NYSE: TLLP National Association of Publicly Traded Partnerships 2013 MLP Investor Conference May 2013 Tesoro Logistics LP Exhibit 99.1

2 This Presentation includes forward-looking statements. These statements relate to, among other things, projections of operational volumetrics and improvements, growth projects, cash flows, capital expenditures and future performance; the expected completion of the Chevron Northwest Products System acquisition; the expected completion of the acquisition of the first tranche of logistics assets from Tesoro Corporation’s acquisition of BP’s Southern California Refining and Marketing Business; potential acquisitions, including the anticipated offer of additional logistics assets from Tesoro; and the estimated impact to EBITDA of past and potential asset acquisitions. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,“ “potential” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. Please see our Risk Factor disclosures included in our 2012 Annual Report on Form 10-K and our quarterly reports on Form 10-Q. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward- looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have estimated annual EBITDA, a non-GAAP financial measure, for the company and certain acquisitions and growth projects. Please see the Appendix for the definition and reconciliation of these annual EBITDA estimates. Forward Looking Statements

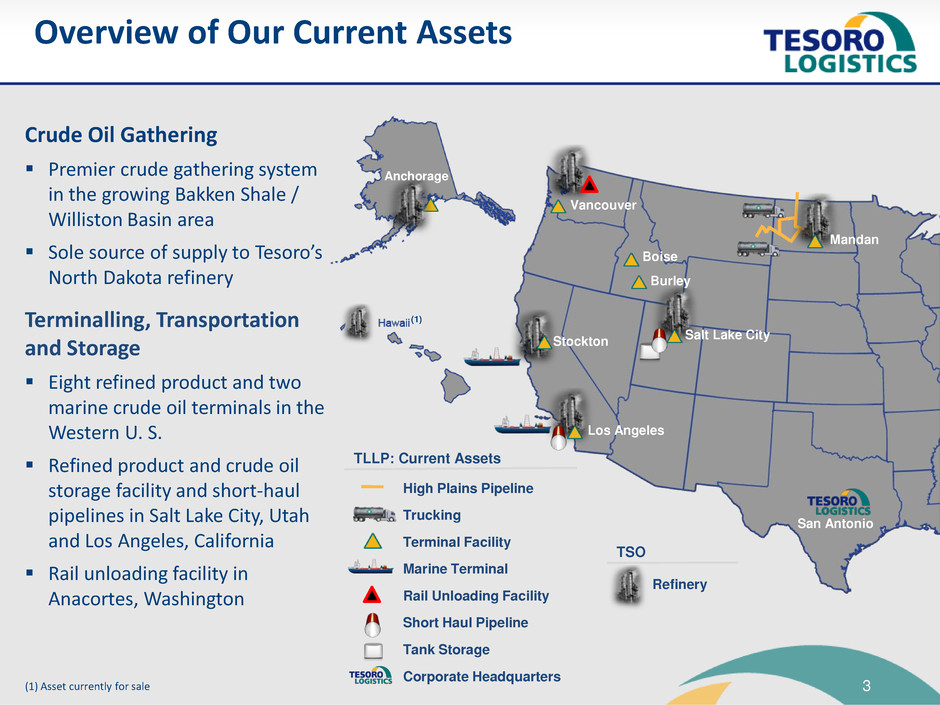

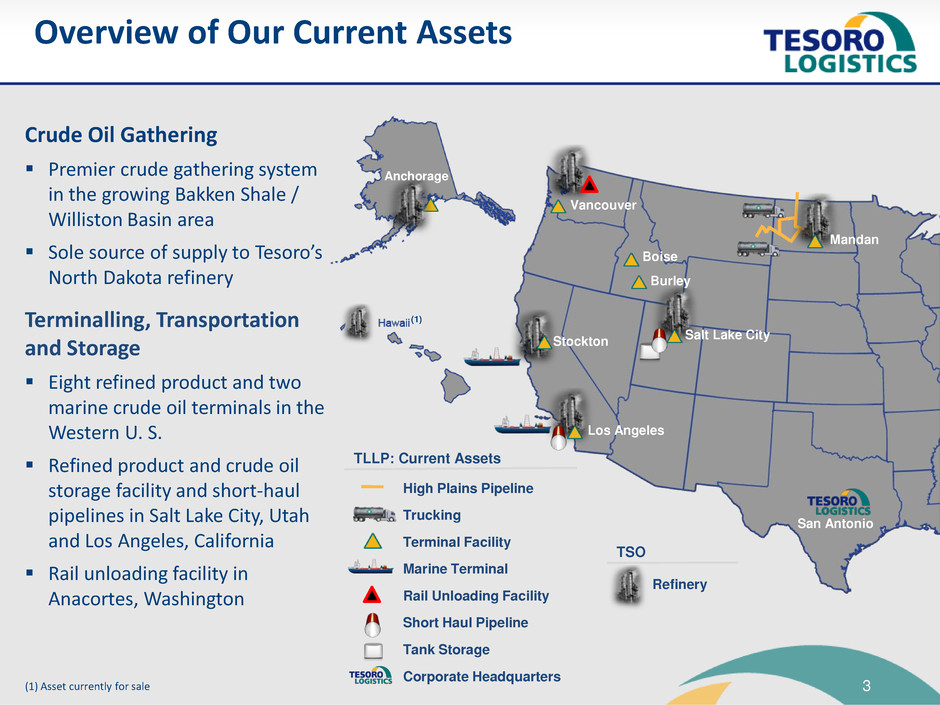

3 Overview of Our Current Assets Crude Oil Gathering Premier crude gathering system in the growing Bakken Shale / Williston Basin area Sole source of supply to Tesoro’s North Dakota refinery Terminalling, Transportation and Storage Eight refined product and two marine crude oil terminals in the Western U. S. Refined product and crude oil storage facility and short-haul pipelines in Salt Lake City, Utah and Los Angeles, California Rail unloading facility in Anacortes, Washington TLLP: Current Assets High Plains Pipeline Trucking Terminal Facility Marine Terminal Rail Unloading Facility Short Haul Pipeline Tank Storage Corporate Headquarters TSO Refinery Vancouver Stockton Los Angeles Boise San Antonio Mandan Burley Salt Lake City Anchorage (1) (1) Asset currently for sale

4 Investment Highlights Well-Positioned Assets Stable Cash Flow Experienced Management Team Strong Sponsorship Attractive, Visible Growth Opportunities Organic growth prospects Optimization opportunities Drop down assets Long-term contracts Fee-based, inflation protected and fixed minimum commitments Successful track record of acquiring and expanding assets Expected Bakken growth Western U.S. Footprint Expected refined product demand growth MLP drives logistics growth Critical infrastructure to Tesoro Drop down assets cannot be replicated

5 Tesoro’s Strategic Goals Support TLLP Operational efficiency and effectiveness Safety and reliability Improving refinery utilization driving higher volumes on TLLP assets Commercial excellence Marketing integration increasing terminal throughputs Logistics supports access to advantaged crude oil supplies Financial discipline TLLP provides low cost of capital for logistics growth Value-driven growth High-return capital projects include TLLP assets Kenai, AK Mandan, ND Salt Lake City, UT Anacortes, WA Martinez, CA Wilmington, CA Kapolei, HI (1) Asset currently for sale (1)

