NYSE: TLLP 2014 RBC Capital Markets MLP Conference November 2014 Tesoro Logistics LP Exhibit 99.1

2 This Presentation includes forward-looking statements. These statements relate to, among other things, the following: execution of our strategy, including growth and expansion projects and the resulting volumetric improvements, asset optimization opportunities, and growth in third party business and revenues; cash flows; the timing and amount of capital expenditures; expected timeframe for construction projects; our leverage targets and anticipated cost of capital; the proportion of Tesoro’s total consolidated EBITDA represented by our operations; the expected closing, benefits and the future performance of the QEP Field Services acquisition; and other aspects of future performance. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,“ “potential” and similar terms and phrases to identify forward-looking statements in this Presentation. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a variety of factors which are described in greater detail in our filings with the SEC. Please see our Risk Factor disclosures included in our 2013 Annual Report on Form 10-K and our quarterly reports on Form 10-Q. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward- looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Presentation. We have included quarterly and annual EBITDA, adjusted EBITDA, distributable cash flow and results of operating excluding Predecessor, each of which is a non-GAAP financial measure, for the company. Please see the Appendix for the definition and reconciliation of these amounts. Forward Looking Statements

3 Overview of Current Assets GATHERING(1) High Plains System Crude oil gathering system and truck fleet in North Dakota Rocky Mountain Natural Gas Gathering Systems Natural gas gathering pipelines in Rocky Mountain region TERMINALLING AND TRANSPORTATION Southern California Distribution System Distribution system with marine facilities, pipelines, and product terminals Northwest Products System Refined products pipeline and products terminals in Rocky Mountain and Pacific Northwest regions PROCESSING(1) Natural gas processing complexes and fractionation facility in Rocky Mountain region Gathering High Plains crude oil pipelines Trucking Natural Gas Gathering pipeline(1) Terminalling and Transportation Northwest Products System pipeline Crude oil and refined product terminal Marine terminal Rail unloading facility Pipeline Refinery Martinez Tesoro Logistics Tesoro Corporation Mandan Salt Lake City Los Angeles Kenai Anacortes Natural Gas Processing Complex(1) Processing Green River Uinta Bakken San Juan Denver Julesburg (Niobrara) Powder River (1) QEPFS acquisition expected to close in Q4 2014

4 Investment Highlights Well-Positioned Assets Stable Cash Flow Experienced Management Team Strong Sponsorship Attractive, Visible Growth Opportunities Organic growth prospects Optimization opportunities Drop down assets Long-term contracts Fee-based, inflation protected and fixed minimum commitments Minimal commodity exposure Successful track record of acquiring and expanding assets Poised to benefit from Bakken and Rockies crude oil and natural gas production growth West Coast refined product distribution footprint Operate critical West Coast import/export facilities Tesoro committed to logistics driving higher proportion of consolidated EBITDA Leverage low cost of capital to support growth and value creation

5 Strategic Initiatives Focus on Stable, Fee-Based Business Fee-based committed businesses Maintain stable cash flow Optimize Existing Asset Base Increase third-party volumes Improve operating efficiency Capture Tesoro volumes currently moving through 3rd party assets Pursue Organic Expansion Opportunities Execute growth projects/sponsor drop-down opportunities Invest to capture the full value of logistics assets Leverage low cost of capital to unlock Tesoro commercial opportunities Grow Through Strategic Acquisitions Pursue third-party assets that fit Western-US footprint Strategic partner in Tesoro’s growth plan Increase EBITDA and cash distributions through fee-based logistics business model

6 -50% 0% 50% 100% 150% 200% 250% 300% 350% Un it h o ld er R et u rn TLLP Alerian Driving Unitholder Return Visible track record of growing the business, driving unitholder returns 1) IPO 2) Stockton Expansion Project Completed 3) High Plains Pipeline Interconnects Announced 4) High Plains Reversal Announced 5) Los Angeles Terminal Asset Acquired 6) Northwest Products System Acquisition Announced 7) Southern California Terminaling Expansion Announced 8) Los Angeles Logistics Assets Acquired 9) Connolly Gathering Announced 10) QEPFS Acquisition Announced 1 2 4 5 6 7 8 9 3 2011 2012 2013 2014 10

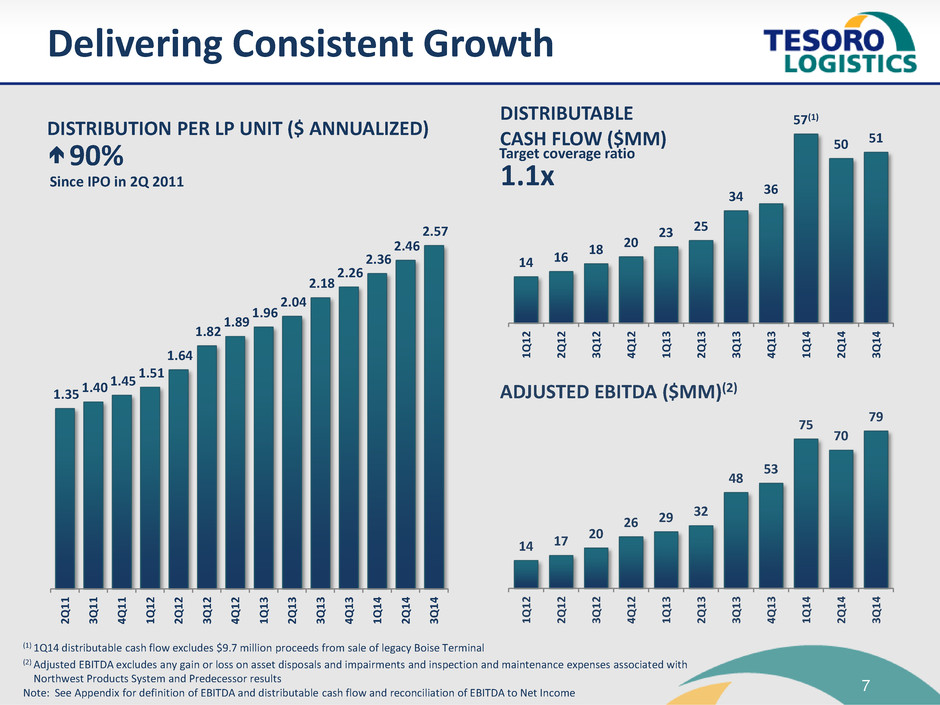

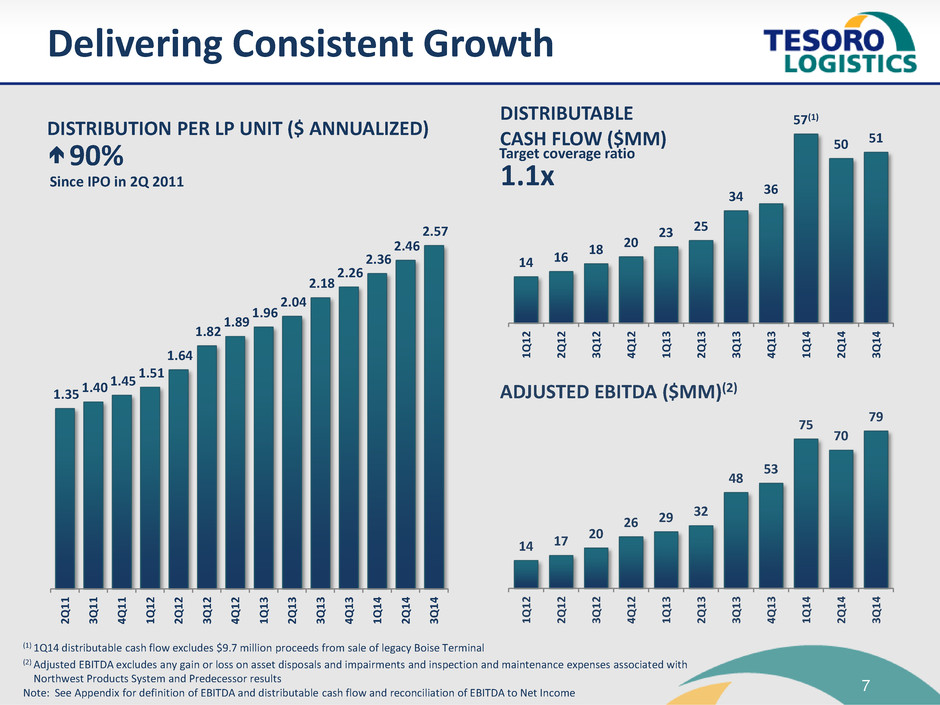

7 14 16 18 20 23 25 34 36 57(1) 50 51 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 DISTRIBUTABLE CASH FLOW ($MM) 14 17 20 26 29 32 48 53 75 70 79 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 ADJUSTED EBITDA ($MM)(2) 1.35 1.40 1.45 1.51 1.64 1.82 1.89 1.96 2.04 2.18 2.26 2.36 2.46 2.57 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 Delivering Consistent Growth DISTRIBUTION PER LP UNIT ($ ANNUALIZED) 90% Since IPO in 2Q 2011 1.1x Target coverage ratio (1) 1Q14 distributable cash flow excludes $9.7 million proceeds from sale of legacy Boise Terminal (2) Adjusted EBITDA excludes any gain or loss on asset disposals and impairments and inspection and maintenance expenses associated with Northwest Products System and Predecessor results Note: See Appendix for definition of EBITDA and distributable cash flow and reconciliation of EBITDA to Net Income

