Tesoro Logistics LP

NAPTP Conference

May 2011

2

Forward Looking Statements

This Presentation includes forward-looking statements. These statements relate to, among other

things, projections of operational volumetrics and improvements, growth projects, cash flows and

capital expenditures. We have used the words "anticipate", "believe", "could", "estimate", "expect",

"intend", "may", "plan", "predict", "project", “should”, "will“, “potential”, “forecast” and similar

terms and phrases to identify forward-looking statements in this Presentation.

Although we believe the assumptions upon which these forward-looking statements are based are

reasonable, any of these assumptions could prove to be inaccurate and the forward-looking

statements based on these assumptions could be incorrect. Our operations involve risks and

uncertainties, many of which are outside our control, and any one of which, or a combination of

which, could materially affect our results of operations and whether the forward-looking statements

ultimately prove to be correct.

Actual results and trends in the future may differ materially from those suggested or implied by the

forward-looking statements depending on a variety of factors which are described in greater detail in

our filings with the SEC. Please see our Risk Factor disclosures included in our Registration Statement

filed with the SEC. All future written and oral forward-looking statements attributable to us or

persons acting on our behalf are expressly qualified in their entirety by the previous statements. We

undertake no obligation to update any information contained herein or to publicly release the

results of any revisions to any forward-looking statements that may be made to reflect events or

circumstances that occur, or that we become aware of, after the date of this Presentation.

3

Introduction and Overview

4

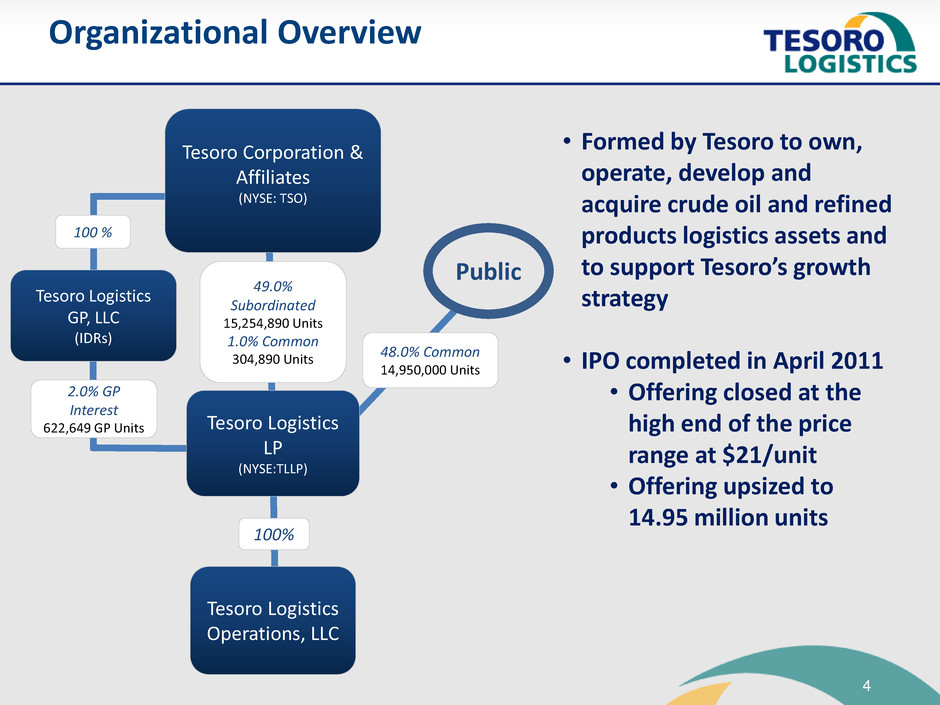

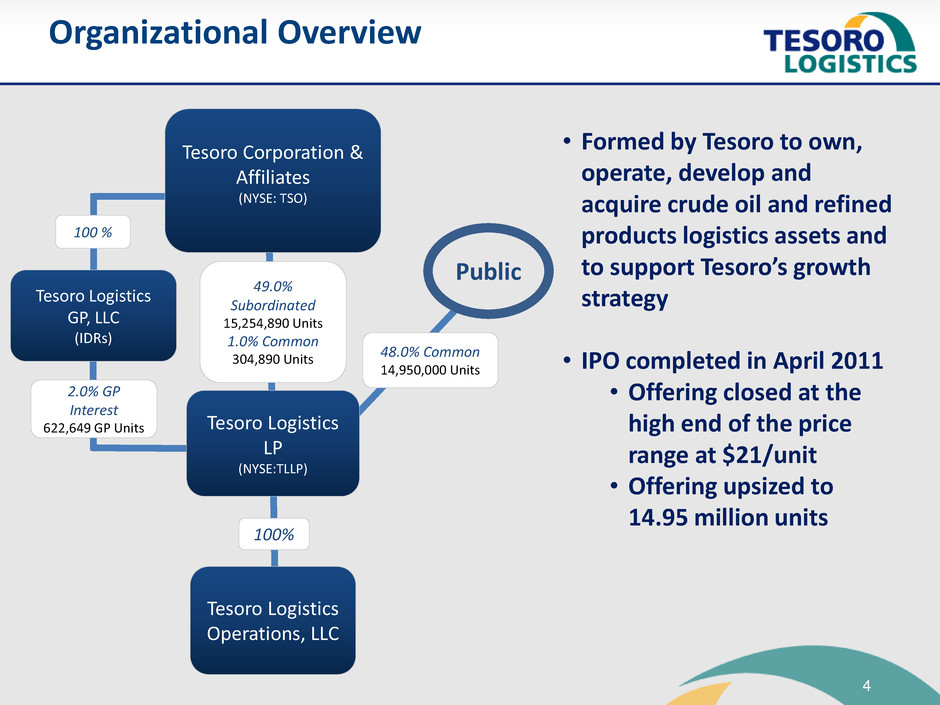

Organizational Overview

Tesoro Corporation &

Affiliates

(NYSE: TSO)

100 %

Tesoro Logistics

GP, LLC

(IDRs)

Tesoro Logistics

LP

(NYSE:TLLP)

