Exhibit 99.2

Q3 2019 Earnings Call November 6, 2019

2 Forward Looking Statements Statements included herein, including statements regarding Sutter Rock's beliefs, expectations, intentions or strategies for the future, may constitute "forward - looking statements" . Sutter Rock cautions you that forward - looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected or implied in these statements . All forward - looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from the plans, intentions and expectations reflected in or suggested by the forward - looking statements . Risk factors, cautionary statements and other conditions which could cause Sutter Rock's actual results to differ from management's current expectations are contained in Sutter Rock's filings with the Securities and Exchange Commission . Sutter Rock undertakes no obligation to update any forward - looking statement to reflect events or circumstances that may arise after the date of this press release . Certain information discussed in this presentation (including information relating to portfolio companies) was derived from third - party sources and has not been independently verified . SSSS makes no representation or warranty with respect to this information . The following slides contain summaries of certain financial and statistical information about SSSS . The information contained in this presentation is summary information intended to be considered in connection with review of our SEC filings and other public announcements we may make, by press release or otherwise, from time to time . We undertake no duty or obligation to publicly update or revise the information contained in this presentation unless required to do so by law . In addition, information related to past performance, while it may be helpful as an evaluative tool, is not indicative of future results, the achievement of which cannot be assured . You should not view the past performance of SSSS or any of its portfolio companies, or information about the market, as indicative of SSSS’ or any of its portfolio companies’ future results . The performance data stated herein may have been due to extraordinary market or other conditions, which may not be duplicated in the future . Current performance may be lower or higher than the performance data quoted . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of SSSS . Third Quarter 2019

3 3 rd Quarter 2019 NAV Third Quarter 2019 Preliminary NAV of $11.24 9.99 $10.46 $10.58 $9.89 $10.75 $10.75 $11.24 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19

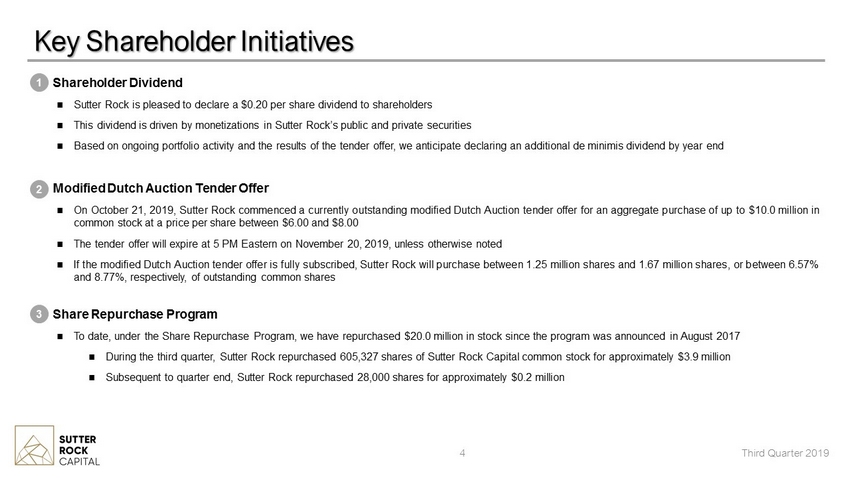

Key Shareholder Initiatives 4 Third Quarter 2019 Shareholder Dividend Sutter Rock is pleased to declare a $ 0 . 20 per share dividend to shareholders This dividend is driven by monetizations in Sutter Rock’s public and private securities Based on ongoing portfolio activity and the results of the tender offer, we anticipate declaring an additional de minimis dividend by year end Modified Dutch Auction Tender Offer On October 21 , 2019 , Sutter Rock commenced a currently outstanding modified Dutch Auction tender offer for an aggregate purchase of up to $ 10 . 0 million in common stock at a price per share between $ 6 . 00 and $ 8 . 00 The tender offer will expire at 5 PM Eastern on November 20 , 2019 , unless otherwise noted If the modified Dutch Auction tender offer is fully subscribed, Sutter Rock will purchase between 1 . 25 million shares and 1 . 67 million shares, or between 6 . 57 % and 8 . 77 % , respectively, of outstanding common shares Share Repurchase Program To date, under the Share Repurchase Program, we have repurchased $ 20 . 0 million in stock since the program was announced in August 2017 During the third quarter, Sutter Rock repurchased 605 , 327 shares of Sutter Rock Capital common stock for approximately $ 3 . 9 million Subsequent to quarter end, Sutter Rock repurchased 28 , 000 shares for approximately $ 0 . 2 million 1 2 3

