UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

(Mark One)

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______________to __________

Commission File Number 1‑35143

ANDEAVOR LOGISTICS LP

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 27‑4151603 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

| | | |

| 200 East Hardin Street, Findlay, Ohio 45840 |

| (Address of principal executive offices) (Zip Code) |

| |

| 419-421-2414 |

| (Registrant’s telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| | Large accelerated filer | þ | | Accelerated filer | o | |

| | Non-accelerated filer | o | | Smaller reporting company | o | |

| | | | | Emerging growth company | o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

There were 245,484,047 common units of the registrant outstanding at November 2, 2018.

Andeavor Logistics LP

Quarterly Report on Form 10-Q

For the Quarterly Period Ended September 30, 2018

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

Part I - Financial Information

Item 1. Financial Statements

Andeavor Logistics LP

Condensed Statements of Consolidated Operations

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2018 (a) | | 2017 (a) | | 2018 (a) | | 2017 (a) |

| | (In millions, except per unit amounts) |

| Revenues: (b) | | | | | | | |

| Affiliate | $ | 415 |

| | $ | 468 |

| | $ | 1,131 |

| | $ | 951 |

|

| Third-party | 227 |

| | 626 |

| | 626 |

| | 1,184 |

|

| Total Revenues | 642 |

| | 1,094 |

| | 1,757 |

| | 2,135 |

|

| Costs and Expenses: | | | | | | | |

| Cost of fuel and other (excluding items shown separately below) (b) | — |

| | 554 |

| | — |

| | 716 |

|

| NGL expense (excluding items shown separately below) | 73 |

| | 64 |

| | 166 |

| | 179 |

|

| Operating expenses (excluding depreciation and amortization) | 236 |

| | 199 |

| | 658 |

| | 512 |

|

| Depreciation and amortization expenses | 86 |

| | 85 |

| | 268 |

| | 222 |

|

| General and administrative expenses | 31 |

| | 44 |

| | 91 |

| | 107 |

|

| Loss (gain) on asset disposals and impairments | 1 |

| | 1 |

| | 2 |

| | (25 | ) |

| Operating Income | 215 |

| | 147 |

| | 572 |

| | 424 |

|

| Interest and financing costs, net | (57 | ) | | (68 | ) | | (172 | ) | | (193 | ) |

| Equity in earnings of equity method investments | 7 |

| | 6 |

| | 25 |

| | 13 |

|

| Other income, net | 1 |

| | 5 |

| | 4 |

| | 9 |

|

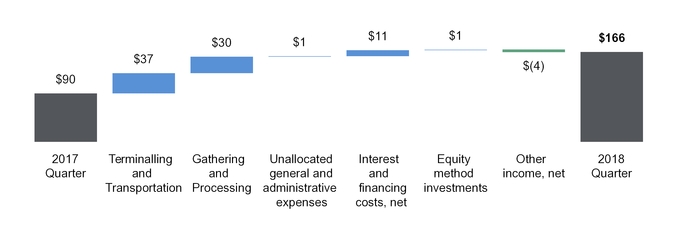

| Net Earnings | $ | 166 |

| | $ | 90 |

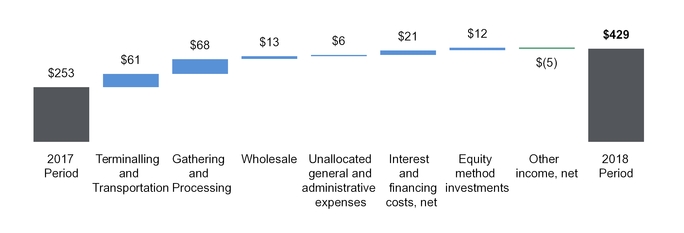

| | $ | 429 |

| | $ | 253 |

|

| | | | | | | | |

| Loss attributable to Predecessors | $ | 4 |

| | $ | 7 |

| | $ | 28 |

| | $ | 46 |

|

| Net Earnings Attributable to Partners | 170 |

| | 97 |

| | 457 |

| | 299 |

|

| Preferred unitholders’ interest in net earnings | (10 | ) | | — |

| | (34 | ) | | — |

|

| General partner’s interest in net earnings, including incentive distribution rights | — |

| | — |

| | — |

| | (79 | ) |

| Limited Partners’ Interest in Net Earnings | $ | 160 |

| | $ | 97 |

| | $ | 423 |

| | $ | 220 |

|

| | | | | | | | |

| Net earnings per limited partner unit | | | | | | | |

| Common - basic | $ | 0.68 |

| | $ | 0.90 |

| | $ | 1.91 |

| | $ | 2.05 |

|

| Common - diluted | $ | 0.68 |

| | $ | 0.90 |

| | $ | 1.91 |

| | $ | 2.05 |

|

| | | | | | | | |

| Weighted average limited partner units outstanding | | | | | | | |

| Common units - basic | 234.4 |

| | 108.0 |

| | 223.0 |

| | 107.0 |

|

| Common units - diluted | 234.6 |

| | 108.1 |

| | 223.2 |

| | 107.1 |

|

| | | | | | | | |

| Cash distributions paid per unit | $ | 1.030 |

| | $ | 0.971 |

| | $ | 3.045 |

| | $ | 2.821 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

| |

| (b) | Due to the adoption of the revenue recognition standard effective January 1, 2018, the revenues and costs associated with our fuel purchase and supply arrangements with Andeavor for the three and nine months ended September 30, 2018 were netted. See Note 1 for further discussion. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | |

| | September 30,

2018 | | December 31, 2017 (a) |

| | (In millions, except unit amounts) |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 30 |

| | $ | 75 |

|

| Receivables, net of allowance for doubtful accounts | | | |

| Trade and other | 250 |

| | 219 |

|

| Affiliate | 251 |

| | 264 |

|

| Prepayments and other current assets | 81 |

| | 27 |

|

| Total Current Assets | 612 |

| | 585 |

|

| Property, Plant and Equipment, Net | | | |

| Property, plant and equipment, at cost | 7,965 |

| | 7,243 |

|

| Accumulated depreciation | (1,215 | ) | | (994 | ) |

| Property, Plant and Equipment, Net | 6,750 |

| | 6,249 |

|

| Acquired Intangibles, Net | 1,116 |

| | 1,154 |

|

| Goodwill | 988 |

| | 956 |

|

| Equity Method Investments | 607 |

| | 440 |

|

| Other Noncurrent Assets, Net | 124 |

| | 121 |

|

| Total Assets | $ | 10,197 |

| | $ | 9,505 |

|

| | | | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Accounts payable | | | |

| Trade and other | $ | 201 |

| | $ | 186 |

|

| Affiliate | 254 |

| | 207 |

|

| Accrued interest and financing costs | 68 |

| | 40 |

|

| Other current liabilities | 81 |

| | 85 |

|

| Total Current Liabilities | 604 |

| | 518 |

|

| Debt, Net of Unamortized Issuance Costs | 4,829 |

| | 4,127 |

|

| Other Noncurrent Liabilities | 77 |

| | 54 |

|

| Total Liabilities | 5,510 |

| | 4,699 |

|

| Commitments and Contingencies (Note 8) |

|

| |

|

|

| Equity | | | |

| Equity of Predecessors | — |

| | 1,292 |

|

Preferred unitholders; 600,000 units issued and outstanding in 2018 and 2017 | 594 |

| | 589 |

|

Common unitholders; 245,472,743 units issued and outstanding (217,097,057 in 2017) | 4,093 |

| | 2,925 |

|

| Total Equity | 4,687 |

| | 4,806 |

|

| Total Liabilities and Equity | $ | 10,197 |

| | $ | 9,505 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Statements of Consolidated Cash Flows

