UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2016

or

|

|

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35952

ARATANA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

| 38-3826477 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification Number) |

11400 Tomahawk Creek Parkway

Suite 340

Leawood, KS 66211

(913) 353-1000

(Address of principal executive offices, zip code and telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes: ☒ No: ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes: ☒ No: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☒ |

|

|

|

| |||

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: ☐ No: ☒

As of May 2, 2016, there were 35,347,186 shares of common stock outstanding.

ARATANA THERAPEUTICS, INC.

|

|

| |

|

| Page | |

| |||

Item 1. | 3 | ||

| Consolidated Balance Sheets as of March 31, 2016 and December 31, 2015 | 3 | |

| Consolidated Statements of Operations for the Three Months ended March 31, 2016 and 2015 | 4 | |

| Consolidated Statements of Comprehensive Loss for the Three Months ended March 31, 2016 and 2015 | 5 | |

| Consolidated Statements of Cash Flows for the Three Months ended March 31, 2016 and 2015 | 6 | |

| 7 | ||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 | |

Item 3. | 33 | ||

Item 4. | 33 | ||

| |||

Item 1. | 34 | ||

Item 1A. | 34 | ||

Item 2. | 35 | ||

Item 3. | 35 | ||

Item 4. | 35 | ||

Item 5. | 35 | ||

Item 6. | 35 | ||

| 36 | |||

2

CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARCH 31, 2016 |

| DECEMBER 31, 2015 | ||

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

| $ | 13,814 |

| $ | 26,755 |

Short-term investments |

|

| 58,999 |

|

| 59,447 |

Accounts receivable, net |

|

| 11 |

|

| 60 |

Inventories |

|

| 2,353 |

|

| 1,306 |

Prepaid expenses and other current assets |

|

| 1,879 |

|

| 1,451 |

Total current assets |

|

| 77,056 |

|

| 89,019 |

Property and equipment, net |

|

| 2,417 |

|

| 2,555 |

Goodwill |

|

| 40,472 |

|

| 39,781 |

Intangible assets, net |

|

| 15,411 |

|

| 15,067 |

Restricted cash |

|

| 350 |

|

| 350 |

Other long-term assets |

|

| 288 |

|

| 294 |

Total assets |

| $ | 135,994 |

| $ | 147,066 |

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

| $ | 6,380 |

| $ | 1,400 |

Accrued expenses |

|

| 2,236 |

|

| 4,247 |

Other current liabilities |

|

| 21 |

|

| 37 |

Total current liabilities |

|

| 8,637 |

|

| 5,684 |

Loans payable, net |

|

| 39,830 |

|

| 39,710 |

Other long-term liabilities |

|

| 604 |

|

| 122 |

Total liabilities |

|

| 49,071 |

|

| 45,516 |

Commitments and contingencies (Notes 8 and 10) |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized at March 31, 2016 and December 31, 2015, 34,701,500 and 34,563,816 issued and outstanding at March 31, 2016 and December 31, 2015, respectively |

|

| 35 |

|

| 35 |

Treasury stock |

|

| (1,088) |

|

| (1,088) |

Additional paid-in capital |

|

| 266,204 |

|

| 263,941 |

Accumulated deficit |

|

| (170,085) |

|

| (152,018) |

Accumulated other comprehensive loss |

|

| (8,143) |

|

| (9,320) |

Total stockholders’ equity |

|

| 86,923 |

|

| 101,550 |

Total liabilities and stockholders’ equity |

| $ | 135,994 |

| $ | 147,066 |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

3

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| THREE MONTHS ENDED | ||||

|

| MARCH 31, | ||||

|

| 2016 |

| 2015 | ||

Revenues |

|

|

|

|

|

|

Licensing and collaboration revenue |

| $ | 151 |

| $ | — |

Product sales |

|

| 21 |

|

| 156 |

Total revenues |

|

| 172 |

|

| 156 |

Costs and expenses |

|

|

|

|

|

|

Cost of product sales |

|

| 19 |

|

| 110 |

Royalty expense |

|

| 18 |

|

| 20 |

Research and development |

|

| 10,749 |

|

| 6,221 |

Selling, general and administrative |

|

| 6,551 |

|

| 4,185 |

Amortization of acquired intangible assets |

|

| 95 |

|

| 483 |

Total costs and expenses |

|

| 17,432 |

|

| 11,019 |

Loss from operations |

|

| (17,260) |

|

| (10,863) |

Other income (expense) |

|

|

|

|

|

|

Interest income |

|

| 77 |

|

| 71 |

Interest expense |

|

| (849) |

|

| (218) |

Other income (expense), net |

|

| (35) |

|

| 1,965 |

Total other income (expense) |

|

| (807) |

|

| 1,818 |

Loss before income taxes |

|

| (18,067) |

|

| (9,045) |

Income tax benefit |

|

| — |

|

| 271 |

Net loss |

| $ | (18,067) |

| $ | (8,774) |

Net loss per share, basic and diluted |

| $ | (0.52) |

| $ | (0.26) |

Weighted average shares outstanding, basic and diluted |

|

| 34,653,479 |

|

| 34,193,994 |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

4

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (Unaudited)

(Amounts in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| THREE MONTHS ENDED | ||||

|

| MARCH 31, | ||||

|

| 2016 |

| 2015 | ||

Net loss |

| $ | (18,067) |

| $ | (8,774) |

|

|

|

|

|

|

|

Other comprehensive income/(loss): |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

| 1,177 |

|

| (4,581) |

Unrealized gain on available-for-sale securities |

|

| — |

|

| 1,664 |

Net gain reclassified into income on sale of |

|

| — |

|

| (1,010) |

Other comprehensive income/(loss) |

|

| 1,177 |

|

| (3,927) |

Comprehensive loss |

| $ | (16,890) |

| $ | (12,701) |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

5

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

| THREE MONTHS ENDED | ||||

| MARCH 31, | ||||

| 2016 |

| 2015 | ||

Cash flows from operating activities |

|

|

|

|

|

Net loss | $ | (18,067) |

| $ | (8,774) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

Stock-based compensation expense |

| 2,253 |

|

| 2,360 |

Depreciation and amortization expense |

| 244 |

|

| 520 |

Gain on sale of marketable securities |

| — |

|

| (1,010) |

Non-cash interest expense |

| 120 |

|

| 10 |

Change in fair value of contingent consideration |

| — |

|

| (1,248) |

Change in fair value of derivative instruments |

| — |

|

| (958) |

Deferred tax benefit |

| — |

|

| (271) |

Changes in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable, net |

| 49 |

|

| 227 |

Inventories |

| (1,047) |

|

| (218) |

Prepaid expenses |

| (406) |

|

| (197) |

Other assets |

| 17 |

|

| — |

Accounts payable |

| 4,978 |

|

| 630 |

Accrued expenses and other liabilities |

| (1,550) |

|

| (77) |

Net cash used in operating activities |

| (13,409) |

|

| (9,006) |

Cash flows from investing activities |

|

|

|

|

|

Purchases of property and equipment, net |

| (6) |

|

| (49) |

Proceeds from sales of marketable securities |

| — |

|

| 1,500 |

Purchase of investments |

| (196,399) |

|

| (193,000) |

Proceeds from maturities of investments |

| 196,847 |

|

| 224,000 |

Net cash provided by investing activities |

| 442 |

|

| 32,451 |

Cash flows from financing activities |

|

|

|

|

|

Cash paid for contingent consideration |

| — |

|

| (3,000) |

Net cash used in financing activities |

| — |

|

| (3,000) |

Effect of exchange rate on cash |

| 26 |

|

| (104) |

Net increase/(decrease) in cash and cash equivalents |

| (12,941) |

|

| 20,341 |

Cash and cash equivalents, beginning of period |

| 26,755 |

|

| 9,823 |

Cash and cash equivalents, end of period | $ | 13,814 |

| $ | 30,164 |

Supplemental disclosure of cash flow information |

|

|

|

|

|

Cash paid for interest | $ | 721 |

| $ | 206 |

The accompanying notes are an integral part of these unaudited interim consolidated financial statements.

