UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

Corvus Gold Inc.

| (Exact Name of Registrant as Specified in its Charter) |

(Name of Person(a) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2019 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 3, 2019

Dear Shareholder:

You are receiving this notification as Corvus Gold Inc. (the“Company”) has decided to use the notice and access model for delivery of meeting materials for its 2019 Annual General and Special Meeting (the “Meeting”) to its registered and Canadian and United States beneficial shareholders. This Notice and Access Notification regarding the Meeting is prepared under the notice-and-access rules that came into effect on February 11, 2013 under National Instrument 54-101– Communication with Beneficial Owners of Securities of a Reporting Issuer, National Instrument 51-102 –Continuous Disclosure Obligations and pursuant to Rule 14a-16 under the United States Securities Exchange Act of 1934, as amended.Under notice and access, instead of a paper copy of the Notice of Meeting, Proxy Statement/Information Circular (the “Proxy Statement”), 2019 Annual Report (“2019 Annual Report”), and form of proxy (the “Proxy”, together with the Notice of Meeting, the Proxy Statement and the 2019 Annual Report, the “Meeting Materials”) shareholders receive this notice with information on how they may access such materials electronically. The use of this alternative means of delivery is more environmentally responsible as it will help reduce paper use and also will reduce the cost of printing and mailing materials to shareholders. This communication is not a form for voting and presents only an overview of the more complete information in the Meeting Materials which contain important information and can be accessed online as provided below.

The Company has elected not to use the procedure known as “stratification” in relation to its shareholders under the “notice and access” rules. Stratification occurs when a reporting issuer using the “notice and access” rules provides a paper copy of proxy-related materials to some, but not all, of its shareholders.

The 2019 Annual General and Special Meeting of Shareholders will be held on Thursday, October 3, 2019 at the offices of the Company, Suite 1750, 700 West Pender Street, Vancouver, British Columbia, Canada, at 3:00 p.m. Pacific time. Only shareholders who own common shares of the Company at the close of business on the record date of August 7, 2019 may vote at the Meeting or any adjournment or postponement of the Meeting. The purpose of the Meeting is to consider and act upon the following proposals:

