Filed by C&J Energy Services, Inc.

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: C&J Energy Services, Inc.

Commission File No: 001-35255

Combination of C&J Energy Services with Nabors Completion and Production Businesses

July 7, 2014

© C&J Energy Services, Inc. 2014

Disclaimer

Important Information for Investors and Stockholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, Nabors Red Lion (“Red Lion”), a subsidiary of Nabors Industries Ltd. (“Nabors”) will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, which will include a prospectus of Red Lion and a proxy statement of C&J Energy Services, Inc. (“C&J”). Nabors, Red Lion and C&J also plan to file other documents with the SEC regarding the proposed merger. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of C&J. INVESTORS AND SECURITY HOLDERS OF C&J ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Nabors, Red Lion and C&J, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Nabors and Red Lion will be available free of charge on Nabors’s internet website at www.nabors.com under the tab “Investor Relations” and then under the tab “SEC Filings” or by contacting Nabors’s Investor Relations Department at 281-775-8038. Copies of the documents filed with the SEC by C&J will be available free of charge on C&J’s internet website at www.cjenergy.com under the tab “Investor Relations” and then under the tab “SEC Filings” or by contacting C&J’s Investor Relations Department at 713-260-9986.

Participants in the Solicitation

C&J, its directors and certain executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of C&J in connection with the proposed transaction. Information about the directors and executive officers of C&J is set forth in C&J’s proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 10, 2014. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Free copies of these documents can be obtained using the contact information above.

© C&J Energy Services, Inc. 2014

2

Disclaimer

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. These include statements regarding the effects of the proposed merger, estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties and are typically identified by words or phrases such as “may,” “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. For example, statements regarding future financial performance, future competitive positioning and business synergies, future acquisition cost savings, future accretion to earnings per share, future market demand, future benefits to stockholders, future economic and industry conditions, the proposed merger (including its benefits, results, effects and timing), the attributes of C&J as a subsidiary of Red Lion and whether and when the transactions contemplated by the merger agreement will be consummated, are forward-looking statements within the meaning of federal securities laws.

These forward-looking statements are subject to numerous risks and uncertainties, many of which are beyond the companies’ control, which could cause actual benefits, results, effects and timing to differ materially from the results predicted or implied by the statements. These risks and uncertainties include, but are not limited to: the failure of the stockholders of C&J to approve the proposed merger; the risk that the conditions to the closing of the proposed merger are not satisfied; the risk that regulatory approvals required for the proposed merger are not obtained or are obtained subject to conditions that are not anticipated; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed merger; uncertainties as to the timing of the proposed merger; competitive responses to the proposed merger; costs and difficulties related to the integration of C&J’s business and operations with Red Lion’s business and operations; the inability to obtain or delay in obtaining cost savings and synergies from the proposed merger; unexpected costs, charges or expenses resulting from the proposed merger; the outcome of pending or potential litigation; the inability to retain key personnel; uncertainty of the expected financial performance of C&J following completion of the proposed merger; and any changes in general economic and/or industry specific conditions.

Nabors and C&J caution that the foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in Nabors’s and C&J’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings, which are available at the SEC’s website, http://www.sec.gov. All subsequent written and oral forward-looking statements concerning Nabors, C&J, the proposed transaction or other matters attributable to Nabors and C&J or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Each forward looking statement speaks only as of the date of the particular statement, and neither Nabors nor C&J undertakes any obligation to publicly update any of these forward-looking statements to reflect events or circumstances that may arise after the date hereof.

© C&J Energy Services, Inc. 2014 3

A Powerful Combination of

Complementary Businesses

| | | | |

| | | | | NABORS |

C&J Energy Services | | Pro Forma | | Completion & |

| | | C&J Energy Services | | Production Services |

The combination of C&J Energy and Nabors Completion & Production Services Businesses creates the 5th largest completion and production services provider, positioned to capitalize on opportunities through its greater scale, enhanced offerings and significant operating efficiencies

~1.1 million HHP of pressure pumping capacity across the US

683 workover rigs in the US and Canada

~1,500 fluid management trucks

~$3.2 billion combined LTM revenue

Over 10,000 employees

© C&J Energy Services, Inc. 2014 4

The Combined Company

Vertically Integrated & Other Services Equipment

Manufacturing

Completion Services

Specialty Chemicals

Production Services

Hydraulic Fracturing

Downhole Tools &

Fluids Management

Coiled Tubing

Directional Drilling

Workover &

Wireline &

Data Control Systems

Well Servicing

Related Services

Research & Technology

Special Services

Cementing

© C&J Energy Services, Inc. 2014 5

Compelling Financial Benefits for Shareholders of Both Companies

Transaction expected to be accretive to C&J Energy’s cash earnings for the first full year of combined operations

Annual run-rate synergies of more than $100 million are expected to be fully realized by 2017

Combined company retains strong balance sheet and preserves leverage capacity for further expansion

Transaction enhances financial flexibility as the combined company becomes a more global enterprise