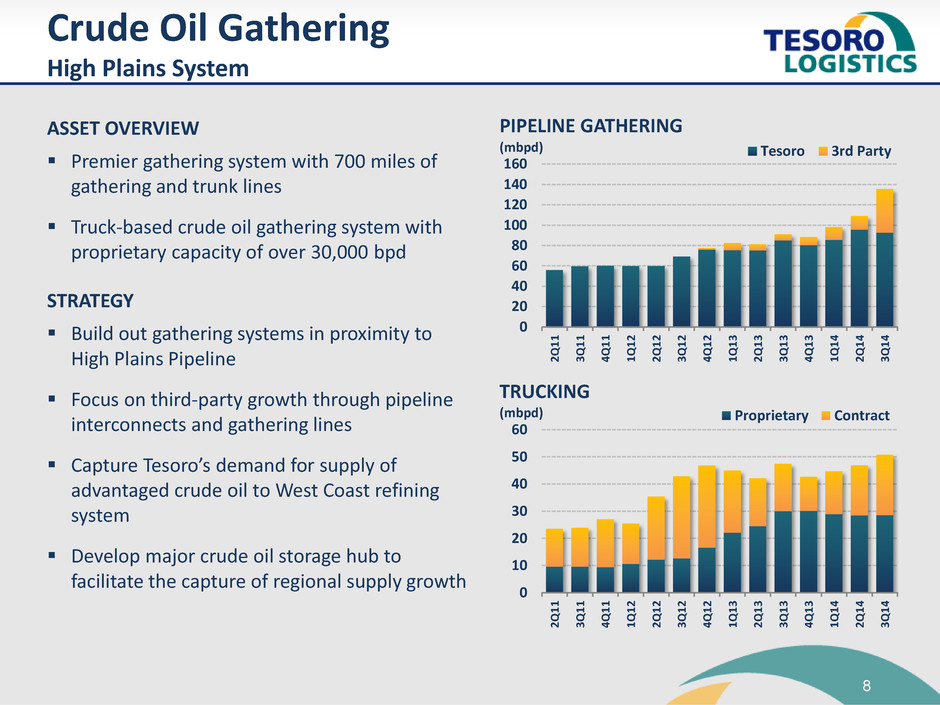

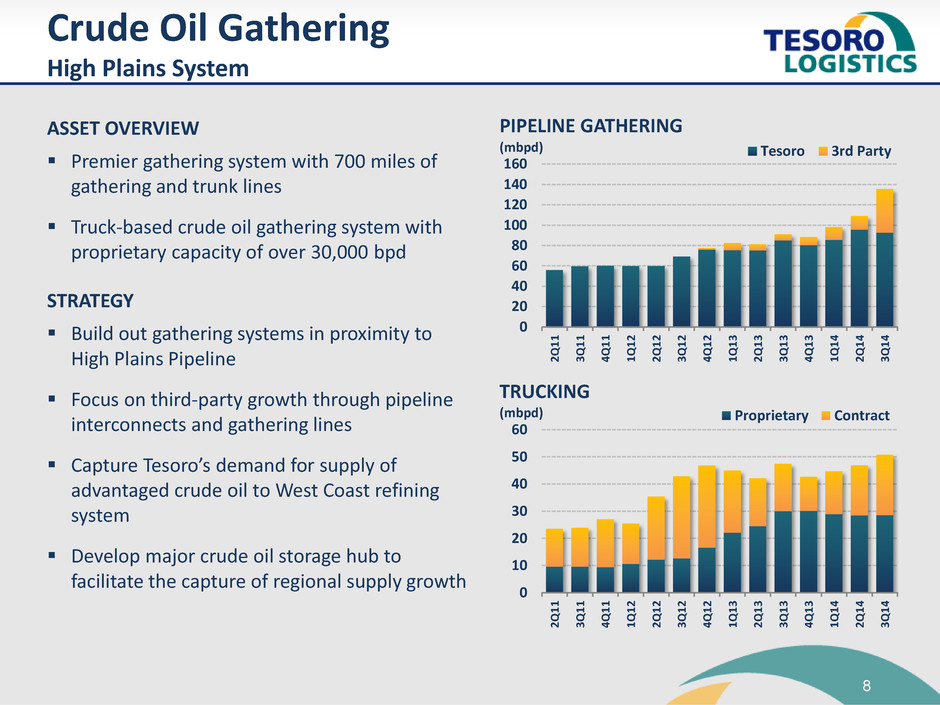

8 Crude Oil Gathering High Plains System ASSET OVERVIEW Premier gathering system with 700 miles of gathering and trunk lines Truck-based crude oil gathering system with proprietary capacity of over 30,000 bpd STRATEGY Build out gathering systems in proximity to High Plains Pipeline Focus on third-party growth through pipeline interconnects and gathering lines Capture Tesoro’s demand for supply of advantaged crude oil to West Coast refining system Develop major crude oil storage hub to facilitate the capture of regional supply growth 0 20 40 60 80 100 120 140 160 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 PIPELINE GATHERING (mbpd) Tesoro 3rd Party 0 10 20 30 40 50 60 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 TRUCKING (mbpd) Proprietary Contract