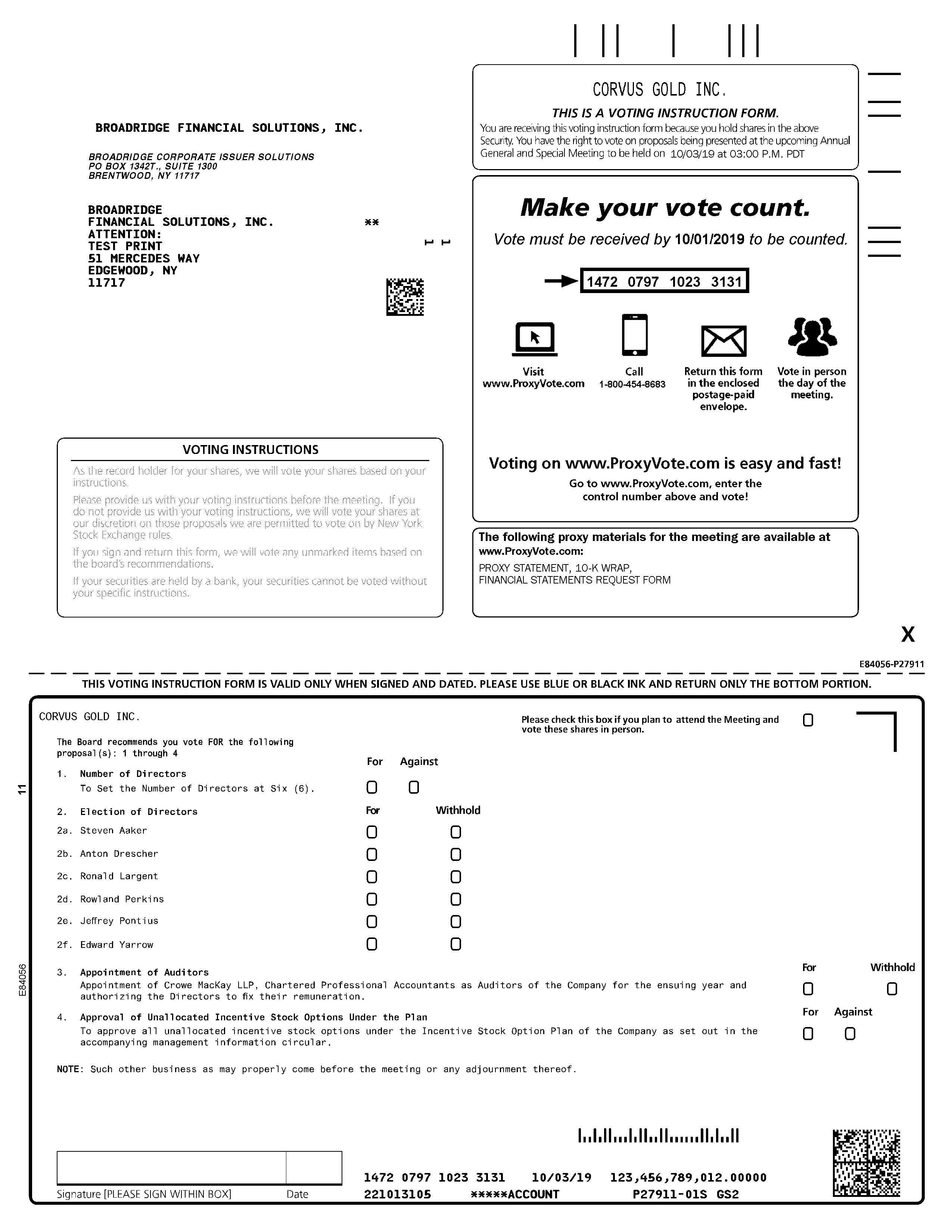

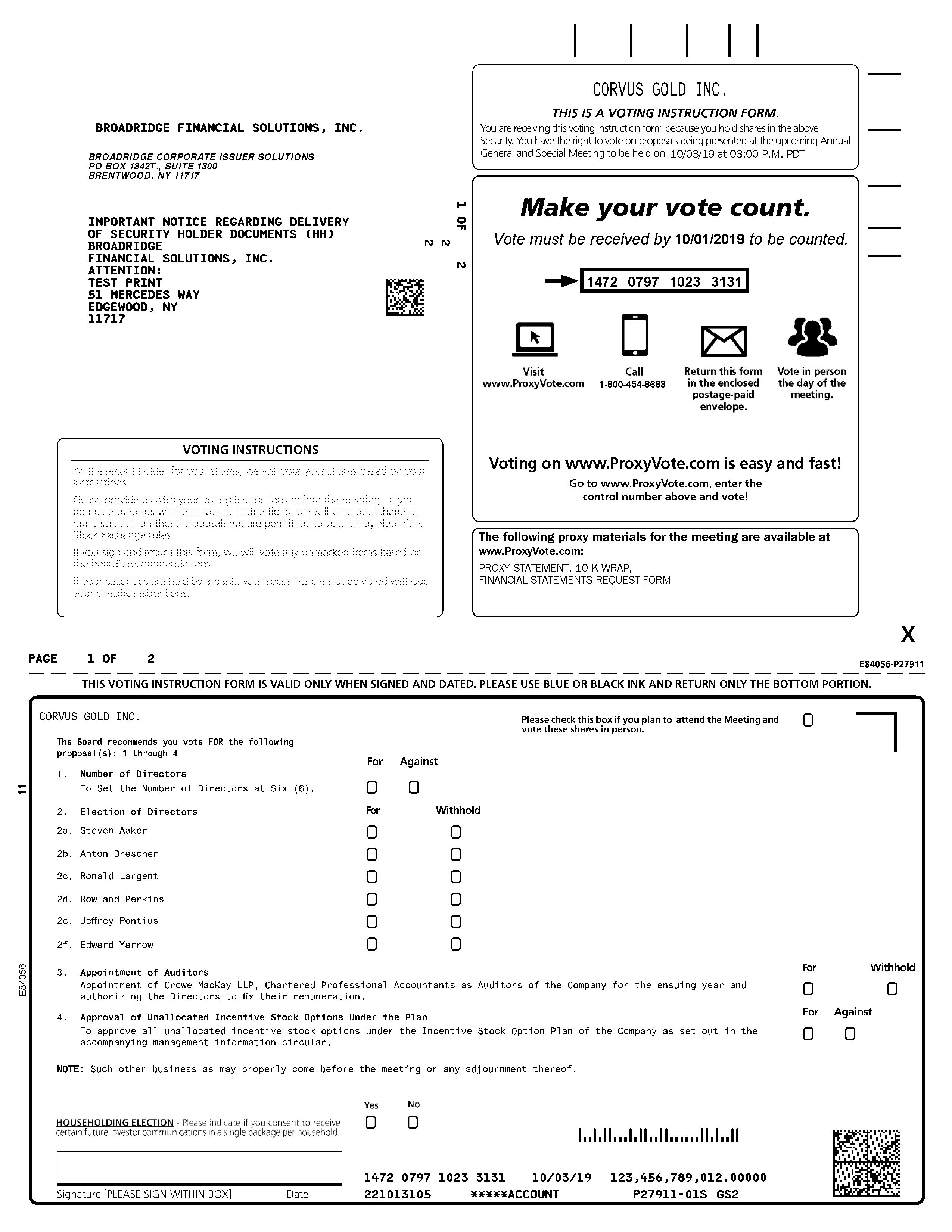

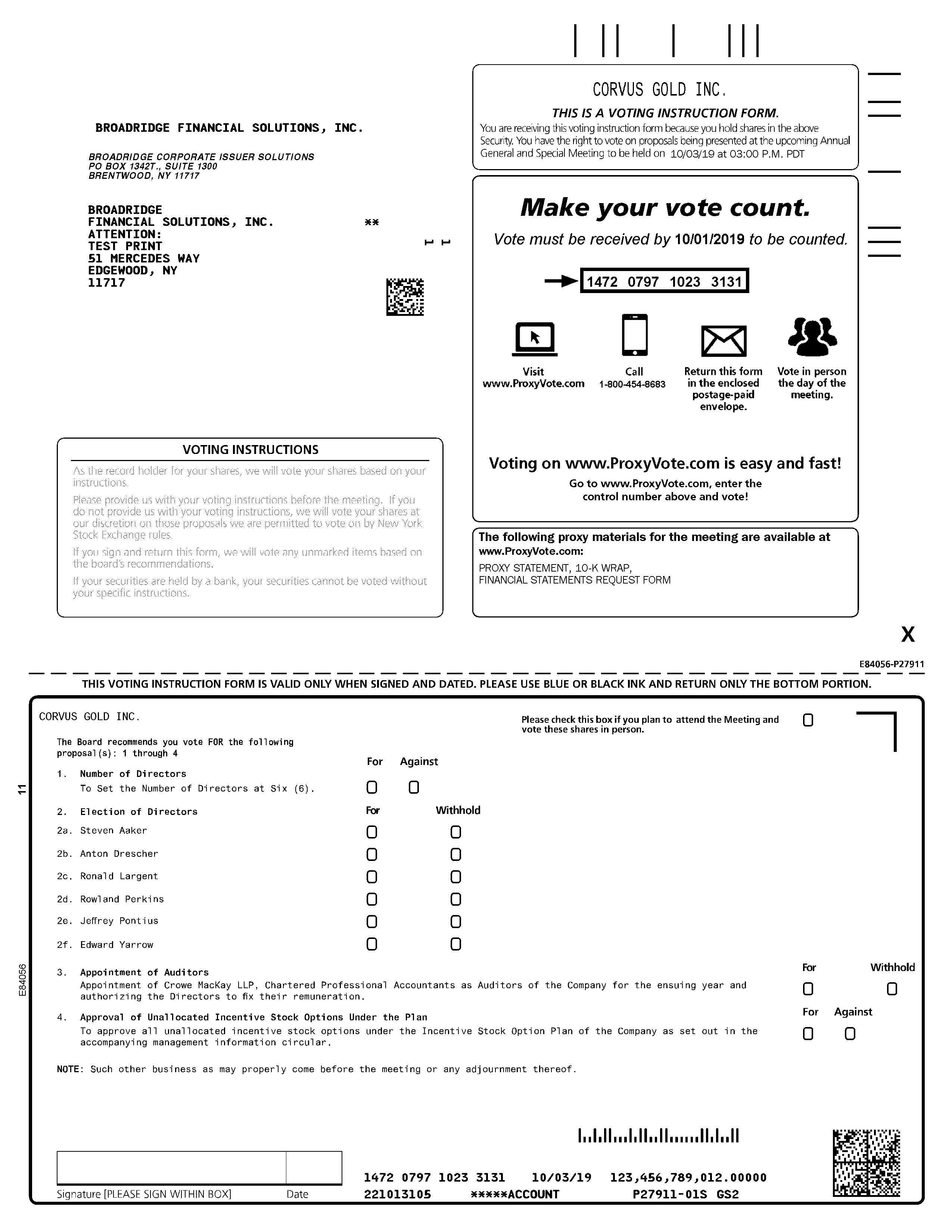

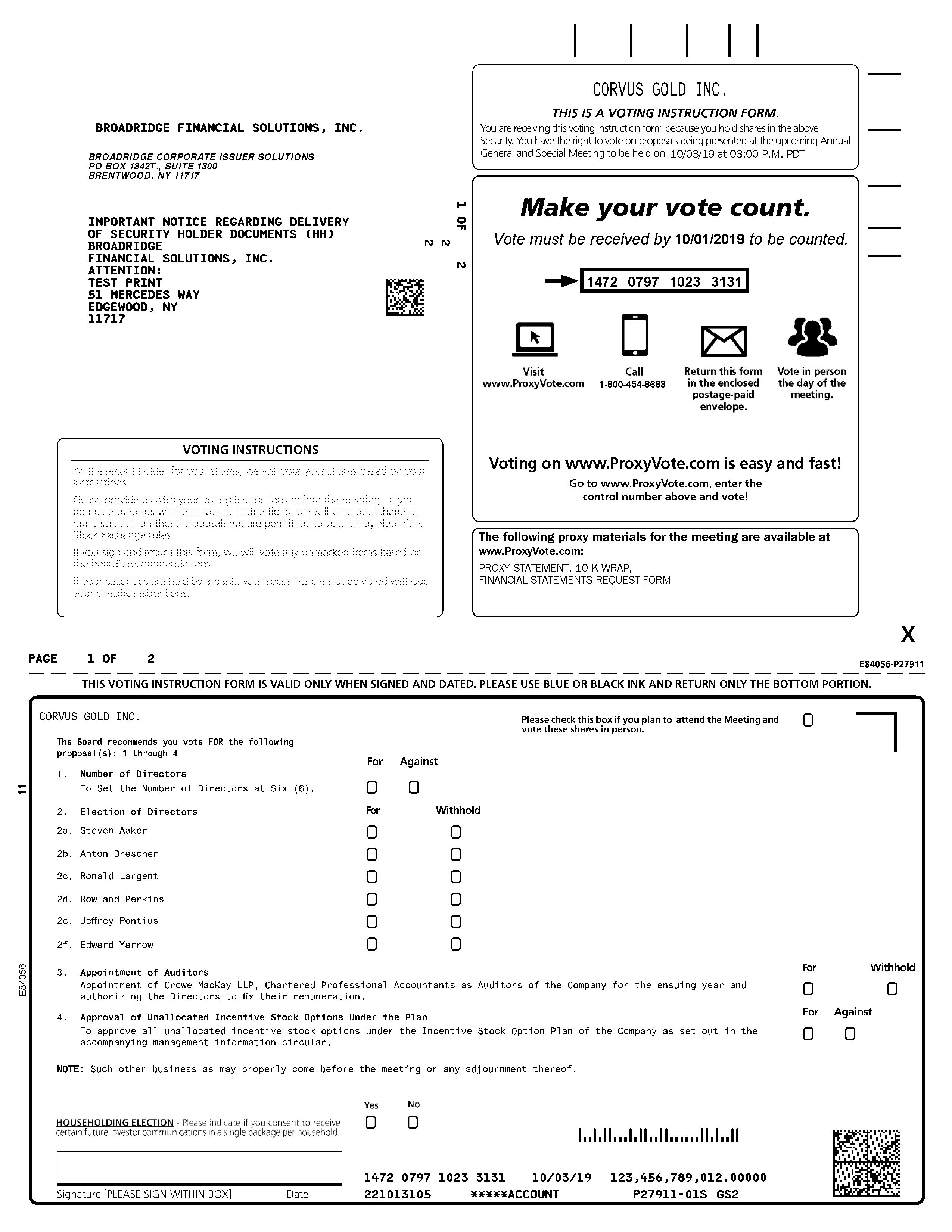

| 1. | Fixing Number of Directors: Shareholders will be asked to fix the number of directors of the Company at six (6). Information can be found in the “Proposal One – Fixing Number of Directors” section of the Proxy Statement. |

| 2. | Election of Directors: Shareholders will be asked to elect six (6) directors for the ensuing year. Information can be found in the “Proposal Two – Election of Directors” section of the Proxy Statement. |

| 3. | Appointment of Independent Auditors: Shareholders will be asked to appoint Crowe MacKay LLP, Chartered Professional Accountants, as the Company’s auditors/independent registered public accountants, for the fiscal year ending May 31, 2020, and to authorize the Company’s directors to fix their remuneration. Information can be found in the “Proposal Three – Appointment of Auditor” section of the Proxy Statement. |

| 4. | Approval of Unallocated Incentive Stock Options Under the Incentive Stock Option Plan: Shareholders will be asked to consider and, if thought fit, pass, with or without variation, an ordinary resolution approving all unallocated incentive stock options under the incentive stock option plan of the Company as described in the Company’s Proxy Statement. Information can be found in the “Proposal Four –Approval of Unallocated Incentive Stock Options Under the Plan” section of the Proxy Statement. |

| 5. | Other Business: Shareholders may be asked to consider other items of business that may be properly brought before the Meeting. Information respecting the use of discretionary authority to vote on any such other business can be found in the “Proxy Instructions” section of the Proxy Statement. |

THE BOARD RECOMMENDS A VOTE FOR EACH NOMINEE AND FOR EACH MATTER TO BE VOTED ON.