© C&J Energy Services, Inc. 2014 6

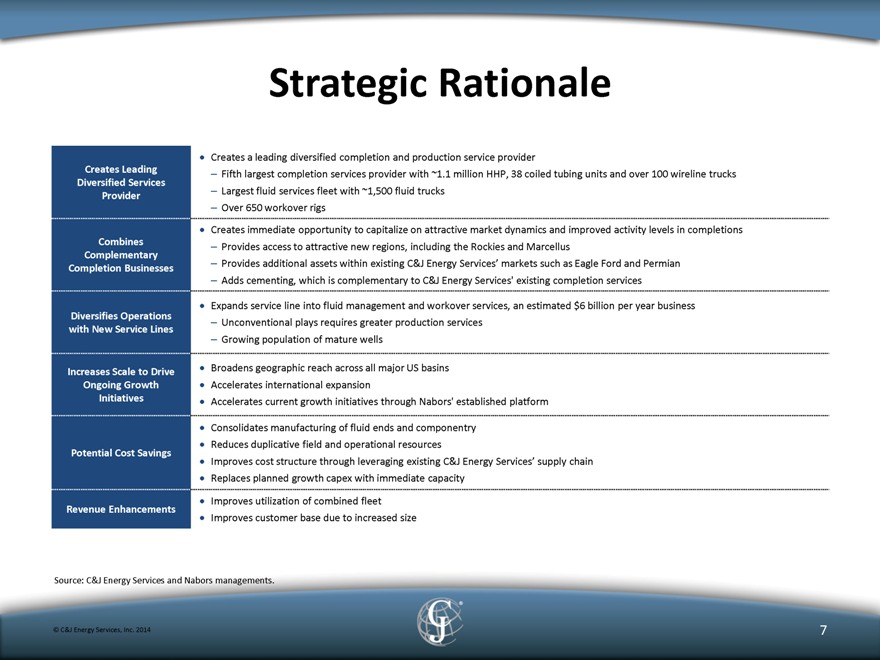

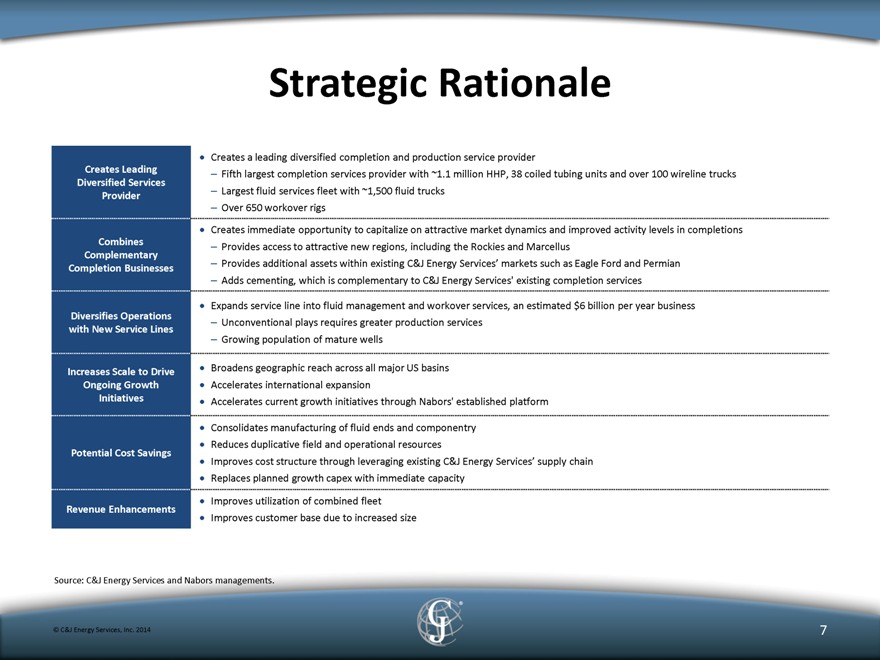

Strategic Rationale

Creates Leading Diversified Services Provider

· Creates a leading diversified completion and production service provider

– Fifth largest completion services provider with 1.1 million HHP, 38 coiled tubing units and over 100 wireline trucks

– Largest fluid services fleet with 1,500 fluid trucks

– Over 650 workover rigs

Combines Complementary Completion Businesses

· Creates immediate opportunity to capitalize on attractive market dynamics and improved activity levels in completions

– Provides access to attractive new regions, including the Rockies and Marcellus

– Provides additional assets within existing C&J Energy Services’ markets such as Eagle Ford and Permian

– Adds cementing, which is complementary to C&J Energy Services’ existing completion services

Diversifies Operations with New Service Lines

· Expands service line into fluid management and workover services, an estimated $6 billion per year business

– Unconventional plays requires greater production services

– Growing population of mature wells

Increases Scale to Drive Ongoing Growth Initiatives

· Broadens geographic reach across all major US basins

· Accelerates international expansion

· Accelerates current growth initiatives through Nabors’ established platform

· Consolidates manufacturing of fluid ends and componentry

Potential Cost Savings

· Reduces duplicative field and operational resources

· Improves cost structure through leveraging existing C&J Energy Services’ supply chain

· Replaces planned growth capex with immediate capacity

Revenue Enhancements

· Improves utilization of combined fleet

· Improves customer base due to increased size

Source: C&J Energy Services and Nabors managements.

© C&J Energy Services, Inc. 2014 7

Acceleration of Long-Term Growth Strategy

Ability to capitalize on attractive market dynamics and improved activity levels in completions

Diversifies product and service offerings to serve customers better

Strengthens presence in all major domestic basins

Improved scale further harnesses vertical integration and technological advancement

Enhances ability to capitalize on international growth opportunities

Opportunity to leverage complementary strengths of each company

© C&J Energy Services, Inc. 2014 8

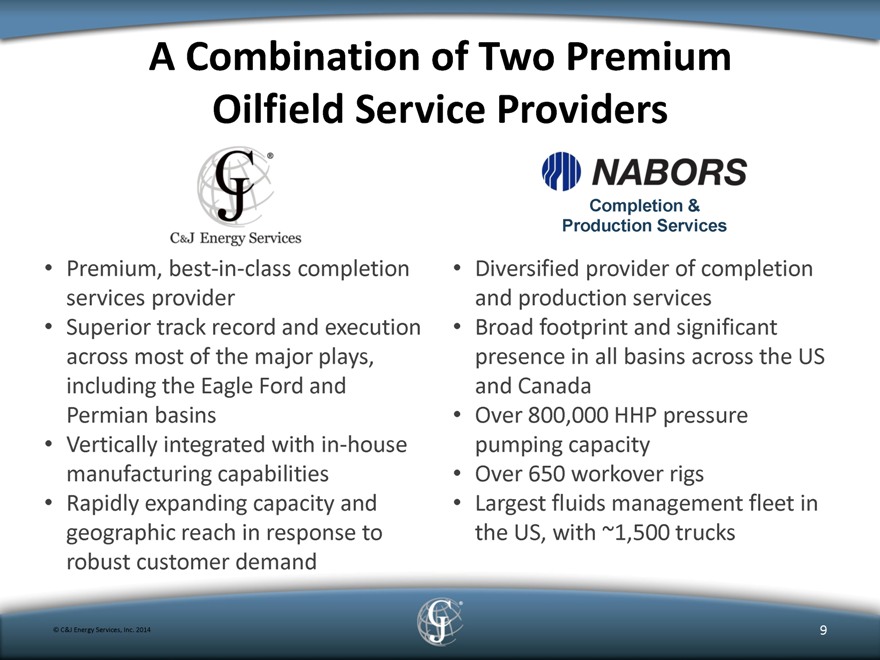

A Combination of Two Premium

Oilfield Service Providers

NABORS

C&J Energy Services Completion & Production Services

Premium, best-in-class completion services provider Diversified provider of completion and production services

