NQ Mobile Inc.

No. 4 Building, 11 Heping Li East Street

Dongcheng District, Beijing 100013

People’s Republic of China

January 20, 2017

VIA EDGAR

Ms. Kathleen Collins, Accounting Branch Chief

Ms. Joyce Sweeney, Staff Accountant

Mr. Bernard Nolan, Staff Attorney

Ms. Jan Woo, Legal Branch Chief

Office of Information Technologies and Services

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Re: | NQ Mobile Inc. (the “Company”) |

Form 20-F for the Fiscal Year Ended December 31, 2015

Filed April 6, 2016

File No. 001-35145

Dear Ms. Collins, Ms. Sweeney, Mr. Nolan and Ms. Woo:

This letter sets forth the Company’s responses to the comments contained in the letter dated January 5, 2017 from the staff (the “Staff”) of the U.S. Securities and Exchange Commission regarding the Company’s Form 20-F for the fiscal year ended December 31, 2015 (the “2015 Form 20-F”). The Staff’s comments are repeated below and are followed by the Company’s responses thereto. All capitalized terms used but not defined in this letter shall have the meaning ascribed to such terms in the 2015 Form 20-F.

Item 4. Information on the Company

C. Organizational Structure, page 66

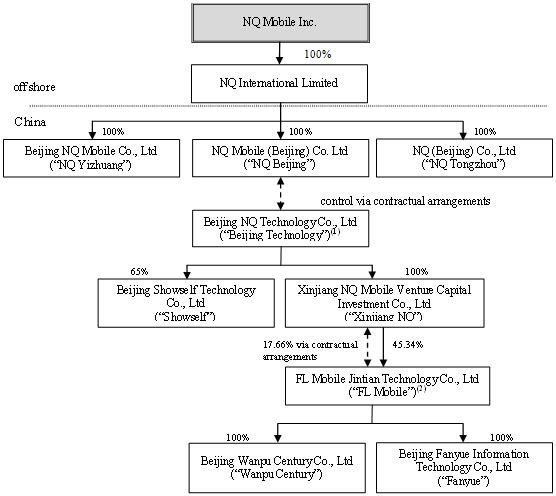

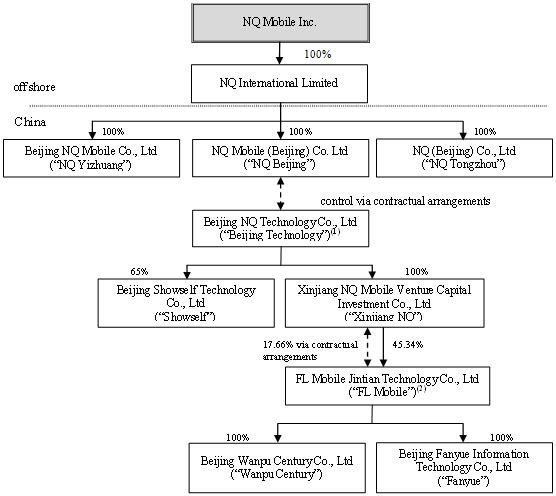

| 1. | We note your proposed disclosure in response to prior comment 3. Please provide us with an updated organization chart reflective of the recent FL Mobile transactions. |

In response to the Staff’s comments, the Company presents below an updated organizational chart with major subsidiaries as of the date of this letter, which reflects the recent transactions related to the proposed divestment of FL Mobile (the “FL Mobile Divestment”).

1

| | |

| | Equity interest. |

| |

| | Contractual arrangements including exclusive technical consulting services agreement, exclusive business cooperation agreement, business operation agreements, powers of attorney, equity disposition agreements, loan agreements and equity interest pledge agreements. |

| (1) | The shareholders of Beijing Technology are Dr. Vincent Wenyong Shi, our founder, chief operating officer and chairman of the board, Ms. Lingyun Guo, our chief strategy officer and director, and Mr. Xu Zhou, our founder, holding 14.75%, 52.00% and 33.25% of Beijing Technology’s equity interests respectively. Dr. Shi, Ms. Guo and Mr. Zhou also collectively own RPL, which holds 10.5% of common shares and 53.9% of voting power in our Company. |