6

ARATANA THERAPEUTICS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited, amounts in thousands, except share and per share data)

1. Summary of Significant Accounting Policies

Business Overview

Aratana Therapeutics, Inc., including its subsidiaries (the “Company” or “Aratana”), is a pet therapeutics company focused on licensing, developing and commercializing innovative biopharmaceutical products for companion animals. The Company has one operating segment: pet therapeutics.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. These unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2015 and the notes thereto in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 15, 2016. In the opinion of management, all adjustments, consisting of a normal and recurring nature, considered necessary for a fair presentation, have been included.

The Company has incurred recurring losses and negative cash flows from operations and has an accumulated deficit of $170,085 as of March 31, 2016. The Company expects to continue to generate operating losses for the foreseeable future. The Company believes that its cash, cash equivalents and short-term investments on hand will be sufficient to fund operations at least through March 31, 2017. As disclosed in Note 8 to the consolidated financial statements, the Company has a term loan and a revolving credit facility with an aggregate principal balance of $40,000 as of March 31, 2016. The terms of this agreement require the Company to receive unrestricted net cash proceeds of at least $45,000 from partnering transactions and/or the issuance of equity securities from October 16, 2015 to October 16, 2016. The loan agreements also require that the Company have at least three products fully United States Department of Agriculture (“USDA”) or U.S. Food and Drug Administration (“FDA”) approved for commercialization by December 31, 2016. If these conditions had not been met, the Company may have been required to repay the loan prior to December 31, 2016. However, with the FDA approval of GALLIPRANT in March 2016 and upon the receipt of the upfront payment of $45,000 from the Elanco Animal Health, Inc. (“Elanco”) agreement (Note 10) entered into in April 2016, the Company will have met both conditions.

Consolidation

The Company’s consolidated financial statements include its financial statements, and those of its wholly-owned subsidiaries and a consolidated variable interest entity. Intercompany balances and transactions are eliminated in consolidation.

To determine if the Company holds a controlling financial interest in an entity, the Company first evaluates if it is required to apply the variable interest entity (“VIE”) model to the entity. Where the Company holds current or potential rights that give it the power to direct the activities of a VIE that most significantly impact the VIE’s economic performance combined with a variable interest that gives it the right to receive potentially significant benefits or the obligation to absorb potentially significant losses, the Company is the primary beneficiary of that VIE. When changes occur to the design of an entity, the Company reconsiders whether it is subject to the VIE model. The Company continuously evaluates whether it is the primary beneficiary of a consolidated VIE.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates are periodically reviewed in light of changes in circumstances, facts and experience. Actual results could differ from those estimates.

Pre-Launch Inventory

The Company may scale-up and make commercial quantities of certain of its product candidates prior to the date it anticipates that such products will receive final FDA/USDA approval. The scale-up and commercial production of pre-launch inventories involves the risk that such products may not be approved for marketing by the FDA/USDA on a timely basis, or ever. Inventory costs associated with product candidates that have not yet received regulatory approval are capitalized if the Company believes there is probable future commercial use and future economic benefit. If the probability of future commercial use and future economic benefit cannot be reasonably determined, then pre-launch inventory costs associated with such product candidates are expensed as research and development expense during the period the costs are incurred. Specifically, the Company has determined that for FDA-regulated product candidates there is a probable future commercial use and future economic benefit upon the receipt of the three major technical section complete letters from the FDA’s Center for Veterinary Medicine (“CVM”). For USDA product candidates, the Company has determined there is a probable future commercial use and future economic benefit upon the receipt of a conditional license from the USDA’s Center for Veterinary Biologics. The Company makes at least quarterly reassessments of the probability of regulatory

7

approval and useful life of the pre-launch inventory, and determines whether such inventory continues to have a probable future economic benefit.

Property and Equipment, net

Property and equipment is recorded at historical cost, net of accumulated depreciation and amortization of $583 and $430 as of March 31, 2016, and December 31, 2015, respectively.

Goodwill

During the first quarter of 2016, the Company completed an interim impairment assessment due to a decline in its market capitalization. In performing step one of the assessment, the Company determined that as of March 31, 2016, its fair value exceeded its carrying value by 121%. Based on this result, step two of the assessment was not required to be performed, and the Company determined there was no impairment of goodwill during the first quarter of 2016.

New Accounting Standards

Revenue from Contracts with Customers

In May 2014, the Financial Accounting Standards Board (“FASB”) issued guidance on recognizing revenue in contracts with customers. The guidance affects any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets unless those contracts are within the scope of other standards (e.g., insurance contracts or lease contracts). This guidance will supersede the revenue recognition requirements in topic, Revenue Recognition, and most industry-specific guidance. This guidance also supersedes certain cost guidance included in subtopic, Revenue Recognition – Construction-Type and Production-Type Contracts. In addition, the existing requirements for the recognition of a gain or loss on the transfer of nonfinancial assets that are not in a contract with a customer (e.g., assets within the scope of topic, Property, Plant, and Equipment, and tangible assets within the scope of topic, Intangibles – Goodwill and Other) are amended to be consistent with the guidance on recognition and measurement (including the constraint on revenue) in this guidance.

The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

In July 2015, the FASB approved a one-year delay in the effective date of the new revenue standard. These changes become effective for the Company on January 1, 2018. Early adoption is permitted but not before the original effective date of January 1, 2017. The standard permits the use of either the retrospective or cumulative effect transition method. The Company is currently assessing the impact, if any, this new guidance will have on its consolidated financial statements.

Inventory – Simplifying the Measurement of Inventory

In July 2015, the FASB issued guidance that requires entities to measure most inventory “at lower of cost and net realizable value” thereby simplifying the current guidance under which an entity must measure inventory at the lower of cost or market. This guidance is effective for financial statements issued for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted and is to be applied using a prospective basis. The Company does not expect that this new guidance will have a material impact on its consolidated financial statements.

Leases

In February 2016, the FASB issued guidance that requires, for operating leases, a lessee to recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in its balance sheet. The standard also requires a lessee to recognize a single lease cost, calculated so that the cost of the lease is allocated over the lease term, on a generally straight-line basis. This guidance is effective for financial statements issued for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted and is to be applied using a modified retrospective transition method. The Company is currently assessing the effect that adoption of this guidance will have on its consolidated financial statements.

Compensation – Stock Compensation

In March 2016, the FASB issued guidance that simplifies several aspects of the accounting for employee share-based payment transactions including accounting for income taxes, forfeitures and statutory tax withholding requirements, as well as classification in the statement of cash flows. This guidance is effective for financial statements issued for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted and is to be applied using a modified retrospective transition method by means of a cumulative-effect adjustment to equity as of the beginning of the period in which the guidance is adopted. The Company is currently assessing the effect that adoption of this guidance will have on its consolidated financial statements.

