Exhibit 99.2

Q2 2020 Earnings Call August 5 , 2020

2 Forward Looking Statements Statements included herein, including statements regarding SuRo Capital Corp . 's ("SuRo Capital", "SSSS", "we", "us" or "our") beliefs, expectations, intentions or strategies for the future, may constitute "forward - looking statements" . SuRo Capital cautions you that forward - looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected or implied in these statements . All forward - looking statements involve a number of risks and uncertainties, including the impact of the COVID - 19 pandemic and any market volatility that may be detrimental to our business, our portfolio companies, our industry, and the global economy, that could cause actual results to differ materially from the plans, intentions and expectations reflected in or suggested by the forward - looking statements . Risk factors, cautionary statements and other conditions which could cause SuRo Capital’s actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange Commission . SuRo Capital undertakes no obligation to update any forward - looking statement to reflect events or circumstances that may arise after the date of this press release . Certain information discussed in this presentation (including information relating to portfolio companies) was derived from third - party sources and has not been independently verified . SuRo Capital makes no representation or warranty with respect to this information . The following slides contain summaries of certain financial and statistical information about SuRo Capital . The information contained in this presentation is summary information intended to be considered in connection with review of our SEC filings and other public announcements we may make, by press release or otherwise, from time to time . We undertake no duty or obligation to publicly update or revise the information contained in this presentation unless required to do so by law . In addition, information related to past performance, while it may be helpful as an evaluative tool, is not indicative of future results, the achievement of which cannot be assured . You should not view the past performance of SuRo Capital or any of its portfolio companies, or information about the market, as indicative of SuRo Capital’s or any of its portfolio companies’ future results . The performance data stated herein may have been due to extraordinary market or other conditions, which may not be duplicated in the future . Current performance may be lower or higher than the performance data quoted . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of SuRo Capital . Second Quarter 2020