| (2) | The shareholders of FL Mobile are Xinjiang NQ, Dr. Vincent Wenyong Shi, Beijing Jinxin Hengrui Investment Center (Limited Partnership), Xinjiang Yinghe Equity Investment Management Limited Partnership (“Xinjiang Yinghe”), Nantong Jinxin Haoyue Investment Center (Limited Partnership), Nantong Jinxin Huatong Equity Investment Center (Limited Partnership) and Tibet Zhuohua Capital Management Co., Ltd., each holding 45.34%, 22.00%, 13.13%, 12.00%, 3.53%, 3.00% and 1.00% of equity interests, respectively. Xinjiang NQ is our consolidated affiliate and Xinjiang Yinghe is an affiliate of the management of FL Mobile. Dr. Vincent Wenyong Shi is our founder, chief operating officer and chairman of the board. He also partially owns RPL, which holds 10.5% of the common shares and 53.9% of voting power in our Company. All the remaining shareholders of FL Mobile are not affiliated to us. |

Dr. Vincent Wenyong Shi and Xinjiang Yinghe act as nominee shareholders of us for 5.66% and 12.00% of equity interests in FL Mobile via contractual arrangements, respectively.

Item 5. Operating and Financial Review and Prospects

A. Operating Results

2

Year Ended December 31, 2015 Compared to Year Ended December 31, 2014, page 84

D. Trend Information

| 2. | We note your response to prior comment 5 that you determined it was not necessary to discuss the potential impact of the FL Mobile divestiture on your business because it was not likely to be completed this fiscal year. To the extent known, you should discuss not only short-term material trends but also long-term material trends and events. In this regard, we note in part your response to prior comment 13 that you have remained committed to the divestiture pursuant to the FL Framework Agreement. In addition, you stated on your 2016 third quarter earnings call that the divestiture “remains a major focus” and you are “working as hard as [you] can to reach a conclusion as soon as possible.” Thus, it appears that the FL Mobile divestiture has been a known material event or uncertainty notwithstanding the cancellation of transactional agreements with Gansu Huangtai and Shenzhen Prince. Please confirm that you will provide conforming disclosure in future filings. Refer to Item 5 of Form 20-F and Section III of SEC Release No. 33-8350. To clarify the significance of the FL Mobile business, such disclosure should quantify the amount of revenues and net income/(loss), if determinable, generated by FL Mobile for the periods presented. |

The Company respectfully advises the Staff that it will describe and quantify the potential impact on the Company’s operating results by quantifying the amount of revenues and net income/(loss) generated by FL Mobile in its future filings.

| 3. | We note from your response to prior comment 5 that revenues generated by FL Mobile comprised approximately 36% of total revenues in 2015. On page F-9 you disclose that the principal activities of FL Mobile are mobile advertising and mobile games services. Please separately quantify the amount of advertising and mobile gaming revenues generated by FL Mobile for fiscal year 2015 and the nine months ended September 30, 2016. If determinable, please tell us the amount of net income/(loss) generated by FL Mobile for these periods, separately quantifying amounts attributed to non-controlling interests. Also, revise your disclosures as necessary to clarify the source of your advertising and mobile gaming revenues. In this regard, on page 47 you disclose that revenues generated from advertising are derived mainly from the third party application referrals in your online and offline advertising networks which were the result of your acquisition of Wanpu Century and Fanyue. |

The amount of advertising and mobile gaming revenues to third parties generated by FL Mobile for fiscal year 2015 was US$64.2 million and US$73.8 million, respectively. For the nine months ended September 30, 2016, the amount was US$63.2 million and US$63.2 million, respectively.

Net income generated by FL Mobile for fiscal year 2015 was US$36.2 million, in which US$1.7 million was recorded as attributable to non-controlling interest. Net income for the nine months ended September 30, 2016 was US$29.8 million, in which US$8.0 million was recorded as attributable to non-controlling interest.