Superior track record and execution across most of the major plays, including the Eagle Ford and Permian basins Broad footprint and significant presence in all basins across the US and Canada

Over 800,000 HHP pressure pumping capacity

Vertically integrated with in-house manufacturing capabilities Over 650 workover rigs

Rapidly expanding capacity and geographic reach in response to robust customer demand Largest fluids management fleet in the US, with ~1,500 trucks

© C&J Energy Services, Inc. 2014 9

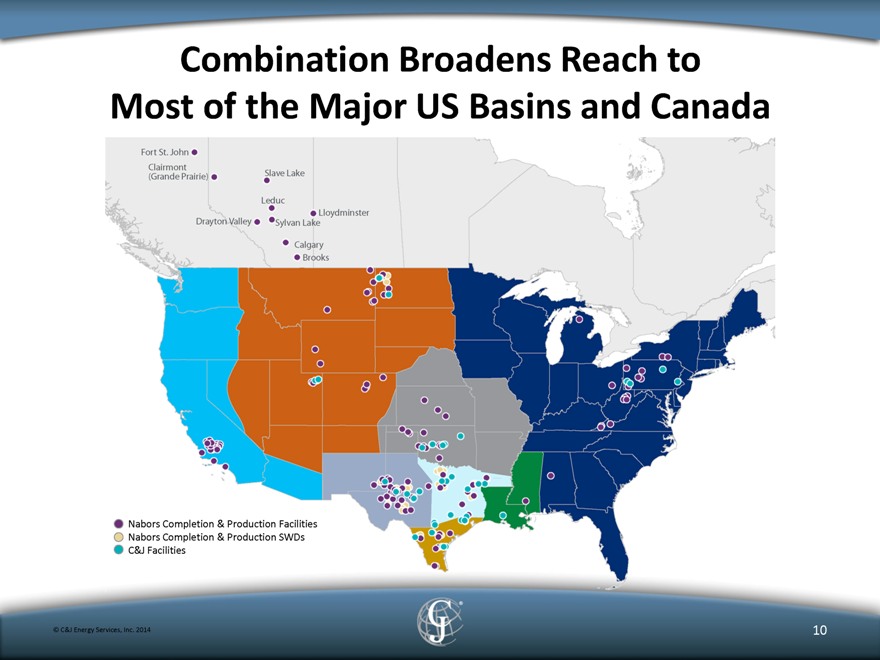

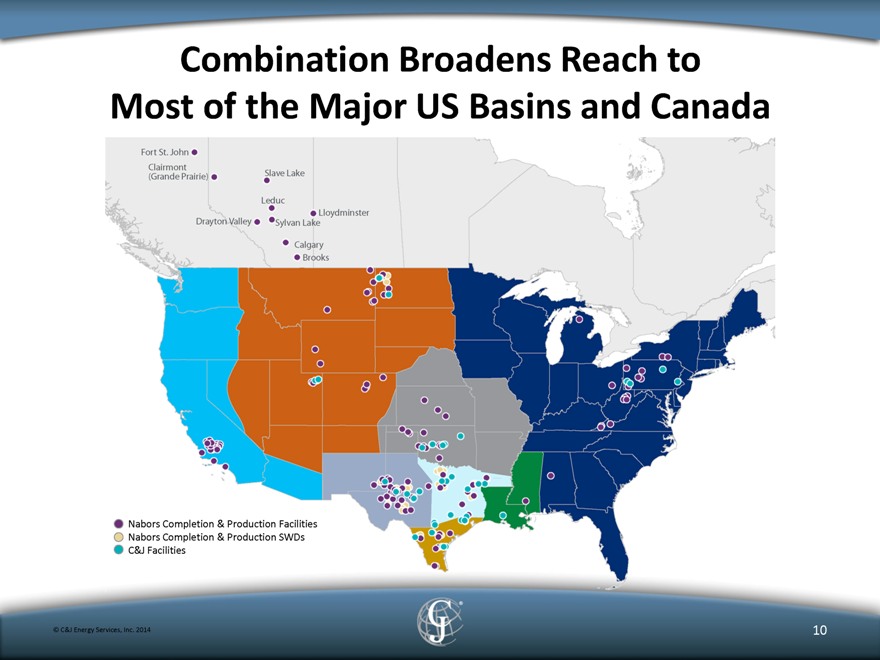

Combination Broadens Reach to Most of the Major US Basins and Canada

Fort St. John

Clairmont (Grande Prairie)

