UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

(Mark One)

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______________to __________

Commission File Number 1‑35143

ANDEAVOR LOGISTICS LP

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 27‑4151603 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

| | | |

| 19100 Ridgewood Pkwy, San Antonio, Texas 78259-1828 |

| (Address of principal executive offices) (Zip Code) |

| |

| 210-626-6000 |

| (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| | Large accelerated filer | þ | | Accelerated filer | o | |

| | Non-accelerated filer | o (Do not check if a smaller reporting company) | | Smaller reporting company | o | |

| | | | | Emerging growth company | o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

There were 217,187,916 common units of the registrant outstanding at May 3, 2018.

Andeavor Logistics LP

Quarterly Report on Form 10-Q

For the Quarterly Period Ended March 31, 2018

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

Part I - Financial Information

Item 1. Financial Statements

Andeavor Logistics LP

Condensed Statements of Consolidated Operations

(Unaudited)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| | (In millions, except per unit amounts) |

| Revenues: | | | |

| Affiliate | $ | 318 |

| | $ | 203 |

|

| Third-party | 217 |

| | 217 |

|

| Total Revenues | 535 |

| | 420 |

|

| Costs and Expenses: | | | |

| NGL expense (excluding items shown separately below) | 48 |

| | 59 |

|

| Operating expenses (excluding depreciation and amortization) | 190 |

| | 126 |

|

| Depreciation and amortization expenses | 80 |

| | 58 |

|

| General and administrative expenses | 27 |

| | 27 |

|

| Operating Income | 190 |

| | 150 |

|

| Interest and financing costs, net | (54 | ) | | (62 | ) |

| Equity in earnings of equity method investments | 2 |

| | 2 |

|

| Other income, net | 1 |

| | 2 |

|

| Net Earnings Attributable to Partners | 139 |

| | 92 |

|

| Preferred unitholders’ interest in net earnings | (14 | ) | | — |

|

| General partner’s interest in net earnings, including incentive distribution rights | — |

| | (37 | ) |

| Limited Partners’ Interest in Net Earnings | $ | 125 |

| | $ | 55 |

|

| | | | |

| Net earnings per limited partner unit | | | |

| Common - basic | $ | 0.59 |

| | $ | 0.51 |

|

| Common - diluted | $ | 0.59 |

| | $ | 0.51 |

|

| | | | |

| Weighted average limited partner units outstanding | | | |

| Common units - basic | 217.2 |

| | 104.8 |

|

| Common units - diluted | 217.4 |

| | 104.9 |

|

| | | | |

| Cash distributions paid per unit | $ | 1.000 |

| | $ | 0.910 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | |

| | March 31,

2018 | | December 31,

2017 |

| | (In millions, except unit amounts) |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 27 |

| | $ | 75 |

|

| Receivables, net of allowance for doubtful accounts | | | |

| Trade and other | 198 |

| | 219 |

|

| Affiliate | 166 |

| | 184 |

|

| Prepayments and other current assets | 40 |

| | 27 |

|

| Total Current Assets | 431 |

| | 505 |

|

| Property, Plant and Equipment, Net | | | |

| Property, plant and equipment, at cost | 6,381 |

| | 6,295 |

|

| Accumulated depreciation | (945 | ) | | (882 | ) |

| Property, Plant and Equipment, Net | 5,436 |

| | 5,413 |

|

| Acquired Intangibles, Net | 1,140 |

| | 1,153 |

|

| Goodwill | 684 |

| | 692 |

|

| Equity Method Investments | 312 |

| | 320 |

|

| Other Noncurrent Assets, Net | 106 |

| | 86 |

|

| Total Assets | $ | 8,109 |

| | $ | 8,169 |

|

| | | | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Accounts payable | | | |

| Trade and other | $ | 133 |

| | $ | 160 |

|

| Affiliate | 198 |

| | 199 |

|

| Accrued interest and financing costs | 68 |

| | 40 |

|

| Other current liabilities | 63 |

| | 75 |

|

| Total Current Liabilities | 462 |

| | 474 |

|

| Debt, Net of Unamortized Issuance Costs | 4,148 |

| | 4,127 |

|

| Other Noncurrent Liabilities | 66 |

| | 54 |

|

| Total Liabilities | 4,676 |

| | 4,655 |

|

| Commitments and Contingencies (Note 5) | | | |

| Equity | | | |

Preferred unitholders; 600,000 units issued and outstanding in 2018 and 2017 | 594 |

| | 589 |

|

Common unitholders; 217,170,024 units issued and outstanding (217,097,057 in 2017) | 2,839 |

| | 2,925 |

|

| Total Equity | 3,433 |

| | 3,514 |

|

| Total Liabilities and Equity | $ | 8,109 |

| | $ | 8,169 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Statements of Consolidated Cash Flows

(Unaudited)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| | (In millions) |

| Cash Flows From (Used In) Operating Activities | | | |

| Net earnings | $ | 139 |

| | $ | 92 |

|

| Adjustments to reconcile net earnings to net cash from operating activities: | | | |

| Depreciation and amortization expenses | 80 |

| | 58 |

|

| Other operating activities | 10 |

| | 8 |

|

| Changes in current assets and liabilities | 21 |

| | 54 |

|

| Changes in noncurrent assets and liabilities | (20 | ) | | (5 | ) |

| Net cash from operating activities | 230 |

| | 207 |

|

| Cash Flows Used In Investing Activities | | | |

| Capital expenditures | (81 | ) | | (49 | ) |

| Acquisitions | — |

| | (672 | ) |

| Deposits for acquisitions | (10 | ) | | — |

|

| Net cash used in investing activities | (91 | ) | | (721 | ) |

| Cash Flows From (Used In) Financing Activities | | | |

| Borrowings under revolving credit agreements | 150 |

| | 44 |

|

| Repayments under revolving credit agreements | (130 | ) | | (334 | ) |

| Proceeds from issuance of common units, net of issuance costs | — |

| | 281 |

|

| Proceeds from issuance of general partner units, net of issuance costs | — |

| | 6 |

|

| Quarterly distributions to common unitholders | (205 | ) | | (94 | ) |

| Quarterly distributions to preferred unitholders | (8 | ) | | — |

|

| Quarterly distributions to general partner | — |

| | (46 | ) |

| Distributions in connection with acquisitions | — |

| | (5 | ) |

| Capital contributions by affiliate | 9 |

| | 9 |

|

| Other financing activities | (3 | ) | | — |

|

| Net cash used in financing activities | (187 | ) | | (139 | ) |

| Decrease in Cash and Cash Equivalents | (48 | ) | | (653 | ) |

| Cash and Cash Equivalents, Beginning of Period | 75 |

| | 688 |

|

| Cash and Cash Equivalents, End of Period | $ | 27 |

| | $ | 35 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Note 1 - Organization and Basis of Presentation

Organization

Andeavor Logistics LP (“Andeavor Logistics” or the “Partnership”) is a fee-based, growth-oriented Delaware limited partnership formed in December 2010 by Andeavor and its wholly-owned subsidiary, Tesoro Logistics GP, LLC (“TLGP”), our general partner, to own, operate, develop and acquire logistics and related assets and businesses. Unless the context otherwise requires, references in this report to “we,” “us,” “our,” or “ours” refer to Andeavor Logistics LP, one or more of its consolidated subsidiaries, or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Andeavor” refer collectively to Andeavor and any of its subsidiaries, other than Andeavor Logistics, its subsidiaries and its general partner.

