February 2013 Updated Information on SandRidge Related - Party Land Transactions

1 DISCLAIMER THIS PRESENTATION IS FOR GENERAL INFORMATIONAL PURPOSES ONLY. IT DOES NOT HAVE REGARD TO THE SPECIFIC INVESTMENT OBJECTIVE, FINANCIAL SITUATION, SUITABILITY, OR THE PARTICULAR NEED OF ANY SPECIFIC PERSON WHO MAY RECEIVE THIS PRESENTATION, AND SHOULD NOT BE TAKEN AS ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. THE VIEWS EXPRESSED HEREIN REPRESENT THE OPINIONS OF TPG - AXON MANAGEMENT LP, TPG - AXON PARTNERS GP, L.P., TPG - AXON GP, LLC, TPG - AXON PARTNERS, LP, TPG - AXON INTERNATIONAL, L.P., TPG - AXON INTERNATIONAL GP, LLC, DINAKAR SINGH LLC AND DINAKAR SINGH ("TPG - AXON" AND, TOGETHER WITH STEPHEN C. BEASLEY, EDWARD W. MONEYPENNY, FREDRIC G. REYNOLDS, PETER H. ROTHSCHILD, ALAN J. WEBER AND DAN A. WESTBROOK, THE "PARTICIPANTS"), AND ARE BASED ON PUBLICLY AVAILABLE INFORMATION WITH RESPECT TO SANDRIDGE ENERGY, INC. (THE "ISSUER "). THE PARTICIPANTS RESERVE THE RIGHT TO CHANGE ANY OF THEIR OPINIONS EXPRESSED HEREIN AT ANY TIME AS THEY DEEM APPROPRIATE. THE PARTICIPANTS DISCLAIM ANY OBLIGATION TO UPDATE THE INFORMATION CONTAINED HEREIN. THE PARTICIPANTS HAVE NOT SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION INDICATED IN THIS PRESENTATION AS HAVING BEEN OBTAINED OR DERIVED FROM STATEMENTS MADE OR PUBLISHED BY THIRD PARTIES. ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN. NO WARRANTY IS MADE THAT DATA OR INFORMATION, WHETHER DERIVED OR OBTAINED FROM FILINGS MADE WITH THE SEC OR FROM ANY THIRD PARTY, ARE ACCURATE. THE PARTICIPANTS SHALL NOT BE RESPONSIBLE OR HAVE ANY LIABILITY FOR ANY MISINFORMATION CONTAINED IN ANY SEC FILING OR THIRD PARTY REPORT. UNDER NO CIRCUMSTANCES IS THIS PRESENTATION TO BE USED OR CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY . THE PARTICIPANTS HAVE FILED WITH THE SEC A DEFINITIVE CONSENT STATEMENT AND ACCOMPANYING CONSENT CARD TO BE USED TO SOLICIT WRITTEN CONSENTS FROM THE STOCKHOLDERS OF THE ISSUER IN CONNECTION WITH TPG - AXON'S INTENT TO TAKE CORPORATE ACTION BY WRITTEN CONSENT. ALL STOCKHOLDERS OF THE ISSUER ARE ADVISED TO READ THE DEFINITIVE CONSENT STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF WRITTEN CONSENTS BY THE PARTICIPANTS FROM STOCKHOLDERS OF THE ISSUER BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE CONSENT STATEMENT AND ACCOMPANYING CONSENT CARD HAVE BEEN FURNISHED TO SOME OR ALL OF THE ISSUER'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS , AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV . IN ADDITION, TPG - AXON WILL PROVIDE COPIES OF THE DEFINITIVE CONSENT STATEMENT AND ACCOMPANYING CONSENT CARD WITHOUT CHARGE UPON REQUEST. INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS IS CONTAINED IN THE DEFINITIVE CONSENT STATEMENT ON SCHEDULE 14A FILED BY TPG - AXON WITH THE SEC ON JANUARY 18, 2013. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCES INDICATED ABOVE.

2 Massive scale of competition could yield billions in profit for the Ward family • We believe the Ward family has acquired massive mineral rights in the Mississippian – ½ million acres! • Extensive overlap with SandRidge – in 22 counties in Oklahoma and Kansas…and often acquired in advance of, or alongside, SandRidge • SandRidge is spending enormous amounts on development and critical infrastructure. This investment – by SandRidge – could cause the adjacent holdings of the Ward family to be worth BILLIONS • The conflicts of interest, and potential for harm, to SandRidge stockholders are staggering!

3 Extraordinary investment by SandRidge stockholders could yield enormous profit for the Ward family The Mississippian is still a play in its developmental stage There is still controversy about the size of the play, and whether it is statistical (equally good across the play) or has sweet spots It is a relatively shallow play, so actual well costs are not as high as in some deeper plays, but… …The unusual cost is in the infrastructure Water disposal is a critical aspect of extracting oil and gas in the Mississippian Other utilities, such as electricity, must be built and provided as well Unless you build the infrastructure and water disposal systems, there is little value in mineral rights. SandRidge projects it will spend over $1.7 billion in capital expenditures this year – added to over $800 million in financing costs and overhead spending, this represents roughly 80% of SandRidge’s entire remaining market capitalization being spent just this year! Much of this money is being spent to increase value of the Mississippian mineral rights Drill wells to ‘de risk’ and ‘prove’ the value of the mineral rights in an area Massive investment in infrastructure necessary for drilling in the region ‘Use it or lose it’ – mineral rights often expire in 5 years if activity isn’t commenced We believe the Ward family has acquired massive amounts of land in overlap with SandRidge. This land could be worth BILLIONS of dollars if SandRidge efforts to build infrastructure and ‘prove out’ acreage in the Mississippian are successful!

4 Is it not logical that the existence of another buyer, acquiring massive amounts of mineral rights in the same areas, would affect the price SandRidge had to pay ? Were SandRidge resources and information used for the benefit of the Ward family entities? Given how expensive infrastructure development are, why did SandRidge not take a more concentrated approach to acquiring mineral rights? To use a railroad analogy – why lay more track but let others buy land next to the tracks? What mineral rights ended up with SandRidge, and what rights ended up with the Ward family (particularly WCT Resources)? Do we have the good acreage, or the bad acreage? The massive capital expenditure investment in the Mississippian is a ‘life or death’ bet for SandRidge. How can stockholders be certain that this investment is being made judiciously solely in their interest , as opposed to being spent to maximize the value of Ward family interests? Recent well results from the Kansas portion of the play appear to be weaker than the original Oklahoma portions. Yet the Ward family appears to be more heavily exposed to these newer areas... and SandRidge continues to invest heavily in the Kansas extensions. Is this in the best interests of SandRidge stockholders? Or the Ward family? SandRidge has been seeking to monetize its Mississippian acreage – first by investing to prove its value and build infrastructure, and then by selling those rights to third parties. Does it not affect SandRidge’s value when the Ward family is a large owner of similar rights, and is clearly actively selling those rights to third parties? The conflicts of interest are staggering!

5 CEO Tom Ward and his family have been an aggressive competitor to SandRidge, as we noted in the past They aggressively buy land, often in advance of the company, and then either keep it, sell it to others or even in a few instances, sell it to SandRidge We think this competition is abhorrent . The company defends it simply by saying WCT Resources is independent, and by implying the overlap is coincidental or immaterial. We do not believe WCT deserves the presumption of independence TPG - Axon is continuing its process of exhaustive information gathering and analysis, using a team of independent investigators across a large number of counties in Kansas and Oklahoma We first published our initial findings on January 23, 2013, where we detailed specific instances of adjacent acquisitions between SandRidge and WCT Resources or other entities associated with the Ward family. We provide additional examples of various patterns of activity in the Appendix to this presentation. These repeated instances of adjacent acquisitions are additional examples of the types of transactions we have uncovered by WCT Resources (and other entities associated with the Ward family). We are continuing our investigation. Entities controlled by the Ward family compete with SandRidge…