(Unaudited)

|

| | | | | | | |

| | Nine Months Ended

September 30, |

| | 2018 (a) | | 2017 (a) |

| | (In millions) |

| Cash Flows From (Used In) Operating Activities | | | |

| Net earnings | $ | 429 |

| | $ | 253 |

|

| Adjustments to reconcile net earnings to net cash from operating activities: | | | |

| Depreciation and amortization expenses | 268 |

| | 222 |

|

| Loss (gain) on asset disposals and impairments | 2 |

| | (25 | ) |

| Other operating activities | 27 |

| | 23 |

|

| Changes in current assets and liabilities | 4 |

| | 62 |

|

| Changes in noncurrent assets and liabilities | (11 | ) | | (11 | ) |

| Net cash from operating activities | 719 |

| | 524 |

|

| Cash Flows From (Used In) Investing Activities | | | |

| Capital expenditures | (566 | ) | | (220 | ) |

| Acquisitions, net of cash | (379 | ) | | (1,230 | ) |

| Proceeds from sales of assets | — |

| | 46 |

|

| Net cash used in investing activities | (945 | ) | | (1,404 | ) |

| Cash Flows From (Used In) Financing Activities | | | |

| Borrowings under revolving credit agreements | 1,030 |

| | 319 |

|

| Repayments under revolving credit agreements | (333 | ) | | (614 | ) |

| Proceeds from issuance of common units, net of issuance costs | — |

| | 284 |

|

| Proceeds from issuance of general partner units, net of issuance costs | — |

| | 6 |

|

| Quarterly distributions to common unitholders | (620 | ) | | (329 | ) |

| Quarterly distributions to general partner | — |

| | (131 | ) |

| Distributions to preferred unitholders | (29 | ) | | — |

|

| Distributions in connection with acquisitions | (300 | ) | | (5 | ) |

| Sponsor contributions of equity to the Predecessors | 406 |

| | 678 |

|

| Capital contributions by affiliate | 27 |

| | 24 |

|

| Other financing activities | — |

| | (2 | ) |

| Net cash from financing activities | 181 |

| | 230 |

|

| Decrease in Cash and Cash Equivalents | (45 | ) | | (650 | ) |

| Cash and Cash Equivalents, Beginning of Period | 75 |

| | 688 |

|

| Cash and Cash Equivalents, End of Period | $ | 30 |

| | $ | 38 |

|

(a) Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion.

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Note 1 - Organization and Basis of Presentation

Organization

Andeavor Logistics LP (“Andeavor Logistics” or the “Partnership”) is a fee-based, growth-oriented Delaware limited partnership formed in December 2010 by Andeavor and its wholly-owned subsidiary, Tesoro Logistics GP, LLC (“TLGP”), our general partner, to own, operate, develop and acquire logistics and related assets and businesses. Unless the context otherwise requires, references in this report to “we,” “us,” “our,” or “ours” refer to Andeavor Logistics LP, one or more of its consolidated subsidiaries, or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Andeavor” refer collectively to Andeavor for all activity through September 30, 2018, or Andeavor LLC, successor-by-merger to Andeavor effective October 1, 2018 and a wholly owned subsidiary of Marathon Petroleum Corporation (“MPC” or “Marathon”), and any of Andeavor’s or Andeavor LLC’s subsidiaries, as applicable, other than Andeavor Logistics, its subsidiaries and its general partner.

Marathon Petroleum Corporation Merger

On October 1, 2018, MPC completed its acquisition of Andeavor in accordance with the Agreement and Plan of Merger, dated as of April 29, 2018, as amended (the “MPC Merger Agreement”), under which MPC acquired all of Andeavor’s outstanding shares (the “MPC Merger”). Following the MPC Merger, MPC is the beneficial owner of approximately 156 million common units out of approximately 245 million common units outstanding in the Partnership as of October 1, 2018, representing an approximate 64% limited partner interest. MPC is also the beneficial owner of 100% of the equity interests of TLGP.

Principles of Consolidation and Basis of Presentation

Principles of Consolidation

Assets acquired from Andeavor, and the associated liabilities and results of operations, are collectively referred to as the “Predecessors.” See Note 1 of our Annual Report on Form 10-K for the year ended December 31, 2017 and Note 2 for additional information regarding the assets acquired from Andeavor.

Transfers of businesses between entities under common control are accounted for as if the transfer occurred at the beginning of the period, and prior periods are retrospectively adjusted to furnish comparative information. On August 6, 2018, we acquired Permian, refining logistics and asphalt assets (the “2018 Drop Down”) from Andeavor. See Note 2 for additional information. As an entity under common control with Andeavor, we record the assets that we acquire from Andeavor, on our condensed consolidated balance sheet at Andeavor’s historical basis instead of fair value. Accordingly, the accompanying financial statements and related notes of Andeavor Logistics have been retrospectively adjusted to include the historical results of the assets acquired prior to the effective date of the acquisition.

The financial statements of our Predecessors have been prepared from the separate records maintained by Andeavor and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessors had been operated as an unaffiliated entity. For the nine months ended September 30, 2018, the Partnership’s net cash from operating activities includes $40 million and net cash used in investing activities of $446 million from our Predecessors, offset by sponsor contributions of equity to the Predecessors in net cash from financing activities. The Partnership’s operating activities and investing activities for the nine months ended September 30, 2017 include $25 million and $653 million, respectively, of cash used by our Predecessors, offset by sponsor contributions of equity to the Predecessors in net cash from financing activities.

We acquired certain logistics assets located in Anacortes, Washington (the “Anacortes Logistics Assets”) in 2017. While this acquisition is a common control transaction, prior periods have not been recast as these assets did not constitute a business in accordance with Accounting Standards Update (“ASU”) 2017-01, “Clarifying the Definition of a Business.”

The interim condensed consolidated financial statements and notes thereto have been prepared by management without audit according to the rules and regulations of the Securities and Exchange Commission (“SEC”) and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Basis of Presentation

We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared under U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying interim condensed consolidated financial statements and notes should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2017. Certain prior year balances have been aggregated or disaggregated in order to conform to the current year presentation, including the adoption of recent accounting standards discussed further below.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

We are required under U.S. GAAP to make estimates and assumptions that affect the amounts of assets and liabilities and revenues and expenses reported as of and during the periods presented. We review our estimates on an ongoing basis using currently available information. Changes in facts and circumstances may result in revised estimates, and actual results could differ from those estimates. The results of operations of the Partnership for any interim period are not necessarily indicative of results for the full year.

Cost Classifications

Natural gas liquids (“NGL”) expense results from the cost of NGL purchases under our percent of proceeds (“POP”) arrangements as well as the non-cash acquisition of replacement dry gas under our keep-whole arrangements.

During the three and nine months ended September 30, 2017, cost of fuel and other included the purchase cost of refined products sold within our Wholesale segment, the cost of inbound transportation and distribution costs incurred to transport product to our customers. Due to the adoption of ASU 2014-09, “Revenue from Contracts with Customers,” and the associated subsequent amendments (collectively, “ASC 606”) on January 1, 2018, the revenues and costs associated with our fuel purchase and supply arrangements were netted, as further described in Note 10.

Operating expenses are comprised of direct operating costs including costs incurred for direct labor, repairs and maintenance, outside services, chemicals and catalysts, utility costs, including the purchase of electricity and natural gas used by our facilities, property taxes, environmental compliance costs related to current period operations, rent expense and other direct operating expenses incurred in the provision of services.

Depreciation and amortization expenses consist of the depreciation and amortization of property, plant and equipment, deferred charges and intangible assets. General and administrative expenses represent costs that are not directly or indirectly related to or otherwise are not allocated to our operations. NGL expense, direct operating expenses, and depreciation and amortization expenses recognized by our Terminalling and Transportation, Gathering and Processing, and Wholesale segments constitute costs of revenue as defined by U.S. GAAP.

