- MPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Marathon Petroleum (MPC) DEF 14ADefinitive proxy

Filed: 15 Mar 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Marathon Petroleum Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2016

Annual Meeting of

Shareholders

March 15, 2016

Dear Fellow Marathon Petroleum Corporation Shareholder:

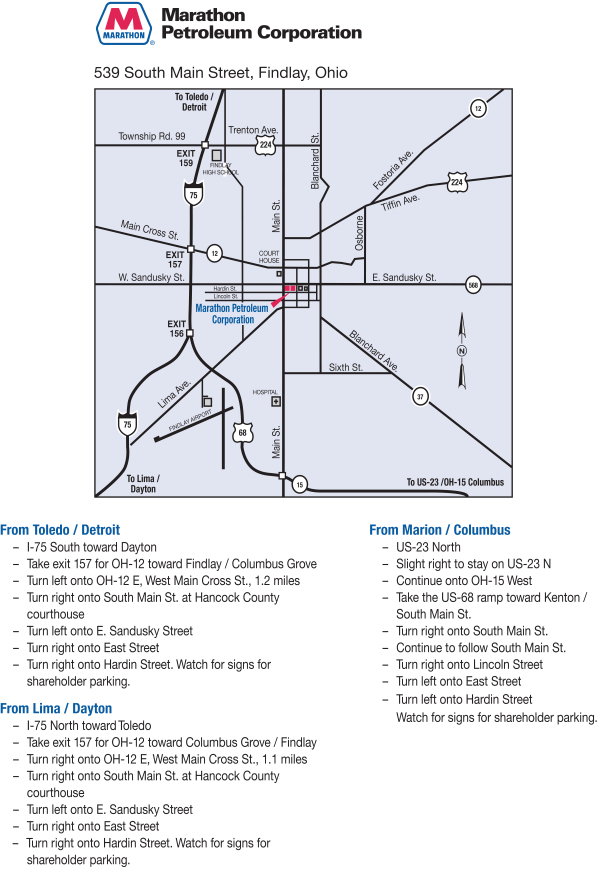

On behalf of the Board of Directors and management team, I am pleased to invite you to attend Marathon Petroleum Corporation’s Annual Meeting of Shareholders to be held in the Auditorium of Marathon Petroleum Corporation, 539 South Main Street, Findlay, Ohio 45840 on Wednesday, April 27, 2016, at 10 a.m. Eastern Daylight Time.

Shareholders have the option to receive Marathon Petroleum Corporation proxy materials (which include the 2016 Proxy Statement, the 2015 Annual Report and the form of proxy card or voting instruction form) via the Internet. We believe this option provides our shareholders the information they need in an efficient, lower-cost and environmentally-conscious manner. Shareholders may still request paper copies of the proxy materials if desired.

We plan to commence mailing a Notice Regarding the Availability of Proxy Materials to our shareholders on or about March 15, 2016. The Notice contains instructions on accessing the proxy materials online, voting online and obtaining a paper copy of our proxy materials. Shareholders who have previously requested the continued receipt of printed proxy materials will receive proxy materials by mail.

We have included a Proxy Summary at the beginning of our Proxy Statement. The Proxy Summary is intended to provide highlights of the Proxy Statement, including facts regarding our corporate governance and our 2015 company performance and return to shareholders. We hope you find the Proxy Summary beneficial.

Thank you for your support of Marathon Petroleum Corporation.

Sincerely,

|

Gary R. Heminger President and Chief Executive Officer |

| Meeting Information | ||||

| Date: | April 27, 2016 | |||

| Time: | 10 a.m. EDT | |||

| Location: | Marathon Petroleum Corporation 539 South Main Street Findlay, Ohio 45840

| |||

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will authorize your proxy as soon as possible. You may vote by proxy using the Internet. Alternatively, if you receive the proxy materials by mail, you may vote by proxy using the Internet, by calling a toll-free telephone number or by completing and returning a proxy card or voting instruction form in the mail. Your vote will ensure your representation at the Annual Meeting regardless of whether you attend in person.

You are entitled to vote at the meeting if you were an owner of record of Marathon Petroleum Corporation common stock at the close of business on February 29, 2016.Owners of record will need to have a valid form of identification to be admitted to the meeting. If your ownership is through a broker or other intermediary, then, in addition to a valid form of identification, you will also need to have proof of your share ownership to be admitted to the meeting. A recent account statement, letter or proxy from your broker or other intermediary will suffice.

You Can Access the Proxy Materials Online atwww.proxyvote.com

Please vote promptly by:

¨using the Internet;

¨marking, signing and returning your proxy card or voting instruction form; or

¨calling a toll-free telephone number.

|

| i | ||||||||

| 1 | |||||||

| 6 | |||||||

| 6 | |||||||

| 9 | |||||||

| 19 | |||||||

| 21 | |||||||

| Proposal No. 1 | Election of Class II Directors | 21 | ||||||

| Nominees for Class II Directors | 22 | |||||||

Proposal No. 2 |

| 29 | ||||||

Proposal No. 3 |

Shareholder Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | 30 | ||||||

| 31 | |||||||

| Proposal No. 4 | Shareholder Proposal Seeking the Adoption of an Alternative Shareholder Proxy Access Bylaw | 31 | ||||||

Proposal No. 5 |

Shareholder Proposal Seeking a Report on Safety and Environmental Incidents | 34 | ||||||

| Proposal No. 6 | Shareholder Proposal Seeking the Adoption of Quantitative Greenhouse Gas Emission Reduction Goals and Associated Reports | 37 | ||||||

| 41 | |||||||

| 42 | |||||||

| 43 | |||||||

| 44 | |||||||

| 46 | |||||||

| 47 | |||||||

| 48 | |||||||

| 72 | |||||||

| 72 | |||||||

| 73 | |||||||

| 94 | |||||||

| 97 | |||||||

| 97 | |||||||

| 97 | |||||||

Notice of Annual Meeting of Shareholders of

Marathon Petroleum Corporation

Date:

Wednesday, April 27, 2016

Time:

10 a.m. EDT

Place:

The Auditorium of Marathon Petroleum Corporation

539 South Main Street, Findlay, Ohio 45840

Purpose:

| • | Elect Messrs. Evan Bayh, Charles E. Bunch and Frank M. Semple to serve as Class II Directors, each for a three-year term expiring on the date of the 2019 Annual Meeting; |

| • | Ratify the selection of PricewaterhouseCoopers LLP as independent auditor for 2016; |

| • | Approve, on an advisory basis, named executive officer compensation; |

| • | Vote on three proposals submitted by shareholders, if presented; and |

| • | Transact any other business that properly comes before the meeting. |

Other Important Information:

You are entitled to vote at the meeting if you were an owner of record of Marathon Petroleum Corporation common stock at the close of business on February 29, 2016.Owners of record will need to have a valid form of identification to be admitted to the meeting. If your ownership is through a broker or other intermediary, then, in addition to a valid form of identification, you will also need to have proof of your share ownership to be admitted to the meeting. A recent account statement, letter or proxy from your broker or other intermediary will suffice.

You can find directions to the location of the Annual Meeting on the back cover of this Proxy Statement.

In reliance on the rules of the Securities and Exchange Commission, most Marathon Petroleum Corporation shareholders are being furnished proxy materials via the Internet. If you received printed proxy materials, a copy of the Marathon Petroleum Corporation 2015 Annual Report is enclosed.

By order of the Board of Directors,

|

Molly R. Benson Vice President, Corporate Secretary and Chief Compliance Officer

|

March 15, 2016

Marathon Petroleum Corporation Proxy Statement / page i

|  | |||||

This summary highlights information contained elsewhere in the Proxy Statement. This summary does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting.