The Company respectfully advises the Staff that Wanpu Century and Fanyue are wholly owned by FL Mobile. In response of the Staff’s comment, the Company plans to revise its disclosure in its future filings to clarify that revenues generated from advertising business are derived mainly from the third party application referrals in its online and offline advertising networks which were the result of the acquisitions of Wanpu Century and Fanyue by FL Mobile.

3

Consolidated Financial Statements

Notes to Consolidated Financial Statements

Note 1. Principal Activities and Organization

(b) Reorganization and Proposed FL Transaction, page F-7

| 4. | We note your response to prior comment 6. Please describe your basis for concluding that consideration under the Termination Agreements was determined on an arm’s-length basis considering the related party nature of the transaction. Explain why Dr. Shi is paying less for his percentage ownership in FL Mobile than the other parties and tell us how you are accounting for the difference. |

The Company respectfully advises the Staff that in August 2015, the parties to the FL Framework Agreement agreed on the valuation of FL Mobile at RMB4 billion based on discounted cash flow analysis and asset liquidation value method. The series of transactions of the FL Mobile Divestment, including the sale of 22% equity interests in FL Mobile to Dr. Shi as announced on March 24, 2016, the sale of 13.13% equity interests in FL Mobile to Jinxin Hengrui as announced on May 6, 2016, and the sale of 64.87% equity interests in FL Mobile to Shenzhen Prince as announced on May 17, 2016, were negotiated among the Company and the purchasers as one deal pursuant to the Framework Agreement in early 2016 after the termination of the proposed transaction with Gangsu Huangtai. The key factor in concluding the consideration for the transactions announced on May 6 and May 17, 2016, is that Shenzhen Prince together with Jinxin Hengrui and its affiliates sought to obtain control over FL Mobile and agreed to pay a premium for such controlling power. The accounting treatment of the divestiture of FL Mobile to Dr. Shi and other investors is the same, and the difference of the valuation reflects the difference between controlling interests and minority interests.

In addition, the Company would like to further update the Staff that it is currently engaged in an active discussion with another potential purchaser to complete the FL Mobile Divestment, which is likely to value FL Mobile at RMB4 billion based on the purchase price specified in the non-binding letter of intent.

| 5. | In your response to prior comment 6 you state that concurrently with the reversal of his 5.66% equity interest, Dr. Shi entered into a series of contractual arrangements with Xinjiang NQ to act as the nominee shareholder of the 5.66% equity interest on behalf of Xinjiang NQ. We further note based on the Form 6-K filed on November 25, 2016 that Xinjiang Yinghe will act as the nominee shareholder of the 12% equity interest on behalf of Xinjiang NQ. Please describe the reasons for the nominee shareholder arrangements and describe any voting or dispositive rights that Dr. Shi and Xinjiang Yinghe may have as nominee shareholders. |

The Company respectfully advises the Staff that the nominee shareholder arrangement through contractual arrangements was used because in anticipation of upcoming transaction(s) to complete the FL Mobile Divestment, the parties would like to avoid the documentation and filing process with local PRC governmental authorities in connection with the reversal of Dr. Shi’s and Xinjiang Yinghe’s equity interests in FL Mobile.

4

Under the contractual arrangement with Dr. Shi and Xinjiang Yinghe, Dr. Shi and Xinjiang Yinghe granted the irrevocable and exclusive power of attorney to the Company to exercise their voting power of the 17.66% equity interests. In addition, they are also contractually obliged not to dispose or exercise voting power themselves with respect to the 17.66% equity interests in FL Mobile. Dr. Shi and Xinjiang Yinghe have presigned all necessary documents for the Company to regain direct holding of the 17.66% equity interests in lieu of contractual arrangements at anytime.

| 6. | Regarding the August 26, 2015 FL Framework Agreement, you disclose that all shareholders of FL Mobile Inc. agreed to sell the entire stake in FL Mobile Inc. for no less than RMB4 billion, with the final price being subject to the valuation of an independent third party appraiser. Please address the following: |

| | • | | Tell us the parties involved in arriving at the RMB4 billion minimum consideration and their relationship to the company; |