Financial Instruments

The fair value of our senior notes is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The borrowings under our amended revolving credit facility (the “Revolving Credit Facility”) and our dropdown credit facility (“Dropdown Credit Facility”), which include a variable interest rate, approximate fair value. The carrying value and fair value of our debt were both $4.9 billion as of September 30, 2018 and were $4.2 billion and $4.3 billion at December 31, 2017, respectively. These carrying and fair values of our debt exclude the unamortized issuance costs, which are netted against our total debt.

We believe the carrying value of our other financial instruments, including cash and cash equivalents, receivables, accounts payable and certain accrued liabilities, approximate fair value. Our fair value assessment incorporates a variety of considerations, including the short-term duration of the instruments and the expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk.

New Accounting Standards and Disclosures

Revenue Recognition

In May 2014, the Financial Accounting Standards Board (“FASB”) issued ASC 606 to replace existing revenue recognition rules with a single comprehensive model to use in accounting for revenue arising from contracts with customers. Under ASC 606, revenue is recognized when a customer obtains control of promised goods or services for an amount that reflects the consideration the entity expects to receive in exchange for those goods or services. In addition, ASC 606 requires expanded disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

We adopted ASC 606 on January 1, 2018 utilizing the modified retrospective method. We recognized a $22 million reduction to the opening balance of partners’ equity as of January 1, 2018 for the cumulative effect adjustment related to contracts in process but not substantially complete as of that date. We reflected the aggregate impact of all modifications executed and effective as of January 1, 2018 in applying the new standard to these contracts. The cumulative effect adjustment is primarily related to the period over which revenue is recognized on contracts for which customers pay minimum throughput volume commitments and claw-back provisions apply. Additionally, upon the adoption of ASC 606, the gross versus net presentation of certain contractual arrangements and taxes has changed as further described in Note 10. The current period results and balances are presented in accordance with ASC 606, while comparative periods continue to be presented in accordance with the accounting standards in effect for those periods.

For the three and nine months ended September 30, 2018, we recorded lower revenues of $709 million and $2.0 billion, respectively, and lower costs and expenses of $709 million and $2.0 billion, respectively, for presentation impacts of applying ASC 606. These impacts were primarily associated with the netting of revenues and costs associated with our fuel purchase and supply arrangements with Andeavor, as further described in Note 10. We recorded lower revenues of $13 million and $10 million

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

associated with minimum volume commitments during the three and nine months ended September 30, 2018, respectively, as a result of applying the new standard. There were no material impacts during the period to the condensed consolidated balance sheets or condensed statement of consolidated cash flows, as a result of the adoption.

Leases

In February 2016, the FASB issued ASU 2016-02, “Leases” (“ASU 2016-02”), which amends existing accounting standards for lease accounting and adds additional disclosures about leasing arrangements. Under the new guidance, lessees are required to recognize right-of-use assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either a financing lease or operating lease with classification affecting the pattern of expense recognition in the condensed statements of consolidated operations and presentation of cash flows in the condensed statements of consolidated cash flows. The new standard also requires additional disclosures to help financial statement users better understand the amount, timing, and uncertainty of cash flows arising from leases. ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, and interim reporting periods within those annual reporting periods, with early adoption being permitted. In July 2018, the FASB issued ASU 2018-11, which permits entities with the option to adopt the provisions of ASU 2016-02 prospectively without adjusting comparative periods. We will elect this option and adopt the standard on January 1, 2019. In addition, we also expect to adopt the package of practical expedients which allows an entity, on the date of adoption, to not reassess expired or existing contracts in whether they are a lease or contain a lease and to not reassess the historical lease classification for expired or existing leases.

We continue to progress through our implementation plan, which includes the following activities: testing and implementing a new lease accounting system, finalizing design and implementation of new business processes and related internal controls, the continued extraction of the required accounting and reporting data from our lease agreements as well as the continued assessment and documentation of the accounting impacts related to the new standard. While we are still working through our implementation plan, we do expect that the recognition of right-of-use assets and lease liabilities, which are not currently reflected on our consolidated balance sheets, will have a material impact on total assets and liabilities. However, we do not expect the adoption of the standard to have a material impact on our statement of consolidated operations or liquidity. At this time, we are unable to estimate the full impact of the standard given we are still extracting the accounting data from our lease agreements as well as testing and implementing our new lease accounting system, which will be used to calculate the accounting impacts.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU requires the estimation of credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. ASU 2016-13 is effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect to early adopt ASU 2016-13 and we do not expect the adoption of this standard to have a material impact on our condensed consolidated financial statements.

Restricted Cash

In November 2016, the FASB issued ASU 2016-18, "Restricted Cash" (“ASU 2016-18”), which clarifies how restricted cash and restricted cash equivalents are presented in the statements of cash flows. The ASU requires that changes in restricted cash that result from transfers between cash, cash equivalents and restricted cash should not be presented as cash flow activities in the statements of cash flows. ASU 2016-18 was effective for annual reporting periods beginning after December 15, 2017, and interim reporting periods within those annual reporting periods. We adopted ASU 2016-08 as of January 1, 2018 on a retrospective basis. Adoption of this standard resulted in an increase in cash and cash equivalents during the second quarter of 2017 of $14 million, but the restriction was released during the third quarter of 2017 as the cash was used to reinvest in assets used in our business and as a payment of debt. As a result, the adoption of this standard did not have an impact on our condensed statement of consolidated cash flows for the nine months ended September 30, 2017. See Note 2 for further information regarding restricted cash.

Pension and Postretirement Costs

In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (“ASU 2017-07”), which requires the current service-cost component of net benefit costs to be presented similarly with other current compensation costs for related employees on the statement of consolidated operations and stipulates that only the service cost component of net benefit cost is eligible for capitalization. Additionally, the Partnership will present other components of net benefit costs elsewhere on the condensed statements of consolidated operations since these costs are allocated to the Partnership’s financial statements by Andeavor. The amendments to the presentation of the condensed statements of consolidated operations in this update should be applied retrospectively while the change in capitalized benefit cost is to be applied prospectively. We adopted ASU 2017-07 as of January 1, 2018. Adoption of the standard resulted in an increase to interest and financing costs of $2 million and $6 million, respectively, with a corresponding increase to other income of $2 million and $6 million, respectively, for the three and nine months ended September 30, 2017 with no impact to net earnings. ASU 2017-07 does not impact the condensed consolidated balance sheets or condensed statements of consolidated cash flows.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Stock Compensation

In June 2018, the FASB issued ASU 2018-07, “Improvements to Nonemployee Share-Based Payment Accounting” (“ASU 2018-07”), which expands the scope of Topic 718 to include share-based payment awards to nonemployees and eliminates the classification differences for employee and nonemployee share-based payment awards. This guidance is effective for interim and annual periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2018-07, we do not expect the adoption of this standard to have a material impact on our condensed consolidated financial statements.

Note 2 - Acquisitions and Divestitures

Acquisitions

2018 Drop Down

On August 6, 2018, we completed the 2018 Drop Down for total consideration of $1.55 billion comprised of $300 million in cash financed with borrowings under our Dropdown Credit Facility and 28,283,742 newly issued common units of the Partnership with a fair value of $1.25 billion. These assets include gathering, storage and transportation assets in the Permian Basin; legacy Western Refining, Inc. assets and associated crude terminals; the majority of Andeavor’s remaining refining terminalling, transportation and storage assets; and equity method investments in Andeavor Logistics RIO Pipeline LLC (“ALRP”), Minnesota Pipe Line Company, LLC (“MPL”), and PNAC, LLC (“PNAC”). In addition, the Conan Crude Oil Gathering System and the Los Angeles Refinery Interconnect Pipeline (“LARIP”) were transferred at cost plus incurred interest. In conjunction with the 2018 Drop Down, we entered into additional commercial agreements with Andeavor. See Note 3 for further information regarding these agreements.