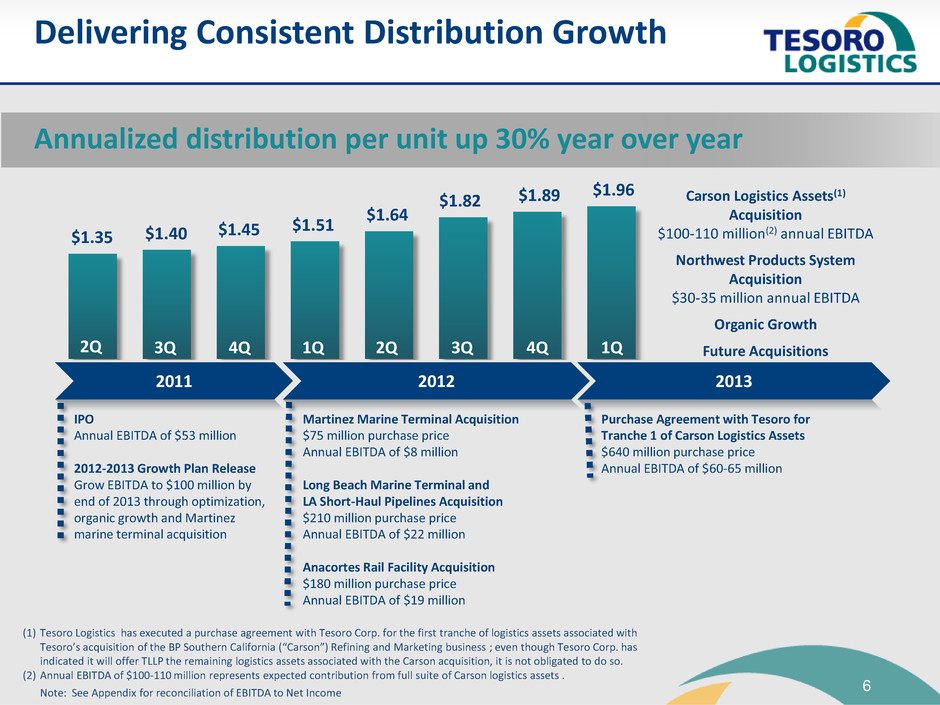

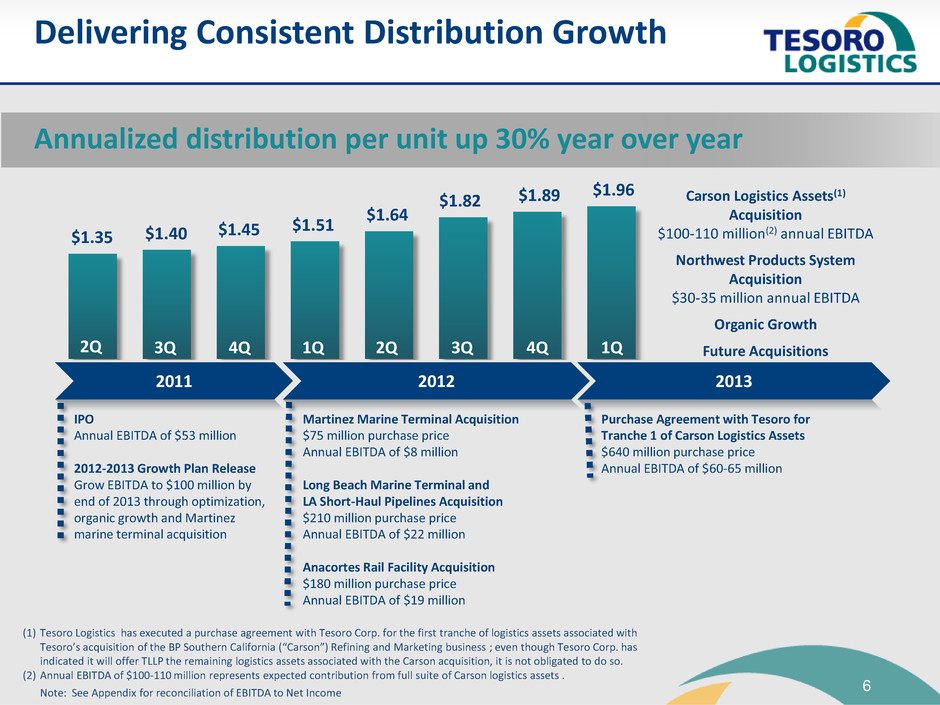

6 Delivering Consistent Distribution Growth $1.35 $1.40 $1.45 $1.51 $1.64 $1.82 $1.89 $1.96 Annualized distribution per unit up 30% year over year IPO Annual EBITDA of $53 million 2012-2013 Growth Plan Release Grow EBITDA to $100 million by end of 2013 through optimization, organic growth and Martinez marine terminal acquisition Martinez Marine Terminal Acquisition $75 million purchase price Annual EBITDA of $8 million Long Beach Marine Terminal and LA Short-Haul Pipelines Acquisition $210 million purchase price Annual EBITDA of $22 million Anacortes Rail Facility Acquisition $180 million purchase price Annual EBITDA of $19 million Carson Logistics Assets(1) Acquisition $100-110 million(2) annual EBITDA Northwest Products System Acquisition $30-35 million annual EBITDA Organic Growth Future Acquisitions Note: See Appendix for reconciliation of EBITDA to Net Income 2012 2011 (1) Tesoro Logistics has executed a purchase agreement with Tesoro Corp. for the first tranche of logistics assets associated with Tesoro’s acquisition of the BP Southern California (“Carson”) Refining and Marketing business ; even though Tesoro Corp. has indicated it will offer TLLP the remaining logistics assets associated with the Carson acquisition, it is not obligated to do so. (2) Annual EBITDA of $100-110 million represents expected contribution from full suite of Carson logistics assets . 2013 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q Purchase Agreement with Tesoro for Tranche 1 of Carson Logistics Assets $640 million purchase price Annual EBITDA of $60-65 million