YOU ARE ENCOURAGED TO ACCESS THE FOLLOWING MATERIALS FOR THE MEETINGPRIOR TO VOTING AT http://www.corvusgold.com/investors/agm/ and at www.SEDAR.com:

| 1. | The Company’s 2019 Notice of Meeting; |

| 2. | The Company’s 2019 Proxy Statement; |

| 3. | The Company’s 2019 Annual Report; |

| 4. | The Annual Return Card; and |

| 5. | The Form of Proxy or Voting Instruction Form. |

You may access the above proxy materials at http://www.corvusgold.com/investors/agm/ and atwww.SEDAR.com and thereafter, a proxy card online by logging on to www.investorvote.com and entering the control number and account number above your name and address at the top of this letter to vote your shares. We encourage and remind you to review the proxy materials prior to voting.

If you prefer a paper copy of the proxy materials, have questions about notice and access or wish to have proxy materials for future meetings of shareholders sent to you in paper copy, please call us toll-free at 1-844-638-3245, email us at marla@corvusgold.com, or send a written request to our offices at the address below:

Suite 1750, 700 West Pender Street

Vancouver, British Columbia

Canada V6C 1G8

Attention: Corporate Secretary

Requests may be made up to one (1) year from the date the Proxy Statement was filed on SEDAR, but requests should be received at least five (5) business days in advance of October 1, 2019, being the proxy cut-off date for voting at the Meeting, in order to receive the materials for the Meeting in advance of the proxy cut-off date for the Meeting. If you do not request paper copies they will not otherwise be provided to you.

If interested, you may attend the Meeting in person. Directions to attend the Meeting where registered shareholders may vote in person can be found on our website at www.corvusgold.com/investors/agm.

VOTING:

Registered shareholders are asked to return their proxies using one of the following methods not later than 3:00 p.m. Pacific time, on October 1, 2019, being the proxy cut-off date for the Meeting:

| INTERNET: | www.investorvote.com | | |

| TELEPHONE PROXY: | Toll Free: 1-866-732-VOTE (8683) | TELEPHONE VIF: | Toll Free: 1-866-734-VOTE (8383) |

| | International: 312-588-4290 | | International: 312-588-4291 |

| | |

| FAX: | Toll Free: 1-866-249-7775

International: 1-416-263-9524 |

| | |

| MAIL: | Computershare Investor Services Inc., Proxy Dept 100 University Avenue, 8th Floor, Toronto, Ontario, Canada M5J 2Y1 |

Non-registered holders are asked to use the Voting Instruction Form provided by Computershare or Broadridge, as applicable, and RETURN IT TO COMPUTERSHARE OR BROADRIDGE, as applicable (not to the Company), or vote through the Internet or by telephone as indicated on the Voting Instruction Form, in each case as soon as practicable to ensure that it is transmitted on time. It must be received by Computershare or Broadridge, as applicable, with sufficient time for them to file a proxy by the proxy deadline of 3:00 p.m. Pacific time on October 1, 2019.

Shareholders with questions about notice-and-access can email the Company at marla@corvusgold.com.

CORVUS GOLD INC.

(the “Company”)

Request for Annual and/or Interim Financial Statements and related

Management’s Discussion and Analysis

National Instrument 51-102 –Continuous Disclosure Obligations requires the Company to send annually to the registered holders and beneficial owners of its securities (“Securityholders”) a form to allow Securityholders to request a copy of the Company’s annual financial statements and related Management’s Discussion and Analysis (“MD&A”), interim financial statements and related MD&A, or both. If you wish to receive such mailings, please complete and return this form to:

CORVUS GOLD INC.

Suite 1750 – 700 West Pender Street

Vancouver, BC V6C 1G8

The undersigned Securityholder hereby elects to receive:

| ¨ | Interim Financial Statements for the first quarter ended August 31, 2019, second quarter ended November 30, 2019 and third quarter ended February 28, 2020, and the related MD&A; |

| ¨ | Annual Financial Statements for the fiscal year ended May 31, 2020 and related MD&A; or |

| ¨ | BOTH – Interim Financial Statements and related MD&A and the Annual Financial Statements and related MD&A. |

Please note that a request form will be mailed and/or emailed each year andSecurityholders must return such form each year in order to receive the documents indicated above.

| Name: | | |

| | | |

| Address: | | |

| | | |

| Postal Code: | | |

OR

By consenting to electronic delivery, Securityholders: (i) agree to receive all documents to which they are entitled electronically, rather than by mail; and (ii) understand that access to the Internet is required to receive a document electronically and certain system requirements must be installed (currently Adobe Acrobat Reader to view Adobe’s portable document format). At any time, the Company may elect to not send a document electronically, or a document may not be available electronically. In either case, a paper copy will be mailed to shareholders.

I confirm that I am aregistered/beneficial (circle one) shareholder of the Company.

| Signature of | | |

| Securityholder: | | | Date: | |

CUSIP: 221013105

2019 ANNUAL REPORT TO SHAREHOLDERS |

| Suite 1750, 700 W. Pender St. Vancouver, British Columbia CANADA V6C 1G8 TSX: KOR OTCQX: CORVF | Tel: (604) 638-3246 Toll Free: 1-844-638-3246 info@corvusgold.com www.corvusgold.com |

August 7, 2019

Dear Fellow Shareholders:

On behalf of Corvus Gold Inc. (the “Company”), it is my pleasure to provide an update on the progress of the Company and at our 100% owned Nevada, Mother Lode and North Bullfrog projects. It is our belief that in an appreciating gold price environment, value creation will be amplified with efficient and effective exploration.

The findings from the Mother Lode Phase I & II drill programs resulted in a maiden mineral resource estimate prepared in accordance with the disclosure standards of National Instrument 43-101 -Standards of Disclosure for Mineral Projects at the Mother Lode property, followed by a combined North Bullfrog/Mother Lode preliminary economic assessment (PEA) completed and published in Q4 2018. The PEA showed a robust project at a USD $1,250 gold price, outlining a large new Nevada mining project with attractive projected production statistics that include an estimated 347,000 ounces of gold annual production during the first four years and an after-tax 5% discounted net present value (NPV) of $586M (USD) with an internal rate of return of 38%. A Phase III drill program at the Mother Lode property began in July 2018 and carried through May 2019. This follow-up phase continues to show the expansion potential of the deposit along strike and at depth and had multiple high-grade intercepts outside the known resource. Corvus Gold will be assessing this new expansion and anticipates a follow-up phase IV drilling program in the near future.1

In December of 2018, the Company completed a strategic CAD $2.08M financing with AngloGold Ashanti (USA) Exploration Inc. (AngloGold Ashanti). In May of 2019, the Company arranged for the sale of non-core Alaskan assets for CAD $0.35M and completed a financing for CAD $0.90M with EMX Royalty Corp. These financings provided additional funding for the continued exploration drill program at Mother Lode and a new discovery drill program at North Bullfrog.

Activity and exploration in the Greater Bullfrog area has been extensive over the last year. We believe that the successful exploration by the Company at North Bullfrog and Mother Lode project areas have fostered this increase in activity. New neighboring adjacent projects controlled by major operating companies like AngloGold Ashanti and Coeur Mining, Inc. continues to highlight the potential of the district. There is evidence that the area hosts a multitude of high-quality exploration targets, which could potentially contain a number of higher grade structurally, controlled deposits like the Company’s YellowJacket discovery and the nearby historic Bullfrog mine or sediment hosted deposits like Mother Lode. The Company will be continuing to evaluate the new discovery and resource expansion potential of the North Bullfrog area as well as the resource expansion potential of the Mother Lode deposit over the coming year.

Please join us at our 2019 Annual and Special Meeting (the “AGM”) of shareholders to be held on Thursday, October 3, 2019 at 3:00 pm PDT, Vancouver time, at the Company’s office at Suite 1750, 700 West Pender, Vancouver, British Columbia, Canada. The Notice of Meeting and Information Circular/Proxy Statement for the AGM have been sent or otherwise made available to you, as these documents contain important information, you are encouraged to read them carefully. If you are unable to attend the 2019 AGM in person, please ensure that you take the opportunity to vote online, by telephone or by mail.

On behalf of

CORVUS GOLD INC.