The 2018 Drop Down includes:

| |

| • | Crude oil and other feedstock storage tankage and refined product storage tankage at Andeavor’s Mandan, Salt Lake City and Los Angeles refineries; |

| |

| • | Rail terminals and truck racks at Andeavor’s Mandan, Salt Lake City and Los Angeles refineries for the loading and unloading of various refined products from manifest and other railcars and trucks, respectively; |

| |

| • | Interconnecting pipeline facilities in the Los Angeles area as well as other railroad tracks and adjoining lands; |

| |

| • | Mesquite and Yucca truck unloading stations in New Mexico for the unloading of crude trucks and injection of crude into the TexNewMex pipeline; |

| |

| • | Mason East and Jackrabbit (“Wink”) truck unloading and injection stations in Texas that receive crude via the T-Station line and trucks for injection into the Kinder Morgan and Bobcat Pipeline; |

| |

| • | The Jal storage, injection and rail unloading facility in New Mexico that stores and supplies natural gas liquids for use in Andeavor’s El Paso refinery; |

| |

| • | Natural gas liquid storage tankage, a rail and truck terminal for the loading and unloading of natural gas liquids from railcars and trucks as well as from the waterline at the Wingate facility in New Mexico; |

| |

| • | Crude oil and other feedstock storage tankage at the Clearbrook terminal in Minnesota; |

| |

| • | Bobcat Pipeline that transports crude oil between the Mason East Station and the Wink Station; |

| |

| • | Benny Pipeline that delivers crude oil from the Conan terminal in Texas to a connection with gathering lines in New Mexico; |

| |

| • | All of the issued and outstanding limited liability company interests in: (i) Tesoro Great Plains Midstream LLC, which owns BakkenLink Pipeline LLC, (ii) Andeavor MPL Holdings LLC, which holds the investment in MPL, (iii) Andeavor Logistics CD LLC, (iv) Western Refining Conan Gathering, LLC, which owns the Conan Crude Oil Gathering System (v) Western Refining Delaware Basin Storage, LLC, (vi) Asphalt Terminals LLC, which holds the investment in PNAC, and (vii) 67% of all of the issued and outstanding limited liability company interests in ALRP; and |

| |

| • | Certain related real property interests. |

SLC Core Pipeline System

On May 1, 2018, we completed our acquisition of the SLC Core Pipeline System (formerly referred to as the Wamsutter Pipeline System) from Plains All American Pipeline, L.P. for total consideration of $180 million. The system consists of pipelines that transport crude oil to another third-party pipeline system that supply the Salt Lake City area refineries, including Andeavor’s Salt Lake City refinery. We financed the acquisition using our Revolving Credit Facility. This acquisition is not material to our condensed consolidated financial statements and its operating results are reported in our Terminalling and Transportation segment.

Western Refining Logistics, LP Merger

Effective October 30, 2017, Andeavor Logistics closed its merger with Western Refining Logistics, LP (“WNRL”) (the “WNRL Merger”), exchanging all outstanding common units of WNRL for units of Andeavor Logistics, representing an equity value of $1.7 billion.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Andeavor Logistics accounted for the WNRL Merger as a common control transaction and, accordingly, inherited Andeavor’s basis in WNRL’s net assets. Andeavor accounted for the acquisition of WNRL using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values and liabilities assumed be recognized on the balance sheet as of the acquisition date, or June 1, 2017, the date Andeavor acquired WNRL. The purchase price allocation for the WNRL Merger has been allocated based on fair values of the assets acquired and liabilities assumed at the acquisition date. The allocation of the WNRL purchase price was final as of May 31, 2018. Prior to the purchase price finalization, we recorded adjustments to the allocation to increase property, plant and equipment and reduce goodwill by $7 million during 2018.

Acquisition Date Purchase Price Allocation (in millions)

|

| | | |

| Cash | $ | 22 |

|

| Receivables | 112 |

|

| Inventories | 11 |

|

| Prepayments and Other Current Assets | 25 |

|

| Property, Plant and Equipment (a) | 1,357 |

|

| Goodwill | 558 |

|

| Acquired Intangibles | 130 |

|

| Other Noncurrent Assets | 2 |

|

| Accounts Payable | (167 | ) |

| Accrued Liabilities | (41 | ) |

| Debt | (347 | ) |

| Total purchase price | $ | 1,662 |

|

| |

| (a) | Estimated useful lives ranging from 3 to 22 years have been assumed based on the valuation. |

Goodwill

We evaluated several factors that contributed to the amount of goodwill presented above. These factors include the acquisition of a logistics business located in advantageous areas where there is crude oil marketing capabilities and meaningful refining offtake with an assembled workforce that cannot be duplicated at the same costs by a new entrant. Further, the WNRL Merger provides a platform for future growth through operating efficiencies Andeavor Logistics expects to gain from the application of best practices across the combined company and an ability to realize synergies from the geographic diversification of Andeavor Logistics’ business and rationalization of general and administrative costs. We allocated $352 million, $144 million and $62 million of goodwill to the Gathering and Processing, Terminalling and Transportation, and Wholesale segments, respectively.

Property, Plant and Equipment

The fair value of property, plant and equipment is $1.4 billion. This fair value is based on a valuation using a combination of the income, cost and market approaches. The useful lives of acquired assets have been aligned to similar assets at Andeavor Logistics.

Acquired Intangible Assets

The fair value of the acquired identifiable intangible assets is $130 million. This fair value is based on valuation completed for the business enterprise, along with the related tangible assets, using a combination of the income method, cost method and comparable market transactions. We recognized intangible assets associated with customer relationships of $130 million with third parties, all of which will be amortized on a straight-line basis over a weighted average useful life of 15 years. The accumulated amortization of our finite life intangibles acquired from the WNRL Merger was $12 million as of September 30, 2018. Amortization expense related to the acquired intangible assets is expected to be approximately $9 million per year for the next 15 years.

WNRL Revenues and Net Earnings

During the nine months ended September 30, 2018, we recognized $303 million in revenues and $87 million of net earnings related to the business acquired.

Pro Forma Financial Information

The following unaudited pro forma information combines the historical operations of Andeavor Logistics and WNRL, giving effect to the WNRL Merger and related transactions as if they had been consummated on January 1, 2017, the beginning of the earliest period presented.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Pro Forma Consolidated Revenues and Consolidated Net Earnings (in millions)

|

| | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2017 | | September 30, 2017 |

| Revenues | $ | 1,094 |

| | $ | 3,172 |

|

| Net earnings (a) | 90 |

| | 258 |

|

| |

| (a) | While many recurring adjustments impact the pro forma figures presented, the pro forma condensed statements of consolidated operations for the three and nine months ended September 30, 2017 includes a significant non-recurring adjustment to recognize the WNRL Merger acquisition and integration costs and reflects these costs in the first quarter of 2017, the period the acquisition was assumed to be completed for pro forma purposes. For the nine months ended September 30, 2017, we recognized acquisition costs related to the WNRL Merger of $17 million as well as $3 million of severance costs. |

Post-Acquisition Financial Information

The following tables present our unaudited results of operations disaggregated to present results relating to the Partnership and the Predecessors for the assets acquired from Andeavor and the total amounts included in our combined consolidated financial statements for the three and nine months ended September 30, 2018 and 2017.