The Company respectfully advises the Staff that the parties involved are then shareholders of FL Mobile Inc., including Bison Mobile Limited, Prosnav Mobile Investment, Zhou Jing, Treasure Getter Limited, Camaxx International Trade Company Limited (collectively “non-controlling shareholders”) and the Company, on the one hand, and Beijing Jinxin Rongda Investment Management Co., Ltd. (“Jinxin Rongda”), on the other hand, agreed on the minimum consideration of RMB4 billion in the August 26, 2015 FL Framework Agreement. Both the non-controlling shareholders of FL Mobile and Jinxin Rongda were not affiliated with the Company.

| | • | | Describe in detail how this initial purchase price was established, including any specific valuation techniques used; |

The Company respectfully advises the Staff that discounted cash flow analysis was used to evaluate the operation of FL Mobile and the liquidation value method was used to evaluate the assets not used in FL Mobile’s operation.

| | • | | Tell us whether there are any conditions, such as a minimum and/or maximum amount, for the final price determination upon receipt of an independent third party appraisal; |

The Company respectfully advises the Staff that the minimum amount for the final price is RMB4 billion, and there were no other conditions attached to the final price determination.

| | • | | Describe what would be the impact if such an independent appraisal resulted in a valuation estimate less than RMB4 billion; and |

The Company respectfully advises the Staff that the final price would remain RMB4 billion even if the independent appraisal resulted in a valuation estimate less than such amount.

5

| | • | | Explain the reasons for the significant increase in the valuation to RMB5 billion as disclosed in your May 17, 2016 Form 6-K. |

Please refer to the Company’s response to comment 4 above.

| 7. | We note your response to prior comment 13 that Dr. Shi’s transaction is still subject to both parties’ option to revert in certain circumstances. Please describe the circumstance in which the option to revert is exercisable and clarify if the option is exercisable by either party unilaterally. Also, tell us whether there are any circumstances in which the transactions with Jinxin Hengrui, Jinxin Haoyue, Jinxin Huatong, and Tibet Zhuohua could be reversed or the purchase price adjusted. |

The Company respectfully advises the Staff that, for the transaction with Dr. Shi as announced on March 24, 2016, either party has the option to unilaterally revert the transaction if the proposed listing of FL Mobile on the stock exchanges in China (the “A-Share Listing”) is terminated or the parties reasonably concluded that it’s unlikely to obtain necessary approvals from government authorities in China for the A-Share Listing. Dr. Shi has the option to unilaterally revert the transaction after the second anniversary of the agreement date, provided that neither party may request to revert the transaction after the A-Share Listing is approved by the Chinese government authorities.

The transactions with Jinxin Hengrui, Jinxin Haoyue, Jinxin Huatong and Tibet Zhuohua, respectively, are not subject to reversal, unless otherwise mutually agreed by both parties.

| 8. | As a related matter, on page F-20 you disclose that since the occurrence of the put option is not solely within the control of the company, you classify the non-controlling interest of the FL Mobile shareholders as mezzanine equity instead of permanent equity. Please tell us how you considered the guidance in ASC 480-10-S99-3A as it relates to Dr. Shi’s equity interest in FL Mobile. |

ASC 480-10-S99-3 a requires preferred securities that are redeemable for cash or other assets to be classified outside of permanent equity if they are redeemable (1) at a fixed or determinable price on a fixed or determinable date, (2) at the option of the holder, or (3) upon the occurrence of an event that is not solely within the control of the issuer. This guidance also applies to other redeemable equity instruments including non-controlling interest. Dr. Shi’s transaction contains an option of reversal by either party, not redeemable upon the occurrence of an event that is not solely within the control of the company. Therefore, the Company recorded the consideration received from Dr. Shi as a deposit liability.

