UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One) |

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2019 |

| |

| | OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from _________ to __________ |

Commission file numbers: 001-35263 and 333-197780

|

|

| VEREIT, Inc. |

| VEREIT Operating Partnership, L.P. |

| (Exact name of registrant as specified in its charter) |

|

| | |

| Maryland (VEREIT, Inc.) | | 45-2482685 |

| Delaware (VEREIT Operating Partnership, L.P.) | | 45-1255683 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 2325 E. Camelback Road, 9th Floor, Phoenix, AZ | | 85016 |

| (Address of principal executive offices) | | (Zip Code) |

|

|

| (800) 606-3610 |

| (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. VEREIT, Inc. Yes x No o VEREIT Operating Partnership, L.P. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). VEREIT, Inc. Yes x No o VEREIT Operating Partnership, L.P. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | | | | | | |

| VEREIT, Inc. | Large accelerated filer | x | | Accelerated filer | o | | Non-accelerated filer | o |

| | | | | | | | |

| | Smaller reporting company | o | | Emerging growth company | o | | |

|

| | | | | | | | |

| VEREIT Operating Partnership, L.P. | Large accelerated filer | o | | Accelerated filer | o | | Non-accelerated filer | x |

| | | | | | | | |

| | Smaller reporting company | o | | Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. VEREIT, Inc. ¨ VEREIT Operating Partnership, L.P. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

VEREIT, Inc. Yes o No x VEREIT Operating Partnership, L.P. Yes o No x |

| | | |

| | | | |

| Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: |

| Title of each class: | Trading symbol(s): | Name of each exchange on which registered: |

| Common Stock, $0.01 par value per share (VEREIT, Inc.) | VER | New York Stock Exchange |

| 6.70% Series F Cumulative Redeemable Preferred Stock, $0.01 par value per share (VEREIT, Inc.) | VER PF | New York Stock Exchange |

There were 973,307,068 shares of common stock of VEREIT, Inc. outstanding as of May 3, 2019.

EXPLANATORY NOTE

This report combines the Quarterly Reports on Form 10-Q for the three months ended March 31, 2019 of VEREIT, Inc., a Maryland corporation, and VEREIT Operating Partnership, L.P., a Delaware limited partnership, of which VEREIT, Inc. is the sole general partner. Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “VEREIT,” the “Company” or the “General Partner” mean VEREIT, Inc. together with its consolidated subsidiaries, including VEREIT Operating Partnership, L.P., and all references to the “Operating Partnership” or “OP” mean VEREIT Operating Partnership, L.P. together with its consolidated subsidiaries.

As the sole general partner of VEREIT Operating Partnership, L.P., VEREIT, Inc. has the full, exclusive and complete responsibility for the Operating Partnership’s day-to-day management and control.

We believe combining the Quarterly Reports on Form 10-Q of VEREIT, Inc. and VEREIT Operating Partnership, L.P. into this single report results in the following benefits:

| |

| • | enhancing investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| |

| • | eliminating duplicative disclosure and providing a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

| |

| • | creating time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

There are a few differences between the Company and the Operating Partnership, which are reflected in the disclosure in this report. We believe it is important to understand the differences between the Company and the Operating Partnership in the context of how we operate as an interrelated consolidated company. VEREIT, Inc. is a real estate investment trust whose only material asset is its ownership of partnership interests of the Operating Partnership. As a result, VEREIT, Inc. does not conduct business itself, other than acting as the sole general partner of the Operating Partnership, issuing equity or debt from time to time and guaranteeing certain unsecured debt of the Operating Partnership and certain of its subsidiaries. The Operating Partnership holds substantially all of the assets of the Company and holds the ownership interests in the Company’s joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for net proceeds from public equity or debt issuances by VEREIT, Inc., which are generally contributed to the Operating Partnership in exchange for partnership units, the Operating Partnership generates the capital required by the Company’s business through the Operating Partnership’s operations, by the Operating Partnership’s direct or indirect incurrence of indebtedness or through the issuance of partnership units. To help investors understand the significant differences between VEREIT, Inc. and the Operating Partnership, there are separate sections in this report that separately discuss VEREIT, Inc. and the Operating Partnership, including the consolidated financial statements and certain notes to the consolidated financial statements as well as separate disclosures in Item 4. Controls and Procedures and Exhibit 31 and Exhibit 32 certifications. As general partner with control of the Operating Partnership, VEREIT, Inc. consolidates the Operating Partnership for financial reporting purposes. Therefore, the assets and liabilities of VEREIT, Inc. and VEREIT Operating Partnership, L.P. are the same on their respective consolidated financial statements. The separate discussions of VEREIT, Inc. and VEREIT Operating Partnership, L.P. in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

For the quarterly period ended March 31, 2019

VEREIT, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data) (Unaudited)

PART I — FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

|

| | | | | | | | |

| | | March 31, 2019 | | December 31, 2018 |

| ASSETS | | | | |

| Real estate investments, at cost: | | | | |

| Land | | $ | 2,824,666 |

| | $ | 2,843,212 |

|

| Buildings, fixtures and improvements | | 10,741,995 |

| | 10,749,228 |

|

| Intangible lease assets | | 2,003,825 |

| | 2,012,399 |

|

| Total real estate investments, at cost | | 15,570,486 |

| | 15,604,839 |

|

| Less: accumulated depreciation and amortization | | 3,544,252 |

| | 3,436,772 |

|

| Total real estate investments, net | | 12,026,234 |

| | 12,168,067 |

|

| Operating lease right-of-use assets | | 224,859 |

| | — |

|

| Investment in unconsolidated entities | | 35,790 |

| | 35,289 |

|

| Cash and cash equivalents | | 12,788 |

| | 30,758 |

|

| Restricted cash | | 18,517 |

| | 22,905 |

|

| Rent and tenant receivables and other assets, net | | 361,641 |

| | 366,092 |

|

| Goodwill | | 1,337,773 |

| | 1,337,773 |

|

| Real estate assets held for sale, net | | 36,022 |

| | 2,609 |

|

| Total assets | | $ | 14,053,624 |

|

| $ | 13,963,493 |

|

| | | | | |

| LIABILITIES AND EQUITY | | | | |

| Mortgage notes payable, net | | $ | 1,918,826 |

| | $ | 1,922,657 |

|

| Corporate bonds, net | | 2,619,956 |

| | 3,368,609 |

|

| Convertible debt, net | | 395,823 |

| | 394,883 |

|

| Credit facility, net | | 1,089,725 |

| | 401,773 |

|

| Below-market lease liabilities, net | | 166,708 |

| | 173,479 |

|

| Accounts payable and accrued expenses | | 141,126 |

| | 145,611 |

|

| Deferred rent and other liabilities | | 70,220 |

| | 69,714 |

|

| Distributions payable | | 190,246 |

| | 186,623 |

|

| Operating lease liabilities | | 228,120 |

| | — |

|

| Total liabilities | | 6,820,750 |

|

| 6,663,349 |

|

| Commitments and contingencies (Note 10) | |

| |

|

|

| Preferred stock, $0.01 par value, 100,000,000 shares authorized and 42,871,246 and 42,834,138 issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | | 429 |

| | 428 |

|

| Common stock, $0.01 par value, 1,500,000,000 shares authorized and 971,576,377 and 967,515,165 issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | | 9,716 |

| | 9,675 |

|

| Additional paid-in-capital | | 12,645,148 |

| | 12,615,472 |

|

| Accumulated other comprehensive loss | | (12,202 | ) | | (1,280 | ) |

| Accumulated deficit | | (5,550,574 | ) | | (5,467,236 | ) |

| Total stockholders’ equity | | 7,092,517 |

| | 7,157,059 |

|

| Non-controlling interests | | 140,357 |

| | 143,085 |

|

| Total equity | | 7,232,874 |

| | 7,300,144 |

|

| Total liabilities and equity | | $ | 14,053,624 |

|

| $ | 13,963,493 |

|

The accompanying notes are an integral part of these statements.