Principles of Consolidation and Basis of Presentation

Principles of Consolidation

Acquired assets from Andeavor, and the associated liabilities and results of operations, are collectively referred to as the “Predecessors.” See Note 1 of our Annual Report on Form 10-K for the year ended December 31, 2017 for additional information regarding the acquired assets from Andeavor. The acquisition of logistics assets located in Anacortes, Washington in 2017 was immaterial to our condensed consolidated financial statements. While this acquisition is a common control transaction, prior periods have not been recast as these assets do not constitute a business in accordance with ASU 2017-01, “Clarifying the Definition of a Business” (“ASU 2017-01”).

The interim condensed consolidated financial statements and notes thereto have been prepared by management without audit according to the rules and regulations of the Securities and Exchange Commission (“SEC”) and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Basis of Presentation

We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared under U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying interim condensed consolidated financial statements and notes should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2017. Certain prior year balances have been aggregated or disaggregated in order to conform to the current year presentation, including the adoption of recent accounting standards discussed further below.

We are required under U.S. GAAP to make estimates and assumptions that affect the amounts of assets and liabilities and revenues and expenses reported as of and during the periods presented. We review our estimates on an ongoing basis using currently available information. Changes in facts and circumstances may result in revised estimates, and actual results could differ from those estimates. The results of operations of the Partnership for any interim period are not necessarily indicative of results for the full year.

Cost Classifications

Natural gas liquids (“NGL”) expense results from the cost of NGL purchases under our percent of proceeds (“POP”) arrangements, as well as the non-cash gross presentation of replacement dry gas under our keep-whole arrangements.

Operating expenses are comprised of direct operating costs including costs incurred for direct labor, repairs and maintenance, outside services, chemicals and catalysts, utility costs, including the purchase of electricity and natural gas used by our facilities, property taxes, environmental compliance costs related to current period operations, rent expense and other direct operating expenses incurred in the provision of services.

Depreciation and amortization expenses consist of the depreciation and amortization of property, plant and equipment, deferred charges and intangible assets. General and administrative expenses represent costs that are not directly or indirectly related to or otherwise are not allocated to our operations. NGL expense, direct operating expenses, and depreciation and amortization expenses recognized by our Terminalling and Transportation, Gathering and Processing, and Wholesale segments constitute costs of revenue as defined by U.S. GAAP.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Financial Instruments

We believe the carrying value of our other financial instruments, including cash and cash equivalents, receivables, accounts payable and certain accrued liabilities approximate fair value. Our fair value assessment incorporates a variety of considerations, including the short-term duration of the instruments and the expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk.

The fair value of our senior notes is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The borrowings under our amended revolving credit facility (the “Revolving Credit Facility”) and our dropdown credit facility (“Dropdown Credit Facility”), which include a variable interest rate, approximate fair value. The carrying value and fair value of our debt were both approximately $4.2 billion as of March 31, 2018, and were approximately $4.2 billion and $4.3 billion at December 31, 2017, respectively. These carrying and fair values of our debt do not consider the unamortized issuance costs, which are netted against our total debt.

New Accounting Standards and Disclosures

Revenue Recognition

In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with Customers” to replace existing revenue recognition rules with a single comprehensive model to use in accounting for revenue arising from contracts with customers. Under this ASU and the associated subsequent amendments (collectively, “ASC 606”), revenue is recognized when a customer obtains control of promised goods or services for an amount that reflects the consideration the entity expects to receive in exchange for those goods or services. In addition, ASC 606 requires expanded disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

We adopted ASC 606 on January 1, 2018 utilizing the modified retrospective method. We recognized a $22 million reduction to the opening balance of partners’ equity as of January 1, 2018 for the cumulative effect adjustment related to contracts in process but not substantially complete as of that date. We reflected the aggregate impact of all modifications executed and effective as of January 1, 2018 in applying the new standard to these contracts. The cumulative effect adjustment is primarily related to the period over which revenue is recognized on contracts for which customers pay minimum throughput volume commitments and contain claw-back provisions. Additionally, upon the adoption of ASC 606, the gross versus net presentation of certain contractual arrangements and taxes has changed as further described in Note 7. The current period results and balances are presented in accordance with ASC 606, while comparative periods continue to be presented in accordance with the accounting standards in effect for those periods.

For the period ending March 31, 2018, we recorded lower revenue of $566 million and correspondingly $566 million in lower costs and expenses, for presentation impacts of applying ASC 606. These impacts were primarily associated with the netting of revenues and costs associated with our fuel purchase and supply arrangements with Andeavor, as further described in Note 7. We recorded an additional $2 million in revenues during the three months ended March 31, 2018 as a result of applying the new standard, associated with minimum volume commitments. There were no material impacts during the period to the condensed consolidated balance sheets or condensed statement of consolidated cash flows, as a result of the adoption.

Leases

In February 2016, the FASB issued ASU 2016-02, “Leases” (“ASU 2016-02”), which amends existing accounting standards for lease accounting and adds additional disclosures about leasing arrangements. Under the new guidance, lessees are required to recognize right-of-use assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either a financing lease or operating lease with classification affecting the pattern of expense recognition in the condensed statements of consolidated operations and presentation of cash flows in the condensed statements of consolidated cash flows. The new standard also requires new disclosures to help financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases. ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, and interim reporting periods within those annual reporting periods. Early adoption is permitted and in the original guidance the modified retrospective application was required, however, in March 2018, the FASB approved another transition method in which the effective date would be the date of initial application of transition. Under this optional transition method, we would recognize a cumulative effect adjustment to the opening balance of partners’ equity in the period of adoption. We expect to elect the optional transition method and will not early adopt the standard.

We are progressing through our implementation plan and continue to evaluate the impact of the standard on our business processes, accounting systems, controls and financial statement disclosures. In addition, we continue to assess the impact in certain areas where industry consensus continues to be formed. While we are still working through our implementation plan, we do expect that the recognition of right-of-use assets and lease liabilities, which are not currently reflected on our condensed consolidated balance sheets, to have a material impact on total assets and liabilities. However, we do not expect the adoption of the standard to have a material impact on our condensed statements of consolidated operations or liquidity. At this time, we are

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

unable to estimate the full impact of the standard until we progress further through our plan and the industry reaches a consensus on certain industry specific issues.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU requires the estimation of credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. ASU 2016-13 is effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect the adoption of this standard to have a material impact on our condensed consolidated financial statements.

Pension and Postretirement Costs

In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (“ASU 2017-07”), which requires the current service-cost component of net benefit costs to be presented similarly with other current compensation costs for related employees on the statement of consolidated operations and stipulates that only the service cost component of net benefit cost is eligible for capitalization. Additionally, the Partnership will present other components of net benefit costs elsewhere on the condensed statements of consolidated operations since these costs are allocated to the Partnership’s financial statements by Andeavor. The amendments to the presentation of the condensed statements of consolidated operations in this update should be applied retrospectively while the change in capitalized benefit cost is to be applied prospectively. We adopted ASU 2017-07 as of January 1, 2018. Adoption of the standard resulted in an increase to interest and financing costs for the three months ended March 31, 2017 of $2 million with a corresponding increase to other income of $2 million with no impact to net earnings. ASU 2017-07 does not impact the condensed consolidated balance sheets or condensed statements of consolidated cash flows.

Note 2 - Acquisitions

Wamsutter Pipeline System

On May 1, 2018, we completed our acquisition of the Wamsutter Pipeline System from Plains All American Pipeline, L.P for total consideration of $180 million. The system consists of pipelines that transport crude oil to another third-party pipeline system that supply the Salt Lake City area refineries, including Andeavor’s Salt Lake City refinery. We financed the acquisition using our Revolving Credit Facility. This acquisition is not material to our condensed consolidated financial statements.