Slave Lake

Leduc

Lloydminster

Drayton Valley

Sylvan Lake

Calgary

Brooks

Nabors Completion & Production Facilities

Nabors Completion & Production SWDs

C&J Facilities

© C&J Energy Services, Inc. 2014 10

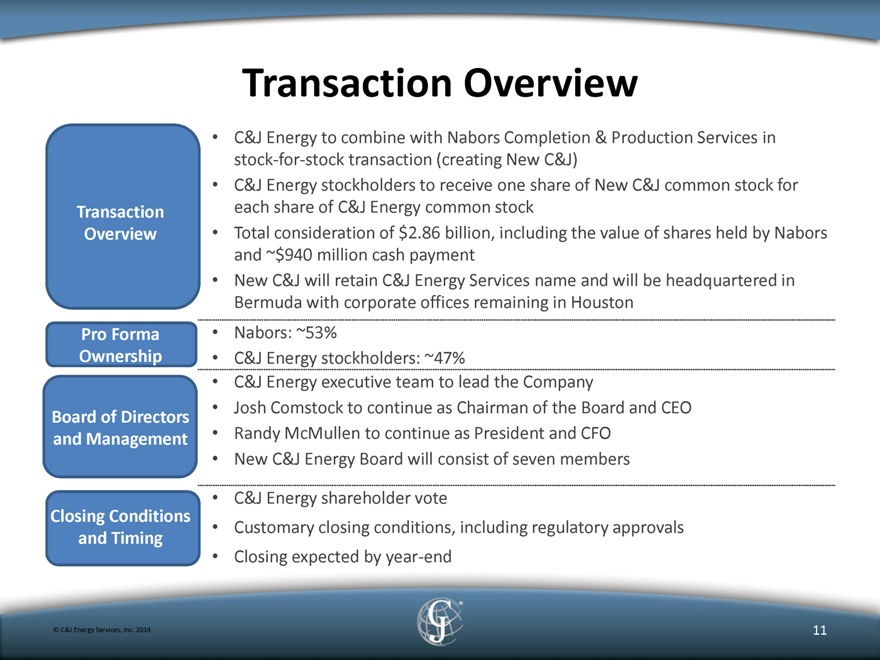

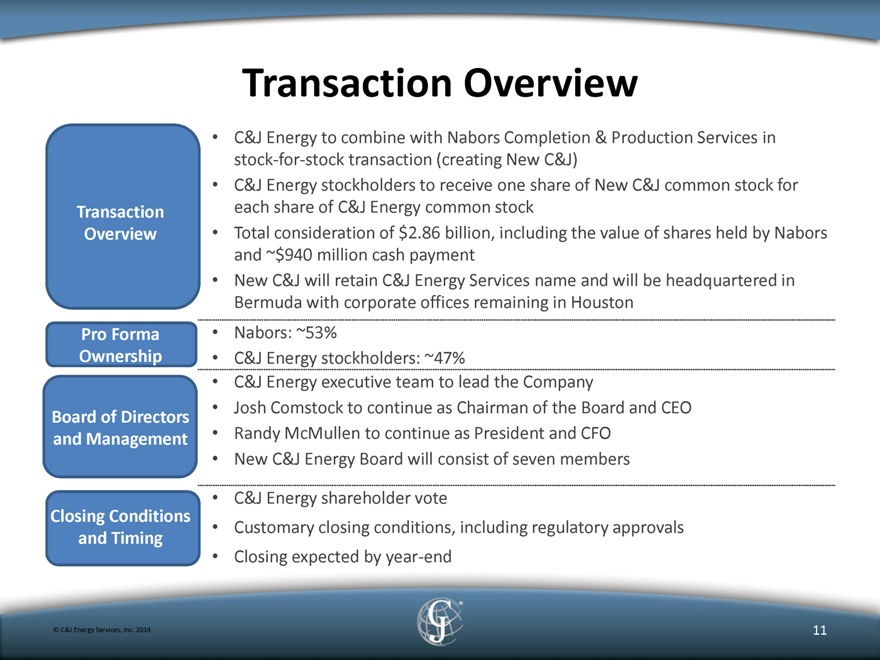

Transaction Overview

C&J Energy to combine with Nabors Completion & Production Services in stock-for-stock transaction (creating New C&J)

C&J Energy stockholders to receive one share of New C&J common stock for each share of C&J Energy common stock

Total consideration of $2.86 billion, including the value of shares held by Nabors and ~$940 million cash payment

New C&J will retain C&J Energy Services name and will be headquartered in Bermuda with corporate offices remaining in Houston

