- MPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-I Filing

Marathon Petroleum (MPC) SC TO-IIssuer tender offer statement

Filed: 17 May 21, 8:06am

Exhibit (a)(1)(F)

IMMEDIATE ATTENTION REQUIRED

May 17, 2021

Re: Marathon Petroleum Corporation Tender Offer

Dear Participant in the Marathon Petroleum Thrift Plan:

The enclosed tender offer materials and Direction Form require your immediate attention. Our records reflect that, as a participant in the Marathon Petroleum Thrift Plan (the “Plan”, and including the portion of the Plan known as the “Speedway Component”, which is also known as the “Retirement Savings Sub-Plan”), all or a portion of your individual account is invested in the Marathon Petroleum Corporation Stock Fund (the “Stock Fund”). The tender offer materials describe an offer by Marathon Petroleum Corporation (“Marathon”) to purchase up to $4,000,000,000 in value of shares of its common stock, par value $0.01 per share (the “Shares”), at a purchase price of not less than $56.00 nor greater than $63.00 per Share (the “Offer”). As described below, you have the right to instruct Fidelity Management Trust Company (“Fidelity”), as trustee of the Plan, concerning whether to tender Shares related to your individual account under the Plan. If you wish to instruct Fidelity on this matter, you will need to complete the enclosed Direction Form and return it to Fidelity’s tabulator in the enclosed return envelope (or provide directions via the Internet) so that it is RECEIVED by 4:00 p.m., New York City Time, on June 8, 2021, unless the Offer is extended, in which case the deadline for receipt of instructions will, to the extent feasible, be four business days prior to the expiration date of the Offer. If you do not provide directions to Fidelity’s tabulator on a timely basis, you will be deemed to have elected not to participate in the Offer and no Shares related to your individual account under the Plan will be tendered.

The remainder of this letter summarizes the transaction, your rights under the Plan and the procedures for providing your directions to Fidelity. You should also review the more detailed explanation provided in the Offer to Purchase, dated May 17, 2021 (as may be amended from time to time, the “Offer to Purchase”), enclosed with this letter.

BACKGROUND

Marathon has made an offer to purchase up to $4,000,000,000 in value of its Shares from its shareholders at a price not less than $56.00 nor greater than $63.00 per Share, upon the terms and subject to the conditions set forth in the enclosed Offer to Purchase. Marathon will select the lowest purchase price (in increments of $0.50) that will allow it to purchase up to $4,000,000,000 in value of its Shares. Subject to the terms and conditions of the Offer as set forth in the Offer to Purchase, if the total value of Shares tendered is less than or equal to $4,000,000,000, Marathon will purchase all Shares that are properly tendered and not withdrawn. All Shares acquired in the Offer will be acquired at the same purchase price regardless of whether the shareholder tendered at a lower price.

The enclosed Offer to Purchase sets forth the terms and conditions of the Offer and is being provided to all Marathon shareholders. To understand the Offer fully and for a more complete description of the terms and conditions of the Offer, you should carefully read the entire Offer to Purchase.

The Offer extends to the Shares held by the Plan. As of May 10, 2021, the Plan held approximately 14,671,248 Shares. Only Fidelity, as trustee of the Plan, can tender these Shares in the Offer. Nonetheless, as a participant under the Plan, you have the right to direct Fidelity whether or not to tender some or all of the Shares credited to your individual account under the Plan, and at what price or prices. Unless otherwise required by applicable law, Fidelity will tender Shares credited to participant accounts in accordance with participant instructions and Fidelity will not tender Shares credited to participant accounts for which it does not receive timely instructions. If you do not complete the enclosed Direction Form and return it to Fidelity’s tabulator on a timely basis, or do not provide timely directions via the Internet, you will be deemed to have elected not to participate in the Offer and no Shares credited to your Plan account will be tendered.

LIMITATIONS ON FOLLOWING YOUR DIRECTION

The enclosed Direction Form, and Fidelity’s tabulator’s website, allows you to specify the percentage of the Shares credited to your account that you wish to tender and the price or prices at which you want to tender Shares credited to your account. As detailed below, when Fidelity tenders Shares on behalf of the Plan, it may be required to tender Shares on terms different than those set forth on your Direction Form and on Fidelity’s tabulator’s website.