Reconciliation of Combined Financial Statements (in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| | Combined | | Andeavor Logistics LP | | Predecessors | | Combined | | Andeavor Logistics LP | | Predecessors |

| | | | | | | | | | | | |

| Revenues | | | | | | | | | | | |

| Affiliate | $ | 415 |

| | $ | 411 |

| | $ | 4 |

| | $ | 1,131 |

| | $ | 1,110 |

| | $ | 21 |

|

| Third-party | 227 |

| | 224 |

| | 3 |

| | 626 |

| | 617 |

| | 9 |

|

| Total Revenues | 642 |

| | 635 |

| | 7 |

| | 1,757 |

| | 1,727 |

| | 30 |

|

| Costs and Expenses | | | | | | | | | | | |

| NGL expense (exclusive of items shown separately below) | 73 |

| | 73 |

| | — |

| | 166 |

| | 166 |

| | — |

|

| Operating expenses (exclusive of depreciation and amortization) | 236 |

| | 227 |

| | 9 |

| | 658 |

| | 618 |

| | 40 |

|

| Depreciation and amortization expenses | 86 |

| | 83 |

| | 3 |

| | 268 |

| | 246 |

| | 22 |

|

| General and administrative expenses | 31 |

| | 30 |

| | 1 |

| | 91 |

| | 82 |

| | 9 |

|

| Loss on asset disposals and impairments | 1 |

| | 1 |

| | — |

| | 2 |

| | 2 |

| | — |

|

| Operating Income (Loss) | 215 |

| | 221 |

| | (6 | ) | | 572 |

| | 613 |

| | (41 | ) |

| Interest and financing costs, net | (57 | ) | | (56 | ) | | (1 | ) | | (172 | ) | | (168 | ) | | (4 | ) |

| Equity in earnings of equity method investments | 7 |

| | 4 |

| | 3 |

| | 25 |

| | 9 |

| | 16 |

|

| Other income, net | 1 |

| | 1 |

| | — |

| | 4 |

| | 3 |

| | 1 |

|

| Net Earnings (Loss) | $ | 166 |

| | $ | 170 |

| | $ | (4 | ) | | $ | 429 |

| | $ | 457 |

| | $ | (28 | ) |

| Loss attributable to Predecessors | 4 |

| | — |

| | 4 |

| | 28 |

| | — |

| | 28 |

|

| Net Earnings Attributable to Partners | 170 |

| | 170 |

| | — |

| | 457 |

| | 457 |

| | — |

|

| Preferred unitholders’ interest in net earnings | (10 | ) | | (10 | ) | | — |

| | (34 | ) | | (34 | ) | | — |

|

| Limited Partners’ Interest in Net Earnings | $ | 160 |

| | $ | 160 |

| | $ | — |

| | $ | 423 |

| | $ | 423 |

| | $ | — |

|

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Reconciliation of Combined Financial Statements (in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2017 | | Nine Months Ended September 30, 2017 |

| | Combined | | Andeavor Logistics LP | | Predecessors | | Combined | | Andeavor Logistics LP | | Predecessors |

| | | | | | | | | | | | |

| Revenues | | | | | | | | | | | |

| Affiliate | $ | 468 |

| | $ | 219 |

| | $ | 249 |

| | $ | 951 |

| | $ | 624 |

| | $ | 327 |

|

| Third-party | 626 |

| | 225 |

| | 401 |

| | 1,184 |

| | 653 |

| | 531 |

|

| Total Revenues | 1,094 |

| | 444 |

| | 650 |

| | 2,135 |

| | 1,277 |

| | 858 |

|

| Costs and Expenses | | | | | | | | | | | |

| Cost of fuel and other (exclusive of items shown separately below) (a) | 554 |

| | — |

| | 554 |

| | 716 |

| | — |

| | 716 |

|

| NGL expense (exclusive of items shown separately below) | 64 |

| | 64 |

| | — |

| | 179 |

| | 179 |

| | — |

|

| Operating expenses (exclusive of depreciation and amortization) | 199 |

| | 141 |

| | 58 |

| | 512 |

| | 399 |

| | 113 |

|

| Depreciation and amortization expenses | 85 |

| | 60 |

| | 25 |

| | 222 |

| | 178 |

| | 44 |

|

| General and administrative expenses | 44 |

| | 27 |

| | 17 |

| | 107 |

| | 78 |

| | 29 |

|

| (Gain) loss on asset disposals and impairments | 1 |

| | 1 |

| | — |

| | (25 | ) | | (24 | ) | | (1 | ) |

| Operating Income (Loss) | 147 |

| | 151 |

| | (4 | ) | | 424 |

| | 467 |

| | (43 | ) |

| Interest and financing costs, net | (68 | ) | | (61 | ) | | (7 | ) | | (193 | ) | | (184 | ) | | (9 | ) |

| Equity in earnings of equity method investments | 6 |

| | 2 |

| | 4 |

| | 13 |

| | 7 |

| | 6 |

|

| Other income, net | 5 |

| | 5 |

| | — |

| | 9 |

| | 9 |

| | — |

|

| Net Earnings (Loss) | $ | 90 |

| | $ | 97 |

| | $ | (7 | ) | | $ | 253 |

| | $ | 299 |

| | $ | (46 | ) |

| Loss attributable to Predecessors | 7 |

| | — |

| | 7 |

| | 46 |

| | — |

| | 46 |

|

| Net Earnings Attributable to Partners | 97 |

| | 97 |

| | — |

| | 299 |

| | 299 |

| | — |

|

| General partner’s interest in net earnings, including incentive distribution rights | — |

| | — |

| | — |

| | (79 | ) | | (79 | ) | | — |

|

| Limited Partners’ Interest in Net Earnings | $ | 97 |

| | $ | 97 |

| | $ | — |

| | $ | 220 |

| | $ | 220 |

| | $ | — |

|

Divestitures

Alaska Storage and Terminalling Assets

On June 2, 2017, due to Andeavor’s consent decree with the state of Alaska associated with our 2016 acquisition of certain terminalling and storage assets owned by Andeavor, we sold one of our existing Alaska products terminals (“Alaska Terminal”) for $28 million. The sale resulted in a $25 million gain on sale in our condensed statements of consolidated operations for the nine months ended September 30, 2017. The Alaska Terminal divestiture did not have an impact on our operations.

WNRL Lubricant Operations

On June 30, 2017, WNRL sold its remaining lubricant operations located in Arizona and Nevada for $14 million. There was no gain or loss resulting from this sale. Due to provisions in WNRL’s senior secured revolving credit facility agreement and senior notes indenture, the proceeds received from the sale of the lubricant operations were restricted to be used in the business or as a prepayment of debt. This cash was used during the third quarter of 2017 to reinvest in assets used in its business and as a payment of debt.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Note 3 - Related-Party Transactions

Affiliate Agreements

The Partnership has various long-term, fee-based commercial agreements with Andeavor, under which we provide terminal distribution, storage services, pipeline transportation, crude oil, natural gas and produced water gathering and processing, wholesale, and trucking services to Andeavor, and Andeavor commits to provide us with minimum monthly throughput volumes of crude oil, refined products and other. If, in any calendar month, Andeavor fails to meet its minimum volume commitments under these agreements, it will be required to pay us a shortfall payment. For the NGLs that we handle under keep-whole agreements, the Partnership transfers the commodity risk exposure associated with these keep-whole agreements to Andeavor pursuant to the Keep-Whole Commodity Fee Agreement, as amended (the “Keep-Whole Commodity Agreement”). Under the Keep-Whole Commodity Agreement, Andeavor pays us a processing fee for NGLs related to the keep-whole agreements and delivers replacement dry gas to the producers on our behalf. We then pay Andeavor a marketing fee in exchange for assuming the commodity risk. The terms and pricing of this agreement are subject to revision each year.

In conjunction with the 2018 Drop Down, the Partnership entered into additional commercial agreements with Andeavor.

