| Writer's Direct Number | Writer's E-mail Address |

| 212.756.2208 | david.rosewater@srz.com |

January 15, 2013

VIA EDGAR

Perry J. Hindin Special Counsel Office of Mergers and Acquisitions Securities and Exchange Commission Washington, D.C. 20549 | |

| | Re: | SandRidge Energy, Inc. ("SandRidge" or the "Company") Revised Preliminary Consent Statement On Schedule 14A Filed January 14, 2013 by TPG-Axon Partners, LP, Dinakar Singh, et al. File No. 001-33784 |

| | | |

Dear Mr. Hindin:

In response to your verbal comment related to the revised preliminary consent statement on Schedule 14A filed by TPG-Axon Partners, LP and its affiliates on January 14, 2013, please find attached supplemental support, which was previously sent to you via e-mail, for the following statements therein:

"The Company's Net Asset Value (as estimated by research analysts)…[has] also declined dramatically since the Company's IPO. The Common Stock continues to trade at a meaningful discount to NAV, based on many analyst estimates."

In the event that you have any further questions, please contact me at (212) 756-2208, Marc Weingarten at (212) 756-2280 or Eleazer Klein at (212) 756-2374.

Very truly yours,

/s/ David Rosewater

David Rosewater

SandRidge Energy, Inc.'s Net Asset Value Over Time

The above chart provides the per share Net Asset Value of SandRidge by three research analysts (UBS, Deutsche Bank and Howard Weil) calculated at three times: (i) prior to the end of the company's third fiscal quarter in 2008, (ii) prior to the end of the company's third fiscal quarter in 2012, and (iii) in the most recent reports.

