About Sixth Street Specialty Lending

Sixth Street Specialty Lending is a specialty finance company focused on lending to middle-market companies. The Company seeks to generate current income primarily in U.S.-domiciled middle-market companies through direct originations of senior secured loans and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds and equity securities. The Company has elected to be regulated as a business development company, or a BDC, under the Investment Company Act of 1940 and the rules and regulations promulgated thereunder. The Company is externally managed by Sixth Street Specialty Lending Advisers, LLC, an affiliate of Sixth Street and a Securities and Exchange Commission (“SEC”) registered investment adviser. The Company leverages the deep investment, sector, and operating resources of Sixth Street, a global investment firm with approximately $34 billion of assets under management as of March 31, 2020. For more information, visit the Company’s website at www.sixthstreetspecialtylending.com.

About Sixth Street

Sixth Street is a global investment firm with approximately $34 billion in assets under management and committed capital as of March 31, 2020. Sixth Street operates eight diversified, collaborative investment platforms across our growth investing, adjacencies, direct lending, fundamental public strategies, infrastructure, special situations, agriculture and par liquid credit businesses. Our long-term oriented, highly flexible capital base and “One Team” cultural philosophy allow us to invest thematically across sectors, geographies and asset classes. Founded in 2009, Sixth Street has more than 275 team members including over 140 investment professionals operating from nine locations around the world. For more information, visit www.sixthstreet.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking statements,” which relate to future events or the Company’s future performance or financial condition, including the Company’s future operating results and liquidity position, expectations regarding the timing and outcome of bankruptcy, reorganization and liquidation proceedings of its portfolio companies and the impact on the Company, expectations with respect to future dividends, the impact of COVID-19 and related changes in base interest rates and market volatility on the Company’s business, the Company’s portfolio companies, the Company’s industry and the global economy. These statements are not guarantees of future performance, conditions or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update any such forward-looking statements.

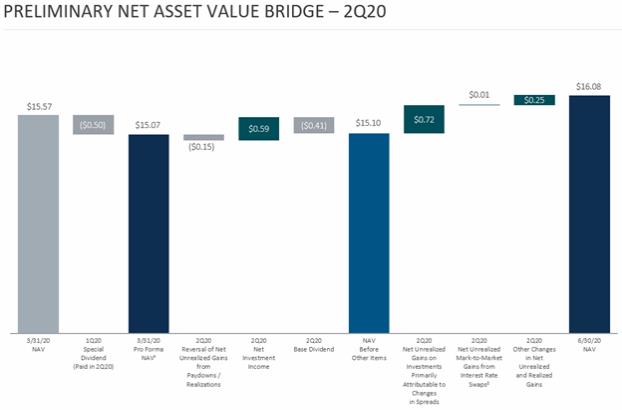

The Company’s closing procedures for the three months ended June 30, 2020 are not yet complete and, as a result, these preliminary estimates of the financial information above reflect the Company’s preliminary estimate with respect to such results based on information currently available to management, and may vary from the Company’s actual financial results as of and for the quarter ended June 30, 2020. For example, estimated net asset value per share is based on the value of the Company’s total assets, including the Company’s investments (some of which are not publicly traded or whose market prices are not readily available, the fair value of which is determined by the Company’s board of directors in good faith). The fair value of the Company’s investments have not yet been determined by the Company’s board of directors or

11