Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| x | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Under Rule 14a-12 | |

TICC CAPITAL CORP.

(Name of Registrant as Specified in Its Charter)

TPG SPECIALTY LENDING, INC.

T. KELLEY MILLET

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| ||||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials: | |||

| ||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| ||||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

PRELIMINARY COPY SUBJECT TO COMPLETION DATED MAY 12, 2016

2016 ANNUAL MEETING OF STOCKHOLDERS

OF

TICC CAPITAL CORP.

PROXY STATEMENT

OF

TPG SPECIALTY LENDING, INC.

T. KELLEY MILLET

This proxy statement (“Proxy Statement”) and accompanying GOLD proxy card are being furnished to the stockholders of TICC Capital Corp., a Maryland corporation (“TICC” or the “Company”), by TPG Specialty Lending, Inc., a Delaware corporation (“TSLX”), in connection with the solicitation of proxies from you, the holders (the “Stockholders”) of common stock, par value $0.01 per share, of the Company (the “Common Stock”), to be exercised at the 2016 annual meeting of Stockholders, including any and all postponements, adjournments, continuations or reschedulings thereof, or any other meeting of Stockholders held in lieu thereof (the “2016 Annual Meeting”). Unless the context requires otherwise, we use the terms “we,” “our” or “us” throughout this Proxy Statement to refer to TSLX. The 2016 Annual Meeting is scheduled to be held at [ �� ], on [ ], at [ ] local time.

THIS SOLICITATION IS BEING MADE BY TSLX AND NOT ON

BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY

This solicitation is dated [ ], 2016, and this Proxy Statement and the accompanying GOLD proxy card are first being sent or given to Stockholders on or about [ ], 2016.

We intend to vote all proxies solicited by us at the 2016 Annual Meeting as follows and to vote proxies in our discretion with respect to such other business as may properly come before the 2016 Annual Meeting:

1. “FOR” the election of TSLX’s nominee, T. Kelley Millet, (the “Nominee”) to serve as a director until the 2019 annual meeting of Stockholders and until his successor is duly elected and qualified;

2. “FOR” TSLX’s proposal to terminate the Investment Advisory Agreement, dated as of July 1, 2011, by and between the Company and TICC Management, LLC (“TICC Management” or the “Existing Adviser”) (such agreement, the “Investment Advisory Agreement”), as contemplated by Section 15(a) of the Investment Company Act of 1940, as amended (the “1940 Act”);

3. “FOR” the Company’s proposal to ratify the appointment of PricewaterhouseCoopers LLP to serve as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2016 (the “Accountant Ratification Proposal”); and

4. “AGAINST” the Company’s proposal to approve the adjournment of the 2016 Annual Meeting (the “Adjournment Proposal”).

Table of Contents

TSLX URGES YOU TO VOTE THE GOLD PROXY CARD (1) “FOR” THE ELECTION OF TSLX’S NOMINEE, T. KELLEY MILLET, (2) “FOR” TSLX’S PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT, (3) “FOR” THE ACCOUNTANT RATIFICATION PROPOSAL AND (4) “AGAINST” THE ADJOURNMENT PROPOSAL.

TSLX is a specialty finance company that has elected to be regulated as a business development company (“BDC”) under the 1940 Act. TSLX seeks to generate current income primarily through direct originations of senior secured loans and, to a lesser extent, originations of mezzanine and unsecured loans and investments in corporate bonds and equity securities. TSLX leverages the deep investment, sector and operating resources of TPG Special Situations Partners which, with over $16 billion of assets under management as of March 31, 2016, is the dedicated special situations and credit platform of TPG, a global private investment firm with over $74 billion of assets under management as of December 31, 2015. TSLX is externally managed by TSL Advisers, LLC, a registered investment adviser with the Securities and Exchange Commission (“SEC”) under the 1940 Act.

For additional information concerning TSLX and the other participants in this proxy solicitation, please refer to the information set forth in the section entitled “Information About the Participants.” This Proxy Statement and the GOLD proxy card are first being furnished to Stockholders on or about [ ], 2016.

The board of directors of the Company (the “Board”) has set the close of business on [ ], 2016 as the record date for determining Stockholders entitled to notice of and to vote at the 2016 Annual Meeting (the “Record Date”). The principal executive offices of TICC are located at 8 Sound Shore Drive, Suite 255, Greenwich, Connecticut 06830. Stockholders of record on the Record Date will be entitled to vote at the 2016 Annual Meeting. As of the date of this Proxy Statement, TSLX is the beneficial owner of an aggregate 1,633,719 shares of Common Stock, which represents approximately 3.2% of the shares of Common Stock outstanding, 1,059 of which are also owned of record by TSLX.1 TSLX intends to hold all of such shares through the Record Date and to vote or cause such shares to be voted “FOR” the election of TSLX’s nominee, Mr. Millet, “FOR” TSLX’s proposal to terminate the Investment Advisory Agreement, “FOR” the Accountant Ratification Proposal and “AGAINST” the Adjournment Proposal. In order to be eligible to make nominations for election to the Board, a Stockholder and its proposed nominee must comply with the advance notice and other provisions of Article II, Section 11 of the Company’s Second Amended and Restated Bylaws (the “Bylaws”). TSLX timely submitted a notice of nomination and related documentation to TICC on February 3, 2016.

TSL Advisers, LLC, in its capacity as an investment adviser to TSLX, holds voting and dispositive power over, and may be deemed to be the beneficial owner of, all of the shares of Common Stock held by TSLX. TSSP HoldCo Management, LLC is the managing member of TSL Advisers, LLC and, as a result, may be deemed to be the beneficial owner of all of the shares of Common Stock held by TSLX. TSSP HoldCo Management, LLC is managed by its board of directors, whose members are Messrs. David Bonderman, James Coulter and Alan Waxman. Any decision or determination by the board of directors of TSSP HoldCo Management, LLC requires unanimous approval of the directors in attendance once a quorum is established. Messrs. Bonderman, Coulter and Waxman may also be deemed to be the beneficial owners of all of the shares of Common Stock held by TSLX. As of the date of this Proxy Statement, the Nominee owns no shares of Common Stock, either beneficially or of record.

We are soliciting your support to elect our Nominee at the 2016 Annual Meeting. In our view, the Board, as currently composed, has not taken, and is not capable of taking, the necessary steps to enhance Stockholder value. We believe our Nominee has the experience, qualifications and commitment necessary to represent the best interests of Stockholders. We urge all Stockholders to support us in this effort by voting “FOR” our Nominee.

| 1 | All percentages set forth in this Proxy Statement relating to the beneficial ownership of Common Stock are based upon 51,479,409 shares of Common Stock outstanding, which was the total number of shares of Common Stock outstanding as of May 4, 2016, as reported in TICC’s quarterly report on Form 10-Q for the quarter ended March 31, 2016. |

Table of Contents

We are also soliciting your support to terminate the Investment Advisory Agreement because, among other reasons described herein, we have lost confidence in the Existing Adviser given the Company’s significant underperformance. In our view, the market will not fully value the Company so long as TICC Management remains the Company’s investment adviser. We urge all Stockholders to support us in this effort by voting “FOR” our proposal to terminate the Investment Advisory Agreement.

THIS SOLICITATION IS BEING MADE BY TSLX AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF TICC. TSLX IS NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE 2016 ANNUAL MEETING. SHOULD OTHER MATTERS BE BROUGHT BEFORE THE 2016 ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WHETHER OR NOT YOU INTEND TO ATTEND THE 2016 ANNUAL MEETING, YOUR PROMPT ACTION IS IMPORTANT. MAKE YOUR VIEWS CLEAR TO THE COMPANY BY MARKING, SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD TODAY.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY SHARES OF COMMON STOCK YOU OWN.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY TICC OR ANY OTHER PERSON, YOU MAY REVOKE THAT PROXY BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. IF YOUR SHARES OF COMMON STOCK ARE HELD IN YOUR OWN NAME, YOU MAY REVOKE YOUR PROXY BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER-DATED PROXY FOR THE 2016 ANNUAL MEETING TO TSLX, C/O MACKENZIE PARTNERS, INC., WHICH IS ASSISTING IN THIS SOLICITATION, OR TO TICC, C/O [BROADRIDGE FINANCIAL SOLUTIONS, INC.], OR BY VOTING IN PERSON AT THE 2016 ANNUAL MEETING. ATTENDANCE AT THE ANNUAL MEETING WILL NOT, BY ITSELF, REVOKE A PROPERLY EXECUTED PROXY. IF YOU HOLD YOUR SHARES OF COMMON STOCK IN STREET NAME WITH A BANK, BROKERAGE FIRM, DEALER, TRUST COMPANY OR OTHER NOMINEE, PLEASE FOLLOW THE VOTING INSTRUCTIONS PROVIDED BY THE HOLDER OF YOUR COMMON STOCK REGARDING HOW TO REVOKE YOUR PROXY.