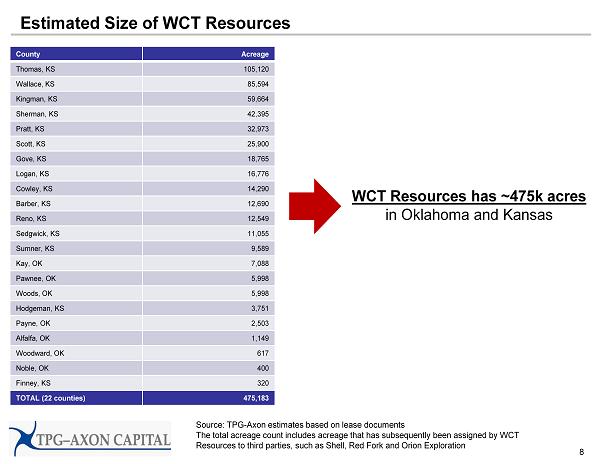

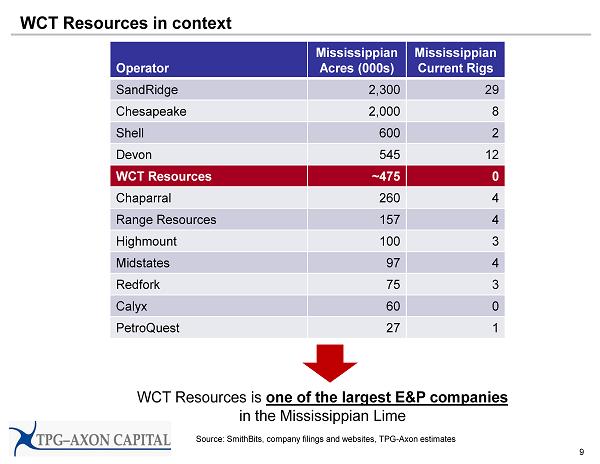

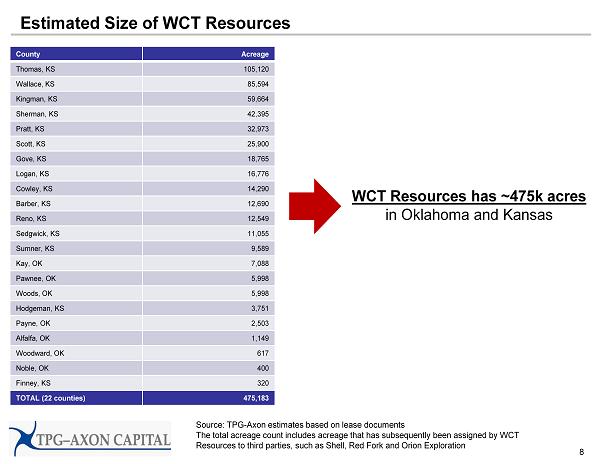

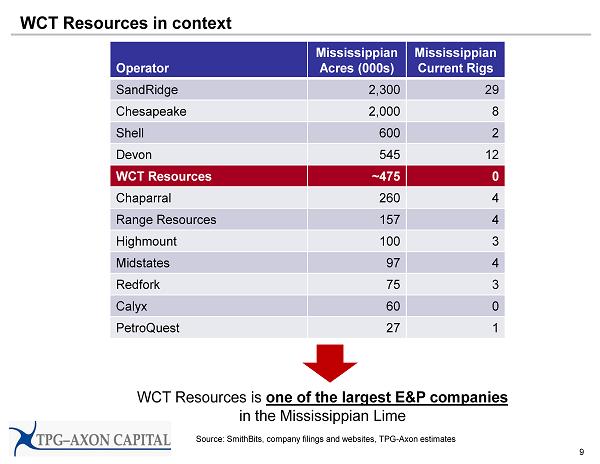

6 … and the scale of this competition is truly massive! WCT Resources has been among the largest acquirers of mineral rights in the Mississippian Previously, we had not yet completed enough work to assess the degree of competition and overlap. Based on our additional work, it is now clear to us that the degree of overlap and competition is truly massive . We believe WCT Resources is the 5 th largest acreage holder in the Mississippian, behind only SandRidge, Chesapeake , Shell and Devon From a thorough review the 22 counties where WCT Resources has overlap with SandRidge, we have found that WCT Resources has ~475k acres in the Mississippian

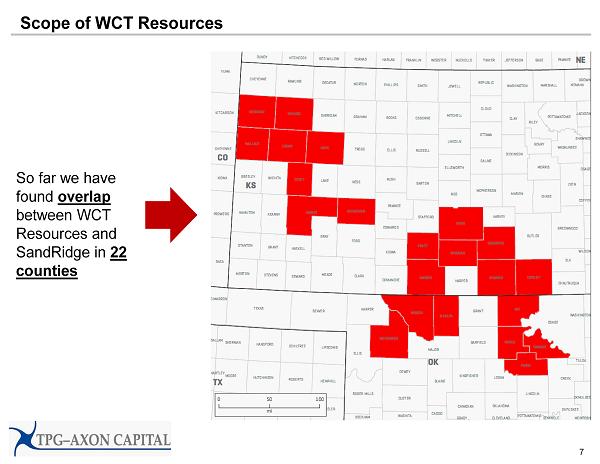

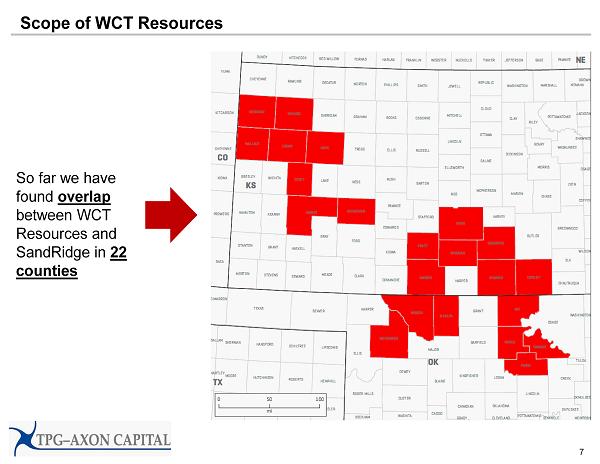

7 Scope of WCT Resources So far we have found overlap between WCT Resources and SandRidge in 22 counties

8 Estimated Size of WCT Resources County Acreage Thomas, KS 105,120 Wallace, KS 85,594 Kingman, KS 59,664 Sherman, KS 42,395 Pratt, KS 32,973 Scott, KS 25,900 Gove, KS 18,765 Logan, KS 16,776 Cowley, KS 14,290 Barber, KS 12,690 Reno, KS 12,549 Sedgwick, KS 11,055 Sumner, KS 9,589 Kay, OK 7,088 Pawnee, OK 5,998 Woods, OK 5,998 Hodgeman, KS 3,751 Payne, OK 2,503 Alfalfa, OK 1,149 Woodward, OK 617 Noble, OK 400 Finney, KS 320 TOTAL (22 counties) 475,183 WCT Resources has ~475k acres in Oklahoma and Kansas Source: TPG - Axon estimates based on lease documents The total acreage count includes acreage that has subsequently been assigned by WCT Resources to third parties, such as Shell, Red Fork and Orion Exploration

9 WCT Resources in context Operator Mississippian Acres (000s) Mississippian Current Rigs SandRidge 2,300 29 Chesapeake 2,000 8 Shell 600 2 Devon 545 12 WCT Resources ~475 0 Chaparral 260 4 Range Resources 157 4 Highmount 100 3 Midstates 97 4 Redfork 75 3 Calyx 60 0 PetroQuest 27 1 Source: SmithBits, company filings and websites, TPG - Axon estimates WCT Resources is one of the largest E&P companies in the Mississippian Lime

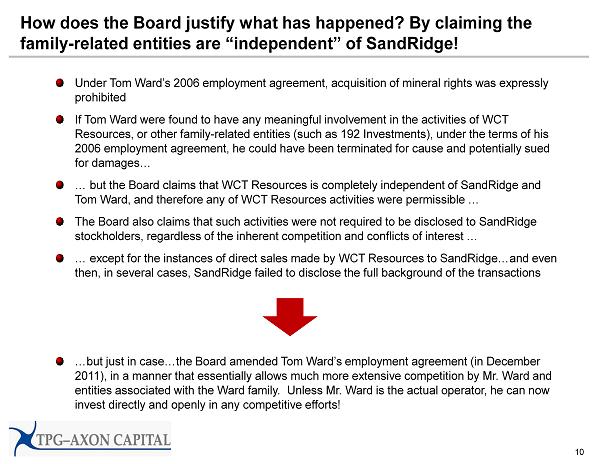

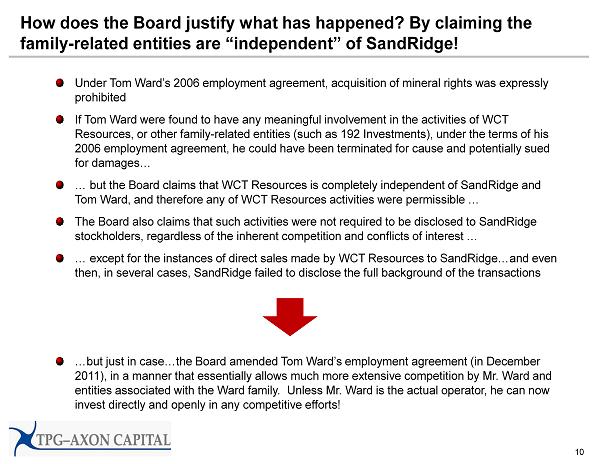

10 How does the Board justify what has happened? By claiming the family - related entities are “independent” of SandRidge ! Under Tom Ward’s 2006 employment agreement, acquisition of mineral rights was expressly prohibited If Tom Ward were found to have any meaningful involvement in the activities of WCT Resources, or other family - related entities (such as 192 Investments), under the terms of his 2006 employment agreement, he could have been terminated for cause and potentially sued for damages… … but the Board claims that WCT Resources is completely independent of SandRidge and Tom Ward, and therefore any of WCT Resources activities were permissible … The Board also claims that such activities were not required to be disclosed to SandRidge stockholders, regardless of the inherent competition and conflicts of interest … … except for the instances of direct sales made by WCT Resources to SandRidge…and even then, in several cases, SandRidge failed to disclose the full background of the transactions …but just in case…the Board amended Tom Ward’s employment agreement (in December 2011), in a manner that essentially allows much more extensive competition by Mr. Ward and entities associated with the Ward family. Unless Mr. Ward is the actual operator, he can now invest directly and openly in any competitive efforts!