VEREIT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for per share data) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Rental revenue | | $ | 316,843 |

| | $ | 315,074 |

|

| Operating expenses: | | | | |

| Acquisition-related | | 985 |

| | 777 |

|

| Insurance recoveries, net of litigation and non-routine costs | | (21,492 | ) | | 21,740 |

|

| Property operating | | 32,378 |

| | 30,565 |

|

| General and administrative | | 14,846 |

| | 15,240 |

|

| Depreciation and amortization | | 136,555 |

| | 166,152 |

|

| Impairments | | 11,988 |

| | 6,036 |

|

| Restructuring | | 9,076 |

| | — |

|

| Total operating expenses | | 184,336 |

|

| 240,510 |

|

| Other (expenses) income: | | | | |

| Interest expense | | (71,254 | ) | | (70,425 | ) |

| Other (loss) income, net | | (402 | ) | | 7,709 |

|

| Equity in income and gain on disposition of unconsolidated entities | | 500 |

| | 1,065 |

|

| Gain on disposition of real estate and real estate assets held for sale, net | | 10,831 |

| | 17,335 |

|

| Total other expenses, net | | (60,325 | ) |

| (44,316 | ) |

| Income before taxes | | 72,182 |

|

| 30,248 |

|

| Provision for income taxes | | (1,211 | ) | | (1,212 | ) |

| Income from continuing operations | | 70,971 |

|

| 29,036 |

|

| Income from discontinued operations, net of income taxes | | — |

| | 3,501 |

|

| Net income | | 70,971 |

| | 32,537 |

|

Net income attributable to non-controlling interests (1) | | (1,667 | ) | | (742 | ) |

| Net income attributable to the General Partner | | $ | 69,304 |

|

| $ | 31,795 |

|

| | | | | |

| Basic and diluted net income per share from continuing operations attributable to common stockholders | | $ | 0.05 |

| | $ | 0.01 |

|

| Basic and diluted net income per share from discontinued operations attributable to common stockholders | | $ | — |

| | $ | 0.00 |

|

| Basic and diluted net income per share attributable to common stockholders | | $ | 0.05 |

| | $ | 0.01 |

|

_______________________________________________

| |

| (1) | Represents income attributable to limited partners and a consolidated joint venture partner. |

The accompanying notes are an integral part of these statements.

VEREIT, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Net income | | $ | 70,971 |

| | $ | 32,537 |

|

| Other comprehensive loss: | | | | |

| Unrealized loss on interest rate derivatives | | (11,286 | ) | | — |

|

| Reclassification of previous unrealized loss on interest rate derivatives into net income | | 97 |

| | 105 |

|

| Unrealized loss on investment securities, net | | — |

| | (837 | ) |

| Total other comprehensive loss | | (11,189 | ) |

| (732 | ) |

| | | | | |

| Total comprehensive income | | 59,782 |

| | 31,805 |

|

Comprehensive income attributable to non-controlling interests (1) | | (1,400 | ) | | (725 | ) |

| Total comprehensive income attributable to the General Partner | | $ | 58,382 |

| | $ | 31,080 |

|

_______________________________________________

| |

| (1) | Represents comprehensive income attributable to limited partners and a consolidated joint venture partner. |

The accompanying notes are an integral part of these statements.

VEREIT, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In thousands, except for share data) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | | | | | | | | | | | |

| | | Number

of Shares | | Par

Value | | Number

of Shares | | Par

Value | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income | | Accumulated

Deficit | | Total Stock-holders’ Equity | | Non-Controlling Interests | | Total Equity |

| Balance, January 1, 2019 | | 42,834,138 |

| | $ | 428 |

| | 967,515,165 |

| | $ | 9,675 |

| | $ | 12,615,472 |

| | $ | (1,280 | ) | | $ | (5,467,236 | ) | | $ | 7,157,059 |

| | $ | 143,085 |

| | $ | 7,300,144 |

|

| Issuance of Common Stock, net | | — |

| | — |

| | 3,309,808 |

| | 33 |

| | 27,511 |

| | — |

| | — |

| | 27,544 |

| | — |

| | 27,544 |

|

| Conversion of OP Units to Common Stock | | — |

| | — |

| | — |

| | — |

| | (26 | ) | | — |

| | — |

| | (26 | ) | | 26 |

| | — |

|

| Conversion of Series F Preferred Units to Series F Preferred Stock | | 37,108 |

| | 1 |

| | — |

| | — |

| | 922 |

|

| — |

|

| — |

| | 923 |

| | (923 | ) | | — |

|

| Repurchases of Common Stock to settle tax obligation | | — |

| | — |

| | (199,083 | ) | | (2 | ) | | (1,593 | ) | | — |

| | — |

| | (1,595 | ) | | — |

| | (1,595 | ) |

| Equity-based compensation, net | | — |

| | — |

| | 950,487 |

| | 10 |

| | 2,862 |

| | — |

| | — |

| | 2,872 |

| | — |

| | 2,872 |

|

| Contributions from non-controlling interest holders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 64 |

| | 64 |

|

Distributions declared on Common Stock —

$0.1375 per common share | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (133,480 | ) | | (133,480 | ) | | — |

| | (133,480 | ) |

| Distributions to non-controlling interest holders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (3,262 | ) | | (3,262 | ) |

| Dividend equivalents on awards granted under the Equity Plan | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,222 | ) | | (1,222 | ) | | — |

| | (1,222 | ) |

| Distributions to preferred shareholders and unitholders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (17,940 | ) | | (17,940 | ) | | (33 | ) | | (17,973 | ) |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 69,304 |

| | 69,304 |

| | 1,667 |

| | 70,971 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | — |

| | (10,922 | ) | | — |

| | (10,922 | ) | | (267 | ) | | (11,189 | ) |

| Balance, March 31, 2019 | | 42,871,246 |

|

| $ | 429 |

|

| 971,576,377 |

|

| $ | 9,716 |

|

| $ | 12,645,148 |

|

| $ | (12,202 | ) |

| $ | (5,550,574 | ) |

| $ | 7,092,517 |

|

| $ | 140,357 |

|

| $ | 7,232,874 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | | Common Stock | | | | | | | | | | | | |

| | | Number

of Shares | | Par

Value | | Number

of Shares | | Par

Value | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated

Deficit | | Total Stock-holders’ Equity | | Non-Controlling Interests | | Total Equity |

| Balance, January 1, 2018 | | 42,834,138 |

| | $ | 428 |

| | 974,208,583 |

| | $ | 9,742 |

| | $ | 12,654,258 |

| | $ | (3,569 | ) | | $ | (4,776,581 | ) | | $ | 7,884,278 |

| | $ | 158,598 |

| | $ | 8,042,876 |

|

| Repurchases of Common Stock under share repurchase programs | | — |

| | — |

| | (6,399,666 | ) | | (64 | ) | | (44,521 | ) | | — |

| | — |

| | (44,585 | ) | | — |

| | (44,585 | ) |

| Repurchases of Common Stock to settle tax obligation | | — |

| | — |

| | (230,436 | ) | | (2 | ) | | (1,658 | ) | | — |

| | — |

| | (1,660 | ) | | — |

| | (1,660 | ) |

| Equity-based compensation, net | | — |

| | — |

| | 576,005 |

| | 5 |

| | 2,927 |

| | — |

| | — |

| | 2,932 |

| | — |

| | 2,932 |

|

Distributions declared on Common Stock —

$0.1375 per common share | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (133,104 | ) | | (133,104 | ) | | — |

| | (133,104 | ) |

| Distributions to non-controlling interest holders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (3,264 | ) | | (3,264 | ) |

| Dividend equivalents on awards granted under the Equity Plan | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (522 | ) | | (522 | ) | | — |

| | (522 | ) |

| Distributions to preferred shareholders and unitholders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (17,937 | ) | | (17,937 | ) | | (36 | ) | | (17,973 | ) |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 31,795 |