Western Refining Logistics, LP Merger

Effective October 30, 2017, Andeavor Logistics closed its merger with Western Refining Logistics, LP (“WNRL”) (the “WNRL Merger”) exchanging all outstanding common units of WNRL with units of Andeavor Logistics, representing an equity value of $1.7 billion.

Andeavor Logistics accounted for the WNRL Merger as a common control transaction and, accordingly, inherited Andeavor’s basis in WNRL’s net assets. Andeavor accounted for the acquisition of WNRL using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values and liabilities assumed be recognized on the balance sheet as of the acquisition date, or June 1, 2017, the date Andeavor acquired WNRL. However, we accounted for the WNRL Merger as a reorganization of entities under common control, which requires us to recognize the assets and liabilities acquired using Andeavor’s basis. The purchase price allocation for the WNRL Merger is preliminary and has been allocated based on estimated fair values of the assets acquired and liabilities assumed at the acquisition date, pending the completion of an independent valuation and other information as it becomes available to us. We expect that, as we obtain more information, the preliminary purchase price allocation disclosed below may change. Although the purchase price allocation is substantially complete, adjustments can be made through the end of Andeavor’s measurement period, which is not to exceed one year from the acquisition date. During the three months ended March 31, 2018, we recorded adjustments to our preliminary allocation to increase property, plant and equipment and reduce goodwill by $7 million.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Preliminary Acquisition Date Purchase Price Allocation (in millions)

|

| | | |

| Cash | $ | 22 |

|

| Receivables | 112 |

|

| Inventories | 11 |

|

| Prepayments and Other Current Assets | 25 |

|

| Property, Plant and Equipment (a) | 1,357 |

|

| Goodwill | 558 |

|

| Acquired Intangibles | 130 |

|

| Other Noncurrent Assets | 2 |

|

| Accounts Payable | (167 | ) |

| Accrued Liabilities | (41 | ) |

| Debt | (347 | ) |

| Total purchase price | $ | 1,662 |

|

| |

| (a) | Estimated useful lives ranging from 3 to 22 years have been assumed based on the preliminary valuation. |

Goodwill

We evaluated several factors that contributed to the amount of goodwill presented above. These factors include the acquisition of a logistics business located in advantageous areas where there is crude oil marketing capabilities and meaningful refining offtake with an assembled workforce that cannot be duplicated at the same costs by a new entrant. Further, the WNRL Merger provides a platform for future growth through operating efficiencies Andeavor Logistics expects to gain from the application of best practices across the combined company and an ability to realize synergies from the geographic diversification of Andeavor Logistics’ business and rationalization of general and administrative costs. We have preliminarily allocated $267 million, $202 million and $89 million of goodwill to the Gathering and Processing, Terminalling and Transportation, and Wholesale segments, respectively.

Property, Plant and Equipment

The fair value of property, plant and equipment is $1.4 billion. This preliminary fair value is based on a valuation using a combination of the income, cost and market approaches. The useful lives of acquired assets have been aligned to similar assets at Andeavor Logistics.

Acquired Intangible Assets

We estimated the fair value of the acquired identifiable intangible assets at $130 million. This fair value is based on a preliminary valuation completed for the business enterprise, along with the related tangible assets, using a combination of the income method, cost method and comparable market transactions. We recognized intangible assets associated with customer relationships of $130 million with third parties, all of which will be amortized on a straight-line basis over an estimated weighted average useful life of 15 years. The accumulated amortization of our finite life intangibles acquired from the WNRL Merger was $7 million as of March 31, 2018. Amortization expense related to the acquired intangible assets is expected to be approximately $9 million per year for the next five years. Although we have substantially completed our valuation estimate and related evaluation of the useful lives; accordingly, future amortization of intangible assets related to customer relationships, these may be revised during the measurement period.

WNRL Revenues and Net Earnings

During the three months ended March 31, 2018, we recognized $92 million in revenues and $45 million of net earnings related to the business acquired.

Pro Forma Financial Information

The following unaudited pro forma information combines the historical operations of Andeavor Logistics and WNRL, giving effect to the merger and related transactions as if they had been consummated on January 1, 2017, the beginning of the earliest period presented.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Pro Forma Consolidated Revenues and Consolidated Net Earnings (in millions)

|

| | | |

| | Three Months Ended

March 31, 2017 |

| Revenues | $ | 1,024 |

|

| Net earnings (a) | 130 |

|

| |

| (a) | While many recurring adjustments impact the pro forma figures presented, the pro forma condensed statements of consolidated operations for the three months ended March 31, 2017, the period the acquisition was assumed to be completed for pro forma purposes, includes a significant non-recurring adjustment to recognize the WNRL Merger acquisition and integration costs. We recognized acquisition costs related to the WNRL Merger of $17 million as well as $3 million of severance costs. |

Note 3 - Related-Party Transactions

Affiliate Agreements

The Partnership has various long-term, fee-based commercial agreements with Andeavor, under which we provide terminal distribution, storage services, pipeline transportation, crude oil, natural gas and produced water gathering and processing, wholesale, and trucking services to Andeavor, and Andeavor commits to provide us with minimum monthly throughput volumes of crude oil, refined products and other. If, in any calendar month, Andeavor fails to meet its minimum volume commitments under these agreements, it will be required to pay us a shortfall payment. For the NGLs that we handle under keep-whole agreements, the Partnership transfers the commodity risk exposure associated with these keep-whole agreements to Andeavor (“Keep-Whole Commodity Agreement”). Under the Keep-Whole Commodity Agreement with Andeavor, Andeavor pays us a processing fee for NGLs related to the keep-whole agreements and delivers replacement dry gas to the producers on our behalf. We then pay Andeavor a marketing fee in exchange for assuming the commodity risk. The terms and pricing of this agreement are subject to revision each year.

In addition, we have agreements for the provision of various general and administrative services by Andeavor. Under our partnership agreement, we are required to reimburse TLGP and its affiliates for all costs and expenses that they incur on our behalf for managing and controlling our business and operations. Except to the extent specified under our amended omnibus agreement (the “Amended Omnibus Agreement”) or our amended secondment agreement (the “Amended Secondment Agreement”), TLGP determines the amount of these expenses. The Amended Omnibus Agreement and the Amended Secondment Agreement were amended and restated in connection with the WNRL Merger. Under the terms of the Amended Omnibus Agreement in effect as of March 31, 2018, we are required to pay Andeavor an annual corporate services fee of $13 million for the provision of various centralized corporate services, including executive management, legal, accounting, treasury, human resources, health, safety and environmental, information technology, certain insurance coverage, administration and other corporate services. Andeavor charged the Partnership $6 million and $5 million pursuant to the Amended Secondment Agreement for the three months ended March 31, 2018 and 2017, respectively. Additionally, pursuant to the Amended Omnibus Agreement and Amended Secondment Agreement, we reimburse Andeavor for any direct costs incurred by Andeavor in providing other operational services with respect to certain of our other assets and operations.

Summary of Affiliate Transactions

Summary of Revenue and Expense Transactions with Andeavor (in millions)

|

| | | | | | | |

| | Three Months Ended

March 31, |

| | 2018 | | 2017 |

| Revenues (a) | $ | 318 |

| | $ | 203 |

|

| Operating expenses (b) | 51 |

| | 39 |

|

| General and administrative expenses | 20 |

| | 20 |

|

| |

| (a) | Andeavor accounted for 59% and 48% of our total revenues for the three months ended March 31, 2018 and 2017, respectively. |

| |

| (b) | Net of reimbursements from Andeavor pursuant to the Amended Omnibus Agreement, the Carson Assets Indemnity Agreement and other affiliate agreements of $7 million and $2 million for the three months ended March 31, 2018 and 2017, respectively. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Distributions

In accordance with our partnership agreement, the unitholders of our limited partner interests are entitled to receive quarterly distributions of available cash. During the three months ended March 31, 2018, we paid quarterly cash distributions of $115 million to Andeavor, net of $12.5 million waived by Andeavor and its affiliates. On April 18, 2018, we declared a quarterly cash distribution of $1.015 per unit, which will be paid on May 15, 2018. The distribution will include a payment of $115 million to Andeavor, net of $15 million waived by Andeavor and its affiliates. TLGP’s distribution waivers for 2018 and 2019 remain in effect as instituted in 2017 under the terms of our partnership agreement.