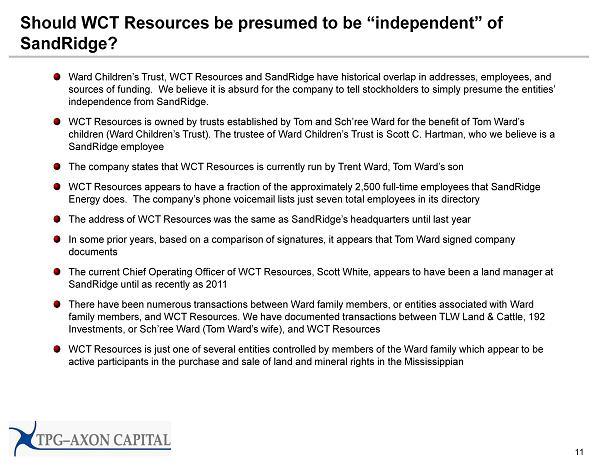

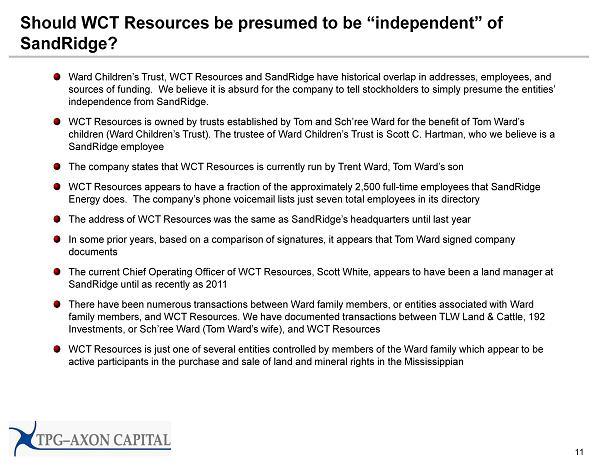

11 Should WCT Resources be presumed to be “independent” of SandRidge ? Ward Children’s Trust, WCT Resources and SandRidge have historical overlap in addresses, employees, and sources of funding. We believe it is absurd for the company to tell stockholders to simply presume the entities’ independence from SandRidge. WCT Resources is owned by trusts established by Tom and Sch’ree Ward for the benefit of Tom Ward’s children (Ward Children’s Trust). The trustee of Ward Children’s Trust is Scott C. Hartman, who we believe is a SandRidge employee The company states that WCT Resources is currently run by Trent Ward, Tom Ward’s son WCT Resources appears to have a fraction of the approximately 2,500 full - time employees that SandRidge Energy does. The company’s phone voicemail lists just seven total employees in its directory The address of WCT Resources was the same as SandRidge’s headquarters until last year In some prior years, based on a comparison of signatures, it appears that Tom Ward signed company documents The current Chief Operating Officer of WCT Resources, Scott White, appears to have been a land manager at SandRidge until as recently as 2011 There have been numerous transactions between Ward family members, or entities associated with Ward family members, and WCT Resources. We have documented transactions between TLW Land & Cattle, 192 Investments, or Sch’ree Ward (Tom Ward’s wife), and WCT Resources WCT Resources is just one of several entities controlled by members of the Ward family which appear to be active participants in the purchase and sale of land and mineral rights in the Mississippian

Appendix: Additional Illustrative Examples of Related - Party Land Transactions 12

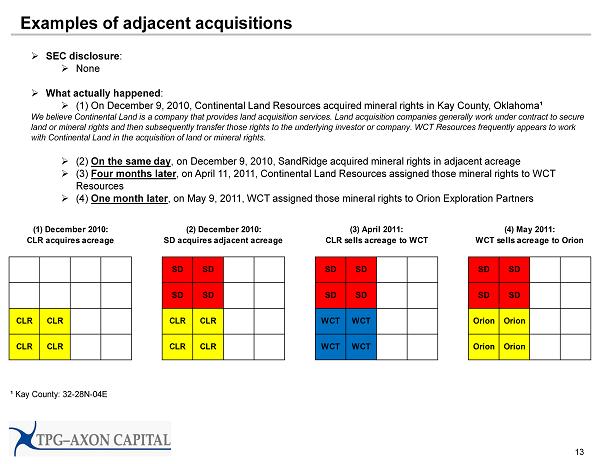

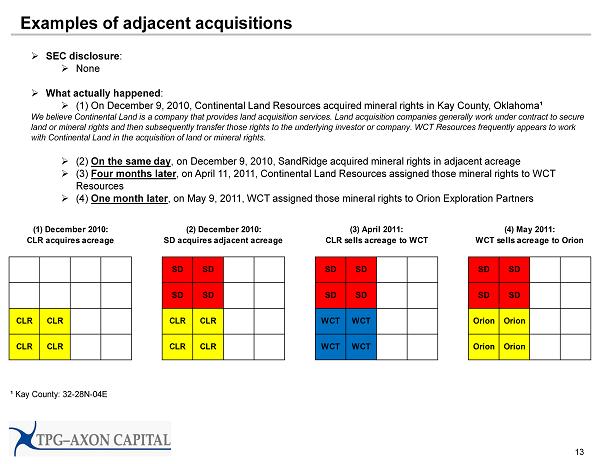

13 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On December 9, 2010, Continental Land Resources acquired mineral rights in Kay County, Oklahoma¹ We believe Continental Land is a company that provides land acquisition services. Land acquisition companies generally work under contract to secure land or mineral rights and then subsequently transfer those rights to the underlying investor or company. WCT Resources frequently appears to work with Continental Land in the acquisition of land or mineral rights . » (2) On the same day , on December 9, 2010, SandRidge acquired mineral rights in adjacent acreage » (3) Four months later , on April 11, 2011, Continental Land Resources assigned those mineral rights to WCT Resources » (4) One month later , on May 9, 2011, WCT assigned those mineral rights to Orion Exploration Partners ¹ Kay County: 32 - 28N - 04E (1) December 2010: (2) December 2010: (3) April 2011: (4) May 2011: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT sells acreage to Orion SD SD SD SD SD SD SD SD SD SD SD SD CLR CLR CLR CLR WCT WCT Orion Orion CLR CLR CLR CLR WCT WCT Orion Orion

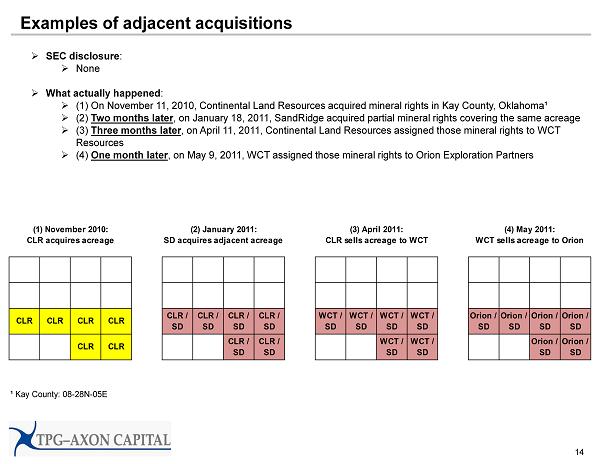

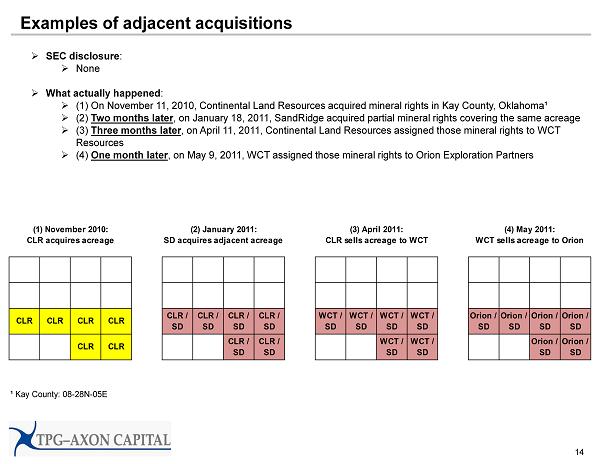

14 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On November 11, 2010, Continental Land Resources acquired mineral rights in Kay County, Oklahoma¹ » (2) Two months later , on January 18, 2011, SandRidge acquired partial mineral rights covering the same acreage » (3) Three months later , on April 11, 2011, Continental Land Resources assigned those mineral rights to WCT Resources » (4) One month later , on May 9, 2011, WCT assigned those mineral rights to Orion Exploration Partners ¹ Kay County: 08 - 28N - 05E (1) November 2010: (2) January 2011: (3) April 2011: (4) May 2011: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT sells acreage to Orion CLR CLR CLR CLR CLR / SD CLR / SD CLR / SD CLR / SD WCT / SD WCT / SD WCT / SD WCT / SD Orion / SD Orion / SD Orion / SD Orion / SD CLR CLR CLR / SD CLR / SD WCT / SD WCT / SD Orion / SD Orion / SD

