1. Organization and Significant Accounting Policies

The Oakhurst Defined Risk Fund (the "Fund") is a series of the Leeward Investment Trust (the "Trust"). The Trust, originally the Hanna Investment Trust, was organized as a Delaware statutory trust on July 30, 2010. The Hanna Investment Trust was subsequently named the Vertical Capital Investors Trust on February 7, 2014. The current name of the Trust, known as the Leeward Investment Trust, was effective on July 1, 2015. The Trust is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company.

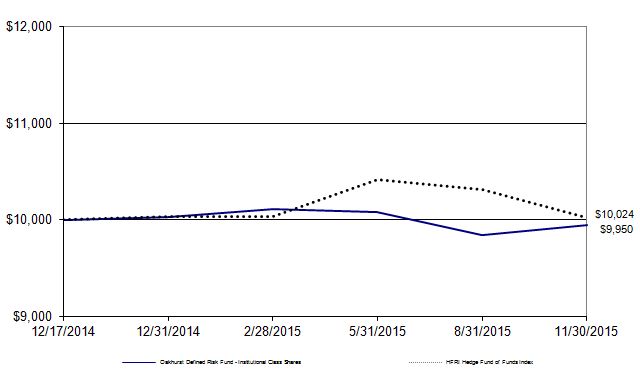

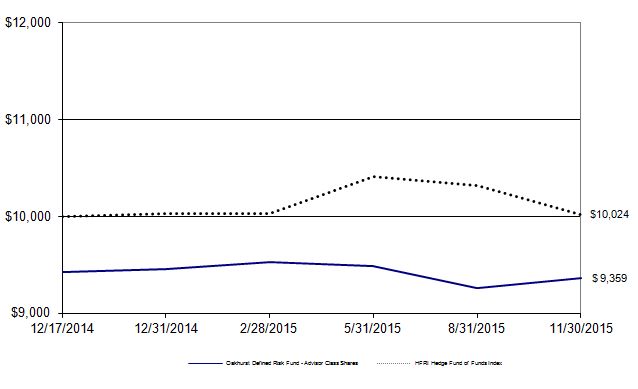

The Fund is a separate diversified series of the Trust and commenced operations on December 17, 2014. The investment objective of the Fund is to seek capital appreciation while seeking to limit short-term risk. The Fund seeks to achieve its investment objective by utilizing an alternatives investment strategy using its self-developed hedged-hybrid model, by which it invests in a variety of hedging strategies. The Fund utilizes a "fund of funds" methodology to allocate its assets among one or more investment companies, principally unaffiliated open-end investment companies.

The Fund currently has an unlimited number of authorized shares, which are divided into two classes - Institutional Class Shares and Advisor Class Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical except that the Advisor Class Shares are subject to distribution and service fees which are further discussed in Note 3. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. A maximum sales load of 5.75% is imposed on purchases, as a percentage of the offering price, on the Advisor Class Shares. All classes have equal voting privileges, except where otherwise required by law or when the Board of Trustees ("Trustees") determines that the matter to be voted on affects only the interests of the shareholders of a particular class.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

Investment Valuation

The Fund's investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the security is principally traded closes early or if trading of the particular security is halted during the day and does not resume prior to the Fund's net asset value calculation) or which cannot be accurately valued using the Fund's normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees, who consist of the Independent Trustees, the Chairman, and the Chief Executive Officer of the Advisor. A security's "fair value" price may differ from the price next available for that security using the Fund's normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

The Fund may invest in portfolios of open-end investment companies (the "Underlying Funds"). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their fair values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds. Open-ended funds are valued at their respective net asset values as reported by such investment companies.

Valuation of Securities For Which Independent Pricing Sources Are Not Available

The Fund may hold certain interests in private placement securities, such as limited liability companies and limited partnerships, and will not have readily available market quotations or will not be priced by an independent pricing source or pricing model. Such securities will be valued by the Advisor and Sub-Advisor, OBP Capital, LLC (the "Advisor") and Lido Advisors, LLC (the "Sub-Advisor"), respectively, according to the fair value process set forth in the Fund's valuation policies and procedures.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

