Exhibit 99.3 Investor Review Q2 2020

About the Data INVESTOR REVIEW This data and other information described herein are as of and for the three months ended June€30, 2020 and based on Annualized Rental Income ("ARI"), unless otherwise indicated. Future performance may not be consistent with past performance and is subject to change and inherent risks and uncertainties. This information should be read in conjunction with the financial statements and the Management's Discussion and Analysis of Financial Condition and Results of Operations sections contained in VEREIT, Inc.'s (the "Company," "VEREIT," "us," "our" and "we") Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the three months ended June€30, 2020, filed with the Securities and Exchange Commission ("SEC"). Rent€collection€percentages€disclosed€are€based€on€contractual€rent€and€recoveries€paid€by€tenants€to cover estimated tax, insurance and common area maintenance expenses, including the Company's pro rata share of such amounts related to properties€owned€by€unconsolidated€joint€ventures. Percentages are calculated using a denominator that reflects pre-COVID-19 rents that has not been adjusted for any rent relief granted. Amounts exclude any tenants in€bankruptcy. In the second quarter of 2020, the Company updated its definition of Normalized EBITDA to include the impact of straight-line rent, in order to be consistent with peer companies. The Company recast the data presented for prior periods, including ratios impacted by the change. For definitions and reconciliations of the Company's non-GAAP measures and operating metrics, please view the Definitions & Reconciliations section of this presentation. Tenants, Trademarks and Logos VEREIT is not affiliated with, is not endorsed by, does not endorse and is not sponsored by or a sponsor of the products or services pictured or mentioned. The names, logos and all related product and service names, design marks and slogans are the trademarks or service marks of their respective companies. 2 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Forward-Looking Statements INVESTOR REVIEW Information set forth herein contains ‚forward-looking statements" which reflect the Companyƒs expectations and projections regarding future events and plans, the Companyƒs future financial condition, results of operations, liquidity and business, including acquisitions, rent receipts, rent relief requests and rent relief granted, debt levels, maturities and refinancings, liquidity, the payment of future dividends and the impact of COVID-19 on the Companyƒs business. Generally, the words ‚anticipates,„ ‚assumes,„ ‚believes,„ ‚continues,„ ‚could,„ ‚estimates,„ ‚expects,„ ‚goals,„ ‚intends,„ ‚may,„ ‚plans,„ ‚projects,„ ‚seeks,„ ‚should,„ ‚targets,„ ‚will,„ variations of such words and similar expressions identify forward-looking statements. These forward-looking statements are based on information currently available and involve a number of known and unknown assumptions and risks, uncertainties and other factors, which are difficult to predict and beyond the Companyƒs control, that could cause actual events and plans or could cause the Companyƒs business, financial condition, liquidity and results of operations to differ materially from those expressed or implied in the forward-looking statements. Further, information provided regarding historical rent collections should not serve as an indication of future rent collections. The following factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: the duration and extent of the impact of COVID-19 on our business and the businesses of our tenants (including their ability to timely make rent payments) and the economy generally; federal, state or local legislation or regulation that could impact the timely payment of rent by tenants in light of COVID-19; the Companyƒs ability to renew leases, lease vacant space or re-lease space as leases expire on favorable terms or at all; risks associated with tenant, geographic and industry concentrations with respect to the Companyƒs properties; risks accompanying the management of its industrial partnership and office partnership; the impact of impairment charges in respect of certain of the Companyƒs properties; unexpected costs or liabilities that may arise from potential dispositions, including related to limited partnership, tenant-in-common and Delaware statutory trust real estate programs and the Companyƒs management with respect to such programs; competition in the acquisition and disposition of properties and in the leasing of its properties including that the Company may be unable to acquire, dispose of, or lease properties on advantageous terms or at all; risks associated with bankruptcies or insolvencies of tenants, from tenant defaults generally or from the unpredictability of the business plans and financial condition of the Companyƒs tenants, which are heightened as a result of the COVID-19 pandemic; risks associated with the Companyƒs substantial indebtedness, including that such indebtedness may affect the Companyƒs ability to pay dividends and that the terms and restrictions within the agreements governing the Companyƒs indebtedness may restrict its borrowing and operating flexibility; the ability to retain or hire key personnel; and continuation or deterioration of current market conditions. Additional factors that may affect future results are contained in the Companyƒs filings with the SEC, which are available at the SECƒs website at www.sec.gov. The Company disclaims any obligation to publicly update or revise any forward-looking statements, whether as a result of changes in underlying assumptions or factors, new information, future events or otherwise, except as required by law. 3 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Contents INVESTOR REVIEW Company Overview 5 COVID-19 Impacts 11 Portfolio Metrics & Analysis 19 Key Financial Highlights 28 Quarter Highlights 31 Contact Information 33 Definitions & Reconciliations 34 4 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Company Overview Q2 2020 a …#†

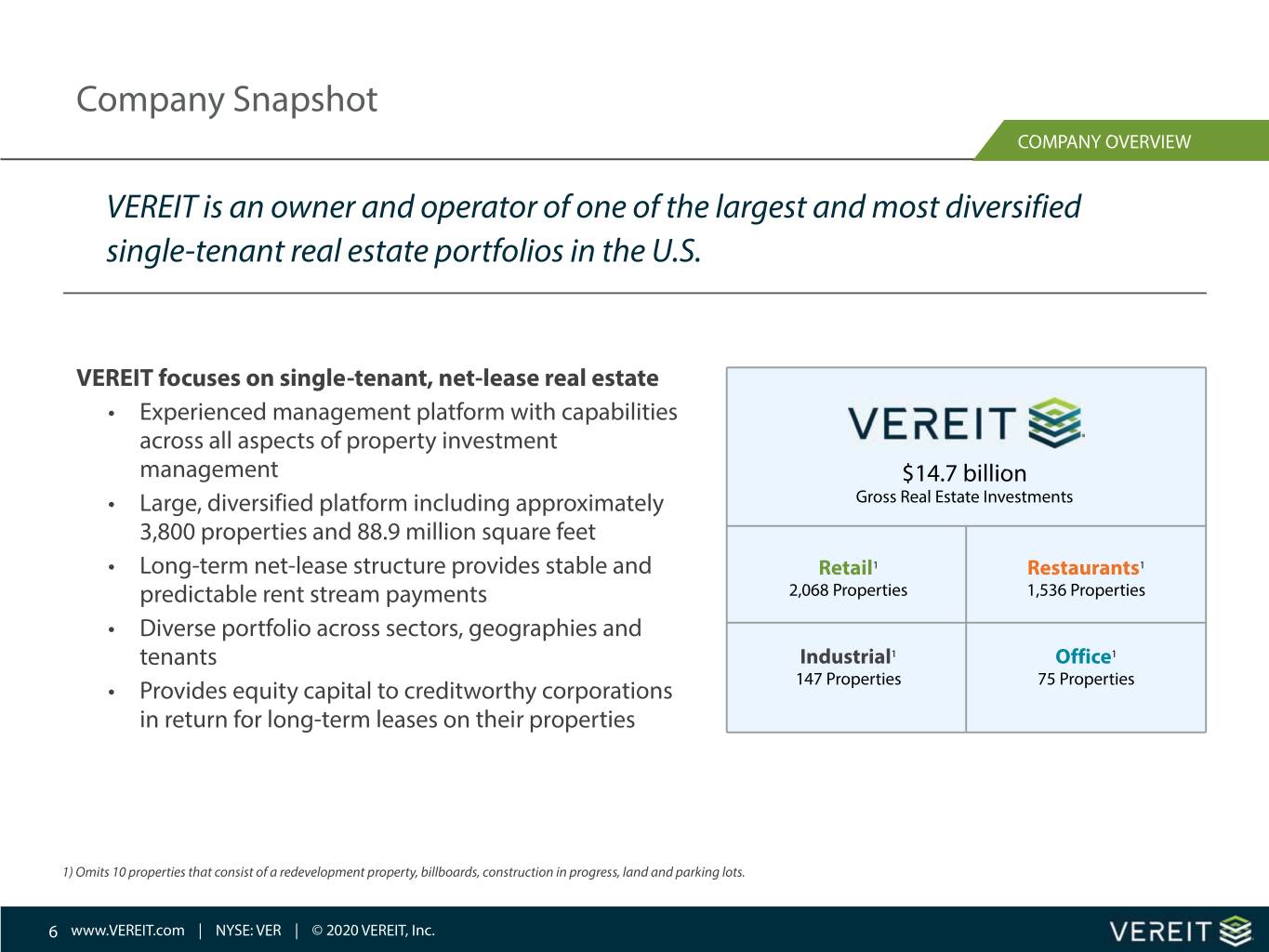

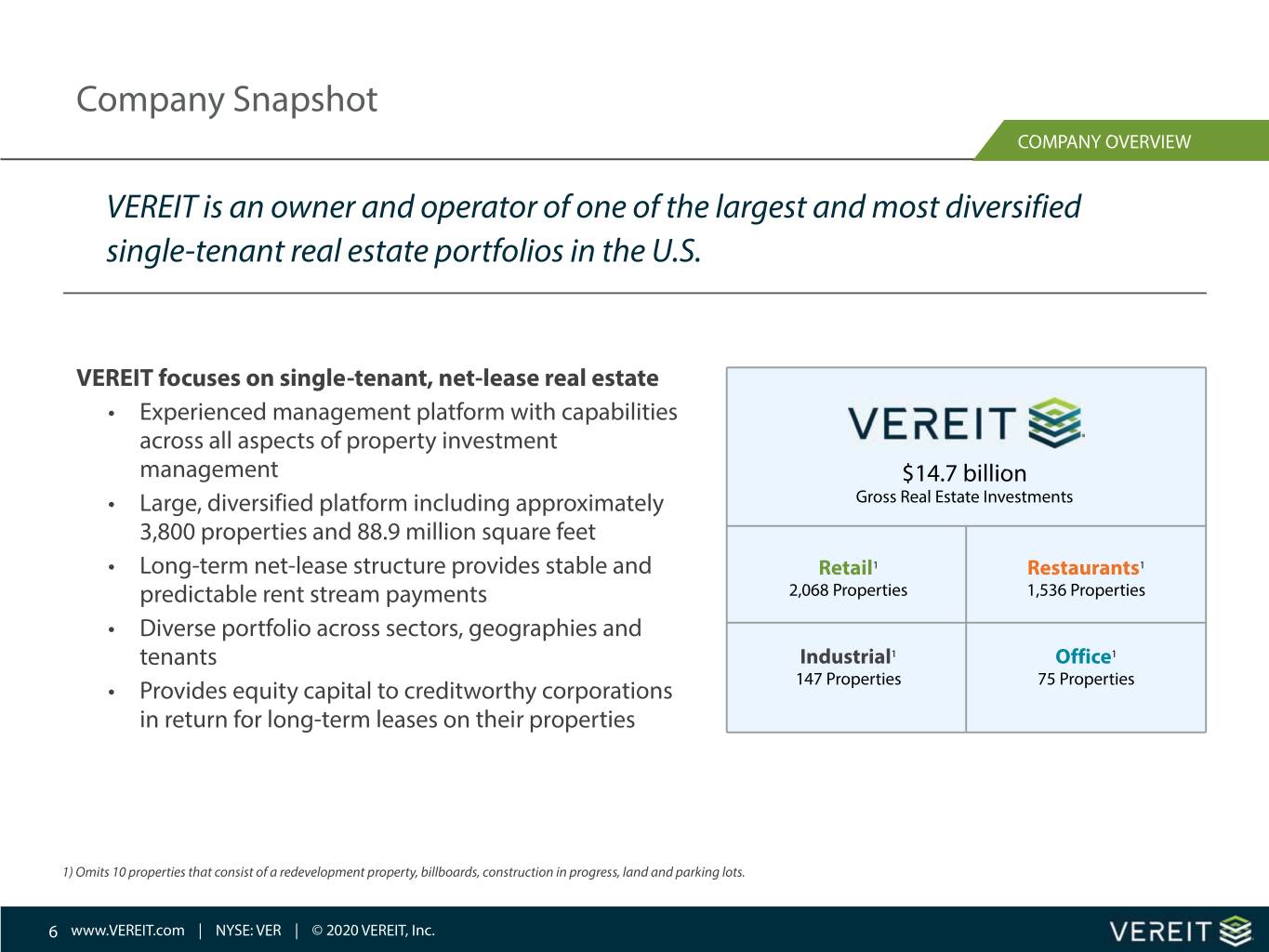

Company Snapshot COMPANY OVERVIEW VEREIT is an owner and operator of one of the largest and most diversified single-tenant real estate portfolios in the U.S. VEREIT focuses on single-tenant, net-lease real estate ‡ Experienced management platform with capabilities across all aspects of property investment management $14.7 billion ‡ Large, diversified platform including approximately Gross Real Estate Investments 3,800 properties and 88.9 million square feet ‡ Long-term net-lease structure provides stable and Retail1 Restaurants1 predictable rent stream payments 2,068 Properties 1,536 Properties ‡ Diverse portfolio across sectors, geographies and tenants Industrial1 Office1 ‡ Provides equity capital to creditworthy corporations 147 Properties 75 Properties in return for long-term leases on their properties 1) Omits 10 properties that consist of a redevelopment property, billboards, construction in progress, land and parking lots. 6 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

VEREIT Is a Full-Service Real Estate Operating Company COMPANY OVERVIEW VEREIT's in-house team of acquisition and disposition experts allow the Company to have full knowledge of the transaction market. ‡ Since 2015, VEREIT has sold approximately $5.0 billion in properties and mortgage related investments at net gains and acquired approximately $2.0 billion in assets, with another $2.8 billion acquired for Cole through Q1 2019. ‡ Since 2015, VEREIT has completed 24.9 million square feet of leasing activity. ‡ VEREIT's leasing team continues to maintain occupancy with a focus on early renewals. ‡ In 2019, VEREIT completed 3.7 million square feet of leasing activity, of which 978,000 square feet were early renewals. ‡ YTD Q2 2020, VEREIT has completed 4.1 million square feet of leasing activity, of which 2.2 million square feet were early renewals. 7 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Experienced and Proven Management Team Along With Sound Corporate Governance COMPANY OVERVIEW Glenn J. Rufrano Paul McDowell Chief Executive Officer ‡ Since assuming role of CEO on April 1, 2015, has reconstituted Board of Executive Vice President and Chief Operating Officer Directors, formalized new management team and implemented business plan ‡ Responsible for VEREITƒs asset management, property management, to guide the Companyƒs strategy construction management, portfolio management, underwriting, ‡ Prior to VEREIT, was CEO of OƒConnor Capital Partners, a real estate investment credit analysis and leasing firm he co-founded in 1983 ‡ Also serves on VEREIT investment committee, which reviews each ‡ From 2010 to 2013 was Global President and CEO of Cushman & Wakefield, Inc. asset to ensure alignment with the Companyƒs objectives ‡ Previously held executive leadership roles at Centro Properties Group and New ‡ Previously was founder of CapLease, a formerly publicly traded net- Plan Excel Realty Trust, Inc. lease REIT, where he served as CEO from 2001-2014 and Chairman from 2007-2014 ‡ Previously served on the Boards of General Growth Properties, Trizec Properties, Inc., Columbia Property Trust, Inc. and Ventas, Inc. Michael J. Bartolotta Thomas W. Roberts Executive Vice President and Chief Financial Officer Executive Vice President and Chief Investment Officer ‡ Oversees VEREITƒs real estate transaction activities for institutional ‡ Oversees the accounting, external reporting, financial planning & analysis, partnerships, single-tenant retail, office and industrial properties treasury and IT functions at VEREIT including acquisitions, sale-leaseback transactions, build-to-suits ‡ Prior to joining VEREIT, served as EVP and CFO of Cushman & Wakefield, Inc. and dispositions from 2012 to 2015 ‡ Previously served as President and CEO of Opus West Corporation ‡ Prior to Cushman, was CFO for EXOR, Inc., a leading European investment from 1993 to 2009, where he was responsible for design, company from 1991 to 2012, where he was involved in over 15 U.S. construction and development of more than 50 million square feet acquisitions and divestitures ranging in size from $20mm to $700+mm of commercial real estate ‡ Served on Board of Directors of Cushman & Wakefield, Inc. ‡ Served as VP, Real Estate Development for Koll Company prior to Opus West Lauren Goldberg Corporate Governance Executive Vice President, General Counsel and Secretary VEREIT remains committed to sound corporate governance policies. ‡ Oversees the Companyƒs legal and regulatory affairs, compliance and risk ‡ Opted-out of Maryland anti-takeover statutes management ‡ Majority voting for uncontested director elections ‡ Prior to joining VEREIT, served as EVP, General Counsel and the Chief Compliance Officer for Revlon, the global cosmetics company, where she was ‡ Stockholder rights plan limits responsible for legal and regulatory affairs, served on senior operating ‡ Proxy access committee and oversaw corporate governance ‡ Clawback policy for the potential recoupment of officer compensation ‡ Previously served as SVP - Law for MacAndrews & Forbes, Inc., Assistant United States Attorney for the Southern District of New York, and as an associate with Stillman & Friedman P.C. and Fried, Frank, Harris, Shriver & Jacobson LLP ‡ Law degree from Columbia Law School and undergraduate degree from the Wharton School, University of Pennsylvania 8 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

VEREIT's Corporate Responsibility Standards COMPANY OVERVIEW The Company has a strong commitment to serve our tenants, stakeholders, and employees through our business approach which is disciplined, transparent, and consistent. This model Industry Impact permeates into every part of our business, including company culture, environmental VEREIT contributes to steering initiatives and our community involvement. Below are highlights of our commitment: the REIT industry on ESG issues Environmental through participation in Nareitƒs Real Estate Sustainability Corporate Headquarters - LEED green building certification at the Companyƒs corporate headquarters certifies that the building is highly Council. efficient and a cost-saving green building. Commitment to Sustainable Trip Reduction Program - We participate in the Phoenix Valley Metroƒs Transportation Clean Air Campaign Trip Reduction Program to encourage alternative modes of transportation for employees. In 2019, VEREIT received the€Outstanding Travel Reduction Award from the Phoenix Tenant Environmental Practices - Tenants play a primary role in the Department of Transportation. environmental practices of the properties included in the Companyƒs portfolio. The organizationƒs Property Management team engages with top tenants to participate in programs such as LEED certification, GHG Employee Satisfaction reporting, carbon intensity testing, water efficiency and FSC certification to maintain environmental standards. In part because of programs like vibe, Social the Companyƒs wellness initiative, VEREIT has received multiple corporate Diverse Hiring Practices - The Company has a commitment to equal employment opportunities and does not discriminate against any culture awards. person based on race, color, religion, sex, national origin, age, disability, sexual orientation, gender identification or expression, genetic information or any other basis made unlawful by federal, state or local Dedicated to Diversity law, ordinance or regulation. VEREIT has been designated as a ‚winning„ Community Involvement - Since 2015, our employees have company by the 2020 Women on Boards contributed more than 1,200 service hours to local nonprofit organizations and have made substantial financial contributions. organization for having more than 20% of women on its Board of Directors. Industry Growth - We participate in local university partnerships and manage an internship program to support the development of future real estate professionals. Community Engagement Governance The VEREIT Values program was created to connect employees with charitable Commitment to Sound Corporate Governance Policies - The Company remains committed to sound corporate governance policies organizations in the community. and has, among other things, opted-out of Marylandƒs anti-takeover statutes, adopted majority voting for uncontested director elections, adopted proxy access and stockholder rights plan limits and requires that all directors are elected annually. 9 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

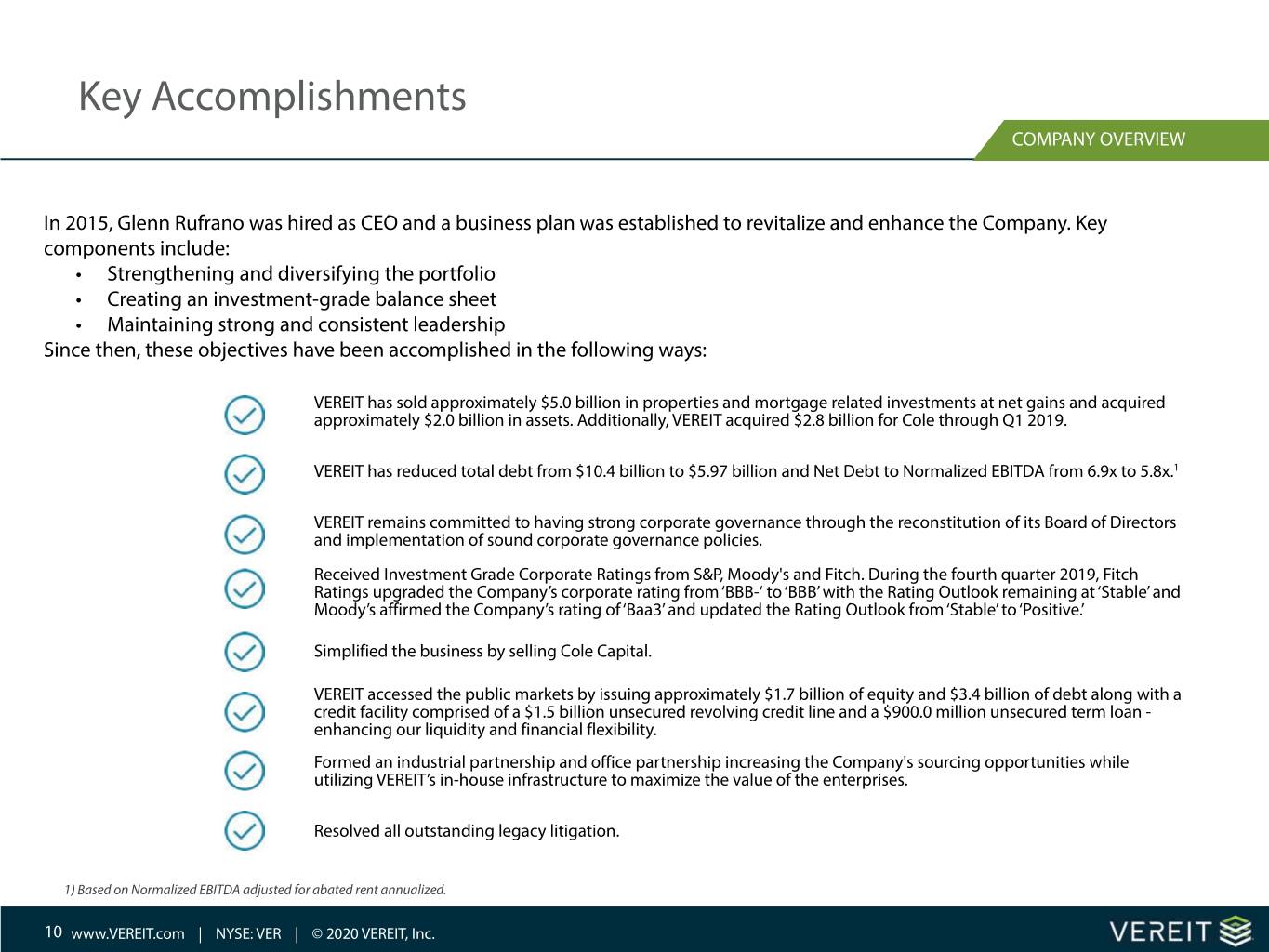

Key Accomplishments COMPANY OVERVIEW In 2015, Glenn Rufrano was hired as CEO and a business plan was established to revitalize and enhance the Company. Key components include: ‡ Strengthening and diversifying the portfolio ‡ Creating an investment-grade balance sheet ‡ Maintaining strong and consistent leadership Since then, these objectives have been accomplished in the following ways: VEREIT has sold approximately $5.0 billion in properties and mortgage related investments at net gains and acquired approximately $2.0 billion in assets. Additionally, VEREIT acquired $2.8 billion for Cole through Q1 2019. VEREIT has reduced total debt from $10.4 billion to $5.97 billion and Net Debt to Normalized EBITDA from 6.9x to 5.8x.1 VEREIT remains committed to having strong corporate governance through the reconstitution of its Board of Directors and implementation of sound corporate governance policies. Received Investment Grade Corporate Ratings from S&P, Moody's and Fitch. During the fourth quarter 2019, Fitch Ratings upgraded the Companyƒs corporate rating from ˆBBB-ˆ to ˆBBBƒ with the Rating Outlook remaining at ˆStableƒ and Moodyƒs affirmed the Companyƒs rating of ˆBaa3ƒ and updated the Rating Outlook from ˆStableƒ to ˆPositive.ƒ Simplified the business by selling Cole Capital. VEREIT accessed the public markets by issuing approximately $1.7 billion of equity and $3.4 billion of debt along with a credit facility comprised of a $1.5 billion unsecured revolving credit line and a $900.0 million unsecured term loan - enhancing our liquidity and financial flexibility. Formed an industrial partnership and office partnership increasing the Company's sourcing opportunities while utilizing VEREITƒs in-house infrastructure to maximize the value of the enterprises. Resolved all outstanding legacy litigation. 1) Based on Normalized EBITDA adjusted for abated rent annualized. 10 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