IMPORTANT VOTING INFORMATION

If your shares of Common Stock are held in your own name, please authorize a proxy to vote by marking, signing and dating the enclosed GOLD proxy card and returning it in the postage-paid envelope provided to you by us or follow the instructions located on the GOLD proxy card to authorize a proxy by telephone or Internet.

If you hold your shares of Common Stock in street name with a bank, brokerage firm, dealer, trust company or other nominee, only they can exercise your right to vote with respect to your shares of Common Stock and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to your bank, brokerage firm, dealer, trust company or other nominee to ensure that a GOLD proxy card is submitted on your behalf. Please follow the instructions to authorize a proxy to vote on the enclosed GOLD proxy card provided to you by us. If your bank, brokerage firm, dealer, trust company or other nominee provides for voting instructions to be delivered to them by telephone or Internet, instructions will be included with the enclosed GOLD proxy card. We urge you to confirm in writing your instructions to the person responsible for your account and to provide a copy of those instructions to us, c/o MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016, or by email at TPG@mackenziepartners.com, so that we may be aware of all instructions given and can attempt to ensure that such instructions are followed.

THE ELECTION OF THE NOMINEE IS, IN OUR VIEW, AN IMPORTANT STEP IN ENSURING THAT YOU HAVE A BOARD THAT WE BELIEVE WILL, CONSISTENT WITH ITS DUTIES, EXERCISE INDEPENDENT JUDGMENT, ACT IN YOUR BEST INTERESTS AND PROMPTLY EXPLORE ALL ALTERNATIVES FOR MAXIMIZING STOCKHOLDER VALUE, WHICH MAY INCLUDE SELLING TICC TO TSLX, SELLING TICC TO A THIRD PARTY OR REMAINING INDEPENDENT.

Table of Contents

WE ARE NOT SOLICITING PROXIES TO APPROVE A SALE TRANSACTION INVOLVING TICC. YOUR VOTE FOR THE ELECTION OF THE INDEPENDENT CANDIDATE NOMINATED BY US DOES NOT OBLIGATE YOU OR THE NOMINEE TO APPROVE ANY SUCH SALE.

PLEASE DO NOT RETURN ANY [WHITE] PROXY CARD YOU MAY RECEIVE FROM THE COMPANY OR OTHERWISE AUTHORIZE ANY OTHER PROXY TO VOTE YOUR SHARES OF COMMON STOCK AT THE 2016 ANNUAL MEETING, NOT EVEN AS A SIGN OF PROTEST. IF YOU HAVE ALREADY RETURNED A [WHITE] PROXY CARD TO THE COMPANY OR OTHERWISE AUTHORIZED ANY OTHER PROXY TO VOTE YOUR SHARES OF COMMON STOCK AT THE 2016 ANNUAL MEETING, IT IS NOT TOO LATE TO CHANGE YOUR VOTE. TO REVOKE YOUR PRIOR PROXY AND CHANGE YOUR VOTE, SIMPLY MARK, SIGN AND DATE THE ENCLOSED GOLD PROXY CARD AND RETURN IT IN THE POSTAGE-PAID ENVELOPE PROVIDED OR FOLLOW THE INSTRUCTIONS LOCATED ON THE GOLD PROXY CARD TO AUTHORIZE A PROXY BY TELEPHONE OR INTERNET. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

Only Stockholders of record on the Record Date are entitled to receive notice of and vote at the 2016 Annual Meeting.

[Remainder of page intentionally left blank.]

Table of Contents

MacKenzie Partners, Inc. is assisting TSLX with its effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares of Common Stock, please contact:

105 Madison Avenue

New York, New York 10016

(212) 929-5500 (Call Collect)

or

CALL TOLL FREE (800) 322-2885

TPG@mackenziepartners.com

It is important that your shares of Common Stock be represented and voted at the 2016 Annual Meeting. Accordingly, regardless of whether you plan to attend the 2016 Annual Meeting in person, please mark, sign, date and return the GOLD proxy card that has been provided to you by us (and NOT the [WHITE] proxy card that has been provided to you by the Company or any other proxy card or form that may be provided to you) and authorize a proxy to vote (1) “FOR” the election of TSLX’s nominee, T. Kelley Millet, (2) “FOR” TSLX’s proposal to terminate the Investment Advisory Agreement, (3) “FOR” the Accountant Ratification Proposal and (4) “AGAINST” the Adjournment Proposal.

[Remainder of page intentionally left blank.]

Table of Contents

Table of Contents

QUESTIONS AND ANSWERS RELATING TO THIS PROXY STATEMENT

The following are some of the questions you may have as a Stockholder, as well as the answers to those questions. The following is not a substitute for the information contained elsewhere in this Proxy Statement, and the information contained below is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this Proxy Statement. We urge you to read this Proxy Statement carefully and in its entirety.

Who is making this solicitation?

TSLX, a Delaware corporation, is a specialty finance company that has elected to be regulated as a BDC under the 1940 Act. TSLX seeks to generate current income primarily through direct originations of senior secured loans and, to a lesser extent, originations of mezzanine and unsecured loans and investments in corporate bonds and equity securities. TSLX leverages the deep investment, sector and operating resources of TPG Special Situations Partners which, with over $16 billion of assets under management as of March 31, 2016, is the dedicated special situations and credit platform of TPG, a global private investment firm with over $74 billion of assets under management as of December 31, 2015.

TSLX is making this solicitation of proxies for the election of the Nominee and to approve a proposal to terminate the Investment Advisory Agreement. For more information regarding TSLX and the other participants in the solicitation, please see Annex A.

What are we asking you to vote for?

We are asking you to vote on the following matters at the 2016 Annual Meeting:

1. The election of TSLX’s nominee, T. Kelley Millet, to serve as a director until the 2019 annual meeting of Stockholders and until his successor is duly elected and qualified;

2. TSLX’s proposal to terminate the Investment Advisory Agreement;

3. The Company’s proposal to ratify the appointment of PricewaterhouseCoopers LLP to serve as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2016; and

4. The Company’s proposal to approve the adjournment of the 2016 Annual Meeting.

TSLX URGES YOU TO VOTE THE GOLD PROXY CARD (1) “FOR” THE ELECTION OF TSLX’S NOMINEE, T. KELLEY MILLET, (2) “FOR” TSLX’S PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT, (3) “FOR” THE ACCOUNTANT RATIFICATION PROPOSAL AND (4) “AGAINST” THE ADJOURNMENT PROPOSAL.

Please refer to the sections entitled “Proposal No. 1: Election of Director,” “Proposal No. 2: TSLX’s Proposal to Terminate the Investment Advisory Agreement,” “Proposal No. 3: The Company’s Proposal to Ratify the Appointment of PricewaterhouseCoopers LLP” and “Proposal No. 4: The Company’s Proposal to Approve the Adjournment of the 2016 Annual Meeting” for a more complete description of these proposals.

Why are we soliciting your vote?

We are soliciting your support to elect our Nominee at the 2016 Annual Meeting. In our view, the Board, as currently composed, has not taken, and is not capable of taking, the necessary steps to enhance Stockholder value. We believe our Nominee has the experience, qualifications and commitment necessary to represent the best interests of Stockholders. We urge all Stockholders to support us in this effort by voting “FOR” our Nominee.

Table of Contents

We are also soliciting your support to terminate the Investment Advisory Agreement because, among other reasons described herein, we have lost confidence in the Existing Adviser given the Company’s significant underperformance. In our view, the market will not fully value the Company so long as TICC Management remains the Company’s investment adviser. We urge all Stockholders to support us in this effort by voting “FOR” our proposal to terminate the Investment Advisory Agreement.

Who is the Nominee?

We are proposing that T. Kelley Millet be elected as director of the Company to serve on the Board until the 2019 annual meeting of Stockholders and until his successor is duly elected and qualified.

Set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to our determining that the Nominee should serve as a director for the Company as of the date hereof, in light of the Company’s business and structure. This information has been furnished to us by the Nominee. Additional information about the Nominee can also be found in Annex A.