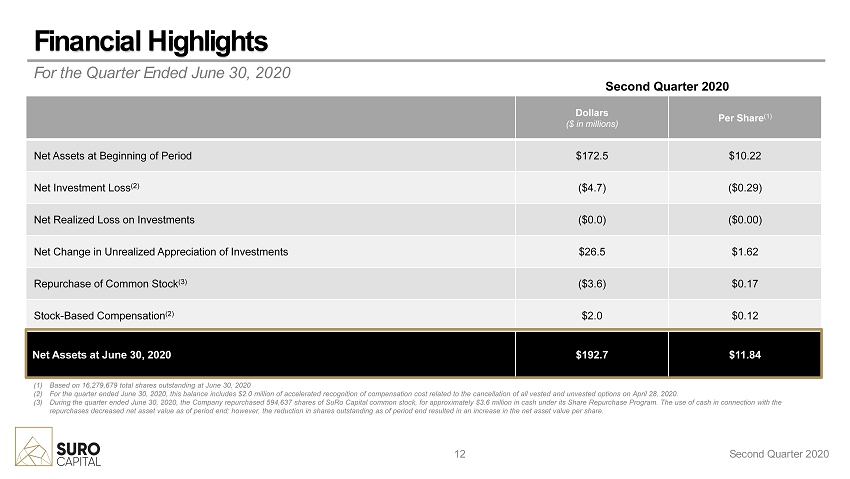

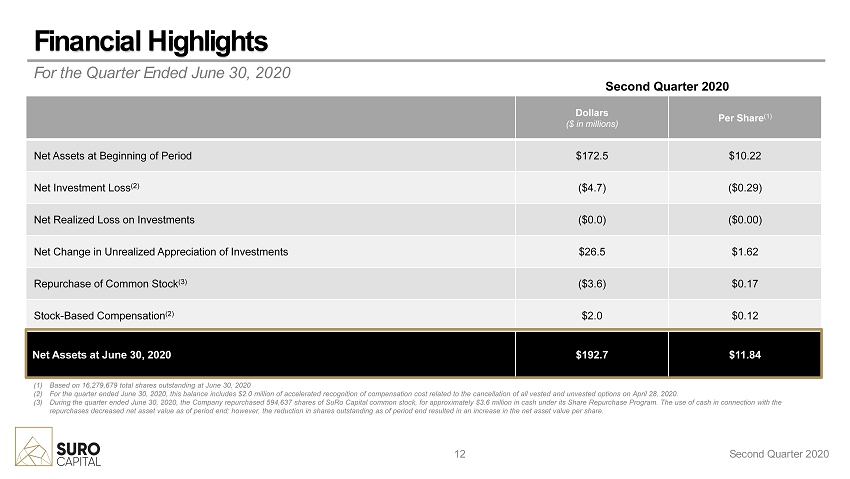

Overview and Impact of COVID - 19 Outbreak 3 SuRo Capital’s Net Asset Value per share is $ 11 . 84 as of June 30 , 2020 , SuRo Capital’s highest dividend - adjusted NAV in 5 years Increase from $ 10 . 22 per share at March 31 , 2020 Net Asset Value totaled approximately $ 192 . 7 million at quarter - end We continue to be optimistic about the future of our portfolio and believe our portfolio companies’ strong operating fundamentals and market opportunities will drive Net Asset Value growth as the economy recovers from the COVID - 19 outbreak On July 29 , 2020 , SuRo Capital declared a $ 0 . 15 per share dividend to be paid on August 25 , 2020 The COVID - 19 outbreak has had a severe negative impact on many families and on the financial markets, but our portfolio continues to be well positioned to manage the effects of the economic dislocation caused by COVID - 19 1 3 Second Quarter 2020 2