COVID-19 Impacts a …#†

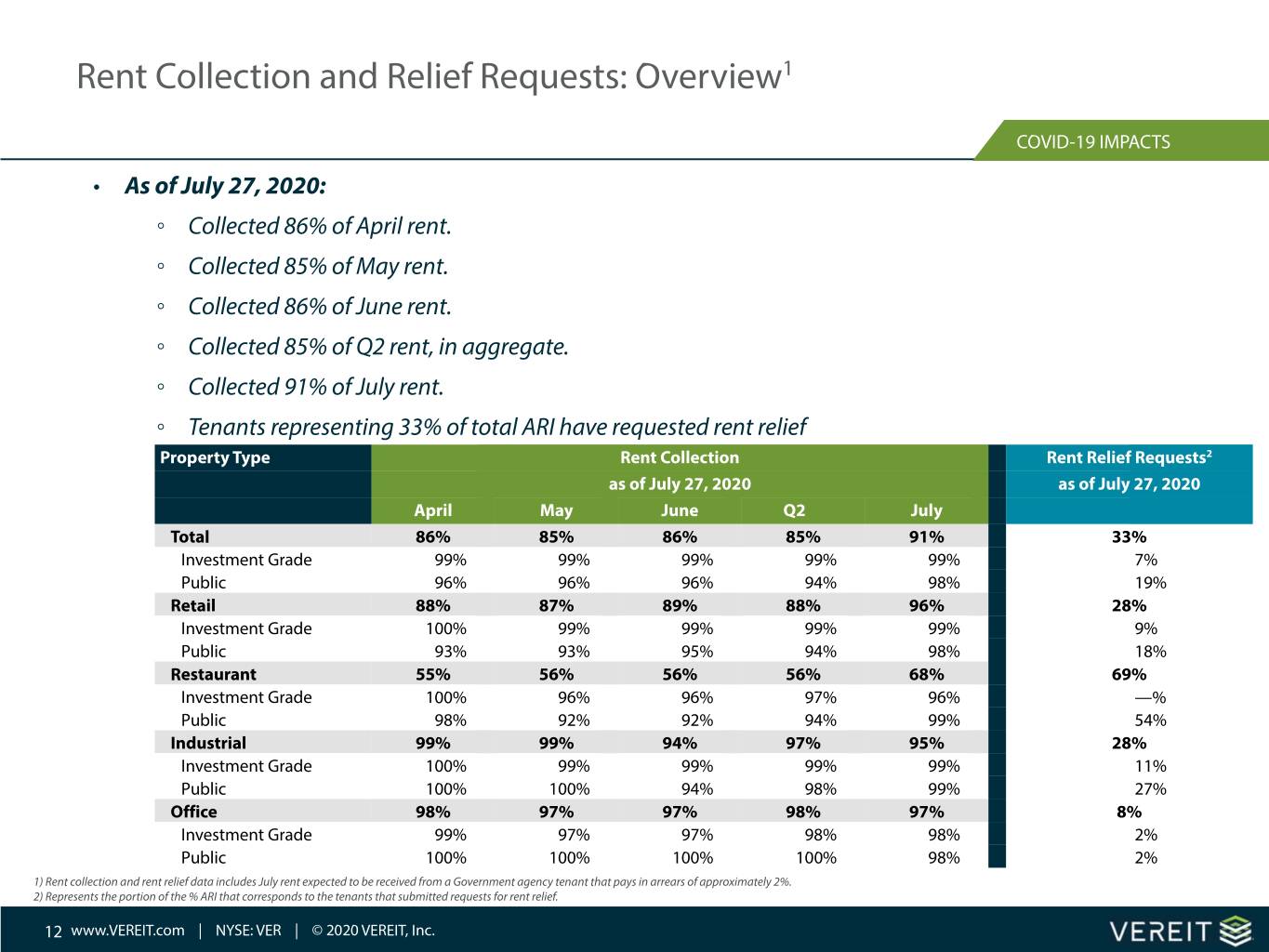

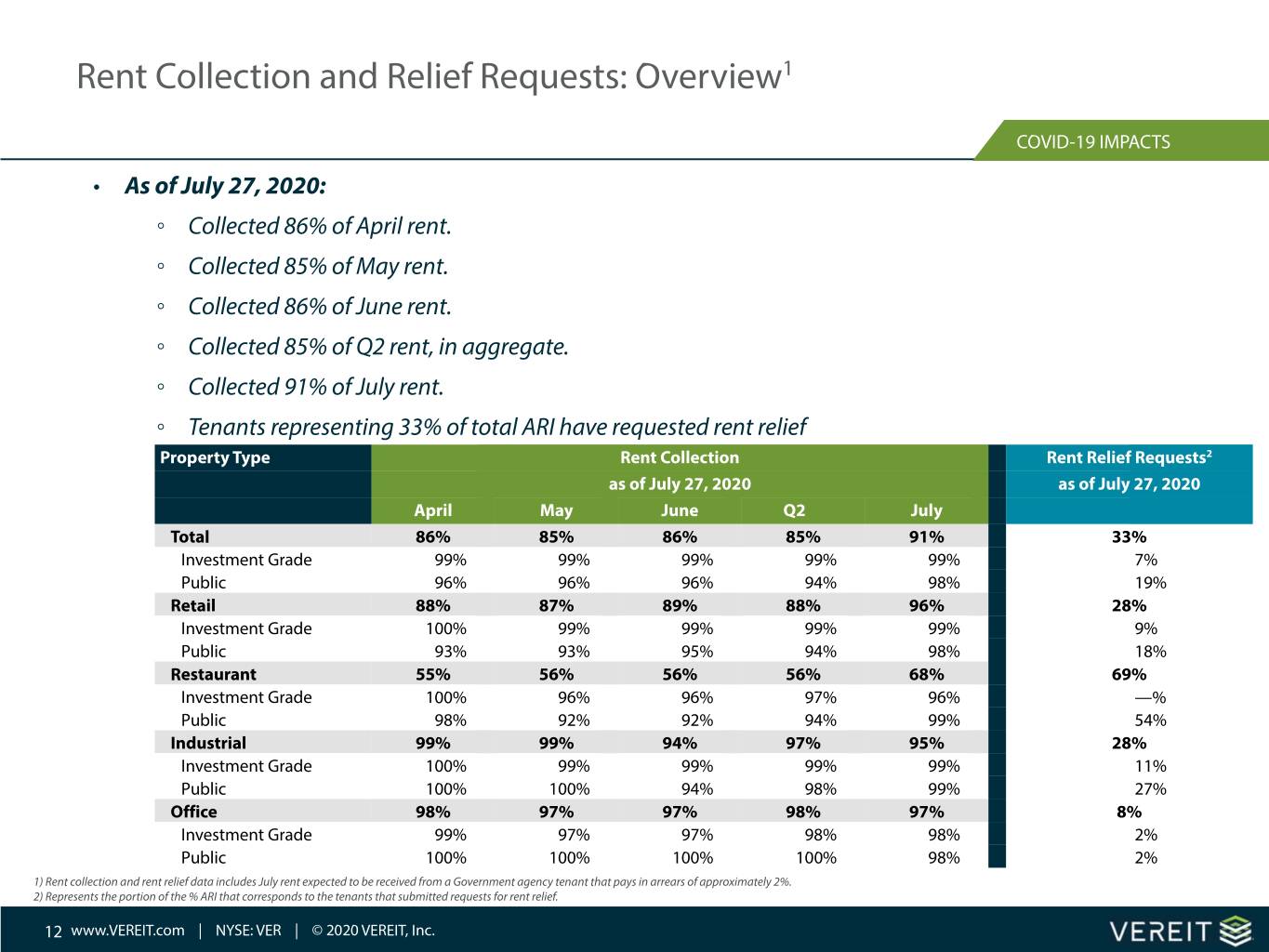

Rent Collection and Relief Requests: Overview1 COVID-19 IMPACTS € As of July€27, 2020: COVID-19€ Collected IMPACTS 86% of April rent. € Collected 85% of May rent. € Collected 86% of June rent. € Collected 85% of Q2 rent, in aggregate. € Collected 91% of July rent. € Tenants representing 33% of total ARI have requested rent relief Property Type Rent Collection Rent Relief Requests2 as of July 27, 2020 as of July 27, 2020 April May June Q2 July Total 86% 85% 86% 85% 91% 33% Investment Grade 99% 99% 99% 99% 99% 7% Public 96% 96% 96% 94% 98% 19% Retail 88% 87% 89% 88% 96% 28% Investment Grade 100% 99% 99% 99% 99% 9% Public 93% 93% 95% 94% 98% 18% Restaurant 55% 56% 56% 56% 68% 69% Investment Grade 100% 96% 96% 97% 96% ‰% Public 98% 92% 92% 94% 99% 54% Industrial 99% 99% 94% 97% 95% 28% Investment Grade 100% 99% 99% 99% 99% 11% Public 100% 100% 94% 98% 99% 27% Office 98% 97% 97% 98% 97% 8% Investment Grade 99% 97% 97% 98% 98% 2% Public 100% 100% 100% 100% 98% 2% 1) Rent collection and rent relief data includes July rent expected to be received from a Government agency tenant that pays in arrears of approximately 2%. 2) Represents the portion of the % ARI that corresponds to the tenants that submitted requests for rent relief. 12 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Rent Collection and Relief Requests: Overview1 COVID-19 IMPACTS ‡ VEREIT has been in communication ‡ 8 of VEREIT's top 10 tenants have paid April rent, representing 78% of with all tenants who have requested top 10 tenant rent. ‡ 8 of VEREIT's top 10 tenants have paid May rent, representing 77% of rent relief to discuss the impact of top 10 tenant rent. COVID-19 on their businesses. ‡ 8 of VEREIT's top 10 tenants have paid June rent, representing 77% of top 10 tenant rent. ‡ VEREIT is evaluating tenant relief ‡ 10 of VEREIT's top 10 tenants have paid July rent, representing 90% of requests on a case-by-case basis top 10 tenant rent. with close attention to the tenants' ‡ 17 of VEREIT's top 20 tenants have paid April rent, representing 82% of ongoing operations, unit coverage, top 20 tenant rent. liquidity and financial health. ‡ 17 of VEREIT's top 20 tenants have paid May rent, representing 81% of top 20 tenant rent. ‡ Rent relief requests generally range ‡ 17 of VEREIT's top 20 tenants have paid June rent, representing 79% of from 2 to 4 months and would be top 20 tenant rent. expected to be paid back within 12 ‡ 20 of VEREIT's top 20 tenants have paid July rent, representing 92% of top 20 tenant rent. months. ‡ VEREIT received rent relief requests from tenants representing approximately 33% of ARI. - 17% were approved, - 3% are in negotiations, and - 13% have either been denied or VEREIT has not yet taken action ‡ Rent collection within the 13% was approximately 87% in Q2 and 89% in July 1) Rent collection and rent relief data as of July 27, 2020 and includes July rent expected to be received from a Government agency tenant that pays in arrears of approximately 2%. 13 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Rent Collection and Relief Requests by Industry1 Industry designations based on NAICS categorization COVID-19 IMPACTS Rent Relief April Rent May Rent June Rent July Rent Property Type % ARI Requests2 Collected Collected Collected Collected High Collection / Necessity: Retail - Discount 8.1% 11% 98% 97% 98% 98% Retail - Pharmacy 5.6% ‰% 100% 100% 100% 100% Retail - Grocery & Supermarket 3.8% ‰% 100% 100% 100% 100% Retail - Home & Garden 3.5% 15% 98% 96% 100% 100% Retail - Gas & Convenience 3.0% 2% 100% 100% 100% 100% Retail - Motor Vehicle 2.9% 28% 94% 97% 97% 100% Finance 1.9% 9% 100% 100% 100% 99% Retail - Warehouse Clubs 1.7% ‰% 100% 100% 100% 100% Retail - Medical Services 1.1% 5% 99% 99% 99% 100% Retail - Pet Supply 1.0% 100% 100% 94% 94% 82% Retail - Department Stores 0.7% 92% 100% 100% 100% 100% Retail - Electronics & Appliances 0.7% 96% 100% 100% 100% 95% Rental 0.6% 22% 100% 100% 100% 100% Retail - Hobby, Books & Music 0.5% 4% 95% 96% 97% 98% Retail - Specialty (Other) 0.4% 53% 87% 84% 85% 92% Retail - Apparel & Jewelry 0.3% 93% 47% 47% 97% 92% All Other 0.4% 57% 80% 81% 83% 82% Total Retail - High Collection / Necessity 36.2% 16% 98% 97% 99% 98% Restaurants - Quick Service 8.8% 52% 82% 79% 81% 80% Industrial 16.7% 28% 99% 99% 94% 95% Office 17.6% 8% 98% 97% 97% 97% Total High Collection / Necessity 79.3% 21% 97% 96% 96% 95% Improving: Retail - Home Furnishings 2.9% 61% 32% 27% 47% 99% Retail - Sporting Goods 2.1% 82% 50% 64% 67% 74% Total Improving 5.0% 70% 41% 45% 57% 86% Other: Restaurants - Casual Dining 12.1% 82% 35% 39% 38% 59% Entertainment & Recreation 3.6% 99% 33% 26% 28% 82% Total Other 15.7% 86% 34% 36% 36% 64% Total 100.0% 33% 86% 85% 86% 91% 1) Rent collection and rent relief data as of July 27, 2020 and includes July rent expected to be received from a Government agency tenant that pays in arrears of approximately 2%. 2) Represents the portion of the % ARI that corresponds to the tenants that submitted requests for rent relief. 14 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

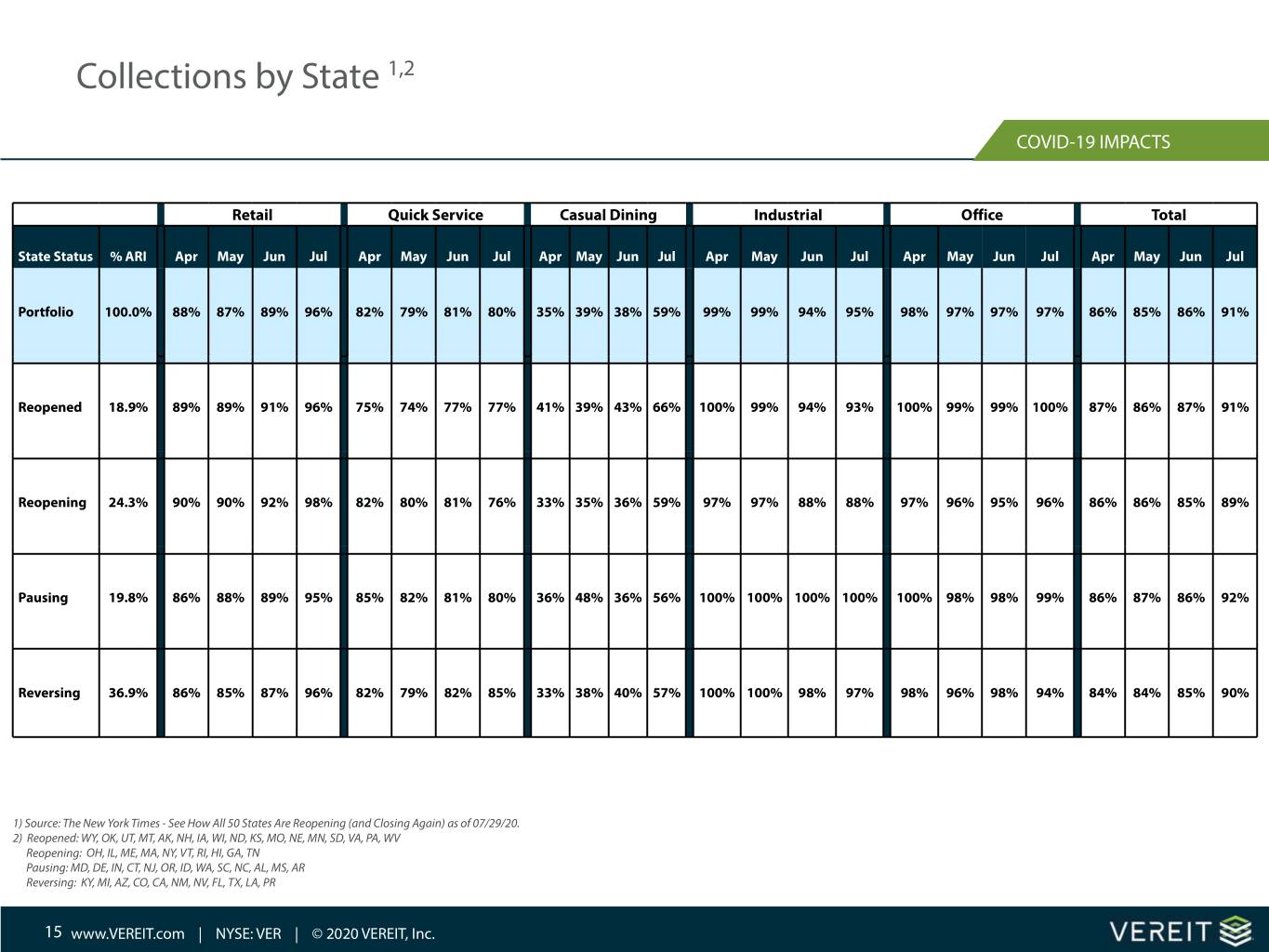

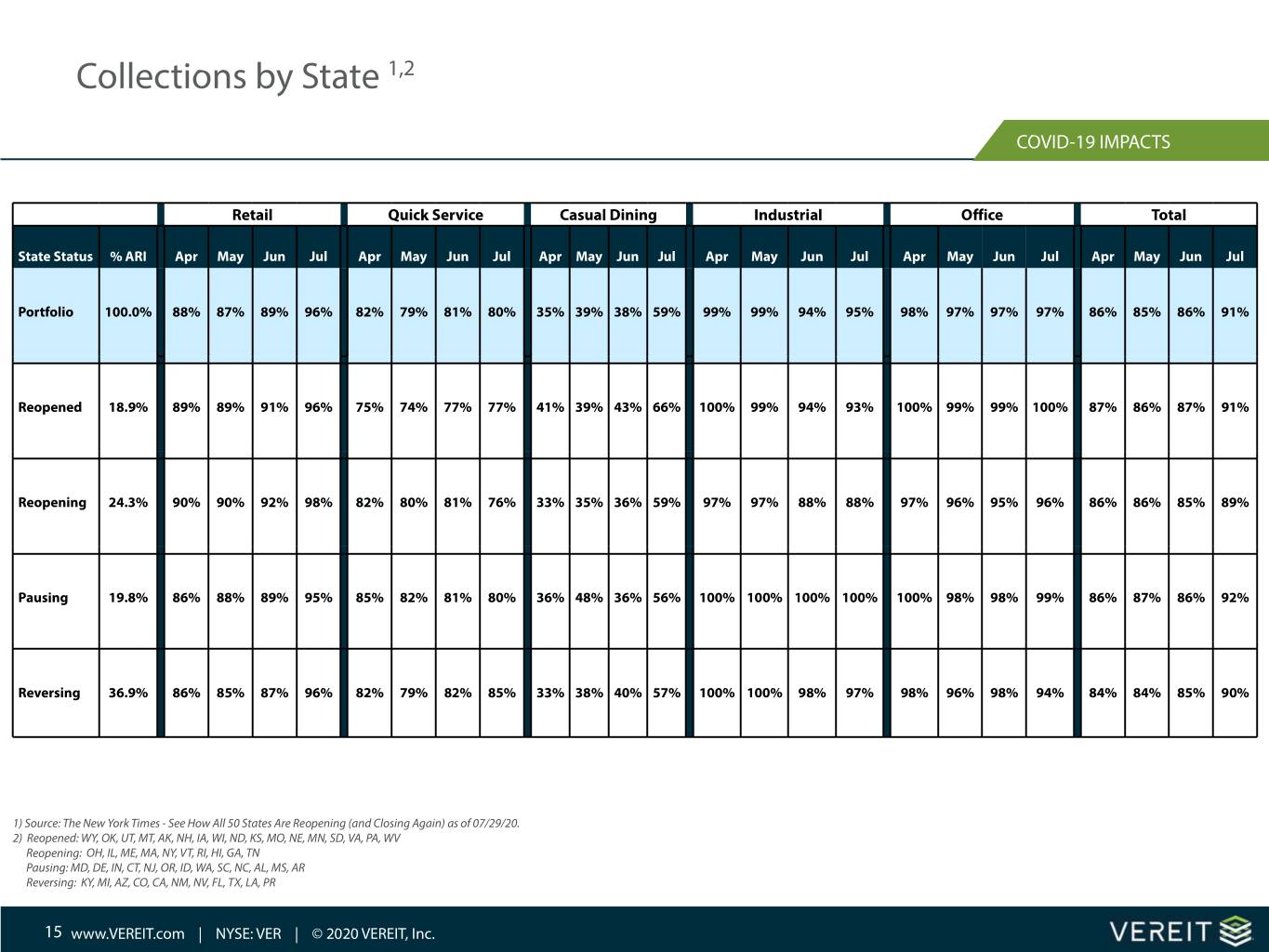

Collections by State 1,2 COVID-19 IMPACTS Retail Quick Service Casual Dining Industrial Office Total State Status % ARI Apr May Jun Jul Apr May Jun Jul Apr May Jun Jul Apr May Jun Jul Apr May Jun Jul Apr May Jun Jul Portfolio 100.0% 88% 87% 89% 96% 82% 79% 81% 80% 35% 39% 38% 59% 99% 99% 94% 95% 98% 97% 97% 97% 86% 85% 86% 91% Reopened 18.9% 89% 89% 91% 96% 75% 74% 77% 77% 41% 39% 43% 66% 100% 99% 94% 93% 100% 99% 99% 100% 87% 86% 87% 91% Reopening 24.3% 90% 90% 92% 98% 82% 80% 81% 76% 33% 35% 36% 59% 97% 97% 88% 88% 97% 96% 95% 96% 86% 86% 85% 89% Pausing 19.8% 86% 88% 89% 95% 85% 82% 81% 80% 36% 48% 36% 56% 100% 100% 100% 100% 100% 98% 98% 99% 86% 87% 86% 92% Reversing 36.9% 86% 85% 87% 96% 82% 79% 82% 85% 33% 38% 40% 57% 100% 100% 98% 97% 98% 96% 98% 94% 84% 84% 85% 90% 1) Source: The New York Times - See How All 50 States Are Reopening (and Closing Again) as of 07/29/20. 2) Reopened: WY, OK, UT, MT, AK, NH, IA, WI, ND, KS, MO, NE, MN, SD, VA, PA, WV Reopening: OH, IL, ME, MA, NY, VT, RI, HI, GA, TN Pausing: MD, DE, IN, CT, NJ, OR, ID, WA, SC, NC, AL, MS, AR Reversing: KY, MI, AZ, CO, CA, NM, NV, FL, TX, LA, PR 15 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

