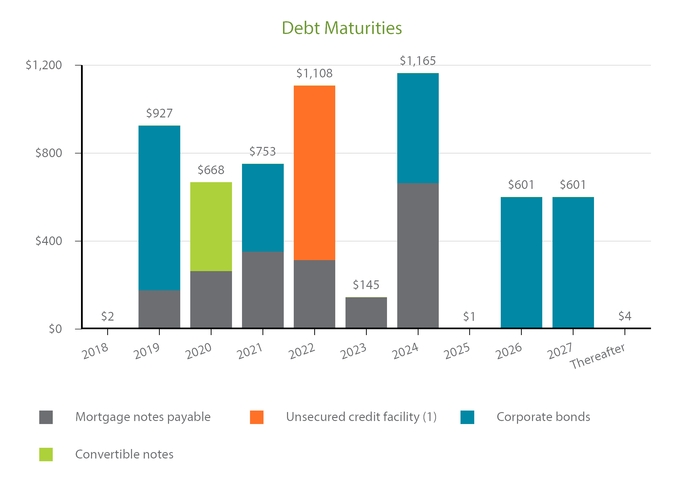

| Principal Payments Due | Total | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Thereafter | |||||||||||||||||||||||||||

| Mortgage notes payable | $ | 1,929,607 | $ | 2,437 | $ | 177,317 | $ | 265,183 | $ | 352,767 | $ | 314,898 | $ | 144,843 | $ | 665,196 | $ | 6,966 | ||||||||||||||||||

Credit facility (1) | 793,000 | — | — | — | — | 793,000 | — | — | — | |||||||||||||||||||||||||||

| Corporate bonds | 2,850,000 | — | 750,000 | — | 400,000 | — | — | 500,000 | 1,200,000 | |||||||||||||||||||||||||||

| Convertible notes | 402,500 | — | — | 402,500 | — | — | — | — | — | |||||||||||||||||||||||||||

| Total Adjusted Principal Outstanding | $ | 5,975,107 | $ | 2,437 | $ | 927,317 | $ | 667,683 | $ | 752,767 | $ | 1,107,898 | $ | 144,843 | $ | 1,165,196 | $ | 1,206,966 | ||||||||||||||||||

| Debt Type | Percentage of Adjusted Principal Outstanding | Weighted-Average Interest Rate | Weighted-Average Years to Maturity | ||||||

| Mortgage notes payable | 32.3 | % | 4.93 | % | 3.7 | ||||

| Unsecured credit facility | 13.3 | % | 3.44 | % | 3.6 | ||||

| Corporate bonds | 47.7 | % | 4.03 | % | 4.9 | ||||

| Convertible notes | 6.7 | % | 3.75 | % | 2.2 | ||||

| Total | 100.0 | % | 4.22 | % | 4.2 | ||||

| Debt Type | Percentage of Adjusted Principal Outstanding | Weighted-Average Interest Rate | Weighted-Average Years to Maturity | ||||||

| Total unsecured debt | 67.7 | % | 3.89 | % | 4.4 | ||||

| Total secured debt | 32.3 | % | 4.93 | % | 3.7 | ||||

| Total | 100.0 | % | 4.22 | % | 4.2 | ||||

Total fixed-rate debt (2) | 86.5 | % | 4.34 | % | 4.2 | ||||

| Total variable-rate debt | 13.5 | % | 3.48 | % | 3.6 | ||||

| Total | 100.0 | % | 4.22 | % | 4.2 | ||||

| Preferred Equity | Balance (3) | Percent of Total Preferred Equity | Dividend Rate | |||||||

| Series F preferred stock | $ | 1,073,025 | 100.00 | % | 6.7 | % | ||||

| (1) | On October 16, 2018, the Company closed a senior note offering, consisting of $550.0 million aggregate principal amount of the operating partnership’s 4.625% senior notes due 2025. The net proceeds of $541.3 million were used to repay borrowings under the credit facility. |

| (2) | Includes $50.9 million of variable rate mortgage notes effectively fixed through the use of interest rate swap agreements. Debt payment obligations in future periods are based on the effective interest rates fixed under the agreements. |

| (3) | Balance represents 42.8 million shares of Series F Preferred Stock (and 42.8 million corresponding general partner Series F Preferred Units) and 86,874 limited partner Series F Preferred Units outstanding at September 30, 2018, multiplied by the liquidation preference of $25 per share. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 16

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Debt and Preferred Equity Summary (cont.) (unaudited, dollars in millions) |

___________________________________

| (1) | On October 16, 2018, the Company closed a senior note offering, consisting of $550.0 million aggregate principal amount of the operating partnership’s 4.625% senior notes due 2025. The net proceeds of $541.3 million were used to repay borrowings under the credit facility. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 17

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Mortgage Notes Payable (unaudited, dollars in thousands) |

| Lender | Maturity | Adjusted Principal Outstanding As Of September 30, 2018 | Coupon Rate | Interest Rate (1) | Payment Terms (2) | |||||||||

| Cantor Commercial Real Estate Lending, L.P. | 01/06/24 | $ | 465,000 | 4.97 | % | 4.97 | % | I/O | ||||||

| Cantor Commercial Real Estate Lending, L.P. | 01/06/24 | 155,000 | 4.97 | % | 4.97 | % | I/O | |||||||

| JPMorgan Chase Bank, N.A. | 09/01/20 | (3) | 93,617 | 5.55 | % | 5.55 | % | P&I | ||||||

| Wells Fargo Bank, National Association | 03/01/23 | (3) | 74,250 | 4.23 | % | 4.23 | % | I/O | ||||||

| Wells Fargo Bank, National Association | 07/01/22 | (3) | 68,110 | 4.54 | % | 4.54 | % | I/O | ||||||

| Goldman Sachs Commercial Mortgage Capital, L.P. | 06/06/20 | 60,947 | 5.73 | % | 5.73 | % | P&I | |||||||

| Wells Fargo Bank, National Association | 05/01/21 | 60,450 | 5.54 | % | 5.54 | % | I/O | |||||||

| Citigroup Global Markets Realty Corp | 05/06/22 | 54,300 | 6.05 | % | 6.05 | % | I/O | |||||||

| American General Life Insurance Company | 11/01/21 | 51,250 | 5.25 | % | 5.25 | % | I/O | |||||||

| Capital One, N.A. | 11/20/19 | 50,850 | 1mo. Libor + 1.95% | (4) | 3.27 | % | P&I | |||||||