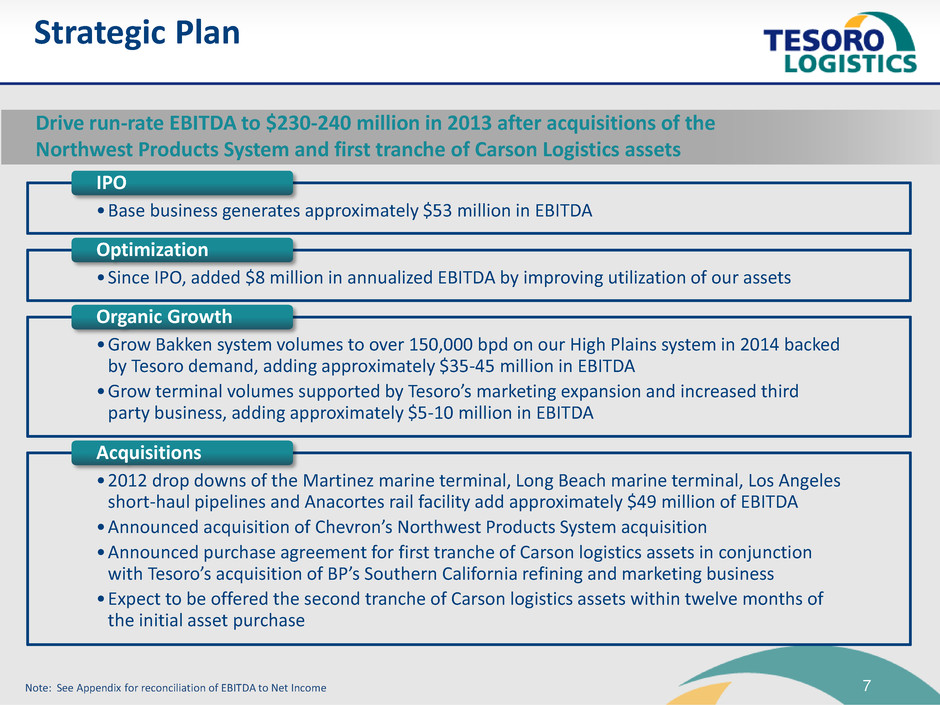

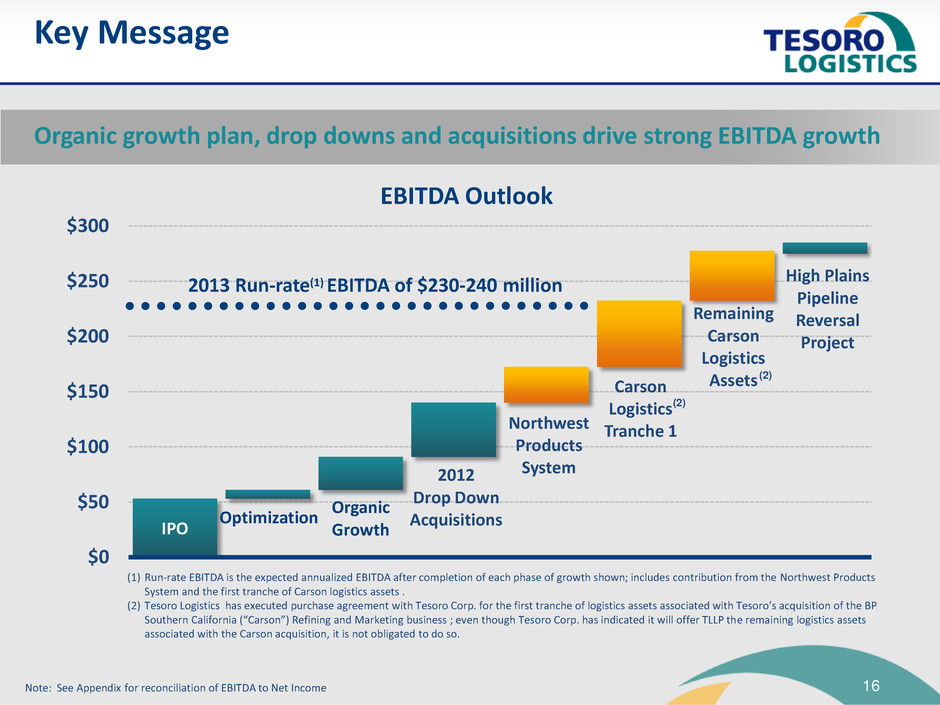

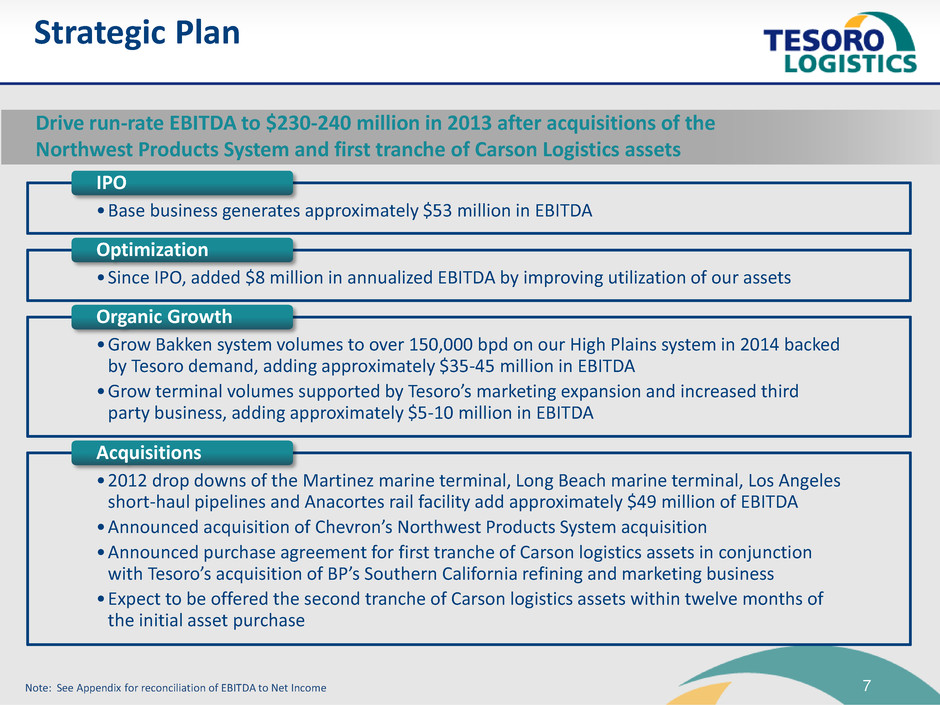

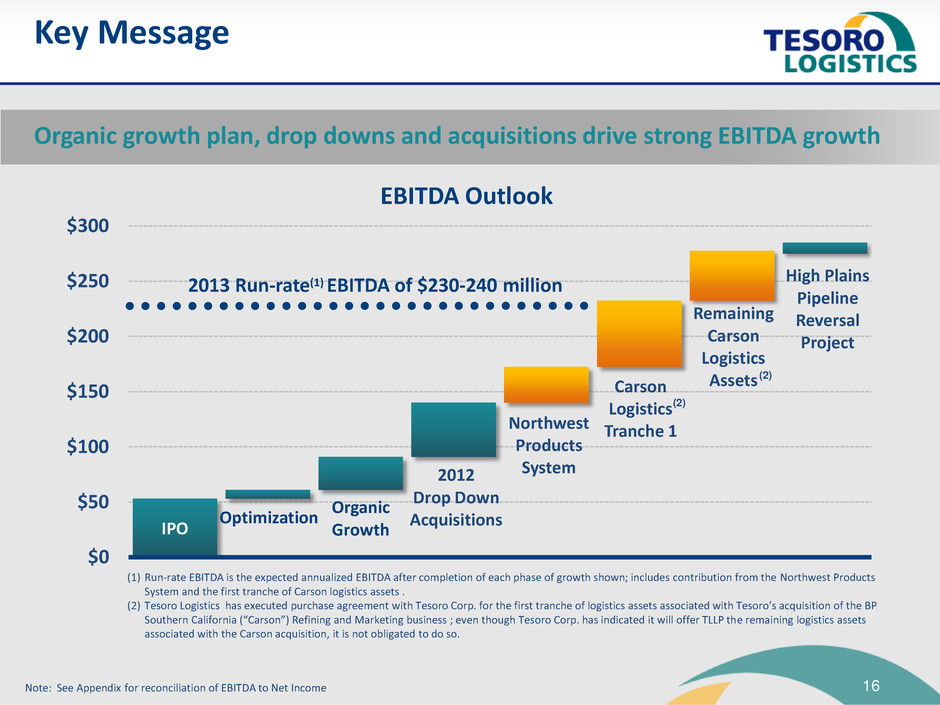

7 Strategic Plan Note: See Appendix for reconciliation of EBITDA to Net Income •Base business generates approximately $53 million in EBITDA IPO •Since IPO, added $8 million in annualized EBITDA by improving utilization of our assets Optimization •Grow Bakken system volumes to over 150,000 bpd on our High Plains system in 2014 backed by Tesoro demand, adding approximately $35-45 million in EBITDA •Grow terminal volumes supported by Tesoro’s marketing expansion and increased third party business, adding approximately $5-10 million in EBITDA Organic Growth •2012 drop downs of the Martinez marine terminal, Long Beach marine terminal, Los Angeles short-haul pipelines and Anacortes rail facility add approximately $49 million of EBITDA •Announced acquisition of Chevron’s Northwest Products System acquisition •Announced purchase agreement for first tranche of Carson logistics assets in conjunction with Tesoro’s acquisition of BP’s Southern California refining and marketing business •Expect to be offered the second tranche of Carson logistics assets within twelve months of the initial asset purchase Acquisitions Drive run-rate EBITDA to $230-240 million in 2013 after acquisitions of the Northwest Products System and first tranche of Carson Logistics assets

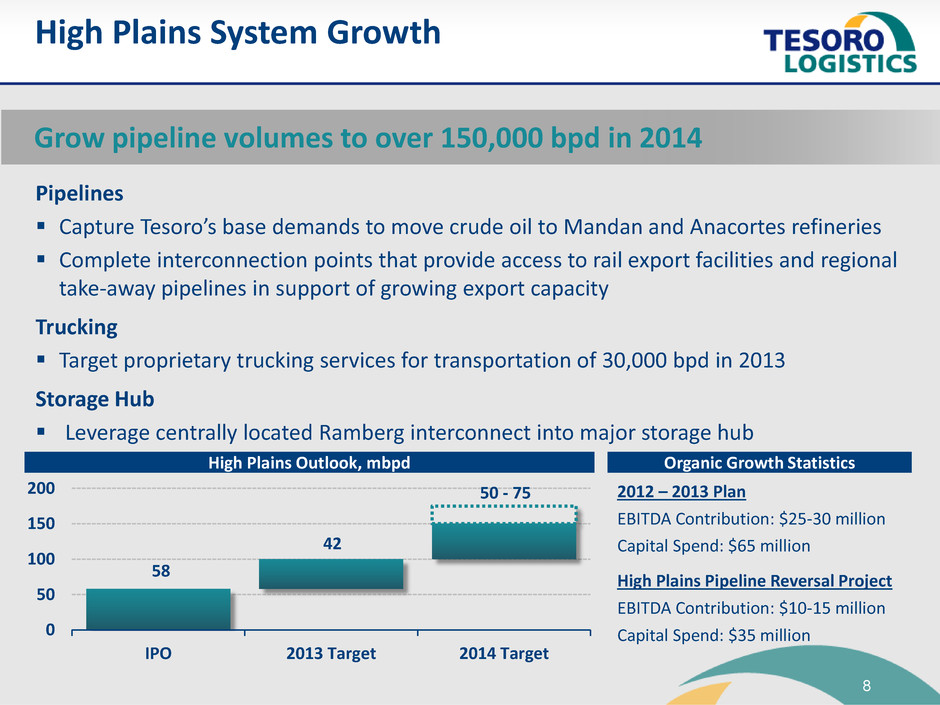

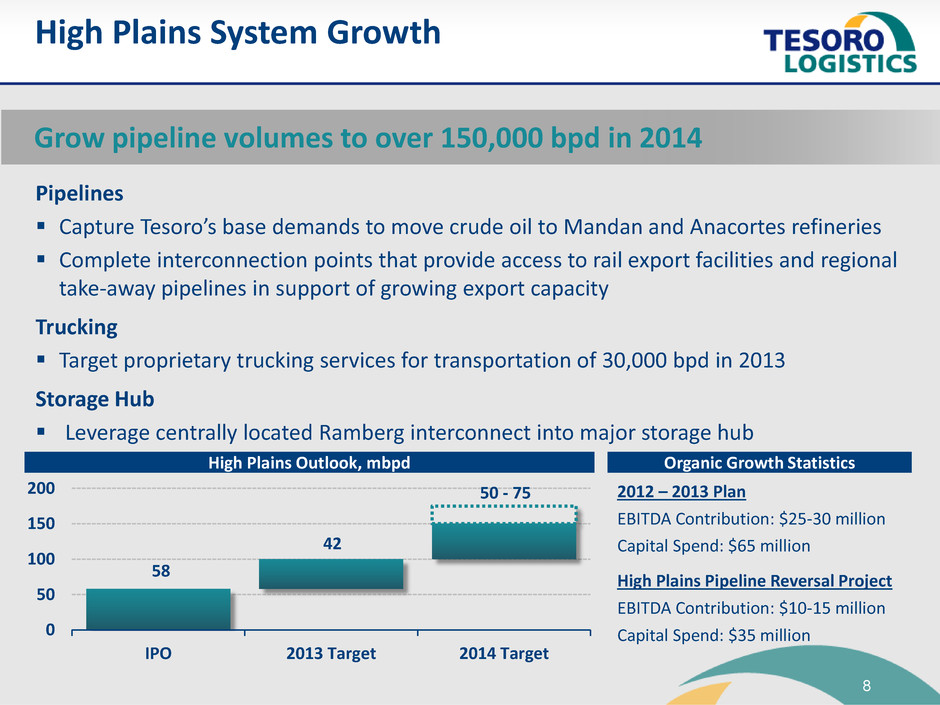

8 58 42 50 - 75 0 50 100 150 200 IPO 2013 Target 2014 Target High Plains System Growth Pipelines Capture Tesoro’s base demands to move crude oil to Mandan and Anacortes refineries Complete interconnection points that provide access to rail export facilities and regional take-away pipelines in support of growing export capacity Trucking Target proprietary trucking services for transportation of 30,000 bpd in 2013 Storage Hub Leverage centrally located Ramberg interconnect into major storage hub 2012 – 2013 Plan EBITDA Contribution: $25-30 million Capital Spend: $65 million High Plains Pipeline Reversal Project EBITDA Contribution: $10-15 million Capital Spend: $35 million High Plains Outlook, mbpd Organic Growth Statistics Grow pipeline volumes to over 150,000 bpd in 2014