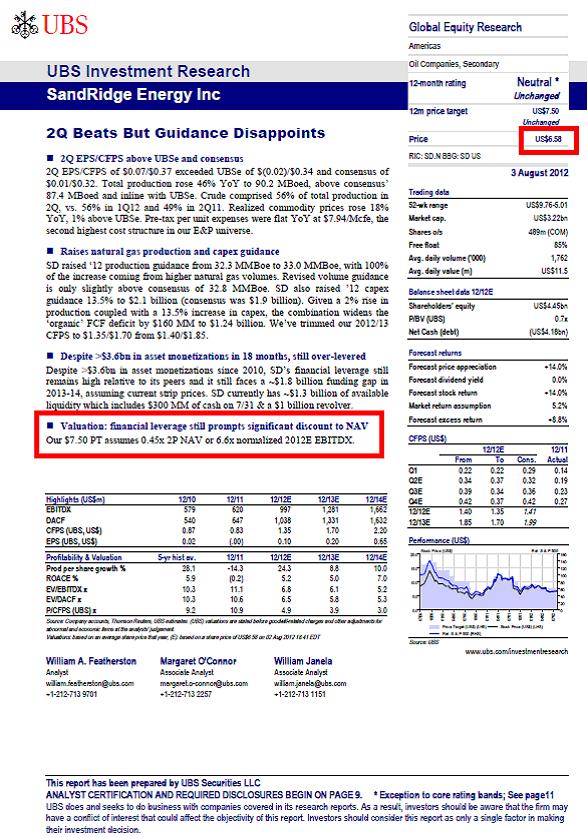

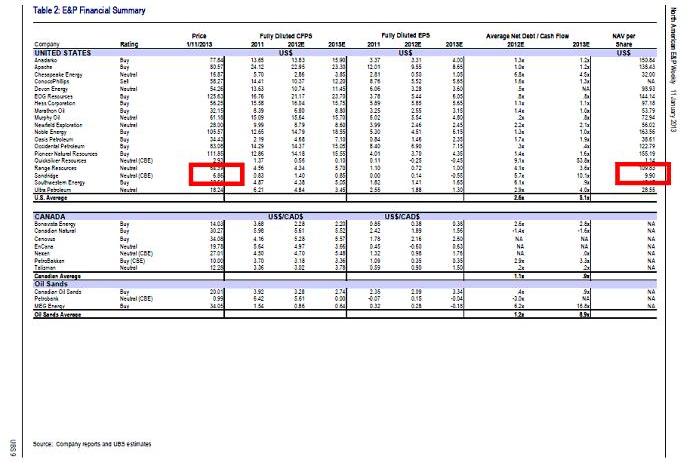

UBS: Prior to the end of Q3 2008, UBS estimated SandRidge's per share NAV to be $39.00. As of the date of its report publishing such NAV estimate, the stock was trading at $23.89, which was a 38.74% discount to its NAV estimate. Prior to the end of Q3 2012, UBS estimated SandRidge's per share NAV to be $16.00. As of the date of its report publishing such NAV estimate, the stock was trading at $6.58, which was a 58.88% discount to its NAV estimate. In its most recent report (dated January 11, 2013), UBS estimated SandRidge's per share NAV to be $9.90. As of the date of its report publishing such NAV estimate, the stock was trading at $6.86, which was a 30.71% discount to its NAV estimate.