2016 ANNUAL MEETING OF SHAREHOLDERS

Date: | April 27, 2016 | |

Time: |

10 a.m. EDT | |

Place: |

The Auditorium of Marathon Petroleum Corporation 539 South Main Street, Findlay, Ohio 45840 | |

Record Date: |

February 29, 2016 | |

Voting: |

You are entitled to vote at the meeting if you were an owner of record of Marathon Petroleum Corporation common stock at the close of business on February 29, 2016.Owners of record will need to have a valid form of identification to be admitted to the meeting. If your ownership is through a broker or other intermediary, then, in addition to a valid form of identification, you will also need to have proof of your share ownership to be admitted to the meeting. A recent account statement, letter or proxy from your broker or other intermediary will suffice.

| |

| Regardless of whether you plan to attend the Annual Meeting, we hope you will authorize your proxy as soon as possible. You may vote by proxy using the Internet. Alternatively, if you receive the proxy materials by mail, you may vote by proxy using the Internet, by calling a toll-free telephone number or by completing and returning a proxy card or voting instruction form in the mail. Your vote will ensure your representation at the Annual Meeting. |

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING

| ||||||

| Item | Description

| | Page | | ||

| 1 | Election of Class II Directors

Board Recommendation:üFOR each nominee | 21 | ||||

2 |

Ratification of Independent Auditor for 2016

Board Recommendation:üFOR |

|

29 |

| ||

3 |

Advisory Approval of Named Executive Officer Compensation

Board Recommendation:üFOR |

|

30 |

| ||

4 |

Shareholder Proposal: Alternative Shareholder Proxy Access Bylaw

Board Recommendation:×AGAINST |

|

31 |

| ||

5 |

Shareholder Proposal: Report on Safety and Environmental Incidents

Board Recommendation:×AGAINST |

|

34 |

| ||

6 |

Shareholder Proposal: Greenhouse Gas Emission Reduction Goals and Report

Board Recommendation:×AGAINST |

|

37 |

| ||

Marathon Petroleum Corporation Proxy Statement / page 1

|  | |||||

GOVERNANCE HIGHLIGHTS

The MPC Board of Directors is pleased to report the following three important steps it has recently taken to enhance corporate governance:

MPC has adopted Proxy Access

In recognition that proxy access has come to be viewed by many (though not all) of our shareholders as a good governance practice, our Board reviewed the published positions of our shareholders representing approximately 40% of our shareholder base. (Not all of our shareholders have made available their views on proxy access.) Informed by this process, on February 24, 2016, our Board amended the MPC Bylaws to provide for shareholder proxy access. MPC shareholders now have a more meaningful voice in nominating directors for election at MPC.

MPC’s Proxy Access Bylaw1:

| does allow shareholder(s) to submit director nominees for inclusion in the Company’s proxy statement; |

| does require a 3% ownership threshold; |

| does limit to 20 the number of shareholders aggregating shares to comprise the 3% ownership threshold; |

| does cap proxy access nominees at the greater of two individuals or 20% of the Board; and |

| does explicitly allow loaned shares to count as “owned” shares if recallable. |

MPC’s Proxy Access Bylaw1:

| does not prohibit re-nomination of failed nominees; |

| does not impose MPC stock holding requirements beyond the annual meeting in question; |

| does not prohibit the counting of loaned shares to meet the 3% ownership threshold so long as they are subject to recall (no actual recall action required); |

| does not count individual funds within a family of funds as separate shareholders for purposes of the 20 shareholder aggregation limit; |

| does not contain a delayed implementation mechanism; proxy access will be available for our 2017 Annual Meeting; |

| does not prohibit third-party director compensation arrangements so long as disclosed; and |

| does not impose qualification restrictions on proxy access nominees that are different than those imposed on Board nominees. |

| 1 | The description of the material terms of the MPC proxy access bylaw provisions included within this Proxy Summary is qualified in its entirety by reference to the MPC Bylaws, which are available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Restated Certificate of Incorporation and Bylaws,” “Bylaws of Marathon Petroleum Corporation.” |

MPC has adopted Majority Voting for uncontested director elections

Commencing with the 2017 Annual Meeting, a majority voting standard will apply to uncontested director elections.

MPC has named a Lead Director

At the conclusion of the Annual Meeting, David A. Daberko will serve as our Lead Director. In that new capacity, he will function as a voice of the non-management directors and reinforce effective independent leadership.

In addition, features of our corporate governance framework include:

| n | The Board has three fully independent committees: |

| • | Audit; |

| • | Compensation; and |

| • | Corporate Governance and Nominating. |

| page 2 / Marathon Petroleum Corporation Proxy Statement

| |||

| n | Ten members of the 12-member Board are independent. |

| n | Ten members of the 12-member Board are current or former chief executive officers. |

| n | Independent directors meet regularly in executive session without the chief executive officer present. |

| n | Director attendance averaged 98% of all Board and committee meetings in 2015. |

| n | Members of the Board and committees perform self-evaluations each year and meet to review and discuss results. |

| n | We maintain stock ownership guidelines for directors, as well as executive officers. |

| n | We have specific policies and practices to align our executive compensation with long-term shareholder interests. For example, we maintain a policy that prohibits hedging and pledging of MPC stock by our executives and have clawback provisions within our executive cash bonus and long term incentive programs to recoup funds under certain forfeiture events. Other important shareholder-friendly features of our executive compensation program are described in the Compensation Discussion and Analysis portion of this Proxy Statement. |

| n | Corporate political spending oversight resides with the Corporate Governance and Nominating Committee. |

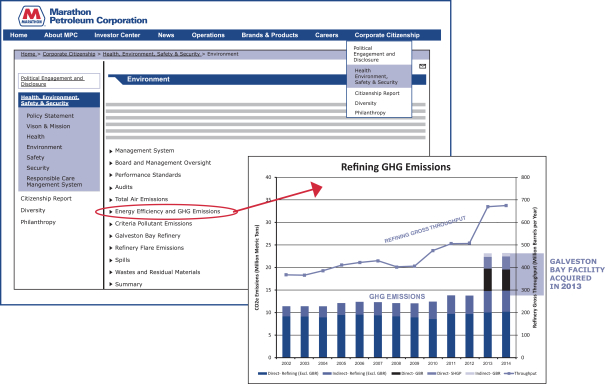

| n | Voluntary disclosures of political contributions and environmental data are available on the Company website. In recognition that our promotion of a strong U.S. energy industry in public policy matters and our significant achievements in energy efficiency and environmental performance may be of interest to our shareholders and other stakeholders, we have elected to make extensive voluntary disclosures in these areas. We invite our shareholders and others to visit our website athttp://www.marathonpetroleum.com and select “Corporate Citizenship” to access our “Political Engagement and Disclosure” and “Health, Environment, Safety & Security” web pages. Representative samples of our voluntary disclosures are included in this Proxy Statement onPage 15 as to political contributions and lobbying expenditures, and onPage 40 as to energy efficiency and emissions data. |

GENERAL INFORMATION

We completed a two-for-one stock split in June 2015 (which we refer to as the Stock Split). Certain information in this Proxy Statement has been adjusted to reflect the Stock Split.

MPLX LP (or MPLX) is a diversified, growth-oriented master limited partnership formed in 2012 by Marathon Petroleum Corporation to own, operate, develop and acquire midstream energy infrastructure assets. MPLX is engaged in the gathering, processing and transportation of natural gas; the gathering, transportation, fractionation, storage and marketing of NGLs; and the transportation and storage of crude oil and refined petroleum products.

On December 4, 2015, MarkWest Energy Partners, L.P. (or MarkWest), which owns and operates midstream service businesses, merged with and became a wholly-owned subsidiary of MPLX (which we refer to as the MPLX/

MarkWest Merger). MarkWest has a leading presence in many natural gas resource plays, including the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formation. We own an approximate 20% interest in MPLX, including the general partner interest, and we consolidate this entity for financial reporting purposes. References to MPLX are included in these materials as appropriate to add clarity to certain disclosures.

The separation of Marathon Petroleum Corporation from Marathon Oil Corporation (which we refer to as Marathon Oil) was completed on June 30, 2011. References to the separation of Marathon Petroleum Corporation from Marathon Oil (which we refer to as the Spinoff) are included in these materials as appropriate to provide an explanation of certain disclosures relating to prior periods or compensation programs.