The Advisor and Sub-Advisor meet with the Board of Trustees on a monthly basis, or more frequently as needed, to review and discuss the appropriateness of such fair values using more current information such as, recent security news, recent market transactions, updated corporate action information and/or other macro or security specific events. The Advisor and Sub-Advisor are responsible for developing the Fund's written valuation processes and procedures, conducting periodic reviews of the valuation policies, and evaluating the overall fairness and consistent application of the valuation policies as well as ensuring that the valuation methodologies for investments that are categorized within Level 3 of the fair value hierarchy are fair, consistent, and verifiable. Valuations determined by the Advisor and Sub-Advisor are required to be supported by market data, third-party pricing sources, industry accepted third-party pricing models, counterparty prices, or other methods the Board of Trustees deem to be appropriate, including the use of internal proprietary pricing models. When determining the reliability of third party pricing information for investments owned by the Fund, the Board of Trustees, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

Also, when observable inputs become available, the Board of Trustees conducts back testing of the methodologies used to value Level 3 financial instruments to substantiate the unobservable inputs used to value those investments. Such back testing includes comparing Level 3 investment values to observable inputs such as exchange-traded prices, transaction prices, and/or vendor prices.

The fair value methodologies and processes set forth in the Fund's valuation policies and procedures take into account applicable regulatory and accounting guidance, including the fair value measurement standards incorporated in Financial Accounting Standards Board ("FASB") Topic 820, in addition to other factors, as defined below.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities and identical securities in inactive markets, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A description of the valuation techniques applied to the Fund's major categories of investments measured at fair value on a recurring basis follows.

Limited Liability Companies. The Fund's investments in limited liability companies consist of investments in first trust deeds. The transaction price, excluding transaction costs, is typically the Fund's best estimate of fair value at inception. When evidence supports a change to the carrying value from the transaction price, adjustments are made to reflect expected exit values in the investment's principal market under current market conditions. Ongoing reviews by management are based on an assessment of each underlying investment from the inception date through the most recent valuation date. These assessments typically incorporate assessing that the fair market value of the underlying properties is greater than the amount of the first mortgage on such properties. In certain instances, the partnership, that manages the underlying investments, may use multiple valuation methodologies for a particular investment. Equity investments in private limited liability companies are generally included in Level 3 of the fair value hierarchy. Techniques for pricing these Level 3 securities include obtaining broker price opinions (BPO) or appraisals, reviewing valuation information provided by the loan servicer, and examining local market resources and sales trends (published by the National Association of Realtors or others), and then applying the information to the investment to determine if a change in value is warranted. Adjustments to value, which may be significant, are attributable to inputs such as market conditions, foreclosure and liquidation costs, historical performance of the loan portfolio, and characteristics of the remaining loans, including loan performance.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

At November 30, 2015, investments in the Limited Liability Companies within Level 3 have been valued at fair value using unadjusted third party transaction prices as described above by the Advisor and Sub-Advisor.

The following table summarizes the inputs as of November 30, 2015 for the Fund's assets measured at fair value:

| Investments (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

| Exchange-Traded Products | $ | 6,336,237 | $ | 6,336,237 | $ | - | $ | - |

| Open-End Funds | | 19,223,301 | | 19,223,301 | | - | | - |

| Limited Liability Companies | | 2,500,000 | | - | | - | | 2,500,000 |

| Short-Term Investment | | 325,803 | | 325,803 | | - | | - |

| Total | $ | 28,385,341 | $ | 25,885,341 | $ | - | $ | 2,500,000 |

| (a) | The Fund had no significant transfers into or out of Levels 1, 2, or 3 during the period from December 17, 2014 (Date of Initial Public Investment) through November 30, 2015. The Fund held Level 3 securities during the period. The aggregate value of such securities is 8.44% of net assets, and they have been fair valued under procedures approved by the Fund's Board of Trustees. It is the Fund's policy to record transfers at the end of the period. |

The table below presents a reconciliation of all Level 3 fair value measurements existing at November 30, 2015:

| | Limited Liability Companies |

| Opening Balance as of December 17, 2014 | $ | - |

| Purchases | 2,500,000 |

| Principal payments/sales | - |

| Accrued discounts (premiums) | - |

| Realized Gains | - |

| Unrealized Gains | - |

| Ending Balance as of November 30, 2015 | $ | 2,500,000 |

| | |

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion/amortization of discounts and premiums. Realized gains and losses are determined on the identified cost basis, which is the same basis used for Federal income tax purposes.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of Trust level expenses. Fund expenses are allocated based on the average net assets of each share class. Trust level expenses are allocated equally among each Fund in the Trust.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) quarterly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are determined in accordance with income tax regulations and are recorded on ex-dividend date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Recently Issued Accounting Pronouncement

In May 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2015-07 "Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent)." The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured using the NAV practical expedient. The ASU also removes certain disclosure requirements for investments that qualify, but do not utilize, the NAV practical expedient. The amendments in the ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Management is currently evaluating the impact these changes will have on the Fund's financial statements and related disclosures.