Commercial Agreements with Andeavor

|

| | | | | |

| | | | | Termination Provisions |

| Commercial Agreement | Initiation Date | Term | Renewals | Refinery Shutdown Notice Period (a) | Force Majeure |

| Transportation Services Agreement (LAR Interconnecting Pipelines) | August 2018 | 10 years | 2 x 5 years | 12 months | Andeavor Logistics can declare (unilateral) |

| Master Terminalling Services Agreement | August 2018 | 10 years | 2 x 5 years |

| Master Unloading and Storage Agreement (WNRL) | August 2018 | 10 years | 2 x 5 years | N/A |

| Asphalt Terminalling, Transportation and Storage Services Agreement | August 2018 | 10 years | 2 x 5 years |

| |

| (a) | Fixed minimum volumes remain in effect during routine turnarounds. |

In addition, we have agreements for the provision of various general and administrative services by Andeavor. Under our partnership agreement, we are required to reimburse TLGP and its affiliates for all costs and expenses they incur on our behalf for managing and controlling our business and operations. Except to the extent specified under our amended omnibus agreement (the “Amended Omnibus Agreement”) or our amended secondment agreement (the “Amended Secondment Agreement”), TLGP determines the amount of these expenses. The Amended Omnibus Agreement was most recently amended and restated as of September 28, 2018. Under the terms of the Amended Omnibus Agreement in effect as of September 30, 2018, we are required to pay Andeavor an annual corporate services fee of approximately $17 million for the provision of various centralized corporate services, including executive management, legal, accounting, treasury, human resources, health, safety and environmental, information technology, certain insurance coverage, administration and other corporate services. Andeavor charged the Partnership $28 million and $6 million pursuant to the Amended Secondment Agreement for the three months ended September 30, 2018 and 2017, respectively, with $38 million and $16 million for the nine months ended September 30, 2018 and 2017, respectively, reflecting increased services provided in conjunction with the assets acquired in the 2018 Drop Down. Additionally, pursuant to the Amended Omnibus Agreement and Amended Secondment Agreement, we reimburse Andeavor for any direct costs incurred by Andeavor in providing other operational services with respect to certain of our other assets and operations. In conjunction with the 2018 Drop Down, we entered into a construction service agreement with Andeavor to complete the construction of LARIP (the “Construction Service Agreement”). Andeavor charged the Partnership $11 million pursuant to the Construction Service Agreement during the three and nine months ended September 30, 2018.

Summary of Affiliate Transactions

Summary of Revenue and Expense Transactions with Andeavor, Including Predecessors (in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues (a) | $ | 415 |

| | $ | 468 |

| | $ | 1,131 |

| | $ | 951 |

|

| Operating expenses (b) | 82 |

| | 67 |

| | 216 |

| | 185 |

|

| General and administrative expenses | 31 |

| | 30 |

| | 77 |

| | 77 |

|

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

| |

| (a) | Andeavor accounted for 65% and 43% of our total revenues for the three months ended September 30, 2018 and 2017, respectively, and 64% and 45% for the nine months ended September 30, 2018 and 2017, respectively. |

| |

| (b) | Net of reimbursements from Andeavor pursuant to the Amended Omnibus Agreement, the Carson Assets Indemnity Agreement and other affiliate agreements of $2 million and $7 million for the three months ended September 30, 2018 and 2017 respectively, and $12 million for both the nine months ended September 30, 2018 and 2017. |

Distributions

In accordance with our partnership agreement, the unitholders of our limited partner interests are entitled to receive quarterly distributions of available cash. During the nine months ended September 30, 2018, we paid quarterly cash distributions of $347 million to Andeavor. On October 26, 2018, we declared a quarterly cash distribution of $1.03 per unit, which will be paid on November 14, 2018. The distribution will include a payment of $146 million to Marathon. TLGP’s distribution waivers for 2018 and 2019 remain in effect as instituted in 2017 under the terms of our partnership agreement.

Note 4 - Property, Plant and Equipment

Property, Plant & Equipment (in millions)

|

| | | | | | | |

| | September 30,

2018 | | December 31, 2017 (a) |

| Terminals and tankage | $ | 3,595 |

| | $ | 3,557 |

|

| Pipelines | 3,344 |

| | 2,825 |

|

| Land and leasehold improvements | 289 |

| | 282 |

|

| Buildings and improvements | 94 |

| | 91 |

|

| Other | 142 |

| | 142 |

|

| Construction in progress | 501 |

| | 346 |

|

| Property, Plant and Equipment, at Cost | 7,965 |

| | 7,243 |

|

| Accumulated Depreciation | (1,215 | ) | | (994 | ) |

| Property, Plant and Equipment, Net | $ | 6,750 |

| | $ | 6,249 |

|

| |

| (a) | Property, plant and equipment transferred to the Partnership in the 2018 Drop Down was recorded at historical costs. The Partnership recorded property, plant and equipment of $948 million and accumulated depreciation of $112 million as of December 31, 2017 in connection with the 2018 Drop Down. |

Note 5 - Goodwill

Goodwill represents the excess of the consideration paid over the fair value of the net assets acquired in a business combination. Goodwill acquired in a business combination is not amortized, but instead tested for impairment at least annually or more frequently should an event occur or circumstances indicate that the carrying amount may be impaired. Goodwill impairment testing is performed at the reporting unit level on November 1 of each year and when circumstances change that might indicate impairment. There were no impairments of goodwill during the three and nine months ended September 30, 2018 and 2017.

Goodwill by Operating Segment (in millions)

|

| | | | | | | |

| | September 30,

2018 | | December 31, 2017 (a) |

| Terminalling and Transportation (b) | $ | 231 |

| | $ | 260 |

|

| Gathering and Processing (b) | 695 |

| | 607 |

|

| Wholesale | 62 |

| | 89 |

|

| Goodwill | $ | 988 |

| | $ | 956 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

| |

| (b) | Goodwill transferred to the Partnership in the 2018 Drop Down was recorded at historical cost. We recorded goodwill of $39 million and $225 million in our Terminalling and Transportation and Gathering and Processing segments, respectively, as of December 31, 2017 as a result of the 2018 Drop Down. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Note 6 - Equity Method Investments and Joint Ventures

For each of the following investments, we have the ability to exercise significant influence over each of these investments through our participation in the management committees, which make all significant decisions. However, since we have equal or proportionate influence over each committee as a joint interest partner and all significant decisions require the consent of the other investors without regard to economic interest, we have determined that these entities should not be consolidated and apply the equity method of accounting with respect to our investments in each entity.

| |

| • | ALRP - We own a 67% interest in ALRP, a recently constructed crude oil pipeline located in the Delaware and Midland basins in west Texas. |

| |

| • | MPL - We have a 17% interest in MPL, which owns and operates a crude oil pipeline in Minnesota. |

| |

| • | PNAC - We own a 50% interest in PNAC, which owns and operates an asphalt terminal in Nevada. |

| |

| • | RGS - We have a 78% interest in Rendezvous Gas Services, L.L.C. (“RGS”), which owns and operates the infrastructure that transports gas from certain fields to several re-delivery points in southwestern Wyoming, including natural gas processing facilities that are owned by us or a third party. |

| |

| • | TRG - We own a 50% interest in Three Rivers Gathering, L.L.C. (“TRG”) located in the southeastern Uinta Basin. TRG was formed with Ute Energy to transport natural gas gathered by Uintah Basin Field Services, L.L.C. (“UBFS”) and other third-party volumes to gas processing facilities. |

| |

| • | UBFS - We own a 38% interest in UBFS, which owns and operates the natural gas gathering infrastructure located in the southeastern Uinta Basin. |