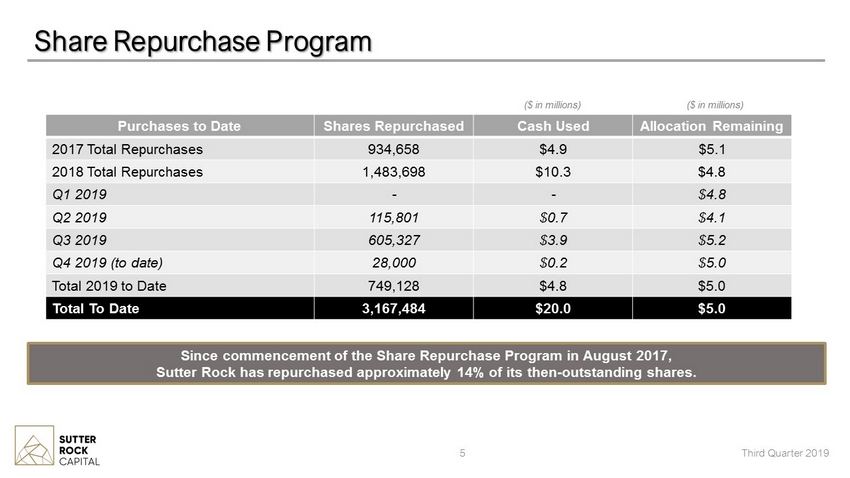

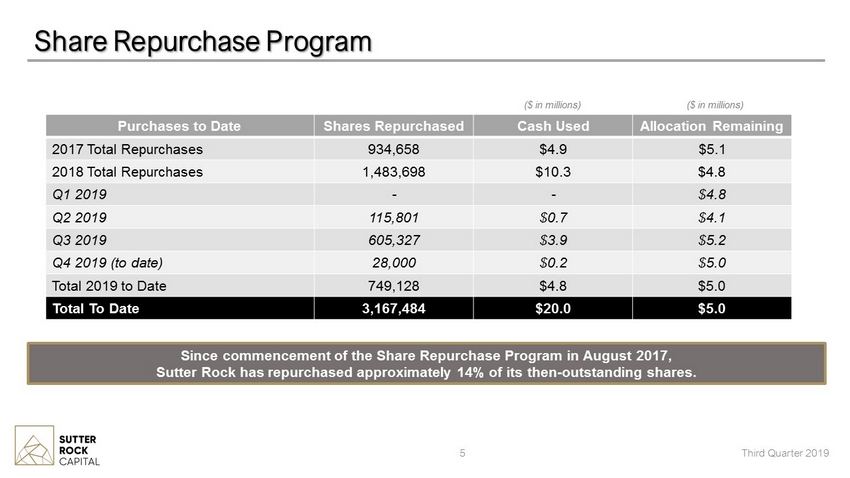

5 Share Repurchase Program Third Quarter 2019 Since commencement of the Share Repurchase Program in August 2017, Sutter Rock has repurchased approximately 14% of its then - outstanding shares. Purchases to Date Shares Repurchased Cash Used Allocation Remaining 2017 Total Repurchases 934,658 $4.9 $5.1 2018 Total Repurchases 1,483,698 $10.3 $4.8 Q1 2019 - - $4.8 Q2 2019 115,801 $0.7 $4.1 Q3 2019 605,327 $3.9 $5.2 Q4 2019 (to date) 28,000 $0.2 $5.0 Total 2019 to Date 749,128 $4.8 $5.0 Total To Date 3,167,484 $20.0 $5.0 ($ in millions) ($ in millions)