| | 31,795 |

| | 742 |

| | 32,537 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | — |

| | (715 | ) | | — |

| | (715 | ) | | (17 | ) | | (732 | ) |

| Balance, March 31, 2018 | | 42,834,138 |

|

| $ | 428 |

|

| 968,154,486 |

| | $ | 9,681 |

| | $ | 12,611,006 |

| | $ | (4,284 | ) | | $ | (4,896,349 | ) |

| $ | 7,720,482 |

|

| $ | 156,023 |

|

| $ | 7,876,505 |

|

VEREIT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Cash flows from operating activities: | | | | |

|

| Net income | | $ | 70,971 |

| | $ | 32,537 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 139,394 |

| | 172,458 |

|

| Gain on real estate assets, net | | (10,831 | ) | | (18,036 | ) |

| Impairments | | 11,988 |

| | 6,036 |

|

| Equity-based compensation | | 2,872 |

| | 2,927 |

|

| Equity in income of unconsolidated entities and gain on joint venture | | (500 | ) | | (364 | ) |

| Distributions from unconsolidated entities | | — |

| | 936 |

|

| Loss (Gain) on investments | | 470 |

| | (5,638 | ) |

| Loss (Gain) on derivative instruments | | 34 |

| | (273 | ) |

| Non-cash restructuring expense | | 4,018 |

| | — |

|

| Changes in assets and liabilities: | | | | |

| Investment in direct financing leases | | 409 |

| | 538 |

|

| Rent and tenant receivables, operating lease right-of-use and other assets, net | | (7,160 | ) | | (23,344 | ) |

| Assets held for sale classified as discontinued operations | | — |

| | (2,490 | ) |

| Accounts payable and accrued expenses | | (2,415 | ) | | (7,653 | ) |

| Deferred rent, operating lease and other liabilities | | (15,216 | ) | | 6,158 |

|

| Due to affiliates | | — |

| | (66 | ) |

| Liabilities related to discontinued operations | | — |

| | (13,861 | ) |

| Net cash provided by operating activities | | 194,034 |

| | 149,865 |

|

| Cash flows from investing activities: | | | | |

| Investments in real estate assets | | (81,065 | ) | | (139,882 | ) |

| Capital expenditures and leasing costs | | (7,498 | ) | | (4,993 | ) |

| Real estate developments | | (3,232 | ) | | (1,899 | ) |

| Principal repayments received on investment securities and mortgage notes receivable | | 62 |

| | 4,615 |

|

| Return of investment from unconsolidated entities | | — |

| | 386 |

|

| Proceeds from disposition of real estate and joint venture | | 60,496 |

| | 122,526 |

|

| Proceeds from disposition of discontinued operations | | — |

| | 123,925 |

|

| Investment in leasehold improvements and other assets | | (177 | ) | | (85 | ) |

| Deposits for real estate assets | | (900 | ) | | (4,000 | ) |

| Proceeds from sale of investments and other assets | | 8,199 |

| | 1,351 |

|

| Uses and refunds of deposits for real estate assets | | 1,240 |

| | 5,120 |

|

| Proceeds from the settlement of property-related insurance claims | | 32 |

| | 269 |

|

| Line of credit advances to Cole REITs | | — |

| | (2,200 | ) |

| Line of credit repayments from Cole REITs | | — |

| | 3,800 |

|

| Net cash (used in) provided by investing activities | | (22,843 | ) | | 108,933 |

|

| Cash flows from financing activities: | | | | |

| Proceeds from mortgage notes payable | | — |

| | 89 |

|

| Payments on mortgage notes payable and other debt, including debt extinguishment costs | | (2,426 | ) | | (2,676 | ) |

| Proceeds from credit facility | | 899,000 |

| | 380,000 |

|

| Payments on credit facility | | (207,000 | ) | | (445,000 | ) |

| Payments on corporate bonds, including extinguishment costs | | (750,000 | ) | | — |

|

| Payments of deferred financing costs | | (172 | ) | | — |

|

| Repurchases of Common Stock under the Share Repurchase Programs | | — |

| | (44,585 | ) |

| Repurchases of Common Stock to settle tax obligations | | (1,595 | ) | | (1,659 | ) |

| Proceeds from the issuance of Common Stock, net of underwriters’ discount | | 20,894 |

| | — |

|

| Contributions from non-controlling interest holders | | 64 |

| | — |

|

| Distributions paid | | (152,314 | ) | | (152,519 | ) |

| Net cash used in financing activities | | (193,549 | ) | | (266,350 | ) |

| Net change in cash and cash equivalents and restricted cash | | (22,358 | ) | | (7,552 | ) |

| | | | | |

VEREIT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS – (Continued)

(In thousands)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Cash and cash equivalents and restricted cash, beginning of period | | $ | 53,663 |

| | $ | 64,036 |

|

| Less: cash and cash equivalents of discontinued operations | | — |

| | (2,198 | ) |

| Cash and cash equivalents and restricted cash from continuing operations, beginning of period | | 53,663 |

| | 61,838 |

|

| | | | | |

| Cash and cash equivalents and restricted cash from continuing operations, end of period | | $ | 31,305 |

| | $ | 56,484 |

|

| Reconciliation of Cash and Cash Equivalents and Restricted Cash | | | | |

| Cash and cash equivalents at beginning of period | | $ | 30,758 |

| | $ | 34,176 |

|

| Restricted cash at beginning of period | | 22,905 |

| | 27,662 |

|

| Cash and cash equivalents and restricted cash at beginning of period | | 53,663 |

| | 61,838 |

|

| | | | | |

| Cash and cash equivalents at end of period | | 12,788 |

| | 28,435 |

|

| Restricted cash at end of period | | 18,517 |

| | 28,049 |

|

| Cash and cash equivalents and restricted cash at end of period | | $ | 31,305 |

| | $ | 56,484 |

|

The accompanying notes are an integral part of these statements.

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED BALANCE SHEETS

(In thousands, except for unit data) (Unaudited)

|

| | | | | | | | |

| | | March 31, 2019 | | December 31, 2018 |

| ASSETS | | | | |

| Real estate investments, at cost: | | | | |

| Land | | $ | 2,824,666 |

| | $ | 2,843,212 |

|

| Buildings, fixtures and improvements | | 10,741,995 |

| | 10,749,228 |

|

| Intangible lease assets | | 2,003,825 |

| | 2,012,399 |

|

| Total real estate investments, at cost | | 15,570,486 |

|

| 15,604,839 |

|

| Less: accumulated depreciation and amortization | | 3,544,252 |

| | 3,436,772 |

|

| Total real estate investments, net | | 12,026,234 |

|

| 12,168,067 |

|

| Operating lease right-of-use assets | | 224,859 |

| | — |

|

| Investment in unconsolidated entities | | 35,790 |

| | 35,289 |

|

| Cash and cash equivalents | | 12,788 |

| | 30,758 |

|

| Restricted cash | | 18,517 |

| | 22,905 |

|

| Rent and tenant receivables and other assets, net | | 361,641 |

| | 366,092 |

|

| Goodwill | | 1,337,773 |

| | 1,337,773 |

|

| Real estate assets held for sale, net | | 36,022 |

| | 2,609 |

|

| Total assets | | $ | 14,053,624 |

|

| $ | 13,963,493 |

|

| | | | | |

| LIABILITIES AND EQUITY | | | | |

|

| Mortgage notes payable, net | | $ | 1,918,826 |

| | $ | 1,922,657 |

|

| Corporate bonds, net | | 2,619,956 |

| | 3,368,609 |

|

| Convertible debt, net | | 395,823 |

| | 394,883 |

|

| Credit facility, net | | 1,089,725 |

| | 401,773 |

|

| Below-market lease liabilities, net | | 166,708 |

| | 173,479 |

|

| Accounts payable and accrued expenses | | 141,126 |

| | 145,611 |

|

| Deferred rent and other liabilities | | 70,220 |

| | 69,714 |

|

| Distributions payable | | 190,246 |

| | 186,623 |

|

| Operating lease liabilities | | 228,120 |

| | — |

|

| Total liabilities | | 6,820,750 |

|

| 6,663,349 |

|

| Commitments and contingencies (Note 10) | |

|

| |

|

|

| General Partner's preferred equity, 42,871,246 and 42,834,138 General Partner Series F Preferred Units issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | | 693,308 |

| | 710,325 |

|

| General Partner's common equity, 971,576,377 and 967,515,165 General Partner OP Units issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | | 6,399,209 |

| | 6,446,734 |

|

| Limited Partner's preferred equity, 49,766 and 86,874 Limited Partner Series F Preferred Units issued and outstanding as of March 31, 2019 and December 31, 2018, respectively | | 1,927 |

| | 2,883 |

|

| Limited Partner's common equity, 23,715,908 Limited Partner OP Units issued and outstanding as of each of March 31, 2019 and December 31, 2018 | | 137,123 |

| | 138,931 |

|

| Total partners’ equity | | 7,231,567 |

|

| 7,298,873 |

|

| Non-controlling interests | | 1,307 |

| | 1,271 |

|

| Total equity | | 7,232,874 |

|

| 7,300,144 |

|

| Total liabilities and equity | | $ | 14,053,624 |

|

| $ | 13,963,493 |

|

The accompanying notes are an integral part of these statements.