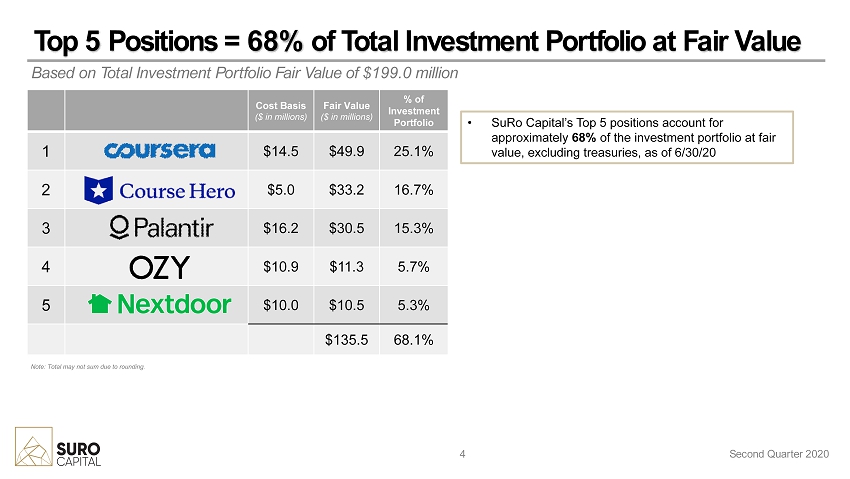

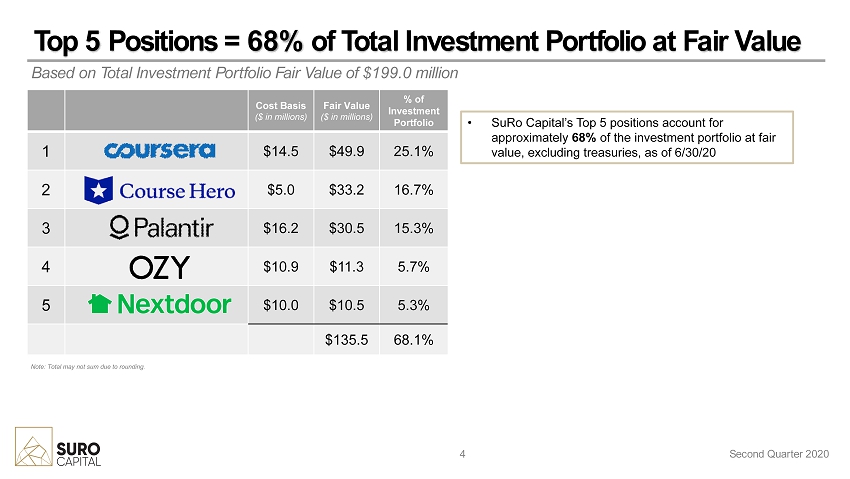

Top 5 Positions = 68 % of Total Investment Portfolio at Fair Value Based on Total Investment P ortfolio Fair V alue of $199.0 million 4 Cost Basis ($ in millions) Fair Value ($ in millions) % of Investment Portfolio 1 $14.5 $49.9 25.1% 2 $5.0 $33.2 16.7% 3 $16.2 $30.5 15.3% 4 $10.9 $11.3 5.7% 5 $10.0 $10.5 5.3% $135.5 68.1% • SuRo Capital’s Top 5 positions account for approximately 68% of the investment portfolio at fair value, excluding treasuries, as of 6/30/20 Note: Total may not sum due to rounding. Second Quarter 2020