Nabors: ~53%

C&J Energy stockholders: ~47%

C&J Energy executive team to lead the Company

Josh Comstock to continue as Chairman of the Board and CEO

Randy McMullen to continue as President and CFO

New C&J Energy Board will consist of seven members

C&J Energy shareholder vote

Customary closing conditions, including regulatory approvals

Closing expected by year-end

Transaction Overview

Pro Forma Ownership

Board of Directors and Management

Closing Conditions and Timing

© C&J Energy Services, Inc. 2014

11

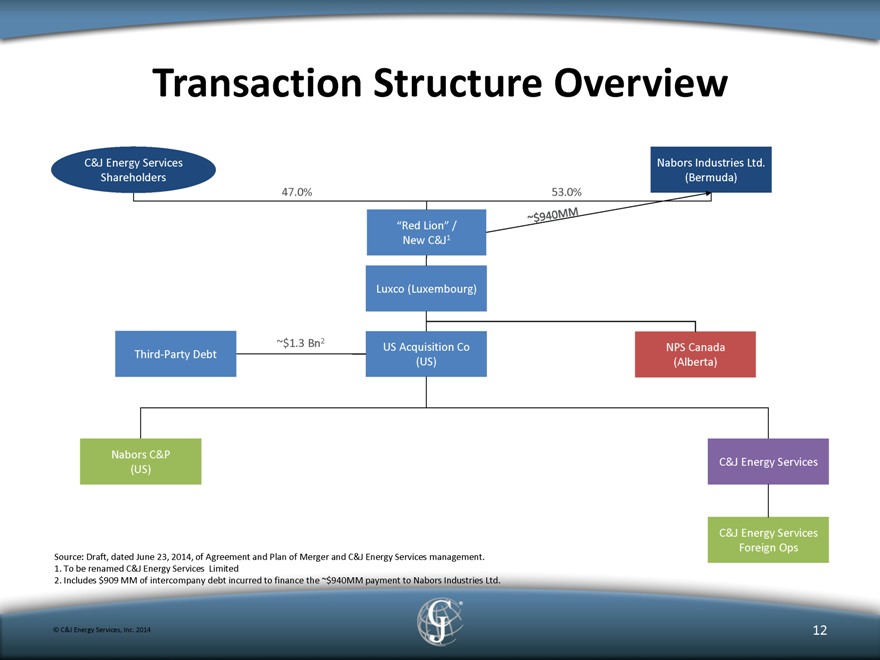

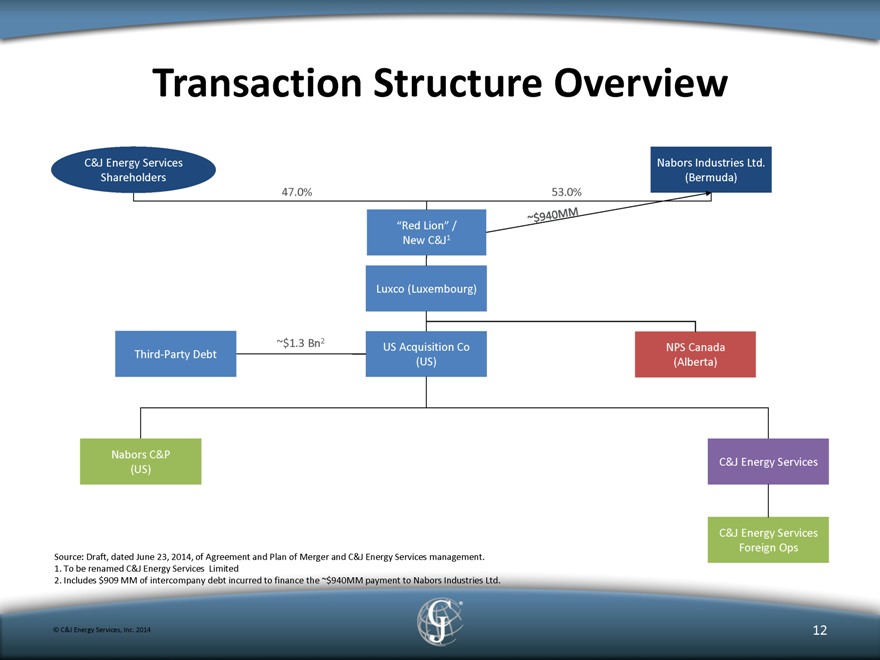

Transaction Structure Overview

C&J Energy Services Nabors Industries Ltd.

Shareholders (Bermuda)

47.0% 53.0%

“Red Lion” / ~940MM

New C&J1

Luxco (Luxembourg)

~$1.3 Bn2 US Acquisition Co NPS Canada

Third-Party Debt

(US) (Alberta)

Nabors C&P

C&J Energy Services

(US)

C&J Energy Services

Foreign Ops

Source: Draft, dated June 23, 2014, of Agreement and Plan of Merger and C&J Energy Services management.

1. To be renamed C&J Energy Services Limited

2. Includes $909 MM of intercompany debt incurred to finance the ~$940MM payment to Nabors Industries Ltd.

© C&J Energy Services, Inc. 2014

12

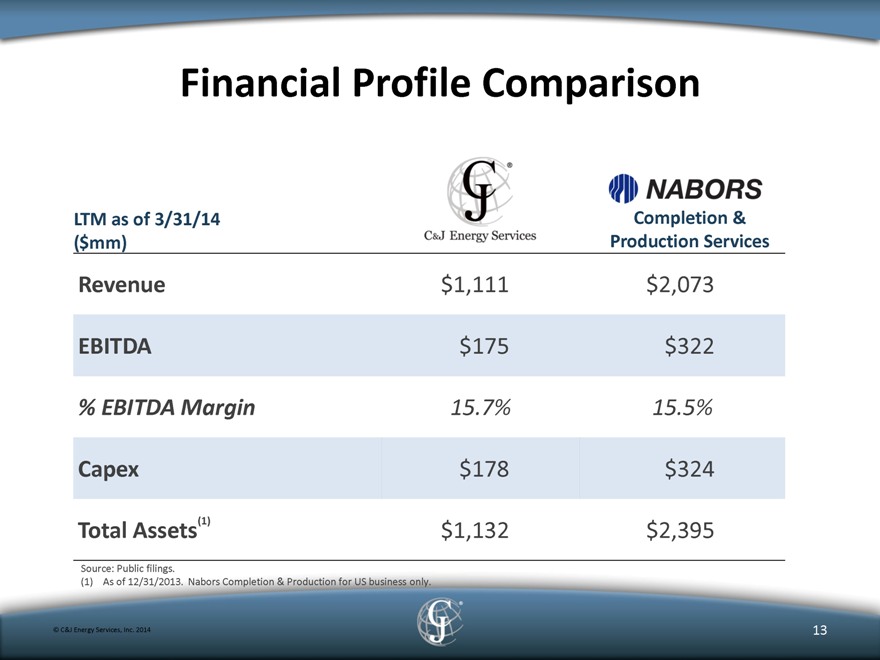

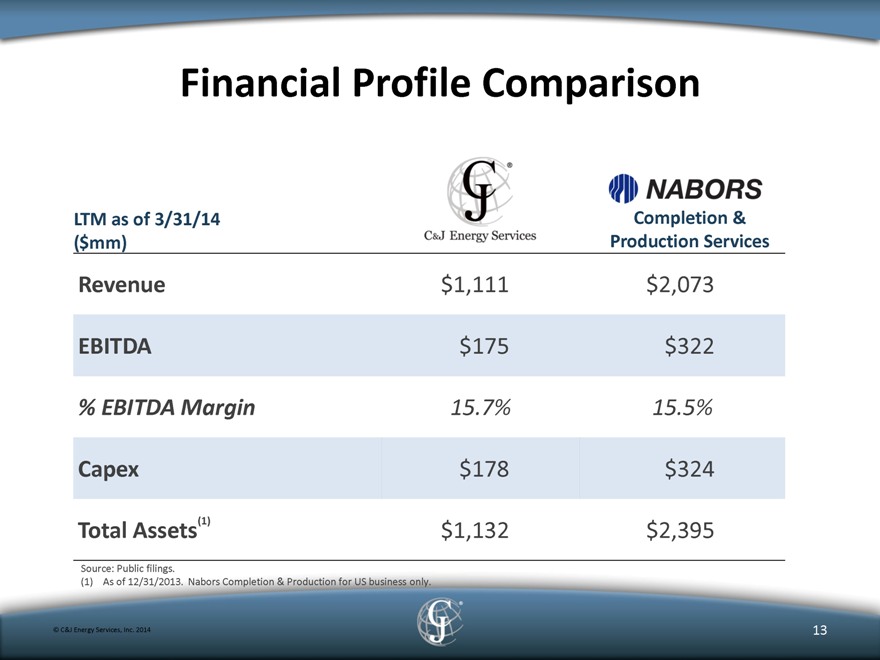

Financial Profile Comparison

NABORS

LTM as of 3/31/14 Completion &

($mm) Production Services

Revenue $1,111 $2,073

EBITDA $175 $322

% EBITDA Margin 15.7% 15.5%

Capex $178 $324

Total Assets(1) $1,132 $2,395

Source: Public filings.