| JPMorgan Chase Bank, N.A. | 05/01/21 | 46,910 | 5.53 | % | 5.53 | % | I/O | |||||||

| Goldman Sachs Commercial Mortgage Capital, L.P. | 05/06/21 | (3) | 46,670 | 5.92 | % | 5.92 | % | I/O | ||||||

| People's United Bank | 04/01/21 | 41,099 | 5.55 | % | 5.55 | % | P&I | |||||||

| Wells Fargo Bank, National Association | 06/01/22 | (3) | 41,000 | 4.73 | % | 4.73 | % | I/O | ||||||

| Morgan Stanley Mortgage Capital Holdings LLC | 01/01/23 | 40,800 | 4.46 | % | 4.46 | % | I/O | |||||||

| JPMorgan Chase Bank, N.A. | 06/01/20 | 39,867 | 5.71 | % | 5.71 | % | P&I | |||||||

| JPMorgan Chase Bank, N.A. | 11/01/19 | (3) | 38,500 | 4.10 | % | 4.10 | % | I/O | ||||||

| The Royal Bank of Scotland Plc | 01/01/21 | 33,908 | 5.48 | % | 5.48 | % | I/O | |||||||

| Goldman Sachs Mortgage Company | 12/06/20 | 31,500 | 5.25 | % | 5.25 | % | I/O | |||||||

| Oritani Bank | 05/01/24 | 30,050 | 3.25 | % | 3.25 | % | I/O through 05/01/2019, then P&I | |||||||

| Goldman Sachs Mortgage Company | 12/06/20 | 30,000 | 5.25 | % | 5.25 | % | I/O | |||||||

| German American Capital Corporation | 10/06/22 | (3) | 29,160 | 4.48 | % | 4.48 | % | I/O | ||||||

| German American Capital Corporation | 10/06/22 | (3) | 28,440 | 4.48 | % | 4.48 | % | I/O | ||||||

| PNC Bank, National Association | 06/01/22 | 27,750 | 4.22 | % | 4.22 | % | I/O | |||||||

| GS Commercial Real Estate LP | 08/06/19 | (3) | 27,725 | 4.73 | % | 4.73 | % | I/O | ||||||

| Jackson National Life Insurance Company | 07/01/19 | 27,200 | 3.10 | % | 3.10 | % | I/O | |||||||

| PNC Bank, National Association | 09/01/22 | 26,599 | 4.00 | % | 4.00 | % | P&I | |||||||

| John Hancock Life Insurance Company | 10/03/22 | 22,500 | 4.04 | % | 4.04 | % | I/O | |||||||

| Aviva Life and Annuity Company | 07/01/21 | 19,600 | 5.02 | % | 5.02 | % | I/O through 07/01/2019, then P&I | |||||||

| The Variable Annuity Life Insurance Company | 01/01/23 | 19,525 | 4.00 | % | 4.00 | % | I/O | |||||||

| Morgan Stanley Mortgage Capital Holdings LLC | 05/10/21 | 19,513 | 5.67 | % | 5.67 | % | I/O | |||||||

| Oritani Bank | 05/01/24 | 18,889 | 3.25 | % | 3.25 | % | I/O through 05/01/2019, then P&I | |||||||

| German American Capital Corp | 06/06/22 | 18,475 | 4.60 | % | 4.60 | % | P&I | |||||||

| The Royal Bank of Scotland Plc | 03/01/21 | 18,100 | 5.88 | % | 5.88 | % | I/O | |||||||

| JPMorgan Chase Bank, National Association | 05/01/21 | (3) | 15,004 | 5.54 | % | 5.54 | % | P&I | ||||||

| Amegy Bank, National Association | 08/19/19 | 14,119 | 1mo. Libor + 2.95% | 5.42 | % | P&I | ||||||||

| JPMorgan Chase Bank, N.A. | 07/01/20 | 10,893 | 5.50 | % | 5.50 | % | P&I | |||||||

| 40/86 Mortgage Capital, Inc. | 01/01/19 | 10,050 | 5.00 | % | 5.00 | % | I/O | |||||||

| Monumental Life Insurance Company | 04/01/23 | 9,160 | 3.95 | % | 3.95 | % | P&I | |||||||

| Transamerica Life Insurance Company | 08/01/30 | 6,451 | 5.57 | % | 5.57 | % | P&I | |||||||

| Transamerica Life Insurance Company | 08/01/30 | 5,742 | 5.32 | % | 5.32 | % | P&I | |||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 18

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Mortgage Notes Payable (unaudited, dollars in thousands) |

| Lender | Maturity | Adjusted Principal Outstanding As Of September 30, 2018 | Coupon Rate | Interest Rate (1) | Payment Terms (2) | |||||||||

| Transamerica Life Insurance Company | 08/01/30 | $ | 328 | 5.93 | % | 5.93 | % | P&I | ||||||

| US Bank National Association | 04/15/19 | 306 | 5.40 | % | 5.40 | % | P&I | |||||||

| $ | 1,929,607 | 4.93 | % | |||||||||||

| (1) | Represents the interest rate in effect at September 30, 2018. For loans subject to interest rate swaps, this represents the all-in fixed interest rate. |

| (2) | I/O means interest only is due monthly with the principal due at maturity. P&I means both principal and interest are due monthly. |

| (3) | The maturity date shown represents the anticipated maturity date of the loan as specified in the loan agreement. Should the loan not be repaid at the anticipated maturity date, the applicable interest rate will increase as specified in the loan agreement. |

| (4) | Variable-rate loan fixed by way of interest rate swap agreement. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 19

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Credit Facility and Corporate Bond Covenants (unaudited) |

The following is a summary of key financial covenants for the Company's unsecured credit facility and corporate bonds, as defined and calculated per the terms of the facility's credit agreement and the bonds' governing documents, respectively. These calculations, which are not based on GAAP measurements, are presented to investors to show that the Company is in compliance with the financial covenants and are not measures of our liquidity or performance. As of September 30, 2018, the Company believes it is in compliance with these covenants based on the covenant limits and calculations in place at that time.