Tesoro Logistics

Operations, LLC

2.0% GP

Interest

622,649 GP Units

49.0%

Subordinated

15,254,890 Units

1.0% Common

304,890 Units

100%

Public

48.0% Common

14,950,000 Units

• Formed by Tesoro to own,

operate, develop and

acquire crude oil and refined

products logistics assets and

to support Tesoro’s growth

strategy

• IPO completed in April 2011

• Offering closed at the

high end of the price

range at $21/unit

• Offering upsized to

14.95 million units

5

Investment Highlights

Stable Cash Flow

Well-Positioned Assets

Experienced

Management Team

Strong Sponsorship

Attractive, Visible

Growth

Opportunities

6

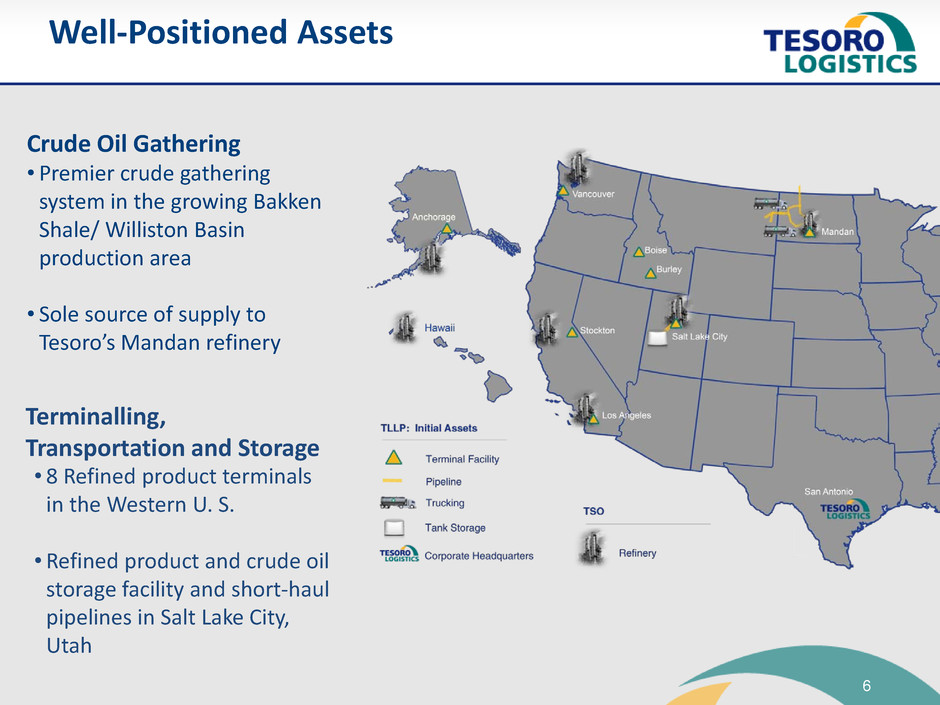

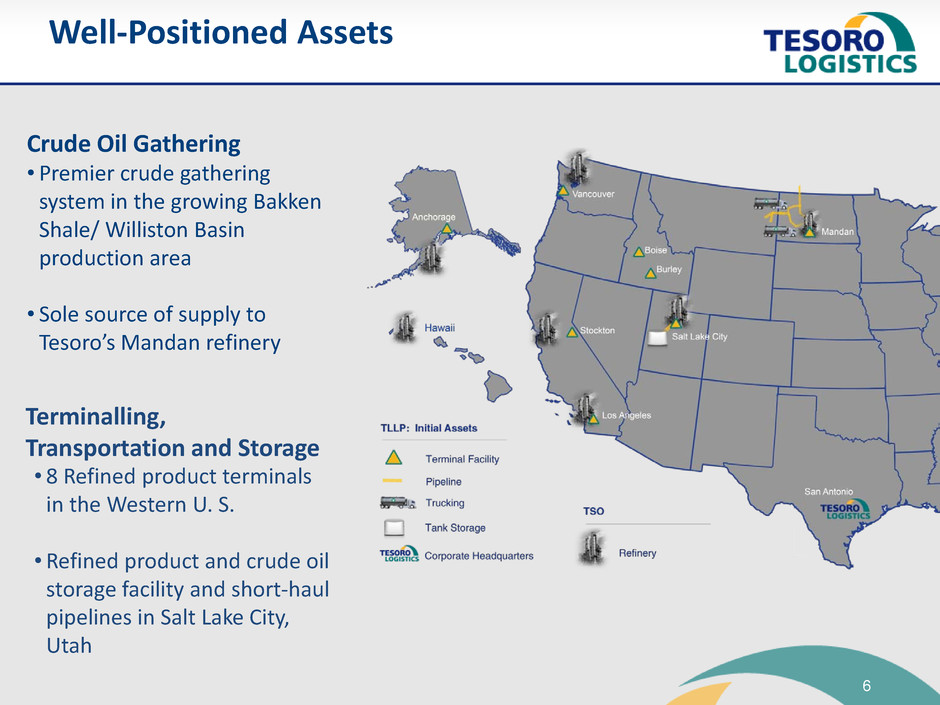

Well-Positioned Assets

Crude Oil Gathering

• Premier crude gathering

system in the growing Bakken

Shale/ Williston Basin

production area

• Sole source of supply to

Tesoro’s Mandan refinery

Terminalling,

Transportation and Storage

• 8 Refined product terminals

in the Western U. S.

• Refined product and crude oil

storage facility and short-haul

pipelines in Salt Lake City,

Utah

7

• Long-term contracts

– All 10-year contracts except for trucking

– Renewal options extend another 10 years, except for trucking

• Fee-based and inflation protected

– 100% fee-based contracts

– Standard FERC or CPI-U escalation provisions

– Fuel and mileage surcharges for trucking agreement

• Fixed minimum volume commitments

– 84% of pro forma revenues backed by fixed minimum volume

commitments from our sponsor

– Unilateral force majeure at TLLP

• Minimal commodity exposure risk

– No inventory ownership

Stable Cash Flow

Stable cash flows are core to our business

8

• Second largest US independent

refiner/marketer by capacity

– 7 Refineries

– 665 mbpd capacity

– Nearly 1,200 retail stations primarily

branded Tesoro®, Shell® and USA

Gasoline™

• Focused on higher-margin markets in the

western US

• Logistics assets offer growth platform

• Access to growing Pacific Rim

• Approximately $5 Billion of enterprise

value

Strong Sponsorship

Kenai, AK

Mandan, ND

Salt Lake City, UT

Anacortes, WA

Martinez, CA

Los Angeles, CA

Kapolei, HI

Note: Enterprise Value calculated as market value of equity as of May 19, 2011 using debt net of cash and common stock outstanding

included in Tesoro Corporation’s Annual Report on Form 10-K

Tesoro is our parent sponsor

9

• Tesoro will be a superior sponsor

– Strategic footprint that cannot be replicated

– Logistics growth drives additional value capture in refining,

marketing and trading businesses at Tesoro

– The MLP will focus on fee-based opportunities

• Leverages strategic value of embedded logistics assets

• Improves cost of capital/source of funds for potential organic

growth opportunities

• Creates strategic vehicle for partnering around growth

opportunities

TLLP Supports Tesoro’s Growth Strategy

Logistics is a key part of Tesoro’s growth strategy

10

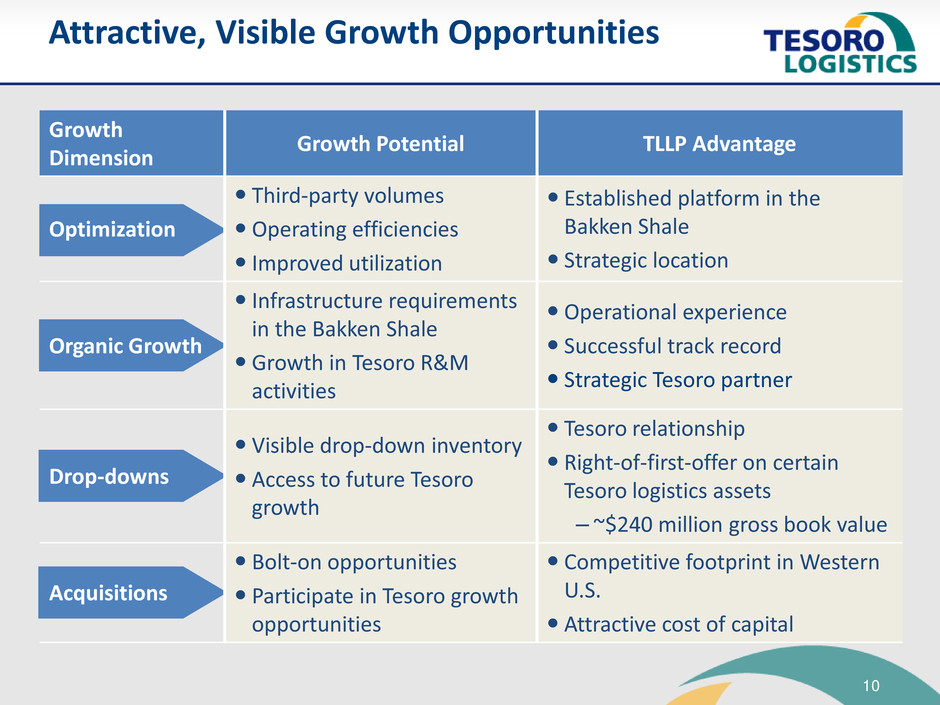

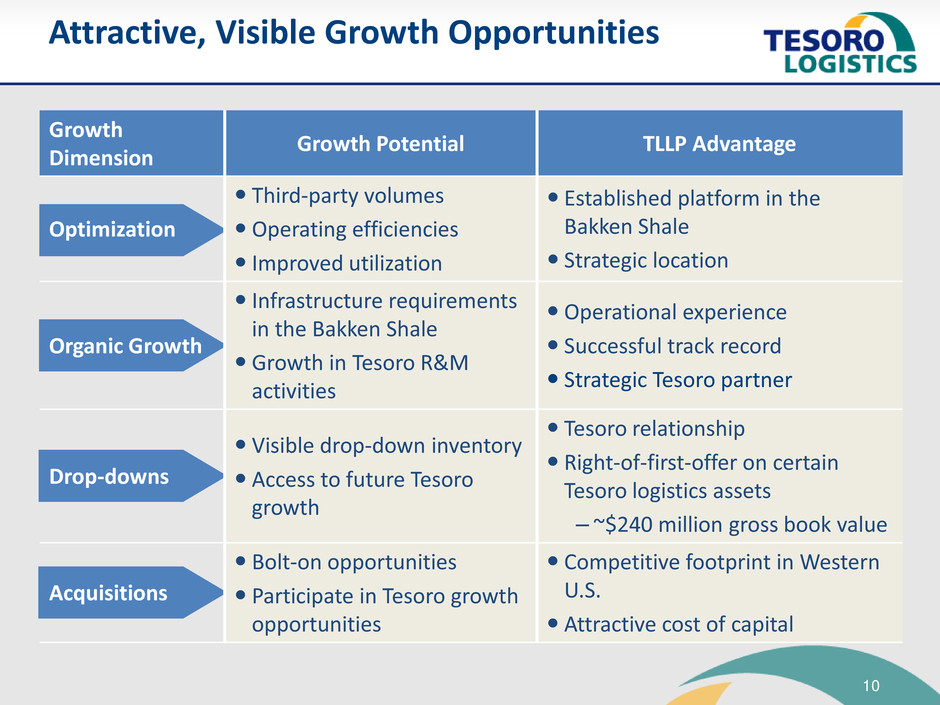

Growth

Dimension

Growth Potential TLLP Advantage

Optimization

Third-party volumes

Operating efficiencies

Improved utilization

Established platform in the

Bakken Shale

Strategic location

Organic Growth

Infrastructure requirements

in the Bakken Shale

Growth in Tesoro R&M

activities

Operational experience

Successful track record

Strategic Tesoro partner

Drop-downs

Visible drop-down inventory

Access to future Tesoro

growth

Tesoro relationship

Right-of-first-offer on certain

Tesoro logistics assets

– ~$240 million gross book value

Acquisitions

Bolt-on opportunities

Participate in Tesoro growth

opportunities

Competitive footprint in Western

U.S.