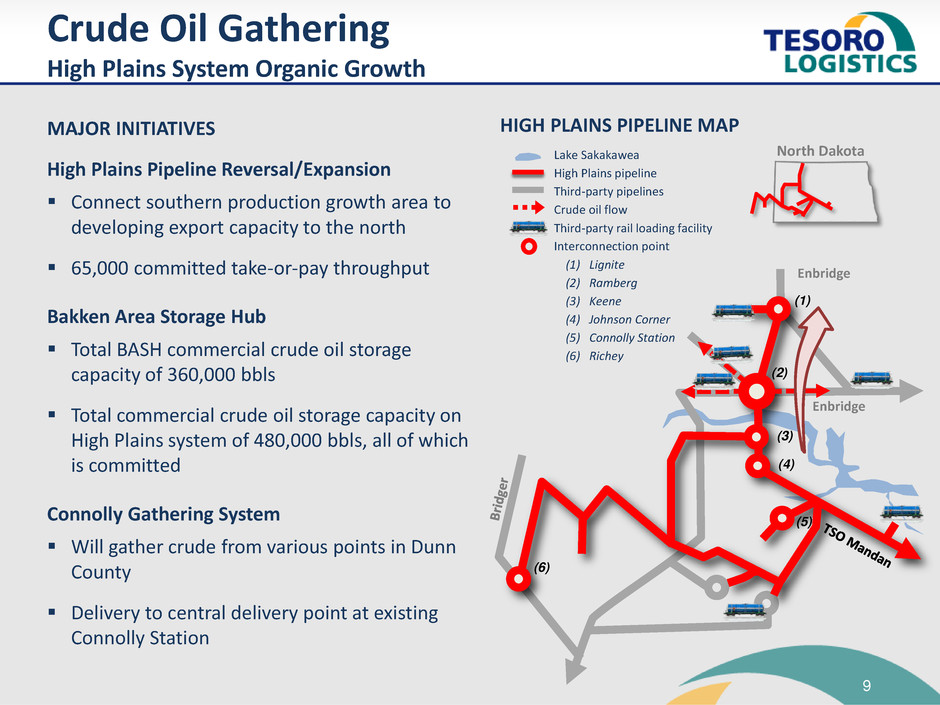

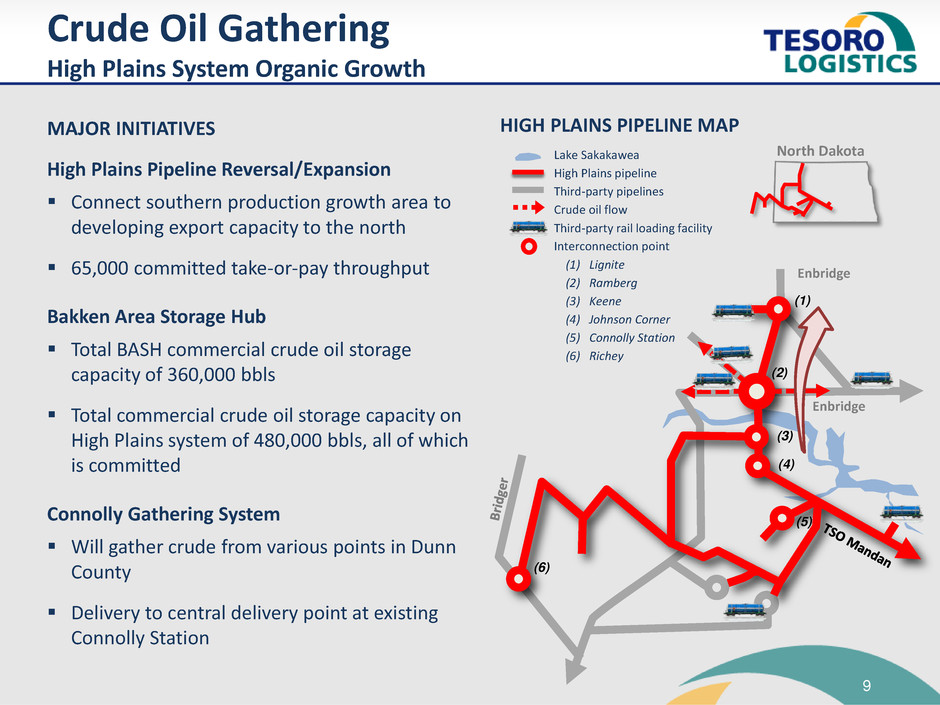

9 Crude Oil Gathering High Plains System Organic Growth MAJOR INITIATIVES High Plains Pipeline Reversal/Expansion Connect southern production growth area to developing export capacity to the north 65,000 committed take-or-pay throughput Bakken Area Storage Hub Total BASH commercial crude oil storage capacity of 360,000 bbls Total commercial crude oil storage capacity on High Plains system of 480,000 bbls, all of which is committed Connolly Gathering System Will gather crude from various points in Dunn County Delivery to central delivery point at existing Connolly Station Lake Sakakawea High Plains pipeline Third-party pipelines Crude oil flow Third-party rail loading facility Interconnection point (1) Lignite (2) Ramberg (3) Keene (4) Johnson Corner (5) Connolly Station (6) Richey (4) (3) (2) (1) (6) Enbridge Enbridge HIGH PLAINS PIPELINE MAP North Dakota (5)

10 ASSET OVERVIEW 24 refined product and storage terminals with over 650,000 bpd of throughput capacity Four West Coast marine terminals with 795,000 bpd of total throughput capacity Crude oil rail unloading facility in Anacortes, Washington with 50,000 bpd capacity Petroleum coke handling and storage facility Over 9.2 million barrels of dedicated storage capacity STRATEGY Capture an additional 25,000 bpd of Tesoro’s Southern California business Open Southern California product terminals to third-party business Provide additive and biodiesel blending services Expand Salt Lake City, Utah and San Diego, California terminals Terminalling and Transportation Terminalling 0 200 400 600 800 1,000 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 TERMINALLING(1) (mbpd) Add image (1) Excludes Predecessor results

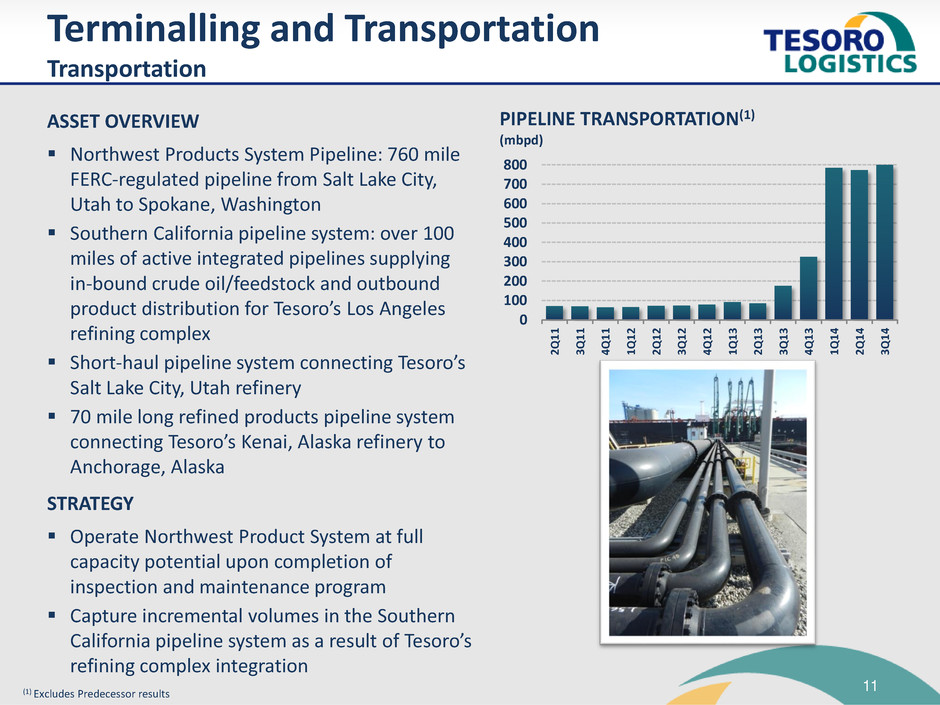

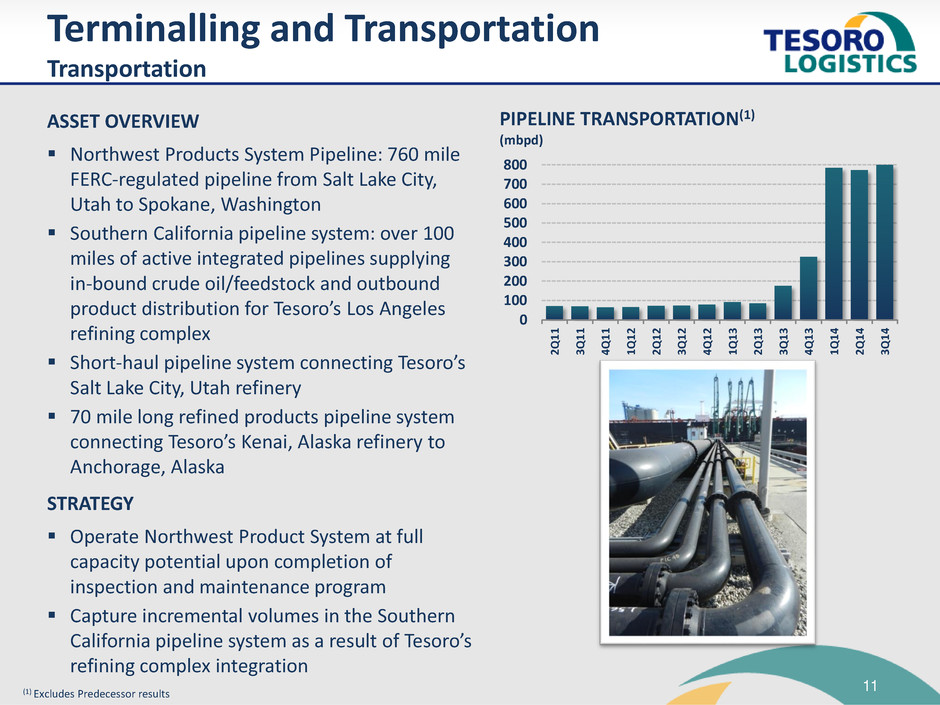

11 ASSET OVERVIEW Northwest Products System Pipeline: 760 mile FERC-regulated pipeline from Salt Lake City, Utah to Spokane, Washington Southern California pipeline system: over 100 miles of active integrated pipelines supplying in-bound crude oil/feedstock and outbound product distribution for Tesoro’s Los Angeles refining complex Short-haul pipeline system connecting Tesoro’s Salt Lake City, Utah refinery 70 mile long refined products pipeline system connecting Tesoro’s Kenai, Alaska refinery to Anchorage, Alaska STRATEGY Operate Northwest Product System at full capacity potential upon completion of inspection and maintenance program Capture incremental volumes in the Southern California pipeline system as a result of Tesoro’s refining complex integration Terminalling and Transportation Transportation 0 100 200 300 400 500 600 700 800 2 Q 1 1 3 Q 1 1 4 Q 1 1 1 Q 1 2 2 Q 1 2 3 Q 1 2 4 Q 1 2 1 Q 1 3 2 Q 1 3 3 Q 1 3 4 Q 1 3 1 Q 1 4 2 Q 1 4 3 Q 1 4 PIPELINE TRANSPORTATION(1) (mbpd) Add image (1) Excludes Predecessor results