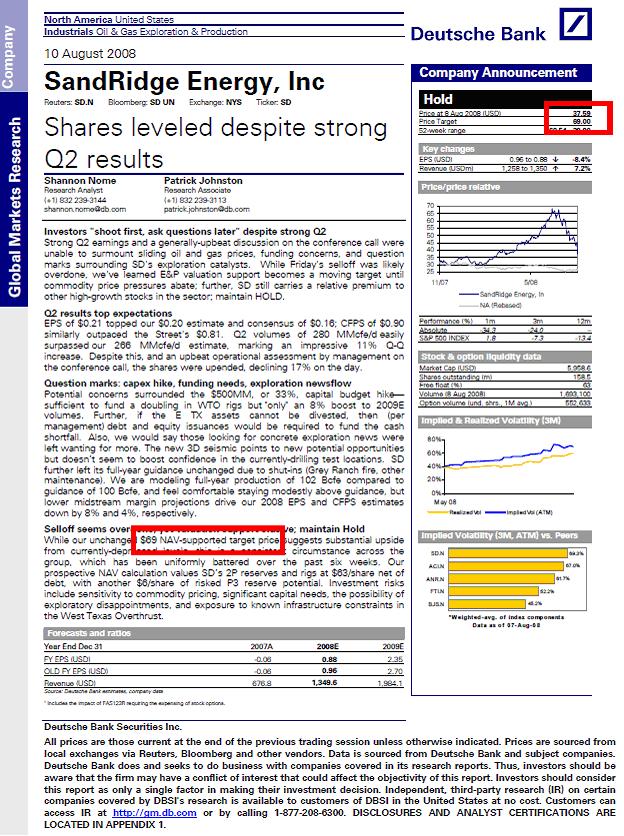

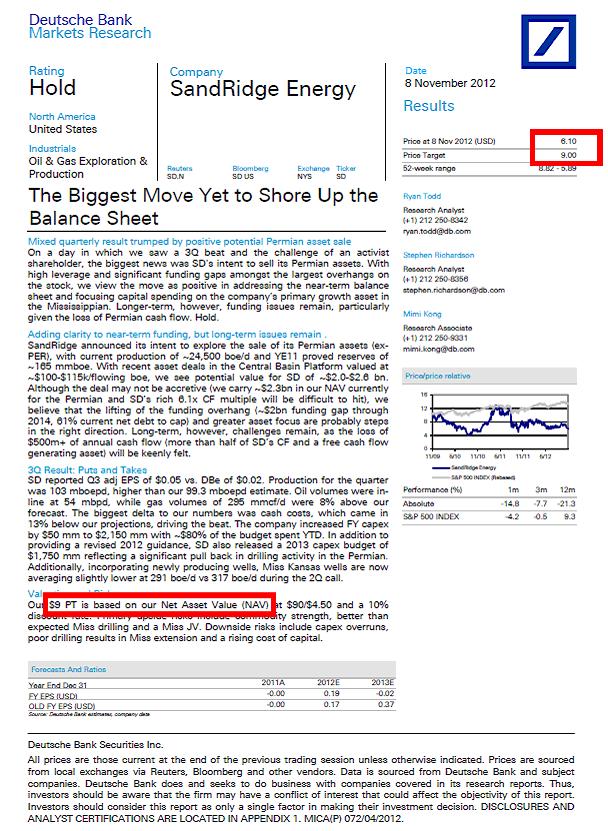

Deutsche Bank: Prior to the end of Q3 2008, Deutsche Bank estimated SandRidge's per share NAV to be $69.00. As of the date of its report publishing such NAV estimate, the stock was trading at $37.59, which was a 45.52% discount to its NAV estimate. Prior to the end of Q3 2012, Deutsche Bank estimated SandRidge's per share NAV to be $10.00. As of the date of its report publishing such NAV estimate, the stock was trading at $6.58, which was a 34.20% discount to its NAV estimate. In its most recent report (dated November 9, 2012), Deutsche Bank estimated SandRidge's per share NAV to be $9.00. As of the date of its report publishing such NAV estimate, the stock was trading at $6.10, which was a 32.22% discount to its NAV estimate.