Name and Business Address | Age | Principal Occupation for Past | ||

T. Kelley Millet

1 William Street, New York, New York 10004

| 56 | T. Kelley Millet is the Chief Executive Officer (“CEO”), Vice Chairman, Treasurer and member of the board of directors of Banca IMI Securities Corp., a provider of banking and brokerage services to institutional investors. In addition, Mr. Millet currently serves on the board of directors of Investment Technology Group, Inc., where he is also a member of the Audit, Capital and Technology Committees. From 2012 until 2016, Mr. Millet served on the board of The Mutual Fund Store, a provider of personalized financial planning and money management services. From 2013 to 2014, Mr. Millet served as a consultant to Investment Technology Group, Inc.’s CEO and board of directors. Previously, (a) from 2012 until 2013, Mr. Millet served as Co-President, Partner and a member of the board of directors of Pierpont Securities LLC, a fixed income broker-dealer, (b) from 2011 until 2012, Mr. Millet was CEO and a member of the board of directors of the broker-dealer, Cortview Capital Holdings Inc. and (c) from 2006 until 2011, Mr. Millet served as President and as a member of the board of directors of MarketAxess Holdings Inc., a publicly-traded company that operates an electronic fixed income trading platform. Prior to MarketAxess Holdings Inc., Mr. Millet was Global Head of Capital Markets and Credit Trading at Bear Stearns & Co. Inc. from 2001 through 2006. From 1982 to 2001, Mr. Millet held a variety of positions at JPMorgan Chase & Co., which culminated in his appointment as Managing Director, Head of Global Syndicate and Capital Markets. Mr. Millet received a B.A. from Amherst College. Mr. Millet’s significant experience as a senior executive coupled with his extensive financial expertise and public company board experience well qualifies him for service on the Board. |

The Board is currently composed of five directors—two interested directors and three independent directors. One of the independent directors, Tonia L. Pankopf, is up for election at the 2016 Annual Meeting. TSLX, through this Proxy Statement, is soliciting proxies to elect Mr. Millet to serve as a director to replace Ms. Pankopf.

We are not seeking control of the Board at the 2016 Annual Meeting. If elected, the Nominee will constitute a minority of the directors and will not alone be able to adopt resolutions or otherwise cause the Board to act.

2

Table of Contents

However, the Nominee expects to be able to actively engage other Board members in full discussion of the issues facing the Company and resolve them together. By utilizing his experience and working constructively with Board members, the Nominee believes he can effect positive change at the Company.

The corporate governance guidelines of the Company provide that determinations of independence shall be made in accordance with the criteria for independence required by the NASDAQ Stock Market. The following information regarding director independence has also been reproduced from the Form 10-K/A filed by the Company with the SEC on April 29, 2016:

In accordance with rules of the NASDAQ Stock Market, our Board of Directors annually determines each director’s independence. We do not consider a director independent unless our Board of Directors has determined that he or she has no material relationship with us. [ . . . ]

In order to evaluate the materiality of any such relationship, our Board of Directors uses the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. Rule 5605(a)(2) provides that a director of a BDC, shall be considered to be independent if he or she is not an “interested person” of TICC, as defined in Section 2(a)(19) of the 1940 Act.

Based on the information furnished by the Nominee, TSLX believes that the Nominee is independent and is not an interested person under such standards and TSLX has no knowledge of any facts that would prevent a determination that the Nominee is independent or is not an interested person under such standards.

You should refer to the Company’s proxy statement for the 2016 Annual Meeting (the “TICC 2016 Proxy Statement”), when available, for the name, background, qualifications and other information concerning the Company’s nominee.

Who can vote at the 2016 Annual Meeting?

Holders of record of shares of Common Stock at the close of business on the Record Date will be entitled to vote at the 2016 Annual Meeting. Stockholders as of the Record Date are entitled to cast one vote for as many individuals as there are directors to be elected at the 2016 Annual Meeting and to cast one vote on each other matter presented at the 2016 Annual Meeting for each share of Common Stock held on the Record Date. Stockholders may not cumulate their votes in the election of directors. It is anticipated that the TICC 2016 Proxy Statement will state the number of shares of Common Stock issued and outstanding as of the Record Date.

How do proxies work?

TSLX is asking you to appoint [Joshua Easterly] and [Ian Simmonds], and each of them, as your proxy holders to vote your shares of Common Stock at the 2016 Annual Meeting. You may authorize a proxy by (1) marking, signing and dating the enclosed GOLD proxy card and returning it in the enclosed postage-paid envelope or (2) telephone or Internet by following the instructions located on the GOLD proxy card. Submitting your proxy means you authorize the proxy holders to vote your shares at the 2016 Annual Meeting, according to the directions you provide. Whether or not you are able to attend the 2016 Annual Meeting, you are urged to mark, sign and date the enclosed GOLD proxy card and return it in the enclosed postage-paid envelope or follow the instructions located on the GOLD proxy card to authorize a proxy by telephone or Internet. All valid proxies received prior to the 2016 Annual Meeting will be voted. If you specify a choice with respect to any item by marking the appropriate box on the proxy, your shares of Common Stock will be voted in accordance with that specification. IF NO SPECIFICATION IS MADE, BUT YOU SIGN AND RETURN THE ENCLOSED GOLD PROXY CARD, YOUR SHARES OF COMMON STOCK WILL BE VOTED (1) “FOR” THE ELECTION OF TSLX’S NOMINEE, T. KELLEY MILLET, (2) “FOR” TSLX’S PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT, (3) “FOR” THE ACCOUNTANT RATIFICATION PROPOSAL AND (4) “AGAINST” THE ADJOURNMENT PROPOSAL.

3

Table of Contents

We do not know of any other matters to be presented for approval by Stockholders at the 2016 Annual Meeting. Unless you indicate otherwise on the GOLD proxy card or through the telephone or Internet voting procedures, your appointment also authorizes your proxy holders to vote your shares of Common Stock in their discretion on any matters that may be properly presented for action by Stockholders at the 2016 Annual Meeting.

What do I need to attend the 2016 Annual Meeting?

The 2016 Annual Meeting will be held at [ ] on [ ], 2016 at [ ] local time. If you are a Stockholder of record, your name will be verified against the list of Stockholders of record prior to admittance to the 2016 Annual Meeting. If you are a beneficial owner, you must provide proof of beneficial ownership on the Record Date, such as a brokerage account statement showing that you owned your shares of Common Stock as of the Record Date, a copy of the voting instruction form provided by your bank, brokerage firm, dealer, trust company or other nominee, or other similar evidence of ownership. You do not need to attend the 2016 Annual Meeting to vote. Even if you plan to attend the 2016 Annual Meeting, please authorize your vote in advance as instructed in this Proxy Statement.

What is the quorum requirement for the 2016 Annual Meeting?

A quorum must be present at the 2016 Annual Meeting for any business to be conducted. The presence at the 2016 Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the Record Date will constitute a quorum. Abstentions and broker non-votes (as defined below), if any, will be counted as shares present for purposes of determining whether a quorum exists for the transaction of business.

What is a broker non-vote?

A broker non-vote is a vote that is not cast on a non-routine matter because the shares entitled to cast the vote are held in street name, the broker lacks discretionary authority to vote the shares and the broker has not received voting instructions from the beneficial owner. Proposal No. 1: Election of Director, Proposal No. 2: TSLX’s Proposal to Terminate the Investment Advisory Agreement and Proposal No. 4: The Company’s Proposal to Approve the Adjournment of the 2016 Annual Meeting are considered non-routine matters. Accordingly, if you hold your shares of Common Stock in street name with a bank, brokerage firm, dealer, trust company or other nominee, they can only exercise your right to vote with respect to these matters if they receive instructions from you.

If your shares are held of record by a bank, brokerage firm, dealer, trust company or other nominee, we urge you to give instructions to your bank, brokerage firm, dealer, trust company or other nominee as to how you wish your shares to be voted so you may participate in the stockholder voting on the important matters to be presented at the 2016 Annual Meeting.

What vote is required to elect the Nominee?

The election of a director requires the affirmative vote of a plurality of the votes cast at the 2016 Annual Meeting in person or by proxy. Stockholders may not cumulate their votes. This means that the nominee who receives the greatest number of “FOR” votes cast will be elected. Neither broker non-votes nor votes marked “WITHHOLD AUTHORITY” will have an effect on the result of the vote.

What vote is required to approve TSLX’s Proposal to Terminate the Investment Advisory Agreement?

The approval of TSLX’s proposal to terminate the Investment Advisory Agreement requires the affirmative vote of “a majority of the Company’s outstanding voting securities” entitled to vote at the 2016 Annual Meeting, as defined under the 1940 Act. For purposes of approval of TSLX’s proposal to terminate the Investment

4

Table of Contents

Advisory Agreement, “a majority of the Company’s outstanding voting securities” is the lesser of: (i) 67% or more of the shares of Common Stock present at the 2016 Annual Meeting, if the holders of more than 50% of the outstanding shares of Common Stock are present or represented by proxy or (ii) more than 50% of the outstanding shares of Common Stock. Abstentions and broker non-votes, if any, will have the same effect as a vote “AGAINST” this proposal.

What vote is required to approve the other proposals described in this Proxy Statement?