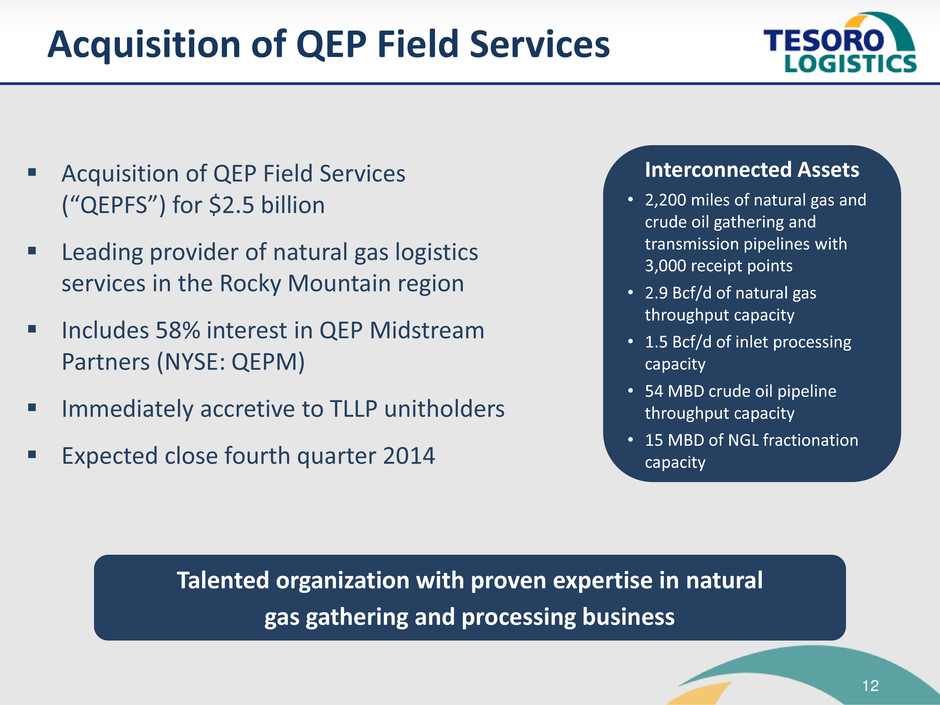

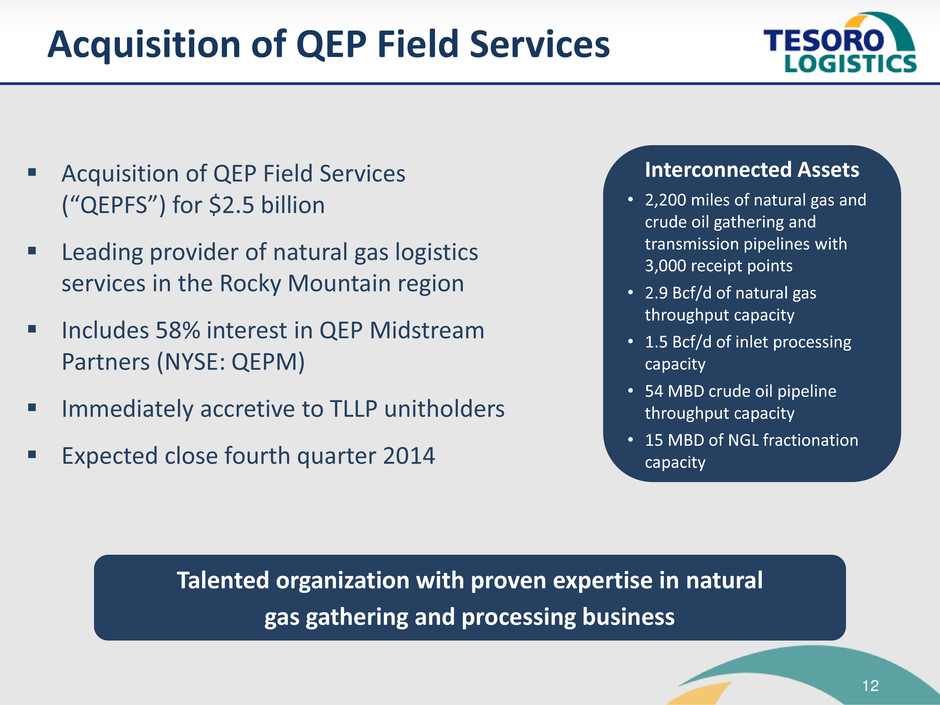

12 Acquisition of QEP Field Services Acquisition of QEP Field Services (“QEPFS”) for $2.5 billion Leading provider of natural gas logistics services in the Rocky Mountain region Includes 58% interest in QEP Midstream Partners (NYSE: QEPM) Immediately accretive to TLLP unitholders Expected close fourth quarter 2014 Interconnected Assets • 2,200 miles of natural gas and crude oil gathering and transmission pipelines with 3,000 receipt points • 2.9 Bcf/d of natural gas throughput capacity • 1.5 Bcf/d of inlet processing capacity • 54 MBD crude oil pipeline throughput capacity • 15 MBD of NGL fractionation capacity Talented organization with proven expertise in natural gas gathering and processing business

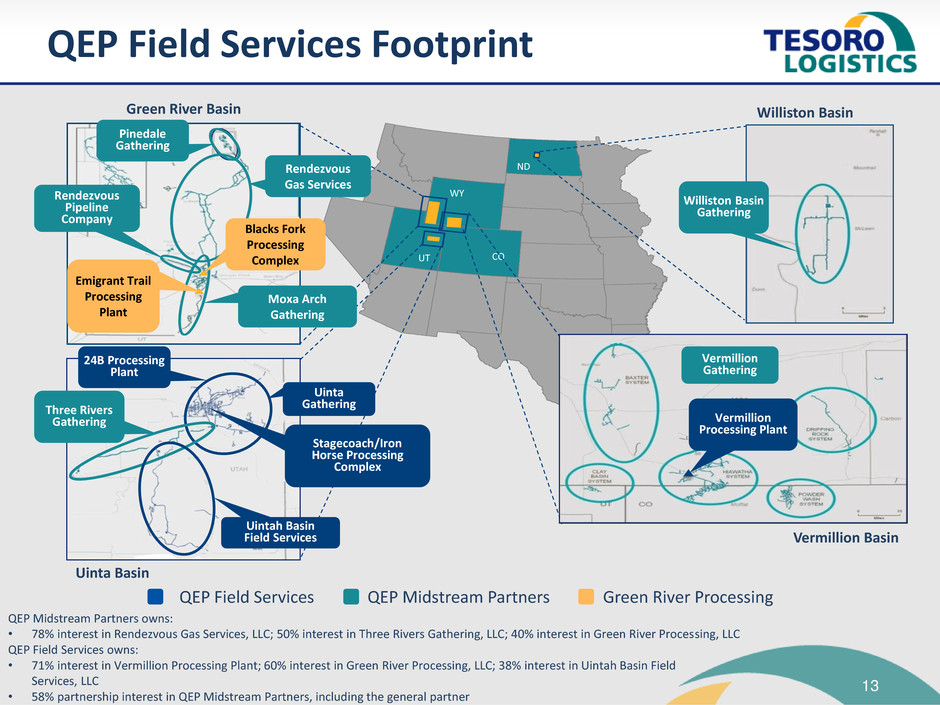

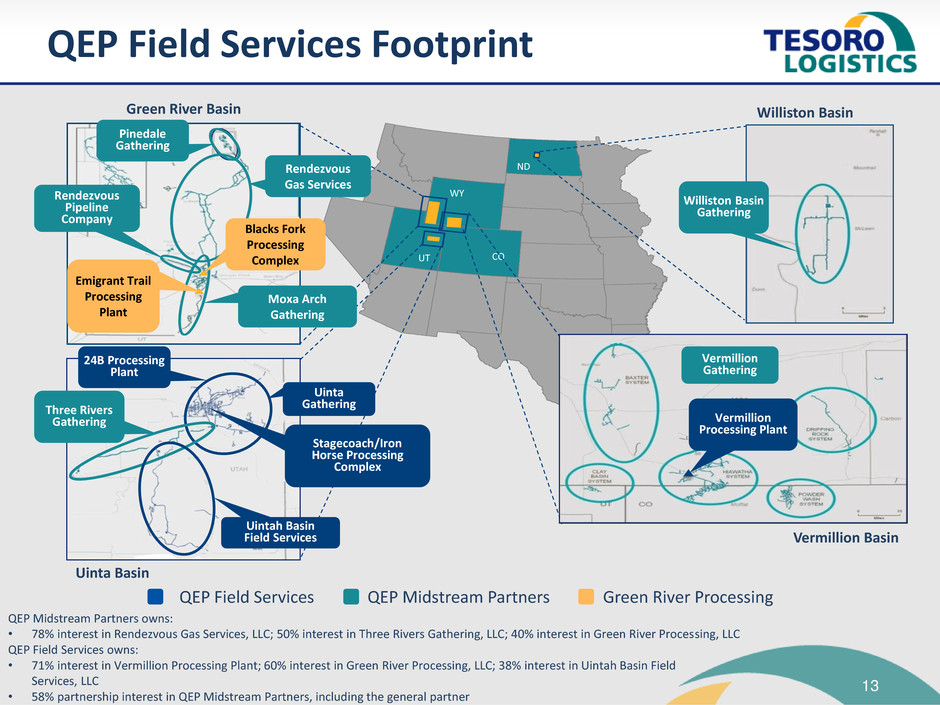

13 QEP Field Services Footprint QEP Field Services QEP Midstream Partners Green River Processing 568019_1.wor (NY007VUG) 568019_2.wor (NY007VUG) CO UT WY ND (NY00813G) 576455_Map 1.psd Green River Basin Pinedale Gathering E m i g r a Proce s s i n g Rendezvous Pipeline Company Rendezvous Gas Services Moxa Arch Gathering Blacks Fork Processing Complex Emigrant Trail Processing Plant (NY00813G) 576455_Map 1.psd Three Rivers Gathering Uintah Basin Field Services Stagecoach/Iron Horse Processing Complex Uinta Gathering 24B Processing Plant Uinta Basin Vermillion Gathering Vermillion Processing Plant Vermillion Basin Williston Basin Williston Basin Gathering QEP Midstream Partners owns: • 78% interest in Rendezvous Gas Services, LLC; 50% interest in Three Rivers Gathering, LLC; 40% interest in Green River Processing, LLC QEP Field Services owns: • 71% interest in Vermillion Processing Plant; 60% interest in Green River Processing, LLC; 38% interest in Uintah Basin Field Services, LLC • 58% partnership interest in QEP Midstream Partners, including the general partner