The Employee Retirement Income Security Act of 1974, as amended (“ERISA”), prohibits the sale of Shares to Marathon for less than “adequate consideration,” which is defined by ERISA for a publicly-traded security as the prevailing market price on a national securities exchange. Fidelity will determine “adequate consideration,” based on the prevailing or closing market price of the Shares on the New York Stock Exchange, on or about the date the Shares are tendered by Fidelity (the “prevailing market price”). Accordingly, depending on the prevailing market price of the Shares on such date, Fidelity may be unable to follow participant directions to tender Shares to Marathon at certain prices within the offered range. Fidelity will tender or not tender Shares as follows:

| • | If the prevailing market price is greater than the maximum tender price offered by Marathon ($63.00 per Share), notwithstanding your direction to tender Shares in the Offer, the Shares will not be tendered. |

| • | If the prevailing market price is lower than the price at which you direct Shares be tendered, Fidelity will follow your direction both as to percentage of Shares to tender and as to the price at which such Shares are tendered. |

| • | If the prevailing market price is greater than the price at which you direct the Shares be tendered but within the range of $56.00 to $63.00, Fidelity will follow your direction regarding the percentage of Shares to be tendered, but will increase the price at which such Shares are to be tendered to the lowest tender price that is not less than the prevailing market price. |

| • | If the prevailing market price is within the range of $56.00 to $63.00, for all Shares directed to be tendered at the “per Share purchase price to be determined pursuant to the tender offer,” Fidelity will tender such Shares at the lowest tender price that is not less than the prevailing market price. |

Unless otherwise required by applicable law, Fidelity will not tender Shares credited to participant accounts for which it has not received a completed Direction Form, directions via the Internet or for which it has received a direction not to tender pursuant to the Direction Form. Fidelity makes no recommendation as to whether to direct the tender of Shares or whether to refrain from directing the tender of Shares. EACH PARTICIPANT OR BENEFICIARY MUST MAKE HIS OR HER OWN DECISIONS.

CONFIDENTIALITY

To assure the confidentiality of your decision, Fidelity and their affiliates or agents will tabulate participant directions. Neither Fidelity nor their affiliates or agents will make your individual direction to Fidelity available to Marathon.

PROCEDURE FOR DIRECTING TRUSTEE

Enclosed is a Direction Form which should be completed and returned to Fidelity’s tabulator. You may also utilize the Internet to provide your directions. Please note that the Direction Form indicates the number of Shares credited to your individual account as of May 10, 2021. However, for purposes of the final tabulation, Fidelity will apply your instructions to the number of Shares credited to your account as of June 9, 2021, or as of a later date if the Offer is extended. If you do not provide timely and proper directions, such Shares will be considered NOT TENDERED.

To properly complete your Direction Form, you must do the following:

| (1) | On the face of the Direction Form, check Box 1 or 2. CHECK ONLY ONE BOX (if more than one box is checked, you will be deemed to have not tendered): |

| • | CHECK BOX 1 if you do not want the Shares credited to your individual account tendered for sale in accordance with the terms of the Offer and simply want the Plan to continue holding such Shares. |

| • | CHECK BOX 2 in all other cases and complete the table immediately below Box 2. Specify the percentage (between 1% and 100% in whole numbers) of Shares credited to your individual account that you want to tender at each price indicated. |

You may direct the tender of Shares credited to your account at different prices. To do so, you must state the percentage (between 1% and 100% in whole numbers) of Shares to be sold at each price by

filling in the percentage of such Shares on the line immediately before the price. Also, you may elect to accept the per Share purchase price to be determined pursuant to the Offer, which will result in receiving a price per Share as low as $56.00 or as high as $63.00. You should understand that an election to accept the per Share price to be determined pursuant to the Offer may cause the purchase price to be lower and could result in the tendered Shares being purchased at the minimum price of $56.00 per Share. Leave a given line blank if you want no Shares tendered at that particular price. The total of the percentages you provide on the Direction Form may not exceed 100%, but it may be less than 100%. If this amount is less than 100%, you will be deemed to have instructed Fidelity NOT to tender the balance of the Shares credited to your individual account.