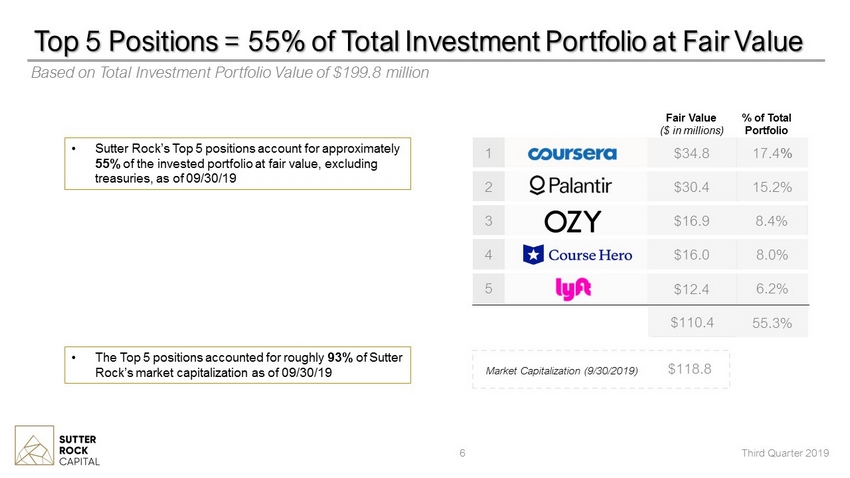

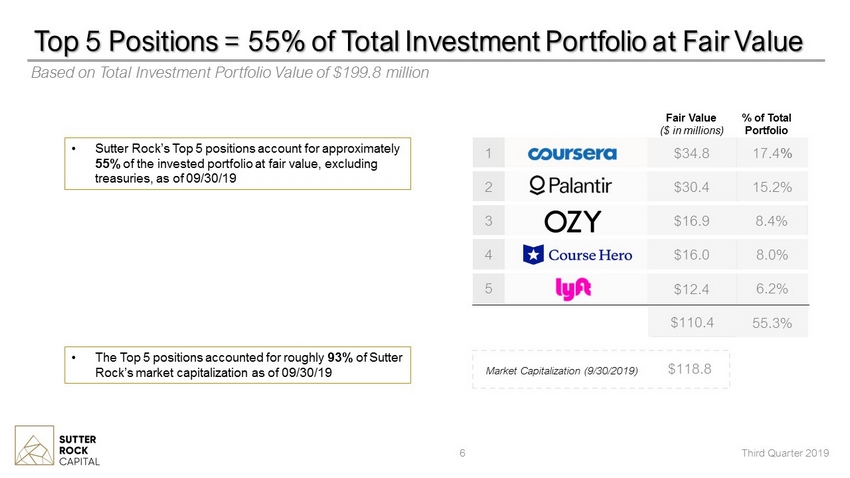

Top 5 Positions = 55% of Total Investment Portfolio at Fair Value Based on Total Investment Portfolio Value of $199.8 million 6 Third Quarter 2019 Fair Value ($ in millions) % of Total Portfolio 5 $12.4 6.2% 4 $16.0 8.0% 3 $16.9 8.4% 2 $30.4 15.2% 1 $34.8 17.4 % $110.4 55.3% $118.8 Market Capitalization (9/30/2019) • Sutter Rock’s Top 5 positions account for approximately 55% of the invested portfolio at fair value, excluding treasuries, as of 09/30/19 • The Top 5 positions accounted for roughly 93% of Sutter Rock’s market capitalization as of 09/30/19