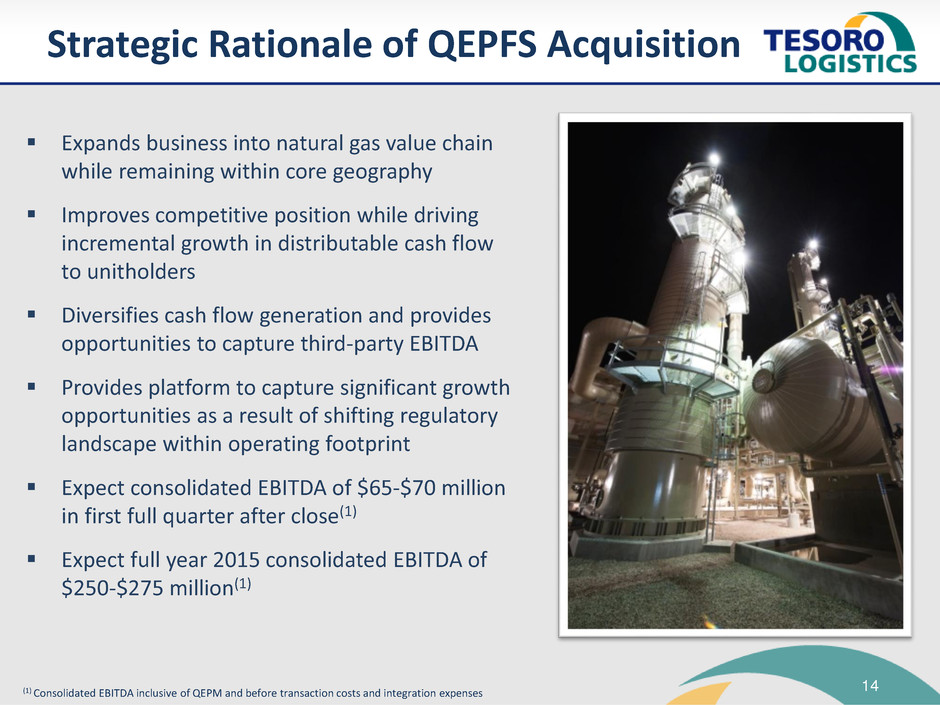

14 Strategic Rationale of QEPFS Acquisition Expands business into natural gas value chain while remaining within core geography Improves competitive position while driving incremental growth in distributable cash flow to unitholders Diversifies cash flow generation and provides opportunities to capture third-party EBITDA Provides platform to capture significant growth opportunities as a result of shifting regulatory landscape within operating footprint Expect consolidated EBITDA of $65-$70 million in first full quarter after close(1) Expect full year 2015 consolidated EBITDA of $250-$275 million(1) (1) Consolidated EBITDA inclusive of QEPM and before transaction costs and integration expenses

15 Typical projects have an IRR of 15-25% Near-term capital projects primarily focused on expanding gathering capabilities and Southern California Distribution System Long-term capital projects focused on driving third-party business Growth capital excludes spend associated with potential growth opportunities currently under evaluation 160 300 260 100 110 40 60 70 2014E 2015E 2016E CAPITAL SPEND ($MM) Base Growth Natural Gas Growth Total Maintenance Capital Plan Overview Committed to investing in base assets to continue to grow the business Note: All capital spend is gross of any TSO reimbursements

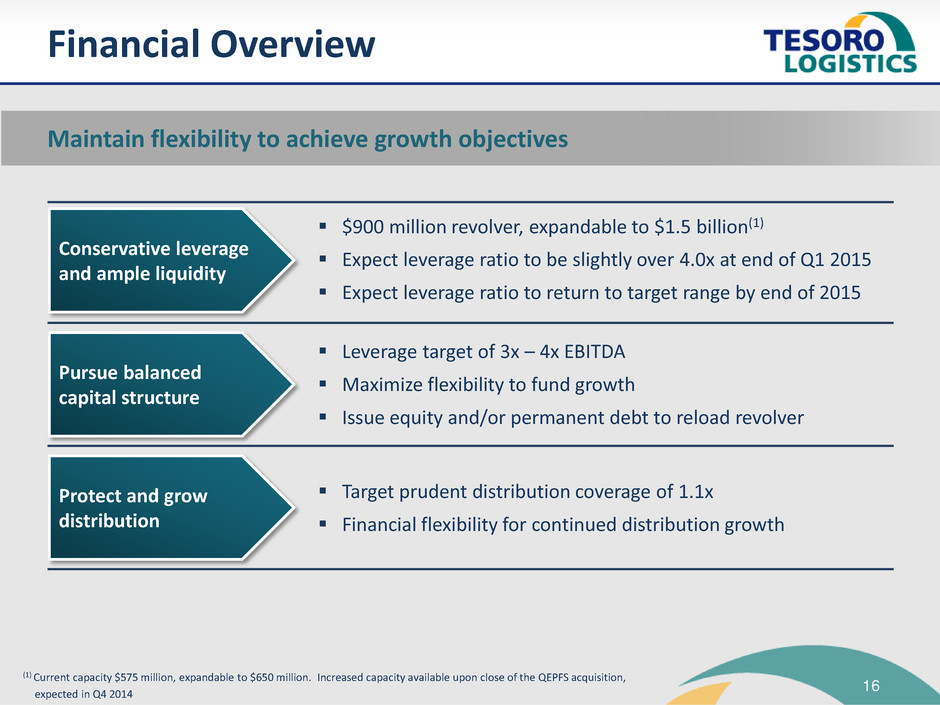

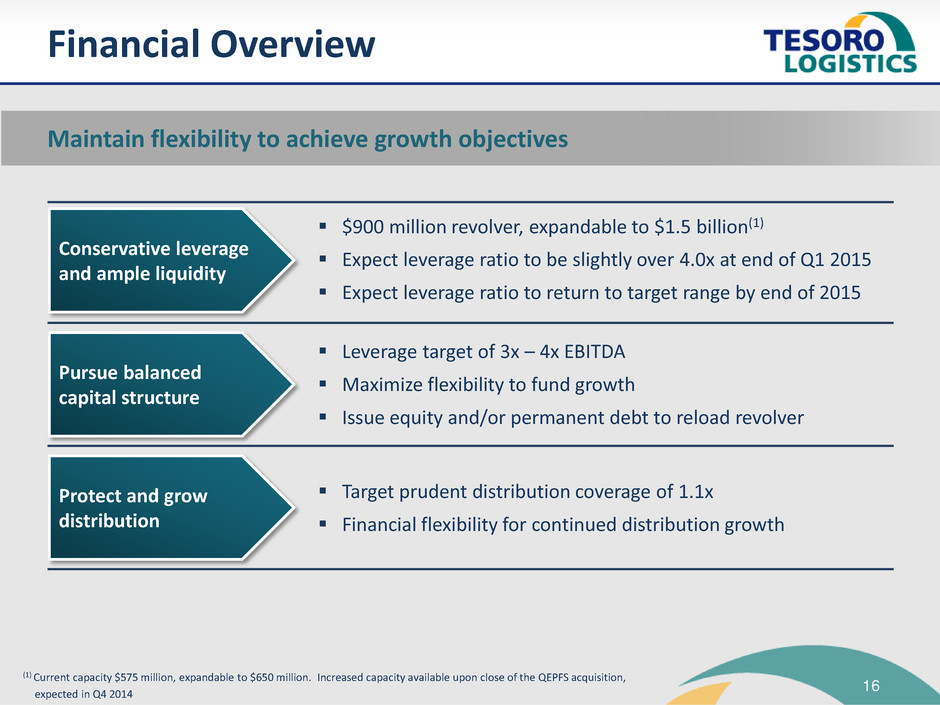

16 Financial Overview Maintain flexibility to achieve growth objectives Conservative leverage and ample liquidity $900 million revolver, expandable to $1.5 billion(1) Expect leverage ratio to be slightly over 4.0x at end of Q1 2015 Expect leverage ratio to return to target range by end of 2015 Pursue balanced capital structure Leverage target of 3x – 4x EBITDA Maximize flexibility to fund growth Issue equity and/or permanent debt to reload revolver Protect and grow distribution Target prudent distribution coverage of 1.1x Financial flexibility for continued distribution growth (1) Current capacity $575 million, expandable to $650 million. Increased capacity available upon close of the QEPFS acquisition, expected in Q4 2014