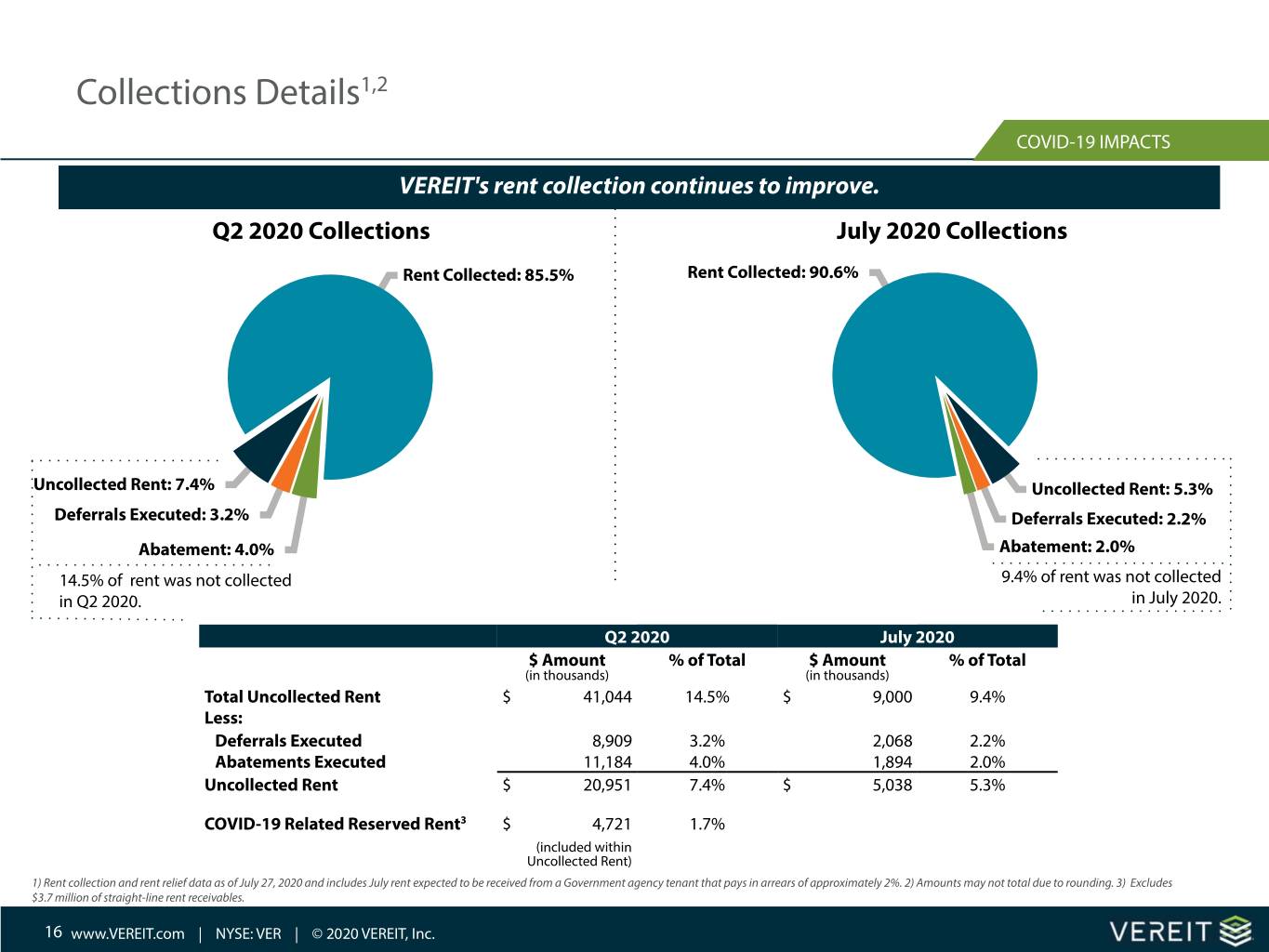

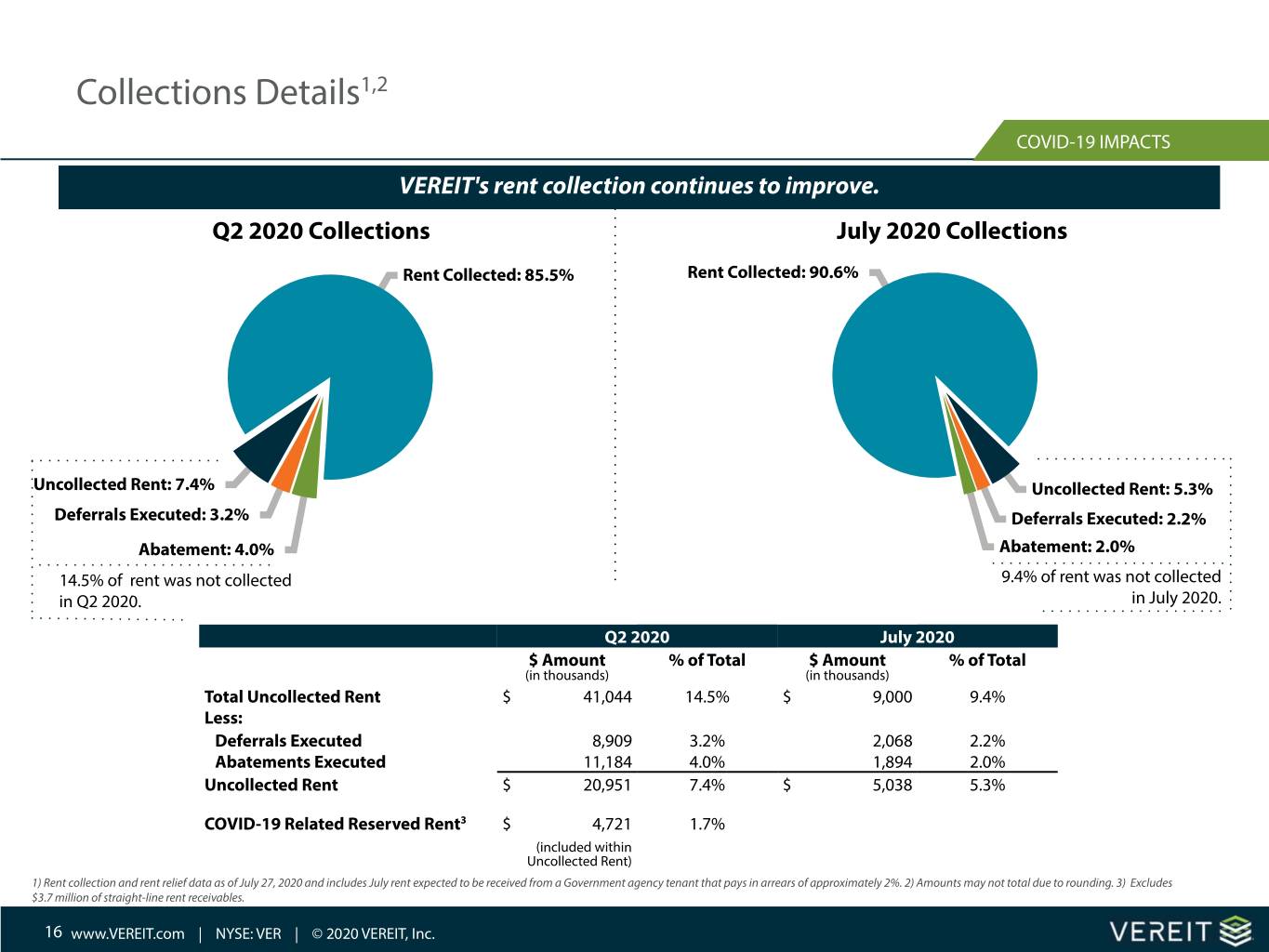

Collections Details1,2 COVID-19 IMPACTS VEREIT's rent collection continues to improve. Q2 2020 Collections July 2020 Collections Rent Collected: 85.5% Rent Collected: 90.6% Uncollected Rent: 7.4% Uncollected Rent: 5.3% Deferrals Executed: 3.2% Deferrals Executed: 2.2% Abatement: 4.0% Abatement: 2.0% 14.5% of rent was not collected 9.4% of rent was not collected in Q2 2020. in July 2020. Q2 2020 July 2020 $ Amount % of Total $ Amount % of Total (in thousands) (in thousands) Total Uncollected Rent $ 41,044 14.5% $ 9,000 9.4% Less: Deferrals Executed 8,909 3.2% 2,068 2.2% Abatements Executed 11,184 4.0% 1,894 2.0% Uncollected Rent $ 20,951 7.4% $ 5,038 5.3% COVID-19 Related Reserved Rent3 $ 4,721 1.7% (included within Uncollected Rent) 1) Rent collection and rent relief data as of July 27, 2020 and includes July rent expected to be received from a Government agency tenant that pays in arrears of approximately 2%. 2) Amounts may not total due to rounding. 3) Excludes $3.7 million of straight-line rent receivables. 16 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Open Stores1 COVID-19 IMPACTS Open Store Count - May 15, 2020 Partially Open Open Closed % % % Total Retail & Restaurant 76% 16% 8% Total Retail 90% 5% 5% Casual Dining 20% 67% 13% Quick Service 79% 13% 8% Total Restaurant 57% 33% 10% Open Store Count - July 27, 2020 Partially Open Open Closed % % % Total Retail & Restaurant 94% 3% 3% Total Retail 98% 1% 1% Casual Dining 88% 7% 5% Quick Service 87% 8% 5% Total Restaurant 87% 8% 5% 1) Data estimates are compiled from available sources, including news reports, tenant contact and public filings. Figures are calculated based on store counts and not on ARI. 17 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

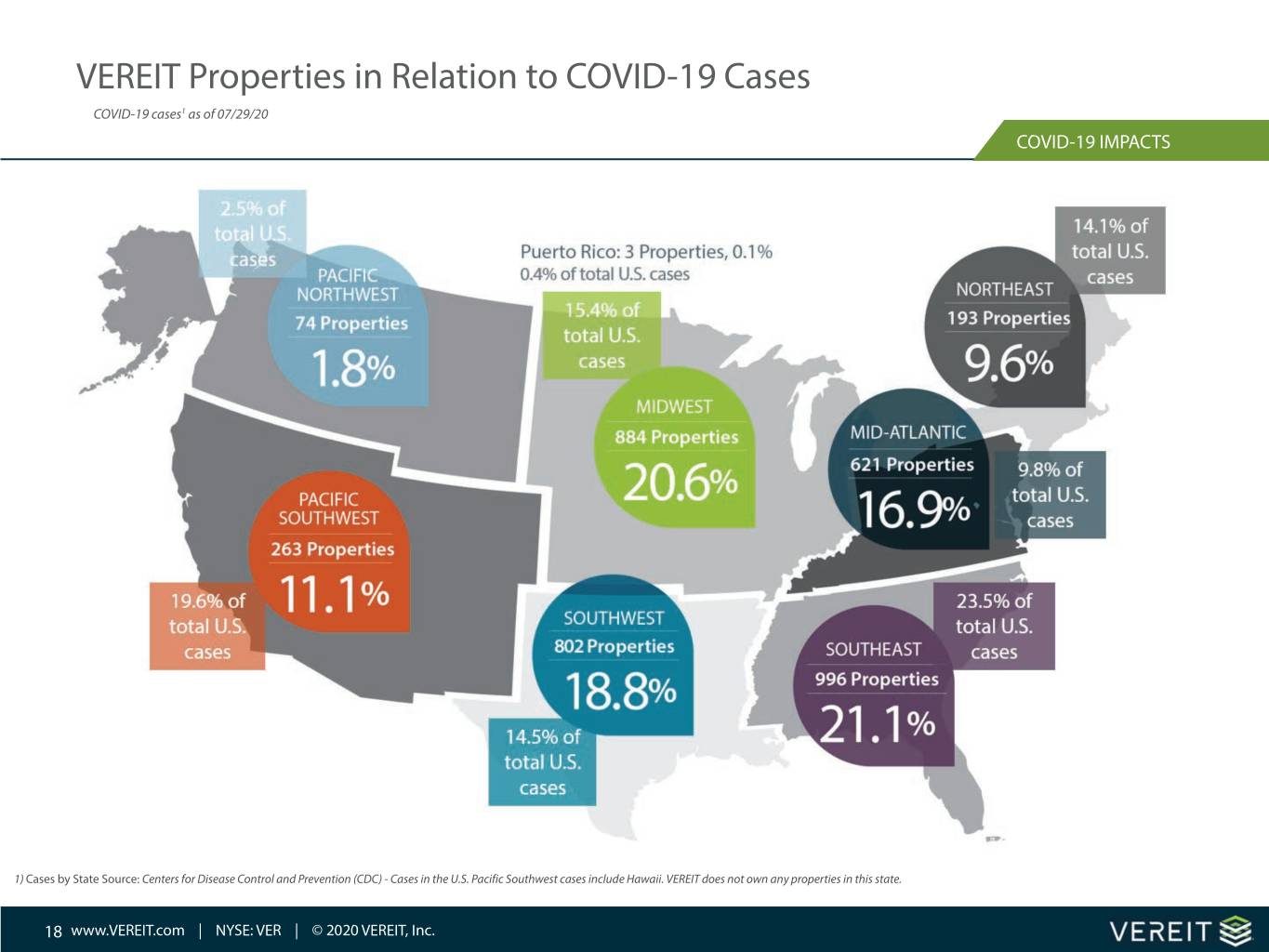

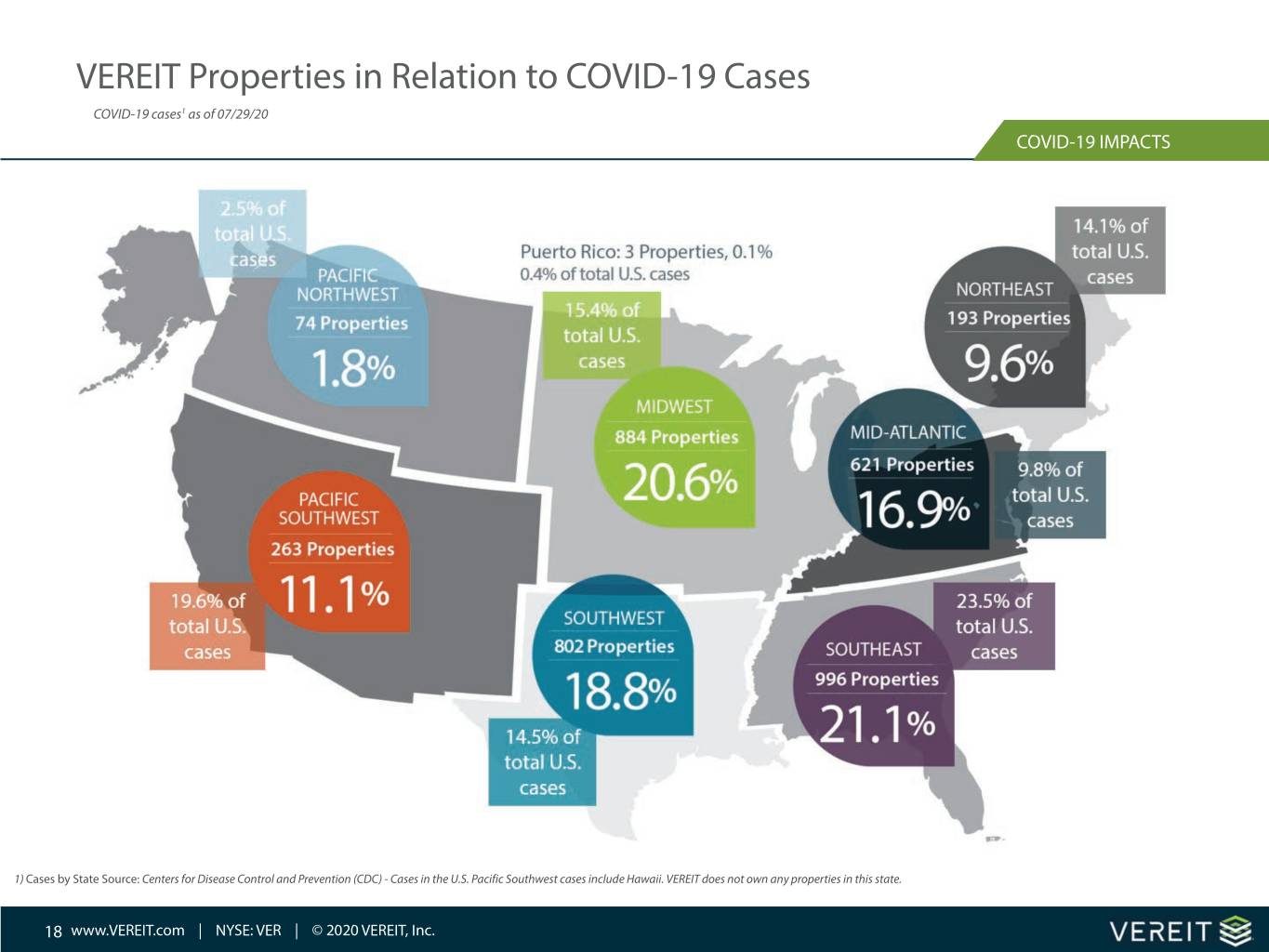

VEREIT Properties in Relation to COVID-19 Cases COVID-19 cases1 as of 07/29/20 COVID-19 IMPACTS 1) Cases by State Source: Centers for Disease Control and Prevention (CDC) - Cases in the U.S. Pacific Southwest cases include Hawaii. VEREIT does not own any properties in this state. 18 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Portfolio Metrics & Analysis Q2 2020 a …#†

Key Portfolio Metrics PORTFOLIO Portfolio Property Type As of 6/30/2020 Other: 0.1% Office: 17.6% Operating Properties 3,836 Total Rentable Square Feet (in millions) 88.9 Retail: 44.9% Annualized Rental Income $1.1 Billion Industrial: 16.7% Economic Occupancy Rate 98.8% WALT (years) 8.5 Restaurant: 20.7% 3 Investment Grade 1 37.0% Number of Tenants 602 Number of Industries 41 Number of States 2 49 Top 10 Tenant Concentration 26.8% Gross Real Estate Investments $14.7 Billion 1) Investment-grade tenants are those with an S&P credit rating of BBB- or higher or a Moody's credit rating of Baa3 or higher. The ratings may reflect those assigned by S&P or Moody's to the lease guarantor or the parent company, as applicable. 2) The CompanyÅs properties are also located in Puerto Rico (3 properties). 3) Restaurant category includes Casual Dining (12.1%) and Quick Service (8.8%) (industry percentages include restaurant tenants in other property types). 20 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