Attractive cost of capital

Attractive, Visible Growth Opportunities

11

Assets and Growth Opportunities

12

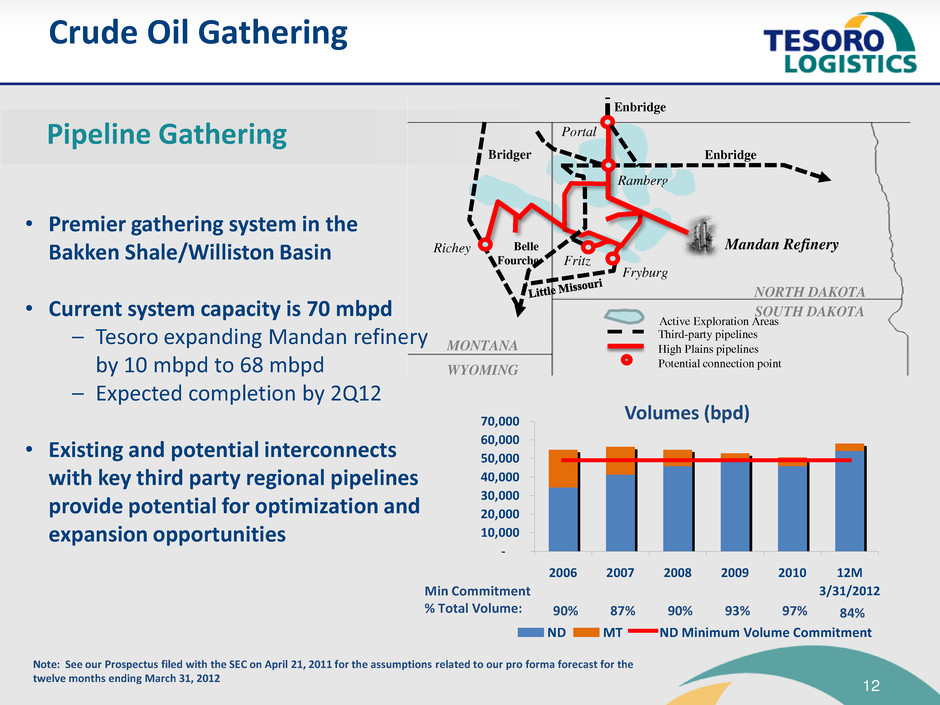

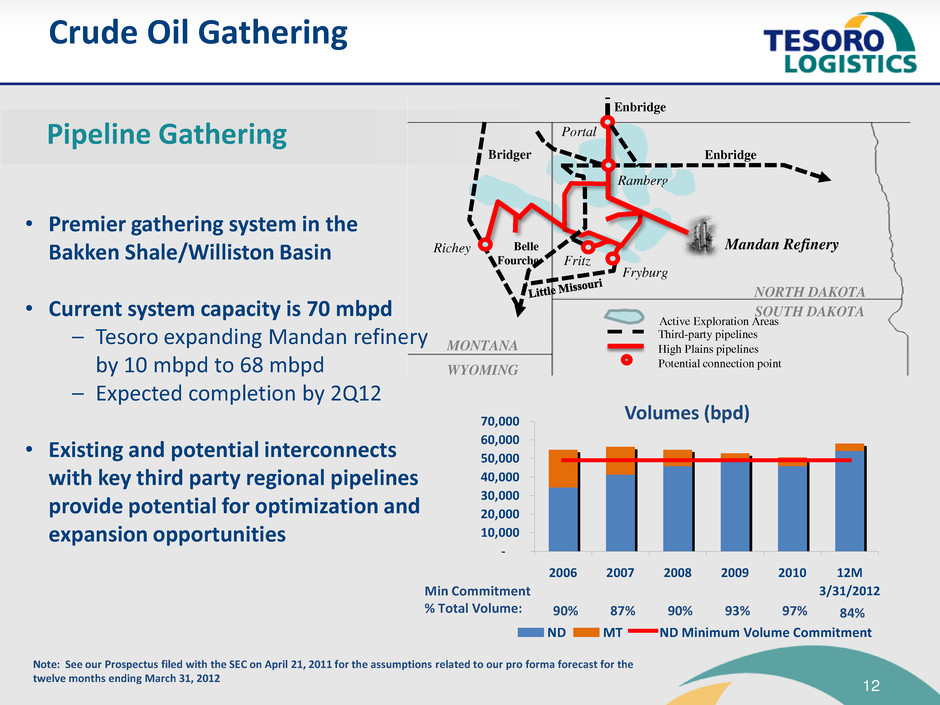

Crude Oil Gathering

• Premier gathering system in the

Bakken Shale/Williston Basin

• Current system capacity is 70 mbpd

– Tesoro expanding Mandan refinery

by 10 mbpd to 68 mbpd

– Expected completion by 2Q12

• Existing and potential interconnects

with key third party regional pipelines

provide potential for optimization and

expansion opportunities

Pipeline Gathering

Volumes (bpd)

90% 87% 90% 93% 97% 84%

Min Commitment

% Total Volume:

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

2006 2007 2008 2009 2010 12M

3/31/2012

ND MT ND Minimum Volume Commitment

Mandan Refinery

Ramberg

Enbridge

Fryburg

Belle

Fourche Fritz

Bridger

Richey

Enbridge

Portal

NORTH DAKOTA

SOUTH DAKOTA

WYOMING

MONTANA

Third-party pipelines

High Plains pipelines

Potential connection point

Active Exploration Areas

13

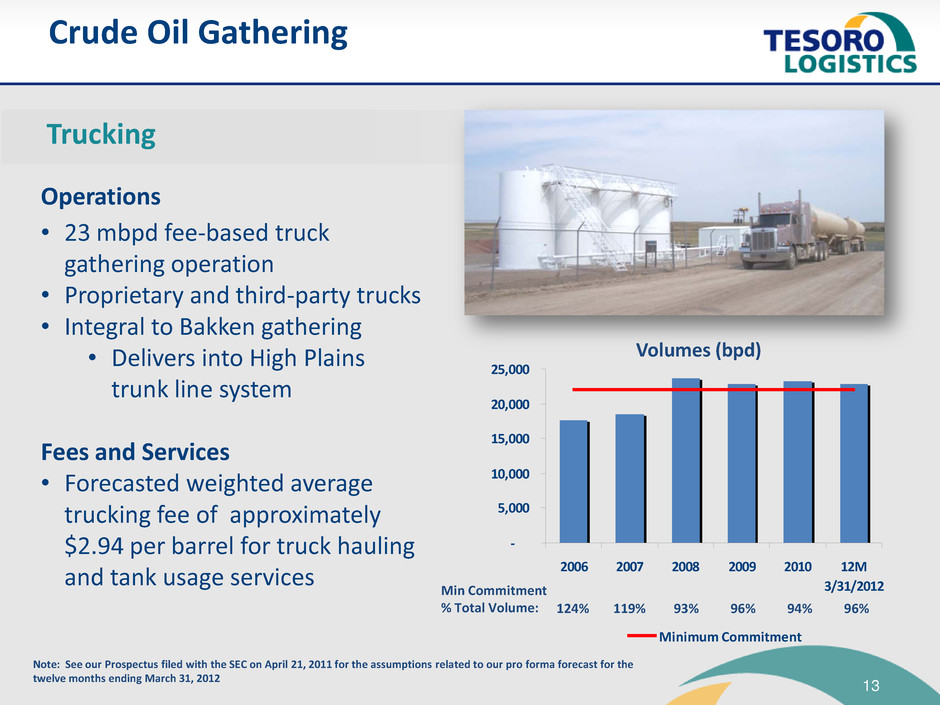

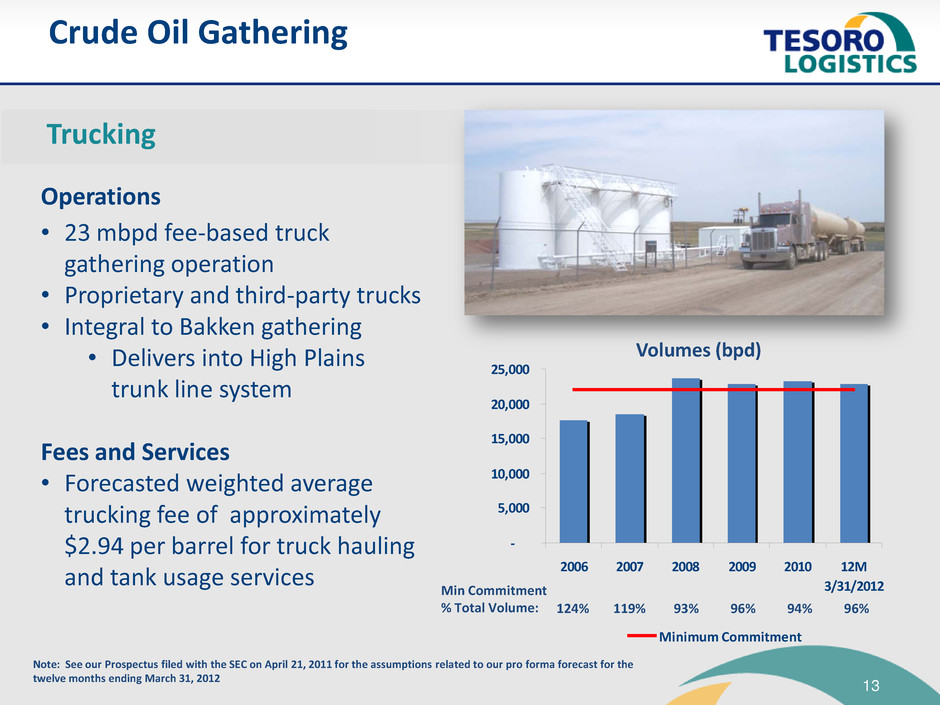

Crude Oil Gathering

Operations

• 23 mbpd fee-based truck

gathering operation

• Proprietary and third-party trucks

• Integral to Bakken gathering

• Delivers into High Plains

trunk line system

Fees and Services

• Forecasted weighted average

trucking fee of approximately

$2.94 per barrel for truck hauling

and tank usage services

Trucking

Volumes (bpd)

124% 119% 93% 96% 94% 96%

Min Commitment

% Total Volume:

