Indemnification Agreements

We have entered into indemnification agreements with our directors. The indemnification agreements are intended to provide our directors the maximum indemnification permitted under Maryland law and the 1940 Act. Each indemnification agreement provides that the Company shall indemnify the director who is a party to the agreement, or an Indemnitee, including the advancement of legal expenses, if, by reason of his or her corporate status, the Indemnitee is, or is threatened to be, made a party to or a witness in any threatened, pending, or completed proceeding, to the maximum extent permitted by Maryland law and the 1940 Act.

Certain Relationships and Transactions

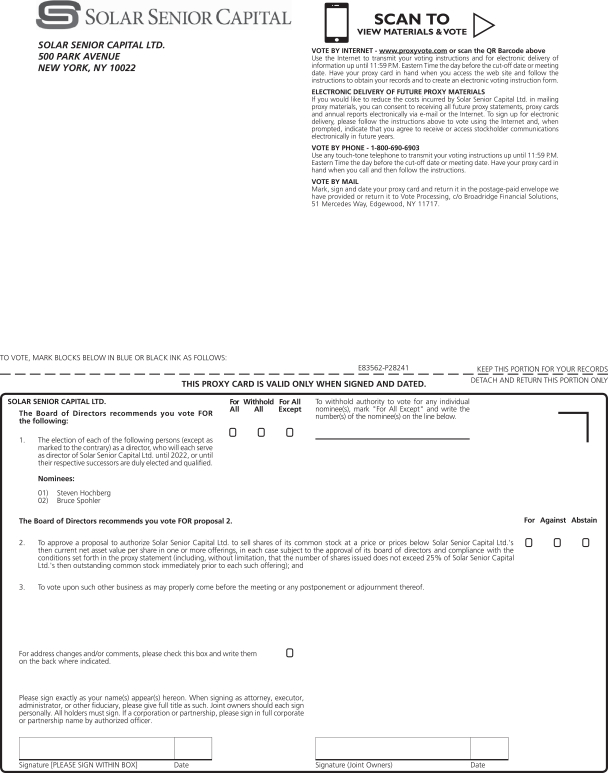

We have entered into the Advisory Agreement with Solar Capital Partners. Mr. Gross, our Chairman,Co-Chief Executive Officer and President, and Mr. Spohler, ourCo-Chief Executive Officer, Chief Operating Officer and board member, are managing members and senior investment professionals of, and have financial and controlling interests in, Solar Capital Partners. In addition, Mr. Peteka, our Chief Financial Officer, Treasurer and Secretary, serves as the Chief Financial Officer for Solar Capital Partners.

Solar Capital Partners and its affiliates may also manage other funds in the future that may have investment mandates that are similar, in whole and in part, with ours. For example, Solar Capital Partners presently serves as investment adviser to private funds and managed accounts as well as to Solar Capital Ltd., a publicly-traded BDC, which focuses on investing primarily in leveraged middle-market companies, including in first lien, stretch first lien, and asset-based loans and, to a lesser degree, second lien and unsecured debt and equity securities, and SCP Private Credit Income BDC LLC, an unlisted BDC, which focuses on investing primarily in senior secured loans, includingnon-traditional asset-based loans and first lien loans. In addition, Michael S. Gross, our Chairman andCo-Chief Executive Officer, Bruce Spohler, ourCo-Chief Executive Officer and Chief Operating Officer, and Richard L. Peteka, our Chief Financial Officer, serve in similar capacities for Solar Capital Ltd. and SCP Private Credit Income BDC LLC.

Solar Capital Partners and certain investment advisory affiliates may determine that an investment is appropriate for us and one or more of those other funds. In such event, depending on the availability of such investment and other appropriate factors, Solar Capital Partners or its affiliates may determine that we should investside-by-side with one or more other funds. Any such investments will be made only to the extent permitted by applicable law and interpretive positions of the SEC and its staff, and consistent with Solar Capital Partners’ allocation procedures.

Related party transactions may occur among the Company, Gemino Healthcare Finance LLC (“Gemino”) and North Mill Capital LLC (“NMC”). These transactions may occur in the normal course of business. No administrative fees are paid to Solar Capital Partners by Gemino or NMC.

In addition, we have adopted a formal code of ethics that governs the conduct of our officers and directors. Our officers and directors also remain subject to the duties imposed by both the 1940 Act and the Maryland General Corporation Law.

Regulatory restrictions limit our ability to invest in any portfolio company in which any affiliate currently has an investment. The Company obtained an exemptive order from the SEC on July 28, 2014 (the “Prior Exemptive Order”). The Prior Exemptive Order permitted us to participate in negotiatedco-investment transactions with certain affiliates, each of whose investment adviser is Solar Capital Partners, in a manner consistent with our investment objective, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors, and pursuant to the conditions to the Prior Exemptive Order. On June 13, 2017, the Company, Solar Capital Ltd., and Solar Capital Partners received an exemptive order that supersedes the Prior Exemptive Order (the “New Exemptive Order”) and extends the relief granted in the Prior Exemptive Order such that it no longer applies to certain affiliates only if their respective investment adviser is

17