Note 4 - Debt

Debt Balance, Net of Unamortized Issuance Costs (in millions)

|

| | | | | | | |

| | March 31,

2018 | | December 31, 2017 |

| Total debt | $ | 4,201 |

| | $ | 4,182 |

|

| Unamortized issuance costs | (52 | ) | | (54 | ) |

| Current maturities | (1 | ) | | (1 | ) |

| Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 4,148 |

| | $ | 4,127 |

|

Available Capacity Under Credit Facilities (in millions)

|

| | | | | | | | | | | | | | | | | | | | |

| | Total Capacity | | Amount Borrowed as of March 31, 2018 | | Outstanding Letters of Credit | | Available Capacity as of March 31, 2018 | | Weighted Average Interest Rate | | Expiration |

| Revolving Credit Facility (a) | $ | 1,100 |

| | $ | 443 |

| | $ | — |

| | $ | 657 |

| | 3.59 | % | | January 29, 2021 |

| Dropdown Credit Facility | 1,000 |

| | — |

| | — |

| | 1,000 |

| | — | % | | January 29, 2021 |

| Total Credit Facilities (a) | $ | 2,100 |

| | $ | 443 |

| | $ | — |

| | $ | 1,657 |

| | | | |

| |

| (a) | On January 5, 2018, we amended our Revolving Credit Facility to increase the aggregate commitments from $600 million to $1.1 billion and to permit the incurrence of incremental loans. We are allowed to request that the loan availability be increased up to an aggregate of $2.1 billion, subject to receiving increased commitments from the lenders. |

Note 5 - Commitments and Contingencies

In the ordinary course of business, we may become party to lawsuits, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but we will accrue liabilities for these matters if the amount is probable and can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, we believe there would be no material impact on our consolidated financial statements.

Note 6 - Equity and Net Earnings per Unit

We had 89,280,638 common public units and 600,000 6.875% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (the “Preferred Units”) outstanding as of March 31, 2018. Additionally, Andeavor owned 127,889,386 of our common units, constituting approximately 59% ownership interest in us. Andeavor also held 80,000 Andeavor Logistics TexNew Mex units and 2,202,880 non-economic general partner units as of March 31, 2018.

Andeavor and Marathon Petroleum Corporation (“MPC”) entered into an Agreement and Plan of Merger, dated as of April 29, 2018 (the “MPC Merger Agreement”), under which MPC will acquire all outstanding shares of Andeavor. The MPC Merger Agreement contains customary representations, warranties and covenants. As a subsidiary of Andeavor, the MPC Merger Agreement limits our ability to issue additional common or preferred units, with certain exceptions as outlined in the MPC Merger Agreement, and from incurring any additional indebtedness outside the ordinary course of business. However, the MPC Merger Agreement allows us to continue paying the regular quarterly distributions on our common units including regular increases consistent with our past practices. Additionally, the MPC Merger Agreement allows us to continue paying the scheduled distribution on our Preferred Units. The transaction was unanimously approved by the boards of directors of both companies and is subject to regulatory and other customary closing conditions, including approvals from the shareholders of each company.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Changes to Equity (in millions)

|

| | | | | | | | | | | |

| | Partnership | | Total |

| | Common | | Preferred | |

| Balance at December 31, 2017 | $ | 2,925 |

| | $ | 589 |

| | $ | 3,514 |

|

| Distributions to common and preferred unitholders (a) | (205 | ) | | (8 | ) | | (213 | ) |

| Net earnings attributable to partners | 125 |

| | 14 |

| | 139 |

|

| Cumulative effect of accounting standard adoption | (22 | ) | | — |

| | (22 | ) |

| Contributions (b) | 16 |

| | — |

| | 16 |

|

| Other | — |

| | (1 | ) | | (1 | ) |

| Balance at March 31, 2018 | $ | 2,839 |

| | $ | 594 |

| | $ | 3,433 |

|

| |

| (a) | Represents cash distributions declared and paid during the three months ended March 31, 2018. |

| |

| (b) | Includes Andeavor and TLGP contributions to the Partnership primarily related to reimbursements for capital spending pursuant predominantly to the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement. |

Cash Distributions

Our partnership agreement, as amended, sets forth the calculation to be used to determine the amount and priority of cash distributions that the limited partner unitholders will receive.

Quarterly Distributions on common units

|

| | | | | | | | | | | |

| Quarter Ended | Quarterly Distribution Per Common Unit | | Total Cash Distribution (in millions) | | Date of Distribution | | Unitholders Record Date |

| December 31, 2017 (a) | $ | 1.000 |

| | $ | 205 |

| | February 14, 2018 | | January 31, 2018 |

| March 31, 2018 (a)(b)(c) | 1.015 |

| | 205 |

| | May 15, 2018 | | May 1, 2018 |

| |

| (a) | This distribution is net of $15 million and $12.5 million waived by TLGP for the three months ended March 31, 2018 and December 31, 2017, respectively. TLGP’s distribution waivers for 2018 and 2019 remain in effect as instituted in 2017 under the terms of our partnership agreement. |

| |

| (b) | This distribution was declared on April 18, 2018 and will be paid on the date of distribution. |

| |

| (c) | On February 15, 2018, we paid distributions associated with our Preferred Units of $8 million. |

Net Earnings per Unit

Prior to the WNRL Merger, we used the two-class method when calculating the net earnings per unit applicable to limited partners, because we had more than one participating security consisting of limited partner common units, general partner units and incentive distribution rights (“IDRs”). Net earnings earned by the Partnership were allocated between the limited and general partners in accordance with our partnership agreement. At the effective time of the WNRL Merger, the IDRs were canceled (the “IDR Exchange”) and the general partner units were converted into a non-economic general partner interest in Andeavor Logistics (together with the IDR Exchange, the “IDR/GP Transaction”). As a result, the general partner units no longer participate in earnings or distributions, including IDRs. With the issuance of the Preferred Units, earnings are allocated first to the Preferred Units to equal their fixed distribution rate. We base our calculation of net earnings per unit using the weighted-average number of common limited partner units outstanding during the period.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Net Earnings per Unit (in millions, except per unit amounts)

|

| | | | | | | |

| | Three Months Ended

March 31, |

| | 2018 | | 2017 |

| Net earnings | $ | 139 |

| | $ | 92 |

|

| Special allocations of net earnings (“Special Allocations”) (a) | — |

| | 1 |

|

| Net earnings, including Special Allocations | 139 |

| | 93 |

|

| Distributions on Preferred Units (b) | (10 | ) | | — |

|

| Net earnings attributable to common units | 129 |

| | 93 |

|

| General partner’s distributions | — |

| | (3 | ) |

| General partner’s IDRs (c) | — |

| | (36 | ) |

| Limited partners’ distributions on common units | (205 | ) | | (101 | ) |

| Distributions on common units greater than earnings | $ | (76 | ) | | $ | (47 | ) |