| Unsecured Credit Facility Key Covenants | Required | September 30, 2018 | ||

| Ratio of total indebtedness to total asset value | ≤ 60% | 37.4% | ||

| Ratio of adjusted EBITDA to fixed charges | ≥ 1.5x | 3.02x | ||

| Ratio of secured indebtedness to total asset value | ≤ 45% | 12.0% | ||

| Ratio of unsecured indebtedness to unencumbered asset value | ≤ 60% | 34.2% | ||

| Ratio of unencumbered adjusted NOI to unsecured interest expense | ≥ 1.75x | 4.99x | ||

| Corporate Bond Key Covenants | Required | September 30, 2018 | ||

| Limitation on incurrence of total debt | ≤ 65% | 37.9% | ||

| Limitation on incurrence of secured debt | ≤ 40% | 12.3% | ||

| Debt service coverage | ≥ 1.5x | 4.07x | ||

| Maintenance of total unencumbered assets | ≥ 150% | 290.4% | ||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 20

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Acquisitions and Dispositions (unaudited, square feet and dollars in thousands) |

Acquisitions

The following table summarizes the Company's property acquisition activity during the three months ended September 30, 2018.

| Property Type | Number of Properties | Square Feet | Weighted Average Lease Term (Years) (1) | Weighted Average Cash Cap Rate | Purchase Price | ||||||||||

| Retail | 23 | 477 | 15.8 | 7.4 | % | $ | 98,604 | ||||||||

| Total acquisitions | 23 | 477 | 15.8 | 7.4 | % | $ | 98,604 | ||||||||

Dispositions

The following table summarizes the Company's disposition activity and the related gains/losses during the three months ended September 30, 2018.

| Real Estate | Number of Properties | Square Feet | Weighted Average Lease Term (Years) (2) | Weighted Average Cash Cap Rate (3) | Sale Price | Gain (Loss) | |||||||||||||

| Retail | 8 | 270 | 16.9 | 6.4 | % | $ | 48,672 | $ | 9,915 | ||||||||||

| Industrial | 1 | 751 | 9.3 | 5.1 | % | 61,750 | 24,926 | ||||||||||||

Red Lobster - GGC Participation (4) | 11 | 83 | 20.5 | 7.0 | % | 49,149 | 8,039 | ||||||||||||

| Office | 1 | 65 | 5.1 | 8.9 | % | 15,000 | 2,695 | ||||||||||||

| Other restaurants | 2 | 5 | 0.6 | N/A | 680 | 188 | |||||||||||||

Vacant and other (5) | 12 | 70 | N/A | N/A | 5,827 | 377 | |||||||||||||

| Total real estate dispositions | 35 | 1,244 | 14.2 | 6.3 | % | $ | 181,078 | $ | 46,140 | ||||||||||

| Held for sale assets | (845 | ) | |||||||||||||||||

| Total gain on disposition of real estate, net | $ | 45,295 | |||||||||||||||||

| Other | |||||||||||||||||||

Investments in CMBS (6) | N/A | N/A | N/A | N/A | $ | 9,880 | $ | (2,372 | ) | ||||||||||

| (1) | Represents the remaining lease term from the date of acquisition. |

| (2) | Represents the remaining lease term from the date of sale. |

| (3) | Excludes certain properties' cash cap rates considered not meaningful due to factors such as physical and economic vacancy or short remaining lease terms. Of the $181.1 million of dispositions, $174.4 million was used in the total weighted average cash cap rate calculation of 6.3%. |

| (4) | The Red Lobster properties were sold under an agreement with the tenant, under which the tenant received a portion of the sales proceeds. The sales price and cash cap rate presented are based on our proceeds after making the participation payment to the tenant. The cash cap rate on the gross sales price of $57.5 million was 6.0%. |

| (5) | Represents eight vacant restaurant properties, including one relinquished to the ground lessor upon expiration of the ground lease for no proceeds, and four vacant retail properties. Gain (loss) amounts also include partial condemnations or easements related to certain properties and post-closing adjustments. |

| (6) | Represents three CMBS investments sold during the three months ended September 30, 2018. Prior to disposition, changes in the fair value of the CMBS were recorded in accumulated other comprehensive income (loss) as a component of equity on the balance sheet. The loss on disposition is included in other (expense) income, net in the consolidated statements of operations and includes $3.3 million of cumulative unrealized losses recorded in accumulated other comprehensive income (loss) as of June 30, 2018, net of fair value adjustments from June 30, 2018 to the date of sale of $0.9 million. |