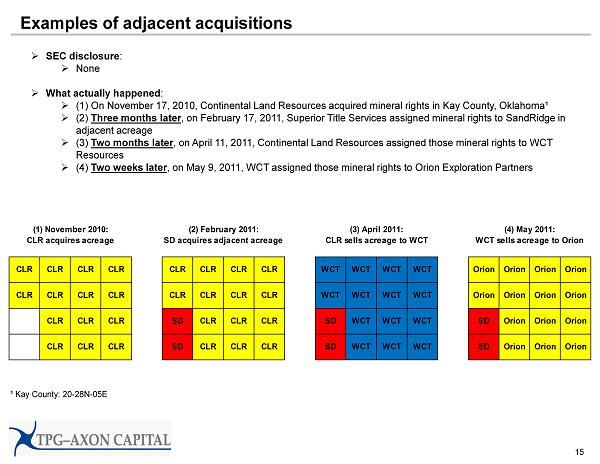

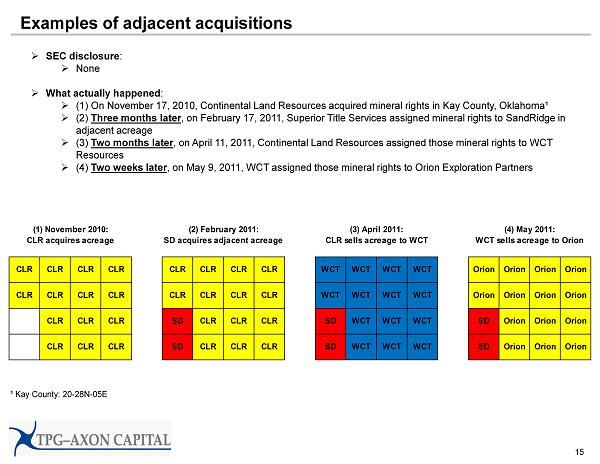

15 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » ( 1) O n November 17, 2010, Continental Land Resources acquired mineral rights in Kay County, Oklahoma ¹ » (2) Three months later , o n February 17, 2011, Superior Title Services assigned mineral rights to SandRidge in adjacent acreage » (3) Two months later , on April 11, 2011, Continental Land Resources assigned those mineral rights to WCT Resources » ( 4) Two weeks later , on May 9, 2011, WCT assigned those mineral rights to Orion Exploration Partners ¹ Kay County: 20 - 28N - 05E (1) November 2010: (2) February 2011: (3) April 2011: (4) May 2011: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT sells acreage to Orion CLR CLR CLR CLR CLR CLR CLR CLR WCT WCT WCT WCT Orion Orion Orion Orion CLR CLR CLR CLR CLR CLR CLR CLR WCT WCT WCT WCT Orion Orion Orion Orion CLR CLR CLR SD CLR CLR CLR SD WCT WCT WCT SD Orion Orion Orion CLR CLR CLR SD CLR CLR CLR SD WCT WCT WCT SD Orion Orion Orion

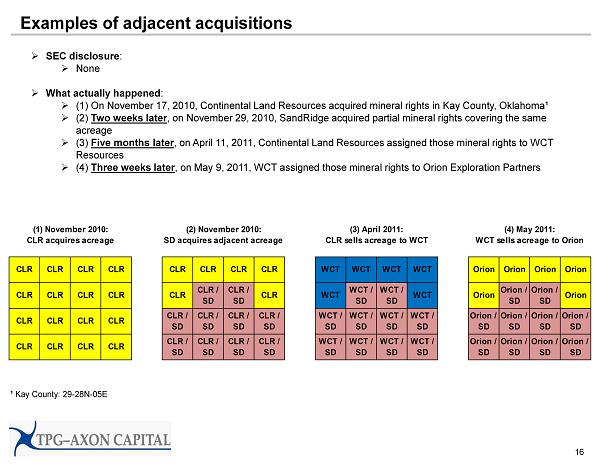

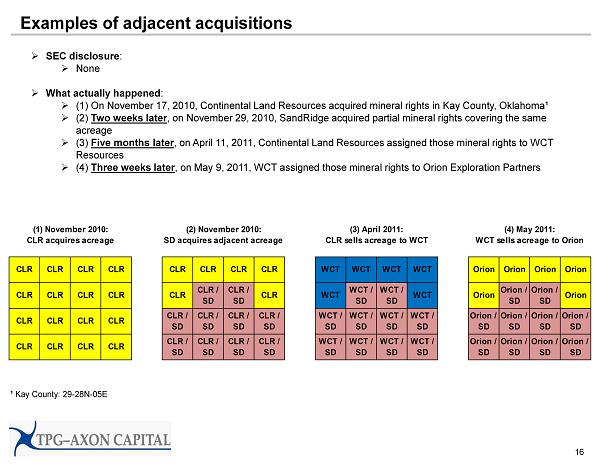

16 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » ( 1) O n November 17, 2010, Continental Land Resources acquired mineral rights in Kay County, Oklahoma ¹ » (2) Two weeks later , o n November 29, 2010, SandRidge acquired partial mineral rights covering the same acreage » (3) Five months later , on April 11, 2011, Continental Land Resources assigned those mineral rights to WCT Resources » ( 4) Three weeks later , on May 9, 2011, WCT assigned those mineral rights to Orion Exploration Partners ¹ Kay County: 29 - 28N - 05E (1) November 2010: (2) November 2010: (3) April 2011: (4) May 2011: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT sells acreage to Orion CLR CLR CLR CLR CLR CLR CLR CLR WCT WCT WCT WCT Orion Orion Orion Orion CLR CLR CLR CLR CLR CLR / SD CLR / SD CLR WCT WCT / SD WCT / SD WCT Orion Orion / SD Orion / SD Orion CLR CLR CLR CLR CLR / SD CLR / SD CLR / SD CLR / SD WCT / SD WCT / SD WCT / SD WCT / SD Orion / SD Orion / SD Orion / SD Orion / SD CLR CLR CLR CLR CLR / SD CLR / SD CLR / SD CLR / SD WCT / SD WCT / SD WCT / SD WCT / SD Orion / SD Orion / SD Orion / SD Orion / SD

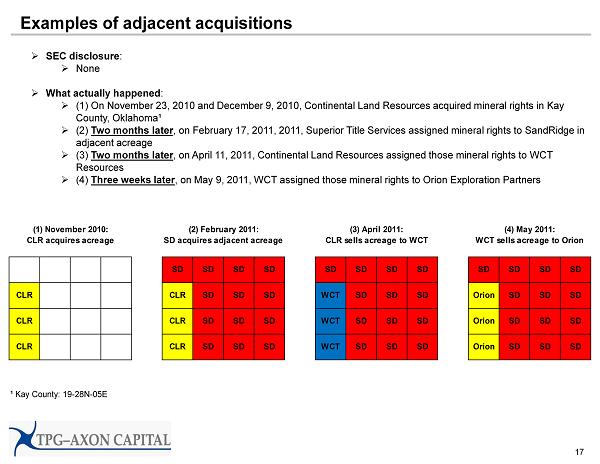

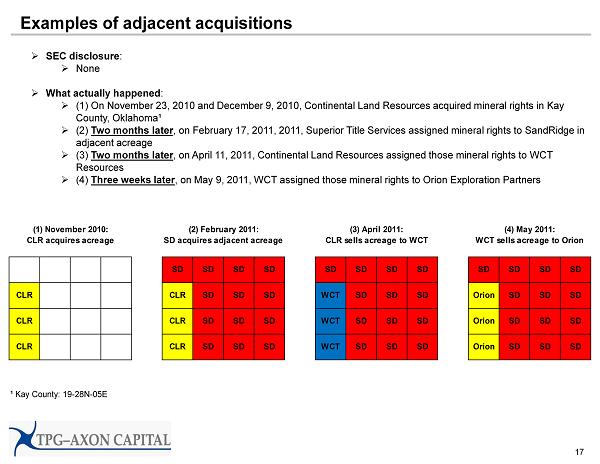

17 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » ( 1) O n November 23, 2010 and December 9, 2010, Continental Land Resources acquired mineral rights in Kay County, Oklahoma ¹ » (2) Two months later , o n February 17, 2011, 2011, Superior Title Services assigned mineral rights to SandRidge in adjacent acreage » (3) Two months later , on April 11, 2011, Continental Land Resources assigned those mineral rights to WCT Resources » ( 4) Three weeks later , on May 9, 2011, WCT assigned those mineral rights to Orion Exploration Partners ¹ Kay County: 19 - 28N - 05E (1) November 2010: (2) February 2011: (3) April 2011: (4) May 2011: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT sells acreage to Orion SD SD SD SD SD SD SD SD SD SD SD SD CLR CLR SD SD SD WCT SD SD SD Orion SD SD SD CLR CLR SD SD SD WCT SD SD SD Orion SD SD SD CLR CLR SD SD SD WCT SD SD SD Orion SD SD SD