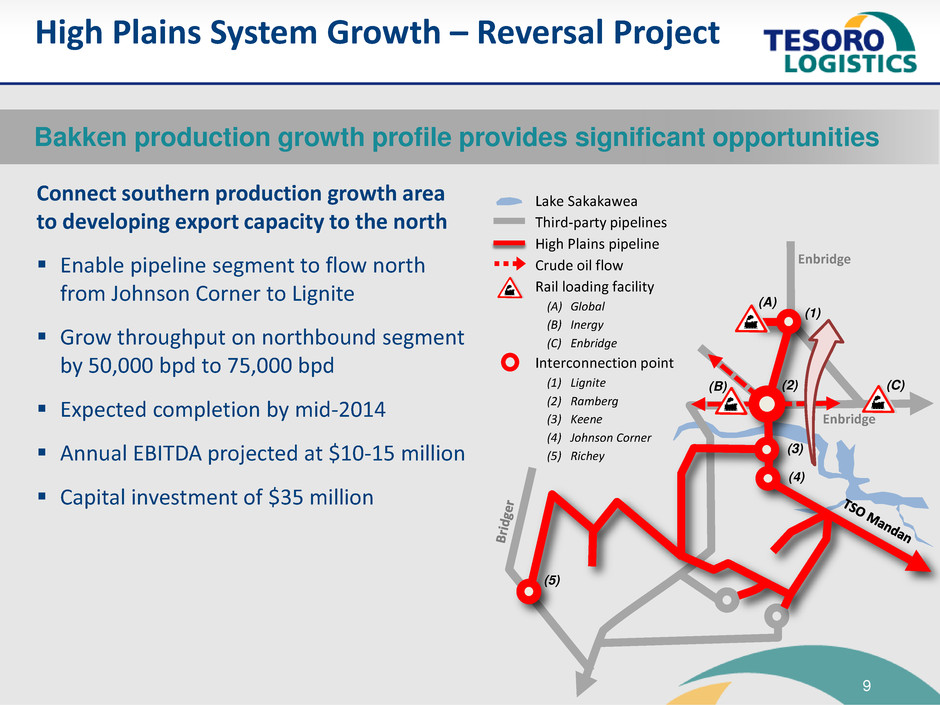

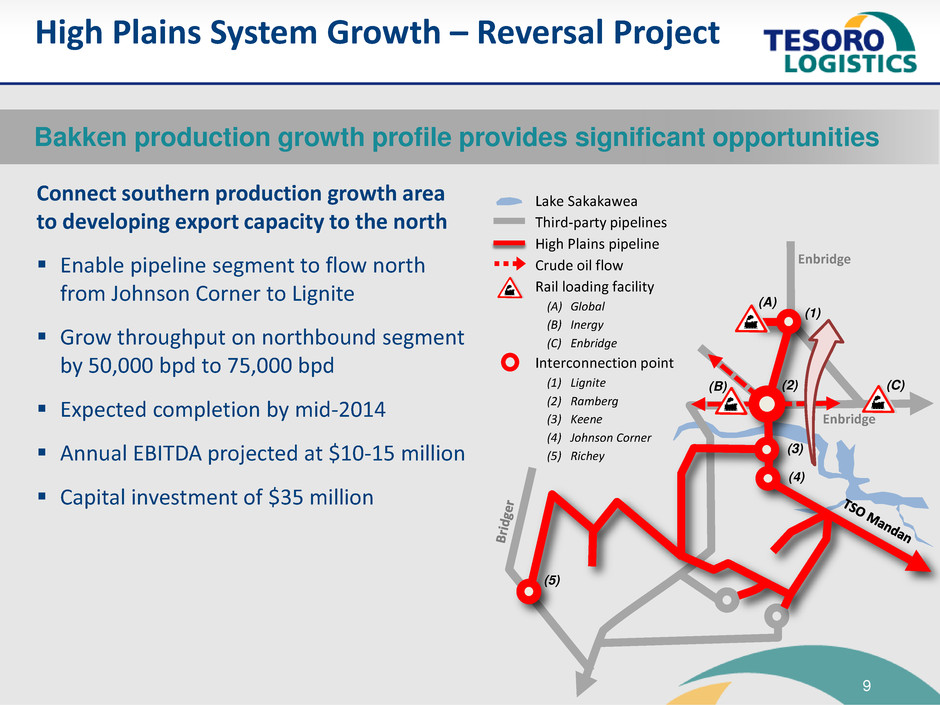

9 Connect southern production growth area to developing export capacity to the north Enable pipeline segment to flow north from Johnson Corner to Lignite Grow throughput on northbound segment by 50,000 bpd to 75,000 bpd Expected completion by mid-2014 Annual EBITDA projected at $10-15 million Capital investment of $35 million High Plains System Growth – Reversal Project Bakken production growth profile provides significant opportunities (4) (3) (2) (1) (5) (B) (A) Enbridge Lake Sakakawea Third-party pipelines High Plains pipeline Crude oil flow Rail loading facility (A) Global (B) Inergy (C) Enbridge Interconnection point (1) Lignite (2) Ramberg (3) Keene (4) Johnson Corner (5) Richey Enbridge (C)

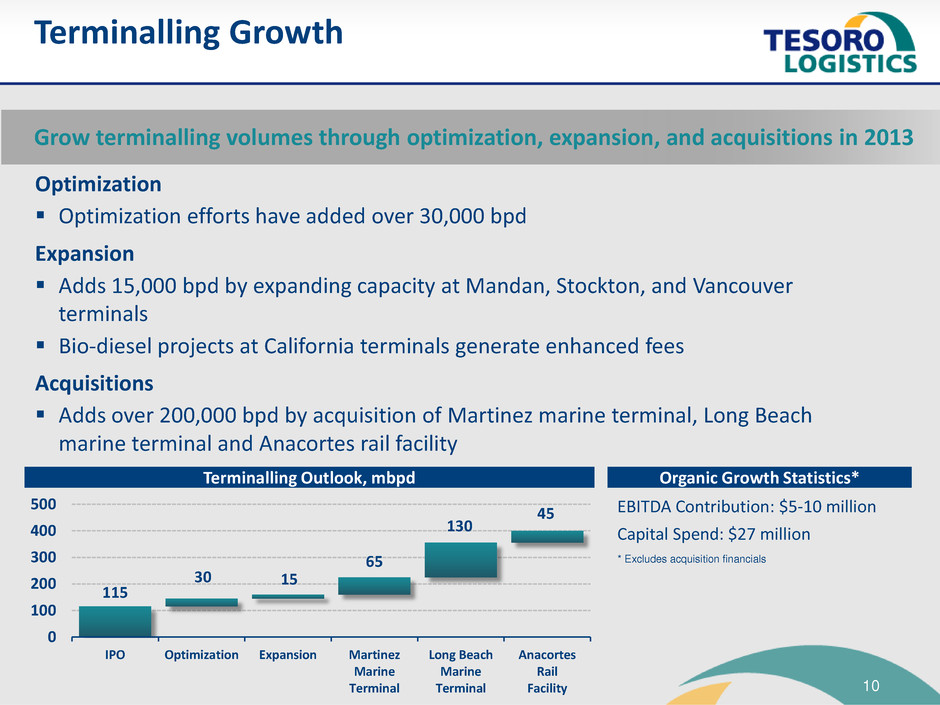

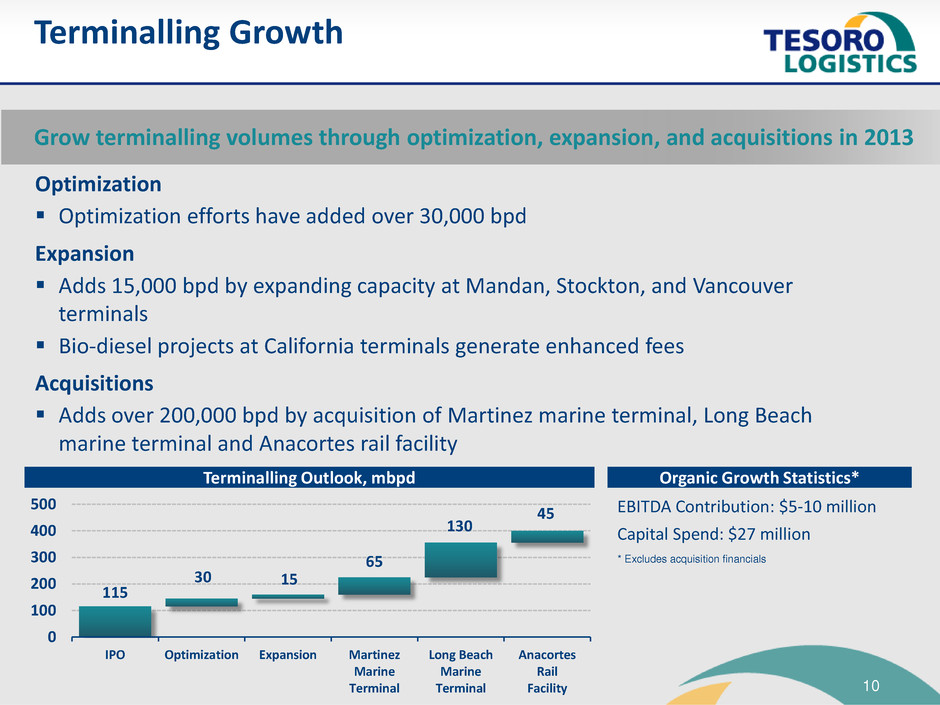

10 Terminalling Growth Optimization Optimization efforts have added over 30,000 bpd Expansion Adds 15,000 bpd by expanding capacity at Mandan, Stockton, and Vancouver terminals Bio-diesel projects at California terminals generate enhanced fees Acquisitions Adds over 200,000 bpd by acquisition of Martinez marine terminal, Long Beach marine terminal and Anacortes rail facility EBITDA Contribution: $5-10 million Capital Spend: $27 million 115 30 15 65 130 45 0 100 200 300 400 500 IPO Optimization Expansion Martinez Marine Terminal Long Beach Marine Terminal Anacortes Rail Facility Terminalling Outlook, mbpd Organic Growth Statistics* Grow terminalling volumes through optimization, expansion, and acquisitions in 2013 * Excludes acquisition financials

11 NW Products System Acquisition Overview Highlights Strategic Fit Volumetrics Financials NW Pipeline Terminal Intermediate Pump Station Boise Pasco Pocatello Acquisition of Chevron’s Northwest Products System for $355 million 760-mile FERC regulated products pipeline from SLC to Spokane Three refined products terminals Expected to close in 2Q 2013 Regulated pipeline business Stable, growing revenue stream Fee-based, inflation protected revenue Approximately 75-80% of revenue from third-parties 2012 pipeline throughput of 87,000 bpd 2012 terminalling throughput of 56,000 bpd 1.3 million barrels storage capacity Transaction to be funded from January equity offering proceeds Invest $15-25 million to implement inspection program to improve pipeline integrity Annual EBITDA projected at $30-35 million Maintenance capital expenditures(1) projected at $4 million annually (1) Annual maintenance capital expenditure estimate does not include expected investment of $15-25 million associated with inspection program and pipeline integrity expenditures, expected to be complete in 1-2 years.