(1) As of 12/31/2013. Nabors Completion & Production for US business only.

© C&J Energy Services, Inc. 2014

13

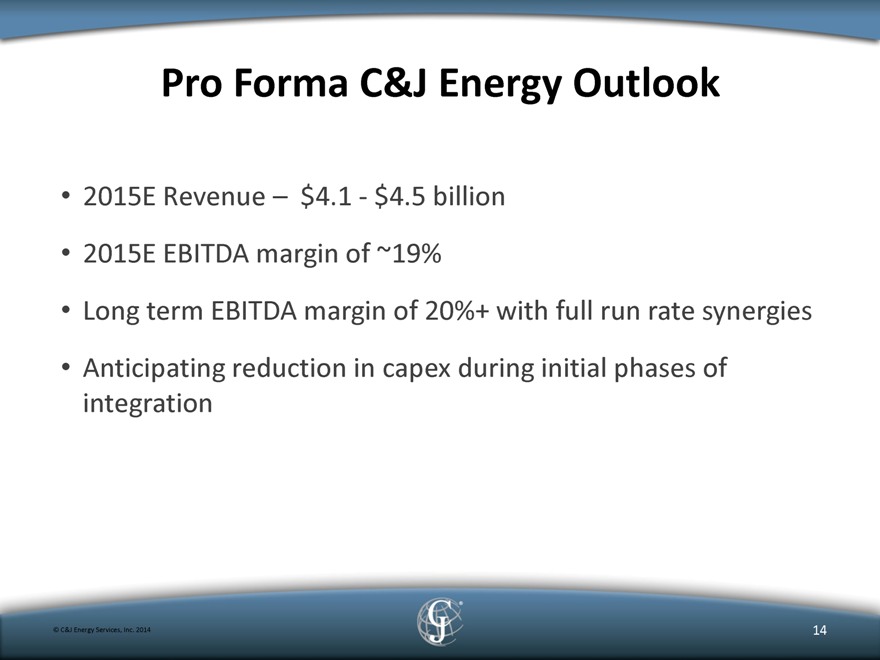

Pro Forma C&J Energy Outlook

2015E Revenue — $4.1 - $4.5 billion

2015E EBITDA margin of ~19%

Long term EBITDA margin of 20%+ with full run rate synergies

Anticipating reduction in capex during initial phases of integration

© C&J Energy Services, Inc. 2014

14

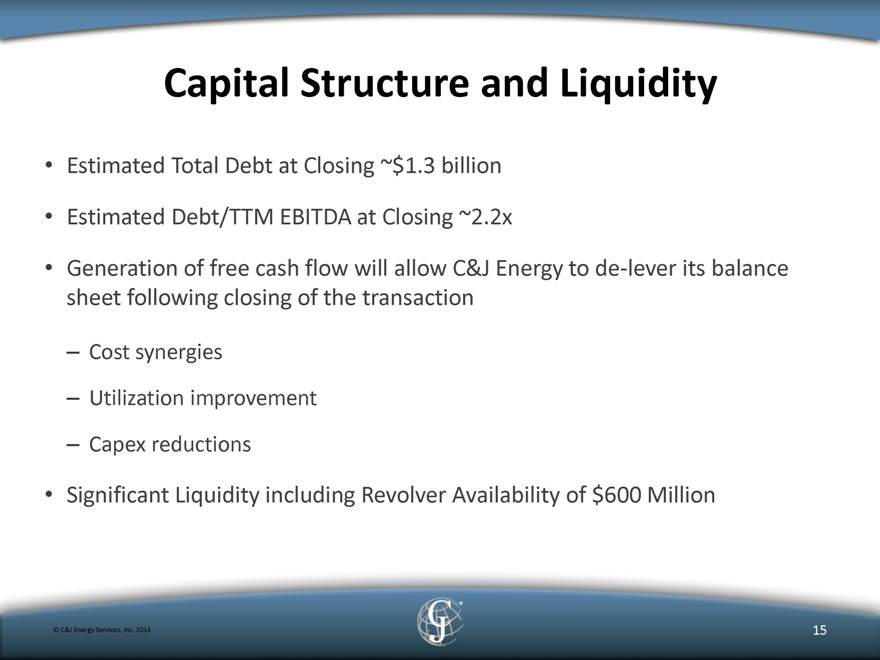

Capital Structure and Liquidity

Estimated Total Debt at Closing ~$1.3 billion

Estimated Debt/TTM EBITDA at Closing ~2.2x

Generation of free cash flow will allow C&J Energy to de-lever its balance sheet following closing of the transaction