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for per unit data) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Rental revenue | | $ | 316,843 |

| | $ | 315,074 |

|

| Operating expenses: | | | | |

| Acquisition-related | | 985 |

| | 777 |

|

| Insurance recoveries, net of litigation and non-routine costs | | (21,492 | ) | | 21,740 |

|

| Property operating | | 32,378 |

| | 30,565 |

|

| General and administrative | | 14,846 |

| | 15,240 |

|

| Depreciation and amortization | | 136,555 |

| | 166,152 |

|

| Impairments | | 11,988 |

| | 6,036 |

|

| Restructuring | | 9,076 |

| | — |

|

| Total operating expenses | | 184,336 |

|

| 240,510 |

|

| Other (expenses) income: | | | | |

| Interest expense | | (71,254 | ) | | (70,425 | ) |

| Other (loss) income, net | | (402 | ) | | 7,709 |

|

| Equity in income and gain on disposition of unconsolidated entities | | 500 |

| | 1,065 |

|

| Gain on disposition of real estate and real estate assets held for sale, net | | 10,831 |

| | 17,335 |

|

| Total other expenses, net | | (60,325 | ) |

| (44,316 | ) |

| Income before taxes | | 72,182 |

|

| 30,248 |

|

| Provision for income taxes | | (1,211 | ) | | (1,212 | ) |

| Income from continuing operations | | 70,971 |

| | 29,036 |

|

| Income from discontinued operations, net of income taxes | | — |

| | 3,501 |

|

| Net income | | 70,971 |

|

| 32,537 |

|

Net loss attributable to non-controlling interests (1) | | 28 |

| | 40 |

|

| Net income attributable to the OP | | $ | 70,999 |

|

| $ | 32,577 |

|

| | | | | |

| Basic and diluted net income per unit from continuing operations attributable to common unitholders | | $ | 0.05 |

| | $ | 0.01 |

|

| Basic and diluted net income per unit from discontinued operations attributable to common unitholders | | $ | — |

| | $ | 0.00 |

|

Basic and diluted net income per unit attributable to common unitholders | | $ | 0.05 |

| | $ | 0.01 |

|

_______________________________________________

| |

| (1) | Represents net loss attributable to a consolidated joint venture partner. |

The accompanying notes are an integral part of these statements.

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Net income | | $ | 70,971 |

| | $ | 32,537 |

|

| Other comprehensive loss: | | | | |

| Unrealized loss on interest rate derivatives | | (11,286 | ) | | — |

|

| Reclassification of previous unrealized loss on interest rate derivatives into net income | | 97 |

| | 105 |

|

| Unrealized loss on investment securities, net | | — |

| | (837 | ) |

| Total other comprehensive loss | | (11,189 | ) |

| (732 | ) |

| | | | | |

| Total comprehensive income | | 59,782 |

|

| 31,805 |

|

Comprehensive loss attributable to non-controlling interests (1) | | 28 |

| | 40 |

|

| Total comprehensive income attributable to the OP | | $ | 59,810 |

|

| $ | 31,845 |

|

_______________________________________________

| |

| (1) | Represents comprehensive loss attributable to a consolidated joint venture partner. |

The accompanying notes are an integral part of these statements.

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In thousands, except for unit data) (Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Units | | Common Units | | | | | | |

| | | General Partner | | Limited Partner | | General Partner | | Limited Partner | | | | | | |

| | | Number of Units | | Capital | | Number of Units | | Capital | | Number of Units | | Capital | | Number of Units | | Capital | | Total Partners' Capital | | Non-Controlling Interests | | Total Capital |

| Balance, January 1, 2019 | | 42,834,138 |

| | $ | 710,325 |

| | 86,874 |

| | $ | 2,883 |

| | 967,515,165 |

| | $ | 6,446,734 |

| | 23,715,908 |

| | $ | 138,931 |

| | $ | 7,298,873 |

| | $ | 1,271 |

| | $ | 7,300,144 |

|

| Issuance of common OP Units, net | | — |

| | — |

| | — |

| | — |

| | 3,309,808 |

| | 27,544 |

| | — |

| | — |

| | 27,544 |

| | — |

| | 27,544 |

|

| Conversion of Limited Partners' Common OP Units to General Partner's Common OP Units | | — |

| | — |

| | — |

| | — |

| | — |

| | (26 | ) | | — |

| | 26 |

| | — |

| | — |

| | — |

|

| Conversion of Limited Partner Series F Preferred Units to Series F Preferred Stock | | 37,108 |

| | 923 |

| | (37,108 | ) | | (923 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchases of common OP Units to settle tax obligation | | — |

| | — |

| | — |

| | — |

| | (199,083 | ) | | (1,595 | ) | | — |

| | — |

| | (1,595 | ) | | — |

| | (1,595 | ) |

| Equity-based compensation, net | | — |

| | — |

| | — |

| | — |

| | 950,487 |

| | 2,872 |

| | — |

| | — |

| | 2,872 |

| | — |

| | 2,872 |

|

| Contributions from non-controlling interest holders | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 64 |

| | 64 |

|

| Distributions to common OP Units and non-controlling interests —$0.1375 per common unit | | — |

| | — |

| | — |

| | — |

| | — |

| | (133,480 | ) | | — |

| | (3,262 | ) | | (136,742 | ) | | — |

| | (136,742 | ) |

| Dividend equivalents on awards granted under the Equity Plan | | — |

| | — |

| | — |

| | — |

| | — |

| | (1,222 | ) | | — |

| | — |

| | (1,222 | ) | | — |

| | (1,222 | ) |

| Distributions to Series F Preferred Units | | — |

| | (17,940 | ) | | — |

| | (33 | ) | | — |

| | — |

| | — |

| | — |

| | (17,973 | ) | | — |

| | (17,973 | ) |

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | 69,304 |

| | — |

| | 1,695 |

| | 70,999 |

| | (28 | ) | | 70,971 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | — |

| | (10,922 | ) | | — |

| | (267 | ) | | (11,189 | ) | | — |

| | (11,189 | ) |

| Balance, March 31, 2019 | | 42,871,246 |

| | $ | 693,308 |

| | 49,766 |

| | $ | 1,927 |

| | 971,576,377 |

| | $ | 6,399,209 |

| | 23,715,908 |

| | $ | 137,123 |

| | $ | 7,231,567 |

| | $ | 1,307 |

| | $ | 7,232,874 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Units | | Common Units | | | | | | |

| | | General Partner | | Limited Partner | | General Partner | | Limited Partner | | | | | | |

| | | Number of Units | | Capital | | Number of Units | | Capital | | Number of Units | | Capital | | Number of Units | | Capital | | Total Partners' Capital | | Non-Controlling Interests | | Total Capital |