| (2) | Date and sign the Direction Form in the space provided. |

| (3) | Return the Direction Form in the enclosed return envelope so that it is received by Fidelity’s tabulator at the address on the return envelope (Broadridge, Attn: Re-Organization Dept., P.O. Box 9116, Farmingdale, NY 11735) not later than 4:00 P.M., New York City Time, on June 8, 2021, unless the Offer is extended, in which case, to the extent feasible, the participant deadline shall be four business days prior to the expiration date of the Offer. If you wish to return the form by overnight courier, please send it to Fidelity’s tabulator at Broadridge, Attn: BCIS–VP 401K Plan Processing, 51 Mercedes Way, Edgewood, NY 11717. Direction Forms will not be accepted via facsimile. |

You may also use the Internet to provide directions to the trustee. If you wish to use the Internet to provide your directions to the trustee, please go to www.proxyvote.com/tender. You will be asked to enter the 16-digit control number from your Trustee Direction Form into the box directly under “Enter Control Number” and click on the Submit button. You will then be able to provide your direction to the trustee on the following screen. Please note that you are not allowed to elect more than 100% between the various price choices; you will get an error message if you do so and be asked to make a new election. You may, however, choose to elect less than 100% between the various price choices; in such event the remaining percentage of the Shares credited to your account will be considered undirected. The website will be available 24 hours per day through 4:00 p.m., New York City Time, on June 8, 2021.

Your direction will be deemed irrevocable unless withdrawn by 4:00 p.m., New York City Time, on June 8, 2021, unless the Offer is extended by Marathon. In order to make an effective withdrawal, you must submit a new Direction Form which may be obtained by calling Fidelity at 1-866-602-0595. Upon receipt of a new Direction Form from you, your previous direction will be deemed cancelled. Additionally, you may change or redirect the tendering of any Shares credited to your individual account by obtaining an additional Direction Form from Fidelity, or by providing new directions via the Internet, and repeating the previous instructions for directing your tender as set forth in this letter.

After the deadline above for returning tender directions to Fidelity’s tabulator, Fidelity and their affiliates or agents will complete the tabulation of all directions. Fidelity will tender the appropriate number of Shares, at the appropriate price(s), on behalf of the Plan.

Subject to the satisfaction of the conditions described in the Offer to Purchase, Marathon will purchase up to $4,000,000,000 in value of its Shares that are properly tendered through the Offer. As described in the Offer to Purchase, if the Offer is oversubscribed, the Shares tendered pursuant to the Offer may be subject to proration. Any Shares credited to your account that are not purchased in the Offer will remain allocated to your individual account under the Plan.

The conditional tender of Shares described in the Offer to Purchase will not apply to participants in the Plan. Additionally, the odd-lot provisions of the Offer will not apply to Plan participants.

EFFECT OF TENDER ON YOUR ACCOUNT

Temporary Suspension of Certain Activities – If you direct Fidelity to tender some or all of the Shares credited to your Plan account, as of 4:00 p.m., New York City Time, on June 9, 2021, certain transactions involving the Stock Fund credited to your account, including all exchanges out, loans, withdrawals and distributions, will be prohibited until all processing related to the Offer has been completed, unless the Offer is terminated or the completion date is extended. We currently anticipate that this freeze on transactions will last until approximately the week of June 21, 2021. This freeze on transactions will apply to ALL Shares credited to your Plan account, even if you elect to tender less than 100% of the Shares credited to your Plan account. No loans or withdrawals will be allowed for participants that have a balance in the stock fund throughout the freeze. The restriction period described here is called a “blackout period.”

Whether or not you are planning retirement in the near future, we encourage you to carefully consider how this “blackout period” may affect your retirement planning, as well as your overall financial plan.

Because you will be unable during the blackout period to sell Shares credited to your Plan account, it is very important that you review and consider the appropriateness of your current investments in light of your inability to direct or diversify your investments in the Stock Fund during the blackout period. For your long-term retirement security, you should give careful consideration to the importance of a well-balanced and diversified investment portfolio, taking into account all your assets, income and investments. You should be aware that there is a risk to holding substantial portions of your assets in the securities of any one company, as individual securities tend to have wider price swings, up and down, in short periods of time, than investments in diversified funds. If the Shares have a wide price swing, you might have a large loss during the blackout period, and you would not be able to direct the sale of Shares from your Plan account during the blackout period.

In the event that the Offer is extended, the freeze on transactions involving the Stock Fund will, if feasible, be temporarily lifted until three days prior to the new completion date of the Offer, as extended, at which time a new freeze on these transactions involving the Stock Fund will commence, at which time a new blackout period will commence. You can call Fidelity at 1-866-602-0595 to obtain updated information on expiration dates, deadlines and Stock Fund freezes, and to otherwise determine whether the blackout period has started or ended.