| General partner’s earnings: | | | |

| Distributions | $ | — |

| | $ | 3 |

|

| General partner’s IDRs (c) | — |

| | 36 |

|

| Allocation of distributions greater than earnings | — |

| | (1 | ) |

| Total general partner’s earnings | $ | — |

| | $ | 38 |

|

| Limited partners’ earnings on common units: | | | |

| Distributions (d) | $ | 205 |

| | $ | 101 |

|

| Special Allocations (a) | — |

| | (1 | ) |

| Allocation of distributions greater than earnings | (76 | ) | | (46 | ) |

| Total limited partners’ earnings on common units | $ | 129 |

| | $ | 54 |

|

| Weighted average limited partner units outstanding: | | | |

| Common units - basic | 217.2 |

| | 104.8 |

|

| Common units - diluted (e) | 217.4 |

| | 104.9 |

|

| Net earnings per limited partner unit: | | | |

| Common - basic | $ | 0.59 |

| | $ | 0.51 |

|

| Common - diluted | $ | 0.59 |

| | $ | 0.51 |

|

| |

| (a) | Normal allocations according to percentage interests are made after giving effect, if any, to priority income allocations in an amount equal to incentive cash distributions fully allocated to the general partner and any special allocations. The adjustment reflects the special allocation to common units held by TLGP for the interest incurred in connection with borrowings on the Revolving Credit Facility in lieu of using all cash on hand to fund the acquisition of crude oil, natural gas and produced water gathering systems and two natural gas processing facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (the “North Dakota Gathering and Processing Assets”) during the three months ended March 31, 2017. |

| |

| (b) | The Preferred Units entitle unitholders to receive preferred distributions on a semi-annually basis. |

| |

| (c) | IDRs entitled the general partner to receive increasing percentages, up to 50%, of quarterly distributions in excess of $0.3881 per unit per quarter. The amount above reflects earnings distributed to our general partner net of $12.5 million of IDRs waived by TLGP for the three months ended March 31, 2017. Our general partner no longer receives IDRs as a result of the IDR/GP Transaction. |

| |

| (d) | Distributions of earnings for limited partners’ common units for the three months ended March 31, 2018 is net of a $15.0 million waiver from Andeavor in connection with the WNRL Merger. |

| |

| (e) | Diluted net earnings per unit include the effects of potentially dilutive units on our common units, which consist of unvested service and performance phantom units. |

Note 7 - Revenues

We recognize revenue upon transfer of control of promised products or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those products or services. For the three months ended March 31, 2018, revenues from contracts with customers were $454 million, which excludes lease revenues of $81 million. Upon adoption of ASC 606, revenue is recognized net of amounts collected from customers for taxes assessed by governmental authorities on, and concurrent with, specific revenue-producing transactions.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Service Revenue

We generate service revenue for gathering and transporting crude oil, natural gas and water; processing and fractionating natural gas and NGLs; and terminalling, transporting, and storing crude oil and refined products. We perform these services under various contractual arrangements with our customers. Under fee-based arrangements, we receive a fixed rate per volumetric unit for services we provide. For many of these fee-based arrangements, customers are required to make deficiency payments when they do not meet their minimum throughput volume commitments. Some of these contracts allow our customers to claw-back all or a portion of prior deficiency payments against excess volumes in future periods. Under keep-whole arrangements, we gather and process natural gas from producer-customers, retain and sell extracted NGLs, and return to the producer replacement dry gas (“shrink gas”) with an equivalent British thermal unit content of the NGLs retained. For these arrangements, we receive from the producer a combination of fixed rate-per unit of cash consideration as well as non-cash consideration in the form of retained NGLs. Other agreements with producers consist of POP arrangements for which we gather and purchase natural gas from the producers, process purchased natural gas, and sell resulting NGLs and shrink gas at market prices. Reimbursements of certain costs and fees received under these purchase arrangements are recorded as a reduction to costs. See further discussion below on our accounting for product revenues related to the sales of products resulting from our processing activities.

We recognize service revenue over time, as customers simultaneously receive and consume the related benefits of the services that we stand ready to provide. Revenue is recognized using an output measure, such as the throughput volume or capacity utilization, as these measures most accurately depict the satisfaction of our performance obligations. Where contracts contain variable pricing terms, the variability is either resolved within the reporting period, or the variable consideration is allocated to the specific unit of service to which it relates. Deficiency payments under contracts with claw-back provisions are deferred and recognized as revenue as customers reclaim amounts by throughputting excess volumes. To the extent it is probable a customer will not recover all or a portion of the deficiency payment, the estimated residual deficiency is recognized ratably over the claw-back period. Payments for services rendered are generally received no later than 60 days from the month of service, with the exception of deficiency payments described above.

For our keep-whole arrangements, we recognize service revenue for the fair value of non-cash consideration we receive in the form of NGLs, and NGL expense for shrink gas we provide back to our customers. We obtain control of the NGLs we receive from our customers and we bear the inventory risk, have discretion in establishing price and have the ability to direct their use. We estimate the fair value of non-cash consideration at the date we obtain control of the respective NGLs, using monthly average published price of underlying commodity adjusted for location differences and commodity specifications.

We experience volume gains and losses, which we sometimes refer to as imbalances, within our pipelines, terminals and storage facilities due to pressure and temperature changes, evaporations and variances in meter reading in other measurement methods. Some of our arrangements require us to bear losses when actual volume losses exceed a contractually specified percentage. Similarly, we receive a benefit when actual volume losses are lower than the contractually specified percentage. For gains and losses which are cash settled, we include the settlement amounts in our service revenues. We recognize non-cash consideration for the stated percentage of commodity we retain and control. We record this non-cash consideration at fair value in service revenue on a gross basis in service revenue and operating expense. Losses in excess of the stated percentage are recorded in operating expenses. When losses are lower than the stated percentage, proceeds from the sale of the retained NGLs are recorded in service revenue. The total amount of service revenue and NGL expense recorded associated with these arrangements is not material to our condensed statement of consolidated operations.

Product Revenue

We generate product revenue from the sale of NGLs and related products along with the sale of gasoline and diesel fuel within our wholesale business. We sell NGLs, shrink gas and condensate using natural gas we acquire from producers under our POP arrangements. We record revenues for the sale of these NGLs and related products at market prices, and record the payments to producers for the agreed-upon percentage of the total sales proceeds as NGL expense, net of certain charges, which is reported within costs and expenses in our condensed statement of consolidated operations.

We have certain fuel purchase and sale arrangements with Andeavor under which we receive certain minimum guaranteed margins with upside potential on a certain portion of our branded and unbranded fuel sales. Andeavor retains control of fuel and is the principal in these affiliate arrangements. Therefore, we net the purchase and sale of fuel in our condensed consolidated statements of operations.

Our product sales arrangements are for specified goods for which enforceable rights and obligations are created when sales volumes are determined, which typically occurs as orders are issued or spot sales are made, but may be determined at contract inception. Each barrel, gallon or other unit of measure of product, is separately identifiable and represents a distinct performance obligation to which the transaction price is allocated based on stand-alone selling price. We use observable market prices for the products we sell to determine the stand-alone selling price of each separate performance obligation. Product revenues are recognized at a point-in-time, which generally occurs upon delivery and transfer of title to the customer. Payments for product sales are generally received within 30 days from when control has transferred.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Other Arrangements

Based on the terms of certain storage and other agreements primarily with Andeavor, we are considered to be the lessor under these implicit operating lease arrangements. Income from these leases is excluded from the scope of the new revenue standard.