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 21

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

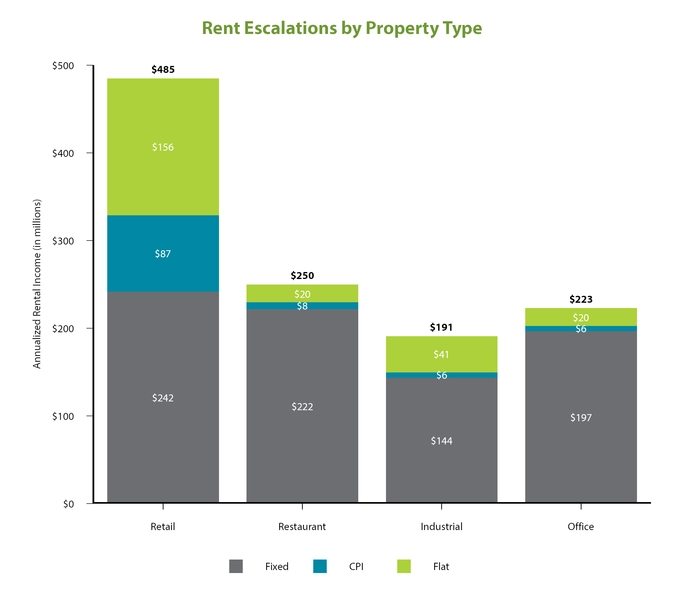

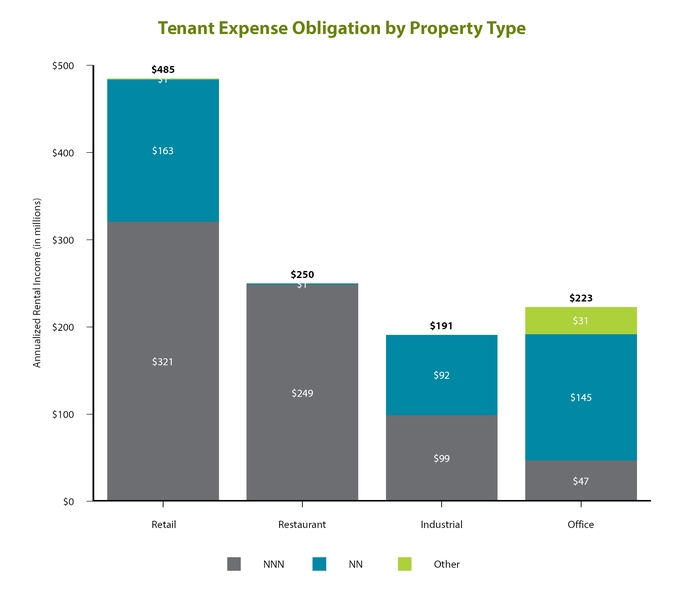

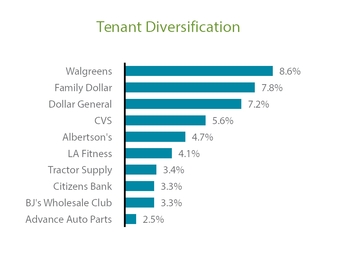

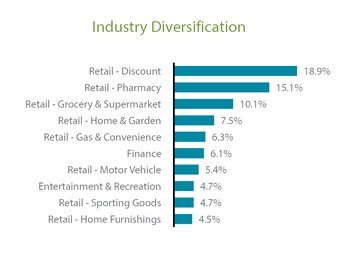

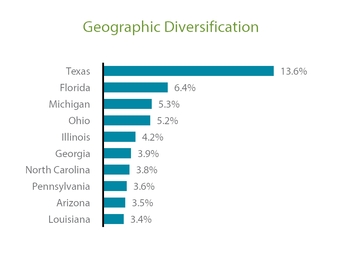

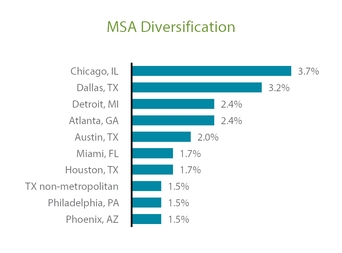

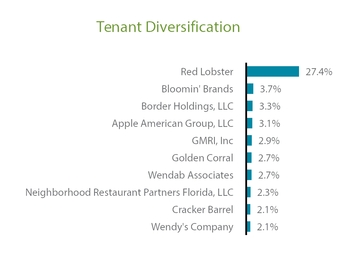

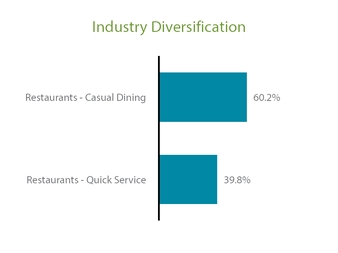

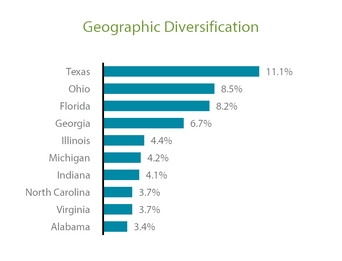

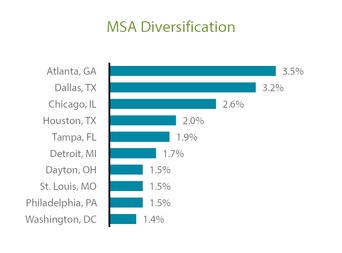

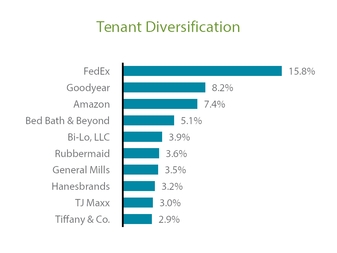

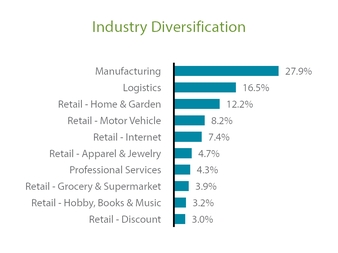

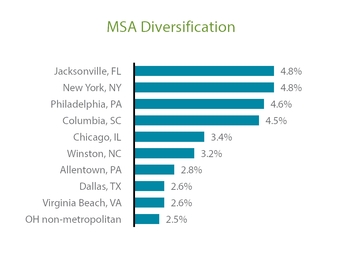

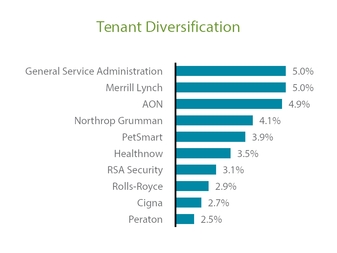

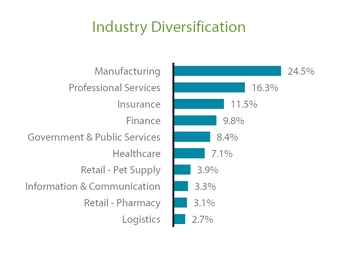

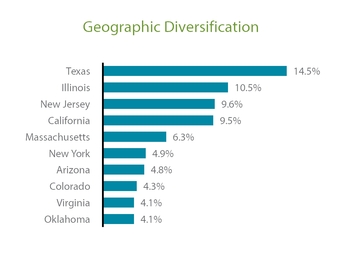

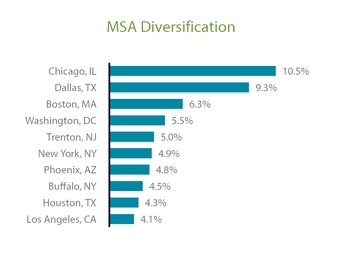

Diversification Statistics: Real Estate Portfolio (unaudited, percentages based on portfolio Annualized Rental Income) |

___________________________________________________

___________________________________________________

___________________________________________________

___________________________________________________

Statistics (square feet in thousands) | ||||

| Operating Properties | 4,021 | |||

| Rentable Square Feet | 93,856 | |||

| Economic Occupancy Rate | 99.1 | % | ||

| Weighted Average Remaining Lease Term | 8.9 | |||

| Investment-Grade Tenants | 42.7 | % | ||

| Flat leases | 20.7 | % | ||

| NNN leases | 62.4 | % | ||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 22

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Top 10 Concentrations: Real Estate Portfolio (unaudited, square feet and dollars in thousands) |