Marathon Petroleum Corporation Proxy Statement / page 3

|  | |||||

BOARD OF DIRECTORS

The Marathon Petroleum Corporation Board of Directors is divided into three classes. Directors are elected for three-year terms. The following table provides summary information about each director nominee standing for election to the Board as a Class II director for a three-year term expiring in 2019, each of the directors continuing to serve as a Class III or Class I director and the two directors, including the Chairman of our Board of Directors, retiring at the conclusion of the 2016 Annual Meeting.

| Name | Age | Director Since | Occupation | Independent | Committees | Other Public Company Boards1 | ||||||||||

Nominees for Class II Directors | ||||||||||||||||

Evan Bayh | 60 | 2011 | Senior Advisor, Apollo Global Management; Partner, McGuireWoods LLP | ü | Audit CG&N2 | 3 | ||||||||||

Charles E. Bunch | 66 | 2015 | Executive Chairman, PPG Industries, Inc. | ü | Comp3 CG&N | 3 | ||||||||||

Frank M. Semple | 64 | 2015 |

Vice Chairman, MPLX GP LLC

| – | ||||||||||||

Continuing Class III and Class I Directors |

| |||||||||||||||

Steven A. Davis | 57 | 2013 | Board Member; and Former Chairman and CEO, Bob Evans Farms, Inc. | ü | Audit CG&N | – | ||||||||||

Gary R. Heminger | 62 | 2011 | President, CEO and Chairman-Elect, Marathon Petroleum Corporation | 1 | ||||||||||||

John W. Snow | 76 | 2011 | Non-Executive Chairman of the Board, Cerberus Capital Management, L.P. | ü | Comp CG&N | 2 | ||||||||||

John P. Surma | 61 | 2011 | Retired Chairman and CEO, United States Steel Corporation | ü | Comp CG&N | 2 | ||||||||||

David A. Daberko | 70 | 2011 | Retired Chairman and CEO, National City Corporation | ü | Audit (Chair) Comp | 1 | ||||||||||

Donna A. James | 58 | 2011 | Managing Director, Lardon & Associates, LLC | ü | Audit Comp | 3 | ||||||||||

James E. Rohr | 67 | 2013 | Retired Chairman and CEO, The PNC Financial Services Group, Inc. | ü | Audit Comp (Chair) | 3 | ||||||||||

Retiring Class II Directors4 |

| |||||||||||||||

William L. Davis | 72 | 2011 | Retired Chairman, President and CEO, R.R. Donnelley & Sons Company | ü | Audit CG&N (Chair) | – | ||||||||||

Thomas J. Usher | 73 | 2011 | Non-Executive Chairman of the Board, Marathon Petroleum Corporation | ü | – | |||||||||||

| 1 | For purposes of this disclosure, “Other Public Company Boards” do not include the board of directors of MPLX GP LLC, a wholly-owned indirect subsidiary of Marathon Petroleum Corporation. |

| 2 | Corporate Governance and Nominating Committee. |

3 Compensation Committee.

| 4 | Retirement effective upon conclusion of the 2016 Annual Meeting of Shareholders. SeePage 28 of this Proxy Statement for directorship information. |

| page 4 / Marathon Petroleum Corporation Proxy Statement

| |||

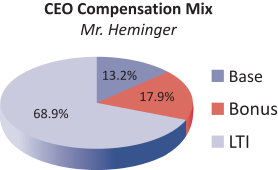

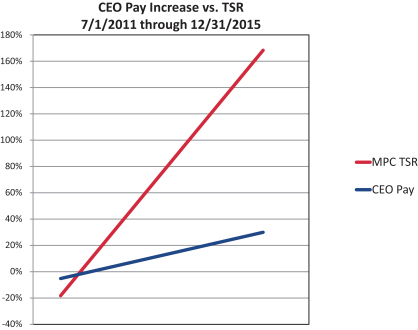

PERFORMANCE AND COMPENSATION HIGHLIGHTS

Pursuant to Section 14A of the Securities Exchange Act of 1934 (or the Exchange Act), Marathon Petroleum Corporation is seeking your advisory vote on the compensation of named executive officers as disclosed in this Proxy Statement. Executive compensation decisions are made to attract, motivate, retain and reward talented executives, with a focus on delivering business results and value to our shareholders.

2015 “Say-on-Pay” Vote Results

At the Annual Meeting held in April 2015, over 95% of votes cast were in support of the compensation of our named executive officers as described in our 2015 Proxy Statement. The Compensation Committee interpreted this strong level of support as affirmation of the design and objectives of our executive compensation programs. Based on this 2015 “Say-on-Pay” vote, the Compensation Committee determined that no material changes to our core compensation programs were warranted and, accordingly, decided to maintain our commitment to compensation decisions that recognize long-term financial performance to drive shareholder value.

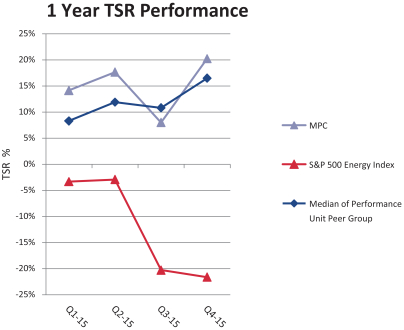

2015 Company Performance

| n | Reported net income attributable to MPC of $2.85 billion, or $5.26 per diluted share, up from $2.52 billion, or $4.39 per diluted share, in 2014, as adjusted for the Stock Split completed in June 2015. |

| n | Returned $1.6 billion of capital to shareholders and increased the quarterly dividend by 28%, to $0.32 from $0.25, as adjusted for the Stock Split. |

| n | Executed on our strategy to grow our midstream stable cash flows with MPLX’s acquisition of MarkWest. |

| n | Substantially completed the conversion of Speedway locations acquired in 2014 along the East Coast and in the Southeast. |

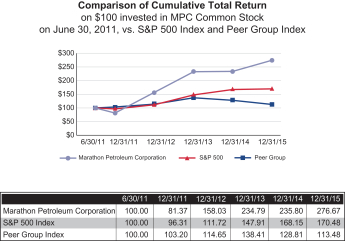

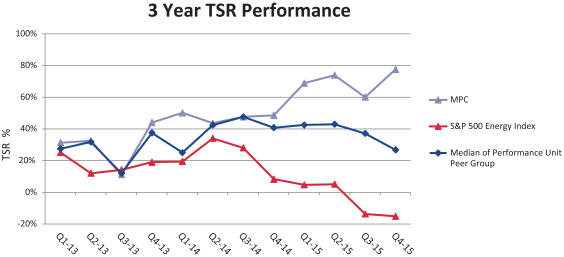

Cumulative Total Shareholder Return

The performance graph above compares the cumulative total return, assuming the reinvestment of dividends, of a $100 investment in our common stock from June 30, 2011, (the effective date of our spinoff from Marathon Oil Corporation) to December 31, 2015, compared to the cumulative total value return of a $100 investment in the S&P 500 index and an index of peer companies (selected by us) for the same period. Our peer group consists of the following companies that engage in domestic refining operations: BP PLC, Royal Dutch Shell PLC, Chevron Corporation, HollyFrontier Corporation, Phillips 66 (ConocoPhillips prior to May 1, 2012), Tesoro Corporation, ExxonMobil Corporation, and Valero Energy Corporation.

Marathon Petroleum Corporation Proxy Statement / page 5

|  | |||||

On behalf of the Board of Directors (which we refer to as the Board of Directors or the Board) of Marathon Petroleum Corporation, a Delaware corporation (which we refer to as Marathon Petroleum, MPC, the Company, we or us), we have provided this Proxy Statement to you in connection with the solicitation by the Board of Directors of your proxy to be voted on your behalf at our 2016 Annual Meeting of Shareholders (which we refer to as the Annual Meeting). The members of the MPC Proxy Committee are Thomas J. Usher, Gary R. Heminger and Donald C. Templin.

We will hold the Annual Meeting at 10 a.m. EDT on April 27, 2016, in the Auditorium of Marathon Petroleum Corporation, 539 South Main Street, Findlay, Ohio 45840. This Proxy Statement contains information about the matters to be voted on and other information that may be of help to you.