8

2. Fair Value of Financial Assets and Liabilities

Financial Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following financial assets are measured at fair value on a recurring basis using quoted prices in active markets for identical assets (Level 1); significant other observable inputs (Level 2); and significant unobservable inputs (Level 3).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FAIR VALUE MEASUREMENTS AS OF | ||||||||||

|

| CARRYING |

| MARCH 31, 2016 USING: | |||||||||||

|

| VALUE |

| LEVEL 1 |

| LEVEL 2 |

| LEVEL 3 |

| TOTAL | |||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

| $ | 7,719 |

| $ | — |

| $ | 7,719 |

| $ | — |

| $ | 7,719 |

Money market fund |

|

| 59 |

|

| 59 |

|

| — |

|

| — |

|

| 59 |

Short-term investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term marketable securities – certificate of deposit |

|

| 249 |

|

| — |

|

| 249 |

|

| — |

|

| 249 |

Reverse repurchase agreements |

|

| 58,750 |

|

| — |

|

| 58,750 |

|

| — |

|

| 58,750 |

|

| $ | 66,777 |

| $ | 59 |

| $ | 66,718 |

| $ | — |

| $ | 66,777 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FAIR VALUE MEASUREMENTS AS OF | ||||||||||

|

| CARRYING |

| DECEMBER 31, 2015 USING: | |||||||||||

|

| VALUE |

| LEVEL 1 |

| LEVEL 2 |

| LEVEL 3 |

| TOTAL | |||||

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

| $ | 6,972 |

| $ | — |

| $ | 6,972 |

| $ | — |

| $ | 6,972 |

Money market fund |

|

| 35 |

|

| 35 |

|

| — |

|

| — |

|

| 35 |

Short-term investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term marketable securities – |

|

| 747 |

|

| — |

|

| 747 |

|

| — |

|

| 747 |

Reverse repurchase agreements |

|

| 58,700 |

|

| — |

|

| 58,700 |

|

| — |

|

| 58,700 |

|

| $ | 66,454 |

| $ | 35 |

| $ | 66,419 |

| $ | — |

| $ | 66,454 |

Certain estimates and judgments are required to develop the fair value amounts shown above. The fair value amounts shown above are not necessarily indicative of the amounts that the Company would realize upon disposition, nor do they indicate the Company’s intent or ability to dispose of the financial instrument.

The following methods and assumptions were used to estimate the fair value of each material class of financial instrument:

· | Marketable securities (short-term) – the fair value of marketable securities has been determined to be amortized cost given the short duration of the agreements. |

· | Reverse repurchase agreements – the fair value of the reverse repurchase agreements has been determined to be amortized cost given the short duration of the agreements. |

· | Cash equivalents – the fair value of the cash equivalents has been determined to be amortized cost or has been based on the quoted prices in active markets or exchanges for identical assets. |

9

Financial Assets and Liabilities that are not Measured at Fair Value on a Recurring Basis

The carrying amounts and estimated fair value of the Company’s financial liabilities which are not measured at fair value on a recurring basis was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARCH 31, 2016 | ||||

|

| CARRYING VALUE |

| FAIR VALUE | ||

Liabilities: |

|

|

|

|

|

|

Loans payable (Level 2) |

| $ | 39,830 |

| $ | 39,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DECEMBER 31, 2015 | ||||

|

| CARRYING VALUE |

| FAIR VALUE | ||

Liabilities: |

|

|

|

|

|

|

Loans payable (Level 2) |

| $ | 39,710 |

| $ | 40,569 |

Certain estimates and judgments were required to develop the fair value amounts. The fair value amount shown above is not necessarily indicative of the amounts that the Company would realize upon disposition, nor does it indicate the Company’s intent or ability to dispose of the financial instrument.

The fair value of loans payable was estimated using discounted cash flow analysis discounted at current rates.

3. Investments

Marketable Securities

Marketable securities consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARCH 31, 2016 | ||||||||||

|

|

|

|

| GROSS |

| GROSS |

|

|

| ||

|

| AMORTIZED |

| UNREALIZED |

| UNREALIZED |

| FAIR | ||||

|

| COST |

| GAINS |

| LOSSES |

| VALUE | ||||

Short-term marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Certificate of deposit |

| $ | 249 |

| $ | — |

| $ | — |

| $ | 249 |

Total |

| $ | 249 |

| $ | — |

| $ | — |

| $ | 249 |

At March 31, 2016, short-term marketable securities consisted of investments that mature within one year. Short-term marketable securities are recorded as short-term investments in the consolidated balance sheets.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DECEMBER 31, 2015 | ||||||||||

|

|

|

|

| GROSS |

| GROSS |

|

|

| ||

|

| AMORTIZED |

| UNREALIZED |

| UNREALIZED |

| FAIR | ||||

|

| COST |

| GAINS |

| LOSSES |

| VALUE | ||||

Short-term marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Certificates of deposit |

| $ | 747 |

| $ | — |

| $ | — |

| $ | 747 |

Total |

| $ | 747 |

| $ | — |

| $ | — |

| $ | 747 |

At December 31, 2015, short-term marketable securities consisted of investments that mature within one year. Short-term marketable securities are recorded as short-term investments in the consolidated balance sheets.

10

Reverse Repurchase Agreements

The Company, as part of its cash management strategy, may invest excess cash in reverse repurchase agreements. All reverse repurchase agreements are tri-party and have maturities of three months or less at the time of investment. The underlying collateral is U.S. government securities including U.S. treasuries, agency debt and agency mortgage securities. The underlying collateral posted by each counterparty is required to cover 102% of the principal amount and accrued interest after the application of a discount to fair value.

4. Derivative Financial Instruments

In 2015, the Company’s derivative financial instrument, the warrant the Company received in connection with the license agreement with Advaxis, Inc. (“Advaxis”), was not designated as a hedging instrument and was adjusted to fair value through earnings in other income (expense). During the year ended December 31, 2015, the Company exercised the Advaxis warrant and subsequently sold the shares of common stock received upon exercise.

The following table shows the Company’s gain recognized in other income (expense) for the three months ended:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAIN RECOGNIZED IN | ||||

|

| OTHER INCOME (EXPENSE) | ||||

|

| THREE MONTHS ENDED | ||||

|

| MARCH 31, | ||||

|

| 2016 |

| 2015 | ||

Derivative assets: |

|

|

|

|

|

|

Warrant |

| $ | — |

| $ | 958 |

As the Company exercised the warrant and subsequently sold the shares of common stock received upon exercise during the second quarter of 2015, no gain was recorded during the three months ended March 31, 2016.

Inventories are stated at the lower of cost or market and comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARCH 31, 2016 |

| DECEMBER 31, 2015 | ||

Raw materials |

| $ | 99 |

| $ | 120 |

Work-in-process |

|

| 1,536 |

|

| 441 |

Finished goods |

|

| 718 |

|

| 745 |

|

| $ | 2,353 |

| $ | 1,306 |

Work-in-process inventories at March 31, 2016, included approximately $868 of pre-launch GALLIPRANT® (grapiprant tablets) product costs capitalized due to anticipated benefit from future commercialization of this product.