The approval of the Accountant Ratification Proposal requires the affirmative vote of a majority of the votes cast at the 2016 Annual Meeting in person or by proxy on the proposal. Abstentions will have no effect on this proposal. Brokers are entitled to vote on the Accountant Ratification Proposal even if no instructions are received from the beneficial holder of shares of Common Stock.

The approval of the Adjournment Proposal requires the affirmative vote of a majority of the votes cast at the 2016 Annual Meeting in person or by proxy. Abstentions and broker non-votes, if any, will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

If other matters are properly brought before the 2016 Annual Meeting, the vote required will be determined in accordance with applicable law, the NASDAQ Listing Rules and the Company’s Charter and Bylaws, as applicable.

What should I do in order to vote for the Nominee and the other proposals?

If your shares of Common Stock are held of record in your own name, please authorize a proxy to vote by marking, signing and dating the enclosed GOLD proxy card and returning it in the postage-paid envelope provided to you by us or follow the instructions on the GOLD proxy card to authorize a proxy by telephone or Internet.

If you hold your shares of Common Stock in street name with a bank, brokerage firm, dealer, trust company or other nominee, only they can exercise your right to vote with respect to your shares of Common Stock. Accordingly, it is critical that you promptly give instructions to your bank, brokerage firm, dealer, trust company or other nominee to ensure that a GOLD proxy card is submitted on your behalf. Please follow the instructions to authorize a proxy to vote provided on the enclosed GOLD proxy card. If your bank, brokerage firm, dealer, trust company or other nominee provides for voting instructions to be delivered to them by telephone or Internet, instructions will be included on the enclosed GOLD proxy card. We urge you to confirm your instructions in writing to the person responsible for your account and provide a copy of those instructions to us, c/o MacKenzie Partners, Inc., 105 Madison Avenue, New York, New York 10016, or by email at TPG@mackenziepartners.com so that we may be aware of all instructions given and can attempt to ensure that such instructions are followed.

YOUR VOTE IS VERY IMPORTANT. If you do not plan to attend the 2016 Annual Meeting, we encourage you to read this Proxy Statement and mark, sign and date your GOLD proxy card and return it in the enclosed postage-paid envelope, or follow the instructions located on your GOLD proxy card to authorize a proxy by telephone or Internet prior to the 2016 Annual Meeting so that your shares of Common Stock will be represented and voted in accordance with your instructions. Even if you plan to attend the 2016 Annual Meeting in person, we recommend that you authorize a proxy to vote your shares of Common Stock in advance as described above so that your vote will be counted if you later decide not to attend the 2016 Annual Meeting. To ensure that your vote is counted, please remember to authorize a proxy to vote your shares.

What does it mean if I receive more than one GOLD proxy card at or about the same time?

It generally means you hold shares registered in more than one account. In order to authorize a proxy to vote all of your shares, please mark, sign, date and return each GOLD proxy card or, if you authorize a proxy by telephone or Internet, please authorize a proxy for each GOLD proxy card you receive.

5

Table of Contents

What is the deadline for submitting proxies?

(a) Internet: Proxies submitted electronically via the Internet must be received by 11:59 p.m. Eastern Time on [ ], 2016.

(b) Telephone: Proxies submitted electronically by telephone must be received by 11:59 p.m. Eastern Time on [ ], 2016.

(c) Mail: Proxies submitted by mail via written proxy must be returned in sufficient time to be received and counted prior to the closing of the polls at the 2016 Annual Meeting.

(d) In Person: All Stockholders of record as of the Record Date will be entitled to vote in person at the 2016 Annual Meeting. If you hold your shares of Common Stock in street name with a bank, brokerage firm, dealer, trust company or other nominee, you will need to request a “legal proxy” from such entity to vote in person at the 2016 Annual Meeting, a process which you must initiate and which may take several days.

How do I revoke a proxy?

Any Stockholder has the power to revoke a previously authorized proxy at any time before it is exercised. If you are a registered holder of Common Stock, you may revoke a previously authorized proxy by:

| • | authorizing a proxy over the Internet or by telephone at a later time in the manner provided on the enclosed GOLD proxy card, the Company’s [WHITE] proxy card or any other later-dated proxy; |

| • | marking, signing, dating and returning the enclosed GOLD proxy card, the Company’s [WHITE] proxy card or any other later-dated proxy in the postage-paid envelope provided; |

| • | delivering a written notice of revocation to the Corporate Secretary of the Company, c/o [Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, New York 11717]; or |

| • | attending the 2016 Annual Meeting and voting in person. |

Please note, however, that only your last-dated proxy will count. Any proxy may be revoked at any time prior to its exercise at the 2016 Annual Meeting as described in this Proxy Statement. Attending the 2016 Annual Meeting alone without taking one of the actions above will not revoke your proxy.

In addition, please note that if you submit, or have already submitted, a [WHITE] proxy card you may revoke it at any time by submitting a later-dated GOLD proxy card.

Stockholders who hold their shares of Common Stock in street name with a bank, brokerage firm, dealer, trust company or other nominee will need to notify the person responsible for their account to revoke or withdraw previously given instructions. Unless revoked in the manner set forth above and subject to the foregoing, duly authorized proxies in the form enclosed will be voted at the 2016 Annual Meeting in accordance with your instructions. We request that a copy of any revocation sent to the Company or any revocation notification sent to the person responsible for a bank or brokerage account also be sent to us, c/o MacKenzie Partners, Inc., at the address listed above, so that we may be aware of any revocation of a proxy.

PLEASE DO NOT RETURN ANY [WHITE] PROXY CARD YOU MAY RECEIVE FROM THE COMPANY OR OTHERWISE AUTHORIZE A PROXY TO VOTE YOUR SHARES OF COMMON STOCK AT THE 2016 ANNUAL MEETING, NOT EVEN AS A SIGN OF PROTEST. IF YOU HAVE ALREADY RETURNED A [WHITE] PROXY CARD TO THE COMPANY OR OTHERWISE AUTHORIZED A PROXY TO VOTE YOUR SHARES OF COMMON STOCK AT THE 2016 ANNUAL MEETING, IT IS NOT TOO LATE TO CHANGE YOUR VOTE. TO REVOKE YOUR PRIOR PROXY AND CHANGE YOUR VOTE, SIMPLY MARK, SIGN AND DATE THE ENCLOSED GOLD PROXY CARD AND RETURN IT IN THE

6

Table of Contents

POSTAGE-PAID ENVELOPE PROVIDED OR USE THE GOLD PROXY CARD TO AUTHORIZE A PROXY BY TELEPHONE OR INTERNET. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

Who is paying for the solicitation on behalf of TSLX?

TSLX will pay all costs of the solicitation of proxies on behalf of TSLX and the other participants described in the section entitled “Information About the Participants.” If the Nominee is elected, TSLX may seek reimbursement of those costs from the Company, subject to any restrictions based on applicable law or in the Company’s Charter or Bylaws.

Whom should I call if I have any questions about the solicitation?

If you have any questions, or need assistance in voting your shares of Common Stock, please call our proxy solicitor, MacKenzie Partners, Inc., toll-free at (800) 322-2885 or contact MacKenzie Partners, Inc. by email at TPG@mackenziepartners.com.

YOUR VOTE IS IMPORTANT, NO MATTER HOW MANY SHARES YOU OWN. TSLX URGES YOU TO MARK, SIGN, DATE AND RETURN THE ENCLOSED GOLD PROXY CARD TODAY TO VOTE (1) “FOR” THE ELECTION OF TSLX’S NOMINEE, T. KELLEY MILLET, (2) “FOR” TSLX’S PROPOSAL TO TERMINATE THE INVESTMENT ADVISORY AGREEMENT, (3) “FOR” THE ACCOUNTANT RATIFICATION PROPOSAL AND (4) “AGAINST” THE ADJOURNMENT PROPOSAL.

7

Table of Contents

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on [ ], 2016:

The proxy materials are available at http://www.stockholderdocs.com/tpg

BACKGROUND OF THE SOLICITATION

As part of the continuous evaluation and planning of its business, TSLX regularly considers a variety of strategic options, including acquisitions. In the course of this ongoing evaluation process, TSLX recognized the opportunity to leverage its expertise in sourcing, underwriting and asset management across credit disciplines to the advantage of both TSLX and target stockholders through mergers or other combinations and, in this respect, has considered from time to time an acquisition of various participants in its industry, including TICC.

On August 4, 2015, TICC issued a press release announcing that members of TICC Management had entered into an agreement with Benefit Street Partners L.L.C. (“BSP”), pursuant to which an affiliate of BSP would acquire TICC Management and enter into a new investment advisory agreement with TICC Management (the “New Advisory Agreement”) on the same terms as the Investment Advisory Agreement, subject to approval at a special meeting of Stockholders (the “Special Meeting”). In connection with this sale, BSP also proposed to expand the size of the Board to accommodate the addition of four new independent directors selected by BSP for election at the Special Meeting and to replace the two existing interested directors on the Board with affiliates of BSP.