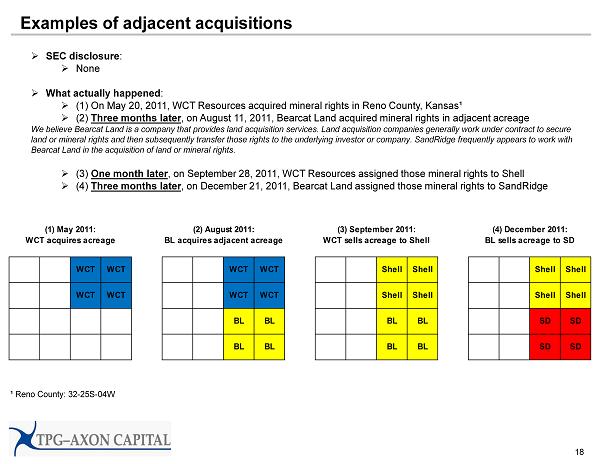

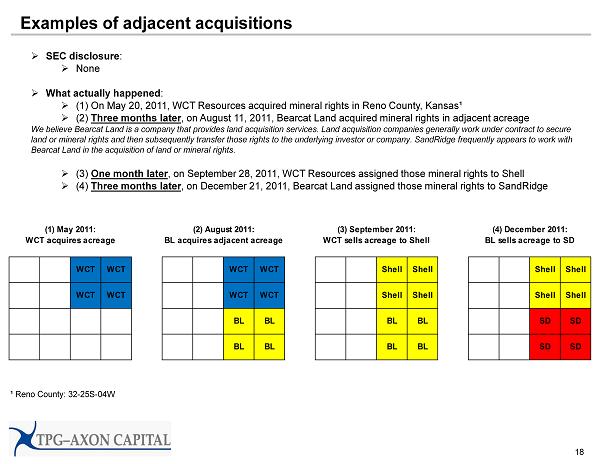

18 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On May 20, 2011, WCT Resources acquired mineral rights in Reno County, Kansas¹ » (2) Three months later , on August 11, 2011, Bearcat Land acquired mineral rights in adjacent acreage We believe Bearcat Land is a company that provides land acquisition services. Land acquisition companies generally work under contract to secure land or mineral rights and then subsequently transfer those rights to the underlying investor or company. SandRidge frequently appears to work with Bearcat Land in the acquisition of land or mineral rights . » (3) One month later , on September 28, 2011, WCT Resources assigned those mineral rights to Shell » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge ¹ Reno County: 32 - 25S - 04W (1) May 2011: (2) August 2011: (3) September 2011: (4) December 2011: WCT acquires acreage BL acquires adjacent acreage WCT sells acreage to Shell BL sells acreage to SD WCT WCT WCT WCT Shell Shell Shell Shell WCT WCT WCT WCT Shell Shell Shell Shell BL BL BL BL SD SD BL BL BL BL SD SD

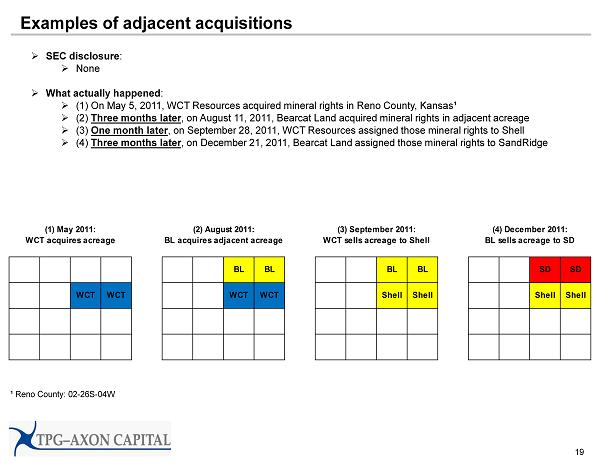

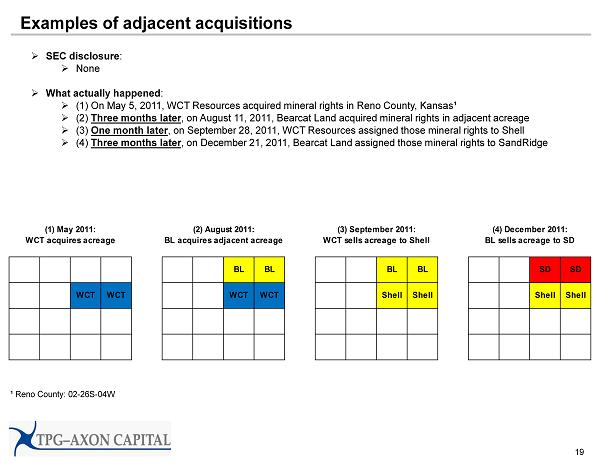

19 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On May 5, 2011, WCT Resources acquired mineral rights in Reno County, Kansas¹ » (2) Three months later , on August 11, 2011, Bearcat Land acquired mineral rights in adjacent acreage » (3) One month later , on September 28, 2011, WCT Resources assigned those mineral rights to Shell » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge ¹ Reno County: 02 - 26S - 04W (1) May 2011: (2) August 2011: (3) September 2011: (4) December 2011: WCT acquires acreage BL acquires adjacent acreage WCT sells acreage to Shell BL sells acreage to SD BL BL BL BL SD SD WCT WCT WCT WCT Shell Shell Shell Shell

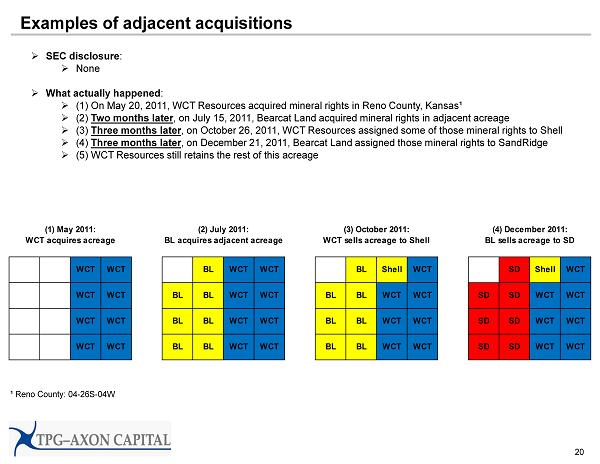

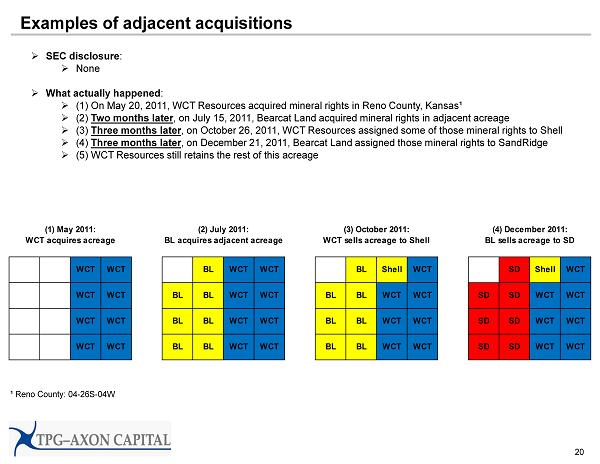

20 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On May 20, 2011, WCT Resources acquired mineral rights in Reno County, Kansas¹ » (2) Two months later , on July 15, 2011, Bearcat Land acquired mineral rights in adjacent acreage » (3) Three months later , on October 26, 2011, WCT Resources assigned some of those mineral rights to Shell » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge » (5) WCT Resources still retains the rest of this acreage ¹ Reno County: 04 - 26S - 04W (1) May 2011: (2) July 2011: (3) October 2011: (4) December 2011: WCT acquires acreage BL acquires adjacent acreage WCT sells acreage to Shell BL sells acreage to SD WCT WCT BL WCT WCT BL Shell WCT SD Shell WCT WCT WCT BL BL WCT WCT BL BL WCT WCT SD SD WCT WCT WCT WCT BL BL WCT WCT BL BL WCT WCT SD SD WCT WCT WCT WCT BL BL WCT WCT BL BL WCT WCT SD SD WCT WCT

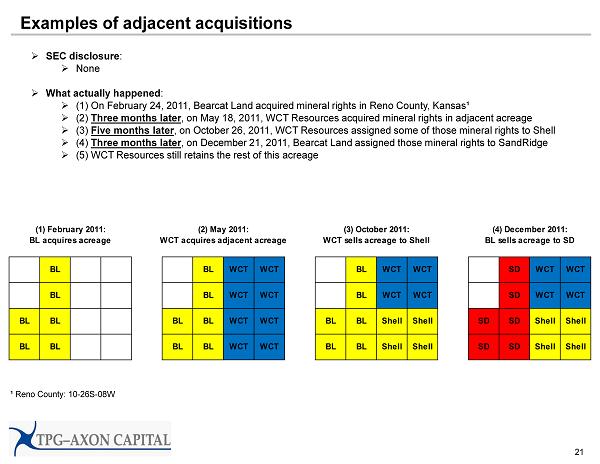

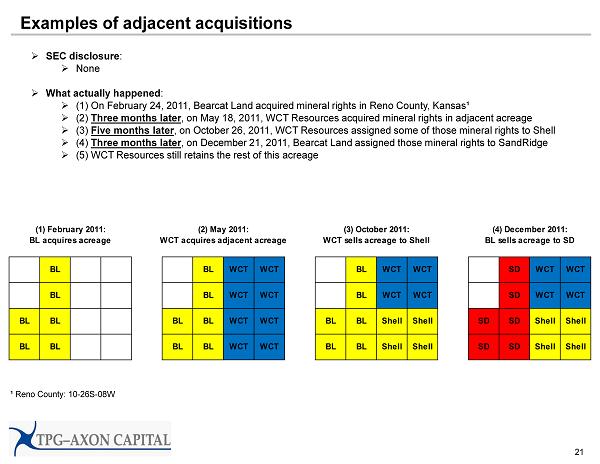

21 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On February 24, 2011, Bearcat Land acquired mineral rights in Reno County, Kansas¹ » (2) Three months later , on May 18, 2011, WCT Resources acquired mineral rights in adjacent acreage » (3) Five months later , on October 26, 2011, WCT Resources assigned some of those mineral rights to Shell » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge » (5) WCT Resources still retains the rest of this acreage ¹ Reno County: 10 - 26S - 08W (1) February 2011: (2) May 2011: (3) October 2011: (4) December 2011: BL acquires acreage WCT acquires adjacent acreage WCT sells acreage to Shell BL sells acreage to SD BL BL WCT WCT BL WCT WCT SD WCT WCT BL BL WCT WCT BL WCT WCT SD WCT WCT BL BL BL BL WCT WCT BL BL Shell Shell SD SD Shell Shell BL BL BL BL WCT WCT BL BL Shell Shell SD SD Shell Shell