On March 20, 2016, the CVM approved GALLIPRANT for the control of pain and inflammation associated with osteoarthritis in dogs.

Goodwill is recorded as an indefinite-lived asset and is not amortized for financial reporting purposes but is tested for impairment on an annual basis or when indications of impairment exist. No goodwill impairment losses have been recognized to date. Goodwill is not expected to be deductible for income tax purposes. The Company performs its annual impairment test of the carrying value of the Company’s goodwill during the third quarter of each year.

During the first quarter of 2016, the Company completed an interim impairment assessment due to a decline in market capitalization. In performing step one of the assessment, the Company determined that as of March 31, 2016, its fair value exceeded

11

its carrying value by 121%. Based on this result, step two of the assessment was not required to be performed, and the Company determined there was no impairment of goodwill during the first quarter of 2016.

Goodwill as of March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS |

| IMPAIRMENT |

| NET | |||

|

| CARRYING AMOUNT |

| LOSSES |

| CARRYING VALUE | |||

Goodwill |

| $ | 40,472 |

| $ | — |

| $ | 40,472 |

The change in the net book value of goodwill for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

| 2016 | |

As of January 1, |

| $ | 39,781 |

Effect of foreign currency exchange |

|

| 691 |

As of the end of the period, |

| $ | 40,472 |

7. Intangible Assets, Net

The change in the net book value of intangible assets for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

| 2016 | |

As of January 1, |

| $ | 15,067 |

Amortization expense |

|

| (95) |

Effect of foreign currency exchange |

|

| 439 |

As of the end of the period, |

| $ | 15,411 |

The estimated useful lives of the individual categories of intangible assets were based on the nature of the applicable intangible asset and the expected future cash flows to be derived from the intangible asset. Amortization of intangible assets with finite lives is recognized over the shorter of the respective term of the agreement or the period of time the intangible assets are expected to contribute to future cash flows. The Company amortizes finite-lived intangible assets using the straight-line method. The Company recognized amortization expense of $95 and $483 for the three months ended March 31, 2016 and 2015, respectively. Indefinite-lived in-process research and development (“IPR&D”) intangible assets are not amortized until a product reaches its first conditional license or approval, and then they are amortized over their estimated useful lives.

Unamortized Intangible Assets

Unamortized intangible assets as of March 31, 2016, were as follows:

|

|

|

|

|

|

|

|

|

| NET | |

|

| CARRYING | |

|

| VALUE | |

Unamortized intangible assets: |

| 2016 | |

Intellectual property rights acquired for IPR&D |

| $ | 9,413 |

The net carrying value above includes asset impairment charges to date of $8,717 and $5,819 for AT-007 and AT-011, respectively.

Unfavorable outcomes of the Company’s development activities or the Company’s estimates of the market opportunities for the product candidates could result in impairment charges in future periods.

12

Amortized Intangible Assets

Amortized intangible assets as of March 31, 2016, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS |

|

|

|

| NET |

|

|

| ||

|

| CARRYING |

| ACCUMULATED |

| CARRYING |

| AVERAGE | ||||

Amortized intangible assets: |

| VALUE |

| AMORTIZATION |

| VALUE |

| USEFUL LIFE | ||||

Intellectual property rights for currently marketed products: |

|

|

|

|

|

|

|

|

|

|

|

|

BLONTRESS® |

| $ | 28,572 |

| $ | 23,180 |

| $ | 5,392 |

| 20 | Years |

TACTRESSTM |

| $ | 10,080 |

| $ | 9,511 |

| $ | 569 |

| 8.25 | Years |

Accumulated amortization includes both amortization expense and asset impairment charges. Asset impairment charges to date are $20,228 and $8,634 for BLONTRESS and TACTRESS, respectively.

Unfavorable outcomes of the Company’s development activities or the Company’s estimates of the market opportunities for the product candidates could result in impairment charges in future periods.

8. Debt

Loan and Security Agreements

Effective as of October 16, 2015, the Company and Vet Therapeutics, Inc., (the “borrowers”), entered into a Loan and Security Agreement (“Loan Agreement”), with Pacific Western Bank, or Pacific Western, as a collateral agent and Oxford Finance, LLC, (the “Lenders”). The loan is secured by substantially all of the borrowers’ personal property other than intellectual property. The outstanding principal balance under the Loan Agreement was $35,000 under the term loan facility and $5,000 under the revolving facility at March 31, 2016. The interest rate on the term loan and revolving credit facility as of March 31, 2016, was 7.16%. During the three months ended March 31, 2016 and 2015, the Company recognized interest expense of $843 and $216, respectively.

The Loan Agreement contains customary representations and warranties and customary affirmative and negative covenants, including, among others, limits or restrictions on the borrowers’ ability to incur liens, incur indebtedness, make certain restricted payments, make certain investments, merge, consolidate, make an acquisition, enter into certain licensing arrangements and dispose of certain assets. In addition, the Loan Agreement contains customary events of default that entitle the Lenders to cause the borrowers’ indebtedness under the Loan Agreement to become immediately due and payable. The events of default, some of which are subject to cure periods, include, among others, a non-payment default, a covenant default, the occurrence of a material adverse change, the occurrence of an insolvency, a material judgment default, defaults regarding other indebtedness and certain actions by governmental authorities. Upon the occurrence and for the duration of an event of default, an additional default interest rate equal to 4% per annum will apply to all obligations owed under the Loan Agreement.

The Loan Agreement requires that the Company receive unrestricted net cash proceeds of at least $45,000 from partnering transactions and/or the issuance of equity securities from October 16, 2015 to October 16, 2016. The Loan Agreement also requires that the Company has at least three products fully USDA- or FDA-approved for commercialization by December 31, 2016. If these conditions had not been met, the Company may have been required to repay the loan prior to December 31, 2016. However, with the FDA approval of GALLIPRANT in March 2016 and upon the receipt of the upfront payment of $45,000 from the Elanco agreement (Note 10) entered into in April 2016, the Company will have met both conditions. Additionally, the Loan Agreement requires that the Company maintain certain minimum liquidity (approximately $26,900 at March 31, 2016) at all times. At March 31, 2016, the Company was in compliance with all financial covenants. If the minimum liquidity covenant is not met the Company may be required to repay the loan prior to scheduled maturity date.

13

Loans payable as of March 31, 2016, were as follows:

|

|

|

|

Principal amounts |

|

|

|

Term loan, 7.16%, due October 16, 2019 |

| $ | 35,000 |

Revolving line, 7.16%, due October 16, 2017 |

|

| 5,000 |

Add: accretion of final payment and termination fees |

|

| 169 |

Less: unamortized debt issuance costs |

|

| (339) |

As of the end of the period, |

| $ | 39,830 |

9. Accrued Expenses

Accrued expenses consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MARCH 31, 2016 |

| DECEMBER 31, 2015 | ||

Accrued expenses: |

|

|

|

|

|

|

Accrued payroll and related expenses |

| $ | 1,063 |

| $ | 1,922 |

Accrued professional fees |

|

| 201 |

|

| 388 |

Accrued royalty expense |

|

| 18 |

|

| 1 |

Accrued interest expense |

|

| 247 |

|

| 238 |

Accrued research and development costs |

|

| 489 |

|

| 1,111 |

Accrued other contracts |

|

| 105 |

|

| — |

Accrued milestone |

|

| 68 |

|

| 500 |

Accrued other |

|

| 45 |

|

| 87 |

Total accrued expenses |

| $ | 2,236 |

| $ | 4,247 |

10. Agreements

RaQualia Pharma Inc. (“RaQualia”)

On December 27, 2010, the Company entered into two Exclusive License Agreements with RaQualia (the “RaQualia Agreements”) that granted the Company global rights, subject to certain exceptions for injectables in Japan, Korea, China and Taiwan for development and commercialization of licensed animal health products for compounds RQ-00000005 (ENTYCE, also known as AT-002) and RQ-00000007 (GALLIPRANT, also known as AT-001). The Company will be required to pay RaQualia milestone payments associated with GALLIPRANT and ENTYCE of up to $10,000 and $8,500, respectively, upon the Company’s achievement of certain development, regulatory and commercial milestones, as well as mid-single digit royalties on the Company’s or the Company’s sublicensee’s product sales, if any.