From August 5 to August 24, 2015, TSLX acquired 1,633,719 shares of Common Stock through purchases in the open market, which represented 2.72% of the number of shares of TICC Common Stock outstanding as of August 6, 2015 and 3.2% of the number of shares of TICC Common Stock outstanding as of the date of this Proxy Statement.

On August 11, 2015, according to a press release issued on August 19, NexPoint Advisors, L.P. (“NexPoint”) proposed to the Board that it be selected as a replacement for the Existing Adviser instead of the BSP affiliate. According to TICC’s proxy statement for the Special Meeting, following receipt of NexPoint’s proposal, the Board formed a special committee consisting of TICC’s three independent directors (the “Special Committee”) in order to evaluate NexPoint’s proposal.

On September 3, 2015, TICC rejected NexPoint’s proposal and instead announced that BSP had agreed to revise the New Advisory Agreement to provide for lower fees and other commitments.

On September 10, 2015, Joshua Easterly, Co-Chief Executive Officer and Chairman of the board of directors of TSLX, called Steven Novak, the Chairman of the Special Committee, to convey TSLX’s interest in acquiring TICC. Prior to September 2015, TSLX had not proactively initiated contact with TICC with respect to any potential transaction between the parties. Following the call, Mr. Easterly delivered to the Special Committee a letter setting forth a non-binding proposal for TSLX to acquire TICC in an all-stock transaction that would result in Stockholders receiving a number of shares of TSLX common stock that would result in Stockholders receiving $7.50 in market value per share as of the signing date of a definitive agreement. On September 16, 2015, TSLX issued a press release publicizing this proposal.

On September 15, 2015, after requesting only background information based on publicly available information from TSLX, Mr. Novak called Mr. Easterly to convey that TICC was not interested in pursuing TSLX’s proposal and that the Special Committee would continue to support the BSP transaction.

Also on September 15, 2015, NexPoint announced in a press release its intention to nominate a competing slate of six directors for election and to solicit proxies to vote against the proposals at the Special Meeting.

8

Table of Contents

On October 8, 2015, after TICC refused to confirm that NexPoint’s slate would be placed on the ballot, NexPoint filed a request for a preliminary injunction in the U.S. District Court for the District of Connecticut (the “District Court”).

On October 23, 2015, the District Court issued a ruling (i) enjoining the Special Meeting from being held as scheduled on October 27, 2015, (ii) finding that TICC had likely violated federal securities laws by failing to disclose the amount of payments to be made under the BSP deal to its interested directors and requiring new disclosure from TICC to mitigate this failure and (iii) finding that NexPoint was not entitled to nominate a slate at the Special Meeting.

On November 2, 2015, TSLX revised its non-binding proposal such that Stockholders would receive a number of shares of TSLX stock that would result in their receiving 90% of TICC’s net asset value (“NAV”) per share as of the date of an agreement (i.e., $7.74 per share based on the then latest available NAV).

On December 2 and 3, 2015, respectively, NexPoint appealed to the United States Court of Appeals for the Second Circuit and sought a stay from the District Court for the duration of its appeal. On December 4, 2015, TICC nonetheless announced that the Special Meeting would be held on December 22, 2015.

On December 9, 2015, the District Court denied NexPoint’s motion for a stay, allowing the Special Meeting to proceed as rescheduled.

On December 22, 2015, the Special Meeting was held, with 63.6% of TICC’s shares present and voting. Despite beginning their solicitation in early September 2015, TICC was only able to garner the support of approximately 34.5% of all outstanding TICC shares for the BSP proposal—and as a result the proposal did not pass.

For the next several weeks, despite a clear mandate for change, TICC failed to engage with TSLX and failed to take any actions to improve the status quo. As a result, on February 3, 2016, TSLX delivered a notice to the Company nominating Mr. Millet for election as a director at the 2016 Annual Meeting. The notice also stated TSLX’s intent to bring a proposal before the 2016 Annual Meeting to terminate the Investment Advisory Agreement. The following morning, TSLX issued a press release announcing the same. TSLX submitted this notice to the Company because we believe that the Company can and should do significantly more to improve its performance and generate value for all Stockholders.

On February 8, 2016, NexPoint issued a press release announcing the nomination of its own director candidate for election at the 2016 Annual Meeting.

On March 9, 2016, TICC announced its entry into a new investment advisory fee waiver arrangement with TICC Management and also named Mr. Novak as Chairman of the Board. On March 17, 2016, TSLX issued a press release responding to these announcements.

On April 22, 2016, at the invitation of TICC’s Chairman, Mr. Millet met with TICC’s independent directors to discuss the Company, its prospects and strategy, and to ask questions of those present about their views of the Company’s prospects, strategy and strategic alternatives.

On May 2, 2016, in anticipation of the release of the Company’s earnings for the first quarter of 2016, TSLX issued a press release raising fundamental questions about the future of TICC.

According to TICC’s proxy statement for the 2015 annual meeting of Stockholders (the “2015 Annual Meeting”), the 2016 Annual Meeting is expected to be held in June 2016. As of the date hereof, however, the Company had yet to schedule the 2016 Annual Meeting, despite having announced the date of every prior annual meeting in the last 11 years by no later than May 2 of that year.

9

Table of Contents

We are making this solicitation as one of the largest Stockholders of TICC and in the greater interest of all Stockholders. As of the date of this Proxy Statement, TSLX is the beneficial and economic owner of approximately 3.2% of the outstanding shares of Common Stock.

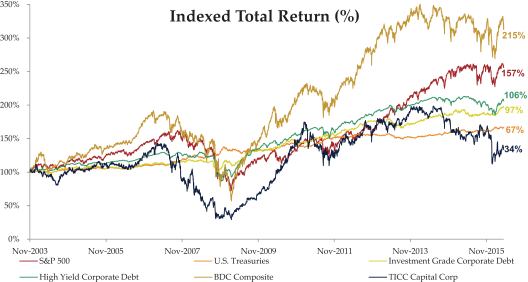

By nearly every measure imaginable, TICC and its Existing Adviser have consistently failed Stockholders. Since TICC’s initial public offering in 2003, the Company has delivered total returns of just 34.3% versus 215.2% for the BDC Composite.2 Even more disturbing, TICC has underperformed the return of U.S. Treasuries over the last year and the last three years, as well as since its initial public offering. Since Stockholders blocked the flawed BSP transaction backed by management on December 22, 2015, Stockholders have suffered further value destruction, with TICC’s stock down 16.5% since that date.3

As we approach the 2016 Annual Meeting, TICC has made it clear that, once again, it does not intend to take meaningful actions to deliver Stockholder value. That is why on February 3, 2016, we delivered a formal notice of our nomination of a highly qualified and independent candidate—Mr. Millet—for election to the Board at the 2016 Annual Meeting. As part of our formal notice, we also submitted a proposal for Stockholders to vote on the termination of the Investment Advisory Agreement. Under the 1940 Act, Stockholders have the power to terminate the Existing Adviser at no cost to Stockholders.

We have taken these actions because we are gravely concerned that the Board’s leadership and the Existing Adviser’s actions will continue to destroy Stockholder value. The need for an independent, highly qualified voice in the boardroom is overwhelmingly clear and the Existing Adviser’s decade of failed returns demands immediate change.

Our proposed actions would positively impact Stockholders by:

| • | Bringing a new, independent perspective to the boardroom by adding Mr. Millet to the Board. His more than 30 years of proven industry expertise across the financial sector and particularly in credit markets coupled with his proven leadership as a director make him the ideal candidate to effect change at TICC. Of note, Mr. Millet, currently CEO of Banca IMI Securities, has guided companies in CEO and senior executive roles across the financial sector, including roles with Pierpont Securities LLC (2012-2013), Cortview Capital Holdings Inc. (2011-2012), MarketAxess Holdings Inc. (2006-2011), Bear Stearns & Co. Inc. (2001-2006) and JPMorgan Chase & Co. (1982-2001). He also brings board experience that spans public financial technology companies to private equity-backed financial services companies to equity trading firms. He has a track record of success in reinvigorating companies, driving growth, prioritizing stockholder interests and protecting their investments. |

| • | Once and for all severing ties with a failed Existing Adviser that has not only delivered shockingly terrible Stockholder returns but pursued a strategy that has impaired TICC’s financial future and served to enrich itself to the detriment of Stockholders. |

| • | Creating an opportunity and a path for TICC to fully and thoroughly explore its strategic alternatives with a view to maximizing value for all Stockholders. |

This is not our preferred course of action, but the Board’s failure to take meaningful action leaves us no choice. We feel strongly that change is needed at TICC for the reasons that follow.

| 2 | TICC and benchmark returns indexed to November 21, 2003. Total return calculation includes share price appreciation and cumulative dividends paid. BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD. Calculated through May 6, 2016. |

| 3 | Calculated based on TICC’s closing price of $5.00 on May 6, 2016 and a closing price of $5.99 on December 22, 2015. |

10

Table of Contents

APPALLING PERFORMANCE

Since its inception in 2003—and over almost any measurement period since—TICC has woefully underperformed all relevant benchmarks. In the hands of the Existing Adviser and the Board, the total return on the Company’s stock has underperformed nearly every significant measure imaginable—including relative performance compared to the BDC Composite, S&P 500, Investment Grade Debt, High Yield Debt and even U.S. Treasuries—over the past 12 years.