Equity Method Investments (in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ALRP (a) | | MPL (a) | | PNAC (a) | | RGS | | TRG | | UBFS | | Total |

| Balance at December 31, 2017 (b) | $ | — |

| | $ | 120 |

| | $ | — |

| | $ | 268 |

| | $ | 37 |

| | $ | 15 |

| | $ | 440 |

|

| Acquired interests | 159 |

| | — |

| | 27 |

| | — |

| | — |

| | — |

| | 186 |

|

| Equity in earnings | 4 |

| | 14 |

| | — |

| | 4 |

| | 2 |

| | 1 |

| | 25 |

|

| Cumulative effect of accounting standard adoption | — |

| | — |

| | — |

| | — |

| | (3 | ) | | — |

| | (3 | ) |

| Distributions received | (4 | ) | | (14 | ) | | — |

| | (16 | ) | | (5 | ) | | (2 | ) | | (41 | ) |

| Balance at September 30, 2018 (b) | $ | 159 |

| | $ | 120 |

| | $ | 27 |

| | $ | 256 |

| | $ | 31 |

| | $ | 14 |

| | $ | 607 |

|

| |

| (a) | These equity method investments were included in the 2018 Drop Down. Amounts were adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

| |

| (b) | The carrying amount of our investments in ALRP, MPL, PNAC, RGS, TRG and UBFS exceeded the underlying equity in net assets by $75 million, $34 million, $17 million, $127 million, $14 million and $6 million, respectively, at September 30, 2018. The carrying amount of our investments in MPL, RGS, TRG and UBFS exceeded the underlying equity in net assets by $35 million, $130 million, $15 million and $6 million, respectively, at December 31, 2017. The carrying amounts of our investments that exceed the underlying equity in net assets are amortized over the useful life of the underlying fixed assets and included in equity in earnings (loss). |

We acquired 67% of all of the issued and outstanding limited liability company interests in ALRP as part of the 2018 Drop Down. ALRP is a variable interest entity. We are not the primary beneficiary of ALRP under the partnership agreement because the Partnership and the other minor shareholder jointly direct the activities of ALRP that most significantly impact its economic performance. In addition, we have a 78% interest in RGS. ALRP and RGS are unconsolidated variable interest entities and we use the equity method of accounting with respect to our investments in each entity.

Note 7 - Debt

Debt Balance, Net of Unamortized Issuance Costs (in millions)

|

| | | | | | | |

| | September 30,

2018 | | December 31, 2017 |

| Total debt | $ | 4,878 |

| | $ | 4,182 |

|

| Unamortized issuance costs | (48 | ) | | (54 | ) |

| Current maturities | (1 | ) | | (1 | ) |

| Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 4,829 |

| | $ | 4,127 |

|

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Available Capacity Under Credit Facilities (in millions)

|

| | | | | | | | | | | | | | | | | | | | |

| | Total Capacity | | Amount Borrowed as of September 30, 2018 | | Outstanding Letters of Credit | | Available Capacity as of September 30, 2018 | | Weighted Average Interest Rate | | Expiration |

| Revolving Credit Facility (a) | $ | 1,100 |

| | $ | 820 |

| | $ | — |

| | $ | 280 |

| | 3.95 | % | | January 29, 2021 |

| Dropdown Credit Facility | 1,000 |

| | 300 |

| | — |

| | 700 |

| | 3.86 | % | | January 29, 2021 |

| Total Credit Facilities (a) | $ | 2,100 |

| | $ | 1,120 |

| | $ | — |

| | $ | 980 |

| | | | |

| |

| (a) | On January 5, 2018, we amended our Revolving Credit Facility to increase the aggregate commitments from $600 million to $1.1 billion and to permit the incurrence of incremental loans. We are allowed to request that the loan availability be increased up to an aggregate of $2.1 billion, subject to receiving increased commitments from the lenders. |

Note 8 - Commitments and Contingencies

In the ordinary course of business, we may become party to lawsuits, disputes, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but we will accrue liabilities for these matters if the amount is probable and can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, we believe there would be no material impact on our condensed consolidated financial statements.

Note 9 - Equity and Net Earnings per Unit

We had 89,299,615 common public units and 600,000 6.875% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (the “Preferred Units”) outstanding as of September 30, 2018. Additionally, Andeavor owned 156,173,128 of our common units, constituting approximately 64% ownership interest in us. Andeavor also held 80,000 Andeavor Logistics TexNew Mex units and all of the outstanding non-economic general partner units as of September 30, 2018.

Changes to Equity (in millions)

|

| | | | | | | | | | | | | | | |

| | Equity of Predecessors (a) | | Partnership | | Total |

| | | Common | | Preferred | |

| Balance at December 31, 2017 | $ | 1,292 |

| | $ | 2,925 |

| | $ | 589 |

| | $ | 4,806 |

|

| Sponsor contributions of assets to the Predecessors | 406 |

| | — |

| | — |

| | 406 |

|

| Loss attributable to the Predecessors | (28 | ) | | — |

| | — |

| | (28 | ) |

| Net assets not assumed by Andeavor Logistics | (19 | ) | | — |

| | — |

| | (19 | ) |

| Allocation of net assets acquired by the unitholders | (1,651 | ) | | 1,651 |

| | — |

| | — |

|

| Distributions to common and preferred unitholders (b) | — |

| | (620 | ) | | (29 | ) | | (649 | ) |

| Distributions to common unitholders related to acquisitions (c) | — |

| | (300 | ) | | — |

| | (300 | ) |

| Net earnings attributable to partners | — |

| | 423 |

| | 34 |

| | 457 |

|

| Cumulative effect of accounting standard adoption | — |

| | (22 | ) | | — |

| | (22 | ) |

| Contributions (d) | — |

| | 34 |

| | — |

| | 34 |

|

| Other | — |

| | 2 |

| | — |

| | 2 |

|

| Balance at September 30, 2018 | $ | — |

| | $ | 4,093 |

| | $ | 594 |

| | $ | 4,687 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Notes 1 and 2 for further discussion. |

| |

| (b) | Represents cash distributions declared and paid during the nine months ended September 30, 2018. |

| |

| (c) | Distributions to common unitholders include $300 million in cash payments for the 2018 Drop Down. As an entity under common control with Andeavor, we record the assets that we acquire from Andeavor in our consolidated balance sheets at Andeavor’s historical book value instead of fair value, and any excess of cash paid over the historical book value of the assets acquired from Andeavor is recorded within equity. As a result of this accounting treatment, this transaction resulted in a net increase of $1.4 billion in our equity balance during the nine months ended September 30, 2018. |

| |

| (d) | Includes Andeavor and TLGP contributions to the Partnership primarily related to reimbursements for capital spending pursuant predominantly to the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Cash Distributions

Our partnership agreement, as amended, sets forth the calculation to be used to determine the amount and priority of cash distributions that the limited partner unitholders will receive.

Quarterly Distributions on Common Units

|

| | | | | | | | | | | |

| Quarter Ended | Quarterly Distribution Per Common Unit | | Total Cash Distribution (in millions) | | Date of Distribution | | Unitholders Record Date |

| December 31, 2017 (a) | $ | 1.000 |

| | $ | 205 |

| | February 14, 2018 | | January 31, 2018 |

| March 31, 2018 (a) | 1.015 |

| | 205 |

| | May 15, 2018 | | May 1, 2018 |

| June 30, 2018 (a) | 1.030 |

| | 209 |

| | August 14, 2018 | | August 3, 2018 |

| September 30, 2018 (a)(b) | 1.030 |

| | 238 |

| | November 14, 2018 | | November 5, 2018 |

| |

| (a) | This distribution is net of $15 million waived by TLGP for each of the three months ended September 30, 2018, June 30, 2018 and March 31, 2018, as well as $12.5 million for the three months ended December 31, 2017. TLGP’s distribution waivers for 2018 and 2019 remain in effect as instituted in 2017 under the terms of our partnership agreement. |

| |

| (b) | This distribution was declared on October 26, 2018 and will be paid on the date of distribution. |

On August 15, 2018 and February 15, 2018, we paid distributions associated with our Preferred Units of $21 million and $8 million, respectively.