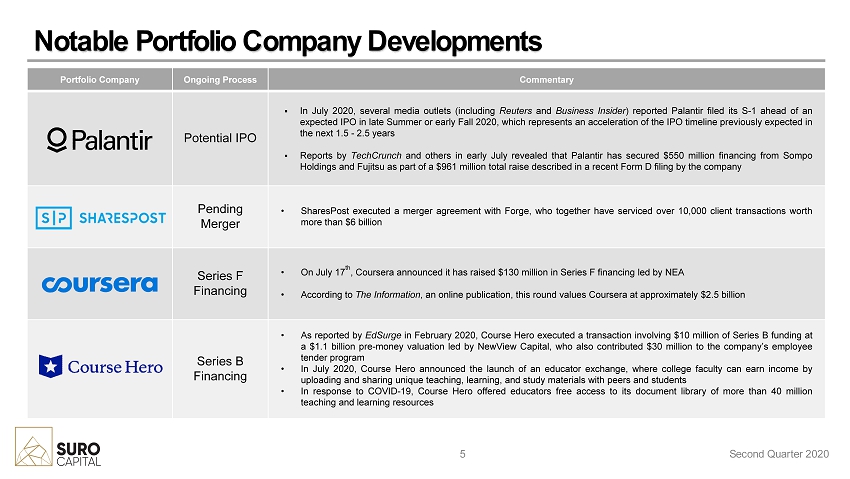

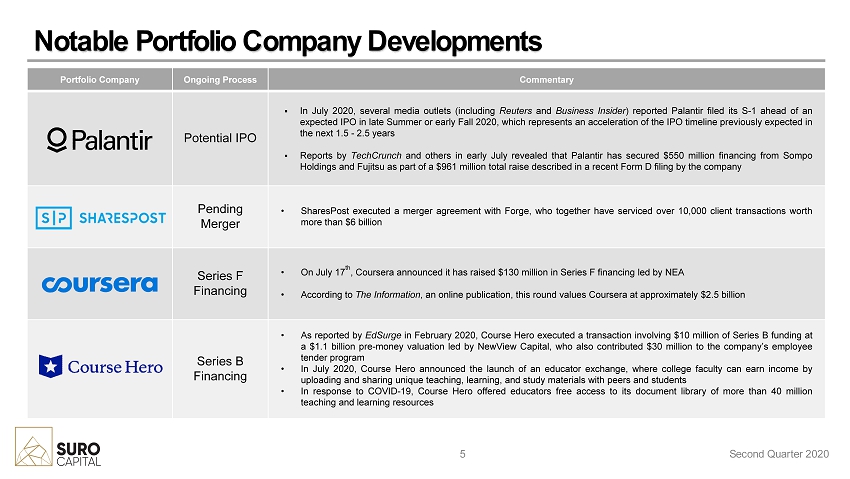

Notable Portfolio Company Developments 5 Second Quarter 2020 Portfolio Company Ongoing Process Commentary Potential IPO ▪ In July 2020 , several media outlets (including Reuters and Business Insider ) reported Palantir filed its S - 1 ahead of an expected IPO in late Summer or early Fall 2020 , which represents an acceleration of the IPO timeline previously expected in the next 1 . 5 - 2 . 5 years ▪ Reports by TechCrunch and others in early July revealed that Palantir has secured $ 550 million financing from Sompo Holdings and Fujitsu as part of a $ 961 million total raise described in a recent Form D filing by the company Pending Merger • SharesPost executed a merger agreement with Forge, who together have serviced over 10 , 000 client transactions worth more than $ 6 billion Series F Financing • On July 17 th , Coursera announced it has raised $ 130 million in Series F financing led by NEA • According to The Information , an online publication, this round values Coursera at approximately $ 2 . 5 billion Series B Financing • As reported by EdSurge in February 2020 , Course Hero executed a transaction involving $ 10 million of Series B funding at a $ 1 . 1 billion pre - money valuation led by NewView Capital, who also contributed $ 30 million to the company’s employee tender program • In July 2020 , Course Hero announced the launch of an educator exchange, where college faculty can earn income by uploading and sharing unique teaching, learning, and study materials with peers and students • In response to COVID - 19 , Course Hero offered educators free access to its document library of more than 40 million teaching and learning resources

47.5% 9.1% 18.8% 12.7% 11.4% Key Investment Themes As a Percentage of Total Investment Portfolio at Fair Value as of 6/30/2020 Note: Sustainability investment theme accounted for 0.5% of Total Investment Portfolio in the second quarter . 6 ($ in millions) (1) Sustainability investment theme accounted for 0.5%, or $0.9 million, of Total Investment Portfolio in the second quarter. (2) Total may not sum due to rounding. Legend Industry Theme (1) Fair Value % of Portfolio Education Technology $94.6 47.5% Big Data & Cloud $37.4 18.8% Financial Technology $25.3 12.7% Marketplaces $18.1 9.1% Social & Mobile $22.7 11.4% Total (2) $199.0 100.0% Second Quarter 2020