| Balance, January 1, 2018 | | 42,834,138 |

| | $ | 782,073 |

| | 86,874 |

| | $ | 3,027 |

| | 974,208,583 |

| | $ | 7,102,205 |

| | 23,748,347 |

| | $ | 154,266 |

| | $ | 8,041,571 |

| | $ | 1,305 |

| | $ | 8,042,876 |

|

| Repurchases of common OP Units under the 2017 Share Repurchase Program | | — |

| | — |

| | — |

| | — |

| | (6,399,666 | ) | | (44,585 | ) | | — |

| | — |

| | (44,585 | ) | | — |

| | (44,585 | ) |

| Repurchases of common OP Units to settle tax obligation | | — |

| | — |

| | — |

| | — |

| | (230,436 | ) | | (1,660 | ) | | — |

| | — |

| | (1,660 | ) | | — |

| | (1,660 | ) |

| Equity-based compensation, net | | — |

| | — |

| | — |

| | — |

| | 576,005 |

| | 2,932 |

| | — |

| | — |

| | 2,932 |

| | — |

| | 2,932 |

|

| Distributions to common OP Units and non-controlling interests —$0.1375 per common unit | | — |

| | — |

| | — |

| | — |

| | — |

| | (133,104 | ) | | — |

| | (3,264 | ) | | (136,368 | ) | | — |

| | (136,368 | ) |

| Dividend equivalents on awards granted under the Equity Plan | | — |

| | — |

| | — |

| | — |

| | — |

| | (522 | ) | | — |

| | — |

| | (522 | ) | | — |

| | (522 | ) |

| Distributions to Series F Preferred Units | | — |

| | (17,937 | ) | | — |

| | (36 | ) | | — |

| | — |

| | — |

| | — |

| | (17,973 | ) | | — |

| | (17,973 | ) |

| Net income (loss) | | — |

| | — |

| | — |

| | — |

| | — |

| | 31,795 |

| | — |

| | 782 |

| | 32,577 |

| | (40 | ) | | 32,537 |

|

| Other comprehensive loss | | — |

| | — |

| | — |

| | — |

| | — |

| | (715 | ) | | — |

| | (17 | ) | | (732 | ) | | — |

| | (732 | ) |

| Balance, March 31, 2018 | | 42,834,138 |

|

| $ | 764,136 |

|

| 86,874 |

|

| $ | 2,991 |

|

| 968,154,486 |

|

| $ | 6,956,346 |

|

| 23,748,347 |

|

| $ | 151,767 |

|

| $ | 7,875,240 |

|

| $ | 1,265 |

|

| $ | 7,876,505 |

|

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Cash flows from operating activities: | | | | |

| Net income | | $ | 70,971 |

| | $ | 32,537 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 139,394 |

| | 172,458 |

|

| Gain on real estate assets, net | | (10,831 | ) | | (18,036 | ) |

| Impairments | | 11,988 |

| | 6,036 |

|

| Equity based compensation | | 2,872 |

| | 2,927 |

|

| Equity in income of unconsolidated entities | | (500 | ) | | (364 | ) |

| Distributions from unconsolidated entities | | — |

| | 936 |

|

| Loss (Gain) on investments | | 470 |

| | (5,638 | ) |

| Loss (Gain) on derivative instruments | | 34 |

| | (273 | ) |

| Non-cash restructuring expense | | 4,018 |

| | — |

|

| Changes in assets and liabilities: | | | | |

| Investment in direct financing leases | | 409 |

| | 538 |

|

| Rent and tenant receivables, operating lease right-of-use and other assets, net | | (7,160 | ) | | (23,344 | ) |

| Assets held for sale classified as discontinued operations | | — |

| | (2,490 | ) |

| Accounts payable and accrued expenses | | (2,415 | ) | | (7,653 | ) |

| Deferred rent, operating lease and other liabilities | | (15,216 | ) | | 6,158 |

|

| Due to affiliates | | — |

| | (66 | ) |

| Liabilities related to discontinued operations | | — |

| | (13,861 | ) |

| Net cash provided by operating activities | | 194,034 |

|

| 149,865 |

|

| Cash flows from investing activities: | | | | |

| Investments in real estate assets | | (81,065 | ) | | (139,882 | ) |

| Capital expenditures and leasing costs | | (7,498 | ) | | (4,993 | ) |

| Real estate developments | | (3,232 | ) | | (1,899 | ) |

| Principal repayments received on investment securities and mortgage notes receivable | | 62 |

| | 4,615 |

|

| Return of investment from unconsolidated entities | | — |

| | 386 |

|

| Proceeds from disposition of real estate and joint venture | | 60,496 |

| | 122,526 |

|

| Proceeds from disposition of discontinued operations | | — |

| | 123,925 |

|

| Investment in leasehold improvements and other assets | | (177 | ) | | (85 | ) |

| Deposits for real estate assets | | (900 | ) | | (4,000 | ) |

| Proceeds from sale of investments and other assets | | 8,199 |

| | 1,351 |

|

| Uses and refunds of deposits for real estate assets | | 1,240 |

| | 5,120 |

|

| Proceeds from the settlement of property-related insurance claims | | 32 |

| | 269 |

|

| Line of credit advances to Cole REITs | | — |

| | (2,200 | ) |

| Line of credit repayments from Cole REITs | | — |

| | 3,800 |

|

| Net cash (used in) provided by investing activities | | (22,843 | ) | | 108,933 |

|

| Cash flows from financing activities: | | | | |

| Proceeds from mortgage notes payable | | — |

| | 89 |

|

| Payments on mortgage notes payable and other debt, including debt extinguishment costs | | (2,426 | ) | | (2,676 | ) |

| Proceeds from credit facility | | 899,000 |

| | 380,000 |

|

| Payments on credit facility | | (207,000 | ) | | (445,000 | ) |

| Payments on corporate bonds, including extinguishment costs | | (750,000 | ) | | — |

|

| Payments of deferred financing costs | | (172 | ) | | — |

|

| Repurchases of Common Stock under the Share Repurchase Programs | | — |

| | (44,585 | ) |

| Repurchases of Common Stock to settle tax obligations | | (1,595 | ) | | (1,659 | ) |

| Proceeds from the issuance of common OP Units, net of underwriters’ discount | | 20,894 |

| | — |

|

| Contributions from non-controlling interest holders | | 64 |

| | — |

|

| Distributions paid | | (152,314 | ) | | (152,519 | ) |

| Net cash used in financing activities | | (193,549 | ) |

| (266,350 | ) |

| Net change in cash and cash equivalents and restricted cash | | (22,358 | ) | | (7,552 | ) |

| | | | | |

VEREIT OPERATING PARTNERSHIP, L.P.

CONSOLIDATED STATEMENTS OF CASH FLOWS – (Continued)

(In thousands)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Cash and cash equivalents and restricted cash, beginning of period | | $ | 53,663 |

| | $ | 64,036 |

|

| Less: cash and cash equivalents of discontinued operations | | — |

| | (2,198 | ) |

| Cash and cash equivalents and restricted cash from continuing operations, beginning of period | | 53,663 |

| | 61,838 |

|

| | | | | |

| Cash and cash equivalents and restricted cash from continuing operations, end of period | | $ | 31,305 |

| | $ | 56,484 |

|

| Reconciliation of Cash and Cash Equivalents and Restricted Cash | | | | |

| Cash and cash equivalents at beginning of period | | $ | 30,758 |

| | $ | 34,176 |

|

| Restricted cash at beginning of period | | 22,905 |

| | 27,662 |

|

| Cash and cash equivalents and restricted cash at beginning of period | | 53,663 |

| | 61,838 |

|

| | | | | |

| Cash and cash equivalents at end of period | | 12,788 |

| | 28,435 |

|

| Restricted cash at end of period | | 18,517 |

| | 28,049 |

|

| Cash and cash equivalents and restricted cash at end of period | | $ | 31,305 |

| | $ | 56,484 |

|

The accompanying notes are an integral part of these statements.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited)

Note 1 – Organization

VEREIT is a Maryland corporation, incorporated on December 2, 2010, that qualified as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning in the taxable year ended December 31, 2011. The OP is a Delaware limited partnership of which the General Partner is the sole general partner. VEREIT’s common stock, par value $0.01 per share (“Common Stock”), and its 6.70% Series F Cumulative Redeemable Preferred Stock, par value $0.01 per share (“Series F Preferred Stock”) trade on the New York Stock Exchange (“NYSE”) under the trading symbols, “VER” and “VER PF,” respectively. As used herein, the terms the “Company,” “we,” “our” and “us” refer to VEREIT, together with its consolidated subsidiaries, including the OP.