Net Earnings per Unit

Prior to the WNRL Merger, we used the two-class method when calculating the net earnings per unit applicable to limited partners, because we had more than one participating security consisting of limited partner common units, general partner units and incentive distribution rights (“IDRs”). Net earnings earned by the Partnership were allocated between the limited and general partners in accordance with our partnership agreement. At the effective time of the WNRL Merger, the IDRs were canceled (the “IDR Exchange”) and the general partner units were converted into a non-economic general partner interest in Andeavor Logistics (together with the IDR Exchange, the “IDR/GP Transaction”). As a result, the general partner units no longer participate in earnings or distributions, including IDRs. With the issuance of the Preferred Units, earnings are allocated first to the Preferred Units to equal their fixed distribution rate. We base our calculation of net earnings per unit using the weighted-average number of common limited partner units outstanding during the period.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Net Earnings per Unit (in millions, except per unit amounts)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| Net earnings | $ | 166 |

| | $ | 90 |

| | $ | 429 |

| | $ | 253 |

|

| Special allocations of net earnings (“Special Allocations”) (a) | — |

| | — |

| | — |

| | 1 |

|

| Net earnings, including Special Allocations | 166 |

| | 90 |

| | 429 |

| | 254 |

|

| Distributions on Preferred Units (b) | (11 | ) | | — |

| | (31 | ) | | — |

|

| Net earnings attributable to common units | 155 |

| | 90 |

| | 398 |

| | 254 |

|

| General partner’s distributions | — |

| | — |

| | — |

| | (6 | ) |

| General partner’s IDRs (c) | — |

| | — |

| | — |

| | (75 | ) |

| Limited partners’ distributions on common units | (238 | ) | | (201 | ) | | (652 | ) | | (407 | ) |

| Distributions on common units greater than earnings | $ | (83 | ) | | $ | (111 | ) | | $ | (254 | ) | | $ | (234 | ) |

| General partner’s earnings: | | | | | | | |

| Distributions | $ | — |

| | $ | — |

| | $ | — |

| | $ | 6 |

|

| General partner’s IDRs (c) | — |

| | — |

| | — |

| | 75 |

|

| Allocation of distributions greater than earnings (d) | (4 | ) | | (8 | ) | | (28 | ) | | (48 | ) |

| Total general partner’s earnings | $ | (4 | ) | | $ | (8 | ) | | $ | (28 | ) | | $ | 33 |

|

| Limited partners’ earnings on common units: | | | | | | | |

| Distributions (e) | $ | 238 |

| | $ | 201 |

| | $ | 652 |

| | $ | 407 |

|

| Special Allocations (a) | — |

| | — |

| | — |

| | (1 | ) |

| Allocation of distributions greater than earnings | (79 | ) | | (103 | ) | | (226 | ) | | (186 | ) |

| Total limited partners’ earnings on common units | $ | 159 |

| | $ | 98 |

| | $ | 426 |

| | $ | 220 |

|

| Weighted average limited partner units outstanding: | | | | | | | |

| Common units - basic | 234.4 |

| | 108.0 |

| | 223.0 |

| | 107.0 |

|

| Common units - diluted (f) | 234.6 |

| | 108.1 |

| | 223.2 |

| | 107.1 |

|

| Net earnings per limited partner unit: (g) | | | | | | | |

| Common - basic | $ | 0.68 |

| | $ | 0.90 |

| | $ | 1.91 |

| | $ | 2.05 |

|

| Common - diluted | $ | 0.68 |

| | $ | 0.90 |

| | $ | 1.91 |

| | $ | 2.05 |

|

| |

| (a) | Normal allocations according to percentage interests are made after giving effect, if any, to priority income allocations in an amount equal to incentive cash distributions fully allocated to the general partner and any special allocations. The adjustment reflects the special allocation to common units held by TLGP for the interest incurred in connection with borrowings on the Revolving Credit Facility in lieu of using all cash on hand to fund the acquisition of crude oil, natural gas and produced water gathering systems and two natural gas processing facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (the “North Dakota Gathering and Processing Assets”) during the nine months ended September 30, 2017. |

| |

| (b) | The Preferred Units entitle unitholders to receive preferred distributions on a semi-annually basis. |

| |

| (c) | IDRs entitled the general partner to receive increasing percentages, up to 50%, of quarterly distributions in excess of $0.3881 per unit per quarter. The amount above reflects earnings distributed to our general partner net of $38 million of IDRs waived by TLGP for the nine months ended September 30, 2017, respectively. Our general partner no longer holds IDRs as a result of the IDR/GP Transaction. |

| |

| (d) | We have revised the historical allocation of general partner earnings to include the Predecessors’ losses of $4 million and $28 million for the three and nine months ended September 30, 2018, respectively, and losses of $7 million and $46 million for the three and nine months ended September 30, 2017, respectively. |

| |

| (e) | Distributions of earnings for limited partners’ common units for the three and nine months ended September 30, 2018 is net of a $15 million and $45 million waiver, respectively, from Andeavor in connection with the WNRL Merger. |

| |

| (f) | Diluted net earnings per unit include the effects of potentially dilutive units on our common units, which consist of unvested service and performance phantom units. |

| |

| (g) | Amounts may not recalculate due to rounding of dollar and unit information. |

Note 10 - Revenues

We recognize revenue upon transfer of control of promised products or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those products or services. For the three and nine months ended September 30, 2018, revenues from contracts with customers were $528 million and $1.5 billion, respectively, which excludes lease revenues of $114 million and $292 million, respectively. Upon adoption of ASC 606, revenue is recognized net of amounts

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

collected from customers for taxes assessed by governmental authorities on, and concurrent with, specific revenue-producing transactions.

Service Revenue

We generate service revenue for gathering and transporting crude oil, natural gas and water; processing and fractionating natural gas and NGLs; and terminalling, transporting, and storing crude oil and refined products. We perform these services under various contractual arrangements with our customers. Under fee-based arrangements, we receive a fixed rate per volumetric unit for services we provide. For many of these fee-based arrangements, customers are required to make deficiency payments when they do not meet their minimum throughput volume commitments. Some of these contracts allow our customers to claw-back all or a portion of prior deficiency payments against excess volumes in future periods. Under keep-whole arrangements, we gather and process natural gas from producer-customers, retain and sell extracted NGLs, and return to the producer replacement dry gas (“shrink gas”) with an equivalent British thermal unit content of the NGLs retained. For these arrangements, we receive from the producer a combination of fixed rate-per unit of cash consideration as well as non-cash consideration in the form of retained NGLs. Other agreements with producers consist of POP arrangements for which we gather and purchase natural gas from the producers, process purchased natural gas, and sell resulting NGLs and shrink gas at market prices. Reimbursements of certain costs and fees received under these purchase arrangements are recorded as a reduction to NGL expense. See further discussion below on our accounting for product revenues related to the sales of products resulting from our processing activities.

We recognize service revenue over time, as customers simultaneously receive and consume the related benefits of the services that we stand ready to provide. Revenue is recognized using an output measure, such as the throughput volume or capacity utilization, as these measures most accurately depict the satisfaction of our performance obligations. Where contracts contain variable pricing terms, the variability is either resolved within the reporting period, or the variable consideration is allocated to the specific unit of service to which it relates. Deficiency payments under contracts with claw-back provisions are deferred and recognized as revenue as customers reclaim amounts by throughputting excess volumes. To the extent it is probable a customer will not recover all or a portion of the deficiency payment, the estimated residual deficiency is recognized ratably over the claw-back period. Payments for services rendered are generally received no later than 60 days from the month of service, with the exception of deficiency payments described above.

For our keep-whole arrangements, we recognize service revenue for the fair value of non-cash consideration we receive in the form of NGLs. We obtain control of the NGLs we receive from our customers, have discretion in establishing price and have the ability to direct their use. We estimate the fair value of non-cash consideration at the date we obtain control of the respective NGLs, using the monthly average published price of underlying commodity adjusted for geography and commodity specifications.