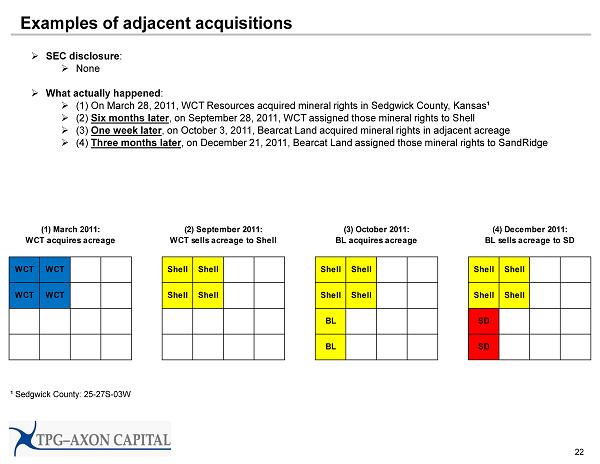

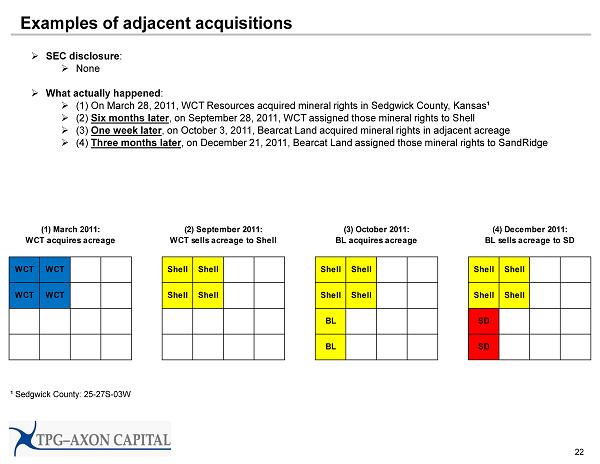

22 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On March 28, 2011, WCT Resources acquired mineral rights in Sedgwick County, Kansas¹ » (2) Six months later , on September 28, 2011, WCT assigned those mineral rights to Shell » (3) One week later , on October 3, 2011, Bearcat Land acquired mineral rights in adjacent acreage » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge ¹ Sedgwick County: 25 - 27S - 03W (1) March 2011: (2) September 2011: (3) October 2011: (4) December 2011: WCT acquires acreage WCT sells acreage to Shell BL acquires acreage BL sells acreage to SD WCT WCT Shell Shell Shell Shell Shell Shell WCT WCT Shell Shell Shell Shell Shell Shell BL SD BL SD

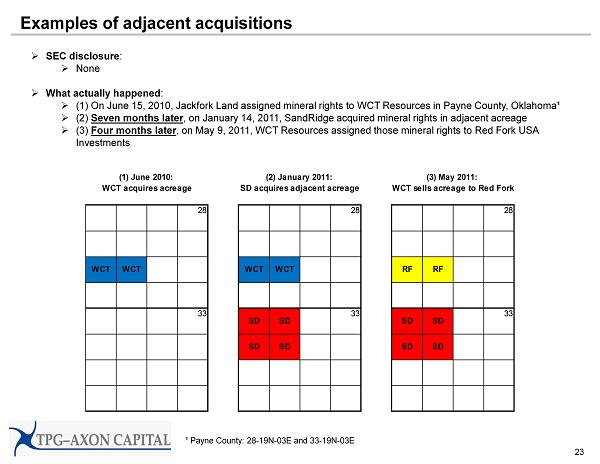

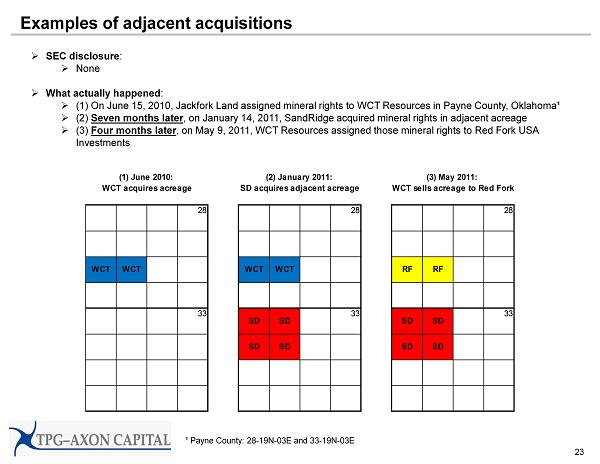

23 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On June 15, 2010, Jackfork Land assigned mineral rights to WCT Resources in Payne County, Oklahoma¹ » (2) Seven months later , on January 14, 2011, SandRidge acquired mineral rights in adjacent acreage » (3) Four months later , on May 9, 2011, WCT Resources assigned those mineral rights to Red Fork USA Investments ¹ Payne County: 28 - 19N - 03E and 33 - 19N - 03E (1) June 2010: (2) January 2011: (3) May 2011: WCT acquires acreage SD acquires adjacent acreage WCT sells acreage to Red Fork 28 28 28 WCT WCT WCT WCT RF RF 33 SD SD 33 SD SD 33 SD SD SD SD

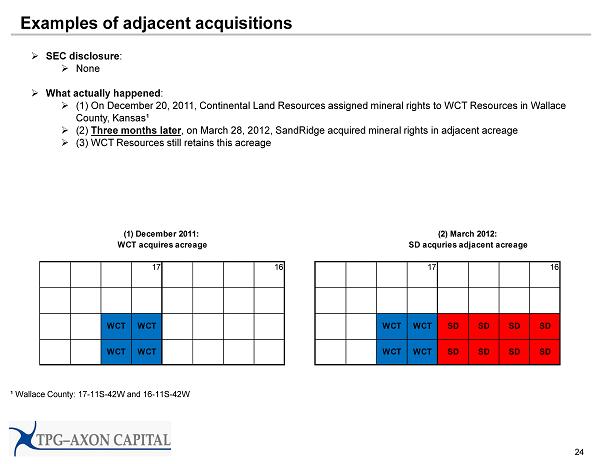

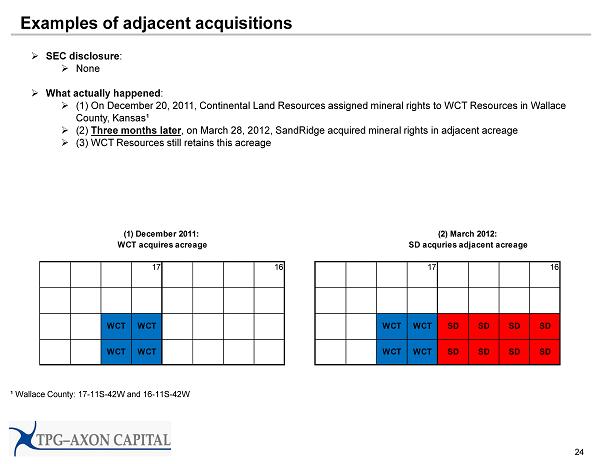

24 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On December 20, 2011, Continental Land Resources assigned mineral rights to WCT Resources in Wallace County, Kansas¹ » (2) Three months later , on March 28, 2012, SandRidge acquired mineral rights in adjacent acreage » (3) WCT Resources still retains this acreage ¹ Wallace County: 17 - 11S - 42W and 16 - 11S - 42W (1) December 2011: (2) March 2012: WCT acquires acreage SD acquries adjacent acreage 17 16 17 16 WCT WCT WCT WCT SD SD SD SD WCT WCT WCT WCT SD SD SD SD

