2016 Q3 Earnings Release Summary October 25, 2016

2 Important Disclosure Information This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements related to, among other things, future financial performance, including our 2016 outlook, the expected timing, completion and effects of any proposed disposals, expected performance, free cash flow, debt reduction, distribution growth and other growth opportunities, as such, involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results or performance to differ from those projected in the forward-looking statements, possibly materially. For a description of factors that may cause the Company’s actual results or performance to differ from future results or performance implied by forward-looking statements, please review the information under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” included in the combined annual report on Form 10-K of Extended Stay America, Inc. and ESH Hospitality, Inc. (collectively, the “Company”) filed with the SEC on February 23, 2016 and other documents of the Company on file with or furnished to the SEC. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company, its business or operations. Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. We caution you that actual outcomes and results may differ materially from what is expressed, implied or forecasted by the Company’s forward-looking statements. This presentation includes certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, Hotel Operating Profit and Hotel Operating Margin. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP.

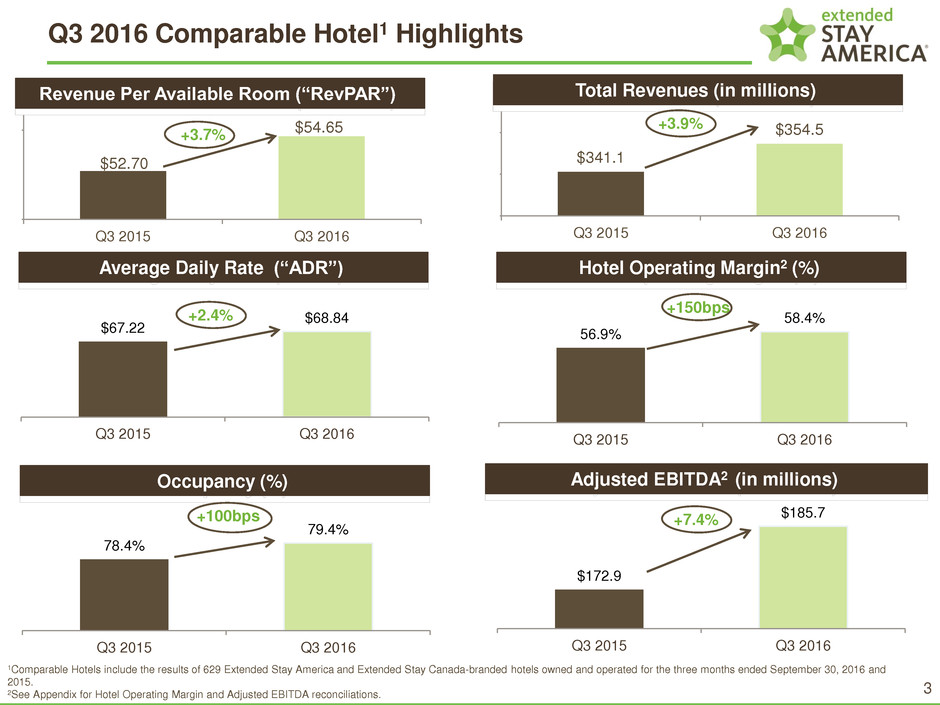

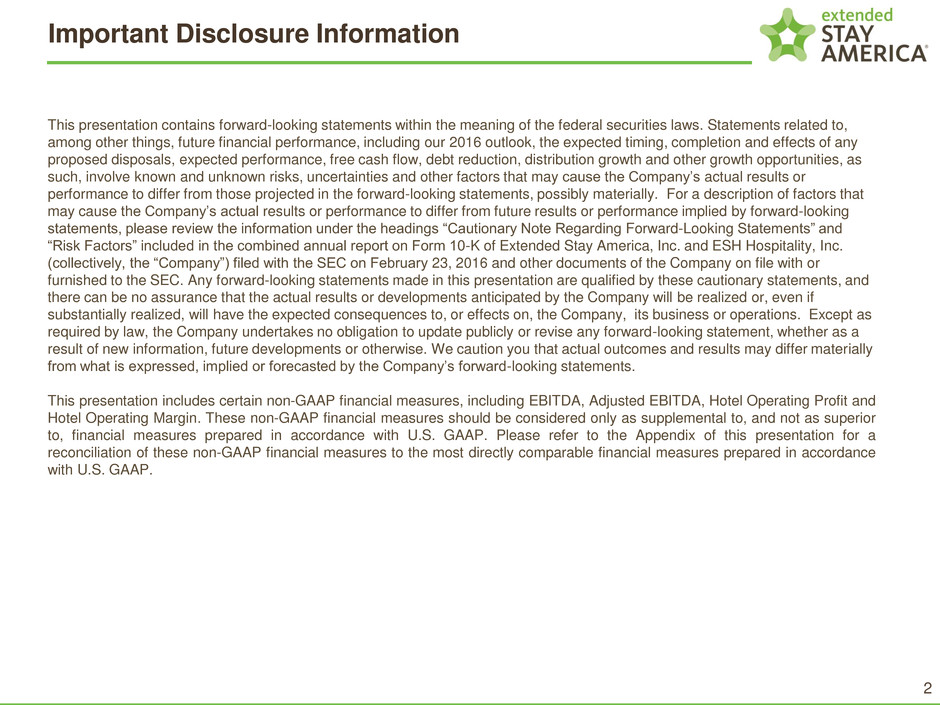

3 1Comparable Hotels include the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for the three months ended September 30, 2016 and 2015. 2See Appendix for Hotel Operating Margin and Adjusted EBITDA reconciliations. Q3 2016 Comparable Hotel1 Highlights $52.70 $54.65 Q3 2015 Q3 2016 Revenue Per Available Room (“RevPAR”) $67.22 $68.84 Q3 2015 Q3 2016 Average Daily Rate (“ADR”) 78.4% 79.4% Q3 2015 Q3 2016 Occupancy (%) +3.7% +2.4% +100bps $341.1 $354.5 Q3 2015 Q3 2016 Total Revenues (in millions) $172.9 $185.7 Q3 2015 Q3 2016 Hotel Operating Margin2 (%) 56.9% 58.4% Q3 2015 Q3 2016 Adjusted EBITDA2 (in millions) +3.9% +150bps +7.4%