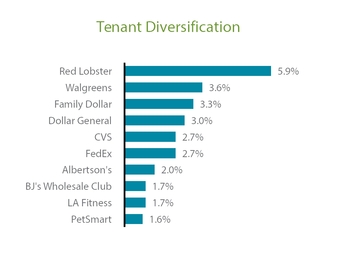

| Tenant Concentration | Number of Leases | Leased Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | Investment Rating | ||||||||||||

| Red Lobster | 26 | 1,905 | 2.0 | % | $ | 68,247 | 5.9 | % | B- | |||||||||

| Walgreens | 119 | 1,687 | 1.8 | % | 41,486 | 3.6 | % | BBB | ||||||||||

| Family Dollar | 149 | 3,348 | 3.6 | % | 37,628 | 3.3 | % | BBB- | ||||||||||

| Dollar General | 407 | 3,767 | 4.0 | % | 34,691 | 3.0 | % | BBB | ||||||||||

| CVS | 95 | 1,353 | 1.4 | % | 30,575 | 2.7 | % | BBB | ||||||||||

| FedEx | 46 | 3,230 | 3.4 | % | 30,435 | 2.7 | % | BBB | ||||||||||

| Albertson's | 32 | 1,880 | 2.0 | % | 22,963 | 2.0 | % | B | ||||||||||

| BJ's Wholesale Club | 3 | 2,223 | 2.4 | % | 19,849 | 1.7 | % | B | ||||||||||

| LA Fitness | 24 | 1,027 | 1.1 | % | 19,800 | 1.7 | % | B+ | ||||||||||

| PetSmart | 15 | 906 | 1.0 | % | 18,582 | 1.6 | % | CCC | ||||||||||

| Total | 916 | 21,326 | 22.7 | % | $ | 324,256 | 28.2 | % | ||||||||||

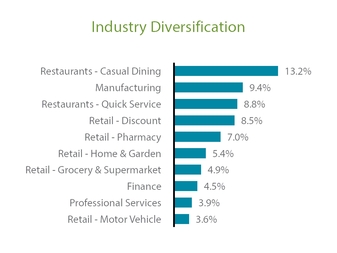

| Tenant Industry Concentration | Number of Leases | Leased Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| Restaurants - Casual Dining | 323 | 4,311 | 4.6 | % | $ | 151,778 | 13.2 | % | ||||||||

| Manufacturing | 52 | 16,205 | 17.3 | % | 107,913 | 9.4 | % | |||||||||

| Restaurants - Quick Service | 829 | 3,331 | 3.5 | % | 100,555 | 8.8 | % | |||||||||

| Retail - Discount | 604 | 10,519 | 11.2 | % | 97,536 | 8.5 | % | |||||||||

| Retail - Pharmacy | 233 | 3,484 | 3.7 | % | 80,159 | 7.0 | % | |||||||||

| Retail - Home & Garden | 112 | 8,561 | 9.1 | % | 61,585 | 5.4 | % | |||||||||

| Retail - Grocery & Supermarket | 84 | 5,347 | 5.7 | % | 56,603 | 4.9 | % | |||||||||

| Finance | 235 | 2,317 | 2.5 | % | 51,566 | 4.5 | % | |||||||||

| Professional Services | 54 | 3,440 | 3.7 | % | 44,696 | 3.9 | % | |||||||||

| Retail - Motor Vehicle | 182 | 6,000 | 6.4 | % | 41,876 | 3.6 | % | |||||||||

| Total | 2,708 | 63,515 | 67.7 | % | $ | 794,267 | 69.2 | % | ||||||||

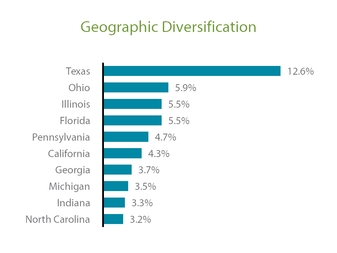

| Geographic Concentration | Number of Properties | Rentable Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| Texas | 540 | 10,668 | 11.4 | % | $ | 144,358 | 12.6 | % | ||||||||

| Ohio | 293 | 8,459 | 9.0 | % | 67,639 | 5.9 | % | |||||||||

| Illinois | 159 | 4,556 | 4.9 | % | 63,304 | 5.5 | % | |||||||||

| Florida | 253 | 4,582 | 4.9 | % | 63,086 | 5.5 | % | |||||||||

| Pennsylvania | 145 | 5,595 | 6.0 | % | 54,318 | 4.7 | % | |||||||||

| California | 67 | 3,729 | 4.0 | % | 49,308 | 4.3 | % | |||||||||

| Georgia | 182 | 3,771 | 4.0 | % | 42,492 | 3.7 | % | |||||||||

| Michigan | 182 | 2,285 | 2.4 | % | 40,194 | 3.5 | % | |||||||||

| Indiana | 135 | 4,101 | 4.4 | % | 38,436 | 3.3 | % | |||||||||

| North Carolina | 152 | 3,292 | 3.5 | % | 36,576 | 3.2 | % | |||||||||

| Total | 2,108 | 51,038 | 54.5 | % | $ | 599,711 | 52.2 | % | ||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 23

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Top 10 Concentrations: Real Estate Portfolio (unaudited, square feet and dollars in thousands) |

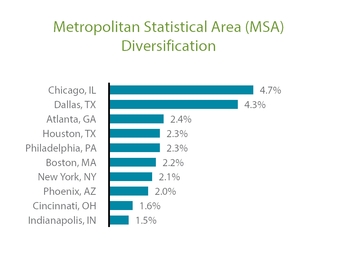

| Metropolitan Statistical Area (MSA) Concentration | Number of Properties | Rentable Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| Chicago, IL | 101 | 4,087 | 4.4 | % | $ | 54,243 | 4.7 | % | ||||||||

| Dallas, TX | 109 | 3,529 | 3.8 | % | 49,083 | 4.3 | % | |||||||||

| Atlanta, GA | 85 | 2,716 | 2.9 | % | 27,052 | 2.4 | % | |||||||||

| Houston, TX | 88 | 2,465 | 2.6 | % | 26,633 | 2.3 | % | |||||||||

| Philadelphia, PA | 45 | 1,983 | 2.1 | % | 26,551 | 2.3 | % | |||||||||

| Boston, MA | 26 | 1,810 | 1.9 | % | 24,808 | 2.2 | % | |||||||||

| New York, NY | 24 | 1,100 | 1.2 | % | 24,494 | 2.1 | % | |||||||||

| Phoenix, AZ | 47 | 1,196 | 1.3 | % | 22,682 | 2.0 | % | |||||||||

| Cincinnati, OH | 42 | 2,245 | 2.4 | % | 17,910 | 1.6 | % | |||||||||

| Indianapolis, IN | 41 | 1,770 | 1.9 | % | 17,534 | 1.5 | % | |||||||||

| Total | 608 | 22,901 | 24.5 | % | $ | 290,990 | 25.4 | % | ||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 24