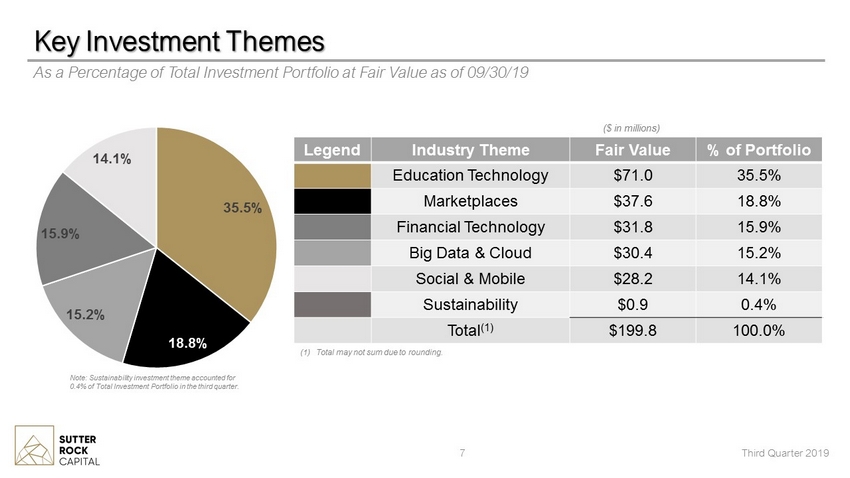

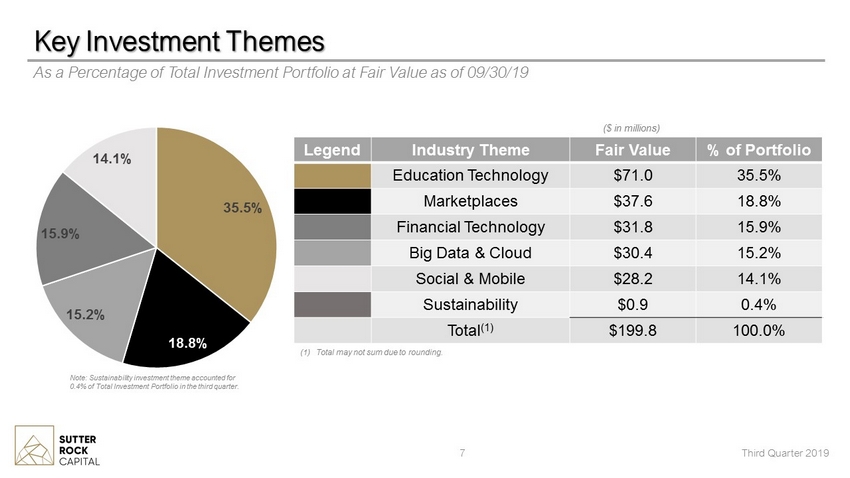

35.5% 18.8% 15.2% 15.9% 14.1% Key Investment Themes As a Percentage of Total Investment Portfolio at Fair Value as of 09/30/19 Third Quarter 2019 Note: Sustainability investment theme accounted for 0.4% of Total Investment Portfolio in the third quarter. 7 ($ in millions) (1) Total may not sum due to rounding. Legend Industry Theme Fair Value % of Portfolio Education Technology $71.0 35.5% Marketplaces $37.6 18.8% Financial Technology $31.8 15.9% Big Data & Cloud $30.4 15.2% Social & Mobile $28.2 14.1% Sustainability $0.9 0.4% Total (1) $199.8 100.0%