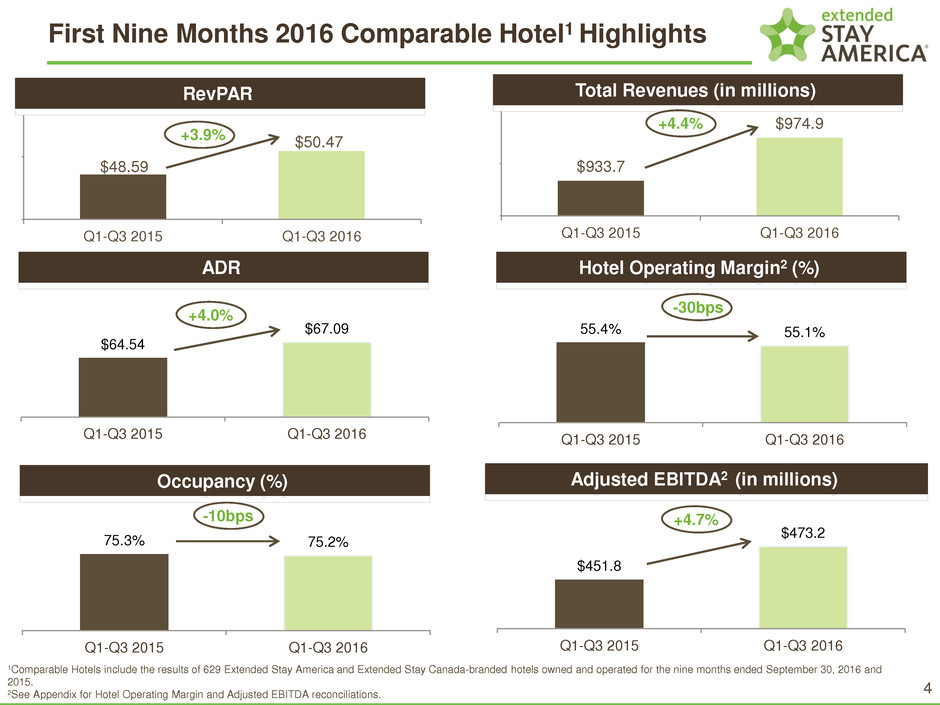

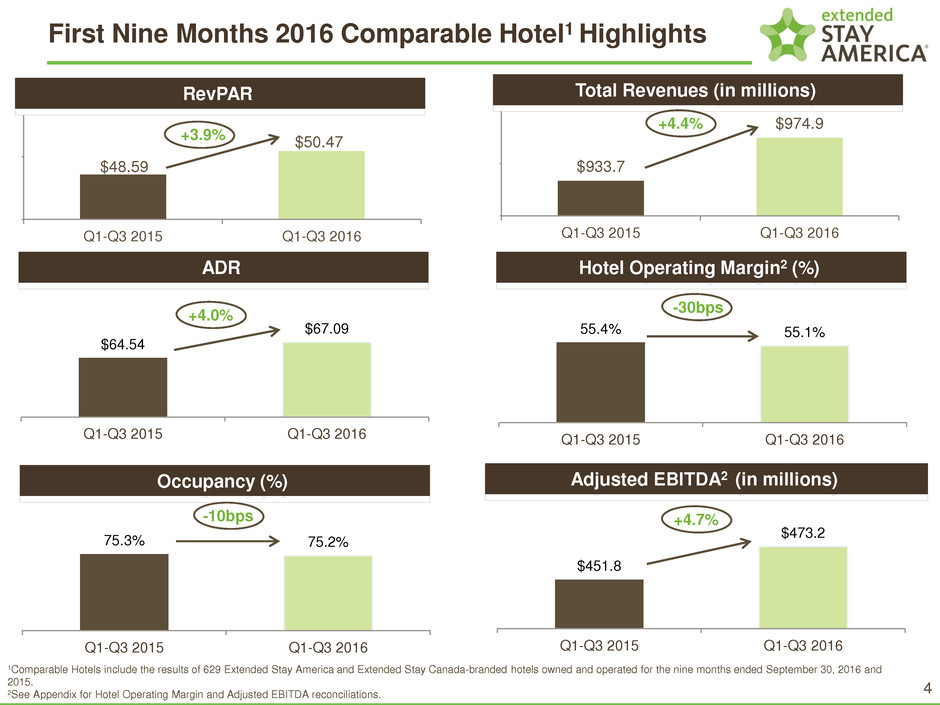

4 First Nine Months 2016 Comparable Hotel1 Highlights $48.59 $50.47 Q1-Q3 2015 Q1-Q3 2016 RevPAR $64.54 $67.09 Q1-Q3 2015 Q1-Q3 2016 ADR 75.3% 75.2% Q1-Q3 2015 Q1-Q3 2016 Occupancy (%) +3.9% +4.0% -10bps $933.7 $974.9 Q1-Q3 2015 Q1-Q3 2016 Total Revenues (in millions) $451.8 $473.2 Q1-Q3 2015 Q1-Q3 2016 Hotel Operating Margin2 (%) 55.4% 55.1% Q1-Q3 2015 Q1-Q3 2016 Adjusted EBITDA2 (in millions) +4.4% -30bps +4.7% 1Comparable Hotels include the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for the nine months ended September 30, 2016 and 2015. 2See Appendix for Hotel Operating Margin and Adjusted EBITDA reconciliations.