Appendix

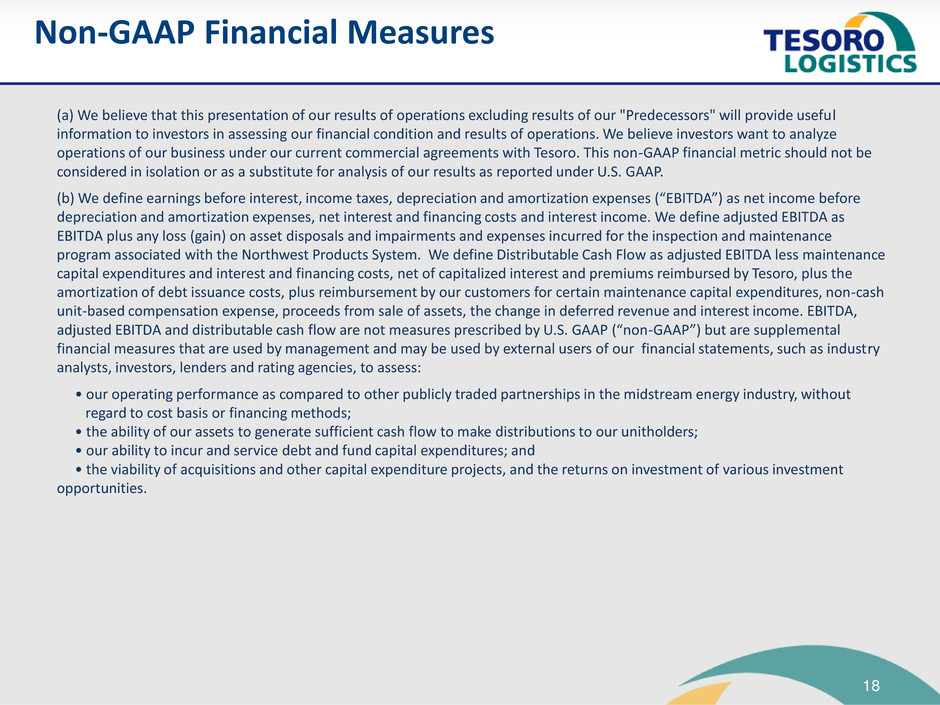

18 Non-GAAP Financial Measures (a) We believe that this presentation of our results of operations excluding results of our "Predecessors" will provide useful information to investors in assessing our financial condition and results of operations. We believe investors want to analyze operations of our business under our current commercial agreements with Tesoro. This non-GAAP financial metric should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. (b) We define earnings before interest, income taxes, depreciation and amortization expenses (“EBITDA”) as net income before depreciation and amortization expenses, net interest and financing costs and interest income. We define adjusted EBITDA as EBITDA plus any loss (gain) on asset disposals and impairments and expenses incurred for the inspection and maintenance program associated with the Northwest Products System. We define Distributable Cash Flow as adjusted EBITDA less maintenance capital expenditures and interest and financing costs, net of capitalized interest and premiums reimbursed by Tesoro, plus the amortization of debt issuance costs, plus reimbursement by our customers for certain maintenance capital expenditures, non-cash unit-based compensation expense, proceeds from sale of assets, the change in deferred revenue and interest income. EBITDA, adjusted EBITDA and distributable cash flow are not measures prescribed by U.S. GAAP (“non-GAAP”) but are supplemental financial measures that are used by management and may be used by external users of our financial statements, such as industry analysts, investors, lenders and rating agencies, to assess: • our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to cost basis or financing methods; • the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; • our ability to incur and service debt and fund capital expenditures; and • the viability of acquisitions and other capital expenditure projects, and the returns on investment of various investment opportunities.

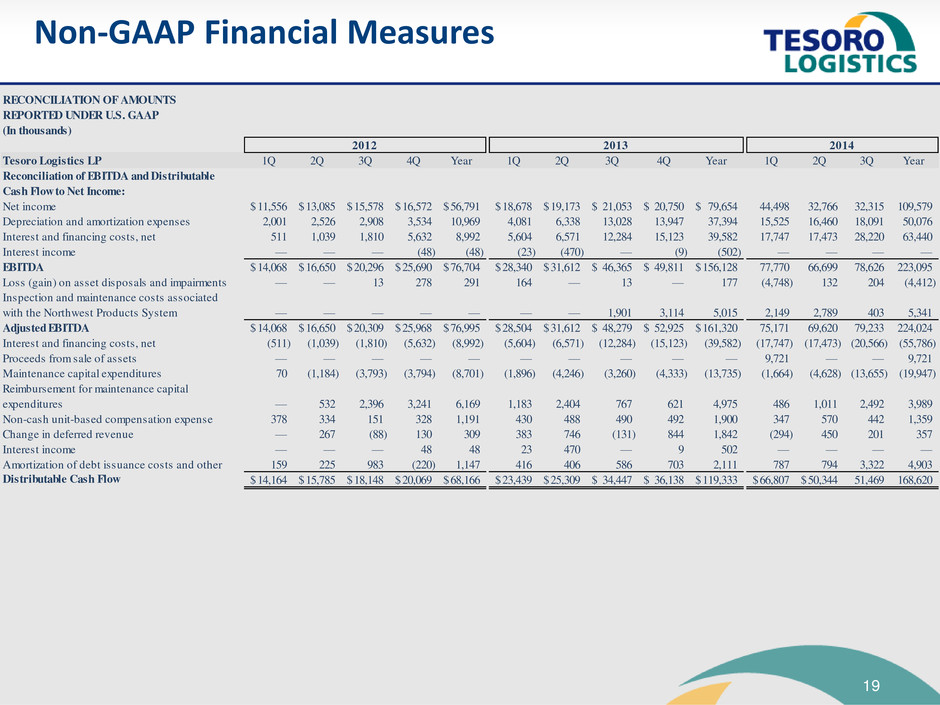

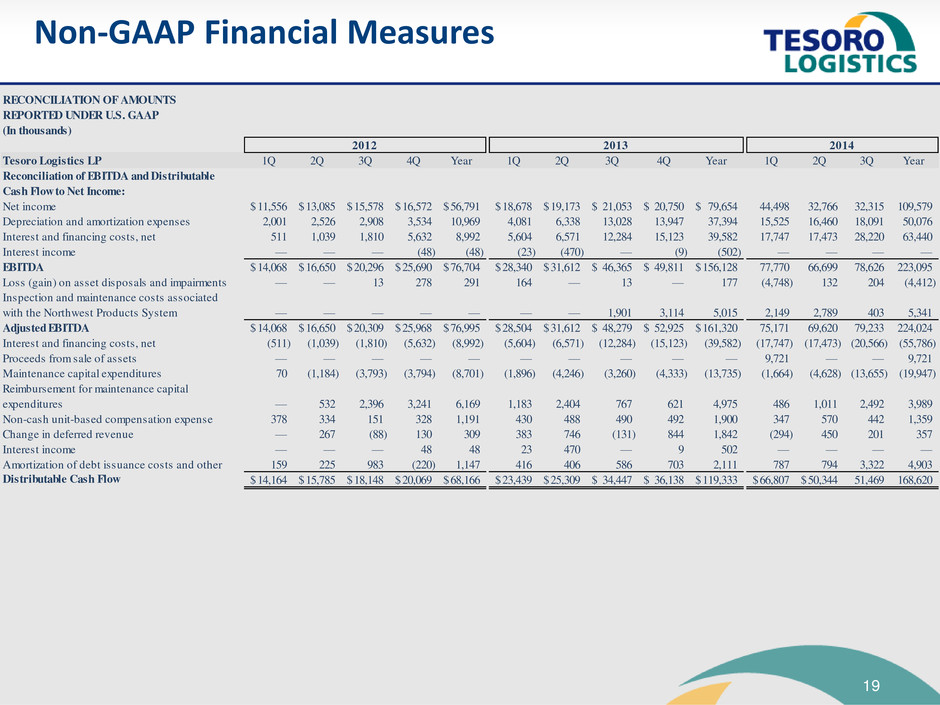

19 Non-GAAP Financial Measures (In thousands) Tesoro Logistics LP 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q Year Reconciliation of EBITDA and Distributable Cash Flow to Net Income: Net income 11,556$ 13,085$ 15,578$ 16,572$ 56,791$ 18,678$ 19,173$ 21,053$ 20,750$ 79,654$ 44,498 32,766 32,315 109,579 Depreciation and amortization expenses 2,001 2,526 2,908 3,534 10,969 4,081 6,338 13,028 13,947 37,394 15,525 16,460 18,091 50,076 Interest and financing costs, net 511 1,039 1,810 5,632 8,992 5,604 6,571 12,284 15,123 39,582 17,747 17,473 28,220 63,440 Interest income — — — (48) (48) (23) (470) — (9) (502) — — — — EBITDA 14,068$ 16,650$ 20,296$ 25,690$ 76,704$ 28,340$ 31,612$ 46,365$ 49,811$ 156,128$ 77,770 66,699 78,626 223,095 Loss (gain) on asset disposals and impairments — — 13 278 291 164 — 13 — 177 (4,748) 132 204 (4,412) Inspection and maintenance costs associated with the Northwest Products System — — — — — — — 1,901 3,114 5,015 2,149 2,789 403 5,341 Adjusted EBITDA 14,068$ 16,650$ 20,309$ 25,968$ 76,995$ 28,504$ 31,612$ 48,279$ 52,925$ 161,320$ 75,171 69,620 79,233 224,024 Interest and financing costs, net (511) (1,039) (1,810) (5,632) (8,992) (5,604) (6,571) (12,284) (15,123) (39,582) (17,747) (17,473) (20,566) (55,786) Proceeds from sale of assets — — — — — — — — — — 9,721 — — 9,721 Maintenance capital expenditures 70 (1,184) (3,793) (3,794) (8,701) (1,896) (4,246) (3,260) (4,333) (13,735) (1,664) (4,628) (13,655) (19,947) Reimbursement for maintenance capital expenditures — 532 2,396 3,241 6,169 1,183 2,404 767 621 4,975 486 1,011 2,492 3,989 Non-cash unit-based compensation expense 378 334 151 328 1,191 430 488 490 492 1,900 347 570 442 1,359 Change in deferred revenue — 267 (88) 130 309 383 746 (131) 844 1,842 (294) 450 201 357 Interest income — — — 48 48 23 470 — 9 502 — — — — Amortization of debt issuance costs and other 159 225 983 (220) 1,147 416 406 586 703 2,111 787 794 3,322 4,903 Distributable Cash Flow 14,164$ 15,785$ 18,148$ 20,069$ 68,166$ 23,439$ 25,309$ 34,447$ 36,138$ 119,333$ 66,807$ 50,344$ 51,469 168,620 RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP 2012 2013 2014