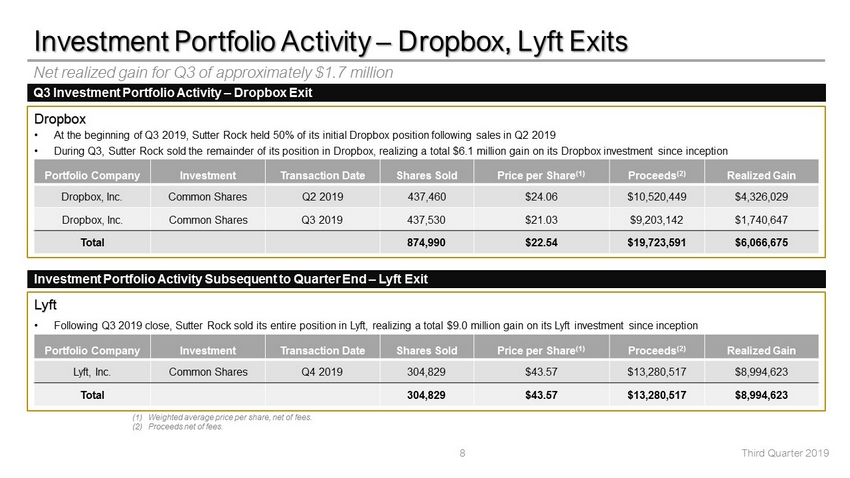

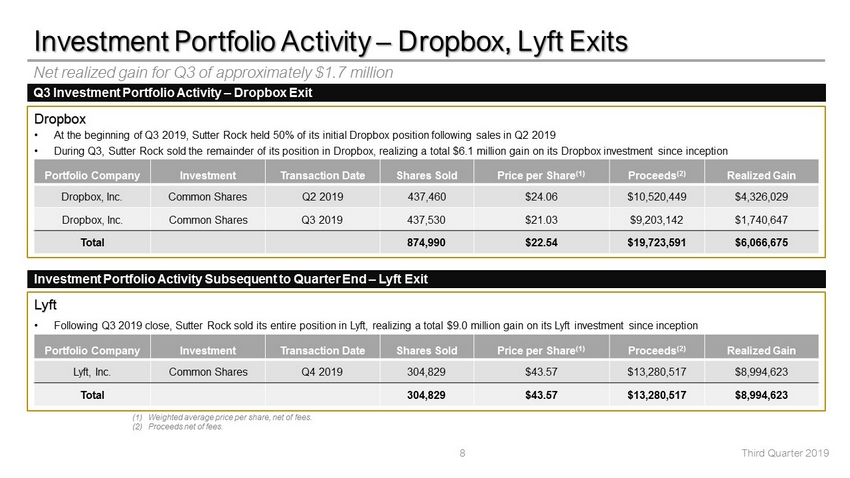

Lyft • Following Q3 2019 close, Sutter Rock sold its entire position in Lyft, realizing a total $9.0 million gain on its Lyft invest men t since inception Investment Portfolio Activity – Dropbox, Lyft Exits Net realized gain for Q3 of approximately $1.7 million (1) Weighted average price per share, net of fees. (2) Proceeds net of fees. Dropbox • At the beginning of Q3 2019, Sutter Rock held 50% of its initial Dropbox position following sales in Q2 2019 • During Q3, Sutter Rock sold the remainder of its position in Dropbox, realizing a total $6.1 million gain on its Dropbox inve stm ent since inception Portfolio Company Investment Transaction Date Shares Sold Price per Share (1) Proceeds (2) Realized Gain Dropbox, Inc. Common Shares Q2 2019 437,460 $24.06 $10,520,449 $4,326,029 Dropbox, Inc. Common Shares Q3 2019 437,530 $21.03 $9,203,142 $1,740,647 Total 874,990 $22.54 $19,723,591 $6,066,675 Portfolio Company Investment Transaction Date Shares Sold Price per Share (1) Proceeds (2) Realized Gain Lyft, Inc. Common Shares Q4 2019 304,829 $43.57 $13,280,517 $8,994,623 Total 304,829 $43.57 $13,280,517 $8,994,623 Investment Portfolio Activity Subsequent to Quarter End – Lyft Exit 8 Third Quarter 2019 Q3 Investment Portfolio Activity – Dropbox Exit