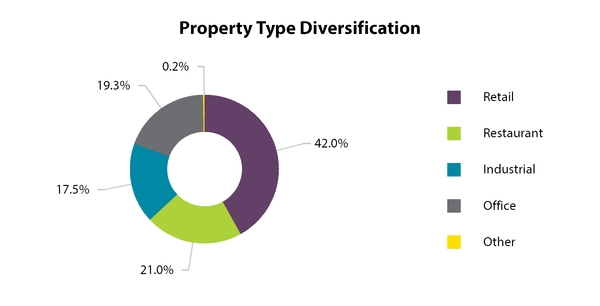

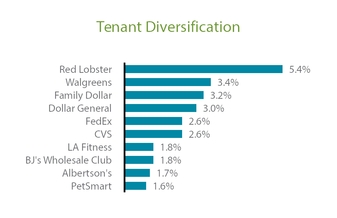

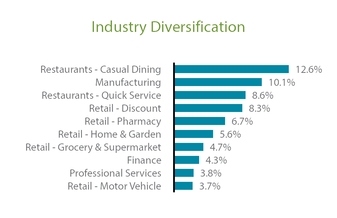

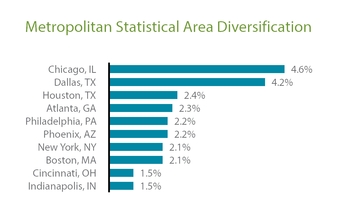

VEREIT is a full-service real estate operating company which owns and manages one of the largest portfolios of single-tenant commercial properties in the U.S. VEREIT’s business model provides equity capital to creditworthy corporations in return for long-term leases on their properties. The Company actively manages its portfolio considering a number of metrics including property type, concentration and key economic factors for appropriate balance and diversity.

Substantially all of the Company’s operations are conducted through the OP. VEREIT is the sole general partner and holder of 97.6% of the common equity interests in the OP as of March 31, 2019 with the remaining 2.4% of the common equity interests owned by unaffiliated investors and certain former directors, officers and employees of ARC Properties Advisors, LLC (the “Former Manager”). Under the limited partnership agreement of the OP, as amended (the “LPA”), after holding common units of limited partner interests in the OP (“OP Units”) or Series F Preferred Units of limited partnership interests in the OP (“Series F Preferred Units”), for a period of one year and meeting the other requirements in the LPA, unless we otherwise consent to an earlier redemption, holders have the right to redeem the units for the cash value of a corresponding number of shares of Common Stock or Series F Preferred Stock, as applicable, or, at our option, a corresponding number of shares of Common Stock or Series F Preferred Stock, as applicable, subject to adjustment pursuant to the terms of the LPA. The remaining rights of the holders of OP Units are limited, however, and do not include the ability to replace the General Partner or to approve the sale, purchase or refinancing of the OP’s assets.

The actions of the OP and its relationship with the General Partner are governed by the LPA. The General Partner does not have any significant assets other than its investment in the OP. Therefore, the assets and liabilities of the General Partner and the OP are the same. Additionally, pursuant to the LPA, all administrative expenses and expenses associated with the formation, continuity, existence and operation of the General Partner incurred by the General Partner on the OP’s behalf shall be treated as expenses of the OP. Further, when the General Partner issues any equity instrument that has been approved by the General Partner’s Board of Directors, the LPA requires the OP to issue to the General Partner equity instruments with substantially similar terms, to protect the integrity of the Company’s umbrella partnership REIT structure, pursuant to which each holder of interests in the OP has a proportionate economic interest in the OP reflecting its capital contributions thereto. OP Units and Series F Preferred Units issued to the General Partner are referred to as “General Partner OP Units” and “General Partner Series F Preferred Units,” respectively. OP Units and Series F Preferred Units issued to parties other than the General Partner are referred to as “Limited Partner OP Units” and “Limited Partner Series F Preferred Units,” respectively. The LPA also provides that the OP issue debt with terms and provisions consistent with debt issued by the General Partner. The LPA will be amended to provide for the issuance of any additional class of equivalent equity instruments to the extent the General Partner’s Board of Directors authorizes the issuance of any new class of equity securities.

Note 2 – Summary of Significant Accounting Policies

Basis of Accounting

The consolidated financial statements of the Company presented herein include the accounts of the General Partner and its consolidated subsidiaries, including the OP. All intercompany transactions have been eliminated upon consolidation. The financial statements are prepared on the accrual basis of accounting in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The information furnished includes all adjustments and accruals of a normal recurring nature, which, in the opinion of management, are necessary for a fair presentation of results for the interim periods. The results of operations for the three months ended March 31, 2019 are not necessarily indicative of the results for the entire year or any subsequent interim period.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto as of and for the year ended December 31, 2018 of the Company, which are included in the Company’s Annual Report on Form 10-K filed on February 21, 2019. There have been no significant changes to the Company’s significant accounting policies during the three months ended March 31, 2019, except any policies impacted by the adoption of the Leasing ASUs, as defined in the “Recent Accounting Pronouncements” section herein. Information and footnote disclosures normally included in financial statements have been condensed or omitted pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and U.S. GAAP.

Principles of Consolidation and Basis of Presentation

The consolidated financial statements include the accounts of the Company and its consolidated subsidiaries and a consolidated joint venture. The portion of the consolidated joint venture not owned by the Company is presented as non-controlling interest in VEREIT’s and the OP’s consolidated balance sheets, statements of operations, statements of comprehensive income (loss) and statements of changes in equity. In addition, as described in Note 1 – Organization, certain third parties have been issued OP Units. Holders of OP Units are considered to be non-controlling interest holders in the OP and their ownership interest in the limited partner’s share is presented as non-controlling interests in VEREIT’s consolidated balance sheets, statements of operations, statements of comprehensive income (loss) and statements of changes in equity. Further, a portion of the earnings and losses of the OP are allocated to non-controlling interest holders based on their respective ownership percentages. Upon conversion of OP Units to Common Stock, any difference between the fair value of shares of Common Stock issued and the carrying value of the OP Units converted is recorded as a component of equity. As of each of March 31, 2019 and December 31, 2018, there were approximately 23.7 million Limited Partner OP Units outstanding.

For legal entities being evaluated for consolidation, the Company must first determine whether the interests that it holds and fees it receives qualify as variable interests in the entity. A variable interest is an investment or other interest that will absorb portions of an entity’s expected losses or receive portions of the entity’s expected residual returns. The Company’s evaluation includes consideration of fees paid to the Company where the Company acts as a decision maker or service provider to the entity being evaluated. If the Company determines that it holds a variable interest in an entity, it evaluates whether that entity is a variable interest entity (“VIE”). VIEs are entities where investors lack sufficient equity at risk for the entity to finance its activities without additional subordinated financial support or where equity investors, as a group, lack one of the following characteristics: (a) the power to direct the activities that most significantly impact the entity’s economic performance, (b) the obligation to absorb the expected losses of the entity, or (c) the right to receive the expected returns of the entity.

The Company then qualitatively assesses whether it is (or is not) the primary beneficiary of a VIE, which is generally defined as the party who has a controlling financial interest in the VIE. Consideration of various factors include, but are not limited to, the Company’s ability to direct the activities that most significantly impact the entity’s economic performance and its obligation to absorb losses from or right to receive benefits of the VIE that could potentially be significant to the VIE. The Company consolidates any VIEs when the Company is determined to be the primary beneficiary of the VIE and the difference between consolidating the VIE and accounting for it using the equity method could be material to the Company’s consolidated financial statements. The Company continually evaluates the need to consolidate these VIEs based on standards set forth in U.S. GAAP.

Reclassification

As described below, the following items previously reported have been reclassified to conform with the current period’s presentation.