Customer Contract Assets

Our receivables are generated primarily from contracts with customers. Our payment terms vary by product or service type. The period between invoicing and payment is not significant, and our assets associated with contracts with customers consist primarily of billed accounts receivable, which are included in receivables, net of allowance for doubtful accounts in our condensed consolidated balance sheets. Our contract assets include amounts recognized for deficiency payments associated with minimum volume commitments which have not been billed to customers. These contract assets are included in prepayments and other current assets in our condensed consolidated balance sheets.

Customer Contract Liabilities

For certain products or services, we receive payment in advance of when performance obligations are satisfied. These liabilities from contracts with customers consist primarily of certain deficiency payments for minimum volume commitments and customer reimbursements of costs for capital projects. Customer advances for capital projects are generally recognized over the contract term. We do not have a material impact for financing components associated with these customer advances. Payments for minimum volume commitments and other customer advances are included in deferred income within other current liabilities and other noncurrent liabilities based on timing of expected recognition, which may extend up to 15 years. During the three months ended March 31, 2018, we recognized $14 million in revenue from contract liabilities existing as of January 1, 2018, after cumulative adjustments for the adoption of ASC 606.

Summary of Customer Contract Assets and Liabilities (in millions)

|

| | | | | | | | | | | | | | | |

| | December 31, 2017 | | Adjustments for ASC 606 (a) | | Balance at January 1, 2018 | | March 31, 2018 |

| Receivables from contracts with customers | $ | 363 |

| | $ | (34 | ) | | $ | 329 |

| | $ | 325 |

|

| Other contract assets | — |

| | 34 |

| | 34 |

| | 13 |

|

| Deferred income, current | 23 |

| | — |

| | 23 |

| | 21 |

|

| Deferred income, noncurrent | 43 |

| | 19 |

| | 62 |

| | 56 |

|

| |

| (a) | These amounts exclude balances associated with equity method investments. We recognized a cumulative adjustment of $3 million as a decrease to Equity Method Investments in our condensed consolidated balance sheets as of January 1, 2018 for the impacts related to our equity method investment in Three Rivers Gathering, LLC. There were no material impacts to this balance during the three months ended March 31, 2018 due to the adoption. |

Remaining Performance Obligations

We do not disclose the value of unsatisfied performance obligations for contracts with original expected terms of one year or less or the value of variable consideration related to unsatisfied performance obligations, when such values are not required to be estimated for purposes of allocation and recognition. Revenues associated with remaining obligations under contracts with terms in excess of one year consist primarily of arrangements for which the customer has agreed to fixed consideration based on minimum throughput volume commitments or capacity utilization. As of March 31, 2018, we had $4.2 billion of expected revenues from remaining performance obligations.

The future revenues from our service arrangements with fixed fees or minimum throughput volume commitments will be recognized over the period of performance to which the fixed fee or commitment relates, which primarily range from 1 year to 15 years. We expect approximately 80% of our total remaining obligations to be recognized within 5 years.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Disaggregation

Revenue Disaggregation by Type and Product Line (in millions)

|

| | | | | | | | | | | |

| | March 31, 2018 |

| | Terminalling and Transportation | | Gathering and Processing | | Wholesale |

| Service Revenues (a) | | | | | |

| Refined products | $ | 203 |

| | $ | — |

| | $ | 6 |

|

| Crude oil and water | 26 |

| | 87 |

| | — |

|

| Natural gas | — |

| | 98 |

| | — |

|

| Other | 2 |

| | — |

| | — |

|

| Total Service Revenues | 231 |

| | 185 |

| | 6 |

|

| | | | | | |

| Product Revenues | | | | | |

| NGL products | — |

| | 104 |

| | — |

|

| Refined products | — |

| | — |

| | 9 |

|

| Total Product Revenues | — |

| | 104 |

| | 9 |

|

| Total Revenues | $ | 231 |

| | $ | 289 |

| | $ | 15 |

|

| |

| (a) | Includes $81 million of lease revenues for the three months ended March 31, 2018. |

Note 8 - Operating Segments

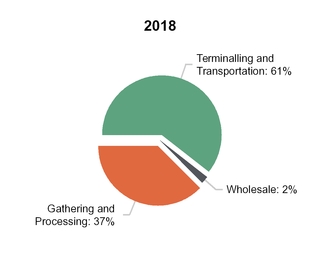

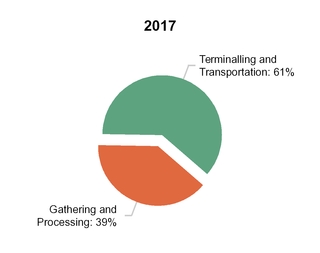

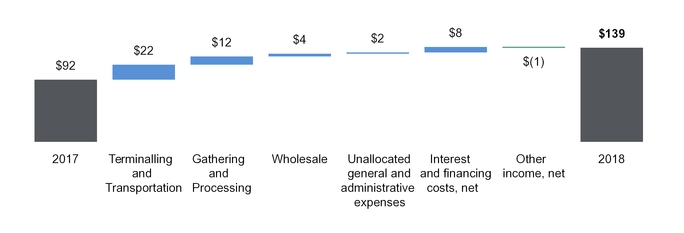

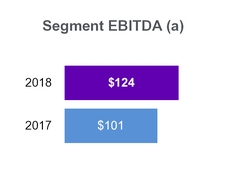

Our revenues are derived from three operating segments: Terminalling and Transportation, Gathering and Processing, and Wholesale. We evaluate the performance of our segments based primarily on segment operating income and net earnings before interest, income taxes, depreciation and amortization expenses (“EBITDA”). For the purposes of our operating segment disclosure, we present operating income as it is the most comparable measure to the amounts presented in our condensed statements of consolidated operations. Segment operating income includes those revenues and expenses that are directly attributable to management of the respective segment. Certain general and administrative expenses and interest and financing costs are excluded from segment operating income as they are not directly attributable to a specific operating segment.

Our Terminalling and Transportation segment consists of pipeline systems, including regulated common carrier refined products pipeline systems and other pipelines, which transport products and crude oil primarily from Andeavor’s refineries to nearby facilities, as well as crude oil and refined products terminals and storage facilities, marine terminals, asphalt terminals, rail-car unloading facilities, an asphalt trucking operation and a petroleum coke handling and storage facility.

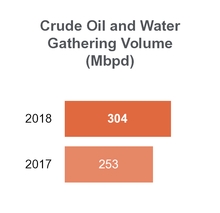

Our Gathering and Processing segment consists of crude oil, natural gas and produced water gathering systems in the Bakken Shale/Williston Basin area of North Dakota and Montana, the Green River Basin, Uinta Basin, and Vermillion Basin in the states of Utah, Colorado and Wyoming, the Delaware Basin in the Permian Basin area of West Texas and Southern New Mexico, and in the San Juan Basin in the Four Corners area of Northwestern New Mexico. It also consists of gas processing and fractionation complexes in the Bakken Shale, Green River Basin, Uinta Basin and Vermillion Basin.