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Tenants Comprising Over 1% of Annualized Rental Revenue (unaudited, square feet and dollars in thousands) |

| Tenant | Number of Leases | Leased Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | Investment Rating | ||||||||||||

| Red Lobster | 26 | 1,905 | 2.0 | % | $ | 68,247 | 5.9 | % | B- | |||||||||

| Walgreens | 119 | 1,687 | 1.8 | % | 41,486 | 3.6 | % | BBB | ||||||||||

| Family Dollar | 149 | 3,348 | 3.6 | % | 37,628 | 3.3 | % | BBB- | ||||||||||

| Dollar General | 407 | 3,767 | 4.0 | % | 34,691 | 3.0 | % | BBB | ||||||||||

| CVS | 95 | 1,353 | 1.4 | % | 30,575 | 2.7 | % | BBB | ||||||||||

| FedEx | 46 | 3,230 | 3.4 | % | 30,435 | 2.7 | % | BBB | ||||||||||

| Albertson's | 32 | 1,880 | 2.0 | % | 22,963 | 2.0 | % | B | ||||||||||

| BJ's Wholesale Club | 3 | 2,223 | 2.4 | % | 19,849 | 1.7 | % | B | ||||||||||

| LA Fitness | 24 | 1,027 | 1.1 | % | 19,800 | 1.7 | % | B+ | ||||||||||

| PetSmart | 15 | 906 | 1.0 | % | 18,582 | 1.6 | % | CCC | ||||||||||

| Citizens Bank | 136 | 710 | 0.8 | % | 16,873 | 1.5 | % | A- | ||||||||||

| Goodyear | 10 | 4,728 | 5.0 | % | 16,550 | 1.4 | % | BB | ||||||||||

| Tractor Supply | 61 | 1,274 | 1.4 | % | 16,502 | 1.4 | % | NR | ||||||||||

| Amazon | 3 | 3,048 | 3.2 | % | 14,159 | 1.2 | % | AA- | ||||||||||

| Advance Auto Parts | 106 | 736 | 0.8 | % | 12,120 | 1.1 | % | BBB- | ||||||||||

| Home Depot | 11 | 1,695 | 1.8 | % | 11,586 | 1.0 | % | A | ||||||||||

| Total | 1,243 | 33,517 | 35.7 | % | $ | 412,046 | 35.8 | % | ||||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 25

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Diversification: Tenant Industry (unaudited, square feet and dollars in thousands) |

| Industry | Number of Leases | Leased Square Feet | Leased Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| Administration & Support Services | 4 | 427 | 0.5 | % | $ | 4,003 | 0.3 | % | ||||||||

| Agricultural | 2 | 138 | 0.2 | % | 1,245 | 0.1 | % | |||||||||

| Education | 5 | 219 | 0.2 | % | 2,155 | 0.2 | % | |||||||||

| Entertainment & Recreation | 28 | 1,181 | 1.3 | % | 22,937 | 1.9 | % | |||||||||

| Finance | 235 | 2,317 | 2.5 | % | 51,566 | 4.5 | % | |||||||||

| Government & Public Services | 21 | 930 | 1.0 | % | 19,114 | 1.7 | % | |||||||||

| Healthcare | 12 | 1,061 | 1.1 | % | 16,692 | 1.5 | % | |||||||||

| Information & Communication | 12 | 510 | 0.5 | % | 7,834 | 0.7 | % | |||||||||

| Insurance | 12 | 1,310 | 1.4 | % | 25,715 | 2.2 | % | |||||||||

| Logistics | 50 | 4,037 | 4.3 | % | 37,769 | 3.3 | % | |||||||||

| Manufacturing | 52 | 16,205 | 17.3 | % | 107,913 | 9.4 | % | |||||||||

| Mining & Natural Resources | 4 | 413 | 0.4 | % | 6,605 | 0.6 | % | |||||||||

| Other Services | 16 | 475 | 0.5 | % | 2,118 | 0.2 | % | |||||||||

| Professional Services | 54 | 3,440 | 3.7 | % | 44,696 | 3.9 | % | |||||||||

| Rental | 11 | 714 | 0.8 | % | 6,885 | 0.6 | % | |||||||||

| Restaurants - Casual Dining | 323 | 4,311 | 4.6 | % | 151,778 | 13.2 | % | |||||||||

| Restaurants - Quick Service | 829 | 3,331 | 3.6 | % | 100,555 | 8.8 | % | |||||||||

| Retail - Apparel & Jewelry | 13 | 1,313 | 1.4 | % | 14,678 | 1.3 | % | |||||||||

| Retail - Department Stores | 13 | 965 | 1.0 | % | 8,010 | 0.7 | % | |||||||||

| Retail - Discount | 604 | 10,519 | 11.2 | % | 97,536 | 8.5 | % | |||||||||

| Retail - Electronics & Appliances | 17 | 1,541 | 1.6 | % | 10,444 | 0.9 | % | |||||||||

| Retail - Gas & Convenience | 126 | 613 | 0.7 | % | 30,737 | 2.7 | % | |||||||||

| Retail - Grocery & Supermarket | 84 | 5,347 | 5.7 | % | 56,603 | 4.9 | % | |||||||||

| Retail - Hobby, Books & Music | 16 | 1,901 | 2.0 | % | 11,497 | 1.0 | % | |||||||||

| Retail - Home & Garden | 112 | 8,561 | 9.1 | % | 61,585 | 5.4 | % | |||||||||

| Retail - Home Furnishings | 45 | 1,806 | 1.9 | % | 21,802 | 1.9 | % | |||||||||

| Retail - Internet | 3 | 3,048 | 3.2 | % | 14,159 | 1.2 | % | |||||||||

| Retail - Medical Services | 62 | 522 | 0.6 | % | 11,755 | 1.0 | % | |||||||||

| Retail - Motor Vehicle | 182 | 6,000 | 6.4 | % | 41,876 | 3.6 | % | |||||||||

| Retail - Office Supply | 4 | 58 | 0.1 | % | 793 | 0.1 | % | |||||||||

| Retail - Pet Supply | 19 | 964 | 1.0 | % | 19,623 | 1.7 | % | |||||||||

| Retail - Pharmacy | 233 | 3,484 | 3.7 | % | 80,159 | 7.0 | % | |||||||||

| Retail - Specialty (Other) | 29 | 730 | 0.8 | % | 5,702 | 0.5 | % | |||||||||

| Retail - Sporting Goods | 20 | 1,711 | 1.8 | % | 22,630 | 2.0 | % | |||||||||

| Retail - Warehouse Clubs | 7 | 2,631 | 2.8 | % | 22,963 | 2.0 | % | |||||||||

| Other | 20 | 278 | 0.2 | % | 6,262 | 0.5 | % | |||||||||

| Total | 3,279 | 93,011 | 99.1 | % | $ | 1,148,394 | 100.0 | % | ||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 26