The operating expense reimbursements line item has been combined into rental revenue for prior periods presented to be consistent with the current year presentation. The (loss) gain on derivative instruments, net line item has been combined into other (loss) income, net for prior periods presented to be consistent with the current year presentation.

The distributions declared on Common Stock line item from prior periods has been updated to exclude distributions on restricted stock units (“Restricted Stock Units”) and deferred stock units (“Deferred Stock Units”) on the consolidated statements of changes in equity for all periods presented. These amounts are now included in the line item dividend equivalents on awards granted under the Equity Plan, which also includes dividend equivalents on restricted share awards (“Restricted Shares”). The dividend equivalents on Restricted Shares were previously included in the line item distributions to participating securities in the consolidated statements of changes in equity.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

Revenue Recognition - Real Estate

The Company continually reviews receivables related to rent and unbilled rent receivables and determines collectability by taking into consideration the tenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates and economic conditions in the area in which the property is located. Upon adoption of Accounting Standards Codification (“ASC”) Topic 842, Leases (“ASC 842”), effective January 1, 2019, the Company recognizes all changes in the collectability assessment for an operating lease as an adjustment to rental income and does not record an allowance for uncollectible accounts.

Insurance Recoveries, Net of Litigation and Non-Routine Costs

The Company has incurred legal fees and other costs associated with litigations and investigations resulting from the Audit Committee Investigation (defined below), which are considered non-routine. The Company’s insurance carriers have paid certain defense costs subject to standard reservation of rights under the respective policies.

Insurance recoveries, net of litigation and non-routine costs include the following costs (amounts in thousands):

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Insurance recoveries, net of litigation and non-routine costs: | | | | |

Audit Committee Investigation and related matters (1) | | $ | 14,691 |

| | $ | 21,728 |

|

Legal fees and expenses (2) | | 2 |

| | 12 |

|

Litigation settlements (3) | | 12,235 |

| | — |

|

| Total costs | | 26,928 |

|

| 21,740 |

|

Insurance recoveries (3) | | (48,420 | ) | | — |

|

| Total | | $ | (21,492 | ) | | $ | 21,740 |

|

| |

| (1) | Includes all fees and costs associated with various litigations and investigations prompted by the results of the 2014 investigation conducted by the audit committee (the “Audit Committee”) of the Company’s Board of Directors (the “Audit Committee Investigation”), including fees and costs incurred pursuant to the Company’s advancement obligations, litigation related thereto and in connection with related insurance recovery matters, net of accrual reversals. |

| |

| (2) | Includes legal fees and expenses associated with litigation resulting from prior mergers and excludes amounts presented in income from discontinued operations, net of income taxes in the consolidated statements of operations for the three months ended March 31, 2018. |

| |

| (3) | Refer to Note 10 – Commitments and Contingencies for additional information. |

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

Equity-based Compensation

The Company has an equity-based incentive award plan (the “Equity Plan”) for non-executive directors, officers, other employees and advisors or consultants who provide services to the Company, as applicable, and a non-executive director restricted share plan, which are accounted for under U.S. GAAP for share-based payments. The expense for such awards is recognized over the vesting period or when the requirements for exercise of the award have been met. As of March 31, 2019, the General Partner had cumulatively awarded under its Equity Plan approximately 16.6 million shares of Common Stock, which was comprised of 4.0 million Restricted Shares, net of the forfeiture of 3.7 million Restricted Shares through that date, 6.6 million Restricted Stock Units, net of the forfeiture/cancellation of 1.8 million Restricted Stock Units through that date, 0.5 million Deferred Stock Units, and 5.5 million stock options, net of forfeiture/cancellation of 0.1 million stock options through that date. Accordingly, as of such date, approximately 82.9 million additional shares were available for future issuance. At March 31, 2019, a total of 45,000 shares were awarded under the non-executive director restricted share plan out of the 99,000 shares reserved for issuance.

The following is a summary of equity-based compensation expense for the three months ended March 31, 2019 and 2018 (in thousands):

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Restricted Shares | | $ | 77 |

| | $ | 160 |

|

Time-Based Restricted Stock Units (1) | | 1,249 |

| | 1,426 |

|

| Long-Term Incentive-Based Restricted Stock Units | | 1,229 |

| | 1,211 |

|

| Deferred Stock Units | | 72 |

| | 59 |

|

| Stock Options | | 245 |

| | 76 |

|

| Total | | $ | 2,872 |

| | $ | 2,932 |

|

___________________________________

| |

| (1) | Includes stock compensation expense attributable to awards for which the requisite service period begins prior to the assumed future grant date. |

As of March 31, 2019, total unrecognized compensation expense related to these awards was approximately $23.3 million, with an aggregate weighted-average remaining term of 2.3 years.

Restructuring

On February 1, 2018, the Company completed the sale of its investment management segment and entered into a services agreement (the “Services Agreement”) with the purchaser, pursuant to which the Company continued to provide certain investment management and other services through March 31, 2019. See Note 13 — Discontinued Operations for further discussion. During the three months ended March 31, 2019, in connection with the cessation of services under the Services Agreement, the Company recorded $9.1 million of restructuring expenses related to the reorganization of its business, of which $8.3 million related to office lease terminations and modifications and $1.1 million related to the cessation of services under the Services Agreement, including severance, net of ASC 842 operating lease adjustments of $0.3 million. No restructuring expenses were recorded prior to January 1, 2019. The Company expects to incur an additional $1.8 million of restructuring expenses.

Recent Accounting Pronouncements

Adopted Accounting Standards

The Company adopted ASC 842, effective January 1, 2019. The adoption did not have a material impact on the Company’s consolidated statements of operations. The most significant impact was the recognition of operating lease right-of-use (“ROU”) assets and operating lease liabilities for operating leases pursuant to which the Company is the lessee. The Company’s impairment assessment for ROU assets will be consistent with the impairment analysis for the Company's other long-lived assets and is reviewed quarterly, which is discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018. The lessor accounting model under ASC 842 is similar to existing guidance, however, it limits the capitalization of initial direct leasing costs, such as internally generated costs.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

The Company elected all practical expedients permitted under ASC 842, other than the hindsight practical expedient. Accordingly, the Company will retain distinction between a finance lease (i.e., capital leases under existing guidance) and an operating lease and account for its existing operating leases as operating leases under the new guidance, without reassessing (a) whether the contracts contain a lease under ASC 842, (b) whether classification of the operating leases would be different in accordance with ASC 842, or (c) whether the unamortized initial direct costs before transition adjustments would have met the definition of initial direct costs in ASC 842 at lease commencement. The Company does not have a cumulative effect adjustment to retained earnings upon adoption.

The Company, as lessor, identified three separate lease components as follows: 1) land lease component, 2) single property lease component comprised of building, land improvements and tenant improvements, and 3) furniture and fixtures. The nonlease components relate to service obligations under certain lease contracts for service of the building, land improvements or tenant improvements. The Company determined the nonlease components are eligible to be combined under the practical expedient in ASU 2018-11, Leases (Topic 842) (“ASU 2018-11,” combined with ASC 842, “Leasing ASUs”) and the nonlease components will be included with the single property lease component as the predominant component. Therefore, the Company will account for the combined component as a lease component under ASC 842. Refer to Note 11 - Leases for the related disclosures.

Accounting Standards Not Yet Adopted

In June 2016, the U.S. Financial Accounting Standards Board (“FASB”) issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326) (“ASU 2016-13”). ASU 2016-13 is intended to improve financial reporting by requiring more timely recognition of credit losses on loans and other financial instruments that are not accounted for at fair value through net income, including loans held for investment, held-to-maturity debt securities, trade and other receivables, net investment in leases and other such commitments. ASU 2016-13 requires that financial assets measured at amortized cost be presented at the net amount expected to be collected, through an allowance for credit losses that is deducted from the amortized cost basis. The amendments in ASU 2016-13 require the Company to measure all expected credit losses based upon historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the financial assets and eliminates the “incurred loss” methodology under current U.S. GAAP. In November 2018, the FASB issued ASU No. 2018-19, Codification Improvements to Topic 326, Financial Instruments—Credit Losses (“ASU 2018-19”). ASU 2018-19 clarifies that receivables from operating leases are accounted for using the lease guidance and not as financial instruments. ASU 2016-13 and ASU 2018-19 are effective for fiscal years (including the interim periods therein) beginning after December 15, 2019. Early adoption is permitted for fiscal years, and interim periods within, beginning after December 15, 2018. The Company is currently evaluating the impact these amendments will have on its consolidated financial statements.