-

5,000

10,000

15,000

20,000

25,000

2006 2007 2008 2009 2010 12M

3/31/2012

Minimum Commitment

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

14

Terminal Operations

Eight strategically located terminals

• Los Angeles and Stockton,

California

• Salt Lake City, Utah

• Anchorage, Alaska

• Mandan, North Dakota

• Vancouver, Washington

• Boise and Burley, Idaho

Fees and Services

• Forecasted weighted average

terminalling fee of approximately

$0.81 per barrel

• Services also include ancillary

services such as additive injection

Volumes (bpd)

Refined Product Terminals

125% 97% 89% 88% 88% 87%

Min Commitment

% Total Volume:

-

25,000

50,000

75,000

100,000

125,000

2006 2007 2008 2009 2010 12M

3/31/2012

TSO Volume Third Party Volume

TSO Minimum Commitment

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

15

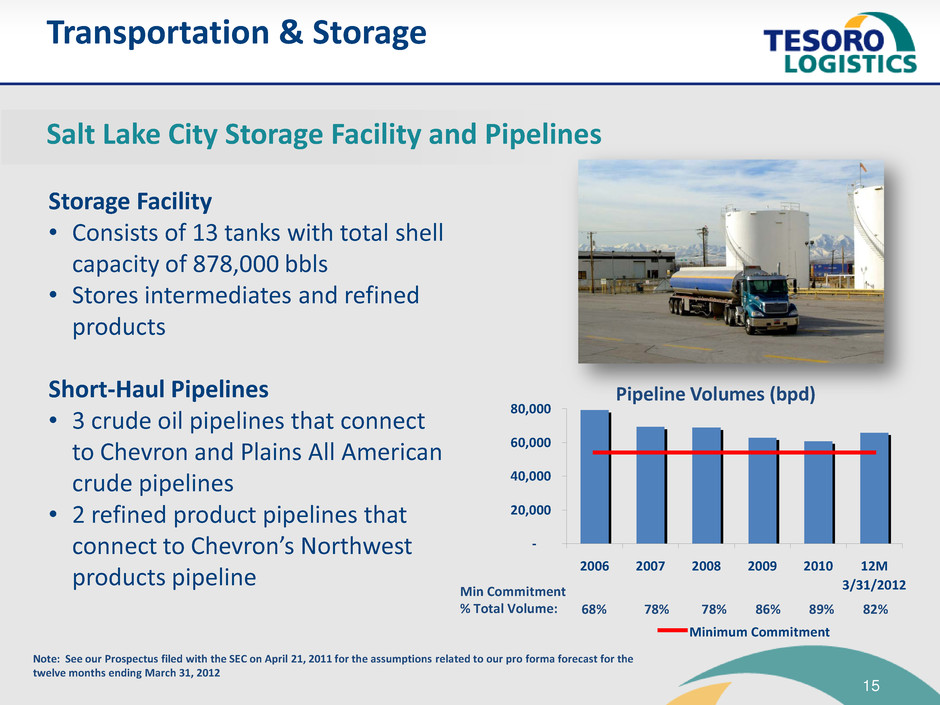

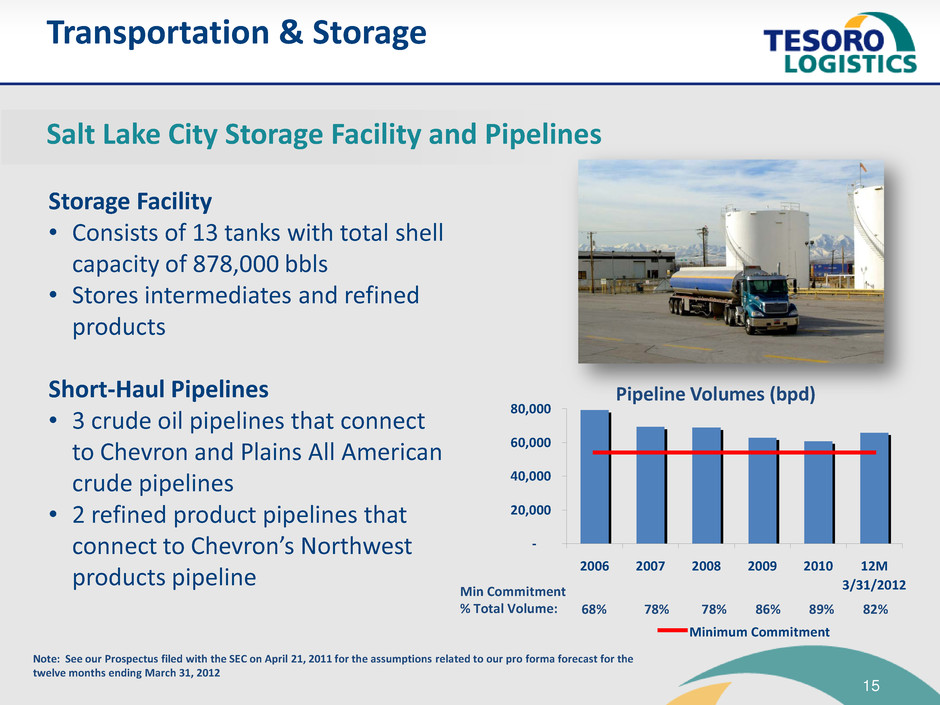

Transportation & Storage

Salt Lake City Storage Facility and Pipelines

Storage Facility

• Consists of 13 tanks with total shell

capacity of 878,000 bbls

• Stores intermediates and refined

products

Short-Haul Pipelines

• 3 crude oil pipelines that connect

to Chevron and Plains All American

crude pipelines

• 2 refined product pipelines that

connect to Chevron’s Northwest

products pipeline

Pipeline Volumes (bpd)

68% 78% 78% 86% 89% 82%

Min Commitment

% Total Volume:

-

20,000

40,000

60,000

80,000

2006 2007 2008 2009 2010 12M

3/31/2012

Minimum Commitment

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

16

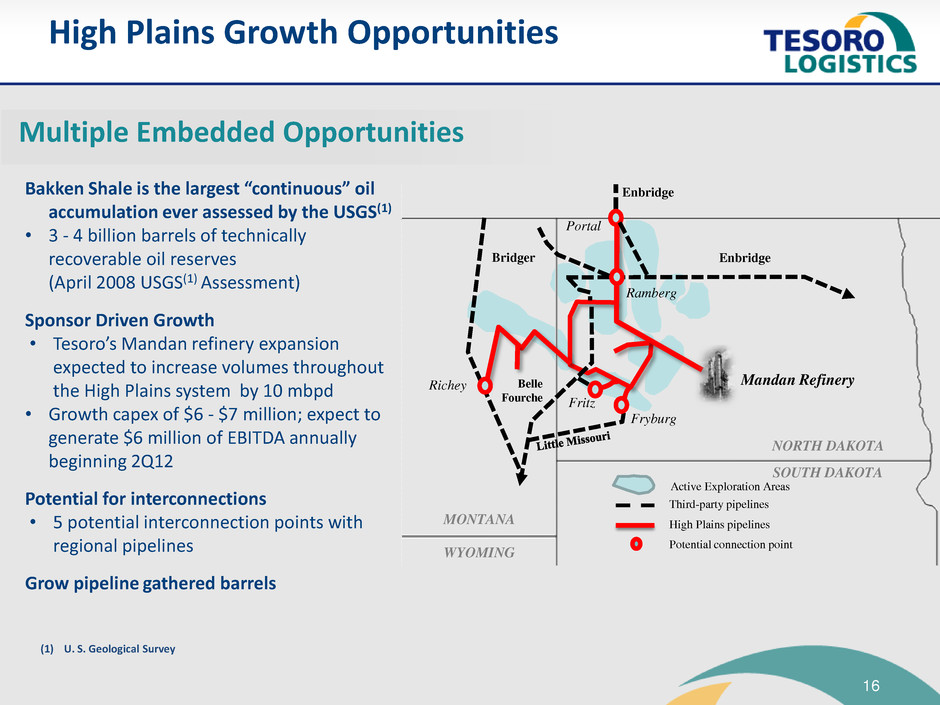

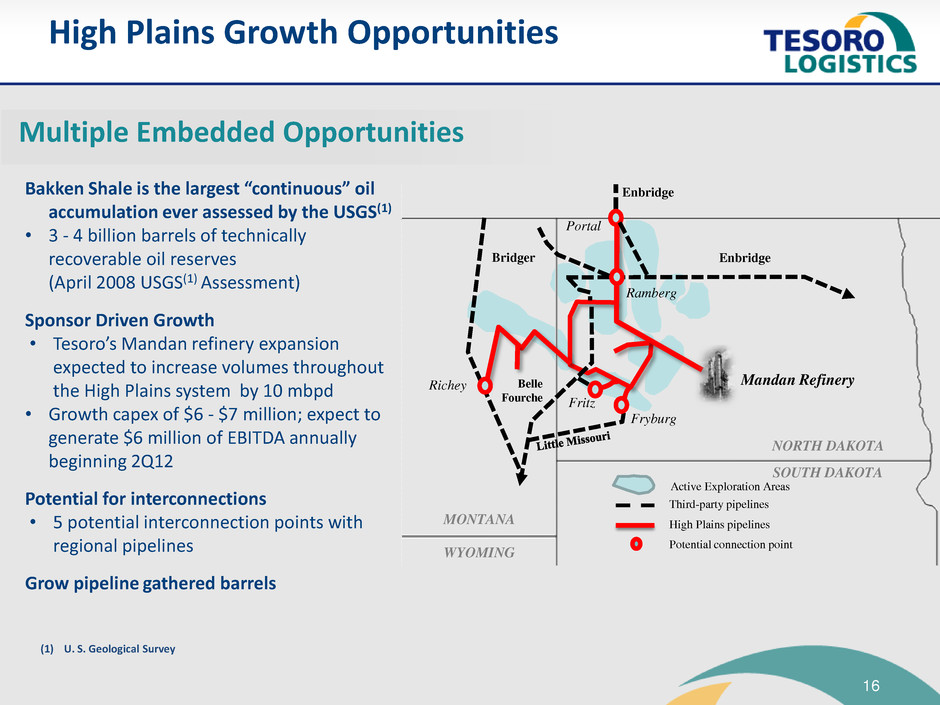

High Plains Growth Opportunities

Bakken Shale is the largest “continuous” oil

accumulation ever assessed by the USGS(1)