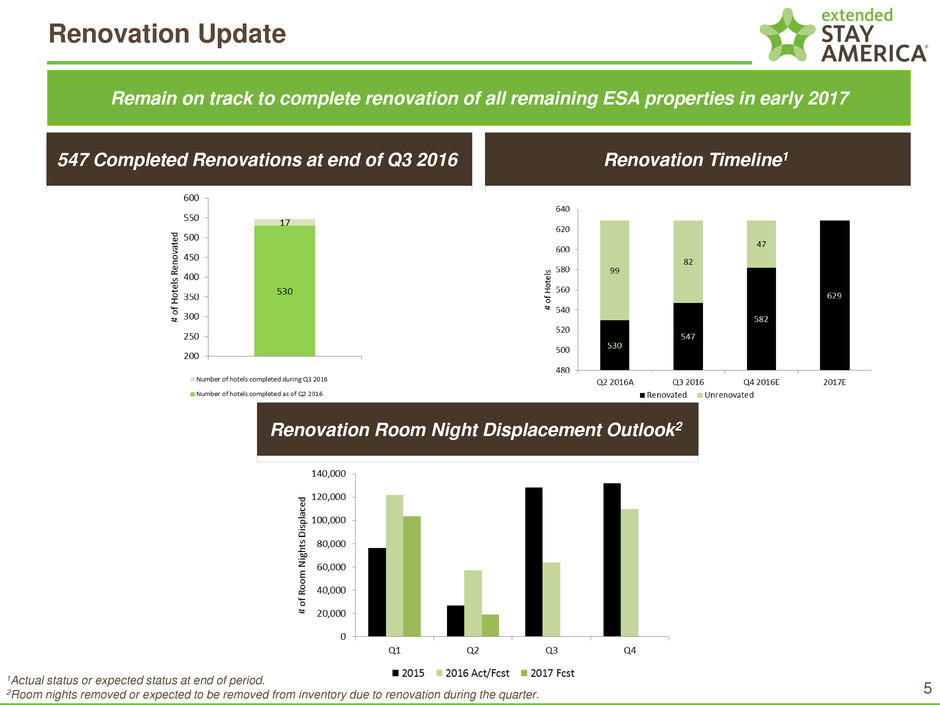

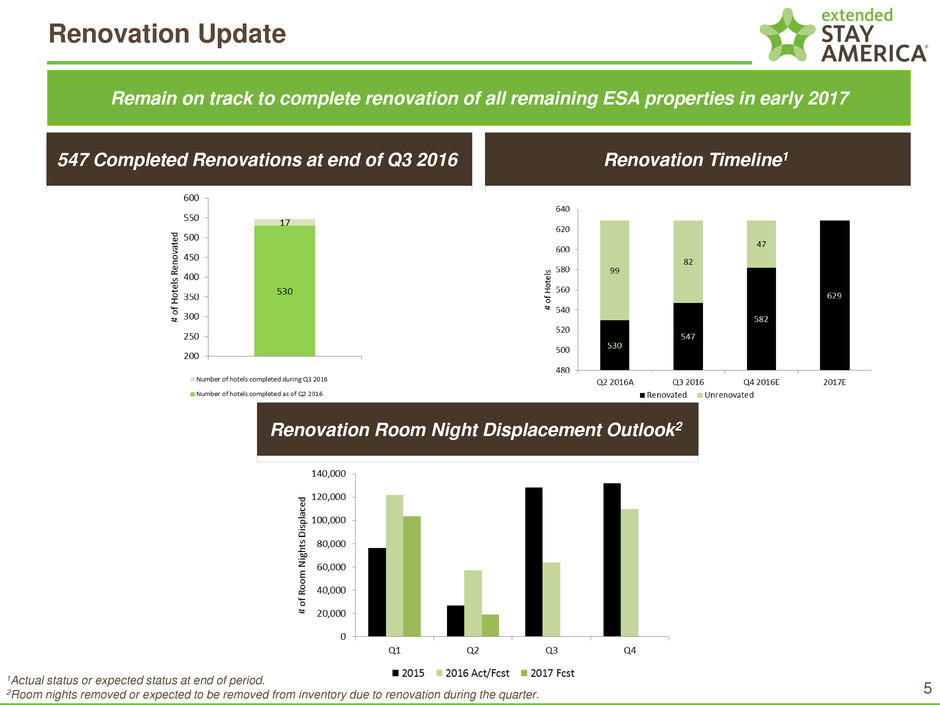

5 Renovation Update Remain on track to complete renovation of all remaining ESA properties in early 2017 547 Completed Renovations at end of Q3 2016 Renovation Timeline1 Renovation Room Night Displacement Outlook2 1Actual status or expected status at end of period. 2Room nights removed or expected to be removed from inventory due to renovation during the quarter.

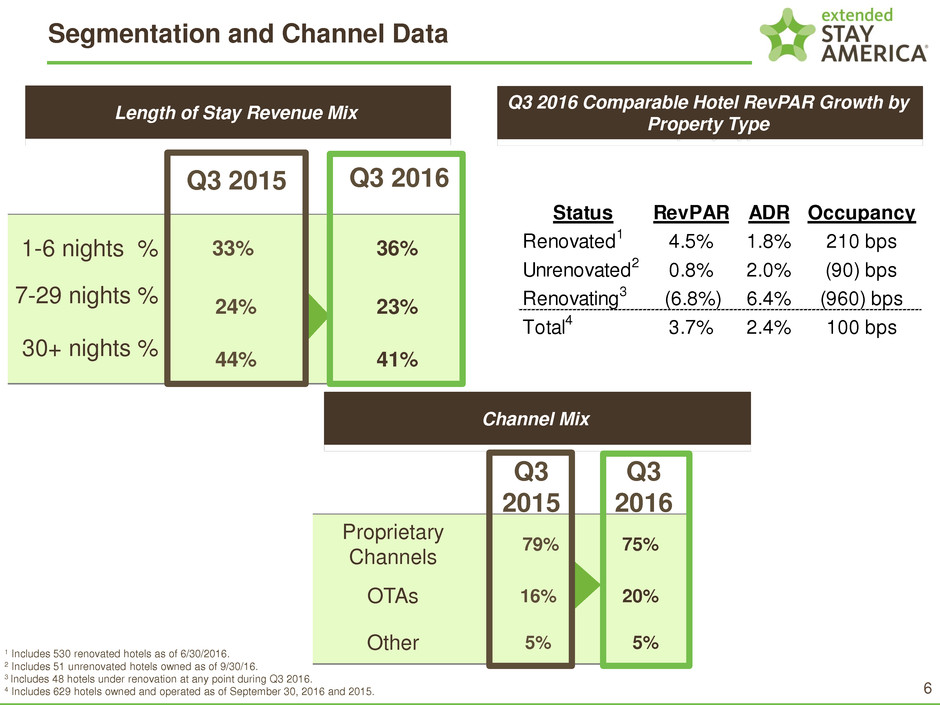

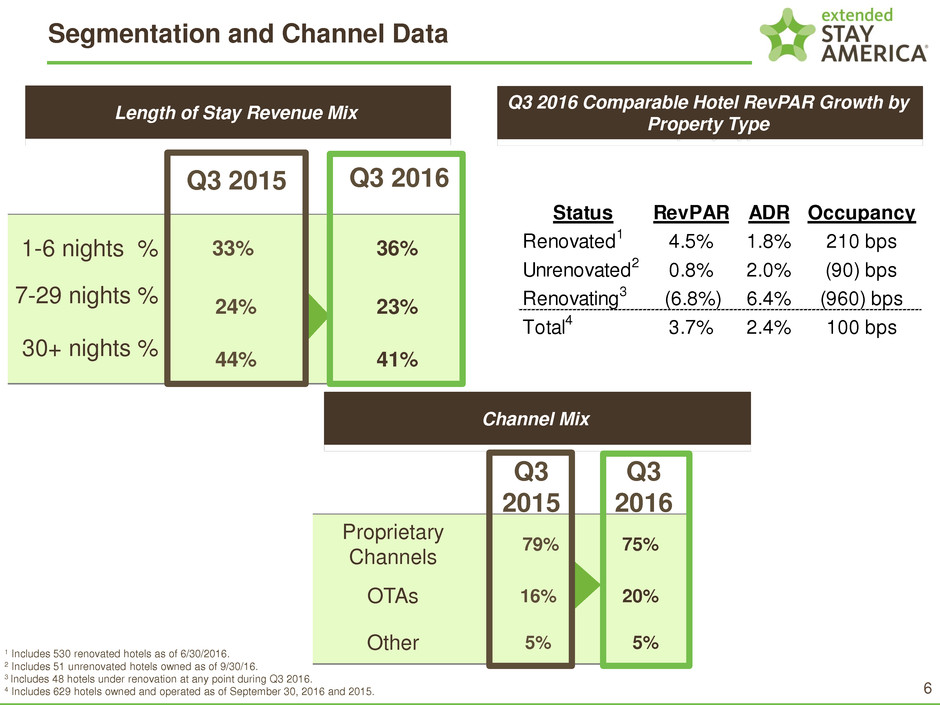

6 Q3 2016 Segmentation and Channel Data Length of Stay Revenue Mix Q3 2016 Comparable Hotel RevPAR Growth by Property Type 1 Includes 530 renovated hotels as of 6/30/2016. 2 Includes 51 unrenovated hotels owned as of 9/30/16. 3 Includes 48 hotels under renovation at any point during Q3 2016. 4 Includes 629 hotels owned and operated as of September 30, 2016 and 2015. Channel Mix 1-6 nights % 33% 36% 7-29 nights % 24% 23% 30+ nights % 44% 41% Q3 2016 Q3 2015 Proprietary Channels 79% 75% OTAs 16% 20% Other 5% 5% Q3 2015 Status RevPAR ADR Occupancy Renovated1 4.5% 1.8% 210 bps Unrenovated2 0.8% 2.0% (90) bps Renovating3 (6.8%) 6.4% (960) bps Total4 3.7% 2.4% 100 bps