Note 3– Real Estate Investments and Related Intangibles

Property Acquisitions

During the three months ended March 31, 2019, the Company acquired controlling financial interests in eight commercial properties for an aggregate purchase price of $81.1 million (the “2019 Acquisitions”), which includes $0.3 million of external acquisition-related expenses that were capitalized. During the three months ended March 31, 2018, the Company acquired a controlling interest in 12 commercial properties for an aggregate purchase price of $139.9 million (the “2018 Acquisitions”), which includes $0.7 million of external acquisition-related expenses that were capitalized.

The following table presents the allocation of the fair values of the assets acquired and liabilities assumed during the periods presented (in thousands):

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2019 | | 2018 |

| Real estate investments, at cost: | | | | |

| Land | | $ | 17,716 |

| | $ | 27,049 |

|

| Buildings, fixtures and improvements | | 53,923 |

| | 96,044 |

|

| Total tangible assets | | 71,639 |

| | 123,093 |

|

| Acquired intangible assets: | | | | |

In-place leases and other intangibles (1) | | 9,445 |

| | 14,037 |

|

Above-market leases (2) | | — |

| | 2,752 |

|

| Total purchase price of assets acquired | | $ | 81,084 |

| | $ | 139,882 |

|

____________________________________

| |

| (1) | The weighted average amortization period for acquired in-place leases and other intangibles is 12.5 years and 14.9 years for 2019 Acquisitions and 2018 Acquisitions, respectively. |

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

| |

| (2) | The weighted average amortization period for acquired above-market leases is 10.8 years for 2018 Acquisitions. |

As of March 31, 2019, the Company invested $8.0 million, including $0.5 million of external acquisition-related expenses and interest that were capitalized, in one build-to-suit development project. The Company’s estimated remaining committed investment is $20.3 million, and the project is expected to be completed within the next 12 months.

Property Dispositions and Real Estate Assets Held for Sale

During the three months ended March 31, 2019, the Company disposed of 22 properties, for an aggregate gross sales price of $66.0 million, of which our share was $62.1 million after the profit participation payments related to the disposition of six Red Lobster properties. The dispositions resulted in proceeds of $60.5 million after closing costs. The Company recorded a gain of $10.8 million related to the dispositions which is included in gain on disposition of real estate and real estate assets held for sale, net in the accompanying consolidated statements of operations.

During the three months ended March 31, 2018, the Company disposed of 40 properties, for an aggregate gross sales price of $120.8 million, of which our share was $119.2 million after the profit participation payment related to the disposition of three Red Lobster properties. The dispositions resulted in proceeds of $116.9 million after closing costs. The Company recorded a gain of $18.2 million related to the sales which is included in gain on disposition of real estate and real estate assets held for sale, net in the accompanying consolidated statements of operations.

During the three months ended March 31, 2018, the Company also disposed of one property owned by an unconsolidated joint venture for a gross sales price of $34.1 million, of which our share was $17.1 million based on our ownership interest in the joint venture, resulting in proceeds of $5.6 million after debt repayments of $20.4 million and closing costs. The Company recorded a gain of $0.7 million related to the sale and liquidation of the joint venture, which is included in equity in income and gain on disposition of unconsolidated entities in the accompanying consolidated statements of operations.

As of March 31, 2019, there were 12 properties classified as held for sale with a carrying value of $36.0 million, included in real estate assets held for sale, net in the accompanying consolidated balance sheets, which are expected to be sold in the next 12 months as part of the Company’s portfolio management strategy. As of December 31, 2018, there were five properties classified as held for sale. During the three months ended March 31, 2019, the Company recorded a loss of less than $0.1 million related to held for sale properties. During the three months ended March 31, 2018, the Company recorded a loss of $0.9 million related to held for sale properties.

Intangible Lease Assets and Liabilities

Intangible lease assets and liabilities of the Company consisted of the following as of March 31, 2019 and December 31, 2018 (amounts in thousands, except weighted-average useful life):

|

| | | | | | | | | | |

| | | Weighted-Average Useful Life | | March 31, 2019 | | December 31, 2018 |

| Intangible lease assets: | | | | | | |

| In-place leases and other intangibles, net of accumulated amortization of $730,221 and $703,909, respectively | | 15.5 | | $ | 948,973 |

| | $ | 980,971 |

|

| Leasing commissions, net of accumulated amortization of $4,566 and $4,048, respectively | | 10.4 | | 16,318 |

| | 15,660 |

|

| Above-market lease assets and deferred lease incentives, net of accumulated amortization of $110,100 and $105,936, respectively | | 16.4 | | 193,647 |

| | 201,875 |

|

| Total intangible lease assets, net | | | | $ | 1,158,938 |

| | $ | 1,198,506 |

|

| | | | | | | |

| Intangible lease liabilities: | | | | | | |

| Below-market leases, net of accumulated amortization of $93,268 and $89,905, respectively | | 18.9 | | $ | 166,708 |

| | $ | 173,479 |

|

The aggregate amount of above‑ and below-market leases and deferred lease incentives amortized and included as a net decrease to rental revenue was $0.7 million and $1.5 million for the three months ended March 31, 2019 and 2018, respectively. The aggregate amount of in-place leases, leasing commissions and other lease intangibles amortized and included in depreciation and amortization expense was $33.8 million and $34.6 million for the three months ended March 31, 2019 and 2018, respectively.

VEREIT, INC. and VEREIT OPERATING PARTNERSHIP, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2019 (Unaudited) – (Continued)

The following table provides the projected amortization expense and adjustments to rental revenue related to the intangible lease assets and liabilities for the next five years as of March 31, 2019 (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | |

| | | Remainder of 2019 | | 2020 | | 2021 | | 2022 | | 2023 |

| In-place leases and other intangibles: | | | | | | | | | | |

| Total projected to be included in amortization expense | | $ | 94,897 |

| | $ | 119,518 |

| | $ | 111,755 |

| | $ | 97,582 |

| | $ | 86,748 |

|

| Leasing commissions: | | | | | | | | | | |

| Total projected to be included in amortization expense | | 1,607 |

| | 2,018 |

| | 1,857 |

| | 1,780 |

| | 1,584 |

|

| Above-market lease assets and deferred lease incentives: | | | | | | | | |

| Total projected to be deducted from rental revenue | | 15,595 |

| | 20,359 |

| | 19,929 |

| | 19,116 |

| | 18,168 |

|

| Below-market lease liabilities: | | | | | | | | | | |

| Total projected to be included in rental revenue | | 14,559 |

| | 16,674 |

| | 15,532 |

| | 14,690 |

| | 13,806 |

|

Consolidated Joint Ventures

The Company had an interest in one consolidated joint venture that owned one property as of March 31, 2019 and December 31, 2018. As of March 31, 2019 and December 31, 2018, the consolidated joint venture had total assets of $32.9 million and $32.5 million, respectively, of which $29.9 million were real estate investments, net of accumulated depreciation and amortization at each of the respective dates. The property is secured by a mortgage note payable, which is non-recourse to the Company and had a balance of $13.9 million and $14.0 million, as of March 31, 2019 and December 31, 2018, respectively. The Company has the ability to control operating and financing policies of the consolidated joint venture. There are restrictions on the use of these assets as the Company would generally be required to obtain the approval of the joint venture partner in accordance with the joint venture agreement for any major transactions. The Company and the joint venture partner are subject to the provisions of the joint venture agreement, which includes provisions for when additional contributions may be required to fund certain cash shortfalls.

Unconsolidated Joint Ventures