Federal law generally requires that you be furnished notice of a blackout period at least 30 days in advance of the last date on which you could exercise your rights immediately before the commencement of any blackout period. The reason for the notice is to provide you with sufficient time to consider the effect of the blackout period on your retirement and financial plans. This notice about the blackout period is being provided to you as soon as reasonably practicable following the launch of the Offer. As noted above, if you have any questions concerning the blackout period, you should contact Fidelity at 1-866-602-0595.

If you directed Fidelity NOT to tender any of the Shares credited to your account or you did not provide directions in a timely manner, you will continue to have access to all transactions normally available to the Stock Fund, subject to Plan rules.

INVESTMENT OF PROCEEDS

For any Shares in the Plan that are tendered and purchased by Marathon, Marathon will pay cash to the Plan. INDIVIDUAL PARTICIPANTS IN THE PLAN WILL NOT, HOWEVER, RECEIVE ANY CASH TENDER PROCEEDS DIRECTLY. ALL SUCH PROCEEDS WILL REMAIN IN THE PLAN AND MAY BE WITHDRAWN ONLY IN ACCORDANCE WITH THE TERMS OF THE PLAN

Fidelity will invest proceeds received with respect to Shares credited to your account in the Marathon Stable Value Fund as soon as administratively possible after receipt of proceeds. Fidelity anticipates that the processing of participant accounts will be completed five to seven business days after receipt of these proceeds. You may call Fidelity at 1-866-602-0595 or log on to www.netbenefits.com after the reinvestment is complete to learn the effect of the tender on your account or to have the proceeds invested in other investment options offered under the Plan.

SHARES OUTSIDE THE PLAN

If you hold Shares outside of the Plan, you will receive, under separate cover, Offer materials to be used to tender those Shares. Those Offer materials may not be used to direct Fidelity to tender or not tender the Shares credited to your individual account under the Plan. Likewise, the tender of Shares credited to your individual account under the Plan will not be effective with respect to Shares you hold outside of the Plan. The direction to tender or not tender Shares credited to your individual account under the Plan may only be made in accordance with the procedures in this letter. Similarly, the enclosed Direction Form may not be used to tender Shares held outside of the Plan.

TAX CONSEQUENCES

While you will not recognize any immediate tax gain or loss as a result of the tender and sale of any Shares credited to your account in the Plan, the tax treatment of future distributions from the Plan may be impacted. Tender offer proceeds will be subject to all applicable taxes at the time you receive a distribution from the Plan. We encourage you to consult your tax advisor concerning your decision to participate in the Offer and possible tax ramifications.

FURTHER INFORMATION

If you require additional information concerning the procedure to tender Shares credited to your individual account under the Plan, please contact Fidelity at 1-866-602-0595. If you require additional information concerning the terms and conditions of the Offer, please call Georgeson LLC, the information agent of the Offer, toll free at 1-888-565-5423.