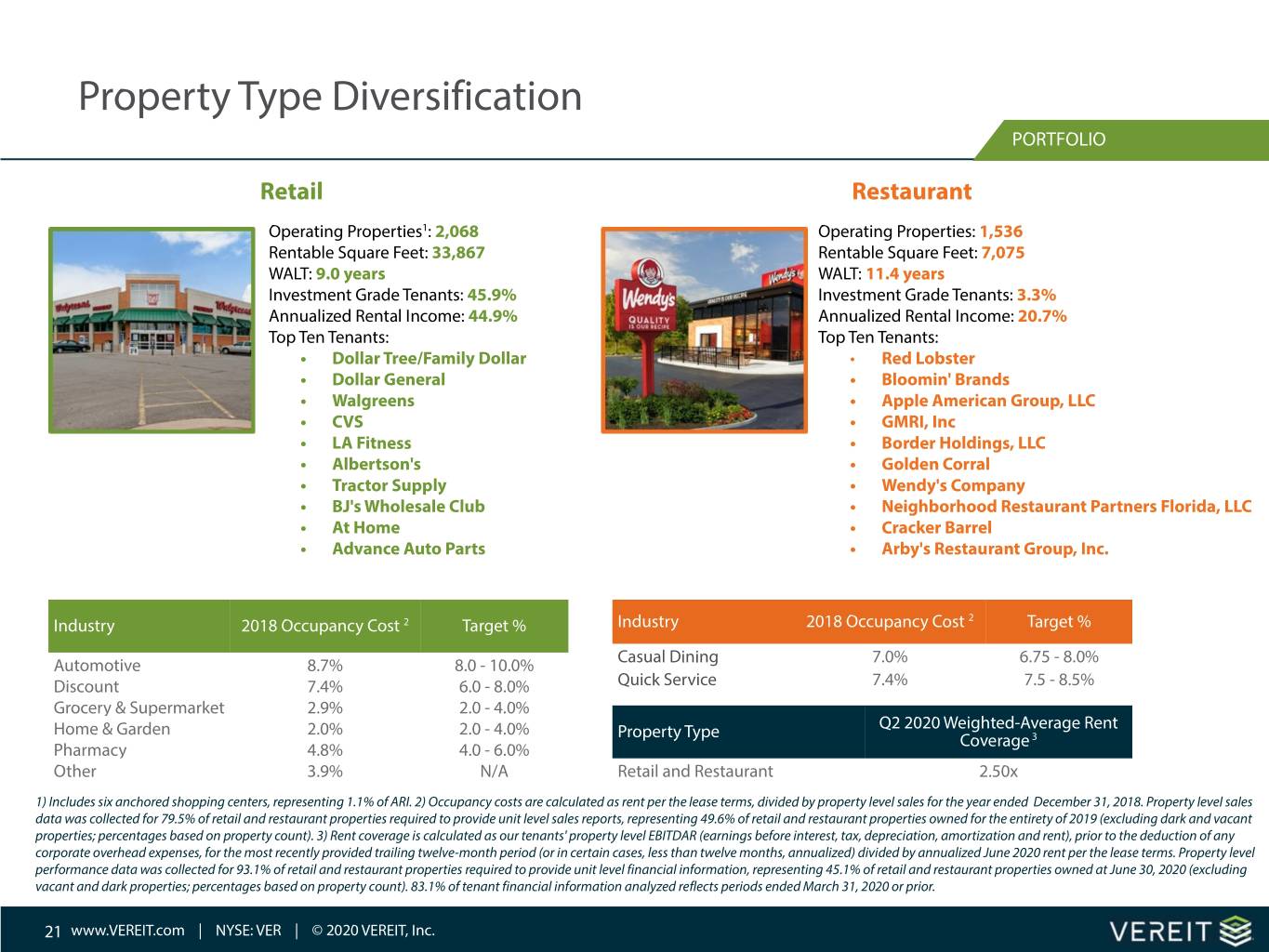

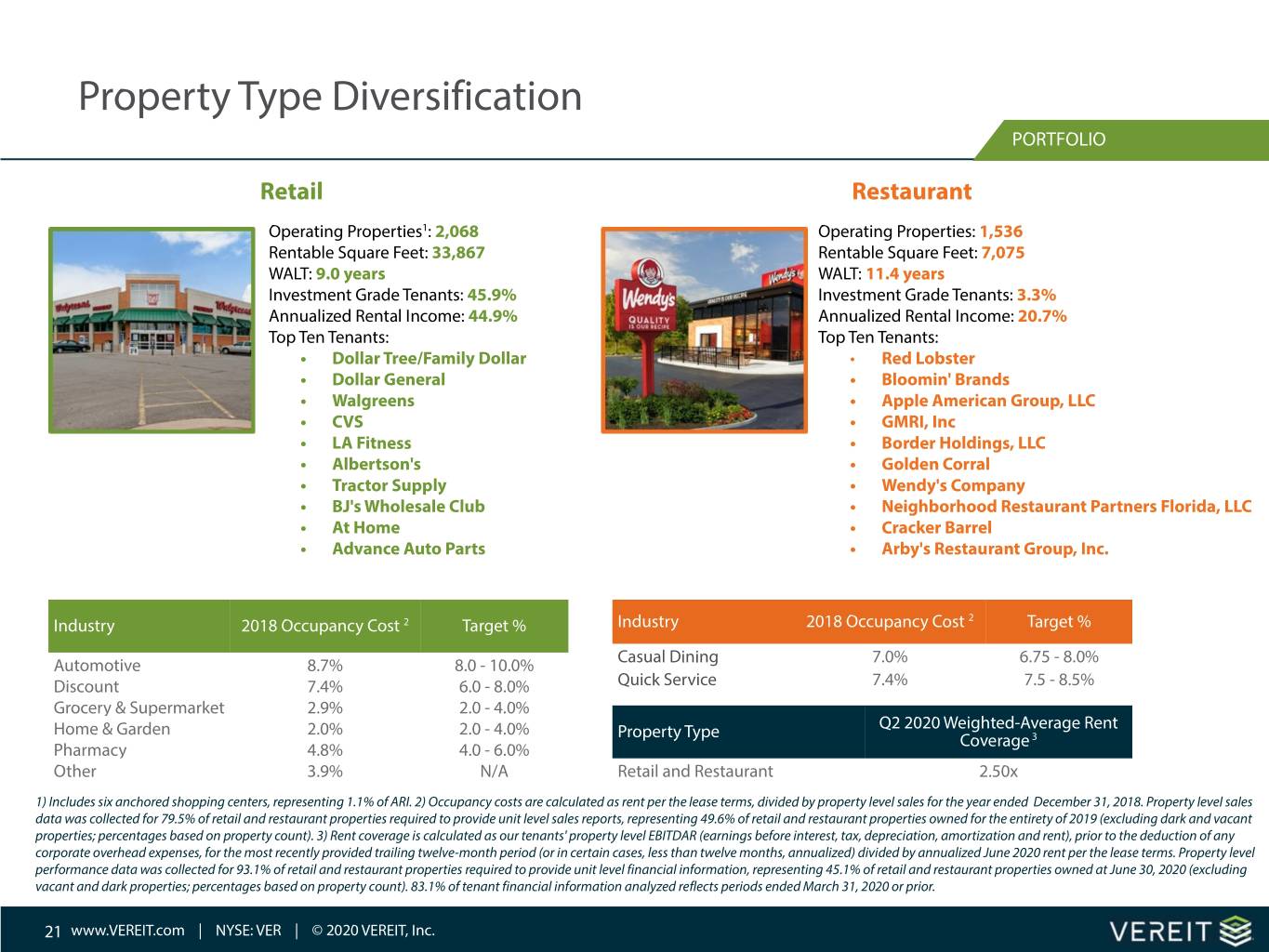

Property Type Diversification PORTFOLIO Retail Restaurant Operating Properties1: 2,068 Operating Properties: 1,536 Rentable Square Feet: 33,867 Rentable Square Feet: 7,075 WALT: 9.0 years WALT: 11.4 years Investment Grade Tenants: 45.9% Investment Grade Tenants: 3.3% Annualized Rental Income: 44.9% Annualized Rental Income: 20.7% Top Ten Tenants: Top Ten Tenants: € Dollar Tree/Family Dollar ‡ Red Lobster € Dollar General € Bloomin' Brands € Walgreens € Apple American Group, LLC € CVS € GMRI, Inc € LA Fitness € Border Holdings, LLC € Albertson's € Golden Corral € Tractor Supply € Wendy's Company € BJ's Wholesale Club € Neighborhood Restaurant Partners Florida, LLC € At Home € Cracker Barrel € Advance Auto Parts € Arby's Restaurant Group, Inc. Industry 2018 Occupancy Cost 2 Target % Industry 2018 Occupancy Cost 2 Target % Automotive 8.7% 8.0 - 10.0% Casual Dining 7.0% 6.75 - 8.0% Discount 7.4% 6.0 - 8.0% Quick Service 7.4% 7.5 - 8.5% Grocery & Supermarket 2.9% 2.0 - 4.0% Home & Garden 2.0% 2.0 - 4.0% Q2 2020 Weighted-Average Rent Property Type Coverage 3 Pharmacy 4.8% 4.0 - 6.0% Other 3.9% N/A Retail and Restaurant 2.50x 1) Includes six anchored shopping centers, representing 1.1% of ARI. 2) Occupancy costs are calculated as rent per the lease terms, divided by property level sales for the year ended December 31, 2018. Property level sales data was collected for 79.5% of retail and restaurant properties required to provide unit level sales reports, representing 49.6% of retail and restaurant properties owned for the entirety of 2019 (excluding dark and vacant properties; percentages based on property count). 3) Rent coverage is calculated as our tenants' property level EBITDAR (earnings before interest, tax, depreciation, amortization and rent), prior to the deduction of any corporate overhead expenses, for the most recently provided trailing twelve-month period (or in certain cases, less than twelve months, annualized) divided by annualized June 2020 rent per the lease terms. Property level performance data was collected for 93.1% of retail and restaurant properties required to provide unit level financial information, representing 45.1% of retail and restaurant properties owned at June‚30, 2020 (excluding vacant and dark properties; percentages based on property count). 83.1% of tenant financial information analyzed reflects periods ended March 31, 2020 or prior. 21 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

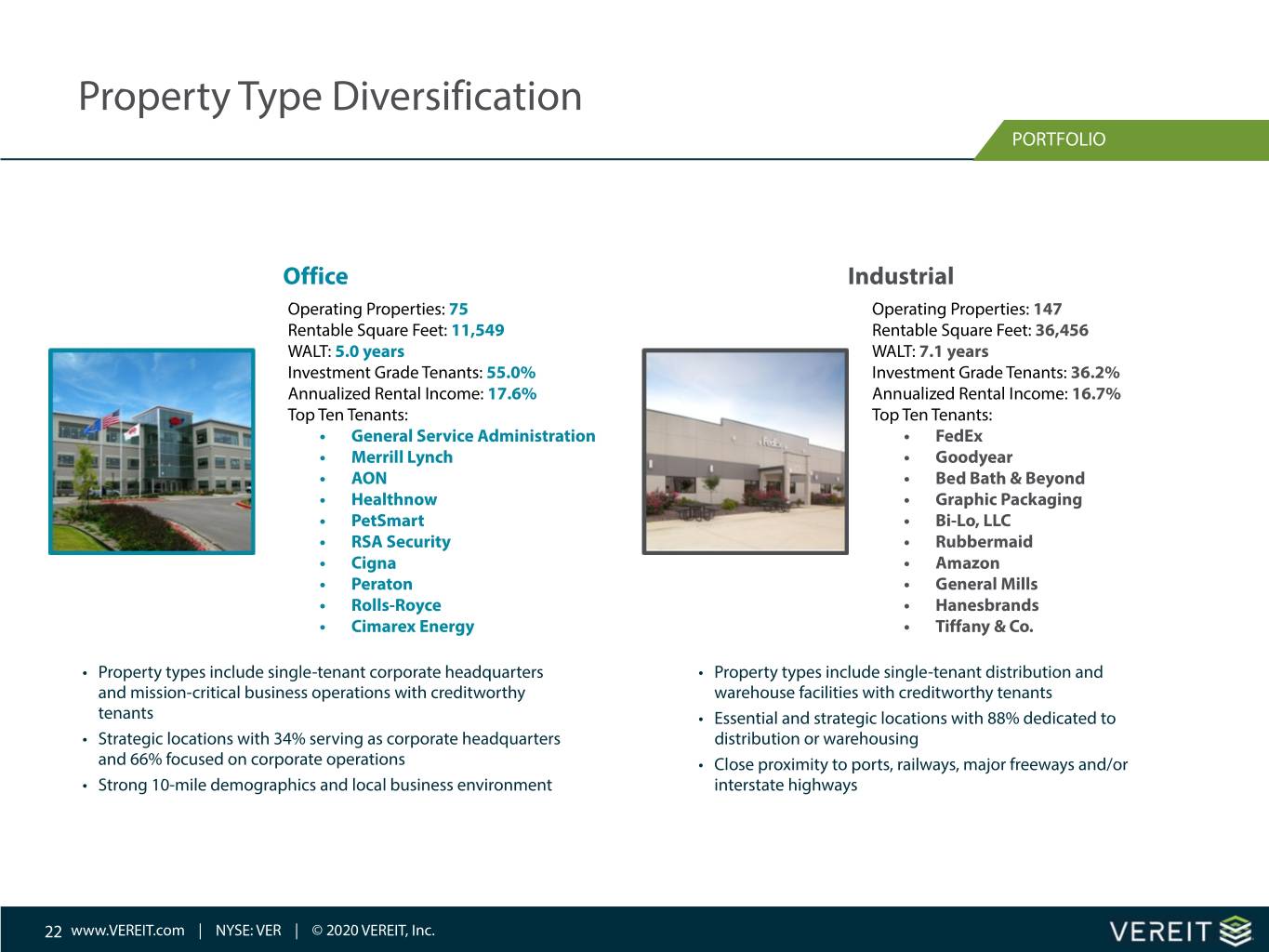

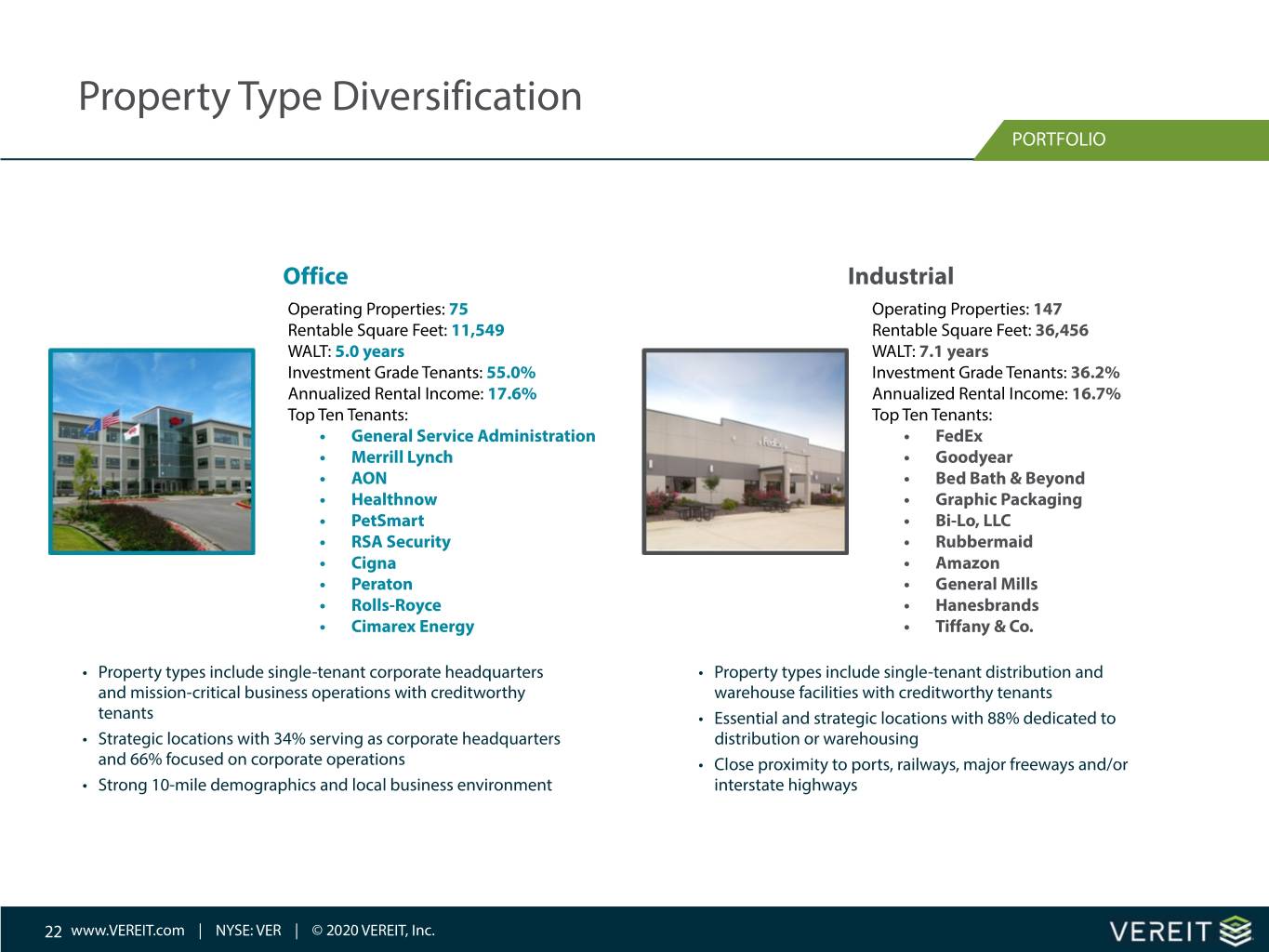

Property Type Diversification PORTFOLIO Office Industrial Operating Properties: 75 Operating Properties: 147 Rentable Square Feet: 11,549 Rentable Square Feet: 36,456 WALT: 5.0 years WALT: 7.1 years Investment Grade Tenants: 55.0% Investment Grade Tenants: 36.2% Annualized Rental Income: 17.6% Annualized Rental Income: 16.7% Top Ten Tenants: Top Ten Tenants: € General Service Administration € FedEx € Merrill Lynch € Goodyear € AON € Bed Bath & Beyond € Healthnow € Graphic Packaging € PetSmart € Bi-Lo, LLC € RSA Security € Rubbermaid € Cigna € Amazon € Peraton € General Mills € Rolls-Royce € Hanesbrands € Cimarex Energy € Tiffany & Co. ‡ Property types include single-tenant corporate headquarters ‡ Property types include single-tenant distribution and and mission-critical business operations with creditworthy warehouse facilities with creditworthy tenants tenants ‡ Essential and strategic locations with 88% dedicated to ‡ Strategic locations with 34% serving as corporate headquarters distribution or warehousing and 66% focused on corporate operations ‡ Close proximity to ports, railways, major freeways and/or ‡ Strong 10-mile demographics and local business environment interstate highways 22 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