(signed) Jeffrey A. Pontius

Chief Executive Officer & President

1Cautionary Note: the PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

FORWARD LOOKING STATEMENTS

This letter to shareholders contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. Forward-looking statements are typically identified by words such as believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements, other than statements of historical fact, included herein are forward-looking statements including, without limitation, statements regarding timing and expectations regarding the potential impact of gold prices on the Company’s ability to create value, the results of the preliminary economic assessment; expected focus of the Company regarding the Company’s exploration activities; anticipated drilling programs; anticipated content, commencement and cost of exploration programs; anticipated exploration program results; the expected use of proceeds from financings; the potential that the area hosts a multitude of high quality exploration targets; the discovery and delineation of mineral deposits/resources/reserves and the potential for updates to any such estimates; the potential to expand the existing estimated mineral resource at the North Bullfrog project; the potential for any mining or production at North Bullfrog; the potential for the identification of multiple deposits; the potential for the existence or location of additional high-grade veins; business and financing plans and business trends. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Certain material assumptions regarding such forward-looking statements are discussed in this letter to shareholders and the Company’s most recent annual and quarterly management’s discussion and analysis filed atwww.sedar.com. In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this letter to shareholders are also subject to the following assumptions: (1) the price of gold and silver being consistent with the prices used herein; (2) the timing of the receipt of regulatory and governmental approvals, permits and authorizations necessary to implement and carry on the Company’s planned exploration and potential development programs; (3) the Company’s ability to attract and retain key staff, (4) the timing of the ability to commence and complete the planned work at the Company’s projects; and (5) the ongoing relations of the Company with its underlying property lessors and the applicable regulatory agencies. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located;variations in commodity prices; results of exploration not being as anticipated; the Company's inability to obtain any necessary permits, consents or authorizations required for its activities; the Company's inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies; and other risks and uncertainties disclosed in the Company’s 2019 Annual Report on Form 10-K and latest interim Management Discussion and Analysis and Quarterly Report on Form 10-Q filed with certain securities commissions in Canada and the United States. All of the Company’s Canadian public disclosure filings may be accessed viawww.sedar.comand the Company’s United States public disclosure filings may be accessed viawww.sec.govand readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties.

Cautionary Note Regarding References to Resources and Reserves:

NI 43-101 has been developed by the Canadian Securities Administrators in order to establish standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this letter to shareholders have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States investors are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”). Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7.

In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a “final” or “bankable” feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. The mine economics presented herein and derived from the PEA are preliminary in nature and may not be realized. The PEA is not a feasibility study. U.S. investors are urged to consider closely the disclosure in our latest reports and registration statements filed with the SEC. You can review and obtain copies of these filings at http://www.sec.gov/edgar.shtml. U.S. Investors are cautioned not to assume that any defined resource will ever be converted into SEC Industry Guide 7 compliant reserves.

The combined Mother Lode and North Bullfrog Projects contains a Measured Mineral Resource for the mill of 9.3 Mt at an average grade of 1.59 g/t gold, containing 475 k ounces of gold and Indicated Mineral Resources for the mill of 18.2 Mt at an average grade of 1.68 g/t gold containing 988 k ounces of gold and an Inferred Mineral Resource for the mill of 2.3 Mt at an average grade of 1.61 g/t gold containing 118 k ounces of gold. In addition, the project contains a Measured Mineral Resource for oxide, run of mine, heap leach of 34.6 Mt at an average grade of 0.27 g/t gold containing 305 k ounces of gold and an Indicated Mineral Resource for, oxide, run of mine, heap leach of 149.4 Mt at an average grade of 0.24 g/t gold containing 1,150 k ounces of gold and an Inferred, oxide, run of mine, heap leach Mineral Resource of 78.7 Mt at an average grade of 0.26 g/t gold containing 549 k ounces of gold.

For additional details, see technical report entitled “Technical Report and Preliminary Economic Assessment for the Integrated Mother Lode and North Bullfrog Projects, Bullfrog Mining District, Nye County, Nevada”, dated November 1, 2018 and amended on November 8, 2018, with an effective date of September 18, 2018 on the Company’s profile at www.sedar.com.

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by NI 43-101, has supervised the preparation of the scientific and technical information that form the basis for this letter to shareholders and has reviewed and approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the President and CEO and holds common shares and incentive stock option.

| Crowe MacKay LLP |

| | 1100 – 1177 West Hastings Street

Vancouver, BC V6E 4T5

Main +1 (604) 687-4511

Fax +1 (604) 687-5805

www.crowemackay.ca |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Corvus Gold Inc.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of Corvus Gold Inc. and subsidiaries (the “Company”) as of May 31, 2019 and 2018, the related consolidated statements of operations and comprehensive loss, changes in equity, and cash flows for the years then ended, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as at May 31, 2019 and 2018 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern.As discussed in Note 1 to the consolidated financial statements, the Company has suffered recurring losses from operations that raise substantial doubt about its ability to continue as a going concern.Management's plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Crowe MacKay LLP

Chartered Professional Accountants

We have served as the Company’s auditor since 2011.

Vancouver, Canada

August 8, 2019

CORVUS GOLD INC.

CONSOLIDATED BALANCE SHEETS

(Expressed in Canadian dollars)

| | | May 31, 2019 | | May 31, 2018 |

| | | | | |

| ASSETS | | | | | | | | |

| | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | $ | 4,145,085 | | | $ | 2,610,541 | |

| Accounts receivable | | | 49,658 | | | | 25,438 | |

| Prepaid expenses | | | 354,971 | | | | 256,772 | |

| | | | | | | | | |

| Total current assets | | | 4,549,714 | | | | 2,892,751 | |

| | | | | | | | | |

| Property and equipment (note 4) | | | 45,016 | | | | 56,490 | |

| Capitalized acquisition costs (note 5) | | | 5,619,005 | | | | 5,238,789 | |

| | | | | | | | | |

| Total assets | | $ | 10,213,735 | | | $ | 8,188,030 | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

| | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable and accrued liabilities (note 7) | | $ | 345,632 | | | $ | 330,704 | |

| | | | | | | | | |

| Total current liabilities | | | 345,632 | | | | 330,704 | |

| | | | | | | | | |

| Asset retirement obligations (note 5) | | | 419,286 | | | | 366,641 | |

| | | | | | | | | |

| Total liabilities | | | 764,918 | | | | 697,345 | |

| | | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Share capital (note 6) | | | 97,726,772 | | | | 83,606,486 | |

| Contributed surplus (note 6) | | | 11,467,753 | | | | 13,030,715 | |

| Accumulated other comprehensive income - cumulative translation differences | | | 1,382,223 | | | | 1,123,410 | |

| Deficit accumulated during the exploration stage | | | (101,127,931 | ) | | | (90,269,926 | ) |

| | | | | | | | | |

| Total shareholders’ equity | | | 9,448,817 | | | | 7,490,685 | |

| | | | | | | | | |

| Total liabilities and shareholders’ equity | | $ | 10,213,735 | | | $ | 8,188,030 | |

Nature and continuance of operations (note 1)

Approved on behalf of the Directors:

| “Jeffrey Pontius” | Director |

| | |

| “Anton Drescher” | Director |

These accompanying notes form an integral part of these consolidated financial statements

CORVUS GOLD INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For the Years Ended May 31,

(Expressed in Canadian dollars)

| | | | | |

| | | 2019 | | 2018 |

| | | | | |

| Operating expenses | | | | | | | | |

| Administration | | $ | 430 | | | $ | 422 | |

| Consulting fees (notes 6 and 7) | | | 1,054,967 | | | | 625,677 | |

| Depreciation (note 4) | | | 15,069 | | | | 18,020 | |

| Exploration expenditures (notes 5 and 6) | | | 5,636,641 | | | | 5,333,180 | |

| Insurance | | | 213,548 | | | | 201,415 | |

| Investor relations (notes 6 and 7) | | | 1,308,792 | | | | 909,798 | |

| Office and miscellaneous | | | 119,687 | | | | 132,168 | |

| Professional fees (note 6) | | | 376,322 | | | | 261,428 | |

| Regulatory | | | 162,313 | | | | 96,982 | |

| Rent | | | 74,529 | | | | 99,440 | |

| Travel | | | 275,602 | | | | 213,335 | |

| Wages and benefits (notes 6 and 7) | | | 1,782,198 | | | | 1,302,813 | |

| | | | | | | | | |

| Total operating expenses | | | (11,020,098 | ) | | | (9,194,678 | ) |

| | | | | | | | | |

| Other income (expense) | | | | | | | | |

| Interest income | | | 76,835 | | | | 20,273 | |

| Foreign exchange gain (loss) | | | 85,258 | | | | (123,758 | ) |

| | | | | | | | | |

| Total other income (expense) | | | 162,093 | | | | (103,485 | ) |

| | | | | | | | | |

| Net loss for the year | | | (10,858,005 | ) | | | (9,298,163 | ) |

| | | | | | | | | |

| Other comprehensive income (loss) | | | | | | | | |

| Exchange difference on translating foreign operations | | | 258,813 | | | | (224,660 | ) |

| | | | | | | | | |

| Comprehensive loss for the year | | $ | (10,599,192 | ) | | $ | (9,522,823 | ) |

| | | | | | | | | |

| Basic and diluted net loss per share | | $ | (0.10 | ) | | $ | (0.09 | ) |

| | | | | | | | | |

| Weighted average number of shares outstanding | | | 108,584,442 | | | | 101,298,273 | |