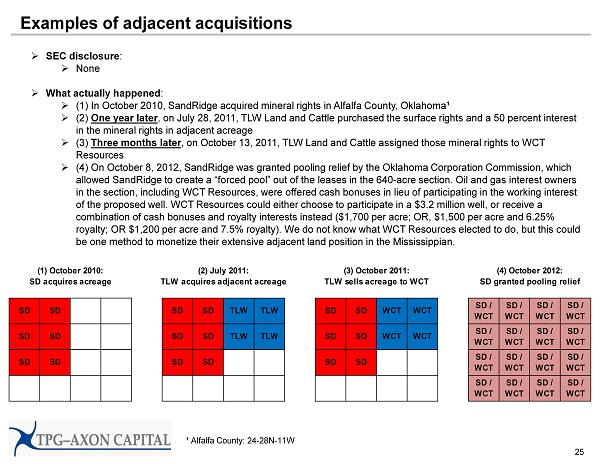

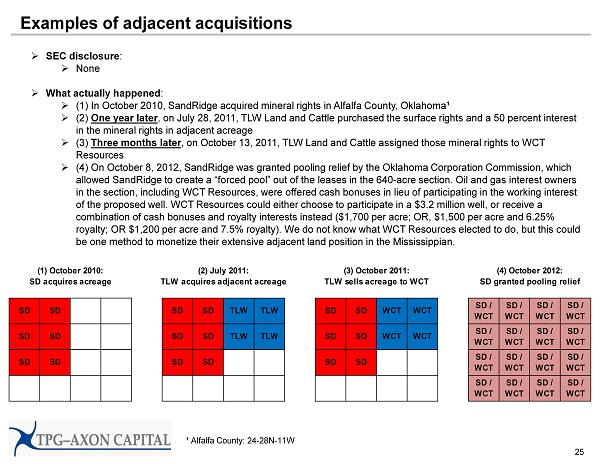

25 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) I n October 2010, SandRidge acquired mineral rights in Alfalfa County, Oklahoma¹ » (2) One year later , on July 28, 2011, TLW Land and Cattle purchased the surface rights and a 50 percent interest in the mineral rights in adjacent acreage » (3) Three months later , on October 13, 2011, TLW Land and Cattle assigned those mineral rights to WCT Resources » (4) On October 8, 2012, SandRidge was granted pooling relief by the Oklahoma Corporation Commission, which allowed SandRidge to create a “forced pool” out of the leases in the 640 - acre section. Oil and gas interest owners in the section, including WCT Resources, were offered cash bonuses in lieu of participating in the working interest of the proposed well. WCT Resources could either choose to participate in a $3.2 million well, or receive a combination of cash bonuses and royalty interests instead ($1,700 per acre; OR, $1,500 per acre and 6.25% royalty; OR $1,200 per acre and 7.5% royalty). We do not know what WCT Resources elected to do, but this could be one method to monetize their extensive adjacent land position in the Mississippian. ¹ Alfalfa County: 24 - 28N - 11W (1) October 2010: (2) July 2011: (3) October 2011: (4) October 2012: SD acquires acreage TLW acquires adjacent acreage TLW sells acreage to WCT SD granted pooling relief SD SD SD SD TLW TLW SD SD WCT WCT SD / WCT SD / WCT SD / WCT SD / WCT SD SD SD SD TLW TLW SD SD WCT WCT SD / WCT SD / WCT SD / WCT SD / WCT SD SD SD SD SD SD SD / WCT SD / WCT SD / WCT SD / WCT SD / WCT SD / WCT SD / WCT SD / WCT

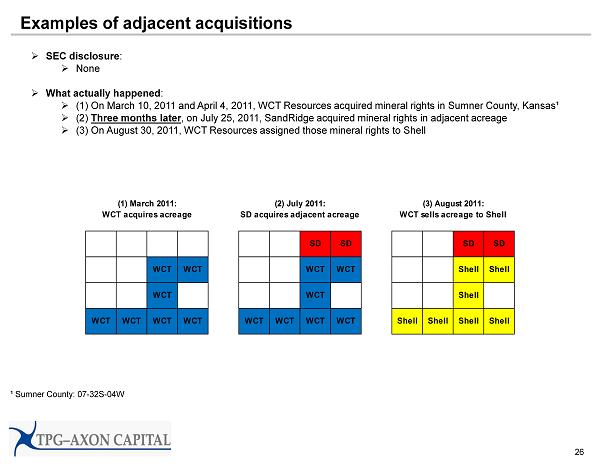

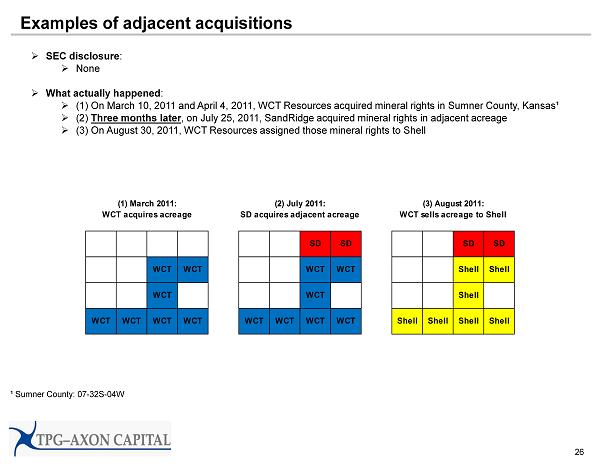

26 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On March 10, 2011 and April 4, 2011, WCT Resources acquired mineral rights in Sumner County, Kansas¹ » (2) Three months later , on July 25, 2011, SandRidge acquired mineral rights in adjacent acreage » (3) On August 30, 2011, WCT Resources assigned those mineral rights to Shell ¹ Sumner County: 07 - 32S - 04W (1) March 2011: (2) July 2011: (3) August 2011: WCT acquires acreage SD acquires adjacent acreage WCT sells acreage to Shell SD SD SD SD WCT WCT WCT WCT Shell Shell WCT WCT Shell WCT WCT WCT WCT WCT WCT WCT WCT Shell Shell Shell Shell

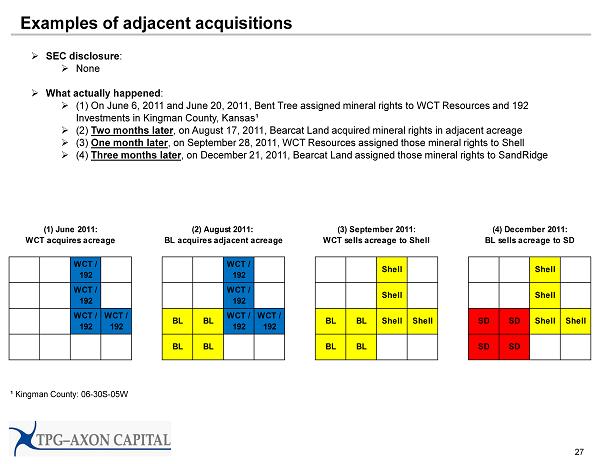

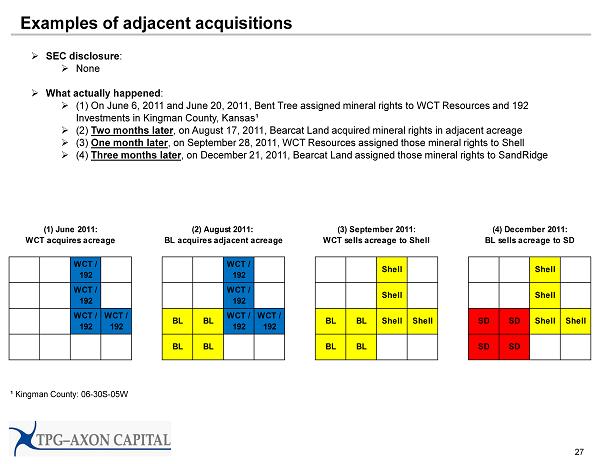

27 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On June 6, 2011 and June 20, 2011, Bent Tree assigned mineral rights to WCT Resources and 192 Investments in Kingman County, Kansas¹ » ( 2) Two months later , on August 17, 2011, Bearcat Land acquired mineral rights in adjacent acreage » ( 3) One month later , on September 28, 2011, WCT Resources assigned those mineral rights to Shell » (4) Three months later , on December 21, 2011, Bearcat Land assigned those mineral rights to SandRidge ¹ Kingman County: 06 - 30S - 05W (1) June 2011: (2) August 2011: (3) September 2011: (4) December 2011: WCT acquires acreage BL acquires adjacent acreage WCT sells acreage to Shell BL sells acreage to SD WCT / 192 WCT / 192 Shell Shell WCT / 192 WCT / 192 Shell Shell WCT / 192 WCT / 192 BL BL WCT / 192 WCT / 192 BL BL Shell Shell SD SD Shell Shell BL BL BL BL SD SD