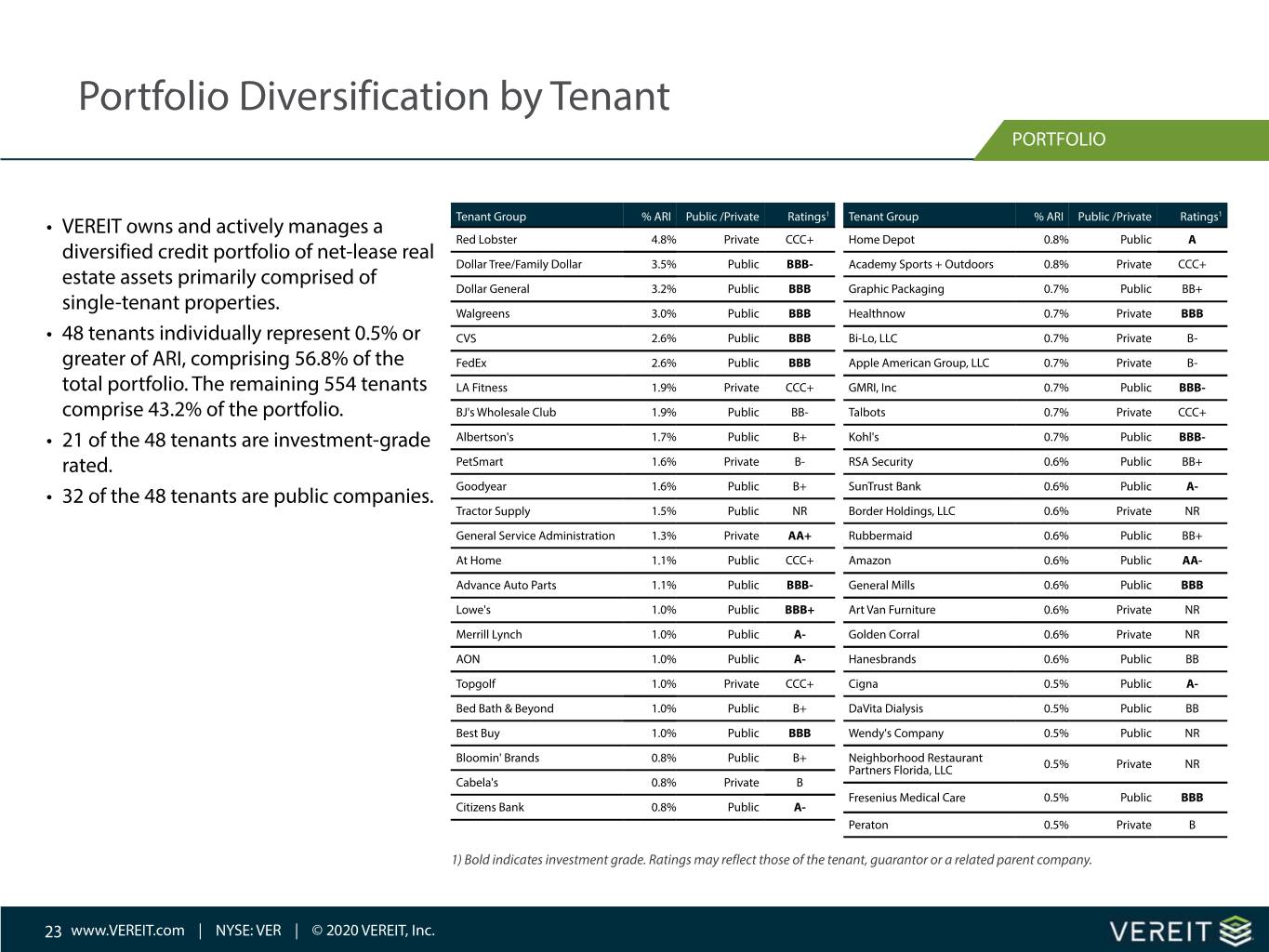

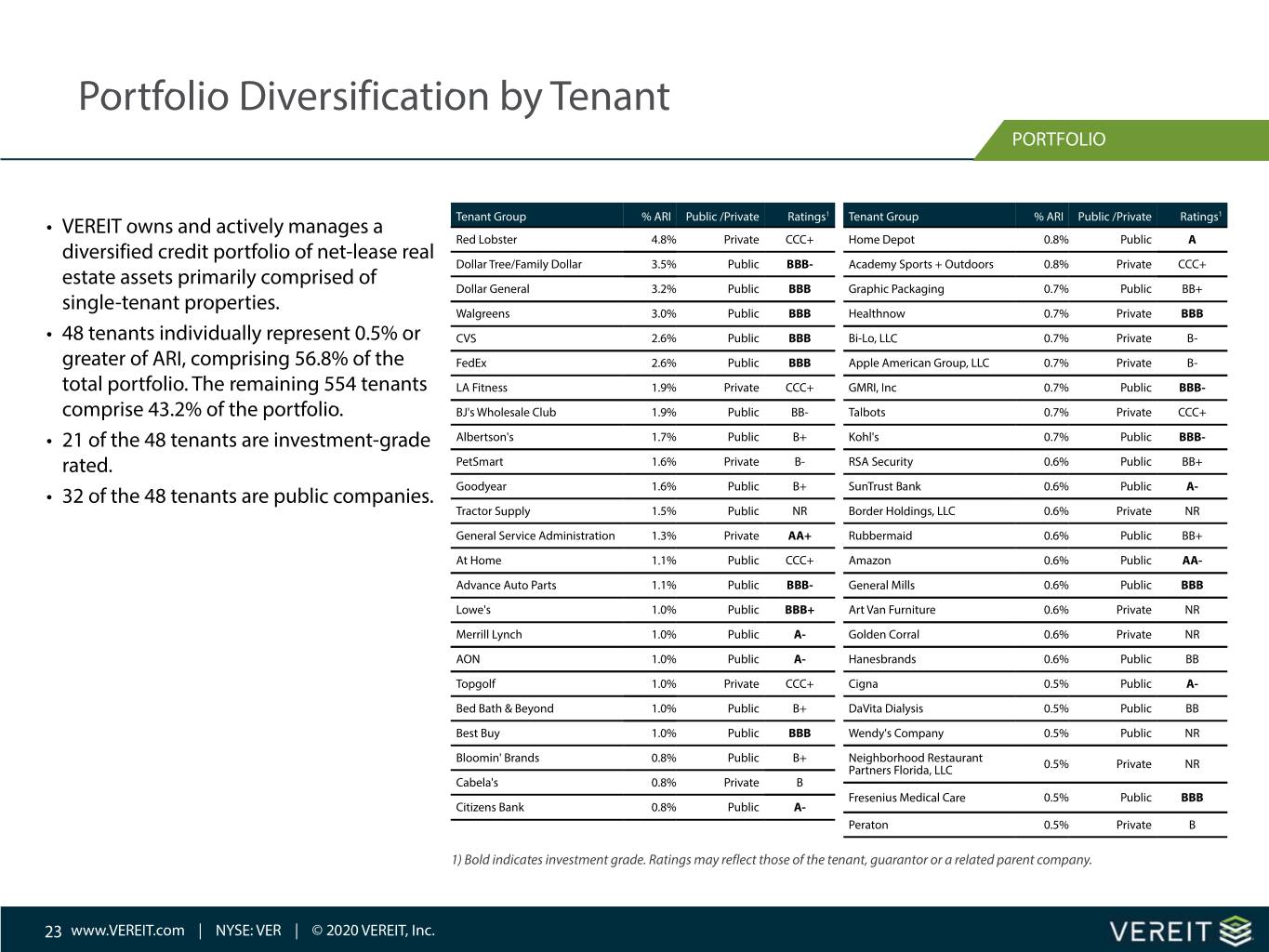

Portfolio Diversification by Tenant PORTFOLIO 1 1 ‡ VEREIT owns and actively manages a Tenant Group % ARI Public /Private Ratings Tenant Group % ARI Public /Private Ratings Red Lobster 4.8% Private CCC+ Home Depot 0.8% Public A diversified credit portfolio of net-lease real Dollar Tree/Family Dollar 3.5% Public BBB- Academy Sports + Outdoors 0.8% Private CCC+ estate assets primarily comprised of Dollar General 3.2% Public BBB Graphic Packaging 0.7% Public BB+ single-tenant properties. Walgreens 3.0% Public BBB Healthnow 0.7% Private BBB ‡ 48 tenants individually represent 0.5% or CVS 2.6% Public BBB Bi-Lo, LLC 0.7% Private B- greater of ARI, comprising 56.8% of the FedEx 2.6% Public BBB Apple American Group, LLC 0.7% Private B- total portfolio. The remaining 554 tenants LA Fitness 1.9% Private CCC+ GMRI, Inc 0.7% Public BBB- comprise 43.2% of the portfolio. BJ's Wholesale Club 1.9% Public BB- Talbots 0.7% Private CCC+ ‡ 21 of the 48 tenants are investment-grade Albertson's 1.7% Public B+ Kohl's 0.7% Public BBB- rated. PetSmart 1.6% Private B- RSA Security 0.6% Public BB+ ‡ 32 of the 48 tenants are public companies. Goodyear 1.6% Public B+ SunTrust Bank 0.6% Public A- Tractor Supply 1.5% Public NR Border Holdings, LLC 0.6% Private NR General Service Administration 1.3% Private AA+ Rubbermaid 0.6% Public BB+ At Home 1.1% Public CCC+ Amazon 0.6% Public AA- Advance Auto Parts 1.1% Public BBB- General Mills 0.6% Public BBB Lowe's 1.0% Public BBB+ Art Van Furniture 0.6% Private NR Merrill Lynch 1.0% Public A- Golden Corral 0.6% Private NR AON 1.0% Public A- Hanesbrands 0.6% Public BB Topgolf 1.0% Private CCC+ Cigna 0.5% Public A- Bed Bath & Beyond 1.0% Public B+ DaVita Dialysis 0.5% Public BB Best Buy 1.0% Public BBB Wendy's Company 0.5% Public NR Bloomin' Brands 0.8% Public B+ Neighborhood Restaurant Partners Florida, LLC 0.5% Private NR Cabela's 0.8% Private B Fresenius Medical Care 0.5% Public BBB Citizens Bank 0.8% Public A- Peraton 0.5% Private B 1) Bold indicates investment grade. Ratings may reflect those of the tenant, guarantor or a related parent company. 23 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Property Type Analysis: Retail1 ARI reflects retail properties only and does not include restaurants, office, industrial and other. Industry designations based on NAICS categorization. PORTFOLIO Diversified Retail Portfolio Rent Relief April Rent May Rent June Rent July Rent Industry Group % ARI Requests2 Collected Collected Collected Collected Retail - Discount 8.1% 11% 98% 97% 98% 98% Retail - Pharmacy 5.6% ‰% 100% 100% 100% 100% VEREIT's Single-Tenant Retail - Grocery & Supermarket 3.8% ‰% 100% 100% 100% 100% Retail Advantages Entertainment & Recreation 3.6% 99% 33% 26% 28% 82% ‡ Dominated by off-price and Retail - Home & Garden 3.5% 15% 98% 96% 100% 100% necessity shopping Retail - Gas & Convenience 3.0% 2% 100% 100% 100% 100% Retail - Motor Vehicle 2.9% 28% 94% 97% 97% 100% ‡ Approximately 71% of retail Retail - Home Furnishings 2.9% 61% 32% 27% 47% 99% revenue derived from Retail - Sporting Goods 2.1% 82% 50% 64% 67% 74% public companies Finance 1.9% 9% 100% 100% 100% 99% ‡ Credit tenants on long- Retail - Warehouse Clubs 1.7% ‰% 100% 100% 100% 100% term leases with substantial Retail - Medical Services 1.1% 5% 99% 99% 99% 100% capital investment (45.9% Retail - Pet Supply 1.0% 100% 100% 94% 94% 82% investment grade) Retail - Department Stores 0.7% 92% 100% 100% 100% 100% ‡ Generally, no use Retail - Electronics & Appliances 0.7% 96% 100% 100% 100% 95% restrictions or co-tenancy Rental 0.6% 22% 100% 100% 100% 100% issues Retail - Hobby, Books & Music 0.5% 4% 95% 96% 97% 98% Retail - Specialty (Other) 0.4% 53% 87% 84% 85% 92% ‡ Ability to target desired Retail - Apparel & Jewelry 0.3% 93% 47% 47% 97% 92% tenants and industries All Other3 0.5% 57% 80% 81% 83% 82% Total 44.9% 28% 88% 87% 89% 96% 1) Rent collection and rent relief data as of July 27, 2020 and includes July rent expected to be received from a Government agency tenant that pays in arrears of approximately 2%. 2) Represents the portion of the % ARI that corresponds to the tenants that submitted requests for rent relief. 3) Includes nine industries that each represent 0.2% or less. 24 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

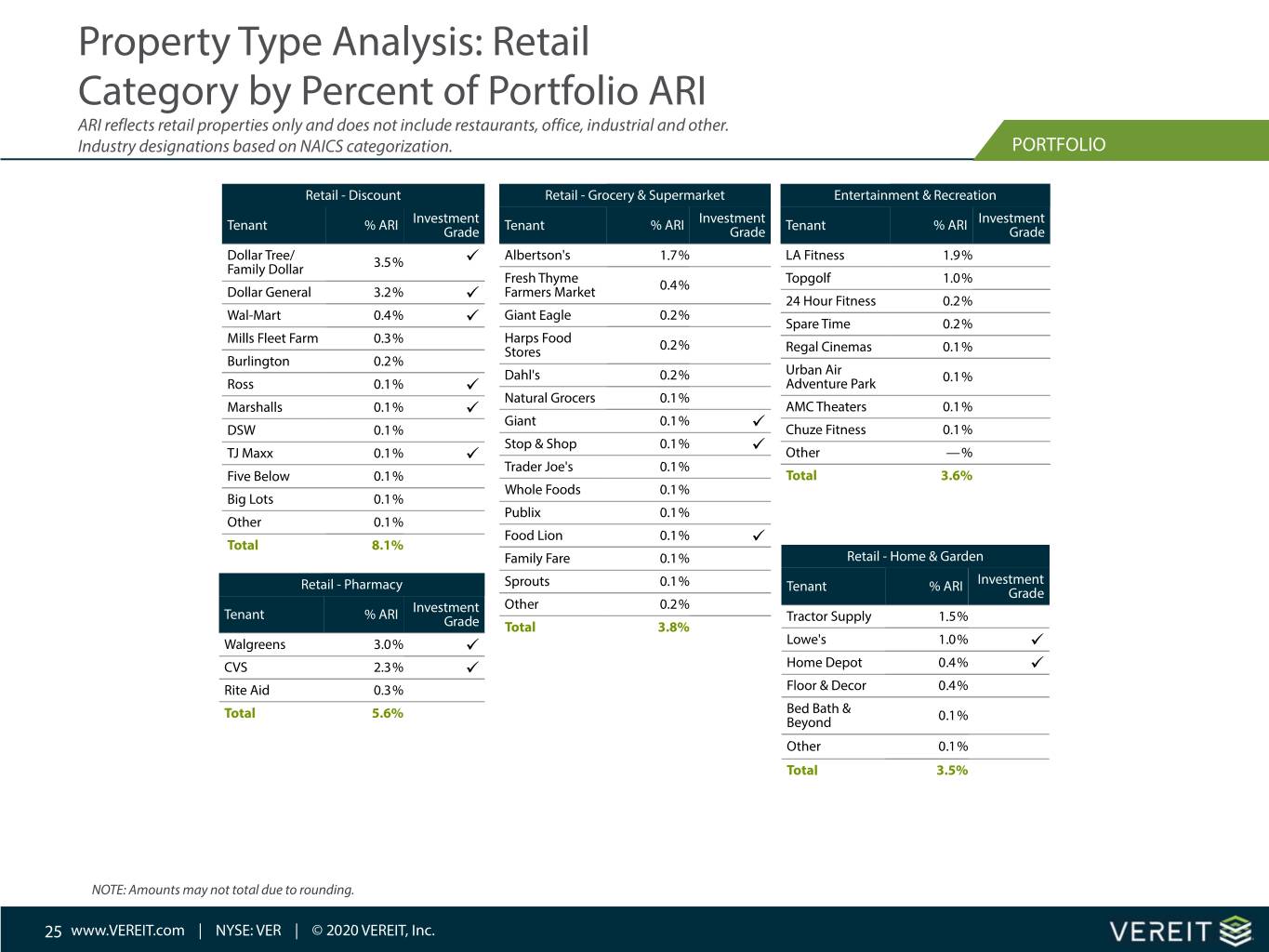

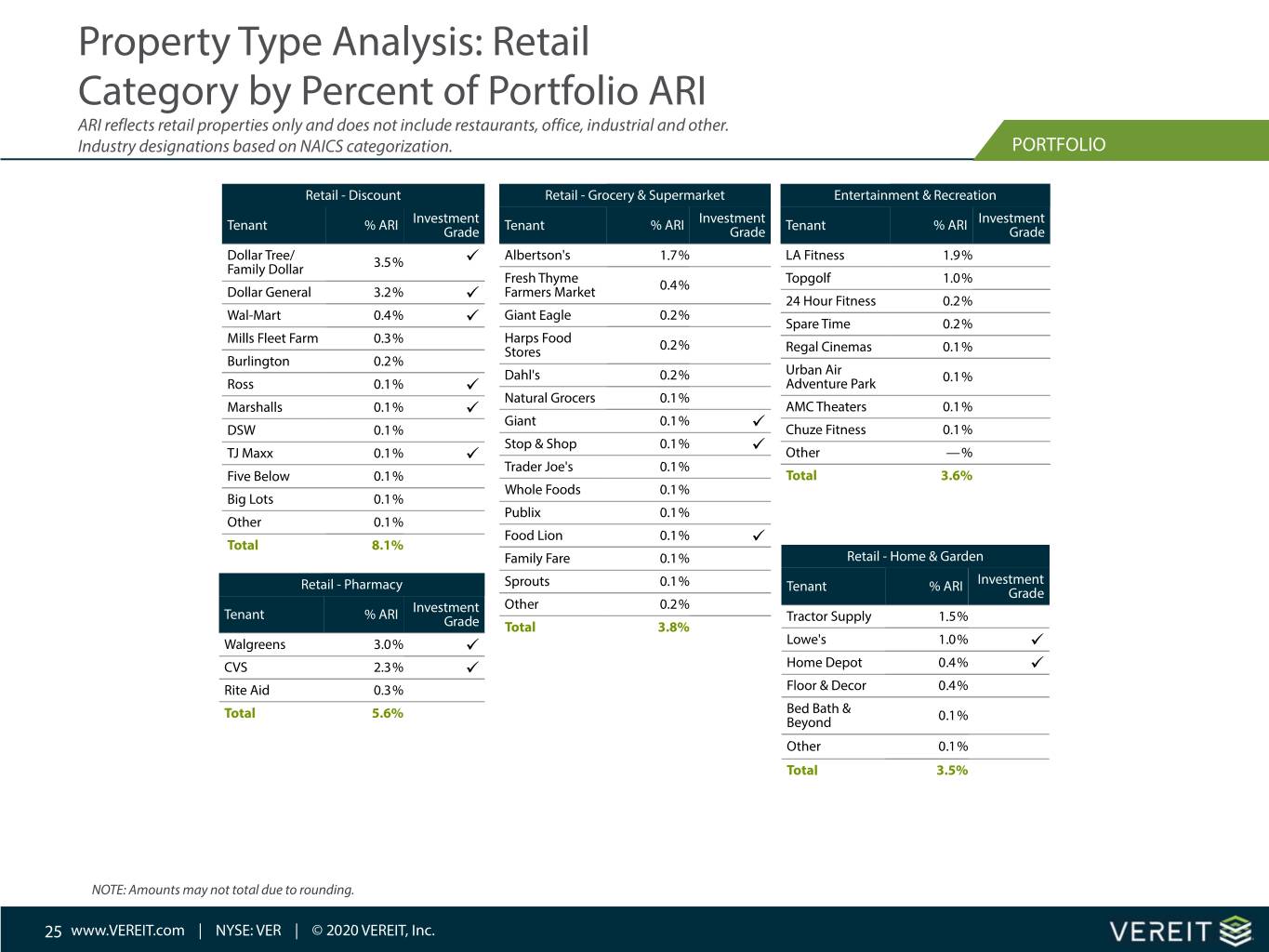

Property Type Analysis: Retail Category by Percent of Portfolio ARI ARI reflects retail properties only and does not include restaurants, office, industrial and other. Industry designations based on NAICS categorization. PORTFOLIO Retail - Discount Retail - Grocery & Supermarket Entertainment & Recreation Investment Tenant % ARI Investment Tenant % ARI Investment Tenant % ARI Grade Grade Grade Dollar Tree/ € Albertson's 1.7% LA Fitness 1.9% Family Dollar 3.5% Fresh Thyme 0.4% Topgolf 1.0% Dollar General 3.2% Farmers Market € 24 Hour Fitness 0.2% Wal-Mart 0.4% Giant Eagle 0.2% € Spare Time 0.2% Mills Fleet Farm 0.3% Harps Food Stores 0.2% Regal Cinemas 0.1% Burlington 0.2% Dahl's 0.2% Urban Air 0.1% Ross 0.1% € Adventure Park Natural Grocers 0.1% Marshalls 0.1% € AMC Theaters 0.1% Giant 0.1% DSW 0.1% € Chuze Fitness 0.1% Stop & Shop 0.1% € TJ Maxx 0.1% € Other ‰% Trader Joe's 0.1% Five Below 0.1% Total 3.6% Whole Foods 0.1% Big Lots 0.1% Publix 0.1% Other 0.1% Food Lion 0.1% Total 8.1% € Family Fare 0.1% Retail - Home & Garden Retail - Pharmacy Sprouts 0.1% Investment Tenant % ARI Grade Investment Other 0.2% Tenant % ARI Tractor Supply 1.5% Grade Total 3.8% Walgreens 3.0% € Lowe's 1.0% € CVS 2.3% € Home Depot 0.4% € Rite Aid 0.3% Floor & Decor 0.4% Total 5.6% Bed Bath & Beyond 0.1% Other 0.1% Total 3.5% NOTE: Amounts may not total due to rounding. 25 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