2. Transactions with Affiliates and Service Providers

Advisor

For the period from December 17, 2014 (Date of Initial Public Investment) through June 30, 2015, Vertical Capital Asset Management, LLC ("VCAM") served as the advisor to the Fund. During this period, Lido Advisors, LLC served as the sub-advisor to the Fund. The Fund pays a monthly fee to the Advisor calculated at the annual rate of 1.00% of the Fund's average daily net assets. During the period ended June 30, 2015, $114,517 in advisory fees were incurred by the Fund, and VCAM waived $60,655 of its fees.

Effective July 1, 2015, VCAM tendered its resignation as Advisor to the Fund. OBP Capital, LLC (the "Advisor") would provide advisory services to the Fund and would serve as an interim investment advisor to the Fund, following approval from the Board of Trustees. The advisory fee otherwise payable under the Interim Agreement would be held in an interest-bearing escrow account to be paid to the Advisor pending approval by shareholders of the Fund. The term of the Interim Advisory Agreement is the earlier of 150 days from the date of the Agreement or the date that a new investment advisory agreement is signed. The Interim Advisory Agreement can be terminated by the Board of Trustees with 10 days' written notice to the Advisor. Upon expiration of the interim period of 150 days, the Advisor was appointed by the Trustees to continue its services as the Advisor to the Fund. As a result, a new Investment Advisory Agreement was entered into between the Advisor and the Trust. This Agreement became effective October 23, 2015 and would continue for an initial two year term and then year to year thereafter provided such continuance is approved at least annually by the Trustees.

For the period from July 1, 2015 through November 30, 2015, $109,137 in advisory fees were incurred by the Fund, and the Advisor waived $85,294 of its fees.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

VCAM and OBP Capital, LLC each have entered into a contractual agreement (the "Expense Limitation Agreement") with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund's total operating expenses (exclusive of interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund's business, and amounts, if any, payable under a Rule 12b-1 distribution plan) to not more than 1.50% of the average daily net assets of the Fund for the current fiscal period. The current term of the Expense Limitation Agreement remains in effect until April 30, 2016. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter. For the period from December 17, 2014 (Date of Initial Public Investment) through June 30, 2015, VCAM reimbursed the Fund for $1,849. For the period from July 1, 2015 through November 30, 2015, the Advisor reimbursed the Fund for $15,462.

Sub-Advisor

Lido Advisors, LLC is responsible for management of the Fund's investment portfolio according to the Fund's investment objective, policies, and restrictions. The Sub-Advisor is subject to the authority of the Board of Trustees and oversight by the Advisor. Lido Advisors, LLC would continue to provide services as the Sub-Advisor to the Fund for the interim period. Upon expiration of the interim period of 150 days, Lido was appointed by the Trustees to continue its services as the Sub-Advisor to the Fund. As a result, a new Investment Sub-Advisory Agreement was entered into between the Sub-Advisor and the Advisor. This Agreement became effective October 23, 2015 and would continue for an initial two year term and then year to year thereafter provided such continuance is approved at least annually by the Trustees.

Pursuant to the Sub-Advisory Agreement, the Sub-Advisor is entitled to receive an investment advisory fee equal to an annualized rate of 0.50% of the average daily net assets of the Fund for the period from December 17, 2014 (Date of Initial Public Investment) through June 30, 2015, and 0.80% of the average daily net assets of the Fund for the period from July 1, 2015 through November 30, 2015. The fee excludes certain operating expenses borne by the Advisor, as agreed to between the Advisor and Sub-Advisor. The Fee shall be calculated as of the last business day of each month based upon the average daily net assets of the Fund.

Administrator

The Fund pays a monthly fee to The Nottingham Company (the "Administrator") based upon the average daily net assets of the Fund and subject to a minimum of $2,000 per month. The Fund incurred $24,887 of fees by the Administrator for the initial period from December 17, 2014 (Date of Initial Public Investment) through November 30, 2015. The payable balance to the Administrator as of the period ended November 30, 2015 was $479.