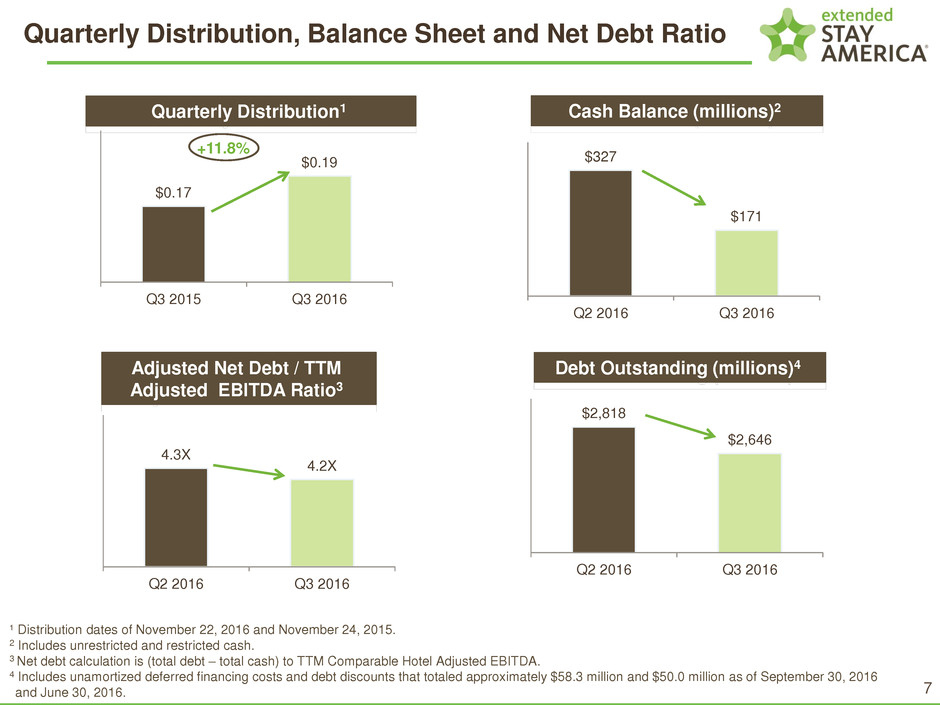

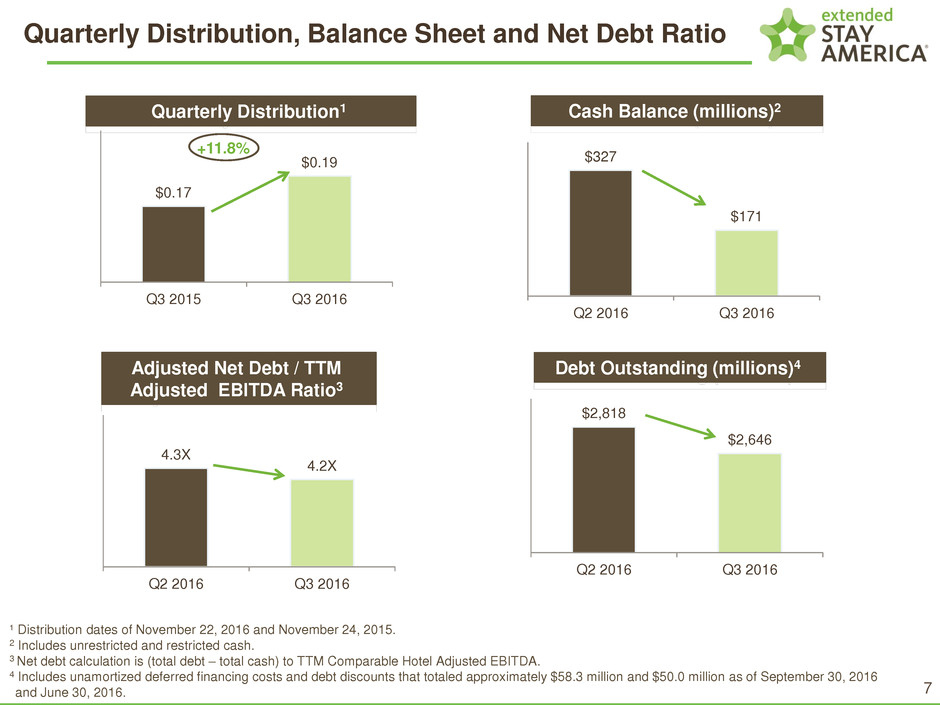

7 Quarterly Distribution, Balance Sheet and Net Debt Ratio Quarterly Distribution1 $0.17 $0.19 Q3 2015 Q3 2016 +11.8% Adjusted Net Debt / TTM Adjusted EBITDA Ratio3 4.3X 4.2X Q2 2016 Q3 2016 ¹ Distribution dates of November 22, 2016 and November 24, 2015. 2 Includes unrestricted and restricted cash. 3 Net debt calculation is (total debt – total cash) to TTM Comparable Hotel Adjusted EBITDA. 4 Includes unamortized deferred financing costs and debt discounts that totaled approximately $58.3 million and $50.0 million as of September 30, 2016 and June 30, 2016. Cash Balance (millions)2 $327 $171 Q2 2016 Q3 2016 Debt Outstanding (millions)4 $2,818 $2,646 Q2 2016 Q3 2016