These accompanying notes form an integral part of these consolidated financial statements

CORVUS GOLD INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended May 31,

(Expressed in Canadian dollars)

| | | | | |

| | | 2019 | | 2018 |

| | | | | |

| Operating activities | | | | | | | | |

| Net loss for the year | | $ | (10,858,005 | ) | | $ | (9,298,163 | ) |

| Add items not affecting cash: | | | | | | | | |

| Depreciation | | | 15,069 | | | | 18,020 | |

| Stock-based compensation (note 6) | | | 1,633,957 | | | | 673,233 | |

| Foreign exchange gain (loss) | | | (85,258 | ) | | | 123,758 | |

| Changes in non-cash items: | | | | | | | | |

| Accounts receivable | | | (24,220 | ) | | | (11,914 | ) |

| Prepaid expenses | | | (98,199 | ) | | | (7,596 | ) |

| Accounts payable and accrued liabilities | | | 14,928 | | | | 37,619 | |

| | | | | | | | | |

| Cash used in operating activities | | | (9,401,728 | ) | | | (8,465,043 | ) |

| | | | | | | | | |

| Financing activities | | | | | | | | |

| Cash received from issuance of shares | | | 10,894,926 | | | | 10,073,362 | |

| Share issuance costs | | | (31,059 | ) | | | (107,348 | ) |

| | | | | | | | | |

| Cash provided by financing activities | | | 10,863,867 | | | | 9,966,014 | |

| | | | | | | | | |

| Investing activities | | | | | | | | |

| Expenditures on property and equipment | | | (1,769 | ) | | | (7,710 | ) |

| Capitalized acquisition costs | | | (47,318 | ) | | | (38,384 | ) |

| | | | | | | | | |

| Cash used in investing activities | | | (49,087 | ) | | | (46,094 | ) |

| | | | | | | | | |

| Effect of foreign exchange on cash | | | 121,492 | | | | (144,889 | ) |

| | | | | | | | | |

| Increase in cash and cash equivalents | | | 1,534,544 | | | | 1,309,988 | |

| | | | | | | | | |

| Cash and cash equivalents, beginning of the year | | | 2,610,541 | | | | 1,300,553 | |

| | | | | | | | | |

| Cash and cash equivalents, end of the year | | $ | 4,145,085 | | | $ | 2,610,541 | |

Supplemental cash flow information (note 10)

These accompanying notes form an integral part of these consolidated financial statements

CORVUS GOLD INC.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Expressed in Canadian dollars)

| | | Number of shares | | Amount | | Contributed Surplus | | Accumulated Other Comprehensive Income – Cumulative Translation Differences | | Deficit | | Total |

| | | | | | | | | | | | | |

| Balance, May 31, 2017 | | | 92,369,582 | | | $ | 72,670,170 | | | $ | 12,480,784 | | | $ | 1,348,070 | | | $ | (80,971,763 | ) | | $ | 5,527,261 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year | | | – | | | | – | | | | – | | | | – | | | | (9,298,163 | ) | | | (9,298,163 | ) |

| Shares issued for cash | | | | | | | | | | | | | | | | | | | | | | | | |

| Private placement | | | 10,603,933 | | | | 9,903,499 | | | | – | | | | – | | | | – | | | | 9,903,499 | |

| Exercise of stock options | | | 256,660 | | | | 169,863 | | | | – | | | | – | | | | – | | | | 169,863 | |

| Share issued for capitalized acquisition costs | | | 1,025,000 | | | | 847,000 | | | | – | | | | – | | | | – | | | | 847,000 | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange difference on translating foreign operations | | | – | | | | – | | | | – | | | | (224,660 | ) | | | – | | | | (224,660 | ) |

| Share issuance costs | | | – | | | | (107,348 | ) | | | – | | | | – | | | | – | | | | (107,348 | ) |

| Reclassification of contributed surplus on exercise of stock options | | | – | | | | 123,302 | | | | (123,302 | ) | | | – | | | | – | | | | – | |

| Stock-based compensation | | | – | | | | – | | | | 673,233 | | | | – | | | | – | | | | 673,233 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, May 31, 2018 | | | 104,255,175 | | | | 83,606,486 | | | | 13,030,715 | | | | 1,123,410 | | | | (90,269,926 | ) | | | 7,490,685 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year | | | – | | | | – | | | | – | | | | – | | | | (10,858,005 | ) | | | (10,858,005 | ) |

| Shares issued for cash | | | | | | | | | | | | | | | | | | | | | | | | |

| Private placement | | | 2,530,770 | | | | 6,580,002 | | | | – | | | | – | | | | – | | | | 6,580,002 | |

| Exercise of stock options | | | 4,651,900 | | | | 4,314,924 | | | | – | | | | – | | | | – | | | | 4,314,924 | |

| Share issued for capitalized acquisition costs | | | 25,000 | | | | 59,500 | | | | – | | | | – | | | | – | | | | 59,500 | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange difference on translating foreign operations | | | – | | | | – | | | | – | | | | 258,813 | | | | – | | | | 258,813 | |

| Share issuance costs | | | – | | | | (31,059 | ) | | | – | | | | – | | | | – | | | | (31,059 | ) |

| Reclassification of contributed surplus on exercise of stock options | | | – | | | | 3,196,919 | | | | (3,196,919 | ) | | | – | | | | – | | | | – | |

| Stock-based compensation | | | – | | | | – | | | | 1,633,957 | | | | – | | | | – | | | | 1,633,957 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, May 31, 2019 | | | 111,462,845 | | | $ | 97,726,772 | | | $ | 11,467,753 | | | $ | 1,382,223 | | | $ | (101,127,931 | ) | | $ | 9,448,817 | |

These accompanying notes form an integral part of these consolidated financial statements

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

On August 25, 2010, International Tower Hill Mines Ltd. (“ITH”) completed a Plan of Arrangement (the “Arrangement”) whereby its existing Alaska mineral properties (other than the Livengood project) and related assets and the North Bullfrog mineral property and related assets in Nevada (collectively, the “Nevada and Other Alaska Business”) were indirectly spun out into a new public company, being Corvus Gold Inc. (“Corvus” or the “Company”). As part of the Arrangement, ITH transferred its wholly-owned subsidiary Corvus Gold Nevada Inc. (“Corvus Nevada”) (which held the North Bullfrog property), to Corvus and a wholly-owned Alaskan subsidiary of ITH, Talon Gold Alaska, Inc. sold to Raven Gold Alaska Inc. (“Raven Gold”), the Terra, Chisna, LMS and West Pogo properties. As a consequence of the completion of the Arrangement, the Terra, Chisna, LMS, West Pogo and North Bullfrog properties were transferred to Corvus.

The Company was incorporated on April 13, 2010 under theBusiness Corporations Act (British Columbia). These consolidated financial statements reflect the cumulative operating results of the predecessor, as related to the mineral properties that were transferred to the Company from June 1, 2006.

The Company is engaged in the business of acquiring, exploring and evaluating mineral properties, and either joint venturing or developing these properties further or disposing of them when the evaluation is completed. At May 31, 2019, the Company had interests in properties in Nevada, U.S.A.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral property interests. The recoverability of amounts shown for mineral properties is dependent on several factors. These include the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development of these properties, and future profitable production or proceeds from disposition of mineral properties. The carrying value of the Company’s mineral properties does not reflect current or future values.

These consolidated financial statements have been prepared on a going concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future. The Company’s ability to continue as a going concern is dependent upon achieving profitable operations and/or obtaining additional financing.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future within one year from the date the consolidated financial statements are issued. There is substantial doubt upon the Company’s ability to continue as going concern, as explained in the following paragraphs.

The Company has sustained significant losses from operations, has negative cash flows, and has an ongoing requirement for capital investment to explore its mineral properties. As at May 31, 2019, the Company had working capital of $4,204,082 compared to working capital of $2,562,047 as at May 31, 2018. On June 7, 2018, the Company closed a non-brokered private placement equity financing and issued 1,730,770 common shares at a price of $2.60 per common share for gross proceeds of $4,500,002. In November of 2018, the Company issued 4,036,900 common shares on the exercise of 4,036,900 stock options at an exercise price of $0.86 per stock option for net proceeds of $3,453,924. On December 20, 2018, the Company closed a non-brokered private placement equity financing and issued 800,000 common shares at a price of $2.60 per common share for gross proceeds of $2,080,000. In April 2019, the Company issued 615,000 common shares on the exercise of 615,000 stock options at an exercise price of $1.40 per stock option for net proceeds of $861,000. On June 5, 2019, the Company closed a non-brokered private placement equity financing and issued 500,000 common shares at a price of $1.80 per common share for gross proceeds of $900,000 (Note 12a)). Based on its current plans, budgeted expenditures, and cash requirements, the Company does not have sufficient cash to finance its current plans for the 12 months from the date the consolidated financial statements are issued.

The Company expects that it will need to raise substantial additional capital to accomplish its business plan over the next several years. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Company as those previously obtained, or at all. Should such financing not be available in that time-frame, the Company will be required to reduce its activities and will not be able to carry out all of its presently planned exploration and development activities on its currently anticipated scheduling.