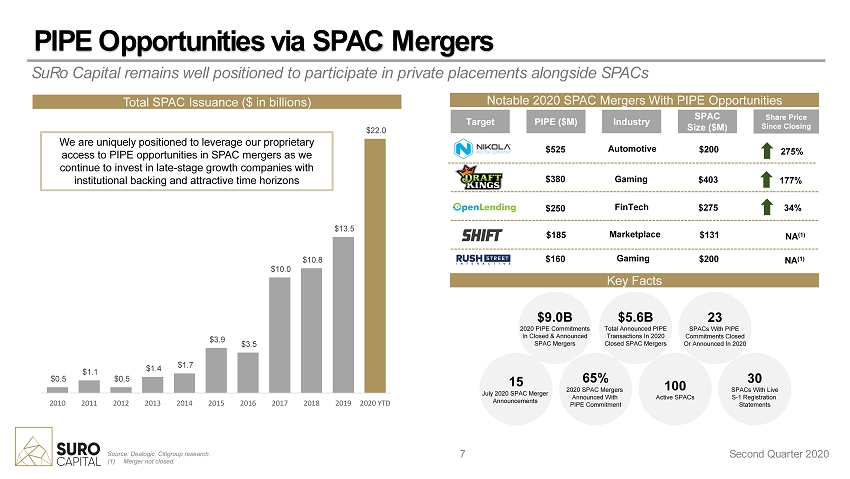

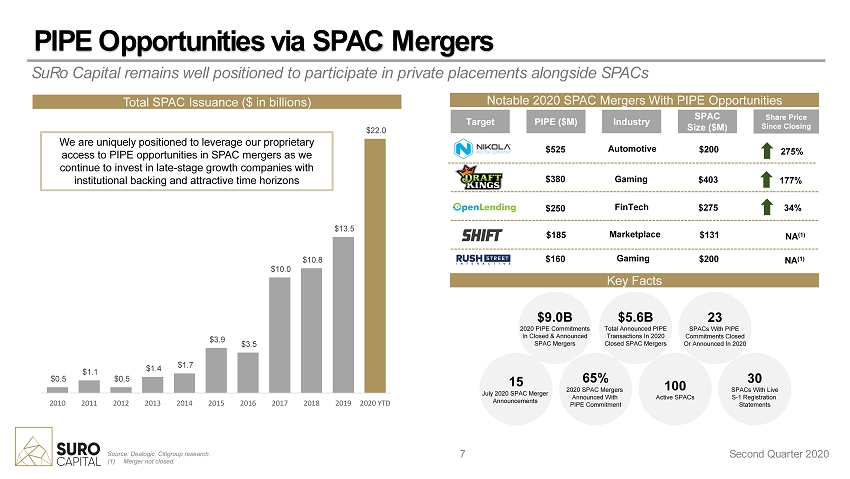

PIPE Opportunities via SPAC Mergers SuRo Capital remains well positioned to participate in private placements alongside SPACs 7 Second Quarter 2020 $0.5 $1.1 $0.5 $1.4 $1.7 $3.9 $3.5 $10.0 $10.8 $13.5 $22.0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD Source: Dealogic , Citigroup research. (1) Merger not closed. Key Facts 15 July 2020 SPAC Merger Announcements 65% 2020 SPAC Mergers Announced With P IPE Commitment 100 Active SPACs 30 SPACs With Live S - 1 Registration Statements $5.6B Total Announced PIPE Transactions In 2020 Closed SPAC Mergers $9.0B 2020 PIPE Commitments In Closed & Announced SPAC Mergers Notable 2020 SPAC Mergers With PIPE Opportunities Total SPAC Issuance ($ in billions) We are uniquely positioned to leverage our proprietary access to PIPE opportunities in SPAC mergers as we continue to invest in late - stage growth companies with institutional backing and attractive time horizons Target PIPE ($M) Industry SPAC Size ($M) Share Price Since Closing $380 Gaming $403 177% 34% FinTech $250 $275 $525 Automotive $200 275% $160 Gaming $200 NA (1) $185 Marketplace $131 NA (1) 23 SPACs With PIPE Commitments Closed Or Announced In 2020