The Company achieved milestones totaling $5,000, which were expensed within research and development expenses during the three months ended March 31, 2016, and included in accounts payable. As of March 31, 2016, the Company had not paid any milestone or royalty payments since execution of the RaQualia Agreements.

It is possible that multiple additional milestones related to the RaQualia Agreements are achieved within the next 12 months totaling $6,500.

Elanco Animal Health, Inc.

On January 2, 2015, the Company was granted a full product license from the USDA for BLONTRESS. The approval resulted in a $3,000 milestone payment being earned and due to the Company per the terms of the Exclusive Commercial License Agreement with Elanco (formerly Novartis Animal Health, Inc.) (the “Elanco Agreement”). During the first quarter of 2015, the Company recognized $3,000 of licensing revenue related to the milestone payment.

On February 24, 2015, the Company and Elanco agreed to terminate the Elanco Agreement. In consideration for the return of the commercial license granted to Elanco, the Company paid Elanco $2,500 in March 2015, and will be required to pay an additional $500 upon the first commercial sale by the Company. At that time the Company determined that it is probable that the $500 payment will be

14

paid, and recorded the $500 as a current liability in the first quarter of 2015. The first commercial sale occurred in March 2016. The Company recorded the $3,000 paid to Elanco as a reduction in revenues received from Elanco as the payment was to re-acquire rights that the Company had previously licensed to Elanco.

On February 25, 2016, the Company and Elanco agreed to amend the terms related to the $500 payment due upon the first commercial sale by the Company. Under the amended terms, upon the first commercial sale, the Company will be required to pay quarterly, a royalty per vial sold until $500 in royalties are paid or the end of two years. After two years, the Company will be required to pay Elanco $500 plus 10% interest, compounded annually against any unpaid balance, less any royalties paid during the two years. If during the two years following the first commercial sale the Company withdraws BLONTRESS from the market and ceases all commercialization, the remaining royalty and related interest are no longer payable. As a result of the amended terms, $431 of the $500 of the accrued milestone was reclassified to other long-term liabilities as of March 31, 2016.

On April 22, 2016, the Company entered into a Collaboration, License, Development and Commercialization Agreement (the “Collaboration Agreement”) with Elanco pursuant to which the Company granted Elanco rights to develop, manufacture, market and commercialize the Company’s products based on licensed grapiprant rights and technology (the “Product”), including GALLIPRANT (grapiprant tablets), an FDA-approved therapeutic for the control of pain and inflammation associated with osteoarthritis in dogs. Pursuant to the Collaboration Agreement, Elanco will have exclusive rights globally outside the United States and co-exclusive rights with the Company in the United States during the term of the Collaboration Agreement.

Under the terms of the Collaboration Agreement, Elanco has agreed to pay the Company an upfront payment of $45,000. Elanco has also agreed to pay the Company a $4,000 milestone related to European approval of GALLIPRANT for the treatment of pain and inflammation and a $4,000 milestone related to the manufacturing of GALLIPRANT and up to $75,000 upon the achievement of certain sales milestones. The sales milestone payments are subject to a one-third reduction for each year the occurrence of the milestone is not achieved beyond December 31, 2021, with any non-occurrence beyond December 31, 2023 cancelling out the applicable milestone payment obligation entirely.

The Collaboration Agreement also provides that Elanco will pay the Company royalty payments on a percentage of net sales in the mid-single to low-double digits. In addition, the Company and Elanco have agreed to pay 25% and 75%, respectively, of all third-party development fees and expenses through December 31, 2018 in connection with preclinical and clinical trials necessary for any registration or regulatory approval of the Products (“Registration”), provided that the Company’s contribution to such development fees and expenses is capped at an amount in the mid-single digit millions. The Company is responsible for all development activities required to obtain the first Registration for the Product for use in dogs in each of the European Union and the United States, and Elanco is responsible for all other development activities.

Commencing on the effective date of the Collaboration Agreement, the Company is responsible for the manufacture and supply of all of Elanco’s reasonable requirements of the Product. However, Elanco retains the ability to assume all or a portion of the manufacturing responsibility during the term of the Collaboration Agreement. The parties have agreed under the Collaboration Agreement to negotiate and enter into a supply agreement formalizing the terms of supply of active product ingredients and/or finished Product by the Company to Elanco.

On April 22, 2016, in connection with the Collaboration Agreement, the Company entered into a Co-Promotion Agreement (the “Co-Promotion Agreement”) with Elanco to co-promote the Product in the United States.

Under the terms of the Co-Promotion Agreement, Elanco has agreed to pay the Company, as a fee for services performed and expenses incurred by the Company under the Co-Promotion Agreement, (i) 25% of the gross margin on net sales of Product sold in the United States under the Collaboration Agreement prior to December 31, 2018 (unless extended by mutual agreement), and (ii) a mid-single digit percentage of net sales of the Product in the United States after December 31, 2018 through 2028 (unless extended by mutual agreement).

11. Common Stock

As of March 31, 2016, there were 34,701,500 shares of the Company’s common stock outstanding, net of 653,766 shares of unvested restricted common stock.

Sales Agreement

On October 16, 2015, the Company entered into a Sales Agreement with Barclays Capital Inc. (“Barclays”) pursuant to which the Company may sell from time to time, at its option, up to an aggregate of $52,000 of shares of its common stock (the “Shares”) through Barclays, as sales agent. Sales of the Shares, if any, will be made under the Company’s previously filed and currently effective Registration Statement on Form S-3 (Reg. No. 333-197414), by means of ordinary brokers’ transactions on the NASDAQ Global Market or otherwise. Additionally, under the terms of the Sales Agreement, the Shares may be sold at market prices, at negotiated prices or at prices related to the prevailing market price. The Company will pay Barclays a commission of 2.75% of the gross proceeds from the sale of the Shares, if any. As of the date of this filing, the Company has not sold any shares pursuant to the Sales Agreement.