We plan to commence mailing a Notice Regarding the Availability of Proxy Materials (or the Notice) on or about March 15, 2016. We have included with these materials our Annual Report for the year ended December 31, 2015. The Notice and Annual Report on Form 10-K for the year ended December 31, 2015, are available atwww.proxyvote.com.

Questions and Answers About the Annual Meeting

| n | What is the purpose of the Annual Meeting? |

At the Annual Meeting, shareholders will act upon the proposals set forth in this Proxy Statement, which are:

| • | the election of three nominees to serve as Class II Directors; |

| • | the ratification of the selection of PricewaterhouseCoopers LLP as our independent auditor for 2016; |

| • | the approval, on an advisory basis, of our named executive officer compensation; and |

| • | three proposals submitted by shareholders, if presented. |

| n | Am I entitled to vote? |

You may vote if you were a holder of MPC common stock at the close of business on February 29, 2016, which is the record date for our Annual Meeting. Each share of common stock entitles its holder to one vote on each matter to be voted on at the Annual Meeting.

| n | Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of printed materials? |

Pursuant to rules adopted by the Securities and Exchange Commission (or SEC) that provide for the delivery of a notice to shareholders of their means of Internet access to proxy materials, we have again this year elected to reduce the number of sets of printed materials. Unless a shareholder has requested receipt of printed proxy materials, we have sent the Notice to our shareholders of record. All shareholders will have the ability to access proxy materials. The Notice provides instructions to access the materials on the Internet or request a traditional set of printed materials be mailed at no cost to the shareholder.

| page 6 / Marathon Petroleum Corporation Proxy Statement

| |||

| n | How does the Board recommend I vote? |

The Board recommends you vote:

| • | FOR each of the nominees for Class II Director; |

| • | FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent auditor for 2016; |

| • | FOR the resolution approving, on an advisory basis, our named executive officer compensation; |

| • | AGAINSTthe proposal seeking the adoption of an alternative shareholder proxy access bylaw; |

| • | AGAINST the proposal seeking a report on safety and environmental incidents; and |

| • | AGAINSTthe proposal seeking the adoption of quantitative greenhouse gas emission reduction goals and associated reports. |

| n | How do I know if I am a shareholder of record or a beneficial owner of shares held in street name? |

If your shares are registered in your name with our transfer agent, Computershare Investor Services, LLC, you are a shareholder of record with respect to those shares and you received the Notice or printed proxy materials directly from us. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, you are the “beneficial owner” of such shares and the Notice or printed proxy materials were forwarded to you by that organization. In that circumstance, the organization is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct the organization how to vote the shares held in your account.

| n | If I am a shareholder of record of MPC shares, how do I cast my vote? |

If you are a shareholder of record of MPC common stock, you may vote:

| • | Via the Internet.You may vote by proxy via the Internet by following the instructions provided in the Notice; |

| • | By Telephone. You may vote by proxy by calling the toll-free telephone number located on the proxy card or available via the Internet; |

| • | By Mail. If you requested a printed copy of the proxy materials, you may vote by proxy by completing the proxy card and returning it in the provided envelope; or |

| • | In Person. You may vote in person at the Annual Meeting. You will be required to present a valid form of identification to be admitted to the meeting and a ballot will be provided to you upon arrival. |

| n | If I am a beneficial owner of MPC shares, how do I cast my vote? |

If you are a beneficial owner of shares of MPC common stock held in street name, you may vote:

| • | Via the Internet.You may vote by proxy via the Internet by following the instructions provided in the Notice forwarded to you by your broker or other intermediary; |

| • | By Telephone. You may vote by proxy by calling the toll-free telephone number located on the voting instruction form or available via the Internet; |

| • | By Mail. If you requested a printed copy of the proxy materials, you may vote by proxy by completing the voting instruction form and returning it in the provided envelope; or |

| • | In Person. You may vote in person at the Annual Meeting but you must first obtain a legal proxy form from the broker or other organization that holds your shares. Please contact such broker or organization for instructions regarding obtaining a legal proxy. If you do obtain a legal proxy and plan to attend the meeting, you will be required to present a valid form of identification. |

We provide Internet proxy voting to allow you to vote your shares online; however, please be aware you must bear any costs associated with your Internet access, such as usage charges from Internet access providers or telecommunication companies.

| n | May I change my vote? |

If you are a shareholder of record of MPC common stock, you may change your vote or revoke your proxy at any time before your shares are voted at the meeting by:

| • | voting again using the Internet or by telephone; |

| • | sending us a proxy card dated later than your last vote; |

| • | notifying the Corporate Secretary of MPC in writing; or |

| • | voting at the meeting. |

If you are a beneficial owner of shares of MPC common stock, you must contact your broker or other intermediary with whom you have an account to obtain information regarding changing your voting instructions.

| n | What is the number of outstanding shares? |

At the close of business on February 29, 2016, which is the record date for the Annual Meeting, there were 529,223,377 shares of MPC common stock outstanding and entitled to vote.

Marathon Petroleum Corporation Proxy Statement / page 7

|  | |||||

| n | What is the voting requirement to approve each of the proposals? |

| • | Proposal No. 1 - At the Annual Meeting, Directors will be elected by a plurality voting standard. The nominees for available directorships who receive the highest number of affirmative votes of the shares present, in person or by proxy, and entitled to vote, are elected;provided,however, that any director nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is expected to tender to the Board his or her resignation promptly following the certification of election results pursuant to the Company’s Plurality Plus Voting Standard Policy, more fully described in Proposal No. 1 and available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Policies and Guidelines,” “Plurality Plus Voting Standard Policy.” Under the plurality voting standard, abstentions and broker non-votes will not have an impact on the election of directors. |

Commencing with the 2017 Annual Meeting, a majority voting standard will apply to uncontested director elections.

| • | Proposal No. 2 will be approved if it receives the affirmative vote of a majority of the votes cast on the proposal, in which case abstentions will not be considered votes “cast” and shall have no effect on the proposal. |

| • | Proposal No. 3 will be approved if it receives the affirmative vote of a majority of the votes cast on the proposal, in which case abstentions and broker non-votes will not be considered votes “cast” and shall have no effect on the proposal. Although the advisory vote on Proposal No. 3 is nonbinding, as provided by law, our Board will review the results of the vote and will take them into account in making determinations concerning executive compensation. |

| • | Each of Proposals No. 4, No. 5 and No. 6 will be approved if it receives the affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote. Abstentions and broker non-votes will have the same effect as votes against these proposals. |

| • | Both abstentions and broker non-votes are counted in determining whether a quorum is present for the meeting. |

| n | What are “broker non-votes?” |

The New York Stock Exchange (or NYSE) permits brokers to vote their customers’ shares on routine matters when the brokers have not received voting instructions from such customers. The ratification of an independent auditor is an example of a routine matter on which brokers may vote in this manner. Brokers may not vote their customers’ shares on non-routine matters such as the election of directors or proposals related to executive compensation unless they have received voting instructions from their customers. Shares held by brokers on behalf of customers who do not provide voting instructions on non-routine matters are “broker non-votes.”

| n | What constitutes a quorum? |

Under our Amended and Restated Bylaws (which we refer to as our Bylaws), a quorum is a majority of the voting power of the outstanding shares of stock entitled to vote. Both abstentions and broker non-votes are counted in determining whether a quorum is present for the meeting.

| n | How will voting be conducted if any matters not contained in this Proxy Statement are raised at the Annual Meeting? |

If any matters are presented at the Annual Meeting other than the proposals on the proxy card, the Proxy Committee will vote on them using their best judgment. Your signed proxy card, or Internet or telephone vote provides this authority. Under our Bylaws, notice of any matter to be presented by a shareholder for a vote at the Annual Meeting must have been received by December 17, 2015, and must have been accompanied by certain information about the shareholder presenting it.

| n | When must shareholder proposals and director nominations be submitted for the 2017 Annual Meeting? |

Shareholder proposals submitted for inclusion in our 2017 Proxy Statement must be received in writing by our Corporate Secretary no later than the close of business on November 15, 2016. Notices of shareholder director nominations for inclusion in our 2017 Proxy Statement must be received by our Corporate Secretary on or after October 16, 2016, and no later than November 15, 2016, and must comply with our proxy access bylaw provisions. Shareholder proposals (including director nominations) submitted outside the process for inclusion in our 2017 Proxy Statement must be received from shareholders of record on or after November 15, 2016, and no later than December 15, 2016, and must be accompanied by certain information about the shareholder making the proposal, in accordance with our Bylaws.

| page 8 / Marathon Petroleum Corporation Proxy Statement

| |||

The Board of Directors and Corporate Governance

Recent Corporate Governance Changes

Proxy Access

Our Board of Directors recently adopted shareholder proxy access bylaw provisions to enable shareholders satisfying certain requirements to submit director nominations for inclusion in the Company’s proxy statement. A single shareholder, or a group of up to 20 shareholders, who have held 3% of MPC stock for at least three years may nominate candidates comprising up to 20% of the Board of Directors. Our Bylaws describe the procedures that must be followed by a shareholder, or group of shareholders, seeking to make director nominations by way of shareholder proxy access.