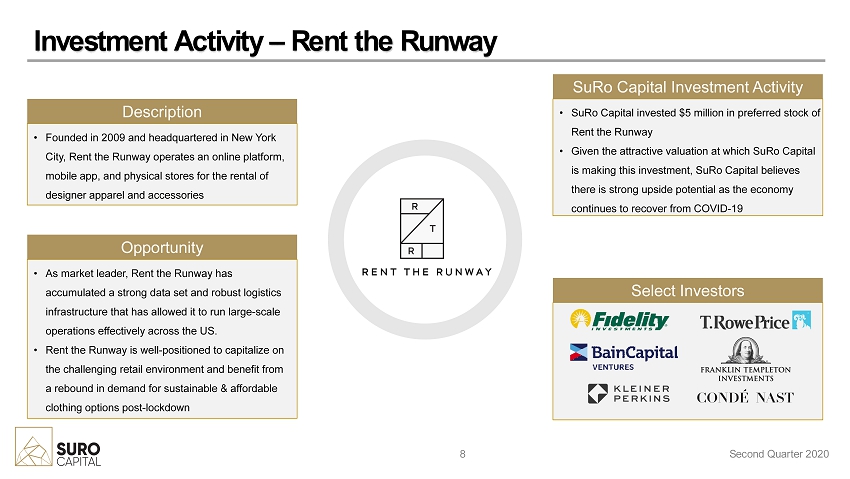

8 Investment Activity – Rent the Runway • Founded in 2009 and headquartered in New York City, Rent the Runway operates an online platform, mobile app, and physical stores for the rental of designer apparel and accessories Description • As market leader, Rent the Runway has accumulated a strong data set and robust logistics infrastructure that has allowed it to run large - scale operations effectively across the US. • Rent the Runway is well - positioned to capitalize on the challenging retail environment and benefit from a rebound in demand for sustainable & affordable clothing options post - lockdown Opportunity • SuRo Capital invested $5 million in preferred stock of Rent the Runway • Given the attractive valuation at which SuRo Capital is making this investment, SuRo Capital believes there is strong upside potential as the economy continues to recover from COVID - 19 SuRo Capital Investment Activity Select Investors Second Quarter 2020

9 Investment Activity – Palantir Lending Trust • As part of our previously announced private credit initiatives, during Q2, SuRo Capital structured a collateralized loan to Palantir Lending Trust, a trust owned by an ex - Palantir employee Description • The collateralized loan funded the exercise of, and payment of associated taxes for, 2.26 million Class B common shares of Palantir Technologies, Inc. • SuRo Capital also participates in additional equity upside of underlying shares in a future liquidity event Opportunity • Term: 24 months (pre - payable if the Palantir shares are sold in an approved private or public transaction) • Interest Rate: 15% • Equity Upside: SuRo Capital participates in equity upside above $5.29 per share. The total participation varies based on the liquidation date of shares as well as the price per share at the time of liquidation Collateralized Loan Terms Palantir Company Update Second Quarter 2020 • In July 2020, several media outlets reported that Palantir confidentially filed its S - 1 ahead of an expected public listing in Summer or Fall 2020 • The potential public listing comes as Palantir reportedly expects to generate $1 billion in revenue this year and break even for the first time in its 16 - year history

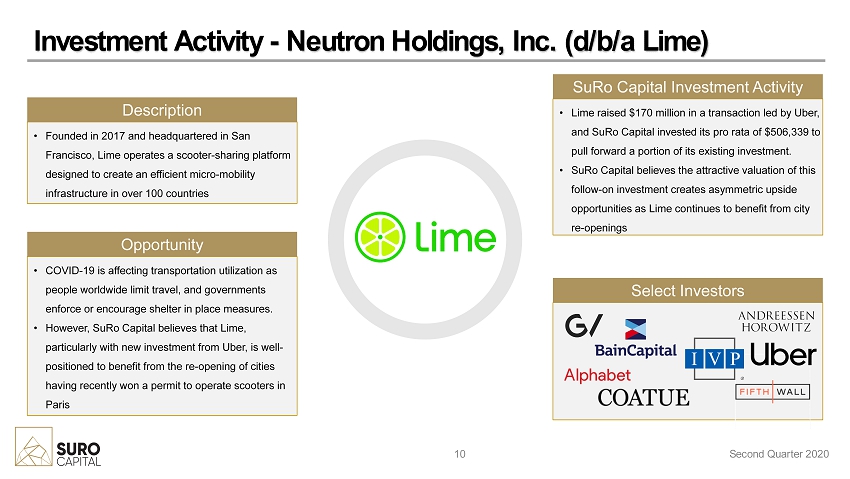

10 Investment Activity - Neutron Holdings, Inc. (d/b/a Lime) Second Quarter 2020 • Founded in 2017 and headquartered in San Francisco, Lime operates a scooter - sharing platform designed to create an efficient micro - mobility infrastructure in over 100 countries Description • COVID - 19 is affecting transportation utilization as people worldwide limit travel, and governments enforce or encourage shelter in place measures. • However, SuRo Capital believes that Lime, particularly with new investment from Uber, is well - positioned to benefit from the re - opening of cities having recently won a permit to operate scooters in Paris Opportunity • Lime raised $170 million in a transaction led by Uber, and SuRo Capital invested its pro rata of $506,339 to pull forward a portion of its existing investment. • SuRo Capital believes the attractive valuation of this follow - on investment creates asymmetric upside opportunities as Lime continues to benefit from city re - openings SuRo Capital Investment Activity Select Investors