• 3 - 4 billion barrels of technically

recoverable oil reserves

(April 2008 USGS(1) Assessment)

Sponsor Driven Growth

• Tesoro’s Mandan refinery expansion

expected to increase volumes throughout

the High Plains system by 10 mbpd

• Growth capex of $6 - $7 million; expect to

generate $6 million of EBITDA annually

beginning 2Q12

Potential for interconnections

• 5 potential interconnection points with

regional pipelines

Grow pipeline gathered barrels

Multiple Embedded Opportunities

(1) U. S. Geological Survey

Mandan Refinery

Ramberg

Enbridge

Fryburg

Belle

Fourche Fritz

Bridger

Richey

Enbridge

Portal

NORTH DAKOTA

SOUTH DAKOTA

WYOMING

MONTANA

Third-party pipelines

High Plains pipelines

Potential connection point

Active Exploration Areas

17

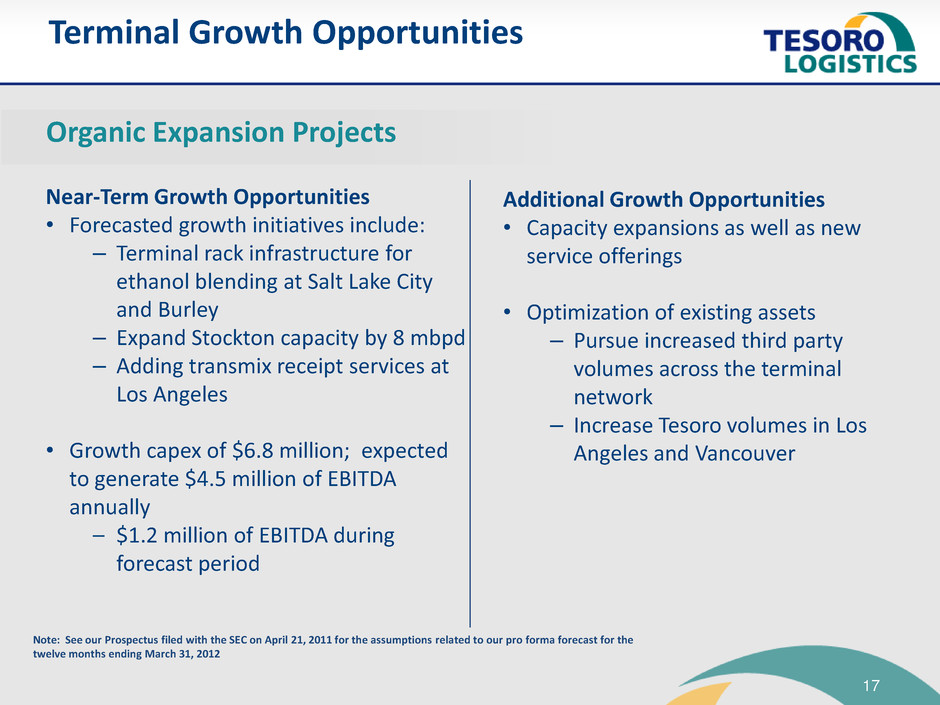

Terminal Growth Opportunities

Organic Expansion Projects

Near-Term Growth Opportunities

• Forecasted growth initiatives include:

– Terminal rack infrastructure for

ethanol blending at Salt Lake City

and Burley

– Expand Stockton capacity by 8 mbpd

– Adding transmix receipt services at

Los Angeles

• Growth capex of $6.8 million; expected

to generate $4.5 million of EBITDA

annually

– $1.2 million of EBITDA during

forecast period

Additional Growth Opportunities

• Capacity expansions as well as new

service offerings

• Optimization of existing assets

– Pursue increased third party

volumes across the terminal

network

– Increase Tesoro volumes in Los

Angeles and Vancouver

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

18

Drop Down Growth Opportunities

Product Terminals

•Kenai, AK

•Anacortes, WA

•Martinez, CA

Pipelines

•Los Angeles, CA

•Kenai, AK

Marine Terminals

•Kenai, AK

•Anacortes, WA

•Martinez, CA (2)