It is unacceptable that, in a historically low interest rate environment, a Stockholder would have generated higher returns by investing in U.S. Treasuries than by holding TICC stock.

Poor Stewardship has Resulted in Drastic Long-Term Underperformance4

| TICC Relative Underperformance | ||||||||||||||||||||||||||||||||||||||||

Total Return (%)(¹) | YTD | 1Y | 3Y | Since IPO(²) | Since IPO Annualized(²) | YTD | 1Y | 3Y | Since IPO(²) | Since IPO Annualized(²) | ||||||||||||||||||||||||||||||

TICC | (12.9 | )% | (8.6 | )% | (22.5 | )% | 34.3 | % | 2.4 | % | — | — | — | — | — | |||||||||||||||||||||||||

BDC Composite(³) | 2.8 | (3.4 | ) | (1.0 | ) | 215.2 | 9.7 | (15.7 | )% | (5.2 | )% | (21.5 | )% | (180.9 | )% | (7.3 | )% | |||||||||||||||||||||||

S&P 500 | 1.4 | 1.1 | 35.5 | 156.9 | 7.9 | (14.3 | ) | (9.6 | ) | (58.0 | ) | (122.6 | ) | (5.5 | ) | |||||||||||||||||||||||||

U.S. Treasuries | 3.8 | 4.0 | 6.5 | 66.8 | 4.2 | (16.6 | ) | (12.6 | ) | (29.0 | ) | (32.5 | ) | (1.8 | ) | |||||||||||||||||||||||||

Investment Grade Debt | 6.5 | 5.3 | 10.4 | 97.1 | 5.6 | (19.4 | ) | (13.8 | ) | (32.9 | ) | (62.8 | ) | (3.2 | ) | |||||||||||||||||||||||||

High Yield Debt | 5.6 | (3.0 | ) | 3.5 | 106.1 | 6.0 | (18.5 | ) | (5.5 | ) | (26.0 | ) | (17.8 | ) | (3.6 | ) | ||||||||||||||||||||||||

| (1) | Total return calculation includes share price appreciation and cumulative dividends paid. |

| (2) | TICC and benchmark returns indexed to November 21, 2003. |

| (3) | BDC Composite comprised of ACAS, AINV, ARCC, BKCC, FSC, GBDC, HTGC, MAIN, MCC, NMFC, PNNT, PSEC, SLRC, TCAP, and TCRD. |

Note: Market data as of May 6, 2016

Source: Bloomberg, fixed income benchmark data from Markit iBoxx

| 4 | Market data as of May 6, 2016. |

11

Table of Contents

As a result, the Company’s NAV per share has rapidly deteriorated, and we believe this trend will continue under the Board’s current investment and capital allocation policies. NAV per share has declined from $9.78 as of March 31, 2014 to $5.89 as of March 31, 2016—a decline of 40% over only two years—and we anticipate that this value destruction will continue absent meaningful change in the composition of the Board, the Existing Adviser and the Company’s investment strategy. It is no surprise then that Stockholders continue to suffer from a stock price that has closed below NAV per share for the past 603 consecutive days5 and now trades at just 84.9% of NAV6 per share.

The Board has yet to offer any credible plan to address this value destruction. Although we applaud management’s willingness to repurchase shares during the fourth quarter of 2015 and during 2016, it is not lost on us nor on other Stockholders that management has refused to commit to continuing this strategy. It is unacceptable that TICC is not continuing to buy back stock at a 15.1% discount to NAV.7 Our estimate is that the 2016 repurchases have added approximately $0.12 to NAV per share. One must ask: why not continue these value-creation measures? It leads one to wonder whether the Board is more concerned with protecting the asset base on which the Existing Adviser earns its revenue stream than interested in creating value for Stockholders.

RAPID DETERIORATION OF CLO INVESTMENT VALUE

These consistently poor returns and the ongoing deterioration of NAV per share are in part a result of a failed investment strategy into collateralized loan obligation (“CLO”) equity. This not only distorts management fees but also contributes to the unsustainable nature of TICC’s dividend.

The reality of the CLO market debunks TICC’s claim that the dividend can be supported by the cash flows from the Company’s CLO investments. The facts are clear. As illustrated in Appendix A, cash-on-cash distributions have been decreasing on a significant proportion of TICC’s CLO equity portfolio, with an astounding decline of almost 10% quarter over quarter. Further, over-collateralization cushions in TICC’s CLO investments have compressed, creating additional risk to future distributions. This will only lead to further pressure on TICC and only serves to emphasize that its current dividend policy is unsustainable.

Although TICC’s management has given lip service to moving the portfolio into bespoke, directly originated credit investments, TICC has failed to follow through on this proposal. Instead, the portfolio remains overweight on CLO investments. And yet—in addition to causing the problems noted above—the Existing Adviser continues to reap significant fees that are excessive and inappropriate for the existing portfolio of assets, which we will discuss further below.

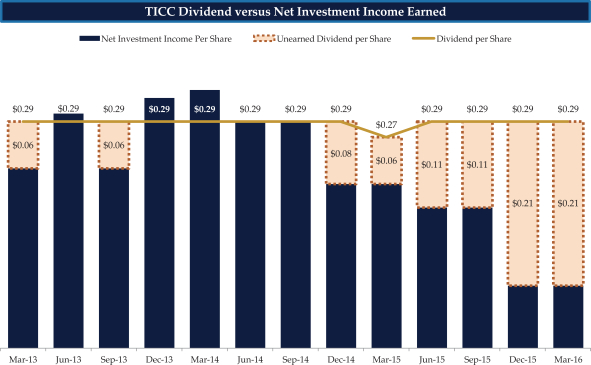

VALUE-DESTRUCTIVE DIVIDEND POLICY AND POOR CAPITAL MANAGEMENT

Contributing to the erosion of NAV is also a flawed and value-destructive capital allocation strategy. By TICC’s own admission, its past dividends are in part a return of investor capital which, as five independent analysts have noted, is unsustainable. TICC has under-earned its dividend by a cumulative 45.3% in the six most recent quarters (and likely would have under-earned its dividend in previous quarters if not for an accounting error made by TICC that was disclosed in the first quarter of 2015).

| 5 | Calculated as of May 6, 2016, based on TICC’s daily closing price as a percentage of the then latest reported net asset value per share. Calculation includes both trading and non-trading days. |

| 6 | Calculated based on TICC’s closing price of $5.00 per share on May 6, 2016 and TICC’s last reported net asset value of $5.89 per share as of March 31, 2016. |

| 7 | Calculated based on TICC’s closing price of $5.00 per share on May 6, 2016 and TICC’s last reported net asset value of $5.89 per share as of March 31, 2016. |

12

Table of Contents

TICC has Consistently Under-earned its Dividend and Eroded NAV

Further, TICC has issued equity in the public markets ten times since its initial public offering and once even issued equity below NAV (in June 2008), notwithstanding the dilutive effect such an offering would have on Stockholders. These equity raises have served only to increase the asset base and resulting revenue stream for the Existing Adviser; TICC has been unable to deploy this incremental capital in ways that improve returns for investors relative to the BDC Composite.

These actions by management—combined with the precipitous decline in NAV per share under its watch and the resulting high debt-to-equity ratio of 1.15x—now severely limit TICC’s ability to raise additional capital or repurchase shares because of regulations that effectively limit BDCs to debt-to-equity ratios of 1.0x. Thus, the Existing Adviser’s actions have not only delivered abysmal results but have resulted in a situation that severely limits the ability of any manager to rescue Stockholder investments.

13

Table of Contents

EXISTING ADVISER HAS BEEN SIGNIFICANTLY OVERCOMPENSATED HISTORICALLY

Perhaps most egregious—particularly in light of the performance noted above and the composition of TICC’s portfolio—is that management has taken a disproportionate share of Total Economics of Stockholders’ investment.8 TICC’s total Stockholder fees and expenses have been well above the BDC Composite median since 2012.9 The numbers show that, since 2012, for every $1.00 of Total Economics created, Stockholders have incurred $1.44 of fees and expenses, the vast majority of which have gone to the Existing Adviser.