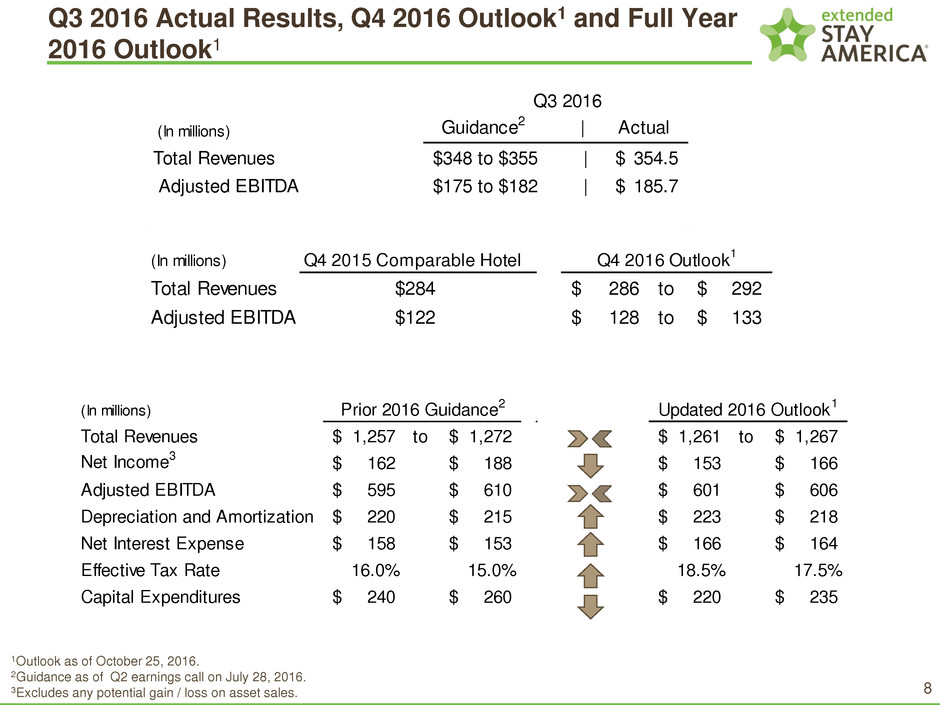

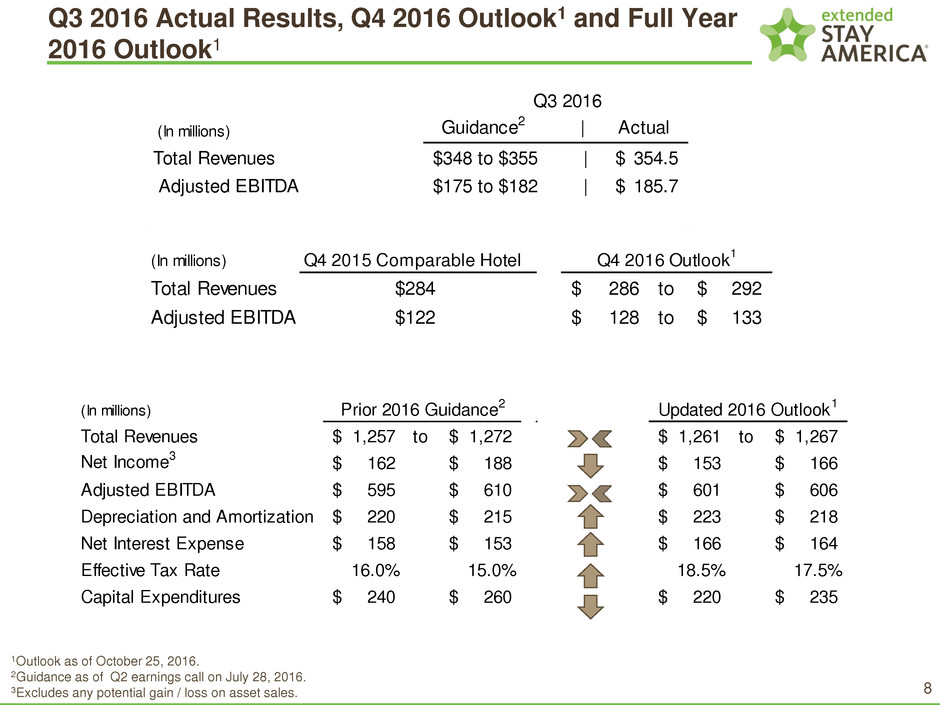

8 Q3 2016 Actual Results, Q4 2016 Outlook1 and Full Year 2016 Outlook1 1,261$ to 1,267$ 153$ 166$ 601$ 606$ 223$ 218$ 166$ 164$ 18.5% 17.5% 220$ 235$ Updated 2016 Outlook1 1Outlook as of October 25, 2016. 2Guidance as of Q2 earnings call on July 28, 2016. 3Excludes any potential gain / loss on asset sales. (In millions) Total Revenues 1,257$ to 1,272$ Net Income3 162$ 188$ Adjusted EBITDA 595$ 610$ Depreciation and Amortization 220$ 215$ Net Interest Expense 158$ 153$ Effective Tax Rate 16.0% 15.0% Capital Expenditures 240$ 260$ Prior 2016 Guidance2 (In millions) Total Revenues $348 to $355 | 354.5$ Adjusted EBITDA $175 to $182 | 185.7$ Q3 2016 Guidance2 | Actual (In millions) Q4 2015 Comparable Hotel Total Revenues $284 286$ to 292$ Adjusted EBITDA $122 128$ to 133$ Q4 2016 Outlook 1