Fund Accounting Services

The Fund engaged The Nottingham Company as its Fund Accounting Service Provider. Under the terms of the Fund Accounting and Administration Agreement, the Fund Accounting Service Provider calculates the daily net asset value per share and maintains the financial books and records for the Fund. The Fund incurred $33,729 of fees by The Nottingham Company for the initial period from December 17, 2014 (Date of Initial Public Investment) through November 30, 2015.

Compliance Services

Cipperman Compliance Services, LLC provides services as the Trust's Chief Compliance Officer. Cipperman Compliance Services, LLC is entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services agreement with the Fund. During the initial period ended November 30, 2015, the Fund incurred $19,473 in compliance fees.

Transfer Agent

The Nottingham Shareholder Services, LLC (the "Transfer Agent") serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent's fee arrangements with the Trust. During the initial period ended November 30, 2015, the Fund incurred fees in the amount of $25,766 for the Transfer Agent.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

Distributor

Capital Investment Group, Inc. (the "Distributor") serves as the Fund's principal underwriter and distributor. The Distributor receives $5,000 per year paid in monthly installments for services provided and expenses assumed. The Distributor also receives compensation for additional expenses incurred relating to the National Securities Clearing Corporation ("NSCC") pricing fees and Mutual Fund Quotation Service ("MFQS") filing fees. The Fund incurred $7,031 of fees by Capital Investment Group, Inc. for the period from December 17, 2014 through November 30, 2015.

Trustees

The Board of Trustees consists of one Independent Trustee who also serves as the Chairman of the Board of Trustees. For the period from December 17, 2014 (Date of Initial Public Investment) through November 30, 2015, the Fund incurred $7,958 in Trustee fees.

Officers

Certain officers of the Fund are also officers of the Administrator, the Transfer Agent, and the Advisor. The Executive Vice President of Client Development for the Administrator serves as a managing member of the Advisor. General Counsel for the Administrator also serves as the Chief Compliance Officer of the Advisor.

3. Distribution and Service Fees

The Independent Trustee, as defined in the 1940 Act and who has no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (the "Plan") for the Advisor Class Shares. The 1940 Act regulates the manner in which a regulated investment company may assume expenses of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may incur certain expenses, which may not exceed 0.25% per annum of the Fund's average daily net assets attributable to the Advisor Class Shares, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel or other expenses reasonably intended to result in sales of shares of the Fund or support servicing of shareholder accounts. For the initial period ended November 30, 2015, $746 in fees were incurred by the Advisor Class Shares.

4. Purchases and Sales of Investment Securities

For the initial period ended November 30, 2015, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $ 42,338,687 | $ 13,924,346 |

There were no long-term purchases or sales of U.S Government Obligations during the initial period ended November 30, 2015.

5. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of November 30, 2015, William Hawkins Scripps owned 66.62% of the Fund and, as a result, could be deemed to have a controlling interest in the Fund.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

6. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. The general ledger is adjusted for permanent book/tax differences to reflect tax character but is not adjusted for temporary differences.

Management has reviewed the Fund's tax positions to be taken on the federal income tax return during the initial period ended November 30, 2015, and determined that the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

There were no distributions during the initial period ended November 30, 2015.

As a result of permanent book to tax differences, certain amounts have been reclassified for the period ended November 30, 2015. The following reclassifications were the result of the deferral of Qualified Late Year Losses so as not to forfeit the Fund's Net Operating Losses totaling $85,159 for the period ended November 30, 2015. These reclassifications have no impact on net assets of the Fund.

For the period ended November 30, 2015, the following reclassifications were made:

| Undistributed Net Investment Income | $ 4,208 |

| Paid In Capital | | (4,208) |

At November 30, 2015, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | | $ | 28,103,868 |

| | | |

| Unrealized Appreciation | | 527,174 |

| Unrealized Depreciation | | (245,701) |

| Net Unrealized Appreciation | | 281,473 |

| | | |

| Accumulated Capital Losses | | (547,326) |

| Other Accumulated Earnings (Losses) | | (85,159) |

| | | |

| Accumulated Deficit | | $ | (351,012) |

| | | | |

Capital Loss Carryforwards

Under the Regulated Investment Company Modernization Act of 2010 ("the Modernization Act"), net capital losses recognized in tax years beginning after December 22, 2010 may be carried forward indefinitely, and the character of the losses is retained as short‐term and/or long‐term. Short-term capital loss carryforwards totaled $547,326 with no expiration.