Moreover, TICC’s management is also vastly overcompensated given that its portfolio—overweight with broadly syndicated CLO investments—is largely the same as a class of mutual funds that charges far lower fees for the same service. In this sense, according to certain industry analysts, TICC has charged approximately six times the fees it should properly be entitled to.10

When considering the nature of TICC’s assets and incorporating the expected return, the bottom line is that one dollar invested with TICC is immediately and automatically worth notably less than one dollar for Stockholders. It’s clear that TICC provides Stockholders with exposure to assets that can otherwise be accessed significantly less expensively, all in an effort to maximize management returns to the detriment of Stockholders.

HIGHLY CONCERNING CONFLICTS OF INTEREST AND POOR CORPORATE GOVERNANCE

In light of the dismal performance, flawed investment strategy and poor capital management, one might think the Board would have cut ties with the Existing Adviser by now. Not so. The current Board has renewed the Existing Adviser’s contract annually for the last 12 years, enabling the Existing Adviser to inflict more than a decade of mismanagement on Stockholders. This is a result of a static, entrenched Board that is conflicted and in dire need of new, independent views.

The extent of the Board’s conflict was revealed this past fall when the Board advocated passionately—for several months—in favor of a transaction that was initially estimated to result in the Existing Adviser receiving as much as $60 million from a third-party buyer to take over the Company’s advisory contract. This was despite the fact that the Board had—and has—the power to terminate the Existing Adviser’s contract at any time on 60 days’ notice—a move that would have cost Stockholders nothing and permitted the Board to negotiate for some of those amounts to be redirected to Stockholders in the form of reduced fees. Recall that this was a Board-approved transaction in which:

| • | The Board refused to meaningfully engage in any alternative proposals and instead pursued a transaction in which Board members stood to personally make millions of dollars; |

| • | At least one “independent” Board member approved the transaction despite glaring personal conflicts of interest, notably being paid $280,000 per year by businesses associated with another conflicted Board member and the owner of the Existing Adviser; |

| 8 | Total Economics defined as Economic Profit + Shareholder Value Gained / (Lost) due to change in Premium / (Discount) to Average NAV. Economic Profit equals Net Increase in Net Assets as a Result of Operations + Total Shareholder Fees & Expenses. Shareholder Value Gained / (Lost) due to change in Premium / (Discount) to Average NAV calculated as the change in premium (or discount) to NAV per share between the close of the trading day following the filing of 12/31/2011 financial statements and the close of the trading day following the release of 3/31/16 financial statements multiplied by the average NAV between those trading days (calculated as shares outstanding on such trading day multiplied by the then-most recently reported NAV per share). See the table in Annex D entitled “Reconciliation of Certain Non-GAAP Financial Measures” for a reconciliation to the most recent comparable financial measures presented in accordance with GAAP. Source: Company Filings. Capital IQ, Financial data as of 3/31/16. |

| 9 | TSLX believes that Total Shareholder Fees & Expenses and Total Economics for each company in the BDC Composite were calculated on a substantially equivalent basis to the methodology shown for TICC in Annex D, including pro forma adjustments to exclude the effects of any management or incentive fee waiver, where applicable. Source: Company Filings. Capital IQ, Financial data as of 3/31/16. |

| 10 | TICC Reiterates Rejection of TSLX’s Offer, Wells Fargo, September 22, 2015. |

14

Table of Contents

| • | The Existing Adviser recut the transaction several times while under pressure and consistent criticism from Stockholders, equity analysts and market commentators; |

| • | Three independent proxy advisory firms recommended that Stockholders vote against the transaction—with one of these firms ultimately changing its recommendation in favor of the transaction in large part due to the potentially adverse consequences for Stockholders if the Existing Adviser continued to advise the Company; |

| • | Five of the six equity analysts covering TICC expressed their opposition to the deal publicly; |

| • | TICC and the Board were found by a federal judge to have likely violated federal securities laws by, among other things, omitting the amount to be paid to the interested directors of TICC in their disclosure to Stockholders; and |

| • | TICC itself threatened that if Stockholders voted down the deal it would leave Stockholders’ investments burdened by the “same adviser” and “same Board.” |

For 12 years, the Board has gone unchanged and overseen drastic underperformance and management enrichment, while each TICC director has received hundreds of thousands of dollars in compensation. TICC’s Chairman alone has received over $1.0 million in compensation from the Company over the course of his tenure. We have grave concerns that these actions indicate the current Board is either unwilling or incapable of acting independently to protect Stockholder value. The lack of reasonable business judgment demonstrated by the Board this past fall demands a new, independent voice in the boardroom to protect Stockholder interests.

WOEFULLY INADEQUATE RECENT EFFORTS

The “fee waiver” and appointment of a new Chairman of the Board announced on March 9, 2016 are empty gestures and a transparent attempt to escape the resounding defeat TICC experienced when Stockholders refused to approve the conflicted transaction at the Special Meeting in late December.

We were surprised to hear TICC say on its fourth quarter earnings call held on March 10, 2016 that, in January, the Board “commenced [a] shareholder outreach program and contacted the 20 largest institutional holders.” As its third largest Stockholder, we did sit down with TICC, but it was just two days prior to the announcements referenced above. It was clear from the very short notice and confirmed in the meeting that TICC’s objective was an attempt to garner our support for an already fully-baked plan and input from Stockholders was not being entertained. This was not a genuine effort to discuss an appropriate path to Stockholder value-creation. If all of TICC’s outreach meetings were as unconstructive as ours, we suspect TICC’s other Stockholders were just as underwhelmed and disappointed as we were.

As far as the proposed course of action:

Reduction in Fees—As part of the March 9 announcement, TICC announced a fee waiver it had entered into with its Existing Adviser.

However, after years of terrible performance, including underperforming the BDC Composite by 180.9 percentage points since TICC’s initial public offering on a total returns basis, a whopping 7.3 percentage points per year of under-performance, the only appropriate response from the Board would have been to terminate the management contract with the Existing Adviser. Again, TICC’s net total return for investors was approximately 1.8% per year less than if a Stockholder had invested in risk-free U.S. Treasuries. As we have said time and again, our issues with TICC are broad and systemic. While important, a simplistic focus on fees distorts the core problems at TICC as easily manipulated and misleading headlines. Paying the Existing Adviser anything is paying it too much, given TICC’s massive and consistent underperformance.

We find Mr. Novak’s characterization of the reduced fee structure as “best in class” laughable. Fees and compensation should be a function of management’s ability to add value and drive return on equity—not metrics

15

Table of Contents

to be viewed in isolation and certainly not ones to be determined against a barely comparable group of other BDCs (particularly a group that conveniently ignores the underlying nature of the assets they own).

In our review of BDC peers, we believe TICC has failed to recognize the unique nature of its own portfolio of broadly syndicated securities (versus a greater focus on bespoke, directly originated transactions by other participants in the BDC industry). In our view, the most appropriate fee structure against which to compare TICC is that adopted by American Capital Senior Floating, Ltd. (“ACSF”). The composition of ACSF’s portfolio is nearly identical to TICC’s: ACSF has a portfolio composed of 84.3% senior secured broadly syndicated debt and 15.7% CLO equity and TICC has a portfolio composed of 72.0% senior secured broadly syndicated debt and 25.6% CLO equity.11 For its efforts, ACSF charges a management fee of 80 basis points on assets under management and no incentive fee. By comparison, TICC’s new fee structure—which includes a 1.5% base management fee and a 20% incentive fee—looks rich indeed. In other words, TICC’s new fee structure is approximately 265% higher than ACSF’s fee structure, after taking into account the incentive fee. It should also be noted that ACSF trades at approximately 86.0% of book value, even with its lower fee structure.12 The sobering reality in our view is that any notion of TICC shares trading at NAV without implementing more significant changes is a distant reality.

Furthermore, rewarding the same management team through marginally reduced fees does not address the core problem of poor performance. A change in the manager was passionately advocated by the Board and the current management team in connection with the now failed BSP transaction. Simply put, after 12 years of underperformance across all time periods, the answer shouldn’t be a reduction in the Existing Adviser’s compensation. The answer, as the Board had previously advocated, is real change—change in management and the Existing Adviser, as well as a change in investment strategy.

New Chairman—TICC’s March 9 announcement also reported that Mr. Novak had been appointed as the “independent” Chairman of the Board, which was disappointing to us given the lack of alignment Mr. Novak has exhibited with Stockholder interests.