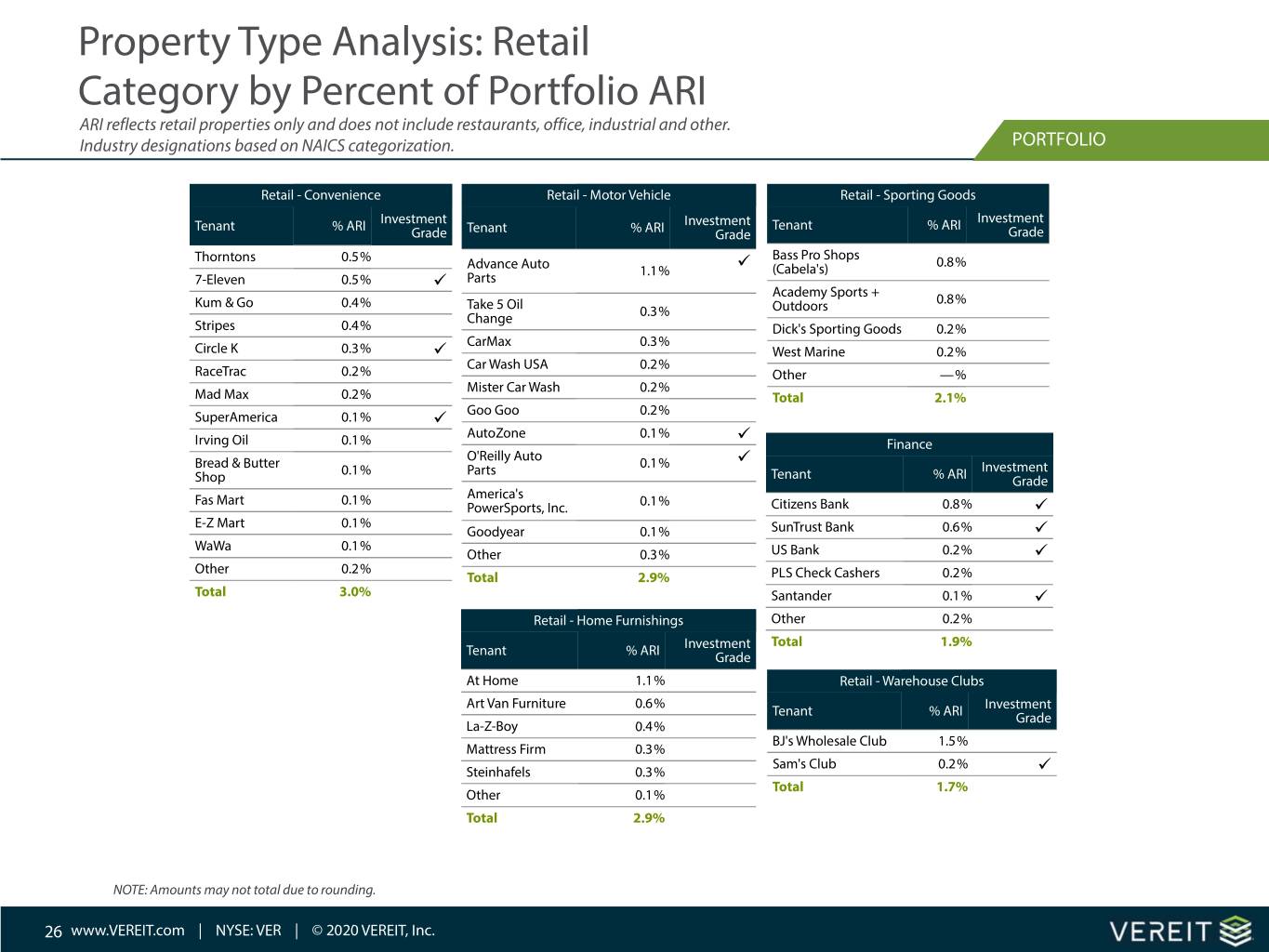

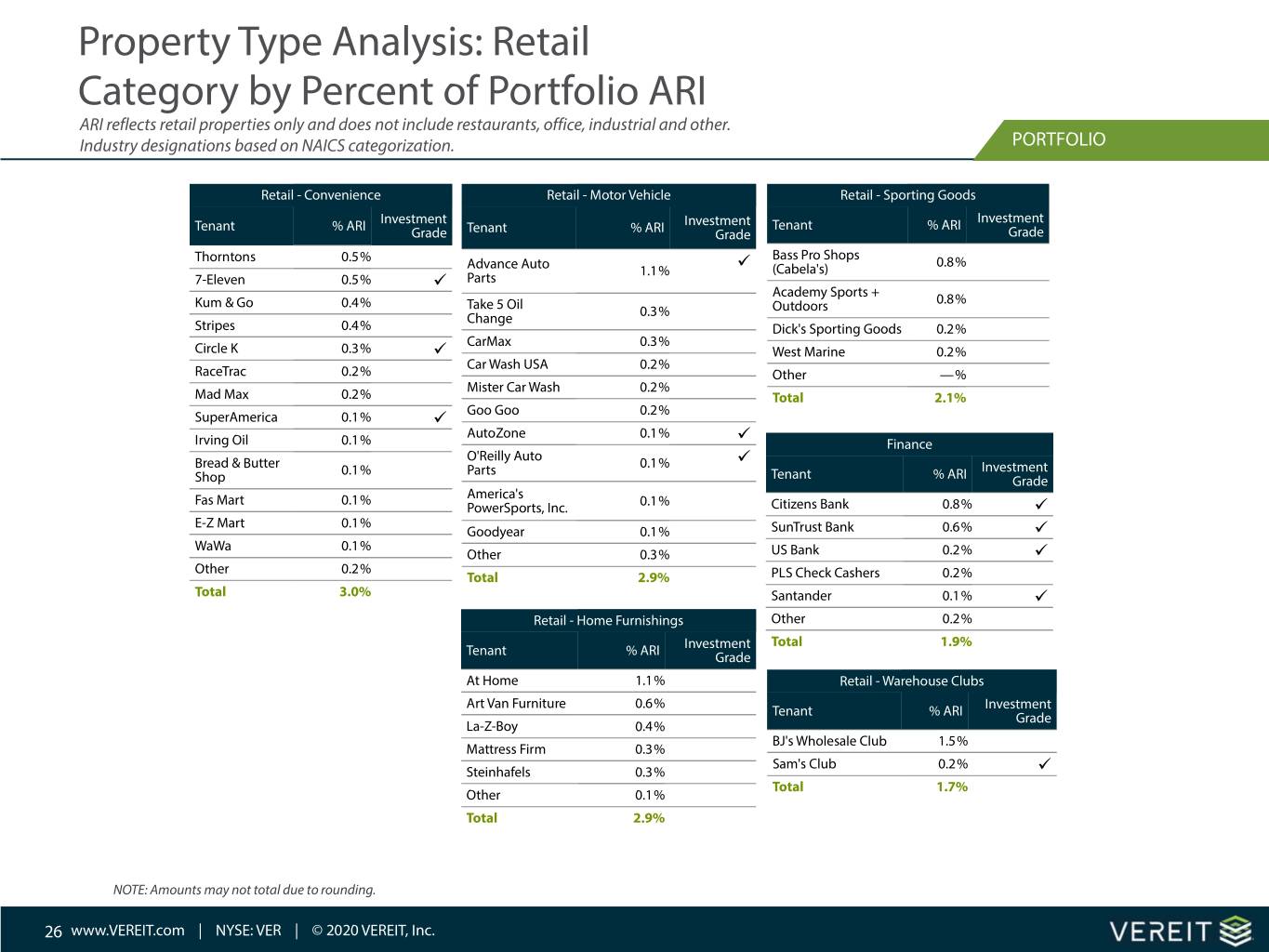

Property Type Analysis: Retail Category by Percent of Portfolio ARI ARI reflects retail properties only and does not include restaurants, office, industrial and other. Industry designations based on NAICS categorization. PORTFOLIO Retail - Convenience Retail - Motor Vehicle Retail - Sporting Goods Investment Tenant % ARI Investment Investment Tenant % ARI Grade Tenant % ARI Grade Grade Thorntons 0.5% € Bass Pro Shops 0.8% Advance Auto 1.1% (Cabela's) 7-Eleven 0.5% € Parts Academy Sports + Kum & Go 0.4% Take 5 Oil Outdoors 0.8% Change 0.3% Stripes 0.4% Dick's Sporting Goods 0.2% CarMax 0.3% Circle K 0.3% € West Marine 0.2% Car Wash USA 0.2% RaceTrac 0.2% Other ‰% Mister Car Wash 0.2% Mad Max 0.2% Total 2.1% SuperAmerica 0.1% € Goo Goo 0.2% AutoZone 0.1% € Irving Oil 0.1% Finance O'Reilly Auto € Bread & Butter 0.1% Parts 0.1% Investment Shop Tenant % ARI Grade Fas Mart 0.1% America's PowerSports, Inc. 0.1% Citizens Bank 0.8% € E-Z Mart 0.1% Goodyear 0.1% SunTrust Bank 0.6% € WaWa 0.1% Other 0.3% US Bank 0.2% € Other 0.2% Total 2.9% PLS Check Cashers 0.2% Total 3.0% Santander 0.1% € Retail - Home Furnishings Other 0.2% Investment Total 1.9% Tenant % ARI Grade At Home 1.1% Retail - Warehouse Clubs Art Van Furniture 0.6% Investment Tenant % ARI Grade La-Z-Boy 0.4% BJ's Wholesale Club 1.5% Mattress Firm 0.3% Sam's Club 0.2% Steinhafels 0.3% € Total 1.7% Other 0.1% Total 2.9% NOTE: Amounts may not total due to rounding. 26 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Property Type Analysis: Retail Category by Percent of Portfolio ARI ARI reflects retail properties only and does not include restaurants, office, industrial and other. Industry designations based on NAICS categorization. PORTFOLIO Retail - Medical Services Retail - Electronics & Appliances Retail - Hobby, Books & Music Investment Investment Investment Tenant % ARI Grade Tenant % ARI Grade Tenant % ARI Grade Fresenius € Best Buy 0.7% € Hobby Lobby 0.3% Medical Care 0.5% Other ‰% Michaels 0.1% DaVita Dialysis 0.3% Total 0.7% Other ‰% Physicians Immediate Care 0.1% Total 0.5% Rental AMITA Health 0.1% Investment Retail - Specialty (Other) Other 0.2% Tenant % ARI Grade Investment Total 1.1% Aaron's 0.4% Tenant % ARI Grade Vanguard Car Ulta Beauty 0.1% Retail - Pet Supply Rental 0.1% Cash Wise 0.1% Investment Other ‰% € Tenant % ARI Grade Other 0.1% Total 0.6% PetSmart 0.9% Total 0.4% Petco 0.1% Total 1.0% Retail - Apparel & Jewelry Investment Tenant % ARI Grade Retail - Department Stores Duluth Trading 0.3% Investment Tenant % ARI Grade Other ‰% Kohl's 0.7% € Total 0.3% Beall's 0.1% Other ‰% Total 0.7% NOTE: Amounts may not total due to rounding. 27 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Key Financial Highlights Q2 2020 a …#†

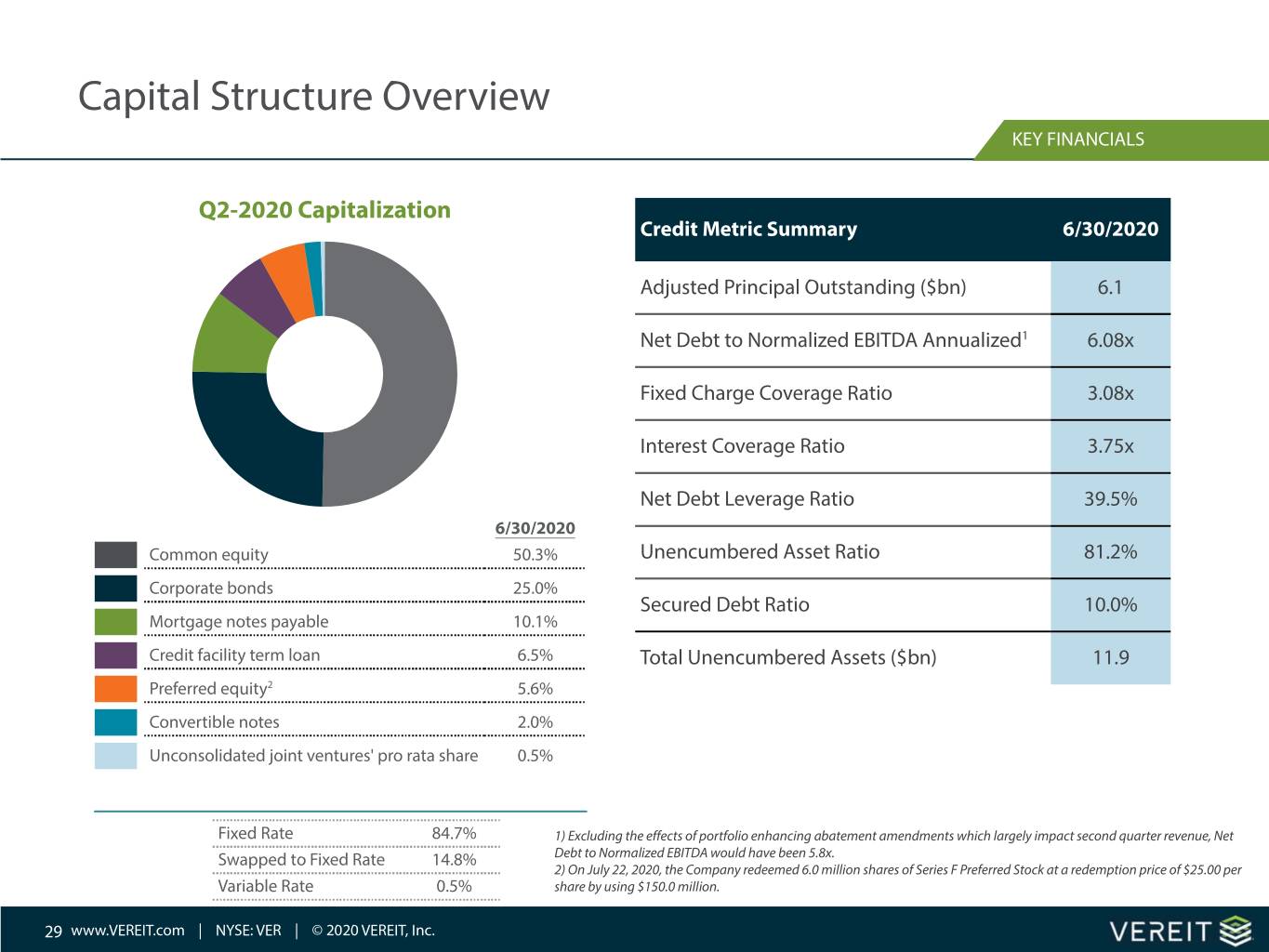

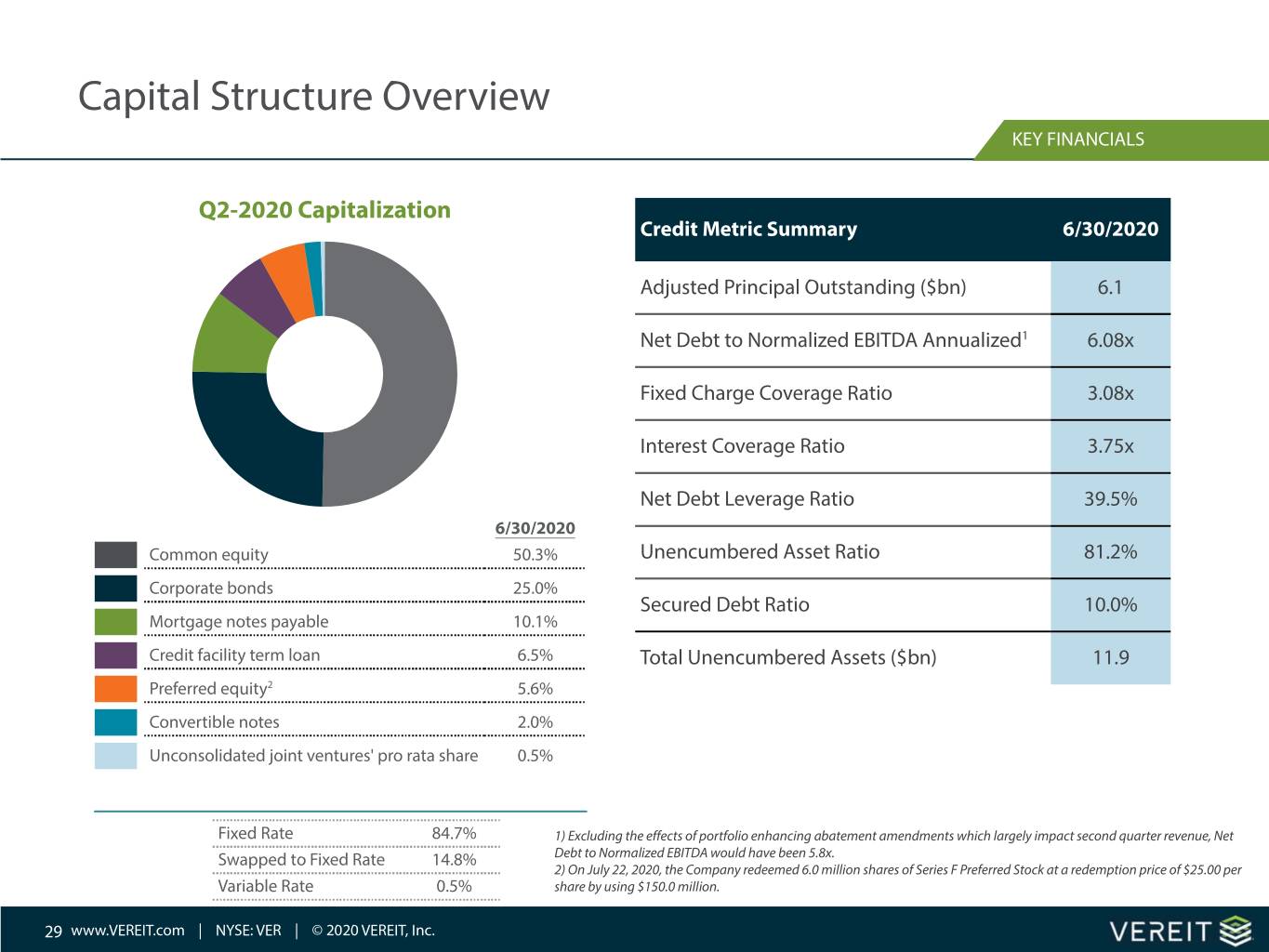

Capital Structure Overview KEY FINANCIALS Q2-2020 Capitalization Credit Metric Summary 6/30/2020 Adjusted Principal Outstanding ($bn) 6.1 Net Debt to Normalized EBITDA Annualized1 6.08x Fixed Charge Coverage Ratio 3.08x Interest Coverage Ratio 3.75x Net Debt Leverage Ratio 39.5% 6/30/2020 Common equity 50.3% Unencumbered Asset Ratio 81.2% Corporate bonds 25.0% Secured Debt Ratio 10.0% Mortgage notes payable 10.1% Credit facility term loan 6.5% Total Unencumbered Assets ($bn) 11.9 Preferred equity2 5.6% Convertible notes 2.0% Unconsolidated joint ventures' pro rata share 0.5% Fixed Rate 84.7% 1) Excluding the effects of portfolio enhancing abatement amendments which largely impact second quarter revenue, Net Swapped to Fixed Rate 14.8% Debt to Normalized EBITDA would have been 5.8x. 2) On July‚22, 2020, the Company redeemed 6.0 million shares of Series F Preferred Stock at a redemption price of $25.00 per Variable Rate 0.5% share by using $150.0 million. 29 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

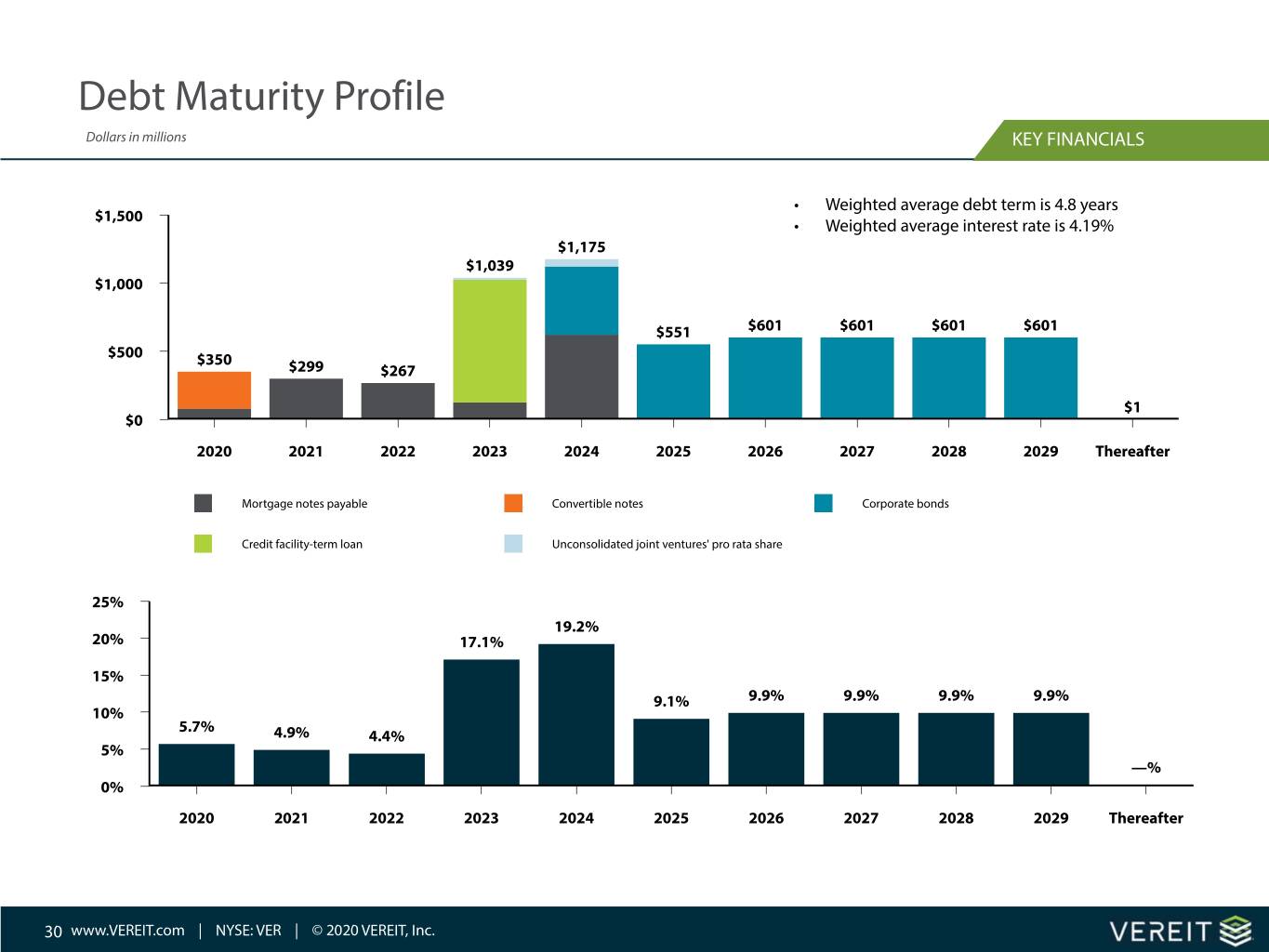

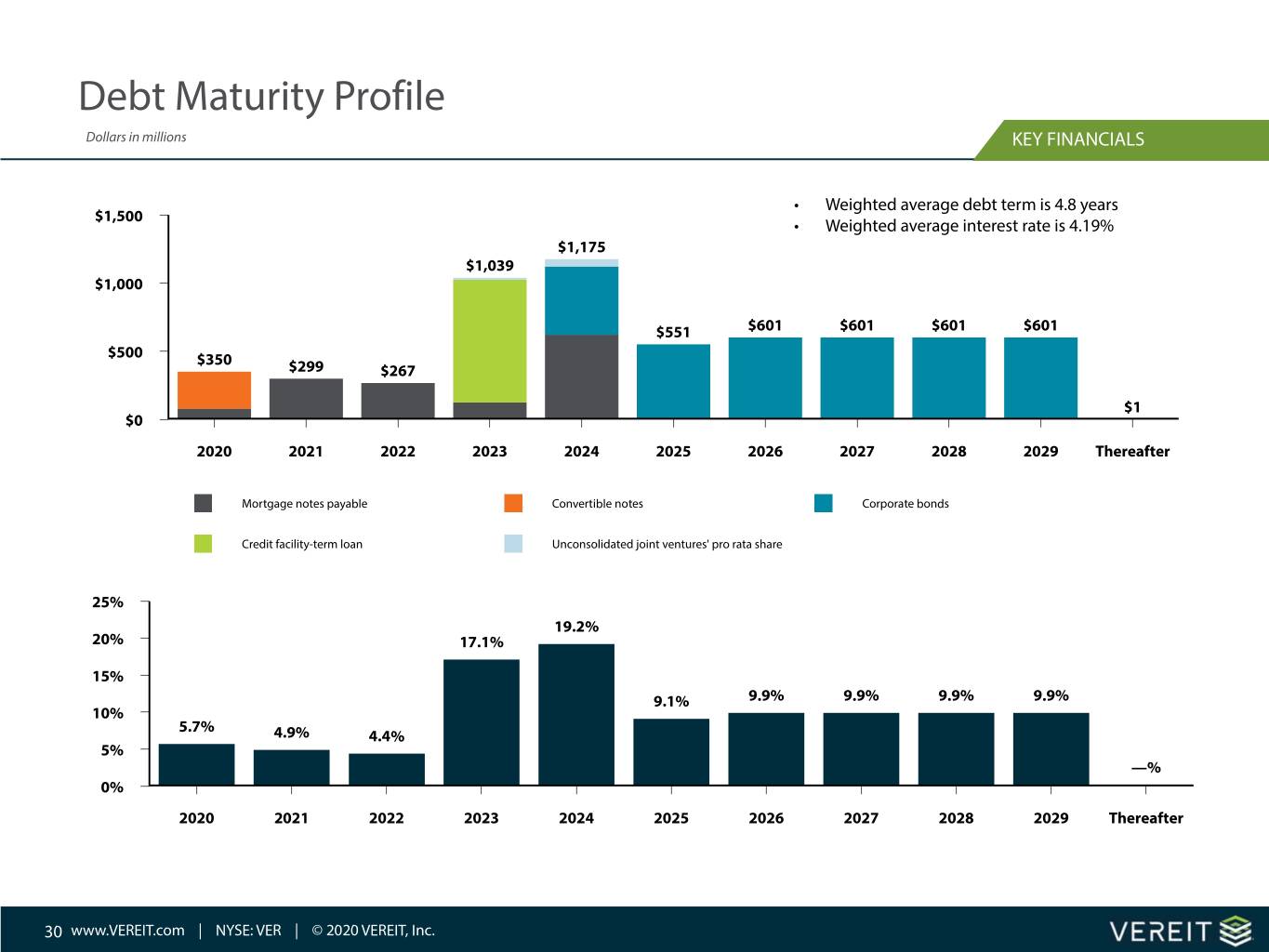

Debt Maturity Profile Dollars in millions KEY FINANCIALS ‡ Weighted average debt term is 4.8 years $1,500 ‡ Weighted average interest rate is 4.19% $1,175 $1,039 $1,000 $551 $601 $601 $601 $601 $500 $350 $299 $267 $1 $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter Mortgage notes payable Convertible notes Corporate bonds Credit facility-term loan Unconsolidated joint ventures' pro rata share 25% 19.2% 20% 17.1% 15% 9.1% 9.9% 9.9% 9.9% 9.9% 10% 5.7% 4.9% 4.4% 5% Å% 0% 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter 30 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Quarter Highlights Q2 2020 a …#†