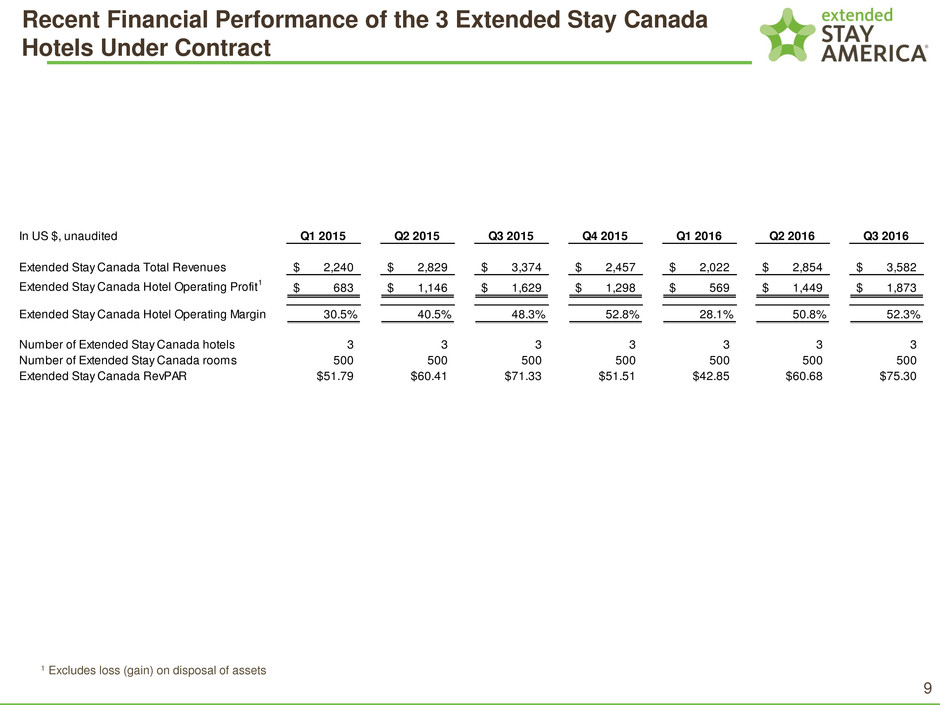

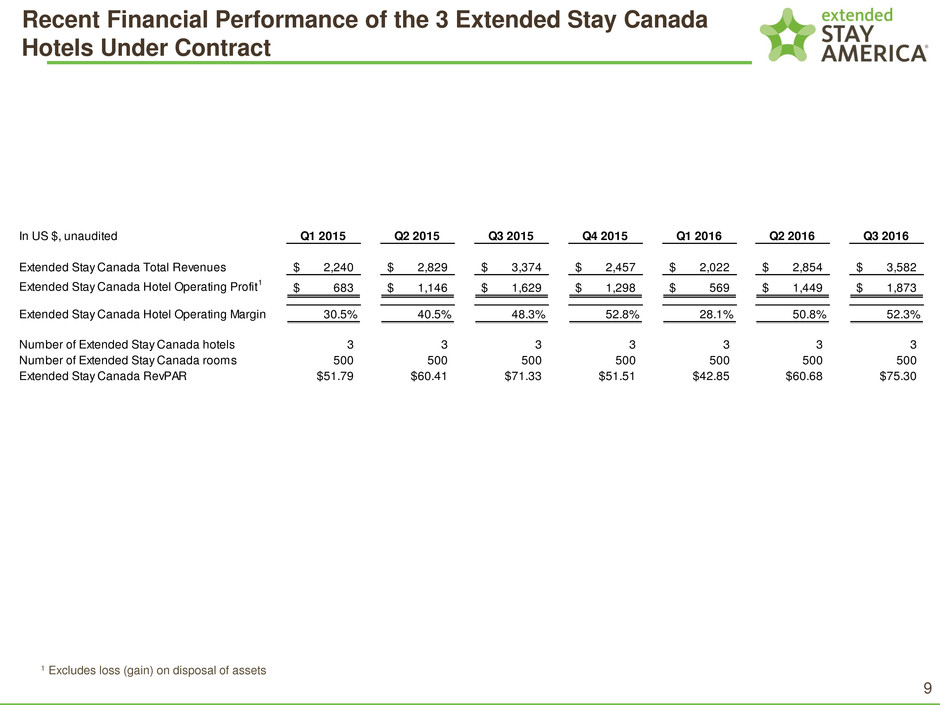

9 Recent Financial Performance of the 3 Extended Stay Canada Hotels Under Contract 1 Excludes loss (gain) on disposal of assets In US $, unaudited Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Extended Stay Canada Total Revenues 2,240$ 2,829$ 3,374$ 2,457$ 2,022$ 2,854$ 3,582$ xt t y H tel Operating Profit 1 683 1,146 1,629 1,298 569 1,449 1,873 Extended Stay Canada Hotel perating Margin 30.5% 40.5% 48.3% 52.8% 28.1% 50.8% 52.3% Number of Extended Stay Canada hotels 3 3 3 3 3 3 3 room 500 500 500 500 500 500 500 Extended Stay Canada RevPAR $51.79 $60.41 $71.3 $51.51 $42.85 $60.68 $75.3