Majority Voting

Our Board also recently adopted a majority voting standard for uncontested director elections to be effective commencing with the 2017 Annual Meeting.

Lead Director

In connection with the appointment of our President and Chief Executive Officer, Gary R. Heminger, as Chairman of the Board to succeed Thomas J. Usher in that capacity effective at the conclusion of the 2016 Annual Meeting, our Board appointed David A. Daberko as Lead Director. As Lead Director, Mr. Daberko will function as a voice of the non-management directors and reinforce effective independent leadership.

We invite our shareholders to review these recent corporate governance changes as reflected in our Bylaws and our Corporate Governance Principles by visiting our website athttp://ir.marathonpetroleum.com and selecting “Corporate Governance.” From that page, the Bylaws are accessible by clicking on “Restated Certificate of Incorporation and Bylaws,” “Bylaws of Marathon Petroleum Corporation” and the Corporate Governance Principles are accessible by clicking on “Corporate Governance Principles.”

The Board of Directors

Under our Bylaws and the laws of the state of Delaware, MPC’s state of incorporation, the business and affairs of MPC are managed under the direction of our Board of Directors. Our Board is divided into three classes, which must be as nearly equal in size as practicable. Currently, each class consists of four directors. Directors are elected by shareholders for terms of three years and hold office until their successors are elected and qualify. One of the three classes is elected each year to succeed the directors whose terms are expiring. As of the Annual Meeting, the terms for the directors in Classes I, II and III of the Board of Directors expire in 2018, 2016 and 2017, respectively.

As part of its ongoing Board succession planning process, our Corporate Governance and Nominating Committee determined to recruit a new member of the Board in 2015. With input from our Chairman of the Board and our President and Chief Executive Officer, and following consideration of the

qualifications and abilities of the nominee, Charles E. Bunch was recommended by our Corporate Governance and Nominating Committee to be elected as a director. On July 29, 2015, the size of the Board was increased from 10 members to 11, and Charles E. Bunch was elected to serve as a Class II director, effective September 22, 2015. As a Class II director, Mr. Bunch’s initial term expires in 2016.

On December 4, 2015, as part of the Board’s ongoing succession planning process and in fulfillment of its obligation in connection with the MPLX/MarkWest Merger to appoint one director identified by MarkWest to the Board, the size of the Board was increased from 11 members to 12, and Frank M. Semple was elected to serve as a Class I director. Mr. Semple has been nominated for election at the Annual Meeting as a Class II director. Reclassifying Mr. Semple as a Class II director nominee will result in his standing for election two years earlier than would be the case if he remained a Class I director. This reclassification is necessary as two of our current Class II directors, Messrs. W.L. Davis and Usher, are retiring upon the expiration of their respective terms at the conclusion of the Annual Meeting in accordance with the retirement provisions of our Bylaws. To maintain the three classes of our Board as nearly equal in size as practicable, Mr. Semple has been nominated for election as a Class II director.

On February 24, 2016, our Board determined that upon the retirements of Messrs. W.L. Davis and Usher at the conclusion of the Annual Meeting, the size of the MPC Board of Directors will be fixed at 10 directors, consistent with MPC’s Corporate Governance Principles. Assuming the election of the three Class II director nominees, at the conclusion of the Annual Meeting, our Board will consist of three classes with three directors in Class I, three directors in Class II and four directors in Class III.

Our Board met 13 times in 2015. The attendance of the members of our Board averaged approximately 98% for the aggregate of the total number of Board and committee meetings held in 2015. Each of our directors attended at least 75% of the meetings of the Board and committees on which he or she served. Pursuant to our Corporate Governance Principles, members of our Board are expected to attend the Annual Meeting. All of the members of our Board attended the annual meeting of shareholders on April 29, 2015.

Our Chairman of the Board presides at all meetings of shareholders and of the Board. If the non-employee directors meet without the Chairman or in circumstances in which the Chairman is unavailable, our Board will designate another director to serve as a lead or presiding director at such meeting. The Chairman also attends Board committee meetings.

Pursuant to our Corporate Governance Principles, non-employee directors of the Board hold executive sessions. An offer of an executive session is extended to non-employee directors at each Board meeting. The Chairman of the Board or the Lead Director presides at these executive sessions. In 2015, non-employee directors of the Board held executive sessions at 10 Board meetings.

Marathon Petroleum Corporation Proxy Statement / page 9

|  | |||||

Our Board has three principal committees, all of the members of which are independent, non-employee directors. The table below shows the current committee memberships of each director and the number of meetings each committee held in 2015.

Board Committee Memberships

| Director | Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | |||

Evan Bayh | ü | ü | ||||

Charles E. Bunch | ü | ü | ||||

David A. Daberko | Chair | ü | ||||

Steven A. Davis | ü | ü | ||||

William L. Davis (retiring) | ü | Chair | ||||

Donna A. James | ü | ü | ||||

James E. Rohr | ü | Chair | ||||

John W. Snow | ü | ü | ||||

John P. Surma | ü | ü | ||||

Number of meetings in 2015 | 5 | 8 | 6 |

Board and Committee Independence

As referenced, the principal committee structure of our Board of Directors includes the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. These committees are comprised entirely of independent directors. Additionally, an Executive Committee of the Board, comprised of Thomas J. Usher and Gary R. Heminger, has been established to address matters that may arise between meetings of the Board. This Executive Committee may exercise the powers and authority of the Board subject to specific limitations consistent with our Bylaws and applicable law.

To determine director independence, our Board uses the categorical standards set forth below and, additionally, considers the materiality of any relationships between a director and the Company. The Board considers all relevant facts and circumstances including, without limitation, transactions between the Company and the director directly, immediate family members of the director or organizations with which the director is affiliated, and the frequency and dollar amounts associated with these transactions. The Board further considers whether such transactions are at arm’s length in the ordinary course of business and whether any such transactions are consummated on terms and conditions similar to those with unrelated parties.