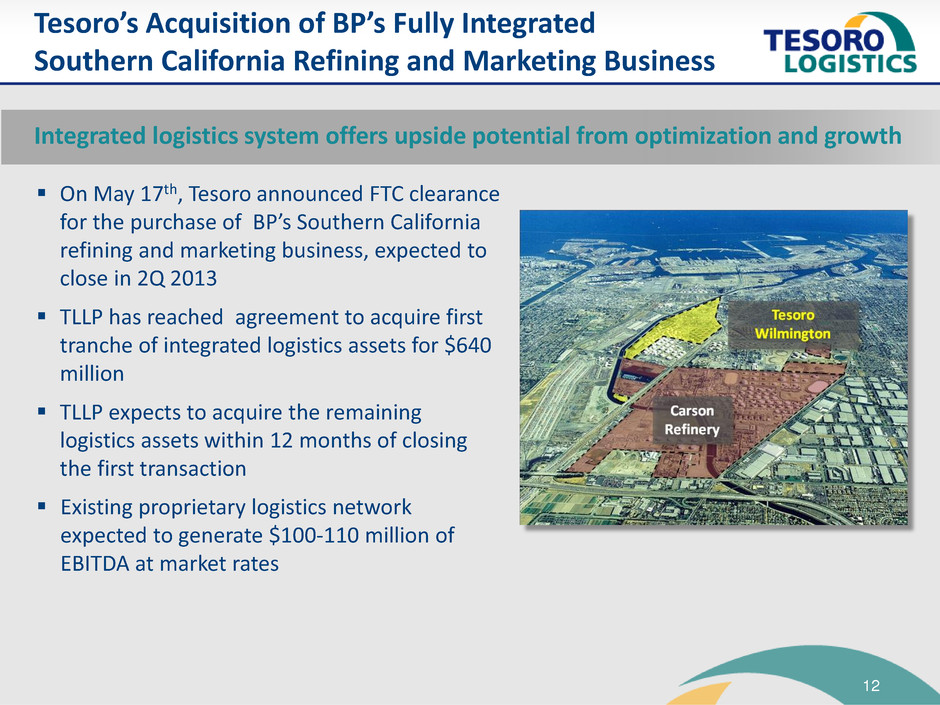

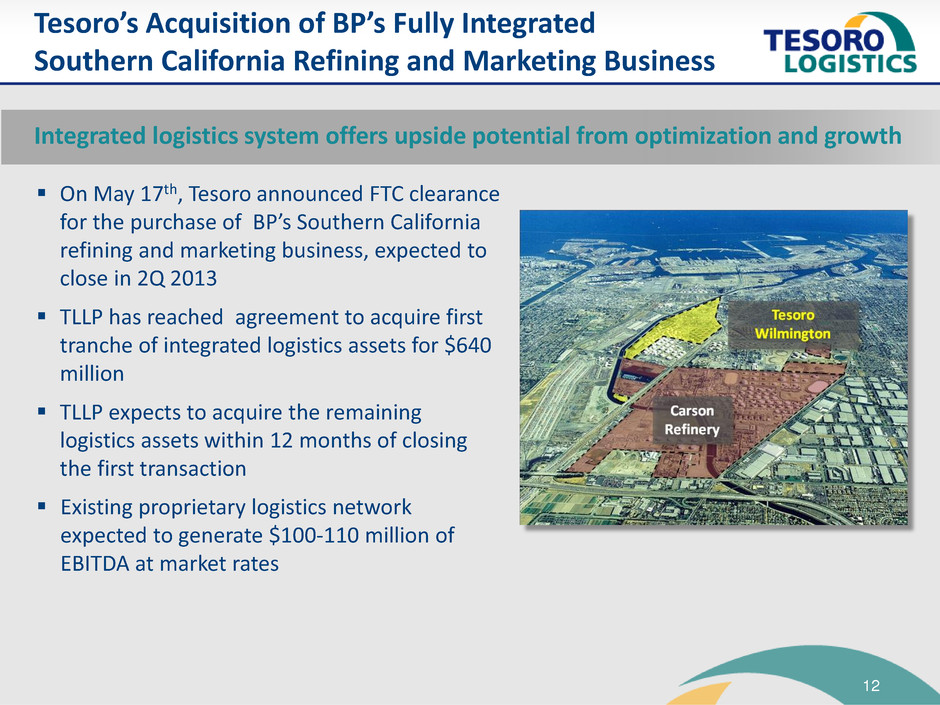

12 On May 17th, Tesoro announced FTC clearance for the purchase of BP’s Southern California refining and marketing business, expected to close in 2Q 2013 TLLP has reached agreement to acquire first tranche of integrated logistics assets for $640 million TLLP expects to acquire the remaining logistics assets within 12 months of closing the first transaction Existing proprietary logistics network expected to generate $100-110 million of EBITDA at market rates Tesoro’s Acquisition of BP’s Fully Integrated Southern California Refining and Marketing Business Integrated logistics system offers upside potential from optimization and growth

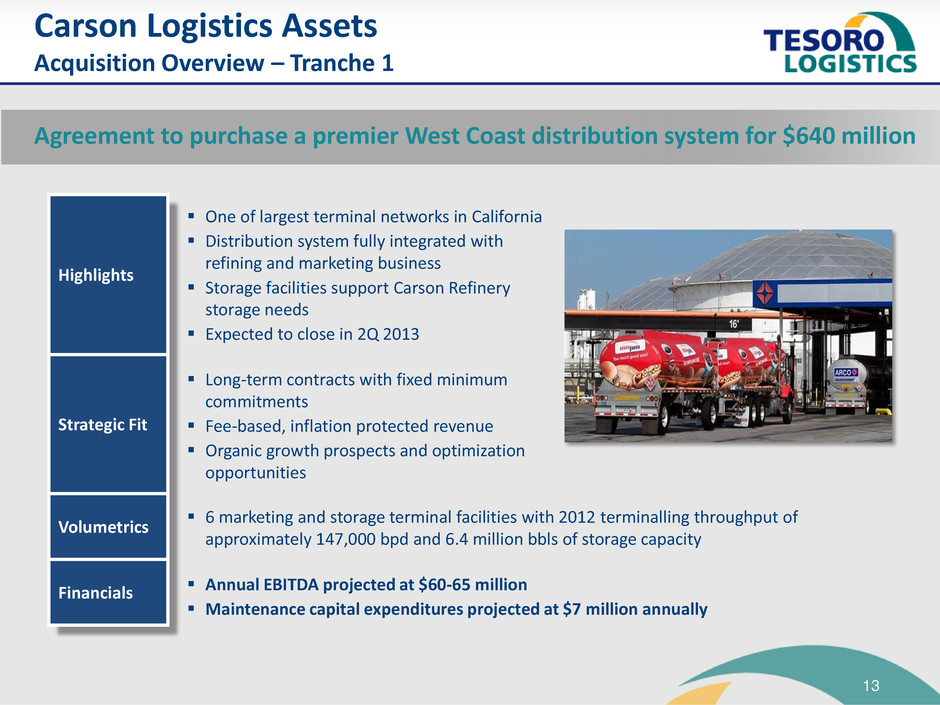

13 Carson Logistics Assets Acquisition Overview – Tranche 1 Agreement to purchase a premier West Coast distribution system for $640 million Highlights Strategic Fit Volumetrics Financials One of largest terminal networks in California Distribution system fully integrated with refining and marketing business Storage facilities support Carson Refinery storage needs Expected to close in 2Q 2013 Long-term contracts with fixed minimum commitments Fee-based, inflation protected revenue Organic growth prospects and optimization opportunities 6 marketing and storage terminal facilities with 2012 terminalling throughput of approximately 147,000 bpd and 6.4 million bbls of storage capacity Annual EBITDA projected at $60-65 million Maintenance capital expenditures projected at $7 million annually

14 Estimated market value of $450-550 million for remaining logistics assets Carson Logistics Assets Tesoro’s Remaining Logistics Portfolio Asset Overview Three marine terminals with historical crude oil and refined product throughput of 400,000 bpd Marine facilities include the only West Coast VLCC-capable dock 114 miles of active pipelines Strategic Fit Long-term contracts with fixed minimum commitments Fee-based, inflation protected revenue Organic growth prospects and optimization opportunities

15 Financial Overview Maintain flexibility to achieve growth objectives • $500 million revolver, expandable to $650 million • Conservative leverage ratio of approximately 2.5x pro-forma EBITDA as of March 31, 2013 Conservative leverage and ample liquidity • Leverage target of 3x – 4x EBITDA • Maximize flexibility to fund growth • Issue equity and/or permanent debt to reload revolver Pursue balanced capital structure • Target prudent distribution coverage of 1.1x • Subordination structure provides additional support • Financial flexibility to grow distribution Protect and grow distribution

