expenses, transfer agent fees and expenses, and other general and administrative expenses. Interest and other credit facility expenses generally consist of interest, unused fees, agency fees and loan origination fees, if any, among others. The increase in net expenses for the year ended December 31, 2017 was primarily due to higher interest expense stemming from the increase in LIBOR year over year. The decrease in net expenses for the year ended December 31, 2016 was primarily due to the waiver of base management fees and incentive fees as well as reduced interest costs from both lower average borrowing year over year and the higher Credit Facility amendment costs in 2015.

Net Investment Income

The Company’s net investment income totaled $22.6 million or $1.41 per average share, $18.3 million or $1.42 per average share and $15.4 million or $1.33 per average share, for the fiscal years ended December 31, 2017, 2016 and 2015, respectively.

Net Realized Gain

The Company had investment sales and prepayments totaling approximately $156 million, $112 million and $135 million, respectively, for the fiscal years ended December 31, 2017, 2016 and 2015. Net realized gain for the fiscal years ended December 31, 2017, 2016 and 2015 totaled $0.2 million, $0.1 million and $0.02 million, respectively. Net realized gain for the fiscal year ended December 31, 2017 was primarily related to select sales of a few portfolio investments. Modest net realized gains for the fiscal years ended December 31, 2016 and 2015 were also primarily related to select sales of a few portfolio investments.

Net Change in Unrealized Gain (Loss)

For the fiscal years ended December 31, 2017, 2016 and 2015, the net change in unrealized gain (loss) on the Company’s assets and liabilities totaled $0.5 million, $5.9 million and ($14.3) million, respectively. Net unrealized gain for the fiscal year ended December 31, 2017 was primarily due to appreciation in the value of our investments in Advantage Sales and Marketing, Inc., FLLP and Trident USA Health Services, among others. Partially offsetting the unrealized gains was depreciation in our investments in PPT Management Holdings, LLC, Meter Readings Holding, LLC and Polycom, Inc., among others. Net unrealized gain for the fiscal year ended December 31, 2016 was primarily due to appreciation in the value of our investments in Securus Technologies, Inc., Gemino and Global Tel*Link Corporation, among others. Partially offsetting the unrealized gains was depreciation in our investments in TwentyEighty, Inc., Metamorph US 3, LLC and Engineering Solutions & Products, LLC, among others. Net unrealized loss for the fiscal year ended December 31, 2015 was primarily due to technical market conditions and market uncertainty related to our investments in Securus Technologies, Inc. and Global Tel*Link Corporation.

Net Increase in Net Assets From Operations

For the fiscal years ended December 31, 2017, 2016 and 2015, the Company had a net increase in net assets resulting from operations of $23.4 million, $24.3 million and $1.0 million, respectively. For the fiscal years ended December 31, 2017, 2016 and 2015, earnings per average share were $1.46, $1.88 and $0.09, respectively.

LIQUIDITY AND CAPITAL RESOURCES

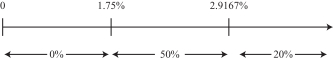

The Company’s liquidity and capital resources are generally available through its Credit Facility, through periodicfollow-on equity offerings, as well as from cash flows from operations, investment sales andpre-payments of investments. At December 31, 2017, the Company had $124.2 million in borrowings outstanding on its Credit Facility and $75.8 million of unused capacity, subject to borrowing base limits.

In September 2016, the Company closed afollow-on public equity offering of 4.5 million shares of common stock at $16.76 per share raising approximately $75.0 million in net proceeds. In the future, the Company may

73