To be determined categorically independent, a director must not:

| • | be a current employee of the Company or former employee of the Company within the past three years; |

| • | have an immediate family member serving as a current executive officer of the Company or former executive officer of the Company within the past three years; |

| • | have personally received, or have an immediate family member who has received, any direct compensation from the Company in excess of $120,000 during any 12-month period within the past three years, other than compensation for Board or committee service, pension or other forms of deferred compensation for prior service or compensation paid to an immediate family member who is a non-executive employee of the Company; |

| • | have any of the following affiliations with respect to the Company’s external auditor: |

| • | current employee of such firm, |

| • | engaged, or have an immediate family member engaged, as a current partner of such firm, |

| • | have an immediate family member who is a current employee of such firm and who personally works on the Company’s audit, or |

| • | has been, or has an immediate family member who has been, engaged or employed by such firm as a partner or employee within the past three years and who personally worked on the Company’s audit within that time; |

| • | be employed, or have an immediate family member employed, within the past three years as an executive officer of another company where now, or at any time during the past three years, any of the Company’s current executive officers at the same time serve or served on the other company’s compensation committee; |

| • | be an employee, or have an immediate family member who is an executive officer, of a company that makes or made payments to, or receives or received payments from, the Company for property or services in an amount which in any of the three preceding fiscal years exceeded the greater of $1 million or 2% of the other company’s consolidated gross revenues; |

| • | be an executive officer of a tax-exempt organization to which the Company has within the three preceding fiscal years made any contributions in any single fiscal year that exceeded the greater of $1 million or 2% of the tax-exempt organization’s consolidated gross revenues; |

| • | be a partner of or of counsel to a law firm that provides substantial legal services to the Company on a regular basis; or |

| • | be a partner, officer or employee of an investment bank or consulting firm that provides substantial services to the Company on a regular basis. |

| page 10 / Marathon Petroleum Corporation Proxy Statement

| |||

Under our Corporate Governance Principles, the following relationships are not considered to be material relationships that would impair a director’s independence:

| • | if the director is, or has an immediate family member who is, a partner (general or limited) in, or a controlling shareholder, equity holder, executive officer or a director of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years where the amount involved in such transaction in any such fiscal year was less than the greater of $1 million or 2% of the recipient’s consolidated gross revenues for that year; |

| • | if the director is, or has an immediate family member who is, a director or trustee of any organization to which the Company has made, or from which the Company has received, payments for property or services, and the director (or his or her immediate family member) was not involved in the negotiations of the terms of the transaction, did not, to the extent applicable, provide any services directly to the Company, and did not receive any special benefits as a result of the transaction; or |

| • | if the director, or an immediate family member of the director, serves as an officer, director or trustee of a foundation, university, charitable or other not-for-profit organization, and the Company’s discretionary charitable contributions to the organization, in the aggregate, are less than the greater of $1 million or 2% of that organization’s latest publicly available annual consolidated gross revenues. |

These categorical independence standards and material relationship considerations are found within our Corporate Governance Principles, which are available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Corporate Governance Principles.”

Our Board performed its independence review for 2016 earlier this year. In applying the categorical standards and assessing the materiality of any relationships, the Board affirmatively determined that each of Ms. James and Messrs. Bayh, Bunch, Daberko, S.A. Davis, W.L. Davis, Rohr, Snow, Surma and Usher meets the categorical independence standards, has no material relationship with the Company other than that arising solely from the capacity as a director and, in addition, satisfies the independence requirements of the NYSE, including the NYSE independence standards applicable to the committees on which each such director serves. Messrs. Lee and Schofield, who both retired effective at the conclusion of our 2015 Annual Meeting held on April 29, 2015, also met the independence standards referred to in the preceding sentence during their service on the Board in 2015.

Audit Committee

Our Audit Committee has a written charter adopted by the Board, which is available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees and Charters,” “Audit Committee,” “Audit Committee Charter.” The Audit Committee Charter requires our Audit Committee to assess and report to the Board on the adequacy of the Charter on an annual basis. Each of the members of our Audit Committee is independent as independence is defined in Exchange Act Rule 10A-3, as well as in the general independence requirements of NYSE Rule 303A.02.

Our Audit Committee is, among other things, responsible for:

| • | appointing, compensating, retaining and overseeing the independent auditor; |

| • | reviewing fees proposed by the independent auditor and approving in advance all audit, audit-related, tax and permissible non-audit services to be performed by the independent auditor; |

| • | separately meeting with the independent auditor, our internal auditors and our management with respect to the status and results of their activities; |

| • | reviewing the structure of the internal audit function to ensure its organizational independence and its access to the Board, the Audit Committee and management; |

| • | approving the appointment of the general manager of internal audit, and reviewing the performance and compensation of the general manager of internal audit on an annual basis; |

| • | reviewing and approving the internal audit expense budget on an annual basis; |

| • | reviewing with our Chief Executive Officer (who we may refer to as our CEO), our Chief Financial Officer (who we may refer to as our CFO) and our General Counsel, disclosure controls and procedures and management’s conclusions about such disclosure controls and procedures; |

| • | reviewing and discussing with our management and the independent auditor, annual and quarterly financial statements, including those reported on Forms 10-K and 10-Q, prior to their filing, and reports of internal controls over financial reporting; |

| • | reviewing our quarterly earnings press releases prior to their publication and discussing any financial information and any earnings guidance to be provided; |

| • | discussing with our management guidelines and policies to govern the process by which risk assessment is undertaken by the Company; |

Marathon Petroleum Corporation Proxy Statement / page 11

|  | |||||

| • | reviewing legal and regulatory compliance regarding the Company’s financial statements, auditing matters and compliance with the Company’s Code of Business Conduct, Code of Ethics for Senior Financial Officers and Whistleblowing Procedures Policy; and |

| • | evaluating the Audit Committee’s performance on an annual basis. |

Our Audit Committee has the authority to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company, and to retain independent legal, accounting or other advisors or consultants.

Audit Committee Policy for Pre-Approval of Audit, Audit-Related, Tax and Permissible Non-Audit Services

Our Pre-Approval of Audit, Audit-Related, Tax and Permissible Non-Audit Services Policy is available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees and Charters,” “Audit Committee,” “Audit Committee Policy for Pre-Approval of Audit, Audit-Related, Tax and Permissible Non-Audit Services.” Among other things, this policy sets forth the procedure for the Audit Committee to pre-approve all audit, audit-related, tax and permissible non-audit services, other than as provided under a de minimis exception.

Under the policy, the Audit Committee may pre-approve any services to be performed by our independent auditor up to 12 months in advance and may approve in advance services by specific categories pursuant to a forecasted budget. Once each year, our CFO presents a forecast of audit, audit-related, tax and permissible non-audit services to the Audit Committee for approval in advance. Our CFO, in coordination with the independent auditor, provides an updated budget to the Audit Committee, as needed, throughout the ensuing fiscal year.

Pursuant to the policy, the Audit Committee has delegated pre-approval authority of up to $500,000 to the Chair of the Audit Committee for unbudgeted items, and the Chair reports the items pre-approved pursuant to this delegation to the full Audit Committee at its next scheduled meeting.

Audit Committee Financial Expert

Based on the attributes, education and experience requirements set forth in the rules of the SEC, our Board has determined David A. Daberko and Donna A. James each qualifies as an “audit committee financial expert.”

Mr. Daberko was chairman of the board and chief executive officer of National City Corporation for 12 years. In addition to certifying the effectiveness of internal controls and

procedures required by his former position as chairman and chief executive officer, Mr. Daberko’s various other roles with National City through his many years of service involved oversight of accounting and both internal and external audit functions. Mr. Daberko was also a member of the audit committee of Williams Partners GP LLC. Mr. Daberko holds a master’s degree in business administration from Case Western Reserve University.

Ms. James previously served as president of Nationwide Strategic Investments, a division of Nationwide Mutual Insurance Company, a financial services and insurance company. Ms. James serves on three other public company boards and has extensive current and former service on the audit committees of public companies. She has experience auditing financial operations and controls and in preparing financial statements under generally accepted accounting principles and statutory accounting principles. She received a bachelor of science degree in accounting from North Carolina Agricultural and Technical State University and is a non-practicing CPA.

Guidelines for Hiring Employees or Former Employees of the Independent Auditor

Our guidelines for the hiring of employees or former employees of the independent auditor satisfy the criteria under applicable law and NYSE listing standards, and are available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees and Charters,” “Audit Committee,” “Guidelines for Hiring of Employees or Former Employees of the Independent Auditor.”

Whistleblowing Procedures Policy

Our Whistleblowing Procedures Policy establishes procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. The Policy for Whistleblowing Procedures is available on our website at http://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees and Charters,” “Audit Committee,” “Policy for Whistleblowing Procedures.”

Compensation Committee

Our Compensation Committee is comprised solely of directors who satisfy all criteria for independence under applicable law, NYSE listing standards and our Corporate Governance Principles. The Compensation Committee has a written charter adopted by the Board, which is available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees

| page 12 / Marathon Petroleum Corporation Proxy Statement

| |||

and Charters,” “Compensation Committee,” “Compensation Committee Charter.” The Compensation Committee Charter requires our Compensation Committee to assess and report to the Board on the adequacy of the Charter on an annual basis.