•Long Beach, CA

ROFO Assets

19

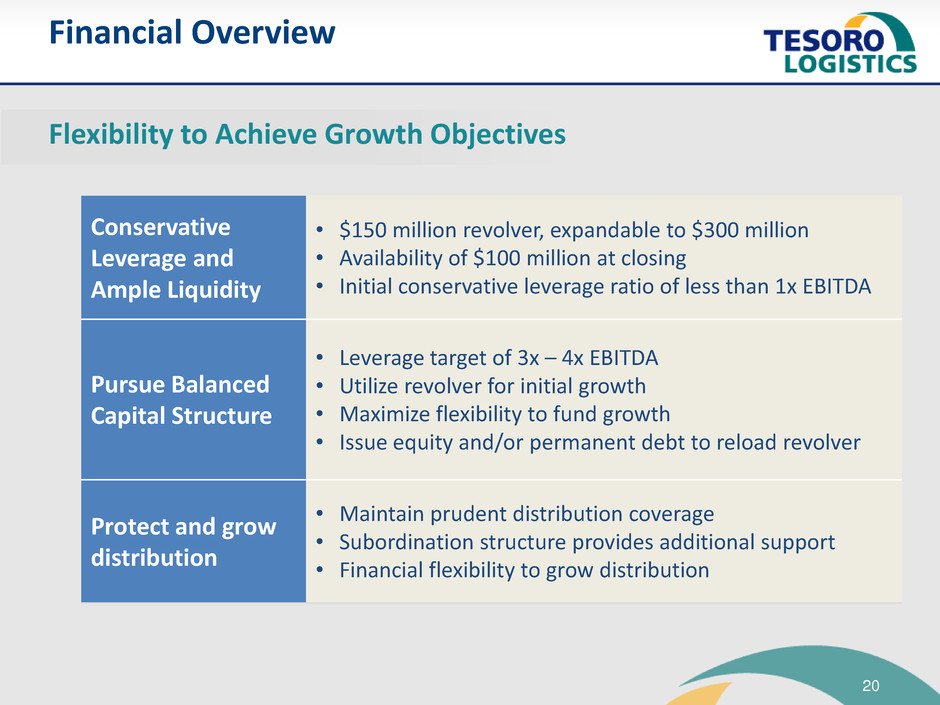

Financial Overview

20

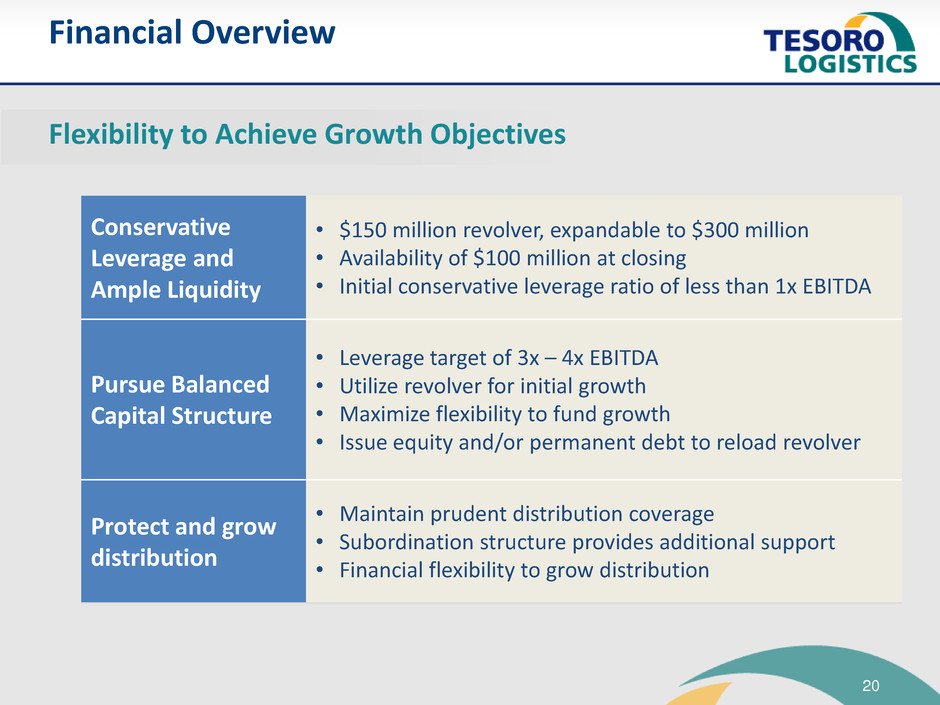

Financial Overview

Conservative

Leverage and

Ample Liquidity

• $150 million revolver, expandable to $300 million

• Availability of $100 million at closing

• Initial conservative leverage ratio of less than 1x EBITDA

Pursue Balanced

Capital Structure

• Leverage target of 3x – 4x EBITDA

• Utilize revolver for initial growth

• Maximize flexibility to fund growth

• Issue equity and/or permanent debt to reload revolver

Protect and grow

distribution

• Maintain prudent distribution coverage

• Subordination structure provides additional support

• Financial flexibility to grow distribution

Flexibility to Achieve Growth Objectives

21

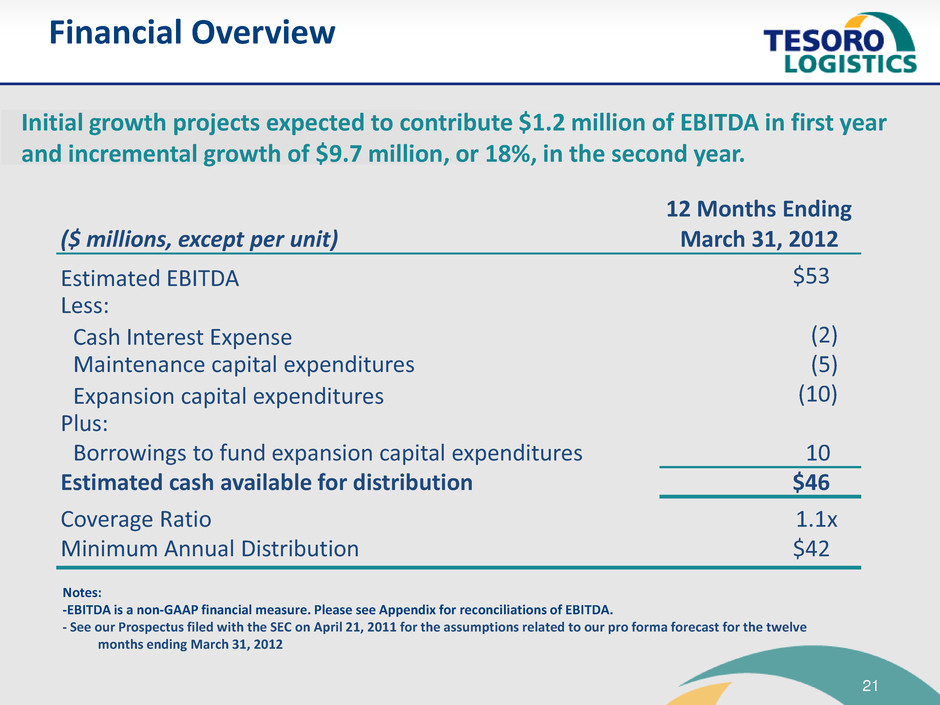

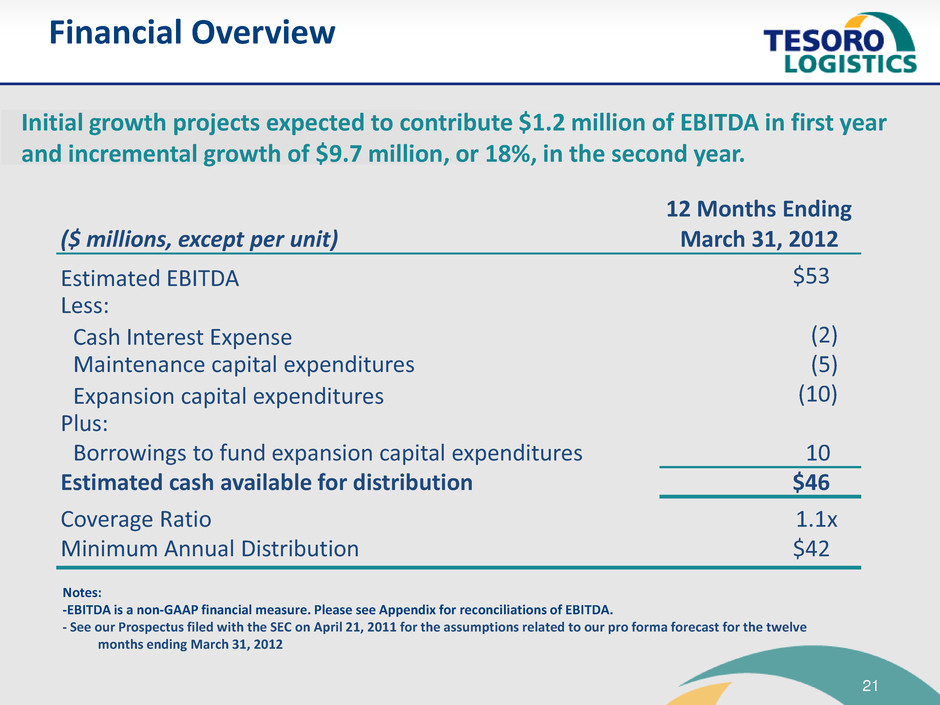

Financial Overview

Notes:

-EBITDA is a non-GAAP financial measure. Please see Appendix for reconciliations of EBITDA.

- See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the twelve

months ending March 31, 2012

Initial growth projects expected to contribute $1.2 million of EBITDA in first year

and incremental growth of $9.7 million, or 18%, in the second year.

12 Months Ending

($ millions, except per unit) March 31, 2012

Estimated EBITDA $53

Less:

Cash Interest Expense (2)

Maintenance capital expenditures (5)

Expansion capital expenditures (10)

Plus:

Borrowings to fund expansion capital expenditures 10

Estimated cash available for distribution $46

Coverage Ratio 1.1x

Minimum Annual Distribution $42

22

Investment Highlights

Stable Cash Flow

Well-Positioned Assets

Experienced

Management Team

Strong Sponsorship

Attractive, Visible

Growth

Opportunities

23

Appendix

24

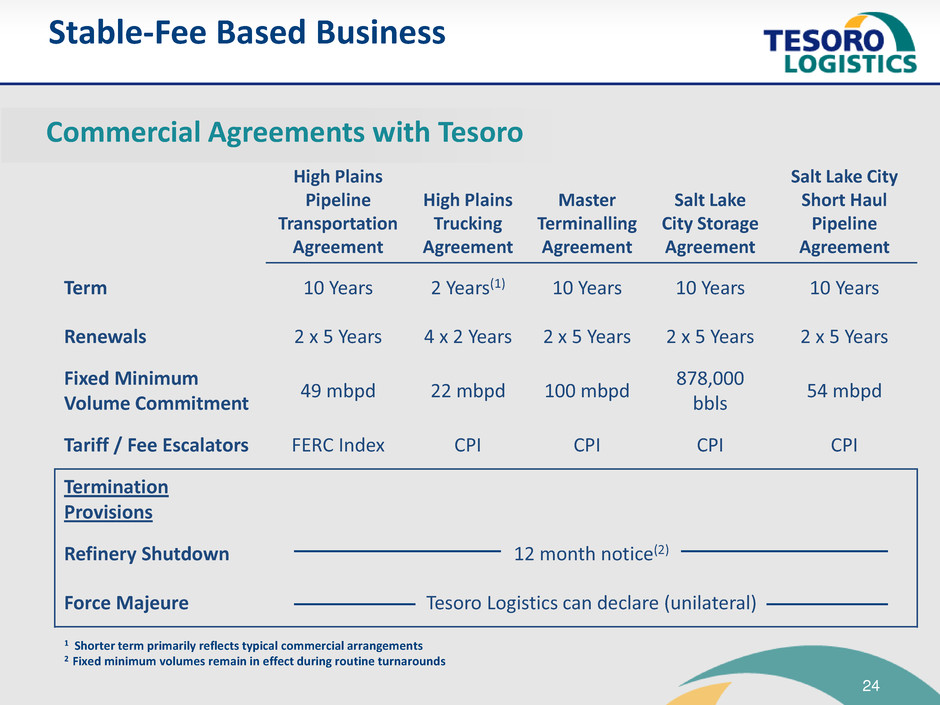

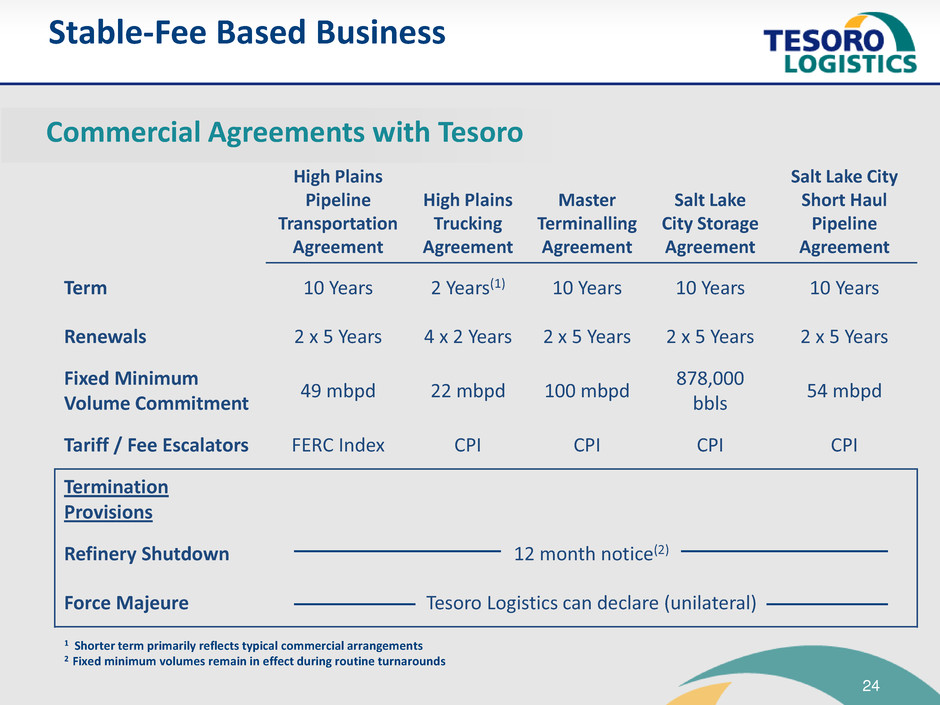

High Plains

Pipeline

Transportation

Agreement

High Plains

Trucking

Agreement

Master

Terminalling

Agreement

Salt Lake

City Storage

Agreement

Salt Lake City

Short Haul

Pipeline

Agreement

Term 10 Years 2 Years(1) 10 Years 10 Years 10 Years

Renewals 2 x 5 Years 4 x 2 Years 2 x 5 Years 2 x 5 Years 2 x 5 Years

Fixed Minimum

Volume Commitment

49 mbpd 22 mbpd 100 mbpd

878,000

bbls

54 mbpd

Tariff / Fee Escalators FERC Index CPI CPI CPI CPI

Termination

Provisions

Refinery Shutdown 12 month notice(2)