7. Commitments and Contingencies

Under the Trust's organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Fund entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects the risk of loss to be remote.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

8. Investments in Restricted Securities

Restricted securities include securities that have not been registered under the Securities Act of 1933. The Fund may invest in restricted securities that are consistent with the Fund's investment strategy. Investments in restricted securities are valued at fair value under procedures approved by the Fund's Board of Trustees.

As of November 30, 2015, the Fund was invested in the following restricted securities:

Security | Initial Purchase Date | Shares | Cost | Fair Value | % of Net Assets |

Anchor Fund, LLC – Class A | 3/20/2015 | 4,077 | $1,250,000 | $1,250,000 | 4.22% |

Rama Fund, LLC | 3/23/2015 | 750 | $750,000 | $750,000 | 2.53% |

Westridge Lending Fund II, LP | 6/11/2015 | 500,000 | $500,000 | $500,000 | 1.69% |

9. Liquidity Risk

There is no public market for the private investments and none is expected to develop. Additionally, there are restrictions on transferability of Membership Interests.

Anchor Fund, LLC – Class A

Class A Members of the Anchor Fund, LLC have no right to withdraw from the Fund or to obtain the return of all or any portion of their investment for at least three months after the date such Interests are purchased (the "Holding Period"). After the Holding Period, Class A Members may withdraw all or part of their capital accounts from the Fund by giving at least 60 days' prior written notice to the Managers (the "Withdrawal Notice") setting forth the amount to be withdrawn (the "Withdrawal Amount"). The Withdrawal Notice will become effective on the 60th day after it is given. Thereafter, the amount requested in the Withdrawal Notice will be paid to the requesting Member (subject to the limitations described below) in four quarterly installments each equal to 25% of the amount being withdrawn, beginning on the last day of the calendar quarter in which the Withdrawal Notice becomes effective.

Rama Fund, LLC

A Member may withdraw as a Member of the LLC and may receive a return of capital provided that the following conditions have been met: (i) the Member has been a Member of the LLC for a period of at least twenty-four (24) months; and (ii) the

Member provides the LLC with a written request for a return of capital at least 90 days prior to such withdrawal. The twenty- four (24) months will be rounded to the nearest quarter going forward. If the LLC does not receive a written request for a return of capital within the first twenty-four (24) months, the withdrawing Member automatically renews for another twenty four (24) month period, and so forth on a rolling twenty four (24) month basis. The LLC will use its best efforts to honor requests for a return of capital subject to, among other things, the LLC's then cash flow, financial condition, and prospective loans. However, redemption requests will not be honored if they are detrimental to the LLC. Notwithstanding the foregoing, the Manager may, in its sole discretion, waive such withdrawal requirements if a Member is experiencing undue hardship.

Westridge Lending Fund II, LP

Members who invest in the LLC may not withdraw their capital until they have been members of the LLC for at least twelve (12) months. Members who have been members of the LLC for a period longer than twelve (12) months may request withdrawal from the LLC in writing as of the end of any calendar quarter-end, and the Member must give the LLC at least ninety (90) days' notice prior to the quarter-end date that the withdrawal request would be effective. The LLC will use its best efforts to return capital subject to, among other things, the LLC's then cash flow, financial condition, and prospective transactions in Loans. The Management Company is not under any circumstances obligated to liquidate any assets, properties, or loans in any efforts to accommodate or facilitate any Member(s)' requests for withdrawal or redemption from the LLC. The maximum aggregate amount of capital that the LLC will return to the Members each quarter is limited to twelve and one half percent (12.5%) of the total outstanding capital of the LLC, calculated as of the respective quarter-end effective withdrawal date.

(Continued)

Oakhurst Defined Risk Fund

Notes to Financial Statements

10. Capital Commitment

The Fund advanced a contribution for the Hershiser Income Fund II, LP (the "LP") on September 3, 2015. The funded commitment totaled $1,250,000, and the capital is not deployed for investing as of the period ended November 30, 2015. Subsequent to November 30, 2015, the LP deployed all capital investments on January 11, 2016. The allocation of capital to purchase the LP will account for 4.22% of the portfolio once invested. There are currently no unfunded commitments to the LP as of November 30, 2015, and the LP shall not invest more than 15% of the aggregate capital commitments of the LP in any single investment once deployed.

11. Subsequent Events

In accordance with GAAP, the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has evaluated subsequent events through the issuance of these financial statements.