(h) Allowance for Doubtful Accounts, page F-17

| 9. | We note your response to prior comment 7 that days sales outstanding has decreased from 152 in fiscal 2013 to 79 in fiscal 2015 due to the expansion of Game and Advertising and Live Mobile Social Video Platform businesses and strengthened control over collection of receivables. Considering these positive factors, please explain why the allowance for doubtful accounts is currently at a significantly higher level relative to accounts receivable than compared to December 31, 2013. Clarify if there are specific significant accounts or customer groups with delinquencies and whether any such collection concerns are with customers with whom you have an ongoing relationship. To the extent that there are credit quality concerns despite improvements in overall days sales outstanding, please discuss this in future filings. |

6

The Company respectfully advises the Staff that due to the expansion of the mobile internet business, the total net revenue increased from US$196.7 million in 2013 to US$ 406.7 million in 2015, and the number of customer rose significantly. Meanwhile, the Company moved its business focus away from security services to mobile application and service since 2014, and as a result, certain previous ongoing customers involved in security business became inactive and the collection period became longer. For specific inactive customers, the Company provides allowance with doubtful collection, based on properly evaluation to specific evidence including historical experience and account balance aging. There are no significant collection concerns with customers with whom the Company have an ongoing relationship.

(r) Revenue Recognition

Live Mobile Social Video Platform, page F-22

| 10. | In your response to prior comment 8 you state that revenues earned from sales through distributors are recognized net of the sales discount, however, your disclosure indicates that such revenues are recognized on a gross basis. In future filings, please revise to disclose that such revenues are recognized net of the sales discount to distributors. In addition, revise to clarify the timing of revenue recognition for sales to distributors. In this regard, it is unclear whether your current disclosure indicating that revenue is recognized ratably over the estimated average paying period of paying users relates solely to sales through third-party collection channels or also to distributor sales. |

The Company respectfully advises the Staff that it will revise the disclosure to clarify that revenues earned from sales through distributors are recognized net of the sales discount to distributors in its future filings. The Company further advises the Staff that both revenues from sales through third-party collection channels and distributors are recognized ratably over the estimated average paying period of paying users, which will also be presented in the Company’s future filings.

| 11. | In your response to prior comment 8 you state that the company has discretion to determining the price sold to distributors. Please clarify whether you have any discretion as to the price at which virtual currency is sold by distributors to the sales agents. If not, in future filings please revise your disclosure where you state currently that the Group has discretion to determine the price of the virtual currency sold to sales agents or users and clarify that you have pricing discretion for sales with distributors. |

The Company respectfully advises the Staff that the Company has discretion to determining the price sold to distributor, but has no discretion as to the price at which virtual currency is sold by distributors to the sales agents. The Company plans to revise relevant disclosure in its future filings.

Note 10. Goodwill, page F-53

| 12. | In your response to prior comment 9 you state that the company’s share price had been relatively stable throughout fiscal 2015 and that you believe the market value was underestimated. Please provide us with a comprehensive analysis supporting your conclusion that the market value was underestimated and for that length of time. In your response, please address the following: |

7

| | • | | Explain how the company’s quoted share price in an active market did not represent the price at which a market participant would purchase shares in an orderly transaction in the current market conditions throughout fiscal 2015; |

In most cases, the quoted market price in active markets is the best indication of fair value. Though such situation holds true in the long run, short term market price may deviate from the fair value due to factors such as, industry specific factors; concerns on economic prospects; currency risk and the extent of confidence in investing in China Concept Stocks. In our case, the Company believes its quoted price was underestimated with the following analysis: from a valuation perspective, the business of the Company can be simply divided into two components: FL Mobile and the rest of the Company. In analyzing the value of the Company as a whole, we shall add the respective fair value of these two parts.

In analyzing the fair value of FL Mobile, we mainly considered and referenced the following transaction:

In August 2015, the Company entered into a legally binding Framework Agreement with Jinxin Rongda, an independent third-party investor, to sell the Company’s entire stake in FL Mobile. Both parties reached an agreement on the transaction price of no less than RMB4 billion (approximately US$626 million). This agreement indicated that the value of FL Mobile, a part of the Company’s current business, was accepted by the capital markets, as evident by the agreed sales price from an independent institutional investor.

Furthermore, 13.13% of FL Mobile’s equity interests were sold to an independent third-party investor in May 2016 and another aggregated 7.53% was sold to three other independent third-party investors on August 2016, as announced by the Company in year 2016. These recently completed equity transactions were regarded as implying an acceptable fair value of FL Mobile with no less than RMB 4 billion (approximately US$626 million).