15

12. Stock-Based Awards

2010 Equity Incentive Plan

Activity related to stock options under the 2010 Equity Incentive Plan (the “2010 Plan”) for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED |

|

|

|

|

| SHARES |

| WEIGHTED |

| AVERAGE |

|

|

| |

|

| ISSUABLE |

| AVERAGE |

| REMAINING |

| AGGREGATE | ||

|

| UNDER |

| EXERCISE |

| CONTRACTUAL |

| INTRINSIC | ||

|

| OPTIONS |

| PRICE |

| TERM |

| VALUE | ||

|

|

|

|

|

|

| (IN YEARS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding as of December 31, 2015 |

| 86,490 |

| $ | 2.95 |

| 7.09 |

| $ | 228 |

Granted |

| — |

|

| — |

|

|

|

|

|

Exercised |

| — |

|

| — |

|

|

|

|

|

Forfeited |

| — |

|

| — |

|

|

|

|

|

Expired |

| — |

|

| — |

|

|

|

|

|

Outstanding as of March 31, 2016 |

| 86,490 |

| $ | 2.95 |

| 6.84 |

| $ | 225 |

As of March 31, 2016, 47,286 shares of common stock granted from early exercised options are unvested and subject to repurchase.

Activity related to restricted stock under the 2010 Plan for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED | |

|

|

|

| AVERAGE GRANT | |

|

| SHARES |

| DATE FAIR VALUE | |

Unvested restricted common stock as of December 31, 2015 |

| 37,078 |

| $ | 0.36 |

Issued |

| — |

|

| — |

Vested |

| (13,566) |

|

| 0.37 |

Forfeited |

| — |

|

| — |

Unvested restricted common stock as of March 31, 2016 |

| 23,512 |

| $ | 0.35 |

For the three months ended March 31, 2016, the total fair value of restricted common stock vested was $51.

16

2013 Incentive Award Plan

Activity related to stock options under the 2013 Incentive Award Plan (the “2013 Plan”) for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED |

|

|

|

|

| SHARES |

| WEIGHTED |

| AVERAGE |

|

|

| |

|

| ISSUABLE |

| AVERAGE |

| REMAINING |

| AGGREGATE | ||

|

| UNDER |

| EXERCISE |

| CONTRACTUAL |

| INTRINSIC | ||

|

| OPTIONS |

| PRICE |

| TERM |

| VALUE | ||

|

|

|

|

|

|

| (IN YEARS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding as of December 31, 2015 |

| 1,728,199 |

| $ | 16.57 |

| 8.31 |

| $ | — |

Granted |

| 534,100 |

|

| 3.14 |

|

|

|

|

|

Exercised |

| — |

|

| — |

|

|

|

|

|

Forfeited |

| (15,697) |

|

| 6.27 |

|

|

|

|

|

Expired |

| (3,624) |

|

| 14.39 |

|

|

|

|

|

Outstanding as of March 31, 2016 |

| 2,242,978 |

| $ | 13.45 |

| 8.46 |

| $ | 1,247 |

For the three months ended March 31, 2016, the weighted average grant date fair value of stock options granted was $2.11.

Activity related to restricted stock under the 2013 Plan for the three months ended March 31, 2016, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| WEIGHTED | |

|

|

|

| AVERAGE GRANT | |

|

| SHARES |

| DATE FAIR VALUE | |

Unvested restricted common stock as of December 31, 2015 |

| 333,263 |

| $ | 17.77 |

Issued |

| 349,650 |

|

| 3.14 |

Vested |

| (99,945) |

|

| 15.98 |

Forfeited |

| (8,080) |

|

| 6.41 |

Unvested restricted common stock as of March 31, 2016 |

| 574,888 |

| $ | 9.35 |

For the three months ended March 31, 2016, the total fair value of restricted common stock vested was $339. The Company did not receive cash proceeds for any of the restricted common stock issued during the three months ended March 31, 2016.

Stock-Based Compensation

The Company recognizes compensation expense for only the portion of awards that are expected to vest. In developing a forfeiture rate estimate, the Company has considered its historical experience to estimate pre-vesting forfeitures for service-based awards. The impact of a forfeiture rate adjustment will be recognized in full in the period of adjustment, and if the actual forfeiture rate is materially different from the Company’s estimate, the Company may be required to record adjustments to stock-based compensation expense in future periods.

17

The Company recorded stock-based compensation expense related to stock options and restricted stock as follows:

|

|

|

|

|

|

|

|

|

| ||||

|

| THREE MONTHS ENDED | ||||

|

| MARCH 31, | ||||

|

| 2016 |

| 2015 | ||

Cost of product sales and inventories |

| $ | 31 |

| $ | 37 |

Research and development |

|

| 365 |

|

| 605 |

Selling, general and administrative |

|

| 1,857 |

|

| 1,718 |

|

| $ | 2,253 |

| $ | 2,360 |

The Company had an aggregate of $10,100 and $4,739, of unrecognized stock-based compensation expense for options outstanding and restricted stock awards, respectively, as of March 31, 2016, which is expected to be recognized over a weighted average period of 2.33 years and 1.72 years, respectively.

13. Net Loss Per Share

Basic and diluted net loss per share attributable to common stockholders was calculated as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| THREE MONTHS ENDED | ||||

|

| MARCH 31, | ||||

|

| 2016 |

| 2015 | ||

Basic and diluted net loss per share: |

|

|

|

|

|

|

Numerator: |

|

|

|

|

|

|

Loss before income taxes |

| $ | (18,067) |

| $ | (9,045) |

Income tax benefit |

|

| — |

|

| 271 |

Net loss |

| $ | (18,067) |

| $ | (8,774) |

Denominator: |

|

|

|

|

|

|

Weighted average shares outstanding – |

|

| 34,653,479 |

|

| 34,193,994 |

Net loss per share – basic and diluted |

| $ | (0.52) |

| $ | (0.26) |

Stock options for the purchase of 2,329,468 and 1,758,363 shares of common stock were excluded from the computation of diluted net loss per share attributable to common stockholders for the three months ended March 31, 2016 and 2015, respectively, because those options had an anti-dilutive impact due to the net loss attributable to common stockholders incurred for the period.

14. Income Taxes

The Company recorded no income tax expense or benefit during the three months ended March 31, 2016, compared to an income tax benefit of $271 during the three months ended March 31, 2015, which was recognized for losses incurred that would reduce the amount of deferred tax liability related to intangible assets. The Company recognized no deferred tax benefit for losses incurred during the three months ended March 31, 2016, due to a full valuation allowance recognized against its deferred tax assets.

18

15. Accumulated Other Comprehensive Loss

The changes in accumulated other comprehensive loss, net of their related tax effects, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FOREIGN |

| ACCUMULATED | ||

|

| CURRENCY |

| OTHER | ||

|

| TRANSLATION |

| COMPREHENSIVE | ||

|

| ADJUSTMENT |

| LOSS | ||

As of December 31, 2015 |

| $ | (9,320) |

| $ | (9,320) |

Foreign currency translation adjustments |

|

| 1,177 |

|

| 1,177 |

As of March 31, 2016 |

| $ | (8,143) |

| $ | (8,143) |

Amounts reclassified from accumulated other comprehensive loss were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AMOUNTS RECLASSIFIED FROM | ||||

|

|

| ACCUMULATED OTHER | ||||

|

|

| COMPREHENSIVE LOSS | ||||

|

|

| THREE MONTHS ENDED | ||||

|

|

| MARCH 31, | ||||

| Income Statement Location |

| 2016 |

| 2015 | ||

Gain on sale of securities available-for-sale | Other income (expense) |

| $ | — |

| $ | 1,010 |

|

|

| $ | — |

| $ | 1,010 |

16. Variable Interest Entity

ViroVet BVBA (“ViroVet”)

During the third quarter of 2015, the Company reviewed certain operations of its wholly owned subsidiary, Aratana Therapeutics NV (“Aratana NV”). As a result, the Company made a strategic decision to wind down pre-clinical discovery efforts being performed at Aratana NV and focus future efforts of Aratana NV on clinical assets, the development of core legacy programs, i.e. AT-001, AT-002 and AT-003 for EU approval and business development and monetization of production animal assets and know-how obtained in the acquisition of Okapi Sciences. To facilitate this reorganization, the Company, via Aratana NV, along with the former General Manager of Aratana NV, the current General Manager of Aratana NV and a consultant to the Company, formed ViroVet BVBA. During the third quarter of 2015 the Company began to transition its employees from Aratana NV to ViroVet. The Company plans to transition selected Aratana NV employees, assets and liabilities over the next three months to ViroVet to further pursue the research and development of production animal products. These employees will be focused on the advancement of production animal assets/know-how and the securing of additional funding for future operations.