16 Key Message IPO Optimization Organic Growth 2012 Drop Down Acquisitions Northwest Products System Carson Logistics Tranche 1 Remaining Carson Logistics Assets High Plains Pipeline Reversal Project $0 $50 $100 $150 $200 $250 $300 EBITDA Outlook 2013 Run-rate(1) EBITDA of $230-240 million Note: See Appendix for reconciliation of EBITDA to Net Income Organic growth plan, drop downs and acquisitions drive strong EBITDA growth (1) Run-rate EBITDA is the expected annualized EBITDA after completion of each phase of growth shown; includes contribution from the Northwest Products System and the first tranche of Carson logistics assets . (2) Tesoro Logistics has executed purchase agreement with Tesoro Corp. for the first tranche of logistics assets associated with Tesoro’s acquisition of the BP Southern California (“Carson”) Refining and Marketing business ; even though Tesoro Corp. has indicated it will offer TLLP the remaining logistics assets associated with the Carson acquisition, it is not obligated to do so. (2) (2)

17 Appendix

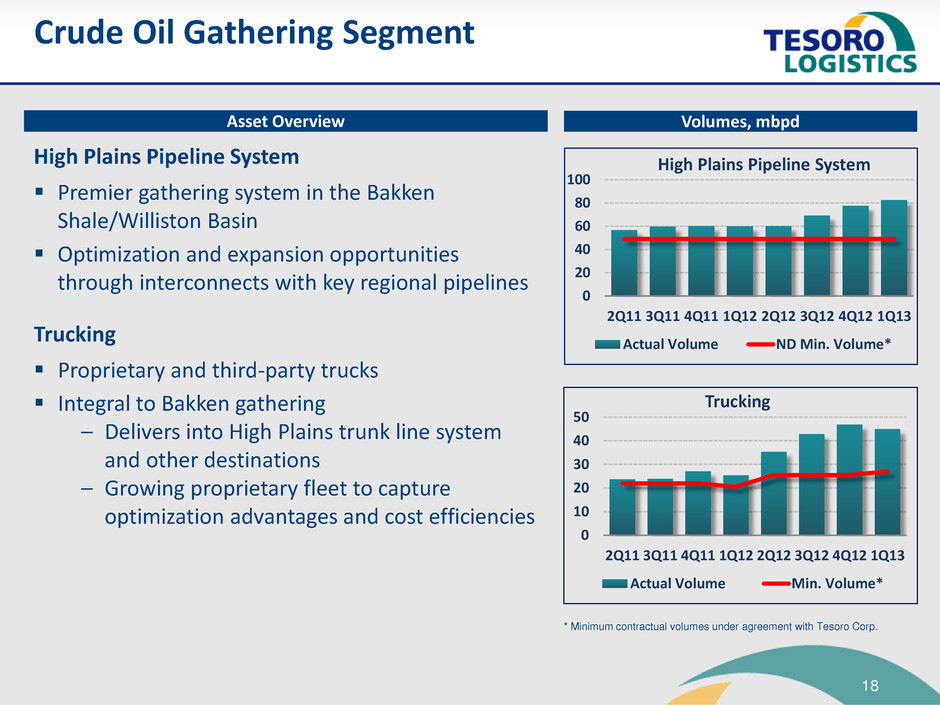

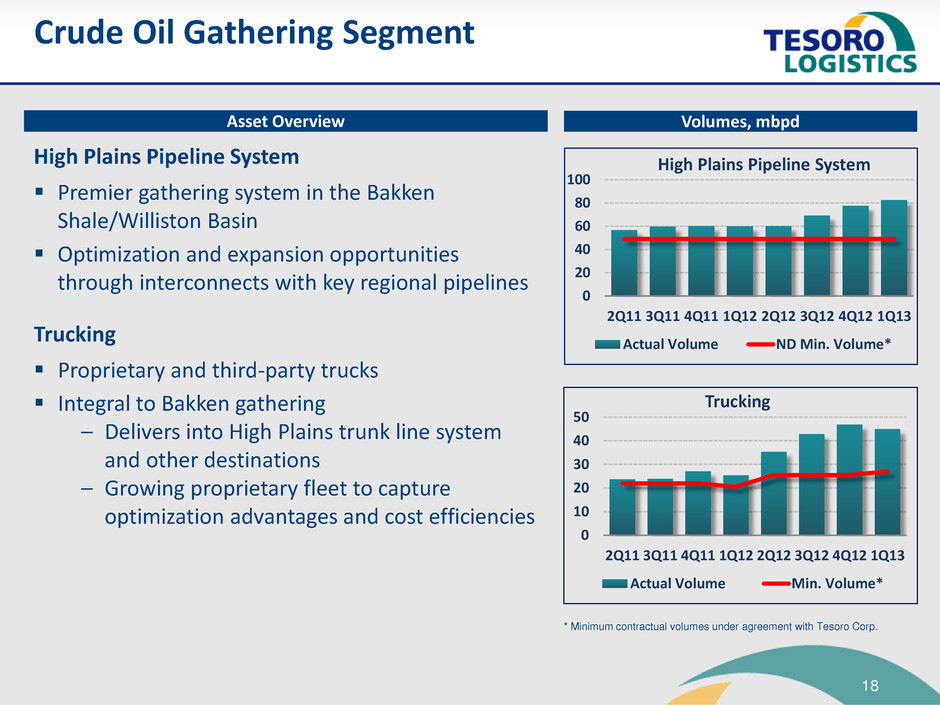

18 Volumes, mbpd 0 20 40 60 80 100 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 High Plains Pipeline System Actual Volume ND Min. Volume* High Plains Pipeline System Premier gathering system in the Bakken Shale/Williston Basin Optimization and expansion opportunities through interconnects with key regional pipelines Trucking Proprietary and third-party trucks Integral to Bakken gathering – Delivers into High Plains trunk line system and other destinations – Growing proprietary fleet to capture optimization advantages and cost efficiencies Crude Oil Gathering Segment 0 10 20 30 40 50 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Trucking Actual Volume Min. Volume* Asset Overview * Minimum contractual volumes under agreement with Tesoro Corp.