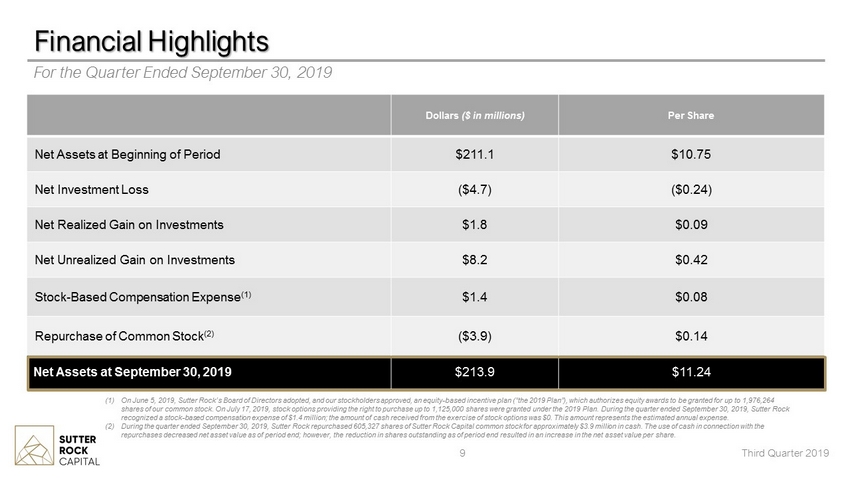

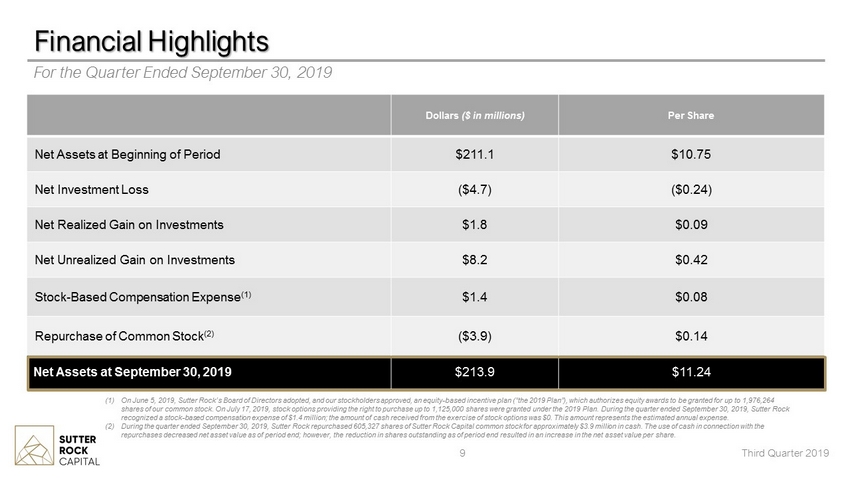

Dollars ($ in millions) Per Share Net Assets at Beginning of Period $211.1 $10.75 Net Investment Loss ($4.7) ($0.24) Net Realized Gain on Investments $1.8 $0.09 Net Unrealized Gain on Investments $8.2 $0.42 Stock - Based Compensation Expense (1) $1.4 $0.08 Repurchase of Common Stock (2) ($3.9) $0.14 Net Assets at September 30, 2019 $213.9 $11.24 9 Financial Highlights For the Quarter Ended September 30, 2019 Third Quarter 2019 (1) On June 5, 2019, Sutter Rock’s Board of Directors adopted, and our stockholders approved, an equity - based incentive plan (“the 2 019 Plan”), which authorizes equity awards to be granted for up to 1,976,264 shares of our common stock. On July 17, 2019, stock options providing the right to purchase up to 1,125,000 shares were grant ed under the 2019 Plan. During the quarter ended September 30, 2019, Sutter Rock recognized a stock - based compensation expense of $1.4 million; the amount of cash received from the exercise of stock options wa s $0. This amount represents the estimated annual expense. (2) During the quarter ended September 30, 2019, Sutter Rock repurchased 605,327 shares of Sutter Rock Capital common stock for a ppr oximately $3.9 million in cash. The use of cash in connection with the repurchases decreased net asset value as of period end; however, the reduction in shares outstanding as of period end resulte d i n an increase in the net asset value per share.