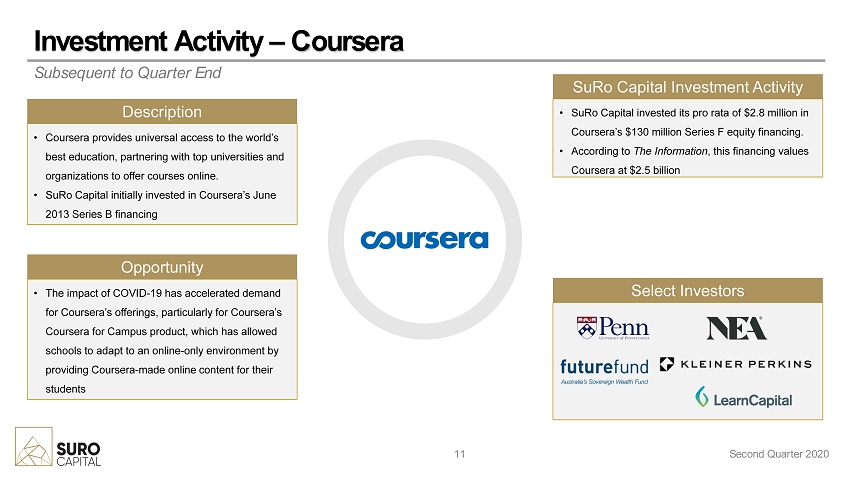

11 Investment Activity – Coursera • Coursera provides universal access to the world’s best education, partnering with top universities and organizations to offer courses online. • SuRo Capital initially invested in Coursera’s June 2013 Series B financing Description • The impact of COVID - 19 has accelerated demand for Coursera’s offerings, particularly for Coursera’s Coursera for Campus product, which has allowed schools to adapt to an online - only environment by providing Coursera - made online content for their students Opportunity • SuRo Capital invested its pro rata of $2.8 million in Coursera’s $130 million Series F equity financing. • According to The Information , this financing values Coursera at $2.5 billion SuRo Capital Investment Activity Select Investors Second Quarter 2020 Subsequent to Quarter End

Dollars ($ in millions) Per Share (1) Net Assets at Beginning of Period $172.5 $10.22 Net Investment Loss (2) ($4.7) ($0.29) Net Realized Loss on Investments ($0.0) ($0.00) Net Change in Unrealized Appreciation of Investments $26.5 $1.62 Repurchase of Common Stock (3) ($3.6) $0.17 Stock - Based Compensation (2) $2.0 $0.12 Net Assets at June 30, 2020 $192.7 $11.84 12 Financial Highlights For the Quarter Ended June 30, 2020 (1) Based on 16,279,679 total shares outstanding at June 30, 2020 (2) For the quarter ended June 30, 2020, this balance includes $2.0 million of accelerated recognition of compensation cost relat ed to the cancellation of all vested and unvested options on April 28, 2020. (3) During the quarter ended June 30, 2020, the Company repurchased 594,637 shares of SuRo Capital common stock, for approximatel y $ 3.6 million in cash under its Share Repurchase Program. The use of cash in connection with the repurchases decreased net asset value as of period end; however, the reduction in shares outstanding as of period end resulte d i n an increase in the net asset value per share. Second Quarter 2020 Second Quarter 2020