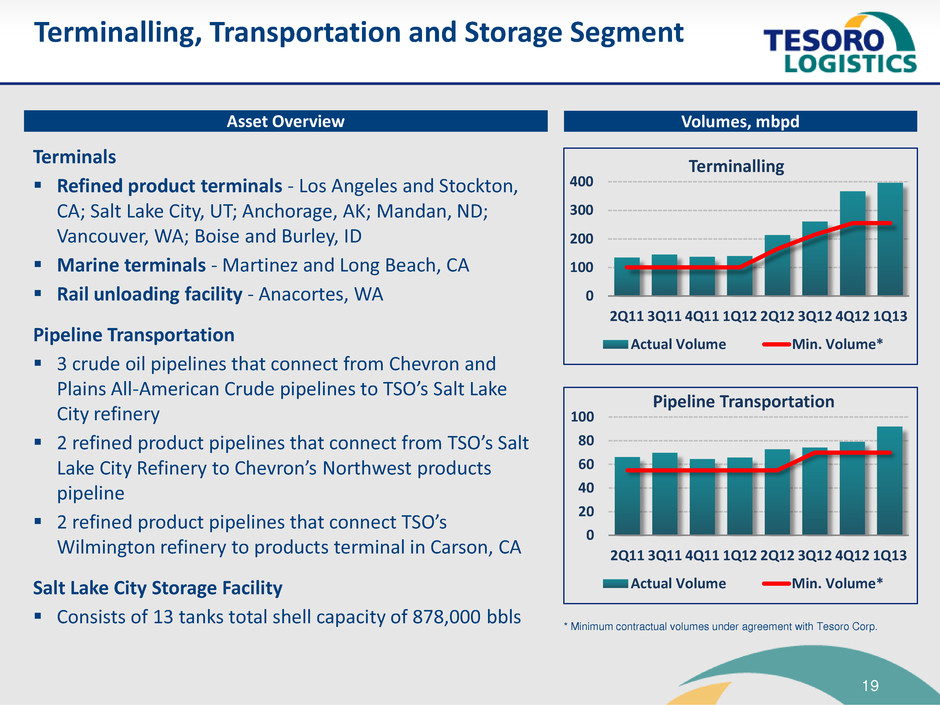

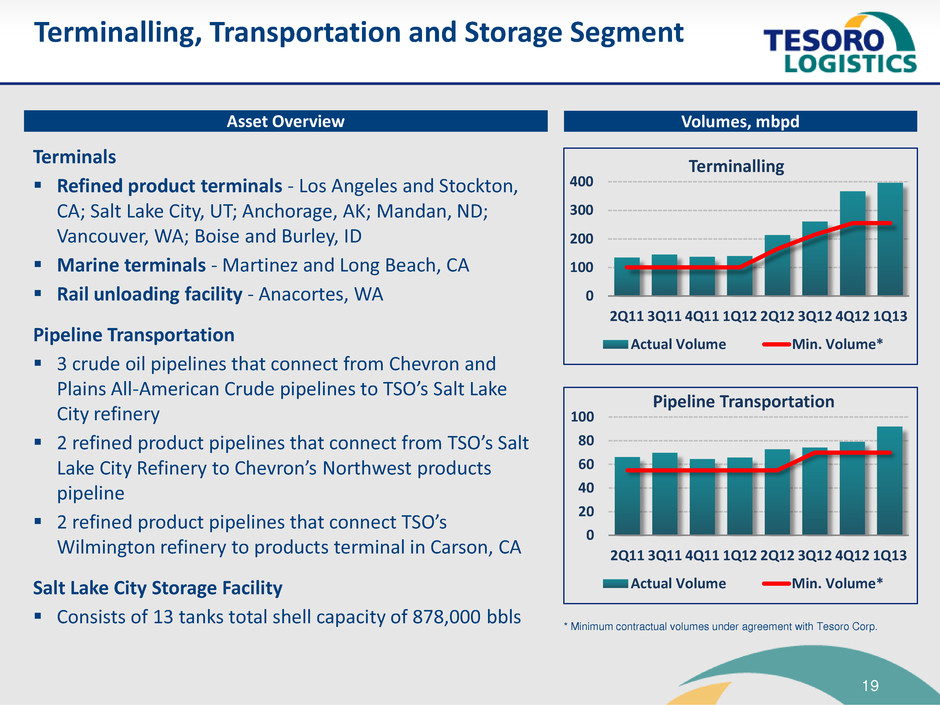

19 0 100 200 300 400 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Terminalling Actual Volume Min. Volume* Asset Overview Terminals Refined product terminals - Los Angeles and Stockton, CA; Salt Lake City, UT; Anchorage, AK; Mandan, ND; Vancouver, WA; Boise and Burley, ID Marine terminals - Martinez and Long Beach, CA Rail unloading facility - Anacortes, WA Pipeline Transportation 3 crude oil pipelines that connect from Chevron and Plains All-American Crude pipelines to TSO’s Salt Lake City refinery 2 refined product pipelines that connect from TSO’s Salt Lake City Refinery to Chevron’s Northwest products pipeline 2 refined product pipelines that connect TSO’s Wilmington refinery to products terminal in Carson, CA Salt Lake City Storage Facility Consists of 13 tanks total shell capacity of 878,000 bbls Terminalling, Transportation and Storage Segment 0 20 40 60 80 100 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 Pipeline Transportation Actual Volume Min. Volume* Volumes, mbpd * Minimum contractual volumes under agreement with Tesoro Corp.

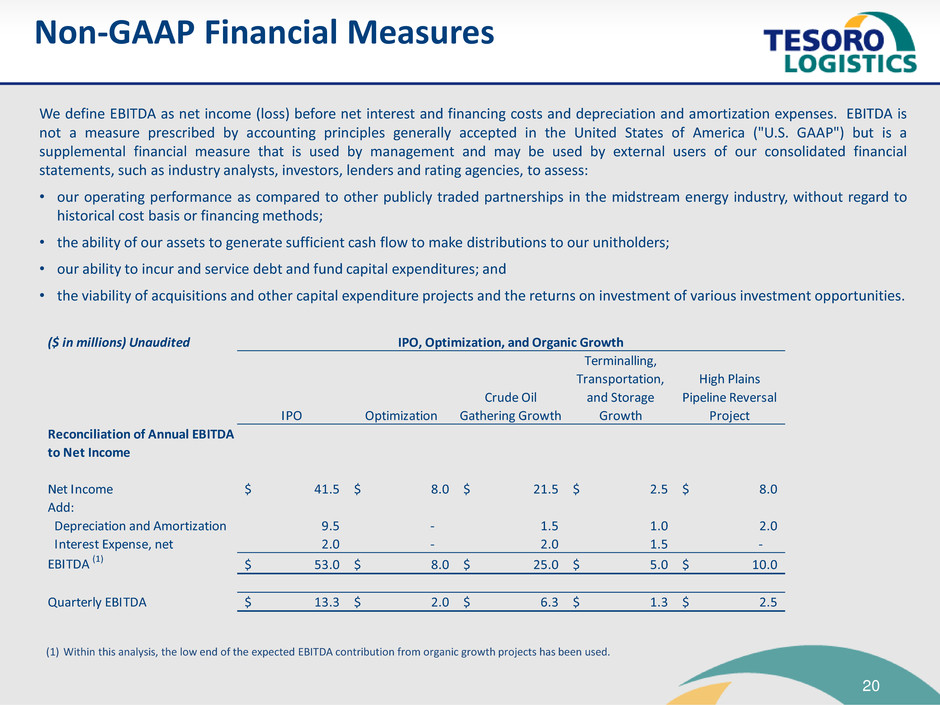

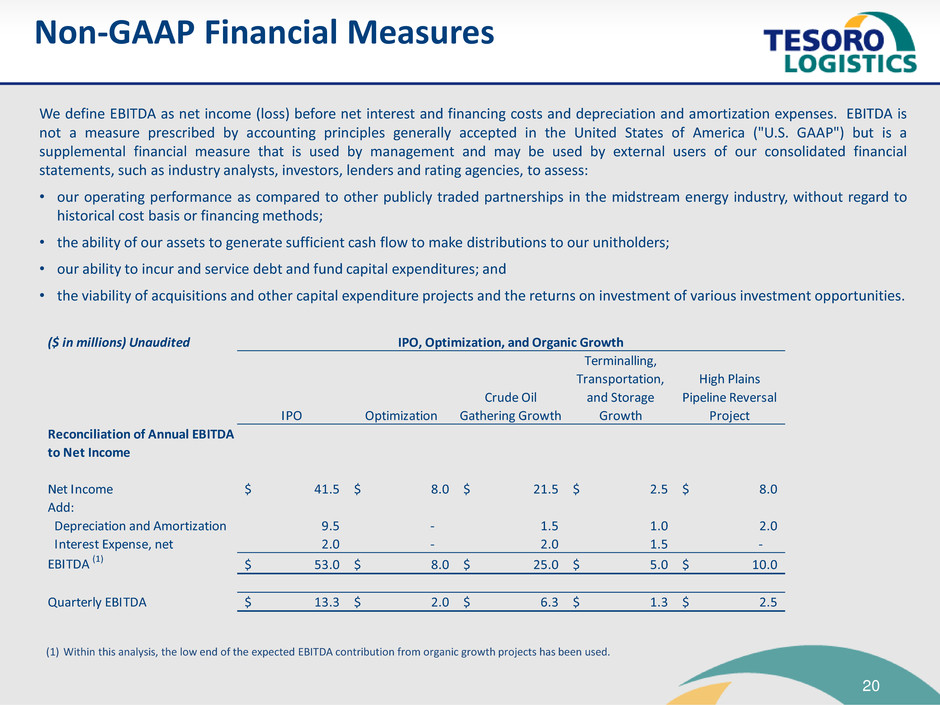

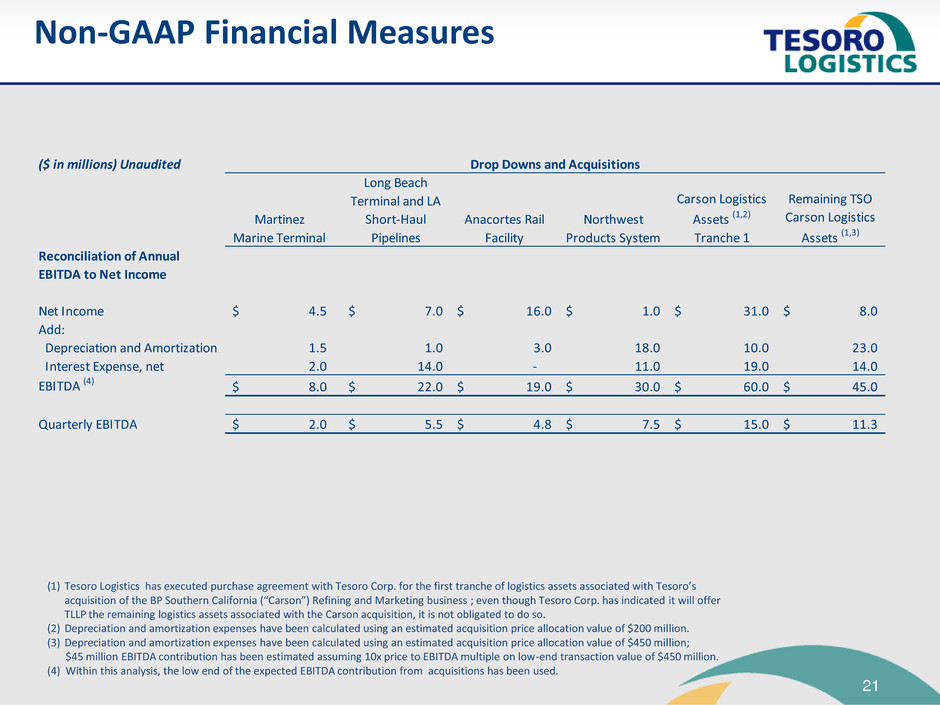

20 We define EBITDA as net income (loss) before net interest and financing costs and depreciation and amortization expenses. EBITDA is not a measure prescribed by accounting principles generally accepted in the United States of America ("U.S. GAAP") but is a supplemental financial measure that is used by management and may be used by external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. Non-GAAP Financial Measures ($ in millions) Unaudited IPO Optimization Crude Oil Gathering Growth Terminalling, Transportation, and Storage Growth High Plains Pipeline Reversal Project Reconciliation of Annual EBITDA to Net Income N t Inc m 41.5$ 8.0$ 21.5$ 2.5$ 8.0$ Add: D r cia ion and Amortization 9.5 - 1.5 1.0 2.0 Interest Expense, net 2.0 - 2.0 1.5 - EBITDA (1) 53.0$ 8.0$ 25.0$ 5.0$ 10.0$ Quarterly EBITDA 13.3$ 2.0$ 6.3$ 1.3$ 2.5$ IPO, Optimization, and Organic Growth (1) Within this analysis, the low end of the expected EBITDA contribution from organic growth projects has been used.