Q2 2020 Highlights HIGHLIGHTS & GUIDANCE Rent Collection for the Quarter of 85% Which Increased to 91% for July Liquidity Increased from $1.2 Billion to $1.8 Billion with $600.0 Million Bond Issuance Q2 2020 Highlights ‡ Net income of $54.2 million and net income per diluted share of $0.04 ‡ Achieved $0.15 AFFO per diluted share ‡ Rent collection for the quarter of 85% which increased to 91% for July ‡ Acquisitions totaled $10.0 million in the second quarter and $156.2 million year-to-date ‡ Dispositions totaled $66.2 million in the second quarter and $200.3 million year-to-date, including the Company's share of dispositions contributed to the office partnership of $70.2 million ‡ Issued $600.0 million aggregate principal amount of 3.40% senior notes due 2028 to ultimately refinance its 3.75% convertible senior notes due December 2020, redeem $150.0 million of VEREITƒs 6.7% Series F preferred stock, and to repay borrowings under the Operating Partnership's revolving credit facility ‡ Total debt decreased from $6.31 billion to $5.97 billion; Net Debt decreased from $5.82 billion to $5.80 billion, or 39.5% Net Debt to Gross Real Estate Investments ‡ Net Debt to Normalized EBITDA ended at 6.1x which includes the negative effects of portfolio enhancing abatement amendments, which largely impact second quarter revenue. Excluding this, Net Debt to Normalized EBITDA would have been 5.8x. 32 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Contact Us CONTACT General Phone Number Registered Stockholders Follow Us 800.606.3610 Computershare Trust Company, N.A. LinkedIn (Transfer Agent) www.linkedin.com/company/vereit Phoenix PO Box 505000 2325 East Camelback Road Louisville, KY 40233-5000 Twitter 9th Floor twitter.com/vereitinc Phoenix, AZ 85016 By overnight delivery 602.778.6000 Computershare Trust Company, N.A. YouTube 462 South 4th Street, Suite 1600 https://www.youtube.com/channel/ New York City Louisville, KY 40202 UCUNu7AUOolITuwpNhr2JEGg 19 West 44th Street Suite 1401 Telephone inquiries Flickr New York, NY 10036 TFN 855.866.0787 https://www.flickr.com/ 212.413.9100 (US, CA, Puerto Rico) photos/143027056@N07/ TN 732.645.4073 Investor Relations (non-US) 877.405.2653 InvestorRelations@VEREIT.com Email web.queries@computershare.com 33 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Definitions & Reconciliations Q2 2020 a …#†

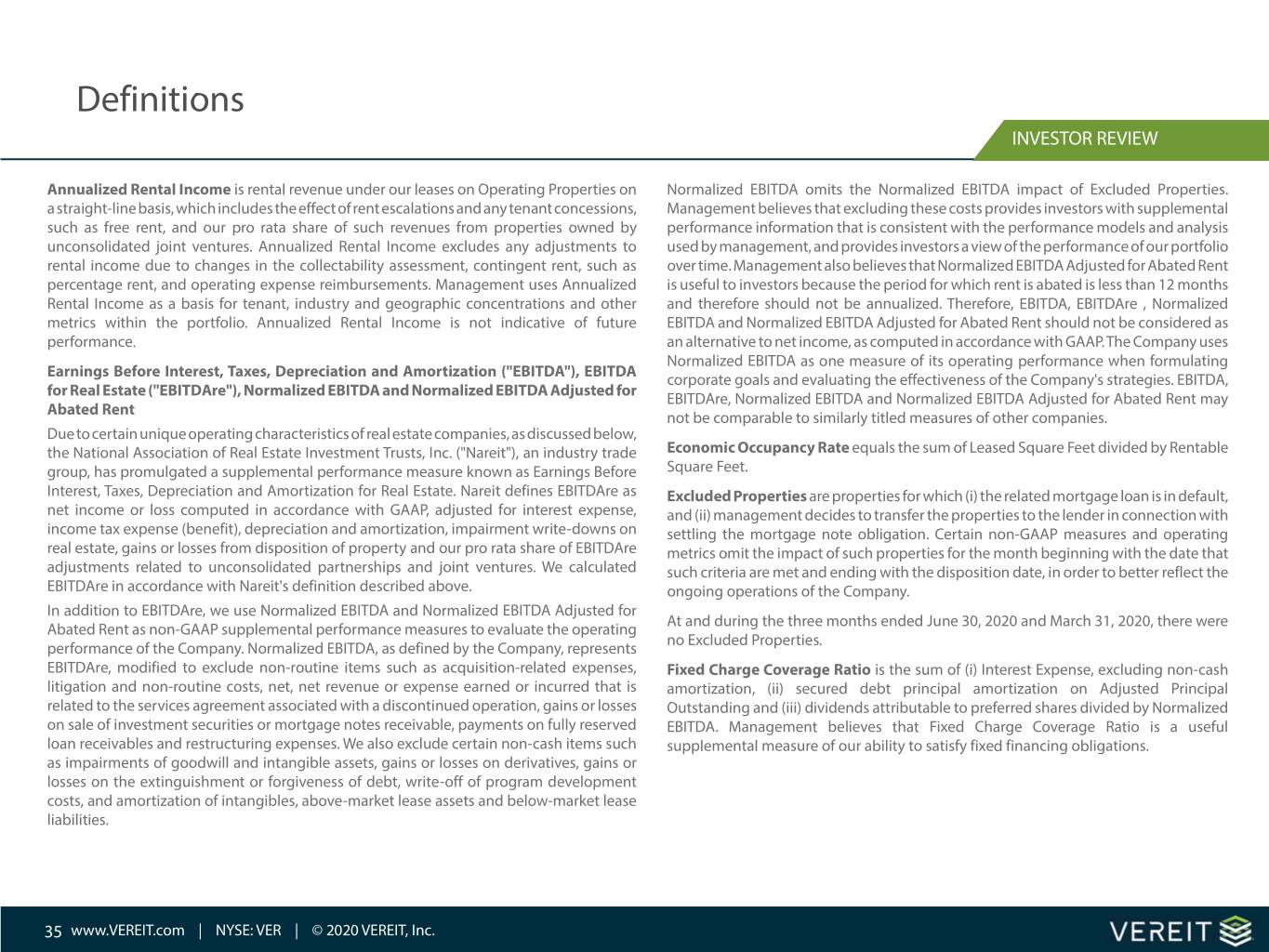

Definitions INVESTOR REVIEW Annualized Rental Income is rental revenue under our leases on Operating Properties on Normalized EBITDA omits the Normalized EBITDA impact of Excluded Properties. a straight-line basis, which includes the effect of rent escalations and any tenant concessions, Management believes that excluding these costs provides investors with supplemental such as free rent, and our pro rata share of such revenues from properties owned by performance information that is consistent with the performance models and analysis unconsolidated joint ventures. Annualized Rental Income excludes any adjustments to used by management, and provides investors a view of the performance of our portfolio rental income due to changes in the collectability assessment, contingent rent, such as over time. Management also believes that Normalized EBITDA Adjusted for Abated Rent percentage rent, and operating expense reimbursements. Management uses Annualized is useful to investors because the period for which rent is abated is less than 12 months Rental Income as a basis for tenant, industry and geographic concentrations and other and therefore should not be annualized. Therefore, EBITDA, EBITDAre , Normalized metrics within the portfolio. Annualized Rental Income is not indicative of future EBITDA and Normalized EBITDA Adjusted for Abated Rent should not be considered as performance. an alternative to net income, as computed in accordance with GAAP. The Company uses Normalized EBITDA as one measure of its operating performance when formulating Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), EBITDA corporate goals and evaluating the effectiveness of the Company's strategies. EBITDA, for Real Estate ("EBITDAre"), Normalized EBITDA and Normalized EBITDA Adjusted for EBITDAre, Normalized EBITDA and Normalized EBITDA Adjusted for Abated Rent may Abated Rent not be comparable to similarly titled measures of other companies. Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts, Inc. ("Nareit"), an industry trade Economic Occupancy Rate equals the sum of Leased Square Feet divided by Rentable group, has promulgated a supplemental performance measure known as Earnings Before Square Feet. Interest, Taxes, Depreciation and Amortization for Real Estate. Nareit defines EBITDAre as Excluded Properties are properties for which (i) the related mortgage loan is in default, net income or loss computed in accordance with GAAP, adjusted for interest expense, and (ii) management decides to transfer the properties to the lender in connection with income tax expense (benefit), depreciation and amortization, impairment write-downs on settling the mortgage note obligation. Certain non-GAAP measures and operating real estate, gains or losses from disposition of property and our pro rata share of EBITDAre metrics omit the impact of such properties for the month beginning with the date that adjustments related to unconsolidated partnerships and joint ventures. We calculated such criteria are met and ending with the disposition date, in order to better reflect the EBITDAre in accordance with Nareit's definition described above. ongoing operations of the Company. In addition to EBITDAre, we use Normalized EBITDA and Normalized EBITDA Adjusted for At and during the three months ended June€30, 2020 and March€31, 2020, there were Abated Rent as non-GAAP supplemental performance measures to evaluate the operating no Excluded Properties. performance of the Company. Normalized EBITDA, as defined by the Company, represents EBITDAre, modified to exclude non-routine items such as acquisition-related expenses, Fixed Charge Coverage Ratio is the sum of (i) Interest Expense, excluding non-cash litigation and non-routine costs, net, net revenue or expense earned or incurred that is amortization, (ii) secured debt principal amortization on Adjusted Principal related to the services agreement associated with a discontinued operation, gains or losses Outstanding and (iii) dividends attributable to preferred shares divided by Normalized on sale of investment securities or mortgage notes receivable, payments on fully reserved EBITDA. Management believes that Fixed Charge Coverage Ratio is a useful loan receivables and restructuring expenses. We also exclude certain non-cash items such supplemental measure of our ability to satisfy fixed financing obligations. as impairments of goodwill and intangible assets, gains or losses on derivatives, gains or losses on the extinguishment or forgiveness of debt, write-off of program development costs, and amortization of intangibles, above-market lease assets and below-market lease liabilities. 35 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Definitions INVESTOR REVIEW Funds from Operations ("FFO") and Adjusted Funds from Operations ("AFFO") For all of these reasons, we believe FFO and AFFO, in addition to net income (loss), as defined Due to certain unique operating characteristics of real estate companies, as discussed below, by GAAP, are helpful supplemental performance measures and useful in understanding the Nareit has promulgated a supplemental performance measure known as FFO, which we various ways in which our management evaluates the performance of the Company over believe to be an appropriate supplemental performance measure to reflect the operating time. However, not all REITs calculate FFO and AFFO the same way, so comparisons with performance of a REIT. FFO is not equivalent to our net income or loss as determined under other REITs may not be meaningful. FFO and AFFO should not be considered as alternatives GAAP. to net income (loss) and are not intended to be used as a liquidity measure indicative of cash flow available to fund our cash needs. Neither the SEC, Nareit, nor any other regulatory Nareit defines FFO as net income or loss computed in accordance with GAAP adjusted for body has evaluated the acceptability of the exclusions used to adjust FFO in order to gains or losses from disposition of property, depreciation and amortization of real estate calculate AFFO and its use as a non-GAAP financial performance measure. assets, impairment write-downs on real estate, and our pro rata share of FFO adjustments related to unconsolidated partnerships and joint ventures. We calculate FFO in accordance Gross Real Estate Investments represent total gross real estate and related assets of with Nareit's definition described above. Operating Properties, equity investments in the Cole REITs, investment in direct financing In addition to FFO, we use AFFO as a non-GAAP supplemental financial performance leases, investment securities backed by real estate and mortgage notes receivable, and the measure to evaluate the operating performance of the Company.€AFFO, as defined by the Company's pro rata share of such amounts related to properties owned by unconsolidated Company, excludes from FFO non-routine items such as acquisition-related expenses, joint ventures, net of gross intangible lease liabilities. litigation and non-routine costs, net, net revenue or expense earned or incurred that is We believe that the presentation of Gross Real Estate Investments, which shows our total related to the services agreement associated with a discontinued operation, gains or losses investments in real estate and related assets, in connection with Net Debt provides useful on sale of investment securities or mortgage notes receivable, payments on fully reserved information to investors to assess our overall financial flexibility, capital structure and loan receivables and restructuring expenses. We also exclude certain non-cash items such leverage. Gross Real Estate Investments should not be considered as an alternative to the as impairments of goodwill and intangible assets, straight-line rent, net direct financing Company's real estate investments balance as determined in accordance with GAAP or any lease adjustments, gains or losses on derivatives, reserves for loan loss, gains or losses on other GAAP financial measures and should only be considered together with, and as a the extinguishment or forgiveness of debt, non-current portion of the tax benefit or supplement to, the Company's financial information prepared in accordance with GAAP. expense, equity-based compensation and amortization of intangible assets, deferred financing costs, premiums and discounts on debt and investments, above-market lease Interest Coverage Ratio equals Normalized EBITDA divided by Interest Expense, excluding assets and below-market lease liabilities. non-cash amortization. Management believes that Interest Coverage Ratio is a useful supplemental measure of our ability to service our debt obligations. We omit the impact of the Excluded Properties and related non-recourse mortgage notes from FFO to calculate AFFO. Management believes that excluding these costs from FFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management, and provides investors a view of the performance of our portfolio over time. AFFO allows for a comparison of the performance of our operations with other publicly-traded REITs, as AFFO, or an equivalent measure, is routinely reported by publicly-traded REITs, and we believe often used by analysts and investors for comparison purposes. 36 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

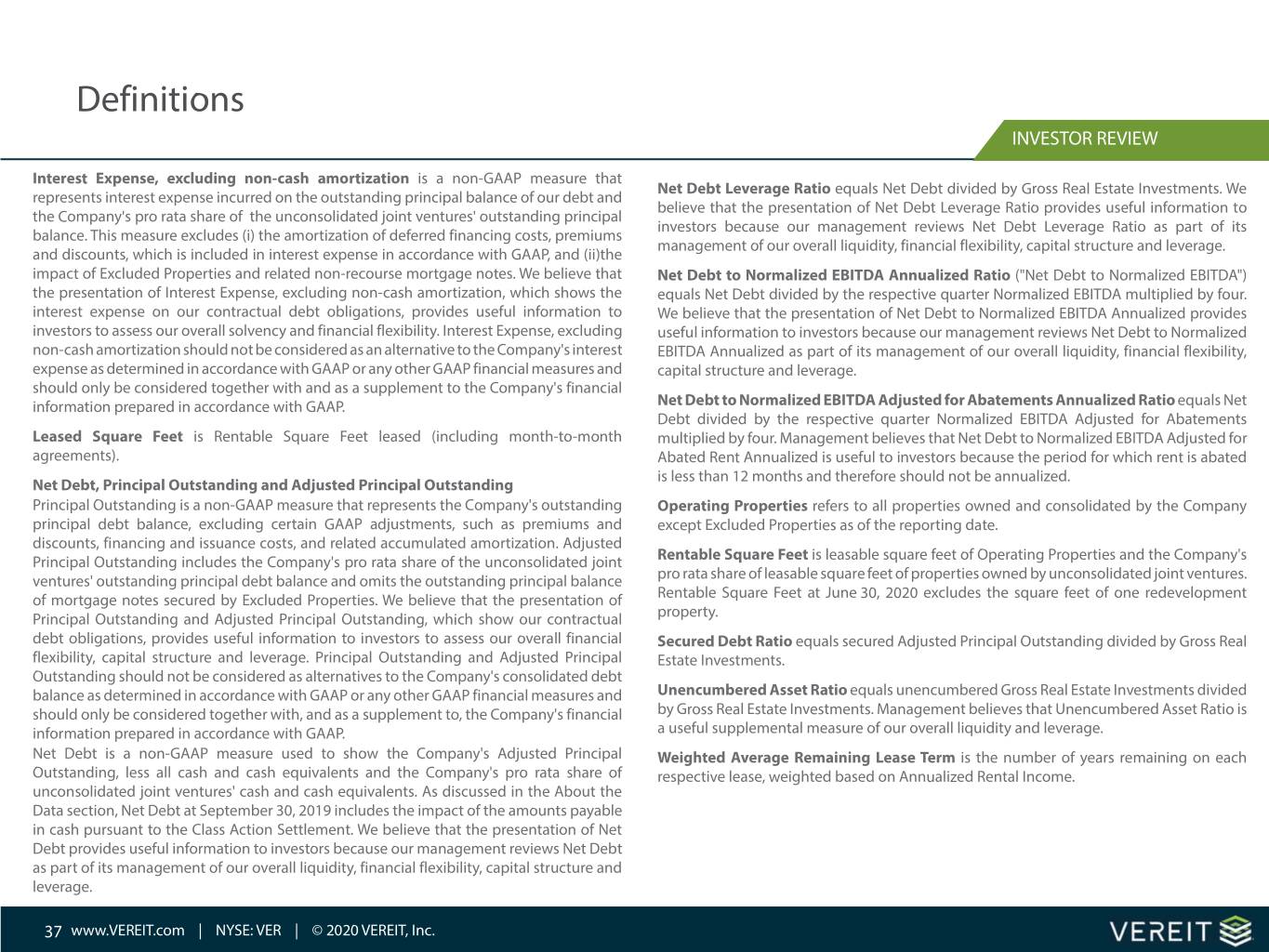

Definitions INVESTOR REVIEW Interest Expense, excluding non-cash amortization is a non-GAAP measure that Net Debt Leverage Ratio equals Net Debt divided by Gross Real Estate Investments. We represents interest expense incurred on the outstanding principal balance of our debt and believe that the presentation of Net Debt Leverage Ratio provides useful information to the Company's pro rata share of the unconsolidated joint ventures' outstanding principal investors because our management reviews Net Debt Leverage Ratio as part of its balance. This measure excludes (i) the amortization of deferred financing costs, premiums management of our overall liquidity, financial flexibility, capital structure and leverage. and discounts, which is included in interest expense in accordance with GAAP, and (ii)the impact of Excluded Properties and related non-recourse mortgage notes. We believe that Net Debt to Normalized EBITDA Annualized Ratio ("Net Debt to Normalized EBITDA") the presentation of Interest Expense, excluding non-cash amortization, which shows the equals Net Debt divided by the respective quarter Normalized EBITDA multiplied by four. interest expense on our contractual debt obligations, provides useful information to We believe that the presentation of Net Debt to Normalized EBITDA Annualized provides investors to assess our overall solvency and financial flexibility. Interest Expense, excluding useful information to investors because our management reviews Net Debt to Normalized non-cash amortization should not be considered as an alternative to the Company's interest EBITDA Annualized as part of its management of our overall liquidity, financial flexibility, expense as determined in accordance with GAAP or any other GAAP financial measures and capital structure and leverage. should only be considered together with and as a supplement to the Company's financial information prepared in accordance with GAAP. Net Debt to Normalized EBITDA Adjusted for Abatements Annualized Ratio equals Net Debt divided by the respective quarter Normalized EBITDA Adjusted for Abatements Leased Square Feet is Rentable Square Feet leased (including month-to-month multiplied by four. Management believes that Net Debt to Normalized EBITDA Adjusted for agreements). Abated Rent Annualized is useful to investors because the period for which rent is abated is less than 12 months and therefore should not be annualized. Net Debt, Principal Outstanding and Adjusted Principal Outstanding‚ Principal Outstanding is a non-GAAP measure that represents the Company's outstanding Operating Properties refers to all properties owned and consolidated by the Company principal debt balance, excluding certain GAAP adjustments, such as premiums and except Excluded Properties as of the reporting date. discounts, financing and issuance costs, and related accumulated amortization. Adjusted Principal Outstanding includes the Company's pro rata share of the unconsolidated joint Rentable Square Feet is leasable square feet of Operating Properties and the Company's ventures' outstanding principal debt balance and omits the outstanding principal balance pro rata share of leasable square feet of properties owned by unconsolidated joint ventures. of mortgage notes secured by Excluded Properties. We believe that the presentation of Rentable Square Feet at June€30, 2020 excludes the square feet of one redevelopment Principal Outstanding and Adjusted Principal Outstanding, which show our contractual property. debt obligations, provides useful information to investors to assess our overall financial Secured Debt Ratio equals secured Adjusted Principal Outstanding divided by Gross Real flexibility, capital structure and leverage. Principal Outstanding and Adjusted Principal Estate Investments. Outstanding should not be considered as alternatives to the Company's consolidated debt balance as determined in accordance with GAAP or any other GAAP financial measures and Unencumbered Asset Ratio equals unencumbered Gross Real Estate Investments divided should only be considered together with, and as a supplement to, the Company's financial by Gross Real Estate Investments. Management believes that Unencumbered Asset Ratio is information prepared in accordance with GAAP. a useful supplemental measure of our overall liquidity and leverage. Net Debt is a non-GAAP measure used to show the Company's Adjusted Principal Weighted Average Remaining Lease Term is the number of years remaining on each Outstanding, less all cash and cash equivalents and the Company's pro rata share of respective lease, weighted based on Annualized Rental Income. unconsolidated joint ventures' cash and cash equivalents. As discussed in the About the Data section, Net Debt at September 30, 2019 includes the impact of the amounts payable in cash pursuant to the Class Action Settlement. We believe that the presentation of Net Debt provides useful information to investors because our management reviews Net Debt as part of its management of our overall liquidity, financial flexibility, capital structure and leverage. 37 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Reconciliations (unaudited, in thousands) INVESTOR REVIEW FFO Three Months Ended June 30, 2020 Net income $ 54,239 Dividends on non-convertible preferred stock (12,948) Gain on disposition of real estate assets, net (8,795) Depreciation and amortization of real estate assets 110,207 Impairment of real estate 12,094 Proportionate share of adjustments for unconsolidated entities 1,146 FFO attributable to common stockholders and limited partners $ 155,943 38 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