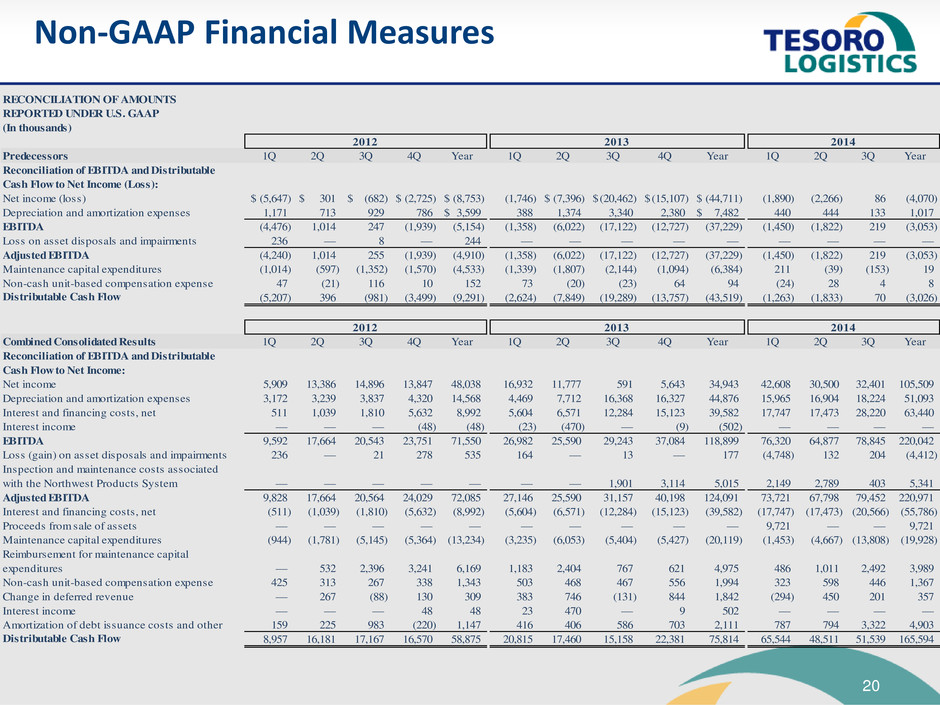

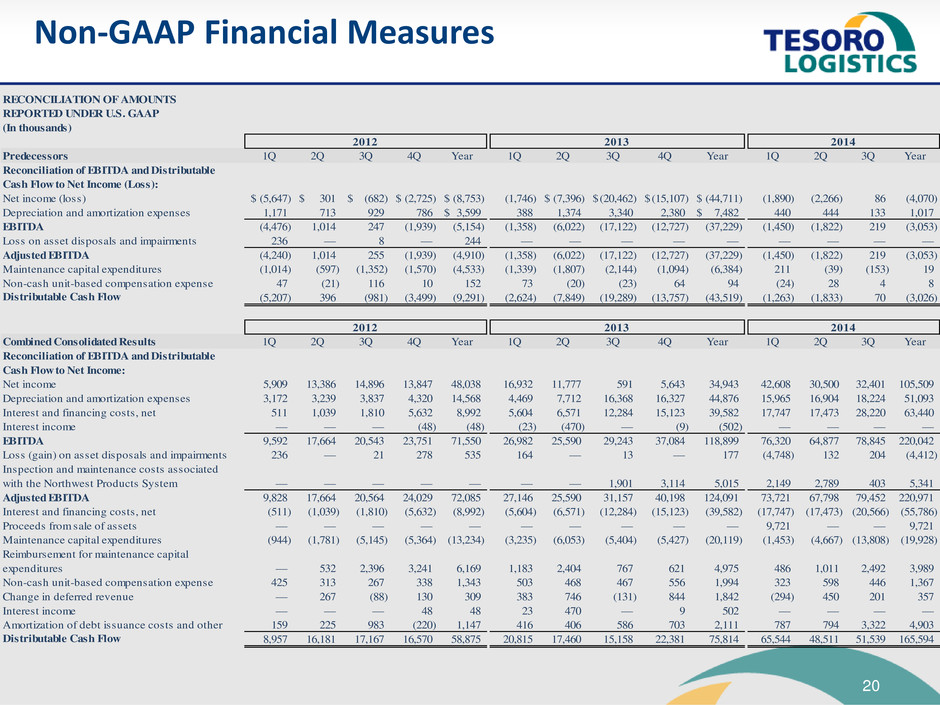

20 Non-GAAP Financial Measures (In thousands) Predecessors 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q Year Reconciliation of EBITDA and Distributable Cash Flow to Net Income (Loss): Net income (loss) (5,647)$ 301$ (682)$ (2,725)$ (8,753)$ (1,746) (7,396)$ (20,462)$ (15,107)$ (44,711)$ (1,890) (2,266) 86 (4,070) Depreciation and amortization expenses 1,171 713 929 786 3,599$ 388 1,374 3,340 2,380 7,482$ 440 444 133 1,017 EBITDA (4,476) 1,014 247 (1,939) (5,154) (1,358) (6,022) (17,122) (12,727) (37,229) (1,450) (1,822) 219 (3,053) Loss on asset disposals and impairments 236 — 8 — 244 — — — — — — — — — Adjusted EBITDA (4,240) 1,014 255 (1,939) (4,910) (1,358) (6,022) (17,122) (12,727) (37,229) (1,450) (1,822) 219 (3,053) Maintenance capital expenditures (1,014) (597) (1,352) (1,570) (4,533) (1,339) (1,807) (2,144) (1,094) (6,384) 211 (39) (153) 19 Non-cash unit-based compensation expense 47 (21) 116 10 152 73 (20) (23) 64 94 (24) 28 4 8 Distributable Cash Flow (5,207) 396 (981) (3,499) (9,291) (2,624) (7,849) (19,289) (13,757) (43,519) (1,263) (1,833) 70 (3,026) Combined Consolidated Results 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q 4Q Year 1Q 2Q 3Q Year Reconciliation of EBITDA and Distributable Cash Flow to Net Income: Net income 5,909 13,386 14,896 13,847 48,038 16,932 11,777 591 5,643 34,943 42,608 30,500 32,401 105,509 Depreciation and amortization expenses 3,172 3,239 3,837 4,320 14,568 4,469 7,712 16,368 16,327 44,876 15,965 16,904 18,224 51,093 Interest and financing costs, net 511 1,039 1,810 5,632 8,992 5,604 6,571 12,284 15,123 39,582 17,747 17,473 28,220 63,440 Interest income — — — (48) (48) (23) (470) — (9) (502) — — — — EBITDA 9,592 17,664 20,543 23,751 71,550 26,982 25,590 29,243 37,084 118,899 76,320 64,877 78,845 220,042 Loss (gain) on asset disposals and impairments 236 — 21 278 535 164 — 13 — 177 (4,748) 132 204 (4,412) Inspection and maintenance costs associated with the Northwest Products System — — — — — — — 1,901 3,114 5,015 2,149 2,789 403 5,341 Adjusted EBITDA 9,828 17,664 20,564 24,029 72,085 27,146 25,590 31,157 40,198 124,091 73,721 67,798 79,452 220,971 Interest and financing costs, net (511) (1,039) (1,810) (5,632) (8,992) (5,604) (6,571) (12,284) (15,123) (39,582) (17,747) (17,473) (20,566) (55,786) Proceeds from sale of assets — — — — — — — — — — 9,721 — — 9,721 Maintenance capital expenditures (944) (1,781) (5,145) (5,364) (13,234) (3,235) (6,053) (5,404) (5,427) (20,119) (1,453) (4,667) (13,808) (19,928) Reimbursement for maintenance capital expenditures — 532 2,396 3,241 6,169 1,183 2,404 767 621 4,975 486 1,011 2,492 3,989 Non-cash unit-based compensation expense 425 313 267 338 1,343 503 468 467 556 1,994 323 598 446 1,367 Change in deferred revenue — 267 (88) 130 309 383 746 (131) 844 1,842 (294) 450 201 357 Interest income — — — 48 48 23 470 — 9 502 — — — — Amortization of debt issuance costs and other 159 225 983 (220) 1,147 416 406 586 703 2,111 787 794 3,322 4,903 Distributable Cash Flow 8,957 16,181 17,167 16,570 58,875 20,815 17,460 15,158 22,381 75,814 65,544 48,511 51,539 165,594 2012 2013 2014 RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP 2012 2013 2014