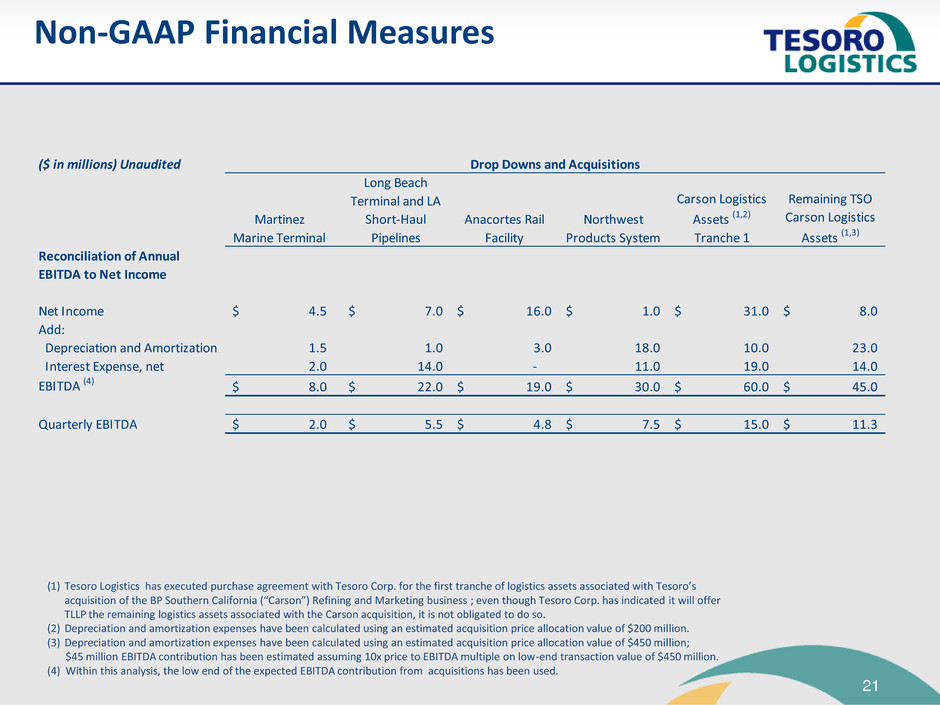

21 Non-GAAP Financial Measures (1) Tesoro Logistics has executed purchase agreement with Tesoro Corp. for the first tranche of logistics assets associated with Tesoro’s acquisition of the BP Southern California (“Carson”) Refining and Marketing business ; even though Tesoro Corp. has indicated it will offer TLLP the remaining logistics assets associated with the Carson acquisition, it is not obligated to do so. (2) Depreciation and amortization expenses have been calculated using an estimated acquisition price allocation value of $200 million. (3) Depreciation and amortization expenses have been calculated using an estimated acquisition price allocation value of $450 million; $45 million EBITDA contribution has been estimated assuming 10x price to EBITDA multiple on low-end transaction value of $450 million. (4) Within this analysis, the low end of the expected EBITDA contribution from acquisitions has been used. ($ in millions) Unaudited Martinez Marine Terminal Long Beach Terminal and LA Short-Haul Pipelines Anacortes Rail Facility Northwest Products System Carson Logistics Assets (1,2) Tranche 1 Remaining TSO Carson Logistics Assets (1,3) Reconciliation of Annual EBITDA to Net Income Net Income 4.5$ 7.0$ 16.0$ 1.0$ 31.0$ 8.0$ Add: Depreciation and Amortization 1.5 1.0 3.0 18.0 10.0 23.0 Interest Expense, net 2.0 14.0 - 11.0 19.0 14.0 EBITDA (4) 8.0$ 22.0$ 19.0$ 30.0$ 60.0$ 45.0$ Quarterly EBITDA 2.0$ 5.5$ 4.8$ 7.5$ 15.0$ 11.3$ Drop Downs and Acquisitions

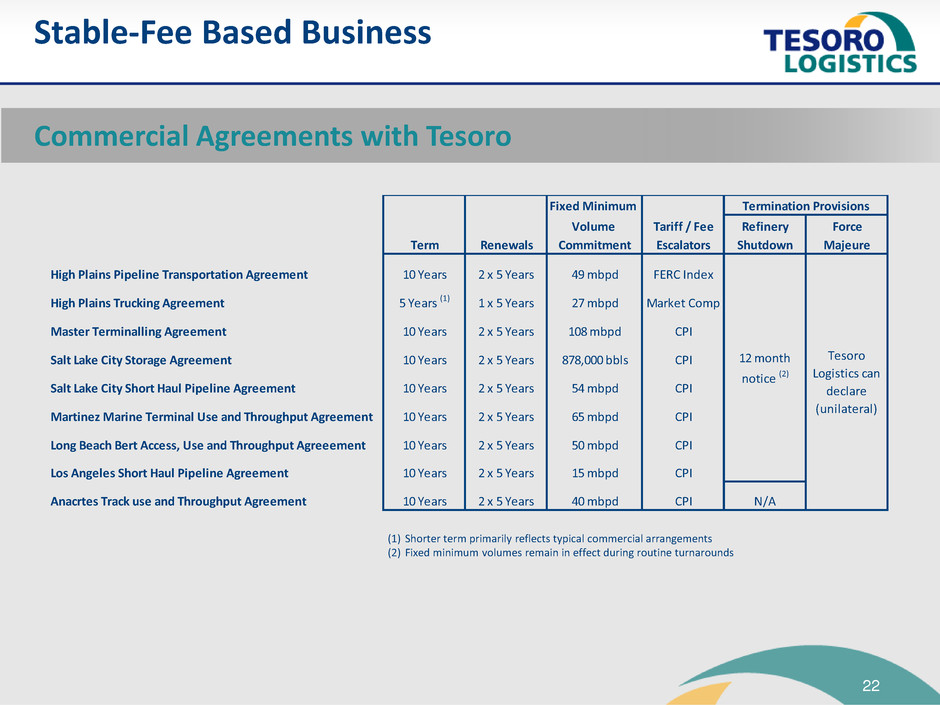

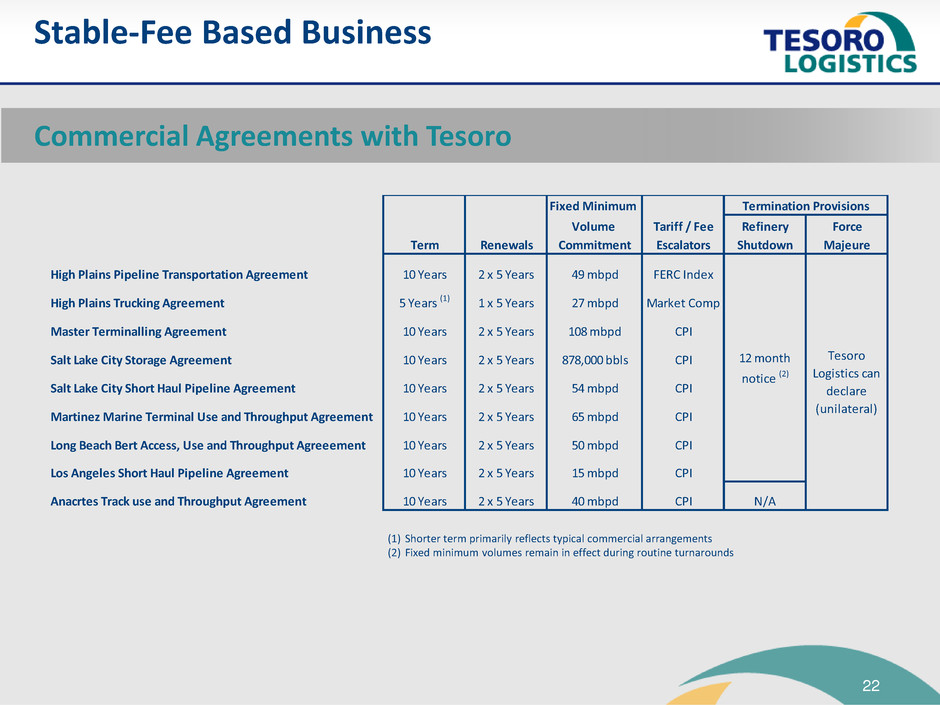

22 Stable-Fee Based Business (1) Shorter term primarily reflects typical commercial arrangements (2) Fixed minimum volumes remain in effect during routine turnarounds Commercial Agreements with Tesoro Fixed Minimum Volume Tariff / Fee Refinery Force Term Renewals Commitment Escalators Shutdown Majeure High Plains Pipeline Transportation Agreement 10 Years 2 x 5 Years 49 mbpd FERC Index High Plains Trucking Agreement 5 Years (1) 1 x 5 Years 27 mbpd Market Comp Master Terminalling Agreement 10 Years 2 x 5 Years 108 mbpd CPI Salt Lake City Storage Agreement 10 Years 2 x 5 Years 878,000 bbls CPI Salt Lake City Short Haul Pipeline Agreement 10 Years 2 x 5 Years 54 mbpd CPI Martinez Marine Terminal Use and Throughput Agreement 10 Years 2 x 5 Years 65 mbpd CPI Long Beach Bert Access, Use and Throughput Agreeement 10 Years 2 x 5 Years 50 mbpd CPI Los Angeles Short Haul Pipeline Agreement 10 Years 2 x 5 Years 15 mbpd CPI Anacrtes Track use and Throughput Agreement 10 Years 2 x 5 Years 40 mbpd CPI N/A Termination Provisions 12 month notice (2) Tesoro Logistics can declare (unilateral)