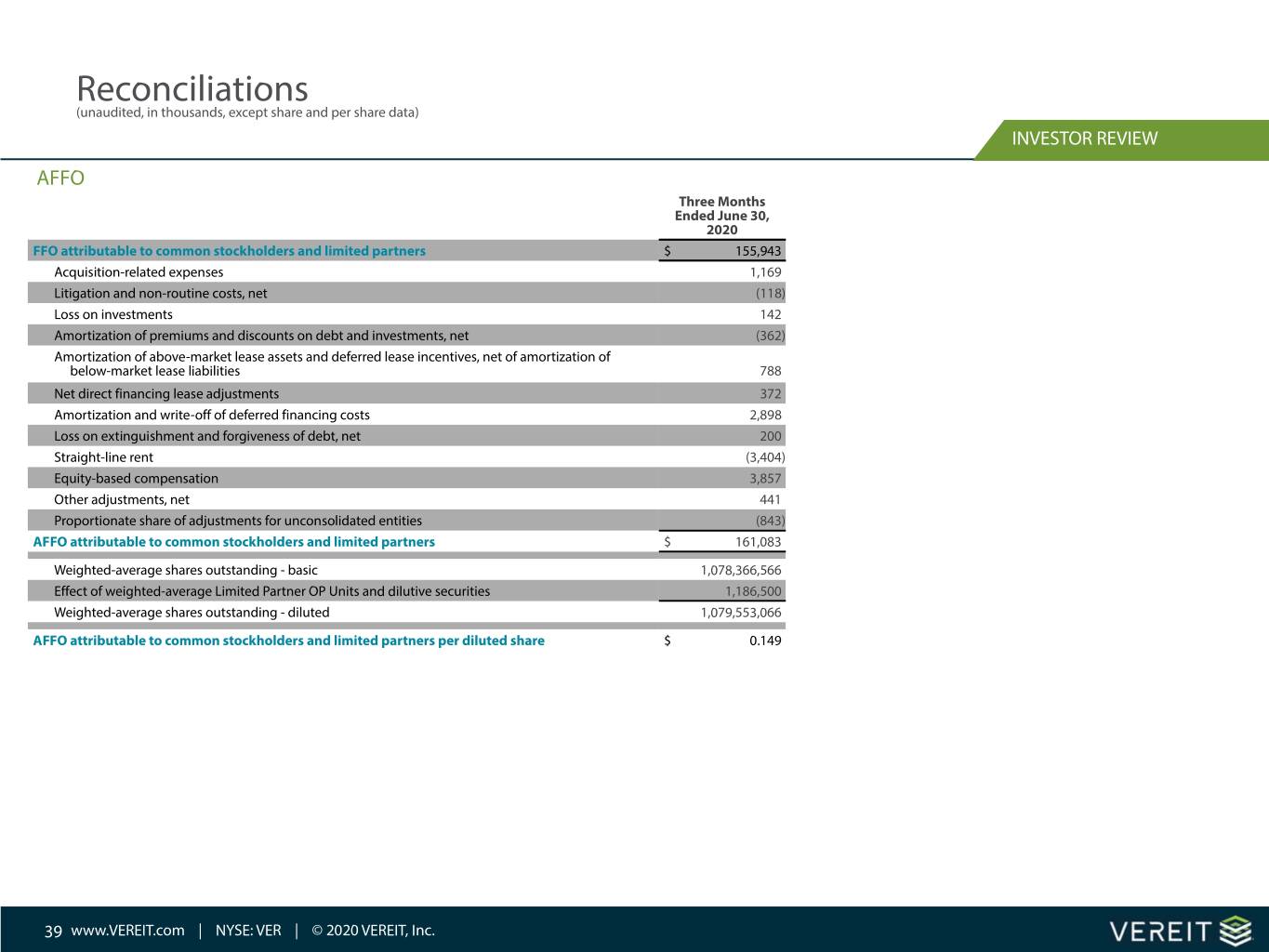

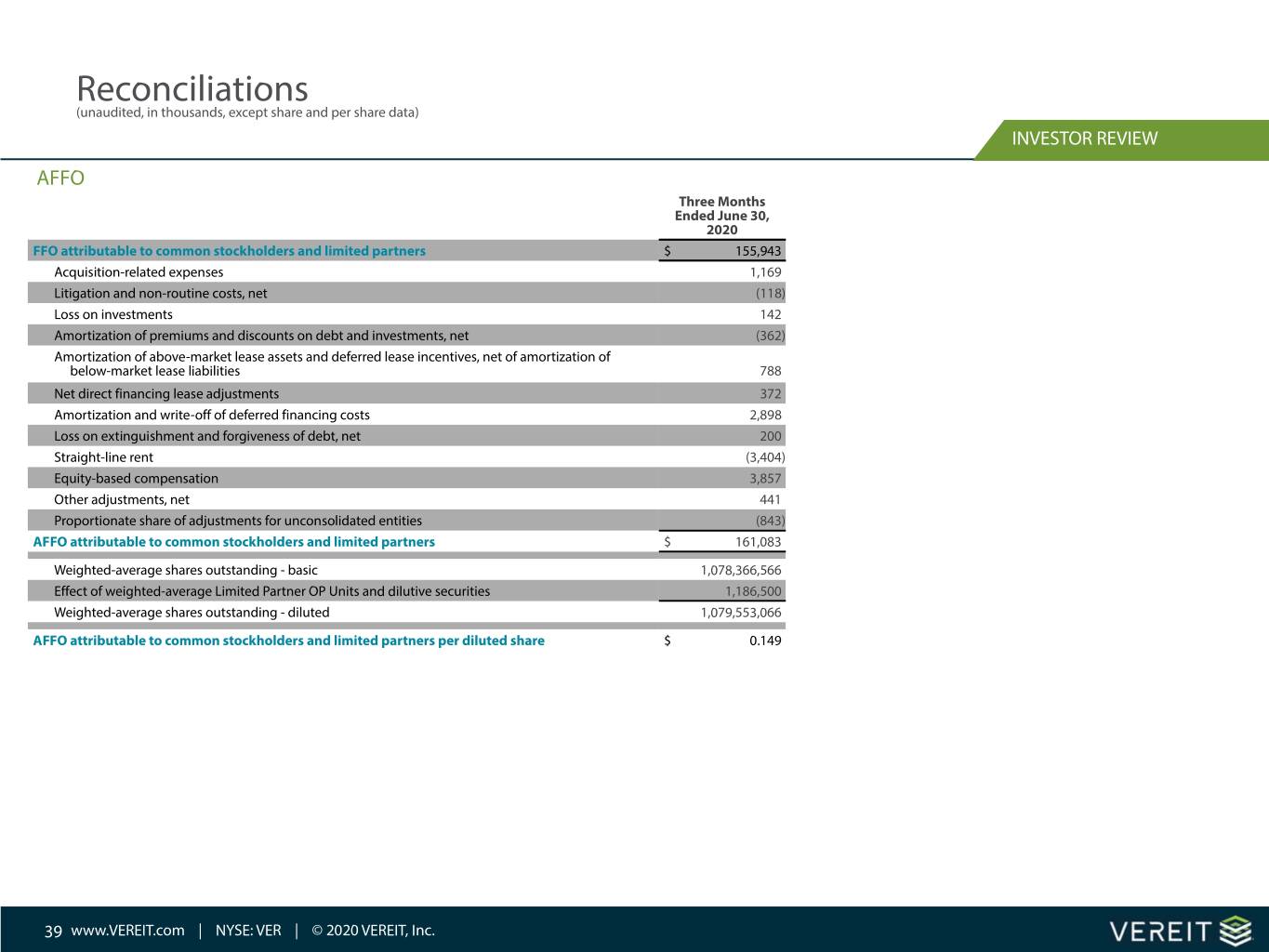

Reconciliations (unaudited, in thousands, except share and per share data) INVESTOR REVIEW AFFO Three Months Ended June 30, 2020 FFO attributable to common stockholders and limited partners $ 155,943 Acquisition-related expenses 1,169 Litigation and non-routine costs, net (118) Loss on investments 142 Amortization of premiums and discounts on debt and investments, net (362) Amortization of above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities 788 Net direct financing lease adjustments 372 Amortization and write-off of deferred financing costs 2,898 Loss on extinguishment and forgiveness of debt, net 200 Straight-line rent (3,404) Equity-based compensation 3,857 Other adjustments, net 441 Proportionate share of adjustments for unconsolidated entities (843) AFFO attributable to common stockholders and limited partners $ 161,083 Weighted-average shares outstanding - basic 1,078,366,566 Effect of weighted-average Limited Partner OP Units and dilutive securities 1,186,500 Weighted-average shares outstanding - diluted 1,079,553,066 AFFO attributable to common stockholders and limited partners per diluted share $ 0.149 39 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

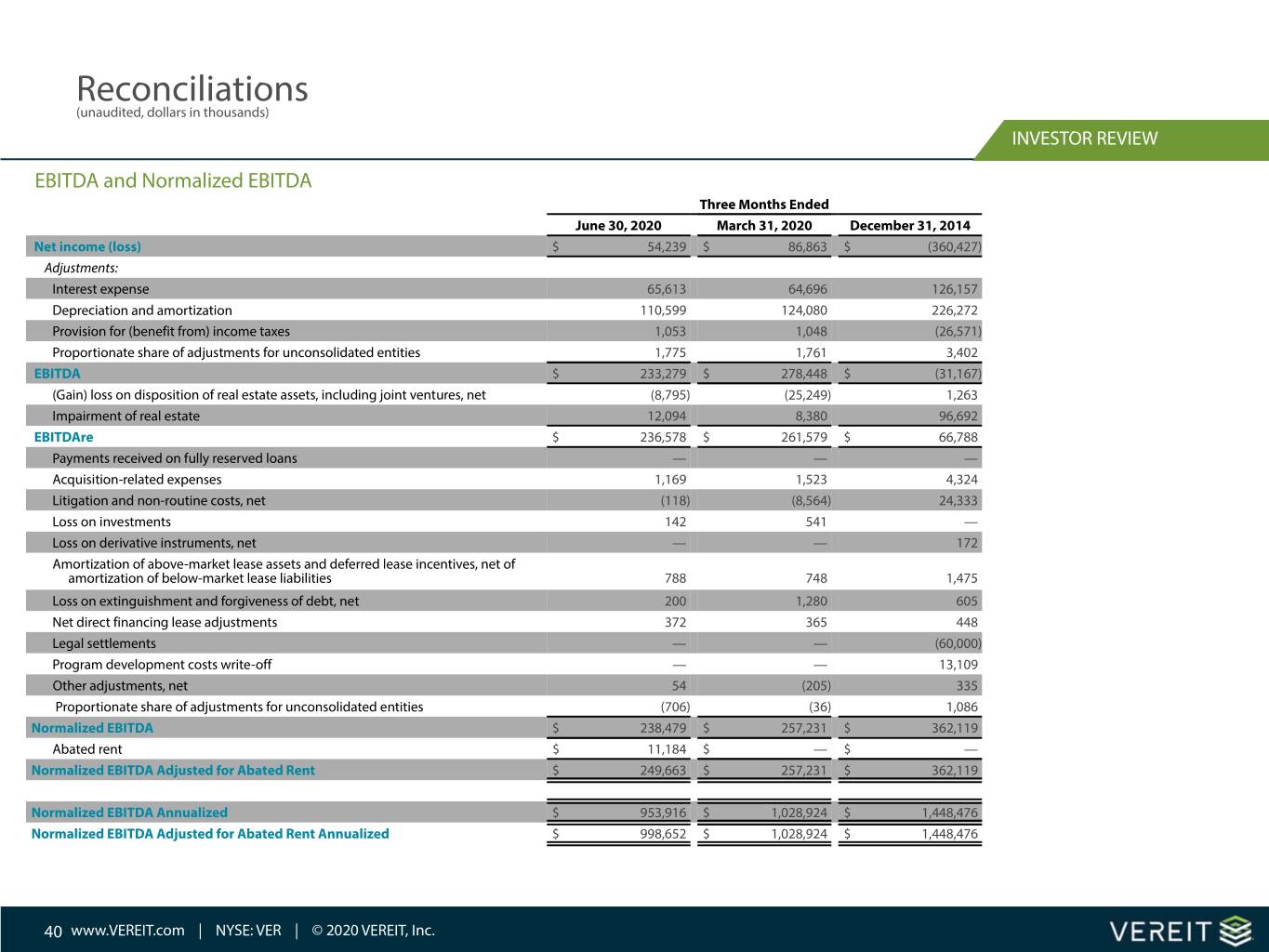

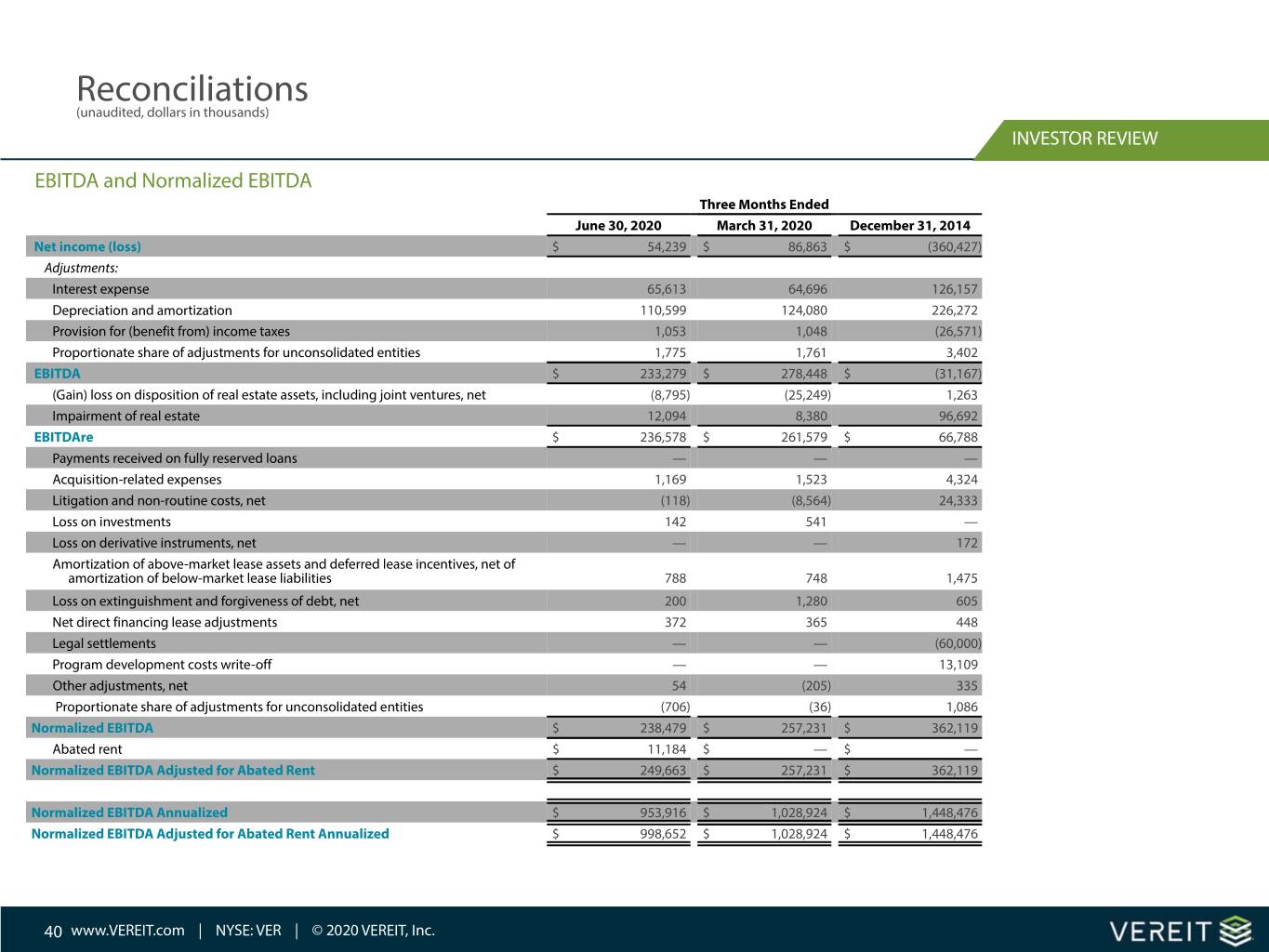

Reconciliations (unaudited, dollars in thousands) INVESTOR REVIEW EBITDA and Normalized EBITDA Three Months Ended June‚30, 2020 March 31, 2020 December 31, 2014 Net income (loss) $ 54,239 $ 86,863 $ (360,427) Adjustments: Interest expense 65,613 64,696 126,157 Depreciation and amortization 110,599 124,080 226,272 Provision for (benefit from) income taxes 1,053 1,048 (26,571) Proportionate share of adjustments for unconsolidated entities 1,775 1,761 3,402 EBITDA $ 233,279 $ 278,448 $ (31,167) (Gain) loss on disposition of real estate assets, including joint ventures, net (8,795) (25,249) 1,263 Impairment of real estate 12,094 8,380 96,692 EBITDAre $ 236,578 $ 261,579 $ 66,788 Payments received on fully reserved loans ‰ ‰ ‰ Acquisition-related expenses 1,169 1,523 4,324 Litigation and non-routine costs, net (118) (8,564) 24,333 Loss on investments 142 541 ‰ Loss on derivative instruments, net ‰ ‰ 172 Amortization of above-market lease assets and deferred lease incentives, net of amortization of below-market lease liabilities 788 748 1,475 Loss on extinguishment and forgiveness of debt, net 200 1,280 605 Net direct financing lease adjustments 372 365 448 Legal settlements ‰ ‰ (60,000) Program development costs write-off ‰ ‰ 13,109 Other adjustments, net 54 (205) 335 Proportionate share of adjustments for unconsolidated entities (706) (36) 1,086 Normalized EBITDA $ 238,479 $ 257,231 $ 362,119 Abated rent $ 11,184 $ ‰ $ ‰ Normalized EBITDA Adjusted for Abated Rent $ 249,663 $ 257,231 $ 362,119 Normalized EBITDA Annualized $ 953,916 $ 1,028,924 $ 1,448,476 Normalized EBITDA Adjusted for Abated Rent Annualized $ 998,652 $ 1,028,924 $ 1,448,476 40 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Reconciliations (unaudited, dollars in thousands) INVESTOR REVIEW Debt, Net Debt to Normalized EBITDA and Net Debt to Normalized EBITDA Adjusted for Abated Rent June 30, 2020 March 31, 2020 December 31, 2014 Mortgage notes payable and other debt, net $ 1,393,652 $ 1,405,701 $ 3,773,922 Corporate bonds, net 3,404,935 2,814,474 2,531,081 Convertible debt, net 270,152 319,120 952,856 Credit facility, net 896,314 1,767,306 3,167,919 Total debt - as reported $ 5,965,053 $ 6,306,601 $ 10,425,778 Deferred financing costs, net 41,152 37,896 88,003 Net discounts (premiums) 11,860 6,389 (44,660) Principal Outstanding $ 6,018,065 $ 6,350,886 $ 10,469,121 Unconsolidated joint ventures' pro rata share 68,360 68,360 ‰ Adjusted Principal Outstanding $ 6,086,425 $ 6,419,246 $ 10,469,121 Cash and cash equivalents (278,883) (600,945) (416,711) Pro rata share of unconsolidated joint ventures' cash and cash equivalents (3,433) (2,567) ‰ Net Debt $ 5,804,109 $ 5,815,734 $ 10,052,410 Normalized EBITDA Annualized 953,916 1,028,924 1,448,476 Net Debt to Normalized EBITDA Annualized Ratio 6.08x 5.65x 6.94x June 30, 2020 December 31, 2014 Net Debt $ 5,804,109 $ 10,052,410 Normalized EBITDA Adjusted for Abated Rent Annualized 998,652 1,448,476 Net Debt to Normalized EBITDA Adjusted for Abated Rent Annualized Ratio 5.81x 6.94x 41 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.

Reconciliations (unaudited, dollars in thousands) INVESTOR REVIEW Interest Three Months Ended June 30, 2020 June 30, 2020 Interest expense - as reported $ 65,613 Net Debt $ 5,804,109 Amortization of deferred financing costs and other non-cash Gross Real Estate Investments 14,704,629 charges (2,995) Net Debt Leverage Ratio 39.5% Amortization of net premiums 459 Unconsolidated joint ventures' pro rata share 559 Unencumbered Gross Real Estate Investments $ 11,933,717 Interest Expense, excluding non-cash amortization $ 63,636 Gross Real Estate Investments 14,704,629 Unencumbered Asset Ratio 81.2% Secured Adjusted Principal Outstanding $ 1,464,792 Gross Real Estate Investments 14,704,629 Secured Debt Ratio 10.0% Financial and Operations Statistics and Ratios Three Months Ended June 30, 2020 June 30, 2020 Interest Expense, excluding non-cash amortization $ 63,636 Total real estate investments, at cost - as reported $ 14,714,616 Normalized EBITDA 238,479 Adjustments: Investment in Cole REITs 6,867 Interest Coverage Ratio 3.75x Gross assets held for sale 54,046 Interest Expense, excluding non-cash amortization $ 63,636 Investment in direct financing leases, net 8,579 Mortgage notes receivable, net 9,959 Secured debt principal amortization 861 Gross below market leases (236,324) Dividends attributable to preferred shares 12,948 Unconsolidated joint ventures' pro rata share 146,886 Total fixed charges 77,445 Gross Real Estate Investments $ 14,704,629 Normalized EBITDA 238,479 Fixed Charge Coverage Ratio 3.08x 42 www.VEREIT.com | NYSE: VER | Å 2020 VEREIT, Inc.