10 APPENDIX

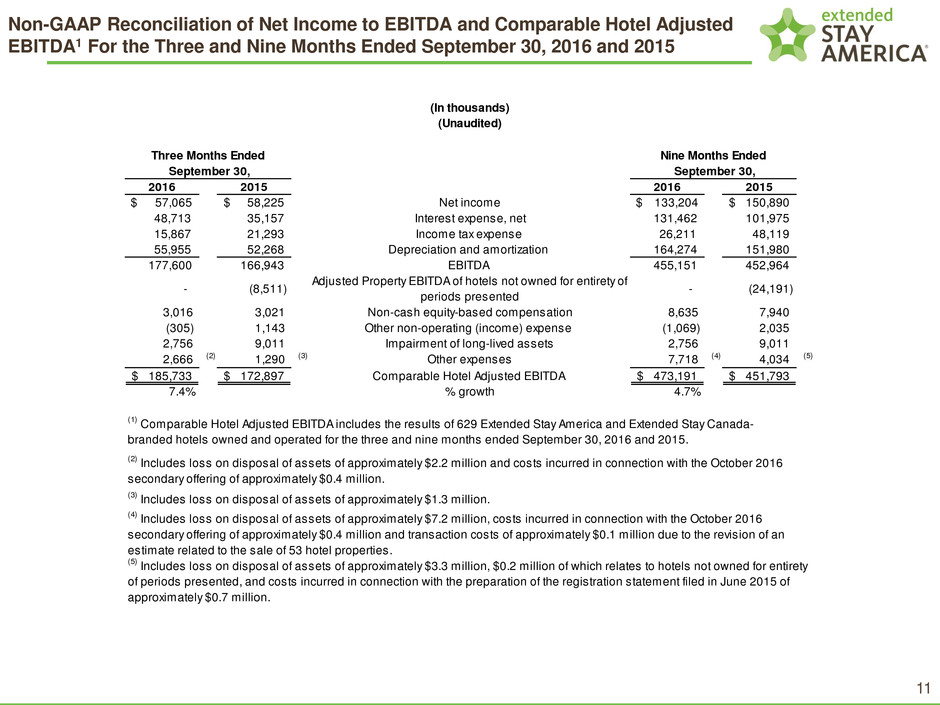

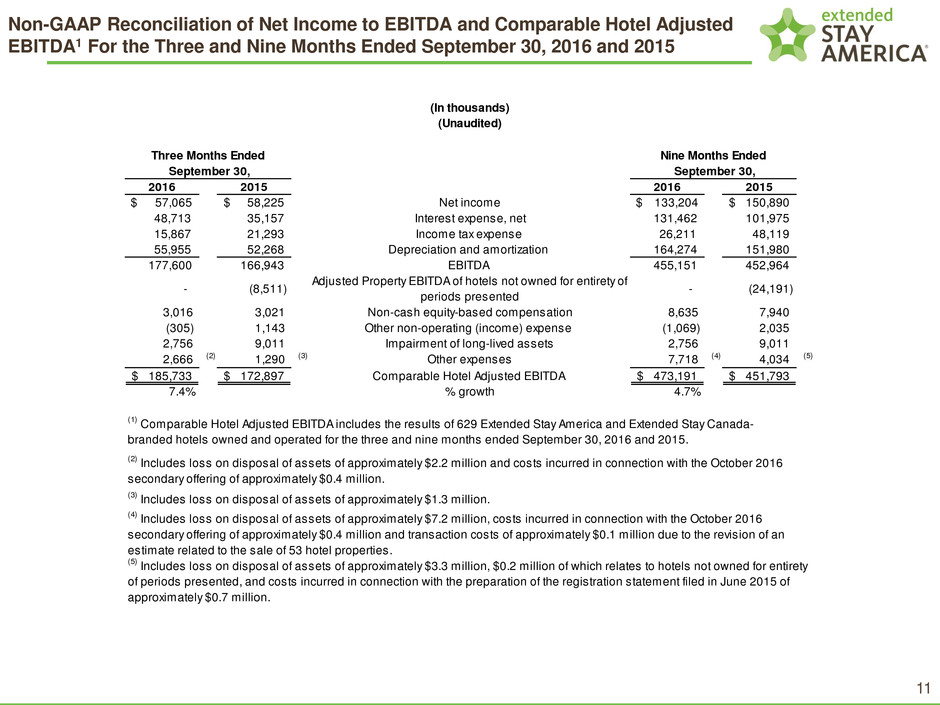

11 Non-GAAP Reconciliation of Net Income to EBITDA and Comparable Hotel Adjusted EBITDA1 For the Three and Nine Months Ended September 30, 2016 and 2015 2016 2015 2016 2015 $ 57,065 58,225$ Net income $ 133,204 150,890$ 48,713 35,157 Interest expense, net 131,462 101,975 15,867 21,293 Income tax expense 26,211 48,119 55,955 52,268 Depreciation and amortization 164,274 151,980 177,600 166,943 EBITDA 455,151 452,964 - (8,511) Adjusted Property EBITDA of hotels not owned for entirety of periods presented - (24,191) 3,016 3,021 Non-cash equity-based compensation 8,635 7,940 (305) 1,143 Other non-operating (income) expense (1,069) 2,035 2,756 9,011 Impairment of long-lived assets 2,756 9,011 2,666 (2) 1,290 (3) Other expenses 7,718 (4) 4,034 (5) 185,733$ 172,897$ Comparable Hotel Adjusted EBITDA 473,191$ 451,793$ 7.4% % growth 4.7% (5) Includes loss on disposal of assets of approximately $3.3 million, $0.2 million of which relates to hotels not owned for entirety of periods presented, and costs incurred in connection with the preparation of the registration statement filed in June 2015 of approximately $0.7 million. (1) Comparable Hotel Adjusted EBITDA includes the results of 629 Extended Stay America and Extended Stay Canada- branded hotels owned and operated for the three and nine months ended September 30, 2016 and 2015. Three Months Ended Nine Months Ended September 30, September 30, (2) Includes loss on disposal of assets of approximately $2.2 million and costs incurred in connection with the October 2016 secondary offering of approximately $0.4 million. (3) I cludes loss on disposal of assets of approximately $1.3 million. (In thousands) (Unaudited) (4) Includes loss on disposal of assets of approximately $7.2 million, costs incurred in connection with the October 2016 secondary offering of approximately $0.4 million and transaction costs of approximately $0.1 million due to the revision of an estimate related to the sale of 53 hotel properties.

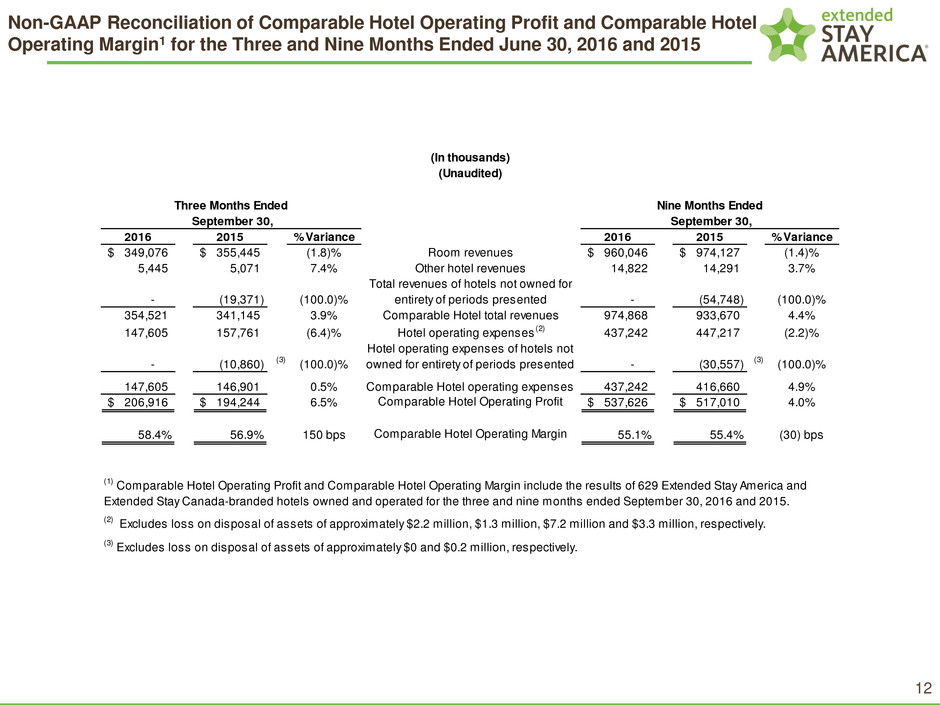

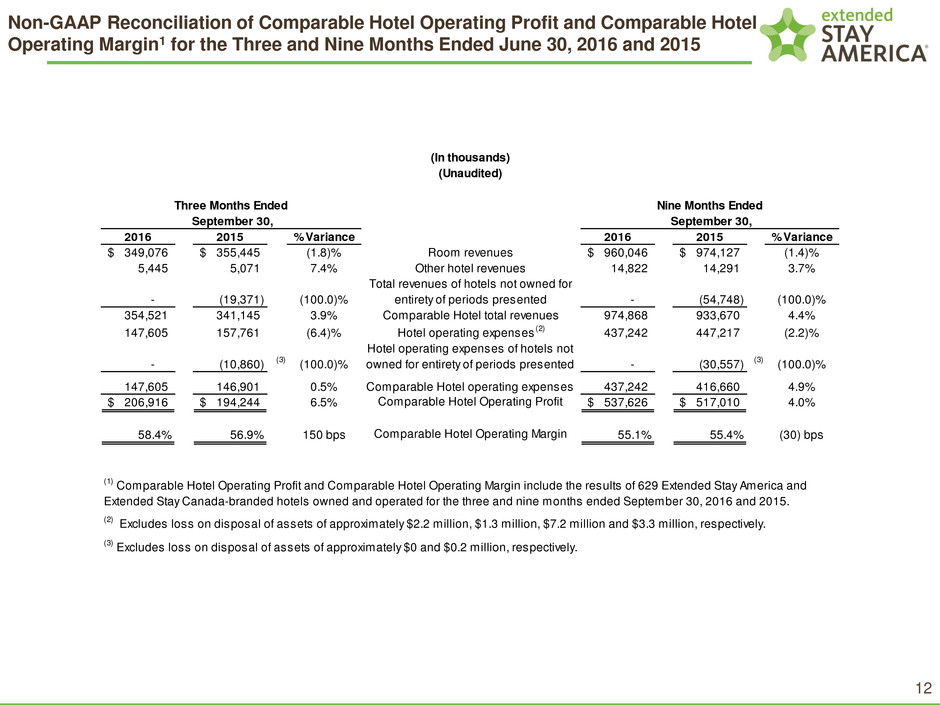

12 Non-GAAP Reconciliation of Comparable Hotel Operating Profit and Comparable Hotel Operating Margin1 for the Three and Nine Months Ended June 30, 2016 and 2015 2016 2015 % Variance 2016 2015 % Variance 349,076$ 355,445$ (1.8)% Room revenues 960,046$ 974,127$ (1.4)% 5,445 5,071 7.4% Other hotel revenues 14,822 14,291 3.7% - (19,371) (100.0)% Total revenues of hotels not owned for entirety of periods presented - (54,748) (100.0)% 354,521 341,145 3.9% Comparable Hotel total revenues 974,868 933,670 4.4% 147,605 157,761 (6.4)% Hotel operating expenses (2) 437,242 447,217 (2.2)% - (10,860) (3) (100.0)% Hotel operating expenses of hotels not owned for entirety of periods presented - (30,557) (3) (100.0)% 147,605 146,901 0.5% Comparable Hotel operating expenses 437,242 416,660 4.9% 206,916$ 194,244$ 6.5% Comparable Hotel Operating Profit 537,626$ 517,010$ 4.0% 58.4% 56.9% 150 bps Comparable Hotel Operating Margin 55.1% 55.4% (30) bps September 30, September 30, (2) Excludes loss on disposal of assets of approximately $2.2 million, $1.3 million, $7.2 million and $3.3 million, respectively. (3) Excludes loss on disposal of assets of approximately $0 and $0.2 million, respectively. (1) Comparable Hotel Operating Profit and Comparable Hotel Operating Margin include the results of 629 Extended Stay America and Extended Stay Canada-branded hotels owned and operated for the three and nine months ended September 30, 2016 and 2015. (In thousands) (Unaudited) Three Months Ended Nine Months Ended