Force Majeure Tesoro Logistics can declare (unilateral)

Stable-Fee Based Business

1 Shorter term primarily reflects typical commercial arrangements

2 Fixed minimum volumes remain in effect during routine turnarounds

Commercial Agreements with Tesoro

25

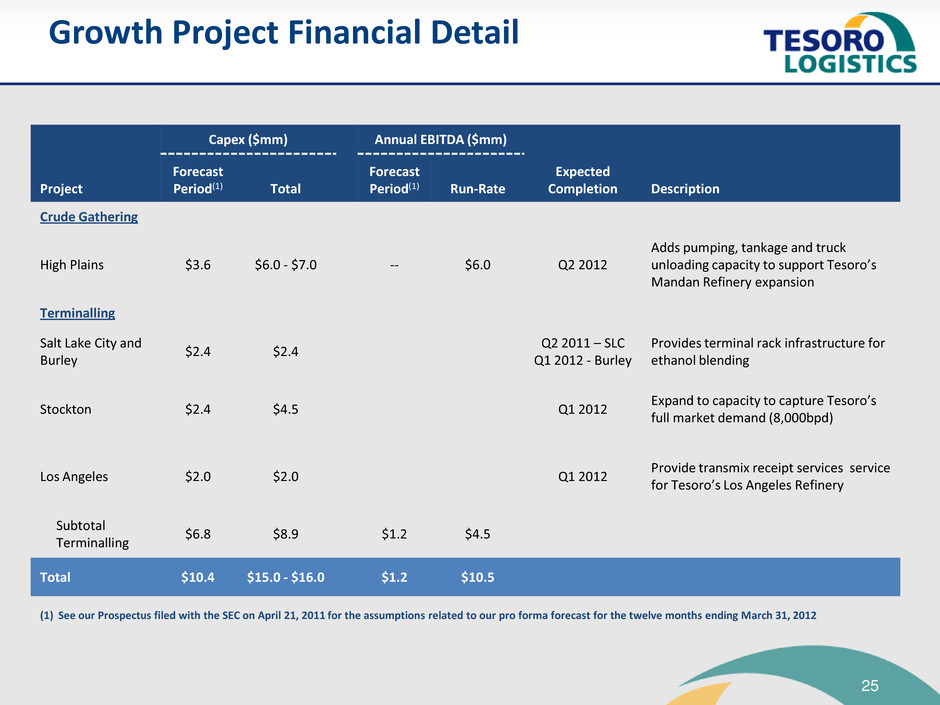

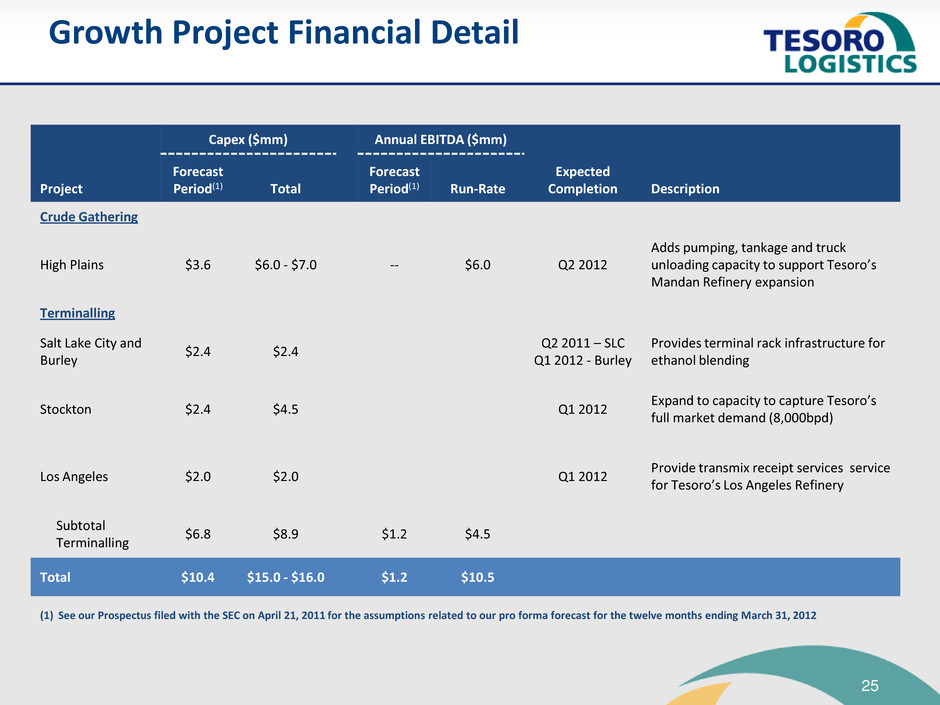

Growth Project Financial Detail

Capex ($mm) Annual EBITDA ($mm)

Project

Forecast

Period(1) Total

Forecast

Period(1) Run-Rate

Expected

Completion Description

Crude Gathering

High Plains $3.6 $6.0 - $7.0 -- $6.0 Q2 2012

Adds pumping, tankage and truck

unloading capacity to support Tesoro’s

Mandan Refinery expansion

Terminalling

Salt Lake City and

Burley

$2.4 $2.4

Q2 2011 – SLC

Q1 2012 - Burley

Provides terminal rack infrastructure for

ethanol blending

Stockton $2.4 $4.5 Q1 2012

Expand to capacity to capture Tesoro’s

full market demand (8,000bpd)

Los Angeles $2.0 $2.0 Q1 2012

Provide transmix receipt services service

for Tesoro’s Los Angeles Refinery

Subtotal

Terminalling

$6.8 $8.9 $1.2 $4.5

Total $10.4 $15.0 - $16.0 $1.2 $10.5

(1) See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the twelve months ending March 31, 2012