We urge Stockholders to consider these simple facts about Mr. Novak:

| • | As of April 29, 2016, Mr. Novak owned 14,474 shares of Common Stock.13 Since April 2012, Mr. Novak has not increased his overall stake in TICC despite shares trading well below NAV for a significant portion of that period. Mr. Novak is not, and has not tried to become, economically aligned with Stockholders. |

| • | Mr. Novak’s 14,474 shares of Common Stock have a current market value of approximately $72,370, representing a mere 7.2% of the more than $1.0 million in aggregate compensation he has received from TICC during his 12-year tenure as a director.14 |

| • | Mr. Novak’s annual compensation as a director has grown at a compound annual rate of 24.3% since 2010, while over the same period Stockholders have seen their shares underperform the BDC Composite by 9.2% on an annualized basis. |

| • | Mr. Novak was even awarded $50,000 for his role as Chairman of the Special Committee that oversaw the attempt to have Stockholders approve the conflicted transaction with BSP, even though that transaction was overwhelmingly rejected by Stockholders and the Board was admonished by a federal judge for misleading Stockholders in connection with its solicitation efforts. |

| 11 | Calculated as of March 31, 2016 by fair value. |

| 12 | Calculated as of May 6, 2016, based on ACSF’s closing price of $10.08 per share and a March 31, 2016 NAV of $11.72 per share. |

| 13 | TICC Form 10-K/A filed on April 29, 2016. |

| 14 | Calculated based on TICC’s closing price of $5.00 on May 6, 2016. Steven P. Novak has received approximately $1,005,125 in compensation for his role as a director from the Company’s inception through December 31, 2015. Source: Company filings. |

16

Table of Contents

We informed Mr. Novak on October 7, 2015 that we would be willing to discontinue our proxy solicitation efforts against the conflicted BSP transaction if the Board agreed to facilitate change at the Company by terminating the Existing Adviser’s contract and redirecting the proceeds of the proposed transaction to replace the Existing Adviser to Stockholders. We believe any party willing to offer a cash payment and future economic interest to the failed Existing Adviser would have readily offered the same consideration through reduced fees to Stockholders if the Board demanded it do so instead of compensating the failed Existing Adviser. The Board instead advocated for a conflicted transaction that would have resulted in members of the Board receiving millions of dollars. As a result, we are now faced with a second costly proxy contest that will only be an additional expense to Stockholders so that the Company can continue to desperately protect its failing Existing Adviser and self-interested directors.

These recent “actions” by TICC are wholly inadequate. Most alarmingly, despite TICC describing these actions as the product of a “comprehensive” review, the Company has not acknowledged whether the Special Committee considered a sale or liquidation, which were direct requests from TSLX and other Stockholders. Any genuine “comprehensive” review would have required an honest and rigorous review, not empty gestures to fiddle with fees and shuffle the same faces around the Board.

FAILURE TO SCHEDULE STOCKHOLDER MEETING

Historically, TICC has held its annual meeting no later than June 18 and has announced the date of each of its annual meetings in the last 11 years by no later than May 2 of that year. The fact that TICC has not set the date for its 2016 Annual Meeting or filed its proxy statement for the 2016 Annual Meeting within 120 days of the end of its fiscal year (and as a result was obligated to file a supplement to its Annual Report on Form 10-K for the year ended December 31, 2015) is another blatant abuse of Stockholders.

TICC is denying Stockholders the opportunity to voice their concerns at the 2016 Annual Meeting and to exercise their right to vote on critical proposals that directly affect their company. Simply put, we believe that the Board is delaying the 2016 Annual Meeting to prevent Stockholders from having the opportunity to vote in favor of our highly qualified director nominee and our proposal to terminate the contract of the failed Existing Adviser.

The Board is clearly stalling. The Board’s failure to take these simple steps demonstrates that it is more interested in entrenching itself and the failed Existing Adviser than providing Stockholders with the opportunity to vote on important matters concerning their investment.

THE TIME FOR CHANGE IS NOW

Despite the Board’s own admission that change was needed, we have been shocked by the lack of meaningful action—particularly since the failed Stockholder vote held in December 2015—and by the Board’s efforts to frustrate Stockholders’ ability to take these actions on their own. As outlined in our November 29, 2015 letter to the Board, we expected it to take meaningful actions regardless of the success or failure of the conflicted transaction. The clear path for change includes:

| • | Immediately seating Mr. Millet on the Board and further refreshing the Board with a new slate of independent directors, in consultation with us and other Stockholders; |

| • | Immediately terminating the existing Investment Advisory Agreement; and |

| • | Promptly following the reconstitution of the Board, conducting a comprehensive strategic review process to identify the best path forward to deliver value to Stockholders. |

Time is overdue for TICC to become a professionally governed public company with a focus on maximizing Stockholder value. Given the poor financial performance, the deterioration of NAV per share, declining values in the CLO equity portfolio, and an overall lack of transparency, TICC needs to act now to prioritize Stockholders’ interests over their own.

17

Table of Contents

We urge the Board to schedule the 2016 Annual Meeting promptly so that Stockholders have the opportunity to vote on our Nominee and on terminating the Investment Advisory Agreement.

As always, we stand ready and willing to immediately engage in a constructive dialogue with the Company. Once the aforementioned issues are addressed, we believe there is a bright path ahead for TICC and its Stockholders.

The time for change is now.

18

Table of Contents

APPENDIX A

Performance Statistics, TICC CLO Equity Portfolio (Selected Constituents)15

CLO Equity Position | Q1 201516 | Q2 2015 | Q3 2015 | Q4 2015 | Q1 2016 | % Change (Q/Q) | % Change (Y/Y) | |||||||||||||||||||||

Weighted Average of Selected Constituents | ||||||||||||||||||||||||||||

Cash on Cash Distribution | (10.9 | )% | (18.9 | )% | ||||||||||||||||||||||||

Junior Overcollateralization Cushion | (17.0 | )% | (20.8 | )% | ||||||||||||||||||||||||

AMMC CLO XII, Ltd. – $6,460,715 Fair Value17 |

| |||||||||||||||||||||||||||

Cash on Cash Distribution18 | 4.6 | % | 5.2 | % | 5.2 | % | 5.0 | % | 6.5 | % | 29.9 | % | 41.0 | % | ||||||||||||||

Junior Overcollateralization Cushion19 | 5.1 | % | 4.9 | % | 4.6 | % | 4.4 | % | 4.6 | % | 3.4 | % | (9.4 | )% | ||||||||||||||

Ares XXV CLO Ltd. – $6,975,000 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 4.1 | % | 3.8 | % | 3.4 | % | 3.6 | % | 2.8 | % | (20.9 | )% | (30.7 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 4.2 | % | 4.2 | % | 3.7 | % | 3.8 | % | 2.5 | % | (34.0 | )% | (40.0 | )% | ||||||||||||||

Ares XXVI CLO Ltd. – $4,229,521 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 5.2 | % | 5.0 | % | 4.4 | % | 4.7 | % | 3.8 | % | (18.5 | )% | (25.9 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 4.0 | % | 4.1 | % | 3.6 | % | 3.6 | % | 2.3 | % | (36.7 | )% | (43.0 | )% | ||||||||||||||

Ares XXIX CLO Ltd. – $5,284,986 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 5.8 | % | 4.9 | % | 4.6 | % | 4.5 | % | 3.9 | % | (13.7 | )% | (31.8 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 3.9 | % | 3.9 | % | 3.3 | % | 3.3 | % | 2.4 | % | (29.3 | )% | (39.1 | )% | ||||||||||||||

Benefit Street Partners CLO II, Ltd. – $15,380,095 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 5.6 | % | 7.5 | % | 6.4 | % | 6.4 | % | 5.1 | % | (19.9 | )% | (9.0 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 4.7 | % | 4.7 | % | 4.7 | % | 4.8 | % | 3.1 | % | (35.7 | )% | (33.5 | )% | ||||||||||||||

Carlyle GMS CLO 2013-2, Ltd. – $5,932,128 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 6.1 | % | 7.0 | % | 5.6 | % | 6.4 | % | 5.5 | % | (14.3 | )% | (9.5 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 5.3 | % | 5.3 | % | 5.3 | % | 5.0 | % | 4.9 | % | (0.4 | )% | (6.1 | )% | ||||||||||||||

Carlyle GMS CLO 2014-4, Ltd. – $14,914,501 Fair Value |

| |||||||||||||||||||||||||||

Cash on Cash Distribution | 11.7 | % | 5.6 | % | 4.6 | % | 5.2 | % | 4.2 | % | (18.1 | )% | (64.0 | )% | ||||||||||||||

Junior Overcollateralization Cushion | 4.5 | % | 4.6 | % | 4.7 | % | 4.8 | % | 4.6 | % | (3.8 | )% | 2.0 | % | ||||||||||||||

Catamaran CLO 2012-1 Ltd. – $5,500,000 Fair Value |

| |||||||||||||||||||||||||||