These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue in business.

All currency amounts are stated in Canadian dollars unless noted otherwise.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of presentation

These consolidated financial statements are presented in Canadian dollars and have been prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”).

Basis of consolidation

These consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries (collectively, the “Group”), Corvus Gold (USA) Inc. (“Corvus USA”) (a Nevada corporation), Corvus Gold Nevada Inc. (“Corvus Nevada”) (a Nevada corporation), Raven Gold Alaska Inc. (“Raven Gold”) (an Alaska corporation), SoN Land and Water LLC (“SoN”) (a Nevada limited liability company) and Mother Lode Mining Company LLC (a Nevada limited liability company). All intercompany transactions and balances were eliminated upon consolidation.

Significant judgments, estimates and assumptions

The preparation of these financial statements in accordance with US GAAP requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting year. Actual outcomes could differ from these estimates. These financial statements include estimates which, by their nature, are uncertain. The impacts of such estimates are pervasive throughout the financial statements, and may require accounting adjustments based on future occurrences. Revisions to accounting estimates are recognized in the year in which the estimate is revised and future periods if the revision affects both current and future years. These estimates are based on historical experience, current and future economic conditions and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

Significant estimates

Significant assumptions about the future and other sources of estimation uncertainty that management has made at the end of the reporting year, that could result in a material adjustment to the carrying amounts of assets and liabilities, in the event that actual results differ from assumptions made, relate to, but are not limited to, the carrying value and the recoverability of the capitalized acquisition costs, the assumptions used to determine the fair value of stock-based compensation, and the estimated amounts of reclamation and environmental obligations.

Significant judgments

Critical accounting judgments are accounting policies that have been identified as being complex or involving subjective judgments or assessments. The Company made the following critical accounting judgments:

| · | The determination of deferred tax assets and liabilities. |

| · | The analysis of resource calculations, drill results, laboratory work, etc., which can impact the Company’s assessment of impairments, and provisions, if any, for environmental rehabilitation and restorations. |

| · | The determination of functional currency. using the currency of the primary economic environment in which each of the parent company and its subsidiaries operates. |

| · | The assessment of the Company’s ability to continue as a going concern. |

Cash and cash equivalents

Cash equivalents include highly liquid investments in term deposits that are readily convertible to known amounts of cash with original maturities of three months or less, and term deposits with original term of maturities greater than three months but are cashable after 30 days with no penalties, and are subject to an insignificant risk of change in value.

Foreign currency translation

The presentation currency of the Company is the Canadian dollar.

The functional currency of each of the parent company and its subsidiaries is measured using the currency of the primary economic environment in which that entity operates. The functional currency of Corvus USA, Corvus Nevada, Raven Gold, SoN, and Mother Lode Mining Company LLC is US dollars, and for the Company the functional currency is Canadian dollars.

Transactions and balances

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the date of the transaction. Foreign currency monetary items are translated at the year-end exchange rate. Non-monetary items measured at historical cost continue to be carried at the exchange rate at the date of the transaction. Non-monetary items measured at fair value are reported at the exchange rate at the date when fair values were determined.

Exchange differences arising on the translation of monetary items or on settlement of monetary items are recognized in profit or loss in the Statement of Operations and Comprehensive Loss in the year in which they arise.

Exchange differences arising on the translation of non-monetary items are recognized in other comprehensive income (loss) in the Statement of Operations and Comprehensive Loss to the extent that gains and losses arising on those non-monetary items are also recognized in other comprehensive income (loss). Where the non-monetary gain or loss is recognized in profit or loss, the exchange component is also recognized in profit or loss.

Parent and Subsidiary Companies

The financial results and position of foreign operations whose functional currency is different from the presentation currency are translated as follows:

| · | Assets and liabilities are translated at year-end exchange rates prevailing at that reporting date; and |

| · | Income and expenses are translated at monthly average exchange rates during the year. |

Exchange differences arising on translation of foreign operations are transferred directly to the Group’s exchange difference on translating foreign operations in the Statement of Operations and Comprehensive Loss and are reported as a separate component of shareholders’ equity titled “Cumulative Translation Differences”. These differences are recognized in profit or loss in the year in which the operation is disposed of.

Property and equipment

| a) | Recognition and measurement |

On initial recognition, property and equipment are valued at cost, being the purchase price and directly attributable costs of acquisition or construction required to bring the asset to the location and condition necessary to be capable of operating in the manner intended by the Company, including appropriate borrowing costs and the estimated present value of any future unavoidable costs of dismantling and removing items.

Property and equipment is subsequently measured at cost less accumulated depreciation, less any accumulated impairment losses, with the exception of land which is not depreciated.

When parts of an item of property and equipment have different useful lives, they are accounted for as separate items (major components) of property and equipment.

The cost of replacing part of an item of property and equipment is recognized in the carrying amount of the item if it is probable that the future economic benefit embodied within the part will flow to the Company and its cost can be measured reliably. The carrying amount of the replaced part is derecognized. The costs of the day-to-day servicing of property and equipment are recognized in profit or loss as incurred.

| c) | Major maintenance and repairs |

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Company and the cost of the item can be measured reliably. All other repairs and maintenance expenditures are charged to profit or loss during the financial year in which they are incurred.

Gains and losses on disposal of an item of property and equipment are determined by comparing the proceeds from disposal with the carrying amount, and are recognized net within other items in profit or loss.

Depreciation is recognized in profit or loss on a declining-balance basis at the following annual rates:

| Computer equipment | - | 30% declining balance |

| Vehicles | - | 30% declining balance |

| Tent | - | 20% declining balance |

Additions during the year are depreciated at one-half the annual rates.

Depreciation methods, useful lives and residual values are reviewed at each financial year-end and adjusted if appropriate.

Mineral properties and exploration and evaluation expenditures

The Company’s mineral projects are currently in the exploration and evaluation phase. All direct costs related to the acquisition of mineral property interests are capitalized. Mineral property exploration costs are expensed as incurred. At such time that the Company determines that a mineral property can be economically developed, subsequent mineral property expenses will be capitalized during the development of such property.

Impairment of long-lived assets

The Company assesses long-lived assets for impairment or when facts and circumstances suggest that the carrying amount of an asset may exceed its recoverable amount. Impairment analysis includes assessment of the following circumstances: a significant decrease in the market price of a long-lived asset or asset group; a significant adverse change in the extent or manner in which a long-lived asset or asset group is being used or in its physical condition; a significant adverse change in legal factors or in the business climate that could affect the value of a long-lived asset or asset group, including an adverse action or assessment by a regulator; an accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of a long-lived asset or asset group; a current-period operating or cash flow loss combined with a history of operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of a long-lived asset or asset group; a current expectation that, more likely than not, a long-lived asset or asset group will be sold or otherwise disposed of significantly before the end of its previously estimated useful life. The term more likely than not refers to a level of likelihood that is more than 50%.

Asset retirement obligations

The Company records a liability based on the best estimate of costs for site closure and reclamation activities that the Company is legally or contractually required to remediate at the time environmental disturbance occurs. The provision for closure and reclamation liabilities is estimated using expected cash flows based on engineering and environmental reports and accreted to full value over time through periodic charges to profit or loss. As at May 31, 2019, the Company recorded a provision of $419,286 (USD 309,000) (2018 - $366,641 (USD 283,000)) for environmental rehabilitation.

Income taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under the asset and liability method, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if it is more likely than not that some portion or the entire deferred tax asset will not be realized.

Share capital

The proceeds from the exercise of stock options, warrants and escrow shares are recorded as share capital in the amount for which the option, warrant or escrow share enabled the holder to purchase a share in the Company.

Commissions paid to agents, and other related share issuance costs, such as legal, auditing, and printing, on the issue of the Company’s shares are charged directly to share capital.

Valuation of equity units issued in private placements

The Company has adopted a residual value method with respect to the measurement of shares and warrants issued as private placement units. The residual value method first allocates value to the more easily measurable component based on fair value and then the residual value, if any, to the less easily measurable component.

The fair value of the common shares issued in the private placements was determined to be the more easily measurable component and were valued at their fair value, as determined by the closing quoted bid price on the announcement date. The balance, if any, is allocated to the attached warrants. Any fair value attributed to the warrants is recorded as contributed surplus. Upon exercise of the warrants, the related fair value is reallocated to share capital.

Earnings (loss) per share

Basic loss per share is calculated using the weighted average number of common shares outstanding during the year. The Company uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on earnings (loss) per share is calculated presuming the exercise of outstanding options, warrants and similar instruments. It assumes that the proceeds of such exercise would be used to repurchase common shares at the average market price during the year. However, the calculation of diluted loss per share excludes the effects of various conversions and exercise of options and warrants that would be anti-dilutive. For the year ended May 31, 2019, 10,000,000 outstanding stock options (2018 – 9,861,900) were not included in the calculation of diluted earnings (loss) per share as their inclusion was anti-dilutive.