21 Non-GAAP Financial Measures Reconciliation of Forecasted first quarter2015 EBITDA to Forecasted Net Income QEPFS Assets 2015E Forecasted Net Income $10 - 15 Add depreciation and amortization expense (k) 33 Add interest and financing costs, net 22 Forecasted first quarter 2015 EBITDA $65 - 70 Reconciliation of Forecasted 2015 annual EBITDA to Forecasted Net Income QEPFS Assets 2015E Forecasted Net Income $32 - 57 Add depreciation and amortization expense (k) 132 Add interest and financing costs, net 86 Forecasted 2015 annual EBITDA $250 - 275 (k) Reflects estimated depreciation expense for the QEPFS Acquisition based upon the estimated fair value allocated to the acquired property, plant and equipment. The Partnership has not performed detailed valuation studies to determine the required estimates of the fair value of the QEPFS assets to be acquired and the liabilities to be assumed. Accordingly, the above estimates for the QEPFS Acquisition are preliminary and subject to further adjustments as additional information becomes available and the independent appraisals and other evaluations are performed. Such adjustments may have a significant effect on depreciation and amortization expenses.

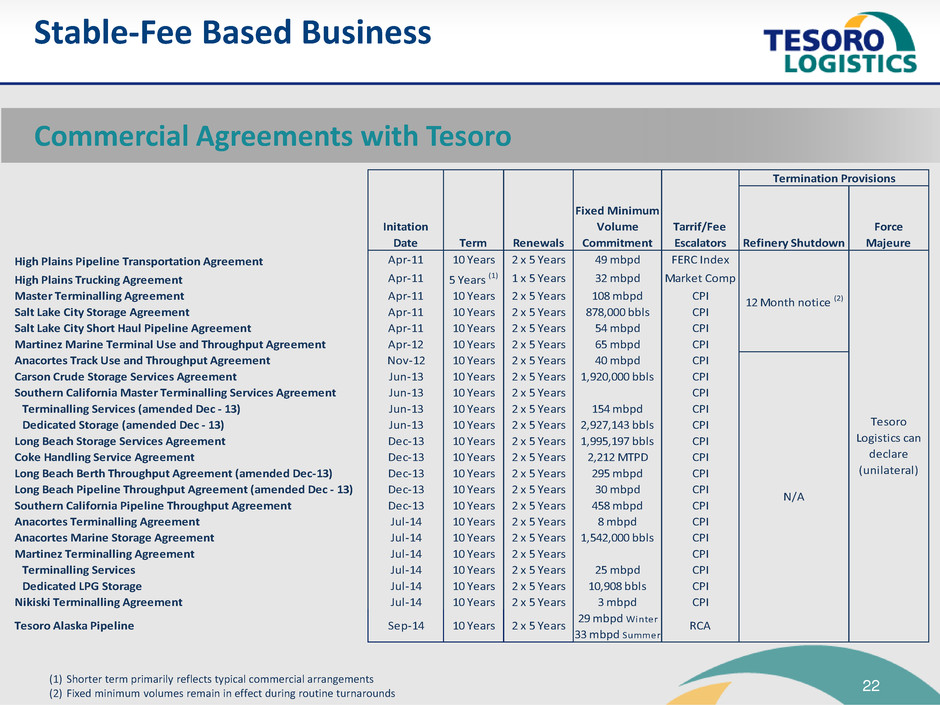

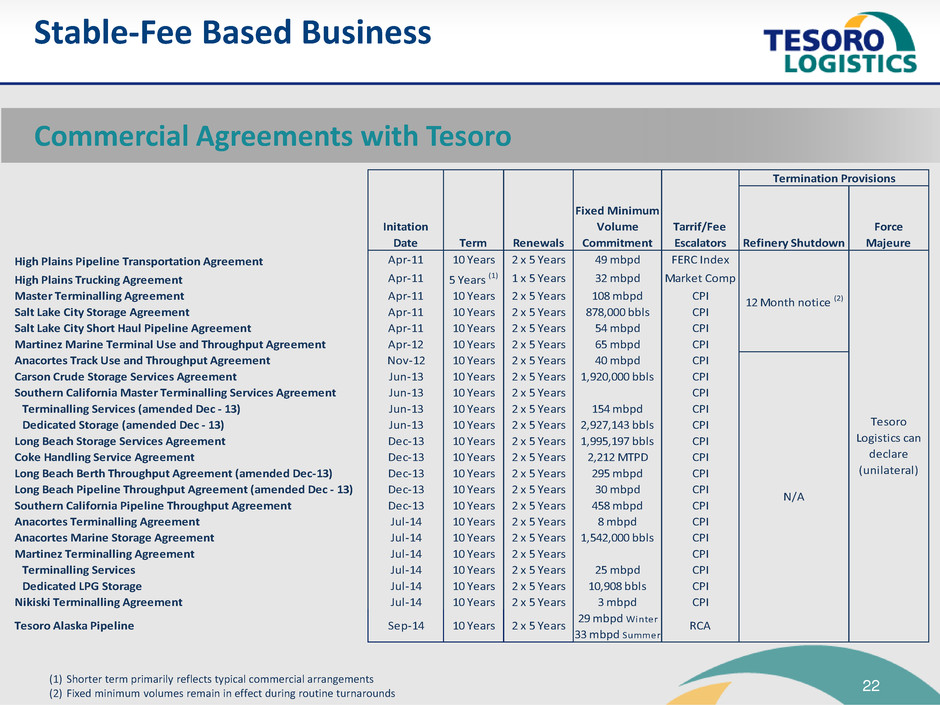

22 Stable-Fee Based Business (1) Shorter term primarily reflects typical commercial arrangements (2) Fixed minimum volumes remain in effect during routine turnarounds Commercial Agreements with Tesoro Refinery Shutdown Force Majeure High Plains Pipeline Transportation Agreement Apr-11 10 Years 2 x 5 Years 49 mbpd FERC Index High Plains Trucking Agreement Apr-11 5 Years (1) 1 x 5 Years 32 mbpd Market Comp Master Terminalling Agreement Apr-11 10 Years 2 x 5 Years 108 mbpd CPI Salt Lake City Storage Agreement Apr-11 10 Years 2 x 5 Years 878,000 bbls CPI Salt Lake City Short Haul Pipeline Agreement Apr-11 10 Years 2 x 5 Years 54 mbpd CPI Martinez Marine Terminal Use and Throughput Agreement Apr-12 10 Years 2 x 5 Years 65 mbpd CPI Anacortes Track Use and Throughput Agreement Nov-12 10 Years 2 x 5 Years 40 mbpd CPI Carson Crude Storage Services Agreement Jun-13 10 Years 2 x 5 Years 1,920,000 bbls CPI Southern California Master Terminalling Services Agreement Jun-13 10 Years 2 x 5 Years CPI Terminalling Services (amended Dec - 13) Jun-13 10 Years 2 x 5 Years 154 mbpd CPI Dedicated Storage (amended Dec - 13) Jun-13 10 Years 2 x 5 Years 2,927,143 bbls CPI Long Beach Storage Services Agreement Dec-13 10 Years 2 x 5 Years 1,995,197 bbls CPI Coke Handling Service Agreement Dec-13 10 Years 2 x 5 Years 2,212 MTPD CPI Long Beach Berth Throughput Agreement (amended Dec-13) Dec-13 10 Years 2 x 5 Years 295 mbpd CPI Long Beach Pipeline Throughput Agreement (amended Dec - 13) Dec-13 10 Years 2 x 5 Years 30 mbpd CPI Southern California Pipeline Throughput Agreement Dec-13 10 Years 2 x 5 Years 458 mbpd CPI Anacortes Terminalling Agreement Jul-14 10 Years 2 x 5 Years 8 mbpd CPI Anacortes Marine Storage Agreement Jul-14 10 Years 2 x 5 Years 1,542,000 bbls CPI Martin z Terminalling Agreement Jul-14 10 Years 2 x 5 Years CPI Terminalling Services Jul-14 10 Years 2 x 5 Years 25 mbpd CPI Dedicated LPG Storage Jul-14 10 Years 2 x 5 Years 10,908 bbls CPI Nikiski Terminalling Agreement Jul-14 10 Years 2 x 5 Years 3 mbpd CPI 29 mbpd Winter 33 mbpd Summer Tesoro Alaska Pipeline 10 Years 2 x 5 Years RCA 12 Month notice (2) Termination Provisions Initation Date Term Renewals Fixed Minimum Volume Commitment Tarrif/Fee Escalators Tesoro Logistics can declare (unilateral) N/A Sep-14