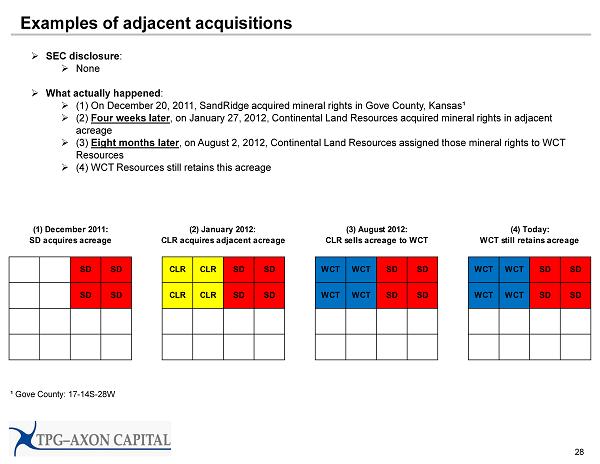

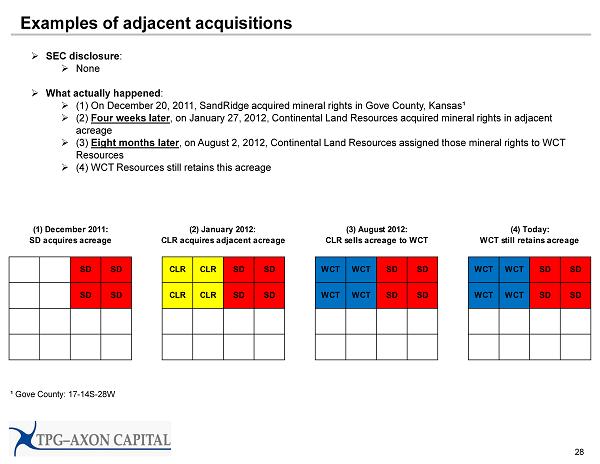

28 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On December 20, 2011, SandRidge acquired mineral rights in Gove County, Kansas¹ » (2) Four weeks later , on January 27, 2012, Continental Land Resources acquired mineral rights in adjacent acreage » (3) Eight months later , on August 2, 2012, Continental Land Resources assigned those mineral rights to WCT Resources » (4) WCT Resources still retains this acreage ¹ Gove County: 17 - 14S - 28W (1) December 2011: (2) January 2012: (3) August 2012: (4) Today: SD acquires acreage CLR acquires adjacent acreage CLR sells acreage to WCT WCT still retains acreage SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT SD SD SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT SD SD

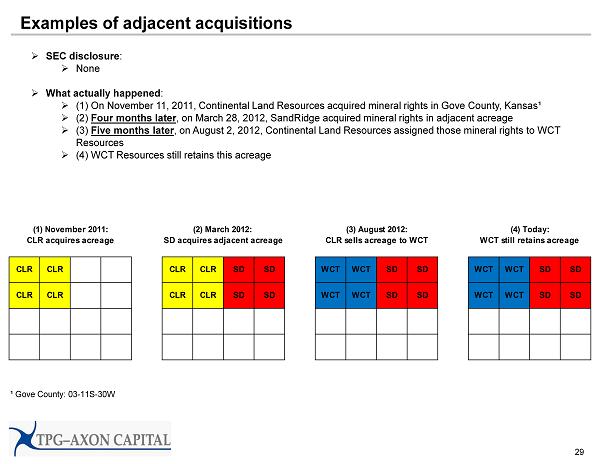

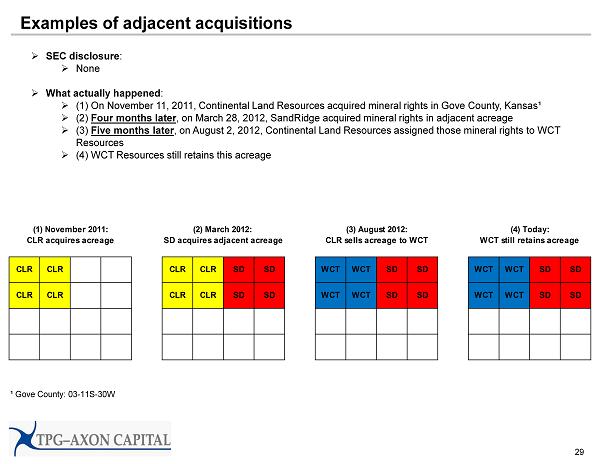

29 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On November 11, 2011, Continental Land Resources acquired mineral rights in Gove County, Kansas¹ » (2) Four months later , on March 28, 2012, SandRidge acquired mineral rights in adjacent acreage » (3) Five months later , on August 2, 2012, Continental Land Resources assigned those mineral rights to WCT Resources » (4) WCT Resources still retains this acreage ¹ Gove County: 03 - 11S - 30W (1) November 2011: (2) March 2012: (3) August 2012: (4) Today: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT still retains acreage CLR CLR CLR CLR SD SD WCT WCT SD SD WCT WCT SD SD CLR CLR CLR CLR SD SD WCT WCT SD SD WCT WCT SD SD

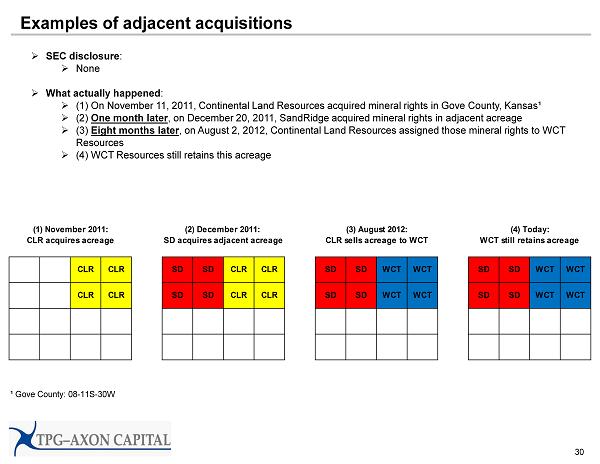

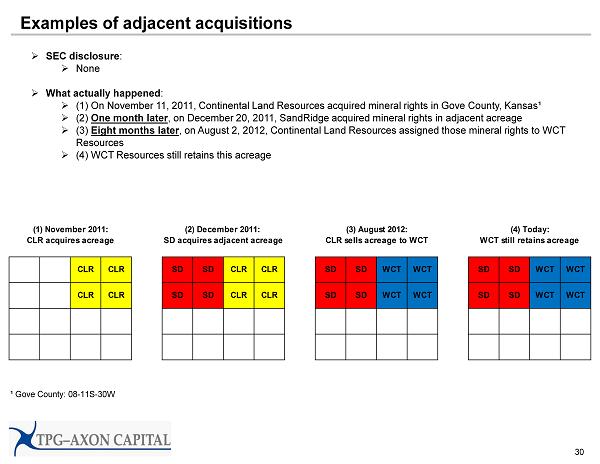

30 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On November 11, 2011, Continental Land Resources acquired mineral rights in Gove County, Kansas¹ » (2) One month later , on December 20, 2011, SandRidge acquired mineral rights in adjacent acreage » (3) Eight months later , on August 2, 2012, Continental Land Resources assigned those mineral rights to WCT Resources » (4) WCT Resources still retains this acreage ¹ Gove County: 08 - 11S - 30W (1) November 2011: (2) December 2011: (3) August 2012: (4) Today: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT still retains acreage CLR CLR SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT CLR CLR SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT

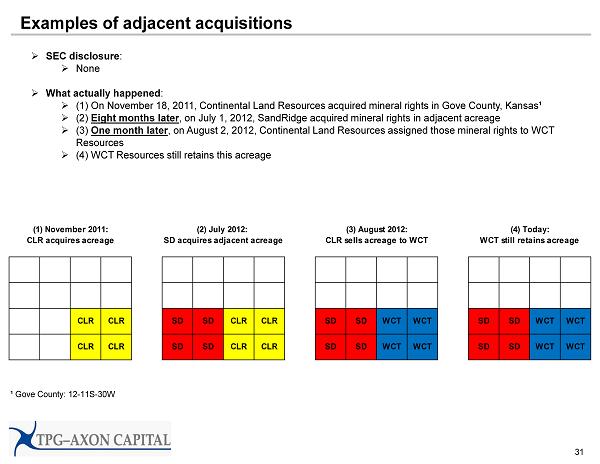

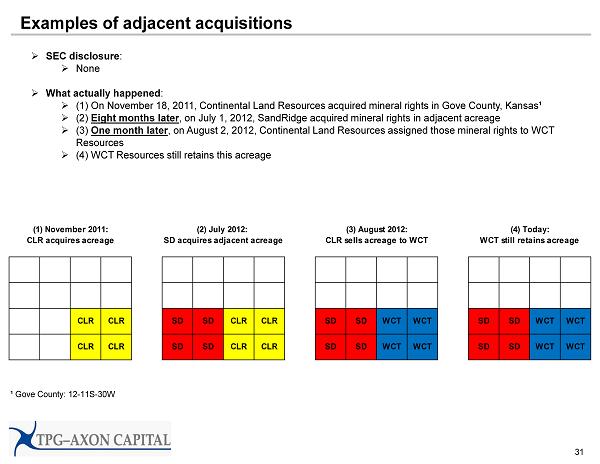

31 Examples of adjacent acquisitions » SEC disclosure : » None » What actually happened : » (1) On November 18, 2011, Continental Land Resources acquired mineral rights in Gove County, Kansas¹ » (2) Eight months later , on July 1, 2012, SandRidge acquired mineral rights in adjacent acreage » ( 3) One month later , on August 2, 2012, Continental Land Resources assigned those mineral rights to WCT Resources » (4) WCT Resources still retains this acreage ¹ Gove County: 12 - 11S - 30W (1) November 2011: (2) July 2012: (3) August 2012: (4) Today: CLR acquires acreage SD acquires adjacent acreage CLR sells acreage to WCT WCT still retains acreage CLR CLR SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT CLR CLR SD SD CLR CLR SD SD WCT WCT SD SD WCT WCT