Stock-based compensation

The Company follows the provisions of Financial Accounting Standards Board Accounting Standards Codification Section 718 “Compensation - Stock Compensation”, which establishes accounting for equity based compensation awards to be accounted for using the fair value method. The Company uses the Black-Scholes option pricing model to determine the grant date fair value of the awards. Compensation expense is measured at the grant date and recognized over the requisite service period, on a straight line basis, which is generally the vesting period. Upon exercise of stock options, the related fair value is reallocated to share capital.

Non-monetary transactions

All non-monetary transactions are measured at the fair value of the asset surrendered or the asset received, whichever is more reliable, unless the transaction lacks commercial substance or the fair value cannot be reliably established. The commercial substance requirement is met when the future cash flows are expected to change significantly as a result of the transaction. When the fair value of a non-monetary transaction cannot be reliably measured, it is recorded at the carrying amount (after reduction, when appropriate, for impairment) of the asset given up adjusted by the fair value of any monetary consideration received or given. When the asset received or the consideration given up is shares in an actively traded market, the value of those shares will be considered fair value.

Joint venture accounting

Where the Company’s exploration and development activities are conducted with others, the accounts reflect only the Company’s proportionate interest in such activities. The Company currently is not a party to any joint venture arrangements.

Recently Issued Accounting Standards Updates

Accounting Standards Update No. 2018-13 Fair Value Measurement (Topic 820). In August 2018, the FASB issued amendments to achieve common fair value measurement and disclosure requirements in U.S. GAAP and IFRSs. The amendments on changes in unrealized gains and losses, the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements, and the narrative description of measurement uncertainty should be applied prospectively for only the most recent interim or annual period presented in the initial fiscal year of adoption. All entities are required to adopt the new standard for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. For calendar year-end public companies, this means an adoption date of January 1, 2020. Early adoption is permitted. The adoption of the guidance has no material impact on the Company’s consolidated financial statements and disclosures.

Accounting Standards Update No. 2018-07 Compensation – Stock Compensation (Topic 718). In June 2018, the FASB issued amendments to improve nonemployee share-based payment accounting. The amendments expand the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from nonemployees. An entity should apply the requirements of Topic 718 to nonemployee awards except for specific guidance on inputs to an option pricing model and the attribution of cost. Public business entities are required to adopt the new standard for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For calendar year-end public companies, this means an adoption date of January 1, 2019. Early adoption is permitted. The adoption of the guidance has no material impact on the Company’s consolidated financial statements and disclosures.

Accounting Standards Update No. 2018-02 Income Statement – Reporting Comprehensive Income (Topic 220). In February 2018, the FASB issued amendments to reclassify certain tax effects from accumulated other comprehensive income. The amendments allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act. The amendments in this Update also require certain disclosure about stranded tax effects. All entities are required to adopt the new standard for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For calendar year-end public companies, this means an adoption date of January 1, 2019. Early adoption is permitted. The adoption of the guidance has no material impact on the Company’s consolidated financial statements and disclosures.

Accounting Standards Update No. 2016-02 Leases (Topic 842). In February 2016, the FASB issued amendments on accounting of leases. These are elements of the new standard that could impact almost all entities to some extent, although lessees will likely see the most significant changes. Lessees will need to recognize virtually all of their leases on the balance sheet, by recording a right-of-use asset and a lease liability. Public business entities are required to adopt the new leasing standard for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. For calendar year-end public companies, this means an adoption date of January 1, 2019. Early adoption is permitted. The adoption of the guidance will have an immaterial impact on the Company’s consolidated financial statements and disclosures.

| 3. | FAIR VALUE OF FINANCIAL INSTRUMENTS |

Financial instruments recorded at fair value are classified using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. The fair value hierarchy has the following levels:

Level 1 – valuation based on quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 – valuation techniques based on inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3 – valuation techniques using inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The fair value hierarchy requires the use of observable market inputs whenever such inputs exist. A financial instrument is classified to the lowest level of the hierarchy for which a significant input has been considered in measuring fair value. The following table presents the financial instruments recorded at fair value, classified using the fair value hierarchy described above:

| May 31, 2019 | | Level 1 |

| | | | | |

| Cash and cash equivalents | | $ | 4,145,085 | |

| May 31, 2018 | | Level 1 |

| | | | | |

| Cash and cash equivalents | | $ | 2,610,541 | |

| | | Computer

Equipment | | Vehicles | | Tent | | Total |

| | | | | | | | | |

| Cost | | | | | | | | | | | | | | | | |

| Balance, May 31, 2017 | | $ | 78,341 | | | $ | 92,094 | | | $ | 67,500 | | | $ | 237,935 | |

| Additions | | | 7,710 | | | | – | | | | – | | | | 7,710 | |

| Currency translation adjustments | | | (2,432 | ) | | | (3,766 | ) | | | (2,760 | ) | | | (8,958 | ) |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2018 | | | 83,619 | | | | 88,328 | | | | 64,740 | | | | 236,687 | |

| Additions | | | 1,769 | | | | – | | | | – | | | | 1,769 | |

| Currency translation adjustments | | | 2,728 | | | | 3,949 | | | | 2,895 | | | | 9,572 | |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2019 | | $ | 88,116 | | | $ | 92,277 | | | $ | 67,635 | | | $ | 248,028 | |

| | | | | | | | | | | | | | | | | |

| Depreciation | | | | | | | | | | | | | | | | |

| Balance, May 31, 2017 | | $ | 53,544 | | | $ | 78,466 | | | $ | 36,396 | | | $ | 168,406 | |

| Depreciation for the year | | | 8,312 | | | | 3,849 | | | | 5,859 | | | | 18,020 | |

| Currency translation adjustments | | | (1,712 | ) | | | (3,137 | ) | | | (1,380 | ) | | | (6,229 | ) |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2018 | | | 60,144 | | | | 79,178 | | | | 40,875 | | | | 180,197 | |

| Depreciation for the year | | | 7,391 | | | | 2,802 | | | | 4,876 | | | | 15,069 | |

| Currency translation adjustments | | | 2,202 | | | | 3,605 | | | | 1,939 | | | | 7,746 | |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2019 | | $ | 69,737 | | | $ | 85,585 | | | $ | 47,690 | | | $ | 203,012 | |

| | | | | | | | | | | | | | | | | |

| Carrying amounts | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2018 | | $ | 23,475 | | | $ | 9,150 | | | $ | 23,865 | | | $ | 56,490 | |

| | | | | | | | | | | | | | | | | |

| Balance, May 31, 2019 | | $ | 18,379 | | | $ | 6,692 | | | $ | 19,945 | | | $ | 45,016 | |

The Company had the following activity related to capitalized acquisition costs:

| | | North

Bullfrog | | Mother Lode | | Total |

| | | (note 5a)) | | (note 5b)) | | |

| | | | | | | |

| Balance, May 31, 2017 | | $ | 4,527,740 | | | $ | – | | | $ | 4,527,740 | |

| Acquisition costs | | | | | | | | | | | | |

| Cash payments (note 5a)(ii)(1)) | | | 38,384 | | | | – | | | | 38,384 | |

| Shares issued (note 5a)(ii)(1), 5b) and 6) | | | 37,000 | | | | 810,000 | | | | 847,000 | |

| Asset retirement obligations | | | 9,899 | | | | 30,475 | | | | 40,374 | |

| Currency translation adjustments | | | (184,271 | ) | | | (30,438 | ) | | | (214,709 | ) |

| | | | | | | | | | | | | |

| Balance, May 31, 2018 | | | 4,428,752 | | | | 810,037 | | | | 5,238,789 | |

| | | | | | | | | | | | | |

| Acquisition costs | | | | | | | | | | | | |

| Cash payments (note 5a)(ii)(1)) | | | 47,318 | | | | – | | | | 47,318 | |

| Shares issued (note 5a)(ii)(1) and 6) | | | 59,500 | | | | – | | | | 59,500 | |

| Asset retirement obligations | | | 24,765 | | | | 11,485 | | | | 36,250 | |

| Currency translation adjustments | | | 200,922 | | | | 36,226 | | | | 237,148 | |

| | | | | | | | | | | | | |

| Balance, May 31, 2019 | | $ | 4,761,257 | | | $ | 857,748 | | | $ | 5,619,005 | |

The following table presents costs incurred for exploration and evaluation activities for the year ended May 31, 2019:

| | | North

Bullfrog | | Mother Lode | | Total |

| | | (note 5a)) | | (note 5b)) | | |

| | | | | | | |

| Exploration costs: | | | | | | | | | | | | |

| Assay | | $ | 14,839 | | | $ | 567,274 | | | $ | 582,113 | |

| Drilling | | | 208,421 | | | | 1,788,433 | | | | 1,996,854 | |

| Equipment rental | | | 33,173 | | | | 66,780 | | | | 99,953 | |

| Field costs | | | 13,620 | | | | 248,059 | | | | 261,679 | |

| Geological/ Geophysical | | | 83,972 | | | | 650,424 | | | | 734,396 | |

| Land maintenance & tenure | | | 414,636 | | | | 271,749 | | | | 686,385 | |

| Permits | | | 7,546 | | | | 155,661 | | | | 163,207 | |

| Studies | | | 98,904 | | | | 891,297 | | | | 990,201 | |

| Travel | | | 14,035 | | | | 107,818 | | | | 121,853 | |

| | | | | | | | | | | | | |

| Total expenditures for the year | | $ | 889,146 | | | $ | 4,747,495 | | | $ | 5,636,641 | |