Cost synergies

Utilization improvement

Capex reductions

Significant Liquidity including Revolver Availability of $600 Million

© C&J Energy Services, Inc. 2014

15

Experienced and Proven Leadership

Josh Comstock, Chairman and Chief Executive Officer, C&J Energy Services

Larry Heidt, President, Nabors Completion and Production Services

Randy McMullen, President and Chief Financial Officer, C&J Energy Services

Ronnie Witherspoon, Executive Vice President, Nabors Completion Services

Don Gawick, Chief Operating Officer, C&J Energy Services

Steve Johnson, Executive Vice President, Nabors Production Services

© C&J Energy Services, Inc. 2014

16

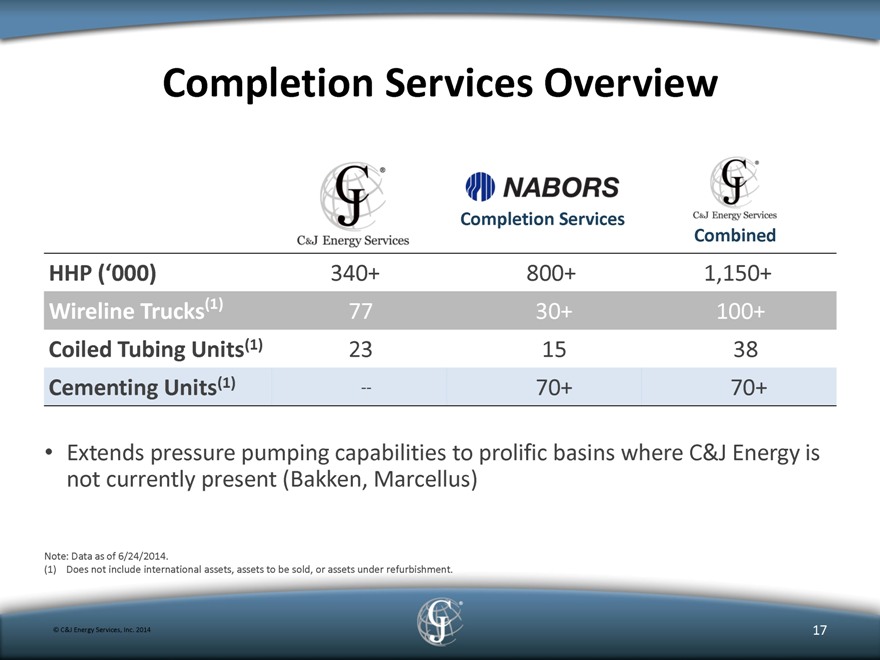

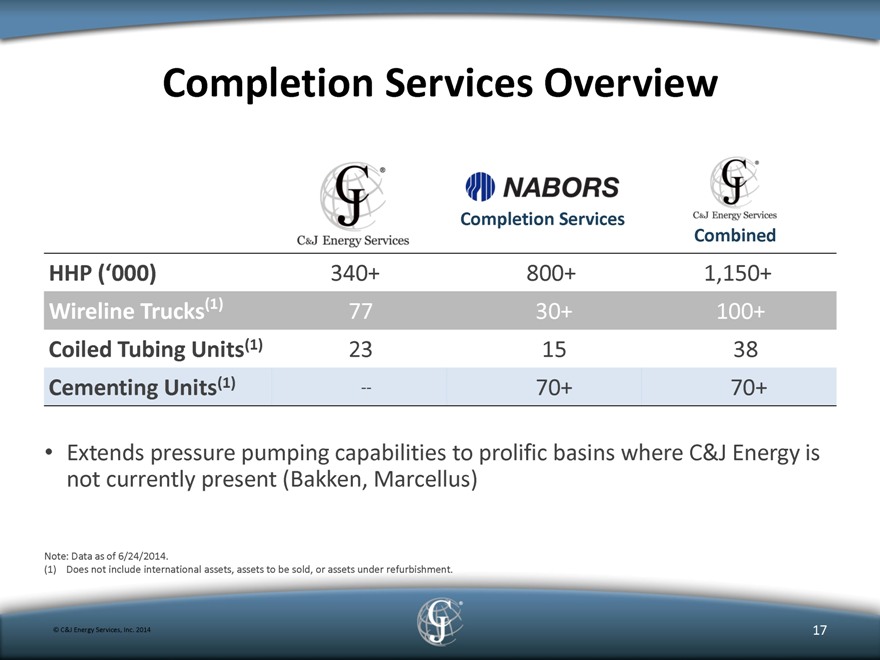

Completion Services Overview

NABORS Completion Services C&J Energy Services C&J Energy Services Combined

HHP (‘000) 340+ 800+ 1,150+

Wireline Trucks(1) 77 30+ 100+

Coiled Tubing Units(1) 23 15 38

Cementing Units(1) — 70+ 70+

Extends pressure pumping capabilities to prolific basins where C&J Energy is not currently present (Bakken, Marcellus)

Note: Data as of 6/24/2014.

(1) Does not include international assets, assets to be sold, or assets under refurbishment.