Our Wholesale segment includes the operations of several bulk petroleum distribution plants and a fleet of refined product delivery trucks that distribute commercial wholesale petroleum products primarily in Arizona, Colorado, Nevada, New Mexico and Texas. The refined product trucking business delivers a significant portion of the volumes sold by our Wholesale segment.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Segment Information (in millions)

|

| | | | | | | |

| | Three Months Ended

March 31, |

| | 2018 | | 2017 |

| Revenues | | | |

| Terminalling and Transportation: | | | |

| Terminalling | $ | 198 |

| | $ | 145 |

|

| Pipeline transportation | 31 |

| | 30 |

|

| Other revenues | 2 |

| | — |

|

| Total Terminalling and Transportation | 231 |

| | 175 |

|

| Gathering and Processing: | | | |

| NGL sales | 104 |

| | 83 |

|

| Gas gathering and processing | 85 |

| | 80 |

|

| Crude oil and water gathering | 65 |

| | 39 |

|

| Pass-thru and other | 35 |

| | 43 |

|

| Total Gathering and Processing | 289 |

| | 245 |

|

| Wholesale: | | | |

| Fuel sales | 9 |

| | — |

|

| Other wholesale | 8 |

| | — |

|

| Total Wholesale | 17 |

| | — |

|

| Intersegment wholesale revenues | (2 | ) | | — |

|

| Total Revenues | $ | 535 |

| | $ | 420 |

|

| | | | |

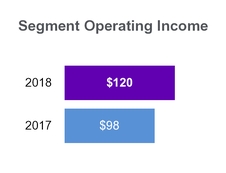

| Segment Operating Income | | | |

| Terminalling and Transportation | $ | 120 |

| | $ | 98 |

|

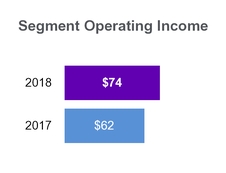

| Gathering and Processing | 74 |

| | 62 |

|

| Wholesale | 4 |

| | — |

|

| Total Segment Operating Income | 198 |

| | 160 |

|

| Unallocated general and administrative expenses | (8 | ) | | (10 | ) |

| Operating Income | 190 |

| | 150 |

|

| Interest and financing costs, net | (54 | ) | | (62 | ) |

| Equity in earnings of equity method investments | 2 |

| | 2 |

|

| Other income, net | 1 |

| | 2 |

|

| Net Earnings | $ | 139 |

| | $ | 92 |

|

| | | | |

| Depreciation and Amortization Expenses | | | |

| Terminalling and Transportation | $ | 29 |

| | $ | 21 |

|

| Gathering and Processing | 48 |

| | 37 |

|

| Wholesale | 3 |

| | — |

|

| Total Depreciation and Amortization Expenses | $ | 80 |

| | $ | 58 |

|

| | | | |

| Capital Expenditures | | | |

| Terminalling and Transportation | $ | 27 |

| | $ | 27 |

|

| Gathering and Processing | 55 |

| | 18 |

|

| Wholesale | 1 |

| | — |

|

| Total Capital Expenditures | $ | 83 |

| | $ | 45 |

|

|

| | |

| Management’s Discussion and Analysis |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Unless the context otherwise requires, references in this report to “Andeavor Logistics LP,” “Andeavor Logistics,” “the Partnership,” “we,” “us” or “our” refer to Andeavor Logistics LP, one or more of its consolidated subsidiaries or all of them taken as a whole. Unless the context otherwise requires, references in this report to Andeavor refer collectively to Andeavor and any of its subsidiaries, other than Andeavor Logistics, its subsidiaries and its general partner. Unless the context otherwise requires, references in this report to “Predecessors” refer collectively to the acquired assets from Andeavor, and those assets, liabilities and results of operations.

Those statements in this section that are not historical in nature should be deemed forward-looking statements that are inherently uncertain. See “Important Information Regarding Forward-Looking Statements” section for a discussion of the factors that could cause actual results to differ materially from those projected in these statements.

This section should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2017.

Business Strategy and Overview

Overview

We are a leading full-service logistics company operating primarily in the western and inland regions of the United States. We own and operate networks of crude oil, refined products and natural gas pipelines, terminals with crude oil and refined product storage capacity, rail loading and offloading facilities, marine terminals, bulk petroleum distribution facilities, a trucking fleet and natural gas processing and fractionation complexes.

We are a fee-based, growth oriented Delaware limited partnership formed by Andeavor and are headquartered in San Antonio, Texas. Our assets are categorized into a Terminalling and Transportation segment, a Gathering and Processing segment, and a Wholesale segment. Approximately 59% of our total revenues for the three months ended March 31, 2018 were derived from Andeavor under various long-term, fee-based commercial agreements, the majority of which include minimum volume commitments.

On April 29, 2018, Andeavor and MPC entered into the MPC Merger Agreement under which MPC will acquire all of its outstanding shares. The transaction was unanimously approved by the boards of directors of both companies and is subject to regulatory and other customary closing conditions, including approvals from the shareholders of each company.

We generate revenues by charging fees for terminalling, transporting and storing crude oil and refined products, gathering crude oil and produced water, gathering and processing natural gas and selling fuel through wholesale commercial contracts. We do not engage in the trading of crude oil, natural gas, NGLs or refined products; therefore, we have minimal direct exposure to risks associated with commodity price fluctuations as part of our normal operations. However, we have certain natural gas gathering and processing contracts structured as POP arrangements. Under these POP arrangements, we gather and process the producers’ natural gas and market the natural gas and NGLs (“Equity NGLs”) and return the majority of the proceeds to the producer. Under these arrangements, we have exposure to fluctuations in commodity prices; however, this exposure is not expected to be material to our results of operations. Also, as part of the WNRL Merger, we acquired a wholesale fuel business that has exposure to commodity prices while the refined product is being transported but are mitigated by fixed margin contracts.

Effective October 30, 2017, we completed our merger with WNRL exchanging all outstanding common units of WNRL with units of Andeavor Logistics. WNRL’s assets include terminals, storage tanks, pipelines and other logistics assets related to the terminalling, transportation, storage and distribution of crude oil, refined products and asphalt. WNRL’s assets and operations include 705 miles of pipelines, approximately 12.4 million barrels of active storage capacity, distribution of wholesale petroleum products and crude oil and asphalt trucking. This acquisition along with the associated infrastructure and Andeavor’s refining and commercial capabilities well position us to pursue organic growth opportunities across our combined geographic footprint including the Midland and Delaware Basins of West Texas.

|

| | |

| Management’s Discussion and Analysis | |

Business Strategy and Goals

Our primary business objectives are to maintain and grow stable cash flows and to increase our quarterly cash distribution per unit over time. We intend to accomplish these objectives by executing the following strategies:

|

| | | |

| | Growing a stable, fee-based business that provides a competitive, full-service logistics offering to customers |

| |

| |

| | |

| | |

| | Optimizing Existing Asset Base | | ● Operating an incident free workplace

● Improving operational efficiency and maximizing asset utilization

● Expanding third-party business; delivering extraordinary customer service |

| |

| |

| | |

| | |

| | Pursuing Organic Expansion Opportunities | | ● Identifying and executing low-risk, high-return growth projects

● Investing to capture the full commercial value of logistics assets

● Growing asset capability to support Andeavor value chain optimization |

| |

| |

| | |

| | |

| | Growing through Third-Party Acquisitions | | ● Pursuing assets and businesses in strategic U.S. geographies that support an integrated business model, delivering synergies and growth

● Focusing on high quality assets that provide stable, fee-based income and enhancing organizational capacity |

| |

| |

| | |

| | |

| | Growing through Andeavor Strategic Expansion | | ● Strategically partnering with Andeavor on acquisitions in refining and marketing value chains