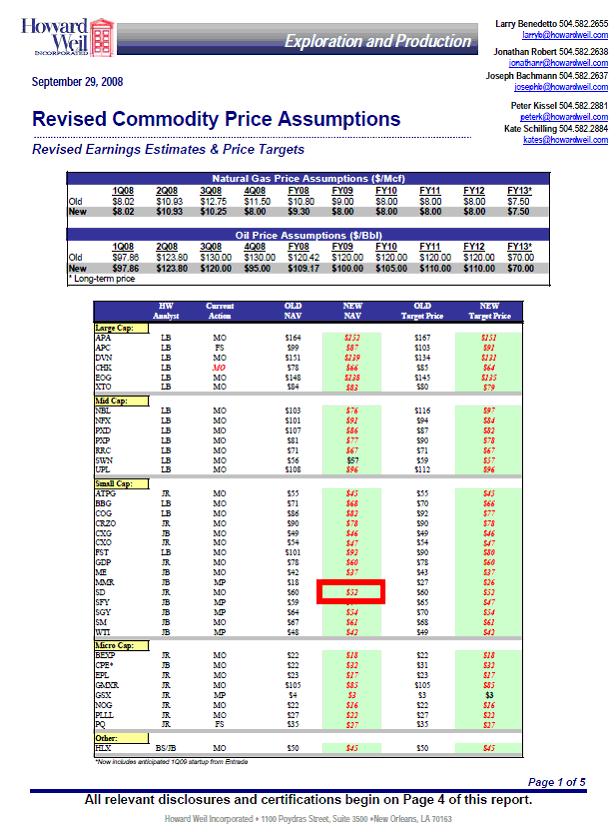

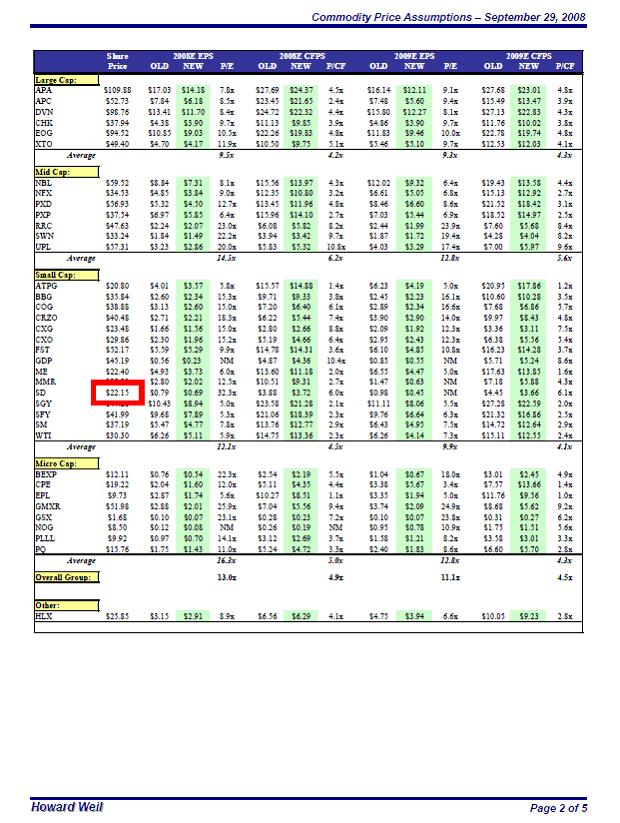

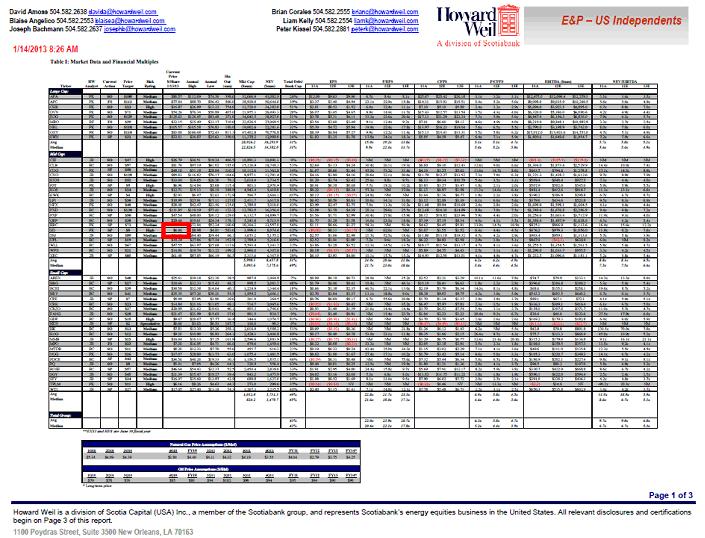

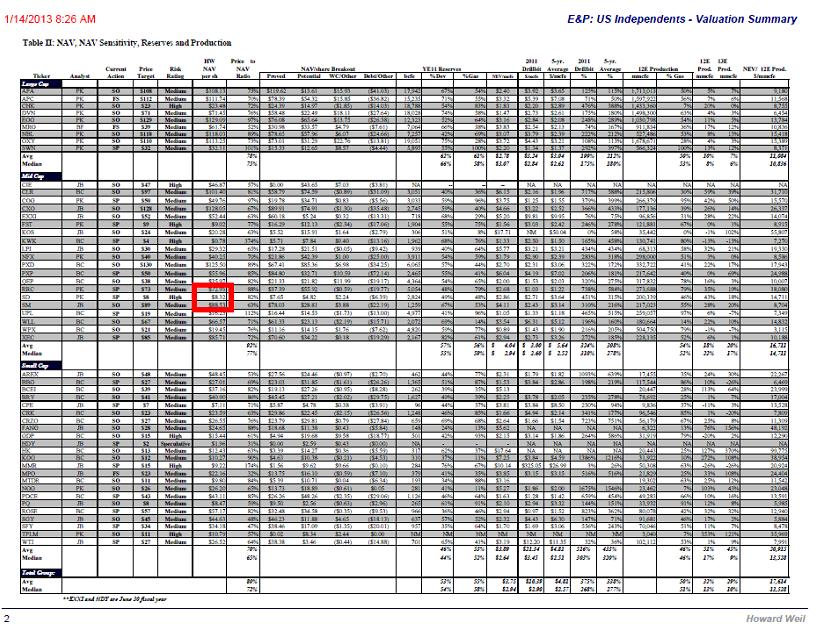

Howard Weil: Prior to the end of Q3 2008, Howard Weil estimated SandRidge's per share NAV to be $52.00. As of the date of its report publishing such NAV estimate, the stock was trading at $22.15, which was a 57.40% discount to its NAV estimate. In its most recent report (dated January 14, 2013), Howard Weil estimated SandRidge's per share NAV to be $8.32. As of the date of its report publishing such NAV estimate, the stock was trading at $6.86, which was a 17.55% discount to its NAV estimate.

UBS, Deutsche Bank and Howard Weil are a sample of research analysts who have presented NAV estimates, to which SandRidge common stock has traded at a discount, both historically and most recently. Accordingly, the above data supports the statements that "The Company's Net Asset Value (as estimated by research analysts)…[has] also declined dramatically since the Company's IPO. The Common Stock continues to trade at a meaningful discount to NAV, based on many analyst estimates."

For your reference, attached as Exhibit A are highlighted (in red boxes) excerpts from each of the aforementioned reports citing the applicable trading price and per share NAV estimate.