In analyzing the value of the remaining part of the Company, we took a conservative method. As the reported net asset excludes all goodwill and intangible assets was US$57.6 million as of 31 Dec 2015, this part of the Company shall be valued at least US$57.6 million accordingly.

From the above method the fair value of the Company as a whole should be at least above US$600 million, which was higher than the market capitalization of the Company throughout the fiscal year of 2015. The market capitalization of the Company was between $259.3 million and $381.7 million during the month of August 2015, which was between 43.2% and 63.6% of the sales price of FL Mobile indicated in the Framework Agreement for the same period. Therefore, the Company believes its quoted share price was underestimated throughout the fiscal year of 2015.

| | • | | Address your consideration of the company’s share price in fiscal 2016; and |

The average closing trading price of the Company’s ADS in the fiscal year of 2016 was $3.87 per ADS, indicating a market capitalization of approximately US$330 million. Therefore, the Company believed that the quoted share price was still underestimated for the fiscal year of 2016. The FL mobile divestment progress might be one consideration of the share price.

8

| | • | | Reconcile the estimated fair value of the reporting units to the company’s market capitalization as of the date of your most recent goodwill impairment testing. |

Please refer to ASC 810-10-35-41.

The Company respectfully advises the Staff that we were not able to determine the relevance of ASC 810-10-35-41 to the matter of reconciling the estimated fair value of the reporting units to the company’s market capitalization. Nevertheless, as stated above, based on a sum-of-the parts valuation, the fair value of the Company is at least determined by aggregating the fair value of FL Mobile and the remaining part of business, which exceeds the current market capitalization.

In reconciling the estimated fair value of the reporting units to the Company’s market capitalization of the date of our most recent goodwill impairment testing, we considered the following items: The aforementioned transaction was priced in RMB, it may bring certain concerns to investors outside mainland China as RMB has been suffering devaluation since the third quarter of 2015. The value of the RMB against the U.S. dollar is affected by, among others, changes in China’s macro political and economic conditions, which may have impact on investors’ confidence abroad. Meanwhile, ongoing changes in Chinese domestic capital market conditions and ongoing uncertainty surrounding relevant policies in China would also affect expectation about the FL divesture, which may result in the difference between the fair value and the market price.

| 13. | In your response to prior comment 10 you state that the Security and Others reporting unit consists of entities historically acquired and your original business line relating to mobile security. You also state that the live mobile social video platform component contributed the majority cash flow to this reporting unit. As such, it appears that at a minimum this reporting unit is comprised of your mobile security business as well as your Showself business. Please identify the various components of this reporting unit and tell us how you determined that the aggregated components have similar economic characteristics. Refer to ASC 350-20-35-35. |

The Security and Others reporting unit included mobile security, live mobile social video platforms, and internet traffic related business including mobile personal medical care application, dynamic mobile wallpaper application and music search application as of December 31, 2015.

According to ASC 280-10-50-11, the Company analyzed the aforementioned components in this reporting unit, and concluded that the aggregated components have similar economic characteristics.

| | a. | The nature of the products and services |

9

According to ASC 280-10-50-11, if the related products or services have similar purposes or end users, they may be expected to have similar rates of profitability, similar degrees of risk and similar opportunities for growth. The end users are mainly individual consumers, especially youths who are fashionable and interested in the IT products. As most of the products or services are in the inception stage and the mobile security business is seeking for business model transition thus is also in an early stage, therefore, they face similar degree of risk. Since they face the similar economic and industry environment, they share similar opportunity for future growth. Therefore, the nature of the products and services are very similar.

| | b. | The nature of the production processes |

The production process for these components is similar. Below is a flow chart that describes the process:

R&D Products (application)

Products (application) Promotion (online or pre-install)