Sincerely,

Fidelity Management Trust Company

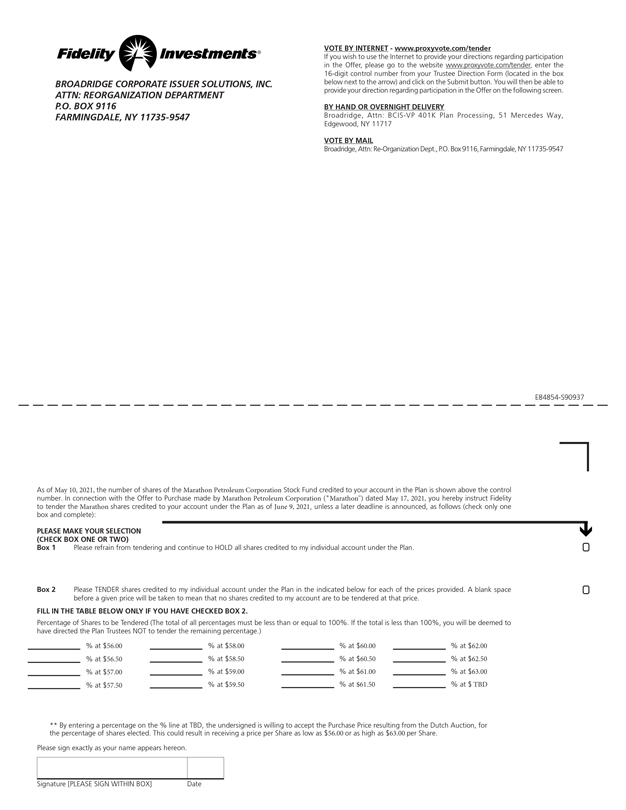

BROADRIDGE CORPORATE ISSUER SOLUTIONS, INC. ATTN: REORGANIZATION DEPARTMENT P.O. BOX 9116 FARMINGDALE, NY 11735-9547 VOTE BY INTERNET - www.proxyvote.com/tender If you wish to use the Internet to provide your directions regarding participation in the Offer, please go to the website www.proxyvote.com/tender, enter the 16-digit control number from your Trustee Direction Form (located in the box below next to the arrow) and click on the Submit button. You will then be able to provide your direction regarding participation in the Offer on the following screen. BY HAND OR OVERNIGHT DELIVERY Broadridge, Attn: BCIS-VP 401K Plan Processing, 51 Mercedes Way, Edgewood, NY 11717 VOTE BY MAIL Broadridge, Attn: Re-Organization Dept., P.O. Box 9116, Farmingdale, NY 11735-9547 E84854-S90937 As of May 10, 2021, the number of shares of the Marathon Petroleum Corporation Stock Fund credited to your account in the Plan is shown above the control number. In connection with the Offer to Purchase made by Marathon Petroleum Corporation ("Marathon") dated May 17, 2021, you hereby instruct Fidelity to tender the Marathon shares credited to your account under the Plan as of June 9, 2021, unless a later deadline is announced, as follows (check only one box and complete): PLEASE MAKE YOUR SELECTION (CHECK BOX ONE OR TWO) Box 1 Please refrain from tendering and continue to HOLD all shares credited to my individual account under the Plan. Box 2 Please TENDER shares credited to my individual account under the Plan in the indicated below for each of the prices provided. A blank space before a given price will be taken to mean that no shares credited to my account are to be tendered at that price. FILL IN THE TABLE BELOW ONLY IF YOU HAVE CHECKED BOX 2. Percentage of Shares to be Tendered (The total of all percentages must be less than or equal to 100%. If the total is less than 100%, you will be deemed to have directed the Plan Trustees NOT to tender the remaining percentage.) % at $56.00 % at $56.50 % at $57.00 % at $57.50 % at $58.00 % at $58.50 % at $59.00 % at $59.50 % at $60.00 % at $60.50 % at $61.00 % at $61.50 % at $62.00 % at $62.50 % at $63.00 % at $ TBD ** By entering a percentage on the % line at TBD, the undersigned is willing to accept the Purchase Price resulting from the Dutch Auction, for the percentage of shares elected. This could result in receiving a price per Share as low as $56.00 or as high as $63.00 per Share. Please sign exactly as your name appears hereon. Signature [PLEASE SIGN WITHIN BOX] Date

E84855-S90937 TRUSTEE DIRECTION FORM MARATHON PETROLEUM CORPORATION MARATHON PETROLEUM THRIFT PLAN BEFORE COMPLETING THIS FORM, PLEASE READ CAREFULLY ALL ENCLOSED MATERIALS PLEASE NOTE THAT IF YOUR TRUSTEE DIRECTION FORM IS NOT RECEIVED BY FIDELITY'S TABULATION AGENT, PROPERLY COMPLETED AND SIGNED OR DIRECTIONS ARE NOT RECEIVED VIA THE INTERNET, BY 4:00 P.M., NEW YORK CITY TIME ON JUNE 8, 2021, UNLESS THE TENDER OFFER DEADLINE IS EXTENDED, FIDELITY WILL NOT TENDER ANY SHARES CREDITED TO YOUR PLAN ACCOUNT, UNLESS OTHERWISE REQUIRED BY LAW. Fidelity Management Trust Company ("Fidelity") makes no recommendation to any participant in the Marathon Petroleum Thrift Plan (the Plan, and including the portion of the Plan known as the Speedway Component, which is also known as the Retirement Savings Sub-Plan) with regard to the tender offer.This Trustee Direction Form, if properly signed, completed and received by Fidelity's tabulation agent in a timely manner, will supersede any previous Trustee Direction Form with respect to the tender offer.PLEASE SIGN AND DATE ON THE REVERSE SIDE.