Except for the financing matters described below, the Company will have little to no involvement in the operations of ViroVet.

Equity Investment

In July 2015, the Company paid $2 and committed another $4 for 28% ownership interest in ViroVet. The Company has no further obligation to provide any further capital.

19

Convertible Loan Agreement

On September 11, 2015, Aratana NV and ViroVet executed a convertible loan agreement in which Aratana NV agreed to loan ViroVet $335 (€300) on September 15, 2015. The proceeds from the loan require ViroVet to use the monies towards the development and operations of ViroVet in accordance with the budget prepared by ViroVet. The loan bears annual interest of 7% and is unsecured.

Primary Beneficiary

The Company determined ViroVet is a VIE and it had a controlling financial interest in ViroVet due to the Company having the power to direct the activities of ViroVet that most significantly impact ViroVet’s economic performance and having the obligation to absorb losses or receive benefits. The Company will continue to consolidate ViroVet unless a reconsideration event occurs, for example, an equity financing.

Total assets and liabilities of the Company’s consolidated VIE were not material as of March 31, 2016.

For the three months ended March 31, 2016, ViroVet’s net loss and non-controlling interest were not material and are included in the Company’s consolidated statement of operations. Creditors in ViroVet only have recourse to the assets owned by the VIE and not to the Company’s general credit. The Company currently does not have implicit support arrangements with ViroVet.

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes and other financial information included elsewhere in this Quarterly Report on Form 10-Q. Some of the statements contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q that are not statements of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. In this Quarterly Report on Form 10-Q, the words “anticipates,” “believes,” “expects,” “intends,” “future,” “could,” “estimates,” “plans,” “would,” “should,” “potential,” “continues” and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. The forward-looking statements herein include without limitation, statements with respect to our plans and strategy for our business, anticipated timing of regulatory submissions and approvals, anticipated timing of availability and announcement of study results, anticipated timing of commercialization of product candidates, and anticipated milestone payments. These and other forward-looking statements included in this Quarterly Report on Form 10-Q involve risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our history of operating losses and our expectation that we will continue to incur losses for the foreseeable future; failure to obtain sufficient capital to fund our operations; risks relating to the impairment of intangible assets AT-004, AT-005, AT-007 and AT-011; unstable market and economic conditions; restrictions on our financial flexibility due to the terms of our credit facility; our substantial dependence upon the success of our product candidates; development of our biologic product candidates is dependent upon relatively novel technologies and uncertain regulatory pathways, and biologics may not be commercially viable; denial or delay of regulatory approval for our existing or future product candidates; failure of our product candidates that receive regulatory approval to obtain market approval or achieve commercial success; failure to realize anticipated benefits of our acquisitions and difficulties associated with integrating the acquired businesses; development of pet therapeutics is a lengthy and expensive process with an uncertain outcome; competition in the pet therapeutics market, including from generic alternatives to our product candidates, and failure to compete effectively; failure to identify, license or acquire, develop and commercialize additional product candidates; failure to attract and retain senior management and key scientific personnel; our reliance on third-party manufacturers, suppliers and partners; regulatory restrictions on the marketing of our product candidates; our small commercial sales organization, and any failure to create a sales force or collaborate with third-parties to commercialize our product candidates; difficulties in managing the growth of our company; significant costs of being a public company; risks related to the restatement of our financial statements for the year ended December 31, 2013, and the identification of a material weakness in our internal control over financial reporting; changes in distribution channels for pet therapeutics; consolidation of our veterinarian customers; limitations on our ability to use our net operating loss carryforwards; impacts of generic products; safety or efficacy concerns with respect to our product candidates; effects of system failures or security breaches; failure to obtain ownership of issued patents covering our product candidates or failure to prosecute or enforce licensed patents; failure to comply with our obligations under our license agreements; effects of patent or other intellectual property lawsuits; failure to protect our intellectual property; changing patent laws and regulations; non-compliance with any legal or regulatory requirements; litigation resulting from the misuse of our confidential information; the uncertainty of the regulatory approval process and the costs associated with government regulation of our product candidates; failure to obtain regulatory approvals in foreign jurisdictions; effects of legislative or regulatory reform with respect to pet therapeutics; the volatility of the price of our common stock; our status as an emerging growth company, which could make our common stock less attractive to investors; dilution of our common stock as a result of future financings; the influence of certain significant stockholders over our business; and provisions in our charter documents and under Delaware law could delay or prevent a change in control. These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission (the “SEC”) on March 15, 2016, and the “Risk Factors” section of this Quarterly Report on Form 10-Q, could cause actual results to differ materially from those indicated by the forward-looking statements made in this Quarterly Report on Form 10-Q.

Overview

We are a pet therapeutics company focused on licensing, developing and commercializing innovative biopharmaceutical products for companion animals. We operate in one business segment: pet therapeutics, which sits at the intersection of the more than $60 billion annual U.S. pet market, and more than $23 billion annual worldwide animal health market. Our current product portfolio includes multiple therapeutic candidates in development consisting of small molecule pharmaceuticals and large molecule biologics that target large opportunities in serious medical conditions in pets.

Our lead product and product candidates in development include small molecules directed at treating osteoarthritis pain and inflammation (GALLIPRANT®), appetite stimulation (ENTYCE®) and post-operative pain (NOCITA®).

We have incurred significant net losses since our inception. These losses have resulted principally from costs incurred in connection with in-licensing our product candidates, research and development activities and general and administrative costs associated with our operations. As of March 31, 2016, we had a deficit accumulated since inception of $170.1 million, and cash, cash equivalents and short-term investments of $72.8 million.