Our Compensation Committee is, among other things, responsible for:

| • | determining all matters of policy and procedures relating to officer compensation; |

| • | reviewing and approving corporate goals and objectives relevant to our CEO’s compensation and evaluating our CEO’s performance in light of those goals and objectives and, with guidance from our Board, determining and approving our CEO’s compensation based on the Compensation Committee’s performance evaluation; |

| • | determining and approving the compensation of our other officers and reviewing the succession plan for senior management; |

| • | recommending to the Board and administering the incentive compensation plans and equity-based plans of the Company; |

| • | certifying the achievement of performance levels under our incentive compensation plans; |

| • | reviewing, recommending and discussing with the Company’s management, the Compensation Discussion and Analysis section included in our annual proxy statements or other securities filings; and |

| • | evaluating the Compensation Committee’s performance on an annual basis. |

Our Compensation Committee engaged Pay Governance LLC to serve as its independent compensation consultant for 2015. Pay Governance reported directly to our Compensation Committee and provided the Compensation Committee with comparative data on executive compensation and expert advice on the design and implementation of our compensation policies and programs.

Our Compensation Committee may delegate any of its responsibilities to a subcommittee comprised of one or more members of the Compensation Committee. In addition, the Compensation Committee may delegate to one or more officers of the Company (or to a Salary and Benefits Committee or a similar committee comprised of officers of the Company) any of its responsibilities with respect to non-equity based plans, such as plans created pursuant to health and other employee benefit plans. In 2015, our Compensation Committee delegated certain responsibilities with respect to non-officer compensation to a Salary and Benefits Committee comprised of officers of the Company.

Our Compensation Committee seeks input from our CEO on compensation decisions and performance appraisals for all other officers. However, all officer compensation matters are approved by the Compensation Committee.

Our Compensation Committee meets at least four times a year and is given the opportunity to meet in executive session at each of its meetings. With input from the compensation consultant, our CEO and our Senior Vice President of Human Resources and Administrative Services, the Chair of our Compensation Committee approves the agendas for Compensation Committee meetings.

Compensation Committee Interlocks and Insider Participation

The members of our Compensation Committee are James E. Rohr (Chair), Charles E. Bunch, David A. Daberko, Donna A. James, John W. Snow and John P. Surma. Each member of the Compensation Committee qualifies as an independent director. During 2015, none of the Company’s executive officers served as a member of a compensation committee or board of directors of any unaffiliated entity that has an executive officer serving as a member of our Compensation Committee or Board of Directors. Gary R. Heminger serves as an officer and director of MPC and of the general partner of MPLX, MPLX GP LLC. Frank M. Semple serves as a director of MPC and as an officer and director of MPLX GP LLC.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee has a written charter adopted by our Board, which is available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Board Committees and Charters,” “Corporate Governance and Nominating Committee,” “Corporate Governance and Nominating Committee Charter.” Each member of our Corporate Governance and Nominating Committee is independent and qualified under standards established by applicable law, NYSE listing standards and our Corporate Governance Principles. The Corporate Governance and Nominating Committee Charter requires our Corporate Governance and Nominating Committee to assess and report to the Board on the adequacy of the Charter on an annual basis.

Our Corporate Governance and Nominating Committee is, among other things, responsible for:

| • | reviewing and making recommendations to our Board concerning the appropriate size and composition of the Board, including: |

| • | candidates for election or re-election as directors; |

| • | the criteria to be used for the selection of candidates for election or re-election as directors; |

Marathon Petroleum Corporation Proxy Statement / page 13

|  | |||||

| • | the appropriate skills and characteristics required of Board members in the context of the current composition of the Board; |

| • | the composition and functions of Board committees; and |

| • | all matters relating to the development and effective functioning of the Board; |

| • | considering and recruiting candidates to fill positions on our Board; |

| • | considering nominees recommended by shareholders for election as directors; |

| • | reviewing and making recommendations to our Board, based on the qualifications set forth in our Corporate Governance Principles, concerning each Board committee’s membership and committee chairs including, without limitation, a determination of whether one or more Audit Committee member qualifies as an “audit committee financial expert” as defined by the rules of the SEC; |

| • | assessing and recommending overall corporate governance practices; |

| • | reviewing political contributions, lobbying expenditures and payments to certain trade associations; |

| • | establishing the process for, and overseeing the evaluation of, our Board; |

| • | reviewing and approving codes of conduct applicable to directors, officers and employees; |

| • | reviewing the Company’s position statement on stockholders’ rights plans and reporting any recommendations to our Board related thereto; and |

| • | evaluating the Corporate Governance and Nominating Committee’s performance on an annual basis. |

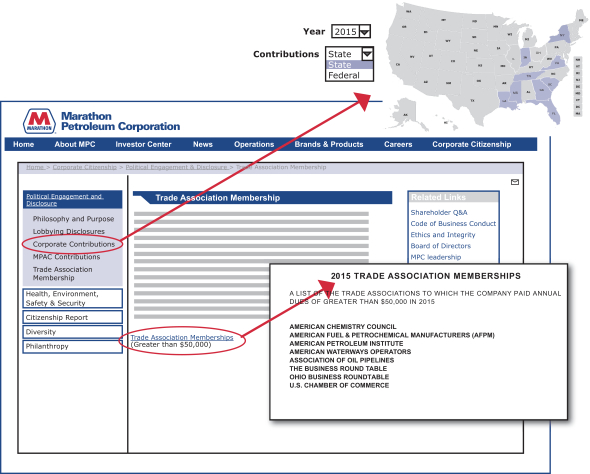

Oversight of Political Engagement, Contributions and Disclosure

The Corporate Governance and Nominating Committee Charter memorializes among the Committee’s responsibilities semi-annual review of contributions made by the Company to political candidates, committees or parties and the annual review of lobbying expenditures, payments of $50,000 or more to trade associations that engage in lobbying activities and the content of the “Political Engagement and Disclosure” page on our website. Our Corporate Governance and Nominating Committee believes this oversight, formalized in its charter, conveys the strength of its commitment to ensure our exercise of political speech and involvement in the public policy process remains aligned with the interests of our shareholders.

At the direction of our Corporate Governance and Nominating Committee, we provide detail on our website describing the role of our Government Affairs Organization and our means of promoting and ensuring compliance with our political activity policy through the support of our Office of Business Integrity and Compliance and our Internal Audit Organization. Political activities by and on behalf of the Company are managed by our Government Affairs Organization. To ensure compliance with laws regulating political contributions and lobbying activities, and to ensure that such activities are aligned with the interests of the Company and its shareholders, lobbying contacts made on behalf of the Company with federal, state and local government officials, and all political contributions made by the Company, are centrally coordinated through the management and other professional staff members of our Government Affairs Organization. Additionally, members of our executive management, in consultation with the leadership of our Government Affairs Organization, are involved in approving lobbying expenditures through our annual budgeting process and throughout the year as appropriate.

On an annual basis our Office of Business Integrity and Compliance circulates a Code of Business Conduct questionnaire and each member of our Board of Directors, and all executive officers and employees are required to complete the questionnaire and sign a certification that includes a specific statement of compliance with our political activity policy. Our Internal Audit Organization routinely conducts reviews of the practices of, and reporting documentation prepared by, the Government Affairs Organization, as well as the eligibility of employees contributing to the Marathon Petroleum Corporation Employees Political Action Committee (or MPAC), and reports its findings to executive management.