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

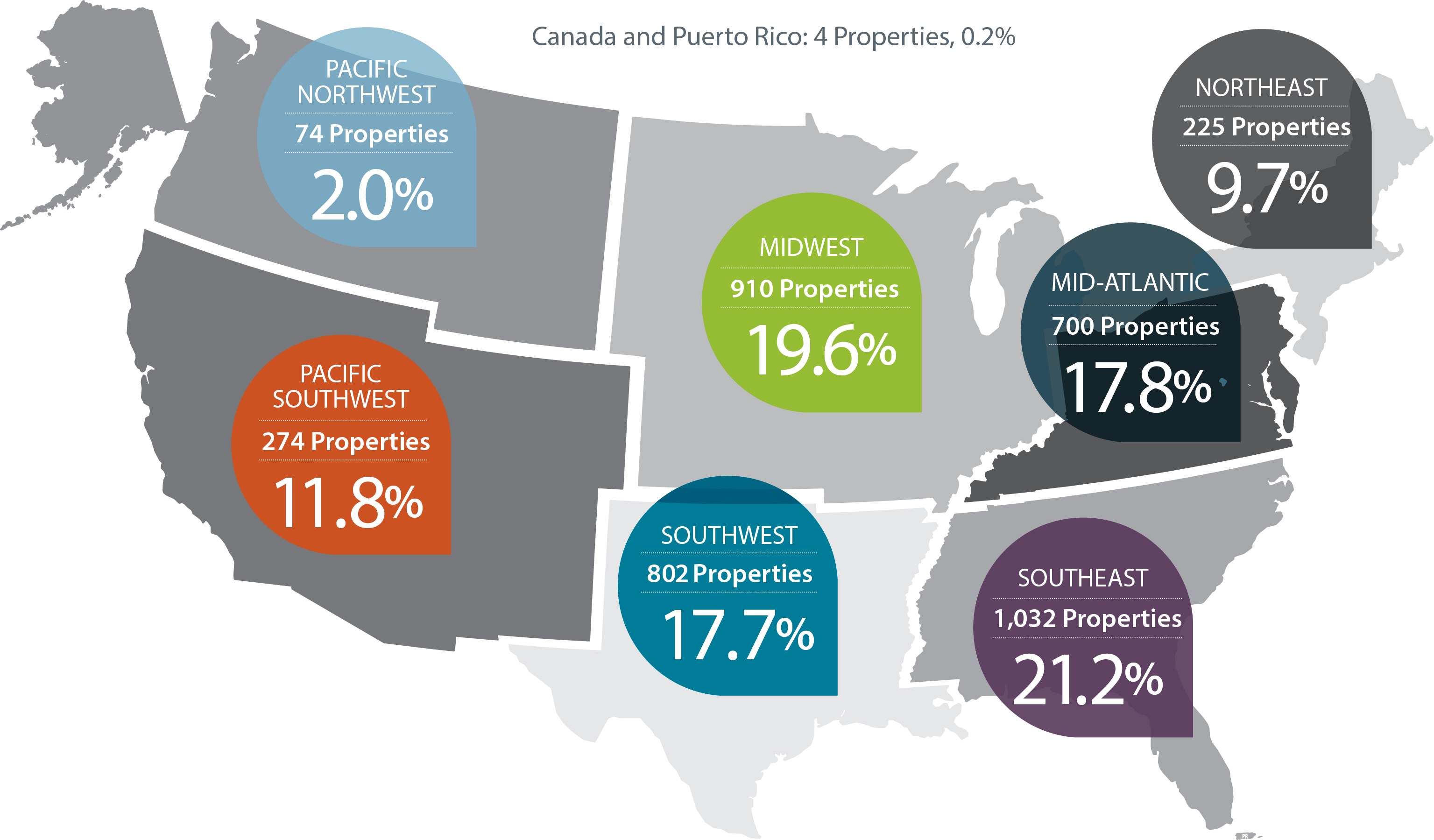

Diversification: Property Geographic (unaudited, square feet and dollars in thousands) |

| Location | Number of Properties | Rentable Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| United States | ||||||||||||||||