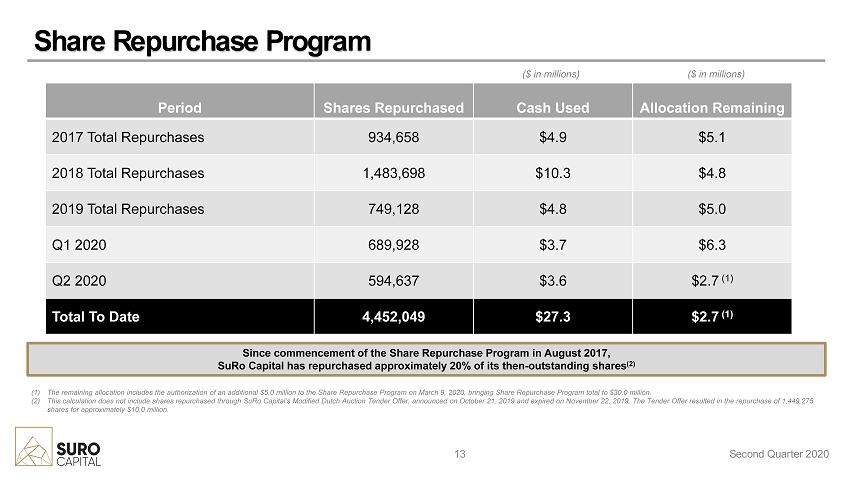

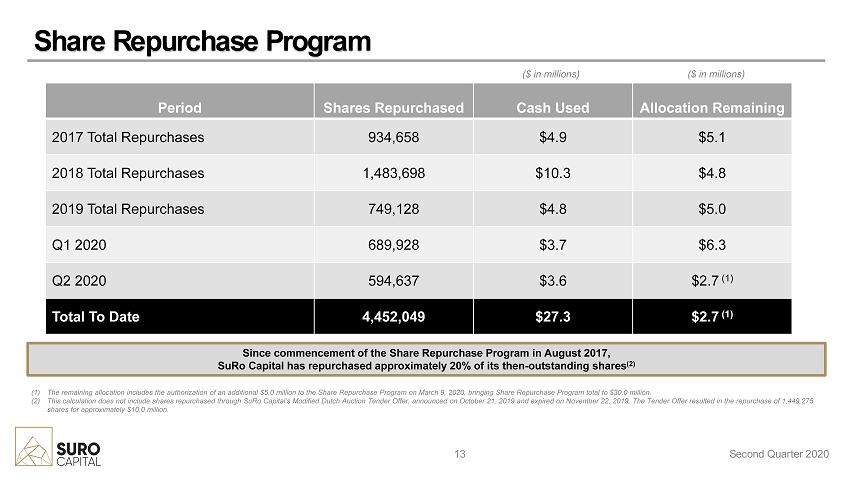

13 Share Repurchase Program Since commencement of the Share Repurchase Program in August 2017, SuRo Capital has repurchased approximately 20% of its then - outstanding shares (2) Period Shares Repurchased Cash Used Allocation Remaining 2017 Total Repurchases 934,658 $4.9 $5.1 2018 Total Repurchases 1,483,698 $10.3 $4.8 2019 Total Repurchases 749,128 $4.8 $5.0 Q1 2020 689,928 $3.7 $6.3 Q2 2020 594,637 $3.6 $2.7 (1) Total To Date 4,452,049 $27.3 $2.7 (1) ($ in millions) ($ in millions) (1) The remaining allocation includes the authorization of an additional $5.0 million to the S hare Repurchase Program on March 9, 2020, bringing Share Repurchase Program total to $30.0 million. (2) This calculation does not include shares repurchased through SuRo Capital’s Modified Dutch Auction T ender Offer, announced on October 21, 2019 and expired on November 22, 2019. The Tender Offer resulted in the repurchase of 1 ,44 9,275 shares for approximately $10.0 million. Second Quarter 2020