26

Pipeline Gathering

28%

Trucking

25%

Terminalling

35%

Short-Haul Pipeline

Transportation

6%

Storage

6%

Stable Fee-Based Business

84% of Total Pro Forma Revenues Derived from Fixed Minimum Volume Commitments

Revenue Source Fixed Minimum Volume

Commitment Contribution

Third Party

and Excess

16%

Minimum

Volumes

84%

Forecasted Pro Forma Revenue Composition

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

27

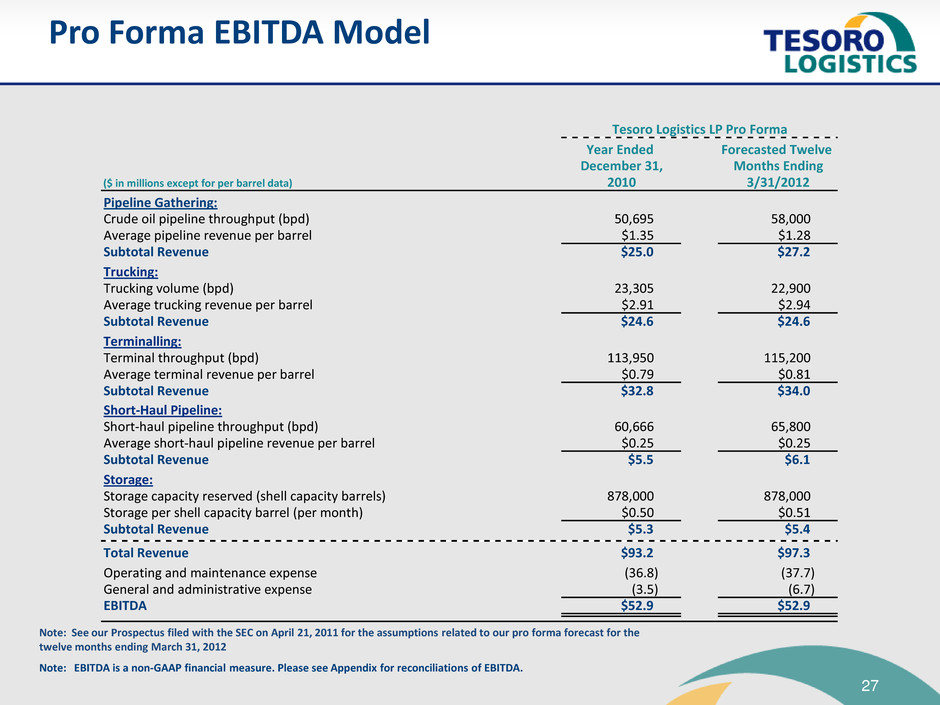

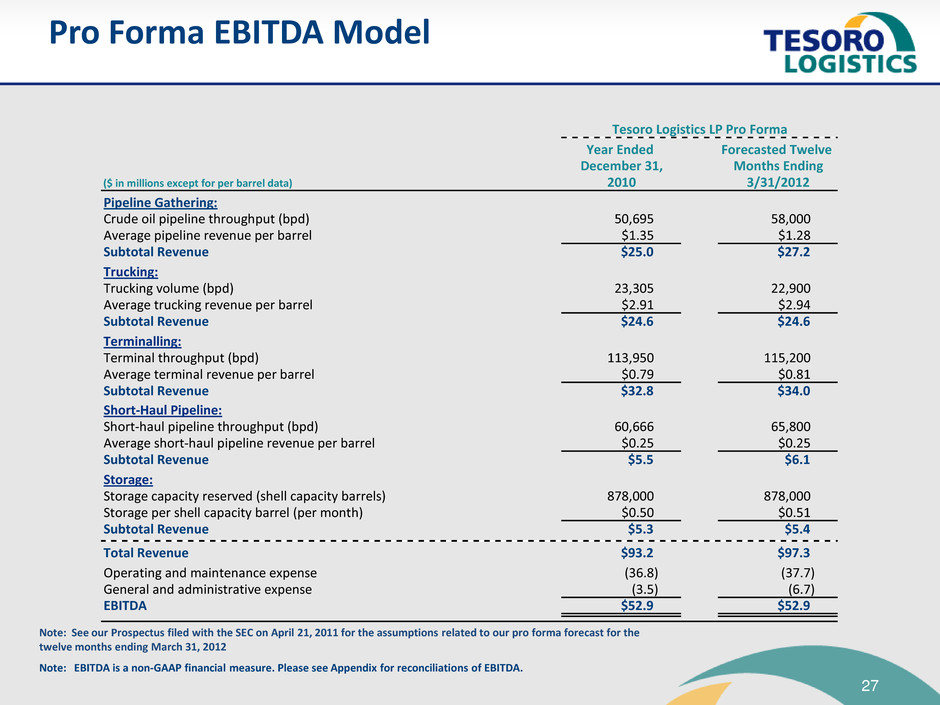

Pro Forma EBITDA Model

Tesoro Logistics LP Pro Forma

Year Ended Forecasted Twelve

December 31, Months Ending

($ in millions except for per barrel data) 2010 3/31/2012

Pipeline Gathering:

Crude oil pipeline throughput (bpd) 50,695 58,000

Average pipeline revenue per barrel $1.35 $1.28

Subtotal Revenue $25.0 $27.2

Trucking:

Trucking volume (bpd) 23,305 22,900

Average trucking revenue per barrel $2.91 $2.94

Subtotal Revenue $24.6 $24.6

Terminalling:

Terminal throughput (bpd) 113,950 115,200

Average terminal revenue per barrel $0.79 $0.81

Subtotal Revenue $32.8 $34.0

Short-Haul Pipeline:

Short-haul pipeline throughput (bpd) 60,666 65,800

Average short-haul pipeline revenue per barrel $0.25 $0.25

Subtotal Revenue $5.5 $6.1

Storage:

Storage capacity reserved (shell capacity barrels) 878,000 878,000

Storage per shell capacity barrel (per month) $0.50 $0.51

Subtotal Revenue $5.3 $5.4

Total Revenue $93.2 $97.3

Operating and maintenance expense (36.8) (37.7)

General and administrative expense (3.5) (6.7)

EBITDA $52.9 $52.9

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012

Note: EBITDA is a non-GAAP financial measure. Please see Appendix for reconciliations of EBITDA.

28

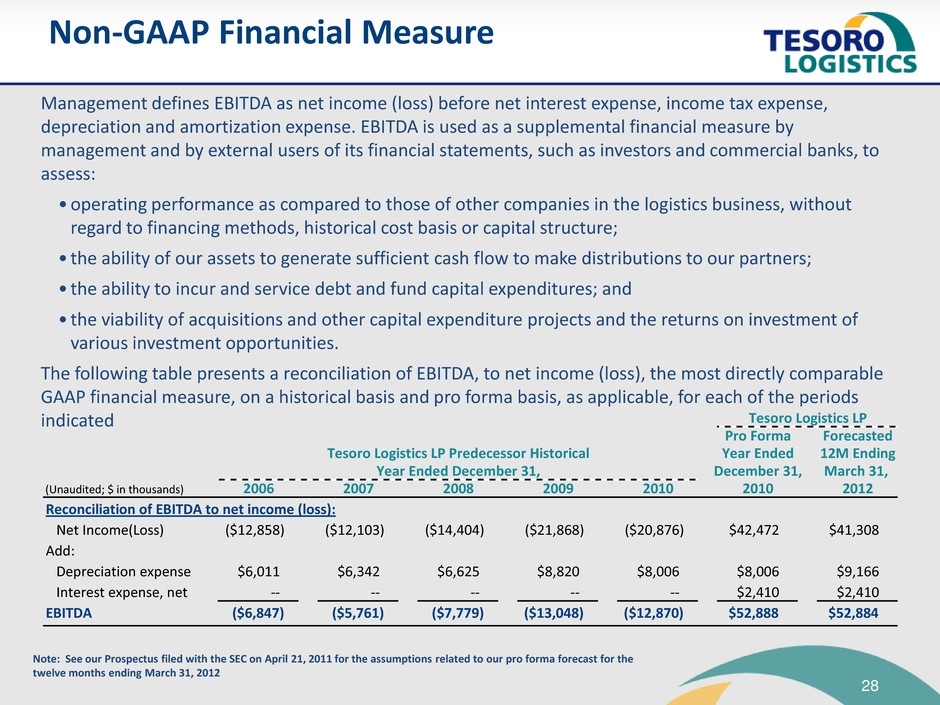

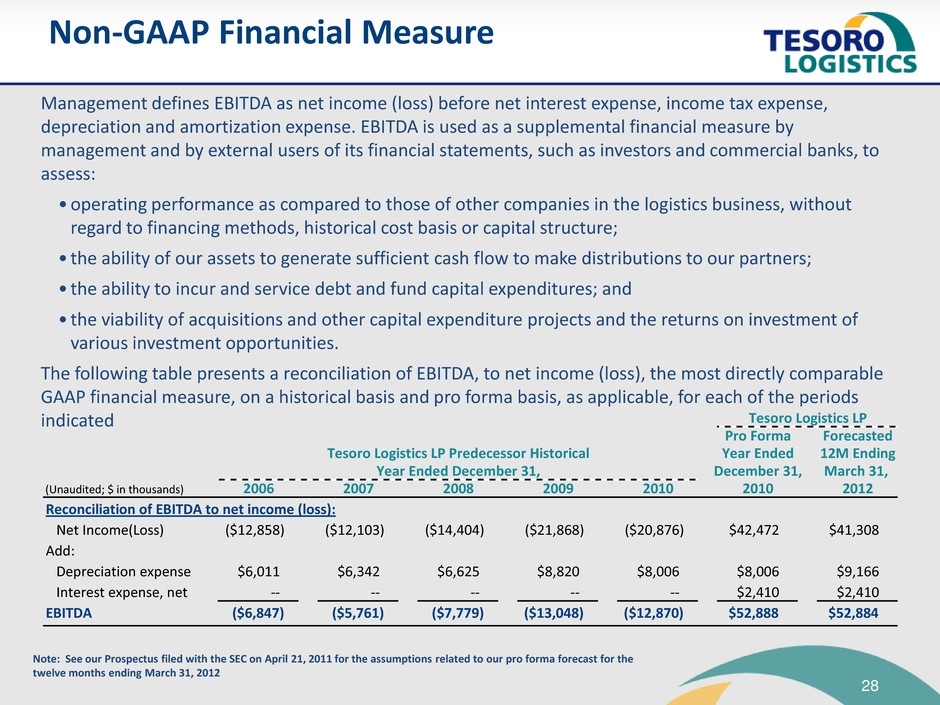

Non-GAAP Financial Measure

Management defines EBITDA as net income (loss) before net interest expense, income tax expense,

depreciation and amortization expense. EBITDA is used as a supplemental financial measure by

management and by external users of its financial statements, such as investors and commercial banks, to

assess:

•operating performance as compared to those of other companies in the logistics business, without

regard to financing methods, historical cost basis or capital structure;

• the ability of our assets to generate sufficient cash flow to make distributions to our partners;

• the ability to incur and service debt and fund capital expenditures; and

• the viability of acquisitions and other capital expenditure projects and the returns on investment of

various investment opportunities.

The following table presents a reconciliation of EBITDA, to net income (loss), the most directly comparable

GAAP financial measure, on a historical basis and pro forma basis, as applicable, for each of the periods

indicated Tesoro Logistics LP

Pro Forma Forecasted

Tesoro Logistics LP Predecessor Historical Year Ended 12M Ending

Year Ended December 31, December 31, March 31,

(Unaudited; $ in thousands) 2006 2007 2008 2009 2010 2010 2012

Reconciliation of EBITDA to net income (loss):

Net Income(Loss) ($12,858) ($12,103) ($14,404) ($21,868) ($20,876) $42,472 $41,308

Add:

Depreciation expense $6,011 $6,342 $6,625 $8,820 $8,006 $8,006 $9,166

Interest expense, net -- -- -- -- -- $2,410 $2,410

EBITDA ($6,847) ($5,761) ($7,779) ($13,048) ($12,870) $52,888 $52,884

Note: See our Prospectus filed with the SEC on April 21, 2011 for the assumptions related to our pro forma forecast for the

twelve months ending March 31, 2012