● Capturing full value of Andeavor’s embedded logistics assets |

| |

| |

| | |

Relative to these goals, in 2018, we intend to continue implementing this strategy and have completed or announced plans to expand our Terminalling and Transportation business across the western U.S. through:

| |

| • | increasing our terminalling volumes by expanding capacity and growing our third-party services at certain of our terminals; |

| |

| • | optimizing Andeavor volumes and growing third-party throughput at our Terminalling and Transportation assets; and |

| |

| • | pursuing strategic assets in the western U.S. |

In addition, we have completed or announced plans to grow our assets in our Gathering and Processing segment in support of third-party demand for crude oil, natural gas and water gathering services, natural gas processing services, as well as serving Andeavor’s demand for Bakken crude oil in the inland and west coast refining systems and providing crude oil supply to support Andeavor’s southwest refining system through our Permian Basin logistics assets, including:

| |

| • | further expanding capacity and capabilities as well as adding new origin and destination points for our common carrier pipelines in North Dakota and Montana; |

| |

| • | expanding our crude oil, natural gas and water gathering and associated gas processing footprint in the Bakken region to enhance and improve overall basin logistics efficiencies; |

| |

| • | expanding our crude oil gathering footprint in the Permian Basin, principally in the Delaware basin where Andeavor has a strong logistics asset base, crude oil marketing capabilities and meaningful refining offtake; and |

| |

| • | pursuing strategic assets across the western U.S. including potential acquisitions from Andeavor. |

Acquisitions

On May 1, 2018, we completed our acquisition of the Wamsutter Pipeline System from Plains All American Pipeline, L.P for total consideration of $180 million. The system consists of pipelines that transport crude oil to another third party pipeline system that supply the Salt Lake City area refineries, including Andeavor’s Salt Lake City refinery. We financed the acquisition using our Revolving Credit Facility. This acquisition is not material to our condensed consolidated financial statements.

Current Market Conditions

Although we have minimal exposure to commodity prices, pricing conditions were mixed for the products we handle during the first quarter. Crude oil and gasoline prices rose while natural gas and the majority of NGL prices fell. The price of the U.S.

|

| | |

| Management’s Discussion and Analysis |

domestic benchmark crude, West Texas Intermediate (WTI), gained over $4.50 per barrel in the quarter as the global market continued to show signs of rebalancing and high seasonal refinery runs drove total U.S. crude stocks below the 5-year average. The domestic rig count rose steadily throughout the first quarter, although at a more measured pace than previous quarters, as prices remain above breakeven levels in many basins. Despite the slower rate of rig additions, U.S. crude production notably exceeded historical records as producers continue to implement efficiencies and focus on core acreage. Additionally, growing export opportunities, particularly those to Latin America, are providing an incentive for U.S. refiners to maximize production of gasoline and diesel. These factors create a positive outlook for U.S. oil, gas, natural gas and refined product throughput volumes; however, regional impacts may differ.

Seasonal trends and continued healthy domestic economic conditions during the first quarter continued to support healthy refined product demand from our downstream and marketing customers. We continue to monitor the impact of commodity prices and fundamentals as it relates to our business. Given the outlined market conditions, we believe our diversified portfolio of businesses as well as our strong customer base are sufficient to continue to meet our goals and objectives outlined above.

Results of Operations

A discussion and analysis of the factors contributing to our results of operations presented below includes the consolidated financial results of Andeavor Logistics. The financial statements, together with the following information, are intended to provide investors with a reasonable basis for assessing our historical operations, but should not serve as the only criteria for predicting future performance.

Operating Metrics

Management utilizes the following operating metrics to evaluate performance and compare profitability to other companies in the industry (amounts may not recalculate due to rounding of dollar and volume information):

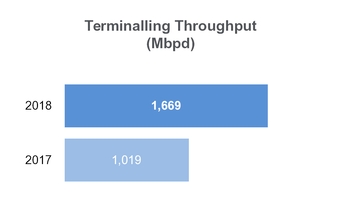

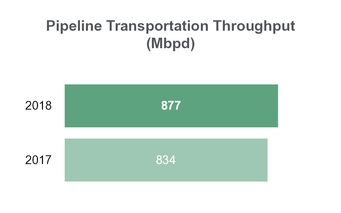

| |

| • | Average terminalling revenue per barrel - calculated as total terminalling revenue divided by terminalling throughput presented in thousands of barrels per day (“Mbpd”) multiplied by 1,000 and multiplied by the number of days in the period, (90 days for both the three months ended March 31, 2018 (the “2018 Quarter”) and three months ended March 31, 2017 (the “2017 Quarter”)); |

| |

| • | Average pipeline transportation revenue per barrel - calculated as total pipeline transportation revenue divided by pipeline transportation throughput presented in Mbpd multiplied by 1,000 and multiplied by the number of days in the period as outlined above; |

| |

| • | Average margin on NGL sales per barrel - calculated as the difference between the NGL sales revenues and the amounts recognized as NGL expense divided by our NGL sales volumes in barrels presented in Mbpd multiplied by 1,000 and multiplied by the number of days in the period as outlined above; |

| |

| • | Average gas gathering and processing revenue per Million British thermal units (“MMBtu”) - calculated as total gathering and processing fee-based revenue divided by gas gathering throughput presented in thousands of MMBtu per day (“MMBtu/d”) multiplied by 1,000 and multiplied by the number of days in the period as outlined above; |

| |

| • | Average crude oil and water gathering revenue per barrel - calculated as total crude oil and water gathering fee-based revenue divided by crude oil and water gathering throughput presented in Mbpd multiplied by 1,000 and multiplied by the number of days in the period as outlined above; and |

| |

| • | Wholesale fuel sales per gallon - calculated as wholesale fuel revenues divided by our total wholesale fuel sales volume in gallons. |

There are a variety of ways to calculate average revenue per barrel, average margin per barrel, average revenue per MMBtu, and sales per gallon; other companies may calculate these in different ways.

Non-GAAP Measures

As a supplement to our financial information presented in accordance with U.S. GAAP, our management uses certain “non-GAAP” measures to analyze our results of operations, assess internal performance against budgeted and forecasted amounts and evaluate future impacts to our financial performance as a result of capital investments, acquisitions, divestitures and other strategic projects. These measures are important factors in assessing our operating results and profitability and include:

| |

| • | Financial non-GAAP measure of EBITDA - calculated as U.S. GAAP-based net earnings before interest, income taxes and depreciation and amortization expense; |

| |

| • | Financial non-GAAP measure of Segment EBITDA - calculated as a segment’s U.S. GAAP-based operating income before depreciation and amortization expense plus equity in earnings (loss) of equity method investments and other income (expense), net; |

|

| | |

| Management’s Discussion and Analysis | |

| |

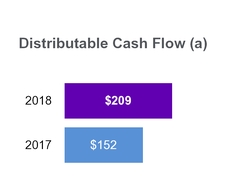

| • | Liquidity non-GAAP measure of distributable cash flow - calculated as U.S. GAAP-based net cash flow from operating activities adjusted for changes in working capital, amounts spent on maintenance capital net of reimbursements and other adjustments not expected to settle in cash; |

| |

| • | Liquidity non-GAAP measure of distributable cash flow attributable to common unitholders - calculated as distributable cash flow minus distributions associated with the Preferred Units; and |

| |

| • | Operating performance measure of average margin on NGL sales per barrel - calculated as the difference between the NGL sales revenues and the amounts recognized as NGL expense divided by our NGL sales volumes in barrels presented in Mbpd multiplied by 1,000 and multiplied by the number of days in the period as previously outlined. |

We present these measures because we believe they may help investors, analysts, lenders and ratings agencies analyze our results of operations and liquidity in conjunction with our U.S. GAAP results, including but not limited to:

| |

| • | our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; |

| |

| • | the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; |

| |

| • | our ability to incur and service debt and fund capital expenditures; and |

| |

| • | the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. |

Management also uses these measures to assess internal performance, and we believe they may provide meaningful supplemental information to the users of our financial statements. Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect net earnings, operating income and net cash from operating activities. These measures should not be considered substitutes for their most directly comparable U.S. GAAP financial measures.

For further information regarding these non-GAAP measures including the reconciliation of these non-GAAP measures to their most directly comparable U.S. GAAP financial measures, see “Non-GAAP Reconciliations” section below.