© C&J Energy Services, Inc. 2014

17

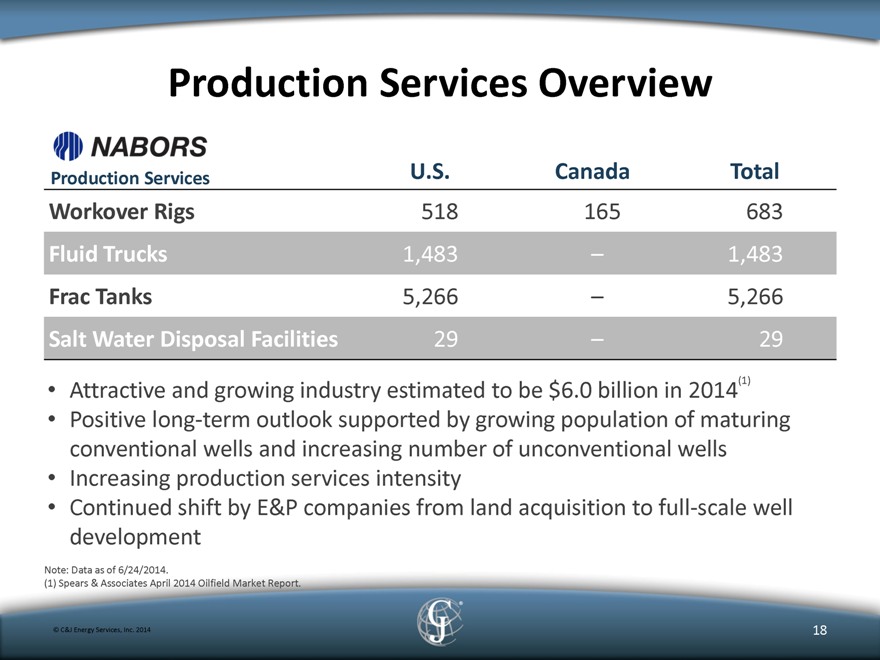

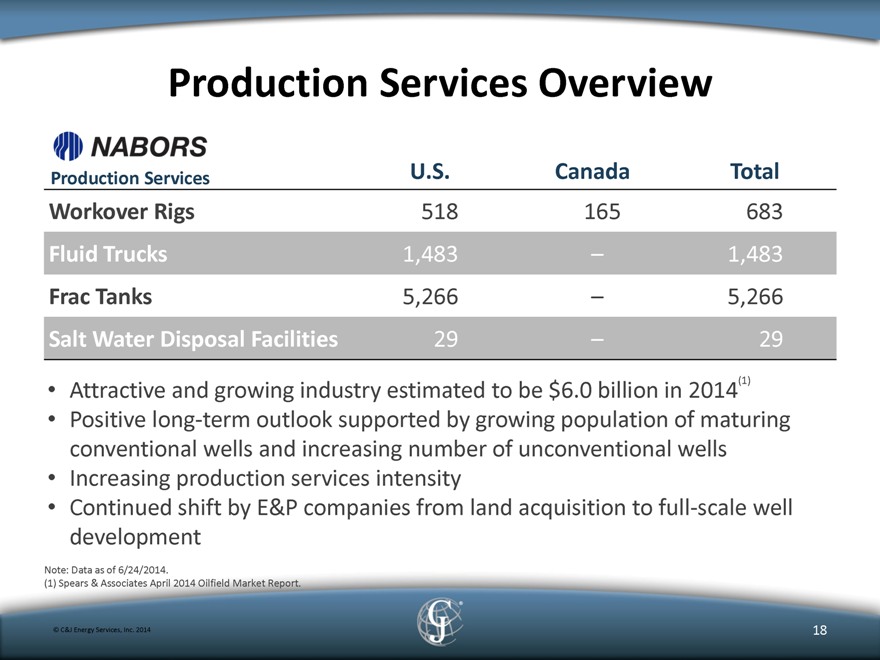

Production Services Overview

NABORS

Production Services U.S. Canada Total

Workover Rigs 518 165 683

Fluid Trucks 1,483 – 1,483

Frac Tanks 5,266 – 5,266

Salt Water Disposal Facilities 29 – 29

Attractive and growing industry estimated to be $6.0 billion in 2014(1)

Positive long-term outlook supported by growing population of maturing conventional wells and increasing number of unconventional wells

Increasing production services intensity

Continued shift by E&P companies from land acquisition to full-scale well development

Note: Data as of 6/24/2014.

(1) Spears & Associates April 2014 Oilfield Market Report.

© C&J Energy Services, Inc. 2014

18

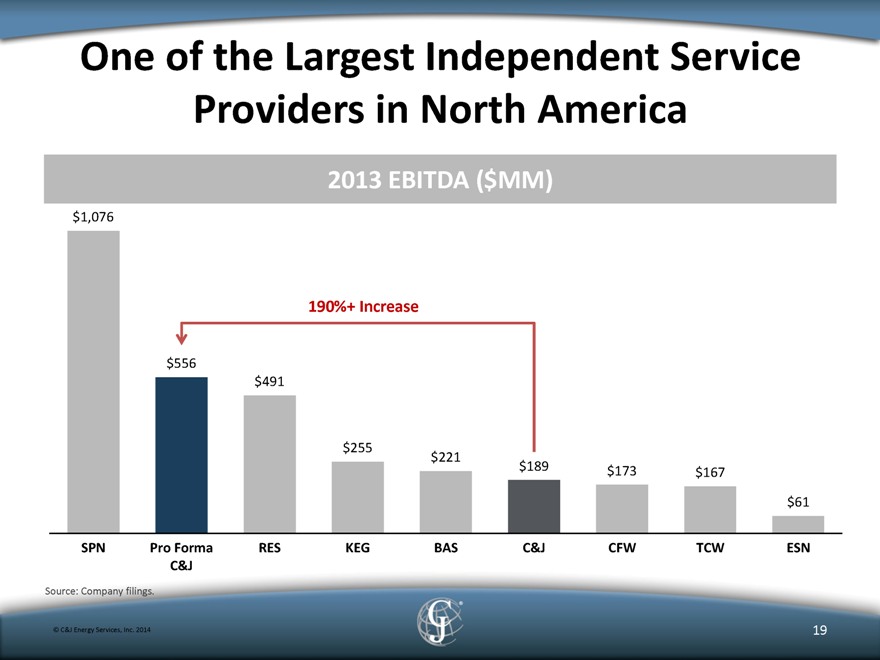

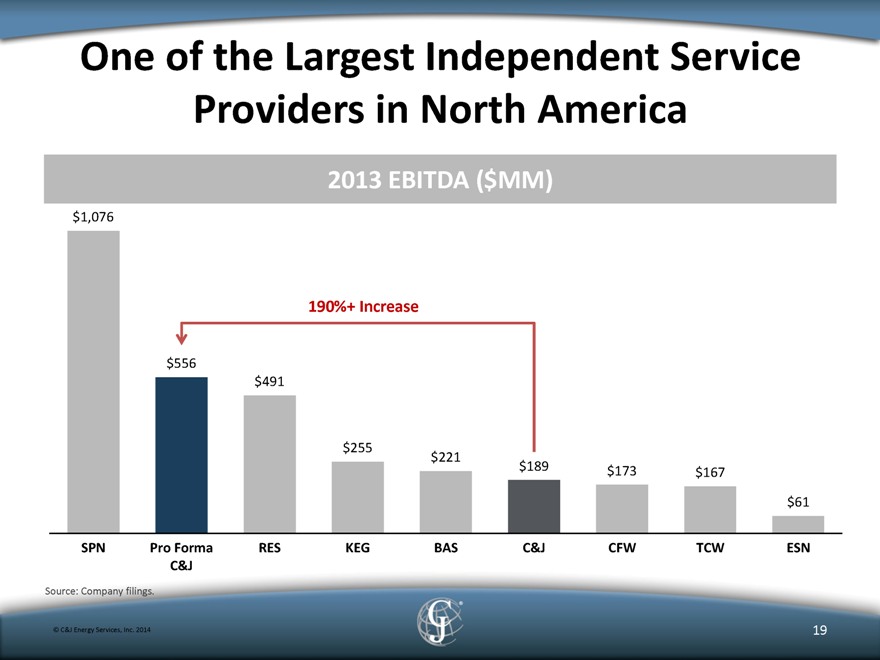

One of the Largest Independent Service

Providers in North America

2013 EBITDA ($MM)

$1,076

190%+ Increase

$556

$491

$255

$221

$189 $173 $167

$61

SPN Pro Forma RES KEG BAS C&J CFW TCW ESN

C&J

Source: Company filings.

© C&J Energy Services, Inc. 2014

19

A Powerful Combination

Bringing together complementary portfolios to create an industry leader

Meaningful financial benefits that will drive shareholder value and future growth

Strongly positioned to capitalize on industry trends and future acquisition opportunities

© C&J Energy Services, Inc. 2014

20