We expect to continue to incur operating losses for the next several years as we work to develop and commercialize our product candidates. As a result, we expect to seek to fund our operations through corporate collaborations and licensing arrangements, as well

21

as public or private equity offerings or further debt financings. We cannot assure you that such funds will be available on terms favorable to us, if at all. Arrangements with collaborators or others may require us to relinquish rights to certain of our technologies or product candidates. In addition, there is a risk that we may never successfully complete development of our product candidates, obtain adequate patent protection for our technology, obtain necessary regulatory approval for our product candidates or achieve commercial viability for any approved product candidates. If we are not able to raise additional capital on terms acceptable to us, or at all, as and when needed, we may be required to curtail our operations which could include delaying the commercial launch of our products, discontinuing product development programs, or granting rights to develop and market products or product candidates that we would otherwise prefer to develop and market ourselves. As disclosed in Note 8 to the consolidated financial statements, we have a term loan and a revolving credit facility with an aggregate principal balance of $40.0 million as of March 31, 2016. The terms of this agreement require us to receive unrestricted net cash proceeds of at least $45.0 million from partnering transactions and/or the issuance of equity securities from October 16, 2015 to October 16, 2016. The loan agreements also require that we have at least three products fully United States Department of Agriculture (“USDA”) or U.S. Food and Drug Administration (“FDA”)-approved for commercialization by December 31, 2016. If these conditions had not been met, we may have been required to repay the loan prior to December 31, 2016. However, with the FDA approval of GALLIPRANT in March 2016 and upon the receipt of the upfront payment of $45.0 million from the Elanco Animal Health, Inc. (“Elanco”) agreement entered into in April 2016, we will have met both conditions. As of the date of the filing of this Quarterly Report on Form 10-Q, we believe that our existing cash, cash equivalents and short-term investments of $72.8 million, will allow us to fund our operations, at least through March 31, 2017.

Business Updates

During the three months ended March 31, 2016, we continued to make progress towards our objective of becoming a fully integrated and commercial-stage company in 2016. During the quarter we received our first FDA approval, submitted for our second FDA approval, and continued to progress on the manufacturing of commercial supply for upcoming product launches and prepare ourselves to have a commercial presence in the pet therapeutic market.

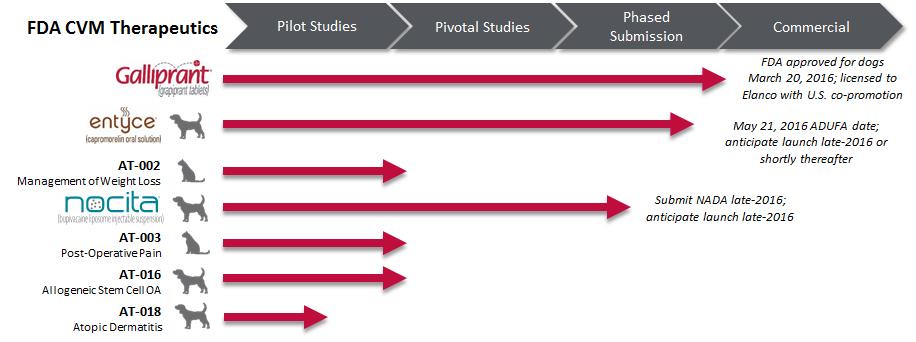

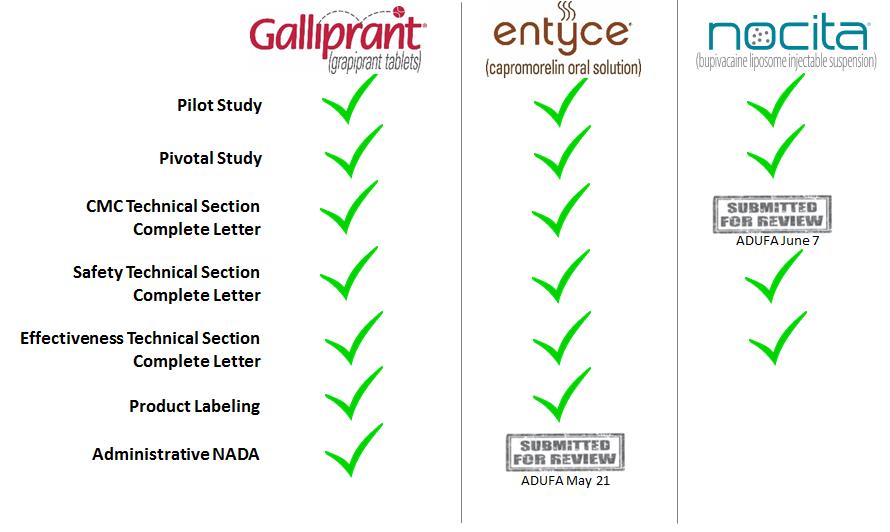

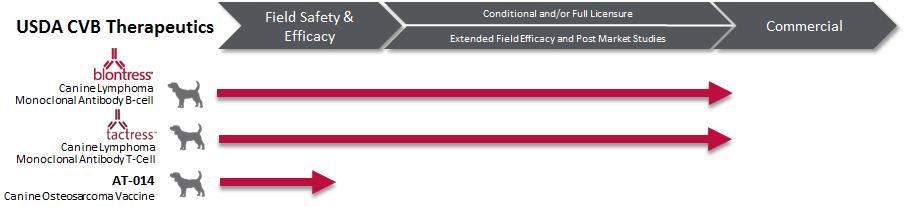

Research and Development

The following tables identify the most advanced product candidates being developed under the FDA’s Center for Veterinary Medicine (“CVM”) regulations and their current regulatory status:

22

GALLIPRANT

On March 20, 2016, the FDA’s CVM approved GALLIPRANT® (grapiprant tablets) for the control of pain and inflammation associated with osteoarthritis in dogs.

The approval was based upon the results from a randomized, prospective, blinded, placebo-controlled multi-site pivotal study of 285 client-owned dogs evaluating the efficacy of GALLIPRANT for dogs with osteoarthritis. The primary endpoint of the study was an owner assessed success rate based on pre-determined improvements in the Pain Severity Score (PSS) and the Pain Interference Score (PIS) of the Canine Brief Pain Inventory on day 28. The statistically significantly results (p=0.0315) showed 48 percent of GALLIPRANT-treated dogs were classified as a “success” compared to 31 percent of the dogs receiving placebo; similar to results seen with the COX-inhibiting NSAID, carprofen, when the same success criteria was applied. Secondary endpoints included success at days 7, 14 and 21 compared to placebo, all of which were statistically greater in the GALLIPRANT-treated group (p=0.0154, p=0.0442, and p=0.0443, respectively). Other secondary endpoints were percentage changes in the PSS and PIS scores at days 7, 14, 21, and 28. GALLIPRANT-treated dogs had statistically significant greater (p<0.05) improvements for both PSS and PIS at each time-point compared to placebo. The most common adverse reactions were vomiting, diarrhea/soft stool, and anorexia/inappetence. These pivotal study results were recently published in the Journal of Veterinary Internal Medicine, “A prospective, randomized, masked, placebo-controlled multi-site clinical study of grapiprant, an EP4 prostaglandin receptor antagonist (PRA), in dogs with osteoarthritis” (J Vet Intern Med, 2016 Online 13Apr2016 DOI: 10.1111/jvim.13948).

On February 17, 2016, we announced we had filed a marketing authorization application for grapiprant for dogs with the European Medicines Agency (“EMA”). The EMA has begun the submission review process and, if approved, we anticipate marketing authorization in 2017.

ENTYCE

On March 22, 2016, we announced we filed an administrative new animal drug application (“NADA”) with the CVM for ENTYCE (capromorelin oral solution) for appetite stimulation for dogs. The Animal Drug User Fee Act (“ADUFA”) date for approval has been set for May 21, 2016. If approved, we anticipate commercial availability of ENTYCE to veterinarians in late-2016 or shortly thereafter.

NOCITA

In February 2016, we received the technical section complete letter for effectiveness from the CVM for NOCITA (bupivacaine liposome injectable suspension) for post-operative pain management in dogs undergoing knee surgery. We have an ADUFA date of

23