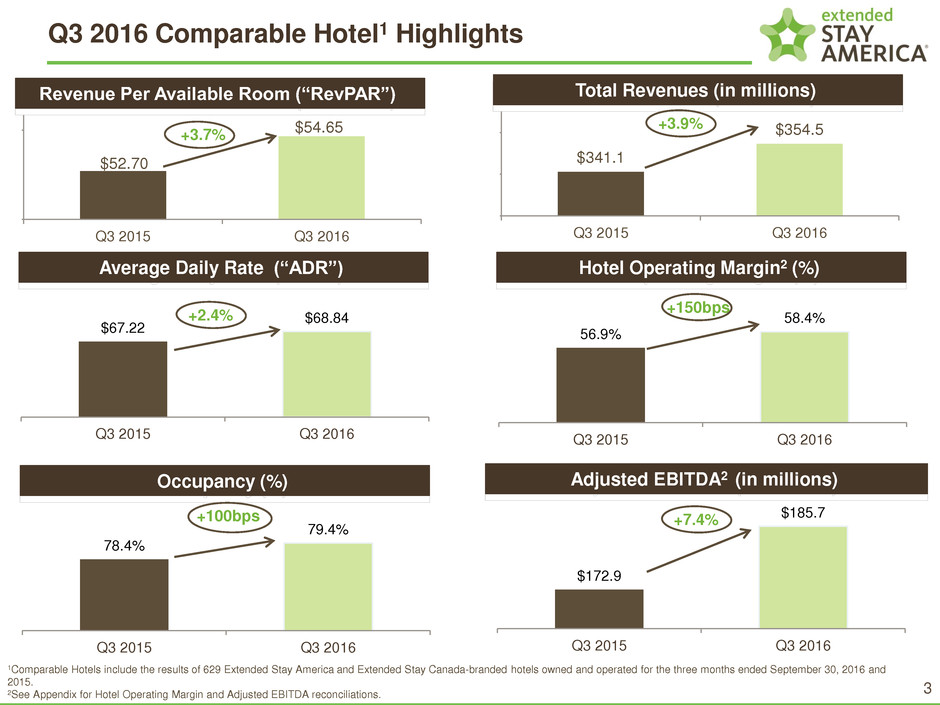

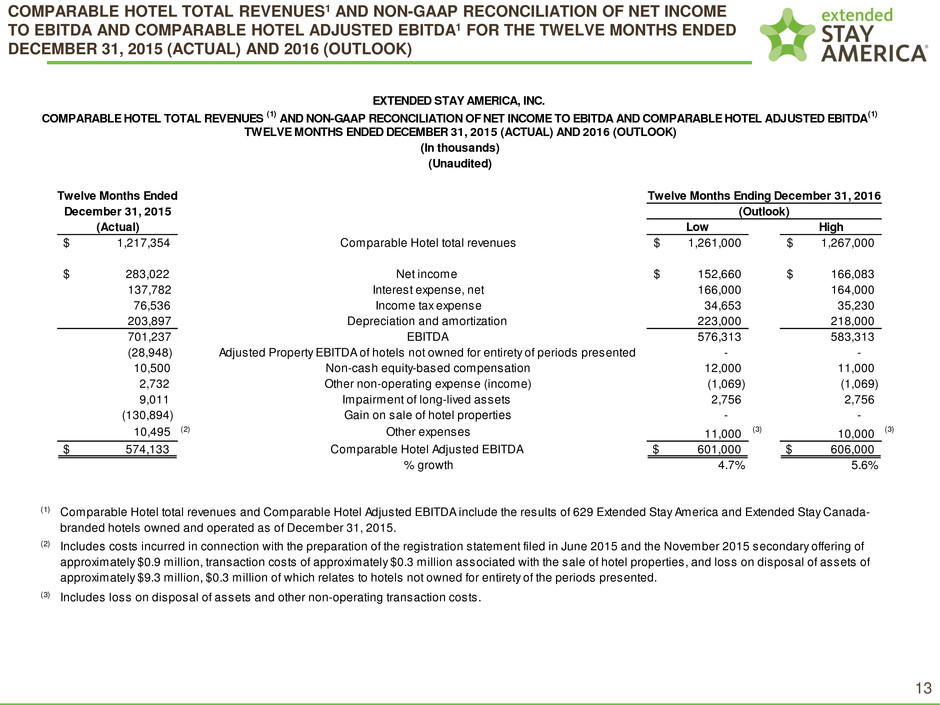

13 COMPARABLE HOTEL TOTAL REVENUES1 AND NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND COMPARABLE HOTEL ADJUSTED EBITDA1 FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2015 (ACTUAL) AND 2016 (OUTLOOK) Twelve Months Ended December 31, 2015 (Actual) Low High $ 1,217,354 Comparable Hotel total revenues 1,261,000$ 1,267,000$ $ 283,022 Net income 152,660$ 166,083$ 137,782 Interest expense, net 166,000 164,000 76,536 Income tax expense 34,653 35,230 203,897 Depreciation and amortization 223,000 218,000 701,237 EBITDA 576,313 583,313 (28,948) Adjusted Property EBITDA of hotels not owned for entirety of periods presented - - 10,500 Non-cash equity-based compensation 12,000 11,000 2,732 Other non-operating expense (income) (1,069) (1,069) 9,011 Impairment of long-lived assets 2,756 2,756 (130,894) Gain on sale of hotel properties - - 10,495 (2) Other expenses 11,000 (3) 10,000 (3) $ 574,133 Comparable Hotel Adjusted EBITDA $ 601,000 $ 606,000 % growth 4.7% 5.6% (2) (3) Includes loss on disposal of assets and other non-operating transaction costs. (Outlook) (1) Comparable Hotel total revenues and Comparable Hotel Adjusted EBITDA include the results of 629 Extended Stay America and Extended Stay Canada- branded hotels owned and operated as of December 31, 2015. Includes costs incurred in connection with the preparation of the registration statement filed in June 2015 and the November 2015 secondary offering of approximately $0.9 million, transaction costs of approximately $0.3 million associated with the sale of hotel properties, and loss on disposal of assets of approximately $9.3 million, $0.3 million of which relates to hotels not owned for entirety of the periods presented. Twelve Months Ending December 31, 2016 EXTENDED STAY AMERICA, INC. COMPARABLE HOTEL TOTAL REVENUES (1) AND NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND COMPARABLE HOTEL ADJUSTED EBITDA (1) TWELVE MONTHS ENDED DECEMBER 31, 2015 (ACTUAL) AND 2016 (OUTLOOK) (In thousands) (Unaudited)