Like most large companies, we are active in trade associations and similar groups at the national, state and local levels. We believe participation in these associations is important in the Company’s role as an industry leader and as an active member of the business communities in which we operate. While not our primary motivation for joining or maintaining our memberships, many trade associations actively engage in lobbying on issues that impact their respective members. We believe it is important to be engaged with these organizations so our positions on issues of importance to the Company can be expressed. We take seriously our leadership in the industry by maintaining an active role in our trade associations and have executives, technical experts and other personnel serving in various leadership and support roles within such groups. Each year our executive management undertakes a review of trade association memberships and assesses the effectiveness of the respective groups and the utility of our new or continued participation and our Corporate Governance and Nominating Committee has oversight of annual payments to such groups of $50,000 or more.

| page 14 / Marathon Petroleum Corporation Proxy Statement

| |||

Visitors to our “Political Engagement and Disclosure” page on the Company website are able to directly access:

| • | federal lobbying reports that MPC files quarterly with the Office of the Clerk of the U.S. House of Representatives and links to state lobbying report databases; |

| • | itemized lists of corporate political contributions in an interactive map format; |

| • | itemized lists of MPAC contributions in an interactive map format; |

| • | a list of trade associations to which MPC paid annual dues of greater than $50,000 in 2015; |

| • | statements on key positions MPC has taken on important regulatory and legislative issues; and |

| • | a statement of philosophy and purpose that includes several embedded links, including to public sources of information. |

We have included a representative sample of our voluntary disclosures below.

The federal lobbying reports and itemized corporate and MPAC contributions available on our website are included for the period commencing with our inception as a standalone public company in mid-2011 through 2015, and we plan to archive disclosures on this website for a period of five years.

Evaluating Board and Committee Effectiveness

Our Corporate Governance and Nominating Committee oversees an annual Board and committee self-evaluation

process that involves each member of the Board completing detailed surveys designed to assess the effectiveness of the Board as a whole and, separately, the effectiveness of each of its committees. The surveys seek feedback on Board and

committee composition and organization, the frequency and content of Board and committee meetings, the quality of management presentations to the Board and its committees, the Board’s relationship to senior management, and the performance of the Board and its committees in light of the responsibilities of each body as established in our Corporate Governance Principles and the respective committee

Marathon Petroleum Corporation Proxy Statement / page 15

|  | |||||

charters. Along with these surveys, each director reviews the Corporate Governance Principles and the charter of each committee on which he or she serves, and offers comments and revision suggestions as deemed appropriate. Summary reports of survey results are compiled and provided to the directors. Our Chairman of the Board leads a discussion of survey results with all of the directors as a group, and each committee chair leads a discussion of committee results within a committee meeting setting. Our Corporate Governance and Nominating Committee views this process, which combines the opportunity for each director to individually reflect on Board and committee effectiveness with a collaborative discussion on performance, as providing a meaningful assessment tool and a forum for discussing areas for improvement.

Director Identification and Selection

The processes for director selection and the establishment of director qualifications are set forth in Article III of our Corporate Governance Principles, which are available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Corporate Governance Principles.” In summary, our Board has delegated the director recruiting process to the Corporate Governance and Nominating Committee with input from our Chairman of the Board and our CEO. Our Corporate Governance and Nominating Committee may work with a third-party professional search firm to review director candidates and their credentials. At least one member of the Corporate Governance and Nominating Committee, our Chairman of the Board and our CEO are expected to meet with each potential director candidate as part of the recruiting process. The foregoing recruiting process applies to nominees recommended by our Corporate Governance and Nominating Committee, as well as nominees recommended by shareholders in accordance with our Bylaws and applicable law.

The criteria for selecting new directors include the following:

| • | their independence, as defined by applicable law, stock exchange listing standards and the categorical standards listed in our Corporate Governance Principles; |

| • | their business or professional experience; |

| • | their integrity and judgment; |

| • | their record of public service; |

| • | their ability to devote sufficient time to the affairs of the Company; |

| • | the diversity of backgrounds and experiences they bring to the Board; and |

| • | the needs of the Company from time to time. |

Directors should also be individuals of substantial accomplishment and experience with demonstrated leadership capabilities, and the ability to represent all shareholders as opposed to a specific constituency. The Corporate Governance and Nominating Committee Charter also gives the Committee the authority to retain and terminate any search firm used to identify director candidates, including the authority to approve the search firm’s fees and other retention terms.

The Board’s Role in Risk Oversight

Responsibility for risk oversight rests with our Board of Directors and the committees of the Board. Our Audit Committee assists our Board in fulfilling its oversight responsibilities by regularly reviewing risks associated with financial and accounting matters, as well as those related to financial reporting. In this regard, our Audit Committee monitors compliance with regulatory requirements and internal control systems. Our Audit Committee reviews risks associated with financial strategies and the capital structure of the Company. Our Audit Committee also reviews the process by which enterprise risk management is undertaken by the Company.

Our Compensation Committee assists the Board with risk oversight through its review of compensation programs to help ensure such programs do not encourage excessive risk-taking. The Compensation Committee reviews base compensation levels, incentive compensation and succession plans to confirm the Company has appropriate practices in place to support the retention and development of the employees necessary to achieve the Company’s business goals and objectives.

The Board receives regular updates from these committees regarding their activities and also reviews risks of a more strategic nature. Key risks associated with the strategic plan of the Company are reviewed annually at a designated strategy meeting of the Board and on an ongoing basis periodically throughout the year.

While our Board and its committees oversee risk management, the senior management team of the Company is charged with managing risk. The Company has a strong enterprise risk management process for identifying, assessing and managing risk, as well as monitoring the performance of risk mitigation strategies. The governance of this process is effected through the executive sponsorship of our CEO and CFO, and is led by an enterprise risk manager, and officers and senior managers responsible for working across the business to manage enterprise level risks and identify emerging risks. These leaders meet periodically and provide regular updates to our Board and its committees throughout the year.

| page 16 / Marathon Petroleum Corporation Proxy Statement

| |||

Corporate Governance Principles

Our Corporate Governance Principles are available on our website athttp://ir.marathonpetroleum.com by selecting “Corporate Governance” and clicking on “Corporate Governance Principles.” In summary, our Corporate Governance Principles provide the functional framework of our Board of Directors, including its roles and responsibilities. These principles also address director independence, committee composition, the presiding and lead director positions, the process for director selection and director qualifications, the Board’s performance review, the Board’s planning and oversight functions, director compensation and director retirement and resignation.

Leadership Structure of the Board

As provided in our Corporate Governance Principles, our Board of Directors does not have a policy requiring the roles of chairman of the board and chief executive officer to be filled by separate persons or a policy requiring the chairman of the board to be a non-employee director. Our Board will make determinations about leadership structure based on what it believes is best for the Company given specific circumstances. The Board views its active engagement in the process of assessing specific risks through the involvement of our Audit and Compensation Committees, assessing more strategic risks at its annual strategy review meeting and assessing operational and other risks periodically with members of our senior management as providing the desired level of oversight and accountability for our current leadership structure. At present, the positions of chairman of the board and chief executive officer of the Company are separate. Thomas J. Usher serves as our Chairman of the Board and Gary R. Heminger serves as our President and CEO. Effective with the retirement of Mr. Usher at the conclusion of the 2016 Annual Meeting, the Board has appointed Gary R. Heminger as Chairman of the Board and David A. Daberko as Lead Director.

On February 24, 2016, our Board of Directors amended our Corporate Governance Principles to include responsibilities of the Lead Director. The Lead Director’s responsibilities include, but are not limited to:

| • | consulting with the Chairman of the Board to include on the agenda for Board meetings any matters requested by the Lead Director; |

| • | presiding at meetings of the Board in the absence of, or upon the request of, the Chairman of the Board, including presiding over all executive sessions of the independent directors; |

| • | serving as liaison between the Chairman of the Board and the independent directors; |

| • | approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | having the authority to call meetings of the independent directors; |

| • | coordinating the agenda for moderating sessions of the Board’s independent directors; and |

| • | being available for direct communication from significant stockholders. |

Our Board has determined that due to Mr. Heminger’s extensive knowledge of all aspects of MPC’s business as its Chief Executive Officer and President, Mr. Heminger is in the best position at this time to lead the Board of Directors as its Chairman, and Mr. Daberko is in the best position to serve in the new capacity as Lead Director. The Board believes that this leadership structure is appropriate because it strikes an effective balance between management and independent director participation in the Board process.

Communications with the Board of Directors