The following table presents costs incurred for exploration and evaluation activities for the year ended May 31, 2018:

| | | North

Bullfrog | | Mother Lode | | Total |

| | | (note 5a)) | | (note 5b)) | | |

| | | | | | | |

| Exploration costs: | | | | | | | | | | | | |

| Assay | | $ | 44,703 | | | $ | 742,751 | | | $ | 787,454 | |

| Drilling | | | (3,265 | ) | | | 1,885,504 | | | | 1,882,239 | |

| Equipment rental | | | 15,698 | | | | 89,965 | | | | 105,663 | |

| Field costs | | | 33,310 | | | | 315,406 | | | | 348,716 | |

| Geological/ Geophysical | | | 80,771 | | | | 658,575 | | | | 739,346 | |

| Land maintenance & tenure | | | 337,695 | | | | 144,985 | | | | 482,680 | |

| Permits | | | 9,036 | | | | 113,246 | | | | 122,282 | |

| Studies | | | 478,904 | | | | 270,754 | | | | 749,658 | |

| Travel | | | 10,245 | | | | 104,897 | | | | 115,142 | |

| | | | | | | | | | | | | |

| Total expenditures for the year | | $ | 1,007,097 | | | $ | 4,326,083 | | | $ | 5,333,180 | |

| a) | North Bullfrog Project, Nevada |

The Company’s North Bullfrog project consists of certain leased patented lode mining claims and federal unpatented mining claims owned 100% by the Company.

| (i) | Interests acquired from Redstar Gold Corp. |

On October 9, 2009, a US subsidiary of ITH at the time (Corvus Nevada) completed the acquisition of all of the interests of Redstar Gold Corp. (“Redstar”) and Redstar Gold U.S.A. Inc. (“Redstar US”) in the North Bullfrog project, which consisted of six leases covering 33 patented mining claims. The leases have an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the Company:

The Company is required to pay annual advance minimum royalty payments (recoupable from production royalties) for as long as there are mining activities continuing on the claims or contiguous claims held by the Company. The required annual advance minimum royalty payments are:

| ¤ | 17,700 USD (adjusted annually for inflation) |

The lessor is entitled to receive a separate NSR royalty related to all production from the leased property of the various individual leases which may be purchased by the Company as follows:

| ¤ | a 4% NSR royalty, which may be purchased by the Company for USD 1,250,000 per 1% (USD 5,000,000 for the entire royalty). |

| ¤ | a 2% NSR royalty on all production, which may be purchased by the Company for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| ¤ | a 3% NSR royalty on all production, which may be purchased by the Company for USD 850,000 per 1% (USD 2,550,000 for the entire royalty). |

| ¤ | a 3% NSR royalty on all production which may be purchased by the Company for USD 770,000 per 1% (USD 2,310,000 for the entire royalty). |

| ¤ | a 4% NSR royalty on all production, which may be purchased by the Company for USD 1,000,000 per 1% (USD 4,000,000 for the entire royalty). |

| ¤ | a 2% NSR royalty on all production, which may be purchased by the Company for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| ¤ | a 2% NSR royalty on all production, which may be purchased by the Company for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty) |

The various NSR royalties above relate only to the property covered by each specific lease and are not cumulative.

The Company has an option to purchase a property related to twelve patented mining claims for USD 1,000,000 at any time during the life of the lease (subject to the net smelter return (“NSR”) royalty of 4% which may be purchased by the Company for USD 1,250,000 per 1% (USD 5,000,000 for the entire royalty).

| (ii) | Interests acquired directly by Corvus Nevada |

| (1) | Pursuant to a mining lease and option to purchase agreement made effective December 1, 2007 between Corvus Nevada and a group of arm’s length limited partnerships, Corvus Nevada has leased (and has the option to purchase) patented mining claims referred to as the “Mayflower” claims which form part of the North Bullfrog project. The terms of the lease/option are as follows: |

| ¤ | Terms:Initial term of five years, commencing December 1, 2007, with the option to extend the lease for an additional five years. Pursuant to an extension agreement dated January 15, 2016 and fully executed and effective as of November 22, 2017, the parties agreed to extend the lease and option granted for an additional ten years with the same lease payment terms. |

| ¤ | Lease Payments: Corvus Nevada will pay USD 10,000 and deliver 50,000 common shares of ITH (USD 10,000 paid on November 15, 2018 and 50,000 common shares of ITH, purchased for $34,116 in the market by the Company, were delivered on November 6, 2018). |

| ¤ | Anti-Dilution: Pursuant to an amended agreement agreed to by the lessors in March 2015, the Company, all future payments will be satisfied by the delivery of an additional ½ common shares of the Company for each of the ITH common shares due per the original agreement (issued 25,000 shares of the Company on November 26, 2018). |

| ¤ | Work Commitments:USD 100,000 per year for the first three years (incurred), USD 200,000 per year for the years four to six (incurred), USD 300,000 for the years seven to ten (incurred) and USD 300,000 for the years 11 – 20 (incurred). Excess expenditures in any year may be carried forward. If Corvus Nevada does not incur the required expenditures in year one, the deficiency is required to be paid to the lessors. |

| ¤ | Retained Royalty: Corvus Nevada will pay the lessors a NSR royalty of 2% if the average gold price is USD 400 per ounce or less, 3% if the average gold price is between USD 401 and USD 500 per ounce and 4% if the average gold price is greater than USD 500 per ounce. |

| (2) | Pursuant to a mining lease and option to purchase made effective March 1, 2011 between Corvus Nevada and an arm’s length individual, Corvus Nevada has leased, and has the option to purchase, two patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, subject to extension for an additional ten years (provided advance minimum royalties are timely paid), and for so long thereafter as mining activities continue on the claims. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties, but not applicable to the purchase price if the option to purchase is exercised) of USD 30,000 (paid to March 1, 2019), adjusted for inflation. The lessor is entitled to receive a 2% NSR royalty on all production. The lessee may purchase the NSR royalty for USD 1,000,000 per 1%. If the lessee purchases the entire NSR royalty (USD 2,000,000) the lessee will also acquire all interest of the lessor in the subject property. |

| (3) | Pursuant to a purchase agreement made effective March 28, 2013, Corvus Nevada agreed to purchase the surface rights of five patented mining claims owned by two arm’s length individuals for USD 160,000 paid on closing (March 28, 2013). The terms include payment by Corvus Nevada of a fee of USD 0.02 per ton of overburden to be stored on the property, subject to payment for a minimum of 12 million short tons. The minimum tonnage fee (USD 240,000) bears interest at 4.77% per annum from closing and is evidenced by a promissory note due on the sooner of the commencing of use of the property for waste materials storage or December 31, 2015 (balance paid December 17, 2015). As a result, the Company recorded $406,240 (USD 400,000) in acquisition costs with $157,408 paid in cash and the remaining $248,832 (USD 240,000) in promissory note payable during the year ended May 31, 2013. |

| (4) | In December 2013, SoN completed the purchase of a parcel of land approximately 30 kilometres north of the North Bullfrog project which carries with it 1,600 acre feet of irrigation water rights. The cost of the land and associated water rights was cash payment of $1,100,118 (USD 1,034,626). |

| (5) | On March 30, 2015, Lunar Landing, LLC signed a lease agreement with Corvus Nevada to lease private property containing the three patented Sunflower claims to Corvus Nevada, which are adjacent to the Yellow Rose claims leased in 2014. The term of the lease is three years with provision to extend the lease for an additional seven years, and an advance minimum royalty payment of USD 5,000 per year with USD 5,000 paid upon signing (paid to March 2019). The lease includes a 4% NSR royalty on production, with an option to purchase the royalty for USD 500,000 per 1% or USD 2,000,000 for the entire 4% royalty. The lease also includes the option to purchase the property for USD 300,000. |

| b) | Mother Lode Property, Nevada |

Pursuant to a purchase agreement made effective June 9, 2017 between Corvus Nevada and Goldcorp USA, Inc. (“Goldcorp USA”), Corvus Nevada has acquired 100% of the Mother Lode property (the “Mother Lode Property”). In addition, Corvus Nevada staked two additional adjacent claim blocks to the Mother Lode Property. In connection with the acquisition, the Company issued 1,000,000 common shares at a price of $0.81 per common share to Goldcorp USA (note 6). The Mother Lode Property is subject to an NSR in favour of Goldcorp USA. The NSR pays 1% from production at the Mother Lode Property when the price of gold is less than USD 1,400 per ounce and an additional 1% NSR for a total of 2% NSR when gold price is greater than or equal to USD 1,400 per ounce.

Acquisitions