Promotion (online or pre-install) Monetization

Monetization

Usually, the process starts with research and development, and after the completion of the research and development process, a product is produced and delivered to the market. Then the entity will enter the promotion stage, when the entity will either promote the products online or pre-install the program in mobile devices. The goal of the promotion stage is to obtain as many end users as possible. After the entity obtains sufficient end users, they will enter the monetization stage. The entity generates revenue either by charging forward or charging backward. Charging forward is to ask users to pay before they use the product. For example, customers of Showself are required to purchase virtual currency in order to purchase value-added services in its online video chat room, online games and other services. Charging backward is mainly through the charge to advertisers or business partners for advertising fee or commission fees. These two methods are the popular monetization methods in the internet industry.

| | c. | The type or class of customer for their products and services |

All of the products or services’ customers are individual consumers, mainly youths who are fashionable and enthusiastic about the IT products.

| | d. | The methods used to distribute their products or provide their services |

The products or services are promoted online or through pre-installing their applications in mobile devices. The common characteristic of these products or services is the intention to reach end users first. Once the end users base is built, the entity could monetize the business. Also, the Company expects these entities to share the user traffic and end users to maximize the synergy.

| | e. | If applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities. |

The components are all in the IT industry; therefore, they face the same regulatory environment within China and overseas.

| 14. | Please confirm that in future filings you will provide the information included in response to prior comment 10 for reporting units that you believe are at risk of failing step one of the goodwill impairment testing. In addition, revise to clarify that your live mobile social video platform business is included within the Security and Others reporting unit. |

10

The Company respectfully advises the Staff that it will provide the information included in response to prior comment 10 for reporting units that are believed to be at risk of failing step one of the goodwill impairment testing in its future filings. The Company further advises the Staff that the live mobile social video platform business is included within the Security and others reporting unit, which will also presented in the Company’s future filings.

| 15. | We note your response to prior comment 10 regarding potential events and/or changes in circumstances that could negatively affect key assumptions. To the extent that the reporting unit’s current results differ significantly from the assumptions used in your analysis, please confirm that in future filings you will specifically discuss how the reporting unit is performing and any changes in assumptions compared to what you expected as part of your most recent impairment analysis. We would expect disclosure to address how such trends could reasonably be expected to negatively affect the key assumptions and impact your fair value estimates. We refer you to Item 5.D of Form 20-F, Section V of SEC Release No. 33-8350 and FRR 501.14. |

The Company respectfully advises the Staff that if there is significant difference between the assumption used in most recent impairment analysis and the reporting unit’s performance, the Company will discuss how the reporting unit is performing and any changes in assumptions in its future filings and will disclose how such trends could reasonably be expected to negatively affect the key assumptions and impact your fair value estimates.

Note 21. Segment Information, page F-74

| 16. | We note your response to prior comment 11 that the investment in NationSky was recorded by Beijing Technology, which is included in the Consumer segment. There are disclosures throughout your filing discussing NationSky as contributing to your enterprise mobility revenues, including your MD&A discussion on page 84 and your purchase accounting disclosure on page F-31. Please tell us whether the results of operations related to NationSky were presented within your Enterprise segment. If so, please revise your future disclosure to present the related gain on disposal within the Enterprise segment. |

The Company respectfully advises the Staff that it will revise the disclosure to present the related gain on disposal within the Enterprise segment in its future filings.

* * *

11

If you have any additional questions or comments regarding this submission, please contact the Company’s U.S. counsel, Z. Julie Gao of Skadden, Arps, Slate, Meagher & Flom LLP, at (852) 3740-4863 or email at julie.gao@skadden.com or Rong Liu, the audit engagement partner at Marcum Bernsterin & Pinchuk LLP, by phone at (001) 646-472-1879 or via email at rong.liu@marcumbp.com. Marcum Bernsterin & Pinchuk LLP is the independent registered public accounting firm of the Company

|

| Very truly yours, |

|

/s/ Roland Wu |

| Roland Wu |

| Chief Financial Officer |

| cc: | Vincent Wenyong Shi, Chairman of the Board and Chief Operating Officer of NQ Mobile Inc. |

Z. Julie Gao, Esq., Partner, Skadden, Arps, Slate, Meagher & Flom LLP

Haiping Li, Esq., Partner, Skadden, Arps, Slate, Meagher & Flom LLP

Rong Liu, Partner, Marcum Bernsterin & Pinchuk LLP

12

Products (application)

Products (application)