| Alabama | 148 | 1,712 | 1.8 | % | $ | 26,006 | 2.3 | % | ||||||||

| Alaska | 3 | 25 | — | % | 777 | 0.1 | % | |||||||||

| Arizona | 75 | 1,944 | 2.1 | % | 33,602 | 2.9 | % | |||||||||

| Arkansas | 93 | 1,071 | 1.1 | % | 13,477 | 1.2 | % | |||||||||

| California | 67 | 3,729 | 4.0 | % | 49,308 | 4.3 | % | |||||||||

| Colorado | 47 | 1,776 | 1.9 | % | 26,443 | 2.3 | % | |||||||||

| Connecticut | 17 | 86 | 0.1 | % | 2,381 | 0.2 | % | |||||||||

| Delaware | 11 | 97 | 0.1 | % | 2,051 | 0.2 | % | |||||||||

| Florida | 253 | 4,582 | 4.9 | % | 63,086 | 5.5 | % | |||||||||

| Georgia | 182 | 3,771 | 4.0 | % | 42,492 | 3.7 | % | |||||||||

| Idaho | 16 | 130 | 0.2 | % | 3,254 | 0.3 | % | |||||||||

| Illinois | 159 | 4,556 | 4.9 | % | 63,304 | 5.5 | % | |||||||||

| Indiana | 135 | 4,101 | 4.4 | % | 38,436 | 3.3 | % | |||||||||

| Iowa | 47 | 885 | 0.9 | % | 9,827 | 0.9 | % | |||||||||

| Kansas | 40 | 2,126 | 2.3 | % | 9,800 | 0.9 | % | |||||||||

| Kentucky | 83 | 2,241 | 2.4 | % | 24,458 | 2.1 | % | |||||||||

| Louisiana | 93 | 1,655 | 1.8 | % | 21,182 | 1.8 | % | |||||||||

| Maine | 26 | 703 | 0.7 | % | 8,637 | 0.8 | % | |||||||||

| Maryland | 28 | 610 | 0.7 | % | 14,555 | 1.3 | % | |||||||||

| Massachusetts | 36 | 2,567 | 2.7 | % | 29,996 | 2.6 | % | |||||||||

| Michigan | 182 | 2,285 | 2.4 | % | 40,194 | 3.5 | % | |||||||||

| Minnesota | 52 | 689 | 0.7 | % | 9,268 | 0.8 | % | |||||||||

| Mississippi | 74 | 1,940 | 2.1 | % | 15,502 | 1.3 | % | |||||||||

| Missouri | 156 | 1,733 | 1.8 | % | 23,080 | 2.0 | % | |||||||||

| Montana | 9 | 115 | 0.1 | % | 1,962 | 0.2 | % | |||||||||

| Nebraska | 19 | 321 | 0.3 | % | 5,399 | 0.5 | % | |||||||||

| Nevada | 28 | 717 | 0.8 | % | 8,491 | 0.7 | % | |||||||||

| New Hampshire | 19 | 253 | 0.3 | % | 4,435 | 0.4 | % | |||||||||

| New Jersey | 31 | 1,614 | 1.7 | % | 34,686 | 3.0 | % | |||||||||

| New Mexico | 46 | 880 | 0.9 | % | 11,985 | 1.0 | % | |||||||||

| New York | 77 | 1,522 | 1.6 | % | 27,555 | 2.4 | % | |||||||||

| North Carolina | 152 | 3,292 | 3.5 | % | 36,576 | 3.2 | % | |||||||||

| North Dakota | 13 | 215 | 0.2 | % | 4,670 | 0.4 | % | |||||||||

| Ohio | 293 | 8,459 | 9.0 | % | 67,639 | 5.9 | % | |||||||||

| Oklahoma | 76 | 2,002 | 2.1 | % | 24,712 | 2.2 | % | |||||||||

| Oregon | 13 | 88 | 0.1 | % | 2,254 | 0.2 | % | |||||||||

| Pennsylvania | 145 | 5,595 | 6.0 | % | 54,318 | 4.7 | % | |||||||||

| Rhode Island | 13 | 171 | 0.2 | % | 3,226 | 0.3 | % | |||||||||

| South Carolina | 113 | 3,304 | 3.5 | % | 27,827 | 2.4 | % | |||||||||

| South Dakota | 12 | 180 | 0.2 | % | 2,169 | 0.2 | % | |||||||||

| Tennessee | 110 | 3,715 | 4.0 | % | 32,002 | 2.8 | % | |||||||||

| Texas | 540 | 10,668 | 11.4 | % | 144,358 | 12.6 | % | |||||||||

| Utah | 11 | 515 | 0.5 | % | 5,735 | 0.5 | % | |||||||||

| Vermont | 6 | 19 | — | % | 292 | — | % | |||||||||

| Virginia | 101 | 2,854 | 3.0 | % | 35,563 | 3.1 | % | |||||||||

| Washington | 25 | 710 | 0.8 | % | 12,523 | 1.1 | % | |||||||||

| West Virginia | 39 | 256 | 0.3 | % | 6,080 | 0.5 | % | |||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 27

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Diversification: Property Geographic (cont.) (unaudited, square feet and dollars in thousands) |

| Location | Number of Properties | Rentable Square Feet | Square Feet as a % of Total Portfolio | Annualized Rental Income | Annualized Rental Income as a % of Total Portfolio | |||||||||||

| Wisconsin | 95 | 1,228 | 1.3 | % | 18,705 | 1.6 | % | |||||||||

| Wyoming | 8 | 54 | 0.1 | % | 1,436 | 0.1 | % | |||||||||

| Territories | ||||||||||||||||

| Puerto Rico | 3 | 88 | 0.1 | % | 2,335 | 0.2 | % | |||||||||

| Canadian Provinces | ||||||||||||||||

| Ontario | 1 | 7 | — | % | 345 | — | % | |||||||||

| Total | 4,021 | 93,856 | 100.0 | % | $ | 1,148,394 | 100.0 | % | ||||||||

Percentages based on Annualized Rental Income.

See the Definitions section for a description of the Company's non-GAAP and operating metrics.

VEREIT, Inc. | WWW.VEREIT.COM | 28

| ||

| Q3 2018 SUPPLEMENTAL INFORMATION | ||

Lease Expirations (unaudited, square feet and dollars in thousands) |

| Year of Expiration | Number of Leases Expiring | Leased Square Feet | Leased Square Feet as a % of Total Portfolio | Annualized Rental Income Expiring | Annualized Rental Income Expiring as a % of Total Portfolio | |||||||||||

| 2018 | 39 | 609 | 0.6 | % | $ | 6,386 | 0.6 | % | ||||||||

| 2019 | 156 | 2,600 | 2.8 | % | 41,926 | 3.7 | % | |||||||||

| 2020 | 209 | 3,496 | 3.7 | % | 39,639 | 3.5 | % | |||||||||

| 2021 | 194 | 10,510 | 11.2 | % | 83,852 | 7.3 | % | |||||||||

| 2022 | 262 | 9,254 | 9.9 | % | 78,965 | 6.9 | % | |||||||||

| 2023 | 310 | 6,596 | 7.0 | % | 82,733 | 7.2 | % | |||||||||

| 2024 | 193 | 9,272 | 9.9 | % | 109,390 | 9.5 | % | |||||||||

| 2025 | 272 | 4,288 | 4.6 | % | 60,735 | 5.3 | % | |||||||||

| 2026 | 221 | 8,658 | 9.2 | % | 80,929 | 7.0 | % | |||||||||

| 2027 | 358 | 6,870 | 7.3 | % | 100,085 | 8.7 | % | |||||||||

| Thereafter | 1,065 | 30,858 | 32.9 | % | 463,754 | 40.3 | % | |||||||||

| Total | 3,279 | 93,011 | 99.1 | % | $ | 1,148,394 | 100.0 | % | ||||||||

See the Definitions section for a description of the Company's non-GAAP and operating metrics.